UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to §240.14a-11(c) or §240.14a-12 | |

Cheniere Energy, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount previously paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing party:

| |||

| (4) | Date Filed:

| |||

Notes:

Reg. §240.14a-101.

SEC 1913 (3-99)

April 17, 2017

To our Shareholders:

It is our pleasure to invite you to attend the Cheniere Energy, Inc. 2017 Annual Meeting of Shareholders. The meeting will be held at 9:00 a.m., Central Time on May 18, 2017 at our corporate headquarters located at 700 Milam Street, Suite 1900, Houston, Texas 77002.

The following Notice of Annual Meeting describes the business to be conducted at the 2017 Annual Meeting of Shareholders. We encourage you to review the materials and vote your shares.

You may vote via the Internet, by telephone, or by submitting your completed proxy card by mail. If you attend the 2017 Annual Meeting of Shareholders, you may vote your shares in person if you are a shareholder of record.

Thank you for your continued support as investors in Cheniere Energy, Inc.

Very Truly Yours,

|

| |||

| G. Andrea Botta | Jack A. Fusco | |||

| Chairman of the Board | President and Chief Executive Officer |

CHENIERE ENERGY, INC.

700 Milam Street, Suite 1900

Houston, Texas 77002

(713) 375-5000

Notice of Annual Meeting of Shareholders

| Time and Date |

9:00 a.m., Central Time on May 18, 2017 |

| Place |

Cheniere Energy, Inc. |

700 Milam Street, Suite 1900

Houston, TX 77002

| Items of Business |

• | To elect eleven members of the Board of Directors to hold office for a one-year term expiring at the 2018 Annual Meeting of Shareholders. |

| • | To approve, on an advisory and non-binding basis, the compensation of the Company’s named executive officers for 2016. |

| • | To approve, on an advisory and non-binding basis, the frequency of holding future advisory votes on the compensation of the Company’s named executive officers. |

| • | To ratify the appointment of KPMG LLP as the Company’s independent registered public accounting firm for 2017. |

| • | To approve the amendment and restatement of the Cheniere Energy, Inc. 2011 Incentive Plan. |

| • | To transact such other business as may properly come before the meeting and any adjournment or postponement thereof. |

| Record Date |

You can vote if you were a shareholder of record on March 30, 2017. |

| Proxy Voting |

It is important that your shares be represented and voted at the meeting. You can vote your shares by completing and returning your proxy card or by voting on the Internet or by telephone. See details under the heading “How do I vote?” |

| Electronic Availability of Proxy Materials |

We are making this Proxy Statement, including the Notice of Annual Meeting and 2016 Annual Report on Form 10-K for the year ended December 31, 2016, available on our website at: |

http://www.cheniere.com/2017AnnualMeeting

By order of the Board of Directors

Sean N. Markowitz

Corporate Secretary

April 17, 2017

| (i | ) | |||

| 1 | ||||

| 1 | ||||

| 5 | ||||

| 5 | ||||

| 7 | ||||

| 7 | ||||

| 8 | ||||

| 10 | ||||

| 14 | ||||

| 14 | ||||

| 14 | ||||

| 15 | ||||

| 16 | ||||

| 16 | ||||

| 17 | ||||

| 17 | ||||

| 18 | ||||

| 19 | ||||

| Code of Conduct and Ethics and Corporate Governance Guidelines |

19 | |||

| 19 | ||||

| 20 | ||||

| 22 | ||||

| 22 | ||||

| 23 | ||||

| 24 | ||||

| 25 | ||||

| 25 | ||||

| 26 | ||||

| 27 | ||||

| 27 | ||||

| 33 | ||||

| 33 | ||||

| 43 | ||||

| 45 | ||||

| 47 | ||||

The following is an overview of information that you will find throughout this Proxy Statement. This summary highlights key elements of the more detailed information contained elsewhere in this Proxy Statement, but does not contain all of the information that you should consider. For more complete information about these topics, please review the complete Proxy Statement prior to voting.

Annual Meeting of Shareholders

| Time and Date | 9:00 a.m., Central Time on May 18, 2017 | |

| Place | Cheniere Energy, Inc. | |

| 700 Milam Street, Suite 1900 | ||

| Houston, TX 77002 | ||

| Record Date | March 30, 2017 | |

| Voting | Shareholders as of the close of business on the record date are entitled to vote. | |

| Each share of common stock is entitled to one vote for each matter to be voted upon. | ||

| Admission | No admission card is required to enter the Cheniere Energy, Inc. (“Cheniere,” the “Company,” “we,” “us” or “our”) 2017 Annual Meeting of Shareholders (the “Meeting”), but you will need proof of your stock ownership and valid government-issued picture identification. Please see “General Information” on page 1 of this Proxy Statement for more information. | |

Voting Matters and Board Recommendations

| Proposal | Board Vote Recommendation |

Page Reference (for more details) |

||||

| 1. Election of directors |

FOR EACH NOMINEE | 7 | ||||

| 2. Advisory and non-binding vote on the compensation of the Company’s named executive officers for 2016 |

FOR | 59 | ||||

| 3. Advisory and non-binding vote on frequency of holding future advisory votes on the compensation of the Company’s named executive officers |

1 YEAR | 60 | ||||

| 4. Ratification of appointment of KPMG LLP as the Company’s independent registered public accounting firm for 2017 |

FOR | 62 | ||||

| 5. Approval of the amendment and restatement of the Cheniere Energy, Inc. 2011 Incentive Plan |

FOR | 63 | ||||

2016 Performance and Strategic Accomplishments

| • | In May 2016 and September 2016, Trains 1 and 2 of the natural gas liquefaction facilities at Sabine Pass (the “SPL Project”) achieved substantial completion, respectively. Subsequent to 2016, in March 2017, Train 3 of the SPL Project achieved substantial completion. |

| • | Consolidated revenue for Cheniere was approximately $1.3 billion for 2016, with over $500 million in LNG revenue in the fourth quarter. |

| • | In 2016, the SPL Project produced and exported a total of 56 cargoes representing approximately 200 million MMBtu of natural gas. |

| • | In May 2016, the Board of Directors (the “Board”) of Cheniere appointed Jack A. Fusco to serve as President and CEO. |

(i)

Corporate Governance

We are committed to the values of effective corporate governance and high ethical standards. Our Board believes that these values are conducive to strong performance and creating long-term shareholder value. Our governance framework gives our highly experienced directors the structure necessary to provide oversight, advice and counsel to Cheniere.

Since December 2015, we have taken the following governance actions:

| • | amended our bylaws to provide for proxy access by eligible shareholders, and later further amended the proxy access bylaw to expand the definition of Eligible Holder, clarify the timing required for a shareholder to propose a director nominee and eliminate a provision that allowed the Company to omit a director nominee under certain circumstances; |

| • | added additional details regarding the experience of our directors to our proxy statements; |

| • | split the Chairman of the Board and CEO roles; |

| • | appointed Jack A. Fusco to serve as President and CEO and as a member of the Board; |

| • | implemented a prohibition on pledging company securities; and |

| • | increased our director ownership guidelines. |

The “Governance Information” section of this Proxy Statement, beginning on page 14, describes our corporate governance structure, which includes the following:

| Board and Governance Information | ||||||||||

| Size of Board as of March 30, 2017 |

11 | Independent Directors Meet Without Management Present | Yes | |||||||

| Number of Independent Directors as of March 30, 2017 |

9 | Annual Board and Committee Evaluations | Yes | |||||||

| Average Age of Directors (as of May 18, 2017) |

55 | Succession Planning and Implementation Process | Yes | |||||||

| Board Meetings Held in 2016 (attendance at Board and committee meetings averaged 96%) |

17 | Codes of Conduct for Directors, Officers and Employees | Yes | |||||||

| Annual Election of Directors |

Yes | Board Risk Oversight | Yes | |||||||

| Mandatory Retirement Age |

75 | Stock Ownership Guidelines for Directors and Executive Officers | Yes | |||||||

| Board Diversity |

Yes | Prohibition on Hedging and “Short Sales” or “Sales Against the Box” | Yes | |||||||

| Majority Voting in Director Elections |

Yes | Executive Compensation Pay for Performance Metrics | Yes | |||||||

| Non-Executive Chairman of the Board / Lead Independent Director | Yes | Separate Chairman of the Board and CEO | Yes | |||||||

| Prohibition on Pledging Company Securities |

Yes | |||||||||

(ii)

