PRELIMINARY PROXY STATEMENT – SUBJECT TO COMPLETION

CHENIERE ENERGY, INC. 2024 PROXY STATEMENT

| ☒ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☐ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to §240.14a-11(c) or §240.14a-12 | |

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

| ☐ | Fee paid previously with preliminary materials. | |||

PRELIMINARY PROXY STATEMENT – SUBJECT TO COMPLETION

CHENIERE ENERGY, INC. 2024 PROXY STATEMENT

April , 2024

Fellow Shareholders:

On behalf of Cheniere’s Board of Directors, we are pleased to invite you to attend the Cheniere Energy, Inc. 2024 Annual Meeting of Shareholders (the “Meeting”). The Meeting will be held at 9:00 a.m. Central Time, on May 23, 2024 at our corporate headquarters located at 845 Texas Avenue, Suite 1250, Houston, Texas 77002. The following Notice of Annual Meeting describes the business to be conducted at the Meeting. We encourage you to review the materials and vote your shares. You may vote via the Internet, by telephone, or by submitting your completed proxy card by mail. If you attend the Meeting, you may vote your shares in person if you are a shareholder of record.

| In 2023, the Cheniere team reinforced its track record of reliability and operational excellence, producing approximately 2,300 TBtu of LNG – 73% of which was delivered to Europe. Our relentless focus on ensuring safe and reliable operations across our $40 billion infrastructure platform resulted in a top decile safety record for the year, as well as record annual net income of $9.9 billion, Consolidated Adjusted EBITDA1 at the high end of our guidance range, and Distributable Cash Flow1 above our guidance range.

These outstanding operational and financial results enabled us to deploy approximately $5 billion towards our long-term capital allocation plan – our ‘20/20 Vision’ – delivering meaningful value to our shareholders by achieving investment grade ratings throughout our corporate structure, executing on share repurchases and dividend growth, and advancing accretive growth projects at both Sabine Pass and Corpus Christi. |

2023 was another exceptional year for Cheniere, as we achieved outstanding results across the key strategic priorities of the Company, while reinforcing our track record on safety, execution and operational reliability, and solidifying Cheniere as best-in-class across our platform. |

Throughout 2023, we further built upon our project execution track record by making significant progress on our 10+ million tonnes per annum (“mtpa”) growth project at Corpus Christi. The Stage 3 project has reached over 50% completion with over 10% of total project construction complete as of December 31, 2023, and Bechtel is progressing on an accelerated timeline. We also advanced the development and engineering for our growth project at Sabine Pass, and signed approximately 6.5 mtpa of long-term contracts that are expected to support the project. It is clear that global energy markets are calling for reliable, affordable and cleaner-burning energy supply, and Cheniere is well-positioned to answer that call with our Gulf Coast LNG given our brownfield economic advantage, track record of project execution and operational reliability, and history of environmental stewardship.

We take great pride in the progress made throughout 2023 on our efforts to ensure the long-term sustainability of our business while supporting the communities where we live and work. Throughout the year, the Cheniere team continued to lead in accordance with our T.R.A.I.N.S. (Teamwork, Respect, Accountability, Integrity, Nimble, and Safety) values, encouraging development and promoting inclusivity, both inside and outside of the workplace. We adhered to our fundamental approach to climate and sustainability – to remain actionable, not aspirational – leading on data-driven transparency in our climate & sustainability efforts, guided by our foundational principles of science, transparency, operational excellence and supply chain. We plan to continue to advance these initiatives in order to maximize the climate benefits of our LNG to our global customer base.

We are incredibly proud of what our team accomplished in 2023 and the role Cheniere played in support of our customers, employees and stakeholders. We are excited to embark on the next chapter of the Cheniere story as we continue to execute on our long-term growth and capital allocation strategies to further enhance the value of the Cheniere platform in 2024.

We thank you for your continued support as investors in Cheniere and look forward to your attendance on May 23rd.

|

|

G. Andrea Botta

Chairman of the Board |

|

Jack A. Fusco

President and Chief Executive Officer |

| 1 | For a definition of Consolidated Adjusted EBITDA and Distributable Cash Flow and a reconciliation of non-GAAP measures to net income (loss), the most directly comparable GAAP financial measure, please see Appendix D. |

CHENIERE ENERGY, INC.

845 Texas Avenue, Suite 1250

Houston, Texas 77002

(713) 375-5000

|

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

|

||||||

| TIME AND DATE: | 9:00 a.m. Central Time on May 23, 2024 |

|||||

| PLACE: | Cheniere Energy, Inc. 845 Texas Avenue, Suite 1250 Houston, TX 77002 |

|||||

|

ITEMS OF BUSINESS: |

• To elect nine members of the Board of Directors named in this proxy statement to hold office for a one-year term expiring at the 2025 Annual Meeting of Shareholders.

• To approve, on an advisory and non-binding basis, the compensation of the Company’s named executive officers for 2023 (say-on-pay vote).

• To ratify the appointment of KPMG LLP as the Company’s independent registered public accounting firm for 2024.

• To approve the Cheniere Energy, Inc. Amended and Restated 2020 Incentive Plan.

• To approve an amendment to the Company’s Certificate of Incorporation to limit the personal liability of officers as permitted by law.

• To transact such other business as may properly come before the Meeting and any adjournment or postponement thereof.

|

|||||

| RECORD DATE: | You can vote if you were a shareholder of record as of the close of business on April 8, 2024.

|

|||||

| PROXY VOTING: | It is important that your shares be represented and voted at the Meeting. You can vote your shares by completing and mailing the enclosed proxy card or by voting on the Internet or by telephone. See details under the heading “Frequently Asked Questions—How do I vote?”

|

|||||

| ELECTRONIC AVAILABILITY OF PROXY MATERIALS: | We are making this Proxy Statement, including the Notice of Annual Meeting and 2023 Annual Report on Form 10-K for the year ended December 31, 2023, available on our website at: www.cheniere.com/2024AnnualMeeting.

|

|||||

By order of the Board of Directors

Sean N. Markowitz

Corporate Secretary

April , 2024

TABLE OF CONTENTS

|

|

|

1

|

| |

| PROPOSAL 1 – ELECTION OF DIRECTORS

|

|

11

|

| |

| 11 | ||||

| 14 | ||||

| 16 | ||||

|

|

|

21

|

| |

| 21 | ||||

| 21 | ||||

| 22 | ||||

| 23 | ||||

| 24 | ||||

| 28 | ||||

| 31 | ||||

| CODE OF BUSINESS CONDUCT AND ETHICS AND CORPORATE GOVERNANCE GUIDELINES |

32 | |||

| 32 | ||||

| 32 | ||||

| 33 | ||||

|

|

|

35

|

| |

| EQUITY COMPENSATION PLAN INFORMATION

|

|

37

|

| |

|

|

|

38

|

| |

| COMPENSATION DISCUSSION AND ANALYSIS

|

|

40

|

| |

| 40 | ||||

| 45 | ||||

| 45 | ||||

| 46 | ||||

| 56 | ||||

| 60 | ||||

| 61 | ||||

|

|

|

71

|

| |

Note Regarding Forward-Looking Statements

This Proxy Statement contains forward-looking statements relating to, among other things, business strategy, performance and expectations for project development, as well as our goals, commitments and strategies in relation to environmental and social matters. The reader is cautioned not to place undue reliance on these statements and should review the sections captioned “Cautionary Statement Regarding Forward-Looking Statements” and “Risk Factors” in our Annual Report on Form 10-K for important information about these statements, including the risks, uncertainties and other factors that could cause actual results to vary materially from the assumptions, expectations and projections expressed in any forward-looking statements. These forward-looking statements speak only as of the date made, and, other than as required by law, we undertake no obligation to update or revise any forward-looking statement, whether as a result of new information, future events or developments or otherwise.

Website References

This Proxy Statement includes several website addresses and references to additional materials found on those websites. These websites and materials are not incorporated by reference herein.

