Corporate

Presentation November 2007 CHENIERE ENERGY, INC. (Gp:) *Corpus Christi LNG,

LLC Cheniere Energy, Inc. 100% *Artist’s Rendition (Gp:) *Creole

Trail LNG, L.P. Cheniere Energy, Inc. 100% *Freeport LNG Development, L.P.

Cheniere Energy, Inc. 30% * Sabine Pass LNG, L.P. Cheniere Energy Partners,

L.P.

Cheniere Energy, Inc. 91%

This

presentation contains certain statements that are, or may be deemed to be,

“forward-looking statements” within the meaning of Section 27A of the Securities

Act and Section 21E of the Securities Exchange Act of 1934, as amended, or

the

Exchange Act. All statements, other than statements of historical

facts, included herein are “forward-looking statements.” Included

among “forward-looking statements” are, among other things: statements that we

expect to commence or complete construction of each or any of our proposed

liquefied natural gas, or LNG, receiving terminals by certain dates, or at

all;

statements that we expect to receive authorization from the Federal Energy

Regulatory Commission, or FERC, to construct and operate proposed LNG receiving

terminals by a certain date, or at all; statements regarding future levels

of

domestic natural gas production and consumption, or the future level of LNG

imports into North America, or regarding projected future capacity of

liquefaction or regasification, liquifaction utilization or total monthly

LNG

trade facilities worldwide, regardless of the source of such information

statements regarding any financing transactions or arrangements, whether

on the

part of Cheniere or at the project level; statements relating to the

construction of our proposed LNG receiving terminals, including statements

concerning estimated costs, and the engagement of any EPC

contractor; statements regarding any Terminal Use Agreement, or TUA,

or other commercial arrangements presently contracted, optioned, marketed

or

potential arrangements to be performed substantially in the future, including

any cash distributions and revenues anticipated to be received; statements

regarding the commercial terms and potential revenues from activities

described in this presentation; statements regarding the commercial terms

or

potential revenue from any arrangements which may arise from the marketing

of

uncommitted capacity from any of the terminals, including the Creole Trail

and

Corpus Christi terminals which do not currently have contractual commitments;

statements regarding the commercial terms or potential revenue from any

arrangement relating to the proposed contracting for excess or expansion

capacity for the Sabine Pass LNG Terminal or the Indexed Purchase Agreement

(“IPA”) or LNG spot purchase examples described in this presentation; statements

that our proposed LNG receiving terminals, when completed, will have certain

characteristics, including amounts of regasification and storage capacities,

a

number of storage tanks and docks and pipeline interconnections; statements

regarding Cheniere and Cheniere Marketing forecasts, and any potential revenues

and capital expenditures which may be derived from any of Cheniere business

groups; statements regarding Cheniere Pipeline Company, and the capital

expenditures and potential revenues related to this business group; statements

regarding our proposed LNG receiving terminals’ access to existing pipelines,

and their ability to obtain transportation capacity on existing pipelines;

statements regarding the Louisiana Natural Gas Header, and its

potential business opportunities statements regarding possible expansions

of the

currently projected size of any of our proposed LNG receiving terminals;

statements regarding the payment by Cheniere Energy Partners, L.P. of cash

distributions; statements regarding our business strategy, our business plan

or

any other plans, forecasts, examples, models, or objectives; any or all of

which

are subject to change; statements regarding estimated corporate overhead

expenses; and any other statements that relate to non-historical information.

These forward-looking statements are often identified by the use of terms

and

phrases such as “achieve,” “anticipate,” “believe,” “estimate,” “example,”

“expect,” “forecast,” “opportunities,” “plan,” “potential,” “project,”