Our Director Nominees

You are being asked to vote on the election of the 11 director nominees listed below. Each director is elected annually by a majority of the votes cast. Detailed information about each nominee, background, skills and expertise can be found in “Proposal 1—Election of Directors” beginning on page 7.

| Name | Age (as of May 18, |

Director Since |

Principal Occupation | |||

| G. Andrea Botta |

63 | 2010 | Chairman of the Board, Cheniere Energy, Inc.; President, Glenco LLC | |||

| Jack A. Fusco |

54 | 2016 | President and Chief Executive Officer, Cheniere Energy, Inc. | |||

| Vicky A. Bailey |

65 | 2006 | President, Anderson Stratton International, LLC | |||

| Nuno Brandolini |

63 | 2000 | Former General Partner, Scorpion Capital Partners, L.P. | |||

| Jonathan Christodoro |

41 | 2015 | Former Managing Director, Icahn Capital LP | |||

| David I. Foley |

49 | 2012 | Senior Managing Director, The Blackstone Group L.P. | |||

| David B. Kilpatrick |

67 | 2003 | President, Kilpatrick Energy Group | |||

| Samuel Merksamer |

36 | 2015 | Former Managing Director, Icahn Capital LP | |||

| Donald F. Robillard, Jr. |

65 | 2014 | Chief Executive Officer and Chairman, ES Xplore, LLC | |||

| Neal A. Shear |

62 | 2014 | Partner, Silverpeak Partners LP | |||

| Heather R. Zichal |

41 | 2014 | Independent Energy Consultant |

Each director nominee attended or participated in at least 75% of the aggregate number of all meetings of the Board of Directors and of each committee on which he or she sits for which the director was eligible to attend.

Corporate Governance Highlight–Proxy Access

Our Board approved a proxy access bylaw amendment on December 9, 2015, which provided for a shareholder (or group of up to 20 shareholders) holding 3% or more of the common stock of the Company for a period of 3 years to nominate up to 20% of the number of directors serving on our Board. Any such nominees will be included with the Board’s nominees in our proxy materials.

In September 2016, the Board amended the Company’s proxy access bylaw to (i) expand the definition of Eligible Holder to specifically allow groups of funds under common management and funded primarily by the same employer to be treated as one Eligible Holder, (ii) clarify the timing required for a shareholder to propose a director nominee and (iii) eliminate the provision that allowed the Company to omit from its Proxy Statement a director nominee who receives a vote of less than 25% of the shares of common stock entitled to vote for such nominee at one of the two preceding annual meetings.

Executive Compensation Highlights

| • | Implemented a more consistent, competitive and conventional total compensation philosophy |

| • | Adopted a performance scorecard for the 2017 annual cash bonus |

| • | Adopted a Long-Term Incentive program (the “LTI program”) providing for annual awards that reflects a conventional and competitive approach |

| • | Terminated the Cheniere Energy, Inc. 2014-2018 Long-Term Cash Incentive Program |

| • | Terminated the Company’s 2008 Change of Control Cash Payment Plan and individual Change of Control Agreements; replaced with new, market-competitive arrangements |

(iii)

Compensation Governance Practices

| • | Clear, direct link between pay and performance |

| • | Primarily performance-based incentive awards |

| • | No hedging or “short sales” of Company stock |

| • | No pledging of Company stock as collateral for a loan or holding Company stock in margin accounts |

| • | Robust stock ownership guidelines |

| • | No defined benefit retirement plan or supplemental executive retirement plan |

| • | Robust compensation risk management program |

Philosophy and Objectives

The Board and the Compensation Committee are committed to a pay-for-performance compensation structure that aligns our executive compensation with the key drivers of long-term growth and creation of shareholder value, including:

| • | Annual and long-term incentive awards are primarily performance-based |

| • | Annual cash bonus incentive metrics are tied to specific financial, operating, construction, safety and strategic goals |

| • | Significant portion of long-term compensation is linked to financial performance and growth metrics |

| • | Equity-based compensation that delivers annual, market-competitive opportunities within common norms of shareholder dilution and required value creation |

Named Executive Officer Compensation Components

The primary components of the 2016 Named Executive Officer compensation program are as follows:

| Type | Purpose | Page Reference |

||||

| Base Salary | Provide a minimum, fixed level of cash compensation for the named executive officers to compensate executives for services rendered during the fiscal year. | 33 | ||||

| Annual Incentive Program |

Drive achievement of annual corporate goals including key financial, operating, construction, safety and strategic goals that drive value for shareholders. | 34 | ||||

| LTI Program | Align executive officers’ interests with the interests of shareholders by rewarding financial performance and growth metrics. | 36 | ||||

| Post-Employment Compensation |

Assist executive officers and other eligible employees to prepare financially for retirement, to offer benefits that are competitive and tax-efficient, and to provide a benefits structure that allows for reasonable certainty of future costs. Help retain executive officers and certain other qualified employees, maintain a stable work environment and provide financial security in the event of a change-in-control or in the event of an involuntary termination of employment in connection with or without a change-in-control. |

41 | ||||

Ratification of KPMG as Auditor for 2017

As a matter of good corporate governance, we are asking our shareholders to ratify the selection of KPMG LLP as the Company’s independent registered public accounting firm for 2017. The following table sets forth the fees billed to us by KPMG for professional services for 2016 and 2015.

| 2016 | 2015 | |||||||

| Audit Fees |

$ | 6,299,746 | $ | 6,017,850 | ||||

| Audit Related Fees |

$ | — | $ | 173,000 | ||||

| Tax Fees |

$ | 47,473 | $ | 115,405 | ||||

| All Other Fees |

$ | 2,550 | $ | 2,550 | ||||

| Total |

$ | 6,349,769 | $ | 6,308,805 | ||||

(iv)

Amendment and Restatement of the Cheniere Energy, Inc. 2011 Incentive Plan

On April 13, 2017, the Board unanimously approved an amended and restated 2011 Incentive Plan (the “Amended and Restated 2011 Plan”), subject to shareholder approval. The Amended and Restated 2011 Plan will be effective on May 18, 2017 (the “Effective Date”) if it is approved by our shareholders at the Meeting. The Amended and Restated 2011 Plan will apply only to awards granted on or after the Effective Date. The terms and conditions of awards granted under the Cheniere Energy, Inc. 2011 Incentive Plan (the “2011 Plan”) prior to the Effective Date will not be affected by the adoption or approval of the Amended and Restated 2011 Plan. If the Amended and Restated 2011 Plan is not approved by our shareholders at the Meeting, then the 2011 Plan will remain in effect on the terms in force prior to the Meeting with the proposed amendments to the 2011 Plan not taking effect.

The Amended and Restated 2011 Plan revises the 2011 Plan to incorporate several features designed to protect shareholder interests and promote current best practices, including:

| • | Minimum Vesting Requirements: All awards under the Amended and Restated 2011 Plan will be subject to a minimum vesting schedule of at least 12 months following the date of grant of the award; provided, however, that up to 5% of the shares underlying awards granted after the Effective Date may be subject to vesting schedules of less than 12 months. For purposes of this minimum vesting requirement, awards granted to non-employee directors in respect of regular annual fees will be deemed to satisfy the requirement, even if the regular annual shareholder meeting at which the award would vest is not at least 12 months following the grant date of the award. |

| • | No Dividend Payments on Unvested Awards: No award granted under the Amended and Restated 2011 Plan may provide for the payment of dividends or dividend equivalents before the date on which the award vests. |

| • | Clawbacks: Awards under the Amended and Restated 2011 Plan will be subject to any clawback or recapture policy that the Company may adopt from time to time to the extent provided in such policy. |

| • | Share Counting: The Amended and Restated 2011 Plan clarifies that the following will not remain available for awards under the Amended and Restated 2011 Plan: (1) any shares withheld in respect of taxes; (2) any shares tendered or withheld to pay the exercise price of stock options; (3) any shares repurchased by the Company from a participant with the proceeds from the exercise of options; and (4) any shares reserved for issuance under a stock appreciation right award that exceed the number of shares actually issued upon exercise. |

| • | Director Grant Limit: No non-employee director may be granted in any calendar year awards under the Amended and Restated 2011 Plan in respect of regular annual fees (excluding, for the avoidance of doubt, any special or one-time awards) with an aggregate grant date fair value exceeding $495,000. |

| • | Section 162(m) Performance Goals: The Amended and Restated 2011 Plan updates the performance criteria that the Compensation Committee may use in establishing goals for performance-based awards in accordance with Section 162(m) of the Code. |

(v)

CHENIERE ENERGY, INC.

