CHENIERE ENERGY, INC. 2020 PROXY STATEMENT

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to §240.14a-11(c) or §240.14a-12 | |

Cheniere Energy, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount previously paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing party:

| |||

| (4) | Date Filed:

| |||

Notes:

Reg. §240.14a-101.

SEC 1913 (3-99)

CHENIERE ENERGY, INC. 2020 PROXY STATEMENT

April 10, 2020

To our Shareholders:

It is our pleasure to invite you to attend the Cheniere Energy, Inc. 2020 Annual Meeting of Shareholders. The meeting will be held at 3:00 p.m., Central Time on May 14, 2020 at our corporate headquarters located at 700 Milam Street, Suite 1900, Houston, Texas 77002. As part of our precautions regarding the coronavirus or COVID-19, we are planning for the possibility that the Meeting may be held solely by means of remote communication. If we take this step, we will announce the decision to do so in advance as promptly as practicable, and details on how to participate will be included in a press release available at www.cheniere.com/2020AnnualMeeting and filed with the Securities and Exchange Commission as additional proxy materials. If you are planning to participate in the Meeting, please check the Company’s website prior to the meeting date. This does not represent a change in our shareholder engagement philosophy, and we currently intend to host an in-person meeting next year.

The following Notice of Annual Meeting describes the business to be conducted at the 2020 Annual Meeting of Shareholders. We encourage you to review the materials and vote your shares.

You may vote via the Internet, by telephone, or by submitting your completed proxy card by mail. If you attend the 2020 Annual Meeting of Shareholders, you may vote your shares in person if you are a shareholder of record.

Thank you for your continued support as investors in Cheniere Energy, Inc.

Very truly yours,

|

| |||

| G. Andrea Botta | Jack A. Fusco | |||

| Chairman of the Board | President and Chief Executive Officer | |||

CHENIERE ENERGY, INC.

700 Milam Street, Suite 1900

Houston, Texas 77002

(713) 375-5000

|

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

|

||||||

| TIME AND DATE:

|

3:00 p.m., Central Time on May 14, 2020

|

|||||

| PLACE: | Cheniere Energy, Inc. 700 Milam Street, Suite 1900 Houston, TX 77002*

|

|||||

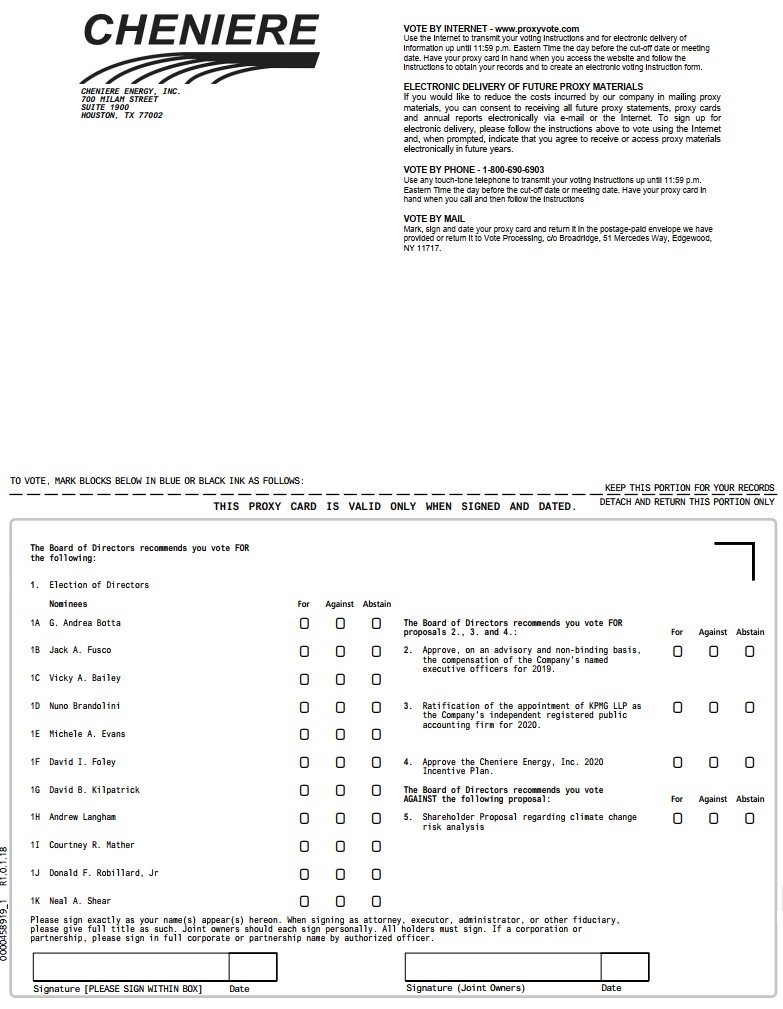

| ITEMS OF BUSINESS: | • To elect eleven members of the Board of Directors to hold office for a one-year term expiring at the 2021 Annual Meeting of Shareholders.

• To approve, on an advisory and non-binding basis, the compensation of the Company’s named executive officers for 2019.

• To ratify the appointment of KPMG LLP as the Company’s independent registered public accounting firm for 2020.

• To approve the Cheniere Energy, Inc. 2020 Incentive Plan.

• To act on a shareholder proposal regarding climate change risk analysis.

• To transact such other business as may properly come before the meeting and any adjournment or postponement thereof.

|

|||||

| RECORD DATE:

|

You can vote if you were a shareholder of record as of the close of business on March 30, 2020.

|

|||||

| PROXY VOTING: |

It is important that your shares be represented and voted at the meeting. You can vote your shares by completing and mailing the enclosed proxy card or by voting on the Internet or by telephone. See details under the heading “How do I vote?”

|

|||||

| ELECTRONIC AVAILABILITY OF PROXY MATERIALS:

|

We are making this Proxy Statement, including the Notice of Annual Meeting and 2019 Annual Report on Form 10-K for the year ended December 31, 2019, available on our website at: http://www.cheniere.com/2020AnnualMeeting.

|

|||||

By order of the Board of Directors

Sean N. Markowitz

Corporate Secretary

April 10, 2020

| * | As part of our precautions regarding the coronavirus or COVID-19, we are planning for the possibility that the Meeting may be held solely by means of remote communication. If we take this step, we will announce the decision to do so in advance as promptly as practicable, and details on how to participate will be included in a press release available at www.cheniere.com/2020AnnualMeeting and filed with the Securities and Exchange Commission as additional proxy materials. It is important that you retain a copy of the control number found on the proxy card, as such number will be required in order for shareholders to gain access to any meeting held solely by means of remote communication. |

Note Regarding Forward-Looking Statements

This Proxy Statement contains forward-looking statements relating to, among other things, business strategy, performance and expectations for project development. The reader is cautioned not to place undue reliance on these statements and should review the sections captioned “Cautionary Statement Regarding Forward-Looking Statements” and “Risk Factors” in our Annual Report on Form 10-K for important information about these statements, including the risks, uncertainties and other factors that could cause actual results to vary materially from the assumptions, expectations and projections expressed in any forward-looking statements. These forward-looking statements speak only as of the date made, and, other than as required by law, we undertake no obligation to update or revise any forward-looking statement, whether as a result of new information, future events or developments or otherwise.