PROXY SUMMARY

The following is an overview of information that you will find throughout this Proxy Statement in connection with the 2024 Annual Meeting of Shareholders (the “Meeting”) of Cheniere Energy, Inc. (“Cheniere” or the “Company”). This summary does not contain all of the information that you should consider. For more complete information about these topics, please review the complete Proxy Statement prior to voting. For more complete information about our 2023 performance, please review our Annual Report on Form 10-K for the year ended December 31, 2023, available on our website at www.cheniere.com/2024AnnualMeeting. The Notice of Annual Meeting (“Notice”), Proxy Statement, proxy card and 2023 Annual Report on Form 10-K for the year ended December 31, 2023, are being mailed to shareholders on or about April , 2024.

|

ANNUAL MEETING OF SHAREHOLDERS

| ||||

|

|

TIME AND DATE:

|

9:00 a.m. Central Time on May 23, 2024

| ||

|

PLACE: | Cheniere Energy, Inc. 845 Texas Avenue, Suite 1250 Houston, TX 77002 | ||

|

RECORD DATE:

|

The close of business on April 8, 2024 (the “Record Date”)

| ||

|

VOTING: | Shareholders as of the close of business on the Record Date are entitled to vote. Each share of common stock is entitled to one vote for each matter to be voted upon. | ||

|

ADMISSION: | No admission card is required to enter the Meeting, but you will need proof of your stock ownership and valid government-issued picture identification. Please see “Frequently Asked Questions” on page 93 of this Proxy Statement for more information.

| ||

VOTING MATTERS AND BOARD RECOMMENDATIONS

| PROPOSAL

|

DESCRIPTION

|

BOARD VOTE RECOMMENDATION

|

PAGE REFERENCE (FOR MORE DETAILS)

| |||

| 1 |

Election of directors | FOR EACH NOMINEE | 11 | |||

| 2 |

Advisory and non-binding vote on the compensation of the Company’s named executive officers for 2023 (say-on-pay vote) | FOR | 77 | |||

| 3 |

Ratification of appointment of KPMG LLP as the Company’s independent registered public accounting firm for 2024 | FOR | 80 | |||

| 4 |

Approval of Cheniere Energy, Inc. Amended and Restated 2020 Incentive Plan | FOR | 81 | |||

| 5 |

Approval of amendment to the Company’s Certificate of Incorporation to limit the personal liability of officers as permitted by law | FOR | 91 | |||

| 2024 PROXY STATEMENT |

1 | |||

PROXY SUMMARY

2023 PERFORMANCE AND

STRATEGIC ACCOMPLISHMENTS

The following items highlight our 2023 and recent accomplishments. For more information about these accomplishments and their relationship to our executive compensation program, please see “Compensation Discussion and Analysis” on page 40 of this Proxy Statement.

| EXCEPTIONAL FINANCIAL RESULTS

Record Net Income of $9.9 billion

Exceeded midpoints of original Full Year 2023 Consolidated Adjusted EBITDA & Distributable Cash Flow guidance ranges by >$500 million each

Out-earned our 9-train run-rate Consolidated Adjusted EBITDA & Distributable Cash Flow guidance for the 2nd year in a row |

EXECUTION OF LONG-TERM CAPITAL ALLOCATION PLAN

~$5 billion deployed under “20/20 Vision” capital allocation plan

Investment grade credit ratings achieved across the Cheniere complex

Repaid ~$1.2 billion of long-term indebtedness & issued inaugural investment grade bond at Cheniere Partners

Funded ~$1.5 billion of capex towards financially disciplined growth at CCL Stage 3 Project

Repurchased ~9.5 million shares for ~$1.5 billion

10% increase to quarterly dividend in Q3 consistent with annual target, with $1.66/share of dividends declared for 2023 |

BEST IN CLASS SAFETY & SEAMLESS LNG OPERATIONS

Top decile safety record with Total Reportable Incident Rate (TRIR) of 0.10

Exported 637 cargoes & produced ~2,300 tbtu, representing ~11% of global LNG produced in 2023

>94% utilization rate in 2023 vs. ~89% global average1

Continued to support global call for reliable, flexible LNG supply with ~73% of our volume delivered to Europe

Signed long-term contracts representing >119 million tonnes of aggregate volumes between 2026-2050 in support of the SPL Expansion Project |

PREMIER LNG DEVELOPMENT

CCL Stage 3 Project ahead of schedule and 51.4%2 complete at year-end, with first LNG from the first train expected in 2024

Submitted applications to FERC & DOE for the CCL Midscale Trains 8 & 9 Project

Initiated permitting process for the SPL Expansion Project, inclusive of Carbon Capture & Storage (“CCS”) at SPL |

| * | For a definition of Consolidated Adjusted EBITDA and Distributable Cash Flow and a reconciliation of these non-GAAP measures to net income (loss), the most directly comparable GAAP financial measure, please see Appendix D. |

| 1 | Global utilization average in 2022 per International Gas Union. Cheniere utilization reflects 2023 feed gas processed / production capacity. |

| 2 | CCL Stage 3 Project completion percentage as of December 31, 2023 and reflects: engineering 83.7% complete, procurement 72.2% complete, subcontract work 66.9% complete and construction 11.1% complete. |

Strategic Accomplishments: Adding to our Foundation for Growth and Cash Flow Stability

| • | Achieved key milestones for SPL Expansion Project: In May 2023, certain of our subsidiaries entered the pre-filing review process with the Federal Energy Regulatory Commission (“FERC”) under the National Energy Policy Act (“NEPA”) for an expansion adjacent to the natural gas liquefaction and export facilities at the Sabine Pass LNG terminal in Louisiana (the “SPL Project”) with a total production capacity of up to approximately 20 million tonnes per annum (“mtpa”) of LNG (the “SPL Expansion Project”), inclusive of estimated debottlenecking opportunities, and in April 2023, one of our subsidiaries executed a contract with Bechtel Energy, Inc. (“Bechtel”) to provide the front end engineering and design work on the project. |

| 2 | CHENIERE |

|||

2023 PERFORMANCE AND STRATEGIC ACCOMPLISHMENTS

| • | Received additional export authorizations for FTA countries: In April 2023, certain of our subsidiaries filed an application with the Department of Energy (“DOE”) with respect to two midscale Trains with an expected total production capacity of approximately 3 mtpa of LNG (the “CCL Midscale Trains 8 & 9 Project”) adjacent to the expansion consisting of seven midscale Trains with an expected total production capacity of over 10 mtpa of LNG (the “CCL Stage 3 Project”), both adjacent to the natural gas liquefaction and export facilities at the Corpus Christi LNG terminal, (the “CCL Project”), requesting authorization to export LNG to free trade agreement (“FTA”) countries and non-FTA countries. In July 2023, we received authorization from the DOE to export LNG to FTA countries. |

| • | FERC application submitted: In March 2023, certain of our subsidiaries submitted an application with the FERC under the Natural Gas Act (“NGA”) for the CCL Midscale Trains 8 & 9 Project. |

| • | Signed significant new long-term contracts: During 2023, we signed approximately 6.5 mtpa of long-term contracts, which included: |

| • | long-term LNG sale and purchase agreements (“SPAs”) with Foran Energy Group Co. Ltd., BASF, ENN LNG (Singapore) Pte. Ltd., Equinor ASA and Korea Southern Power Co. Ltd. with estimated volumes totaling approximately 106 million tonnes of LNG and expected deliveries between 2026 and 2050. Approximately 65 million tonnes is subject to Cheniere Energy Partners, L.P. (“Cheniere Partners”) (NYSE: CQP) making a positive final investment decision (“FID”) on the first or second trains of the SPL Expansion Project, as applicable, or Cheniere unilaterally waiving that requirement. |

| • | an integrated production marketing (“IPM”) agreement with ARC Resources U.S. Corp., a subsidiary of ARC Resources Ltd., to purchase 140,000 MMBtu per day of natural gas at a price based on the Dutch Title Transfer Facility (“TTF”), less a fixed regasification fee, fixed LNG shipping costs and a fixed liquefaction fee, for a term of approximately 15 years commencing with commercial operations of the first train of the SPL Expansion Project. This agreement is subject to Cheniere Partners making a positive FID on the first train of the SPL Expansion Project or Cheniere Partners unilaterally waiving that requirement. |

Operational Highlights: Industry Leading Safety, Growing Production, and Operational Excellence

| • | Reliable and growing production: As of February 16, 2024, approximately 3,280 cumulative LNG cargoes totaling over 225 million tonnes of LNG have been produced, loaded and exported from the CCL Project and the SPL Project. |

| • | Operational excellence enabled industry leading safety results: For full year 2023, over 10 million hours of labor were completed with a Total Recordable Incident Rate (employees and contractors combined) of 0.10, which places us within the top decile of our industry. |

Financial Highlights: Financial Results and Consistent Outperformance Relative to Guidance

| • | For full year 2023, we generated: |

| • | Revenue of approximately $20.4 billion and Net Income of approximately $9.9 billion. |

| • | Consolidated Adjusted EBITDA of approximately $8.8 billion, reaching the high end of the latest guidance range. |

| • | Distributable Cash Flow of approximately $6.5 billion, exceeding the high end of the latest guidance range. |

| • | During 2023, we accomplished the following pursuant to our long-term capital allocation priorities: |

| • | We prepaid approximately $1.2 billion of consolidated long-term indebtedness. |

| • | We repurchased approximately 9.5 million shares of our common stock for approximately $1.5 billion. |

| • | We declared dividends of $1.66 per share of common stock in the aggregate for the year ended December 31, 2023. |

| • | We continued to invest in accretive organic growth, funding approximately $1.5 billion of capital expenditures related to the CCL Stage 3 Project. |

| • | Ratings upgrades: Throughout 2023, the Cheniere complex received 7 distinct upgrades to the credit ratings of its entities by the ratings agencies, with the entire Cheniere complex reaching investment grade status. The achievement of investment grade ratings was a priority of our “20/20 Vision” capital allocation plan announced in September 2022. |

| 2024 PROXY STATEMENT |

3 | |||

PROXY SUMMARY

CORPORATE RESPONSIBILITY

Climate Strategy

As the leading U.S. LNG exporter, we aim to supply customers with affordable, reliable, and cleaner-burning natural gas. A central part of our climate strategy is to measure and mitigate emissions—to support Cheniere’s LNG supplies remaining economically and climate-competitive in a lower carbon future. This strategy is reflected in a cadence of actions that focus on science, operational excellence, collaboration along our supply chain, and transparency. We are working to better understand the emissions profile of the LNG we deliver to our customers, and to identify strategic and cost-effective opportunities to improve greenhouse gas (“GHG”) emissions performance.