“propose,” “subject to,” and similar terms and phrases. Although we

believe that the expectations reflected in these forward-looking statements

are

reasonable, they do involve assumptions, risks and uncertainties, and these

expectations may prove to be incorrect. You should not place undue

reliance on these forward-looking statements, which speak only as of the

date of

this presentation. Our actual results could differ materially from

those anticipated in these forward-looking statements as a result of a variety

of factors, including those discussed in “Risk Factors” in the Cheniere Energy,

Inc. Annual Report on Form 10-K for the year ended December 31, 2006, which

are

incorporated by reference into this presentation. All forward-looking

statements attributable to us or persons acting on our behalf are expressly

qualified in their entirety by these ”Risk Factors”. These

forward-looking statements are made as of the date of this presentation,

and we

undertake no obligation to publicly update or revise any forward-looking

statements. Safe Harbor Act

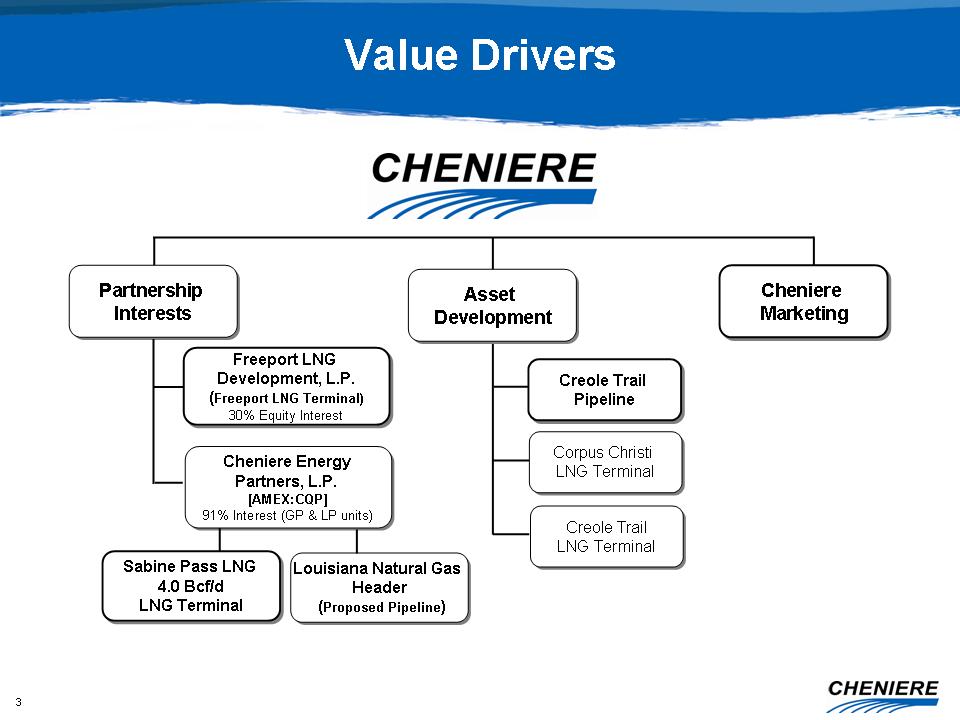

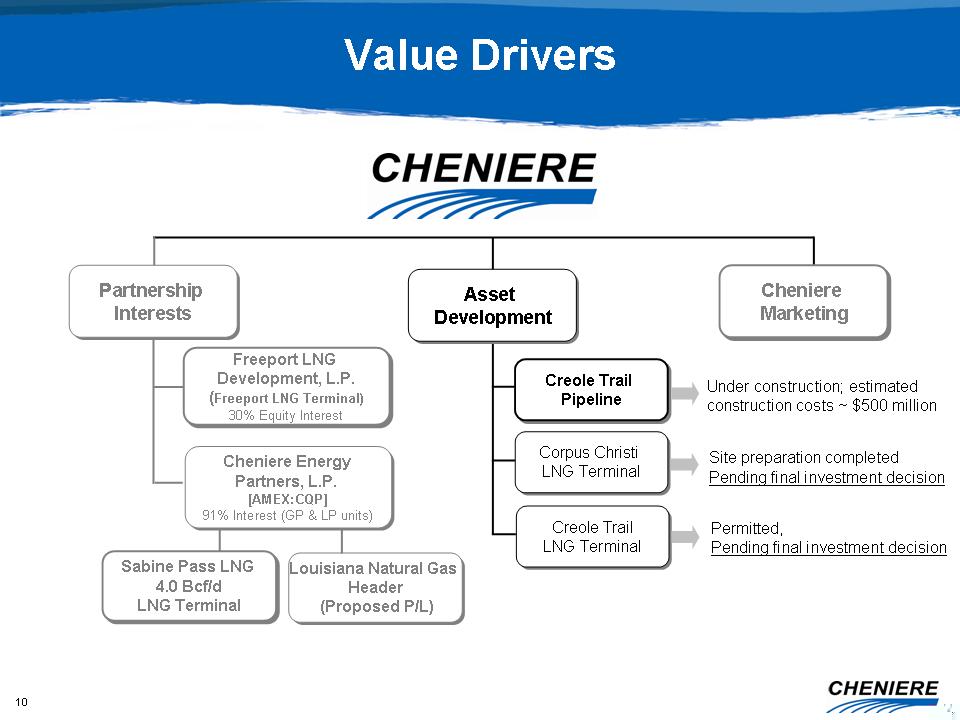

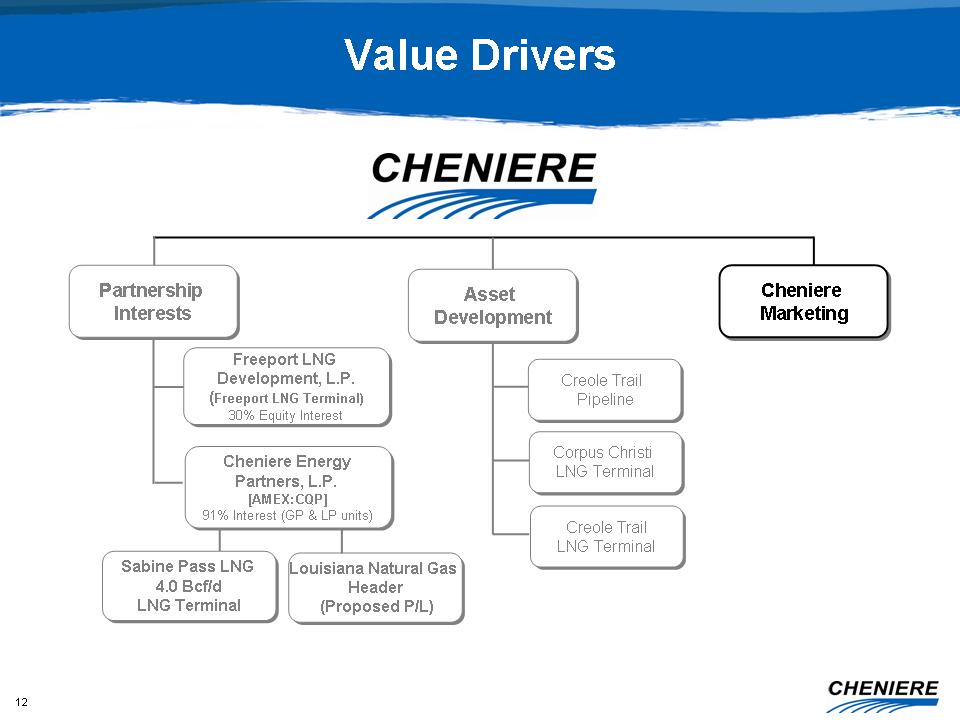

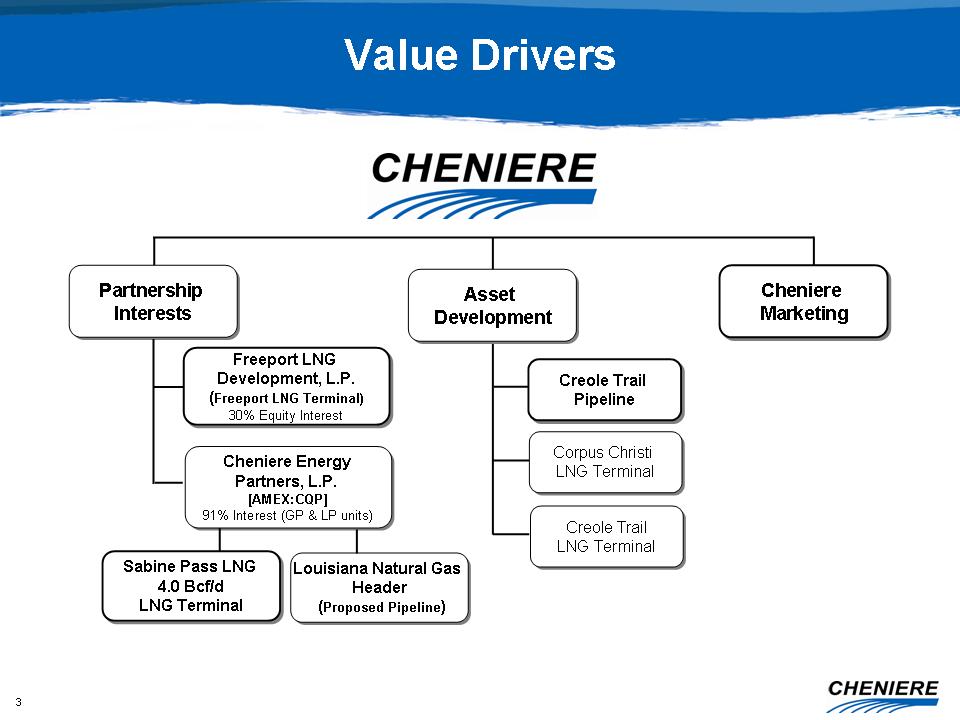

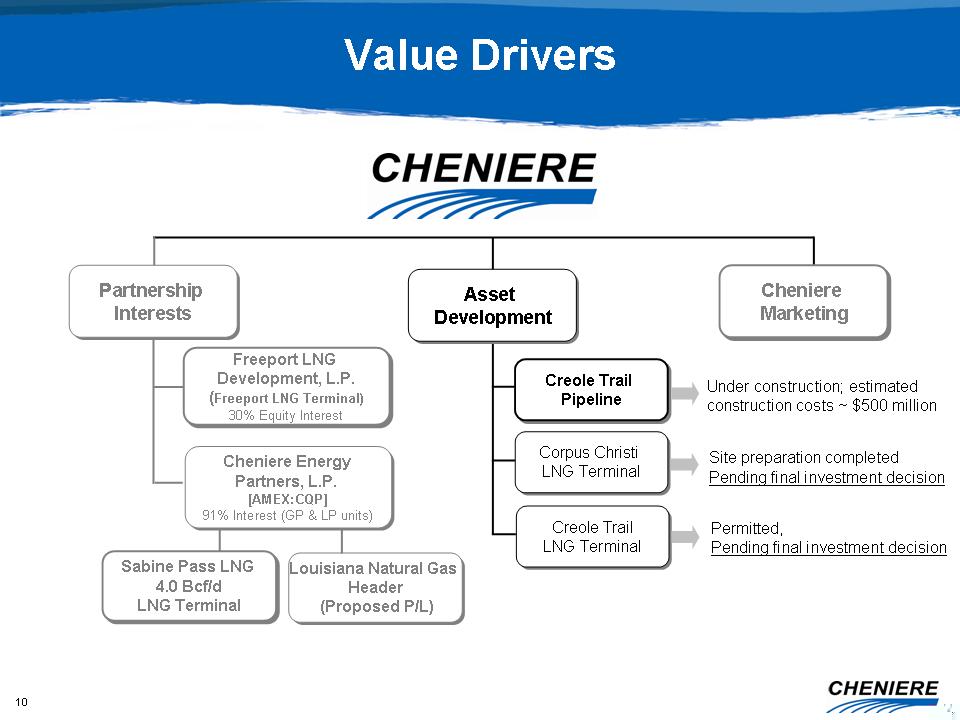

Value

Drivers Cheniere Marketing Asset Development Partnership Interests

Sabine Pass LNG 4.0 Bcf/d LNG TerminalCheniere

Energy Partners, L.P. [AMEX:CQP] 91% Interest (GP & LP

units) Creole Trail LNG Terminal Creole Trail Pipeline Corpus Christi LNG

Terminal Freeport LNG Development, L.P. (Freeport LNG Terminal) 30% Equity

Interest Louisiana Natural Gas Header (Proposed

Pipeline)

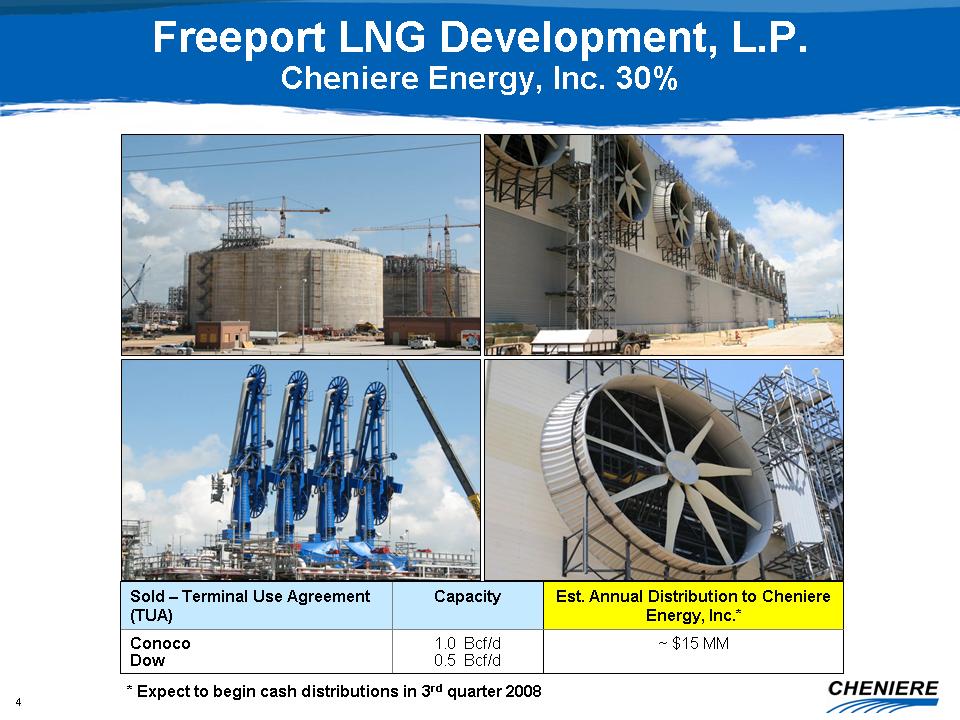

Freeport

LNG Development, L.P. Cheniere Energy, Inc. 30% * Expect to begin cash

distributions in 3rd quarter 2008

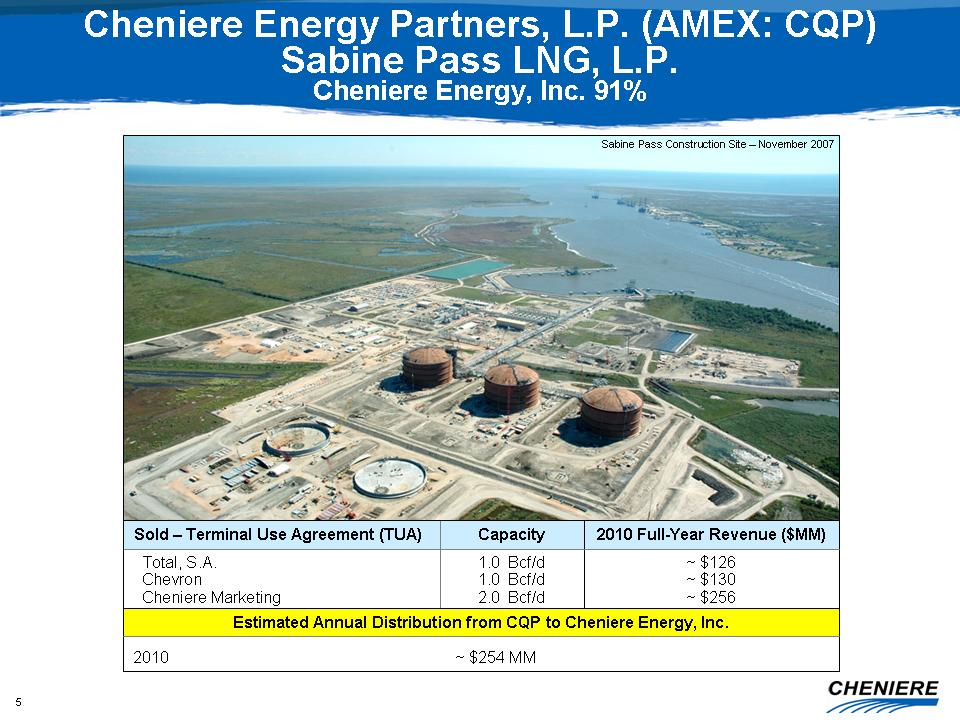

Cheniere

Energy Partners, L.P. (AMEX: CQP) Sabine Pass LNG, L.P. Cheniere Energy,

Inc.

