CHENIERE ENERGY, INC. 2022 PROXY STATEMENT

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to §240.14a-11(c) or §240.14a-12 | |

Cheniere Energy, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

| ☐ | Fee paid previously with preliminary materials. | |||

CHENIERE ENERGY, INC. 2022 PROXY STATEMENT

April 8, 2022

To our Shareholders:

It is our pleasure to invite you to attend the Cheniere Energy, Inc. 2022 Annual Meeting of Shareholders (the “Meeting”). The Meeting will be held at 9:00 a.m. Central Time, on May 12, 2022 at our corporate headquarters located at 700 Milam Street, Suite 1900, Houston, Texas 77002. As part of our precautions regarding COVID-19, we are planning for the possibility that the Meeting may be held solely by means of remote communication. If we take this step, we will announce the decision to do so in advance as promptly as practicable, and details on how to participate will be included in a press release available at www.cheniere.com/2022AnnualMeeting and filed with the Securities and Exchange Commission as additional proxy materials. If you are planning to participate in the Meeting, please check the Company’s website prior to the meeting date.

The following Notice of Annual Meeting describes the business to be conducted at the Meeting. We encourage you to review the materials and vote your shares.

You may vote via the Internet, by telephone, or by submitting your completed proxy card by mail. If you attend the Meeting, you may vote your shares in person if you are a shareholder of record.

Thank you for your continued support as investors in Cheniere Energy, Inc.

Very truly yours,

|

| |||

| G. Andrea Botta | Jack A. Fusco | |||

| Chairman of the Board |

President and Chief Executive Officer | |||

CHENIERE ENERGY, INC.

700 Milam Street, Suite 1900

Houston, Texas 77002

(713) 375-5000

|

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

|

||||||

| TIME AND DATE:

|

9:00 a.m., Central Time on May 12, 2022

|

|||||

| PLACE: | Cheniere Energy, Inc. 700 Milam Street, Suite 1900 Houston, TX 77002*

|

|||||

| ITEMS OF BUSINESS: | • To elect ten members of the Board of Directors named in this proxy statement to hold office for a one-year term expiring at the 2023 Annual Meeting of Shareholders.

• To approve, on an advisory and non-binding basis, the compensation of the Company’s named executive officers for 2021.

• To ratify the appointment of KPMG LLP as the Company’s independent registered public accounting firm for 2022.

• To transact such other business as may properly come before the Meeting and any adjournment or postponement thereof.

|

|||||

| RECORD DATE:

|

You can vote if you were a shareholder of record as of the close of business on March 28, 2022.

|

|||||

| PROXY VOTING: |

It is important that your shares be represented and voted at the Meeting. You can vote your shares by completing and mailing the enclosed proxy card or by voting on the Internet or by telephone. See details under the heading “How do I vote?”

|

|||||

| ELECTRONIC AVAILABILITY OF PROXY MATERIALS:

|

We are making this Proxy Statement, including the Notice of Annual Meeting and 2021 Annual Report on Form 10-K for the year ended December 31, 2021, available on our website at: www.cheniere.com/2022AnnualMeeting.

|

|||||

By order of the Board of Directors

Sean N. Markowitz

Corporate Secretary

April 8, 2022

| * | As part of our precautions regarding COVID-19, we are planning for the possibility that the Meeting may be held solely by means of remote communication. If we take this step, we will announce the decision to do so in advance as promptly as practicable, and details on how to participate will be included in a press release available at www.cheniere.com/2022AnnualMeeting and filed with the Securities and Exchange Commission as additional proxy materials. It is important that you retain a copy of the control number found on your proxy card, as such number will be required in order for shareholders to gain access to any meeting held solely by means of remote communication. |

|

|

|

1

|

| |

| PROPOSAL 1 – ELECTION OF DIRECTORS

|

|

9

|

| |

| 9 | ||||

| 11 | ||||

| 13 | ||||

|

|

|

19

|

| |

| 19 | ||||

| 19 | ||||

| 20 | ||||

| 21 | ||||

| 22 | ||||

| 26 | ||||

| 29 | ||||

| CODE OF BUSINESS CONDUCT AND ETHICS AND CORPORATE GOVERNANCE GUIDELINES |

30 | |||

| 30 | ||||

| 30 | ||||

| 30 | ||||

|

|

|

33

|

| |

| EQUITY COMPENSATION PLAN INFORMATION

|

|

35

|

| |

|

|

|

36

|

| |

| COMPENSATION DISCUSSION AND ANALYSIS

|

|

38

|

| |

| 38 | ||||

| 41 | ||||

| 42 | ||||

| 43 | ||||

| 53 | ||||

| 57 | ||||

| 58 | ||||

|

|

|

70

|

| |

|

|

|

71

|

| |

|

|

|

72

|

| |

| PROPOSAL 3 – RATIFICATION OF KPMG LLP AS INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR 2022

|

|

73

|

| |

|

|

|

76

|

| |

|

|

|

80

|

| |

| 80 | ||||

| 80 | ||||

| 81 | ||||

| 81 | ||||

| 81 | ||||

| APPENDIX A: Definition of Cumulative Distributable Cash Flow Per Share and Absolute Total Shareholder Return for 2021 LTI Awards

|

|

A-1

|

| |

| APPENDIX B: Definition of Cumulative Distributable Cash Flow Per Share and Absolute Total Shareholder Return for 2022 LTI Awards

|

|

B-1

|

| |

| APPENDIX C: Definition and Reconciliation of Non-GAAP Measures

|

|

C-1

|

| |

Note Regarding Forward-Looking Statements

This Proxy Statement contains forward-looking statements relating to, among other things, business strategy, performance and expectations for project development, as well as our goals in relation to environmental and social matters. The reader is cautioned not to place undue reliance on these statements and should review the sections captioned “Cautionary Statement Regarding Forward-Looking Statements” and “Risk Factors” in our Annual Report on Form 10-K for important information about these statements, including the risks, uncertainties and other factors that could cause actual results to vary materially from the assumptions, expectations and projections expressed in any forward-looking statements. These forward-looking statements speak only as of the date made, and, other than as required by law, we undertake no obligation to update or revise any forward-looking statement, whether as a result of new information, future events or developments or otherwise.

The following is an overview of information that you will find throughout this Proxy Statement in connection with the 2022 Annual Meeting of Shareholders (the “Meeting”) of Cheniere Energy, Inc. (“Cheniere” or the “Company”). This summary does not contain all of the information that you should consider. For more complete information about these topics, please review the complete Proxy Statement prior to voting. For more complete information about our 2021 performance, please review our Annual Report on Form 10-K for the year ended December 31, 2021, available on our website at www.cheniere.com/2022AnnualMeeting. The Notice of Annual Meeting (“Notice”), Proxy Statement, proxy card and 2021 Annual Report on Form 10-K for the year ended December 31, 2021, are being mailed to shareholders on or about April 8, 2022.

|

|

ANNUAL MEETING OF SHAREHOLDERS

|

|||||||

|

|

TIME AND DATE:

|

9:00 a.m., Central Time on May 12, 2022

|

| |||||

|

PLACE: | Cheniere Energy, Inc. 700 Milam Street, Suite 1900 Houston, TX 77002 |

||||||

|

RECORD DATE:

|

The close of business on March 28, 2022 (the “Record Date”)

|

||||||

|

VOTING: | Shareholders as of the close of business on the Record Date are entitled to vote. Each share of common stock is entitled to one vote for each matter to be voted upon. |

||||||

|

ADMISSION: | No admission card is required to enter the Meeting, but you will need proof of your stock ownership and valid government-issued picture identification. Please see “Frequently Asked Questions” on page 76 of this Proxy Statement for more information.

|

||||||

VOTING MATTERS AND BOARD RECOMMENDATIONS

| PROPOSAL

|

DESCRIPTION

|

BOARD VOTE RECOMMENDATION

|

PAGE REFERENCE (FOR MORE DETAILS)

| |||

| 1 |

Election of directors | FOR EACH NOMINEE | 9 | |||

| 2 |

Advisory and non-binding vote on the compensation of the Company’s named executive officers for 2021 |

FOR |

71 | |||

| 3 |

Ratification of appointment of KPMG LLP as the Company’s independent registered public accounting firm for 2022 |

FOR |

73 | |||

| 2022 PROXY STATEMENT |

1 | |||

PROXY SUMMARY

2021 PERFORMANCE AND

STRATEGIC ACCOMPLISHMENTS

The following items highlight our 2021 and recent accomplishments. For more information about these accomplishments and their relationship to our executive compensation program, please see “Compensation Discussion and Analysis” on page 38 of this Proxy Statement.

