Exhibit 99.1

CHENIERE Corporate Presentation

This presentation contains certain statements that are, or may be deemed to be, "forward-looking statements" within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. All statements, other than statements of historical facts, included herein are "forward-looking statements." Included among "forward-looking statements" are, among other things: statements that we expect to commence or complete construction of each or any of our proposed liquefied natural gas, or LNG, receiving terminals by certain dates, or at all; statements that we expect to receive authorization from the Federal Energy Regulatory Commission, or FERC, to construct and operate proposed LNG receiving terminals by a certain date, or at all; statements regarding future levels of domestic natural gas production and consumption, or the future level of LNG imports into North America, or regarding projected future capacity of liquefaction or regasification, liquefaction utilization or total monthly LNG trade facilities worldwide, regardless of the source of such information statements regarding any financing transactions or arrangements, whether on the part of Cheniere or at the project level; statements relating to the construction of our proposed LNG receiving terminals and pipelines, including statements concerning estimated costs, and the engagement of any contractor; statements regarding any Terminal Use Agreement, or TUA, or other commercial arrangements presently contracted, optioned, marketed or potential arrangements to be performed substantially in the future, including any cash distributions and revenues anticipated to be received; statements regarding the commercial terms and potential revenues from activities described in this presentation; statements regarding the commercial terms or potential revenue from any arrangements which may arise from the marketing of uncommitted capacity from any of the terminals, including the Creole Trail and Corpus Christi terminals which do not currently have contractual commitments; statements regarding the commercial terms or potential revenue from any arrangement relating to the proposed contracting for excess or expansion capacity for the Sabine Pass LNG Terminal or the Indexed Purchase Agreement ("IPA") or LNG spot purchase examples described in this presentation; statements that our proposed LNG receiving terminals, when completed, will have certain characteristics, including amounts of regasification and storage capacities, a number of storage tanks and docks and pipeline interconnections; statements regarding Cheniere and Cheniere Marketing forecasts, and any potential revenues and capital expenditures which may be derived from any of Cheniere business groups; statements regarding Cheniere Pipeline Company, and the capital expenditures and potential revenues related to this business group; statements regarding our proposed LNG receiving terminals’ access to existing pipelines, and their ability to obtain transportation capacity on existing pipelines; statements regarding the Cheniere Southern Trail Pipeline, and its potential business opportunities; statements regarding the Cheniere Southern Trail Pipeline, and its potential business opportunities; statements regarding possible expansions of the currently projected size of any of our proposed LNG receiving terminals, and statements regarding potential acquisitions; statements regarding the payment by Cheniere Energy Partners, L.P. of cash distributions; statements regarding our business strategy, our business plan or any other plans, forecasts, examples, models, or objectives, any or all of which are subject to change; statements regarding estimated corporate overhead expenses; and any other statements that relate to non-historical information. These forward-looking statements are often identified by the use of terms and phrases such as "achieve," "anticipate," "believe," "estimate," "example," "expect," "forecast," "opportunities," "plan," "potential," "project," "propose," "subject to," and similar terms and phrases. Although we believe that the expectations reflected in these forward-looking statements are reasonable, they do involve assumptions, risks and uncertainties, and these expectations may prove to be incorrect. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of a variety of factors, including those discussed in "Risk Factors" in the Cheniere Energy, Inc. Annual Report on Form 10-K for the year ended December 31, 2007, which are incorporated by reference into this presentation. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by these "Risk Factors". These forward-looking statements are made as of the date of this presentation, and we undertake no obligation to publicly update or revise any forward-looking statements. Safe Harbor Act 2

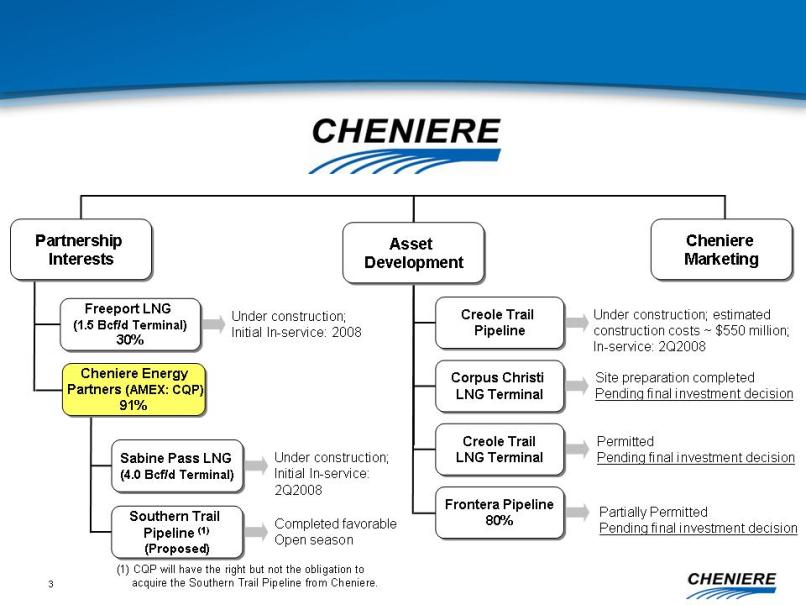

Cheniere Marketing Asset Development Partnership Interests Cheniere Energy Partners (AMEX: CQP) 91% Freeport LNG (1.5 Bcf/d Terminal) 30% Sabine Pass LNG (4.0 Bcf/d Terminal) Southern Trail Pipeline (1) (Proposed) Creole Trail Pipeline Under construction; estimated construction costs ~ $550 million; In-service: 2Q2008 Corpus Christi LNG Terminal Site preparation completed Pending final investment decision Creole Trail LNG Terminal Permitted Pending final investment decision Frontera Pipeline 80% Under construction; Initial In-service: 2008 Under construction; Initial In-service: 2Q2008 Completed favorable Open season Partially Permitted Pending final investment decision (1) CQP will have the right but not the obligation to acquire the Southern Trail Pipeline from Cheniere.

Freeport LNG Development, L.P. Cheniere Energy, Inc. 30% Freeport LNG Construction Site August 2007 TUA Contracts totaling 1.55 Bcf/d Conoco 0.90 Bcf/d Dow 0.50 Bcf/d Mitsubishi 0.15 Bcf/d Operational in 2008 Facility ownership: Cheniere (30%), M. Smith (45%), Contango (10%) and Dow (15%) Contango recently sold their 10% interest to Osaka Gas for $68 million Freeport LNG has obtained ~$1.1 billion debt to fund construction Cheniere expects to receive annual cash receipts of ~$15mm 4

