Exhibit 10.2

GAS PURCHASE AND SALE AGREEMENT

between

Cheniere LNG Marketing, Inc.,

as Seller,

and

PPM Energy, Inc.,

as Buyer

Dated April 4, 2006

Execution Version

TABLE OF CONTENTS

| ARTICLE I | DEFINITIONS AND INTERPRETATION | 1 | ||

| ARTICLE II | TERM | 8 | ||

| ARTICLE III | QUANTITY | 8 | ||

| ARTICLE IV | PRICE | 13 | ||

| ARTICLE V | DELIVERY POINT | 14 | ||

| ARTICLE VI | TRANSPORTATION | 14 | ||

| ARTICLE VII | QUALITY AND MEASUREMENT | 15 | ||

| ARTICLE VIII | TERMINATION | 16 | ||

| ARTICLE IX | BILLING, PAYMENT AND AUDIT | 16 | ||

| ARTICLE X | TITLE, WARRANTY AND INDEMNITY | 18 | ||

| ARTICLE XI | FORCE MAJEURE | 18 | ||

| ARTICLE XII | DEFAULTS AND REMEDIES | 22 | ||

| ARTICLE XIII | DISPUTE RESOLUTION | 24 | ||

| ARTICLE XIV | CREDIT SUPPORT | 26 | ||

| ARTICLE XV | MISCELLANEOUS | 27 | ||

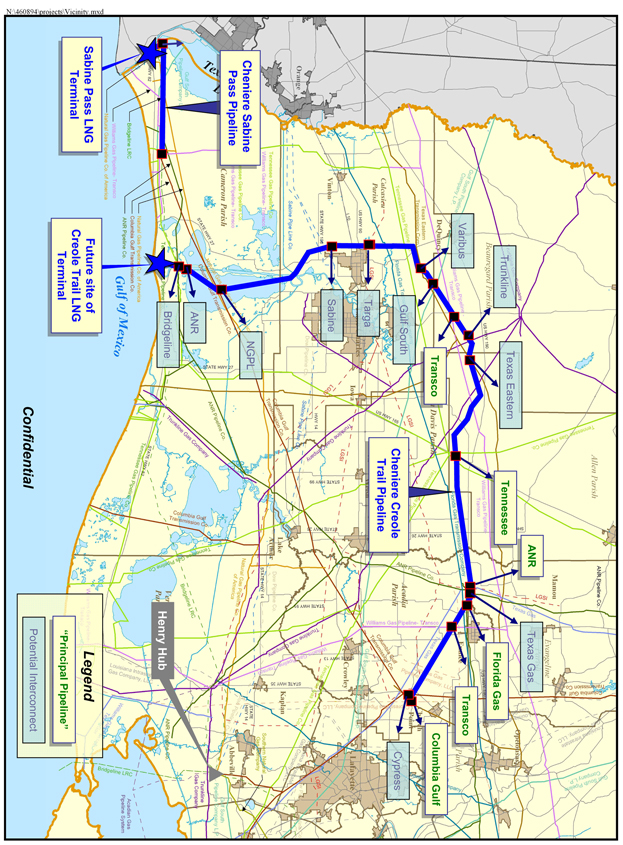

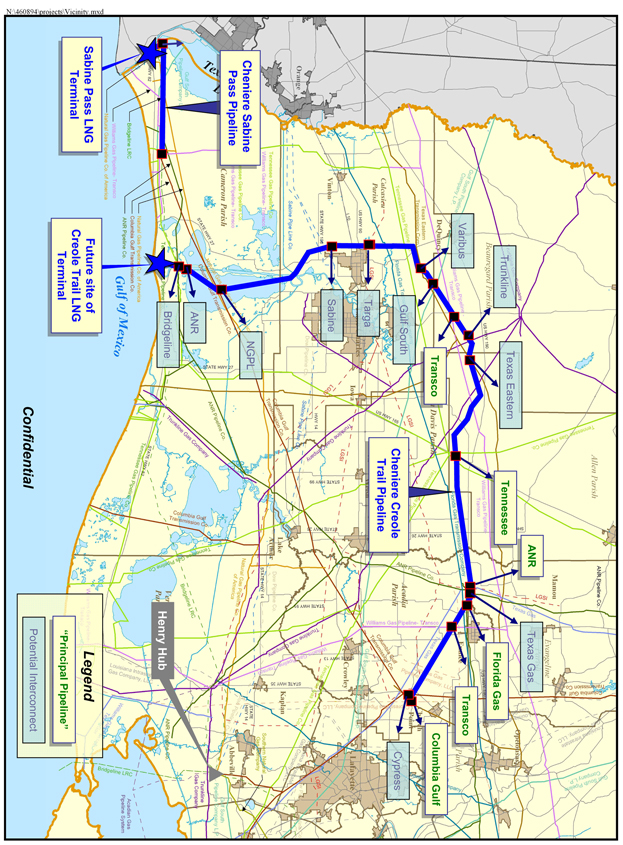

| Exhibit A: | Map of Cheniere Creole Trail Pipeline and Cheniere Sabine Pass Pipeline | |||

| Exhibit B: | Form of Increase Notice | |||

| Exhibit C: | Buyer Guarantee | |||

| Exhibit D: | Seller Guarantee | |||

i

Gas Purchase and Sale Agreement

This Gas Purchase and Sale Agreement (“Agreement”), dated as of this 4th day of April, 2006 (“Effective Date”) is made by and between PPM Energy, Inc., a company incorporated under the laws of the state of Oregon (“Buyer”) and Cheniere LNG Marketing, Inc., a company incorporated under the laws of the state of Delaware (“Seller”). Buyer or Seller may be referred to herein as “Party” and collectively Buyer and Seller may be referred to as “Parties.”

RECITALS

WHEREAS, as one facet of its Gas marketing portfolio, Seller intends to purchase LNG for import into the United States, regasify such LNG into Gas and sell such Gas in the North American market;

WHEREAS, affiliates of Seller are developing LNG regasification terminals, including the Sabine Pass LNG Terminal, and are developing Gas pipelines, including the Cheniere Sabine Pass Pipeline and the Cheniere Creole Trail Pipeline;

WHEREAS, Seller has or intends to acquire contractual rights to certain LNG terminalling services (including the regasification of LNG) at the Sabine Pass LNG Terminal;

WHEREAS, Seller has or intends to acquire transportation rights on the Cheniere Sabine Pass Pipeline and the Cheniere Creole Trail Pipeline, on the understanding that deliveries of Gas from the Cheniere Sabine Pass Pipeline will be able to be made to the Cheniere Creole Trail Pipeline at or upstream of the Delivery Point(s), thereby allowing regasified LNG from the Sabine Pass LNG Terminal to be delivered at the Delivery Point(s); and

WHEREAS, subject to the fulfillment of certain conditions (including the acquisition by Seller of sufficient LNG supply not dedicated to the supply of Seller’s other customers), Seller desires to sell Gas to Buyer at the Delivery Point(s) beginning at a minimum quantity of 20,000 MMBtu per day, and potentially increasing up to a maximum of 600,000 MMBtu per day, and Buyer desires to purchase such Gas from Seller;

NOW, THEREFORE, for good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged by the Parties hereto and for the mutual covenants contained herein, Buyer and Seller hereby agree as follows:

ARTICLE I

DEFINITIONS AND INTERPRETATION

| A. | Capitalized terms defined in this Article I shall have the meanings set forth below. |

“AAA” has the meaning ascribed to the term in Section XIII.A.

“Adjusted Daily Contract Quantity” or “ADCQ” has the meaning ascribed to the term in Section III.C.1.

1

“Affiliate” means a Person (other than a Party) that directly or indirectly controls, is controlled by, or is under common control with a Party to this Agreement, and for such purposes the terms “control”, “controlled by” and other derivatives shall mean the direct or indirect ownership of more than fifty percent (50%) of the voting rights in a Person.

“Aggregate Exposure” means, as of the relevant date of determination, the sum of (a) the aggregate amount of the Daily Exposure in respect of each day on which Gas has been delivered to and received by Buyer in accordance with this Agreement, to the extent that Buyer has not yet been invoiced in accordance with Article IX in respect of such Gas, and (b) the aggregate amount owing by Buyer to Seller in respect of Gas delivered to and received by Buyer in accordance with this Agreement for which Buyer has been invoiced as of such date in accordance with Article IX.

“Aggregate Exposure Notice” means the notice from Seller to Buyer as required by Section III.C.1.d. that the Aggregate Exposure exceeds the Guarantee Limitation Amount, which written notice must be provided to Buyer at least five (5) Business Days prior to Bid Week for the delivery month.

“Agreement” has the meaning ascribed to the term in the preamble to this Agreement and includes all Exhibits attached hereto and made a part hereof.

“Bid Week” means the week during which the New York Mercantile Exchange’s Henry Hub natural gas futures contract for the immediately following month terminates.

“British thermal unit” or “Btu” means the International BTU, which is also called the Btu (IT).

“Business Day” means any day except Saturday, Sunday or days that New York Mercantile Exchange, Inc., schedules as holidays.

“Buyer” has the meaning ascribed to the term in the preamble to this Agreement.