The following is an overview of information that you will find throughout this Proxy Statement, but does not contain all of the information that you should consider. For more complete information about these topics, please review the complete Proxy Statement prior to voting.

|

ANNUAL MEETING OF SHAREHOLDERS

|

||||||||

|

|

TIME AND DATE:

|

3:00 p.m., Central Time on May 14, 2020

|

||||||

|

PLACE: |

Cheniere Energy, Inc. 700 Milam Street, Suite 1900 Houston, TX 77002

As part of our precautions regarding the coronavirus or COVID-19, we are planning for the possibility that the Meeting may be held solely by means of remote communication. If we take this step, we will announce the decision to do so in advance as promptly as practicable, and details on how to participate will be included in a press release available at www.cheniere.com/2020AnnualMeeting and filed with the Securities and Exchange Commission as additional proxy materials. If you are planning to participate in the Meeting, please check the Company’s website prior to the meeting date.

|

||||||

|

RECORD DATE:

|

March 30, 2020 (the “Record Date”)

|

||||||

|

VOTING: |

Shareholders as of the close of business on the Record Date are entitled to vote. Each share of common stock is entitled to one vote for each matter to be voted upon.

|

||||||

|

ADMISSION: | No admission card is required to enter the Cheniere Energy, Inc. (“Cheniere,” the “Company,” “we,” “us” or “our”) 2020 Annual Meeting of Shareholders (the “Meeting”), but you will need proof of your stock ownership and valid government-issued picture identification. Please see “Frequently Asked Questions” on page 91 of this Proxy Statement for more information.

|

||||||

VOTING MATTERS AND BOARD RECOMMENDATIONS

| PROPOSAL

|

DESCRIPTION

|

BOARD VOTE RECOMMENDATION

|

PAGE REFERENCE (FOR MORE DETAILS) | |||

| 1 |

Election of directors | FOR EACH NOMINEE | 8 | |||

| 2 |

Advisory and non-binding vote on the compensation of the Company’s named executive officers for 2019 |

FOR |

73 | |||

| 3 |

Ratification of appointment of KPMG LLP as the Company’s independent registered public accounting firm for 2020 |

FOR |

75 | |||

| 4 |

Approval of Cheniere Energy, Inc. 2020 Incentive Plan |

FOR |

77 | |||

| 5 |

Shareholder Proposal regarding climate change risk analysis |

AGAINST |

87 | |||

| 2020 PROXY STATEMENT | 1 | |||

PROXY SUMMARY

2019 PERFORMANCE AND

STRATEGIC ACCOMPLISHMENTS

The following items highlight our 2019 and recent accomplishments. For more information about these accomplishments and their relationship to our executive compensation program, please see “Compensation Discussion and Analysis” on page 36 of this Proxy Statement.

| Record financial results:

~$10 billion revenue ~$650 million net income >$2.9 billion Consolidated Adjusted EBITDA* |

Substantial Completion Achieved: Corpus Christi Trains 1 & 2, Sabine Pass Train 5 On Budget, Ahead of Schedule |

Final Investment Decision with respect to Sabine Pass Train 6 | Record production: Over 425 cargoes exported in 2019 totaling over 1.5 TCF of LNG | |||||||||

| * | For a definition of Consolidated Adjusted EBITDA and a reconciliation of this non-GAAP measure to net income, the most directly comparable GAAP financial measure, please see Appendix D. |

Strategic

| • | In November 2019, we received approval from the Federal Energy Regulatory Commission (“FERC”) to site, construct and operate an expansion (“Corpus Christi Stage 3”) of the Corpus Christi terminal adjacent to the natural gas liquefaction and export facility at the Corpus Christi LNG terminal (the “CCL Project”), which is being developed for up to seven midscale Trains with an expected total production capacity of approximately 10 mtpa of LNG. |

| • | In September 2019, our subsidiaries Corpus Christi Liquefaction, LLC (“CCL”) and Cheniere Corpus Christi Liquefaction Stage III, LLC (“CCL Stage III”) entered into an integrated production marketing (“IPM”) transaction with EOG Resources, Inc. to purchase 140,000 MMBtu per day of natural gas, for a term of approximately 15 years beginning in early 2020, at a price based on the Platts Japan Korea Marker, net of a fixed liquefaction fee and certain costs incurred by Cheniere. |

| • | In May 2019, CCL Stage III entered into an IPM transaction with Apache Corporation to purchase 140,000 MMBtu per day of natural gas, for a term of approximately 15 years, at a price based on international LNG indices, net of a fixed liquefaction fee and certain costs incurred by Cheniere. |

| • | In May 2019, the board of directors of the general partner of Cheniere Energy Partners, L.P. (NYSE American: CQP), of which we own 100% of the general partner interest and 48.6% of the limited partner interest (“Cheniere Partners”), made a positive final investment decision (“FID”) with respect to Train 6 of the natural gas liquefaction and export facilities at the Sabine Pass LNG terminal in Louisiana (the “SPL Project”) and issued a full notice to proceed with construction to Bechtel Oil, Gas and Chemicals, Inc. in June 2019. |

Operational

| • | As of February 21, 2020, over 1,000 cumulative LNG cargoes totaling over 70 million tonnes of LNG have been produced, loaded and exported from the SPL Project and the CCL Project (the “Liquefaction Projects”). Cheniere achieved the 1,000 cargo milestone faster than any other LNG operator. |

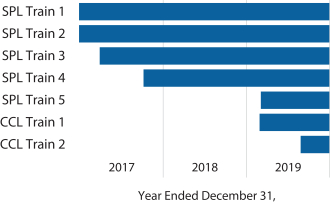

| • | In March 2019, substantial completion was achieved on Train 5 of the SPL Project and operating activities commenced. Train 5 of the SPL Project reached substantial completion over nine months ahead of the guaranteed completion schedule. |

| • | In February 2019 and August 2019, substantial completion was achieved on Trains 1 and 2 of the CCL Project, respectively, and operating activities commenced. Trains 1 and 2 of the CCL Project reached substantial completion over seven and eleven months ahead of the guaranteed completion schedule, respectively. |

| • | For full year 2019, approximately 7 million hours of labor were completed with a Lost Time Incident Rate of approximately 0.03. |

| • | For full year 2019, a total of over 1,500 TBtu of LNG was exported from the SPL Project and the CCL Project, which was approximately 80% of all LNG exported from the United States. |

| 2 | CHENIERE | |||

2019 PERFORMANCE AND STRATEGIC ACCOMPLISHMENTS

Financial

| • | For full year 2019, we achieved record results in multiple key financial metrics, including net income attributable to common stockholders of approximately $650 million, consolidated revenues of nearly $10 billion and Consolidated Adjusted EBITDA of over $2.9 billion. For a definition of Consolidated Adjusted EBITDA and a reconciliation of this non-GAAP measure to net income, the most directly comparable GAAP financial measure, please see Appendix D. |

| • | In June 2019, we announced a capital allocation framework which prioritizes investments in the growth of our liquefaction platform, improvement of consolidated leverage metrics, and a return of excess capital to shareholders under a three-year, $1.0 billion share repurchase program. We commenced share repurchase activity in the second quarter of 2019 and commenced prepayment of outstanding debt in the third quarter of 2019. |

| • | We reached the following contractual milestones: |

| ¡ | In September 2019, the date of first commercial delivery was reached under the 20-year LNG sale and purchase agreements (“SPAs”) with Centrica plc and Total Gas & Power North America, Inc. relating to Train 5 of the SPL Project. |

| ¡ | In June 2019, the date of first commercial delivery was reached under the 20-year SPAs with Endesa S.A. and PT Pertamina (Persero) relating to Train 1 of the CCL Project. |

| ¡ | In March 2019, the date of first commercial delivery was reached under the 20-year SPA with BG Gulf Coast LNG, LLC relating to Train 4 of the SPL Project. |

| • | During 2019, our stock price increased by approximately 3% and the total enterprise value of the Company increased by approximately 3.5%. |

| 2020 PROXY STATEMENT | 3 | |||

PROXY SUMMARY

CORPORATE GOVERNANCE

We are committed to the values of effective corporate governance and high ethical standards. Our Board of Directors (the “Board”) believes that these values are conducive to strong performance and creating long-term shareholder value. Our governance framework gives our highly experienced directors the structure necessary to provide oversight, advice and counsel to Cheniere.

Since our 2017 Annual Meeting, we have taken the following governance actions:

| • | engaged with shareholders holding in excess of 50% of our common stock each year regarding governance matters; |

| • | added details regarding the experience of our directors to our proxy statements; |

| • | increased ownership levels in our director ownership guidelines; |

| • | adopted non-employee director equity compensation limits; and |

| • | expanded the oversight responsibilities of the Governance and Nominating Committee to include oversight of environmental, social and governance (“ESG”) issues. |

The “Governance Information” section of this Proxy Statement, beginning on page 18, describes our corporate governance structure and policies, which include the following:

| Board Independence | • 9 out of 11 of our current directors and director nominees are independent. • Independent directors meet regularly without management present. • Our President and CEO is the only management director.

| |

| Board Composition | • The Board consists of 11 directors, with an average age of 60 (as of May 14, 2020). • We added another highly qualified member to our Board in 2019, Michele A. Evans. • The Board values diversity and experience in assessing its composition.

| |

| Board Performance | • The Board regularly assesses its performance through Board and committee self-evaluations.

| |

| Board Committees | • We have three standing Board committees—Audit, Governance and Nominating and Compensation. • All of our Board committees are comprised of and chaired solely by independent directors.

| |

| Leadership Structure | • Our Chairman of the Board and CEO roles were split in December 2015. • Our independent Non-Executive Chairman of the Board provides leadership to the Board and ensures that the Board operates independently of management.