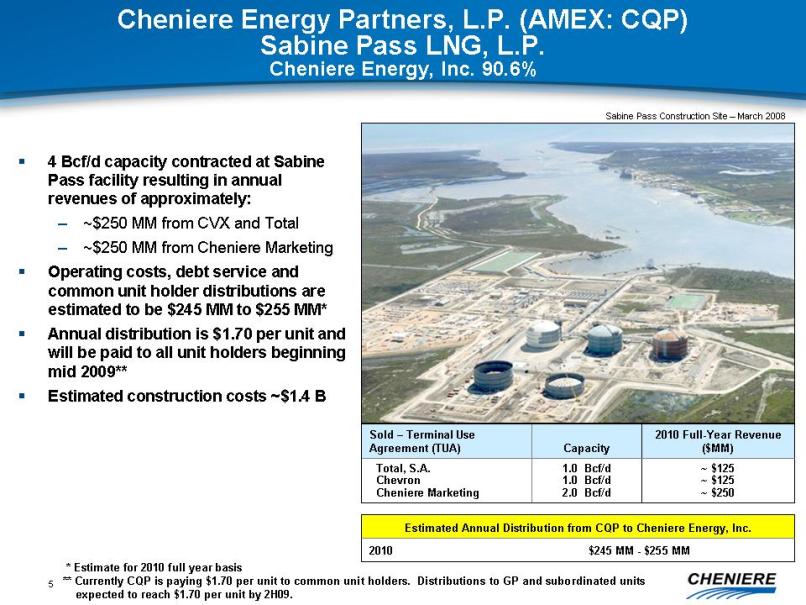

Cheniere Energy Partners, L.P. (AMEX: CQP) abine Pass LNG, L.P. Cheniere Energy, Inc. 90.6% Sabine Pass Construction Site – March 2008 4 Bcf/d capacity contracted at Sabine Pass facility resulting in annual revenues of approximately: ~$250 MM from CVX and Total ~$250 MM from Cheniere Marketing Operating costs, debt service and common unit holder distributions are estimated to be $245 MM to $255 MM* Annual distribution is $1.70 per unit and will be paid to all unit holders beginning mid 2009** Estimated construction costs ~$1.4 B * Estimate for 2010 full year basis ** Currently CQP is paying $1.70 per unit to common unit holders. Distributions to GP and subordinated units expected to reach $1.70 per unit by 2H09. 5

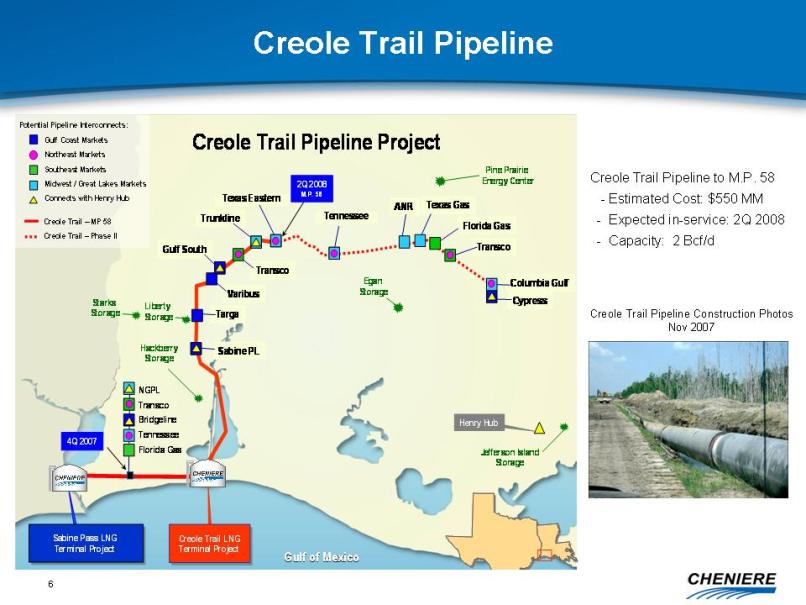

Creole Trail Pipeline Creole Trail Pipeline Construction Photos Nov 2007 Creole Trail Pipeline to M.P. 58 - Estimated Cost: $550 MM - Expected in-service: 2Q 2008 - Capacity: 2 Bcf/d Potential Pipeline Interconnects: Gulf coast Markets Northeast markets southeast Markets Midwest / Great Lakes Markets Connects with Henry Hub Creole Trail – MP 58 Creole Trail – Phase II Sabine Pass LNG Terminal Project Creole Trail LNG Terminal Project CHENIERE NGPL Transco Bridgeline Tennessee Florida Gas Sabine PL Targa Varibus Transco Gulf South Trunkline Texas Eastern Tennessee ANR Texas Gas Florida Gas Transco Golumbia Gulf Cypress 2Q 2008 P.P. 58 4Q 2007

Next Generation of Terminals Including Some Terminals Under Construction Higher construction costs: ~ $1 billion for 1 Bcf/d Utilization constraints Operational Marine access Pipeline takeaway Storage Market size and access Affects regional price basis Seasonality $0.32 per MMBtu TUA is a thing of the past 7

Fuel Efficiency Projects : Projects include installation of waste heat recovery units and ambient air vaporizers Waste heat recovery utilizes waste heat from gas turbine generator exhaust to heat water for use in the submerged combustion vaporizers Ambient air vaporizers reheat LNG without using fuel Proposed projects would result in fuel savings, which would allow for partial monetization of the 2% LNG retained Savings depends on LNG throughput at the terminal Savings will also depend on number of ambient air vaporizers that can be effectively installed Estimated to save potentially 50-75% of the 2% LNG retainage Estimated project completions Waste heat recovery: 2010 Ambient air vaporizers: 2010-2011 8

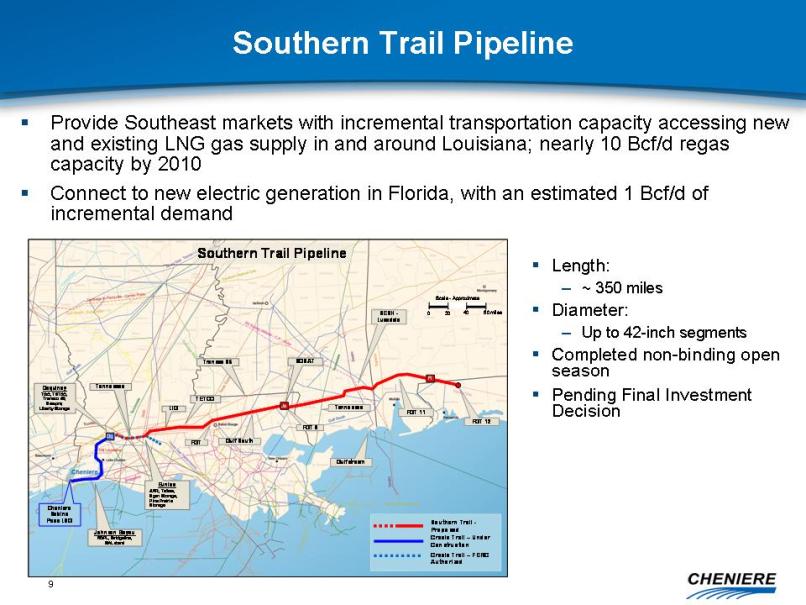

Length: ~ 350 miles Diameter: Up to 42-inch segments Completed non-binding open season Pending Final Investment Decision : Southern Trail Pipeline Provide Southeast markets with incremental transportation capacity accessing new and existing LNG gas supply in and around Louisiana; nearly 10 Bcf/d regas capacity by 2010 Connect to new electric generation in Florida, with an estimated 1 Bcf/d of incremental demand

