Exhibit 99.1

Bank of America Energy Conference November 2008 CHENIERE

2 This presentation contains certain statements that are, or may be deemed to be, “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. All statements, other than statements of historical facts, included herein are “forward-looking statements.” Included among “forward-looking statements” are, among other things: statements that we expect to commence or complete construction of each or any of our proposed liquefied natural gas, or LNG, receiving terminals by certain dates, or at all; statements that we expect to receive authorization from the Federal Energy Regulatory Commission, or FERC, to construct and operate proposed LNG receiving terminals by a certain date, or at all; statements regarding future levels of domestic natural gas production and consumption, or the future level of LNG imports into North America, or regarding projected future capacity of liquefaction or regasification facilities worldwide regardless of the source of such information; statements regarding any financing transactions or arrangements, whether on the part of Cheniere or at the project level; statements relating to the construction of our proposed LNG receiving terminals, including statements concerning estimated costs, and the engagement of any EPC contractor; statements regarding any Terminal Use Agreement, or TUA, or other commercial arrangements presently contracted, optioned, marketed or potential arrangements to be performed substantially in the future, including any cash distributions and revenues anticipated to be received; statements regarding the commercial terms and potential revenues from activities described in this presentation; statements regarding the commercial terms or potential revenue from any arrangements which may arise from the marketing of uncommitted capacity from any of the terminals, including the Creole Trail and Corpus Christi terminals which do not currently have contractual commitments; statements regarding the commercial terms or potential revenue from any arrangement relating to the proposed contracting for excess or expansion capacity for the Sabine Pass LNG Terminal described in this presentation; statements that our proposed LNG receiving terminals, when completed, will have certain characteristics, including amounts of regasification and storage capacities, a number of storage tanks and docks and pipeline interconnections; statements regarding Cheniere, Cheniere Energy Partners and Cheniere Marketing forecasts, and any potential revenues, cash flows and capital expenditures which may be derived from any of Cheniere business groups; statements regarding Cheniere Pipeline Company, and the capital expenditures and potential revenues related to this business group; statements regarding our proposed LNG receiving terminals’ access to existing pipelines, and their ability to obtain transportation capacity on existing pipelines; statements regarding possible expansions of the currently projected size of any of our proposed LNG receiving terminals; statements regarding the payment by Cheniere Energy Partners, L.P. of cash distributions; statements regarding our business strategy, our business plan or any other plans, forecasts, examples, models, forecasts or objectives; any or all of which are subject to change; statements regarding estimated corporate overhead expenses; and any other statements that relate to non-historical information. These forward-looking statements are often identified by the use of terms and phrases such as “achieve,” “anticipate,” “believe,” “estimate,” “example,” “expect,” “forecast,” “opportunities,” “plan,” “potential,” “project,” “propose,” “subject to,” and similar terms and phrases. Although we believe that the expectations reflected in these forward-looking statements are reasonable, they do involve assumptions, risks and uncertainties, and these expectations may prove to be incorrect. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of a variety of factors, including those discussed in “Risk Factors” in the Cheniere Energy, Inc. Annual Report on Form 10-K for the year ended December 31, 2007, which are incorporated by reference into this presentation. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by these ”Risk Factors”. These forward-looking statements are made as of the date of this presentation, and we undertake no obligation to publicly update or revise any forward-looking statements. Safe Harbor Act

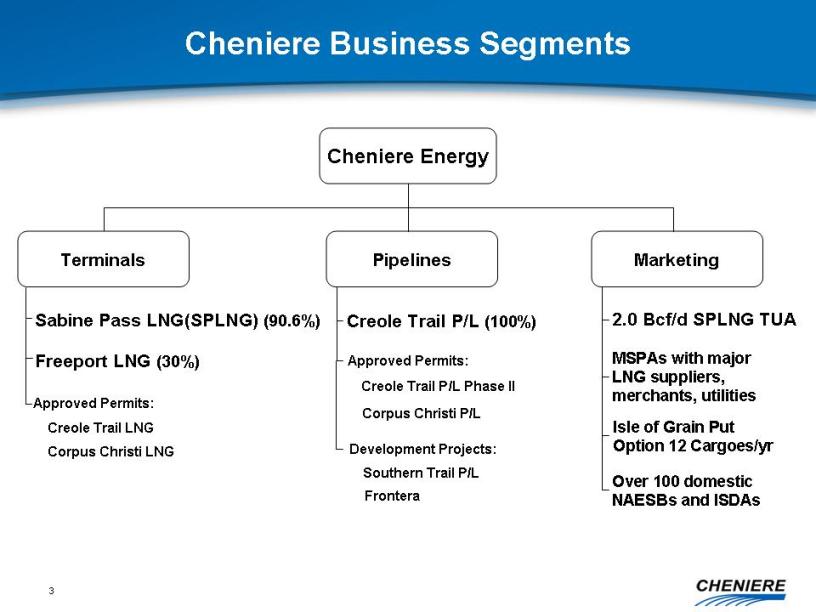

3 Cheniere Energy Marketing Pipelines Terminals Sabine Pass LNG (SPLNG) (90.6%) Freeport LNG (30%) Approved Permits: Creole Trail LNG Corpus Christi LNG Creole Trail P/L (100%) Approved Permits: Creole Trail P/L Phase II Corpus Christi P/L Development Projects: Southern Trail P/L Frontera 2.0 Bcf/d SPLNG TUA Cheniere Business Segments MSPAs with major LNG suppliers, merchants, utilities Isle of Grain Put Option 12 Cargoes/yr Over 100 domestic NAESBs and ISDAs

4 Recent Developments Exited our domestic gas business and two LNG vessel time charter party agreements in April 2008 Our international LNG marketing effort remains in place Entered into our first LNG Throughput Agreement with JP Morgan Secured $395 million in new financing Cheniere has sufficient liquidity to conduct operations for the next few years even if we see NO commercial revenue during that time

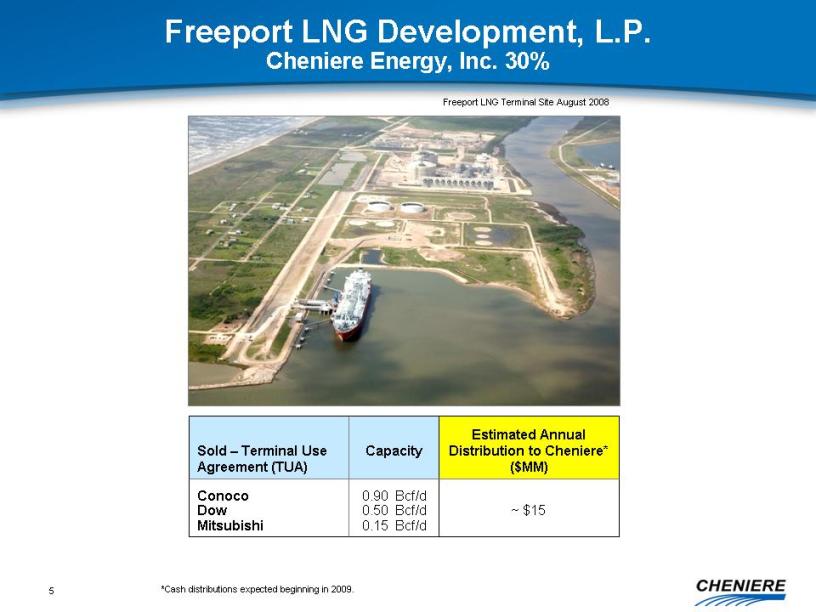

5 Freeport LNG Development, L.P. Cheniere Energy, Inc. 30% Freeport LNG Terminal Site August 2008 *Cash distributions expected beginning in 2009. Sold – Terminal Use Agreement (TUA) Capacity Estimated Annual Distribution to Cheniere* ($MM) Conoco 0.90 Bcf/d Dow 0.50 Bcf/d ~ $15 Mitsubishi 0.15 Bcf/d