| EXCEEDED GUIDANCE & ACHIEVED MEANINGFUL CASH-FLOW INFLECTION POINT

Exceeded high end of initial Full Year 2021 Guidance

Record Revenues of ~$15.9 billion |

ANNOUNCED LONG-TERM COMPREHENSIVE CAPITAL ALLOCATION PLAN

Strengthen balance sheet in support of achieving investment grade metrics

Repaid $1.2 billion of indebtedness

Fund financially disciplined growth Stage 3 FID expected in 2022

Return capital to shareholders Initiated quarterly dividend in 3Q’21 and reset $1 billion, 3-year share repurchase program in 4Q’21 |

ACHIEVED SEAMLESS LNG OPERATIONS & RECORD PRODUCTION, BEST IN CLASS SAFETY ACHIEVEMENT

Achieved record production of >2,000 tbtu and 566 cargoes exported

Effectively managed operations through sustained pricing-related

LNG and U.S. natural gas market volatility as well as unprecedented and extreme weather events at both sites

~40% reduction in Total Reportable Incident Rate (TRIR) |

WORLD-CLASS EXECUTION ON CONSTRUCTION PROGRAM

Corpus Christi Train 3 substantial completion March 2021

Sabine Pass Train 6 first LNG December 2021 and substantial completion timing accelerated by over a year to February 2022 |

| * | For a definition of Consolidated Adjusted EBITDA and Distributable Cash Flow and a reconciliation of these non-GAAP measures to net income (loss), the most directly comparable GAAP financial measure, please see Appendix C. |

Operational

| • | As of February 18, 2022, over 2,000 cumulative LNG cargoes totaling approximately 140 million tonnes of LNG have been produced, loaded and exported from the natural gas liquefaction and export facilities at the Corpus Christi LNG terminal (the “CCL Project”) and the natural gas liquefaction and export facilities at the Sabine Pass LNG terminal in Louisiana (the “SPL Project” and, together with the CCL Project, the “Liquefaction Projects”). |

| • | On February 4, 2022, substantial completion of Train 6 of the SPL Project was achieved. |

| • | On March 26, 2021, substantial completion of Train 3 of the CCL Project was achieved. |

| • | For full year 2021, approximately 16.4 million hours of labor were completed with a Total Recordable Incident Rate (employees and contractors combined) of 0.10. |

Financial

| • | For full year 2021, we generated: |

| • | Consolidated Adjusted EBITDA of $4.9 billion, an increase of 23% over full year 2020, exceeding the midpoint of initial full year 2021 guidance by approximately $800 million, or 20%. |

| 2 | CHENIERE |

|||

2021 PERFORMANCE AND STRATEGIC ACCOMPLISHMENTS

| • | Distributable Cash Flow of approximately $2.0 billion, an increase of approximately 50% over full year 2020, exceeding the midpoint of initial full year 2021 guidance by approximately $700 million, or 50%. |

| • | Net Loss of $2.3 billion (includes non-cash derivative losses). |

| • | In September 2021, our Board of Directors (the “Board”) approved a long-term capital allocation plan which includes (i) the repurchase, repayment or retirement of approximately $1.0 billion of existing indebtedness of the Company each year through 2024 with the intent of achieving consolidated investment grade credit metrics, (ii) initiation of a quarterly dividend for third quarter 2021 at $0.33 per share and (iii) the authorization of an increase in the share repurchase program to $1.0 billion, inclusive of any amounts remaining under the previous authorization as of September 30, 2021, for a three-year term effective October 1, 2021. |

| • | During 2021, we repaid $1.2 billion of indebtedness and raised over $5 billion in aggregate financings across the Cheniere complex, strengthening our balance sheet and executing on our capital allocation plan. Key transactions include: |

| • | In December 2021, we issued a notice of redemption for all $625 million aggregate principal amount outstanding of our 4.25% Convertible Senior Notes due 2045, which were redeemed on January 5, 2022. |

| • | In December 2021, Sabine Pass Liquefaction, LLC (“SPL”) issued an aggregate principal amount of $482 million of Senior Secured Notes due 2037 on a private placement basis. The net proceeds were used to redeem a portion of SPL’s 6.25% Senior Secured Notes due 2022 (the “2022 SPL Senior Notes”). The remaining balance of the 2022 SPL Senior Notes were redeemed with cash on hand, including proceeds from Cheniere Energy Partners, L.P.’s (“CQP”) 3.25% Senior Notes due 2032 (the “CQP 2032 Notes”) issued in September 2021. |

| • | In October 2021, we amended and restated our $1.25 billion Cheniere Revolving Credit Facility to, among other things, (1) extend the maturity through October 2026, (2) reduce the interest rate and commitment fees, which can be further reduced based on our credit ratings and may be positively or negatively adjusted up to five basis points on the interest rate and up to one basis point on the commitment fees based on the achievement of defined environmental, social, and governance (“ESG”) milestones and (3) make certain other changes to the terms and conditions of the existing revolving credit facility. |

| • | In September 2021, CQP issued an aggregate principal amount of $1.2 billion of its CQP 2032 Notes. The net proceeds were used to redeem a portion of the outstanding $1.1 billion aggregate principal amount of CQP’s 5.625% Senior Notes due 2026 (the “2026 CQP Senior Notes”) in September 2021 pursuant to a tender offer. In October 2021, the remaining net proceeds were used to redeem the remaining outstanding principal amount of the 2026 CQP Senior Notes and, together with cash on hand, redeem $318 million of the 2022 SPL Senior Notes. |

| • | In August 2021, Cheniere Corpus Christi Holdings, LLC (“CCH”) issued an aggregate principal amount of $750 million of fully amortizing 2.742% Senior Secured Notes due 2039. The net proceeds were used to prepay a portion of the principal amount outstanding under CCH’s amended and restated term loan credit facility. |

| • | In March 2021, CQP issued an aggregate principal amount of approximately $1.5 billion of 4.000% Senior Notes due 2031. The net proceeds, along with cash on hand, were used to redeem the 5.250% Senior Notes due 2025. |

| • | During 2021, in line with the shareholder return priorities announced as part of our capital allocation plan in September 2021, we: |

| • | Repurchased approximately 0.1 million shares for approximately $9 million, starting in July 2021. |

| • | Declared an inaugural quarterly dividend of $0.33 per share for the third quarter 2021, which was paid on November 17, 2021. |

Environmental, Social and Governance

| • | In October 2021, we announced a partnership with the Thurgood Marshall College Fund to provide $500,000 in scholarships and additional networking opportunities to students enrolled in historically black colleges and universities in the communities where we live and work, including: Howard University, Prairie View A&M University, Southern University and Texas Southern University. |

| • | In November 2021, Diversity, Equity and Inclusion (“DEI”) oversight was added to the charter of the Governance and Nominating Committee. |

| • | In October 2021, we amended and restated our $1.25 billion revolving credit facility with 23 financial institutions, incorporating certain terms and conditions, including interest rate, tied to defined ESG milestones. |

| 2022 PROXY STATEMENT |

3 | |||

PROXY SUMMARY

| • | In August 2021, we announced the publication of our peer-reviewed Greenhouse Gas Life Cycle Analysis (“LCA”), published in the American Chemical Society Sustainable Chemistry & Engineering Journal. |

| • | In July 2021, the Board appointed two new members, Patricia K. Collawn and Lorraine Mitchelmore, following the departure of Nuno Brandolini, who had served as a member of the Board since 2000, further evidencing the Board’s commitment to continued refreshment of its members. |

| • | In June 2021, we published Built for the Challenge, our second corporate responsibility report. |

| • | In June 2021, we announced our collaboration with multiple natural gas suppliers and academic institutions to quantify, monitor, report and verify (“QMRV”) greenhouse gas emissions of natural gas production sites, in order to improve the overall understanding of upstream greenhouse gas (“GHG”) emissions and further the deployment of advanced monitoring technologies and protocols. |

| • | In May 2021, in collaboration with Shell, we delivered our first carbon-neutral cargo of U.S. LNG to Europe. |

| • | In April 2021, we published key findings of a climate scenario analysis, an important component of the Task Force on Climate-Related Financial Disclosures (“TCFD”) framework, to understand the resilience of Cheniere’s existing and future business in various energy transition scenarios. |

| • | In February 2021, we announced that we plan to begin providing our LNG customers with greenhouse gas emissions data associated with each LNG cargo produced at our Liquefaction Projects (“CE Tags”). The CE Tags are designed to enhance environmental transparency by quantifying the estimated GHG emissions of LNG cargoes from the wellhead to the cargo delivery point. |

| • | In February 2021, we updated our annual performance scorecard to include an ESG metric for 2021. For 2022, we have further enhanced this metric to include additional quantifiable criteria with which to measure our progress. ESG metrics, inclusive of safety, represent 30% of the overall annual performance scorecard for 2022. |

| 4 | CHENIERE |

|||

CORPORATE GOVERNANCE

CORPORATE GOVERNANCE

We are committed to the values of effective corporate governance and high ethical standards. Our Board believes that these values are conducive to strong performance and creating long-term shareholder value. Our governance framework gives our highly experienced directors the structure necessary to provide oversight, advice and counsel to Cheniere.