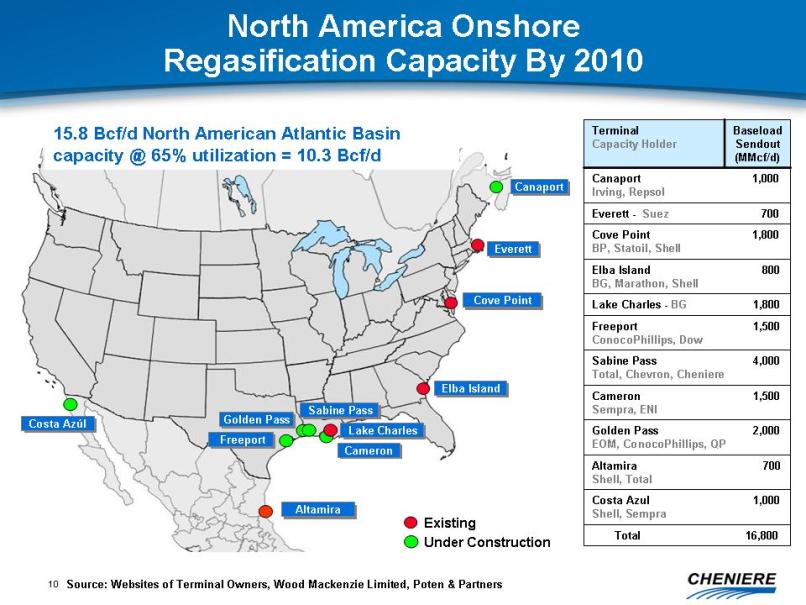

Terminal Capacity Holder Baseload Sendout (MMcf/d) Sabine Pass Freeport Golden Pass Cameron Costa Azúl Canaport Existing Under Construction Altamira Source: Websites of Terminal Owners, Wood Mackenzie Limited, Poten & Partners : North America Onshore Regasification Capacity By 2010 15.8 Bcf/d North American Atlantic Basin capacity @ 65% utilization = 10.3 Bcf/d Irving, Repsol 1,000 Canaport Everett – Suez 700 cove Point BP, Statoil, Shell 1,800 Elba Island BG, Marathon, Shell 800 Lake Charles – BG 1,800 Freeport 1,500 ConocoPhillips, Dow 1,500 Sabine Pass Total, chevron, Cheniere 4,000 Cameron Sempra, ENI 1,500 Golden Pass EOM, ConocoPhillips, QP 2,000 Altamira shell, Total 700 costa Azul Shell, Sempra 1,00 Total 16,800

LNG Fundamentals

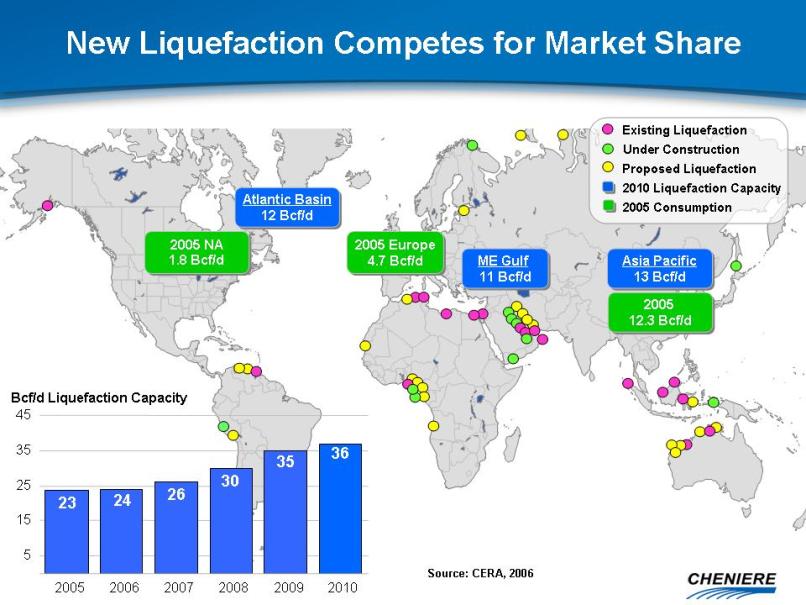

New Liquefaction Competes for Market Share Source: CERA, 2006 Atlantic Basin 12 Bcf/d ME Gulf 11 Bcf/d Asia Pacific 13 Bcf/d 2005 Europe 4.7 Bcf/d 2005 12.3 Bcf/d 2005 NA 1.8 Bcf/d (Gp:) 2010 Liquefaction Capacity (Gp:) 2005 Consumption 5 15 25 35 45 36 23 24 26 30 35 Bcf/d Liquefaction Capacity Existing Liquefaction Under Construction Proposed Liquefaction 2005 2006 2007 2008 2009 2010

Estimated Worldwide Liquefaction Capacity and LNG Consumption - 2010 Global Liquefaction Capacity (Bcf/d) 36 Estimated LNG Delivery @ 90% 32 Asian Consumption <~16> European Consumption <~ 6> Remaining for North America ~10 Source: Cheniere Research

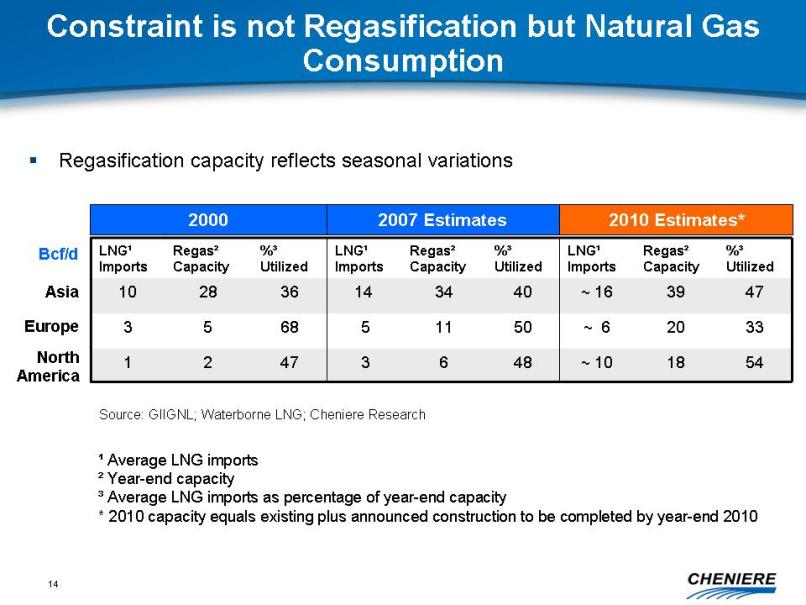

Constraint is not Regasification but Natural Gas Consumption Source: GIIGNL; Waterborne LNG; Cheniere Research Regasification capacity reflects seasonal variations Bcf/d Asia Europe North America 1. Average LNG imports 2. Year-end capacity 3. Average LNG imports as percentage of year-end capacity * 2010 capacity equals existing plus announced construction to be completed by year-end 2010 2000 2007 Estimates 2010 Estimates* LNG 1 Imports 2 47 3 6 48 ~ 10 18 54 5 68 5 11 50 ~ 6 20 33 28 36 14 34 40 ~ 16 39 47 % 3 Utilized Regas 2 Capacity LNG1 Imports % 3 Utilized Regas 2 Capacity LNG 1 Imports %3 Utilized Regas 2 Capacity 10 301 14