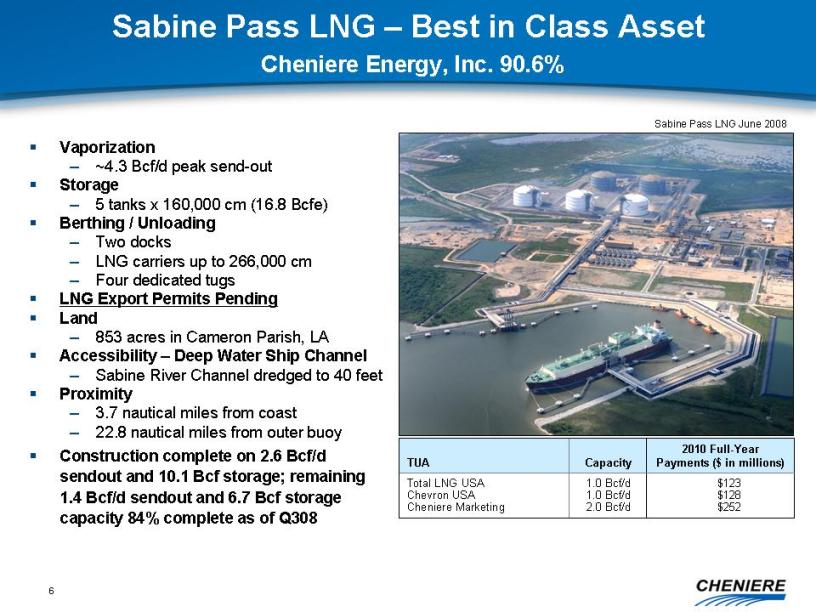

6 Vaporization ~4.3 Bcf/d peak send-out Storage 5 tanks x 160,000 cm (16.8 Bcfe) Berthing / Unloading Two docks LNG carriers up to 266,000 cm Four dedicated tugs LNG Export Permits Pending Land 853 acres in Cameron Parish, LA Accessibility – Deep Water Ship Channel Sabine River Channel dredged to 40 feet Proximity 3.7 nautical miles from coast 22.8 nautical miles from outer buoy Construction complete on 2.6 Bcf/d sendout and 10.1 Bcf storage; remaining 1.4 Bcf/d sendout and 6.7 Bcf storage capacity 84% complete as of Q308 Sabine Pass LNG – Best in Class Asset Cheniere Energy, Inc. 90.6% Sabine Pass LNG June 2008 TUA Capacity 2010 Full-Year Payments ($ in millions) Total LNG USA 1.0 Bcf/d $123 Chevron USA 1.0 Bcf/d $128 Cheniere Marketing 2.0 Bcf/d $252

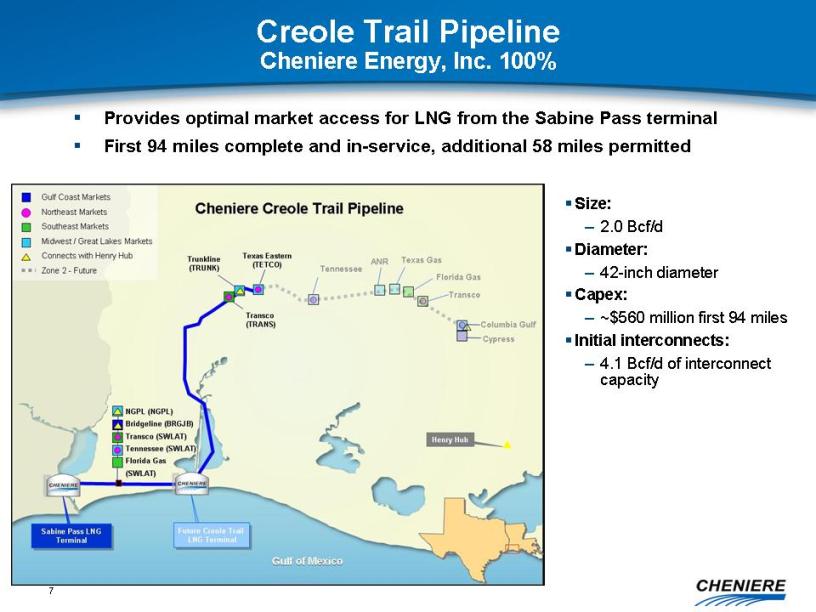

7 Size: 2.0 Bcf/d Diameter: 42-inch diameter Capex: ~$560 million first 94 miles Initial interconnects: 4.1 Bcf/d of interconnect capacity Creole Trail Pipeline Cheniere Energy, Inc. 100% Provides optimal market access for LNG from the Sabine Pass terminal First 94 miles complete and in-service, additional 58 miles permitted Cheniere Creole Trail Pipeline Gulf Coast Markets Northeast Markets Southeast Markets Midwest / Great Lakes Markets Connects with Henry Hub Zone 2 – Future Sabine Pass LNG Terminal Future Creole Trail LNG Terminal Gulf of Mexico NGPL (NGPL) Bridgeline (BRGJB) Transco (SWLAT) Tennessee (SWLAT) Florida Gas (SWLAT) Trunkline (TRUNK) Texas Eastern (TETCO) Transco (TRANS) ANR Texas Gas Florida Gas Columbia Gulf Cypress

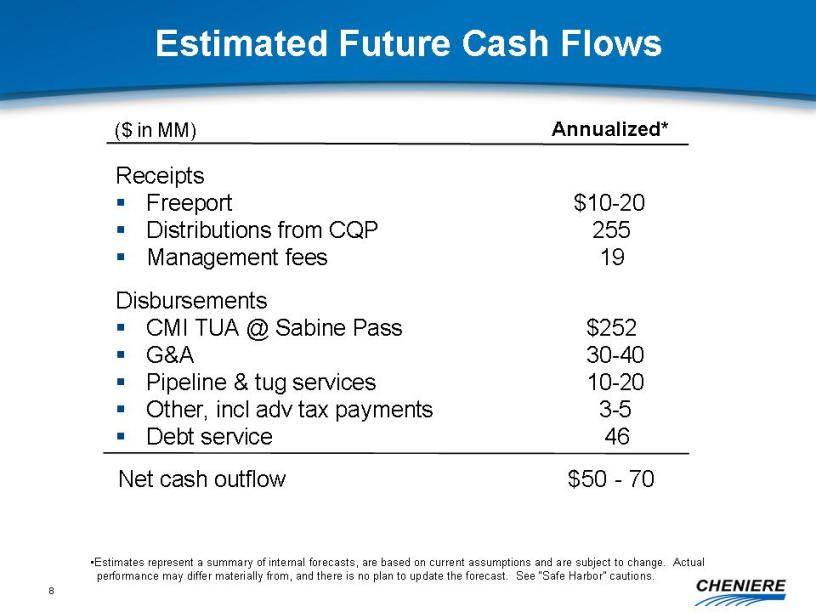

8 Estimated Future Cash Flows Receipts Freeport $10-20 Distributions from CQP 255 Management fees 19 Annualized* ($ in MM) Disbursements CMI TUA @ Sabine Pass $252 G&A 30-40 Pipeline & tug services 10-20 Other, incl adv tax payments 3-5 Debt service 46 Net cash outflow $50 - 70 Estimates represent a summary of internal forecasts, are based on current assumptions and are subject to change. Actual performance may differ materially from, and there is no plan to update the forecast. See “Safe Harbor” cautions.

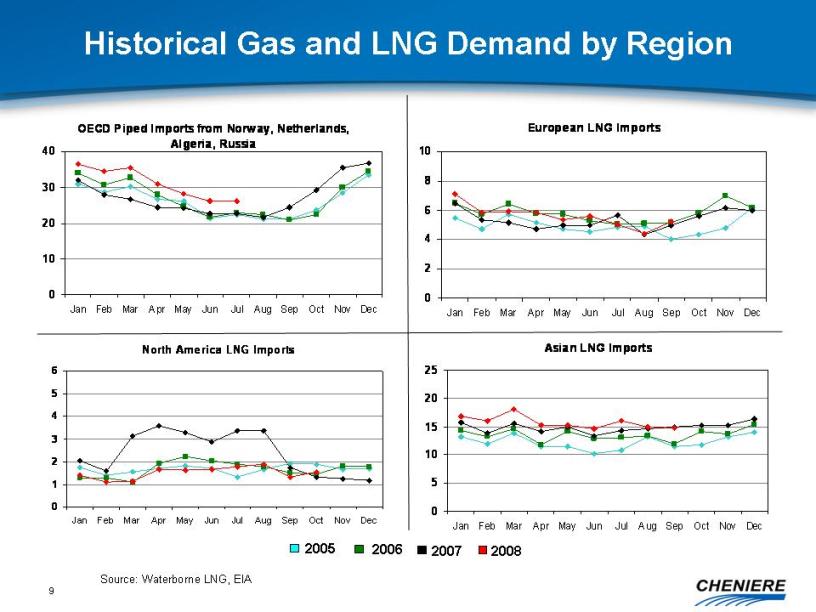

9 Historical Gas and LNG Demand by Region Source: Waterborne LNG, EIA 2005 2006 2007 2008 OECD Piped Imports from Norway, Netherlands, Algeria, Russia Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 0 10 20 30 40 European LNG Imports 0 2 4 6 8 10 North America LNG Imports 0 1 2 3 4 5 6 Asian LNG Imports 0 5 10 15 20 25