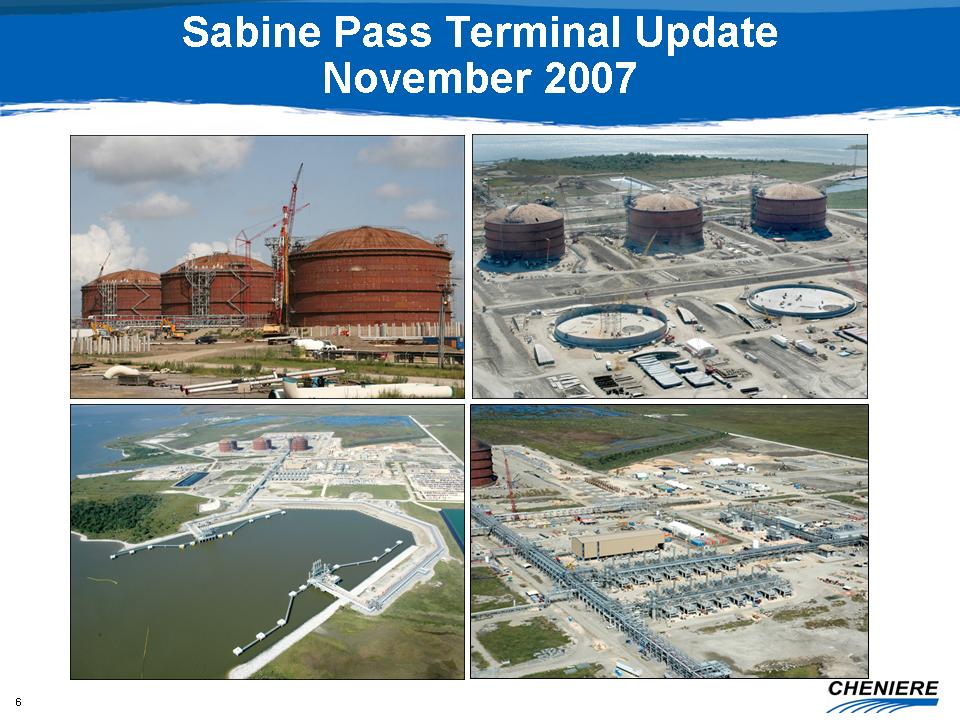

91% Sabine Pass Construction Site – November 2007

Sabine

Pass Terminal Update November 2007

Cheniere

Energy Partners Growth Projects Fuel Efficiency Projects at Sabine Pass LNG

Waste Heat Recovery and Ambient Air Vaporizers (AAV) More economical process

to

reheat LNG, replaces SCVs Developed over next few years, expected in-service

2010 – 2011 Funding from excess cash and financing Louisiana Natural Gas Header

Proposed pipeline extending from Louisiana to Alabama

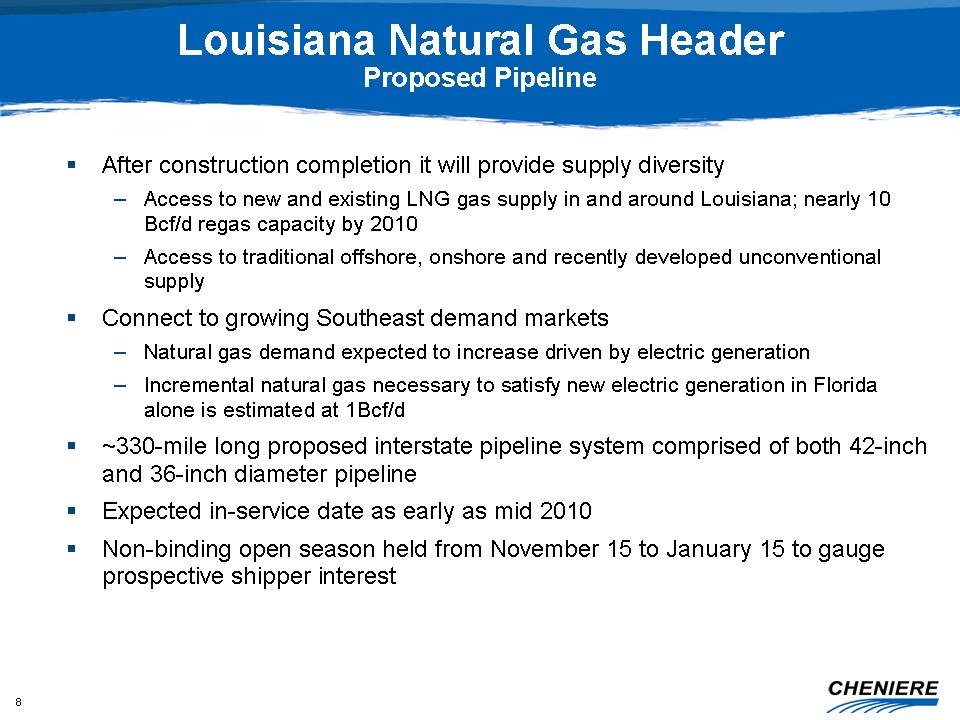

Louisiana

Natural Gas Header Proposed Pipeline After construction completion it will

provide supply diversity Access to new and existing LNG gas supply in and

around

Louisiana; nearly 10 Bcf/d regas capacity by 2010 Access to traditional

offshore, onshore and recently developed unconventional supply Connect to

growing Southeast demand markets Natural gas demand expected to increase

driven

by electric generation Incremental natural gas necessary to satisfy new electric

generation in Florida alone is estimated at 1Bcf/d ~330-mile long proposed

interstate pipeline system comprised of both 42-inch and 36-inch diameter

pipeline Expected in-service date as early as mid 2010 Non-binding open season

held from November 15 to January 15 to gauge prospective shipper

interest

Dq

SESH – Lucedale SONAT Gulf South FGT 11 Tennessee Dequincy TGC, TETCO, Transco

45, Sempra, Liberty Storage Cheniere Sabine Pass LNG Johnson Bayou NGPL,

Bridgeline, SWLateral TETCO FGT Tennessee (Gp:) Scale – Approximate (Gp:) 0

(Gp:) 40 (Gp:) 60 miles (Gp:) 20 FGT 9 Am LIG Louisiana Natural Gas Header

Gulfstream Eunice ANR, TxGas, Egan Storage, Pine Prairie Storage Transco

65

Louisiana Natural Gas Header Creole Trail – Under Construction Creole Trail –

FERC Authorized

Value

Drivers Cheniere Marketing Asset Development Partnership Interests Sabine

Pass

LNG 4.0 Bcf/d LNG Terminal Cheniere Energy Partners, L.P. [AMEX:CQP]

91% Interest (GP & LP units) Creole Trail LNG Terminal Creole Trail Pipeline

Corpus Christi LNG Terminal Freeport LNG Development, L.P. (Freeport LNG

Terminal) 30% Equity Interest Louisiana Natural Gas Header (Proposed P/L)