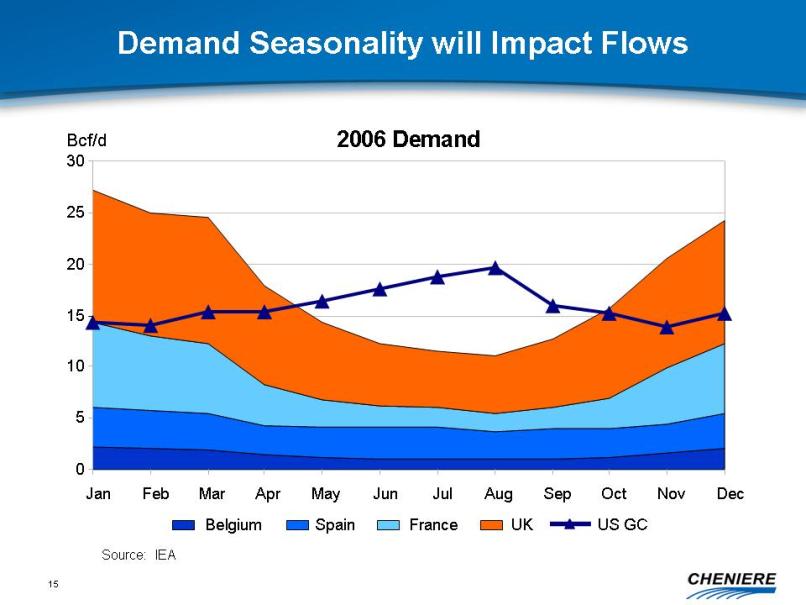

Demand Seasonality will Impact Flows Source: IEA 2006 Demand 0 5 10 15 20 25 30 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Belgium Spain France UK US GC Bcf/d 15

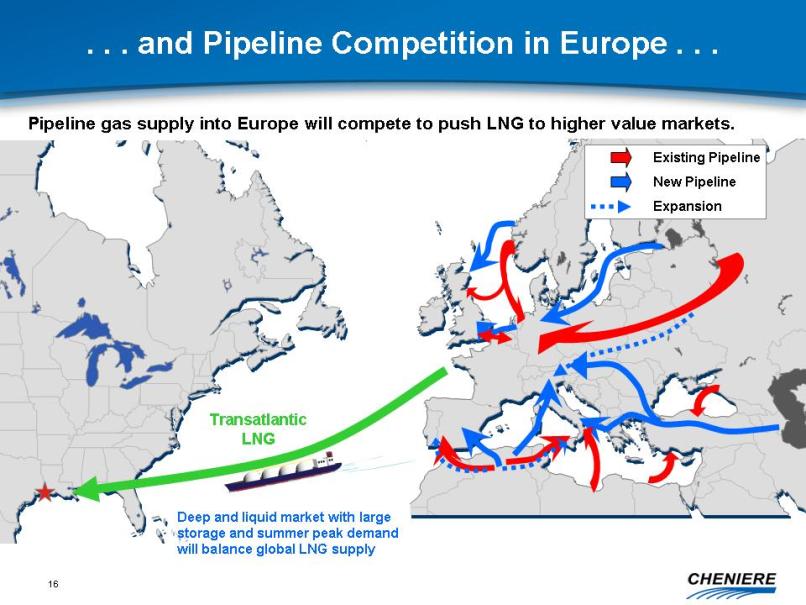

and Pipeline Competition in Europe . . . Transatlantic LNG Deep and liquid market with large storage and summer peak demand will balance global LNG supply Pipeline gas supply into Europe will compete to push LNG to higher value markets. New Pipeline Existing Pipeline Expansion

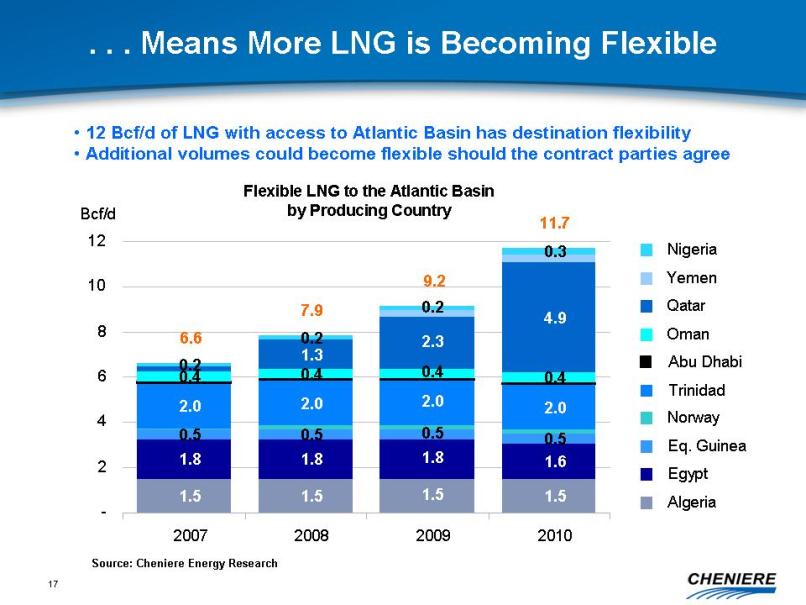

1.5 1.5 1.5 1.5 1.8 1.8 1.8 1.6 0.5 0.5 0.5 0.5 2.0 2.0 2.0 2.0 0.4 0.4 0.4 0.4 1.3 2.3 4.9 0.2 0.2 0.2 0.3 9.2 11.7 7.9 6.6 - 2 4 6 8 10 12 2007 2008 2009 2010 Bcf/d Nigeria Yemen Qatar Oman Abu Dhabi Trinidad Norway Eq. Guinea Egypt Algeria : . . . Means More LNG is Becoming Flexible Flexible LNG to the Atlantic Basin by Producing Country 12 Bcf/d of LNG with access to Atlantic Basin has destination flexibility Additional volumes could become flexible should the contract parties agree Source: Cheniere Energy Research 17