“Buyer Guarantee” means the guarantee dated as of the date hereof given by Buyer Guarantor to Seller guaranteeing the obligations of Buyer under this Agreement, a true and correct copy of which is attached as Exhibit C.

“Buyer Guarantor” means Scottish Power Finance (US) Inc., Delaware corporation.

“Buyer’s Cumulative Interruption Account” means the cumulative amount of the positive difference between the Seller’s Non-Performance Payment and the amount of Seller’s payments to Buyer pursuant to Section III.D.2. over a period of twenty-four (24) months, the first such period to begin with the Commercial Start Date; provided, however, that if the Buyer’s Cumulative Interruption Account balance is reduced pursuant to Section III.B.3.e., Section III.D.2.b. or Section VIII.B.3., the date of the reduction constitutes the beginning of a new twenty-four (24) month period.

“Cheniere Creole Trail Pipeline” means that pipeline, a preliminary map of which is attached as Exhibit A, commencing at or near the future site of the Creole Trail LNG Terminal and terminating at an interconnection with Columbia Gulf Transmission Company pipeline.

2

“Cheniere Sabine Pass Pipeline” means that pipeline, a preliminary map of which is attached as Exhibit A, commencing at the tailgate of the Sabine Pass LNG Terminal and terminating approximately sixteen (16) miles east at Johnson Bayou.

“Claims” has the meaning ascribed to it in Section X.C.

“Commercial Start Date” means the first day of the second calendar month following the later of the date of the commencement of: (a) commercial operation of the Sabine Pass LNG Terminal; (b) commercial operation of the Cheniere Creole Trail Pipeline with firm service to the delivery points at the Principal Pipelines; and (c) the commercial delivery of Gas from the Sabine Pass LNG Terminal to the Cheniere Creole Trail Pipeline.

“Contract Price” has the meaning ascribed to the term in Section IV.A.1.

“Cover Standard” means that if there is an unexcused failure to take or deliver any quantity of Gas pursuant to this Agreement, then the performing Party shall use commercially reasonable efforts to (i) if Buyer is the performing Party, obtain Gas, (or an alternate fuel if elected by Buyer and replacement Gas is not available), or (ii) if Seller is the performing Party, sell Gas, in either case, at a price reasonable for the delivery or production area, as applicable, consistent with: the amount of notice provided by the nonperforming Party; the quantities involved; and the anticipated length of failure by the nonperforming Party.

“Creole Trail LNG Terminal” means the LNG terminal facility in Cameron Parish, Louisiana capable of performing certain LNG terminalling services, including: the berthing of LNG vessels; the unloading, receiving and storing of LNG; the regasification of LNG; and delivery of natural gas to the point of interconnect between the tailgate of such LNG terminal facility and the Cheniere Creole Trail Pipeline.

“Daily Contract Quantity” or “DCQ” has the meaning ascribed to the term in Section III.B.1.

“Daily Exposure” means, as of the relevant date of determination, an amount equal to the product obtained by multiplying (a) the DCQ in respect of such date, by (b) the relevant price as determined in accordance with Article IV.

“Defaulting Party” has the meaning ascribed to the term in Section XII.A.

“Delivery Point(s)” has the meaning ascribed to the term in Section V.A.

“Dispute” means any dispute, controversy or claim (of any and every kind or type, whether based on contract, tort, statute, regulation, or otherwise) arising out of, relating to, or connected with this Agreement, including any dispute as to the construction, validity, interpretation, termination, enforceability or breach of this Agreement.

“Early Termination Date” has the meaning ascribed to the term in Section XII.C.

“Effective Date” has the meaning ascribed to the term in the preamble to this Agreement.

“Event of Default” has the meaning ascribed to the term in Section XII.A.

3

“Excused Party” has the meaning ascribed to the term in Section XI.A.

“Extension Term” has the meaning ascribed to the term in Section II.C.

“FERC” means the Federal Energy Regulatory Commission, or any successor federal regulatory agency.

“FERC Gas Tariff” means the rate schedules, terms and conditions of service and other components comprising a natural gas company’s tariff as required to be on file with FERC and in effect, as it may be modified from time to time.

“Force Majeure” has the meaning ascribed to the term in Section XI.B.

“Gas” means any mixture of hydrocarbons and noncombustible gases in a gaseous state consisting primarily of methane.

“Gas Day” means a period beginning at 09:00 Central Clock Time and ending at 09:00 Central Clock Time on the following day.

“Gas Quality Standard” has the meaning ascribed to the term in Section VII.A.

“Government Approvals” means all consents, authorizations, licenses, waivers, permits, approvals and other similar documents from or by any federal, regional, state, or local government, any subdivision, agency, commission or authority thereof (including maritime authorities, port authority or any quasi-governmental agency) having jurisdiction over a Party, the Sabine Pass LNG Terminal, the Creole Trail LNG Terminal, the Cheniere Sabine Pass Pipeline, the Cheniere Creole Trail Pipeline, as the case may be, and acting within its legal authority.

“Guarantee Limitation Amount” has the meaning ascribed to such term in the Buyer Guarantee.

“Gulf of Mexico” means that body of water located at the southeastern corner of North America, that is approximately 579,000 square miles, measuring approximately 995 miles from east to west, 560 miles from north to south and that is bordered by the United States to the north, Mexico to the west, and the island of Cuba to the southeast.

“Imbalance Charges” mean any fees, penalties, costs or charges (in cash or in kind) assessed by a Transporter for failure to satisfy the Transporter’s balance and/or nomination requirements.

“Increase Notice” has the meaning ascribed to the term in Section III.B.3.

“Initial Term” has the meaning ascribed to the term in Section II.B.

“Interconnect Pipeline” has the meaning ascribed to the term in Section V.A.

“Interruption of LNG Supply” means any act, event or circumstance, not reasonably within the control of Seller, the effects of which could not be avoided or remedied by the commercially reasonable efforts of Seller, and which would not otherwise qualify as Force Majeure hereunder,

4

that prevents or delays LNG from being delivered to the Sabine Pass LNG Terminal, including, for greater certainty: (i) breakdown or loss of an LNG Tanker or its cargo, (ii) interruption of LNG supply from the country from which Seller sources LNG, including breakdown or loss of any LNG liquefaction facilities in such country; and (iii) the loss or failure of Seller’s LNG supply or depletion of reserves of gas used to produce LNG.

“LNG” means Gas in a liquid state at or below its boiling point at a pressure of approximately one (1) atmosphere.

“LNG Tanker” means an ocean-going vessel suitable for transporting LNG.

“LNG Terminals” means the Creole Trail LNG Terminal or the Sabine Pass LNG Terminal.

“Long-Term LNG Supply Agreement” means an LNG supply agreement entered into by Seller or its Affiliates for the supply of LNG that meets the following criteria:

| i. | the initial term of such agreement is two (2) years or greater; |

| ii. | the volume equates to a delivery rate for regasified LNG equal to or greater than one hundred thousand (100,000) MMBtu per Gas Day for the entire initial term of such agreement; |

| iii. | the contract price for the purchase of LNG, as converted into a price per MMBtu is equivalent to not more than ninety-four percent (94%) of the final NYMEX settlement price per MMBtu for a delivery month, less $0.32 per MMBtu, over the remaining Term or the initial term of the LNG supply agreement, whichever is shorter; |

| iv. | the primary destination of the LNG is the Sabine Pass LNG Terminal; |

| v. | such LNG supply agreement is not a Paired Contract; and |

| vi. | at the time of execution the DCQ is less than the Maximum DCQ. |

“Maximum DCQ” means six hundred thousand (600,000) MMBtu per Gas Day, unless otherwise modified pursuant to Section III.B.4.

“MMBtu” means one million (1,000,000) British thermal units.

“Net Settlement Amount” has the meaning ascribed to the term in Section XII.C.

“Non-Defaulting Party” has the meaning ascribed to the term in Section XII.A.

“Paired Contract” means an LNG supply agreement to the extent that LNG supplied under such agreement supports Seller’s or its Affiliate’s obligations under one or more particular regasified LNG sales agreements, each executed by Seller or its Affiliate prior to the Effective Date, or if not executed prior to the Effective Date, each executed by Seller or its Affiliate within six (6) months of the other.

5

“Party” and “Parties” have the meanings ascribed to the terms in the preamble to this Agreement.

“Payment Date” means the later of (a) the 25th day of the month following the month of delivery of Gas; provided Buyer has received the invoice for such month from Seller, and (b) the 10th day following Buyer’s receipt of an invoice from Seller.

“Person” means any individual, company, firm, partnership, association or body corporate.

“Principal Pipelines” means the following pipelines that interconnect with the Cheniere Creole Trail Pipeline:

| i. | Transcontinental Gas Pipe Line Corporation (Zone 3); |

| ii. | Tennessee Gas Pipe Line Company; |

| iii. | Florida Gas Transmission Company (Zone 2); |

| iv. | Columbia Gulf Transmission Company; and |

| v. | ANR Pipeline Company, |

each as described in the Cheniere Creole Trail Pipeline application for certificate of authority filed at FERC, and as shown on Exhibit A, subject to any modifications that may be required or approved by FERC.

