Exhibit

99.1

Corporate

Presentation September 2006 CHENIERE ENERGY ,INC . *Corpus Christi LNG L.P.

Cheniere 100% *Artist’s Rendition *Creole Trail LNG L.P. Cheniere 100% *Sabine

Pass LNG L.P. Cheniere 100% *Freeport LNG L.P. Cheniere 30% Limited

Partner

2

This presentation contains certain statements that are, or may be deemed to

be,

“forward-looking statements” within the meaning of Section 27A of the Securities

Act and Section 21E of the Securities Exchange Act of 1934, as amended, or

the

Exchange Act. All statements, other than statements of historical facts,

included herein are “forward-looking statements.” Included among

“forward-looking statements” are, among other things: ⑀⍽ statements that we

expect to commence or complete construction of each or any of our proposed

liquefied natural gas, or LNG, receiving terminals by certain dates, or at

all;

⑀⍽ statements that we expect to receive Draft Environmental Impact Statements

or

Final Environmental Impact Statements from the Federal Energy Regulatory

Commission, or FERC, by certain dates, or at all, or that we expect to receive

an order from FERC authorizing us to construct and operate proposed LNG

receiving terminals by a certain date, or at all; ⑀⍽ statements regarding future

levels of domestic natural gas production and consumption, or the future level

of LNG imports into North America, or regarding projected future capacity of

liquefaction or regasification facilities worldwide regardless of the source

of

such information; ⑀⍽ statements regarding any financing transactions or

arrangements, whether on the part of Cheniere or at the project level; ⑀⍽

statements relating to the construction of our proposed LNG receiving terminals,

including statements concerning estimated costs, and the engagement of any

EPC

contractor; ⑀⍽ statements regarding any Terminal Use Agreement, or TUA, or other

commercial arrangements presently contracted, optioned, marketed or potential

arrangements to be performed substantially in the future, including any cash

distributions and revenues anticipated to be received; statements regarding

the

commercial terms and potential revenues from Targeted Long-Term Agreements

described in this presentation; ⑀⍽ statements regarding the commercial terms or

potential revenue from any arrangements which may arise from the marketing

of

uncommitted capacity from any of the terminals, including the Creole Trail

and

Corpus Christi terminals which do not currently have contractual commitments;

⑀⍽

statements regarding the commercial terms or potential revenue from any

arrangement relating to the proposed contracting for excess or expansion

capacity for the Sabine Pass LNG Terminal or the Indexed Purchase Agreement

(“IPA’s”) Examples described in this presentation; ⑀⍽ statements that our

proposed LNG receiving terminals, when completed, will have certain

characteristics, including amounts of regasification and storage capacities,

a

number of storage tanks and docks and pipeline interconnections; ⑀⍽ statements

regarding Cheniere and Cheniere Marketing forecasts, and any potential revenues

and capital expenditures which may be derived from either of Cheniere Energy’s

business groups; ⑀⍽ statements regarding Cheniere Pipeline Company, and the

capital expenditures and potential revenues related to this business group;

statements regarding our proposed LNG receiving terminals’ access to existing

pipelines, and their ability to obtain transportation capacity on existing

pipelines; ⑀⍽ statements regarding possible expansions of the currently

projected size of any of our proposed LNG receiving terminals; ⑀⍽ statements

regarding our business strategy, our business plan or any other plans,

forecasts, examples, models, forecasts or objectives; and ⑀⍽ any other

statements that relate to non-historical information. These forward-looking

statements are often identified by the use of terms and phrases such as

“achieve,” “anticipate,” “believe,” “estimate,” “example,” “expect,” “forecast,”

“opportunities,” “plan,” “potential,” “project,” “propose,” “subject to,” and

similar terms and phrases. Although we believe that the expectations reflected

in these forward-looking statements are reasonable, they do involve assumptions,

risks and uncertainties, and these expectations may prove to be incorrect.

You

should not place undue reliance on these forward-looking statements, which

speak

only as of the date of this presentation. Our actual results could differ

materially from those anticipated in these forward-looking statements as a

result of a variety of factors, including those discussed in “Risk Factors” in

the Cheniere Energy, Inc. Annual Report on Form 10-K for the year ended December

31, 2005, which are incorporated by reference into this presentation. All

forward-looking statements attributable to us or persons acting on our behalf

are expressly qualified in their entirety by these ”Risk Factors”. These

forward-looking statements are made as of the date of this presentation. Safe

Harbor Act

3

Freeport LNG, L.P. Cheniere Energy, Inc. 30% L.P. interest ⑀⍽ Land - 233 acres

in Brazoria County, TX ⑀⍽ Berthing/Unloading - 2 docks - 78,000 cm to 250,000 cm

LNGCs - 3 dedicated tugs ⑀⍽ Storage - 2 x 160,000 cm (6.7 Bcfe) ⑀⍽ Vaporization

- 1.5 Bcf/d ⑀⍽ Project Status - 55% complete August 2006 Freeport LNG

Construction Site 1.0 Bcf/d 0.5 Bcf/d Sold Terminal Use Agreement (TUA) Conoco

Dow Capacity Freeport LNG L.P.

