SEPTEMBER 29, 2016 Compelling transaction for CQH shareholders Filed by Cheniere Energy, Inc. pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a-12 of the Securities Exchange Act of 1934 Subject Company: Cheniere Energy Partners LP Holdings, LLC (Commission File No. 001-36234)

DISCLAIMER Special Note Regarding Forward-Looking Statements This document includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. In particular, statements using words such as “may,” “will,” “could,” “should,” “expect,” “plan,” “project,” “intend,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “pursue,” “target,” “continue,” the negative of such terms or other comparable terminology generally involve forward-looking statements. The forward-looking statements contained in this presentation (including statements regarding the proposed transaction and its effects, benefits and costs, savings, opinions, forecasts, projections, expected timetable for completion, expected distribution, and any other statements regarding Cheniere Energy Partners LP Holdings, LLC’s (“Cheniere Partners Holdings”) and Cheniere Energy, Inc.’s (“Cheniere”) future expectations, beliefs, plans, objectives, financial conditions, assumptions or future events or performance that are not statements of historical fact) are largely based on our expectations, which reflect estimates and assumptions made by our management. These estimates and assumptions reflect our best judgment based on currently known market conditions and other factors. Although we believe that such estimates are reasonable, they are inherently uncertain and involve a number of risks and uncertainties beyond our control. In addition, assumptions may prove to be inaccurate. We caution that the forward-looking statements contained in this presentation are not guarantees of future performance and that such statements may not be realized or the forward-looking statements or events may not occur. Actual results may differ materially from those anticipated or implied in forward-looking statements as a result of numerous factors, including, but not limited to, the negotiation and execution, and the terms and conditions, of a definitive agreement relating to the proposed transaction and the ability of Cheniere or Cheniere Partners Holdings to enter into or consummate such an agreement; the risk that the proposed merger does not occur; negative effects from the pendency of the proposed merger; the ability to realize expected cost savings and benefits; failure to obtain the required vote of Cheniere Partners Holdings’ shareholders; the timing to consummate the proposed transaction; the impact of regulatory changes; and other factors affecting future results disclosed in Cheniere’s and Cheniere Partners Holdings’ respective filings with the SEC (available at the SEC’s website at www.sec.gov), including but not limited to those discussed under Item 1A, “Risk Factors”, in Cheniere’s Annual Report on Form 10-K for the year ended December 31, 2015 and Cheniere Partners Holdings’ Annual Report on Form 10-K for the year ended December 31, 2015. These forward-looking statements speak only as of the date made, and other than as required by law, we undertake no obligation to update or revise any forward-looking statement or provide reasons why actual results may differ, whether as a result of new information, future events or otherwise. Additional Information and Where to Find It This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of a proxy or of any vote or approval. This communication may be deemed to be solicitation material in respect of the proposed transaction between Cheniere and Cheniere Partners Holdings. In the event that the parties enter into a definitive agreement with respect to the proposed transaction, the parties intend to file a registration statement on Form S-4, containing a proxy statement/prospectus (the “S-4”) with the SEC. This communication is not a substitute for the registration statement, definitive proxy statement/prospectus or any other documents that Cheniere or Cheniere Partners Holdings may file with the SEC or send to shareholders in connection with the proposed transaction. INVESTORS AND SHAREHOLDERS OF CHENIERE PARTNERS HOLDINGS ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING THE PROXY STATEMENT/PROSPECTUS IF AND WHEN FILED, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. When available, investors and security holders will be able to obtain copies of the S-4, including the proxy statement/prospectus and any other documents that may be filed with the SEC in the event that the parties enter into a definitive agreement with respect to the proposed transaction free of charge at the SEC’s website at http://www.sec.gov. Copies of documents filed with the SEC by Cheniere will also be made available free of charge on Cheniere’s website at www.cheniere.com. Copies of documents filed with the SEC by Cheniere Partners Holdings will also be made available free of charge on Cheniere Partners Holdings’ website at www.cheniere.com. Participants in the Solicitation Cheniere, Cheniere Partners Holdings and their respective directors and executive officers may be deemed to be participants in any solicitation of proxies from Cheniere Partners Holdings’ shareholders with respect to the proposed transaction. Information about Cheniere Partners Holdings’ directors and executive officers is set forth in Cheniere Partners Holdings’ 2015 annual report on Form 10-K, which was filed with the SEC on February 19, 2016, and in Cheniere Partners’ Holdings current reports on Form 8-K, which were filed with the SEC on May 12, 2016, June 6, 2016, and September 19, 2016. Information about Cheniere’s directors and executive officers is set forth in Cheniere’s proxy statement for its 2016 Annual Meeting of Shareholders, which was filed with the SEC on April 21, 2016, and in Cheniere’s current reports on Form 8-K, which were filed with the SEC on May 12, 2016, June 6, 2016, and September 19, 2016. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the proposed transaction if and when they become available. Investors should read the proxy statement/prospectus carefully if and when it becomes available before making any voting or investment decisions.