Since our 2017 Annual Meeting, we have taken the following governance actions:

| • | engaged with shareholders holding in excess of 50% of our common stock each year regarding governance matters; |

| • | added details regarding the experience of our directors and the diversity of our Board to our proxy statements; |

| • | increased ownership levels in our director and executive officer ownership guidelines; |

| • | adopted non-employee director equity compensation limits; |

| • | expanded the oversight responsibilities of the Governance and Nominating Committee to include oversight of ESG issues and our strategies, activities and initiatives related to diversity, equity and inclusion; |

| • | issued our inaugural corporate responsibility report in 2020, titled First and Forward, and our second report in 2021, titled Built for the Challenge; |

| • | added a 15-year term limit to our director retirement policy; and |

| • | increased our proxy statement disclosure surrounding our climate strategy, human capital management and human rights and labor standards. |

The “Governance Information” section of this Proxy Statement, beginning on page 19, describes our corporate governance structure and policies, which include the following:

| Board Independence | • 8 out of 10 of our current directors and director nominees are independent. • Independent directors meet regularly without management present. • Our President and CEO is the only management director.

| |

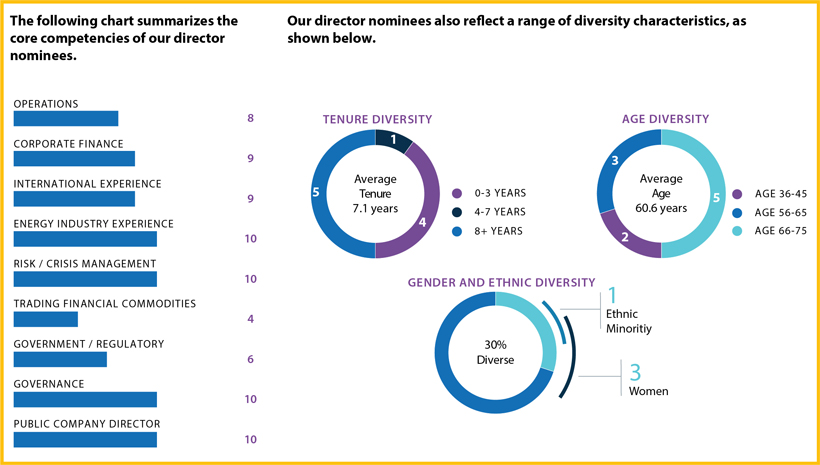

| Board Composition | • The Board consists of 10 directors, with an average age of 60.6 and average tenure of 7.1 years (as of May 12, 2022). • The Board values diversity, experience and relevant skillsets in assessing its composition.

| |

| Board Performance | • The Board regularly assesses its performance through Board and committee self-evaluations.

| |

| Board Committees | • We have three standing Board committees—Audit, Governance and Nominating and Compensation. • All of our Board committees are comprised of and chaired solely by independent directors.

| |

| Leadership Structure | • Our Chairman of the Board and CEO roles were split in December 2015. • Our independent Non-Executive Chairman of the Board provides leadership to the Board and ensures that the Board operates independently of management.

| |

| Risk Oversight | • The Board has oversight responsibility for assessing the primary risks (including liquidity, credit, operations, ESG and regulatory compliance) facing the Company, the relative magnitude of these risks and management’s plan for mitigating these risks. In addition to the Board’s oversight responsibility, the committees of the Board review the risks that are within their areas of responsibility.

| |

| Open Communication | • We encourage open communication and strong working relationships among the Non-Executive Chairman of the Board and other directors. • Our directors have access to management and employees.

| |

| Director and Executive Stock Ownership |

• We have had rigorous stock ownership guidelines for our directors and executive officers since 2008, including amendments to our guidelines for our directors in February 2017, and for our executive officers in February 2021, to make them more rigorous.

| |

| Director Compensation Limit |

• We have capped the annual ordinary course equity award that may be granted to a non-employee director at $495,000 per calendar year. Please see “Director Compensation” on page 30 of this Proxy Statement.

| |

| 2022 PROXY STATEMENT |

5 | |||

PROXY SUMMARY

| Accountability to Shareholders |

• Directors are elected annually by a majority of the votes cast with respect to such director. If a director does not receive the necessary vote at the annual meeting, he/she is required to tender their resignation for consideration by the Board. • The Board maintains a process for shareholders to communicate with the Board. • We conduct an annual advisory say-on-pay vote. • A shareholder, or a group of up to 20 shareholders, continuously owning at least 3% of our common stock for at least the prior 3 consecutive years (and meeting certain other requirements) has the ability to nominate up to 20% of the number of directors serving on our Board via our proxy statement (proxy access). • Special meetings may be called upon the written request of at least 50.1% of the outstanding shares of common stock of the Company, as set forth in our Bylaws.

| |

| Succession Planning | • The Governance and Nominating Committee has oversight of succession planning, both planned and emergency, for the Chief Executive Officer.

| |

| Governance Policies |

• Directors are required to retire upon the earlier of reaching 75 years of age or, beginning at the Company’s 2023 annual meeting of shareholders, 15 years of service, in order to encourage board refreshment. Upon the recommendation of the Governance and Nominating Committee, the Board may waive these requirements as to any non-employee director if it deems such waiver to be in the best interests of the Company. • We maintain codes of conduct for directors, officers and employees. • We do not allow pledging of Company stock as collateral for a loan or holding Company stock in margin accounts. • We do not allow hedging or short sales of Company stock. • We do not have a shareholder rights plan, or “poison pill.”

| |

OUR DIRECTOR NOMINEES

You are being asked to vote on the election of the 10 director nominees listed below. Each director is elected annually by a majority of the votes cast. Detailed information about each nominee, including background, skills and expertise, can be found in “Proposal 1 – Election of Directors” beginning on page 9.

| NAME

|

AGE (AS OF MAY 12,

|

DIRECTOR SINCE

|

PRINCIPAL OCCUPATION

| |||

| G. Andrea Botta | 68 | 2010 | Chairman of the Board, Cheniere Energy, Inc.; President, Glenco LLC | |||

| Jack A. Fusco | 59 | 2016 | President and Chief Executive Officer, Cheniere Energy, Inc. | |||

| Vicky A. Bailey | 70 | 2006 | President, Anderson Stratton International, LLC | |||

| Patricia K. Collawn | 63 | 2021 | Chairman, President and Chief Executive Officer, PNM Resources, Inc. | |||

| David B. Kilpatrick | 72 | 2003 | President, Kilpatrick Energy Group | |||

| Lorraine Mitchelmore | 59 | 2021 | Director, Suncor Energy Inc. and Bank of Montreal, Former President and Chief Executive Officer, Enlighten Innovations Inc. | |||

| Scott Peak | 41 | 2022 | Managing Partner and Chief Investment Officer, Brookfield Infrastructure | |||

| Donald F. Robillard, Jr. | 70 | 2014 | President of Robillard Consulting, LLC, Former Executive Vice President, Chief Financial Officer and Chief Risk Officer of Hunt Consolidated, Inc. and Former Chief Executive Officer and Chairman, ES Xplore, LLC | |||

| Neal A. Shear | 67 | 2014 | Senior Advisor and Chair of the Advisory Committee of Onyxpoint Global Management LP | |||

| Andrew J. Teno |

37 | 2021 | Portfolio Manager of Icahn Capital LP | |||

All director nominees are independent, except Jack A. Fusco and Scott Peak. Each director nominee attended or participated in at least 75% of the aggregate number of all meetings of the Board and of each committee on which he or she sits for which the director was eligible to attend in 2021, with the exception of Scott Peak who was not then a member of the Board.