4

Sabine Pass LNG, L.P. Cheniere Energy 100% ⑀⍽ Land - 853 acres in Cameron

Parish, LA ⑀⍽ Accessibility - Deepwater Ship Channel - Sabine River Channel

dredged to 40 feet ⑀⍽ Proximity - 3.7 nautical miles from coast - 22.8 nautical

miles from outer buoy ⑀⍽ Berthing/Unloading - 2 docks - 87,000 cm to 250,000 cm

LNGCs - 4 dedicated tugs ⑀⍽ Storage - Phase I: 3 x 160,000 cm (10.1 Bcfe) -

Phase II: 2 x 160,000 cm (6.7 Bcfe) ⑀⍽ Vaporization - Phase I: 2.6 Bcf/d - Phase

II: 1.4 Bcf/d ⑀⍽ Potential Pipeline Access - Interstate Access to NE, MW, SE,

& Mid-Atlantic markets - ~14 Bcf/d Within 150 Miles ⑀⍽ Regional Market -

Strong Gas Demand - Port Arthur, Beaumont, Orange, Lake Charles ⑀⍽ Project

Status - Phase I approximately 60% complete; operational Q1 08 - Phase II

commenced Aug 2006; operational mid 09 Sabine Pass Construction Site 1.0

Bcf/d

1.0 Bcf/d Total, S.A. Chevron Capacity Sold - Terminal Use

Agreement

5

Corpus Christi LNG, L.P. Cheniere Energy 100% ⑀⍽ Land - 212 acres in San

Patricio County, TX - ~ 400 acres of permanent easement ⑀⍽ Accessibility -