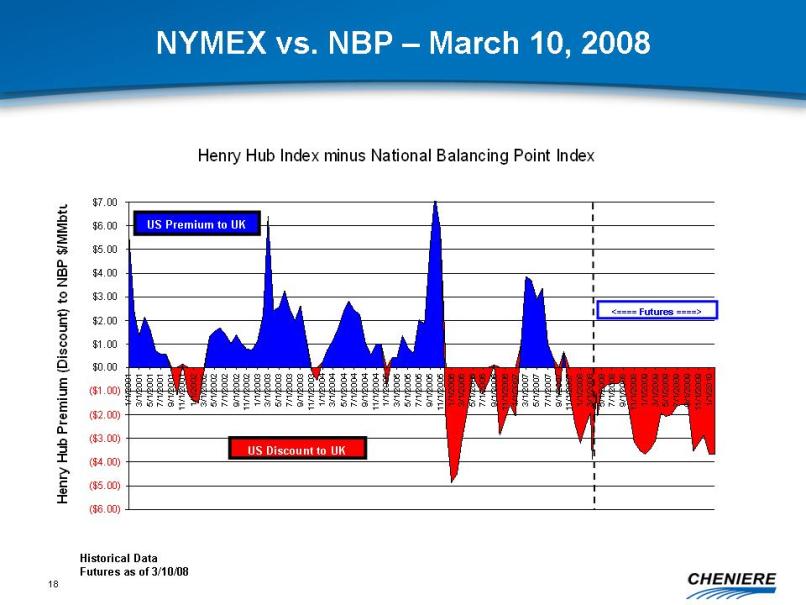

NYMEX vs. NBP – March 10, 2008 Historical Data Futures as of 3/10/08 Henry Hub Index minus National Balancing Point Index ($6.00) ($5.00) ($4.00) ($3.00) ($2.00) ($1.00) $0.00 $1.00 $2.00 $3.00 $4.00 $5.00 $6.00 $7.00 1/1/2001 3/1/2001 5/1/2001 7/1/2001 9/1/2001 11/1/2001 1/1/2002 3/1/2002 5/1/2002 7/1/2002 9/1/2002 11/1/2002 1/1/2003 3/1/2003 5/1/2003 7/1/2003 9/1/2003 11/1/2003 1/1/2004 3/1/2004 5/1/2004 7/1/2004 9/1/2004 11/1/2004 1/1/2005 3/1/2005 5/1/2005 7/1/2005 9/1/2005 11/1/2005 1/1/2006 3/1/2006 5/1/2006 7/1/2006 9/1/2006 11/1/2006 1/1/2007 3/1/2007 5/1/2007 7/1/2007 9/1/2007 11/1/2007 1/1/2008 3/1/2008 5/1/2008 7/1/2008 9/1/2008 11/1/2008 1/1/2009 3/1/2009 5/1/2009 7/1/2009 9/1/2009 11/1/2009 1/1/2010 Henry Hub Premium (Discount) to NBP $/MMbtu US Premium to UK US Discount to UK <==== Futures ====>

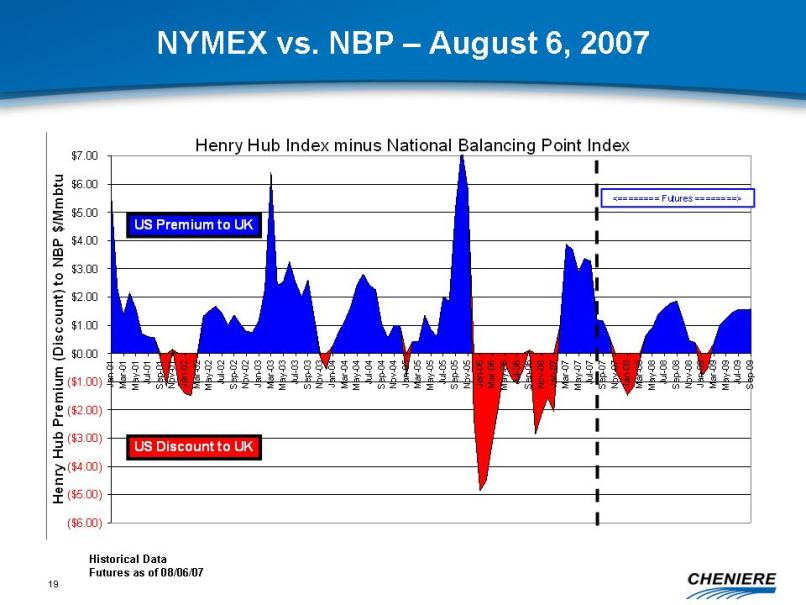

NYMEX vs. NBP – August 6, 2007 Historical Data Futures as of 08/06/07 Henry Hub Index minus National Balancing Point Index ($6.00) ($5.00) ($4.00) ($3.00) ($2.00) ($1.00) $0.00 $1.00 $2.00 $3.00 $4.00 $5.00 $6.00 $7.00 Jan-01 Mar-01 May-01 Jul-01 Sep-01 Nov-01 Jan-02 Mar-02 May-02 Jul-02 Sep-02 Nov-02 Jan-03 Mar-03 May-03 Jul-03 Sep-03 Nov-03 Jan-04 Mar-04 May-04 Jul-04 Sep-04 Nov-04 Jan-05 Mar-05 May-05 Jul-05 Sep-05 Nov-05 Jan-06 Mar-06 May-06 Jul-06 Sep-06 Nov-06 Jan-07 Mar-07 May-07 Jul-07 Sep-07 Nov-07 Jan-08 Mar-08 May-08 Jul-08 Sep-08 Nov-08 Jan-09 Mar-09 May-09 Jul-09 Sep-09 Henry Hub Premium (Discount) to NBP $/Mmbtu <======== Futures ========> US Premium to UK US Discount to UK 19

