Exhibit

99.1

Corporate

Presentation May 2007 CHENIERE ENERGY ,INC . *Corpus Christi LNG, LLC Cheniere

Energy, Inc. 100% *Artist’s Rendition *Creole Trail LNG, L.P. Cheniere Energy,

Inc. 100% *Freeport LNG Development, L.P. Cheniere Energy, Inc. 30% * Sabine

Pass LNG, L.P. Cheniere Energy Partners, L.P. Cheniere Energy, Inc.

91%

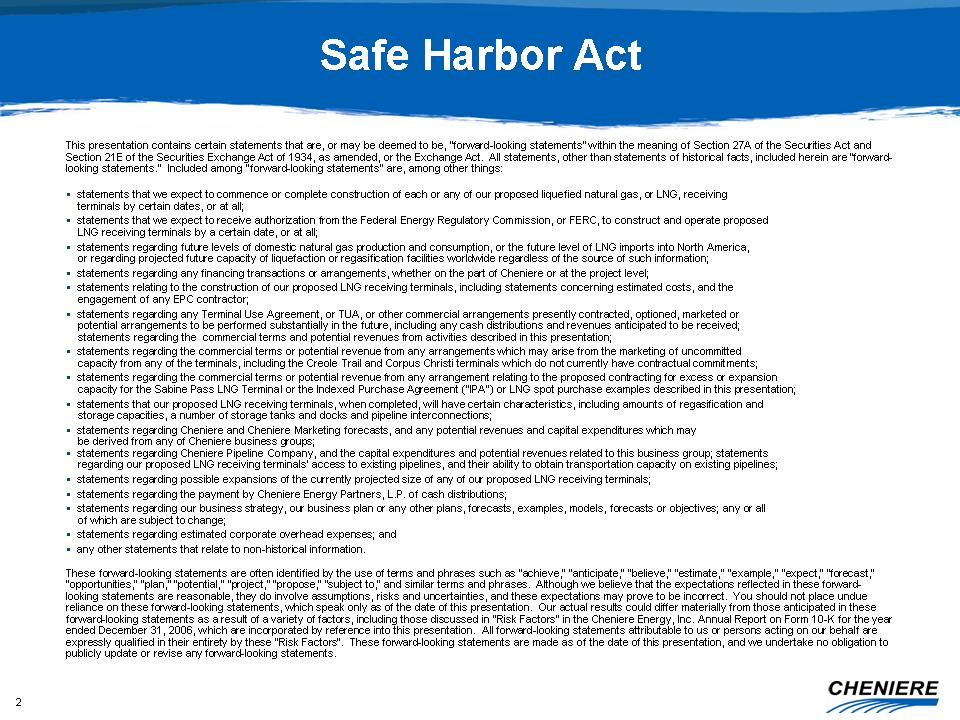

This

presentation contains certain statements that are, or may be deemed to be,

“forward-looking statements” within the meaning of Section 27A of the Securities

Act and Section 21E of the Securities Exchange Act of 1934, as amended, or

the

Exchange Act. All statements, other than statements of historical facts,

included herein are “forwardlooking statements.” Included among “forward-looking

statements” are, among other things: ?? statements that we expect to commence or

complete construction of each or any of our proposed liquefied natural gas,

or

LNG, receiving terminals by certain dates, or at all; ?? statements that

we

expect to receive authorization from the Federal Energy Regulatory Commission,

or FERC, to construct and operate proposed LNG receiving terminals by a certain

date, or at all; ?? statements regarding future levels of domestic natural

gas

production and consumption, or the future level of LNG imports into North

America, or regarding projected future capacity of liquefaction or

regasification facilities worldwide regardless of the source of such

information; ?? statements regarding any financing transactions or arrangements,

whether on the part of Cheniere or at the project level; ?? statements relating

to the construction of our proposed LNG receiving terminals, including

statements concerning estimated costs, and the engagement of any EPC contractor;

?? statements regarding any Terminal Use Agreement, or TUA, or other commercial

arrangements presently contracted, optioned, marketed or potential arrangements

to be performed substantially in the future, including any cash distributions

and revenues anticipated to be received; statements regarding the commercial

terms and potential revenues from activities described in this presentation;

??

statements regarding the commercial terms or potential revenue from any

arrangements which may arise from the marketing of uncommitted capacity from

any

of the terminals, including the Creole Trail and Corpus Christi terminals

which

do not currently have contractual commitments; ?? statements regarding the

commercial terms or potential revenue from any arrangement relating to the

proposed contracting for excess or expansion capacity for the Sabine Pass

LNG

Terminal or the Indexed Purchase Agreement (“IPA”) or LNG spot purchase examples

described in this presentation; ?? statements that our proposed LNG receiving

terminals, when completed, will have certain characteristics, including amounts

of regasification and storage capacities, a number of storage tanks and docks

and pipeline interconnections; ?? statements regarding Cheniere and Cheniere

Marketing forecasts, and any potential revenues and capital expenditures

which

may be derived from any of Cheniere business groups; ?? statements regarding

Cheniere Pipeline Company, and the capital expenditures and potential revenues

related to this business group; statements regarding our proposed LNG receiving

terminals’ access to existing pipelines, and their ability to obtain

transportation capacity on existing pipelines; ?? statements regarding possible

expansions of the currently projected size of any of our proposed LNG receiving

terminals; ?? statements regarding the payment by Cheniere Energy Partners,

L.P.

of cash distributions; ?? statements regarding our business strategy, our

business plan or any other plans, forecasts, examples, models, forecasts

or

objectives; any or all of which are subject to change; ?? statements regarding

estimated corporate overhead expenses; and ?? any other statements that relate

to non-historical information. These forward-looking statements are often

identified by the use of terms and phrases such as “achieve,” “anticipate,”

“believe,” “estimate,” “example,” “expect,” “forecast,” “opportunities,” “plan,”

“potential,” “project,” “propose,” “subject to,” and similar terms and phrases.

