Exhibit 99.2

forward looking statements that no assurances that the company’s financial goals will be realized. Numerous uncertainties cause results to differ materially from those expressed in forward-looking statements made by Cheniere Energy, Inc. January 2004 belief, as well as assumptions made by, and information currently available to management. While the company believes that its management’s the continued need for additional capital, the competition within the oil and gas industry, the price of oil and gas, currency fluctuations, and other risks detailed from time to time in the company’s periodic reports filed with the United States Securities and Exchange Commission. Safe Harbor Act Statement Under the Private Securities Litigation Reform Act of 1995: Certain information in this slide show are are based on expectations are based upon reasonable assumptions, there can be and risk factors may affect the company’s actual results and may or on behalf of the company. These uncertainties and risk factors include political, economic, environmental and geological issues, including but not limited to,

2 181,000 Market Data American Stock Exchange: Ticker LNG Common shares outstanding: 16.6 million Market capitalization: $194 million* Daily trading volume (30-day): • • • • * Closing market price on December 31, 2003, was $11.70.

3 Organization 30% of Freeport LNG 66.66% of Corpus Christi 100% of Sabine Pass, Brownsville 9.3% Interest in Gryphon Exploration Company Cheniere Exploration Group Cheniere LNG, Inc. • • • E & P: – – LNG: – • •

4 20,000 sq. miles + 10 Exploratory Wells 2 Development Wells 26 million cubic feet $ 175 million 48 Bcfe 250,000 Overview (1) (2) Gryphon - NPV-10 of Proved and Probable Reserves Proved and Probable Reserves 3D Seismic Data Set Net Leased Acreage Prospects Drilled 2003 Average Daily Production in September

5 Cheniere Exploration Group 7,000 sq. miles $1.4 million * $5.0 million * 9 exploratory wells, 1 development 8 successful wells 3D Seismic Data Proved Reserves NPV-10 of Proved Reserves 2003 Drilling Results *Estimated at Year-end 2003.

A wholly owned subsidiary of Cheniere Energy, Inc. Cheniere LNG

7 This nation’s] limited capacity to import liquified natural gas effectively restricts our access to the world’s abundant supplies of natural gas.” Alan Greenspan Federal Reserve Chairman May 21, 2003 Testimony before the Joint Economic Committee on the state of the US economy and future economic policy “[

• 8 • (-259°F) liquefies needed it when LNG? until transport times and is cooled vaporized 600 at vaporized is store when What stored pressure to and which reduced odorless safe air gas is and heated than non-toxic and be Natural Volume Colorless, and Shipped atmospheric Easy Can Lighter • • • • • •

• 9 • Mcf. U.S. per the new $3.50 in eight • – LNG to $2.50 countries for six 24 fast of in market range growing the a reserves necessitating in decade day, U.S. gas shipping next per the and Market in stranded the Bcf in 15 landed of capacity that to LNG Tcf 12 be 5,000 to can estimate grow LNG Over Liquefaction We will terminals. • • •

10 Tractebel 500 MMcf/d Dominion 750 MMcf/d Everett—El Paso Cove Pt.—400 MMcf/d Elba Isl. – CMS 750 MMcf/d Trunkline -Cheniere Existing U.S. Import Facilities Texas - Legend Existing Capacities Proposed By Cheniere

11 May 2003 Terminal Siting Best Practices* FERC Staff member Richard Foley, April 9, 2003 Commission LNG Express deepwater port access and compatibility with shipping traffic; safety, especially suitability of acreage for safety takeaway capacity in proximity to natural gas pipelines; acceptance by local communities; coordination of federal and state environmental approvals; technological advances for LNG storage and transfer systems. * Meeting, cited in 9 9 exclusion zones; 9 9 9 9