Under

construction; estimated construction costs ~ $500 million Site preparation

completed Pending final investment decision Permitted, Pending final investment

decision

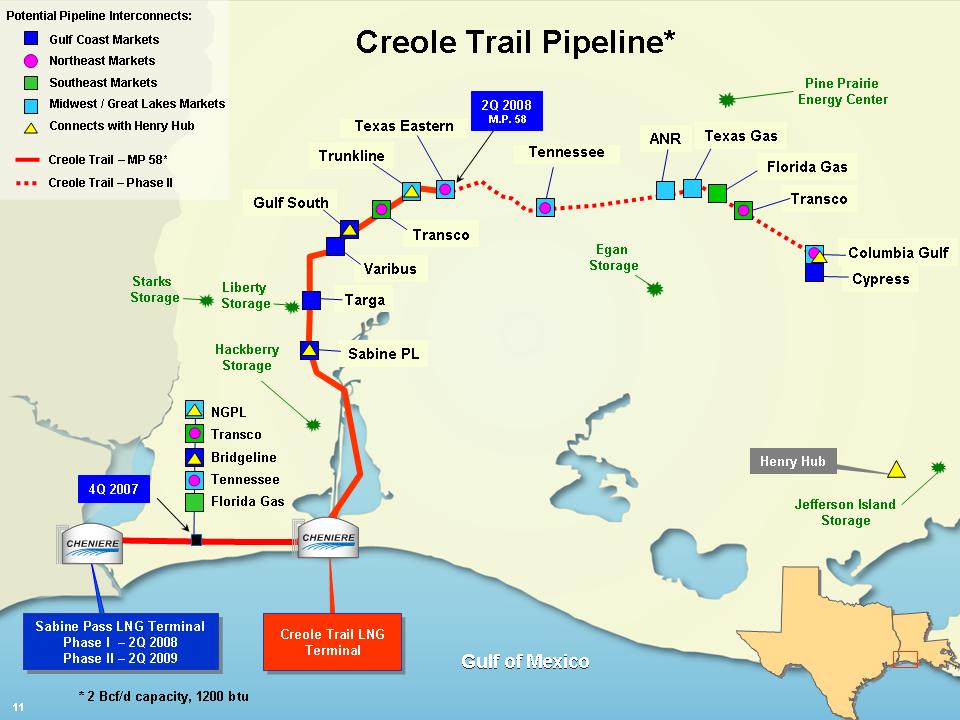

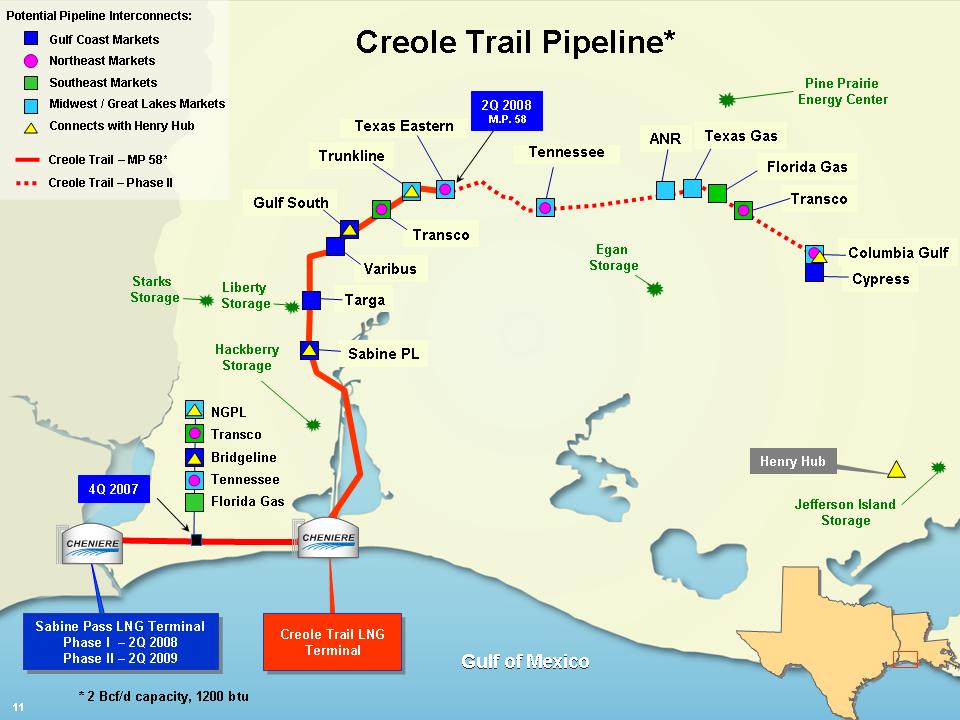

Sabine

PL Targa Transco Gulf South Trunkline Jefferson Island Storage Sabine Pass

LNG

Terminal Phase I – 2Q 2008 Phase II – 2Q 2009 Creole Trail LNG

Terminal Henry Hub Varibus NGPL Transco Bridgeline Tennessee Florida Gas

Creole

Trail Pipeline* Liberty Storage Starks Storage Hackberry Storage Texas Eastern

Gulf Coast Markets Northeast Markets Southeast Markets Midwest / Great Lakes

Markets Connects with Henry Hub Gulf of Mexico 4Q 2007 ANR Texas Gas Transco

Florida Gas Columbia Gulf Cypress Egan Storage Pine Prairie Energy Center

Tennessee 2Q 2008 M.P. 58 Creole Trail – MP 58* Creole Trail – Phase II 11

Potential Pipeline Interconnects: * 2 Bcf/d capacity, 1200

btu

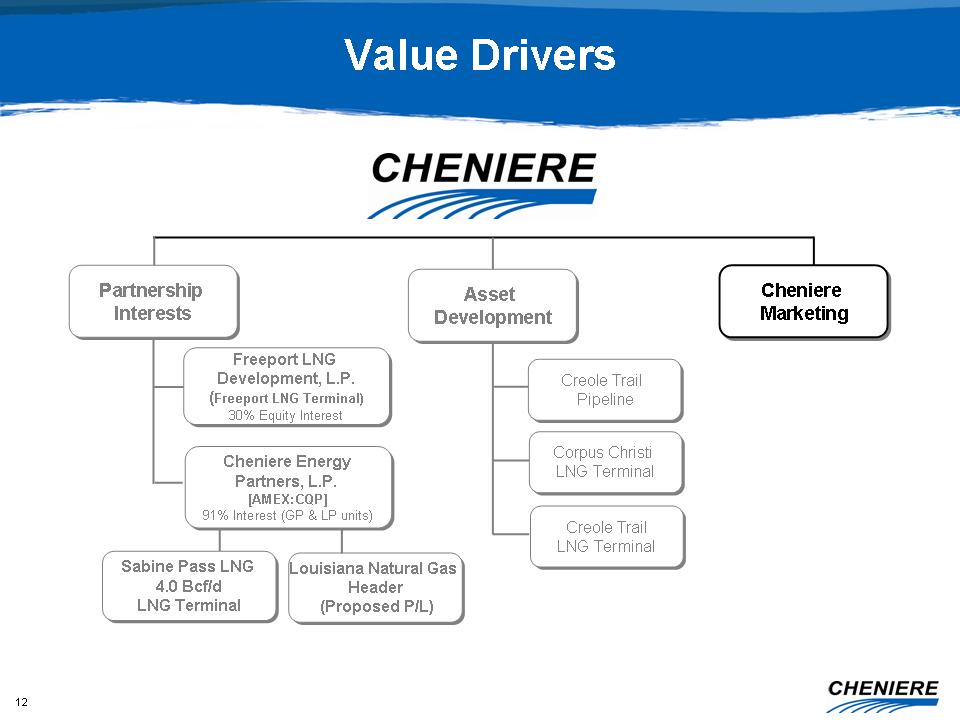

Value

Drivers Cheniere Marketing Asset Development Partnership Interests Sabine

Pass

LNG 4.0 Bcf/d LNG Terminal Cheniere Energy Partners, L.P. [AMEX:CQP] 91%

Interest (GP & LP units) Creole Trail LNG Terminal Creole Trail Pipeline

Corpus Christi LNG Terminal Freeport LNG Development, L.P. (Freeport LNG

Terminal) 30% Equity Interest Louisiana Natural Gas Header (Proposed

P/L)