Although we believe that the expectations reflected in these forwardlooking

statements are reasonable, they do involve assumptions, risks and uncertainties,

and these expectations may prove to be incorrect. You should not place undue

reliance on these forward-looking statements, which speak only as of the

date of

this presentation. Our actual results could differ materially from those

anticipated in these forward-looking statements as a result of a variety

of

factors, including those discussed in “Risk Factors” in the Cheniere Energy,

Inc. Annual Report on Form 10-K for the year ended December 31, 2006, which

are

incorporated by reference into this presentation. All forward-looking statements

attributable to us or persons acting on our behalf are expressly qualified

in

their entirety by these ”Risk Factors”. These forward-looking statements are

made as of the date of this presentation, and we undertake no obligation

to

publicly update or revise any forward-looking statements. Safe Harbor Act

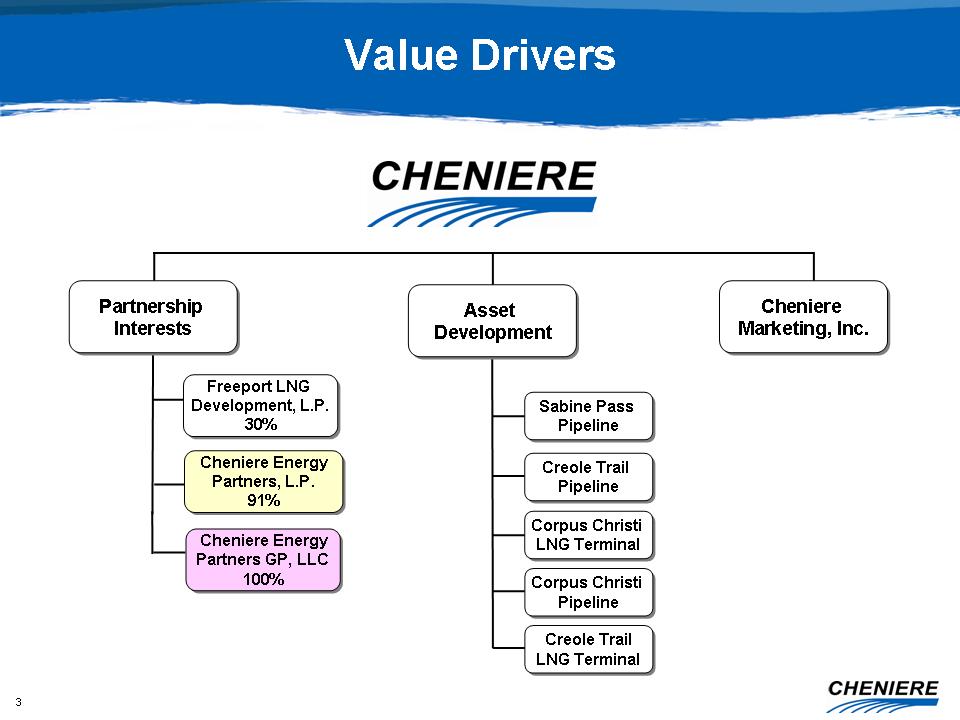

3

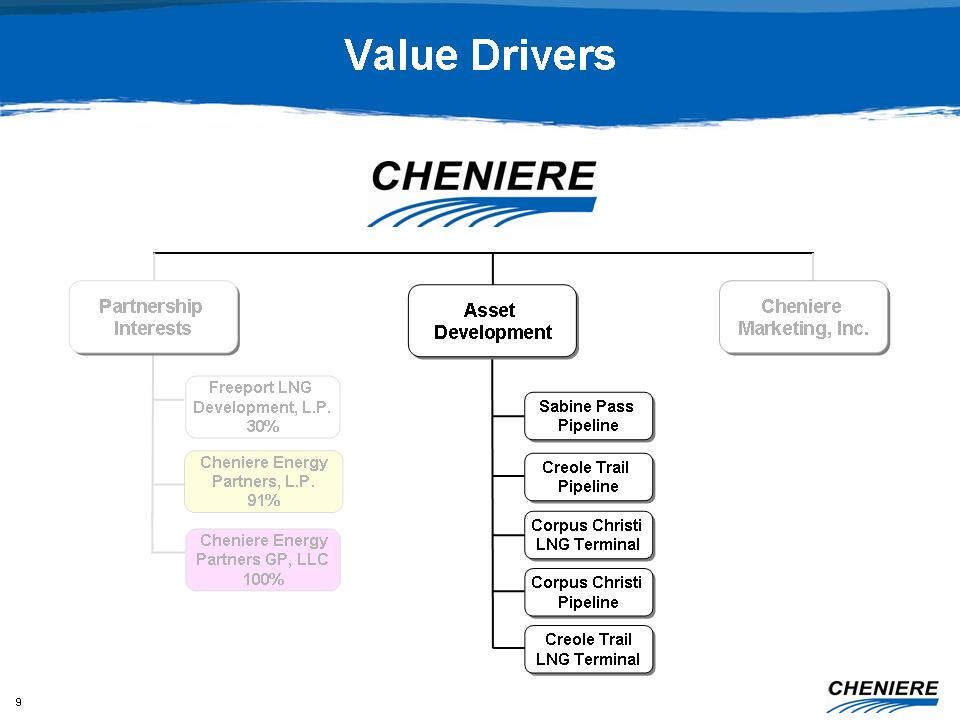

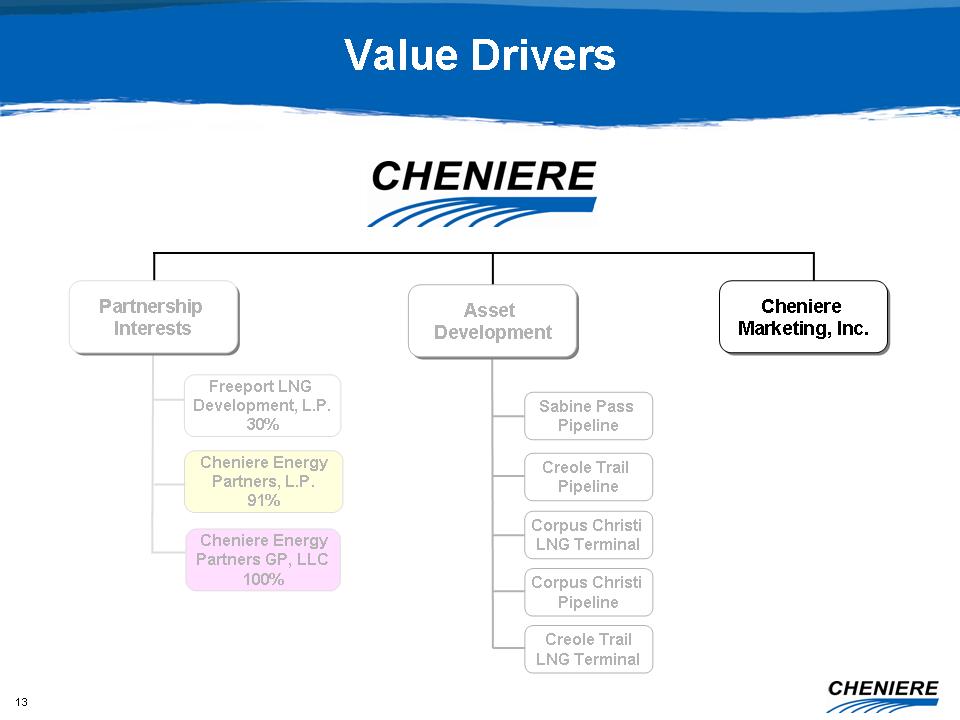

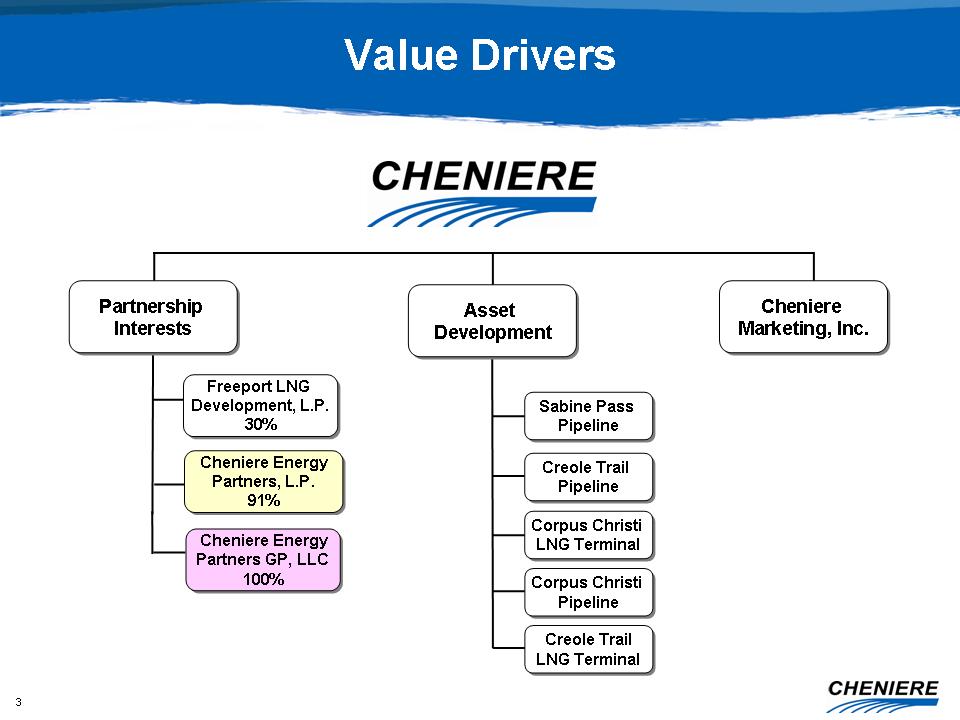

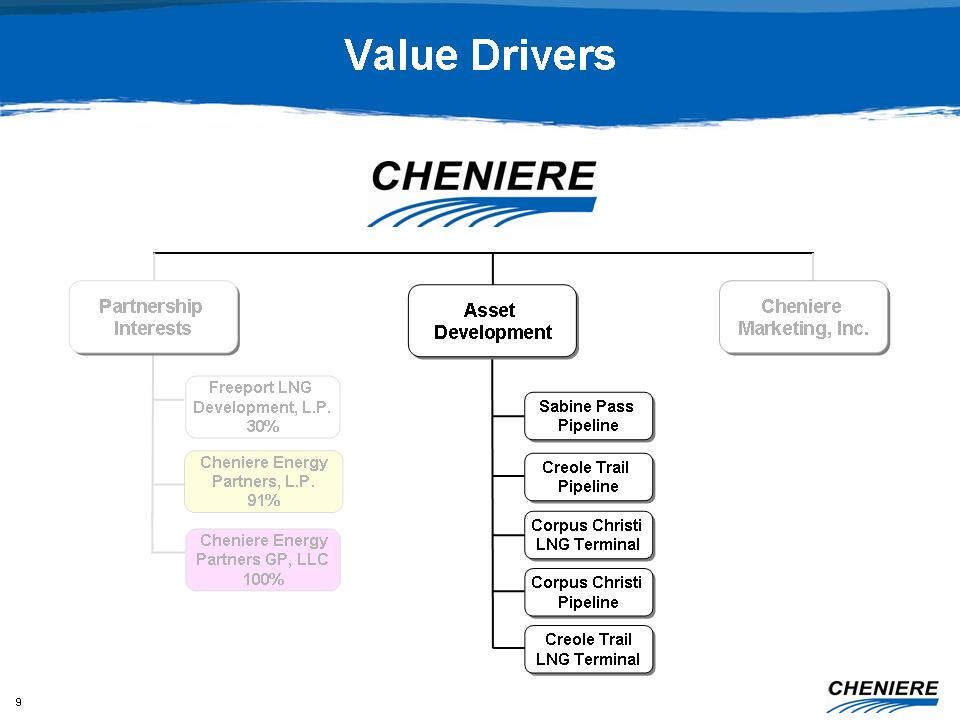

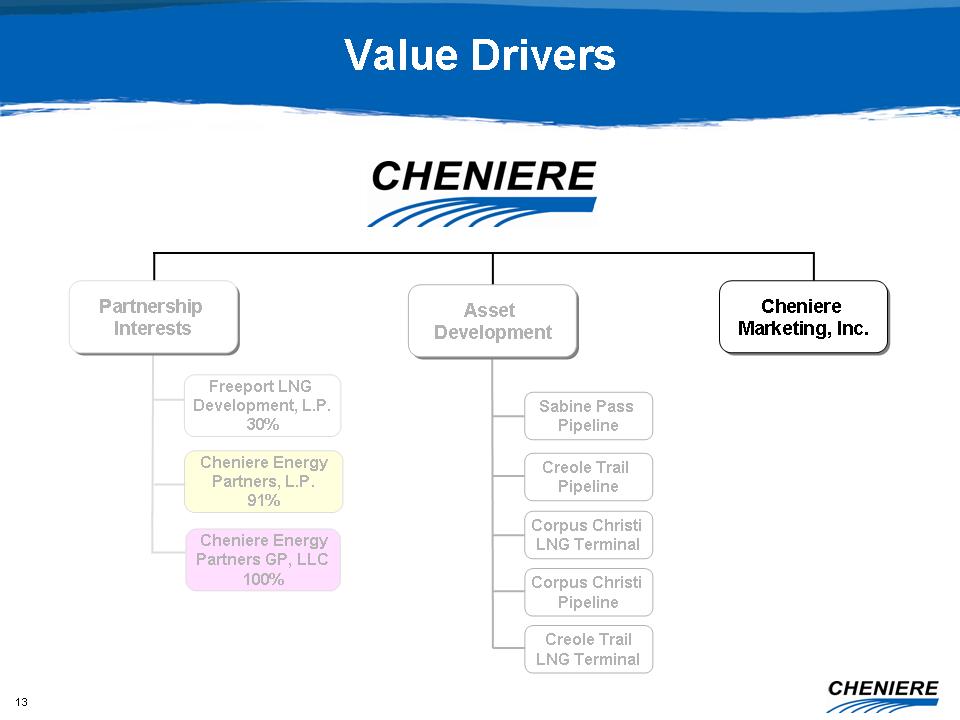

Value Drivers Cheniere Marketing, Inc. Cheniere Marketing, Inc. Corpus Christi

Pipeline Corpus Christi Pipeline Creole Trail LNG Terminal Creole Trail LNG

Terminal Sabine Pass Pipeline Sabine Pass Pipeline Creole Trail Pipeline

Creole

Trail Pipeline Corpus Christi LNG Terminal Corpus Christi LNG Terminal Asset

Development Asset Development Partnership Interests Partnership Interests

Cheniere Energy Partners GP, LLC 100% Cheniere Energy Partners GP, LLC 100%

Cheniere Energy Partners, L.P. 91% Cheniere Energy Partners, L.P. 91% Freeport

LNG Development, L.P. 30% Freeport LNG Development, L.P. 30%

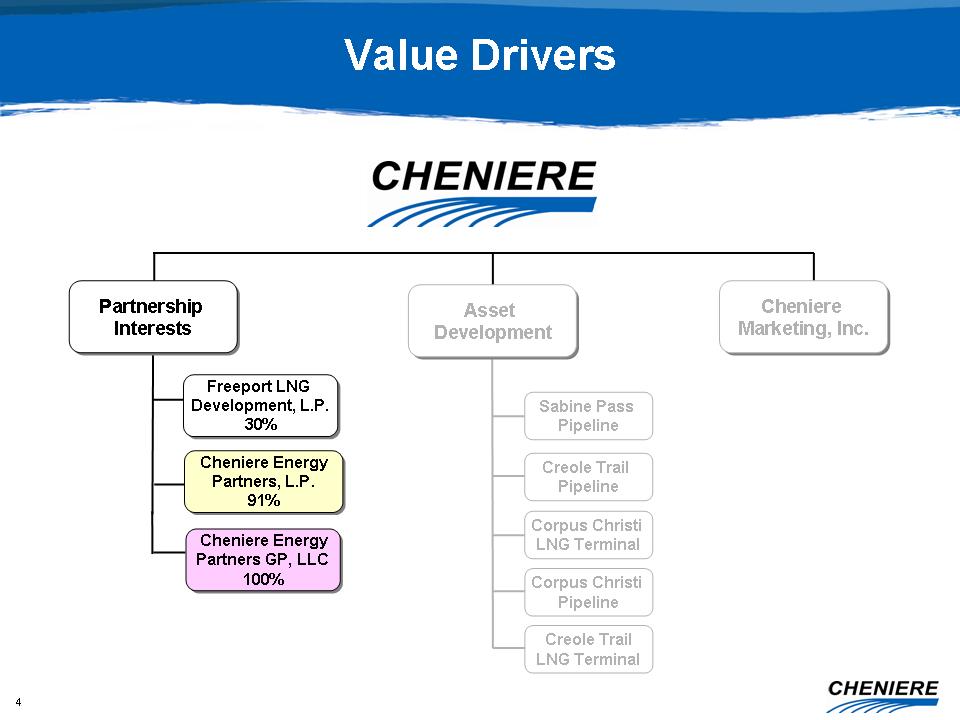

4

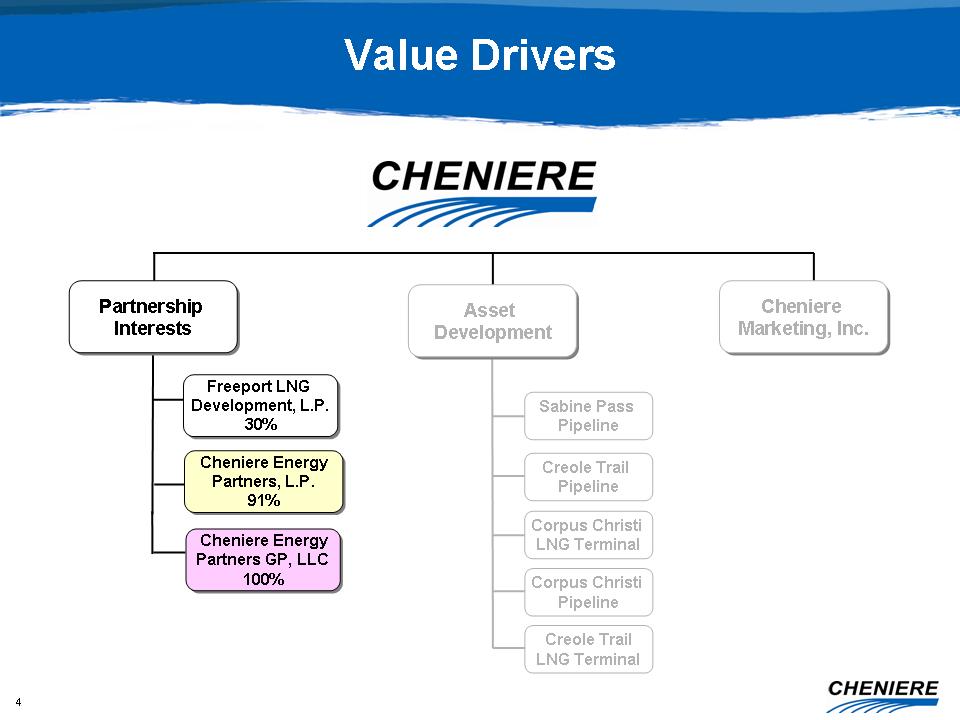

Value Drivers Corpus Christi Pipeline Creole Trail LNG Terminal Sabine Pass

Pipeline Creole Trail Pipeline Corpus Christi LNG Terminal Asset Development

Asset Development Cheniere Marketing, Inc. Cheniere Marketing, Inc. Partnership

Interests Partnership Interests Cheniere Energy Partners GP, LLC 100% Cheniere

Energy Partners GP, LLC 100% Cheniere Energy Partners, L.P. 91% Cheniere

Energy

Partners, L.P. 91% Freeport LNG Development, L.P. 30% Freeport LNG Development,

L.P. 30%

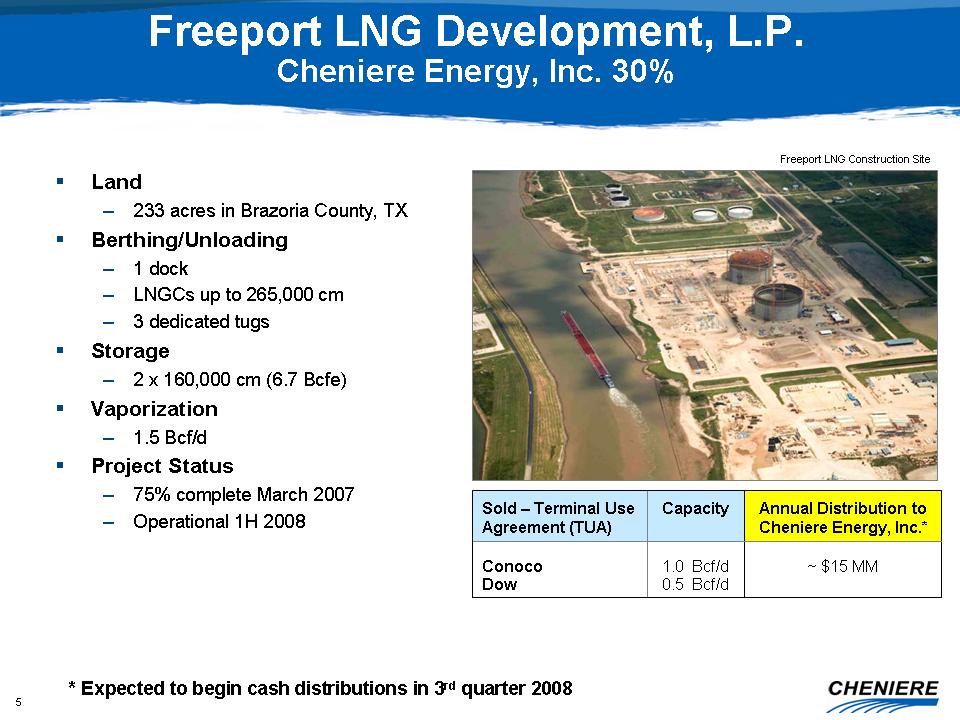

5

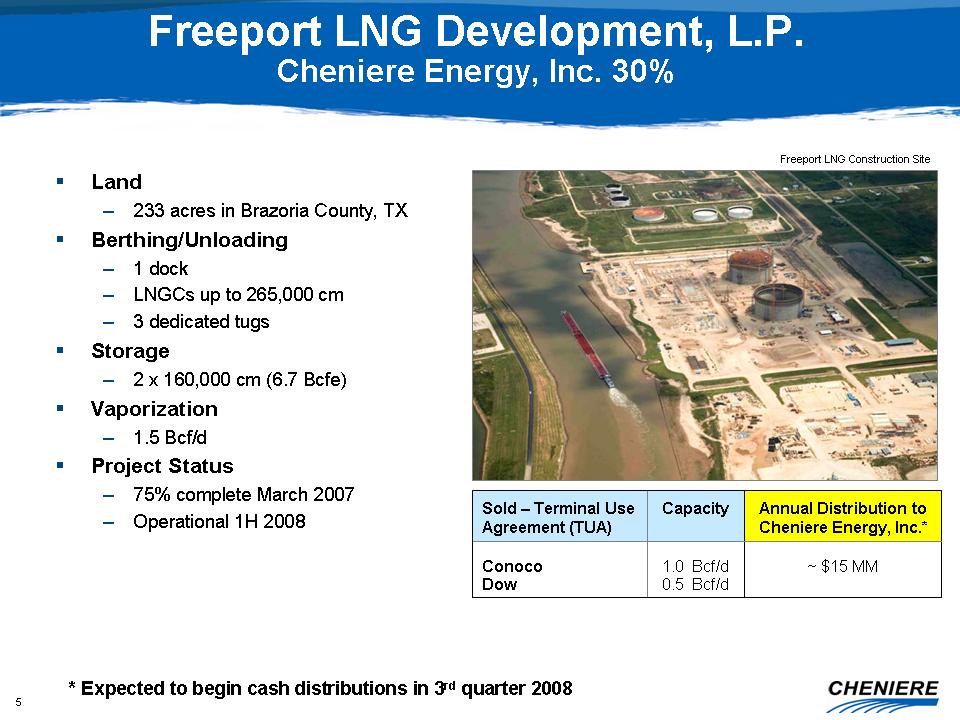

Freeport LNG Development, L.P. Cheniere Energy, Inc. 30% ?? Land – 233 acres in

Brazoria County, TX ?? Berthing/Unloading – 1 dock – LNGCs up to 265,000 cm – 3