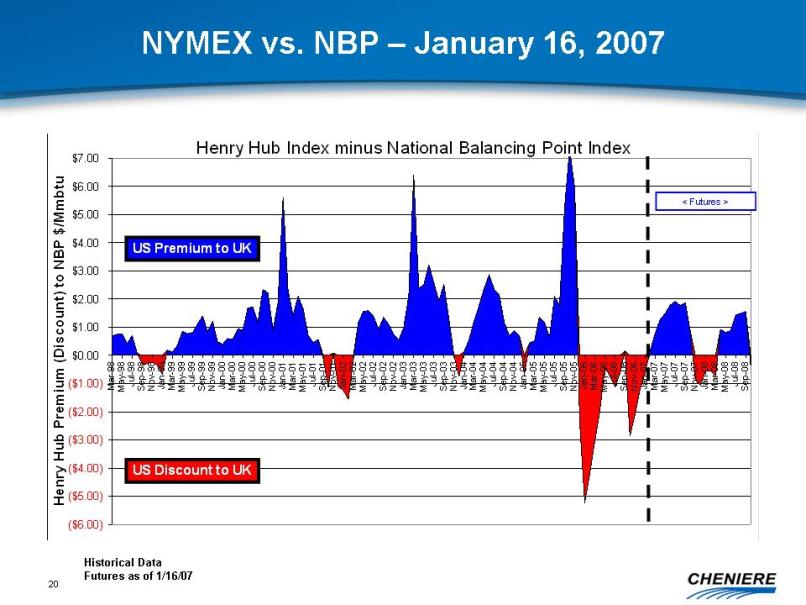

NYMEX vs. NBP – January 16, 2007 Historical Data Futures as of 1/16/07 Henry Hub Index minus National Balancing Point Index ($6.00) ($5.00) ($4.00) ($3.00) ($2.00) ($1.00) $0.00 $1.00 $2.00 $3.00 $4.00 $5.00 $6.00 $7.00 Mar-98 May-98 Jul-98 Sep-98 Nov-98 Jan-99 Mar-99 May-99 Jul-99 Sep-99 Nov-99 Jan-00 Mar-00 May-00 Jul-00 Sep-00 Nov-00 Jan-01 Mar-01 May-01 Jul-01 Sep-01 Nov-01 Jan-02 Mar-02 May-02 Jul-02 Sep-02 Nov-02 Jan-03 Mar-03 May-03 Jul-03 Sep-03 Nov-03 Jan-04 Mar-04 May-04 Jul-04 Sep-04 Nov-04 Jan-05 Mar-05 May-05 Jul-05 Sep-05 Nov-05 Jan-06 Mar-06 May-06 Jul-06 Sep-06 Nov-06 Jan-07 Mar-07 May-07 Jul-07 Sep-07 Nov-07 Jan-08 Mar-08 May-08 Jul-08 Sep-08 Henry Hub Premium (Discount) to NBP $/Mmbtu 20 < Futures >

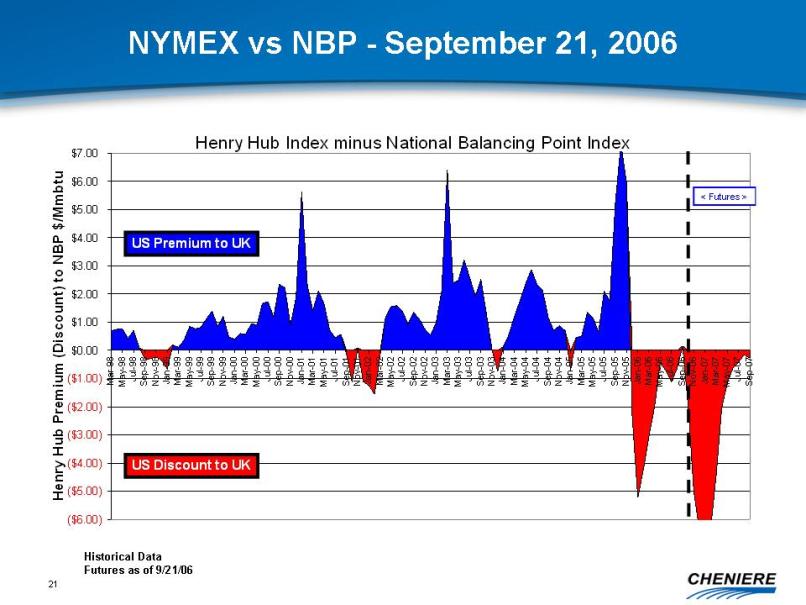

NYMEX vs NBP - September 21, 2006 (Gp:) Historical Data Futures as of 9/21/06 Henry Hub Index minus National Balancing Point Index ($6.00) ($5.00) ($4.00) ($3.00) ($2.00) ($1.00) $0.00 $1.00 $2.00 $3.00 $4.00 $5.00 $6.00 $7.00 Mar-98 May-98 Jul-98 Sep-98 Nov-98 Jan-99 Mar-99 May-99 Jul-99 Sep-99 Nov-99 Jan-00 Mar-00 May-00 Jul-00 Sep-00 Nov-00 Jan-01 Mar-01 May-01 Jul-01 Sep-01 Nov-01 Jan-02 Mar-02 May-02 Jul-02 Sep-02 Nov-02 Jan-03 Mar-03 May-03 Jul-03 Sep-03 Nov-03 Jan-04 Mar-04 May-04 Jul-04 Sep-04 Nov-04 Jan-05 Mar-05 May-05 Jul-05 Sep-05 Nov-05 Jan-06 Mar-06 May-06 Jul-06 Sep-06 Nov-06 Jan-07 Mar-07 May-07 Jul-07 Sep-07 Henry Hub Premium (Discount) to NBP $/Mmbtu < Futures > US Premium to UK US Discount to UK

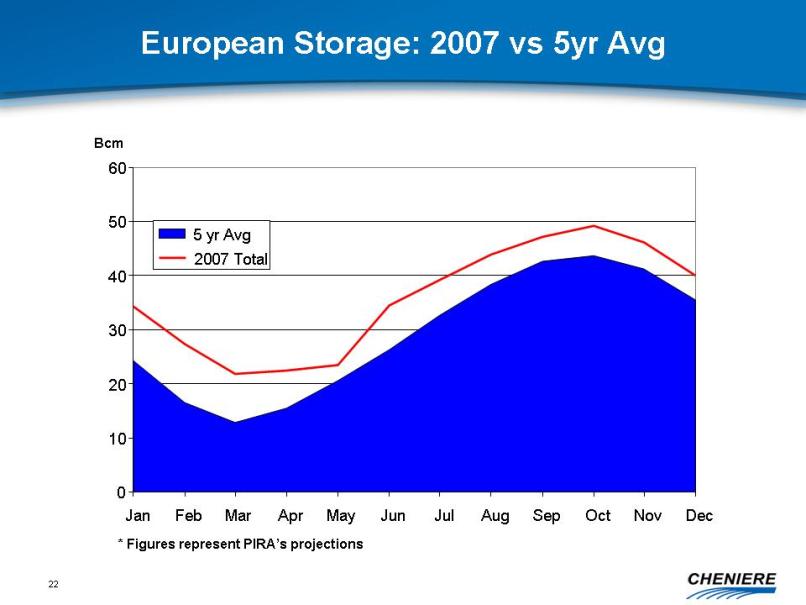

European Storage: 2007 vs 5yr Avg * Figures represent PIRA’s projections 0 10 20 30 40 50 60 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Bcm 5 yr Avg 2007 Total 22

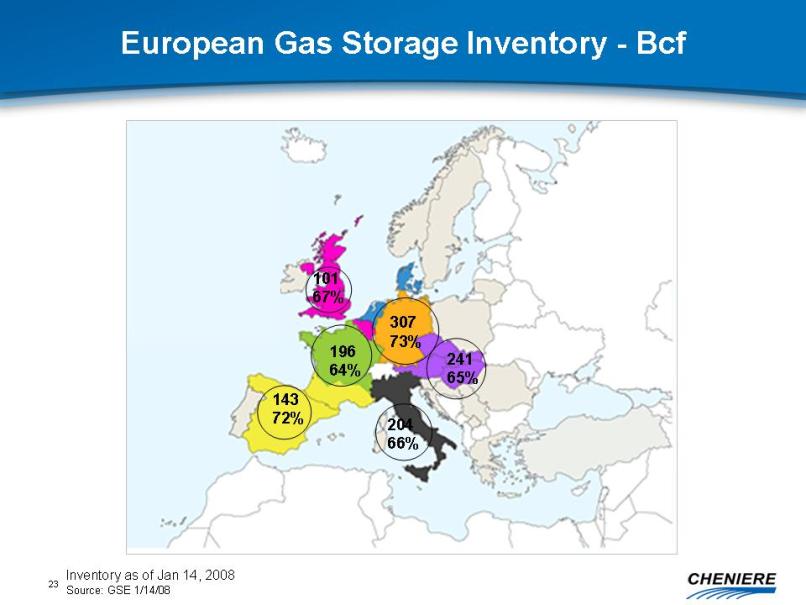

307 73% 143 72% 196 64% 101 67% 204 66% 241 65% : European Gas Storage Inventory - Bcf Inventory as of Jan 14, 2008 Source: GSE 1/14/08 23