| |

| Risk Oversight | • The Board has oversight responsibility for assessing the primary risks (including liquidity, credit, operations and regulatory compliance) facing the Company, the relative magnitude of these risks and management’s plan for mitigating these risks. In addition to the Board’s oversight responsibility, the committees of the Board review the risks that are within their areas of responsibility.

| |

| Open Communication | • We encourage open communication and strong working relationships among the Non-Executive Chairman of the Board and other directors. • Our directors have access to management and employees.

| |

| Director and Executive Stock Ownership |

• We have had rigorous stock ownership guidelines for our directors and executive officers since 2008 and amended our stock ownership guidelines for our directors in February 2017 to make them more rigorous.

| |

| Director Compensation Limit |

• We have capped the annual ordinary course equity award that may be granted to a non-employee director at $495,000 per calendar year. Please see “Director Compensation” on page 29 of this Proxy Statement.

| |

| Accountability to Shareholders |

• Directors are elected annually by a majority of the votes cast with respect to such director. If a director does not receive the necessary vote at the annual meeting, they are required to tender their resignation for consideration by the Board. • The Board maintains a process for shareholders to communicate with the Board. • We conduct an annual advisory say-on-pay vote. • A shareholder, or a group of up to 20 shareholders, continuously owning at least 3% of our common stock for at least the prior 3 consecutive years (and meeting certain other requirements) has the ability to nominate up to 20% of the number of directors serving on our Board (proxy access).

| |

| 4 | CHENIERE | |||

OUR DIRECTOR NOMINEES

| Management Succession Planning |

• The Governance and Nominating Committee has oversight of succession planning, both planned and emergency.

| |

| Governance Policies | • Directors are required to retire at age 75. • We maintain codes of conduct for directors, officers and employees. • We do not allow pledging of Company stock as collateral for a loan or holding Company stock in margin accounts. • We do not allow hedging or short sales of Company stock. • We do not have a shareholder rights plan, or “poison pill”.

| |

OUR DIRECTOR NOMINEES

You are being asked to vote on the election of the 11 director nominees listed below. Each director is elected annually by a majority of the votes cast. Detailed information about each nominee, including background, skills and expertise, can be found in “Proposal 1 – Election of Directors” beginning on page 8.

| NAME

|

AGE (AS OF MAY 14,

|

DIRECTOR SINCE

|

PRINCIPAL OCCUPATION

| |||

| G. Andrea Botta | 66 | 2010 | Chairman of the Board, Cheniere Energy, Inc.; President, Glenco LLC | |||

| Jack A. Fusco | 57 | 2016 | President and Chief Executive Officer, Cheniere Energy, Inc. | |||

| Vicky A. Bailey | 68 | 2006 | President, Anderson Stratton International, LLC | |||

| Nuno Brandolini | 66 | 2000 | Former General Partner, Scorpion Capital Partners, L.P. | |||

| Michele A. Evans | 54 | 2019 | Executive Vice President of Lockheed Martin Corporation | |||

| David I. Foley | 52 | 2012 | Senior Managing Director, The Blackstone Group L.P.; Chief Executive Officer, Blackstone Energy Partners L.P. | |||

| David B. Kilpatrick | 70 | 2003 | President, Kilpatrick Energy Group | |||

| Andrew Langham | 47 | 2017 | General Counsel, Icahn Enterprises L.P. | |||

| Courtney R. Mather | 43 | 2018 | Former Portfolio Manager of Icahn Capital | |||

| Donald F. Robillard, Jr. | 68 | 2014 | President of Robillard Consulting, LLC, Former Executive Vice President, Chief Financial Officer and Chief Risk Officer of Hunt Consolidated, Inc. and Former Chief Executive Officer and Chairman, ES Xplore, LLC | |||

| Neal A. Shear |

65 | 2014 | Senior Advisor and Chair of the Advisory Committee of Onyxpoint Global Management LP | |||

Each director nominee attended or participated in at least 75% of the aggregate number of all meetings of the Board and of each committee on which he or she sits for which the director was eligible to attend in 2019.

EXECUTIVE COMPENSATION HIGHLIGHTS

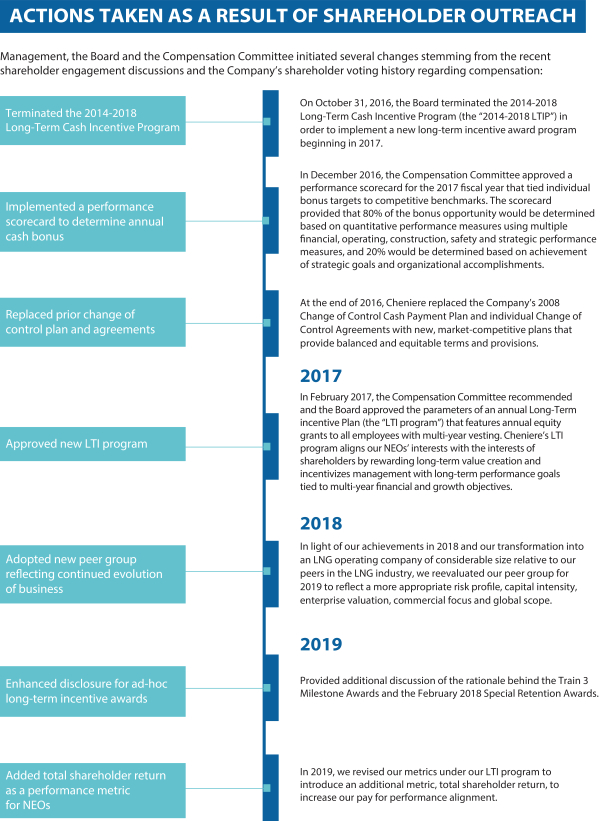

In late 2016 and early 2017, our leadership team and Compensation Committee considered input from our shareholders regarding executive compensation. As a result, we implemented several fundamental changes to our executive compensation program to align with our peer group at the time, which focused on our national industry classification – natural gas storage and transportation – and included a number of regulated utilities and smaller pipeline companies. As a result of our growth from a development company into a top tier LNG operator and receipt of shareholder feedback, the Compensation Committee, together with Meridian Compensation Partners, its independent compensation consultant, further refined the framework of our executive compensation program for 2019. Our achievements and success over the past several years led to a realignment with a new peer group for 2019 that includes companies across the oil and gas industry, excludes large regulated utilities, focuses on companies of comparable size, and offers a large number of peers in order to provide more consistent and credible results over time and reduce the impact of

| 2020 PROXY STATEMENT | 5 | |||

PROXY SUMMARY

outliers. In addition, we reassessed our compensation framework to be consistent with our new peer group and more closely align with our share price performance. Our executive compensation program continues to contemplate awarding all compensation within the designed framework of the approved plan, rather than featuring ad-hoc grants that can lead to significant variation in year over year compensation. We believe the changes made in 2019 align our program with competitive ranges in our peer group and take into account the shareholder feedback that we received.

Compensation Governance Practices

| • | Clear, direct link between pay and performance |

| • | Majority of incentive awards earned based on performance |

| • | No hedging or “short sales” of Company stock |

| • | No pledging of Company stock as collateral for a loan or holding Company stock in margin accounts |

| • | Robust stock ownership guidelines |

| • | No defined benefit retirement plan or supplemental executive retirement plan |

| • | Robust compensation risk management program |

| • | Non-employee director equity compensation limits |

| • | Minimum vesting schedule for long-term incentive awards of at least 12 months, subject to limited exceptions |

| • | No material perquisites |

| • | Solicit annual advisory vote on executive compensation |

| • | Annually review the independence of the compensation consultant retained by the Compensation Committee |

Philosophy and Objectives

The Board and the Compensation Committee are committed to a pay-for-performance compensation structure that aligns our executive compensation with the key drivers of long-term growth and creation of shareholder value, including:

| • | Annual and long-term incentive awards are primarily performance-based |

| • | Annual incentive awards earned are based on achievement of specific financial, operating, safety and strategic goals |

| • | A significant portion of long-term incentive awards earned is based on financial performance and growth metrics |

| • | Equity-based compensation delivers annual, market-competitive opportunities within common norms of shareholder dilution and value creation |