dedicated tugs ?? Storage – 2 x 160,000 cm (6.7 Bcfe) ?? Vaporization – 1.5

Bcf/d ?? Project Status – 75% complete March 2007 – Operational 1H 2008 Freeport

LNG Construction Site 1.0 Bcf/d 0.5 Bcf/d Capacity ~ $15 MM Conoco Dow Annual

Distribution to Cheniere Energy, Inc.* Sold – Terminal Use Agreement (TUA) *

Expected to begin cash distributions in 3rd quarter 2008

6

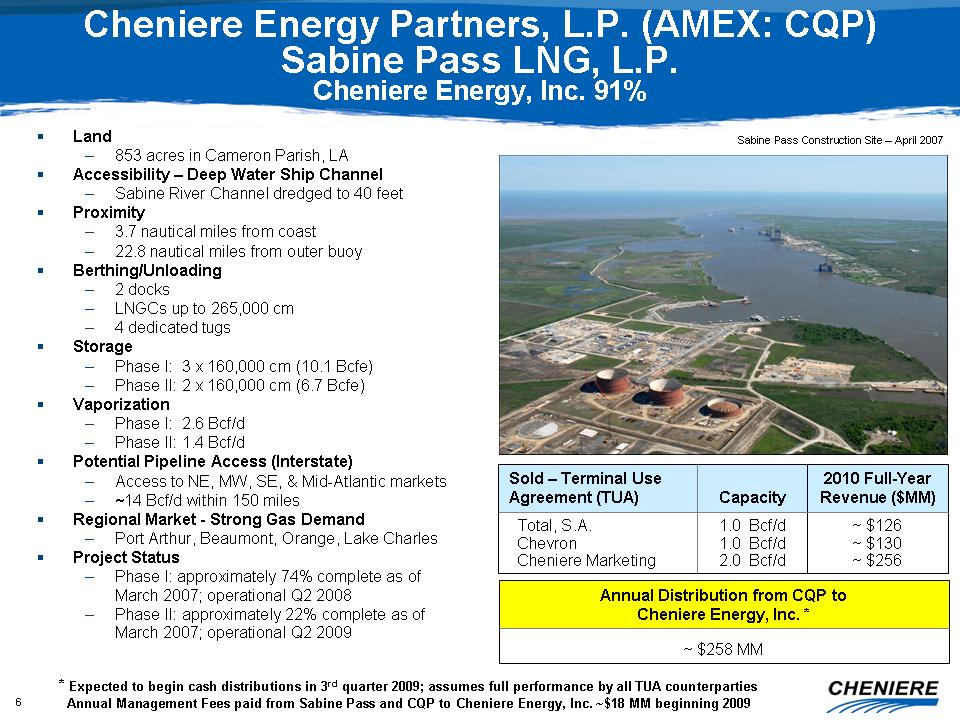

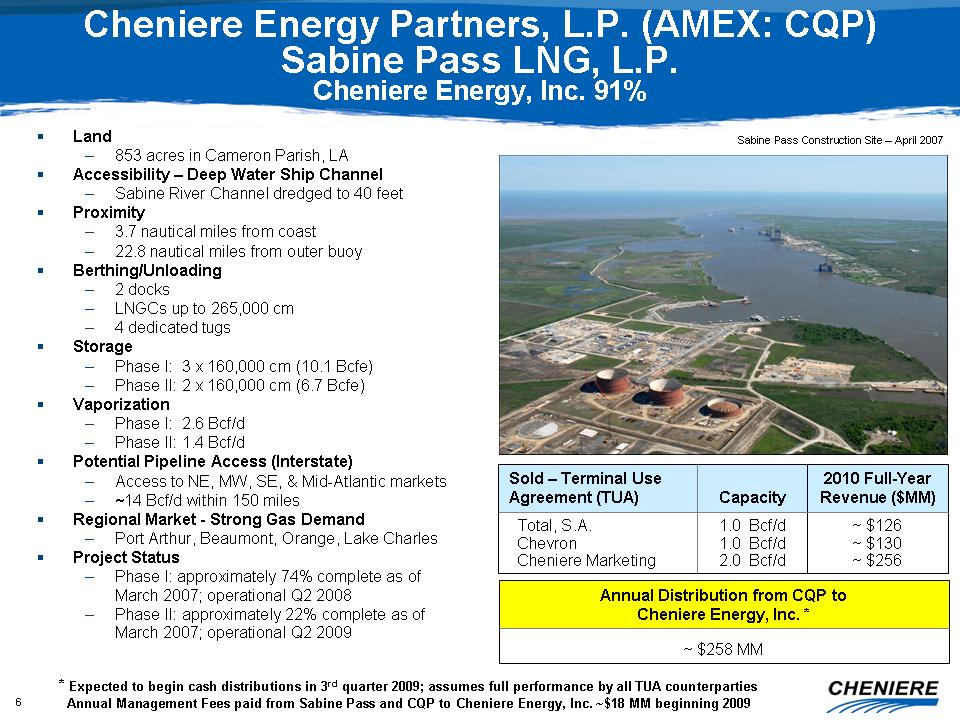

Cheniere Energy Partners, L.P. (AMEX: CQP) Sabine Pass LNG, L.P. Cheniere

Energy, Inc. 91% ?? Land – 853 acres in Cameron Parish, LA ?? Accessibility –

Deep Water Ship Channel – Sabine River Channel dredged to 40 feet ?? Proximity –

3.7 nautical miles from coast – 22.8 nautical miles from outer buoy ??

Berthing/Unloading – 2 docks – LNGCs up to 265,000 cm – 4 dedicated tugs ??

Storage – Phase I: 3 x 160,000 cm (10.1 Bcfe) – Phase II: 2 x 160,000 cm (6.7

Bcfe) ?? Vaporization – Phase I: 2.6 Bcf/d – Phase II: 1.4 Bcf/d ?? Potential

Pipeline Access (Interstate) – Access to NE, MW, SE, & Mid-Atlantic markets

– ~14 Bcf/d within 150 miles ?? Regional Market - Strong Gas Demand – Port

Arthur, Beaumont, Orange, Lake Charles ?? Project Status – Phase I:

approximately 74% complete as of March 2007; operational Q2 2008 – Phase II:

approximately 22% complete as of March 2007; operational Q2 2009 Sabine Pass

Construction Site – April 2007 1.0 Bcf/d 1.0 Bcf/d 2.0 Bcf/d Capacity ~ $126 ~

$130 ~ $256 Total, S.A. Chevron Cheniere Marketing 2010 Full-Year Revenue

($MM)

Sold – Terminal Use Agreement (TUA) ~ $258 MM Annual Distribution from CQP to

Cheniere Energy, Inc. * * Expected to begin cash distributions in 3rd quarter

2009; assumes full performance by all TUA counterparties Annual Management

Fees

paid from Sabine Pass and CQP to Cheniere Energy, Inc. ~$18 MM beginning

2009

7

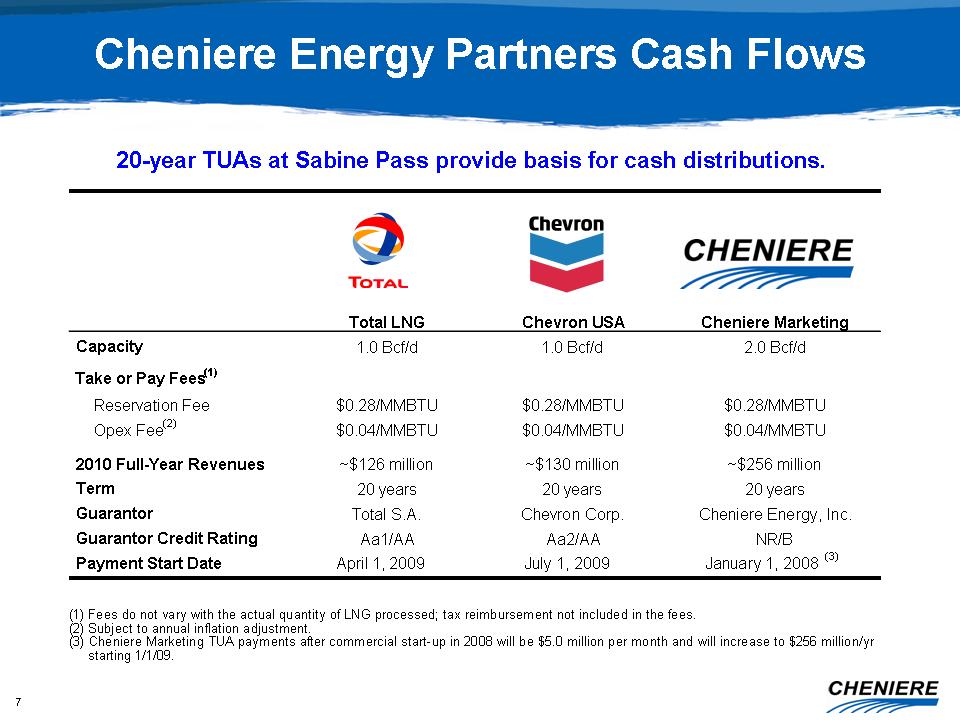

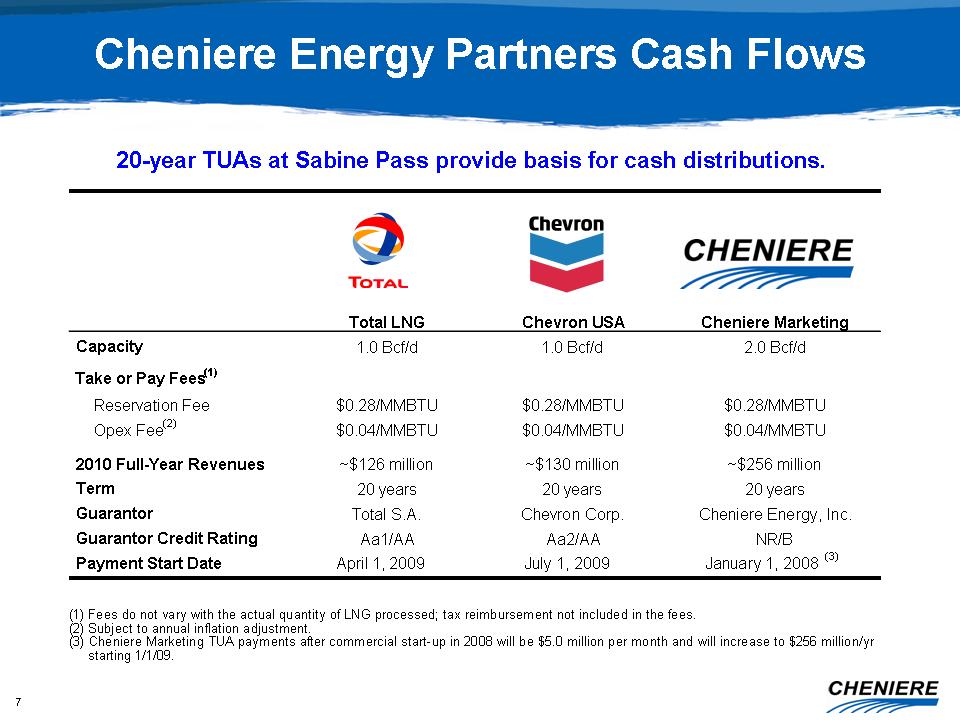

Cheniere Energy Partners Cash Flows (1) Fees do not vary with the actual

quantity of LNG processed; tax reimbursement not included in the fees. (2)

Subject to annual inflation adjustment. (3) Cheniere Marketing TUA payments

after commercial start-up in 2008 will be $5.0 million per month and will

increase to $256 million/yr starting 1/1/09. 20-year TUAs at Sabine Pass

provide

basis for cash distributions. Total LNG Chevron USA Cheniere Marketing Capacity

1.0 Bcf/d 1.0 Bcf/d 2.0 Bcf/d Take or Pay Fees(1) Reservation Fee $0.28/MMBTU

$0.28/MMBTU $0.28/MMBTU Opex Fee(2) $0.04/MMBTU $0.04/MMBTU $0.04/MMBTU 2010

Full-Year Revenues ~$126 million ~$130 million ~$256 million Term 20 years

20

years 20 years Guarantor Total S.A. Chevron Corp. Cheniere Energy, Inc.

