Filed Pursuant to Rule 424(b)(5)

Registration No. 333-181190

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of Each Class of Securities To Be Registered |

Amount To Be Registered |

Maximum Offering Price Per Unit |

Maximum Offering Price |

Amount of Registration | ||||

| 4.25% Convertible Senior Notes |

$625,000,000 | 80.0% | $500,000,000(2) | $58,100(2) | ||||

| Common Stock, par value $0.003 |

(2) | — | —(2) | —(3) | ||||

|

| ||||||||

| (1) | The filing fee is calculated and being paid in accordance with Rule 457(r) of the Securities Act of 1933, as amended (the “Securities Act”), and relates to the registration statement on Form S-3 (File No. 333-181190) filed by Cheniere Energy, Inc. on May 7, 2012. |

| (2) | Includes an indeterminate number of shares of common stock issuable upon conversion of the 4.25% Convertible Senior Notes due 2045 at the initial conversion price of approximately $138.38 per share of common stock. Pursuant to Rule 416 under the Securities Act, such number of shares of common stock registered hereby shall include an indeterminate number of shares of common stock that may be issued in connection with a stock split, stock dividend, recapitalization or similar event. |

| (3) | Pursuant to Rule 457(i) under the Securities Act, there is no additional filing fee with respect to the shares of common stock issuable upon conversion of the 4.25% Convertible Senior Notes due 2045 because no additional consideration will be received in connection with the exercise of the conversion privilege. |

PROSPECTUS SUPPLEMENT

(To Prospectus dated May 7, 2012)

Cheniere Energy, Inc.

$625,000,000

4.25% Convertible Senior Notes due 2045

We are offering $625,000,000 aggregate principal amount at maturity of our 4.25% Convertible Senior Notes due 2045, or the notes. The notes bear interest at a rate of 4.25% per year, payable semiannually in arrears on March 15 and September 15 of each year, beginning on September 15, 2015. The notes will mature on March 15, 2045.

Holders may convert their notes into shares of our common stock, at their option, prior to the close of business on the business day immediately preceding December 15, 2044 only under the following circumstances: (1) during any fiscal quarter commencing after June 30, 2015, if the daily VWAP of our common stock, for at least 20 trading days (whether or not consecutive) in the period of 30 consecutive trading days ending on the last trading day of the immediately preceding fiscal quarter is greater than or equal to 130% of the applicable conversion price of the notes in effect on each applicable trading day; (2) during the five consecutive business-day period after any five consecutive trading-day period in which the trading price per $1,000 principal amount of notes for each trading day of such period was less than 98% of the product of the last reported sale price of our common stock and the applicable conversion rate on each such trading day; (3) upon our election to terminate conversion rights for such notes; (4) if we call the notes for redemption; or (5) upon the occurrence of specified corporate events. On or after December 15, 2044 until the close of business on the second scheduled trading day immediately preceding the maturity date, holders may convert their notes into shares of our common stock at any time, regardless of the foregoing circumstances. Upon conversion, we will pay or deliver, as the case may be, cash, shares of our common stock or a combination of cash and shares of our common stock, at our election, as described in this prospectus supplement.

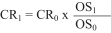

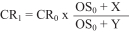

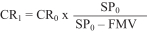

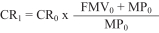

The conversion rate will initially equal 7.2265 shares of our common stock per $1,000 principal amount at maturity of the notes (equivalent to an initial conversion price of approximately $138.38 per share of common stock), subject to adjustment as described in this prospectus supplement. Following certain corporate transactions that occur on or prior to March 15, 2020 or the occurrence of a conversion termination date on or prior to March 15, 2020, we will, in certain circumstances, increase the conversion rate for a holder that converts its notes in connection with such corporate transaction or termination of conversion rights.

We have the right, at our option, at any time after March 15, 2020, to redeem the notes at a redemption price payable in cash equal to the accreted amount of the notes to be redeemed (as set forth under the caption “Description of the Notes — Optional Redemption” in this prospectus supplement), plus accrued and unpaid interest, if any, to, but excluding, such redemption date.

The holders have the right, at their option, to require us to purchase the notes following a fundamental change (as defined under the caption “Description of the Notes — Purchase Rights of Holders — Fundamental Change Permits Holders to Require Us to Purchase Notes” in this prospectus supplement) at a price equal to 100% of the accreted amount of the notes to be purchased, plus accrued and unpaid interest, if any, to, but excluding, the fundamental change purchase date.

We may elect during a 30 consecutive trading day period to terminate the right of holders to convert all or part of their notes if the daily VWAP of our common stock is greater than or equal to 130% of the conversion price for at least 20 trading days during such 30 consecutive trading day period. If we elect to terminate the conversion rights of all or part of the notes on or prior to March 15, 2020, the conversion rate for any notes converted in connection with such termination of conversion rights will be increased as set forth under “Description of the Notes — Adjustment to Conversion Rate Upon Conversion in Connection with a Make-Whole Fundamental Change or Termination of Conversion Rights.”

There is no public market for the notes, and we do not intend to apply to list the notes on any securities exchange or for inclusion of the notes on any automated dealer quotation system. Our common stock is listed on the NYSE MKT under the symbol “LNG.” The last reported sale price of our common stock on the NYSE MKT on March 2, 2015 was $80.11 per share.

We have retained Lazard Frères & Co. LLC as the placement agent for this offering. The placement agent is not purchasing or selling any of the notes offered hereby and it has agreed to use its reasonable best efforts to arrange for the sale of the notes.

Investing in our notes involves risks, including those described under “Risk Factors” beginning on page S-7 of this prospectus supplement.

| Per Note | Total | |||||||

| Public offering price (1) |

80.00 | % | $ | 500,000,000 | ||||

| Placement agent fees as a percentage of public offering price |

0.60 | % | $ | 3,000,000 | ||||

| Proceeds, before expenses, to us (1) |

79.52 | % | $ | 497,000,000 | ||||

| (1) | Plus accrued interest from March 9, 2015, if settlement occurs after that date. |

The notes will be ready for delivery in book-entry form only through the facilities of The Depository Trust Company on or about March 9, 2015. The delivery of notes with respect to each investor is not conditioned upon the purchase of notes by any other investors. If one or more investors fail to fund the purchase price of their notes, we intend to proceed with delivery on March 9, 2015 of the aggregate principal amount of notes for which the purchase price has been received.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying base prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Lazard Frères & Co. LLC

The date of this prospectus supplement is March 3, 2015.

PROSPECTUS SUPPLEMENT

| S-i | ||||

| S-iii | ||||

| S-iii | ||||

| S-iv | ||||

| S-1 | ||||

| S-1 | ||||

| S-6 | ||||

| S-7 | ||||

| S-17 | ||||

| S-18 | ||||

| S-53 | ||||

| S-56 | ||||

| S-60 | ||||

| S-69 | ||||

| S-70 | ||||

| S-70 |

PROSPECTUS

| i | ||||

| ii | ||||

| iii | ||||

| iii | ||||

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 2 | ||||

| 7 | ||||

| 17 | ||||

| 18 | ||||

| 19 | ||||

| 19 | ||||

| 20 | ||||

| 21 |

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is in two parts. The first part is this prospectus supplement, which describes the specific terms of this offering. The second part is the accompanying base prospectus, which gives more general information, some of which may not apply to this offering. Generally, when we refer to the “prospectus,” we are referring to both parts combined. If information in this prospectus supplement conflicts with information in the accompanying base prospectus, you should rely on the information in this prospectus supplement.