700 Milam Street, Suite 1900

Houston, Texas 77002

(713) 375-5000

Why did I receive these proxy materials?

We are providing these proxy materials in connection with the solicitation by the Board of Directors (the “Board”) of Cheniere Energy, Inc. (“Cheniere,” the “Company,” “we,” “us” or “our”), a Delaware corporation, of proxies to be voted at our 2017 Annual Meeting of Shareholders (the “Meeting”) and any adjournment or postponement thereof.

You are invited to attend the Meeting on May 18, 2017, beginning at 9:00 a.m., Central Time. The Meeting will be held at the Company’s headquarters at 700 Milam Street, Suite 1900, Houston, Texas 77002.

This Notice of Annual Meeting (“Notice”), Proxy Statement, proxy card and 2016 Annual Report on Form 10-K for the year ended December 31, 2016, are being mailed to shareholders on or about April 17, 2017.

Do I need a ticket to attend the Meeting?

You will need proof of ownership and valid government-issued picture identification to enter the Meeting.

If your shares are held beneficially in the name of a bank, broker or other holder of record and you plan to attend the Meeting, you must present proof of your ownership of Cheniere stock, as of March 30, 2017 (the “Record Date”), such as a bank or brokerage account statement, to be admitted to the Meeting.

If you have any questions about attending the Meeting, you may contact Investor Relations at info@cheniere.com or 713-375-5100.

No cameras, recording equipment, electronic devices, large bags, briefcases or packages will be permitted at the Meeting.

Who is entitled to vote at the Meeting?

Holders of Cheniere common stock at the close of business on the Record Date are entitled to receive this Notice and to vote their shares at the Meeting. As of the Record Date, there were 237,859,646 shares of common stock outstanding and entitled to vote. Each share of common stock is entitled to one vote on each matter properly brought before the Meeting.

What is the difference between holding shares as a shareholder of record and as a beneficial owner?

If your shares are registered directly in your name with Cheniere’s transfer agent, Computershare Trust Company, N.A., you are considered the “shareholder of record” of those shares. The Notice, Proxy Statement, proxy card and 2016 Annual Report on Form 10-K for the year ended December 31, 2016, have been sent directly to you by Cheniere. If your shares are held in a stock brokerage account or by a bank or other holder of record, you are considered the “beneficial owner” of such shares held in street name. The Notice, Proxy Statement, proxy card and 2016 Annual Report on Form 10-K for the year ended December 31, 2016, have been forwarded to you by your broker, bank or other holder of record, who is considered the shareholder of record of those shares. As the beneficial owner, you have the right to direct your broker, bank or other holder of record on how to vote your shares by using the voting instruction card included in the mailing or by following their instructions for voting by telephone or on the Internet.

| Cheniere Energy, Inc. Notice of Annual Meeting of Shareholders and 2017 Proxy Statement | 1 |

How do I vote?

You may vote using any of the following methods:

By mail

You may submit your proxy vote by mail by signing a proxy card if your shares are registered or, for shares held beneficially in street name, by following the voting instructions included by your broker, trustee or nominee, and mailing it in the enclosed envelope. If you provide specific voting instructions, your shares will be voted as you have instructed. If you do not indicate your voting preferences, your shares will be voted as recommended by the Board; provided, however, if you are a beneficial owner, your bank, broker or other holder of record is not permitted to vote your shares on the following proposals if your bank, broker or other holder of record does not receive specific voting instructions from you: Proposal 1 to elect directors, Proposal 2 to approve, on an advisory and non-binding basis, the compensation of the Company’s named executive officers for 2016, Proposal 3 to approve, on an advisory and non-binding basis, the frequency of holding future advisory votes on the compensation of the Company’s named executive officers and Proposal 5 to approve the amendment and restatement of the Cheniere Energy, Inc. 2011 Incentive Plan.

By telephone or on the Internet

If you have telephone or Internet access, you may submit your proxy vote by following the instructions provided on your proxy card or voting instruction form. If you are a beneficial owner, the availability of telephone and Internet voting will depend on the voting processes of your broker, bank or other holder of record. Therefore, we recommend that you follow the voting instructions in the materials you receive.

In person at the Meeting

If you are the shareholder of record, you have the right to vote in person at the Meeting. If you are the beneficial owner, you are also invited to attend the Meeting. Since a beneficial owner is not the shareholder of record, you may not vote these shares in person at the Meeting unless you obtain a “legal proxy” from your broker, bank or other holder of record that holds your shares, giving you the right to vote the shares at the Meeting.

Can I revoke my proxy?

If you are a shareholder of record, you can revoke your proxy before it is exercised by:

| • | written notice to the Corporate Secretary of the Company; |

| • | timely delivery of a valid, later-dated proxy; or |

| • | voting by ballot at the Meeting. |

If you are a beneficial owner of shares, you may submit new voting instructions by contacting your bank, broker or other holder of record. You may also vote in person at the Meeting if you obtain a legal proxy as described in the answer to the preceding question.

Who will receive a proxy card?

If you are a shareholder of record, you will receive a proxy card for the shares you hold in certificate form or in book-entry form. If you are a beneficial owner, you will receive voting instructions from your bank, broker or other holder of record.

Is there a list of shareholders entitled to vote at the Meeting?

The names of shareholders of record entitled to vote at the Meeting will be available at the Meeting and for ten days prior to the Meeting for any purpose germane to the Meeting. The list will be available between the hours of 8:30 a.m. and 4:30 p.m., Central Time, at our offices at 700 Milam Street, Suite 1900, Houston, Texas 77002, by contacting the Corporate Secretary of the Company.

| 2 | Cheniere Energy, Inc. Notice of Annual Meeting of Shareholders and 2017 Proxy Statement |

What are the voting requirements to elect the directors and to approve each of the proposals discussed in this Proxy Statement?

The presence in person or by proxy of the holders of a majority in voting power of the outstanding shares of common stock entitled to vote at the Meeting is necessary to constitute a quorum. In the absence of a quorum at the Meeting, the Meeting may be adjourned from time to time without notice, other than an announcement at the Meeting, until a quorum is present. Abstentions and “broker non-votes” represented by submitted proxies will be included in the calculation of the number of the shares present at the Meeting for purposes of determining a quorum. “Broker non-votes” occur when a bank, broker or other holder of record holding shares for a beneficial owner does not vote on a particular proposal because that holder does not have discretionary voting power for that particular item and has not received instructions from the beneficial owner.

Proposal 1—Directors are elected by a majority of the votes cast with respect to such director nominee at the Meeting, meaning that the number of votes cast “for” a director must exceed the number of votes cast “against” that director. If you are a beneficial owner, your bank, broker or other holder of record may not vote your shares with respect to Proposal 1 without specific instructions from you as to how to vote with respect to the election of each of the eleven nominees for director. Abstentions and broker non-votes represented by submitted proxies will not be considered votes cast and therefore will not be taken into account in determining the outcome of the election of directors.

Proposal 2—To be approved, Proposal 2 regarding the compensation of the Company’s named executive officers for fiscal year 2016 must receive the affirmative vote of the holders of a majority in voting power of the shares entitled to vote on the matter, present in person or by proxy at the Meeting. Because your vote is advisory, it will not be binding on the Board or the Company. If you are a beneficial owner, your bank, broker or other holder of record may not vote your shares with respect to Proposal 2 without specific instructions from you. Abstentions will be counted “against” Proposal 2. Broker non-votes will not count as shares entitled to vote on the matter.