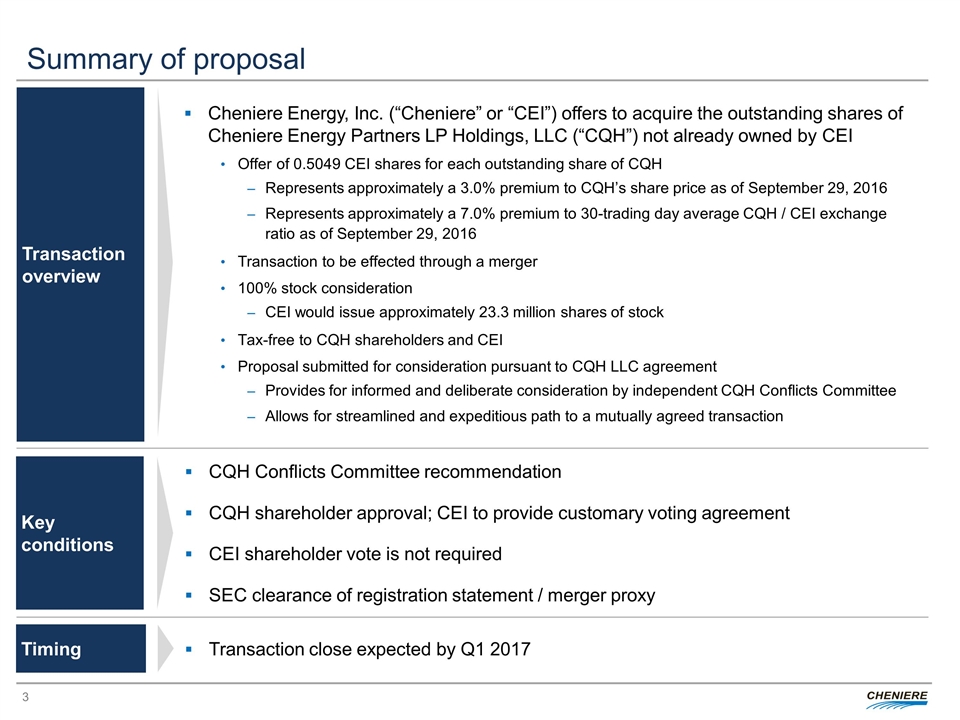

Summary of proposal Timing Transaction close expected by Q1 2017 Key conditions CQH Conflicts Committee recommendation CQH shareholder approval; CEI to provide customary voting agreement CEI shareholder vote is not required SEC clearance of registration statement / merger proxy Transaction overview Cheniere Energy, Inc. (“Cheniere” or “CEI”) offers to acquire the outstanding shares of Cheniere Energy Partners LP Holdings, LLC (“CQH”) not already owned by CEI Offer of 0.5049 CEI shares for each outstanding share of CQH Represents approximately a 3.0% premium to CQH’s share price as of September 29, 2016 Represents approximately a 7.0% premium to 30-trading day average CQH / CEI exchange ratio as of September 29, 2016 Transaction to be effected through a merger 100% stock consideration CEI would issue approximately 23.3 million shares of stock Tax-free to CQH shareholders and CEI Proposal submitted for consideration pursuant to CQH LLC agreement Provides for informed and deliberate consideration by independent CQH Conflicts Committee Allows for streamlined and expeditious path to a mutually agreed transaction