You should rely only on the information contained or incorporated by reference into this prospectus supplement, the accompanying base prospectus and any free writing prospectus filed with the Securities and Exchange Commission, or the SEC. We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not

S-i

rely on it. We are not making an offer of the securities covered by this prospectus supplement in any state where the offer is not permitted. You should assume that the information appearing in this prospectus supplement, the accompanying base prospectus, any free writing prospectus relating to this offering of notes and any document incorporated by reference is accurate only as of the date on the front cover of those documents. Our business, financial condition, results of operations and prospects may have changed since those dates.

The information in this prospectus supplement is not complete. You should carefully read this prospectus supplement and the accompanying base prospectus, including the information incorporated by reference herein and therein, before you invest, as these documents contain information you should consider when making your investment decision.

S-ii

In this prospectus supplement, unless the context otherwise requires:

| • | Liquefaction means the process by which natural gas is supercooled to a temperature of -260 degrees Fahrenheit, transforming the gas into a liquid 1/600th of the volume of its gaseous state; |

| • | LNG means liquefied natural gas, a product of natural gas consisting primarily of methane (CH4) that is in liquid form at near atmospheric pressure; |

| • | Regasification means the process by which, in receiving terminals (either onshore or aboard specialized LNG carriers), the LNG is returned to its gaseous state, or regasified; and |

| • | Train means a compressor train used in the industrial process to convert natural gas into LNG. |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement, the accompanying base prospectus and the documents incorporated herein and therein contain certain statements that are, or may be deemed to be, “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements, other than statements of historical facts, included in or incorporated by reference in this prospectus supplement or the accompanying base prospectus are “forward-looking statements.” Included among “forward-looking statements” are, among other things:

| • | statements that we expect to commence or complete construction of our proposed LNG terminals, liquefaction facilities, pipeline facilities or other projects, or any expansions thereof, by certain dates, or at all; |

| • | statements regarding future levels of domestic and international natural gas production, supply or consumption or future levels of LNG imports into or exports from North America and other countries worldwide or purchases of natural gas, regardless of the source of such information, or the transportation or other infrastructure or demand for and prices related to natural gas, LNG or other hydrocarbon products; |

| • | statements regarding any financing transactions or arrangements, including the amounts or timing thereof, or ability to enter into such transactions; |

| • | statements relating to the construction of our Trains, including statements concerning the engagement of any engineering, procurement and construction (“EPC”) contractor or other contractor and the anticipated terms and provisions of any agreement with any EPC or other contractor, and anticipated costs related thereto; |

| • | statements regarding any agreement to be entered into or performed substantially in the future, including any revenues anticipated to be received and the anticipated timing thereof, and statements regarding the amounts of total LNG regasification, liquefaction or storage capacities that are, or may become, subject to contracts; |

| • | statements regarding counterparties to our commercial contracts, construction contracts and other contracts; |

| • | statements regarding our planned construction of additional Trains, including the financing of such Trains; |

| • | statements that our Trains, when completed, will have certain characteristics, including amounts of liquefaction capacities; |

| • | statements regarding our business strategy, our strengths, our business and operation plans or any other plans, forecasts, projections, or objectives, including anticipated revenues and capital expenditures, any or all of which are subject to change; |

S-iii

| • | statements regarding legislative, governmental, regulatory, administrative or other public body actions, approvals, requirements, permits, applications, filings, investigations, proceedings or decisions; |

| • | statements regarding our anticipated LNG and natural gas marketing activities; and |

| • | any other statements that relate to non-historical or future information. |

In some cases, forward-looking statements can be identified by terminology such as “may,” “will,” “could,” “should,” “expect,” “plan,” “project,” “intend,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “pursue,” “target,” “continue,” the negative of such terms or other comparable terminology. The forward-looking statements contained in this prospectus supplement, the accompanying base prospectus and the documents incorporated by reference herein and therein are largely based on our expectations, which reflect estimates and assumptions made by our management. These estimates and assumptions reflect our best judgment based on market conditions and other factors known at the time such statements were made. Although we believe that such estimates are reasonable, they are inherently uncertain and involve a number of risks and uncertainties beyond our control. In addition, assumptions may prove to be inaccurate. We caution that the forward-looking statements contained or incorporated by reference in this prospectus supplement and the accompanying base prospectus are not guarantees of future performance and that such statements may not be realized or the forward-looking statements or events may not occur. Actual results may differ materially from those anticipated or implied in forward-looking statements due to factors described in this prospectus supplement, the accompanying base prospectus and in the documents incorporated by reference herein and therein. These forward-looking statements speak only as of the date made, and other than as required by law, we undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

Our actual results could differ materially from those anticipated in these forward-looking statements as a result of a variety of factors, including those discussed under “Risk Factors” in this prospectus supplement, the accompanying base prospectus and the documents incorporated herein and therein, including, but not limited to, our Annual Report on Form 10-K for the year ended December 31, 2014. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by these risk factors. Other than as required under the securities laws, we assume no obligation to update or revise these forward-looking statements or provide reasons why actual results may differ.

WHERE YOU CAN FIND MORE INFORMATION

We have filed a registration statement with the SEC under the Securities Act that registers the offer and sale of the securities offered by this prospectus supplement. The registration statement, including the exhibits attached thereto, contains additional relevant information about us. The rules and regulations of the SEC allow us to omit some information included in the registration statement from this prospectus supplement and the accompanying base prospectus.

We file annual, quarterly, and other reports, proxy statements and other information with the SEC under the Exchange Act. You may read and copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the operation of the Public Reference Room. Our SEC filings are also available to the public through the SEC’s website at http://www.sec.gov.

General information about us, including our annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, as well as any amendments and exhibits to those reports, are available free of charge through our website at http://www.cheniere.com as soon as reasonably practicable after we file them with, or furnish them to, the SEC. Information on our website is not incorporated into this prospectus supplement or the accompanying base prospectus and is not a part of this prospectus supplement or the accompanying base prospectus.

S-iv

The SEC allows us to “incorporate by reference” certain information that we file with the SEC, which means that we can disclose information to you by referring to those documents. The information incorporated by reference is an important part of this prospectus supplement and the accompanying base prospectus, and information that we file later with the SEC will automatically update and take the place of this information. We are incorporating by reference in this prospectus supplement the following documents filed with the SEC under the Exchange Act (other than any portions of the respective filings that were furnished pursuant to Item 2.02 or Item 7.01 of Form 8-K or other applicable SEC rules):

| • | our Annual Report on Form 10-K for the year ended December 31, 2014; and |

| • | our Current Reports on Form 8-K, as filed with the SEC on January 16, 2015 and March 2, 2015. |

All documents that we file pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act after the date of this prospectus supplement and until our offering hereunder is completed will be deemed to be incorporated by reference into this prospectus supplement and will be a part of this prospectus supplement from the date of the filing of the document. Any statement contained in a document incorporated or deemed to be incorporated by reference in this prospectus supplement will be deemed to be modified or superseded for purposes of this prospectus supplement to the extent that a statement contained in this prospectus supplement or any other subsequently filed documents that also is or is deemed to be incorporated by reference in this prospectus supplement modifies or supersedes that statement. Any statement that is modified or superseded will not constitute a part of this prospectus supplement, except as modified or superseded.