Guarantor Credit Rating Aa1/AA Aa2/AA NR/B Payment Start Date April 1, 2009

July

1, 2009 January 1, 2008 (3)

8

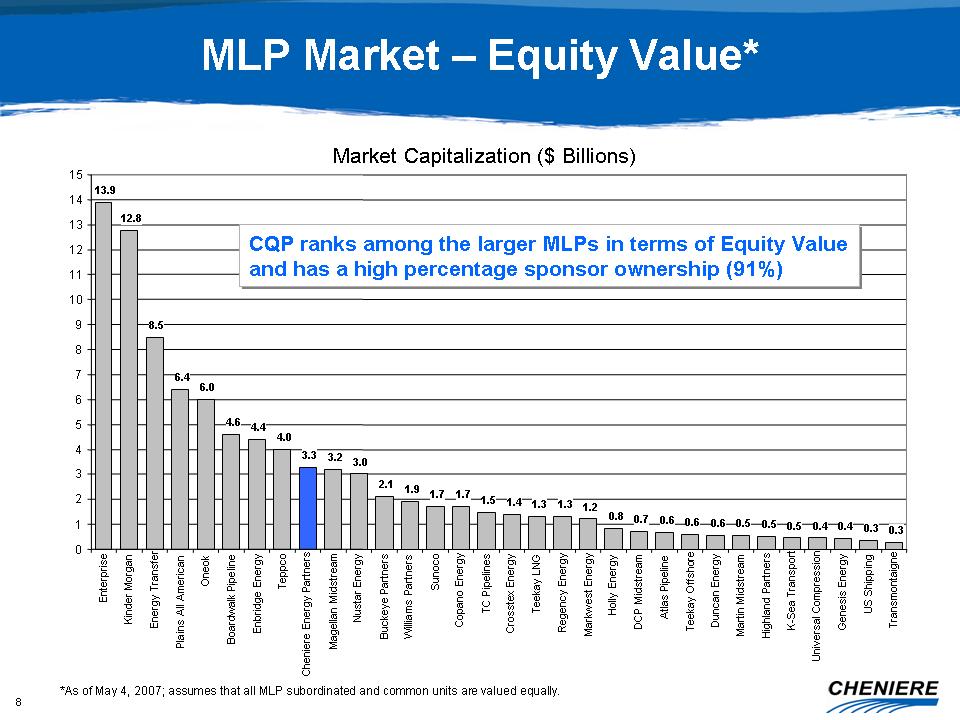

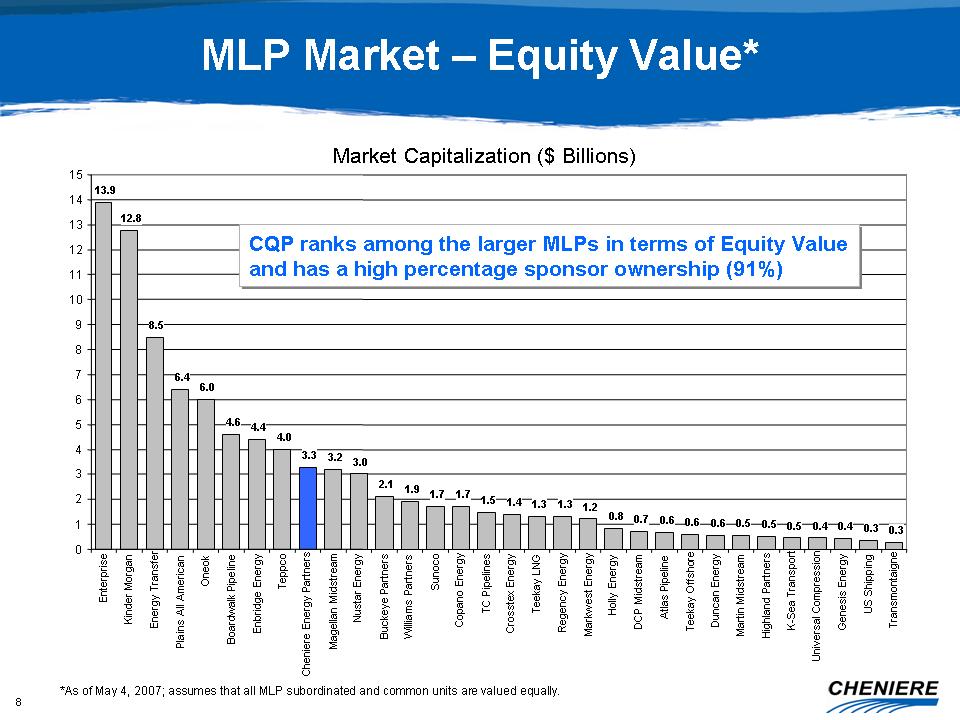

Market Capitalization ($ Billions) MLP Market – Equity Value* *As of May 4,

2007; assumes that all MLP subordinated and common units are valued equally.

13.9 12.8 8.5 6.4 6.0 4.6 4.4 4.0 3.3 3.2 3.0 2.1 1.9 1.7 1.7 1.5 1.4 1.3

1.3

1.2 0.8 0.7 0.6 0.6 0.6 0.5 0.5 0.5 0.4 0.4 0.3 0.3 0 1 2 3 4 5 6 7 8 9 10

11 12

13 14 15 Enterprise Kinder Morgan Energy Transfer Plains All American Oneok

Boardwalk Pipeline Enbridge Energy Teppco Cheniere Energy Partners Magellan

Midstream Nustar Energy Buckeye Partners Williams Partners Sunoco Copano

Energy

TC Pipelines Crosstex Energy Teekay LNG Regency Energy Markwest Energy Holly

Energy DCP Midstream Atlas Pipeline Teekay Offshore Duncan Energy Martin

Midstream Highland Partners K-Sea Transport Universal Compression Genesis

Energy

US Shipping Transmontaigne CQP ranks among the larger MLPs in terms of Equity

Value and has a high percentage sponsor ownership (91%) CQP ranks among the

larger MLPs in terms of Equity Value and has a high percentage sponsor ownership

(91%)

9

Value Drivers Cheniere Marketing, Inc. Cheniere Marketing, Inc. Corpus Christi

Pipeline Corpus Christi Pipeline Creole Trail LNG Terminal Creole Trail LNG

Terminal Sabine Pass Pipeline Sabine Pass Pipeline Creole Trail Pipeline

Creole

Trail Pipeline Corpus Christi LNG Terminal Corpus Christi LNG Terminal Asset

Development Asset Development Partnership Interests Partnership Interests

Cheniere Energy Partners GP, LLC 100% Cheniere Energy Partners, L.P. 91%

Freeport LNG Development, L.P. 30%

10

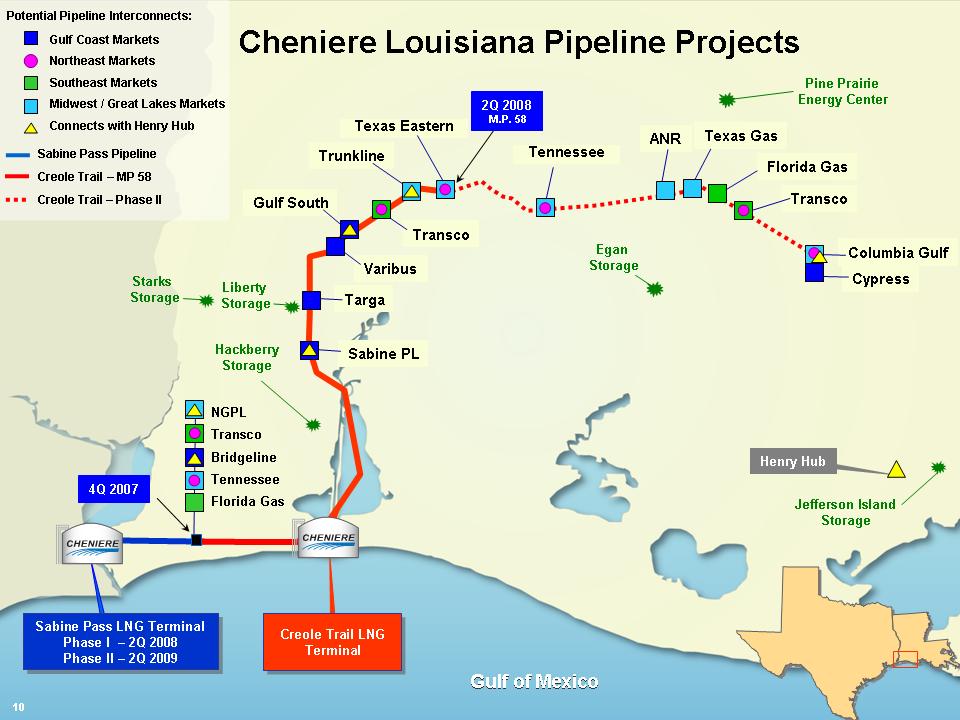

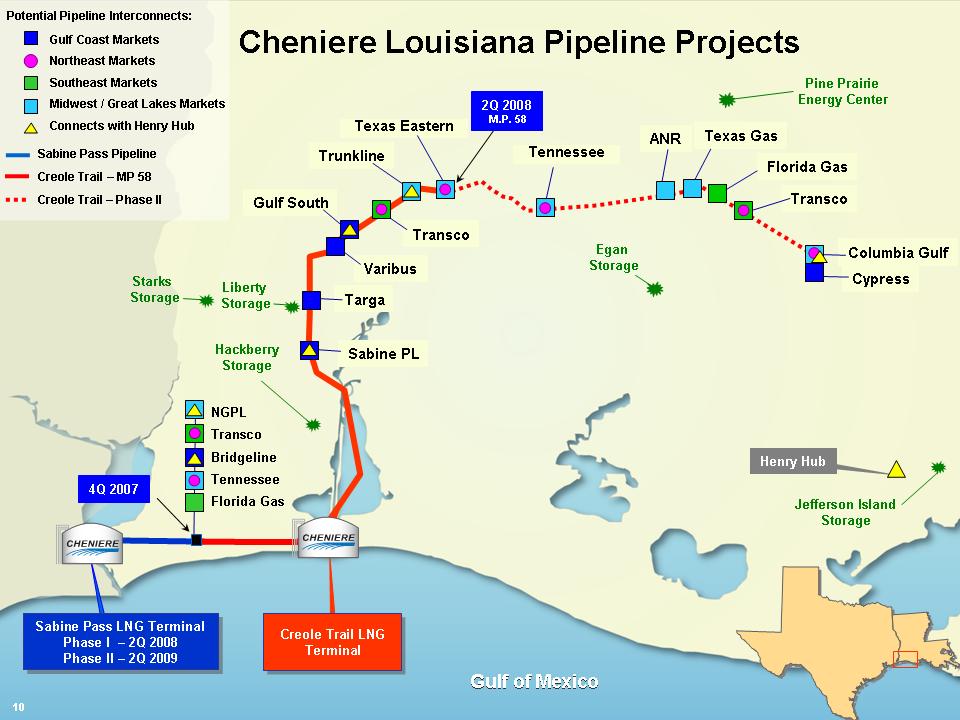

Sabine PL Targa Transco Gulf South Trunkline Jefferson Island Storage Sabine

Pass LNG Terminal Phase I – 2Q 2008 Phase II – 2Q 2009 Sabine Pass LNG Terminal

Phase I – 2Q 2008 Phase II – 2Q 2009 Creole Trail LNG Terminal Creole Trail LNG

Terminal Henry Hub Varibus NGPL Transco Bridgeline Tennessee Florida Gas

Cheniere Louisiana Pipeline Projects Liberty Storage Starks Storage Hackberry

Storage Texas Eastern Gulf Coast Markets Northeast Markets Southeast Markets

Midwest / Great Lakes Markets Connects with Henry Hub Gulf of Mexico Gulf

of

Mexico 4Q 2007 ANR Texas Gas Transco Florida Gas Columbia Gulf Cypress Egan

Storage Pine Prairie Energy Center Tennessee 2Q 2008 M.P. 58 Sabine Pass

Pipeline Creole Trail – MP 58 Creole Trail – Phase II 10 Potential Pipeline

Interconnects:

11

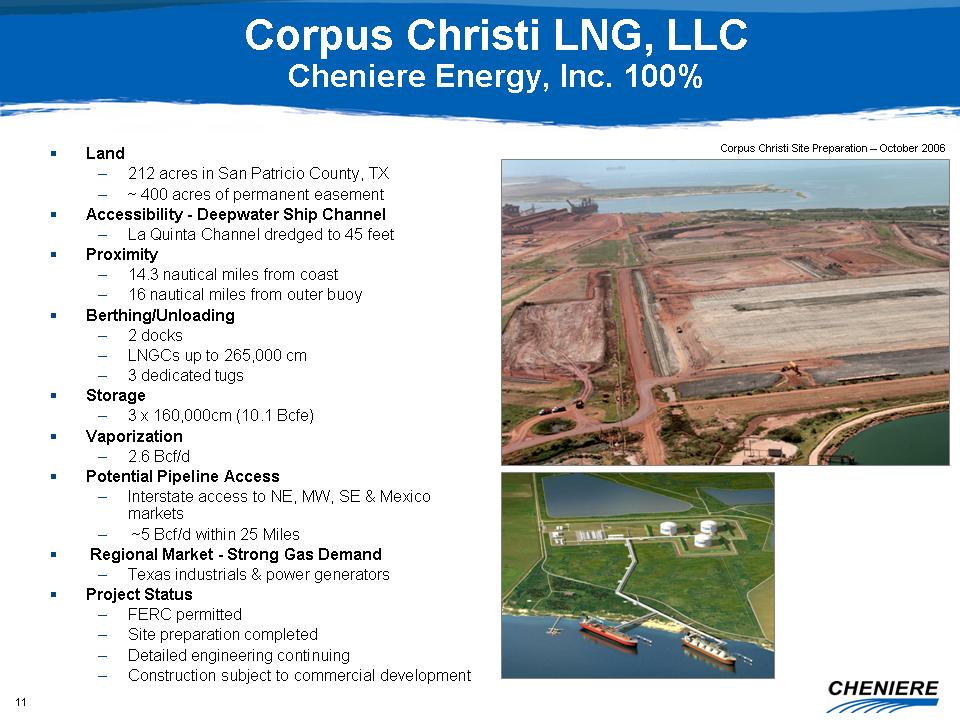

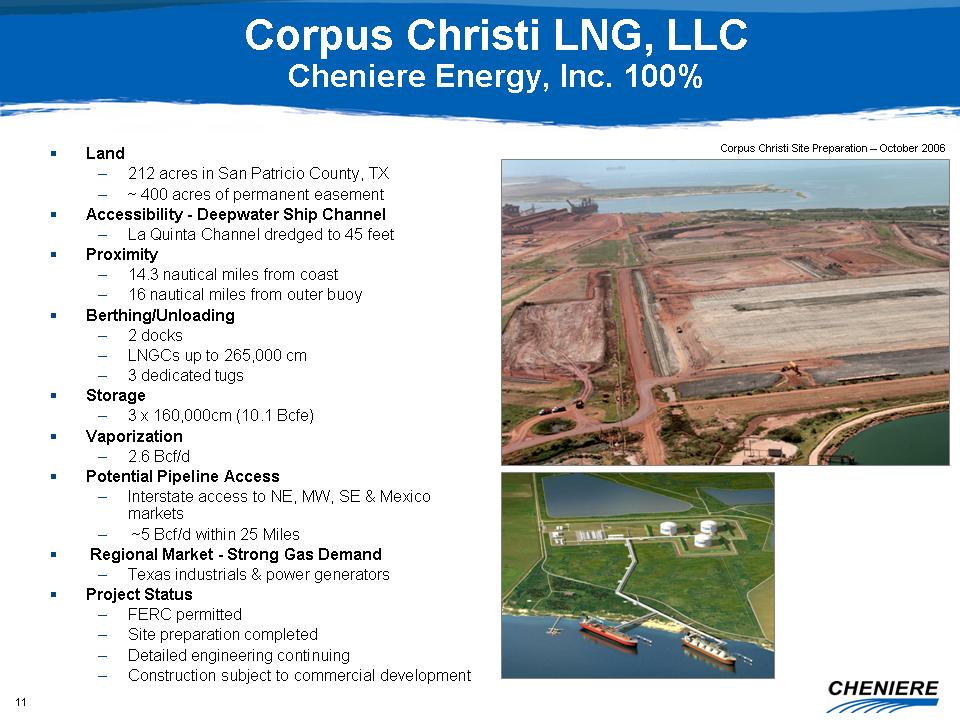

Corpus Christi LNG, LLC Cheniere Energy, Inc. 100% ?? Land – 212 acres in San

Patricio County, TX – ~ 400 acres of permanent easement ?? Accessibility -

Deepwater Ship Channel – La Quinta Channel dredged to 45 feet ?? Proximity –

14.3 nautical miles from coast – 16 nautical miles from outer buoy ??

Berthing/Unloading – 2 docks – LNGCs up to 265,000 cm – 3 dedicated tugs ??