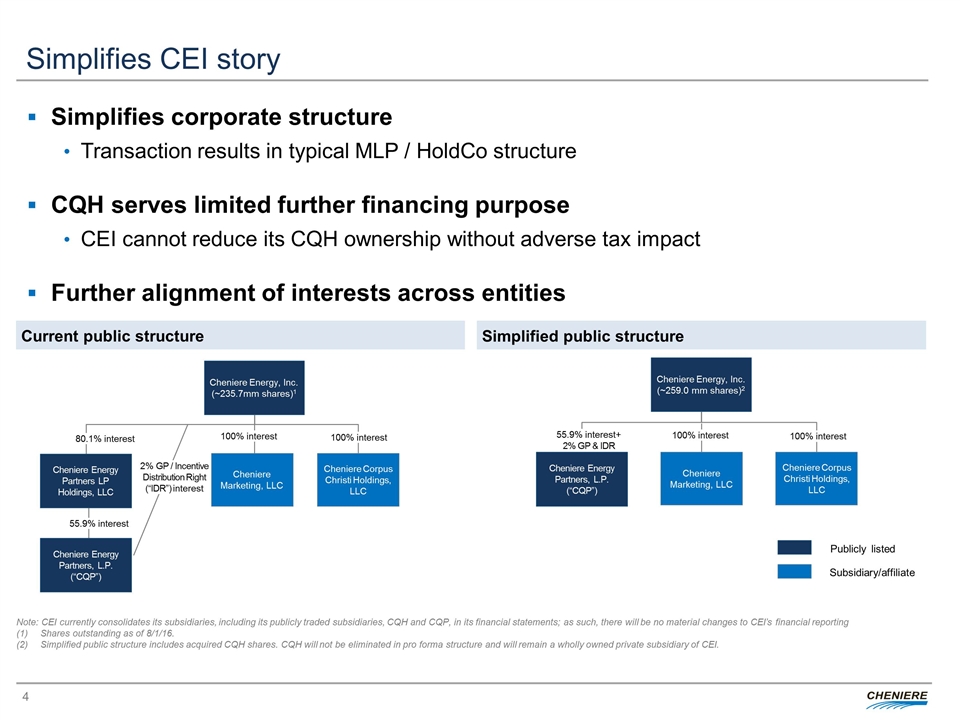

Simplifies CEI story Current public structure Simplified public structure Cheniere Corpus Christi Holdings, LLC 55.9% interest Cheniere Energy Partners LP Holdings, LLC 2% GP / Incentive Distribution Right (“IDR”) interest Cheniere Energy, Inc. (~235.7mm shares)1 80.1% interest Cheniere Energy Partners, L.P. (“CQP”) 100% interest Cheniere Marketing, LLC Cheniere Corpus Christi Holdings, LLC Cheniere Energy, Inc. (~259.0 mm shares)2 Publicly listed Subsidiary/affiliate 55.9% interest+ 2% GP & IDR interest Cheniere Energy Partners, L.P. (“CQP”) Simplifies corporate structure Transaction results in typical MLP / HoldCo structure CQH serves limited further financing purpose CEI cannot reduce its CQH ownership without adverse tax impact Further alignment of interests across entities 100% interest 100% interest 100% interest Note: CEI currently consolidates its subsidiaries, including its publicly traded subsidiaries, CQH and CQP, in its financial statements; as such, there will be no material changes to CEI’s financial reporting Shares outstanding as of 8/1/16. Simplified public structure includes acquired CQH shares. CQH will not be eliminated in pro forma structure and will remain a wholly owned private subsidiary of CEI. Cheniere Marketing, LLC