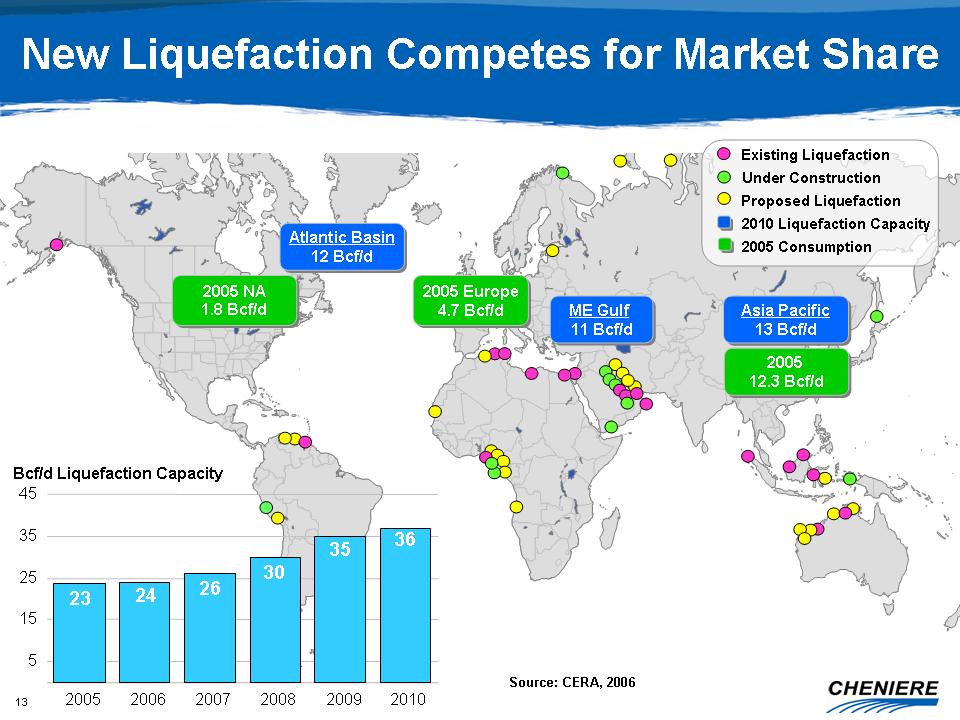

New

Liquefaction Competes for Market Share Source: CERA, 2006 Atlantic Basin

12

Bcf/d ME Gulf 11 Bcf/d Asia Pacific 13 Bcf/d 2005 Europe 4.7 Bcf/d

2005 12.3 Bcf/d 2005 NA 1.8 Bcf/d (Gp:) 2010 Liquefaction Capacity

(Gp:) 2005 Consumption 5 15 25 35 45 2005 2006 2007 2008 2009 2010 36 23

24 26

30 35 Bcf/d Liquefaction Capacity Existing Liquefaction Under Construction

Proposed Liquefaction

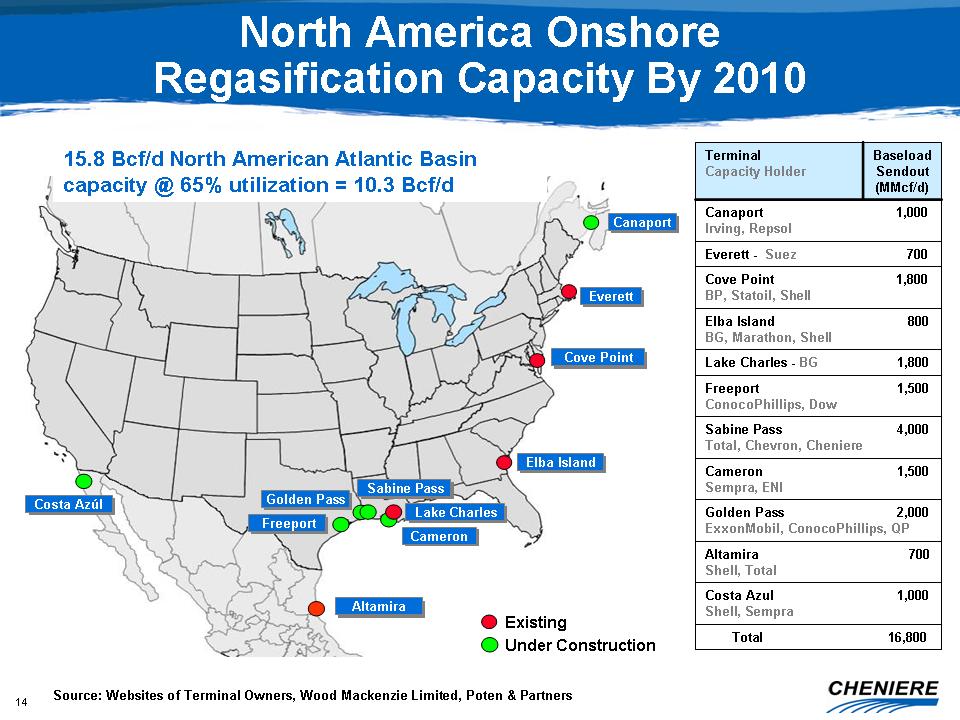

Everett

Cove Point Elba Island Lake Charles Sabine Pass Freeport Golden Pass Cameron

Costa Azúl Canaport Existing Under Construction Altamira Source: Websites of

Terminal Owners, Wood Mackenzie Limited, Poten & Partners North America

Onshore Regasification Capacity By 2010 15.8 Bcf/d North American Atlantic

Basin

capacity @ 65% utilization = 10.3 Bcf/d

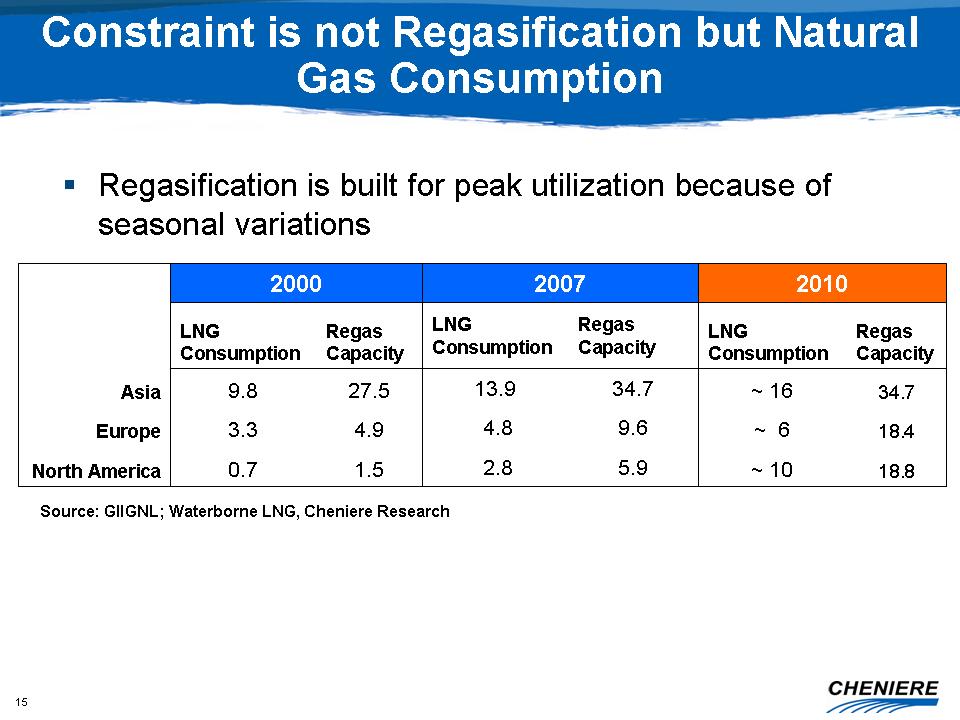

Constraint

is not Regasification but Natural Gas Consumption Source: GIIGNL; Waterborne

LNG, Cheniere Research Regasification is built for peak utilization because

of

seasonal variations