Deepwater Ship Channel - La Quinta Channel dredged to 45 feet ⑀⍽ Proximity -

14.3 nautical miles from coast - 16 nautical miles from outer buoy ⑀⍽

Berthing/Unloading - 2 docks - 87,000 cm to 250,000 cm LNGCs - 3 dedicated

tugs

⑀⍽ Storage - 3 x 160,000cm (10.1 Bcfe) ⑀⍽ Vaporization - 2.6 Bcf/d ⑀⍽ Potential

Pipeline Access - Interstate access to NE, MW, SE & Mexico markets - ~5

Bcf/d within 25 Miles ⑀⍽ Regional Market - Strong Gas Demand - Texas industrials

& power generators ⑀⍽ Project Status - Site Preparation Underway $50 Million

Corpus Christi Site Preparation

6

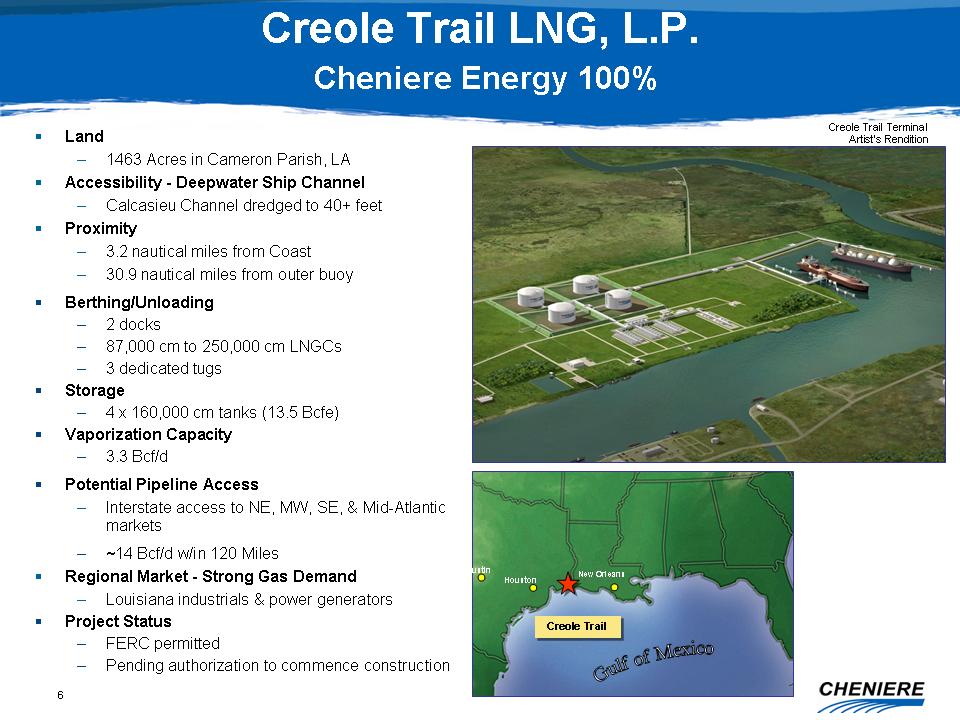

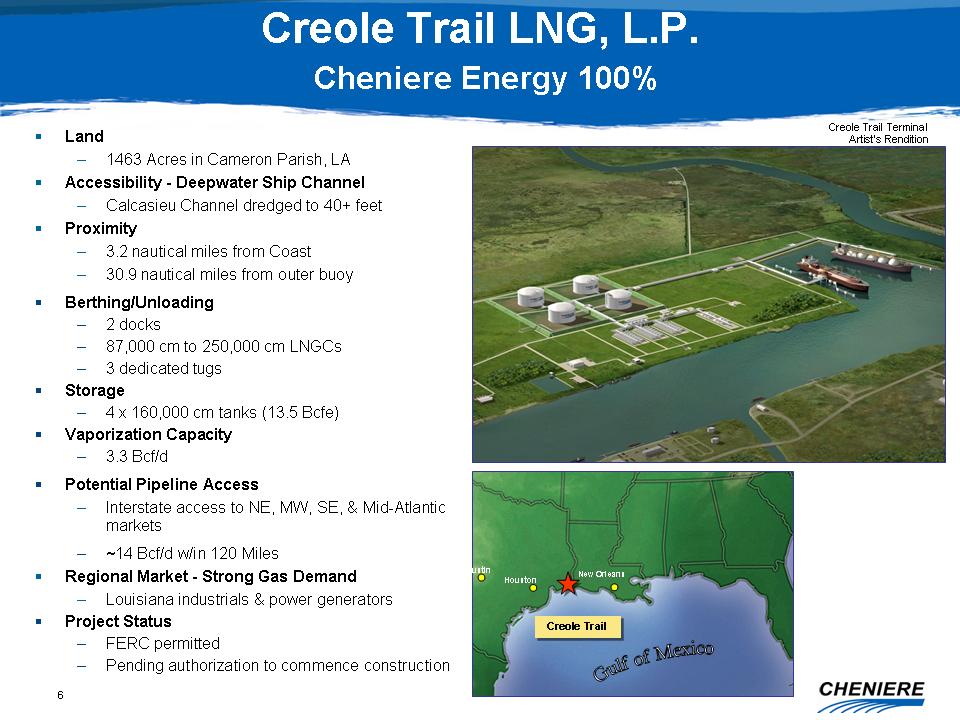

Creole Trail LNG, L.P. Cheniere Energy 100% ⑀⍽ Land - 1463 Acres in Cameron

Parish, LA ⑀⍽ Accessibility - Deepwater Ship Channel - Calcasieu Channel dredged

to 40+ feet ⑀⍽ Proximity - 3.2 nautical miles from Coast - 30.9 nautical miles

from outer buoy ⑀⍽ Berthing/Unloading - 2 docks - 87,000 cm to 250,000 cm LNGCs

- 3 dedicated tugs ⑀⍽ Storage - 4 x 160,000 cm tanks (13.5 Bcfe) ⑀⍽ Vaporization