“Sabine Pass LNG Terminal” means the LNG terminal facility in Cameron Parish, Louisiana capable of performing certain LNG terminalling services, including: the berthing of LNG vessels; the unloading, receiving and storing of LNG; the regasification of LNG; and the delivery of natural gas to the point of interconnect between the tailgate of such LNG terminal facility and the Cheniere Sabine Pass Pipeline.

“Scheduled Maintenance” has the meaning ascribed to the term in Section III.C.3.

“Seller” has the meaning ascribed to the term in the preamble to this Agreement.

“Seller Guarantee” means the guarantee dated as of the date hereof given by Seller Guarantor to Buyer guaranteeing the obligations of Seller under this Agreement, a true and correct copy of which is attached as Exhibit D.

“Seller Guarantor” means Cheniere Energy, Inc., a Delaware corporation.

“Seller’s Cumulative Interruption Account” means the cumulative amount of damages paid by Seller to Buyer pursuant to Section III.D.2. over a period of twenty-four (24) months, the first such period to begin on the Commercial Start Date; provided, however, that if the Seller’s Cumulative Interruption Account balance is reduced pursuant to Section VIII.A.4., the date of the reduction constitutes the beginning of a new twenty-four (24) month period.

“Seller’s Non-Performance Payment” has the meaning ascribed to the term in Section III.D.1.

6

“Spot Price” means the midpoint price listed in the publication “Platt’s Gas Daily” (or, if no longer published, any successor publication or equivalent publication as may be mutually agreed to by the Parties), under the listing applicable to the geographic location closest in proximity to the Delivery Point(s) for the relevant Gas Day; provided, if there is no single price published for such location for such Gas Day, but there is published a range of prices, then the Spot Price shall be the average of such high and low prices. If no price or range of prices is published for such Gas Day, then the Spot Price shall be the average of the following: (i) the price (determined as stated above) for the first Gas Day for which a price or range of prices is published that next precedes the relevant Gas Day; and (ii) the price (determined as stated above) for the first Gas Day for which a price or range of prices is published that next follows the relevant Gas Day.

“Taxes” has the meaning ascribed to the term in Section IV.B.2.

“Term” has the meaning ascribed to the term in Section II.A.

“Transporter” means all Gas pipeline companies acting in the capacity of a transporter, transporting Gas for Seller or Buyer upstream or downstream, respectively, of the Delivery Point.

“Tribunal” has the meaning ascribed to the term in Section XIII.B.

| B. | Interpretation |

| 1. | Headings. The topical headings used in this Agreement are for convenience only and shall not be construed as having any substantive significance or as indicating that all of the provisions of this Agreement relating to any topic are to be found in any particular Article or that an Article relates only to the topical heading. |

| 2. | Singular and Plural. Reference to the singular includes a reference to the plural and vice versa. |

| 3. | Gender. Reference to any gender includes a reference to all other genders. |

| 4. | Article. Unless otherwise provided, reference to any Article, Section or Exhibit means an Article, Section or Exhibit of this Agreement. |

| 5. | Include. The words “include” and “including” shall mean include or including without limiting the generality of the description preceding such term and are used in an illustrative sense and not a limiting sense. |

| 6. | Time Periods. References to “day,” “month,” “quarter” and “year” shall, unless otherwise stated or defined, mean a day, month, quarter and year of the Gregorian calendar, respectively. For the avoidance of doubt, a “day” shall commence at 24:00 midnight. |

| 7. | Currency. References to United States dollars shall be a reference to the lawful currency from time to time of the United States of America. |

7

| 8. | Facilities. References to either the Sabine Pass LNG Terminal, the Creole Trail LNG Terminal, the Cheniere Sabine Pass Pipeline or the Cheniere Creole Trail Pipeline shall be a reference to such facilities as modified from time to time. |

ARTICLE II

TERM

| A. | General. Subject to the terms and conditions of this Agreement, the term of this Agreement (“Term”) shall consist of the Initial Term and, if applicable, any Extension Term. |

| B. | Initial Term. The initial term of this Agreement (“Initial Term”) shall commence on the Effective Date and shall continue in full force and effect until the expiration of ten (10) years from the Commercial Start Date, unless terminated earlier in accordance with this Agreement. Seller shall give notice to Buyer of the Commercial Start Date no later than five (5) days following the later of the date of commencement of: (a) commercial operations of the Sabine Pass LNG Terminal, (b) commercial operations of the Cheniere Creole Trail Pipeline, or (c) the commercial delivery of Gas from the Sabine Pass LNG Terminal to the Cheniere Creole Trail Pipeline. |

| C. | Extension Terms. This Agreement shall extend for a five (5) year period (“Extension Term”) immediately following the expiration of the Initial Term and for a second five (5) year Extension Term immediately following the expiration of the first Extension Term, provided that either Buyer or Seller may terminate this Agreement effective at the expiration of the then-current Term by providing written notice to the other Party at least one-hundred twenty (120) days prior to the expiration of the then-current Term. |

ARTICLE III

QUANTITY

| A. | Sale and Purchase Obligations Generally. |

| 1. | Seller’s Obligation. Subject to the terms and conditions of this Agreement, Seller shall make available to Buyer, for purchase at the Delivery Point(s) on each Gas Day beginning with the Commercial Start Date, an aggregate volume of Gas equal to the Adjusted Daily Contract Quantity. |

| 2. | Buyer’s Obligation. Subject to the terms and conditions of this Agreement, Buyer shall purchase from Seller at the Delivery Point(s) on each Gas Day beginning with the Commercial Start Date an aggregate volume of Gas equal to the Adjusted Daily Contract Quantity. In this regard, Buyer covenants that it is purchasing Gas principally for resale to its customers and not for consumption as an end-user. |

| B. | Determination of Daily Contract Quantity. |

| 1. | Commencing on the Commercial Start Date, the daily contracted quantity to be purchased and sold hereunder (the “Daily Contract Quantity” or “DCQ”) shall be zero (0) MMBtu per Gas Day. |

8

| 2. | If Seller enters into one or more Long-Term LNG Supply Agreements before or during the Term, the Parties acknowledge that the DCQ shall from time to time be increased in accordance with Section III.B.3. |

| a. | If Seller enters into a Long-Term LNG Supply Agreement and at the time of execution of such agreement the DCQ is less than the Maximum DCQ, Seller shall allocate, by issuing to Buyer an Increase Notice, to Seller’s Gas supply obligations under this Agreement not less than forty percent (40%) of the LNG supply to which Seller is entitled under such Long-Term LNG Supply Agreement until the DCQ equals one hundred thousand (100,000) MMBtu per Gas Day, and thereafter not less than twenty percent (20%) of the LNG supply to which Seller is entitled under such Long-Term LNG Supply Agreement, up to the Maximum DCQ. |

| b. | On or before March 1 of each calendar year, Seller shall provide to Buyer a certificate, executed by an officer of Seller, stating that Seller has reviewed its and its Affiliates’ LNG supply agreements and that Seller has allocated to Seller’s Gas supply obligations under this Agreement the proper percentage of supply of all Long-Term LNG Supply Agreements. |

| c. | Seller shall provide written notice to Buyer within five (5) days of the Effective Date of all Paired Contracts then executed. After the Effective Date and during any time that the DCQ is less than the Maximum DCQ, Seller shall provide written notice to Buyer no later than thirty (30) days after Seller’s execution of any LNG supply agreement that constitutes, or will constitute, a Paired Contract, with such written notice (subject to any confidentiality limitations) identifying the volume of such LNG supply agreement. |

| 3. | Seller shall increase the DCQ by providing to Buyer a written notice of such increase in the DCQ (the “Increase Notice”), as follows: |

| a. | An Increase Notice shall be in substantially the same form as set forth in Exhibit B attached hereto and shall indicate the increased DCQ, the calendar month during which the increased DCQ shall first be effective, and the duration of such increase in the DCQ; |

| b. | Seller shall provide the Increase Notice to Buyer at least ninety (90) days in advance of the calendar month during which the increased DCQ shall first be effective, such effective date to be the first day of such calendar month; |

| c. | The duration of the increase in DCQ pursuant to an Increase Notice shall not exceed the remaining Term. At least one hundred eighty (180) days prior to the end of the Term, Buyer may request that Seller provide a reconciliation of which Increase Notices would remain in effect if the then-current Term were extended pursuant to Section II.C; |