We will provide each person, including any beneficial owner, to whom a prospectus is delivered, a copy of any or all information that has been incorporated by reference in the prospectus but not delivered with the prospectus, upon written or oral request and at no cost. Requests should be made by writing or telephoning us at the following address or phone number, as applicable:

Cheniere Energy, Inc.

700 Milam Street, Suite 1900

Houston, Texas 77002

(713) 375-5000

Attn: Investor Relations

S-v

We are incorporated under the laws of the state of Delaware. Our principal executive offices are located at 700 Milam Street, Suite 1900, Houston, Texas 77002, and our telephone number at that address is (713) 375-5000.

The following is a brief summary of the terms of this offering and the notes. We provide the following summary solely for your convenience. This summary is not a complete description of this offering or the notes. You should read the full text and more specific details contained elsewhere in this prospectus supplement. With respect to the discussion of the terms of the notes on the cover page, in this section and in the section entitled “Description of the Notes,” the words “Cheniere,” “we,” “our,” “us” and “the company” refer only to Cheniere Energy, Inc. and not to any of its subsidiaries. For a more detailed description of the notes, see “Description of the Notes” in this prospectus supplement. Unless otherwise indicated, when we refer to the principal amount of the notes, we are referring to $1,000 principal amount at maturity of the notes (and not the accreted amount of the notes on any particular date) and when we refer to the conversion price per $1,000 principal amount of notes, we are referring to $1,000 principal amount of the notes at maturity (and not the accreted amount of the notes on any particular date) divided by the applicable conversion rate.

| Issuer |

Cheniere Energy, Inc., a Delaware corporation. |

| Notes Offered |

$625,000,000 aggregate principal amount of 4.25% Convertible Senior Notes due 2045. |

| Maturity Date |

March 15, 2045, unless earlier purchased or redeemed by us or converted. |

| Interest Rate |

4.25% per year. Interest will accrue from the date of issuance or from the most recent date to which interest has been paid or duly provided for, and will be payable semiannually in arrears on March 15 and September 15 of each year, beginning on September 15, 2015. |

| Ranking |

The notes will be our senior unsecured obligations and will rank: |

| • | senior in right of payment to any of our future indebtedness that is expressly subordinated in right of payment to the notes; |

| • | equal in right of payment to our existing and future unsecured indebtedness that is not so subordinated; and |

| • | effectively subordinated in right of payment to any of our existing and future secured indebtedness, to the extent of the value of the assets securing such indebtedness. |

| In addition, the notes will be structurally subordinated to all existing and future indebtedness (including trade payables) of our subsidiaries, as well as to any of our existing or future indebtedness that may be guaranteed by any of our subsidiaries (to the extent of any such guarantee). |

S-1

| As of December 31, 2014, we had no secured indebtedness outstanding and our subsidiaries had $9,243 million of outstanding indebtedness and other liabilities (before discounts and premiums); this amount does not take into account $2.0 billion aggregate principal amount of senior secured notes issued by Sabine Pass Liquefaction, LLC on March 3, 2015. As of December 31, 2014, our total consolidated indebtedness was $9,990 million (before discounts and premiums). The indenture does not limit the amount of debt that may be issued by us or our subsidiaries under the indenture or otherwise. |

| Use of Proceeds |

We estimate that the net proceeds from this offering, after deducting estimated fees and estimated offering expenses payable by us, will be approximately $495.7 million. We intend to use the net proceeds for general corporate purposes. |

| The delivery of notes with respect to each investor is not conditioned upon the purchase of notes by any other investors. If one or more investors fail to fund the purchase price of their notes, we intend to proceed with delivery of the aggregate principal amount of notes for which the purchase price has been received. |

| Conversion Rights |

Holders may convert their notes at their option prior to the close of business on the business day immediately preceding December 15, 2044, but only under the following circumstances: |

| • | during any fiscal quarter commencing after June 30, 2015 (and only during such fiscal quarter), if the daily VWAP (as defined herein) of our common stock for at least 20 trading days (whether or not consecutive) during the period of 30 consecutive trading days ending on the last trading day of the immediately preceding fiscal quarter is greater than or equal to 130% of the applicable conversion price on each applicable trading day; |

| • | during the five consecutive business-day period after any five consecutive trading-day period (the “measurement period”) in which the trading price (as defined herein) per $1,000 principal amount of notes for each trading day of such measurement period was less than 98% of the product of the last reported sale price of our common stock and the applicable conversion rate on each such trading day; |

| • | if we have elected to terminate the conversion rights for such notes as described under “Description of the Notes — Conversion Rights — Termination of Conversion Rights”; |

| • | if those notes have been called for redemption as described under “Description of the Notes — Conversion Rights — Conversion Upon Notice of Redemption”; or |

S-2

| • | upon the occurrence of specified corporate events described under “Description of the Notes — Conversion Rights — Conversion Upon Specified Corporate Events.” |

| On or after December 15, 2044 until the close of business on the second scheduled trading day immediately preceding the maturity date, holders may convert their notes at any time, regardless of the foregoing circumstances. |

| The conversion rate will initially equal 7.2265 shares of common stock per $1,000 principal amount of notes (equivalent to an initial conversion price of approximately $138.38 per share of common stock), subject to adjustment as described in this prospectus supplement. |

| In addition, following the occurrence of a make-whole fundamental change (as defined herein) on or prior to March 15, 2020 or the occurrence of a conversion termination date on or prior to March 15, 2020, we will, in certain circumstances, increase the conversion rate for a holder that converts its notes in connection with such make-whole fundamental change or such termination of conversion rights. See “Description of the Notes — Adjustment to Conversion Rate Upon Conversion in Connection with a Make-Whole Fundamental Change or Termination of Conversion Rights.” You will not receive any additional cash payment representing accrued and unpaid interest, if any, upon conversion of a note, except in limited circumstances. Instead, interest will be deemed to be paid by the cash, shares of our common stock or a combination of cash and shares of our common stock paid or delivered, as the case may be, to you upon conversion of a note. See “Description of the Notes — Conversion Rights — General.” |

| Settlement Upon Conversion |

We may elect to deliver to holders in full satisfaction of our conversion obligation: |

| • | solely shares of our common stock, together with cash in lieu of fractional shares, which we refer to as a “physical settlement”; |

| • | solely cash without any delivery of shares of our common stock, which we refer to as a “cash settlement”; or |

| • | a combination of cash and shares of our common stock, together with cash in lieu of fractional shares, which we refer to as a “combination settlement.” |

| The amount of cash, if we elect cash settlement, or the amount of cash and the number of shares of our common stock, if any, if we elect a combination settlement, will be based on a daily conversion value (as defined herein) for each of the 25 consecutive trading days (or, in the event of a conversion of notes in connection with a redemption of such notes, for each of the 15 consecutive trading days) during the cash settlement averaging period (as defined herein). |