Storage – 3 x 160,000cm (10.1 Bcfe) ?? Vaporization – 2.6 Bcf/d ?? Potential

Pipeline Access – Interstate access to NE, MW, SE & Mexico markets – ~5

Bcf/d within 25 Miles ?? Regional Market - Strong Gas Demand – Texas industrials

& power generators ?? Project Status – FERC permitted – Site preparation

completed – Detailed engineering continuing – Construction subject to commercial

development Corpus Christi Site Preparation – October 2006

12

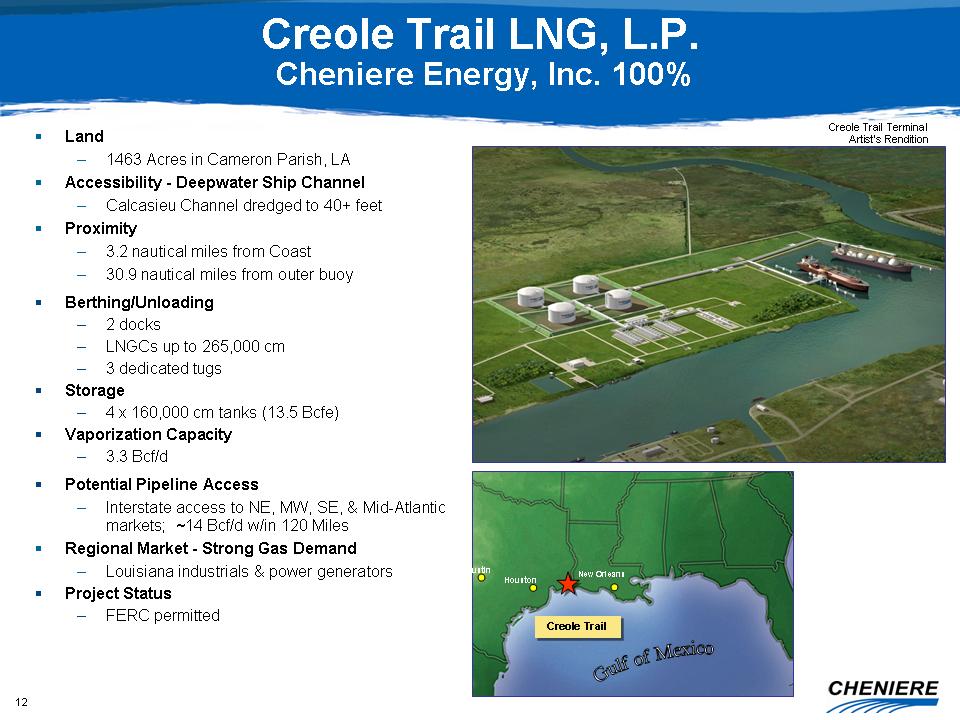

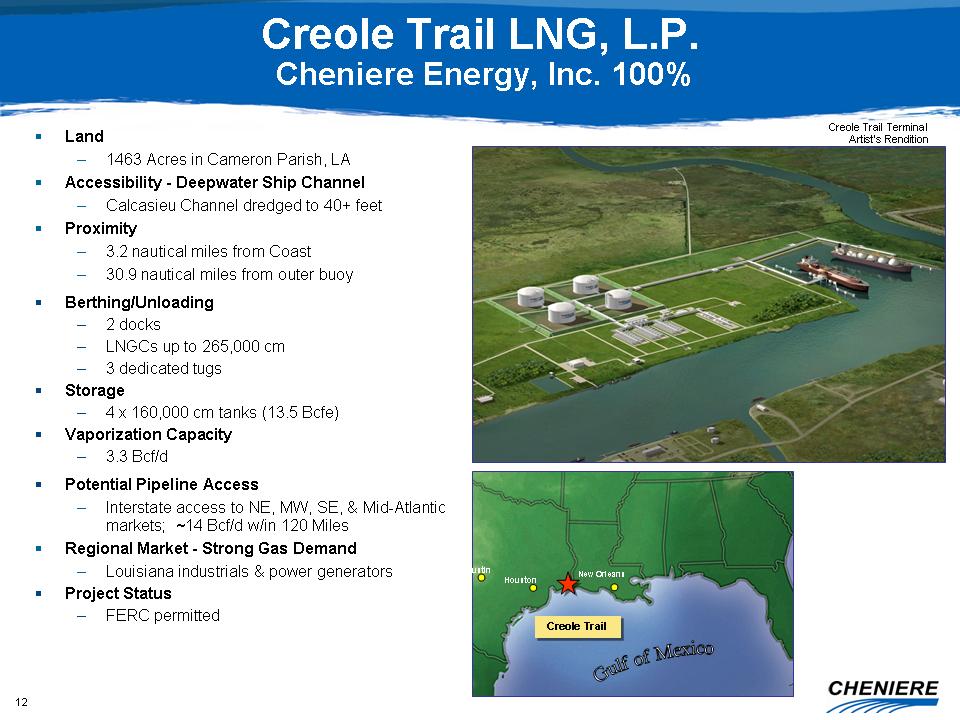

Creole Trail LNG, L.P. Cheniere Energy, Inc. 100% ?? Land – 1463 Acres in

Cameron Parish, LA ?? Accessibility - Deepwater Ship Channel – Calcasieu Channel

dredged to 40+ feet ?? Proximity – 3.2 nautical miles from Coast – 30.9 nautical

miles from outer buoy ?? Berthing/Unloading – 2 docks – LNGCs up to 265,000 cm –

3 dedicated tugs ?? Storage – 4 x 160,000 cm tanks (13.5 Bcfe) ?? Vaporization

Capacity – 3.3 Bcf/d ?? Potential Pipeline Access – Interstate access to NE, MW,

SE, & Mid-Atlantic markets; ~14 Bcf/d w/in 120 Miles ?? Regional Market -

Strong Gas Demand – Louisiana industrials & power generators ?? Project

Status – FERC permitted Creole Trail Terminal Artist’s Rendition Creole Trail

Creole Trail Austin Houston New Orleans

13

Value Drivers Cheniere Marketing, Inc. Cheniere Marketing, Inc. Corpus Christi

Pipeline Creole Trail LNG Terminal Sabine Pass Pipeline Creole Trail Pipeline

Corpus Christi LNG Terminal Asset Development Asset Development Partnership

Interests Partnership Interests Cheniere Energy Partners GP, LLC 100% Cheniere

Energy Partners, L.P. 91% Freeport LNG Development, L.P. 30%

14

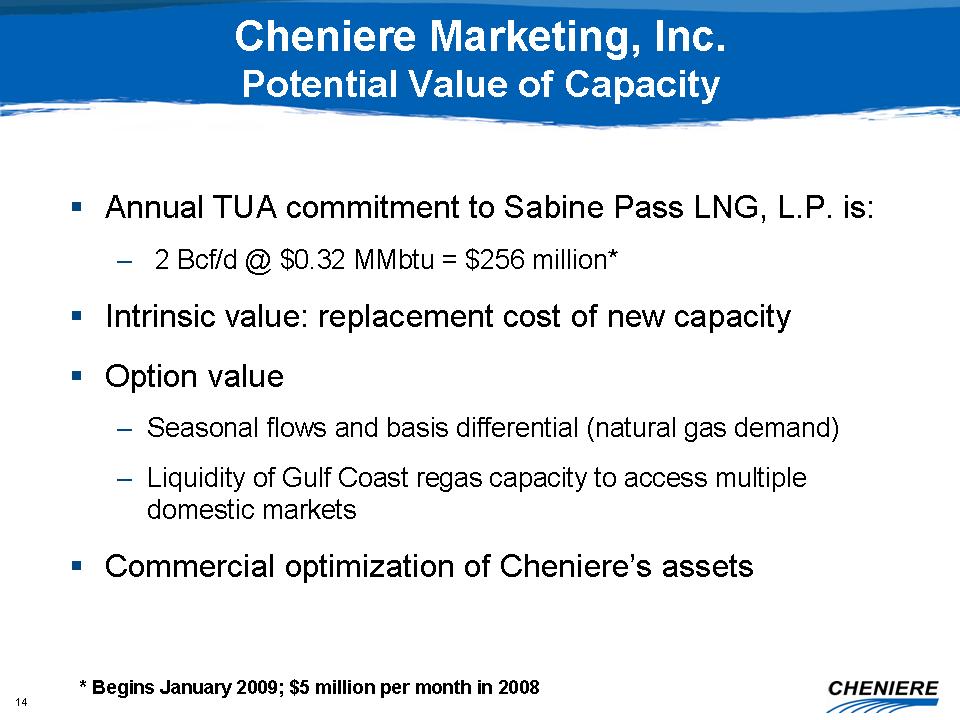

Cheniere Marketing, Inc. Potential Value of Capacity ?? Annual TUA commitment

to

Sabine Pass LNG, L.P. is: – 2 Bcf/d @ $0.32 MMbtu = $256 million* ?? Intrinsic

value: replacement cost of new capacity ?? Option value – Seasonal flows and

basis differential (natural gas demand) – Liquidity of Gulf Coast regas capacity

to access multiple domestic markets ?? Commercial optimization of Cheniere’s

assets * Begins January 2009; $5 million per month in 2008

15

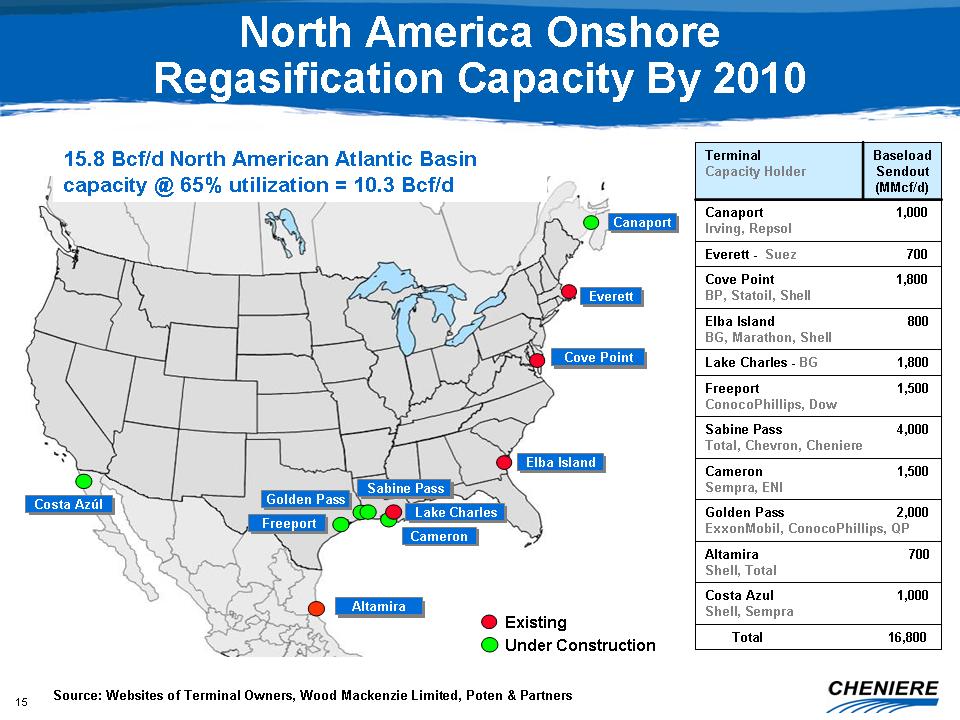

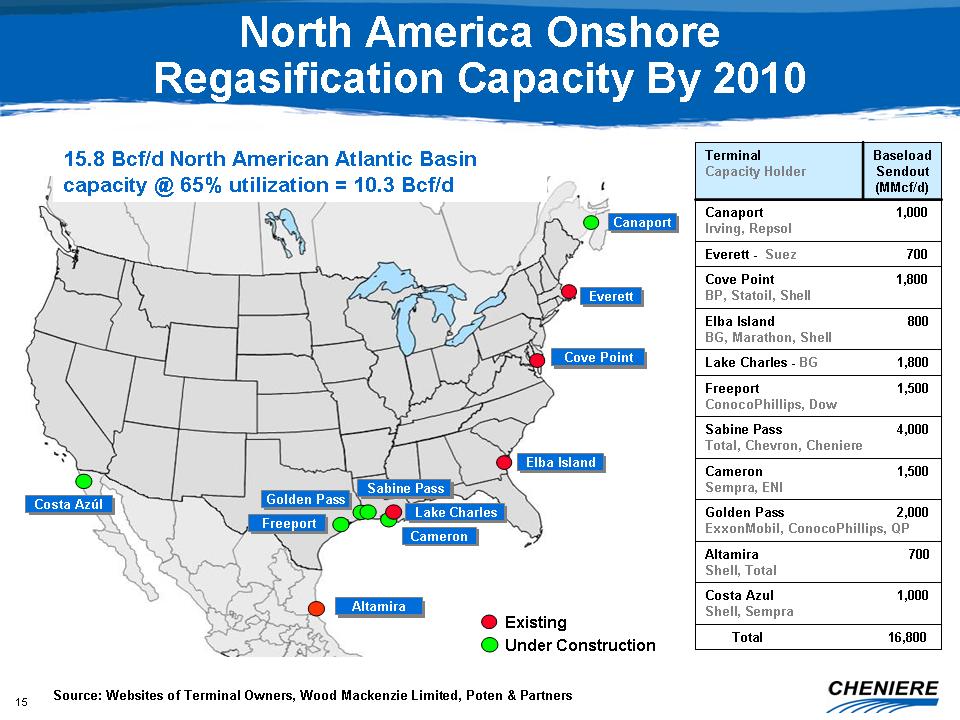

Everett Everett Cove Point Cove Point Elba Island Elba Island Lake Charles

Lake

Charles Sabine Pass Sabine Pass Freeport Freeport Golden Pass Golden Pass

Cameron Cameron Costa Azúl Costa Azúl Canaport Canaport Existing Under

Construction Altamira Altamira Source: Websites of Terminal Owners, Wood

Mackenzie Limited, Poten & Partners Altamira 700 Shell, Total Costa Azul

1,000 Shell, Sempra Canaport 1,000 Irving, Repsol Total 16,800 Golden Pass

2,000

ExxonMobil, ConocoPhillips, QP Cameron 1,500 Sempra, ENI Sabine Pass 4,000

Total, Chevron, Cheniere Freeport 1,500 ConocoPhillips, Dow Lake Charles

- BG

1,800 Elba Island 800 BG, Marathon, Shell Cove Point 1,800 BP, Statoil, Shell

Everett - Suez 700 Baseload Sendout (MMcf/d) Terminal Capacity Holder North

America Onshore Regasification Capacity By 2010 15.8 Bcf/d North American

Atlantic Basin capacity @ 65% utilization = 10.3 Bcf/d

16

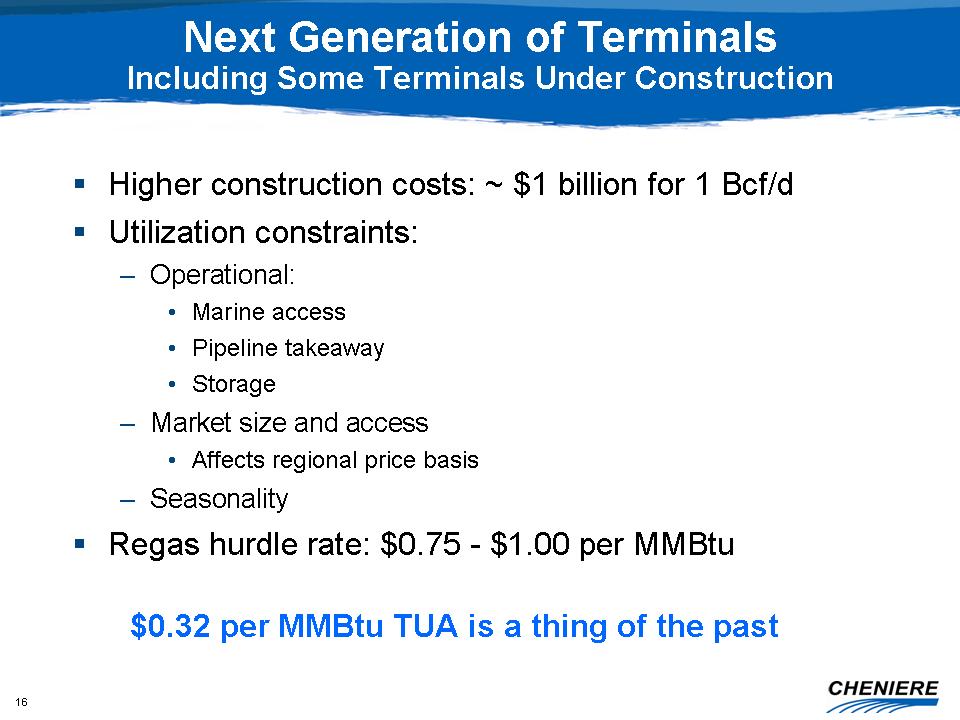

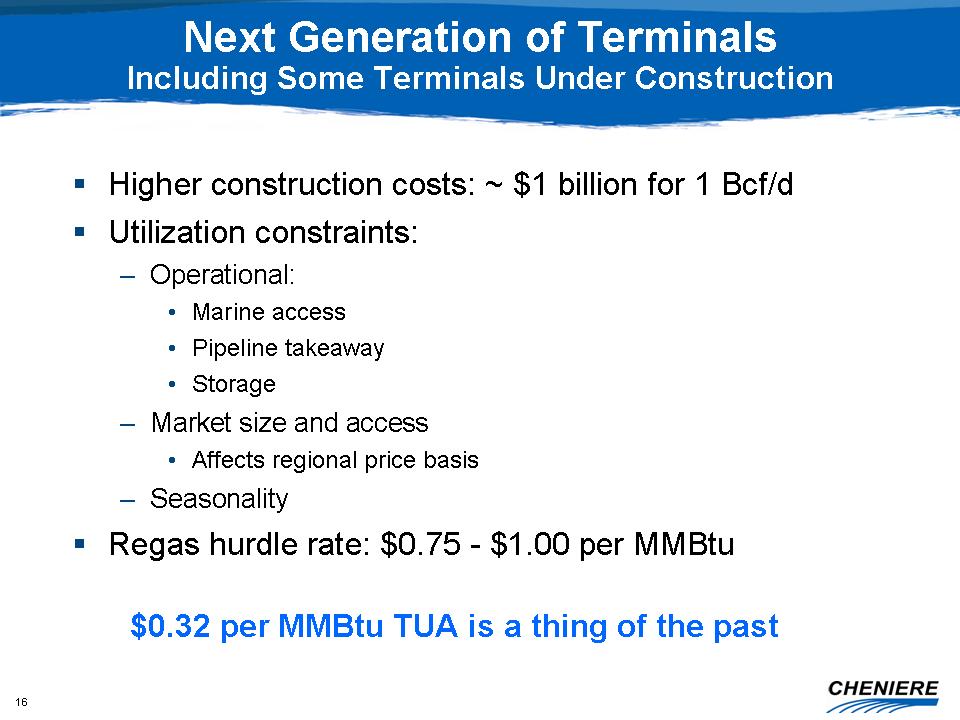

Next Generation of Terminals Including Some Terminals Under Construction

??

Higher construction costs: ~ $1 billion for 1 Bcf/d ?? Utilization constraints:

– Operational: • Marine access • Pipeline takeaway • Storage – Market size and

access • Affects regional price basis – Seasonality ?? Regas hurdle rate: $0.75

- $1.00 per MMBtu $0.32 per MMBtu TUA is a thing of the past

17

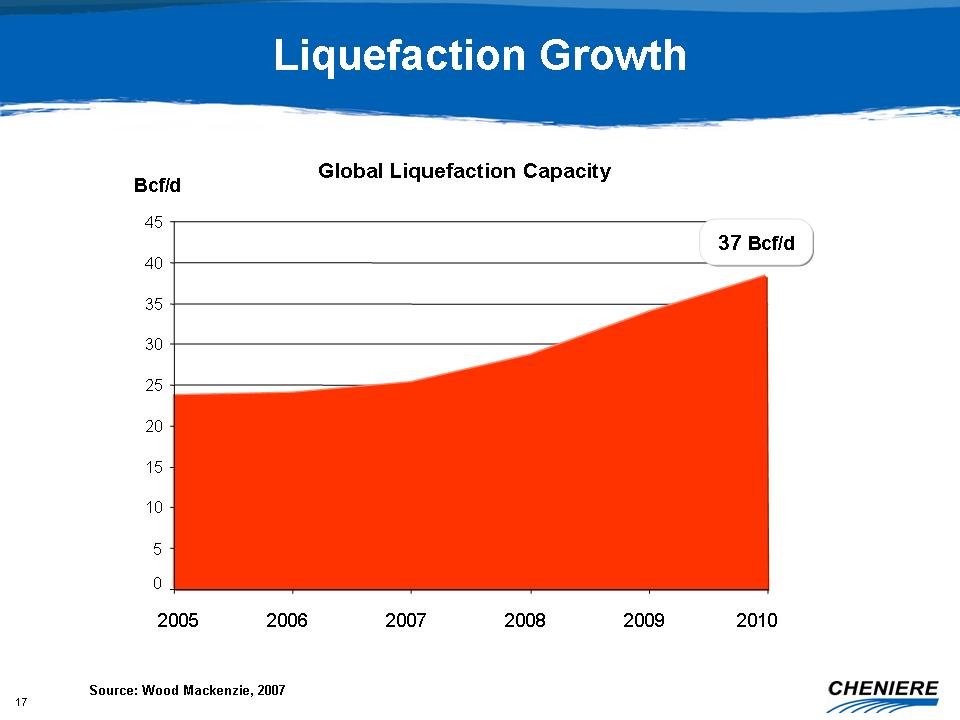

Liquefaction Growth Source: Wood Mackenzie, 2007 Global Liquefaction Capacity

0

5 10 15 20 25 30 35 40 45 2005 2006 2007 2008 2009 2010 Bcf/d 37 Bcf/d 37

Bcf/d

18 12

18

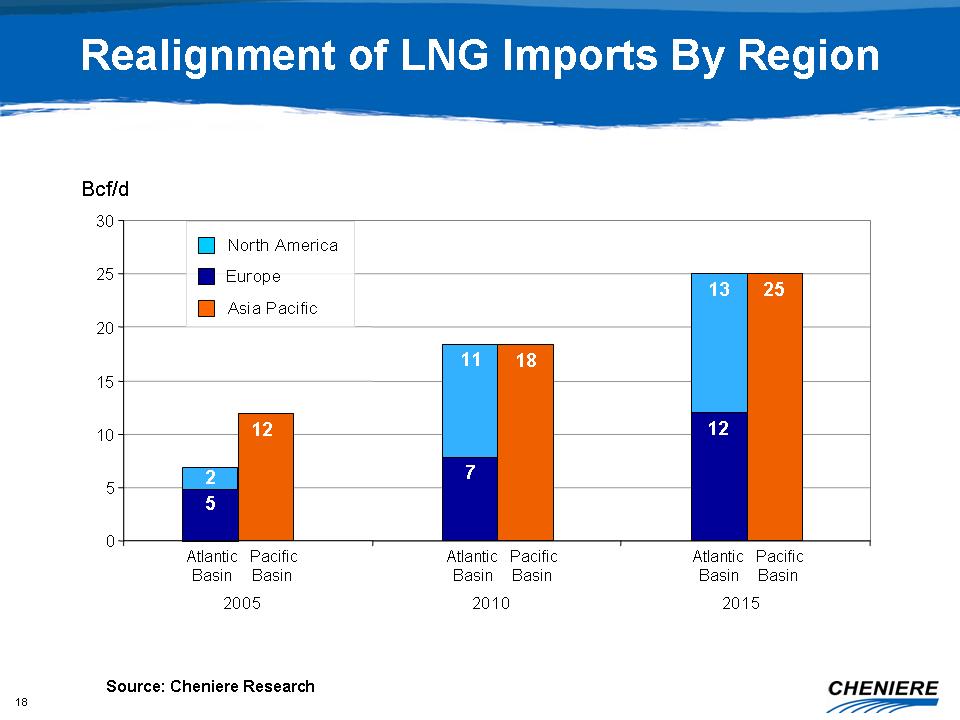

25 5 7 12 2 11 13 0 5 10 15 20 25 30 2005 2010 2015 Source: Cheniere Research

Realignment of LNG Imports By Region Bcf/d North America Europe Asia Pacific

Atlantic Basin Pacific Basin Atlantic Basin Pacific Basin Atlantic Basin

Pacific

Basin

19

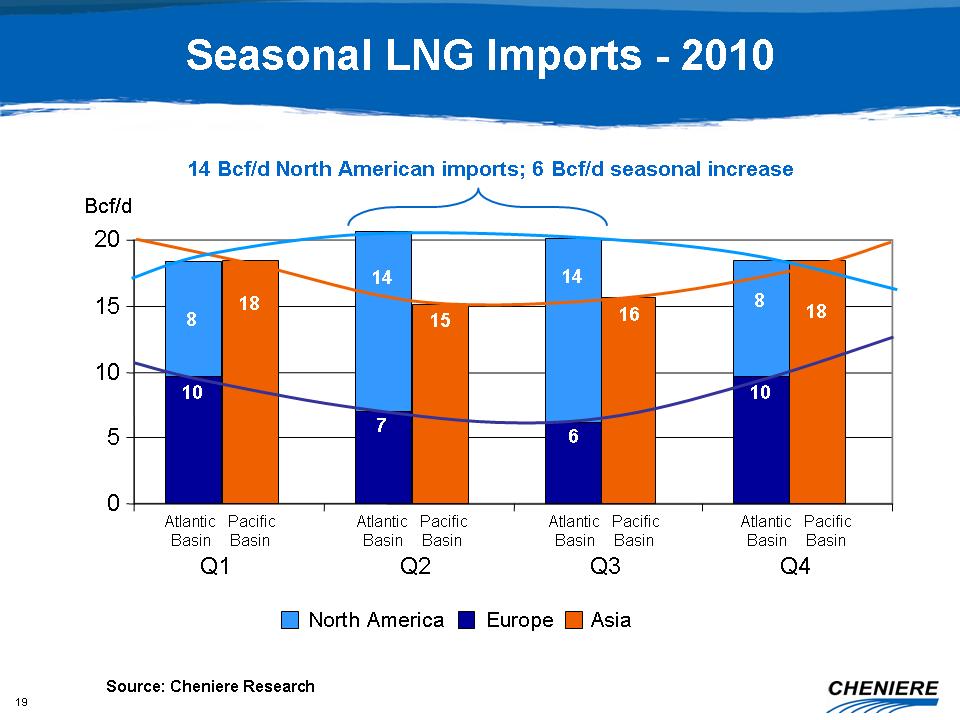

Seasonal LNG Imports - 2010 15 16 18 0 5 10 15 20 Atlantic Basin Q2 Q3 Q4

Bcf/d

North America Europe Asia 10 8 7 14 6 14 10 8 Pacific Basin Atlantic Basin

Pacific Basin Atlantic Basin Pacific Basin Atlantic Basin Pacific Basin Q1

18

Source: Cheniere Research 14 Bcf/d North American imports; 6 Bcf/d seasonal

increase

20

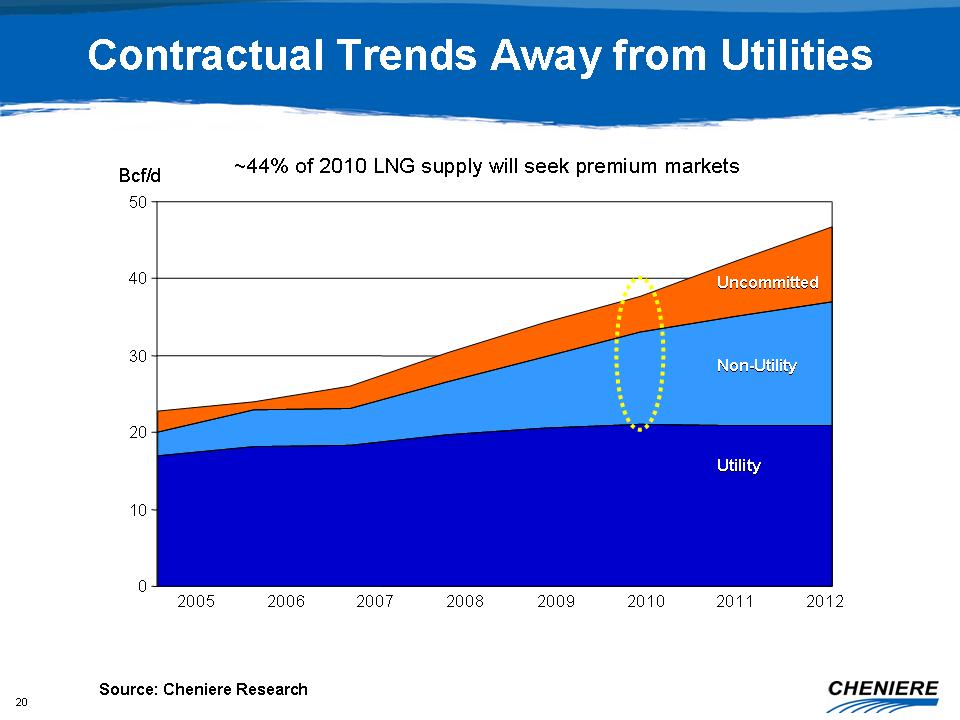

Contractual Trends Away from Utilities 0 10 20 30 40 50 Bcf/d 2005 2006 2007

2008 2009 2010 2011 2012 Non-Utility Non-Utility Uncommitted Uncommitted

Utility

Utility ~44% of 2010 LNG supply will seek premium markets Source: Cheniere

Research

21

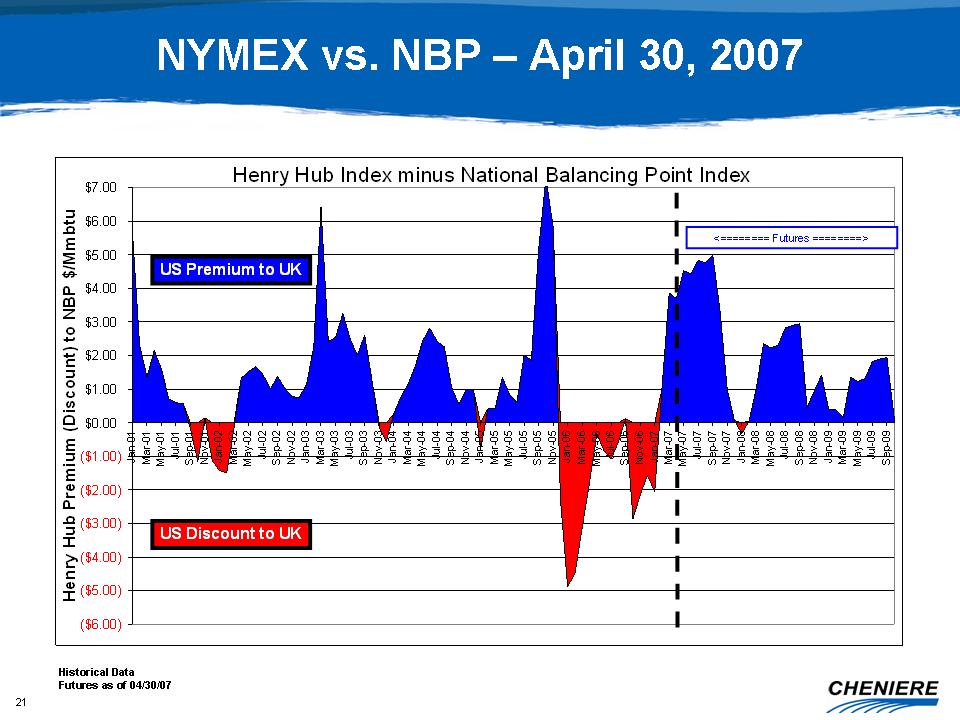

NYMEX vs. NBP – April 30, 2007 Historical Data Futures as of 04/30/07 Henry Hub

Index minus National Balancing Point Index ($6.00) ($5.00) ($4.00) ($3.00)

($2.00) ($1.00) $0.00 $1.00 $2.00 $3.00 $4.00 $5.00 $6.00 $7.00 Jan-01 Mar-01

May-01 Jul-01 Sep-01 Nov-01 Jan-02 Mar-02 May-02 Jul-02 Sep-02 Nov-02 Jan-03

Mar-03 May-03 Jul-03 Sep-03 Nov-03 Jan-04 Mar-04 May-04 Jul-04 Sep-04 Nov-04

Jan-05 Mar-05 May-05 Jul-05 Sep-05 Nov-05 Jan-06 Mar-06 May-06 Jul-06 Sep-06

Nov-06 Jan-07 Mar-07 May-07 Jul-07 Sep-07 Nov-07 Jan-08 Mar-08 May-08 Jul-08

Sep-08 Nov-08 Jan-09 Mar-09 May-09 Jul-09 Sep-09 Henry Hub Premium (Discount)

to

NBP $/Mmbtu <======== Futures ========> US Premium to UK US Discount to UK

22

Cheniere Marketing Goal ?? Exceed Cheniere’s opportunity cost for the capacity

held by Cheniere Marketing by: – Capturing the intrinsic value of cross-Atlantic

spreads – Capturing a portion of the option value associated with being in the

world’s most liquid market

23

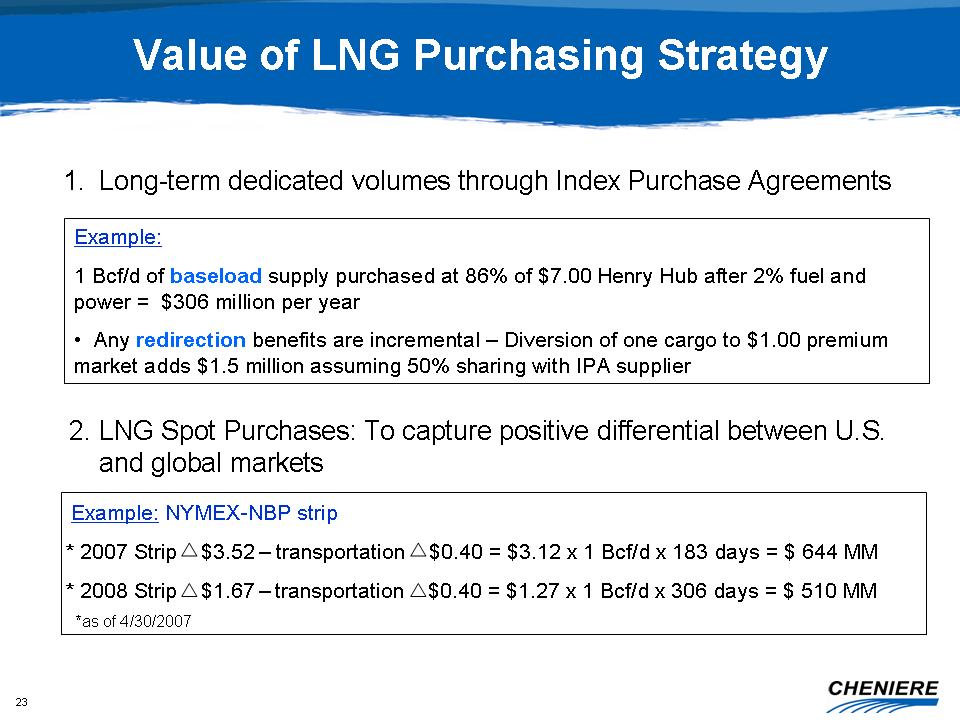

Value of LNG Purchasing Strategy Example: 1 Bcf/d of baseload supply purchased

at 86% of $7.00 Henry Hub after 2% fuel and power = $306 million per year

• Any

redirection benefits are incremental – Diversion of one cargo to $1.00 premium

market adds $1.5 million assuming 50% sharing with IPA supplier 1. Long-term

dedicated volumes through Index Purchase Agreements 2. LNG Spot Purchases:

To

capture positive differential between U.S. and global markets Example: NYMEX-NBP

strip * 2007 Strip $3.52 – transportation $0.40 = $3.12 x 1 Bcf/d x 183 days = $

644 MM * 2008 Strip $1.67 – transportation $0.40 = $1.27 x 1 Bcf/d x 306 days =

$ 510 MM *as of 4/30/2007

2007

24 Value of LNG Purchasing Strategy 3. LNG Gateway Spread Options: Individual

per-cargo put rights that give option buyers the right, but not the obligation,

to sell LNG to Cheniere Marketing, Inc. at pre-agreed index discounts

25

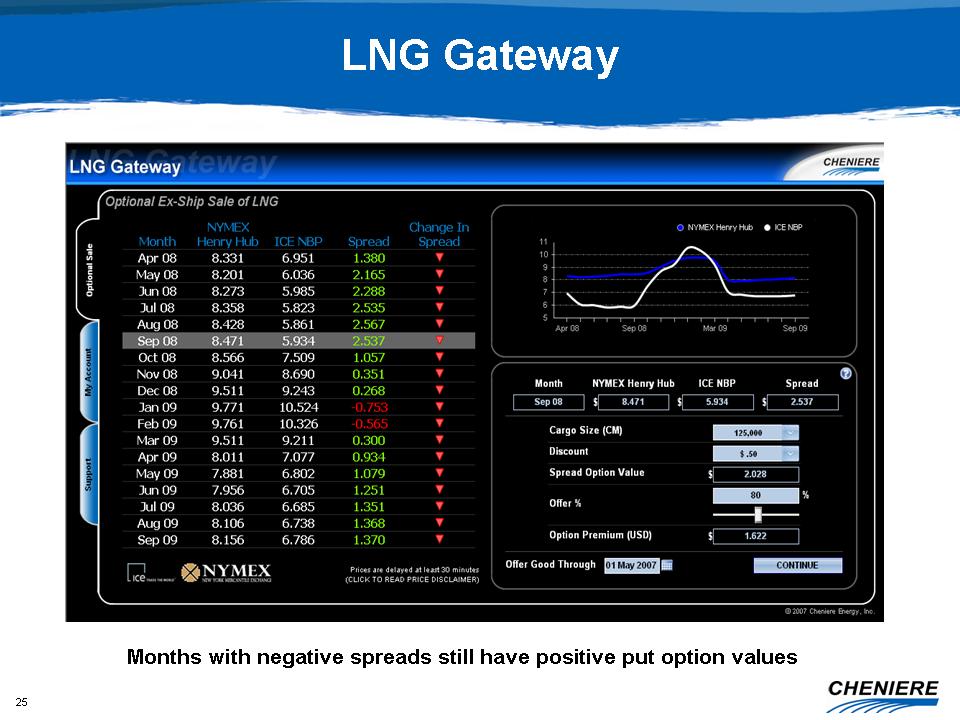

LNG Gateway Months with negative spreads still have positive put option values

Support My Account Optional Sale Month NYMEX Henry Hub Ice NBP Spread Change

in

Spread Apr 08 8.331 6.951 1.380 May 08 8.201 6.036 2.165 Jun 08 8.273 5.985

2.88

Jul 08 8.358 5.823 2.535 Aug 08 8.428 5.861 2.567 Sept 08 8.471 5.934 2.537

Oct

08 8.566 7.509 1.057 Nov 08 9.041 8.690 0.351 Dec 08 9.511 9.243 0.268 Jan

09

9.7711 10.524 -0.743 Feb 09 9.761 10.326 -0.565 Mar 09 9.511 9.211 0.300

Apr 09

8.011 7.077 0.934 May 09 7.881 6.802 1.079 Jun 09 7.956 6.705 1.251 Jul 09

8.036

6.685 1.351 Aug 09 8.106 6.738 1.368 Sep 09 8.156 6.786 1.370 Prices are

delayed

at least 30 minutes (click to read price disclaimer)