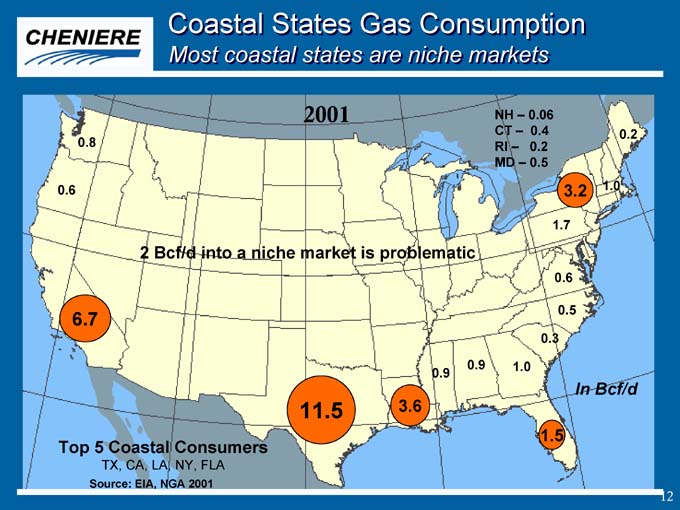

12 0.2 1.0 In Bcf/d 3.2 0.6 0.5 1.7 0.3 1.5 0.06 0.4 0.2 0.5 1.0 NH – CT – RI – MD –0.9 0.9 3.6 Coastal States Gas Consumption Most coastal states are niche markets 2001 2 Bcf/d into a niche market is problematic 11.5 TX, CA, LA, NY, FLA Source: EIA, NGA 2001 0.8 6.7 Top 5 Coastal Consumers 0.6

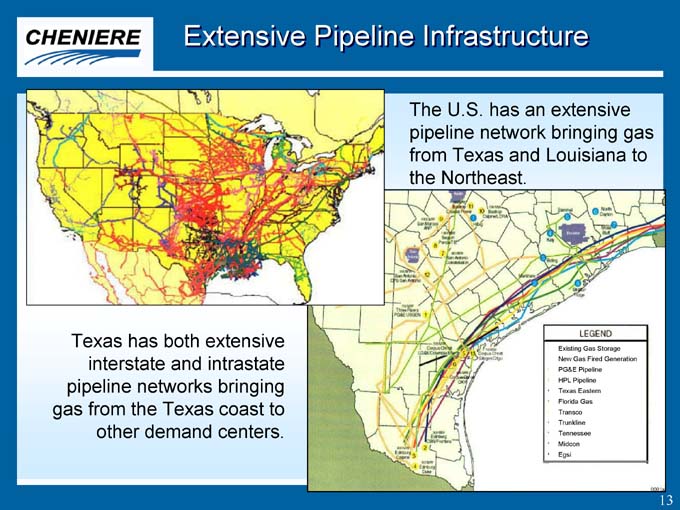

13 pipeline network bringing gas Existing Gas Storage New Gas Fired Generation PG&E Pipeline HPL Pipeline Texas Eastern Florida Gas Transco Trunkline Tennessee Midcon Egsi Extensive Pipeline Infrastructure The U.S. has an extensive from Texas and Louisiana to the Northeast. Texas has both extensive interstate and intrastate pipeline networks bringing gas from the Texas coast to other demand centers.

