600 Travis, Suite 4200

Houston, Texas 77002

713.220.4200 Phone

713.220.4285 Fax

andrewskurth.com

|

600 Travis, Suite 4200 Houston, Texas 77002 713.220.4200 Phone 713.220.4285 Fax andrewskurth.com |

August 31, 2007

Ms. Jill S. Davis

Branch Chief

Securities and Exchange Commission

100 F Street NE, Mail Stop 3561

Washington, D.C. 20549-7010

| Re: | Cheniere Energy, Inc. |

Form 10-K for Fiscal Year Ended December 31, 2006

Filed February 27, 2007

Forms 10-Q for Fiscal Quarters Ended March 31, 2007 and

June 30, 2007

Filed May 9, 2007 and August 8, 2007

File No. 001-16383

Dear Ms. Davis:

On behalf of Cheniere Energy, Inc., a Delaware corporation (the “Company”), we enclose the responses of the Company to comments received from the staff of the Division of Corporation Finance (the “Staff”) of the Securities and Exchange Commission (the “Commission”) by letter dated August 21, 2007, with respect to the Company’s Form 10-K for fiscal year ended December 31, 2006 and Forms 10-Q for fiscal quarters ended March 31, 2007 and June 30, 2007 (File No. 001-16383) (collectively, the “Filings”). For your convenience, the responses are prefaced by the exact text of the Staff’s corresponding comment.

The Company acknowledges the following: (i) the Company is responsible for the adequacy and accuracy of the disclosure in the Filings; (ii) Staff comments or changes to disclosure in response to Staff comments do not foreclose the Commission from taking any action with respect to the Filings; and (iii) the Company may not assert Staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States.

Please let us know if you have any questions or if we can provide additional information or otherwise be of assistance in expediting the review process.

| Sincerely, |

| Meredith S. Mouer |

| cc: | Don A. Turkleson (Cheniere Energy, Inc.) |

Austin Beijing Dallas Houston London Los Angeles New York The Woodlands Washington, DC

Cheniere Energy, Inc.

Form 10-K and Forms 10-Q (File No. 001-16383)

Company’s Responses to

SEC Comment Letter dated August 21, 2007

Form 10-K for the Fiscal Year Ended December 31. 2006

Consolidated Balance Sheet. page 76

| 1. | We note a line item within non-current assets identified as ‘Non-Current Restricted Cash and Cash Equivalents.” Within your discussion of significant accounting policies you explain that cash equivalents include all investments with original maturities of three months or less. As such, please tell us why it is appropriate to identify non-current assets as cash equivalents. If necessary, please revise your disclosures accordingly. |

Response:

Accounting Research Bulletins (“ARB”) No. 43, Restatement and Revisions of Accounting Research Bulletins, Chapter 3, states that cash and claims to cash which are restricted as to withdrawal or use for other than current operations, designated for expenditure in the acquisition or construction of non-current assets, or segregated for the liquidation of long-term debts shall be excluded from current assets. As such, we have segregated on our balance sheet and discussed in Note 3 of our Notes to Consolidated Financial Statements on page 88 certain funds that meet the definition cash and cash equivalents but are legally restricted to acquire non-current assets or liquidate long-term liabilities. We believe that our classification on the balance sheet and our disclosure is appropriate and consistent with guidance promulgated by ARB No. 43.

Notes to Consolidated Financial Statements. page 80

Note 1 — Organization and Nature of Operations. page 80

| 2. | You state that “We are currently engaged primarily in the business of developing and constructing ... a network of three onshore LNG receiving terminals, and related natural gas pipelines ...”. Given the guidelines for identifying a development stage enterprise in paragraphs 8 and 9 of SFAS 7, please tell us why you believe you are not a development stage company. |

Response:

SFAS No. 7 identifies a development stage enterprise as an entity that devotes substantially all of its efforts to establishing a new business and has not commenced planned principal operations or has no significant revenue therefrom. Although our focus is primarily on the development of LNG-related businesses, we continue to be involved to a limited extent in oil and gas exploration, development and exploitation. Our oil and gas exploration and development segment has been operating since our stock initially began trading publicly in 1996. We have built a technical and management team that is experienced in the Gulf of Mexico and in various technical specialties required for our exploration program.