2023 Environmental, Social and Governance Highlights

Our 2023 environmental, social and governance (“ESG”) highlights include:

| • | In December 2023, we completed our previously announced collaboration with multiple natural gas midstream companies, methane detection technology providers and leading academic institutions to implement quantification, monitoring, reporting and verification (“QMRV”) of GHG emissions at natural gas gathering, processing, transmission, and storage systems specific to Cheniere’s supply chain, in order to improve the overall understanding of GHG emissions and further deployment of advanced monitoring technologies and protocols. As a result of the study, we published a paper, Informing Methane Emissions Inventories Using Facility Aerial Measurements at Midstream Natural Gas Facilities, which discusses the analysis and findings of the midstream QMRV study, highlighting the variability across estimated and measured GHG emissions data. |

| • | In October 2023, the field measurement campaign for our liquefaction QMRV research was completed. This concluded our overall QMRV research and development project series across our supply chain, the learnings of which will inform our emission measurement strategy going forward. |

| • | In August 2023, we published The Power of Connection, our fourth Corporate Responsibility (CR) report, which details our approach and progress on ESG issues, including our collaboration with natural gas midstream companies, technology providers and leading academic institutions on life-cycle assessment models, QMRV of greenhouse gas emissions and other research and development projects. |

| • | In July 2023, we launched our lifecycle analysis (“LCA”) supplier portal web application, which is designed to streamline our supply chain data collection and support more robust and frequent LCA modeling. |

| • | In May 2023, certain subsidiaries of Cheniere Partners entered the pre-filing review process with the FERC under the NEPA for a proposed carbon capture and sequestration project as part of the SPL Expansion Project, and initiated the front end engineering and design work with Bechtel, building upon the significant research and development performed over the last few years to determine the viability of such technology at our facilities. |

| • | In January 2023, we co-founded and sponsored the Energy Emissions Modeling and Data Lab (“EEMDL”), a multidisciplinary research and education initiative led by the University of Texas at Austin in collaboration with Colorado State University and the Colorado School of Mines. EEMDL’s goal is to address the growing need for accurate, timely and clear accounting of greenhouse gas emissions across the global oil and natural gas supply chains, which will help public and private institutions develop climate strategies and actions informed by accurate, verified data, identifying opportunities for emissions reductions. |

| • | In 2023, we continued to make meaningful progress on our Diversity, Equity and Inclusion efforts, aligning internally and connecting with our communities through initiatives such as our supplier diversity roadshows at the CCL Project and the SPL Project, the Love Our Parks collaboration with Houston Parks and Recreation, and our work with Historically Black Colleges and Universities (“HBCUs”). |

| • | During 2023, the Cheniere team supported our communities with over 13,000 hours of volunteering and $5.6 million of direct giving, including employee-matching gifts. |

Recognition

In 2023, Cheniere received the following scores and recognition:

| • | MSCI: AA (on a scale of AAA-CCC) in the MSCI ESG Ratings assessment |

| • | Sustainalytics: ESG Risk Rating of 22.7, considered a medium-risk assessment |

| • | Institutional Investor: Voted by the investment community first place overall across all categories, including Best ESG Program and Best Company Board, for the Natural Gas & Master Limited Partnerships sector |

| 4 | CHENIERE |

|||

CORPORATE GOVERNANCE

CORPORATE GOVERNANCE

We are committed to the values of effective corporate governance and high ethical standards. Our Board believes that these values are conducive to strong performance and creating long-term shareholder value. Our governance framework gives our highly experienced directors the structure necessary to provide oversight, advice and counsel to Cheniere.

Since our 2021 Annual Meeting, we have taken the following governance actions:

| • | engaged annually with shareholders holding in excess of 50% of our common stock each year regarding governance matters; |

| • | added details regarding the experience of our directors and the diversity of our Board to our proxy statements, including an individualized skills matrix; |

| • | expanded the oversight responsibilities of the Governance and Nominating Committee to include oversight of our strategies, activities and initiatives related to Diversity, Equity and Inclusion (“DEI”); |

| • | added express oversight responsibility for the security of the Company’s information technology systems and controls, including programs and defenses against cybersecurity threats, to the Audit Committee charter; |

| • | issued corporate responsibility reports on an annual basis, with our fourth report in 2023 titled The Power of Connection; |

| • | undertook meaningful Board refreshment as 5 of our 9 director nominees will have joined the Board since 2021; and |

| • | enhanced our proxy statement disclosure surrounding our climate strategy, human capital management and human rights and labor standards. |

The “Governance Information” section of this Proxy Statement, beginning on page 21, describes our corporate governance structure and policies, which include the following:

| Board Independence | • 7 out of 9 of our current directors and director nominees are independent. • Independent directors meet regularly without management present. • Our President and CEO is the only management director.

| |

| Board Composition | • Our director nominees have an average age of 62.4 and average tenure of 5.5 years (as of May 23, 2024). • The Board values diversity, experience and relevant skillsets in assessing its composition.

| |

| Board Performance | • The Board regularly assesses its performance through Board and committee self-evaluations.

| |

| Board Committees | • We have three standing Board committees—Audit, Governance and Nominating, and Compensation. • All of our Board committees are comprised of and chaired solely by independent directors.

| |

| Leadership Structure | • Our Chairman of the Board and CEO roles were split in December 2015. • Our independent Non-Executive Chairman of the Board provides leadership to the Board and promotes the Board’s independent oversight of management.

| |

| Risk Oversight | • The Board has oversight responsibility for key risks (including liquidity, credit, operations, ESG and regulatory compliance) facing the Company, including assessing the relative magnitude of these risks and management’s plan for mitigating these risks. In addition to the Board’s oversight responsibility, the committees of the Board review the risks that are within their areas of responsibility.

| |

| Open Communication | • We encourage open communication and strong working relationships among our directors. • Our directors have access to management and employees.

| |

| Director and Executive Stock Ownership |

• We have had rigorous stock ownership guidelines for our directors and executive officers since 2008, including amendments to our guidelines for our directors in February 2017, and for our executive officers in February 2021, to make them more rigorous.

| |

| Director Compensation Limit |

• We have capped the aggregate compensation that may be granted to a non-employee director with respect to service for a single calendar year at $750,000, subject to the discretion of the Compensation Committee. Please see “Director Compensation” on page 33 of this Proxy Statement.

| |

| 2024 PROXY STATEMENT |

5 | |||

PROXY SUMMARY

| Accountability to Shareholders |

• Directors are elected annually by a majority of the votes cast (in uncontested elections) with respect to such director. If a director does not receive the necessary vote at the annual meeting, he/she is required to tender their resignation for consideration by the Board. • The Board maintains a process for shareholders to communicate with the Board. • We conduct an annual advisory say-on-pay vote. • As set forth in our Bylaws, a shareholder, or a group of up to 20 shareholders, continuously owning at least 3% of our common stock for at least the prior 3 consecutive years (and meeting certain other requirements) has the ability to nominate up to 20% of the number of directors serving on our Board via our proxy statement (proxy access). • Special meetings may be called upon the written request of at least 50.1% of the outstanding shares of common stock of the Company, as set forth in our Bylaws.

| |

| Succession Planning | • The Governance and Nominating Committee has oversight of succession planning, both planned and emergency, for the Chief Executive Officer.

| |

| Governance Policies | • Non-employee directors are required to retire upon the earlier of reaching 75 years of age or 15 years of service, in order to encourage board refreshment. Upon the recommendation of the Governance and Nominating Committee, the Board may waive these requirements as to any non-employee director if it deems such waiver to be in the best interests of the Company. • We maintain codes of conduct for directors, officers and employees. • We do not allow pledging of Company stock as collateral for a loan or holding Company stock in margin accounts. • We do not allow hedging or short sales of Company stock. • We do not have a shareholder rights plan, or “poison pill.”