| 6 | CHENIERE |

|||

EXECUTIVE COMPENSATION HIGHLIGHTS

EXECUTIVE COMPENSATION HIGHLIGHTS

Compensation Governance Practices

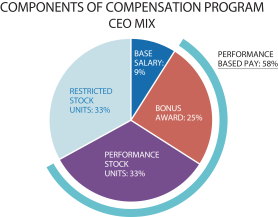

| • | Clear, direct link between pay and performance |

| • | Majority of incentive awards earned based on performance |

| • | No hedging or “short sales” of Company stock |

| • | No pledging of Company stock as collateral for a loan or holding Company stock in margin accounts |

| • | Robust stock ownership guidelines |

| • | No defined benefit retirement plan or supplemental executive retirement plan |

| • | Strong compensation risk management program |

| • | Non-employee director equity compensation limits |

| • | Minimum vesting schedule for long-term incentive awards of at least 12 months, subject to limited exceptions |

| • | No material perquisites |

| • | Solicit annual advisory vote on executive compensation |

| • | Annually review the independence of the compensation consultant retained by the Compensation Committee |

Philosophy and Objectives

We are committed to a pay-for-performance executive compensation program that aligns the interests of our Named Executive Officers (“NEOs”) with the key drivers of long-term growth and creation of shareholder value. The executive compensation program has evolved over the last several years, corresponding to the Company’s transition from a development company into a leading LNG operator. Changes to the executive compensation program were influenced by market practices, feedback from shareholders, and to support the program’s primary objectives.

The Board and the Compensation Committee believe the design of our executive compensation program, and the Committee’s decisions and outcomes in 2021, support our compensation philosophy and objectives, including:

| • | Annual and long-term incentive awards are primarily performance-based |

| • | Annual incentive awards earned are based on achievement of specific financial, operating, safety and strategic goals |

| • | Performance-based long-term incentive awards are tied to specific and formulaic financial performance and stock price growth objectives |

2021 Compensation Highlights

During 2021, the Compensation Committee and Board continued to monitor market conditions and address feedback from key stakeholders and our compensation consultant. Key outcomes and developments included:

| • | The annual incentive plan generated an above-target payout for our NEOs based upon the Company’s 2021 performance across multiple financial, operating, safety and strategic metrics. The Committee made no changes to the performance goals originally established for the 2021 performance period. |

| • | Performance share units awarded in 2019 also generated an above-target payout for our NEOs based upon the Company’s performance across the performance metrics of cumulative Distributable Cash Flow per share and Absolute Total Shareholder Return over the 2019-2021 period. |

| • | In February 2021, the Board approved our 2021 annual performance scorecard which included new ESG-related metrics and milestones, illustrating our Company-wide commitment to these important issues. In 2022, ESG metrics, inclusive of safety, will represent 30% of the annual performance scorecard. |

During 2021, members of our Board and senior management engaged with shareholders holding more than 50% of our outstanding common stock, and with proxy advisory firms. We are committed to maintaining an open dialogue with our shareholders to ensure the successful evolution of our executive compensation program going forward.

| 2022 PROXY STATEMENT |

7 | |||

PROXY SUMMARY

RATIFICATION OF KPMG AS AUDITOR FOR 2022

As a matter of good corporate governance, we are asking our shareholders to ratify, on an advisory (non-binding) basis the selection of KPMG LLP as the Company’s independent registered public accounting firm for 2022. The following table sets forth the fees billed to us by KPMG LLP for professional services for 2021 and 2020.

|

|

2021 | 2020 | ||||||

| Audit Fees |

$ | 6,664,593 | $ | 6,808,018 | ||||

| Audit Related Fees |

$ | — | $ | — | ||||

| Tax Fees |

$ | 24,773 | $ | — | ||||

| All Other Fees |

$ | 3,000 | $ | 3,000 | ||||

| Total |

$ | 6,692,366 | $ | 6,808,018 | ||||

See “Report of the Audit Committee” on page 72 and the information provided in Proposal 3, beginning on page 73, for more details.

| 8 | CHENIERE |

|||

PROPOSAL 1 – ELECTION OF DIRECTORS

This year, there are 10 nominees standing for election as directors at the Meeting. Below is a summary of our director nominees, including their committee memberships as of April 8, 2022. The Board, with assistance from the Governance and Nominating Committee, will evaluate and reassign committee memberships as needed following the Meeting and election of the director nominees. Detailed information about each director’s background, skills and expertise is provided below.

|

NOMINEE COMMITTEE MEMBERSHIPS | ||||||||||||

| NAME CURRENT POSITION |

AGE (AS OF MAY 12, 2022) |

DIRECTOR SINCE |

INDEPENDENT | AUDIT | GOVERNANCE AND NOMINATING |

COMPENSATION | ||||||

| G. Andrea Botta Chairman of the Board, Cheniere Energy, Inc. President, Glenco LLC |

68 | 2010 | YES |

|

Chair |

| ||||||

| Jack A. Fusco President and Chief Executive Officer, Cheniere Energy, Inc. |

59 | 2016 | NO |

|

|

| ||||||

| Vicky A. Bailey President, Anderson Stratton International, LLC |

70 | 2006 | YES | ● | ● |

| ||||||

| Patricia K. Collawn Chairman, President and Chief Executive Officer PNM Resources, Inc. |

63 | 2021 | YES | F |

|

● | ||||||

| David B. Kilpatrick President, Kilpatrick Energy Group |

72 | 2003 | YES | ● |

|

● | ||||||

| Lorraine Mitchelmore Director, Suncor Energy Inc. and Bank of Montreal |

59 | 2021 | YES | ● | ● |

| ||||||

| Scott Peak Managing Partner and Chief Investment Officer, Brookfield Infrastructure |

41 | 2022 | NO |

|

|

| ||||||

| Donald F. Robillard, Jr. President of Robillard Consulting, LLC |

70 | 2014 | YES | Chair; F |

● |

| ||||||

| Neal A. Shear Senior Advisor and Chair of the Advisory Committee of Onyxpoint Global Management LP |

67 | 2014 | YES |

|

● | Chair | ||||||

| Andrew J. Teno Portfolio Manager, Icahn Capital LP |

37 | 2021 | YES | F |

|

| ||||||

F = Audit Committee Financial Expert

The Board has determined that Ms. Collawn and each of Messrs. Robillard and Teno is an “audit committee financial expert” as defined in Item 407(d)(5)(ii) of Regulation S-K promulgated by the Securities and Exchange Commission (“SEC”).

| 2022 PROXY STATEMENT |

9 | |||

PROPOSAL 1 – ELECTION OF DIRECTORS

Summary of Director Core Competencies

Our director nominees complement each other to create a well-rounded boardroom, and each adds:

| • | A deep commitment to stewardship |

| • | A proven record of success |

| • | Unique and valuable insight |

There are 10 nominees standing for election as directors at the Meeting. Each nominee, if elected, will hold office for a one-year term expiring at the 2023 Annual Meeting of Shareholders and will serve until his or her successor is duly elected and qualified or until his or her earlier death, resignation or removal. Each of the director nominees has consented to serve as a director if elected or re-elected.

Each of the director nominees currently serves on the Board. Directors are elected by a majority of votes cast with respect to such director nominee. Unless your proxy specifies otherwise, it is intended that the shares represented by your proxy will be voted for the election of these 10 nominees. If you are a beneficial owner, your bank, broker or other holder of record is not permitted to vote your shares on Proposal 1 to elect directors if the bank, broker or other holder of record does not receive specific voting instructions from you. Proxies cannot be voted for a greater number of persons than the number of nominees named. The Board is unaware of any circumstances likely to render any nominee unavailable.

The Board unanimously recommends a vote FOR the election of the 10 nominees as directors of the Company to hold office for a one-year term expiring at the 2023 Annual Meeting of Shareholders or until their successors are duly elected and qualified.

| 10 | CHENIERE |

|||

DIRECTOR NOMINATIONS AND QUALIFICATIONS

DIRECTOR NOMINATIONS AND QUALIFICATIONS

Director Nomination Policy and Procedures. Our Director Nomination Policy and Procedures is attached to the Governance and Nominating Committee’s written charter as Exhibit A, which is available on our website at www.cheniere.com. The Governance and Nominating Committee considers suggestions for potential director nominees to the Board from any source, including current members of the Board and our management, advisors and shareholders. The Governance and Nominating Committee evaluates potential nominees by reviewing their qualifications and any other information deemed relevant. Director nominees are recommended to the Board by the Governance and Nominating Committee.