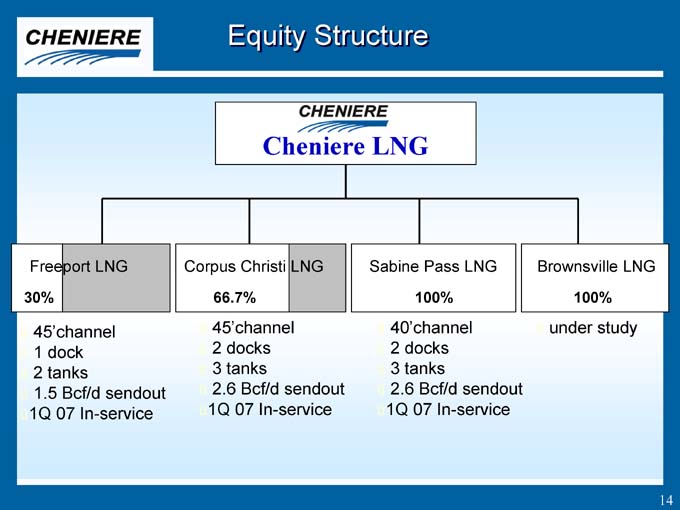

• 14 • LNG study • 100% • Brownsville under sendout 100% docks Bcf/d • 2.6 • ü ü • LNG In-service • Pass • 40’channel tanks 07 • 1Q • Structure LNG Sabine ü ü • Cheniere sendout • Equity docks Bcf/d • 66.7% 2 2.6 • ü ü • LNG In-service Christi 45’channel tanks 07 • 1Q • Corpus ü ü • LNG sendout In-service dock tanks Bcf/d 07 Freeport 30% 45’channel 1 2 1.5 1Q • ü ü ü ü

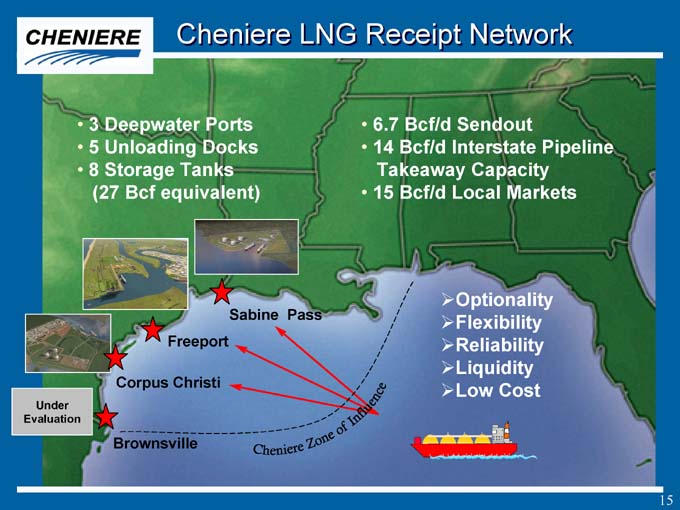

• 15 • Pipeline Markets • Network Sendout Capacity Flexibility Cost Interstate Local Optionality Reliability Liquidity Low Bcf/d Bcf/d Takeaway Bcf/d • Receipt 6.7 14 15 • • • LNG Pass Ports Sabine • Cheniere Tanks equivalent) Freeport Christi Deepwater Storage Bcf Corpus Brownsville • 8 (27 • • • Docks Unloading 5 • Under Evaluation

16 $450 MM 30 MM $ / MMbtu 35¢ Business Model Tenants pay fee per MMBTU for combined terminaling & vaporization services. Sufficient to justify construction Fixed Variable fee structure Operating Costs: Capacity Rates Terminals Operated as Tolling Facility – Long-Term Terminal Use Agreement – – Additional Capacity Available for Customized and Spot Use – Construction Costs per Facility Approximately: • • • •

17 ConocoPhillips, Dow None Provided by Conoco Application Submitted March 2003 Expected 1Q 2004 2007 30 Percent Limited Partner Freeport LNG Cheniere Participation: Major Users: Capacity Available: Financing: Permits: In Service Date: • • • • • •

18 Milestones FEED completed November Application filed December 22, 2003 with FERC Capacity marketing, January 2004 Anticipated construction start, 2004 (Bechtel) Planned in-service, 2007 Corpus Christi, Sabine Pass – – – – –•

19 Strategic Position minimum downtime flexible access Major stakes in three Gulf Coast LNG receiving terminals Gateways for 6.5 Bcf/d of gas to US markets Access to regasification capacity at three Gulf Coast locations ensures • • Lowest cost per Mcf of any receiving facilities By Decade’s End – – – –•

20 Summary Dwayne Stone, Pres. Black & Veatch US needs access to the world’s abundant supplies of natural gas The US Gulf Coast is the best entry point for significant quantities of LNG Cheniere LNG sites are “exceptional” – Freeport capacity off the market Combined, the Cheniere LNG receipt network will provide cost effective optionality, flexibility, and reliability for LNG imports. • • • • •