| |

| 6 | CHENIERE |

|||

OUR DIRECTOR NOMINEES

OUR DIRECTOR NOMINEES

You are being asked to vote on the election of the 9 director nominees listed below. Each director is elected annually by a majority of the votes cast. Detailed information about each nominee, including background, skills and expertise, can be found in “Proposal 1 – Election of Directors” beginning on page 11.

|

COMMITTEE MEMBERSHIPS | ||||||||||||

| NAME PRINCIPAL OCCUPATION

|

AGE (AS OF MAY 23,

|

DIRECTOR SINCE

|

INDEPENDENT

|

AC

|

G&N

|

CC

| ||||||

| G. Andrea Botta Chairman of the Board, Cheniere Energy, Inc.; |

71 | 2010 | Yes | Chair | ||||||||

| Jack A. Fusco President and Chief Executive Officer, |

61 | 2016 | No | |||||||||

| Patricia K. Collawn Chairman and Chief Executive Officer, |

65 | 2021 | Yes | F | ● | |||||||

| Brian E. Edwards Senior Vice President, Caterpillar Inc. |

58 | 2022 | Yes | ● | ● | |||||||

| Denise Gray Chief Executive Officer, DKTN Consulting LLC and |

61 | 2023 | Yes | ● | ● | |||||||

| Lorraine Mitchelmore Director, Suncor Energy Inc. and Bank of |

61 | 2021 | Yes | ● | ● | |||||||

| Scott Peak Managing Partner, Co-President, and Head of North America, Brookfield Infrastructure |

43 | 2024 | No | |||||||||

| Donald F. Robillard, Jr. President of Robillard Consulting, LLC, Former Executive Vice President, Chief Financial Officer and Chief Risk Officer of Hunt Consolidated, Inc. and Former Chief Executive Officer and Chairman, ES Xplore, LLC |

72 | 2014 | Yes | Chair; F |

● | |||||||

| Neal A. Shear Senior Advisor and Chair of the Advisory Committee of Onyxpoint Global Management LP |

69 | 2014 | Yes | ● | Chair | |||||||

| AC: Audit Committee |

F: Audit Committee Financial Expert | |

| G&N: Governance and Nominating Committee |

||

| CC: Compensation Committee |

||

All director nominees have been determined to be independent, except Jack A. Fusco and Scott Peak. Each director nominee attended or participated in at least 75% of the aggregate number of all meetings of the Board and of each committee on which he or she sits for which the director was eligible to attend in 2023.

| 2024 PROXY STATEMENT |

7 | |||

PROXY SUMMARY

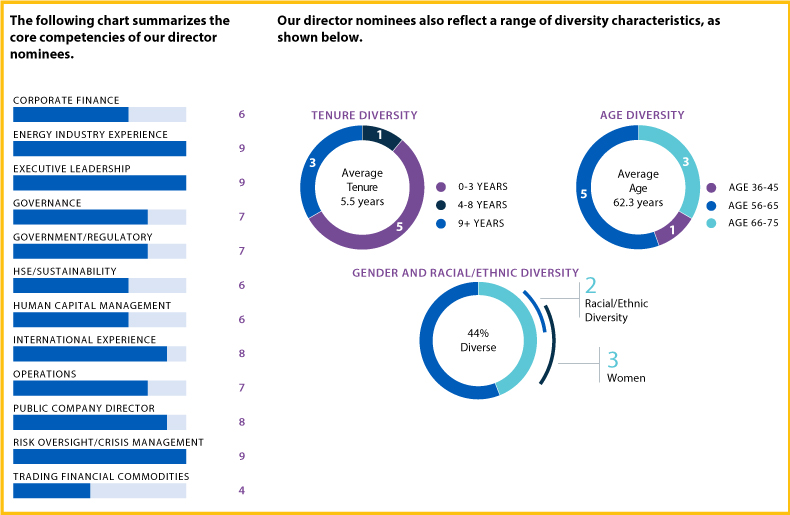

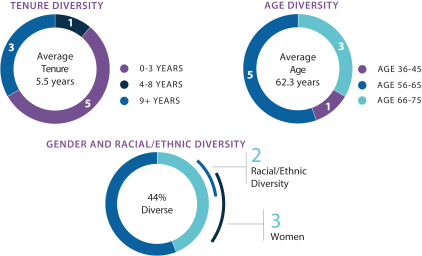

Summary of Director Core Competencies

Our Board believes that having a diverse mix of directors with complementary qualifications, expertise and attributes is essential to meeting its oversight responsibility.

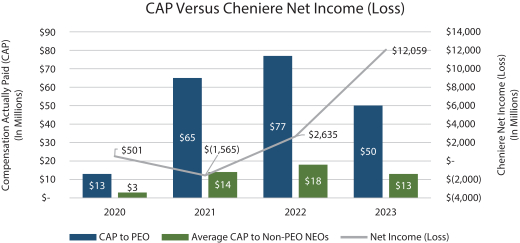

EXECUTIVE COMPENSATION HIGHLIGHTS

Compensation Governance Practices

| • | Clear, direct link between pay and performance |

| • | Majority of incentive awards earned based on performance |

| • | No hedging or “short sales” of Company stock |

| • | No pledging of Company stock as collateral for a loan or holding Company stock in margin accounts |

| • | Robust stock ownership guidelines |

| • | No defined benefit retirement plan or supplemental executive retirement plan |

| • | Strong compensation risk management program |

| • | Clawback policy that requires the Board to recoup erroneously paid performance-based incentive compensation from the Company’s current and former Section 16 officers in the event of a financial restatement |

| • | Non-employee director equity compensation limits |

| • | Minimum vesting schedule for long-term incentive awards of at least 12 months, subject to limited exceptions |

| • | No material perquisites |

| • | Solicit annual advisory vote on executive compensation |

| • | Annually review the independence of the compensation consultant retained by the Compensation Committee |

| 8 | CHENIERE |

|||

CHENIERE ENERGY, INC. AMENDED AND RESTATED 2020 INCENTIVE PLAN

Philosophy and Objectives

We are committed to a pay-for-performance executive compensation program that aligns the interests of our Named Executive Officers (“NEOs”) with the key drivers of long-term growth and creation of shareholder value. Changes to the executive compensation program are influenced by market practices, feedback from shareholders, and to support the program’s primary objectives.

The Board and the Compensation Committee believe the design of our executive compensation program, and the Compensation Committee’s decisions and outcomes in 2023, support our compensation philosophy and objectives, including:

| • | Annual and long-term incentive awards are primarily performance-based |

| • | Annual incentive awards earned are based on achievement of specific financial, operating, ESG and strategic goals |

| • | Performance-based long-term incentive awards are tied to specific and formulaic financial performance and stock price growth objectives |

2023 Compensation Highlights

During 2023, the Compensation Committee and Board continued to monitor market conditions and address feedback from stakeholders and our compensation consultant. Key outcomes and developments included:

| • | The annual incentive plan generated an above-target payout for our NEOs based upon the Company’s 2023 performance across multiple financial, operating, safety and strategic metrics. |

| • | Performance share units awarded in 2021 generated an above-target payout for our NEOs based upon the Company’s performance across the performance metrics of cumulative Distributable Cash Flow per share and Absolute Total Shareholder Return over the 2021-2023 period. |

| • | In 2023, our annual performance scorecard included ESG metrics, inclusive of safety, that represented 30% of the annual performance scorecard. |

During 2023, members of our Board and senior management engaged with shareholders holding more than 50% of our outstanding common stock, with the Company’s executive compensation program being a component of these engagements. We are committed to maintaining an open dialogue with our shareholders to ensure the successful evolution of our executive compensation program going forward.

CHENIERE ENERGY, INC. AMENDED AND RESTATED 2020 INCENTIVE PLAN

On April 2, 2024, the Board unanimously approved the Cheniere Energy, Inc. Amended and Restated 2020 Incentive Plan (the “A&R 2020 Plan”), subject to shareholder approval. The A&R 2020 Plan will be effective on May 23, 2024 (the “Effective Date”) if it is approved by our shareholders at the Meeting. The A&R 2020 Plan will apply only to awards granted on or after the Effective Date. The terms and conditions of awards granted under the Cheniere Energy, Inc. 2020 Incentive Plan (the “2020 Plan”) prior to the Effective Date will not be affected by the adoption or approval of the A&R 2020 Plan. If the A&R 2020 Plan is not approved by our shareholders at the Meeting, then the 2020 Plan will remain in effect on the terms in force prior to the Meeting with the A&R 2020 Plan not taking effect.