Proposal 3—In the case of Proposal 3 regarding the frequency of holding future advisory votes on the compensation of the Company’s named executive officers, the frequency that receives the affirmative vote of holders of a majority in voting power of the shares entitled to vote on the matter, present in person or by proxy at the Meeting will be deemed the frequency selected by shareholders. However, in the event that no frequency receives such majority, the Board will consider the frequency that receives the most votes. Because your vote is advisory, it will not be binding on the Board or the Company. If you are a beneficial owner, your bank, broker or other holder of record may not vote your shares with respect to Proposal 3 without specific instructions from you. Abstentions will be counted “against” each frequency. Broker non-votes will not count as shares entitled to vote on the matter.

Proposal 4—To be approved, Proposal 4 to ratify the appointment of KPMG LLP as the Company’s independent registered public accounting firm for 2017 must receive the affirmative vote of the holders of a majority in voting power of the shares entitled to vote on the matter, present in person or by proxy at the Meeting. If you are a beneficial owner, your bank, broker or other holder of record has the authority to vote your shares on Proposal 4 if you have not furnished voting instructions within a specified period of time prior to the Meeting. Abstentions will be counted “against” Proposal 4.

Proposal 5—To be approved, Proposal 5 to approve the amendment and restatement of the Cheniere Energy, Inc. 2011 Incentive Plan must receive the affirmative vote of the holders of a majority in voting power of the shares entitled to vote on the matter, present in person or by proxy at the Meeting. If you are a beneficial owner, your bank, broker or other holder of record may not vote your shares with respect to Proposal 5 without specific instructions from you. Abstentions will be counted “against” Proposal 5. Broker non-votes will not count as shares entitled to vote on the matter.

What if a director nominee does not receive a majority of votes cast?

Our Amended and Restated Bylaws, as amended (“Bylaws”) require directors to be elected by the majority of the votes cast with respect to such director (i.e., the number of votes cast “for” a director must exceed the number of votes cast “against” that director). If a nominee who is serving as a director is not elected at the Meeting and no one else is elected in place of that director, then, under Delaware law, the director would continue to serve on the Board as a “holdover director.” However, under our Bylaws, the holdover director is required to tender his or her resignation to the Board. The Governance and Nominating Committee of the

| Cheniere Energy, Inc. Notice of Annual Meeting of Shareholders and 2017 Proxy Statement | 3 |

Board then would consider the resignation and recommend to the Board whether to accept or reject the tendered resignation, or whether some other action should be taken. The Board would then make a decision whether to accept the resignation, taking into account the recommendation of the Governance and Nominating Committee. The director who tenders his or her resignation will not participate in the Governance and Nominating Committee’s or the Board’s decision. The Board is required to disclose publicly (by a press release and a filing with the Securities and Exchange Commission (“SEC”)) its decision regarding the tendered resignation and, if the tendered resignation is rejected, the rationale behind the decision within 90 days from the date of the certification of the election results.

Could other matters be decided at the Meeting?

As of the date of this Proxy Statement, we do not know of any matters to be raised at the Meeting other than those referred to in this Proxy Statement. If other matters are properly presented for consideration at the Meeting, the persons named in your proxy card will have the discretion to vote on those matters for you.

Who will pay for the cost of this proxy solicitation?

We will pay for the cost of soliciting proxies. Proxies may be solicited on our behalf by directors, officers or employees in person or by telephone, electronic transmission and facsimile transmission. We have hired D. F. King & Co., Inc., 48 Wall Street, 22nd Floor, New York, NY 10005, to solicit proxies. We will pay D.F. King a fee of $15,000 plus expenses for these services.

Who will count the vote?

Broadridge Financial Solutions, Inc., an independent third party, will tabulate the votes.

Important Notice Regarding the Availability of Proxy Materials for the 2017 Annual Meeting to be held on May 18, 2017

The Proxy Statement, including the Notice and 2016 Annual Report on Form 10-K for the year ended December 31, 2016, are available on our website at http://www.cheniere.com/2017AnnualMeeting. Please note that the Notice is not a form for voting, and presents only an overview of the more complete proxy materials, which contain important information and are available on the Internet or by mail. We encourage our shareholders to access and review the proxy materials before voting.

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Proxy Statement contains forward-looking statements relating to, among other things, business strategy, performance and expectations for project development. The reader is cautioned not to place undue reliance on these statements and should review the sections captioned “Cautionary Statement Regarding Forward-Looking Statements” and “Risk Factors” in our Annual Report on Form 10-K for important information about these statements, including the risks, uncertainties and other factors that could cause actual results to vary materially from the assumptions, expectations, and projections expressed in any forward-looking statements. These forward-looking statements speak only as of the date made, and other than as required by law, we undertake no obligation to update or revise any forward-looking statement, whether as a result of new information, future events or developments or otherwise.

| 4 | Cheniere Energy, Inc. Notice of Annual Meeting of Shareholders and 2017 Proxy Statement |

Corporate Governance at a Glance

| Board Independence | • 9 out of 11 of our directors were independent in 2016 (following the end of Mr. Shear’s term as Interim Special Advisor to the CEO).

• 9 out of 11 of our director nominees are currently independent.

• Our former Interim CEO and President (prior to May 11, 2016) and our current President and CEO (as of June 2, 2016) were the only management directors in 2016.

• Our President and CEO is the only current management director.

| |

| Board Composition | • The Board consists of 11 directors.

• The Board regularly assesses its performance through Board and committee self-evaluations.

• The Board values diversity and experience in assessing its composition.

| |

| Board Committees | • We have three standing Board committees—Audit, Governance and Nominating, and Compensation.

• All of our Board committees are comprised of and chaired solely by independent directors.

| |

| Leadership Structure | • Our Chairman of the Board and CEO roles were split in December 2015.

• Our independent Non-Executive Chairman of the Board provides leadership to the Board and ensures that the Board operates independently of management.

| |

| Risk Oversight | • The Board has oversight responsibility for assessing the primary risks (including liquidity, credit, operations and regulatory compliance) facing the Company, the relative magnitude of these risks and management’s plan for mitigating these risks. In addition to the Board’s oversight responsibility, the committees of the Board review the risks that are within their areas of responsibility.

| |

| Open Communication | • We encourage open communication and strong working relationships among the Non-Executive Chairman of the Board and other directors.

• Our directors have access to management and employees.

| |

| Director and Executive Stock Ownership |

• We have had rigorous stock ownership guidelines for our directors and executive officers since 2008 and amended our stock ownership guidelines for our directors in February 2017 to make them more rigorous.

| |

| Director Compensation Limit | • We have capped the annual ordinary course equity award that may be granted to a non-employee director, which will not exceed $495,000 in a calendar year.

| |

| Accountability to Shareholders |

• Directors are elected by a majority of the votes cast with respect to such director.

• The Board maintains a process for shareholders to communicate with the Board.

| |

| Management Succession Planning |

• The Governance and Nominating Committee has oversight of succession planning, both planned and emergency.

|

Shareholder Outreach–Governance

The Company has been involved in extensive discussions with shareholders during the past several years regarding governance matters, and the evolution of our governance framework is a product of the Board’s responsiveness to shareholder input.

Ahead of our 2016 Annual Meeting of Shareholders (the “2016 Annual Meeting”), members of our Board and management reached out to, and had extensive dialogue with, shareholders representing approximately 60% of our outstanding common stock, through both in-person and telephonic meetings. Following our 2016 Annual Meeting, we engaged with shareholders holding in excess of 50% of the Company’s outstanding common stock, and we intend to continue our shareholder outreach efforts going forward.