The full Board will select and recommend candidates for nomination as directors for shareholders to consider and vote upon at the annual shareholders’ meeting. The Governance and Nominating Committee reviews and considers any candidates submitted by a shareholder or shareholder group in the same manner as all other candidates.

Qualifications for consideration as a director nominee vary according to the particular areas of expertise being sought as a complement to the existing Board composition. However, minimum criteria for selection of members to serve on our Board include the following:

| • | highest professional and personal ethical standards and integrity; |

| • | high level of education and/or business experience; |

| • | broad-based business acumen; |

| • | commitment to understand the Company’s business and industry; |

| • | sufficient time to effectively carry out their duties; |

| • | strategic thinking and willingness to share ideas; |

| • | loyalty and commitment to driving the success of the Company; |

| • | network of business and industry contacts; and |

| • | diversity of experiences, expertise, backgrounds and other demographics among members of the Board. |

Director Search. In 2021, we engaged an independent director search firm to help identify prospective director candidates, with the goal of adding two directors to our Board. Ms. Collawn was recommended by a non-management director to the independent director search firm in connection with this process, and Ms. Mitchelmore was recommended by the independent director search firm. We are continuing to work with an independent director search firm to identify prospective director candidates. In addition to the minimum criteria described above, the Governance and Nominating Committee evaluated the skill sets needed to maximize Board effectiveness and support the strategic direction of the Company. We looked at a diverse pool of candidates, considering each candidate’s business or professional experience, demonstrated leadership ability, integrity and judgment, record of public service, diversity, financial and technological acumen and international and ESG experience. We view and define diversity in a broad sense, which includes gender, ethnicity, age, education, experience and leadership qualities.

Practices for Considering Diversity. The minimum criteria for selection of members to serve on our Board are designed to ensure that the Governance and Nominating Committee selects director nominees taking into consideration that the Board will benefit from having directors that represent a diversity of experience and backgrounds. Director nominees are selected so that the Board represents a diversity of experience in areas needed to foster the Company’s business success, including experience in the energy industry, finance, consulting, international affairs, public service, governance, regulatory compliance and ESG. Each year the Board and each committee participates in a self-assessment or evaluation of the effectiveness of the Board and its committees. These evaluations assess the diversity of talents, expertise and occupational and personal backgrounds of the Board members.

Shareholder Nominations for Director (other than Proxy Access). A shareholder of the Company may nominate a candidate or candidates for election to the Board at an annual meeting of shareholders if such shareholder (1) was a shareholder of record at the time the notice provided for below is delivered to the Corporate Secretary, (2) is entitled to vote at the meeting of shareholders called for the election of directors and is entitled to vote upon such election and (3) complies with the notice procedures set forth in our Bylaws, as amended (the “Bylaws”). Nominations made by a shareholder must be made by giving timely notice in writing to the Corporate Secretary of the Company at the following address: Corporate Secretary, Cheniere Energy, Inc., 700 Milam Street, Suite 1900, Houston, Texas 77002. To be timely, a shareholder’s notice must be delivered not later than the close of business on the 90th day, nor earlier than the close of business on the 120th day, prior to the first anniversary of the preceding year’s annual meeting. However, if (and only if) the date of the annual meeting is more than 30 days before or more than 70 days after such anniversary

| 2022 PROXY STATEMENT |

11 | |||

PROPOSAL 1 – ELECTION OF DIRECTORS

date, notice by the shareholder must be delivered not earlier than the close of business on the 120th day prior to such annual meeting and not later than the close of business on the later of the 90th day prior to such annual meeting or the 10th day following the day on which public announcement of the date of such meeting is first made by the Company. In no event will the public announcement of an adjournment or postponement of an annual meeting of shareholders commence a new time period (or extend any time period) for the giving of a shareholder’s notice as described above. A shareholder’s notice must include information about the shareholder and the nominee, as required by our Bylaws, which are available on our website at www.cheniere.com. The Governance and Nominating Committee will review and consider any candidates submitted by a shareholder or shareholder group in the same manner as all other candidates.

Director Nominations for Inclusion in Proxy Statement (Proxy Access). A shareholder, or group of up to 20 shareholders, continuously owning at least 3% of the Company’s common stock for at least the prior three consecutive years (and meeting the other requirements set forth in our Bylaws) may nominate for election to our Board and inclusion in our proxy statement for our annual meeting of shareholders up to 20% of the number of directors then serving on our Board.

The notice must include all information required by our Bylaws, which are available on our website at www.cheniere.com. In addition to complying with the other requirements set forth in our Bylaws, an eligible shareholder must provide timely notice in writing to the Corporate Secretary of the Company at the following address: Corporate Secretary, Cheniere Energy, Inc., 700 Milam Street, Suite 1900, Houston, Texas 77002. To be timely for purposes of proxy access, a shareholder’s notice must be delivered not later than the close of business on the 120th day, nor earlier than the 150th day, prior to the first anniversary of the date that the Company first mailed its proxy statement to shareholders for the prior year’s annual meeting of shareholders. However, if (and only if) the annual meeting is not scheduled to be held within a period that commences 30 days before such anniversary date and ends 30 days after such anniversary date (an annual meeting date outside such period being referred to herein as an “Other Meeting Date”), notice must be given in the manner provided in our Bylaws by the later of the close of business on the date that is 180 days prior to such Other Meeting Date and the 10th day following the date on which public announcement of such Other Meeting Date is first made.

Director Qualifications. The Board has concluded that, in light of our business and structure, each of our director nominees possesses relevant experience, qualifications, attributes and skills and should continue to serve on our Board as of the date of this Proxy Statement. The primary qualifications of our directors are further discussed under “Director Biographies” below.

Director Retirement Policy. The Board maintains a mandatory director retirement policy that requires each director who has attained the age of 75 to retire from the Board at the annual meeting of shareholders of the Company held in the year in which his or her current term expires, unless the Board determines such mandate for a particular director is not at the time in the best interests of the Company. Additionally, in order to encourage Board refreshment, the Board revised the director retirement policy in 2020 to provide that directors who have reached 15 years of service on the Board will also not be eligible for re-nomination to the Board at the annual meeting of shareholders of the Company in the year at which such director’s current term expires, subject to Board discretion and providing a transition period for current directors who already meet the 15 years of service to remain on the Board until the annual meeting of shareholders of the Company to be held in 2023. The Board believes this policy will ensure a healthy rotation of directors, which will promote the continued influx of new ideas and perspectives to the Board. As a result of our focus on Board refreshment, in 2021 one of our long-serving directors, Mr. Nuno Brandolini, retired, and Mses. Collawn and Mitchelmore joined the Board.

| 12 | CHENIERE |

|||

DIRECTOR BIOGRAPHIES

| JACK A. FUSCO

PRESIDENT & CEO |

AGE: 59

DIRECTOR SINCE: 2016

|

| ||||

Jack A. Fusco is a director and the President and Chief Executive Officer of Cheniere. Mr. Fusco has served as President and Chief Executive Officer since May 2016 and as a director since June 2016. In addition, Mr. Fusco serves as Chairman, President and Chief Executive Officer of Cheniere Energy Partners GP, LLC, a wholly-owned subsidiary of Cheniere and the general partner of Cheniere Energy Partners, L.P. (“Cheniere Partners”) a publicly-traded limited partnership that is operating the Sabine Pass LNG terminal. Mr. Fusco served as Chairman, President and Chief Executive Officer of Cheniere Energy Partners LP Holdings, LLC (“Cheniere Holdings”) from June 2016 to September 2018. Mr. Fusco is also a Manager, President and Chief Executive Officer of the general partner of Sabine Pass LNG, L.P. and Chief Executive Officer of Sabine Pass Liquefaction, LLC. Mr. Fusco received recognition as Best CEO in the electric industry by Institutional Investor in 2012 as ranked by all industry analysts and for Best Investor Relations by a CEO or Chairman among all mid-cap companies by IR Magazine in 2013. Institutional Investor also recognized Mr. Fusco as the 2020 All-American Executive Team Best CEO in the natural gas industry.