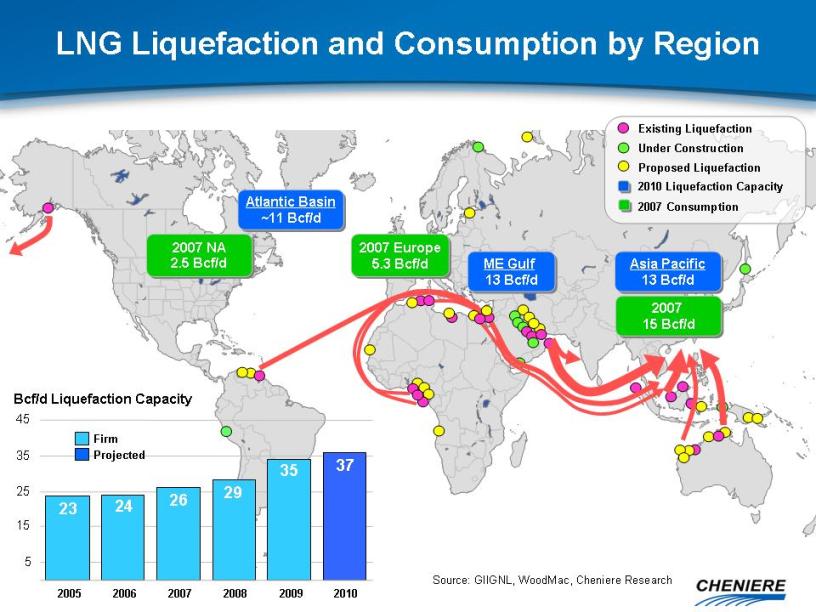

10 LNG Liquefaction and Consumption by Region Source: GIIGNL, WoodMac, Cheniere Research Atlantic Basin ~11 Bcf/d ME Gulf 13 Bcf/d Asia Pacific 13 Bcf/d 2007 Europe 5.3 Bcf/d 2007 15 Bcf/d 2007 NA 2.5 Bcf/d 5 15 25 35 45 37 23 24 26 29 35 Bcf/d Liquefaction Capacity Firm 2010 Liquefaction Capacity 2007 Consumption Existing Liquefaction Under Construction Proposed Liquefaction Projected 2005 2006 2007 2008 2009 2010

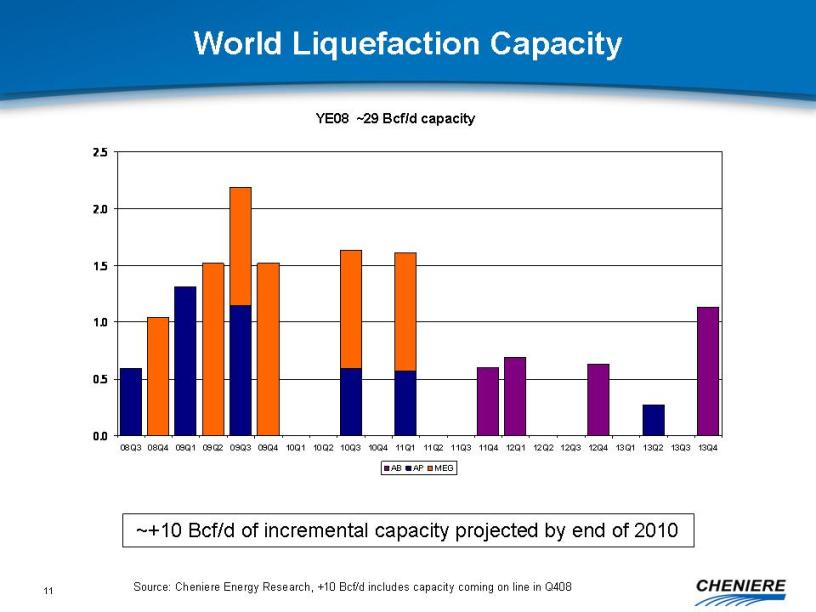

11 World Liquefaction Capacity ~+10 Bcf/d of incremental capacity projected by end of 2010 Source: Cheniere Energy Research, +10 Bcf/d includes capacity coming on line in Q408 YE08 ~29 Bcf/d capacity AB AP MEG 08Q3 08Q4 09Q1 09Q2 09Q3 09Q4 10Q1 10Q2 10Q3 10Q4 11Q1 11Q2 11Q3 11Q4 12Q1 12Q2 12Q3 12Q4 13Q1 13Q2 13Q3 13Q4 0.0 0.5 1.0 1.5 2.0 2.5

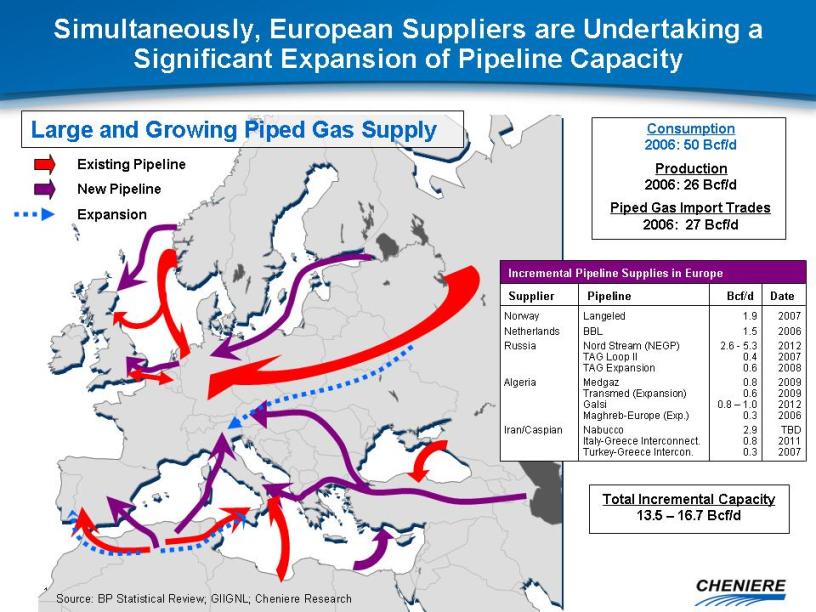

12 Simultaneously, European Suppliers are Undertaking a Significant Expansion of Pipeline Capacity New Pipeline Existing Pipeline Expansion Source: BP Statistical Review; GIIGNL; Cheniere Research Consumption 2006: 50 Bcf/d Production 2006: 26 Bcf/d Piped Gas Import Trades 2006: 27 Bcf/d Total Incremental Capacity 13.5 – 16.7 Bcf/d Large and Growing Piped Gas Supply Incremental Pipeline Supplies in Europe Supplier Pipeline Bcf/d Date 2007 1.9 Langeled Norway 2006 1.5 BBL Netherlands 2.6 - 5.3 Nord Stream (NEGP) Russia 2008 0.6 TAG Expansion 2007 0.4 TAG Loop II 2012 2006 0.3 Maghreb-Europe (Exp.) 2012 0.8 – 1.0 Galsi 2009 0.6 Transmed (Expansion) 2009 0.8 Medgaz Algeria 2007 0.3 Turkey-Greece Intercon. 2011 0.8 Italy-Greece Interconnect. TBD 2.9 Nabucco Iran/Caspian

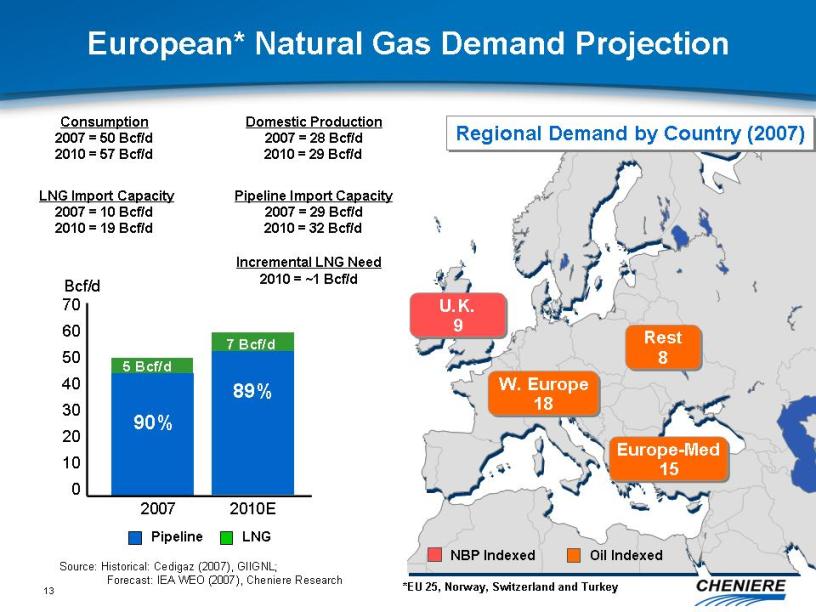

13 European* Natural Gas Demand Projection Bcf/d Source: Historical: Cedigaz (2007), GIIGNL; Forecast: IEA WEO (2007), Cheniere Research Regional Demand by Country (2007) Europe-Med 15 W. Europe 18 U.K. 9 LNG Pipeline 70 60 50 40 30 20 10 0 2007 2010E Pipeline LNG 89% 90% 7 Bcf/d 5 Bcf/d Domestic Production 2007 = 28 Bcf/d 2010 = 29 Bcf/d NBP Indexed Oil Indexed LNG Import Capacity 2007 = 10 Bcf/d 2010 = 19 Bcf/d Consumption 2007 = 50 Bcf/d 2010 = 57 Bcf/d Incremental LNG Need 2010 = ~1 Bcf/d *EU 25, Norway, Switzerland and Turkey Bcf/d Rest 8 Pipeline Import Capacity 2007 = 29 Bcf/d 2010 = 32 Bcf/d