Executive Compensation Components

The primary components of our executive compensation program, as applied to our 2019 Named Executive Officers, are as follows:

| TYPE

|

PURPOSE

|

PAGE REFERENCE

| ||

| Base Salary |

Provide a minimum, fixed level of cash compensation to compensate executives for services rendered during the fiscal year. | 45 | ||

| Annual Incentive Program |

Drive achievement of annual corporate goals including key financial, operating, safety and strategic goals that create value for shareholders. | 46-48 | ||

| LTI Program |

Align executive officers’ interests with the interests of shareholders by rewarding sustained financial performance and growth through a multi-year performance period. | 49-51 | ||

| Post-Employment Compensation |

Assist executive officers and other eligible employees to prepare financially for retirement, to offer benefits that are competitive and tax-efficient and to provide a benefits structure that allows for reasonable certainty of future costs. Help retain executive officers and certain other qualified employees, maintain a stable work environment and provide financial security in the event of a change-in-control or in the event of an involuntary termination of employment. | 52-54 | ||

| 6 | CHENIERE | |||

RATIFICATION OF KPMG AS AUDITOR FOR 2020

RATIFICATION OF KPMG AS AUDITOR FOR 2020

As a matter of good corporate governance, we are asking our shareholders to ratify the selection of KPMG LLP as the Company’s independent registered public accounting firm for 2019. The following table sets forth the fees billed to us by KPMG for professional services for 2019 and 2018.

|

|

2019 | 2018 | ||||||

| Audit Fees |

$ | 7,391,505 | $ | 6,663,332 | ||||

| Audit Related Fees |

$ | — | $ | — | ||||

| Tax Fees |

$ | 80,000 | $ | 196,480 | ||||

| All Other Fees |

$ | 3,000 | $ | 2,430 | ||||

| Total |

$ | 7,474,505 | $ | 6,862,242 | ||||

See “Report of the Audit Committee” on page 74 and the information provided in Proposal 3, beginning on page 75, for more details.

CHENIERE ENERGY, INC. 2020 INCENTIVE PLAN

On April 7, 2020, the Board unanimously approved the Cheniere Energy, Inc. 2020 Incentive Plan (the “2020 Plan”), subject to shareholder approval. The 2020 Plan will be effective on May 14, 2020 (the “Effective Date”) if it is approved by our shareholders at the Meeting. The 2020 Plan will apply only to awards granted on or after the Effective Date. The terms and conditions of awards granted under the Cheniere Energy, Inc. Amended and Restated 2011 Incentive Plan (the “2011 Plan”) prior to the Effective Date will not be affected by the adoption or approval of the 2020 Plan. If the 2020 Plan is not approved by our shareholders at the Meeting, then the 2011 Plan will remain in effect on the terms in force prior to the Meeting with the 2020 Plan not taking effect.

Consistent with the 2011 Plan, the 2020 Plan incorporates several features designed to protect shareholder interests and promote current best practices, including:

| • | Minimum Vesting Requirements: Awards under the 2020 Plan will be subject to a minimum vesting schedule of at least 12 months following the date of grant of the award; provided, however, that up to 5% of the shares underlying awards granted after the Effective Date may be subject to vesting schedules of less than 12 months. For purposes of this minimum vesting requirement, awards granted to non-employee directors in respect of regular annual fees will be deemed to satisfy the requirement, even if the regular annual shareholder meeting at which the award would vest is not at least 12 months following the grant date of the award. |

| • | No Dividend Payments on Unvested Awards: The 2020 Plan expressly prohibits the payment of dividends or dividend equivalents on any award before the date on which the award vests. |

| • | Director Grant Limit: No non-employee director may be granted in any calendar year awards under the 2020 Plan in respect of regular annual fees with an aggregate grant date fair value exceeding $495,000. |

| • | Clawbacks: Awards under the 2020 Plan will be subject to any clawback or recapture policy that the Company may adopt from time to time or any clawback or recapture provisions set forth in an award agreement. |

| • | No Evergreen: The 2020 Plan does not contain any “evergreen” provisions. |

| • | No Discount or Repriced Options: The 2020 Plan does not permit discounted stock options, or repricing options to reduce the exercise price without shareholder approval. |

See Proposal 4, beginning on page 77, for more details.

| 2020 PROXY STATEMENT | 7 | |||

PROPOSAL 1 – ELECTION OF DIRECTORS

This year, there are 11 nominees standing for election as directors at the Meeting. Below is a summary of our director nominees, including their committee memberships as of April 10, 2020. The Board, with assistance from the Governance and Nominating Committee, will evaluate and reassign committee memberships as needed following the Meeting and election of the director nominees. Detailed information about each director’s background, skills and expertise is provided below.

|

NOMINEE COMMITTEE MEMBERSHIPS | ||||||||||||

| NAME CURRENT POSITION |

AGE (AS OF MAY 14, 2020) |

DIRECTOR SINCE |

INDEPENDENT | AUDIT | GOVERNANCE AND NOMINATING |

COMPENSATION | ||||||

| G. Andrea Botta Chairman of the Board, Cheniere Energy, Inc. President, Glenco LLC |

66 | 2010 | YES |

|

Chair |

| ||||||

| Jack A. Fusco President and Chief Executive Officer, Cheniere Energy, Inc. |

57 | 2016 | NO |

|

|

| ||||||

| Vicky A. Bailey President, Anderson Stratton International, LLC |

68 | 2006 | YES | ● | ● |

| ||||||

| Nuno Brandolini Former General Partner, Scorpion Capital Partners, L.P. |

66 | 2000 | YES |

|

● | ● | ||||||

| Michele A. Evans Executive Vice President of Lockheed Martin Corporation |

54 | 2019 | YES | ● | ● |

| ||||||

| David I. Foley Senior Managing Director, The Blackstone Group L.P. Chief Executive Officer, Blackstone Energy Partners L.P. |

52 | 2012 | NO |

|

|

| ||||||

| David B. Kilpatrick President, Kilpatrick Energy Group |

70 | 2003 | YES | ● |

|

● | ||||||

| Andrew Langham General Counsel, Icahn Enterprises L.P. |

47 | 2017 | YES |

|

● | ● | ||||||

| Courtney R. Mather Former Portfolio Manager of Icahn Capital |

43 | 2018 | YES | ● F |

|

| ||||||

| Donald F. Robillard, Jr. President of Robillard Consulting, LLC, |

68 | 2014 | YES | Chair; F |

|

| ||||||

| Neal A. Shear Senior Advisor and Chair of the Advisory Committee of Onyxpoint Global Management LP |

65 | 2014 | YES |

|

|

Chair | ||||||

F Audit Committee Financial Expert

The Board has determined that each of Messrs. Mather and Robillard is an “audit committee financial expert” as defined in Item 407(d)(5)(ii) of Regulation S-K promulgated by the Securities and Exchange Commission (“SEC”).

| 8 | CHENIERE | |||

DIRECTORS AND NOMINEES

Summary of Director Core Competencies

| 2020 PROXY STATEMENT | 9 | |||

PROPOSAL 1 – ELECTION OF DIRECTORS

DIRECTOR NOMINATIONS AND QUALIFICATIONS

Director Nomination Policy and Procedures. Our Director Nomination Policy and Procedures is attached to the Governance and Nominating Committee’s written charter as Exhibit A, which is available on our website at www.cheniere.com. The Governance and Nominating Committee considers suggestions for potential director nominees to the Board from any source, including current members of the Board and our management, advisors and shareholders. The Governance and Nominating Committee evaluates potential nominees by reviewing their qualifications and any other information deemed relevant. Director nominees are recommended to the Board by the Governance and Nominating Committee.

The full Board will select and recommend candidates for nomination as directors for shareholders to consider and vote upon at the annual shareholders’ meeting. The Governance and Nominating Committee reviews and considers any candidates submitted by a shareholder or shareholder group in the same manner as all other candidates.

Qualifications for consideration as a director nominee vary according to the particular areas of expertise being sought as a complement to the existing Board composition. However, minimum criteria for selection of members to serve on our Board include the following:

| • | highest professional and personal ethical standards and integrity; |

| • | high level of education and/or business experience; |

| • | broad-based business acumen; |

| • | understanding of the Company’s business and industry; |

| • | sufficient time to effectively carry out their duties; |

| • | strategic thinking and willingness to share ideas; |

| • | loyalty and commitment to driving the success of the Company; |

| • | network of business and industry contacts; and |

| • | diversity of experiences, expertise and backgrounds among members of the Board. |

Board Expansion. In 2019 we engaged an independent director search firm to help identify prospective director candidates, with the goal of adding one director to our Board. In addition to the minimum criteria described above, the Governance and Nominating Committee evaluated the skill sets needed to maximize Board effectiveness and support the strategic direction of the Company. We looked at a diverse pool of candidates, considering each candidate’s business or professional experience, demonstrated leadership ability, integrity and judgment, record of public service, diversity, financial and technological acumen and international experience. We view and define diversity in a broad sense, which includes gender, ethnicity, age, education, experience and leadership qualities.