Mr. Fusco served as Chief Executive Officer of Calpine Corporation (“Calpine”) from August 2008 to May 2014 and as Executive Chairman of Calpine from May 2014 through May 11, 2016. Mr. Fusco served as a member of the board of directors of Calpine from August 2008 until March 2018, when the sale of Calpine to an affiliate of Energy Capital Partners and a consortium of other investors was completed. Mr. Fusco was recruited by Calpine’s key shareholders in 2008, just as that company was emerging from bankruptcy. Calpine grew to become America’s largest generator of electricity from natural gas, safely and reliably meeting the needs of an economy that

demands cleaner, more fuel-efficient and dependable sources of electricity. As Chief Executive Officer of Calpine, Mr. Fusco managed a team of approximately 2,300 employees and led one of the largest purchasers of natural gas in America, a successful developer of new gas-fired power generation facilities and a company that prudently managed the inherent commodity trading and balance sheet risks associated with being a merchant power producer.

Mr. Fusco’s career of over 38 years in the energy industry began with his employment at Pacific Gas & Electric Company upon graduation from California State University, Sacramento with a Bachelor of Science in Mechanical Engineering in 1984. He joined Goldman Sachs 13 years later as a Vice President with responsibility for commodity trading and marketing of wholesale electricity, a role that led to the creation of Orion Power Holdings, an independent power producer that Mr. Fusco helped found with backing from Goldman Sachs, where he served as President and Chief Executive Officer from 1998-2002. In 2004, he was asked to serve as Chairman and Chief Executive Officer of Texas Genco LLC by a group of private institutional investors, and successfully managed the transition of that business from a subsidiary of a regulated utility to a strong and profitable independent company, generating a more than 5-fold return for shareholders upon its merger with NRG in 2006.

Skills and Qualifications:

Mr. Fusco brings his prior experience leading successful energy industry companies and his perspective as President and Chief Executive Officer of Cheniere.

| 2022 PROXY STATEMENT |

13 | |||

PROPOSAL 1 – ELECTION OF DIRECTORS

| G. ANDREA BOTTA

CHAIRMAN OF THE BOARD AND CHAIRMAN OF |

AGE: 68

DIRECTOR SINCE: 2010

|

| ||||

G. Andrea Botta is the Chairman of the Board and Chairman of our Governance and Nominating Committee. Mr. Botta has served as President of Glenco LLC (“Glenco”), a private investment company since February 2006. Prior to joining Glenco, Mr. Botta served as Managing Director of Morgan Stanley from 1999 to February 2006. Before joining Morgan Stanley, he was President of EXOR America, Inc. (formerly IFINT-USA, Inc.) from 1993 until September 1999 and for more than five years prior thereto, Vice President of Acquisitions of IFINT-USA, Inc. From March 2008 until February 2018, Mr. Botta

served on the board of directors of Graphic Packaging Holding Company. Mr. Botta earned a degree in Economics and Business Administration from the University of Torino in 1976.

Skills and Qualifications:

Mr. Botta brings a unique international perspective to our Board and significant investing expertise. He has over 30 years of investing experience primarily in private equity investing.

| VICKY A. BAILEY

MEMBER OF AUDIT COMMITTEE AND GOVERNANCE AND NOMINATING COMMITTEE |

AGE: 70

DIRECTOR SINCE: 2006

|

| ||||

Vicky A. Bailey is a member of our Audit Committee and Governance and Nominating Committee. Since November 2005, Ms. Bailey has been President of Anderson Stratton International, LLC, a strategic consulting and government relations company in Washington, D.C. and an equity owner of BHMM Energy Services. She was a partner with Johnston & Associates, LLC, a public relations firm in Washington, D.C., from March 2004 through October 2006. Prior to joining Johnston & Associates, LLC, Ms. Bailey served as Assistant Secretary for the Office of Policy and International Affairs of the U.S. Department of Energy from 2001 through February 2004. From February 2000 until May 2001, she was President and a director of PSI Energy, Inc., the Indiana electric utility subsidiary of Cinergy Corp. Prior to joining PSI Energy, Ms. Bailey was a Commissioner on the Federal Energy Regulatory Commission beginning in 1993. Ms. Bailey currently serves on the board of directors of Occidental Petroleum Corporation, a publicly-traded international energy company, Equitrans Midstream Corporation, a publicly-traded natural gas midstream company, PNM Resources, Inc., a publicly-traded energy holding company based in New Mexico, and Battelle Memorial Institute, a private

nonprofit applied science and technology development company in Columbus, Ohio. Ms. Bailey previously served on the board of directors of EQT Corporation, a publicly-traded petroleum and natural gas exploration and pipeline company, from July 2004 to November 2018. In January 2010, Ms. Bailey was appointed as a member of the Secretary of Energy’s Blue Ribbon Commission on America’s Nuclear Future. She received a B.S. in Industrial Management from Purdue University and completed the Advanced Management Program at the Wharton School in 2013.

Skills and Qualifications:

Ms. Bailey has extensive knowledge of the energy industry, including significant experience with the Federal Energy Regulatory Commission, and government and public relations. She brings a diverse perspective to our Board based on her experience as a strategic consultant, a former energy executive and having served as Assistant Secretary for the Office of Policy and International Affairs.

| 14 | CHENIERE |

|||

DIRECTOR BIOGRAPHIES

| PATRICIA K. COLLAWN

MEMBER OF AUDIT COMMITTEE AND COMPENSATION COMMITTEE |

AGE: 63

DIRECTOR SINCE: 2021

|

| ||||

Ms. Collawn is a member of our Audit Committee and Compensation Committee. Ms. Collawn is the Chairman, President and Chief Executive Officer of PNM Resources, Inc., a publicly-traded energy holding company based in New Mexico, becoming Chairman in 2012 and President and CEO in 2010. Ms. Collawn joined PNM Resources in 2007 as President, Utilities, prior to her promotion to President and Chief Operating Officer in 2008. From 2005 to 2007, Ms. Collawn served as President and Chief Executive Officer of Public Service Company of Colorado, an operating utility that is a subsidiary of Xcel Energy, Inc. Ms. Collawn has served on the board of directors of Equitrans Midstream Corporation, a publicly traded natural gas midstream company, since April 2020. Ms. Collawn previously served on the board of directors of EVgo Services, LLC, a publicly traded builder, owner and operator of DC fast charging for electric vehicles in the U.S, from July 2021 to March 2022, and CTS Corporation, a publicly traded designer and manufacturer of sensors, actuators and electronic components for various industries, from 2003 to May 2021. Ms. Collawn also

previously served as Chairman of the Electric Power Research Institute, an independent, non-profit center for public interest energy and environmental research, including sustainability and carbon reduction matters, and Chairman of the Edison Electric Institute, a national association of investor-owned electric companies. Ms. Collawn received a B.A. from Drake University and an M.B.A. from Harvard Business School.

Skills and Qualifications:

As a senior executive in the power utilities sector for more than 25 years, Ms. Collawn has an in-depth understanding of the complex regulatory structure of the utility industry, as well as substantial operations experience. Along with her executive leadership experience and commercial and operational expertise, Ms. Collawn brings a focus on corporate governance, cybersecurity and environmental and sustainability matters to our Board.

| DAVID B. KILPATRICK

MEMBER OF AUDIT COMMITTEE AND COMPENSATION COMMITTEE |

AGE: 72

DIRECTOR SINCE: 2003

|

| ||||

David B. Kilpatrick is a member of our Audit Committee and Compensation Committee. Mr. Kilpatrick previously served as our Lead Director from June 2015 to January 2016. Mr. Kilpatrick has over 30 years of executive, management and operating experience in the oil and gas industry. He has been the President of Kilpatrick Energy Group, which invests in oil and gas ventures and provides executive management consulting services, since 1998. Mr. Kilpatrick served on the board of directors and as Chairman of the Compensation and Governance Committee of the general partner of Breitburn Energy Partners, L.P., a publicly traded MLP, from March 2008 until April 2018. Mr. Kilpatrick served on the board of managers of Woodbine Holdings, LLC, a privately held company engaged in the acquisition, development and production of oil and natural gas properties in Texas from June 2011 to December 2016. In May 2013, he was elected Chairman of the Board of Applied Natural Gas Fuels, Inc., a producer and distributor of liquefied natural gas fuel for the transportation and industrial markets, until the sale of the company in February 2018. He also

served on the board of directors of PYR Energy Corporation, a publicly-traded oil and gas exploration and production company, from 2001 to 2007, and of Whittier Energy Corporation, a publicly-traded oil and gas exploration company, from 2004 to 2007. He was the President and Chief Operating Officer of Monterey Resources, Inc., an independent oil and gas company, from 1996 to 1998 and held various positions with Santa Fe Energy Resources, an oil and gas production company, from 1983 to 1996. Mr. Kilpatrick received a B.S. in Petroleum Engineering from the University of Southern California and a B.A. in Geology and Physics from Whittier College.