Compelling transaction for CQH shareholders Attractive valuation Premium to current CQH share price Favorable exchange ratio relative to historic levels Substantial increase in liquidity for CQH shareholders (~32x increase in trading liquidity) Tax free stock exchange Eliminates overhang of CEI ownership Traditional C-Corp governance in CEI Under the current structure, CQH is expected to be a cash tax payer in the near-term, reducing available cash for distributions to CQH shareholders As of 12/31/2015, CEI and CQH's Federal NOL carryforwards are $3.2bn and $0.5bn, respectively

CEI has an attractive business profile Offers greater cash flow diversity Increase exposure from 1 project and 5 trains to 2 projects and 7 trains Increase exposure from 6 foundation customers to 13, all investment grade Enhances participation in growth upside Corpus Christi Train 3, fully permitted and partially commercialized Increasing participation via GP / IDRs in Sabine Pass Train 6, fully permitted Incremental production from existing facilities available to Cheniere Marketing, LLC (“CMI”) Provides value supported by long-term, fee based contracted cash flow Visible cash flows for 20 years based on ~87% of capacity contracted under long term sale and purchase agreements (“SPAs”) for 7 Trains Limited exposure to commodity price fluctuations due to highly contracted cash flow profile underpinned with fixed fees with investment grade counterparties Positive ratings trajectory with significant current liquidity and no debt maturities until 2020 upon planned repayment of SPLNG Notes this year Current liquidity of $1.0 bn1 Cash and cash equivalents of $1,049.5 million as of 6/30/16

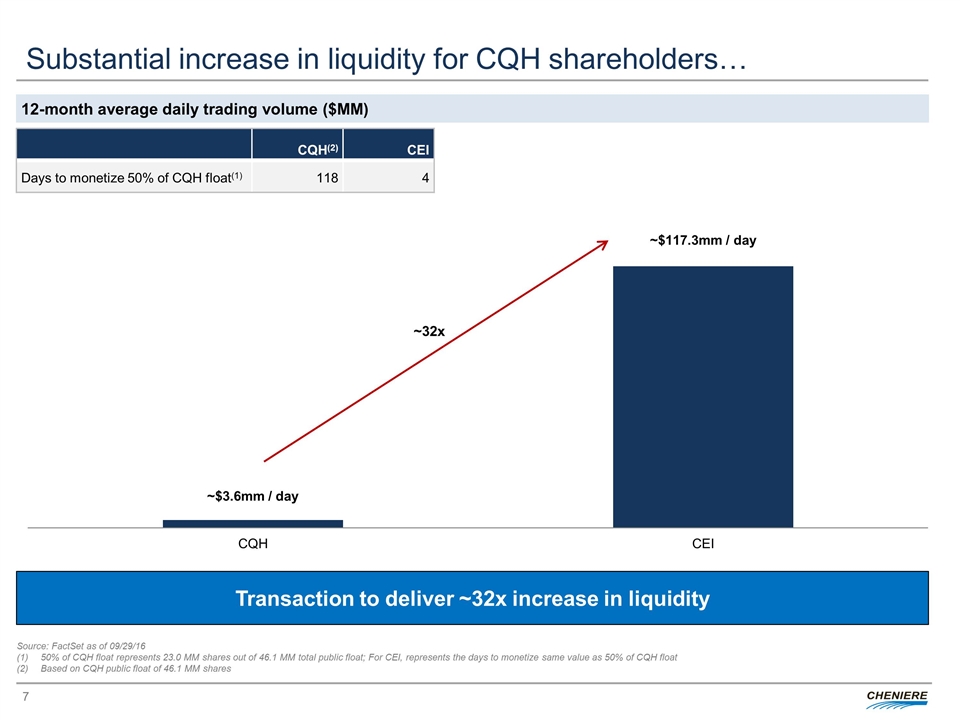

Substantial increase in liquidity for CQH shareholders… 12-month average daily trading volume ($MM) CQH(2) CEI Days to monetize 50% of CQH float(1) 118 4 Transaction to deliver ~32x increase in liquidity Source: FactSet as of 09/29/16 50% of CQH float represents 23.0 MM shares out of 46.1 MM total public float; For CEI, represents the days to monetize same value as 50% of CQH float Based on CQH public float of 46.1 MM shares ~32x