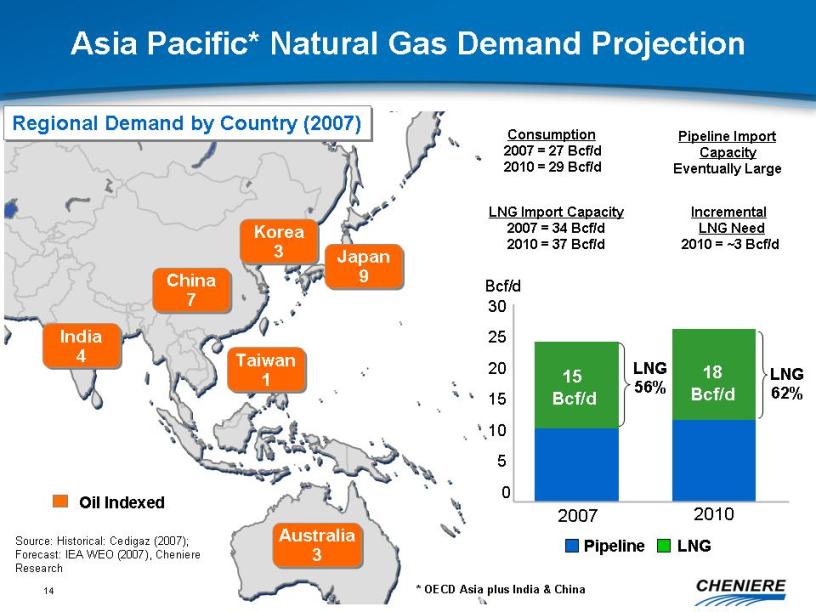

14 Asia Pacific* Natural Gas Demand Projection Pipeline Bcf/d Source: Historical: Cedigaz (2007); Forecast: IEA WEO (2007), Cheniere Research 30 25 20 15 10 5 0 2007 2010 Oil Indexed Pipeline LNG Japan 9 15 Bcf/d Korea 3 China 7 Australia 3 India 4 Taiwan 1 18 Bcf/d LNG 56% LNG 62% Incremental LNG Need 2010 = ~3 Bcf/d Consumption 2007 = 27 Bcf/d 2010 = 29 Bcf/d * OECD Asia plus India & China LNG Import Capacity 2007 = 34 Bcf/d 2010 = 37 Bcf/d Pipeline Import Capacity Eventually Large Bcf/d Oil Indexed Regional Demand by Country (2007)

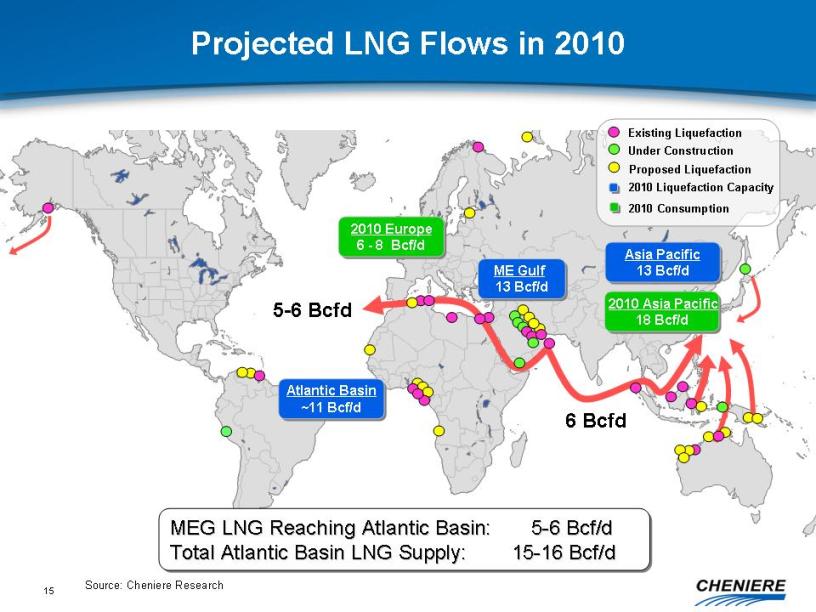

15 Projected LNG Flows in 2010 Existing Liquefaction Under Construction Proposed Liquefaction MEG LNG Reaching Atlantic Basin: 5-6 Bcf/d Total Atlantic Basin LNG Supply: 15-16 Bcf/d Atlantic Basin ~11 Bcf/d ME Gulf 13 Bcf/d Asia Pacific 13 Bcf/d 2010 Europe 6 - 8 Bcf/d 2010 Asia Pacific 18 Bcf/d 2010 Liquefaction Capacity 6 Bcfd 5-6 Bcfd 2010 Consumption Source: Cheniere Research

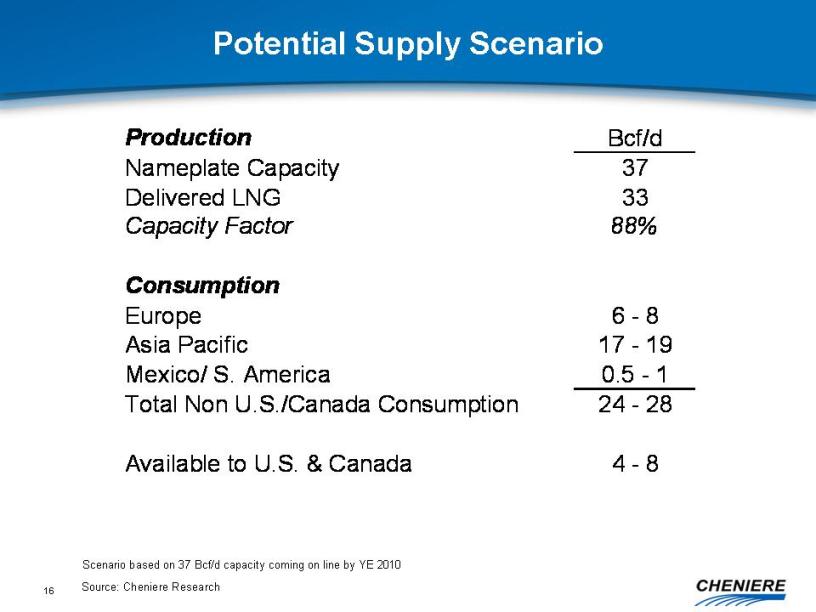

16 Potential Supply Scenario Scenario based on 37 Bcf/d capacity coming on line by YE 2010 Source: Cheniere Research Production Bcf/d Nameplate Capacity 37 Delivered LNG 33 Capacity Factor 88% Consumption Europe 6 – 8 Asia Pacific 17 – 19 Mexico/ S. America 0.5 – 1 Total Non U.S./Canada Consumption 24 – 28 Available to U.S. & Canada 4 - 8

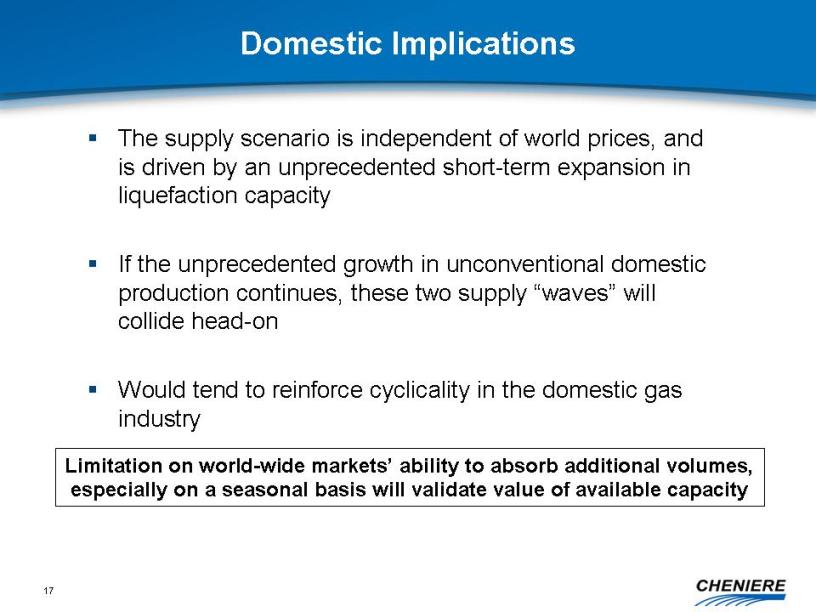

17 Domestic Implications The supply scenario is independent of world prices, and is driven by an unprecedented short-term expansion in liquefaction capacity If the unprecedented growth in unconventional domestic production continues, these two supply “waves” will collide head-on Would tend to reinforce cyclicality in the domestic gas industry Limitation on world-wide markets’ ability to absorb additional volumes, especially on a seasonal basis will validate value of available capacity