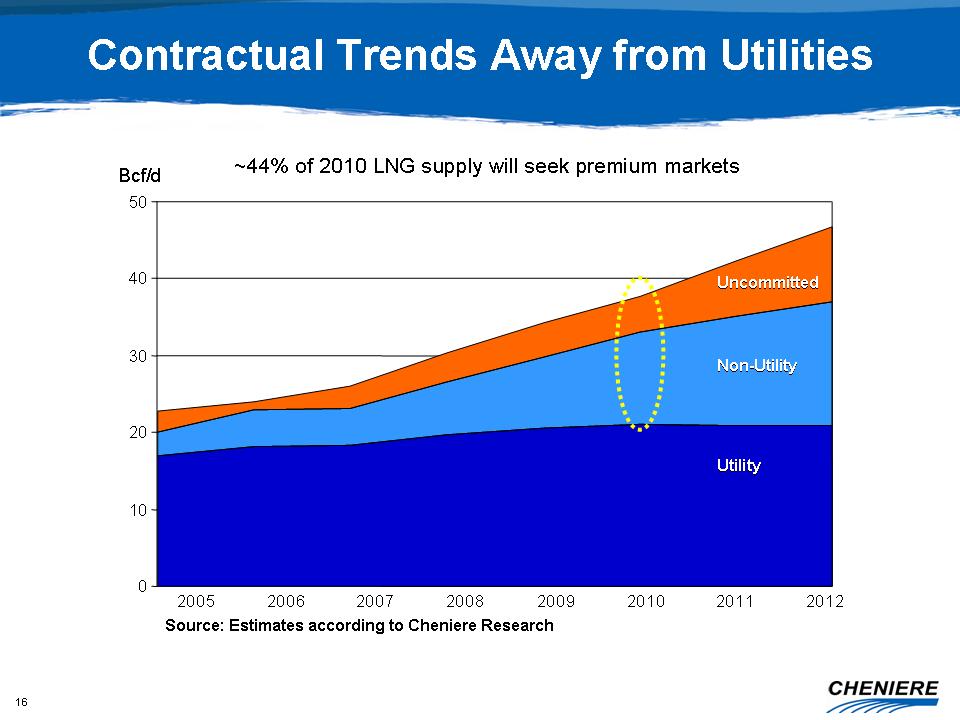

Contractual

Trends Away from Utilities 0 10 20 30 40 50 Bcf/d 2005 2006 2007 2008 2009

2010

2011 2012 Non-Utility Uncommitted Utility ~44% of 2010 LNG supply will seek

premium markets Source: Estimates according to Cheniere

Research

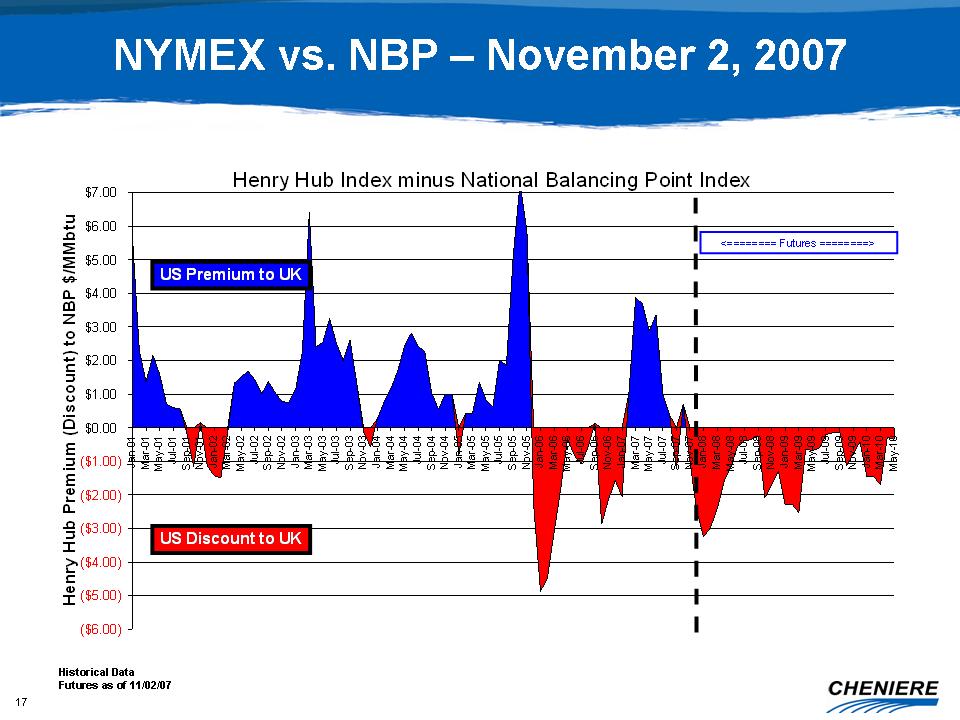

17 NYMEX

vs. NBP – November 2, 2007 Historical Data Futures as of

11/02/07

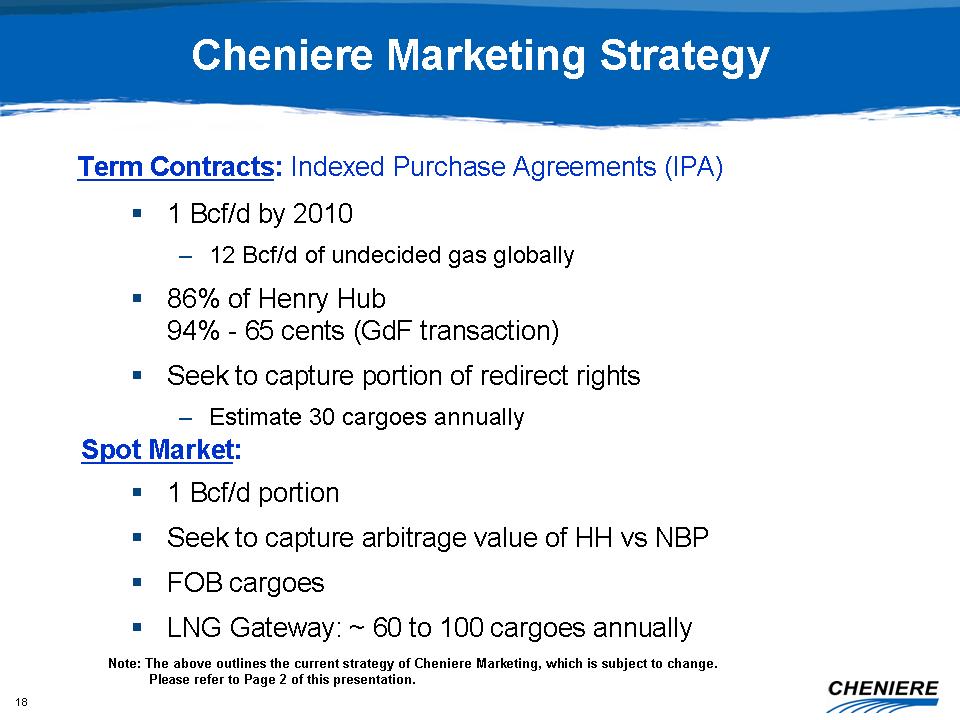

18 1

Bcf/d by 2010 12 Bcf/d of undecided gas globally 86% of Henry

Hub

94%

- 65 cents (GdF transaction) Seek to capture portion of redirect rights

Estimate 30 cargoes annually

Title: Cheniere

Marketing

Strategy Term

Contracts: Indexed Purchase Agreements (IPA)Spot Market: 1 Bcf/d

portion Seek to capture arbitrage value of HH vs NBP FOB

cargoes LNG Gateway: ~ 60 to 100 cargoes annually Note: The above

outlines the current strategy of Cheniere Marketing, which is subject to

change.

Please

refer to Page 2 of this presentation.

19 Title: Cheniere

Growth Strategy Body: Pursue acquisitions for Cheniere Energy

Partners, L.P. (AMEX: CQP) Continue asset development: terminals and