The A&R 2020 Plan incorporates several features designed to protect shareholder interests and promote current best practices, including:

| • | Minimum Vesting Requirements: Awards under the A&R 2020 Plan will be subject to a minimum vesting schedule of at least 12 months following the date of grant of the award; provided, however, that up to 5% of the shares underlying awards granted after the Effective Date may be subject to vesting schedules of less than 12 months. For purposes of this minimum vesting requirement, awards granted to non-employee directors in respect of regular annual fees will be deemed to satisfy the requirement, provided that such award vests no earlier than 50 weeks following the immediately preceding year’s annual meeting, and provided further that awards granted to non-employee directors in substitution for cash compensation otherwise due and payable to such non-employee director will not be subject to such requirement. |

| • | No Dividend Payments on Unvested Awards: The A&R 2020 Plan expressly prohibits the payment of dividends or dividend equivalents on any award before the date on which the award vests. |

| 2024 PROXY STATEMENT |

9 | |||

PROXY SUMMARY

| • | Director Grant Limit: With respect to each non-employee director, the aggregate dollar value of (a) any awards granted under the A&R 2020 Plan (based on the grant date fair value of such awards) with respect to the non-employee director’s service as a non-employee director during a single calendar year and (b) any cash or other compensation that is not equity-based and that is paid by the Company with respect to the non-employee director’s service as a non-employee director for such calendar year, shall not exceed $750,000. The Compensation Committee may make exceptions to this limit for non-employee directors, in its discretion, provided that the non-employee director receiving such additional compensation does not participate in the decision to award such compensation. |

| • | Clawbacks: Awards under the A&R 2020 Plan will be subject to the Cheniere Energy, Inc. Clawback Policy, the Cheniere Energy Partners, L.P. Clawback Policy, if applicable, any other clawback or recapture policy that the Company or an applicable affiliate may adopt from time to time, and any clawback or recapture provisions set forth in an award agreement. |

| • | No Evergreen: The A&R 2020 Plan does not contain any “evergreen” provisions. |

| • | No Discount or Repriced Options: The A&R 2020 Plan does not permit discounted stock options, or repricing options to reduce the exercise price without shareholder approval. |

See Proposal 4, beginning on page 81, for more details.

| 10 | CHENIERE |

|||

PROPOSAL 1 – ELECTION OF DIRECTORS

DIRECTORS AND NOMINEES

This year, there are 9 nominees standing for election as directors at the Meeting. Pursuant to an Investors’ and Registration Rights Agreement that was entered into by the Company, Cheniere Energy Partners GP, LLC, CQP Holdco LP (f/k/a Blackstone CQP Holdco LP) (“CQP Holdco”) and various other related parties in 2012, Mr. Peak was appointed to the Board to replace Mr. Runkle in April 2024. Below is a summary of our director nominees, including their committee memberships as of April , 2024. The Board, with assistance from the Governance and Nominating Committee, will evaluate and reassign committee memberships as needed following the Meeting and election of the director nominees. Detailed information about each nominee’s background, skills and expertise is provided below.

|

NOMINEE COMMITTEE MEMBERSHIPS | ||||||||||||

| NAME CURRENT POSITION |

AGE 2024) |

DIRECTOR SINCE |

INDEPENDENT | AUDIT | GOVERNANCE AND NOMINATING |

COMPENSATION | ||||||

| G. Andrea Botta Chairman of the Board, Cheniere Energy, Inc. President, Glenco LLC |

71 | 2010 | YES |

|

Chair |

| ||||||

| Jack A. Fusco President and Chief Executive Officer, Cheniere Energy, Inc. |

61 | 2016 | NO |

|

|

| ||||||

| Patricia K. Collawn Chairman and Chief Executive Officer, PNM Resources, Inc. |

65 | 2021 | YES | F |

|

● | ||||||

| Brian E. Edwards Senior Vice President, Caterpillar Inc. |

58 | 2022 | YES | ● |

|

● | ||||||

| Denise Gray(1) Chief Executive Officer, DKTN Consulting, LLC and Former Director External Affairs and Government Relations, North America, LG Energy Solution Michigan Inc. |

61 | 2023 | YES | ● |

|

● | ||||||

| Lorraine Mitchelmore Director, Suncor Energy Inc. and Bank of Montreal |

61 | 2021 | YES | ● | ● |

| ||||||

| Scott Peak Managing Partner, Co-President, and Head of North America, Brookfield Infrastructure |

43 | 2024 | NO |

|

|

| ||||||

| Donald F. Robillard, Jr. President, Robillard Consulting, LLC |

72 | 2014 | YES | Chair; F |

● |

| ||||||

| Neal A. Shear Senior Advisor and Chair of the Advisory Committee, Onyxpoint Global Management LP |

69 | 2014 | YES |

|

● | Chair | ||||||

F = Audit Committee Financial Expert

The Board has determined that Ms. Collawn and Mr. Robillard are each an “audit committee financial expert” as defined in Item 407(d)(5)(ii) of Regulation S-K promulgated by the Securities and Exchange Commission (“SEC”).

| 2024 PROXY STATEMENT |

11 | |||

PROPOSAL 1 – ELECTION OF DIRECTORS

Director Diversity and Core Competencies

Our director nominees represent a diverse mix of directors who complement each other to create a well-rounded boardroom, and each adds:

| • | A deep commitment to stewardship |

| • | A proven record of success |

| • | Unique and valuable insight |

Our director nominees also reflect a range of diversity characteristics, as shown below.

The table below summarizes certain of the key qualifications, skills and attributes of our director nominees. The lack of an indicator for a particular item does not mean that the director does not possess that qualification, skill or experience as we look to each director to be knowledgeable in these areas; rather, the indicator represents that the item is a core competency that contributed to his or her nomination to the Board. Our director nominees’ biographies describe each director’s background and relevant experience in more detail.

| DIRECTOR SKILLS, EXPERIENCE AND DEMOGRAPHIC MATRIX |

|

|

|

|

|

|

|

|

| |||||||||

| Key Skills and Experience |

||||||||||||||||||

| Corporate Finance: Has an understanding of finance and financial reporting processes |

|

|

|

|

|

| ||||||||||||

| Energy Industry Experience: Contributes valuable perspective on broader trends and issues specific to our operations in the energy industry |

|

|

|

|

|

|

|

|

| |||||||||

| Executive Leadership: Has a demonstrated record of leadership and valuable perspectives relating to the management and oversight of large and complex organizations |

|

|

|

|

|

|

|

|

| |||||||||

| Governance: Contributes to the Board’s understanding of best practices in corporate governance matters |

|

|

|

|

|

|

| |||||||||||

| 12 | CHENIERE |

|||

DIRECTORS AND NOMINEES

| DIRECTOR SKILLS, EXPERIENCE AND DEMOGRAPHIC MATRIX |

|

|

|

|

|

|

|

|

| |||||||||

| Government / Regulatory: Has an understanding of the role governmental and regulatory actions and decisions may have on our business and contributes to the Board’s ability to navigate complex regulatory and governmental dynamics |

|

|

|

|

|

|

| |||||||||||

| HSE/Sustainability: Strengthens the Board’s oversight and understanding of the interrelationship among environmental and safety matters or sustainability, and our operational activities and strategy |

|

|

|

|

|

|

||||||||||||

| Human Capital Management: Has an understanding of human resources and best practices to enhance the attraction, motivation, and retention of a talented workforce |

|

|

|

|

|

| ||||||||||||

| International Experience: Provides valuable insights into the international aspects of our business and operations |

|

|

|

|

|

|

|

| ||||||||||

| Operations: Provides operational knowledge to aid in managing risks inherent in our business |

|

|

|

|

|

|

| |||||||||||

| Public Company Director: Serves or has served on other public company boards |

|

|

|

|

|

|

|

| ||||||||||

| Risk Oversight / Crisis Management: Has an understanding of, and experience with, the risk oversight necessary for organizational performance and security |

|

|

|

|

|

|

|

|

| |||||||||

| Trading Financial Commodities: Has knowledge of domestic and global energy commodities markets and trading of financial commodities |

|

|

|

| ||||||||||||||

| Age (as of May 23, 2024) |

71 | 61 | 65 | 58 | 61 | 61 | 43 | 72 | 69 | |||||||||

| Gender Identity |

M | M | F | M | F | F | M | M | M | |||||||||

| Racial / Ethnic Diversity |

● | ● | ||||||||||||||||

There are 9 nominees standing for election as directors at the Meeting. Each nominee, if elected, will hold office for a one-year term expiring at the 2025 Annual Meeting of Shareholders and will serve until his or her successor is duly elected and qualified or until his or her earlier death, resignation or removal. Each of the director nominees has consented to serve as a director if elected or re-elected.