The Board believes that its current system of corporate governance oversight enables the directors to be prudent stewards of shareholder capital and represent the long-term interests of the Company and our shareholders. In addition, the Board is responsive to changes in the general corporate governance environment.

| Cheniere Energy, Inc. Notice of Annual Meeting of Shareholders and 2017 Proxy Statement | 5 |

Key Themes from Our Shareholder Outreach

Many of our shareholders have different methodologies and processes for evaluating governance programs. However, a number of common themes emerged during our discussions with shareholders, which included:

| • | Request for implementation of proxy access and amendments thereto. Many of our shareholders expressed a desire for the Company to implement proxy access. Our Board approved a proxy access bylaw amendment on December 9, 2015 which provided for a shareholder (or group of up to 20 shareholders) holding 3% or more of the common stock of the Company for a period of 3 years to nominate up to 20% of the number of directors serving on the Company’s Board, and such nominees will be included with the Board’s nominees in the Company’s proxy materials. During our shareholder outreach, our shareholders generally expressed support for the 20 shareholder group and up to 20% of the board formulation. |

| • | Request for additional detail regarding the experience and expertise of our directors with a focus on Board refreshment. Several of our shareholders have expressed interest in understanding the core competencies of our Board, particularly as we transition from a development company into a liquefied natural gas (“LNG”) operator. We have included tabular disclosure regarding the qualifications of our directors on page 8 of this Proxy Statement. Our Governance & Nominating Committee continues to review the qualifications of the Board for the right experience and expertise. In May 2016, the Board appointed Jack A. Fusco to serve as President and CEO, and in June 2016, the Board appointed Mr. Fusco as a member of the Board. Mr. Fusco has over 30 years of experience in the energy industry and has significant experience leading companies with large-scale, asset-intensive portfolios and implementing corporate strategies focused on capital allocation, strategic developments and optimizing shareholder value, which will help us as we transition into one of the top global LNG companies. |

| • | Request that the Board continue to monitor and implement best governance practices. Our Board is responsive to changes in the general corporate governance environment and strives to implement best governance practices in a timely manner. |

Actions Taken as a Result of Our Shareholder Outreach

Following our shareholder outreach, the Governance and Nominating Committee and the Board reviewed and considered our shareholders’ feedback as part of its review and adoption of changes to our governance structure. The Board then took the following actions:

| Action Taken | Description | |

| Provided Detail regarding Director Experience and Expertise

|

• We have included detail regarding our directors’ core competencies on page 8 of this Proxy Statement.

| |

| Independent Chairman; Hired President and CEO who was Added as a New Director

|

• In December 2015, our Chairman of the Board and CEO roles were split.

• As of January 2016, our independent Non-Executive Chairman of the Board assumed the responsibilities of the Lead Director which include providing leadership to the Board and ensuring that the Board operates independently of management.

• In May 2016, the Board appointed Jack A. Fusco to serve as President and CEO, and in June 2016, the Board appointed Mr. Fusco as a member of the Board.

| |

| Further Amended our Proxy Access Bylaw

|

• In September 2016, the Board amended the Company’s proxy access bylaw to (i) expand the definition of Eligible Holder to specifically allow groups of funds under common management and funded primarily by the same employer to be treated as one Eligible Holder, (ii) clarify the timing required for a shareholder to propose a director nominee, and (iii) eliminate the provision that allowed the Company to omit from its Proxy Statement a director nominee who receives a vote of less than 25% of the shares of common stock entitled to vote for such nominee at one of the two preceding annual meetings.

| |

| Continued Implementation of best governance practices

|

• In September 2016, the Board implemented a prohibition on pledging company securities.

• In February 2017, the Board increased its director ownership guidelines.

|

See page 29 of this Proxy Statement for a discussion regarding actions taken by our Board with respect to compensation matters as a result of shareholder outreach.

| 6 | Cheniere Energy, Inc. Notice of Annual Meeting of Shareholders and 2017 Proxy Statement |

PROPOSAL 1—ELECTION OF DIRECTORS

This year, there are eleven nominees standing for election as directors at the Meeting. Below is a summary of our director nominees, including their committee memberships as of April 17, 2017. The Board, with assistance from the Governance and Nominating Committee, will evaluate and reassign committee memberships as needed following the Meeting and election of the director nominees. Detailed information about each director’s background, skills and expertise is provided below.

| Nominee Committee Memberships | ||||||||||||||||||

| Name Current Position |

Age (as of May 18, 2017) |

Director Since |

Independent | Audit | Governance & Nominating |

Compensation | ||||||||||||

| G. Andrea Botta Chairman of the Board Cheniere Energy, Inc. President Glenco LLC |

63 | 2010 | YES | |||||||||||||||

| Jack A. Fusco President and Chief Executive Officer Cheniere Energy, Inc. |

54 | 2016 | NO | |||||||||||||||

| Vicky A. Bailey President Anderson Stratton International, LLC |

65 | 2006 | YES | ● | Chair | |||||||||||||

| Nuno Brandolini Former General Partner Scorpion Capital Partners, L.P. |

63 | 2000 | YES | Chair | ||||||||||||||

| Jonathan Christodoro Former Managing Director Icahn Capital LP |

41 | 2015 | YES | ● | ||||||||||||||

| David I. Foley Senior Managing Director The Blackstone Group L.P. |

49 | 2012 | NO | |||||||||||||||

| David B. Kilpatrick President Kilpatrick Energy Group |

67 | 2003 | YES | ● | ● | |||||||||||||

| Samuel Merksamer Former Managing Director Icahn Capital LP |

36 | 2015 | YES | F | ● | |||||||||||||

| Donald F. Robillard, Jr. Chief Executive Officer and Chairman ES Xplore, LLC |

65 | 2014 | YES | Chair; F |

||||||||||||||

| Neal A. Shear Partner Silverpeak Partners LP |

62 | 2014 | YES | ● | ||||||||||||||

| Heather R. Zichal Independent Energy Consultant |

41 | 2014 | YES | ● | ● | |||||||||||||

F Financial Expert

| Cheniere Energy, Inc. Notice of Annual Meeting of Shareholders and 2017 Proxy Statement | 7 |

Summary of Director Core Competencies

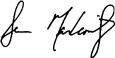

The following chart summarizes the core competencies currently represented on our Board.

There are eleven nominees standing for election as directors at the Meeting. Each nominee, if elected, will hold office for a one-year term expiring at the 2018 Annual Meeting of Shareholders and will serve until his or her successor is duly elected and qualified or until his or her earlier death, resignation or removal.

Each of the director nominees currently serves on the Board and has consented to serve as a director if elected or re-elected. Each of the director nominees was elected by the Company’s shareholders, other than Mr. Fusco, who was appointed by the Board on June 2, 2016.

Directors are elected by a majority of votes cast with respect to such director nominee. Unless your proxy specifies otherwise, it is intended that the shares represented by your proxy will be voted for the election of these eleven nominees. If you are a beneficial owner, your bank, broker or other holder of record is not permitted to vote your shares on Proposal 1 to elect directors if the bank, broker or other holder of record does not receive specific voting instructions from you. Proxies cannot be voted for a greater number of persons than the number of nominees named. The Board is unaware of any circumstances likely to render any nominee unavailable.

The Board recommends a vote FOR the election of the eleven nominees as directors of the Company to hold office for a one-year term expiring at the 2018 Annual Meeting of Shareholders or until their successors are duly elected and qualified.

Director Nominations and Qualifications

Director Nomination Policy and Procedures. Our Director Nomination Policy and Procedures is attached to the Governance and Nominating Committee’s written charter as Exhibit A, which is available on our website at www.cheniere.com. The Governance and Nominating Committee considers suggestions for potential director nominees to the Board from any source, including current members of the Board and our management, advisors and shareholders. The Governance and Nominating Committee evaluates potential nominees by reviewing their qualifications and any other information deemed relevant. Director nominees are recommended to the Board by the Governance and Nominating Committee.

The full Board will select and recommend candidates for nomination as directors for shareholders to consider and vote upon at the annual shareholders’ meeting. The Governance and Nominating Committee reviews and considers any candidates submitted by a shareholder or shareholder group in the same manner as all other candidates.