Practices for Considering Diversity. The minimum criteria for selection of members to serve on our Board are designed to ensure that the Governance and Nominating Committee selects director nominees taking into consideration that the Board will benefit from having directors that represent a diversity of experience and backgrounds. Director nominees are selected so that the Board represents a diversity of experience in areas needed to foster the Company’s business success, including experience in the energy industry, finance, consulting, international affairs, public service, governance and regulatory compliance. Each year the Board and each committee participates in a self-assessment or evaluation of the effectiveness of the Board and its committees. These evaluations assess the diversity of talents, expertise and occupational and personal backgrounds of the Board members.

Shareholder Nominations for Director. A shareholder of the Company may nominate a candidate or candidates for election to the Board at an annual meeting of shareholders if such shareholder (1) was a shareholder of record at the time the notice provided for below is delivered to the Corporate Secretary, (2) is entitled to vote at the meeting of shareholders called for the election of directors and is entitled to vote upon such election and (3) complies with the notice procedures set forth in our Bylaws. Nominations made by a shareholder must be made by giving timely notice in writing to the Corporate Secretary of the Company at the following address: Corporate Secretary, Cheniere Energy, Inc., 700 Milam Street, Suite 1900, Houston, Texas 77002. To be timely, a shareholder’s notice must be delivered not later than the close of business on the 90th day, nor earlier than the close of business on the 120th day, prior to the first anniversary of the preceding year’s annual meeting. However, if (and only if) the date of the annual meeting is more than 30 days before or more than 70 days after such anniversary date, notice by the shareholder must be delivered not earlier than the close of business on the 120th day prior to such annual meeting and not later than the close of business on the later of the 90th day prior to such annual meeting or the 10th day following the day on which public announcement of the date of such meeting is first made by the Company. In no event will the public announcement of an adjournment or postponement of an annual meeting of

| 10 | CHENIERE | |||

DIRECTOR NOMINATIONS AND QUALIFICATIONS

shareholders commence a new time period (or extend any time period) for the giving of a shareholder’s notice as described above. A shareholder’s notice must include information about the shareholder and the nominee, as required by our Bylaws, which are available on our website at www.cheniere.com.

Director Nominations for Inclusion in Proxy Statement (Proxy Access). A shareholder, or group of up to 20 shareholders, continuously owning at least 3% of the Company’s common stock for at least the prior three consecutive years (and meeting the other requirements set forth in our Bylaws) may nominate for election to our Board and inclusion in our proxy statement for our annual meeting of shareholders up to 20% of the number of directors then serving on our Board. In September 2016, the Board amended the Company’s proxy access bylaw to (i) expand the definition of Eligible Holder to specifically allow groups of funds under common management and funded primarily by the same employer to be treated as one Eligible Holder, (ii) clarify the timing required for a shareholder to propose a director nominee and (iii) eliminate the provision that allowed the Company to omit from its Proxy Statement a director nominee who receives a vote of less than 25% of the shares of common stock entitled to vote for such nominee at one of the two preceding annual meetings.

Notice must include all information required by our Bylaws, which are available on our website at www.cheniere.com. In addition to complying with the other requirements set forth in our Bylaws, an eligible shareholder must provide timely notice in writing to the Corporate Secretary of the Company at the following address: Corporate Secretary, Cheniere Energy, Inc., 700 Milam Street, Suite 1900, Houston, Texas 77002. To be timely for purposes of proxy access, a shareholder’s notice must be delivered not later than the close of business on the 120th day, nor earlier than the close of business on the 150th day, prior to the first anniversary of the date that the Company first mailed its proxy statement to shareholders for the prior year’s annual meeting of shareholders. However, if (and only if) the annual meeting is not scheduled to be held within a period that commences 30 days before such anniversary date and ends 30 days after such anniversary date (an annual meeting date outside such period being referred to herein as an “Other Meeting Date”), notice must be given in the manner provided in our Bylaws by the later of the close of business on the date that is 180 days prior to such Other Meeting Date and the 10th day following the date on which public announcement of such Other Meeting Date is first made.

Director Qualifications. The Board has concluded that, in light of our business and structure, each of our director nominees possesses relevant experience, qualifications, attributes and skills and should continue to serve on our Board as of the date of this Proxy Statement. The primary qualifications of our directors are further discussed under “Director Biographies” below.

Director Retirement Policy. The Board has adopted a mandatory director retirement policy that requires each director who has attained the age of 75 to retire from the Board at the annual meeting of shareholders of the Company held in the year in which his or her current term expires, unless the Board determines such mandate for a particular director is not at the time in the best interests of the Company. The Board believes this policy will ensure a healthy rotation of directors, which will promote the continued influx of new ideas and perspectives to the Board.

| 2020 PROXY STATEMENT | 11 | |||

DIRECTOR BIOGRAPHIES

|

VICKY A . BAILEY

MEMBER OF AUDIT COMMITTEE AND GOVERNANCE |

AGE: 68

DIRECTOR SINCE: 2006

|

| ||||

|

NUNO BRANDOLINI

MEMBER OF COMPENSATION COMMITTEE AND |

AGE: 66

DIRECTOR SINCE: 2000

|

| ||||

| 2020 PROXY STATEMENT | 13 | |||

PROPOSAL 1 – ELECTION OF DIRECTORS

|

MICHELE A. EVANS

MEMBER OF AUDIT COMMITTEE AND GOVERNANCE AND NOMINATING COMMITTEE |

AGE: 54

DIRECTOR SINCE: 2019

|

| ||||

|

DAVID I. FOLEY

DIRECTOR |

AGE: 52

DIRECTOR SINCE: 2012

|

| ||||

| 14 | CHENIERE | |||

DIRECTOR BIOGRAPHIES

|

DAVID B. KILPATRICK

MEMBER OF AUDIT COMMITTEE AND COMPENSATION COMMITTEE |

AGE: 70

DIRECTOR SINCE: 2003

|

| ||||

|

ANDREW LANGHAM

MEMBER OF COMPENSATION COMMITTEE AND |

AGE: 47

DIRECTOR SINCE: 2017

|

| ||||

| 2020 PROXY STATEMENT | 15 | |||

PROPOSAL 1 – ELECTION OF DIRECTORS

|

COURTNEY R. MATHER,

MEMBER OF AUDIT COMMITTEE

|

AGE: 43

DIRECTOR SINCE: 2018

|

| ||||

|

DONALD F. ROBILLARD, JR.

CHAIRMAN OF AUDIT COMMITTEE |

AGE: 68

DIRECTOR SINCE: 2014

|

| ||||

| 16 | CHENIERE | |||

DIRECTOR BIOGRAPHIES

|

NEAL A. SHEAR

CHAIRMAN OF COMPENSATION COMMITTEE

|

AGE: 65

DIRECTOR SINCE: 2014

|

| ||||

| 2020 PROXY STATEMENT | 17 | |||

BOARD COMMITTEE MEMBERSHIP AND ATTENDANCE

The following table shows the fiscal year 2019 membership and chairpersons of our Board committees, committee meetings held and committee member attendance as a percentage of meetings eligible to attend. The current Chair of each Board committee is indicated in the table.

| NUMBER OF MEETINGS HELD |

BOTTA | FUSCO | BAILEY | BRANDOLINI | EVANS(1) | FOLEY | KILPATRICK | LANGHAM | MATHER | ROBILLARD | SHEAR | |||||||||||||

| Audit |

7 | — | — | 100% | — | 67% | — | 100% | — | 100% | 100% Chair |

— | ||||||||||||

| Governance and Nominating |

5 | 100% Chair |

— | 80% | 100% | 50% | — | — | 100% | — | — | — | ||||||||||||

| Compensation |

7 | — | — | — | 100% | — | — | 100% | 100% | — | — | 100% Chair | ||||||||||||

| (1) | In June 2019, Ms. Evans was appointed to the Board, Audit Committee and Governance and Nominating Committee. |

The Board determines the independence of each director and nominee for election as a director in accordance with the rules and regulations of the SEC and the NYSE American LLC (“NYSE American”) independence standards, which are listed below. The Board also considers relationships that a director may have:

| • | as a partner, shareholder or officer of organizations that do business with or provide services to Cheniere; |

| • | as an executive officer of charitable organizations to which we have made or make contributions; and |

| • | that may interfere with the exercise of a director’s independent judgment. |