Each of the director nominees currently serves on the Board. Directors are elected annually by a majority of votes cast (in uncontested elections) with respect to such director nominee. Unless your proxy specifies otherwise, it is intended that the shares represented by your proxy will be voted for the election of these 9 nominees. If you are a beneficial owner, your bank, broker or other holder of record is not permitted to vote your shares on Proposal 1 to elect directors if the bank, broker or other holder of record does not receive specific voting instructions from you. The Board is unaware of any circumstances likely to render any nominee unavailable.

|

|

The Board unanimously recommends a vote FOR the election of the 9 nominees as directors of the Company to hold office for a one-year term expiring at the 2025 Annual Meeting of Shareholders or until their successors are duly elected and qualified. | |

| 2024 PROXY STATEMENT |

13 | |||

PROPOSAL 1 – ELECTION OF DIRECTORS

DIRECTOR NOMINATIONS AND QUALIFICATIONS

Director Nomination Policy and Procedures. Our Director Nomination Policy and Procedures is attached to the Governance and Nominating Committee’s written charter as Exhibit A, which is available on our website at www.cheniere.com. The Governance and Nominating Committee may consider suggestions for potential director nominees to the Board from any source, including current members of the Board and our management, advisors and shareholders, and will review and consider any such candidates submitted by a shareholder or shareholder group in the same manner as all other candidates. The Governance and Nominating Committee evaluates potential nominees by reviewing their qualifications and any other information deemed relevant. Director nominees are recommended to the Board by the Governance and Nominating Committee.

The full Board will select and recommend candidates for nomination as directors for shareholders to consider and vote upon at the annual shareholders’ meeting.

Qualifications for consideration as a director nominee vary according to the particular areas of expertise being sought as a complement to the existing Board composition. However, minimum criteria for selection of members to serve on our Board include the following:

| • | highest professional and personal ethical standards and integrity; |

| • | high level of education and/or business experience; |

| • | broad-based business acumen; |

| • | commitment to understand the Company’s business and industry; |

| • | sufficient time to effectively carry out their duties; |

| • | strategic thinking and willingness to share ideas; |

| • | loyalty and commitment to driving the success of the Company; |

| • | network of business and industry contacts; and |

| • | diversity of experiences, expertise, backgrounds and other demographics among members of the Board. |

Practices for Considering Diversity. The minimum criteria for selection of members to serve on our Board are designed to ensure that the Governance and Nominating Committee selects director nominees taking into consideration that the Board will benefit from having directors that represent a diversity of experience and backgrounds. Director nominees are selected so that the Board represents a diversity of experience in areas needed to foster the Company’s business success, including experience in the energy industry, finance, consulting, international affairs, public service, governance, regulatory compliance and ESG. Each year the Board and each committee participates in a self-assessment or evaluation of the effectiveness of the Board and its committees. These evaluations assess the diversity of talents, expertise and occupational and personal backgrounds and attributes (such as gender, ethnicity and age) of the Board members. Over 40% of our director nominees are diverse based on gender or ethnicity.

Shareholder Nominations for Director (other than Proxy Access). A shareholder of the Company may nominate a candidate or candidates for election to the Board at an annual meeting of shareholders if such shareholder (1) was a shareholder of record at the time the notice provided for below is delivered to the Corporate Secretary, (2) is entitled to vote at the meeting of shareholders called for the election of directors and is entitled to vote upon such election and (3) complies with the notice procedures and other requirements set forth in our Bylaws, as amended (the “Bylaws”). Nominations made by a shareholder must be made by giving timely notice in writing to the Corporate Secretary of the Company at the following address: Corporate Secretary, Cheniere Energy, Inc., 845 Texas Avenue, Suite 1250, Houston, Texas 77002. To be timely, a shareholder’s notice must be delivered not later than the close of business on the 90th day, nor earlier than the close of business on the 120th day, prior to the first anniversary of the preceding year’s annual meeting. A shareholder’s notice must include information about the shareholder and the nominee, as required by our Bylaws, which are available on our website at www.cheniere.com.

Director Nominations for Inclusion in Proxy Statement (Proxy Access). As set forth in our Bylaws, a shareholder, or group of up to 20 shareholders, continuously owning at least 3% of the Company’s common stock for at least the prior three consecutive years (and meeting the other requirements set forth in our Bylaws) may nominate for election to our Board and inclusion in our proxy statement for our annual meeting of shareholders up to 20% of the number of directors then serving on our Board.

The notice must include all information required by our Bylaws. In addition to complying with the other requirements set forth in our Bylaws, an eligible shareholder must provide timely notice in writing to the Corporate Secretary of the Company at the following

| 14 | CHENIERE |

|||

DIRECTOR NOMINATIONS AND QUALIFICATIONS

address: Corporate Secretary, Cheniere Energy, Inc., 845 Texas Avenue, Suite 1250, Houston, Texas 77002. To be timely for purposes of proxy access, a shareholder’s notice must be delivered not later than the close of business on the 120th day, nor earlier than the 150th day, prior to the first anniversary of the date that the Company first mailed its proxy statement to shareholders for the prior year’s annual meeting of shareholders. However, if (and only if) the annual meeting is not scheduled to be held within a period that commences 30 days before such anniversary date and ends 30 days after such anniversary date (an annual meeting date outside such period being referred to herein as an “Other Meeting Date”), notice must be given in the manner provided in our Bylaws by the later of the close of business on the date that is 180 days prior to such Other Meeting Date and the 10th day following the date on which public announcement of such Other Meeting Date is first made.

Director Qualifications. The Board has concluded that, in light of our business and structure, each of our director nominees possesses relevant experience, qualifications, attributes and skills and, as of the date of this Proxy Statement, is qualified to and should serve on our Board. The primary qualifications of our directors are further discussed under “Director Biographies” below.

Director Retirement Policy. The Board maintains a mandatory director retirement policy that requires each director who has attained the age of 75 to retire from the Board at the annual meeting of shareholders of the Company held in the year in which his or her current term expires, unless the Board determines such mandate for a particular director is not at the time in the best interests of the Company. Additionally, in order to encourage Board refreshment, the Board revised the director retirement policy in 2020 to provide that directors who have reached 15 years of service on the Board will also not be eligible for re-nomination to the Board at the annual meeting of shareholders of the Company in the year at which such director’s current term expires, subject to Board discretion. The Board believes this policy helps to ensure a healthy rotation of directors, which promotes the continued influx of new ideas and perspectives to the Board.

Recent Board Refreshment. As a result of our focus on Board refreshment and pursuant to our director retirement policy, in 2022 one of our long-serving directors, Mr. David B. Kilpatrick, retired, and Mr. Edwards joined the Board. In addition, Ms. Gray was nominated to join the Board in 2023 as a result of another long-serving director, Ms. Vicky Bailey, not standing for re-election at the 2023 Annual Meeting of Shareholders (the “2023 Annual Meeting”). Pursuant to an Investors’ and Registration Rights Agreement that was entered into by the Company, Cheniere Energy Partners GP, LLC, CQP Holdco and various other related parties in 2012, Mr. Peak was appointed to the Board to replace Mr. Runkle in April 2024. In addition to the minimum criteria described above, the Governance and Nominating Committee evaluated the skill sets needed to maximize Board effectiveness and support the strategic direction of the Company. Of our nine director nominees, three have served on the Board for approximately ten years or more and five have been on our Board for less than five years. We believe this achieves the right balance between new directors who bring new ideas and insights and longer-serving directors with deep institutional knowledge of our Board and our Company.

| 2024 PROXY STATEMENT |

15 | |||

PROPOSAL 1 – ELECTION OF DIRECTORS

DIRECTOR BIOGRAPHIES

| JACK A. FUSCO

PRESIDENT & CEO |

AGE: 61

DIRECTOR SINCE: 2016

|

| ||||

Jack A. Fusco is a director and the President and Chief Executive Officer of Cheniere. Mr. Fusco has served as President and Chief Executive Officer since May 2016 and as a director since June 2016. In addition, Mr. Fusco serves as Chairman, President and Chief Executive Officer of Cheniere Energy Partners GP, LLC (“Cheniere Partners GP”), a wholly-owned subsidiary of Cheniere and the general partner of Cheniere Partners. Mr. Fusco served as Chairman, President and Chief Executive Officer of Cheniere Energy Partners LP Holdings, LLC (“Cheniere Holdings”) from June 2016 to September 2018. Mr. Fusco is also President and Chief Executive Officer of the general partner of Sabine Pass LNG, L.P. and Chief Executive Officer of Sabine Pass Liquefaction, LLC. Mr. Fusco received recognition as Best CEO in the electric industry by Institutional Investor in 2012 as ranked by all industry analysts and for Best Investor Relations by a CEO or Chairman among all mid-cap companies by IR Magazine in 2013. Institutional Investor again recognized Mr. Fusco for the 2020 and 2023 All-American Executive Team Best CEO in the natural gas industry.