18 Conclusion Natural gas price? $6, $8, $10 We expect very volatile natural gas markets given the combination of nonconventional resources and LNG imports Increase in LNG imports could decrease domestic gas price, which discourages production Decrease in domestic gas price could lead to increase in natural gas demand Floor established by coal prices, ceiling set by excess production

19 Appendix

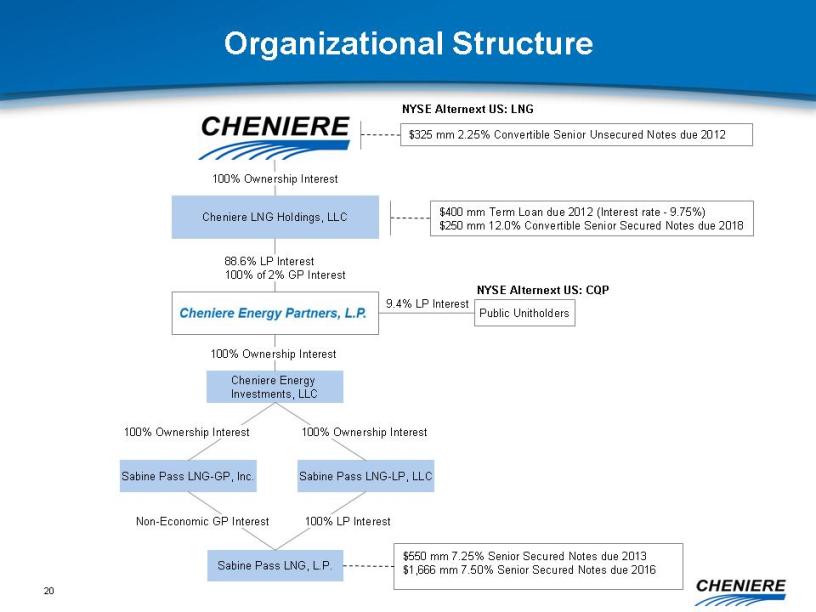

20 Organizational Structure Public Unitholders 9.4% LP Interest Cheniere Energy Investments, LLC Sabine Pass LNG-GP, Inc. Sabine Pass LNG, L.P. Sabine Pass LNG-LP, LLC 100% Ownership Interest 100% Ownership Interest 100% Ownership Interest 100% LP Interest Non-Economic GP Interest 100% Ownership Interest Cheniere LNG Holdings, LLC $325 mm 2.25% Convertible Senior Unsecured Notes due 2012 $550 mm 7.25% Senior Secured Notes due 2013 $1,666 mm 7.50% Senior Secured Notes due 2016 88.6% LP Interest 100% of 2% GP Interest NYSE Alternext US: LNG NYSE Alternext US: CQP $400 mm Term Loan due 2012 (Interest rate - 9.75%) $250 mm 12.0% Convertible Senior Secured Notes due 2018

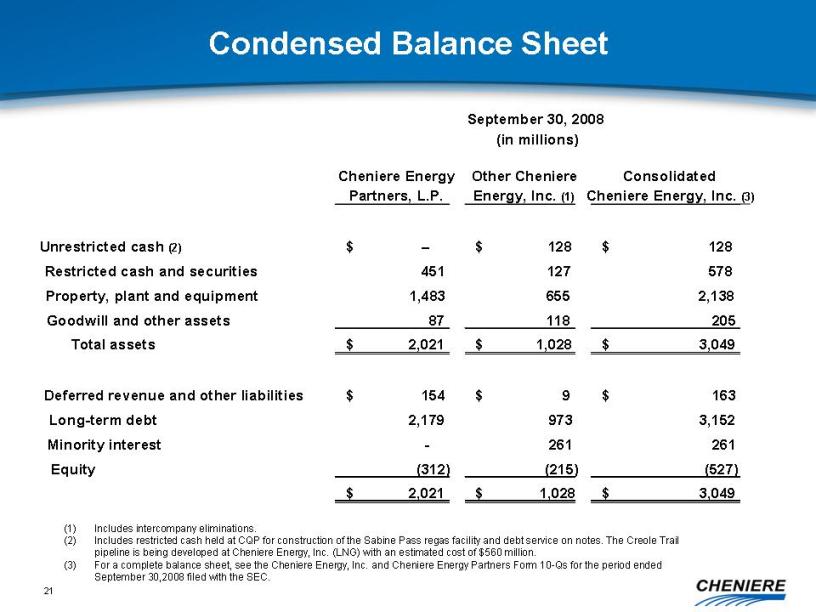

21 Condensed Balance Sheet Cheniere Energy Partners, L.P. Other Cheniere Energy, Inc. (1) Consolidated Cheniere Energy, Inc. (3) Unrestricted cash (2) $ - $ 128 $ 128 Restricted cash and securities 451 127 578 Property, plant and equipment 1,483 655 2,138 Goodwill and other assets 87 118 205 Total assets $ 2,021 $ 1,028 $ 3,049 Deferred revenue and other liabilities $ 154 $ 9 $ 163 Long-term debt 2,179 973 3,152 Minority interest - 261 261 Equity (312) (215) (527) $ 2,021 $ 1,028 $ 3,049 (1) Includes intercompany eliminations. (2) Includes restricted cash held at CQP for construction of the Sabine Pass regas facility and debt service on notes. The Creole Trail pipeline is being developed at Cheniere Energy, Inc. (LNG) with an estimated cost of $560 million. (3) For a complete balance sheet, see the Cheniere Energy, Inc. and Cheniere Energy Partners Form 10-Qs for the period ended September 30,2008 filed with the SEC. September 30, 2008 (in millions)

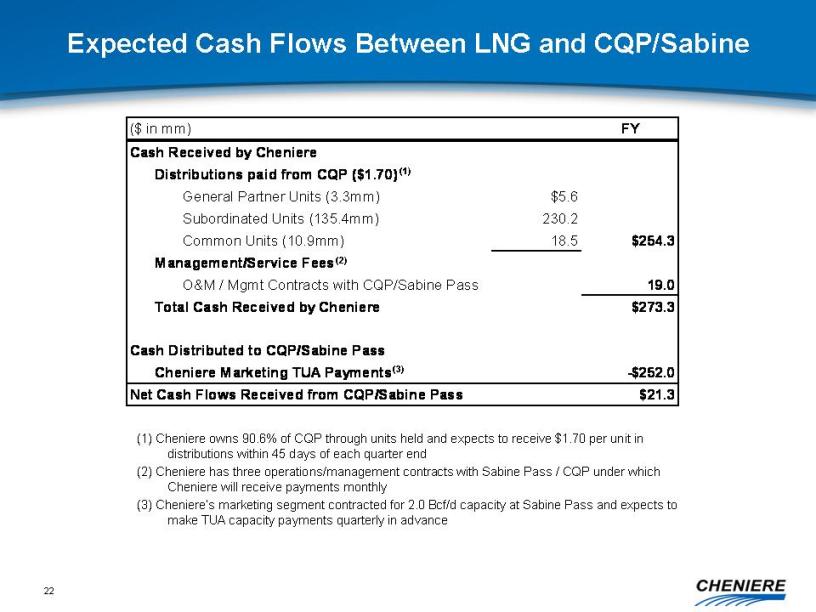

22 Expected Cash Flows Between LNG and CQP/Sabine Body: (1) Cheniere owns 90.6% of CQP through units held and expects to receive $1.70 per unit in distributions within 45 days of each quarter end (2) Cheniere has three operations/management contracts with Sabine Pass / CQP under which Cheniere will receive payments monthly (3) Cheniere’s marketing segment contracted for 2.0 Bcf/d capacity at Sabine Pass and expects to make TUA capacity payments quarterly in advance ($ in mm) FY Cash Received by Cheniere Distributions paid from CQP ($1.70) (1) General Partner Units (3.3mm) $5.6 Subordinated Units (135.4mm) 230.2 Common Units (10.9mm) 18.5 $254.3 Management/Service Fees (2) O&M / Mgmt Contracts with CQP/Sabine Pass 19.0 Total Cash Received by Cheniere $273.3 Cash Distributed to CQP/Sabine Pass Cheniere Marketing TUA Payments (3) -$252.0 Net Cash Flows Received from CQP/Sabine Pass $21.3