S-3

| We will from time to time make an election with respect to the settlement method, which election shall be effective until we provide notice of an election of a different settlement method. We initially elect combination settlement and a specified dollar amount (as defined herein) of $1,000. If we choose to elect a different settlement method in the future, we will provide to all holders of the notes, the trustee and the conversion agent a notice of the newly chosen settlement method and the effective date of such newly chosen method. We may not change a settlement method after the 30th scheduled trading day preceding the maturity date or, with respect to notes converted in connection with a redemption or a termination of conversion rights, after we have provided a notice of redemption of the notes or conversion rights termination notice, as applicable. Prior to the 30th scheduled trading day preceding the maturity date of the notes, we will have the right to irrevocably elect combination settlement with a specified dollar amount of $1,000. Following such irrevocable election, we will not have the right to change the settlement method. See “Description of the Notes — Conversion Rights — Settlement Upon Conversion.” |

| Sinking Fund |

None. |

| Termination of Conversion Rights |

We may elect during a 30 consecutive trading day period to terminate the right of holders to convert all or part of their notes if the daily VWAP of our Common Stock is greater than or equal to 130% of the conversion price for at least 20 trading days during such 30 consecutive trading day period. If we elect to terminate the conversion rights of all or part of the notes on or prior to March 15, 2020, the conversion rate for any notes converted in connection with such termination of conversion rights will be increased as set forth under “Description of the Notes — Adjustment to Conversion Rate Upon Conversion in Connection with a Make-Whole Fundamental Change or Termination of Conversion Rights.” |

| Optional Redemption |

After March 15, 2020, we may, at our option, redeem all or part of the notes at a redemption price equal to the accreted amount of the notes to be redeemed, plus accrued but unpaid interest, if any, to but excluding the redemption date. |

| Fundamental Change |

If we undergo a “fundamental change” (as defined under “Description of the Notes — Purchase Rights of Holders — Fundamental Change Permits Holders to Require Us to Purchase Notes”), you may require us to purchase for cash all or part of your notes. The fundamental change purchase price will equal 100% of the accreted amount of the notes to be purchased, plus accrued and unpaid interest, if any, to, but excluding, the fundamental change purchase date. |

| Events of Default |

Except as described under “Description of the Notes — Events of Default,” if an event of default with respect to the notes occurs, holders may, upon satisfaction of certain conditions, accelerate the accreted principal amount of the notes plus accrued and unpaid |

S-4

| interest. In addition, the accreted principal amount of the notes plus accrued and unpaid interest will automatically become due and payable in the case of certain types of bankruptcy or insolvency events of default involving us. |

| Book-Entry Form |

The notes will be issued in book-entry form and will be represented by one or more permanent global certificates deposited with, or on behalf of, The Depository Trust Company (“DTC”) and registered in the name of a nominee of DTC. Beneficial interests in any of the notes will be shown on, and transfers will be effected only through, records maintained by DTC or its nominee and any such interest may not be exchanged for certificated securities, except in limited circumstances. |

| No Prior Market |

The notes are a new issue of securities and there is no existing market for the notes, and we do not intend to list the notes on any national securities exchange. Our common stock is listed on NYSE MKT, LLC (“NYSE MKT”) under the symbol “LNG.” If no active trading market for the notes develops, you may not be able to resell your notes at their fair market value or at all. Future trading prices of the notes will depend on many factors, including the market price of our common stock, prevailing interest rates, our operating results and the market for similar securities. |

| Certain U.S. Federal Income Tax Consequences |

For a discussion of certain U.S. federal income tax consequences relating to the purchase, ownership and disposition of the notes and the shares of our common stock into which the notes are convertible, see “Certain U.S. Federal Income Tax Consequences.” |

| Original Issue Discount |

The notes may be issued with original issue discount (“OID”) for U.S. federal income tax purposes. If the notes are issued with OID, U.S. holders, whether on the cash or accrual method of tax accounting, will be required to include any amounts representing OID in gross income (as ordinary income) on a constant yield to maturity basis for U.S. federal income tax purposes in advance of the receipt of cash payments to which such income is attributable. For further discussion, see “Certain U.S. Federal Income Tax Consequences.” |

| Trustee, Paying Agent and Conversion Agent |

The Bank of New York Mellon. |

| Risk Factors |

See “Risk Factors” beginning on page S-7 for a discussion of factors that should be considered before investing in the notes. |

S-5

RATIO OF EARNINGS TO FIXED CHARGES

The table below provides our ratio of earnings to fixed charges for each of the years ended December 31, 2014, 2013, 2012, 2011 and 2010. We have derived these ratios from our historical consolidated financial statements. The following should be read in conjunction with our consolidated financial statements, including the notes thereto, and the other financial information included or incorporated by reference herein.

| Year ended December 31, | ||||||||||||||||||||

| 2014 | 2013 | 2012 | 2011 | 2010 | ||||||||||||||||

| Ratio of Earnings to Fixed Charges |

— | (1) | — | (1) | — | (1) | 1.24x | 1.42x | ||||||||||||

| (1) | For the years ended December 31, 2014, 2013 and 2012, earnings were not adequate to cover fixed charges by $673.7 million, $556.2 million and $105.3 million, respectively. |

In calculating the foregoing ratios, “earnings” represent the aggregate of (a) pre-tax income from continuing operations before adjustment for income or loss from equity investees, (b) fixed charges, (c) amortization of capitalized interest, (d) distributed income of equity investees and (e) our share of pre-tax losses of equity investees for which charges arising from guarantees are included in fixed charges, net of (x) interest capitalized, (y) preference security dividend requirements of consolidated subsidiaries, and (z) the non-controlling interest in pre-tax income of subsidiaries that have not incurred fixed charges, and “fixed charges” represent the sum of (a) interest expensed and capitalized, (b) amortized premiums, discounts and capitalized expenses related to indebtedness, (c) an estimate of the interest within rental expense, and (d) preference securities dividend requirements of consolidated subsidiaries. A “preference security dividend” means the amount of pre-tax earnings that is required to pay the dividends on outstanding preference securities.

S-6

The securities offered by this prospectus supplement may involve a high degree of risk. You should carefully read and consider each of the following risk factors and the risk factors set forth in our Annual Report on Form 10-K for the year ended December 31, 2014, together with all of the other information included in, or incorporated by reference into, this prospectus supplement and the accompanying base prospectus. Additional risks and uncertainties not currently known to us, or that we currently deem to be immaterial, may also impair or adversely affect our business, contracts, financial condition, operating results, cash flow, liquidity and prospects.

Risks Related to the Notes and our Common Stock

The notes are effectively subordinated to any of our existing and future secured debt and structurally subordinated to the liabilities of our subsidiaries.

The notes will be our general unsecured obligations and will rank equally in right of payment with our other existing and future senior unsecured indebtedness and senior in right of payment to any of our indebtedness that is contractually subordinated to the notes. As of December 31, 2014, our total consolidated indebtedness was $9,990 million (before discounts and premiums); this amount does not take into account $2.0 billion aggregate principal amount of senior secured notes issued by Sabine Pass Liquefaction, LLC on March 3, 2015. The notes will also be effectively subordinated to any of our existing and future secured indebtedness to the extent of the value of the collateral securing such indebtedness. As of December 31, 2014, we had no secured indebtedness outstanding. The provisions of the indenture governing the notes will not prohibit us from incurring additional secured indebtedness in the future. Consequently, in the event of a bankruptcy, liquidation, dissolution, reorganization or similar proceeding with respect to us, the holders of any secured indebtedness will be entitled to proceed directly against the collateral securing such indebtedness. Therefore, such collateral will not be available for satisfaction of any amounts owed under our unsecured indebtedness, including the notes, until such secured indebtedness is satisfied in full.