9

| d. | The first Increase Notice shall be for at least twenty thousand (20,000) MMBtu per Gas Day; and |

| e. | At the time Seller issues an Increase Notice, if Buyer’s Cumulative Interruption Account is greater than $1.0 million, Buyer’s Cumulative Interruption Account shall revert to zero unless Buyer provides written notice to Seller within thirty (30) days of the date of such Increase Notice that Buyer does not accept such Increase Notice. In the event Buyer does not accept such Increase Notice, the Buyer’s Cumulative Interruption Account shall remain unaffected and Seller shall have no obligation to deliver to Buyer Gas pursuant to such Increase Notice. |

| 4. | If, as of October 31, 2010, the DCQ determined pursuant to all Increase Notices is less than the Maximum DCQ, then either Buyer or Seller may elect to reduce the Maximum DCQ for the remaining Term to the DCQ in effect as of October 31, 2010, as follows. Either Party may elect to reduce the Maximum DCQ by providing written notice to the other Party between October 31, 2010 and December 31, 2010; provided that if, prior to Buyer notifying Seller of any such reduction, Seller delivers one or more Increase Notices increasing the DCQ to the Maximum DCQ, then Buyer may not subsequently reduce the Maximum DCQ. |

| 5. | During any period in which the DCQ is less than the Maximum DCQ, Seller shall provide Buyer once each quarter with Seller’s non-binding estimation of the likelihood that one or more additional Increase Notices will be provided hereunder during the next quarter. |

| C. | Determination of Adjusted Daily Contract Quantity. |

| 1. | For each delivery month, the “Adjusted Daily Contract Quantity” or “ADCQ” shall be calculated by subtracting from the DCQ for each Gas Day: |

| a. | the quantity of Gas which Buyer is unable to receive because of an event of Force Majeure affecting either Seller or Buyer; |

| b. | the quantity of Gas which Seller is unable to deliver due to an Interruption of LNG Supply notified pursuant to Section III.C.2; |

| c. | the quantity of Gas which Seller is unable to deliver due to Scheduled Maintenance notified pursuant to Section III.C.3.; and |

| d. | the quantity of Gas approximately equal in value, based on the closing price per MMBtu of Gas on the NYMEX Henry Hub natural gas futures contract for the delivery month on the date of Seller’s Aggregate Exposure Notice, to the amount by which the anticipated exposure as of the Payment Date in the succeeding delivery month exceeds the Guarantee Limitation Amount, provided that the DCQ shall not be adjusted downward if Buyer reduces the Aggregate Exposure below the Guarantee Limitation Amount at least two (2) Business Days prior to Bid Week for the delivery month. |

10

| 2. | If Seller anticipates that Seller will be unable to deliver Gas to Buyer on any Gas Day for the following month due to an Interruption of LNG Supply, Seller shall notify Buyer at least two (2) Business Days prior to the Bid Week for the delivery month of the estimated amount of the Interruption of LNG Supply. On the basis of such estimated amount, Seller shall set forth in such notice the ADCQ for each Gas Day for the following month. |

| 3. | Seller shall provide written notice to Buyer on the Commercial Start Date and no later than sixty (60) days before January 1 of each calendar year thereafter an estimate of the dates scheduled for maintenance at the Sabine Pass LNG Terminal and the Cheniere Creole Trail Pipeline for the forthcoming calendar year (“Scheduled Maintenance”). Seller shall provide written notice no later than ten (10) days prior to the first day of each calendar quarter (January 1, April 1, July 1 and October 1) of the updated schedule for Scheduled Maintenance for the remainder of such calendar year. If such estimated dates for Scheduled Maintenance change, Seller shall notify Buyer within five (5) days of such changed dates. No later than two (2) Business Days prior to Bid Week for each delivery month, Seller shall notify Buyer of any volume of Gas that Seller will not be able to deliver to Buyer for such delivery month due to Scheduled Maintenance. |

| D. | Damages for Failure to Deliver or Receive Gas. |

| 1. | In the event that Seller fails to deliver the ADCQ to Buyer on one or more Gas Days during a delivery month, Buyer shall calculate for each day of such delivery month (i) the difference, if any, between the purchase price paid by Buyer utilizing the Cover Standard and the Contract Price, adjusted for commercially reasonable differences in transportation costs to or from the Delivery Point(s), multiplied by the difference between the ADCQ and the quantity actually delivered by Seller during such Gas Day; or (ii) in the event that Buyer has used commercially reasonable efforts to replace the Gas, and no such replacement is available, any difference between the Contract Price and the Spot Price, adjusted for such transportation to the applicable Delivery Point, multiplied by the difference between the ADCQ and the quantity actually delivered by Seller and received by Buyer during such Gas Day. In such calculation, Buyer shall net out the losses and gains from such purchases of cover Gas. At the end of such delivery month, Buyer shall provide Seller with the results of such calculation. This amount, if positive, shall be the “Seller’s Non-Performance Payment”, which (except as provided in Section III.D.2.) Seller shall pay to Buyer. |

| 2. | Without prejudice and subject to Article XI, if Seller is unable to deliver the ADCQ to Buyer on any Gas Day due to an Interruption of LNG Supply of which Seller has not notified Buyer pursuant to Section III.C.2 and such inability lasts for a period of less than seventy-two (72) consecutive hours, Seller shall pay Seller’s Non-Performance Payment to Buyer. If Seller is unable to deliver the ADCQ to Buyer on any Gas Day due to such an Interruption of LNG Supply for a period lasting seventy-two (72) consecutive hours or longer, then: |

| a. | Seller shall notify Buyer of such inability as soon as possible; |

11

| b. | Seller shall pay to Buyer an amount equal to the lesser of (i) the Seller’s Non-Performance Payment and (ii) $0.50 per MMBtu multiplied by the deficiency quantity. The “deficiency quantity” is the difference between the total volume of Gas that would have been delivered during the month at the ADCQ and the quantity actually delivered by Seller. The Seller’s Cumulative Interruption Account shall be increased by the amount of such payment. Buyer may at any time elect to reduce the Seller’s Cumulative Interruption Account balance to zero by paying to Seller the balance of the Seller’s Cumulative Interruption Account pursuant to Article IX.; provided that Buyer’s Cumulative Interruption Account shall not be increased by any amounts paid by Buyer pursuant to this sentence; and |

| c. | Buyer’s Cumulative Interruption Account shall be increased by the difference, if any, between Seller’s Non-Performance Payment and the amount actually paid by Seller pursuant to Section III.D.2.b. Seller may at any time elect to reduce the Buyer’s Cumulative Interruption Account balance to zero by paying to Buyer the balance of the Buyer’s Cumulative Interruption Account pursuant to Article IX; provided that Seller’s Cumulative Interruption Account shall not be increased by any amounts paid by Seller pursuant to this sentence. |

| 3. | In the event that Buyer fails to receive the ADCQ from Seller on any one or more Gas Days during a delivery month, then Seller shall calculate for each day of such delivery month (i) the difference, if any, between the Contract Price and the price received by Seller utilizing the Cover Standard for the resale of such Gas, adjusted for commercially reasonable differences in transportation costs to or from the Delivery Point(s), multiplied by the difference between the ADCQ and the quantity actually taken by Buyer during such Gas Day; or (ii) in the event that Seller has used commercially reasonable efforts to sell the Gas to a third party, and no such sale is available, any difference between the Contract Price and the Spot Price, adjusted for such transportation to the applicable Delivery Point, multiplied by the difference between the ADCQ and the quantity actually delivered by Seller and received by Buyer during such Gas Day. In such calculation, Seller shall net out the losses and gains from such resale of Gas. At the end of such delivery month, Seller shall provide Buyer with the results of such calculation. This amount, if positive, shall be added to Buyer’s monthly invoice and paid to Seller pursuant to Article IX. |

| 4. | For avoidance of doubt, neither Party shall have liability to the other for failure to deliver or receive Gas due to an event of Force Majeure. Seller shall have no liability to Buyer for failure to deliver Gas: |

| a. | due to an Interruption of LNG Supply provided that Seller notifies Buyer of an Interruption of LNG Supply in accordance with Section III.C.2; or |

12

| b. | due to Scheduled Maintenance provided that Seller notifies Buyer of Scheduled Maintenance in accordance with Section III.C.3. |

| 5. | Imbalance Charges shall not be recovered under this Section III.D, but Seller and/or Buyer shall be responsible for Imbalance Charges, if any, as provided in Section VI.D. |

| E. | Any amount payable by a Party pursuant to Section III.D shall be treated as actual, direct damages and shall not be treated as consequential damages or as loss of income or profits under Section XII.H. |

| F. | Any amount payable pursuant to Section III.D shall be credited as an offset, in the case of amounts payable by Seller, or itemized on an invoice separately, in the case of amounts payable by Buyer, pursuant to the provisions of Article IX. |

ARTICLE IV

PRICE

| A. | Price of Gas. |

| 1. | The price of Gas sold and purchased with respect to any month (the “Contract Price”) shall be ninety-six percent (96%) of the price in dollars per MMBtu for the NYMEX Henry Hub Natural Gas futures contract for Gas to be delivered during such month, such price to be based upon the final settlement price on the last trading day for the futures contracts for such month, plus ten cents ($0.10) per MMBtu. |

| 2. | If the NYMEX Henry Hub Natural Gas futures contract settlement prices cease to be published for any reason, or the data is so changed in the basis of calculation or quantity or type of commodity included therein or otherwise as to affect materially the validity of the index over time, the Parties shall select a comparable index to be used in its place that maintains the intent and economic effect of the original index. |

| B. | Taxes. |

| 1. | The prices established pursuant to this Article IV are inclusive of all Taxes levied on Seller or for which Seller is responsible. |

| 2. | Seller shall pay or cause to be paid all taxes, fees, levies, penalties, licenses or charges imposed by any governmental authority (“Taxes”) on Seller on or with respect to the Gas prior to the Delivery Point. Buyer shall pay or cause to be paid all Taxes imposed by any governmental authority on Buyer on or with respect to the Gas at and after the Delivery Point. If a Party is required to collect, remit or pay Taxes that are the other Party’s responsibility hereunder, the Party responsible for such Taxes shall promptly reimburse the other Party for such Taxes. Any Party entitled to an exemption from any such Taxes or charges shall furnish the |