The NYSE American independence standards state that the following list of persons will not be considered independent:

| • | a director who is, or during the past three years was, employed by the Company or by any parent or subsidiary of the Company other than prior employment as an interim executive officer for less than one year; |

| • | a director who accepts, or has an immediate family member who accepts, any compensation from the Company or any parent or subsidiary of the Company in excess of $120,000 during any period of 12 consecutive months within the past three years, other than compensation for Board or committee services, compensation paid to an immediate family member who is a non-executive employee of the Company, compensation received for former service as an interim executive officer provided the interim service did not last longer than one year, benefits under a tax-qualified retirement plan or non-discretionary compensation; |

| • | a director who is an immediate family member of an individual who is, or has been in any of the past three years, employed by the Company or any parent or subsidiary of the Company as an executive officer; |

| • | a director who is, or has an immediate family member who is a partner in, or a controlling shareholder or an executive officer of, any organization to which the Company made, or from which the Company received, payments (other than those arising solely from investments in the Company’s securities or payments under non-discretionary charitable contribution matching programs) that exceed 5% of the organization’s consolidated gross revenues for that year, or $200,000, whichever is more, in any of the most recent three fiscal years; |

| • | a director who is, or has an immediate family member who is, employed as an executive officer of another entity where at any time during the most recent three fiscal years any of the Company’s executive officers serve on the compensation committee of such other entity; or |

| 18 | CHENIERE | |||

BOARD LEADERSHIP STRUCTURE AND ROLE IN RISK OVERSIGHT

| • | a director who is, or has an immediate family member who is, a current partner of the Company’s outside auditor, or was a partner or employee of the Company’s outside auditor who worked on the Company’s audit at any time during any of the past three years. |

As of February 2020, the Board determined that Messrs. Botta, Brandolini, Kilpatrick, Langham, Mather, Robillard and Shear and Mses. Bailey and Evans are independent, and none of them has a relationship that may interfere with the exercise of his or her independent judgment.

BOARD LEADERSHIP STRUCTURE AND ROLE IN RISK OVERSIGHT

Board Leadership Structure. Mr. Botta serves as the Non-Executive Chairman of the Board. Mr. Fusco serves as President and CEO of the Company.

The Company has in place strong governance mechanisms to ensure the continued accountability of the CEO to the Board and to provide strong independent leadership, including the following:

| • | the Non-Executive Chairman of the Board provides independent leadership to the Board and ensures that the Board operates independently of management and that directors have an independent leadership contact; |

| • | each of the Board’s standing committees, consisting of the Audit, Compensation and Governance and Nominating Committees, are comprised of and chaired solely by non-employee directors who meet the independence requirements under the NYSE American listing standards and the SEC; |

| • | the independent directors of the Board, along with the Compensation Committee, evaluate the CEO’s performance and determine his compensation; |

| • | the independent directors of the Board meet in executive sessions without management present and have the opportunity to discuss the effectiveness of the Company’s management, including the CEO, the quality of Board meetings and any other issues and concerns; and |

| • | the Governance and Nominating Committee has oversight of succession planning, both planned and emergency, and the Board has approved an emergency CEO succession process. |

The Board believes that its leadership structure assists the Board’s role in risk oversight. See the discussion on the “Board’s Role in Risk Oversight” below.

Non-Executive Chairman of the Board. The Non-Executive Chairman of the Board position is held by Mr. Botta, an independent director. The Board has appointed an independent Chairman of the Board to provide independent leadership to the Board. The Non-Executive Chairman of the Board role allows the Board to operate independently of management with the Non-Executive Chairman of the Board providing an independent leadership contact to the other directors. The responsibilities of the Non-Executive Chairman of the Board are set out in a Non-Executive Chairman of the Board Charter. These responsibilities include the following:

| • | preside at all meetings of the Board, including executive sessions of the independent directors; |

| • | call meetings of the Board and meetings of the independent directors, as may be determined in the discretion of the Non-Executive Chairman of the Board; |

| • | work with the CEO and the Corporate Secretary to prepare the schedule of Board meetings to assure that the directors have sufficient time to discuss all agenda items; |

| • | prepare the Board agendas in coordination with the CEO and the Corporate Secretary; |

| • | advise the CEO of any matters that the Non-Executive Chairman of the Board determines should be included in any Board meeting agenda; |

| • | advise the CEO as to the quality, quantity, appropriateness and timeliness of the flow of information from the Company’s management to the Board; |

| • | recommend to the Board the retention of consultants who report directly to the Board; |

| 2020 PROXY STATEMENT | 19 | |||

GOVERNANCE INFORMATION

| • | act as principal liaison between the directors and the CEO on all issues, including, but not limited to, related party transactions; |

| • | in the discretion of the Non-Executive Chairman of the Board, participate in meetings of the committees of the Board; |

| • | in the absence of the CEO or as requested by the Board, act as the spokesperson for the Company; and |

| • | be available, if requested, for consultation and direct communication with major shareholders of the Company. |

Board’s Role in Risk Oversight. Risks that could affect the Company are an integral part of Board and committee deliberations throughout the year. The Board has oversight responsibility for assessing the primary risks (including liquidity, credit, operations and regulatory compliance) facing the Company, the relative magnitude of these risks and management’s plan for mitigating these risks. In addition to the Board’s oversight responsibility, the committees of the Board consider the risks within their areas of responsibility. The Board and its committees receive regular reports directly from members of management who are responsible for managing particular risks within the Company. The Audit Committee discusses with management the Company’s major financial and risk exposures and the steps management has taken to monitor and control such exposures, including the Company’s risk assessment and risk management policies. The Governance and Nominating Committee reviews with management the current and emerging environmental, sustainability and social responsibility issues impacting the Company. For a discussion of the Compensation Committee’s risk oversight, please see “Review of Compensation Risk” on page 28 of this Proxy Statement. The Board and its committees regularly discuss the risks related to the Company’s business strategy at their meetings.

SHAREHOLDER OUTREACH–GOVERNANCE

The Company proactively engages with shareholders on governance topics as a matter of strategic priority, and the continuous evolution of our governance framework is a product of the Board’s responsiveness to shareholder input.

Ahead of our 2019 Annual Meeting of Shareholders (the “2019 Annual Meeting”), members of our Board and management reached out to, and had extensive dialogue with, shareholders representing more than 50% of our outstanding common stock, through both in-person and telephonic meetings, with governance topics being a priority in these engagements.

Following our 2019 Annual Meeting, we engaged with shareholders holding more than 50% of our outstanding common stock, as well as proxy advisory firms, and we intend to continue our proactive and constructive shareholder outreach efforts going forward and to consider any shareholder concerns that are raised with respect to our governance framework.

The Board believes that its current system of corporate governance oversight enables the directors to be prudent stewards of shareholder capital and the long-term interests of the Company and our shareholders. In addition, the Board is responsive to evolution in the general corporate governance environment.

Key Themes from Our Shareholder Outreach

Many of our shareholders have different methodologies and processes for evaluating governance programs. However, a number of common themes emerged during our engagements with shareholders, which included:

| • | Additional disclosure regarding the Company’s prioritization and efforts regarding Environmental, Social, and Governance (“ESG”) issues. An increasing number of our shareholders have expressed a desire for improved disclosure regarding the Company’s efforts to address ESG-related issues and opportunities. Addressing ESG-related issues and opportunities is a focus of the Company’s executive management, with oversight from the Governance and Nominating Committee of the Board, and we believe we have made significant progress with respect to addressing these issues. We have added disclosure regarding ESG and the Company’s progress below in “Corporate Social Responsibility and Political Advocacy and Oversight.” We will continue to work to address these important issues and evolve our related disclosure in the future. |

| • | Continued monitoring and implementation of best governance practices. Several of our shareholders have expressed a desire that our Board continue to monitor changes in the general corporate governance environment and consider any appropriate changes to our governance practices. Our Board is responsive to changes in the general corporate governance environment and strives to implement best governance practices in a timely manner. |

Please see pages 40-42 of this Proxy Statement for a discussion regarding actions taken by our Board with respect to compensation matters as a result of shareholder outreach.

| 20 | CHENIERE | |||

CORPORATE SOCIAL RESPONSIBILITY AND POLITICAL ADVOCACY AND OVERSIGHT

CORPORATE SOCIAL RESPONSIBILITY AND POLITICAL ADVOCACY AND OVERSIGHT

Climate Change Strategy

At Cheniere, we believe climate change creates important opportunities to address the dual challenge of advancing economic and environmental progress through delivery and use of our product in lieu of more environmentally intensive energy sources.