Skills and Qualifications:

Mr. Kilpatrick has over 30 years of executive, management and operating experience in the oil and gas industry and brings significant executive-level and consulting experience in the oil and gas industry to our Board.

| 2022 PROXY STATEMENT |

15 | |||

PROPOSAL 1 – ELECTION OF DIRECTORS

|

LORRAINE MITCHELMORE

MEMBER OF AUDIT COMMITTEE AND GOVERNANCE AND NOMINATING COMMITTEE |

AGE: 59

DIRECTOR SINCE: 2021

|

| ||||

Ms. Mitchelmore was recently the President and Chief Executive Officer of Enlighten Innovations Inc., a Calgary based clean technology company, from May 2017 to September 2018. Prior to that, she was President and Canada Country Chair of Shell Canada Limited and Executive Vice President, Americas Heavy Oil for Royal Dutch Shell. She has more than 30 years of international oil and gas industry experience. Throughout her career, she has served with increasing responsibility in operational, strategy, and commercial roles. Prior to joining Shell in 2002, she worked with BHP Petroleum, Chevron, and Petro-Canada.

Ms. Mitchelmore has served as a director of the Bank of Montreal, a diversified financial services provider, since May 2015; Suncor Energy Inc., a premier integrated energy company, since November 2019; AIMCO, an Albertan Crown pension investment firm since January 2022; and on the Board of Advisors of Catalyst Canada since 2018. She previously served on the board of directors of TransMountain Corporation from November 2018 to December 2019.

Ms. Mitchelmore is currently an associate of the Creative Destruction Lab where she is a mentor to many early-stage energy transition companies. She is co-founder and co-chair of

the Smart Prosperity Initiative, an organization focused on harnessing new thinking to accelerate Canada’s transition to a stronger, cleaner economy. From 2017 to 2018, she chaired the Resources of the Future Economic Strategy table for the Canadian federal government. She has been named a fellow of the Canadian Academy of Engineering, awarded the Catalyst Canada Champion Honors Award in 2014, recognizing commitment to Diversity and Inclusion, and was a recipient of Canada’s 2016 Clean16 award for leadership in advancing sustainable development in Canada.

Ms. Mitchelmore holds a BSc in Geophysics from Memorial University of Newfoundland, an MSc in Geophysics from the University of Melbourne, Australia and an MBA from Kingston Business School in London, England.

Skills and Qualifications:

Ms. Mitchelmore has over 30 years of international oil and gas industry experience, as well as significant executive, operational, strategy and commercial experience. Ms. Mitchelmore also brings meaningful experience with energy transition issues and sustainable development to our Board.

| SCOTT PEAK

DIRECTOR |

AGE: 41

DIRECTOR SINCE: 2022

|

| ||||

Scott Peak is a director of the Company. Mr. Peak is a Managing Partner in Brookfield’s Infrastructure Group and Chief Investment Officer for North America, where he is responsible for infrastructure investments and is head of the Houston office. Prior to joining Brookfield in January 2016, Mr. Peak spent almost a decade at Macquarie Group Ltd. based in New York and Houston focused on the infrastructure sector. Previously, Mr. Peak worked in the mergers and acquisitions group at Dresdner Kleinwort Wasserstein in New York. Mr. Peak previously served as a director of the general partner of Cheniere Partners from September 2020 to April 2022. Mr. Peak holds a Master of Finance with distinction from INSEAD and a B.A. in Economics from Bates College.

Skills and Qualifications:

Mr. Peak brings energy infrastructure industry expertise and a unique financial perspective to our Board based on his extensive investment experience with Brookfield Infrastructure. Mr. Peak’s appointment to the Board of Cheniere was made pursuant to an Investors’ and Registration Rights Agreement that was entered into by the Company, Cheniere Energy Partners GP, LLC, CQP Holdco LP (f/k/a Blackstone CQP Holdco LP) (“CQP Holdco”) and various other related parties in connection with CQP Holdco’s purchase of Class B units in Cheniere Partners.

| 16 | CHENIERE |

|||

DIRECTOR BIOGRAPHIES

| DONALD F. ROBILLARD, JR.

CHAIRMAN OF AUDIT COMMITTEE AND MEMBER OF GOVERNANCE AND NOMINATING COMMITTEE |

AGE: 70

DIRECTOR SINCE: 2014

|

| ||||

Donald F. Robillard, Jr. is the Chairman of our Audit Committee and a member of our Governance and Nominating Committee. Mr. Robillard served as a director and the Executive Vice President, Chief Financial Officer and Chief Risk Officer of Hunt Consolidated, Inc. (“Hunt”), a private holding company with interests in oil and gas exploration and production, refining, real estate development, private equity investments and ranching, from July 2015 until his retirement on January 31, 2017. Mr. Robillard began his association with Hunt in 1983 as Manager of International Accounting for Hunt Oil Company, Inc., a wholly-owned subsidiary of Hunt. Serving nine of his 34 years of service to the Hunt organization in Yemen in various accounting, finance and management positions, Mr. Robillard returned to the United States to join Hunt’s executive team in 1992. Mr. Robillard was named Senior Vice President and Chief Financial Officer of Hunt in April 2007. Mr. Robillard also served, from February 2016 through August of 2017, as Chief Executive Officer and Chairman of ES Xplore, LLC, a direct hydrocarbon indicator technology company which in 2016 was spun out of

Hunt. He is currently President of Robillard Consulting, LLC, an oil and gas advisory firm. Mr. Robillard is currently on the board of directors of Helmerich & Payne, Inc., a publicly-traded oil and gas drilling company. He is a Certified Public Accountant, a member of the American Institute of Certified Public Accountants, the Texas Society of Certified Public Accountants, the National Association of Corporate Directors (NACD Directorship Certified), Financial Executives International and an advisory board member of the Institute for Excellence in Corporate Governance at the Naveen Jindal School of Management at the University of Texas at Dallas. Mr. Robillard received a B.B.A. from the University of Texas, Austin.

Skills and Qualifications:

Mr. Robillard has over 40 years of experience in the oil and gas industry and over 25 years of senior management experience. Mr. Robillard brings significant executive-level experience in the oil and gas industry, including experience with project financing for LNG facilities.

| NEAL A. SHEAR

CHAIRMAN OF COMPENSATION COMMITTEE AND MEMBER OF GOVERNANCE AND NOMINATING COMMITTEE |

AGE: 67

DIRECTOR SINCE: 2014

|

| ||||

Neal A. Shear is the Chairman of our Compensation Committee and a member of our Governance and Nominating Committee. Mr. Shear is Senior Advisor and Chair of the Advisory Committee of Onyxpoint Global Management LP. Mr. Shear served as Interim Special Advisor to the Chief Executive Officer of Cheniere from May 2016 to November 2016 and as Interim Chief Executive Officer and President of Cheniere from December 2015 to May 2016. Mr. Shear was the Chief Executive Officer of Higgs Capital Management, a commodity focused hedge fund until September 2014. Prior to Higgs Capital Management, Mr. Shear served as Global Head of Securities at UBS Investment Bank from January 2010 to March of 2011. Previously, Mr. Shear was a Partner at Apollo Global Management, LLC, where he served as the Head of the Commodities Division. Prior to Apollo Global Management, Mr. Shear spent 26 years at Morgan Stanley serving in various roles including Head of the Commodities Division, Global Head of Fixed Income, Co-Head of Institutional Sales and Trading, and Chair of the Commodities Business. Mr. Shear has served as a director and limited partner of ESG Energy Holdings LLC, a

company formed to buy refining and other assets for the purpose of improving their environmental footprint in the production of energy-related products, since February 2022; as an Advisor to WasteFuel, a waste to fuels company that converts municipal waste into biofuel, since March 2022; as a director of Galileo Technologies S.A., a global provider of modular technologies for compressed natural gas and LNG production and transportation, since February 2017; and as a director of Narl Refining Inc., the refining arm of North Atlantic Holdings St John’s Newfoundland, since November 2014. Mr. Shear received a B.S. from the University of Maryland, Robert H. Smith School of Business Management in 1976 and an M.B.A. from Cornell University, Johnson School of Business in 1978.