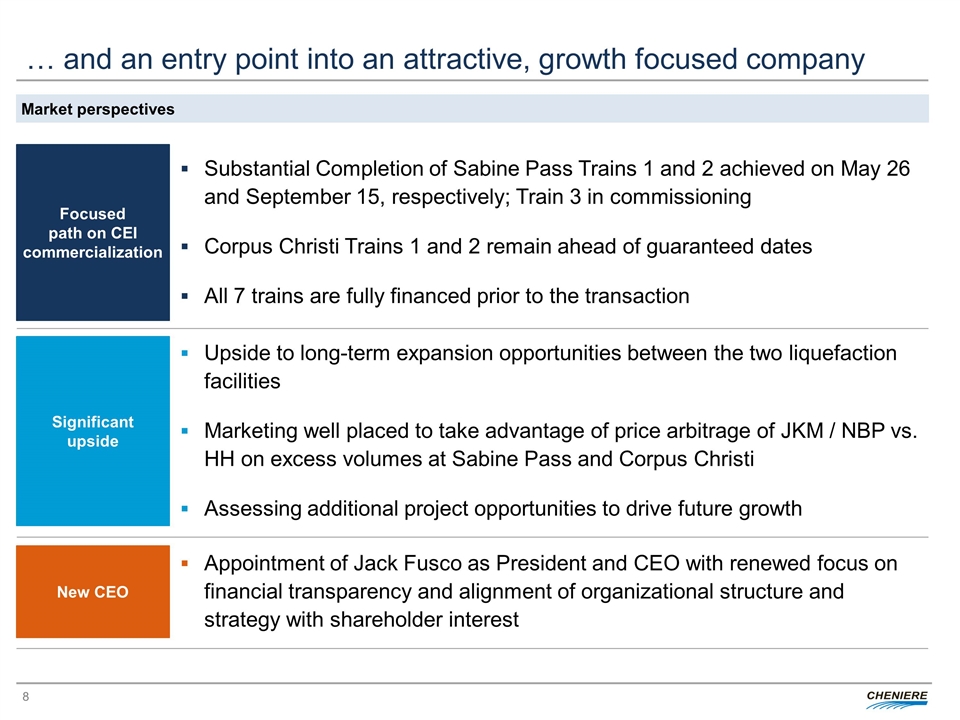

… and an entry point into an attractive, growth focused company Market perspectives Focused path on CEI commercialization Substantial Completion of Sabine Pass Trains 1 and 2 achieved on May 26 and September 15, respectively; Train 3 in commissioning Corpus Christi Trains 1 and 2 remain ahead of guaranteed dates All 7 trains are fully financed prior to the transaction Significant upside Upside to long-term expansion opportunities between the two liquefaction facilities Marketing well placed to take advantage of price arbitrage of JKM / NBP vs. HH on excess volumes at Sabine Pass and Corpus Christi Assessing additional project opportunities to drive future growth New CEO Appointment of Jack Fusco as President and CEO with renewed focus on financial transparency and alignment of organizational structure and strategy with shareholder interest