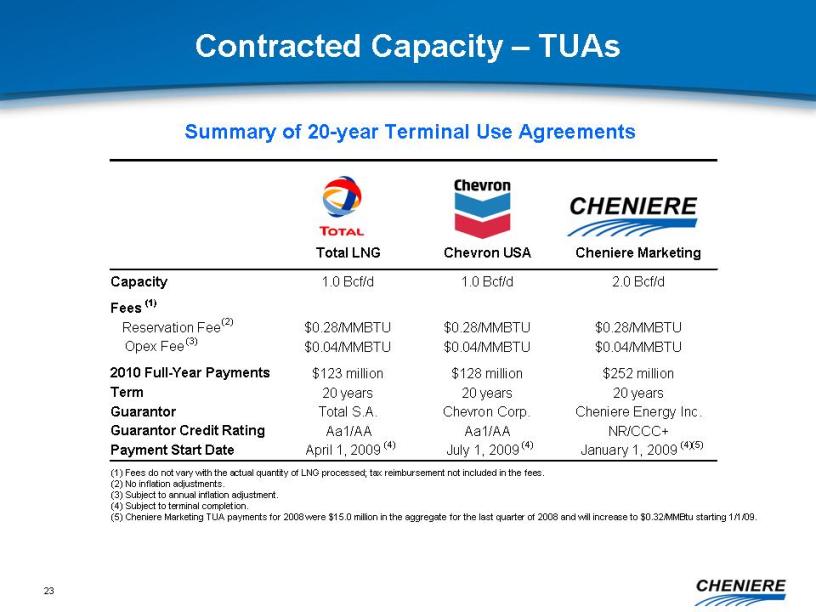

23 Contracted Capacity – TUAs (1) Fees do not vary with the actual quantity of LNG processed; tax reimbursement not included in the fees. (2) No inflation adjustments. (3) Subject to annual inflation adjustment. (4) Subject to terminal completion. (5) Cheniere Marketing TUA payments for 2008 were $15.0 million in the aggregate for the last quarter of 2008 and will increase to $0.32/MMBtu starting 1/1/09. Summary of 20-year Terminal Use Agreements Total LNG Chevron USA Cheniere Marketing Capacity 1.0 Bcf/d 1.0 Bcf/d 2.0 Bcf/d Fees (1) Reservation Fee (2) $0.28/MMBTU $0.28/MMBTU $0.28/MMBTU Opex Fee (3) $0.04/MMBTU $0.04/MMBTU $0.04/MMBTU 2010 Full-Year Payments $123 million $128 million $252 million Term 20 years 20 years 20 years Guarantor Total S.A. Chevron Corp. Cheniere Energy Inc. Guarantor Credit Rating Aa1/AA Aa1/AA NR/CCC+ Payment Start Date April 1, 2009 (4) July 1, 2009 (4) January 1, 2009 (4) (5)

November 12, 2008

This information sheet contains certain statements that may include "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements, other than statements of historical fact, included herein are "forward-looking statements." Included among "forward-looking statements" are, among other things, statements regarding the business strategy, plans, financial projections and objectives of Cheniere Energy, Inc. (“CEI”), Cheniere Energy Partners, L.P. (“CQP”) and Sabine Pass LNG, L.P. (“Sabine Pass LNG”). Although management of each entity believes that the expectations reflected in these forward-looking statements are reasonable, they do involve assumptions, risks and uncertainties, and these expectations may prove to be incorrect. The actual results for CEI, CQP or Sabine Pass LNG could differ materially from those anticipated in these forward-looking statements as a result of a variety of factors, including market conditions and other risks described in each of CEI’s, CQP’s and Sabine Pass LNG’s Annual Report on Form 10-K for the fiscal year ended December 31, 2007 and subsequent quarterly reports on Form 10-Q and current reports on Form 8-K filed with the Securities and Exchange Commission since such date. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this information sheet. Other than as required under the securities laws, the reporting entity does not assume a duty to update these forward-looking statements.

Cheniere Energy, Inc. (NYSE Alternext US: LNG)

Cheniere Energy, Inc. (CEI) primary assets consist of the following:

Cash Flows

At September 30, 2008, Cheniere had unrestricted cash of approximately $128 million and restricted cash of $127 million, excluding cash held by Cheniere Energy Partners. Included in restricted cash was $120 million for the TUA reserve Cheniere established for its affiliate to make payments to Sabine Pass. This reserve requirement will be reduced in Q309 to $63 million and the excess cash will be transferred to unrestricted cash.

After the recent GSO financing, and along with the recent CEI restructuring and significant reduction of annual expenses, CEI estimates that it will have sufficient liquidity to operate its business for the next few years, whether or not it is successful in its plan of securing cargoes or additional third party long-term TUAs.

Listed below are CEI’s estimates of annual cash receipts and expenditures. The list does not include revenues or expenses of CQP and its subsidiaries, including Sabine Pass LNG. Based on these estimates, the net annual cash consumption by CEI is estimated to be $60 million to $70 million. This may be reduced if CEI is able to generate earnings from its Creole Trail Pipeline, assign some or all of Cheniere Marketing’s TUA capacity to third parties on either a short- or long-term basis and/or recover tug expenses from third parties. Revenues could also be generated from spot cargoes secured by Cheniere Marketing, LLC for delivery at the Sabine Pass LNG receiving terminal.

Cash Receipts ($mm)

Cheniere Energy, Inc. cont.

Cash Expenditures ($mm)

Maximum additional revenues/earnings that could be generated from CEI’s existing assets (other than the Sabine Pass LNG receiving terminal) are estimated to be approximately $372 million, as set forth in the table below.

|

$mm |

Annualized |

||

| Future Earnings/Revenue Possibilities from Existing Assets | |||

|

Pipeline (regulated rate) |

$112 |

||

|

Assignment of Cheniere Mktg. TUA @ $0.32 |

250 |

||

|

Tugs |

10 |

||

|

|

$372 |

Indebtedness Outstanding

The following table sets forth CEI’s indebtedness outstanding, except for the indebtedness of Sabine Pass LNG. CEI has both secured and unsecured indebtedness outstanding. The first maturity date occurs in 2012, although GSO has a put option on its convertible in August 2011. Interest expense on the GSO convertible notes accrues for the first three years. The convertible notes due in 2012 are convertible at $35.42 per share.

|

Security |

Maturity |

Int Rate |

$mm |

Security |

||||

|

Term Loan |

Aug 2012 |

9.75% |

$400 |

Freeport and CQP subordinated units |

||||

|

GSO Convertible Notes* |

Aug 2018 |

12.00% |

$250 |

Pipeline, CQP common units, mgmt fees |

||||

|

Convertible Note |

July 2012 |

2.25% |

$325 |

None |

||||

| *Convertible into 50 mm preferred shares; interest accrues for the first three years. | ||||||||

Focus

Our primary business focus is to pursue the following types of agreements:

On an annualized basis, if 500 MMcf/d of capacity under the Cheniere Marketing TUA were sold (and associated revenues from the Creole Trail Pipeline and tug services provided), CEI anticipates that it would be cash flow positive.

November 12, 2008

This information sheet contains certain statements that may include "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements, other than statements of historical fact, included herein are "forward-looking statements." Included among "forward-looking statements" are, among other things, statements regarding the business strategy, plans, financial projections and objectives of Cheniere Energy, Inc. (“CEI”), Cheniere Energy Partners, L.P. (“CQP”) and Sabine Pass LNG, L.P. (“Sabine Pass LNG”). Although management of each entity believes that the expectations reflected in these forward-looking statements are reasonable, they do involve assumptions, risks and uncertainties, and these expectations may prove to be incorrect. The actual results for CEI, CQP or Sabine Pass LNG could differ materially from those anticipated in these forward-looking statements as a result of a variety of factors, including market conditions and other risks described in each of CEI’s, CQP’s and Sabine Pass LNG’s Annual Report on Form 10-K for the fiscal year ended December 31, 2007 and subsequent quarterly reports on Form 10-Q and current reports on Form 8-K filed with the Securities and Exchange Commission since such date. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this information sheet. Other than as required under the securities laws, the reporting entity does not assume a duty to update these forward-looking statements.

This information sheet addresses some, but not all, of the benefits and risks concerning Cheniere Energy Partners, L.P. (NYSE Alternext US: CQP). This information sheet also addresses certain relationships between CQP and both its parent, Cheniere Energy, Inc. (NYSE Alternext US: LNG), and its wholly-owned subsidiary, Sabine Pass LNG, L.P., including ownership structure, management and operational contracts and cash flows between the entities.

CQP owns and operates the Sabine Pass LNG receiving terminal located in western Cameron Parish, Louisiana on the Sabine Pass Channel. Operating expenses for the Sabine Pass LNG receiving terminal are low, and annual maintenance costs are expected to be minimal. Sabine Pass LNG’s TUAs will provide stable, long-term cash flows. The terminal’s regasification capacity is fully contracted on a long-term basis by three customers. Half of the regasification capacity is contracted by two customers, Total LNG USA, Inc. and Chevron U.S.A., Inc., for twenty years and guaranteed by AA rated guarantors, and the other half is contracted by CEI for nineteen years. The contracts are only cancellable under specific conditions, including (a) force majeure, where the Sabine Pass LNG receiving terminal is not operational for over 18 months and (b) the Sabine Pass LNG receiving terminal cannot meet certain delivery requirements, including taking delivery of approximately 192 MMBtu in a 12-month period, taking delivery of 15 cargoes over 90 days or unloading 50 cargoes in a 12-month period. Even in the case of force majeure, the customers are required to pay their capacity reservation fees for the initial 18 months of a force majeure.