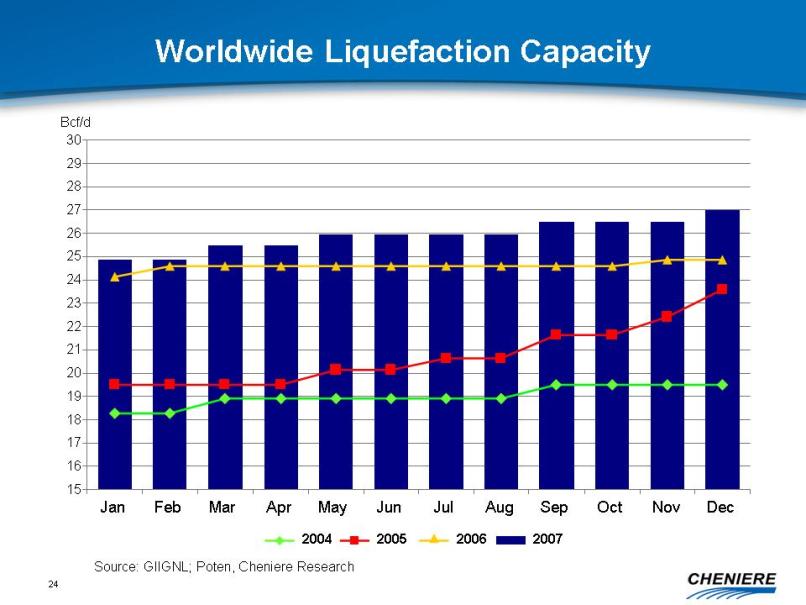

Worldwide Liquefaction Capacity Source: GIIGNL; Poten, Cheniere Research 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 2007 2004 2005 2006 Bcf/d 24

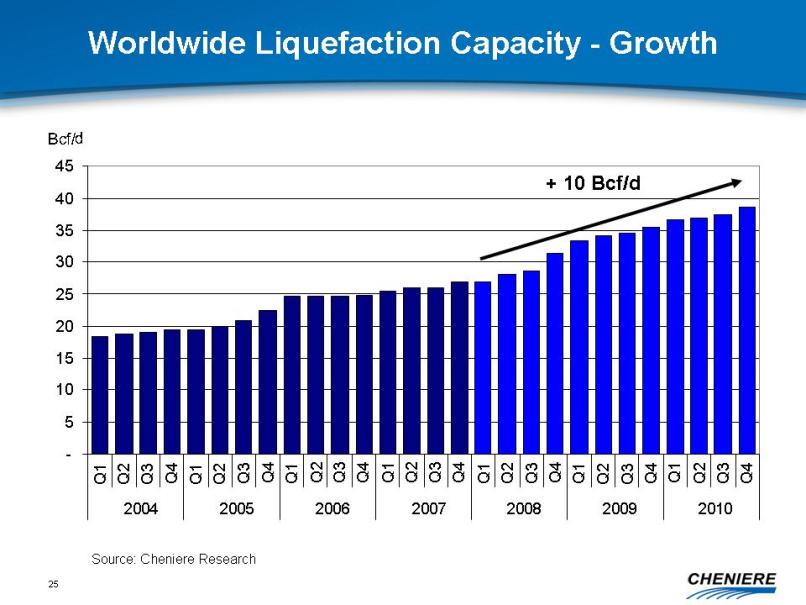

Worldwide Liquefaction Capacity - Growth - 5 10 15 20 25 30 35 40 45 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 2004 2005 2006 2007 2008 2009 2010 Bcf/d Source: Cheniere Research + 10 Bcf/d 25

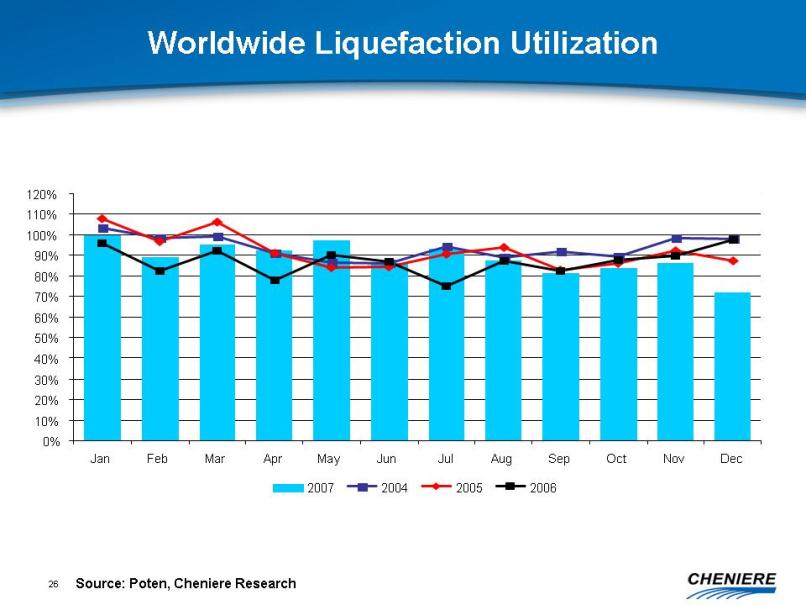

Worldwide Liquefaction Utilization Source: Poten, Cheniere Research 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 110% 120% Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 2007 2004 2005 2006

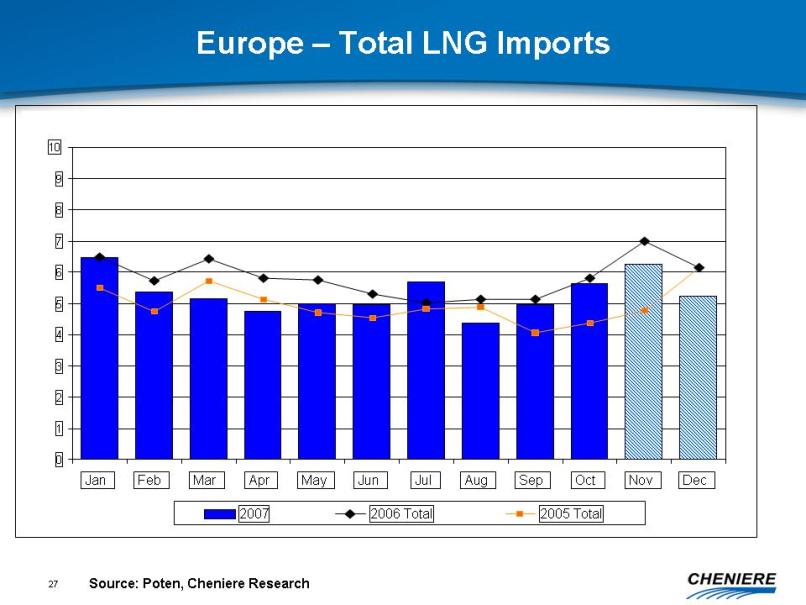

Europe – Total LNG Imports Source: Poten, Cheniere Research 0 1 2 3 4 5 6 7 8 9 10 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 2007 2006 Total 2005 Total 27