Snapshot of 2017 Director Nominees Our Directors complement each other to create a well-rounded boardroom, and each adds: A deep commitment to stewardship A proven record of success Unique and valuable insight International Industry Experience Average Age 55.4 years Average tenure 6.7 years Our Directors core competencies: Operations 6 Corporate Finance 8 International Experience 10 Energy Industry Experience 10 Risk / Crisis Management 10 Trading Financial Commodities 7 Government / Regulatory 5 Governance 10

| 8 | Cheniere Energy, Inc. Notice of Annual Meeting of Shareholders and 2017 Proxy Statement |

Qualifications for consideration as a director nominee vary according to the particular areas of expertise being sought as a complement to the existing Board composition. However, minimum criteria for selection of members to serve on our Board include the following:

| • | highest ethical standards and integrity; |

| • | high level of education and/or business experience; |

| • | broad-based business acumen; |

| • | understanding of the Company’s business and industry; |

| • | strategic thinking and willingness to share ideas; |

| • | loyalty and commitment to driving the success of the Company; |

| • | network of business and industry contacts; and |

| • | diversity of experiences, expertise and backgrounds among members of the Board. |

Practices for Considering Diversity. The minimum criteria for selection of members to serve on our Board are designed to ensure that the Governance and Nominating Committee selects director nominees taking into consideration that the Board will benefit from having directors that represent a diversity of experience and backgrounds. Director nominees are selected so that the Board represents a diversity of experience in areas needed to foster the Company’s business success, including experience in the energy industry, finance, consulting, international affairs, public service, governance and regulatory compliance. Each year the Board and each committee participates in a self-assessment or evaluation of the effectiveness of the Board and its committees. These evaluations assess the diversity of talents, expertise, and occupational and personal backgrounds of the Board members.

Shareholder Nominations for Director. A shareholder of the Company who was a shareholder of record at the time the notice provided for below is delivered to the Corporate Secretary, who is entitled to vote at the meeting of shareholders called for the election of directors and upon such election or proposed business and who complies with the notice procedures set forth in our Bylaws may nominate candidates for election to the Board. Nominations made by a shareholder must be made by giving timely notice in writing to the Corporate Secretary of the Company at the following address: Corporate Secretary, Cheniere Energy, Inc., 700 Milam Street, Suite 1900, Houston, Texas 77002. To be timely, a shareholder’s notice must be delivered not later than the close of business on the 90th day, nor earlier than the close of business on the 120th day, prior to the first anniversary of the preceding year’s annual meeting. However, if (and only if) the date of the annual meeting is more than 30 days before or more than 70 days after such anniversary date, notice by the shareholder must be delivered not earlier than the close of business on the 120th day prior to such annual meeting and not later than the close of business on the later of the 90th day prior to such annual meeting or the 10th day following the day on which public announcement of the date of such meeting is first made by the Company. In no event will the public announcement of an adjournment or postponement of an annual meeting of shareholders commence a new time period (or extend any time period) for the giving of a shareholder’s notice as described above. A shareholder’s notice must include information about the shareholder and the nominee, as required by our Bylaws, which are available on our website at www.cheniere.com.

Director Nominations for Inclusion in Proxy Statement (Proxy Access). A shareholder, or group of up to 20 shareholders, owning at least 3% of the Company’s common stock for at least the prior three consecutive years (and meeting the other requirements set forth in our Bylaws) may nominate for election to our Board and inclusion in our proxy statement for our annual meeting of shareholders up to 20% of the number of directors serving on our Board. Notice must include all information formally stated in our Bylaws, which is available on our website at www.cheniere.com. In addition to complying with the other requirements set forth in our Bylaws, an eligible shareholder must provide timely notice in writing to the Corporate Secretary of the Company at the following address: Corporate Secretary, Cheniere Energy, Inc., 700 Milam Street, Suite 1900, Houston, Texas 77002. To be timely for purposes of proxy access, a shareholder’s notice must be delivered not later than the close of business on the 120th day, nor earlier than the close of business on the 150th day, prior to the first anniversary of the date that the Company first mailed its proxy statement to shareholders for the prior year’s annual meeting of shareholders. However, if (and only if) the annual meeting is not scheduled to be held within a period that commences 30 days before such anniversary date and ends 30 days after such anniversary date (an annual meeting date outside such period being referred to herein as an “Other Meeting Date”), notice must be given in the manner provided in our Bylaws by the later of the close of business on the date that is 180 days prior to such Other Meeting Date and the tenth day following the date on which public announcement of such Other Meeting Date is first made.

Director Qualifications. The Board has concluded that, in light of our business and structure, each of our director nominees possesses relevant experience, qualifications, attributes and skills and should continue to serve on our Board as of the date of this Proxy Statement. The primary qualifications of our directors are further discussed under “Director Biographies” below.

Director Retirement Policy. The Board has adopted a mandatory director retirement policy that requires each director who has attained the age of 75 to retire from the Board at the annual meeting of shareholders of the Company held in the year in which his

| Cheniere Energy, Inc. Notice of Annual Meeting of Shareholders and 2017 Proxy Statement | 9 |

or her current term expires unless the Board determines such mandate for a particular director is not at the time in the best interests of the Company. The Board believes this policy will ensure a healthy rotation of directors, which will promote the continued influx of new ideas and perspectives to the Board.

Jack A. Fusco is a director and the President and Chief Executive Officer of Cheniere. Mr. Fusco has served as President and Chief Executive Officer since May 2016 and as a director since June 2016. In addition, Mr. Fusco serves as Chairman, President and Chief Executive Officer of Cheniere Energy Partners GP, LLC, a wholly-owned subsidiary of Cheniere and the general partner of Cheniere Energy Partners, L.P., a publicly-traded limited partnership that is operating the Sabine Pass LNG terminal. Mr. Fusco also serves as Chairman, President and Chief Executive Officer of Cheniere Energy Partners LP Holdings, LLC, a publicly-traded subsidiary of Cheniere. Mr. Fusco is also a Manager, President and Chief Executive Officer of the general partner of Sabine Pass LNG, L.P. and Chief Executive Officer of Sabine Pass Liquefaction, LLC. Mr. Fusco received recognition as Best CEO in the electric industry by Institutional Investor in 2012 as ranked by all industry analysts and for Best Investor Relations by a CEO or Chairman among all mid-cap companies by IR Magazine in 2013.

Mr. Fusco served as Chief Executive Officer of Calpine Corporation (“Calpine”) from August 2008 to May 2014 and as Executive Chairman of Calpine from May 2014 through May 11, 2016. Mr. Fusco currently serves as a director of Calpine and has been a member of the board of directors since August 2008. Mr. Fusco was recruited by Calpine’s key shareholders in 2008, just as that company was emerging from bankruptcy. Calpine is now America’s largest generator of electricity from natural gas, safely and reliably meeting the needs of an economy that demands cleaner, more fuel-efficient and dependable sources of electricity. As Chief Executive Officer of Calpine, Mr. Fusco managed a team of approximately 2,300 employees and led one of the largest purchasers of natural gas in America, a successful developer of new gas-fired power generation facilities and a company that has prudently managed the inherent commodity trading and balance sheet risks associated with being a merchant power producer.

Mr. Fusco’s career of over 30 years in the energy industry began with his employment at Pacific Gas & Electric Company upon graduation from California State University, Sacramento with a Bachelor of Science in Mechanical Engineering in 1984. He joined Goldman Sachs 13 years later as a Vice President with responsibility for commodity trading and marketing of wholesale electricity, a role that led to the creation of Orion Power Holdings, an independent power producer that Mr. Fusco helped found with backing from Goldman Sachs, where he served as President and Chief Executive Officer from 1998-2002. In 2004, he was asked to serve as Chairman and Chief Executive Officer of Texas Genco LLC by a group of private institutional investors, and successfully managed the transition of that business from a subsidiary of a regulated utility to a strong and profitable independent company, generating a more than 5-fold return for shareholders upon its merger with NRG in 2006

Skills and Qualifications: Mr. Fusco brings his prior experience leading successful energy industry companies and his perspective as President and Chief Executive Officer of Cheniere.