13

| other Party any necessary documentation thereof on or before the date of delivery of the Gas. |

| 3. | Buyer shall provide Seller with information as may be required to allow Seller to properly file all required federal, state, and local tax reports and other regulatory filings. |

ARTICLE V

DELIVERY POINT

| A. | The delivery point(s) shall be the interconnects between the Cheniere Creole Trail Pipeline and any Principal Pipeline or other pipeline interconnecting with the Cheniere Creole Trail Pipeline (each, an “Interconnect Pipeline”) as nominated by Buyer (the “Delivery Point(s)”) |

| B. | Seller shall have the right at the time that Buyer makes its nomination for the upcoming Gas Day pursuant to Section VI.B. to move any Delivery Point from the physical interconnection between the Interconnect Pipeline and the Cheniere Creole Trail Pipeline to the Interconnect Pipeline’s local pooling point, if applicable; provided, however, if such pooling point(s) are allocated or curtailed by an Interconnect Pipeline, Seller shall use commercially reasonable efforts to revert to the Delivery Point(s) nominated by Buyer. |

ARTICLE VI

TRANSPORTATION

| A. | Seller shall have sole responsibility for transporting the Gas to the Delivery Point(s), subject to the following requirements: |

| 1. | The arithmetic sum of the delivery quantity nominated for each Delivery Point on any Gas Day shall not exceed the ADCQ; and |

| 2. | Buyer’s nomination to Seller for delivery at any Interconnect Pipeline shall not exceed Buyer’s pro-rata portion of Seller’s delivery capacity to such pipeline. “Buyer’s pro-rata portion” means the proportion that the ADCQ on any particular Gas Day bears to Seller’s firm capacity on the Cheniere Creole Trail Pipeline. “Seller’s delivery capacity to such pipeline” means the product of: (i) Seller’s share (as a proportion) of firm capacity rights on the Cheniere Creole Trail Pipeline; and (ii) the firm delivery capacity of the Cheniere Creole Trail Pipeline to the Interconnect Pipeline. Seller shall provide Buyer with written notice of “Buyer’s pro-rata portion” and “Seller’s delivery capacity to such pipeline” before the nomination cycle for the Gas Day beginning on the Commercial Start Date. To the extent “Buyer’s pro-rata portion” or “Seller’s delivery capacity to such pipeline” changes, Seller shall provide Buyer with written notice of such change in advance of the first nomination cycle during which such change may effect Buyer’s access to Delivery Point(s). If Buyer’s requested delivery quantity for any Delivery Point exceeds Buyer’s pro-rata portion of Seller’s delivery capacity at such pipeline as provided in Seller’s notices to Buyer, Seller shall have no |

14

| obligation to deliver the excess quantity and Buyer shall be deemed to have failed to receive such excess quantity. |

| B. | Buyer shall have sole responsibility for transporting the Gas from and after the Delivery Point(s). Buyer shall orally communicate to Seller’s pipeline scheduling representative (i) the requested Delivery Point(s) and (ii) the requested delivery quantity for the Gas Day at each Delivery Point no later than 8:30 AM on the day prior to the Gas Day for deliver of such Gas and Buyer shall confirm such nomination request in writing no later than forty-five (45) minutes later. Seller shall use commercially reasonable efforts to accommodate Buyer’s intraday changes to such nominations. |

| C. | In addition to meeting the obligations set forth in Section VI.A.2, the Parties shall coordinate their nomination activities, giving sufficient time to meet the deadlines of the affected Transporter. Should either Party become aware that actual deliveries at the Delivery Point(s) are greater or lesser than the nominated delivery quantity, such Party shall promptly notify the other Party. The Parties expressly agree that any allocation, reduction, or curtailment of capacity at a Delivery Point shall constitute an event of Force Majeure. Seller shall use commercially reasonable efforts to increase, by the amount of the allocation, reduction, or curtailment, the delivery quantities at other Delivery Point(s). |

| D. | The Parties shall use commercially reasonable efforts to avoid imposition of any Imbalance Charges. If Buyer or Seller receives an invoice from a Transporter that includes Imbalance Charges, the Parties shall determine the validity as well as the cause of such Imbalance Charges. If the Imbalance Charges were incurred as a result of Buyer’s receipt of quantities of Gas greater than or less than the Adjusted Daily Contract Quantity, then Buyer shall pay for such Imbalance Charges or reimburse Seller for such Imbalance Charges paid by Seller. If the Imbalance Charges were incurred as a result of Seller’s delivery of quantities of Gas greater than or less than the Adjusted Daily Contract Quantity, then Seller shall pay for such Imbalance Charges or reimburse Buyer for such Imbalance Charges paid by Buyer. |

ARTICLE VII

QUALITY AND MEASUREMENT

| A. | Quality. Deliveries of Gas by Seller to Buyer at the Delivery Point(s) pursuant to this Agreement shall meet the pressure, quality and heat content requirements of the Principal Pipelines as established by the FERC Gas Tariffs for such pipelines, as may be in effect from time to time (“Gas Quality Standard”). |

| 1. | It is the obligation of Seller to notify Buyer if Gas to be delivered by Seller to Buyer will not meet the Gas Quality Standard or if Seller has reason to believe that the Gas will not meet the Gas Quality Standard. |

| 2. | Buyer shall have no obligation to accept, purchase and pay for Gas that does not meet the Gas Quality Standard. If Buyer knowingly accepts Gas that Seller notifies Buyer in writing fails to meet the Gas Quality Standard, Buyer shall be obligated to pay for such Gas, Seller shall have no liability for Claims arising |

15

| from such Gas and as to such Gas, Buyer hereby waives all rights under the New York Uniform Commercial Code for acceptance of non-conforming goods. |

| B. | Measurement. All measurements of Gas delivered and sold hereunder shall be in accordance with the established procedures, as they may be in effect from time to time, of the receiving pipeline at the Delivery Point(s). |

ARTICLE VIII

TERMINATION

| A. | Seller may terminate this Agreement upon thirty (30) days written notice to Buyer in the event of any of the following: |

| 1. | Seller has not received and accepted, in its reasonable discretion, all Government Approvals necessary to perform its obligations under this Agreement by June 30, 2008; provided, however, that Seller shall have exercised reasonable efforts to obtain all such Government Approvals; |

| 2. | the Commercial Start Date has not occurred by June 30, 2010; or |

| 3. | Seller has not issued the first Increase Notice by October 31, 2010; or |

| 4. | Seller’s Cumulative Interruption Account exceeds fifteen million dollars ($15,000,000). If Seller elects not to terminate this Agreement within the notice period of this Section VIII.A., such right shall expire, and the amount of Seller’s Cumulative Interruption Account shall be set to zero ($0.00). |

| B. | Buyer may terminate this Agreement upon thirty (30) days written notice to Seller in the event of either of the following: |

| 1. | the Commercial Start Date has not occurred by June 30, 2010; or |

| 2. | Seller has not issued the first Increase Notice by October 31, 2010; or |

| 3. | Buyer’s Cumulative Interruption Account exceeds fifteen million dollars ($15,000,000). If Buyer elects not to terminate this Agreement within the notice period of this Section VIII.B., such right shall expire, and the amount of Buyer’s Cumulative Interruption Account shall be set to zero ($0.00). |

ARTICLE IX

BILLING, PAYMENT AND AUDIT

| A. | Seller shall invoice Buyer for Gas delivered and received in the preceding month and for any other applicable charges, providing supporting documentation acceptable in industry practice to support the amount charged. Seller shall calculate the invoice amount for Gas delivered based on a Gas price rounded to the fourth decimal place. If the actual quantity delivered is not known by the billing date, billing will be prepared based on the estimated Adjusted Daily Contract Quantity for such month. The invoiced quantity will then be |