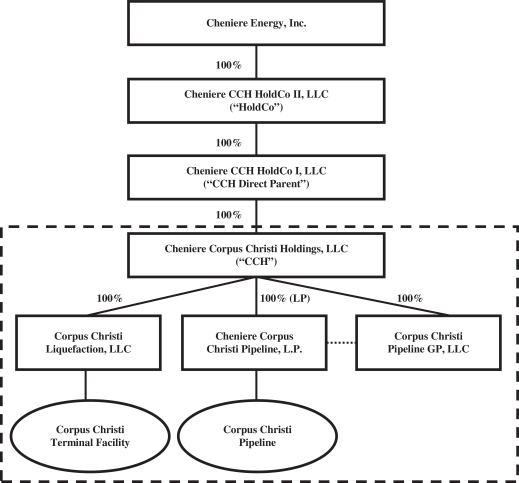

Our subsidiaries will not guarantee the notes. Accordingly, the notes will also be structurally subordinated to all existing and future unsecured and secured liabilities and preferred equity of our subsidiaries. In the event of a bankruptcy, liquidation, dissolution, reorganization or similar proceeding with respect to any such subsidiary, we, as a common equity owner of such subsidiary, and, therefore, holders of our debt, including holders of the notes, will be subject to the prior claims of such subsidiary’s creditors and preferred equity holders. As of December 31, 2014, our subsidiaries had $9,243 million of outstanding indebtedness and other liabilities (before discounts and premiums). As of December 31, 2014, other than the Class B Units of Cheniere Energy Partners, L.P., the holders of which have a preference over the holders of the subordinated units of Cheniere Energy Partners, L.P. in the event of a liquidation or merger, combination or sale of substantially all of its assets, our subsidiaries had no outstanding preferred equity securities. The provisions of the indenture governing the notes will not prohibit our subsidiaries from incurring additional indebtedness or issuing preferred equity in the future.

Our significant level of indebtedness could limit cash flow available for our operations, expose us to risks that could adversely affect our business, financial condition and results of operations and impair our ability to satisfy our obligations under the notes.

We have a significant amount of indebtedness. As of December 31, 2014, our total consolidated indebtedness was $9,990 million (before discounts and premiums); this amount does not take into account $2.0 billion aggregate principal amount of senior secured notes issued by Sabine Pass Liquefaction, LLC on March 3, 2015. We may also incur additional indebtedness to meet future financing needs. Our indebtedness could have significant negative consequences for our business, results of operations and financial condition, including:

| • | increasing our vulnerability to adverse economic and industry conditions; |

| • | limiting our ability to obtain additional financing; |

S-7

| • | requiring the dedication of portions of our cash flow from operations to service our indebtedness, thereby reducing the amount of our cash flow available for other purposes; |

| • | limiting our flexibility in planning for, or reacting to, changes in our business; |

| • | restricting our operational flexibility due to restrictive covenants that will limit our ability to explore certain business opportunities, dispose of assets and take other actions; |

| • | increasing dilution experienced by our existing stockholders as a result of the conversion of the notes into shares of common stock; and |

| • | placing us at a possible competitive disadvantage with less leveraged competitors and competitors that may have better access to capital resources. |

As of December 31, 2014, our annual debt service obligation on our outstanding indebtedness was approximately $574 million. We may be unable to maintain sufficient cash reserves, our business may not generate cash flow from operations at levels sufficient to permit us to pay principal, premium, if any, and interest on our indebtedness, or our cash needs may increase. If we are unable to generate sufficient cash flow or otherwise obtain funds necessary to make required payments, or if we failed to comply with the various requirements of these notes, or any indebtedness that we have incurred or may incur in the future, we would be in default, which would permit the holders of the affected notes or other indebtedness to accelerate the maturity of such notes or other indebtedness and could cause defaults under our other indebtedness. Any default under these notes or any indebtedness that we have incurred or may incur in the future could have a material adverse effect on our business, results of operations and financial condition.

We may not have the ability to raise the funds necessary to finance any required purchases of the notes upon the occurrence of a “fundamental change,” which would constitute an event of default under our indenture.

If a fundamental change (as defined under “Description of the Notes — Purchase Rights of Holders — Fundamental Change Permits Holders to Require Us to Purchase Notes”) occurs, you will have the right, at your option, to require us to purchase for cash any or all of your notes, or any portion of the principal amount thereof such that the principal amount that remains outstanding of each note purchased in part equals $1,000 or an integral multiple of $1,000 in excess thereof. The fundamental change purchase price will equal 100% of the accreted amount of the notes to be purchased, plus accrued and unpaid interest, if any, to, but excluding, the fundamental change purchase date. However, we may not have sufficient funds at the time we are required to purchase the notes surrendered therefor and we may not be able to arrange necessary financing on acceptable terms, if at all.

We have not established a sinking fund for payment of the notes, nor do we anticipate doing so. In addition, we may in the future enter into credit agreements or other agreements that may contain provisions prohibiting redemption or repurchase of the notes under certain circumstances. If a fundamental change occurs at a time when we are prohibited from purchasing the notes, we could seek a waiver from our other creditors or attempt to refinance the notes. If we were not able to obtain such a waiver, we would not be permitted to purchase the notes. Our failure to purchase tendered notes would constitute an event of default under the indenture governing the notes, which might constitute a default under the terms of our other indebtedness.

Our revenues and results of operations may fluctuate as a result of factors beyond our control, which may cause volatility in the price of our shares to common stock, and consequently could materially and adversely affect the trading price of the notes.

Our common stock is listed on NYSE MKT under the symbol “LNG.” Our performance, as well as the risks discussed herein, government or regulatory action, tax laws, interest rates and general market conditions could have a significant impact on the future market price of our common stock, which could materially and adversely affect the trading price of the notes. Some of the factors that could negatively affect our share price or result in fluctuations in the price of our common stock include:

| • | actual or anticipated variations in our quarterly or annual financial results or those of other companies in our industry; |

S-8

| • | changes to our earnings estimates or publications of research reports about us or the industry; |

| • | issuance of additional equity securities, which causes further dilution to stockholders; |

| • | changes in government regulation or proposals applicable to us; |

| • | actual or potential non-performance by any customer or a counterparty under any agreement to which we or one of our affiliates is a party; |

| • | announcements made by us or our competitors of significant contracts; |

| • | adverse market reaction to any increased indebtedness we incur in the future; |

| • | fluctuations in interest rates or inflationary pressures and other changes in the investment environment that affect returns on invested assets; |

| • | changes in accounting standards, policies, guidance, interpretations or principles; |

| • | the failure of securities analysts to cover our common stock or changes in financial or other estimates by analysts; |

| • | changes to our creditworthiness; |

| • | the market for similar securities; |

| • | additions or departures of key personnel; |

| • | reaction to the sale or purchase of company stock by our executive officers; |

| • | changes in tax law; |

| • | speculation in the press or investment community; and |

| • | general market, economic and political conditions. |

If our revenues and results of operations fluctuate as a result of one or more of these developments, the price of our common stock may be volatile, which could materially and adversely affect the trading price of the notes. Further, because the notes are convertible into shares of our common stock, volatility or depressed market prices of our common stock could have a similar effect on the trading price of the notes. Holders who receive shares of our common stock upon conversion of the notes will also be subject to the risk of volatility and depressed market prices of our common stock.

The conversion rights with respect to the notes can be terminated at our option under certain circumstances.