CQP is currently paying an annual distribution to its common unitholders of $1.70 per unit. Distributions are currently being paid from a reserve account, which is available to pay distributions to common unit holders and the general partner until the Sabine Pass LNG receiving terminal begins receiving payments from Total LNG USA, Inc. and Chevron U.S.A., Inc. under their TUAs which begin in April 2009 and July 2009, respectively.

A principal concern expressed by some CQP investors is that one of its largest customers, CEI, through its wholly-owned subsidiary Cheniere Marketing, LLC (“Cheniere Marketing”), may not be able to make payments under its 2.0 Bcf/d terminal use agreement (“TUA”) with Sabine Pass LNG, particularly given CEI’s recent liquidity issues. It is important for investors to understand the mechanics and flow of funds among Cheniere Marketing, Sabine Pass LNG and CQP. Sabine Pass LNG must satisfy certain debt covenants before Sabine Pass LNG can make any distributions to CQP. Only if and to the extent that Sabine Pass LNG makes distributions to CQP will CQP have the cash flow available to make distributions to its common unitholders, including an affiliate of CEI. Sabine Pass LNG is not dependent on Cheniere Marketing’s TUA payments for its ongoing cash needs, as Sabine Pass LNG anticipates receiving adequate cash flows from its other customers to cover all of its operating expenses, debt service requirements and, subject to declaration by its board of directors, distributions on all of its common and general partner units. A portion of these distributions will be made to an affiliate of CEI, which, as discussed below, will be deposited in a reserve account for Cheniere Marketing to make its TUA payments. In summary, the payments between CEI and CQP circulate among the parties in that Cheniere Marketing pays Sabine Pass LNG under its TUA, Sabine Pass LNG makes a distribution to CQP and then CQP declares and makes a distribution to its unitholders, including a distribution to an affiliate of CEI. Regasification capacity reservation fee payments of $62.5 million under the Cheniere Marketing TUA are paid quarterly. Distributions of $63.5 million for CEI’s 90.6% ownership interest in CQP will be paid to CEI from CQP within 45 days of quarter end. As long as Cheniere Marketing continues to make its quarterly TUA payments, the CQP common unitholders should also continue to receive their minimum quarterly distributions. Nonetheless, during any period when Sabine Pass LNG is not permitted to make distributions to CQP, CQP’s common unitholders will be entitled to accrue any distribution arrearages owed on their units, which will be distributable to them once the fixed charge coverage ratio test is satisfied and CQP receives cash from Sabine Pass LNG.

In August 2008, CEI obtained funding from GSO Capital Partners LP which, along with recent CEI restructuring and significant reduction of annual expenses, is estimated to provide CEI with sufficient liquidity to operate its business for the next few years, whether or not it is successful in its plan of securing cargoes or additional third party long-term TUAs. In connection with the transaction, CEI funded a reserve account to make the quarterly payments to Sabine Pass LNG under the Cheniere Marketing TUA. If Cheniere Marketing or CEI were to breach or fail to perform under the Cheniere Marketing TUA, or the guarantee thereof, even in bankruptcy, they would either be ultimately required to assume the contract and make all payments thereunder or Sabine Pass LNG would have a claim for damages. In the event of a breach of the Cheniere Marketing TUA or CEI’s related guarantee and a rejection of the contract in bankruptcy, the 2.0 Bcf/d of regasification capacity under the Cheniere Marketing TUA would no longer be reserved and Sabine Pass LNG could market it for itself and the benefit of CQP. The amount that Sabine Pass LNG could recover from CEI or Cheniere Marketing would depend on what other claims and assets existed and how Sabine Pass LNG’s claim was classified.

Ownership and Capital Structure

The Sabine Pass LNG receiving terminal is owned by Sabine Pass LNG, a partnership entirely owned by CQP. Sabine Pass LNG is a ring-fenced, bankruptcy-remote entity that has an independent director. The general partner of Sabine Pass LNG has two directors, and the general partner of CQP has nine directors, including one recently added by GSO.

Debt. The debt listed below is held under Sabine Pass LNG, L.P.

|

Note |

Maturity |

Int Rate |

$mm |

|

|

Senior Secured |

Nov 2013 |

7.25% |

$550 |

|

|

Senior Secured |

Nov 2016 |

7.50% |

$1,666 |

Equity. CEI owns 90.6% of the equity of CQP and the public owns the remaining 9.4% of CQP equity, as indicated below. CEI also owns all of the general partner interests and all of the subordinated units of CQP.

|

Cheniere |

Cheniere |

Public |

Total |

|

|

Common |

10,891,357 |

15,525,000 |

26,416,357 |

|

|

Subordinated |

135,383,831 |

135,383,831 |

||

|

|

146,275,188 |

15,525,000 |

161,800,188 |

|

|

General Partner |

3,302,045 |

3,302,045 |

||

|

|

149,577,233 |

15,525,000 |

165,102,233 |

|

|

|

90.6% |

9.4% |

100.0% |

All CQP units are anticipated to receive quarterly distributions beginning in Q109. The CQP common units have preferential distribution rights over the subordinated units. In the event of any unpaid CQP common unit distributions, such distributions would accrue for the benefit of the common unitholders until paid. In the event of a liquidation of CQP, the common unitholders would be entitled to the amounts in their capital accounts after giving effect to allocations in accordance with CQP’s partnership agreement.

As set forth in the CQP partnership agreement, the subordinated units will convert into common units after CQP has earned and paid three years of distributions of at least $0.425 on each outstanding common, subordinated and general partner unit per quarter for 12 consecutive quarters. Should the subordinated units begin receiving their full distributions in Q309, the units would be convertible into common units no earlier than Q312. If the subordinated unit distributions are interrupted, the three-year period starts over.

Overview of Sabine Pass LNG Receiving Terminal

The Sabine Pass LNG receiving terminal is located in western Cameron Parish, Louisiana on the Sabine Pass Channel just 3.7 miles from the U.S. Gulf Coast. When construction is complete, the Sabine Pass LNG receiving terminal will have a send-out capacity of 4.0 Bcf/d and storage capacity of 16.8 Bcf. The Sabine Pass LNG receiving terminal will be connected to approximately 5 Bcf/d of take-away capacity via two pipelines, the Creole Trail Pipeline and the Kinder Morgan Louisiana Pipeline (currently under construction). The Creole Trail Pipeline is owned by CEI and has multiple interconnects to interstate pipelines throughout Louisiana. The initial 2.6 Bcf/d of send out capacity and 10.1 Bcf of storage capacity at the Sabine Pass LNG receiving terminal is complete, and the terminal is operating and able to accept commercial cargoes. Construction for the remaining 1.4 Bcf/d was approximately 84% complete as of September 30, 2008. As of September 30, 2008, Sabine Pass LNG had $270 million in cash in various restricted accounts available for completing construction of the Sabine Pass LNG receiving terminal.

Commencing construction of the Sabine Pass LNG receiving terminal in 2005 has proven to be advantageous, particularly considering the escalating construction and labor costs that have occurred over the last few years. The initial 2.6 Bcf/d of send out capacity and 10.1 Bcf of storage capacity was developed under a fixed-price, lump sum, turn-key contract. Estimated construction, commission and operating costs for the entire facility through the achievement of full operability are expected to be approximately $1.6 billion, or approximately $0.4 billion per Bcf. This is significantly below the $1.0 billion per Bcf of construction costs that are suggested in public disclosures by Sabine Pass LNG’s competitors.

Cash Flow Summary

The left side of the table below contains a summary of expected cash flows by Sabine Pass LNG for 2010, which is the first full year of Sabine Pass LNG receiving capacity reservation fees from its three TUAs. See Annex A hereto for important assumptions relating to the table. It is anticipated that the cash flow received from the two TUA counterparties with AA-rated parent guarantors will cover all of Sabine Pass LNG’s operating expenses and interest costs. Net cash available to Sabine Pass LNG for distribution to CQP after these costs is expected to be $47.0 million, which exceeds the annual CQP common unit distribution of $44.9 million. The TUA payments made by Cheniere Marketing are anticipated to cover the CQP general partner and subordinated unit distributions, as shown on the right side of the table below.