16

| adjusted to the actual quantity on the following month’s billing or as soon thereafter as actual delivery information is available. |

| B. | Buyer shall remit the amount due under Section IX.A., in immediately available funds, on or before the Payment Date; provided that if the Payment Date is not a Business Day, payment is due on the next Business Day following that date. In the event any payments are due Buyer hereunder, payment to Buyer shall be made in accordance with this Section IX.B. |

| C. | The invoiced Party shall pay the full amount of any disputed invoice without any deduction or set-off (except as to any deduction or set-off otherwise allowed under this Agreement), provided that in the case of an obvious error in computation, the invoiced Party shall pay the correct amount disregarding such error. If the invoiced Party disputes the amount due, it must provide supporting documentation acceptable in industry practice to support the amount paid or disputed. The Parties will endeavor to resolve any Dispute of an invoice within thirty (30) days after notice of the disputed invoice is given. If it is ultimately determined that all or a portion of the disputed amount was incorrectly invoiced and paid by Buyer to Seller, Seller shall pay Buyer that amount within two Business Days of such determination, along with interest (as determined in Section IX.D). from and including the original payment date to but excluding the date payment is made. In the event the Parties are unable to resolve such Dispute within such period, either Party may refer the Dispute to arbitration under Article XIII. |

| D. | If the invoiced Party fails to remit the full amount payable when due, interest on the unpaid portion shall accrue from the date due until the date of payment at a rate equal to the lower of (i) the then-effective prime rate of interest per annum published under “Money Rates” by The Wall Street Journal, plus two percentage points; or (ii) the maximum applicable lawful interest rate. |

| E. | A Party shall have the right, at its own expense, upon reasonable notice and at reasonable times, to examine, audit and to obtain copies of the relevant portion of the books, records, and telephone recordings of the other Party only to the extent reasonably necessary to verify the accuracy of any statement, charge, payment, or computation made under this Agreement. This right to examine, audit, and to obtain copies and recordings shall not be available with respect to proprietary information not directly relevant to this Agreement. All invoices and billings shall be conclusively presumed final and accurate and all associated claims for under- or overpayments shall be deemed waived unless such invoices or billings are objected to in writing, with adequate explanation and/or documentation, within two years after the month of Gas delivery. All retroactive adjustments under Article IX shall be paid in full by the Party owing payment within thirty days after receipt of notice and substantiation of such inaccuracy. |

| F. | The Parties shall net all amounts due and owing (including amounts owed from Seller to Buyer pursuant to Section III.D), and/or past due, arising under the Agreement such that the Party owing the greater amount shall make a single payment of the net amount to the other Party in accordance with Article IX. If the Parties have executed a separate netting |

17

| agreement, the terms and conditions therein shall prevail to the extent inconsistent herewith. |

ARTICLE X

TITLE, WARRANTY AND INDEMNITY

| A. | Title to the Gas shall pass from Seller to Buyer at the Delivery Point(s). Seller shall have responsibility for and assume any liability with respect to the Gas prior to its delivery to Buyer at the Delivery Point(s). Buyer shall have responsibility for and shall assume any liability with respect to said Gas at and after its delivery to Buyer at the Delivery Point(s). |

| B. | Seller warrants that it will have the right to convey and will transfer good and merchantable title to all Gas sold hereunder and delivered by it to Buyer, free and clear of all liens, encumbrances, and claims. EXCEPT AS PROVIDED IN THIS SECTION X.B ALL OTHER WARRANTIES, EXPRESS OR IMPLIED, INCLUDING ANY WARRANTY OF MERCHANTABILITY OR OF FITNESS FOR ANY PARTICULAR PURPOSE, ARE DISCLAIMED. |

| C. | Seller agrees to indemnify Buyer and save it harmless from all losses, liabilities or claims including reasonable attorneys’ fees and costs of court (“Claims”), from any and all Persons, arising from or out of claims of title, personal injury or property damage from said Gas or other charges thereon which attach before title passes to Buyer. Buyer agrees to indemnify Seller and save it harmless from all Claims, from any and all Persons, arising from or out of claims regarding payment, personal injury or property damage from said Gas or other charges thereon which attach after title passes to Buyer. |

| D. | Notwithstanding the other provisions of this Article X and except in the case where Buyer knowingly accepts Gas that does not meet the Gas Quality Standard, as between Seller and Buyer, Seller will be liable for all Claims to the extent that such arise from the failure of Gas delivered by Seller to meet the Gas Quality Standard. |

ARTICLE XI

FORCE MAJEURE

| A. | Excuse Due to Force Majeure. Neither Seller nor Buyer shall be liable for any delay or failure in performance hereunder if and to the extent (i) such delay or failure in performance (except for the performance of any payment obligation) is a result of Force Majeure, and (ii) the Excused Party satisfies its obligations under this Article XI. The Party so excused shall be called the “Excused Party.” |

| B. | Events of Force Majeure. “Force Majeure” shall mean any act, event or circumstance, whether of the kind described herein or otherwise, that is not reasonably within the control of, does not result from the fault or negligence of, and would not have been avoided or overcome by the exercise of reasonable diligence by, the Party claiming Force Majeure, such Party having observed a standard of conduct that is consistent with a reasonable and prudent operator, and that prevents or delays in whole or in part such Party’s performance of any one or more of its obligations under this Agreement. It may |

18

| include circumstances of the following kind, provided that such circumstances satisfy the definition of Force Majeure set forth above: |

| 1. | physical events such as acts of God, landslides, lightning, atmospheric disturbance, earthquakes, fires, storms or storm warnings, such as hurricanes, tornados, floods, washouts, explosions, and weather related events, including events that impede the unloading of LNG or impede the delivery of regasified LNG to the Delivery Point(s) or the receipt and transportation of Gas away from the Delivery Point(s); |

| 2. | storms, storm warnings, hurricanes, or other weather related events that delay or impede the entry of an LNG Tanker into the Gulf of Mexico, or the transit of an LNG Tanker within the Gulf of Mexico to an LNG Terminal; |

| 3. | acts of others such as strikes, lockouts or other industrial disturbances, riots, sabotage, insurrections, wars, invasions, embargos, terrorism or threat thereof, blockade, acts of public enemies or civil disturbances; |

| 4. | acts of governmental authorities having jurisdiction, including the issuance or promulgation of any court order, law, statute, ordinance, regulation, or policy having the effect of law, the effect of which would prevent, delay or make unlawful a Party’s performance hereunder, or would require such Party to take measures which are unreasonable in the circumstances; |

| 5. | breakdown, accident to, or destruction of facilities or equipment or lines of pipe (including the LNG Terminals), except when such breakdown or destruction is due to normal wear and tear, failure to properly maintain such facilities or equipment or to adequately stock spare repair parts; |

| 6. | inability to obtain, or suspension, termination, adverse modification, interruption, or inability to renew, any servitude, right of way, easement, permit, license, consent, authorization, or approval of any governmental authority; |

| 7. | events affecting the ability of the LNG Terminals to offload, store, and regasify LNG, including unplanned curtailments and unplanned maintenance and governmental actions such as are necessary for compliance with any court order, law, status, ordinance, regulation or policy having the effect of law promulgated by a governmental authority having jurisdiction; and |

| 8. | any other event of Force Majeure that excuses the performance of the Person providing LNG terminalling services to Seller at the LNG Terminals, if and to the extent that it is of a kind or character that, if it had happened to a Party, would have come within the definition of Force Majeure under this Article XI. |

| 9. | For greater certainty, an act, event or circumstance which primarily affects a third party (including an affiliate of a Party) which prevents, impedes or delays Seller’s or Buyer’s performance hereunder, shall constitute Force Majeure hereunder as to Seller or Buyer (as appropriate) if and to the extent that it is of a kind or character |

19

| that, if it had happened to a Party, would have come within the definition of Force Majeure under this Article XI. |

| C. | Events Not Constituting Force Majeure. Notwithstanding the other provisions of this Article XI, Force Majeure shall not include: |

| 1. | breakdown of an LNG Tanker (whether or not otherwise constituting a Force Majeure) prior to it reaching the pilot boarding station at the LNG Terminals; |

| 2. | storms, storm warnings, hurricanes, and other weather related events that delay or impede the transit of an LNG Tanker that is not excused pursuant to Section XI.B.2; |

| 3. | any event (whether or not otherwise constituting a Force Majeure) that affects the liquefaction facilities or country from which Seller sources LNG, including the loss of Seller’s LNG supply or depletion of reserves of gas used to produce such LNG supply; |

| 4. | the non-availability or lack of funds or failure to pay money when due; |

| 5. | the withdrawal, denial or expiration of or failure to obtain any governmental approval of any national or local governmental authority, agency or entity acting for or on behalf thereof, caused by the affected Person’s (i) actions, including a violation of or breach of the terms and conditions of any existing governmental approval or other requirement of law, or (ii) inactions, including the failure to apply for or follow the necessary procedures to obtain any governmental approval or request, acquire or take all necessary actions to obtain the renewal or reissuance of the same, in either event, only if the affected Person knew or should have known, after due inquiry and the exercise of endeavors expected by a reasonable and prudent operator, that such action or inaction, as the case may be, would have caused the withdrawal, denial or expiration of, non-renewal or non-issuance of any governmental approval; or |

| 6. | economic hardship, including Seller’s ability to sell Gas at a higher or more advantageous price than the price for Gas sold under this Agreement, or Buyer’s ability to purchase Gas at a lower or more advantageous price than the price for Gas purchased under this Agreement. |

| D. | Notice; Resumption of Normal Performance. |

| 1. | Immediately upon the occurrence of an event of Force Majeure that may delay or has delayed or prevented, or may or will delay or prevent, the performance by the Excused Party of any of its obligations hereunder, the Excused Party shall give notice thereof (promptly confirmed in writing if originally given orally, but in no event later than three (3) Business Days after the occurrence of such event) to the other Party describing such event and stating each of such Party’s obligations hereunder which such Party may, has been or will be delayed or prevented from performing, and (either in the original or in supplemental notices) stating: (i) its |