G. Andrea Botta is the Chairman of the Board. Mr. Botta has served as President of Glenco LLC, (“Glenco”) a private investment company since February 2006. Prior to joining Glenco, Mr. Botta served as Managing Director of Morgan Stanley from 1999 to February 2006. Before joining Morgan Stanley, he was President of EXOR America, Inc. (formerly IFINT-USA, Inc.) from 1993 until September 1999 and for more than five years prior thereto, Vice President of Acquisitions of IFINT-USA, Inc. He currently serves on the board of directors of Graphic Packaging Holding Company. Mr. Botta earned a degree in Economics and Business Administration from the University of Torino in 1976.

Skills and Qualifications: Mr. Botta brings a unique international perspective to our Board and significant financial expertise. He has over 30 years of investing experience primarily in private equity investing.

Vicky A. Bailey is the Chairman of our Governance and Nominating Committee and a member of our Audit Committee. Since November 2005, Ms. Bailey has been President of Anderson Stratton International, LLC, a strategic consulting and government relations company in Washington, D.C. She was a partner with Johnston & Associates, LLC, a public relations firm in Washington, D.C., from March 2004 through October 2006. Prior to joining Johnston & Associates, LLC, Ms. Bailey served as Assistant Secretary for the Office of Policy and International Affairs of the U.S. Department of Energy from 2001 through February 2004. From 2000 until May 2001, she was President and a director of PSI Energy, Inc., the Indiana electric utility subsidiary of Cinergy Corp. Prior to joining PSI Energy, Ms. Bailey was a Commissioner on the Federal Energy Regulatory Commission beginning in 1993. Ms. Bailey currently serves as a director of EQT Corporation, a publicly-traded petroleum and natural gas exploration and pipeline company and Battelle Memorial Institute, a private nonprofit applied science and technology development company, in Columbus, Ohio. In January 2010, Ms. Bailey was appointed as a member of the Secretary of Energy’s Blue Ribbon Commission on America’s Nuclear Future. She received a B.S. in industrial Management from Purdue University and completed the Advanced Management Program at the Wharton School in 2013.

| 10 | Cheniere Energy, Inc. Notice of Annual Meeting of Shareholders and 2017 Proxy Statement |

Skills and Qualifications: Ms. Bailey has extensive knowledge of the energy industry, including significant experience with the Federal Energy Regulatory Commission, and government and public relations. She brings a diverse perspective to our Board based on her experience as a strategic consultant, a former energy executive and having served as Assistant Secretary for the Office of Policy and International Affairs.

Nuno Brandolini is the Chairman of our Compensation Committee. Mr. Brandolini was a general partner of Scorpion Capital Partners, L.P., a private equity firm organized as a small business investment company, until June 2014. Prior to forming Scorpion Capital and its predecessor firm, Scorpion Holding, Inc., in 1995, Mr. Brandolini served as Managing Director of Rosecliff, Inc., a leveraged buyout fund co-founded by Mr. Brandolini in 1993. Prior to 1993, Mr. Brandolini was a Vice President in the investment banking department of Salomon Brothers, Inc., and a Principal with the Batheus Group and Logic Capital, two venture capital firms. Mr. Brandolini began his career as an investment banker with Lazard Freres & Co. Mr. Brandolini currently serves as a director of Lilis Energy, Inc., an oil and gas exploration and production company. Mr. Brandolini received a law degree from the University of Paris and an M.B.A. from the Wharton School.

Skills and Qualifications: Mr. Brandolini brings a unique financial perspective to our Board based on his extensive experience as an investment banker and having actively managed private equity investments for almost 20 years.

Jonathan Christodoro is a member of our Governance and Nominating Committee. Mr. Christodoro served as a Managing Director of Icahn Capital LP, the entity through which Carl C. Icahn manages investment funds, from July 2012 to February 2017. Mr. Christodoro was responsible for identifying, analyzing and monitoring investment opportunities and portfolio companies for Icahn Capital. Prior to joining Icahn Capital, from 2007 to 2012, Mr. Christodoro served in various investment and research roles at P2 Capital Partners, LLC, Prentice Capital Management, LP and S.A.C. Capital Advisors, L.P. Mr. Christodoro began his career as an investment banking analyst at Morgan Stanley, where he focused on merger and acquisition transactions across a variety of industries. Mr. Christodoro currently serves as a director on the boards of: Xerox Corporation, a provider of document management solutions since June 2016; PayPal Holdings, Inc., a technology platform company that enables digital and mobile payments worldwide since July 2015; Lyft, Inc., a mobile ride-sharing application since May 2015; Enzon Pharmaceuticals, Inc. (“Enzon”), a biotechnology company since October 2013 and Herbalife Ltd., a nutrition company since April 2013. Mr. Christodoro has been Chairman of the Board of Enzon since November 2013. Mr. Christodoro was previously a director of: Hologic, Inc., a supplier of diagnostic, medical imaging and surgical products, from December 2013 to March 2016; eBay Inc., a global commerce and payments company, from March 2015 to July 2015; Talisman Energy Inc., an independent oil and gas exploration and production company, from December 2013 to May 2015; and American Railcar Industries, Inc., a railcar manufacturing company, from June 2015 to February 2017. American Railcar Industries is indirectly controlled by Carl C. Icahn. Mr. Icahn has or previously had non-controlling interests in each of Xerox, PayPal, eBay, Lyft, Hologic, Talisman, Enzon and Herbalife through the ownership of securities. Mr. Christodoro received an M.B.A. with Distinction from the University of Pennsylvania’s Wharton School of Business, majoring in Finance and Entrepreneurial Management. Mr. Christodoro received a B.S. Magna Cum Laude in Applied Economics and Management with Honors Distinction in Research from Cornell University. Mr. Christodoro also served in the United States Marine Corps.

Skills and Qualifications: Mr. Christodoro brings experience to our Board as a former Managing Director of Icahn Capital LP, a subsidiary of Icahn Enterprises L.P. and as a member of the board of directors of several publicly-traded companies.

David I. Foley is a director of the Company. Mr. Foley is a Senior Managing Director in the Private Equity Group of The Blackstone Group L.P., an investment and advisory firm (“Blackstone”), and Chief Executive Officer of Blackstone Energy Partners L.P. Prior to joining Blackstone in 1995, Mr. Foley was an employee of AEA Investors Inc., a private equity investment firm, from 1991 to 1993 and a consultant with The Monitor Company, a business management consulting firm, from 1989 to 1991. Mr. Foley currently serves as a director of Kosmos Energy Ltd. and previously served on the board of directors of PBF Energy, Inc. Mr. Foley’s appointment to the Board was made pursuant to an Investors’ and Registration Rights Agreement that was entered into by the Company, Cheniere Energy Partners GP, LLC (“Cheniere Partners GP”), Blackstone CQP Holdco, LP (“Blackstone Holdco”) and various other related parties in connection with Blackstone Holdco’s purchase of Class B units in Cheniere Energy Partners, L.P. (“Cheniere Partners”). Mr. Foley received a B.A. and an M.A. in Economics from Northwestern University and an M.B.A. from Harvard Business School.

Skills and Qualifications: Mr. Foley brings a unique financial perspective to our Board based on his extensive experience having actively managed private equity investments for over 20 years.

David B. Kilpatrick is a member of our Audit Committee and Compensation Committee. Mr. Kilpatrick previously served as our Lead Director from June 2015 to January 2016. Mr. Kilpatrick has over 30 years of executive, management and operating experience in the oil and gas industry. He has been the President of Kilpatrick Energy Group, which invests in oil and gas ventures and provides executive management consulting services, since 1998. Mr. Kilpatrick has served on the board of directors and is Chairman of the Compensation and Governance Committee of the general partner of Breitburn Energy Partners, L.P., since 2008.

| Cheniere Energy, Inc. Notice of Annual Meeting of Shareholders and 2017 Proxy Statement | 11 |

Since 2011, Mr. Kilpatrick has served on the Board of Managers of Woodbine Holdings, LLC, a privately held company engaged in the acquisition, development and production of oil and natural gas properties in Texas. In May 2013, he was elected Chairman of the Board of Applied Natural Gas Fuels, Inc., a producer and distributor of liquefied natural gas fuel for the transportation and industrial markets. He also served on the board of directors of PYR Energy Corporation, a publicly-traded oil and gas exploration and production company, from 2001 to 2007 and of Whittier Energy Corporation, a publicly-traded oil and gas field exploration services company, from 2004 to 2007. He was the President and Chief Operating Officer for Monterey Resources, Inc., an independent oil and gas company, from 1996 to 1998 and held various positions with Santa Fe Energy Resources, an oil and gas production company, from 1983 to 1996. Mr. Kilpatrick received a B.S. in Petroleum Engineering from the University of Southern California and a B.A. in Geology and Physics from Whittier College.