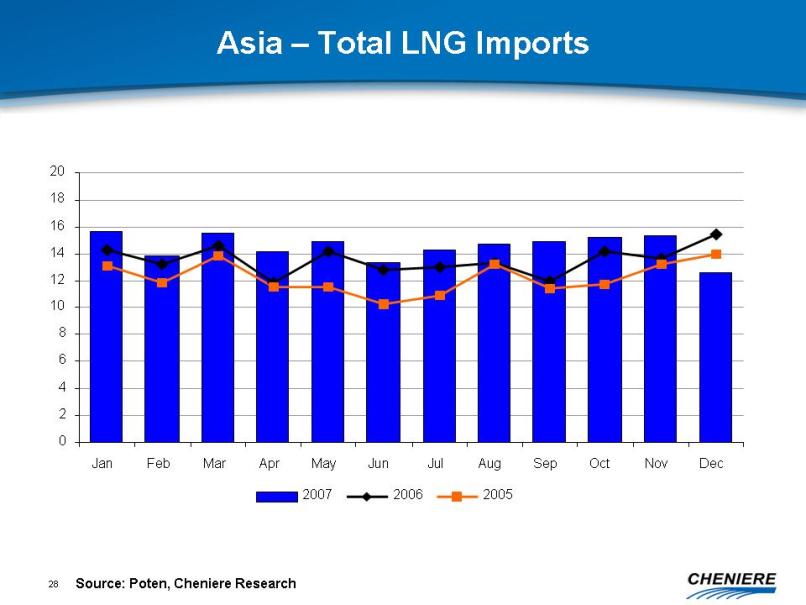

Asia – Total LNG Imports Source: Poten, Cheniere Research 0 2 4 6 8 10 12 14 16 18 20 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 2007 2006 2005 28

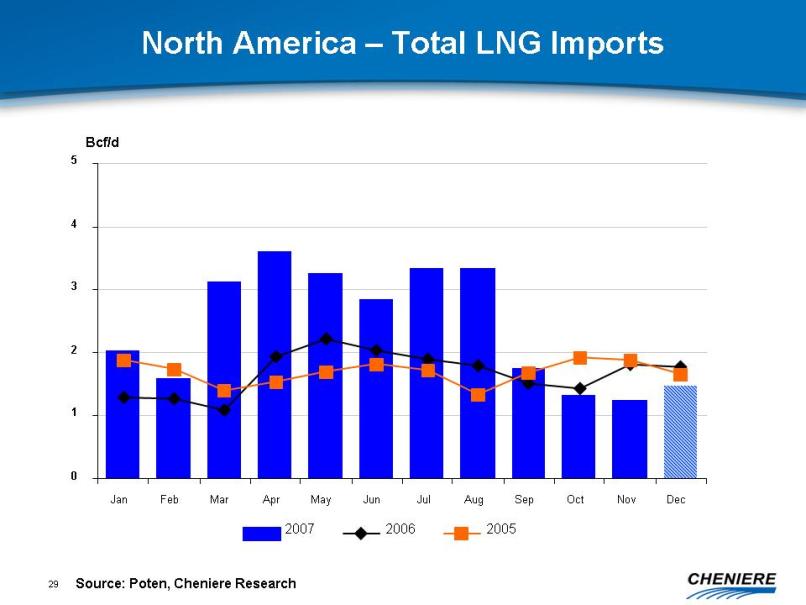

North America – Total LNG Imports Source: Poten, Cheniere Research 0 1 2 3 4 5 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Bcf/d 2007 2006 2005 29

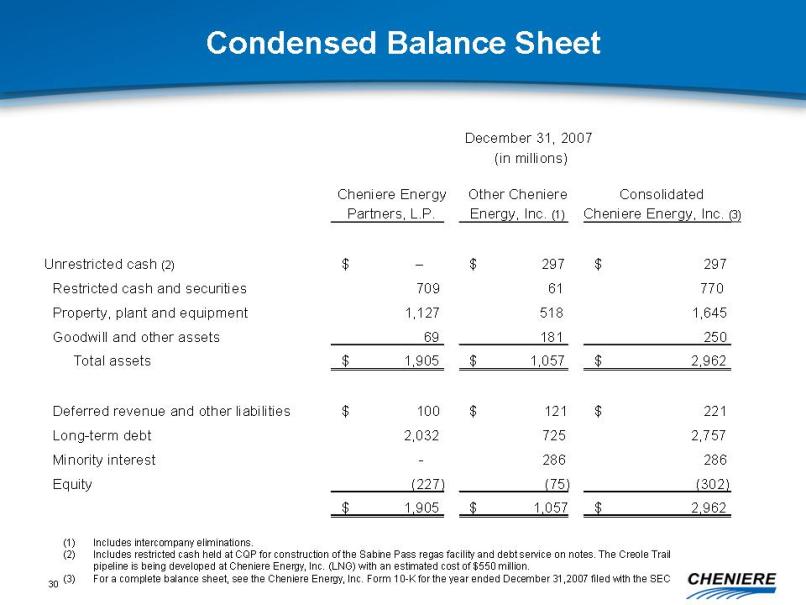

Condensed Balance Sheet Cheniere Energy Other Cheniere Consolidated Partners, L.P. Energy, Inc. (1) Cheniere Energy, Inc. (3) Unrestricted cash (2) - $ - 297 $ 297 $ Restricted cash and securities 709 61 770 Property, plant and equipment 1,127 518 1,645 Goodwill and other assets 69 181 250 Total assets 1,905 $ 1,057 $ 2,962 $ Deferred revenue and other liabilities 100 $ 121 $ 221 $ Long-term debt 2,032 725 2,757 Minority interest - 286 286 Equity (227) (75) (302) 1,905 $ 1,057 $ 2,962 $ Includes intercompany eliminations. Includes restricted cash held at CQP for construction of the Sabine Pass regas facility and debt service on notes. The Creole Trail pipeline is being developed at Cheniere Energy, Inc. (LNG) with an estimated cost of $550 million. For a complete balance sheet, see the Cheniere Energy, Inc. Form 10-K for the year ended December 31,2007 filed with the SEC December 31, 2007 (in millions) 30