Mr. Fusco served as Chief Executive Officer of Calpine Corporation (“Calpine”) from August 2008 to May 2014 and as Executive Chairman of Calpine from May 2014 through May 11, 2016. Mr. Fusco served as a member of the board of directors of Calpine from August 2008 until March 2018, when the sale of Calpine to an affiliate of Energy Capital Partners and a consortium of other investors was completed. Mr. Fusco was recruited by Calpine’s key shareholders in 2008, just as that company was emerging from bankruptcy. Calpine grew to become America’s largest generator of electricity from natural gas, safely and reliably meeting the needs of an economy that demands cleaner, more fuel-efficient and dependable sources of electricity. As Chief Executive Officer of Calpine, Mr. Fusco

managed a team of approximately 2,300 employees and led one of the largest purchasers of natural gas in America, a successful developer of new gas-fired power generation facilities and a company that prudently managed the inherent commodity trading and balance sheet risks associated with being a merchant power producer.

Mr. Fusco’s career of over 40 years in the energy industry began with his employment at Pacific Gas & Electric Company upon graduation from California State University, Sacramento with a Bachelor of Science in Mechanical Engineering in 1984. He joined Goldman Sachs 13 years later as a Vice President with responsibility for commodity trading and marketing of wholesale electricity, a role that led to the creation of Orion Power Holdings, an independent power producer that Mr. Fusco helped found with backing from Goldman Sachs, where he served as President and Chief Executive Officer from 1998-2002. In 2004, he was asked to serve as Chairman and Chief Executive Officer of Texas Genco LLC by a group of private institutional investors, and successfully managed the transition of that business from a subsidiary of a regulated utility to a strong and profitable independent company, generating a more than 5-fold return for shareholders upon its merger with NRG in 2006. Mr. Fusco is currently on the board of directors of the American-Italian Cancer Foundation, a non-profit organization supporting cancer research and education.

Skills and Qualifications:

Mr. Fusco brings his prior experience leading successful energy industry companies and his perspective as President and Chief Executive Officer of Cheniere.

| 16 | CHENIERE |

|||

DIRECTOR BIOGRAPHIES

| G. ANDREA BOTTA

CHAIRMAN OF THE BOARD AND CHAIRMAN OF |

AGE: 71

DIRECTOR SINCE: 2010

|

| ||||

G. Andrea Botta is the Chairman of the Board and Chairman of our Governance and Nominating Committee. Mr. Botta has served as President of Glenco LLC (“Glenco”), a private investment company since February 2006. Prior to joining Glenco, Mr. Botta served as Managing Director of Morgan Stanley from 1999 to February 2006. Before joining Morgan Stanley, he was President of EXOR America, Inc. (formerly IFINT-USA, Inc.) from 1993 until September 1999 and for more than five years prior thereto, Vice President of Acquisitions of IFINT-USA, Inc. From March 2008 until February 2018, Mr. Botta

served on the board of directors of Graphic Packaging Holding Company. Mr. Botta earned a degree in Economics and Business Administration from the University of Torino in 1976.

Skills and Qualifications:

Mr. Botta brings a unique international perspective to our Board and significant investing expertise. He has over 30 years of investing experience primarily in private equity investing.

| PATRICIA K. COLLAWN

MEMBER OF AUDIT COMMITTEE AND |

AGE: 65

DIRECTOR SINCE: 2021

|

| ||||

Ms. Collawn is a member of our Audit Committee and Compensation Committee. Ms. Collawn is the Chairman and Chief Executive Officer of PNM Resources, Inc., a publicly-traded energy holding company based in New Mexico, becoming Chairman in 2012 and CEO in 2010. From 2010 to May 2022, Ms. Collawn also served as President of PNM Resources. Ms. Collawn joined PNM Resources in 2007 as President, Utilities, prior to her promotion to President and Chief Operating Officer in 2008. From 2005 to 2007, Ms. Collawn served as President and Chief Executive Officer of Public Service Company of Colorado, an operating utility that is a subsidiary of Xcel Energy, Inc. Ms. Collawn previously served on the board of directors of Equitrans Midstream Corporation, a publicly traded natural gas midstream company, from April 2020 to April 2023, EVgo Services, LLC, a publicly traded builder, owner and operator of DC fast charging for electric vehicles in the U.S., from July 2021 to March 2022, and CTS Corporation, a publicly traded designer and manufacturer of sensors, actuators and electronic components for various industries, from 2003 to May 2021. Ms. Collawn also previously

served as Chairman of the Electric Power Research Institute, an independent, non-profit center for public interest energy and environmental research, including sustainability and carbon reduction matters, and Chairman of the Edison Electric Institute, a national association of investor-owned electric companies. Ms. Collawn received a B.A. from Drake University and an M.B.A. from Harvard Business School.

Skills and Qualifications:

As a senior executive in the power utilities sector for more than 25 years, Ms. Collawn has an in-depth understanding of the complex regulatory structure of the utility industry, as well as substantial operations experience. Along with her executive leadership experience and commercial and operational expertise, Ms. Collawn brings a focus on corporate governance, cybersecurity and environmental and sustainability matters to our Board.

| 2024 PROXY STATEMENT |

17 | |||

PROPOSAL 1 – ELECTION OF DIRECTORS

| BRIAN E. EDWARDS

MEMBER OF AUDIT COMMITTEE AND COMPENSATION COMMITTEE |

AGE: 58

DIRECTOR SINCE: 2022

|

|

Mr. Edwards is a member of our Audit Committee and Compensation Committee. Mr. Edwards has served as a Senior Vice President of Caterpillar Inc., a construction equipment manufacturer, since January 2021, with responsibility for the Caterpillar Remanufacturing Division, which offers high-quality, lower-cost replacement parts remanufactured from genuine Caterpillar components. Mr. Edwards joined Caterpillar in 2010 as Vice President of Sales and Marketing at the company’s wholly owned subsidiary, Progress Rail. He continued rising in the leadership ranks at Progress Rail, serving in many roles, including Executive Vice President of rolling stock. Prior to joining Caterpillar, Mr. Edwards spent more than 20 years gaining expertise in manufacturing, engineering and supply chain roles at GE and General Motors. Mr. Edwards holds a bachelor’s degree in Chemical

Engineering from Youngstown State University and a master’s degree in Manufacturing Management from GMI Engineering & Management Institute (now Kettering University). Mr. Edwards completed the Caterpillar “Digging Deep” executive development program through Stanford University. Mr. Edwards is affiliated with United Way, March of Dimes and Big Brothers Big Sisters of America.

Skills and Qualifications:

Mr. Edwards provides a differentiated and meaningful perspective to the Board through his deep knowledge of industrial manufacturing, engineering and supply chain, as well as his decades of leadership within large organizations.

| DENISE GRAY

MEMBER OF AUDIT COMMITTEE AND COMPENSATION COMMITTEE |

AGE: 61

DIRECTOR SINCE: 2023

|

|

Ms. Gray has served as the Chief Executive Officer of DKTN Consulting LLC, a global automotive systems and energy storage advisory firm, since May 2023, and previously served as Director External Affairs and Government Relations, North America for LG Energy Solution Michigan Inc., the North American subsidiary of LG Energy Solution Ltd, a manufacturer of large lithium-ion battery cells and packs for electric vehicles and other energy storage applications, from March 2022 until her retirement in May 2023. Ms. Gray previously served as CEO/President and Board Member of LG Chem Power Inc./LG Chem Michigan Inc./LG Energy Solution Michigan Inc. from September 2015 to March 2022. In that position, her team provided battery solutions for automotive and non-automotive applications. Ms. Gray served on the board of directors for Tenneco from March 2019 to November 2022; has served on the board of directors of Canadian National Railway since April 2021 and the Board on Energy and Environmental Systems since January 2020, and on the Advisory Boards of the Joint Office of Energy and Transportation Electric Vehicle Working Group since August 2023 and the United States

Secretary of Energy since October 2021; and as Member of The National Academy of Engineering since February 2022. Ms. Gray previously held automotive leadership positions with AVL List GmbH in Graz, Austria from 2013 to 2015 and Atieva, Inc. in Redwood City, California from 2010 to 2013. The vast majority of Ms. Gray’s 35+ year professional career was with General Motors from 1986 to 2010, where she spearheaded efforts in vehicle electrical, powertrain system controls, and software, including battery systems. Ms. Gray holds a B.S. in Electrical Engineering from Kettering University and a M.S. in Engineering Management of Technology from Rensselaer Polytechnic Institute.

Skills and Qualifications:

Ms. Gray has extensive experience in the automotive industry, including leadership roles of companies at the forefront of battery technology, bringing insights into energy transition issues and engineering expertise to our Board.

| 18 | CHENIERE |

|||

DIRECTOR BIOGRAPHIES

|

LORRAINE MITCHELMORE

MEMBER OF AUDIT COMMITTEE AND GOVERNANCE AND NOMINATING COMMITTEE |

AGE: 61

DIRECTOR SINCE: 2021

|

| ||||

Ms. Mitchelmore is a member of our Audit Committee and Governance and Nominating Committee. Ms. Mitchelmore was recently the President and Chief Executive Officer of Enlighten Innovations Inc., a Calgary based clean technology company, from May 2017 to September 2018. Prior to that, she was President and Canada Country Chair of Shell Canada Limited and Executive Vice President, Americas Heavy Oil for Royal Dutch Shell. She has more than 30 years of international oil and gas industry experience. Throughout her career, she has served with increasing responsibility in operational, strategy, and commercial roles. Prior to joining Shell in 2002, she worked with BHP Petroleum, Chevron, and Petro-Canada.