Skills and Qualifications: Mr. Kilpatrick has over 30 years of executive, management and operating experience in the oil and gas industry and brings significant executive-level and consulting experience in the oil and gas industry to our Board.

Samuel Merksamer is a member of our Compensation Committee and Audit Committee. Mr. Merksamer served as a Managing Director of Icahn Capital LP, from May 2008 to December 2016. He currently serves as a director on the boards of Hertz Global Holdings, Inc., a public company engaged in the car rental business; Transocean Ltd., a public provider of offshore contract drilling services for oil and gas wells, American International Group, Inc., a publicly-traded insurance and financial services company and Navistar International Corporation, a publicly-traded manufacturer of commercial trucks, buses, defense vehicles and engines. Mr. Merksamer was previously a director of Transocean Partners LLC from 2014 to 2016 and a director of Hologic, Inc., a publicly-traded medical products company from 2013 to 2016. Mr. Merksamer received an A.B. in Economics in 2002 from Cornell University.

Skills and Qualifications: Mr. Merksamer brings experience to our Board as a former Managing Director of Icahn Capital LP, a subsidiary of Icahn Enterprises L.P. and as a member of the board of directors of several publicly-traded companies.

Donald F. Robillard, Jr. is the Chairman of our Audit Committee. Mr. Robillard currently serves as Chief Executive Officer and Chairman of ES Xplore, LLC, a direct hydrocarbon indicator technology company which in 2016, spun out of Hunt Consolidated, Inc. (“Hunt”) a private holding company with interests in oil and gas exploration and production, refining, real estate development, private equity investments and ranching. Mr. Robillard served as a director and the Executive Vice President, Chief Financial Officer and Chief Risk Officer of Hunt from July 2015 until his retirement on January 31, 2017. Mr. Robillard began his association with Hunt in 1983 as Manager of International Accounting for Hunt Oil Company, Inc., a wholly-owned subsidiary of Hunt. Serving nine of his 34 years of service to the Hunt organization in Yemen in various accounting, finance and management positions, Mr. Robillard returned to the United States to join Hunt’s executive team in 1992. Mr. Robillard was named Senior Vice President and Chief Financial Officer of Hunt in April 2007. Mr. Robillard is currently on the board of directors of Helmerich & Payne, Inc., a publicly-traded oil and gas drilling company. He is a Certified Public Accountant, and a member of the American Institute of Certified Public Accountants, the Texas Society of Certified Public Accountants, Financial Executives International and the National Association of Corporate Directors. Mr. Robillard received a B.B.A. from the University of Texas, Austin.

Skills and Qualifications: Mr. Robillard has over 40 years of experience in the oil and gas industry and over 25 years of senior management experience. Mr. Robillard brings significant executive-level experience in the oil and gas industry, including experience with project financing for LNG facilities.

Neal A. Shear is a member of our Governance and Nominating Committee. Mr. Shear is a partner of Silverpeak Partners LP, a private investment company. Mr. Shear served as Interim Special Advisor to the Chief Executive Officer of Cheniere from May 2016 to November 2016 and as Interim Chief Executive Officer and President of Cheniere from December 2015 to May 2016. Mr. Shear was the Chief Executive Officer of Higgs Capital Management, a commodity focused hedge fund until September 2014. Prior to Higgs Capital Management, Mr. Shear served as Global Head of Securities at UBS Investment Bank from January 2010 to March of 2011. Previously, Mr. Shear was a Partner at Apollo Global Management, LLC, where he served as the Head of the Commodities Division. Prior to Apollo Global Management, Mr. Shear spent 26 years at Morgan Stanley serving in various roles including Head of the Commodities Division, Global Head of Fixed Income, Co-Head of Institutional Sales and Trading, and Chair of the Commodities Business. He currently serves on the Advisory Board of Green Key Technologies, a financial Voice over Internet Protocol (“VoIP”) technology company. Mr. Shear received a B.S. from the University of Maryland, Robert H. Smith School of Business Management in 1976 and an M.B.A. from Cornell University, Johnson School of Business in 1978.

Skills and Qualifications: Mr. Shear brings a unique financial and trading perspective to our Board based on his more than 30 years of experience managing commodity activity and investments.

| 12 | Cheniere Energy, Inc. Notice of Annual Meeting of Shareholders and 2017 Proxy Statement |

Heather R. Zichal is a member of our Governance and Nominating Committee and Compensation Committee. Ms. Zichal is currently an independent energy consultant. Ms. Zichal previously served as the Deputy Assistant to the President for Energy and Climate Change from January 2009 to November 2013. Prior to serving as Deputy Assistant to the President for Energy and Climate Change, Ms. Zichal served as the Energy and Environmental Policy Director to the 2008 Obama presidential campaign. She previously served as the Legislative Director to Senator John Kerry after managing energy and environmental issues in his 2004 presidential campaign. Prior to this, Ms. Zichal served as Legislative Director for Reps. Frank Pallone (D-NJ) and Rush Holt (D-NJ). Ms. Zichal received a B.S. in Environmental Policy and Science from Rutgers University.

Skills and Qualifications: Ms. Zichal has extensive knowledge of the domestic and global energy markets as well as the U.S. regulatory environment. She brings a diverse perspective about the energy industry to our Board, having served in significant government positions during her career.

| Cheniere Energy, Inc. Notice of Annual Meeting of Shareholders and 2017 Proxy Statement | 13 |

The following table shows the fiscal year 2016 membership and chairpersons of our Board committees, committee meetings held, and committee member attendance as a percentage of meetings eligible to attend. The current Chair of each Board committee is indicated in the table.

| Number of meetings held |

Botta | Fusco | Bailey | Brandolini | Christodoro | Foley | Kilpatrick | Merksamer | Robillard | Shear | Zichal | |||||||||||||

| Audit |

8 | 100% | — | 100% | — | — | — | — | 100% | 100% Chair |

— | — | ||||||||||||

| Governance and Nominating |

5 | — | — | 100% Chair |

— | 100% | — | 80% | — | — | 100% | |||||||||||||

| Compensation |

9 | — | — | — | 100% Chair |

— | — | 100% | 89% | — | — | 100% |

The Board determines the independence of each director and nominee for election as a director in accordance with the rules and regulations of the SEC and the NYSE MKT LLC independence standards, which are listed below. The Board also considers relationships that a director may have:

| • | as a partner, shareholder or officer of organizations that do business with or provide services to Cheniere; |

| • | as an executive officer of charitable organizations to which we have made or make contributions; and |

| • | that may interfere with the exercise of a director’s independent judgment. |

The NYSE MKT LLC independence standards state that the following list of persons will not be considered independent:

| • | a director who is, or during the past three years was, employed by the Company or by any parent or subsidiary of the Company; |

| • | a director who accepts, or has an immediate family member who accepts, any compensation from the Company or any parent or subsidiary of the Company in excess of $120,000 during any period of 12 consecutive months within the past three years, other than compensation for Board or committee services, compensation paid to an immediate family member who is a non-executive employee of the Company, compensation received for former service as an interim executive officer provided the interim service did not last longer than one year, benefits under a tax-qualified retirement plan or non-discretionary compensation; |

| • | a director who is an immediate family member of an individual who is, or has been in any of the past three years, employed by the Company or any parent or subsidiary of the Company as an executive officer; |

| • | a director who is, or has an immediate family member who is a partner in, or a controlling shareholder or an executive officer of, any organization to which the Company made, or from which the Company received, payments (other than those arising solely from investments in the Company’s securities or payments under non-discretionary charitable contribution matching programs) that exceed 5% of the organization’s consolidated gross revenues for that year, or $200,000, whichever is more, in any of the most recent three fiscal years; |