Skills and Qualifications:

Mr. Shear brings a unique financial and trading perspective to our Board based on his more than 30 years of experience managing commodity activity and investments.

| 2022 PROXY STATEMENT |

17 | |||

PROPOSAL 1 – ELECTION OF DIRECTORS

| ANDREW J. TENO

MEMBER OF AUDIT COMMITTEE |

AGE: 37

DIRECTOR SINCE: 2021

|

| ||||

Mr. Teno is a member of the Audit Committee. Mr. Teno has been a Portfolio Manager of Icahn Capital, the entity through which Carl C. Icahn manages investment funds, since October 2020. Mr. Teno currently serves as a director of Herc Holdings Inc., an equipment rental company, and FirstEnergy Corp., an electric utility company. From 2011 to 2020, prior to joining Icahn Capital, Mr. Teno worked at Fir Tree Partners, a New York based private investment firm that invests worldwide in public and private companies, real estate and sovereign debt, where he focused on value investing across capital structures, industries and geographies. Mr. Teno also served on the board of directors of Eco-Stim Energy Solutions, Inc., an oilfield services and technology company, from 2017 to 2018. Prior to joining Fir Tree, Mr. Teno worked at Crestview Partners from 2009 to 2011 as an associate in their Private Equity business.

Prior to joining Crestview, Mr. Teno worked at Gleacher Partners, an M&A boutique, from 2007 to 2009. Mr. Teno received an undergraduate business degree from the Wharton School at the University of Pennsylvania in 2007.

Skills and Qualifications:

Mr. Teno brings significant financial and strategic expertise to our Board through his extensive public and private investment experience across a diverse set of industries and investment platforms. Mr. Teno was appointed to the Board of Cheniere in accordance with a Nomination and Standstill Agreement that was entered into on August 21, 2015 by the Company, Icahn Capital LP and certain affiliates of Icahn Capital LP.

| 18 | CHENIERE |

|||

BOARD COMMITTEE MEMBERSHIP AND MEETING ATTENDANCE

The following table shows our director nominees’ fiscal year 2021 membership and chairpersons of our Board committees, Board and committee meetings held and attendance as a percentage of meetings eligible to attend, with the exception of Mr. Peak who was not a member of the Board in 2021. The current Chair of the Board and each committee is indicated in the table.

| NUMBER OF MEETINGS HELD |

BOTTA | FUSCO | BAILEY | COLLAWN | KILPATRICK | MITCHELMORE | ROBILLARD | SHEAR | TENO | |||||||||||

| Board |

8 | 100% Chair |

100% | 88% | 100% | 100% | 100% | 100% | 100% | 100% | ||||||||||

| Audit Committee |

7 | — | — | 100% | 100% | 100% | 100% | 100% Chair |

— | 100% | ||||||||||

| Governance and Nominating Committee |

7 | 100% Chair |

— | 100% | — | — | 100% | — | — | — | ||||||||||

| Compensation Committee |

6 | — | — | — | 100% | 100% | — | — | 100% Chair |

— | ||||||||||

The Board determines the independence of each director and nominee for election as a director in accordance with the rules and regulations of the SEC and the NYSE American LLC (“NYSE American”) independence standards, which are listed below. The Board also considers relationships that a director may have:

| • | as a partner, shareholder or officer of organizations that do business with or provide services to Cheniere; |

| • | as an executive officer of charitable organizations to which we have made or make contributions; and |

| • | that may interfere with the exercise of a director’s independent judgment. |

The NYSE American independence standards state that the following list of persons will not be considered independent:

| • | a director who is, or during the past three years was, employed by the Company or by any parent or subsidiary of the Company other than prior employment as an interim executive officer for less than one year; |

| • | a director who accepts, or has an immediate family member who accepts, any compensation from the Company or any parent or subsidiary of the Company in excess of $120,000 during any period of 12 consecutive months within the past three years, other than compensation for Board or committee services, compensation paid to an immediate family member who is a non-executive employee of the Company, compensation received for former service as an interim executive officer provided the interim service did not last longer than one year, benefits under a tax-qualified retirement plan or non-discretionary compensation; |

| • | a director who is an immediate family member of an individual who is, or has been in any of the past three years, employed by the Company or any parent or subsidiary of the Company as an executive officer; |

| • | a director who is, or has an immediate family member who is a partner in, or a controlling shareholder or an executive officer of, any organization to which the Company made, or from which the Company received, payments (other than those arising solely from investments in the Company’s securities or payments under non-discretionary charitable contribution matching programs) that exceed 5% of the organization’s consolidated gross revenues for that year, or $200,000, whichever is more, in any of the most recent three fiscal years; |

| • | a director who is, or has an immediate family member who is, employed as an executive officer of another entity where at any time during the most recent three fiscal years any of the Company’s executive officers serve on the compensation committee of such other entity; or |

| 2022 PROXY STATEMENT |

19 | |||

GOVERNANCE INFORMATION

| • | a director who is, or has an immediate family member who is, a current partner of the Company’s outside auditor, or was a partner or employee of the Company’s outside auditor who worked on the Company’s audit at any time during any of the past three years. |

As of April 2022, the Board determined that Messrs. Botta, Kilpatrick, Robillard, Shear and Teno and Mses. Bailey, Collawn and Mitchelmore are independent, and that none of them has a relationship that may interfere with the exercise of his or her independent judgment. In addition, the Board determined that Mr. Brandolini, Andrew Langham and Courtney Mather, who each served as a director for all or a portion of 2021, were independent.

BOARD LEADERSHIP STRUCTURE AND ROLE IN RISK OVERSIGHT

Board Leadership Structure. Mr. Botta serves as the Non-Executive Chairman of the Board. Mr. Fusco serves as President and CEO of the Company.

The Company has in place strong governance mechanisms to ensure the continued accountability of the CEO to the Board and to provide strong independent leadership, including the following:

| • | the Non-Executive Chairman of the Board provides independent leadership to the Board and ensures that the Board operates independently of management and that directors have an independent leadership contact; |

| • | each of the Board’s standing committees, consisting of the Audit, Compensation and Governance and Nominating Committees, are chaired by and comprised solely of non-employee directors who meet the independence requirements under the NYSE American listing standards and the SEC; |

| • | the independent directors of the Board, along with the Compensation Committee, evaluate the CEO’s performance and determine his compensation; |

| • | the independent directors of the Board meet in executive sessions without management present and have the opportunity to discuss the effectiveness of the Company’s management, including the CEO, the quality of Board meetings and any other issues and concerns; and |

| • | the Governance and Nominating Committee has oversight of succession planning, both planned and emergency, and the Board has approved an emergency CEO succession process. |

The Board believes that its leadership structure assists the Board’s role in risk oversight. See the discussion on the “Board’s Role in Risk Oversight” below.

Non-Executive Chairman of the Board. The Non-Executive Chairman of the Board position is held by Mr. Botta, an independent director. The Board has appointed an independent Non-Executive Chairman of the Board to provide independent leadership to the Board. The Non-Executive Chairman of the Board role allows the Board to operate independently of management with the Non-Executive Chairman of the Board providing an independent leadership contact to the other directors. The responsibilities of the Non-Executive Chairman of the Board are set out in a Non-Executive Chairman of the Board Charter. These responsibilities include the following:

| • | preside at all meetings of the Board, including executive sessions of the independent directors; |

| • | call meetings of the Board and meetings of the independent directors, as may be determined in the discretion of the Non-Executive Chairman of the Board; |

| • | work with the CEO and the Corporate Secretary to prepare the schedule of Board meetings to assure that the directors have sufficient time to discuss all agenda items; |

| • | prepare the Board agendas in coordination with the CEO and the Corporate Secretary; |

| • | advise the CEO of any matters that the Non-Executive Chairman of the Board determines should be included in any Board meeting agenda; |

| • | advise the CEO as to the quality, quantity, appropriateness and timeliness of the flow of information from the Company’s management to the Board; |

| 20 | CHENIERE |

|||

SHAREHOLDER OUTREACH–GOVERNANCE

| • | recommend to the Board the retention of consultants who report directly to the Board; |

| • | act as principal liaison between the directors and the CEO; |

| • | in the discretion of the Non-Executive Chairman of the Board, participate in meetings of the committees of the Board; |

| • | in the absence of the CEO or as requested by the Board, act as the spokesperson for the Company; and |

| • | be available, if requested, for consultation and direct communication with major shareholders of the Company. |