Our focus on clean energy sources is so central to our operations that it comprises our vision statement: “We provide clean, secure, and affordable energy to the world.”

The International Energy Agency (“IEA”) concludes that even under a 2-degree carbon-constrained scenario, natural gas may provide a quarter of the global energy demand by 2040 and that LNG facilities will remain critical to meet this future demand. The IEA estimates that switching to natural gas has already helped limit the rise in global emissions since 2010 and has avoided over 500 million metric tons (Mt) of CO2 emissions between 2010 and 2018.

To help us realize our opportunity to help address climate and sustainability, Cheniere has:

| • | Adopted a set of climate and sustainability principles, reviewed by the Board as part of its climate and sustainability oversight: |

| 1. | Science: Cheniere will promote and follow peer-reviewed science to assess our impacts, anchor our engagements, and determine our actions. |

| 2. | Operational Excellence: Cheniere will design and operate our facilities to reduce environmental impacts. |

| 3. | Supply Chain: Cheniere will work with our partners to reduce environmental impacts throughout our supply chain. |

| 4. | Transparency: We will communicate openly and proactively with our stakeholders. |

| • | Co-founded and announced the formation of the Collaboratory to Advance Methane Science to improve scientific understanding of methane emissions across the entire natural gas value chain |

| • | Implemented an Environmental Policy and elements of an Environmental Management System in line with the ISO 14001 standard |

| • | Implemented Leak Detection and Repair programs at our terminals and compressor stations to monitor fugitive emissions, including methane |

| • | Designed and constructed facilities to optimize cost-effective, energy-efficient operations. For example, at our Sabine Pass and Corpus Christi facilities, we capture waste heat from our refrigeration gas turbines and reuse it to support various energy-intensive processes |

| • | Addressed opportunities to better understand the lifecycle greenhouse gas emissions of Cheniere’s supply chain by engaging our major natural gas suppliers and developing analytical models |

| • | Participated in studies coordinated by the National Petroleum Council to assess the opportunities and actions needed to expand the application of carbon capture, utilization, and sequestration |

We plan to publish our inaugural Corporate Responsibility (“CR”) report in 2020. The report is expected to be aligned with elements of reporting standards and recommendations set by the Task Force on Climate Related Financial Disclosures (“TCFD”), and the Sustainability Accounting Standards Board (“SASB”), and other guidelines such as International Petroleum Industry Environmental Conservation Association and the Global Reporting Initiative (“GRI”).

Climate and Sustainability Governance

Our Board oversees our climate and sustainability issues. The Governance and Nominating Committee of the Board oversees our climate and sustainability policies and strategies. Cheniere’s Policy, Government, and Public Affairs (“PGPA”) organization, led by a Senior Vice President (“SVP”), heads our enterprise-wide climate and sustainability initiatives and maintains oversight of climate-related risks. We have a cross-functional CR team, made up of representatives from across the company, led by a dedicated climate and sustainability department.

Additional details can be found at https://www.cheniere.com/corporate-responsibility/climate/.

| 2020 PROXY STATEMENT | 21 | |||

GOVERNANCE INFORMATION

Health and Safety

Cheniere is committed to conducting our business in a way that protects the safety and well-being of our workforce, customers, and others who may be affected by our operations.

Cheniere facilitates this commitment through the Health and Safety Policy which promotes:

| • | A Generative Safety Culture where no job is so important that it cannot be done safely |

| • | Performance measurement to drive continual improvement towards eliminating injuries and ill-health |

| • | Proactive identification and management of risk |

| • | Compliance with applicable legal and regulatory requirements |

| • | Conformance with industry standards |

| • | Integrating process safety into the design and operation of our facilities |

| • | Proactive committed leadership and individual accountability for health and safety |

| • | Employee engagement |

| • | Training and competence in safe work practices and procedures |

| • | Assurance assessments and reviews |

| • | Investigation of health and safety incidents and the implementation of lessons learned |

| • | Integration of health and safety into all aspects of the business |

Cheniere’s commitment to a robust Safety Culture and Committed Leadership is supported through the following key programs that seek to deliver on safety practices and promote safety culture through locally established programs:

| • | An Executive Safety Committee that sets the strategic health and safety direction for Cheniere. It is chaired by a member of our senior leadership with attendance of other senior leaders, including the Chief Executive Officer. Representatives from our assets and office locations serve on the Committee. |

| • | Asset location and Office Safety Committees that are chaired by and include Company employees. These Committees seek to deliver on safety practices and promote safety culture through locally established programs. |

Cheniere utilizes a risk-based approach that establishes the processes through which health and safety excellence is delivered, and it defines the standards and procedures to enable delivery of critical processes, in a consistent approach.

To ensure that our employees can effectively implement safety processes relevant to their roles at Cheniere, we maintain a robust training program. It ensures compliance with all safety regulatory requirements while establishing the competency and training needs to deliver on the health and safety processes.

Governance and assurance programs are also in place which define the safety performance metrics and verification processes that are used to assess the effectiveness of the health and safety programs. In addition, these programs enable a proactive approach to safety through the collation and analysis of the safety performance metrics and determination of health and safety trends. An assurance process verifies that implemented programs are value-added, effective and meeting or exceeding the health and safety requirements.

Through LiveWell 365, Cheniere’s well-being program, employees can participate in activities such as well-being assessments, company and personal challenges, and fitness tracking to earn rewards over the course of the year.

Cheniere has established processes to share lessons learned and promote continuous improvement in systems and processes in meeting our commitment to our core value of safety.

The Health and Safety Policy is reviewed annually to ensure relevance, sustainability, and to adopt any changes to further enhance our commitments.

Additional details can be found at https://www.cheniere.com/corporate-responsibility/health-safety/.

| 22 | CHENIERE | |||

CORPORATE SOCIAL RESPONSIBILITY AND POLITICAL ADVOCACY AND OVERSIGHT

Community Engagement

We work with our communities throughout all stages of a project lifecycle—from early development through permitting, construction, and operation. The Vice President of State and Local Government and Community Affairs manages community stakeholder engagement, community investments, philanthropy, and volunteer efforts. Oversight and initiatives include:

| • | A robust stakeholder engagement plan whereby our site leadership engages with their community counterparts on a regular basis |

| • | A social risk assessment process that informs our community investments and aligns them with community needs |

| • | Direct community engagement including public safety workshops, public presentations to community organizations, community open houses and meet-and-greets |

| • | A Community Advisory Panel with members from the Coastal Bend community to engage with residents from nine different communities near our Corpus Christi facility |

| • | Formal feedback mechanisms that allow us to track, investigate and resolve (or mitigate) community concerns |

Community Investments

We are dedicated to improving our communities to positively impact the areas where we work and live. We demonstrate our commitment not just by opening our wallets, but by rolling up our sleeves. Through our Cheniere Foundation and direct company contributions, we invested more than $3.6 million in 2019 including over $200,000 of in-kind donations. Employee programs include volunteer time-off allowance, matching gifts program and a new employee giving fund. Corporate giving highlights included:

| • | Empowering individuals and families: literacy and GED programs, community mammograms, apprenticeship programs, low income housing and support for local emergency services |

| • | Supporting our military and veterans: USO renovations, Texas A&M Veterans Resource Center for tutoring and successful transitions into the civilian workforce, wounded warriors and support for a homeless wing at the Salvation Army |

| • | Protecting our environment: Continued support to the Coalition to Restore Coastal Louisiana and Restore America’s Estuaries to support the restoration of the Chenier Plain shoreline in southwest Louisiana. Our support since 2008 has helped restore over 50 acres of coastal habitat by planting more than 143,000 marsh plants, installing at least 10,000 feet of sand fence and enhancing over 24 miles of shoreline |

| Invested over $3.6 million |

Provided over 8,000 volunteer hours |

Received Joe D. May Excellence in Public Policy Award

|

Matching Gift Program expanded to include UK and Singapore offices – nearly 50% of employees at these sites utilized the program

| |||||||||

Additional details can be found at https://www.cheniere.com/corporate-responsibility/community/feedback-consultation/ and https://www.cheniere.com/corporate-responsibility/community/community-investment/.

Human Capital Management

Cheniere’s human capital management programs focus on talent attraction and retention, rewards and remuneration, employee relations, employee engagement, diversity and inclusion, and training and development.