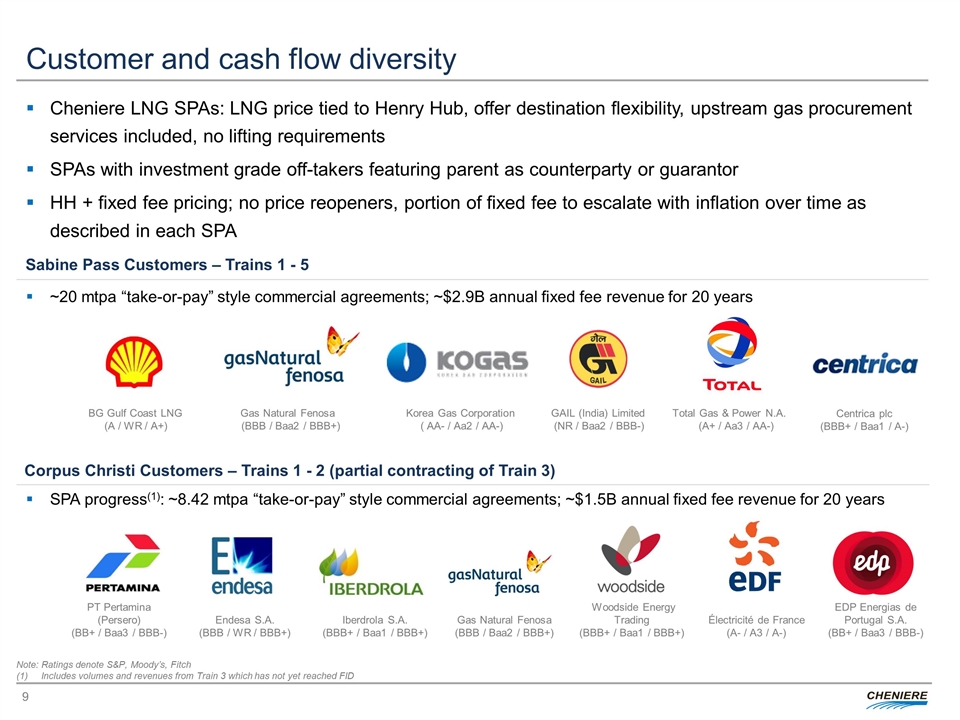

Customer and cash flow diversity Cheniere LNG SPAs: LNG price tied to Henry Hub, offer destination flexibility, upstream gas procurement services included, no lifting requirements SPAs with investment grade off-takers featuring parent as counterparty or guarantor HH + fixed fee pricing; no price reopeners, portion of fixed fee to escalate with inflation over time as described in each SPA PT Pertamina (Persero) (BB+ / Baa3 / BBB-) Endesa S.A. (BBB / WR / BBB+) Iberdrola S.A. (BBB+ / Baa1 / BBB+) Gas Natural Fenosa (BBB / Baa2 / BBB+) Woodside Energy Trading (BBB+ / Baa1 / BBB+) Électricité de France (A- / A3 / A-) EDP Energias de Portugal S.A. (BB+ / Baa3 / BBB-) BG Gulf Coast LNG (A / WR / A+) Gas Natural Fenosa (BBB / Baa2 / BBB+) GAIL (India) Limited (NR / Baa2 / BBB-) Korea Gas Corporation ( AA- / Aa2 / AA-) Total Gas & Power N.A. (A+ / Aa3 / AA-) Corpus Christi Customers – Trains 1 - 2 (partial contracting of Train 3) Sabine Pass Customers – Trains 1 - 5 Centrica plc (BBB+ / Baa1 / A-) Note: Ratings denote S&P, Moody’s, Fitch (1) Includes volumes and revenues from Train 3 which has not yet reached FID ~20 mtpa “take-or-pay” style commercial agreements; ~$2.9B annual fixed fee revenue for 20 years SPA progress(1): ~8.42 mtpa “take-or-pay” style commercial agreements; ~$1.5B annual fixed fee revenue for 20 years

Compelling transaction for CQH shareholders Attractive valuation and premium to current share price Substantial increase in liquidity More favorable tax attributes at CEI Tax free Eliminates overhang of CEI ownership Traditional C-Corp governance in CEI Increased benefits from greater diversity of cash flow sources Participation in the upside of associated future expansion projects and the selling of uncontracted LNG volumes from the existing facilities