2

Cheniere Energy, Inc.

Form 10-K and Forms 10-Q (File No. 001-16383)

Company’s Responses to

SEC Comment Letter dated August 21, 2007

We began developing our LNG-related businesses in 1999 and have since commenced development of new LNG receiving terminals, natural gas pipelines and marketing operations. Our progress has resulted in the formation of development stage subsidiaries that devote substantially all of their efforts in developing our LNG-related businesses. Two of these subsidiaries have made filings with the Commission as development stage enterprises consistent with SFAS No. 7.

Note 2 — Summary of Significant Accounting Policies. page 80

Goodwill page 85

| 3. | We note your determination that the reporting unit level for goodwill impairment testing is your LNG receiving terminals business. We also note your disclosure on page 94 that you consider the LNG receiving terminal business as the reporting unit for review “due to similar economic characteristics.” Given your discrete discussion throughout the filing of the separate LNG receiving terminal projects, please provide an analysis of your reporting unit determination under paragraph 30 of SFAS 142 and the relevant provisions of paragraph 17 of SFAS 131. |

Response:

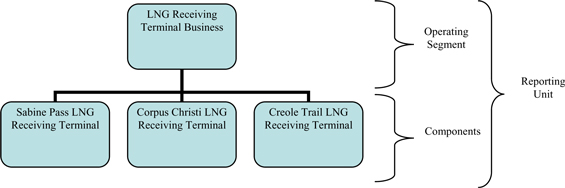

As defined in paragraph 30 of SFAS 142, a reporting unit is an operating segment or one level below an operating segment which is referred to as a component. Two or more components of an operating segment are aggregated and deemed a single reporting unit if the components have similar economic characteristics. Within this definition, we believe that our proposed portfolio of three LNG receiving terminals would constitute two or more components of an operating segment for the goodwill impairment test and, as such, have determined that our LNG receiving terminal business constitutes an operating segment as defined in SFAS No. 131.

3

Cheniere Energy, Inc.

Form 10-K and Forms 10-Q (File No. 001-16383)

Company’s Responses to

SEC Comment Letter dated August 21, 2007

Our three components have the following similar characteristics as considered for aggregation under paragraph 17 of SFAS No. 131:

| • | The terminal designs are substantially the same. |

| • | Each terminal will provide the same service of converting LNG into natural gas. |

| • | We expect the terminals to provide alternative destinations for cargos of LNG. |

| • | The terminals are expected to share a number of support functions and have personnel who are interchangeable. |

The discrete discussion in our filing is appropriate due to the different phases of development of each of our terminal projects.

Note 4 — Leases, page 89

Tug Boat Lease, page 90

| 4. | We note you entered into an agreement for the use of four tug boats and marine services, and the day rate charge for the tug boats include a service component and an equipment component. You further explain that you have concluded the tug boat lease is an operating lease; and as such, the “equipment component” of the Tug Agreement will be charged to expense over the term of the agreement. Please tell us why only the equipment component of the Tug Agreement will be expensed, and how the service component of the agreement is being recorded. |

Response:

The disclosure on page 90 served to disclose the embedded lease component within a service contract entered into by us and to disclose information regarding the lease in accordance with provisions found in SFSA No. 13, as amended. The disclosure was not intended to suggest that the service component was not going to be expensed in the future. The service component of the contract will be recognized as the service is performed. We note your comment, and will clarify the disclosure in future filings to state how the service component will be recognized.

4

Cheniere Energy, Inc.