20

| good faith estimate of the likely duration of the Force Majeure event and of the period during which performance may be suspended or reduced, including to the extent known or ascertainable, the estimated extent of such reduction in performance; and (ii) the particulars of the program to be implemented and any corrective measures already undertaken to ensure full resumption of normal performance hereunder. The Excused Party shall provide, from time to time as warranted, updates to the notices provided in this Section XI.D.1. |

| 2. | In order to ensure resumption of normal performance of this Agreement within the shortest practicable time, the Excused Party shall take all measures to this end which are commercially reasonable in the circumstances, taking into account the consequences resulting from such event of Force Majeure. To the extent that the Excused Party fails to use commercially reasonable efforts to overcome or mitigate the effects of such events of Force Majeure, it shall not be excused for any delay or failure in performance that would have been avoided by using such commercially reasonable efforts. Prior to resumption of normal performance, the Parties shall continue to perform their obligations under this Agreement to the extent not excused or prevented by such event of Force Majeure. |

| 3. | Upon request of the non-excused Party given no sooner than the second Business Day after the Excused Party’s notice of Force Majeure, the Excused Party shall forthwith use all reasonable efforts to give or procure access for representatives of the non-excused Party to examine the scene of the event which gave rise to the claim of Force Majeure, and such access shall be at the expense of the non-excused Party. |

| E. | Seller’s Rights Upon Buyer’s Force Majeure. If Buyer has a claim of Force Majeure and is rendered wholly or partially unable to accept deliveries of Gas under this Agreement, Seller may enter into gas sales agreements with third persons for the quantity of Gas Buyer would have been obligated to take hereunder except for the relevant Force Majeure events, but for a term no longer than the expected duration of the Force Majeure as contained in the notice delivered to Seller. Upon resumption of Buyer’s ability to perform under this Agreement, Seller shall continue to be excused for failure to deliver Gas to Buyer to the extent resulting from Seller’s obligations under such third party agreements until such third party agreements are required to be terminated in accordance with the following: if the estimated duration of Force Majeure, as stated in the notice provided by Buyer pursuant to Section IX.D.1 is less than one hundred eighty (180) days, Seller shall use reasonable efforts, but shall not be required, to terminate such sales prior to the end of the period stated in the notice if the actual period of Force Majeure ends prior to such date. In the event that the estimated duration of Force Majeure, as stated in the notice provided by Buyer pursuant to Section IX.D.1 is greater than one hundred eighty (180) days, Seller shall terminate such sales on no less than ninety (90) days notice from Buyer of the end of the period of Force Majeure, and shall use reasonable efforts, but shall not be required, to terminate such sales on such lesser notice as Buyer may provide. The ninety (90) day notice may not be given by Buyer to Seller prior to ninety (90) days from the start of the Force Majeure event, unless agreed to by Seller. |

21

| F. | Settlement of Industrial Disturbances. Settlement of strikes, lockouts or other industrial disturbances shall be entirely within the discretion of the Party experiencing such situations and nothing herein shall require such Party to settle industrial disputes by yielding to demands made on it when it considers such action inadvisable. |

| G. | Extended Force Majeure. If a Force Majeure event affecting the total DCQ lasts for twenty-four (24) consecutive months and the Parties do not foresee that the Force Majeure situation will be resolved in the foreseeable future, either Party shall have the right to terminate this Agreement by notice to the other Party. If a Force Majeure event affecting a portion of the DCQ lasts for twenty-four (24) consecutive months and the Parties do not foresee that the Force Majeure situation will be resolved in the foreseeable future, either Party shall have the right to reduce the DCQ by a corresponding amount by notice to the other Party. |

ARTICLE XII

DEFAULTS AND REMEDIES

| A. | In the event (each an “Event of Default”) either Party (the “Defaulting Party”) shall: |

| 1. | fail to receive, in the case of Buyer, Gas in accordance with the terms of this Agreement on fifteen (15) days in a twelve-month period; |

| 2. | breach a material representation or warranty if such breach is not remedied within five (5) Business Days after written notice of such breach is given to the Defaulting Party; |

| 3. | fail to make when due any payment required under this Agreement if such failure is not remedied within five (5) Business Days after written notice of such failure is given to the Defaulting Party; |

| 4. | make an assignment or any general arrangement for the benefit of creditors; |

| 5. | file a petition or otherwise commence, authorize, or acquiesce in the commencement of a proceeding or case under any bankruptcy or similar law for the protection of creditors, or have such petition filed or proceeding commenced against it that is not dismissed within sixty (60) days; |

| 6. | otherwise become bankrupt or insolvent (however evidenced); |

| 7. | be unable to pay its debts as they fall due; or |

| 8. | have a receiver, provisional liquidator, conservator, custodian, trustee or other similar official appointed with respect to it or substantially all of its assets that is not dismissed within sixty (60) days, |

then the other Party (the “Non-Defaulting Party”) shall have the right, at its sole election, to immediately withhold and/or suspend deliveries or payments upon two (2) days notice, in addition to any and all other remedies available hereunder.

22

| B. | It shall also be an Event of Default, with Buyer being the Defaulting Party, if the Buyer Guarantor: |

| 1. | suspends payment of its debts or is unable to pay its or their debts; |

| 2. | passes a resolution, commences proceedings or has proceedings commenced against it (which are not stayed within twenty-one (21) days of service thereof on the Buyer Guarantor) in the nature of bankruptcy or reorganization resulting from insolvency or for its liquidation or for the appointment of a receiver, trustee in bankruptcy or liquidator of its undertaking or assets; or |

| 3. | enters into any composition or scheme or arrangement with its creditors, |

unless, within ten (10) Business Days of such Event of Default, a replacement Buyer Guarantee reasonably acceptable to Seller is executed and delivered to the Seller.

| C. | If an Event of Default has occurred and is continuing, the Non-Defaulting Party shall have the right, by written notice to the Defaulting Party, to designate a day, no earlier than the day such notice is given and no later than twenty (20) days after such notice is given, as an early termination date (the “Early Termination Date”), on which date, all of the rights and obligations of each Party pursuant to this Agreement shall terminate. |

| D. | The Non-Defaulting Party shall net or aggregate, as appropriate, any and all amounts owing between the Parties under this Agreement so that all such amounts are netted or aggregated to a single liquidated amount payable by one Party to the other (the “Net Settlement Amount”). |

| E. | If any obligation that is to be included in any netting, aggregation or setoff pursuant to Section XII.D is unascertained, the Non-Defaulting Party may in good faith estimate that obligation and net, aggregate or setoff, as applicable, in respect of the estimate, subject to the Non-Defaulting Party accounting to the Defaulting Party when the obligation is ascertained. Any amount not then due which is included in any netting, aggregation or setoff pursuant to Section XII.D shall be discounted to net present value in a commercially reasonable manner determined by the Non-Defaulting Party. |

| F. | As soon as practicable after a liquidation, notice shall be given by the Non-Defaulting Party to the Defaulting Party of the Net Settlement Amount, and whether the Net Settlement Amount is due to or due from the Non-Defaulting Party. The notice shall include a written statement explaining in reasonable detail the calculation of such amount, provided that failure to give such notice shall not affect the validity or enforceability of the liquidation or give rise to any claim by the Defaulting Party against the Non-Defaulting Party. The Net Settlement Amount shall be paid by the close of business on the second Business Day following such notice, which date shall not be earlier than the Early Termination Date. Interest on any unpaid portion of the Net Settlement Amount shall accrue from the date due until the date of payment at a rate equal to the lower of (i) the then-effective prime rate of interest per annum published under “Money Rates” by The Wall Street Journal, plus two percentage points; or (ii) the maximum applicable lawful interest rate. |

23

| G. | The expiry or termination of this Agreement shall not: (i) relieve either Party from any obligations to the other Party incurred or arising prior to the date of such expiry or termination; (ii) or extinguish any rights of either Party accrued in respect of periods prior to the expiry or termination of this Agreement or (iii) effect a Party’s claim for damages against the other Party on account of the other Party’s breach or default of this Agreement. |

| H. | NEITHER PARTY SHALL BE LIABLE FOR CONSEQUENTIAL, INCIDENTAL, PUNITIVE, EXEMPLARY OR INDIRECT DAMAGES, LOST PROFITS OR OTHER BUSINESS INTERRUPTION DAMAGES, BY STATUTE, IN TORT OR CONTRACT, UNDER ANY INDEMNITY PROVISION OR OTHERWISE. |

| I. | IT IS THE INTENT OF THE PARTIES THAT THE LIMITATIONS HEREIN IMPOSED ON REMEDIES AND THE MEASURE OF DAMAGES BE WITHOUT REGARD TO THE CAUSE OR CAUSES RELATED THERETO, INCLUDING THE NEGLIGENCE OF ANY PARTY, WHETHER SUCH NEGLIGENCE BE SOLE, JOINT OR CONCURRENT, OR ACTIVE OR PASSIVE. WHERE REMEDIES OR DAMAGES ARE SPECIFICALLY ESTABLISHED IN THIS AGREEMENT, SUCH REMEDIES OR DAMAGES SHALL CONSTITUTE THE SOLE AND EXCLUSIVE REMEDY FOR SUCH EVENT(S). TO THE EXTENT ANY DAMAGES REQUIRED TO BE PAID HEREUNDER ARE LIQUIDATED, THE PARTIES ACKNOWLEDGE THAT THE DAMAGES ARE DIFFICULT OR IMPOSSIBLE TO DETERMINE, OR OTHERWISE OBTAINING AN ADEQUATE REMEDY IS INCONVENIENT AND THE DAMAGES CALCULATED HEREUNDER CONSTITUTE A REASONABLE APPROXIMATION OF THE HARM OR LOSS. |