We will have the right, at our option, to elect to terminate the right of the holders to convert all or a portion of their notes if the daily VWAP has been greater than or equal to 130% of the conversion price then in effect for each of at least 20 trading days in a 30 consecutive trading-day period. The termination of the conversion rights with respect to the notes could materially and adversely affect the trading price of the notes. Our exercise of this right to terminate the conversion rights of holders of the notes will permit holders to convert their notes for the 25-day period prior to the conversion termination date, but if holders do not convert their notes prior to the conversion termination date, they shall thereafter have no rights to convert the notes.

If we terminate the conversion rights with respect to less than all of the notes, certain notes may cease to be convertible and such notes will not be fungible with the convertible notes.

If we exercise our option to terminate the right of the holders to convert their notes with respect to less than all of the notes, and holders of less than the applicable portion of notes as to which we have terminated the conversion rights elect to convert their notes, then a portion of outstanding notes will cease to be convertible. Such notes will be represented by a new form of note, with a new CUSIP number, and will not be fungible with the outstanding notes that retain their conversion rights. The trading price of the notes that cease to have

S-9

conversion rights will likely be materially lower than the trading price of notes that retain conversion rights. In addition, an active trading market may not develop for the notes that cease to have conversion rights, and any such market that may develop may have limited liquidity, which may additionally adversely affect the trading price of such notes.

We may redeem notes prior to maturity at their accreted amount.

After March 15, 2020, the notes may be redeemed at our option for the accreted amount, as described below under “Description of the Notes — Optional Redemption.” Redemption of the notes is a conversion contingency entitling holders of the notes to convert the notes. See “Description of the Notes — Conversion Rights.” However, the conversion rate at the time that we elect to exercise our redemption option may adversely affect the value you will receive upon conversion. Prior to March 15, 2045, the accreted amount will be less than $1,000 per $1,000 principal amount of notes. While the exercise of our option to redeem the notes will provide holders the ability to convert their notes, the trading price of our common stock could be lower than the conversion price at the time we exercise our option to redeem the notes. Consequently, in this situation, holders could be faced with the choice of being redeemed at the accreted amount or converting at a time when the value of our common stock is below the conversion price and/or decreasing.

The conditional conversion feature of the notes could result in your receiving less than the value of the cash, shares of our common stock or combination of cash and shares of our common stock into which a note would otherwise be convertible.

Prior to the close of business on the business day immediately preceding December 15, 2044, the notes are convertible into, at our option, cash, shares of our common stock or a combination of cash and shares of our common stock only if specified conditions are met. If these specified conditions are not met, you will not be able to convert your notes until December 15, 2044, and you may not be able to receive the value of the consideration into which the notes would otherwise be convertible. Therefore, you may not be able to realize the appreciation, if any, in the value of our common stock after the issuance of the notes and prior to such date. In addition, the inability to freely convert may also adversely affect the trading price of the notes and your ability to resell the notes.

The conditional conversion features of the notes, if triggered, may adversely affect our financial condition.

If one of the conversion contingencies is triggered, holders of notes will be entitled to convert the notes at any time during specified periods. See “Description of the Notes — Conversion Rights.” If one or more holders elect to convert their notes, we may be required to settle all or a portion of our conversion obligation through the payment of cash, which could adversely affect our liquidity and various aspects of our business (including our credit ratings and the trading price of the notes).

The settlement feature of the notes may have adverse consequences.

The settlement feature of the notes, as described under “Description of the Notes — Conversion Rights — Settlement Upon Conversion,” may:

| • | result in holders receiving no shares of our common stock upon conversion or fewer shares relative to the conversion value of the notes; |

| • | reduce our liquidity; |

| • | delay holders’ receipt of the consideration due upon conversion; and |

| • | subject holders to the market risks of our shares before receiving any shares upon conversion. |

S-10

That is, upon conversion of the notes, you will receive, at our election, cash, shares or a combination of cash and shares. In the event that we elect cash settlement or combination settlement, the consideration that you will receive upon conversion will be based upon the VWAP of our common stock for each of the 25 trading days (or, in the event of a conversion of notes in connection with a redemption of such notes, for each of the 15 trading days) during the applicable cash settlement averaging period described under “Description of the Notes — Conversion Rights — Settlement Upon Conversion.” Accordingly, if the price of our common stock decreases during this period, the amount and/or value of consideration you receive will be adversely affected. See “Description of the Notes — Conversion Rights — Settlement Upon Conversion.”

The conversion rate of the notes may not be adjusted for all dilutive events.

The conversion rate of the notes is subject to adjustment for certain events, including, but not limited to, certain dividends on our common stock, the issuance of certain rights, options or warrants to holders of our common stock, subdivisions or combinations of our common stock, certain distributions of assets, debt securities, capital stock or cash to holders of our common stock and certain tender or exchange offers, as described under “Description of the Notes — Conversion Rights — Conversion Rate Adjustments.” The conversion rate will not be adjusted for other events, such as a payment of certain dividends on our common stock, an issuance of our common stock for cash or the conversion of the convertible notes previously issued to certain investors into shares of our common stock, that may adversely affect the trading price of the notes and the market price of our common stock. There can be no assurance that an event will not occur that is adverse to the interests of the holders of the notes and their value, but does not result in an adjustment to the conversion rate.

Some significant restructuring transactions may not constitute a “fundamental change,” in which case we would not be obligated to offer to purchase the notes.

Upon the occurrence of a “fundamental change” (as defined under “Description of the Notes — Purchase Rights of Holders — Fundamental Change Permits Holders to Require Us to Purchase Notes”), you will have the option to require us to repurchase all or any portion of your notes for cash. However, the definition of “fundamental change” is limited to specified corporate events and may not include other events that might adversely affect our financial condition or the trading price of the notes. For example, events such as leveraged recapitalizations, refinancings, restructurings, or acquisitions initiated by us may not constitute a fundamental change requiring us to purchase the notes. In the event of any such events, the holders of the notes would not have the right to require us to purchase the notes, even though each of these transactions could increase the amount of our indebtedness, or otherwise adversely affect our capital structure or any credit ratings, thereby adversely affecting the trading price of the notes.

The adjustment to the conversion rate for notes converted in connection with certain make-whole fundamental change transactions or in connection with a termination of conversion rights, in each case, occurring on or prior to March 15, 2020 may not adequately compensate holders for the lost option time value of their notes as a result of any such transaction or termination.

If certain transactions that constitute a make-whole fundamental change occur on or prior to March 15, 2020, or if we elect to terminate the conversion right with respect to the notes on or prior to March 15, 2020, under certain circumstances and subject to certain limitations, we will increase the conversion rate by a number of additional shares of our common stock. This increased conversion rate will apply only to holders who convert their notes in connection with any such transaction or any such termination. The number of additional shares of our common stock will be determined based on the date on which the make-whole fundamental change transaction becomes effective or the first date on which the conversion termination threshold was met during the 30 trading-day period immediately preceding the date on which we deliver the related conversion rights termination notice to holders, as the case may be, and the price paid (or deemed paid) per share of our common stock in such transaction or such termination, as described under “Description of the Notes — Adjustment to Conversion Rate Upon Conversion in Connection With a Make-Whole Fundamental Change or Termination of

S-11

Conversion Rights.” While the increase in the conversion rate is designed to compensate holders for the lost option time value of the notes as a result of such transaction or such termination, the increase in the conversion rate is only an approximation of such lost value and may not adequately compensate holders for such loss. In addition, notwithstanding the foregoing, if the price paid (or deemed paid) for our common stock in the transaction or termination of conversion rights is greater than $300.00 per share or less than $81.40 per share (in each case, subject to adjustment under certain circumstances), then we will not be required to adjust the conversion rate if you convert your notes in connection with such transaction. Moreover, in no event will the total number of shares of our common stock issuable upon the conversion of the notes exceed 12.2850 per $1,000 principal amount of notes, subject to adjustment under certain circumstances.