Form 10-K and Forms 10-Q (File No. 001-16383)

Company’s Responses to

SEC Comment Letter dated August 21, 2007

Note 9 — Goodwill, page 94

| 5. | You explain that in February 2005 you acquired the minority interest in Corpus Christi LNG, L.P. in exchange for 2.0 million restricted shares of your common stock valued at $77.2 million, including direct transaction costs. Of this amount, $76.8 million was recorded as goodwill. You further state that the amount of goodwill recorded was “... the difference between the deemed value of the shares conveyed and the historical carrying value of the minority interest under GAAP plus direct transaction costs.” Paragraph 14 of SFAS 141 explains that the acquisition of some or all of the non-controlling interests in a subsidiary shall be accounted for using the purchase method. Please confirm to us that you followed the guidance in SFAS 141 with regard to this acquisition, and tell us why no value was allocated to identifiable tangible or intangible assets. |

Response:

We specifically reviewed the guidance found in SFAS No. 141 in determining the proper accounting treatment of our acquisition of the minority interest in Corpus Christi LNG, L.P. On the date of acquisition, the difference between the cost of acquisition and the carrying value of the minority interest in the partnership was recorded to goodwill due to the partnership having no material tangible assets and the determination that no intangible assets existed. This is consistent with the developmental nature of the business and status of its activity at the date of acquisition.

Supplemental information to Consolidated Financial Statements, page 122

Costs Incurred in Oil and Gas Producing Activities, page 122

| 6. | Please revise your presentation so that amounts incurred related to asset retirement obligations are included in the balance of the line items required to be disclosed (i.e. property acquisition, exploration and/or development costs), as we believe there is no provision for this separate line item in paragraph 21 and Illustration 2 of SFAS 69. |

Response:

We note your comment and concur with your conclusion. In our opinion, the inclusion was not material to the adequacy or accuracy of the disclosure in the filing. We will revise the presentation in future filings so that our asset retirement obligations are included in the development costs line item of costs incurred in oil and gas producing activities.

5

Cheniere Energy, Inc.

Form 10-K and Forms 10-Q (File No. 001-16383)

Company’s Responses to

SEC Comment Letter dated August 21, 2007

Controls and Procedures. page 127

| 7. | You disclose that your officers have concluded that your disclosure controls and procedures “are effective to ensure that information required to be disclosed in reports that we file or submit under the Exchange Act are recorded, processed, summarized and reported within the time periods specified in SEC’s rules and forms.” Item 307 of Regulation S-K requires you to disclose your officer’s conclusions regarding the effectiveness of your disclosure controls and procedures as that term is defined in Rule 13a-15(e) of the Exchange Act. The definition in Rule 13a-15(e) is more comprehensive than that included in your disclosure. Specifically, the term disclosure controls and procedures also “...include, without limitation, controls and procedures designed to ensure that information required to be disclosed by an issuer in the reports that it files or submits under the Act is accumulated and communicated to the issuer’s management, including its principal executive and principal financial officers, or persons performing similar functions, as appropriate to allow timely decisions regarding required disclosure.” Your officer’s conclusion does not state whether your disclosure controls and procedures are effective at accomplishing these items. Please revise your officer’s conclusion to state whether your disclosure controls and procedures are effective at accomplishing all of the items included within the definition of disclosure controls and procedures as defined in Rule 13a-15(e) of the Exchange Act. This comment also applies to your Form l0-Q for the quarterly periods ended March 31, 2007 and June 30, 2007. |

Response:

In response to this comment, we propose to expand our disclosure to state whether our disclosure controls and procedures are effective at accomplishing all of the items included within the definition of disclosure controls and procedures as defined in Rule 13a-15(e) of the Exchange Act. In our opinion, the inclusion of this expanded disclosure was not material to the adequacy or accuracy of the disclosure in the Filings. Therefore, we propose including the text below beginning in our Form 10-Q for the fiscal quarter ended September 30, 2007 and in subsequent Form 10-K and Form 10-Q filings.

Based on their evaluation as of the end of the fiscal quarter ended September 30, 2007, our Chief Executive Officer and our Chief Financial Officer have concluded that our disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e) under the Exchange Act) are effective to ensure that information required to be disclosed in reports that we file or submit under the Exchange Act (i) is recorded, processed, summarized and reported within the time periods specified in the SEC’s rules and forms and (ii) is accumulated and communicated to our management, including our Chief Executive Officer and our Chief Financial Officer, as appropriate to allow timely decisions regarding required disclosure.

6