ARTICLE XIII

DISPUTE RESOLUTION

| A. | Any Dispute shall be settled by arbitration administered by the American Arbitration Association (“AAA”) under its Commercial Arbitration Rules (as then in effect), provided, however, that insofar as any of the provisions of this Article XIII are inconsistent with the Commercial Arbitration Rules, the provisions of this Article XIII shall prevail. |

| B. | The arbitral tribunal (“Tribunal”) shall consist of three (3) arbitrators. Each Party shall appoint one (1) arbitrator within thirty (30) days of the filing of the arbitration, and the two arbitrators so appointed shall select the presiding arbitrator within thirty (30) days after the latter of the two arbitrators has been appointed by the Parties. If a Party fails to appoint its Party-appointed arbitrator or if the two Party-appointed arbitrators cannot reach an agreement on the presiding arbitrator within the applicable time period, then the AAA shall serve as the appointing authority, and shall appoint the remainder of the three arbitrators not yet appointed. All three arbitrators shall be impartial and independent. |

| C. | Unless otherwise expressly agreed in writing by all parties to the Dispute, the place of arbitration shall be Houston, Texas. |

24

| D. | Unless otherwise expressly agreed in writing by all parties to the Dispute, the Tribunal shall strictly apply the law governing this Agreement. Where the measure, nature, scope or type of damages for a claim is expressly limited by the terms of this Agreement, the Tribunal shall have no discretion to award damages beyond those express limitations. |

| E. | The Tribunal shall conduct the arbitration as expeditiously as possible, and shall take all reasonable measures to render the award within six (6) months of the date that the presiding arbitrator is appointed. If the award is not rendered within this (6) six month period, the Tribunal will still have jurisdiction over the Dispute. The award shall (i) be rendered in writing, (ii) state the legal grounds and reasoning for its decision, and (iii) provide for a monetary award immediately payable in United States dollars. |

| F. | All notices required for any arbitration proceeding shall be deemed properly given if given in accordance with Section XV.F. The Parties further agree that service of process for any action to enforce an arbitral award may be accomplished according to the procedures of Section XV.F, as well as any other procedure authorized by law. |

| G. | The Tribunal is authorized to allocate the costs of the arbitration in its award, including: (a) the fees and expenses of the arbitrators; (b) the costs of assistance required by the Tribunal, including any experts; (c) the fees and expenses of the administrator; (d) the reasonable costs for legal representation of a successful Party, including expert fees; and (e) any such costs incurred in connection with an application for interim or emergency relief. The costs of the arbitration proceedings, including attorneys’ fees, shall be borne in the manner determined by the Tribunal. |

| H. | The Tribunal shall have the discretion to award pre-award and post-award interest from the date of any default or other breach of this Agreement until the arbitral award is paid in full. |

| I. | The award shall, as between the Parties, be final and entitled to all of the protections and benefits of a final judgment, e.g., res judicata (claim preclusion) and collateral estoppel (issue preclusion), as to all claims, including compulsory counterclaims, that were or could have been presented to the arbitrators. The award shall not be reviewable by or appealable to any court; provided, however, that the award may be corrected or interpreted pursuant to the Commercial Arbitration Rules. |

| J. | Any arbitration pursuant to this Article XIII (including a settlement resulting from an arbitral award, documents exchanged or produced during an arbitration proceeding, and memorials, briefs or other documents prepared for the arbitration) shall be confidential and may not be disclosed by the Parties, their employees, officers, directors, counsel, consultants, and expert witnesses, except to the extent necessary to enforce this Article XIII or any arbitration award, to enforce other rights of a party to a dispute resolved pursuant to this Article XIII, or as required by law; provided, however, that breach of this confidentiality provision shall not void any settlement, or award. |

| K. | Each Party shall have the right to petition any court for the issuance of any restraining order, other equitable relief or interim measure (i) prior to the constitution of the Tribunal |

25

| (and thereafter as necessary to enforce the Tribunal’s rulings); or (ii) in the absence of the jurisdiction of the Tribunal to rule on interim measures in a given jurisdiction. FOR PURPOSES OF THIS SECTION XIII K, EACH OF THE PARTIES IRREVOCABLY CONSENTS AND SUBMITS UNCONDITIONALLY TO THE NON-EXCLUSIVE JURISDICTION OF ANY STATE OR FEDERAL COURT OF COMPETENT JURISDICTION IN THE STATE OF TEXAS, UNITED STATES OF AMERICA, AND IRREVOCABLY WAIVES ANY PRESENT OR FUTURE OBJECTION TO SUCH VENUE FOR SUCH PURPOSES. |

| L. | A Party’s breach of this Agreement shall not affect this agreement to arbitrate. Moreover, the Parties’ obligations under this arbitration provision are enforceable even after this Agreement has terminated. The invalidity or unenforceability of any provision of this agreement to arbitrate shall not affect the validity or enforceability of the Parties’ obligation to submit their claims to binding arbitration or the other provisions of this agreement to arbitrate. |

ARTICLE XIV

CREDIT SUPPORT

| A. | Generally. Each Party shall deliver to the other Party credit support according to the terms of this Article XIV. |

| B. | Seller Credit Support. Seller shall provide on the date of this Agreement, and cause to be maintained until the delivery of the first invoice pursuant to Article IX of this Agreement, a Seller Guarantee in an amount equal to $5,000,000. Buyer is relying on the legal, valid, binding and enforceable nature of the Seller Guarantee as an essential inducement and consideration for entering into this Agreement. |

| C. | Buyer Credit Support. |

| 1. | Buyer shall provide on the date of this Agreement, and cause to be maintained throughout the Term, a Buyer Guarantee in an amount available to be drawn thereunder equal at any time and from time to time to the Guarantee Limitation Amount. Seller is relying on the legal, valid, binding and enforceable nature of the Buyer Guarantee as an essential inducement and consideration for entering into this Agreement. |

| 2. | At any time, Buyer may elect to reduce the amount of the Aggregate Exposure by making payment to Seller of all or part of amounts invoiced prior to the Payment Date hereunder. Buyer shall notify Seller of its intention to make payments prior to the Payment Date at least two (2) Business Days prior to Bid Week for the delivery month. |

26

ARTICLE XV

MISCELLANEOUS

| A. | This Agreement shall be binding upon and inure to the benefit of the successors, assigns, personal representatives, and heirs of the respective Parties hereto, and the covenants, conditions, rights and obligations of this Agreement shall run for the Term. |

| B. | Either Party may assign this Agreement to a third party, including Buyer to a creditworthy third party, in whole or in part, provided that such Party obtained the prior written consent of the non-assigning Party, which consent will not be unreasonably withheld or delayed; provided, either Party may (i) transfer, sell, pledge, encumber, or assign this Agreement or the accounts, revenues, or proceeds hereof in connection with any financing or other financial arrangements, or (ii) transfer its interest to any parent or affiliate by assignment, merger or otherwise without the prior approval of the other Party. Upon any such assignment, transfer and assumption, the transferor shall remain principally liable for and shall not be relieved of or discharged from any obligations hereunder. |

| C. | If any provision in this Agreement is determined to be invalid, void or unenforceable by any court having jurisdiction, such determination shall not invalidate, void, or make unenforceable any other provision, agreement or covenant of this Agreement. |

| D. | No waiver of any breach of this Agreement shall be held to be a waiver of any other or subsequent breach. |

| E. | This Agreement sets forth all understandings between the Parties respecting the rights and obligations of the Parties pursuant to this Agreement, and any prior contracts, understandings and representations, whether oral or written, relating to the rights and obligations pursuant to this Agreement are merged into and superseded by this Agreement. This Agreement may be amended only by a writing executed by both Parties. |

| F. | Notices. |

| 1. | All notices and other communications to Buyer or Seller shall be in writing and shall be electronically communicated, hand delivered or sent by overnight courier to either Party hereto at the addresses as provided in this Section XV.F: |

All communications intended for Buyer shall be sent to:

PPM Energy Inc.

20333 State Highway 249

Suite 310

Houston, Texas 77070

For Exercising Provisions Under this Contract Agreement:

Attention: Todd A. Blackford

27

Fax Number: 281-379-7444

email: todd.blackford@ppmenergy.com

For Monthly and Daily Scheduling Under this Contract Agreement:

Attention: Zarin Imam or designee

Fax Number 281-379-7444

email: zarin.imam@ppmenergy.com

All communications intended for Seller shall be sent to:

Cheniere LNG Marketing, Inc.

717 Texas Avenue, Suite 3100

Houston, Texas 77002

Attention: Davis Thames

Fax Number: 713-659-5459

email: dthames@cheniere.com

or at any other address of which either of the foregoing shall have notified the other in any manner prescribed in this Section XV.

| 2. | For all purposes of this Agreement, a notice or communication will be deemed effective: |