Highlights include:

Talent Attraction and Employee Engagement

| • | Entry-level rotational positions |

| • | Paid internships with mentoring, structured learning, and real business experience |

| 2020 PROXY STATEMENT | 23 | |||

GOVERNANCE INFORMATION

| • | Competitive benefits package and wellness incentives including subsidies for fitness devices and gym memberships, as well as online training related to health and nutrition |

| • | Cheniere Listens, a program for employees to submit questions or concerns |

| • | Anonymous engagement surveys to better understand our employees’ connection with Cheniere and their work, and to identify opportunities for improvement |

Development and Training

| • | A Learning Management System, Cheniere LEARN, through which employees can access more than 160 online learning courses covering topics including office productivity, project management, and leadership |

| • | Core curriculum training offered to all employees on topics such as project management, crucial conversations, presentation skills, and negotiations |

| • | Leadership development, including executive coaching, university-based immersion programs, and the Leadership Foundations Program |

| • | Funding for employees’ external professional certifications, continuing education, and professional conferences |

| • | Mentoring and job shadowing programs through our partnerships |

| • | Annual performance reviews to ensure the ongoing development of skills and expertise |

We encourage our employees to leverage their unique backgrounds in support of our efforts to grow a culture of diversity. Our employee resource group Women Inspiring and Leading Success—affiliated with Pink PETRO, Lean In Energy, and Women’s Energy Network—has a mission to promote a global culture of diversity and inclusion that fosters teamwork, respect, and a rewarding work environment.

We communicate progress on our human capital programs to our Board annually.

Additional details can be found at https://www.cheniere.com/corporate-responsibility/workplace/.

Advocacy and Oversight

We align all political engagement efforts with our vision statement—to provide clean, secure, and affordable energy to the world. We lend our LNG operational and business expertise to regulators, policymakers, and the global energy industry. Led by the SVP of PGPA, the organization develops and advocates policy positions through our participation in trade associations and partnerships. The SVP of PGPA updates the Board at least annually on political involvement programs and practices.

As the leading provider of LNG in the U.S., we engage with industry, trade, and business associations as a matter of strategic priority. While our participation and involvement in such organizations is important, at times our official position on certain issues may differ from positions or views advocated by such organizations. We provide our insight and expertise on policy issues affecting the natural gas industry and our operations. Our employees may periodically serve on federal advisory committees or non-governmental organizational committees to provide expert counsel.

We expect employees to uphold the highest standards of ethical behavior and conduct all political advocacy activities in compliance with applicable state and federal laws as well as company policies. We comply with regulatory standards associated with registration and reporting of our lobbying activities, which are limited to the U.S. only. Our lobbying expenses are made public as required by Congress in the Federal Lobbying Database and by state agencies in the Texas and Louisiana state databases.

The Cheniere Energy, Inc. Political Action Committee (“PAC”) is a vehicle through which employees may voluntarily make contributions to a fund, which supports the election of candidates (federal or state) in the U.S. only. A five-member PAC Committee oversees the PAC. The Committee reviews and either approves or denies each individual contribution. The dollar value of each contribution and its recipient is publicly available at the Federal Contributions Database. In the 2019 calendar year, the PAC contributed $76,800 to U.S. political parties and candidates.

Cheniere also makes direct corporate contributions as permitted by law. It is our policy that company funds or assets will not be used to make a political contribution to any political party or candidate, unless approval has been given by a compliance officer. In 2019, our direct political contributions were $67,500.

Cheniere’s memberships in 501(c)(4) and 501(c)(6) organizations can be found at https://www.cheniere.com/files/comms/Cheniere_Memberships_2019_Final.pdf.

Additional details can be found at https://www.cheniere.com/corporate-responsibility/governance/political-involvement-program/.

| 24 | CHENIERE | |||

MEETINGS AND COMMITTEES OF THE BOARD

MEETINGS AND COMMITTEES OF THE BOARD

Our operations are managed under the broad supervision and direction of the Board, which has the ultimate responsibility for the oversight of the Company’s general operating philosophy, objectives, goals and policies. Pursuant to authority delegated by the Board, certain Board functions are discharged by the Board’s standing Audit, Governance and Nominating and Compensation Committees. Members of the Audit, Governance and Nominating and Compensation Committees for a given year are selected by the Board following the annual shareholders’ meeting. During the fiscal year ended December 31, 2019, our Board held 8 meetings. Each incumbent member of the Board attended or participated in at least 75% of the aggregate number of: (i) Board meetings; and (ii) committee meetings held by each committee of the Board on which the director served during the period for which each director served. Although directors are not required to attend annual shareholders’ meetings, they are encouraged to attend such meetings. At the 2019 Annual Meeting of Shareholders, 9 of the 10 members of the Board then serving were present.

Committee Membership as of April 10, 2020:

| AUDIT COMMITTEE | GOVERNANCE AND NOMINATING COMMITTEE | COMPENSATION COMMITTEE | ||

| Donald F. Robillard, Jr.* | G. Andrea Botta* | Neal A. Shear* | ||

| Vicky A. Bailey | Vicky A. Bailey | Nuno Brandolini | ||

| Michele A. Evans | Nuno Brandolini | David B. Kilpatrick | ||

| David B. Kilpatrick | Michele A. Evans | Andrew Langham | ||

| Courtney R. Mather | Andrew Langham | |||

| * | Chair of Committee |

AUDIT COMMITTEE

Each member of the Audit Committee has been determined by the Board to be “independent” as defined by the NYSE American listing standards and by the SEC, and the Board determined that each of Messrs. Robillard and Mather is an “audit committee financial expert” as defined in Item 407(d)(5)(ii) of Regulation S-K promulgated by the SEC. The Audit Committee held 7 meetings during the fiscal year ended December 31, 2019.

The Audit Committee has a written charter, which is available on our website at www.cheniere.com. The Audit Committee is appointed by the Board to oversee the accounting and financial reporting processes of the Company and the audits of the Company’s financial statements. The Audit Committee assists the Board in overseeing:

| • | the integrity of the Company’s financial statements; |

| • | the qualifications, independence and performance of our independent auditor; |

| • | our internal audit function and systems of internal controls over financial reporting and disclosure controls and procedures; and |

| • | compliance by the Company with legal and regulatory requirements. |

The Audit Committee maintains a channel of communication among the independent auditor, principal financial and accounting officers, VP-internal audit, compliance officer and the Board concerning our financial and compliance position and affairs. The Audit Committee has and may exercise all powers and authority of the Board in connection with carrying out its functions and responsibilities and has sole authority to select and retain the independent auditor and authority to engage and determine funding for independent legal, accounting or other advisers. The Audit Committee’s responsibility is oversight, and it recognizes that the Company’s management is responsible for preparing the Company’s financial statements and complying with applicable laws and regulations.

| 2020 PROXY STATEMENT | 25 | |||

GOVERNANCE INFORMATION

GOVERNANCE AND NOMINATING COMMITTEE

Each member of the Governance and Nominating Committee has been determined by the Board to be “independent” as defined by the NYSE American listing standards and by the SEC. The Governance and Nominating Committee held 5 meetings during the fiscal year ended December 31, 2019.

The Governance and Nominating Committee has a written charter, which is available on our website at www.cheniere.com. The Governance and Nominating Committee is appointed by the Board to develop and maintain the Company’s corporate governance policies. The Governance and Nominating Committee also oversees our Director Nomination Policy and Procedures. The Governance and Nominating Committee has the following duties and responsibilities, among others:

| • | develop a process, subject to approval by the Board, for an annual evaluation of the Board and its committees and oversee this evaluation; |

| • | identify, recruit and evaluate individuals qualified to serve on the Board in accordance with the Company’s Director Nomination Policy and Procedures and recommend to the Board such director nominees to be considered for election at the Company’s annual meeting of shareholders or to be appointed by the Board to fill an existing or newly created vacancy on the Board; |

| • | identify, at least annually, members of the Board to serve on each Board committee and as chairman of each Board committee and recommend each such member and chairman to the Board for approval; |

| • | assist the Board in evaluating and determining director independence under applicable laws, rules and regulations, including the rules and regulations of the NYSE American; |

| • | develop and maintain policies and procedures with respect to the evaluation of the performance of the CEO; |

| • | review periodically the size of the Board and the structure, composition and responsibilities of the committees of the Board to enhance continued effectiveness; |

| • | review, at least annually, director compensation for service on the Board and Board committees, including committee chairmen compensation, and recommend any changes to the Board; |

| • | review, at least annually, the Company’s policies and practices relating to corporate governance and, when necessary or appropriate, recommend any proposed changes to the Board for approval; |