Ms. Mitchelmore has served as a director of the Bank of Montreal, a diversified financial services provider, since May 2015, where she currently serves as Chair of the Human Resources Committee, and Suncor Energy Inc., a premier integrated energy company, since November 2019, where she currently serves as Chair of the Environment, Health, Safety and Sustainable Development Committee. She has also served on the Board of Directors of the Alberta Investment Management Corporation (AIMCo) since January 2022. Ms. Mitchelmore previously served on the Board of Advisers of Catalyst Canada from 2018 to 2023 and the board of directors of TransMountain Corporation from November 2018 to December 2019.

Ms. Mitchelmore was an associate of the Creative Destruction Lab from 2018 to 2023 where she was a mentor to many early-stage energy transition companies. She is co-founder and

co-chair of the Smart Prosperity Initiative, an organization focused on harnessing new thinking to accelerate Canada’s transition to a stronger, cleaner economy. From 2017 to 2018, she chaired the Resources of the Future Economic Strategy table for the Canadian federal government. She has been named a fellow of the Canadian Academy of Engineering, awarded the Catalyst Canada Champion Honors Award in 2014, recognizing commitment to Diversity and Inclusion, and was a recipient of Canada’s 2016 Clean16 award for leadership in advancing sustainable development in Canada.

Ms. Mitchelmore holds a BSc in Geophysics from Memorial University of Newfoundland, an MSc in Geophysics from the University of Melbourne, Australia and an MBA from Kingston Business School in London, England.

Skills and Qualifications:

Ms. Mitchelmore has over 30 years of international oil and gas industry experience, as well as significant executive, operational, strategy and commercial experience. Ms. Mitchelmore also brings meaningful experience with energy transition issues and sustainable development to our Board.

|

SCOTT PEAK

DIRECTOR |

AGE: 43

DIRECTOR SINCE: 2024

|

| ||||

Mr. Peak is a Managing Partner, Co-President, and Head of North America for Brookfield’s Infrastructure Group. In this role, he is responsible for regional oversight and investment strategy leadership and is involved in the screening and evaluation of global investment initiatives. Mr. Peak previously served as Chief Investment Officer for North America for Brookfield’s Infrastructure Group. Prior to joining Brookfield in January 2016, Mr. Peak spent a decade at Macquarie Group Ltd., where he focused on the infrastructure sector. Previously, Mr. Peak worked in the mergers and acquisitions group at Dresdner Kleinwort Wasserstein. Mr. Peak previously served as a director of the Company from April 2022 to April 2023 and the general partner of Cheniere Partners from September 2020 to April 2022 and April 2023 to April 2024. Mr. Peak holds a Master of Finance with distinction from INSEAD and a B.A. in Economics from Bates College.

Skills and Qualifications:

Mr. Peak brings energy infrastructure industry expertise and a unique financial perspective to our Board based on his extensive investment experience with Brookfield Infrastructure. Mr. Peak’s appointment to the Board of Cheniere was made pursuant to an Investors’ and Registration Rights Agreement that was entered into by the Company, Cheniere Energy Partners GP, LLC, CQP Holdco and various other related parties in connection with CQP Holdco’s purchase of Class B units in Cheniere Partners.

| 2024 PROXY STATEMENT |

19 | |||

PROPOSAL 1 – ELECTION OF DIRECTORS

| DONALD F. ROBILLARD, JR.

CHAIRMAN OF AUDIT COMMITTEE AND MEMBER OF GOVERNANCE AND NOMINATING COMMITTEE |

AGE: 72

DIRECTOR SINCE: 2014

|

| ||||

Donald F. Robillard, Jr. is the Chairman of our Audit Committee and a member of our Governance and Nominating Committee. Mr. Robillard served as a director and the Executive Vice President, Chief Financial Officer and Chief Risk Officer of Hunt Consolidated, Inc. (“Hunt”), a private holding company with interests in oil and gas exploration and production, refining, real estate development, private equity investments and ranching, from July 2015 until his retirement on January 31, 2017. Mr. Robillard began his association with Hunt in 1983 as Manager of International Accounting for Hunt Oil Company, Inc., a wholly-owned subsidiary of Hunt. Serving nine of his 34 years of service to the Hunt organization in Yemen in various accounting, finance and management positions, Mr. Robillard returned to the United States to join Hunt’s executive team in 1992. Mr. Robillard was named Senior Vice President and Chief Financial Officer of Hunt in April 2007. Mr. Robillard also served, from February 2016 through August of 2017, as Chief Executive Officer and Chairman of ES Xplore, LLC, a direct hydrocarbon indicator technology company which in 2016 was spun out of Hunt. He is currently President of Robillard

Consulting, LLC, an oil and gas advisory firm. Mr. Robillard is currently on the board of directors of Helmerich & Payne, Inc., a publicly-traded oil and gas drilling company. He is a Certified Public Accountant, a member of the American Institute of Certified Public Accountants, the Texas Society of Certified Public Accountants, the National Association of Corporate Directors (NACD Directorship Certified), Financial Executives International and an advisory board member of the Institute for Excellence in Corporate Governance at the Naveen Jindal School of Management at the University of Texas at Dallas. Mr. Robillard received a B.B.A. from the University of Texas, Austin.

Skills and Qualifications:

Mr. Robillard has over 40 years of experience in the oil and gas industry and over 25 years of senior management experience. Mr. Robillard brings significant executive-level experience in the oil and gas industry, including experience with project financing for LNG facilities.

| NEAL A. SHEAR

CHAIRMAN OF COMPENSATION COMMITTEE AND MEMBER OF GOVERNANCE AND NOMINATING COMMITTEE |

AGE: 69

DIRECTOR SINCE: 2014

|

| ||||

Neal A. Shear is the Chairman of our Compensation Committee and a member of our Governance and Nominating Committee. Since June 2017, Mr. Shear has served as Senior Advisor and Chair of the Advisory Committee of Onyxpoint Global Management LP, an alternative asset management firm. Mr. Shear served as Interim Special Advisor to the Chief Executive Officer of Cheniere from May 2016 to November 2016 and as Interim Chief Executive Officer and President of Cheniere from December 2015 to May 2016. Mr. Shear was the Chief Executive Officer of Higgs Capital Management, a commodity focused hedge fund from January 2012 until September 2014. Prior to Higgs Capital Management, Mr. Shear served as Global Head of Securities at UBS Investment Bank from January 2010 to March of 2011. Previously, Mr. Shear was a Partner at Apollo Global Management, LLC, where he served as the Head of the Commodities Division. Prior to Apollo Global Management, Mr. Shear spent 26 years at Morgan Stanley serving in various roles including Head of the Commodities Division, Global Head of Fixed Income, Co-Head of Institutional Sales and Trading, and Chair of the Commodities Business. Mr. Shear has served as a director and

limited partner of ESG Energy Holdings LLC, a company formed to buy refining and other assets for the purpose of improving their environmental footprint in the production of energy-related products, since February 2022; as an Advisor to WasteFuel, a waste to fuels company that converts municipal waste into biofuel, since March 2022; as a director of Galileo Technologies S.A., a global provider of modular technologies for compressed natural gas and LNG production and transportation, since February 2017; and as a director of Narl Refining Inc., the refining arm of North Atlantic Holdings St John’s Newfoundland, since November 2014. Mr. Shear received a B.S. from the University of Maryland, Robert H. Smith School of Business Management in 1976 and an M.B.A. from Cornell University, Johnson School of Business in 1978.

Skills and Qualifications:

Mr. Shear brings a unique financial and trading perspective to our Board based on his more than 30 years of experience managing commodity activity and investments

| 20 | CHENIERE |

|||

GOVERNANCE INFORMATION

BOARD COMMITTEE MEMBERSHIP AND MEETING ATTENDANCE

The following table shows our current directors and director nominees’ fiscal year 2023 membership and chairpersons of our Board committees, Board and committee meetings held and attendance as a percentage of meetings eligible to attend. The current Chair of the Board and each committee is indicated in the table.

| NUMBER OF MEETINGS HELD |

BOTTA | FUSCO | COLLAWN | EDWARDS | GRAY | MITCHELMORE | PEAK | ROBILLARD | SHEAR | |||||||||||

| Board |

11 | 100% Chair |

100% | 91% | 100% | 100% | 100% | 100% | 100% | 91% | ||||||||||

| Audit Committee |

8 | — | — | 87.5% | 100% | 100% | 100% | — | 100% Chair |

— | ||||||||||