Furthermore, the definition of make-whole fundamental change that will be contained in the indenture is limited to certain enumerated transactions. As a result, the make-whole fundamental change provisions of the indenture will not afford protection to holders of the notes in the event that other transactions occur that could adversely affect the option value of the notes. For example, transactions, such as a spin-off or sale of a subsidiary with volatile earnings, or a change in our subsidiaries’ lines of business, could significantly affect the trading characteristics of our common stock and thereby reduce the option value embedded in the notes without triggering a make-whole fundamental change.

Our obligation to increase the conversion rate upon certain make-whole fundamental change transactions could be considered a penalty, in which case the enforceability thereof would be subject to general principles of reasonableness of economic remedies.

The issuance of additional stock in connection with acquisitions or otherwise will dilute all other stock holdings and could affect the market price of our common stock and, therefore, the trading price of the notes.

After giving effect to the notes offered hereby, as of March 3, 2015, we would have had an aggregate of approximately 168,949,557 shares of common stock that are authorized and unissued or held as treasury shares and not reserved for issuance under our option and compensation plans or under other convertible or derivative instruments, including the notes. We may issue all of these shares without any action or approval by our stockholders. The issuance of these unreserved shares in connection with acquisitions or otherwise, as well as any shares of our common stock issued in connection with the exercise of stock options, restricted stock units, under convertible or derivative instruments or otherwise would dilute the notional percentage ownership held by the investors who purchase our notes. In addition, we may issue a substantial number of shares of our common stock upon conversion of the notes. We cannot predict the size of the future issuances or the effect, if any, that they may have on the market price for our common stock.

Future sales of our common stock in the public market or the issuance of securities senior to our common stock could adversely affect the market price of our common stock and, in turn, the trading price of the notes and our ability to raise funds in new stock offerings.

We expect that the trading price of the notes will depend on a variety of factors, including, without limitation, the market price of our common stock. Sales by us or our stockholders of a substantial number of shares of our common stock in the public markets after the date of this prospectus supplement and the concurrent transactions, or the perception that these sales might occur, could cause the market price of our common stock and the trading price of the notes to decline or could impair our ability to raise capital through a future sale of, or pay for acquisitions using, our equity or equity-related securities. In addition, the market price of our common stock also could be affected by possible sales of our common stock by investors who view the notes as a more attractive means of equity participation in our company and by hedging or arbitrage trading activity that we expect to develop involving our common stock by holders of the notes. The hedging or arbitrage could, in turn, affect the trading price of the notes and/or the market price of any shares of our common stock that holders of the notes receive upon conversion of their notes.

S-12

We may issue shares of our common stock or equity securities senior to our common stock in the future for a number of reasons, including to finance our operations and business strategy, to adjust our ratio of debt-to-equity, to satisfy our obligations upon the exercise of options or for other reasons. In addition, we have filed registration statements covering approximately 8,076,460 shares of common stock that are either issuable upon the exercise of outstanding options or reserved for future issuance pursuant to our stock plans as of December 31, 2014. No prediction can be made as to the effect, if any, that future sales or issuance of shares of our common stock or other equity securities, or the availability of shares of our common stock or such other equity securities for future sale or issuance, will have on the market price of our common stock or the trading price of the notes.

We expect that the trading price of the notes will be significantly affected by changes in the market price of our common stock, the interest rate environment and our credit quality, each of which could change substantially at any time.

We expect that the trading price of the notes will depend on a variety of factors, including, without limitation, the market price of our common stock, the interest rate environment and our credit quality. Each of these factors may be volatile, and may or may not be within our control.

Changes in interest rates, or expected future interest rates, during the term of the notes may affect the trading price of the notes. Because interest rates and interest rate expectations are influenced by a wide variety of factors, many of which are beyond our control, we cannot assure you that changes in interest rates or interest rate expectations will not adversely affect the trading price of the notes.

Furthermore, the trading price of the notes will likely be significantly affected by any change in our credit quality. Because our credit quality is influenced by a variety of factors, some of which are beyond our control, we cannot guarantee that we will maintain or improve our credit quality during the term of the notes. In addition, because we may choose to take actions that adversely affect our credit quality, such as incurring additional debt, there can be no guarantee that our credit quality will not decline during the term of the notes, which would likely negatively impact the trading price of the notes.

There is currently no public market for the notes, and an active trading market may not develop for the notes. The failure of a market to develop for the notes could adversely affect the liquidity and value of your notes.

The notes are a new issue of securities, and there is no existing market for the notes. We do not intend to apply for listing of the notes on any securities exchange or for quotation of the notes on any automated dealer quotation system. A market may not develop for the notes, and there can be no assurance as to the liquidity of any market that may develop for the notes. If an active, liquid market does not develop for the notes, the market price and liquidity of the notes may be adversely affected. If any of the notes are traded after their initial issuance, they may trade at a discount from their initial offering price.

The liquidity of the trading market, if any, and future trading prices of the notes will depend on many factors, including, among other things, the market price of our common stock, prevailing interest rates, our operating results, financial performance and prospects, the market for similar securities and the overall securities market, and may be adversely affected by unfavorable changes in these factors. Historically, the market for convertible debt has been subject to disruptions that have caused volatility in prices. It is possible that the market for the notes will be subject to disruptions which may have a negative effect on the holders of the notes, regardless of our operating results, financial performance or prospects.

Recent regulatory actions may adversely affect the trading price and liquidity of the notes.

We expect that many investors in, and potential purchasers of, the notes will employ, or seek to employ, a convertible arbitrage strategy with respect to the notes. Investors that employ a convertible arbitrage

S-13

strategy with respect to convertible debt instruments typically implement that strategy by selling short the common stock underlying the convertible notes and dynamically adjusting their short position while they hold the notes. As a result, any specific rules regulating short selling of securities or other governmental action that interferes with the ability of market participants to effect short sales in our common stock could adversely affect the ability of investors in, or potential purchasers of, the notes to conduct the convertible arbitrage strategy that we believe they will employ, or seek to employ, with respect to the notes. This could, in turn, adversely affect the trading price and liquidity of the notes.

The SEC and other regulatory and self-regulatory authorities have implemented various rule changes and are expected to adopt additional rule changes in the future that may impact those engaging in short selling activity involving equity securities (including our common stock), including Rule 201 of SEC Regulation SHO, the Financial Industry Regulatory Authority, Inc.’s “Limit Up-Limit Down” program, market-wide circuit breaker systems that halt trading of stock for certain periods following specific market declines, and rules stemming from the enactment and implementation of the Dodd-Frank Wall Street Reform and Consumer Protection Act. Past regulatory actions, including emergency actions or regulations, have had a significant impact on the trading prices and liquidity of equity-linked instruments. Any governmental action that similarly restricts the ability of investors in, or potential purchasers of, the notes to effect short sales of our common stock could similarly adversely affect the trading price and the liquidity of the notes.