26

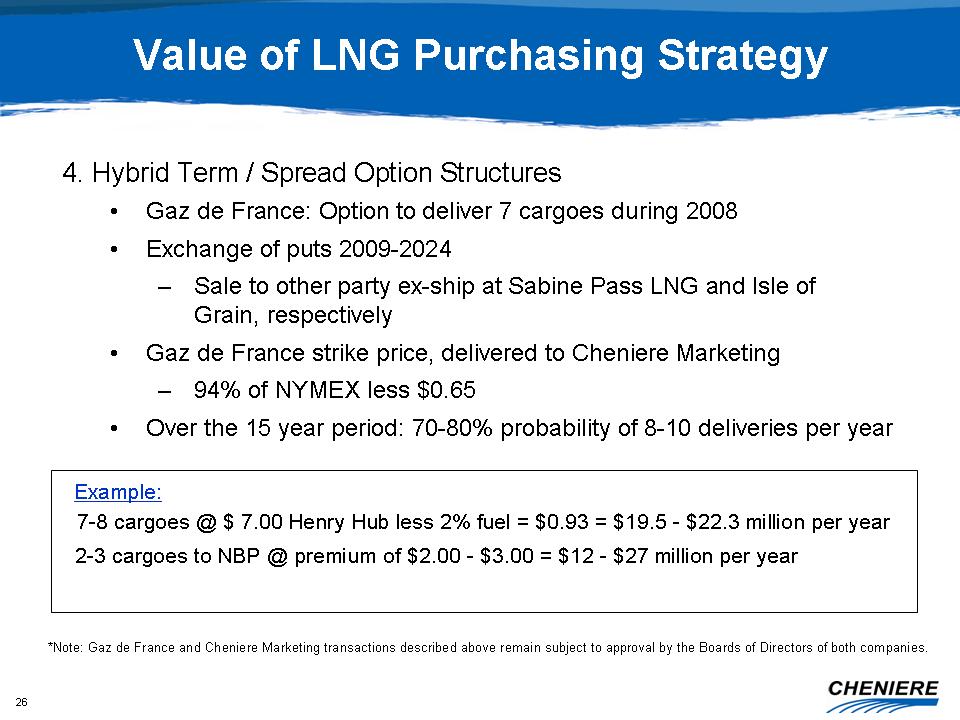

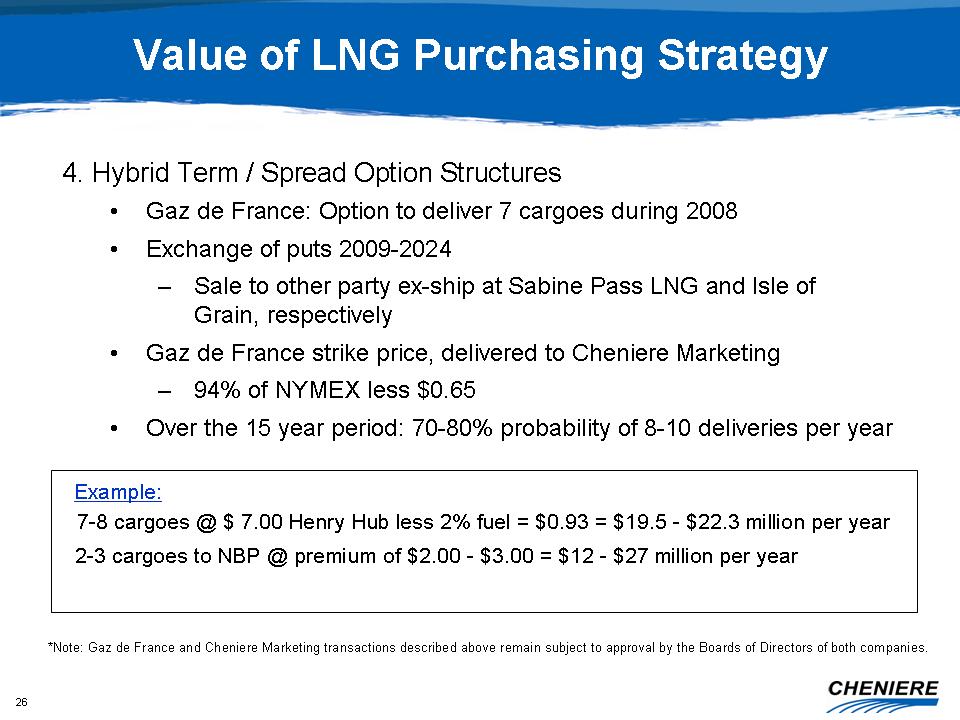

Value of LNG Purchasing Strategy 4. Hybrid Term / Spread Option Structures

• Gaz

de France: Option to deliver 7 cargoes during 2008 • Exchange of puts 2009-2024

– Sale to other party ex-ship at Sabine Pass LNG and Isle of Grain, respectively

• Gaz de France strike price, delivered to Cheniere Marketing – 94% of NYMEX

less $0.65 • Over the 15 year period: 70-80% probability of 8-10 deliveries per

year Example: 7-8 cargoes @ $ 7.00 Henry Hub less 2% fuel = $0.93 = $19.5

-

$22.3 million per year 2-3 cargoes to NBP @ premium of $2.00 - $3.00 = $12

- $27

million per year *Note: Gaz de France and Cheniere Marketing transactions

described above remain subject to approval by the Boards of Directors of

both

companies.

27

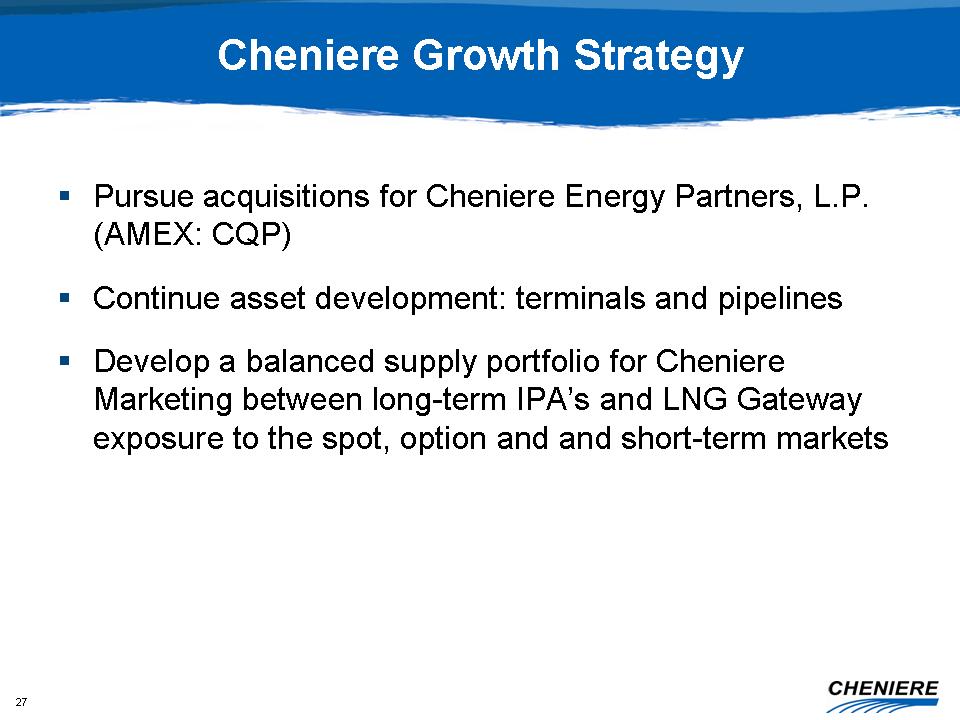

Cheniere Growth Strategy ?? Pursue acquisitions for Cheniere Energy Partners,

L.P. (AMEX: CQP) ?? Continue asset development: terminals and pipelines ??

Develop a balanced supply portfolio for Cheniere Marketing between long-term

IPA’s and LNG Gateway exposure to the spot, option and and short-term markets

28

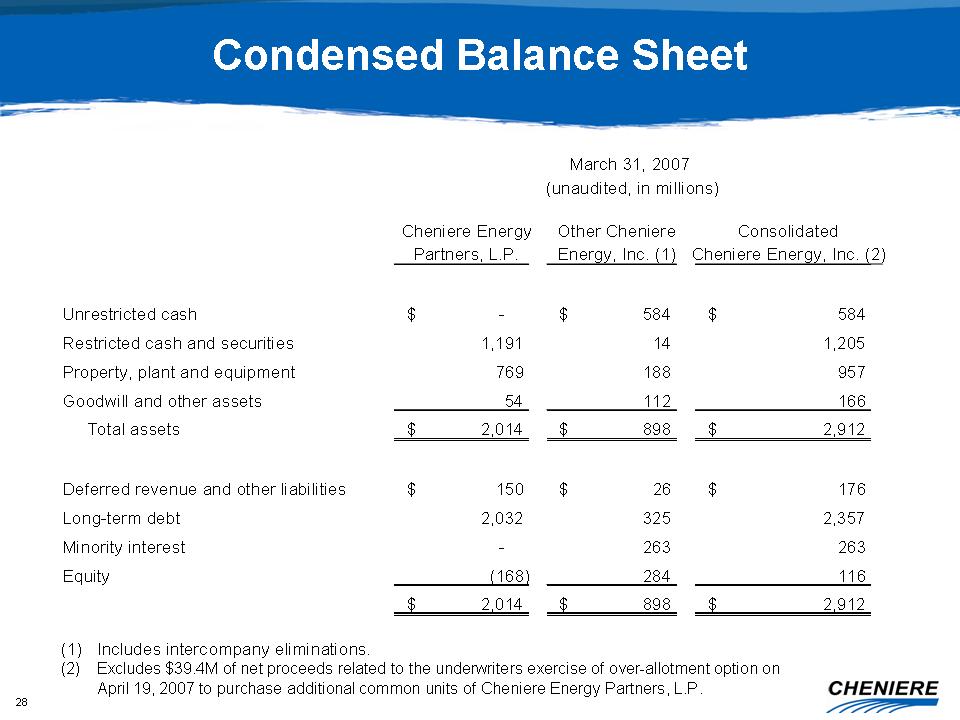

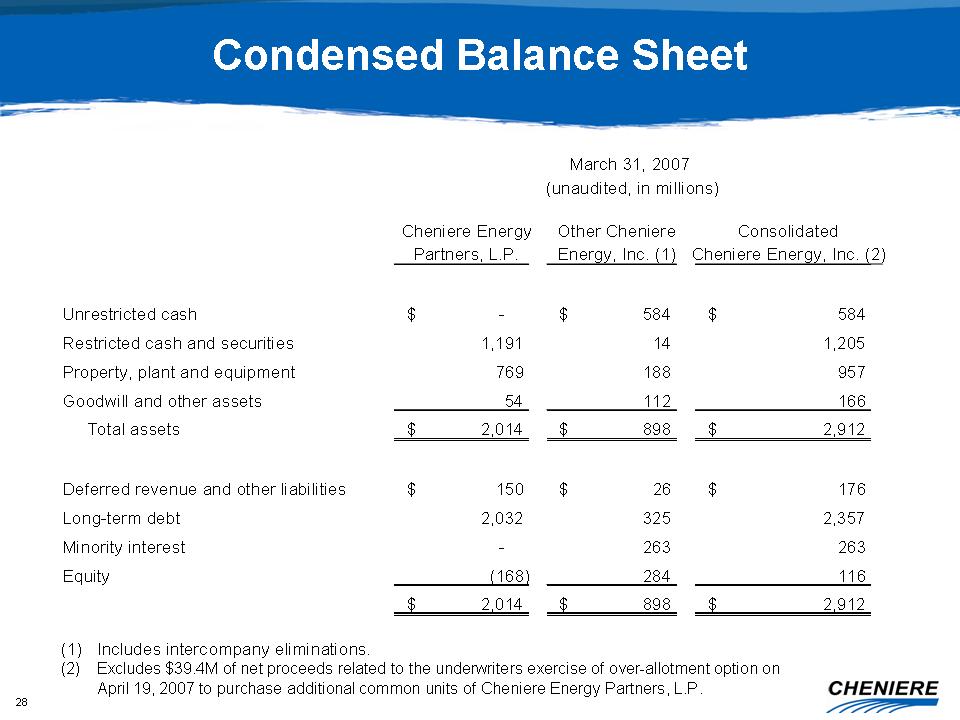

Condensed Balance Sheet Cheniere Energy Other Cheniere Consolidated Partners,

L.P. Energy, Inc. (1) Cheniere Energy, Inc. (2) Unrestricted cash - $ 584

$ 584

$ Restricted cash and securities 1,191 14 1,205 Property, plant and equipment

769 188 957 Goodwill and other assets 54 112 166 Total assets 2,014 $ 898

$

2,912 $ Deferred revenue and other liabilities 150 $ 26 $ 176 $ Long-term

debt

2,032 325 2,357 Minority interest - 263 263 Equity (168) 284 116 2,014 $

898 $

2,912 $ (1) Includes intercompany eliminations. (2) Excludes $39.4M of net

proceeds related to the underwriters exercise of over-allotment option on

April

19, 2007 to purchase additional common units of Cheniere Energy Partners,

L.P.

March 31, 2007 (unaudited, in millions)