pipelines Develop a balanced supply portfolio for Cheniere Marketing

between long-term IPA’s and LNG Gateway exposure to the spot, option and

short-term markets

20

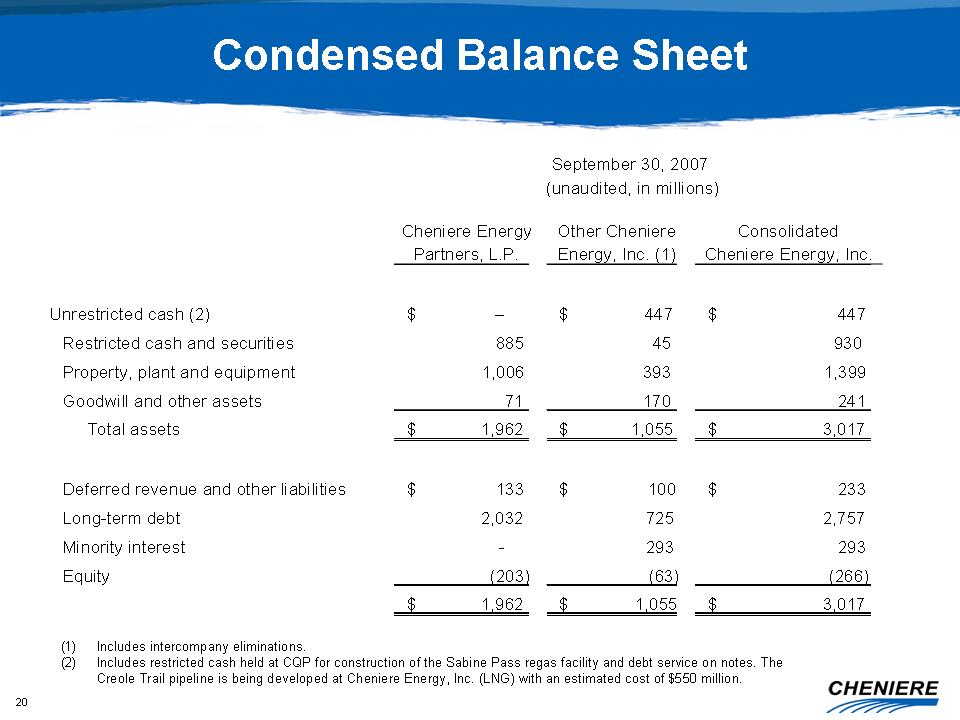

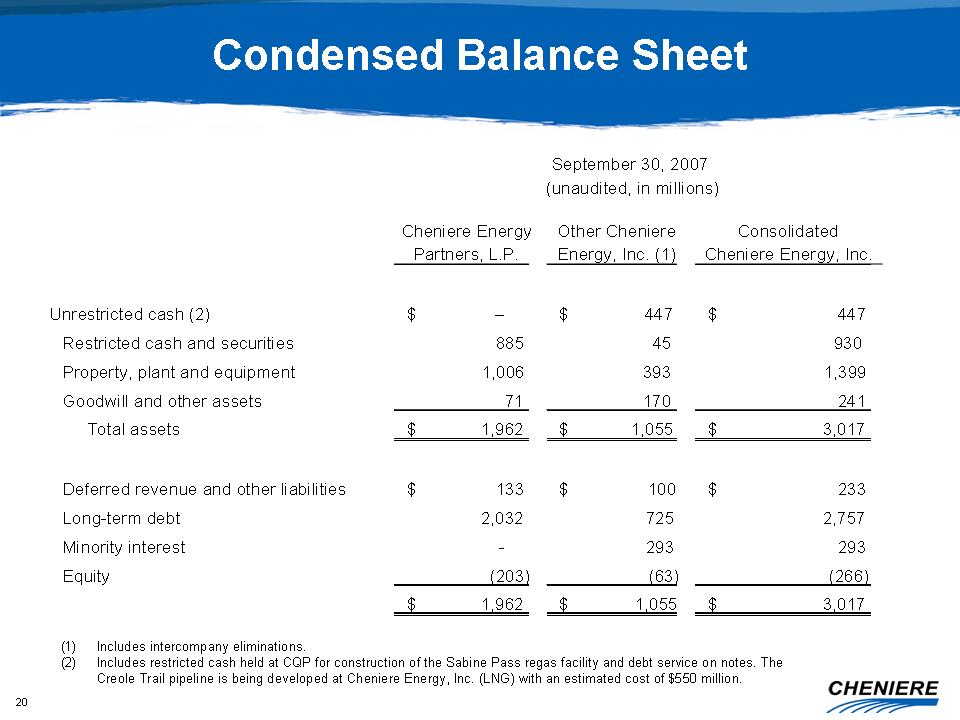

Title: Condensed Balance Sheet Cheniere Energy Other Cheniere Consolidated

Partners, L.P. Energy, Inc. (1) Cheniere Energy, Inc. Unrestricted cash (2)

-

$ - 447

$ 447

$ Restricted

cash and securities

885 45 930 Property,

plant and equipment

1,006 393 1,399 Goodwill

and other

assets 71 170 241 Total

assets 1,962 $ 1,055 $ 3,017 $ Deferred

revenue and other

liabilities 133 $ 100 $ 233 $ Long-term

debt 2,032 725 2,757 Minority

interest - 293 293 Equity (203) (63) (266) 1,962 $ 1,055 $ 3,017 $ Includes

intercompany eliminations. Includes restricted cash held at CQP for construction

of the Sabine Pass regas facility and debt service on notes. The Creole Trail

pipeline is being developed at Cheniere Energy, Inc. (LNG) with an estimated

cost of $550 million. September 30, 2007 (unaudited, in

millions)