The accounting method for convertible debt securities that may be settled in cash, such as the notes, could have a material effect on our reported financial results.

In May 2008 (and effective for fiscal years beginning after December 15, 2008), the Financial Accounting Standards Board, which we refer to as FASB, issued FASB Staff Position No. APB 14-1, Accounting for Convertible Debt Instruments That May Be Settled in Cash Upon Conversion (Including Partial Cash Settlement), and which subsequently was codified under FASB Accounting Standards Codification (“ASC”) Section 470-20, Debt with Conversion and other Options. Under ASC 470-20, an entity must separately account for the liability and equity components of the convertible debt instruments (such as the notes) that may be settled entirely or partially in cash upon conversion in a manner that reflects the issuer’s economic interest cost. The effect of ASC 470-20 on the accounting for the notes is that the equity component is required to be included in the additional paid-in capital section of equity on our consolidated balance sheets and the value of the equity component would be treated as original issue discount for purposes of accounting for the debt component of the notes. As a result, we will be required to record a greater amount of non-cash interest expense in current periods presented as a result of the accretion of the discounted carrying value of the notes to their face amount over the terms of the notes. This could adversely affect our reported or future financial results, the market price of our common stock and the trading price of the notes. In addition, under certain circumstances, convertible debt instruments (such as the notes) that may be settled entirely or partly in cash are currently accounted for utilizing the treasury stock method, the effect of which is that the shares issuable upon conversion of the notes are not included in the calculation of diluted earnings per share except to the extent that the conversion value of the notes exceeds their principal amount. Under the treasury stock method, for diluted earnings per share purposes, the transaction is accounted for as if the number of shares of common stock that would be necessary to settle such excess, if we elected to settle such excess in shares, are issued. We cannot be sure that the accounting standards in the future will continue to permit the use of the treasury stock method. If we are unable to use the treasury stock method in accounting for the shares issuable upon conversion of the notes, then our diluted earnings per share would be adversely affected.

You may be subject to tax upon an adjustment to, or a failure to adjust, the conversion rate of the notes even though you do not receive a corresponding cash distribution.

The conversion rate of the notes is subject to adjustment in certain circumstances, including the payment of certain cash dividends. If the conversion rate is adjusted as a result of a distribution that is taxable to our common stockholders, such as a cash dividend, you may be deemed to have received for U.S. federal income

S-14

tax purposes a taxable dividend to the extent of our earnings and profits without the receipt of any cash. In addition, a failure to adjust (or adjust adequately) the conversion rate after an event that increases your proportionate interest in us could be treated as a deemed taxable dividend to you. Such deemed dividend may be subject to U.S. federal withholding tax or backup withholding, which may be set off against subsequent payments of cash and common stock payable on the notes (or, in certain circumstances, against any payments on our common stock). See “Description of the Notes — Conversion Rights — Conversion Rate Adjustments” and “Certain U.S. Federal Income Tax Consequences.”

If a make-whole fundamental change event occurs on or prior to March 15, 2020 or we terminate the conversion rights with respect to the notes on or prior to March 15, 2020, under some circumstances, we will increase the conversion rate for the notes converted in connection with such make-whole fundamental change or termination of conversion rights. Such increase may be treated as a distribution subject to U.S. federal income tax as a dividend. Such deemed dividend may be subject to U.S. federal withholding tax or backup withholding, which may be set off against payments on the notes or common stock. See “Certain U.S. Federal Income Tax Consequences.”

The notes may be issued with OID for U.S. federal income tax purposes.

The notes will be treated as issued with OID for U.S. federal income tax purposes if the difference between the principal amount of the notes and their issue price is equal to or greater than a statutory de minimis amount. If the notes are issued with OID, U.S. holders will be required to include such OID in gross income (as ordinary income) on a constant yield to maturity basis in advance of the receipt of cash payment thereof, regardless of such holders’ method of accounting for U.S. federal income tax purposes. See “Certain U.S. Federal Income Tax Consequences — Consequences to U.S. Holders — Stated Interest and OID on the Notes.”

If a bankruptcy petition were filed by or against us under the U.S. Bankruptcy Code after the issuance of the notes, the claim by any holder of the notes for the principal amount of the notes may be limited to an amount equal to the sum of:

| • | the original issue price for the notes; and |

| • | that portion of the OID (if any) that does not constitute “unmatured interest” for purposes of the U.S. Bankruptcy Code. |

Any OID that was not amortized as of the date of the bankruptcy filing would constitute unmatured interest. Accordingly, holders of the notes under these circumstances may receive a lesser amount than they would be entitled to receive under the terms of the indenture governing the notes, even if sufficient funds were available.

Certain provisions in the notes and the indenture could delay or prevent an otherwise beneficial takeover or takeover attempt of us and, therefore, the ability of holders to exercise their rights associated with a potential fundamental change or a make-whole fundamental change.

Certain provisions in the notes and the indenture could make it more difficult or more expensive for a third party to acquire us. For example, if an acquisition event constitutes a fundamental change, holders of the notes will have the right to require us to purchase their notes in cash. Such an acquisition event may also trigger the availability for holders of the notes to convert their notes. In addition, if an acquisition event constitutes a make-whole fundamental change and such event occurs on or prior to March 15, 2020, we may be required to increase the conversion rate for holders who convert their notes in connection with such make-whole fundamental change. In any of these cases, and in other cases, our obligations under the notes and the indenture as well as provisions of our organizational documents and other agreements could increase the cost of acquiring us or otherwise discourage a third party from acquiring us or removing incumbent management. For additional information about our organizational documents and other agreements and their potential effect on transactions involving a change of control, see “Description of Capital Stock.”

S-15

The notes may not be rated or may receive a lower rating than anticipated.

We do not intend to seek a rating on the notes. However, if one or more rating agencies rates the notes and assigns the notes a rating lower than the rating expected by investors, or reduces their rating in the future, the trading price of the notes and the market price of our common stock could be harmed.

In addition, the trading price of the notes is directly affected by market perceptions of our creditworthiness. Consequently, if a credit ratings agency downgrades or withdraws its rating of any of our debt, or puts us on credit watch, the trading price of the notes is likely to decline.

The notes are not protected by financial or restrictive covenants.

The indenture governing the notes will not contain any financial or operating covenants or restrictions on the payments of dividends, the incurrence of indebtedness or the issuance or repurchase of securities by us or any of our subsidiaries. The indenture governing the notes will not contain any covenants or other provisions to afford protection to holders of the notes in the event of a fundamental change involving us except to the extent described under “Description of the Notes — Recapitalizations, Reclassifications and Changes of Our Common Stock,” “Description of the Notes — Adjustment to Conversion Rate Upon Conversion in Connection With a Make-Whole Fundamental Change or Termination of Conversion Rights,” “Description of the Notes — Purchase Rights of Holders — Fundamental Change Permits Holders to Require Us to Repurchase Notes,” and “Description of the Notes — Consolidation, Merger and Sale of Assets.” Accordingly, under the indenture, we could enter into certain transactions, such as acquisitions, refinancings or recapitalizations, that could affect our capital structure and the value of the notes and common stock but would not constitute a fundamental change or a make-whole fundamental change under the terms of the notes.

Holders of the notes will not be entitled to any rights with respect to our common stock, but will be subject to all changes made with respect to our common stock.