|

($mm) |

FY 2010E |

($mm) |

FY 2010E |

|

|

TUA Payments (1) |

Cash Flow Coverage -AA rated contracts |

|||

|

Total LNG USA, Inc. (2) |

$123 |

Payments from Chevron and Total |

$251 |

|

|

Chevron U.S.A., Inc. (2) |

128 |

Less operating expenses |

-39 |

|

|

Cheniere Marketing |

252 |

Less estimated interest expense |

-165 |

|

|

Aggregate Payments |

$503 |

Net Cash Flows Available for Distribution |

$47 |

|

|

Estimated Operating Expenses (3) |

-39 |

Distributions to CQP unitholders ($1.70/yr) |

$45 |

|

|

EBITDA (4) |

$464 |

Coverage for CQP common unitholders |

1.05x |

|

|

Interest Coverage |

Cash Flow Coverage - All contracts |

|||

|

Annual Interest |

$165 |

Net Cash Flows Available for Distribution |

$47 |

|

|

EBITDA less Interest Expense |

$299 |

Cheniere Marketing TUA |

252 |

|

|

EBITDA/ Interest Expense |

2.81x |

Less management contract to CEI |

-10 |

|

|

|

Net Cash Flows Available for Distribution |

$289 |

||

|

EBITDA from AA-rated TUAs |

$212 |

Distributions to all CQP unitholders ($1.70/yr) |

$281 |

|

|

EBITDA from AA-rated TUAs/ Interest Expense |

1.28x |

Coverage for all CQP unitholders |

1.03x |

|

Net cash flows for Sabine Pass LNG are expected to be fairly consistent each year. Sabine Pass LNG’s operating expenses are fairly predictable and primarily include labor, insurance and management fees. Net costs for Sabine Pass LNG to process cargoes are forecasted to be breakeven, as they are expected to be covered by the 2% fuel retained by Sabine Pass LNG from each cargo delivered; the terminal is expected to use less than the 2% of LNG that is retained. Increases in operating costs are expected to be covered from increased revenues, as the TUA fee of $0.32/MMBtu consists of a fixed component of $0.28/MMBtu, which is non-escalating, and a component of $0.04/MMBtu, which escalates over the life of the contract based on the CPI index. Sabine Pass LNG’s interest costs are also fixed.

CQP is anticipated to be able to make distributions only as long as certain debt covenants are met by Sabine Pass LNG. The Sabine Pass LNG indenture governing its debt stipulates that Sabine Pass LNG may only distribute cash to CQP when it maintains a 2:1 EBITDA/Fixed Charge coverage ratio (where fixed charges are primarily interest expense), has cash in a permanent interest reserve account equivalent to one semi-annual interest payment (approximately $83 million) and deposits one month’s interest payment into an account for the next semi-annual interest payment. Sabine Pass LNG anticipates being able to meet the 2:1 ratio when it has EBITDA greater than or equal to $330 million. EBITDA from the two third-party TUAs will be $212 million. As long as Cheniere Marketing continues to make payments under the Cheniere Marketing TUA, then Sabine Pass LNG is anticipated to meet its coverage ratio. If the Cheniere Marketing TUA payments are not made, then, in order to be able to make distributions to CQP, Sabine Pass LNG would need to fund from a third-party source the difference between the $330 million required to meet the coverage test and the $212 million provided by third-party TUA customers. Common unit distributions would accrue during this time that Sabine Pass LNG is unable to make distributions to CQP; distributions on the subordinated units do not accrue.

Relationship Between CEI and CQP

As noted above, CEI owns approximately 90.6% of CQP through its interests in the CQP general partner and ownership of the common and subordinated units. CEI manages and operates the Sabine Pass LNG receiving terminal under three separate management and operational agreements between CEI and either CQP or Sabine Pass LNG.

Cash flows between CEI and CQP are shown below—the net result is a cash outflow to CEI. Timing of cash flows is such that Cheniere Marketing anticipates making quarterly payments in advance under its TUA with Sabine Pass LNG, and CQP anticipates making distributions of $0.425 per common unit within 45 days after each quarter end. As noted above, Cheniere Marketing’s TUA payments are being managed out of one account that was recently established as a TUA reserve account; payments are restricted for that purpose. One quarter of Cheniere Marketing TUA payments to Sabine Pass LNG is approximately $63 million. One quarter of CQP distributions on the common units to an affiliate of CEI is approximately $64 million. As long as Cheniere Marketing can continue making its payments under its TUA with Sabine Pass LNG and Sabine Pass LNG’s coverage ratio is otherwise met, CEI anticipates continuing to receive distributions from CQP nearly equivalent to the amount that Cheniere Marketing must pay Sabine Pass LNG.

|

($ in mm) |

FY |

||

| Cash Distributed to Cheniere | |||

| Distributions paid from CQP ($1.70) | |||

|

General Partner Units (3.3mm) |

$5.6 |

||

|

Subordinated Units (135.4mm) |

230.2 |

||

|

Common Units (10.9mm) |

18.5 |

-$254.3 |

|

| Management/Service Fees | |||

|

O&M / Mgmt Contracts w ith CQP/Sabine Pass |

-19.0 |

||

|

Total Cash Distributed to Cheniere |

-$273.3 |

||

| Cash Distributed to CQP/Sabine Pass | |||

|

Cheniere Marketing TUA Payments |

$252.0 |

||

|

Net Cash Flows Paid to Cheniere from CQP/Sabine Pass |

-$21.3 |

CEI Operations

In August, Cheniere closed on a $250 million senior secured convertible loan agreement with GSO Capital Partners LP. Proceeds were used to repay a bridge loan and to fund a reserve account for payments to be made under the Cheniere Marketing TUA. This investment, combined with CEI’s recent restructuring and significant reduction of annual expenses, will provide CEI with sufficient liquidity to operate its business for the next few years, whether or not it is successful in its plan of securing cargoes or additional third-party, long-term TUAs. Aside from those expenses incurred for the Sabine Pass LNG receiving terminal, CEI has its own general and administrative and interest costs, which are anticipated to be partially offset by cash that it expects to receive from the limited partner interest that it holds in the Freeport LNG receiving terminal, three management and operational contracts with Sabine Pass LNG and/or CQP and tug reimbursement costs. The net annual cash consumption by CEI is estimated to be $60 million to $70 million. This may be reduced if CEI is able to generate earnings from its Creole Trail Pipeline or assigns some of all of Cheniere Marketing’s TUA capacity to third parties on either a short- or long-term basis. Maximum total revenues that could be generated from CEI’s existing assets (other than the Sabine Pass LNG receiving terminal) are estimated to be approximately $372 million.

Summary

Annex A

Illustrative Cash Flow Assumptions

The information set forth in the table represents Sabine Pass LNG’s anticipated results of operations, including the projected payments under its three long-term TUAs, for the year ending December 31, 2010, the first anticipated full calendar year under which all three TUAs are in effect. In preparing this information, reliance has been placed on assumptions regarding circumstances beyond the control of CEI and its affiliates or any other person. By their nature, the assumptions are subject to significant uncertainties and actual results will differ, perhaps materially, from those projected. No assurance can be given that these assumptions are correct or that this information will reflect actual results. Accordingly, this financial estimate is not intended to be a prediction of future results.

Table Footnotes

| (1) | Fixed capacity reservation fees, including an operating fee component that is subject to adjustment for consumer price index inflation (assumed to be 2.5% annually). The entire 4.0 Bcf/d of regasification capacity that will be available at the Sabine Pass LNG receiving terminal upon completion of construction has been fully reserved under three long-term TUAs, under which the customers are required to pay fixed monthly fees, whether or not they use the terminal. |

| (2) | Amounts represent expected cash payments to be received. Cheniere previously received $20 million of advance capacity payments from both Total and Chevron which will be amortized over the first 10 years of the TUAs. |

| (3) | Includes management estimates of operating expenses and management fees; assumes that no additional LNG cargoes are necessary to maintain cryogenic readiness to provide services under Sabine Pass LNG’s TUAs. |

| (4) | Calculated as aggregate TUA revenues including estimated deferred revenues of $4 million annually, less estimated operating expenses. See “Non-GAAP Financial Measure” below for more information. |

The operating expenses set forth in the table for the year ending December 31, 2010 may be higher in later years due to numerous factors, such as increased maintenance costs of the Sabine Pass LNG receiving terminal as the facility ages. As a result, the EBITDA forecast for the year ending December 31, 2010 may not be indicative of EBITDA in periods thereafter. In addition, approximately one-half of the forecast revenues are attributable to Cheniere Marketing, which is a small, developing company with virtually no operating history.

Non-GAAP Financial Measure

EBITDA is computed as aggregate TUA revenues less estimated operating expenses. It does not include depreciation expense and certain non-operating items. Because there has not been a forecast of such depreciation expense and non-operating items, no forecast has been made of net income, which would be the most directly comparable financial measure under generally accepted accounting principles (“GAAP”). As a result, there is an inability to reconcile differences between forecasts of EBITDA and net income. EBITDA is used as a supplemental financial measure by management and by external users of Sabine Pass LNG’s financial statements, such as commercial banks, to assess:

Sabine Pass LNG’s EBITDA should not be considered an alternative to net income, operating income, cash flows from operating activities or any other measure of financial performance or liquidity presented in accordance with GAAP. Sabine Pass LNG’s EBITDA excludes some, but not all, items that affect net income and operating income, and it does not include capital expenditures and other non-operating items that require capital expenditures. In addition, these expenditures excluded from EBITDA may, over time, be material to Sabine Pass LNG’s business and may have a negative impact on the cash available to make interest payments on Sabine Pass LNG’s indebtedness and to repay Sabine Pass LNG’s indebtedness. These EBITDA measures may vary among companies. Therefore, Sabine Pass LNG’s EBITDA may not be comparable to similarly titled measures of other companies.

5