Capacity - 3.3 Bcf/d ⑀⍽ Potential Pipeline Access - Interstate access to NE, MW,

SE, & Mid-Atlantic markets - ~14 Bcf/d w/in 120 Miles ⑀⍽ Regional Market -

Strong Gas Demand - Louisiana industrials & power generators ⑀⍽ Project

Status - FERC permitted - Pending authorization to commence construction

Creole

Trail Terminal Artist’s Rendition Creole Trail Creole Trail Austin Houston New

Orleans

7

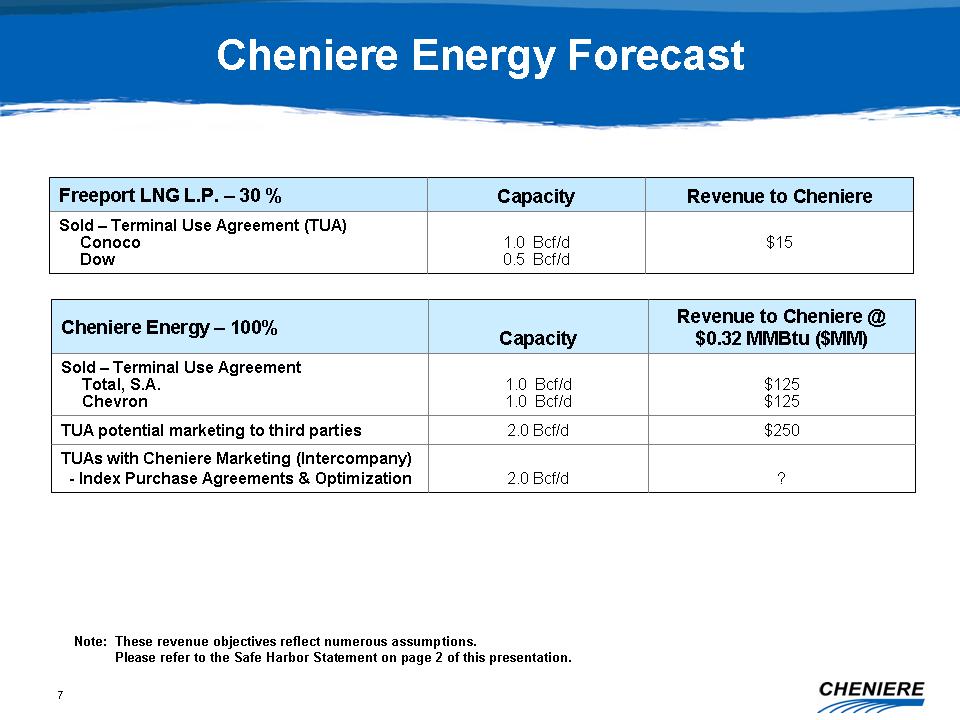

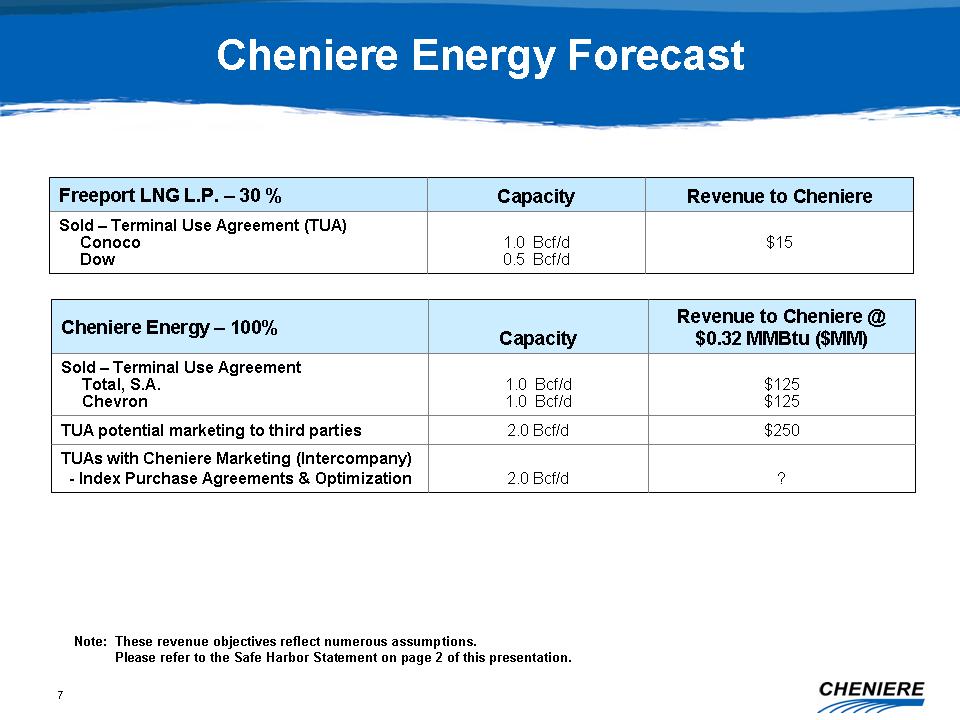

Cheniere Energy Forecast Note: These revenue objectives reflect numerous

assumptions. Please refer to the Safe Harbor Statement on page 2 of this

presentation. $125 $125 1.0 Bcf/d 1.0 Bcf/d Sold - Terminal Use Agreement

Total,

S.A. Chevron $250 2.0 Bcf/d TUA potential marketing to third parties ? Revenue

to Cheniere @ $0.32 MMBtu ($MM) 2.0 Bcf/d TUAs with Cheniere Marketing

(Intercompany) - Index Purchase Agreements & Optimization Capacity Cheniere

Energy - 100% $15 1.0 Bcf/d 0.5 Bcf/d Sold - Terminal Use Agreement (TUA)

Conoco

Dow Revenue to Cheniere Capacity Freeport LNG L.P. - 30 %

Potential

Value of Spare Capacity

9

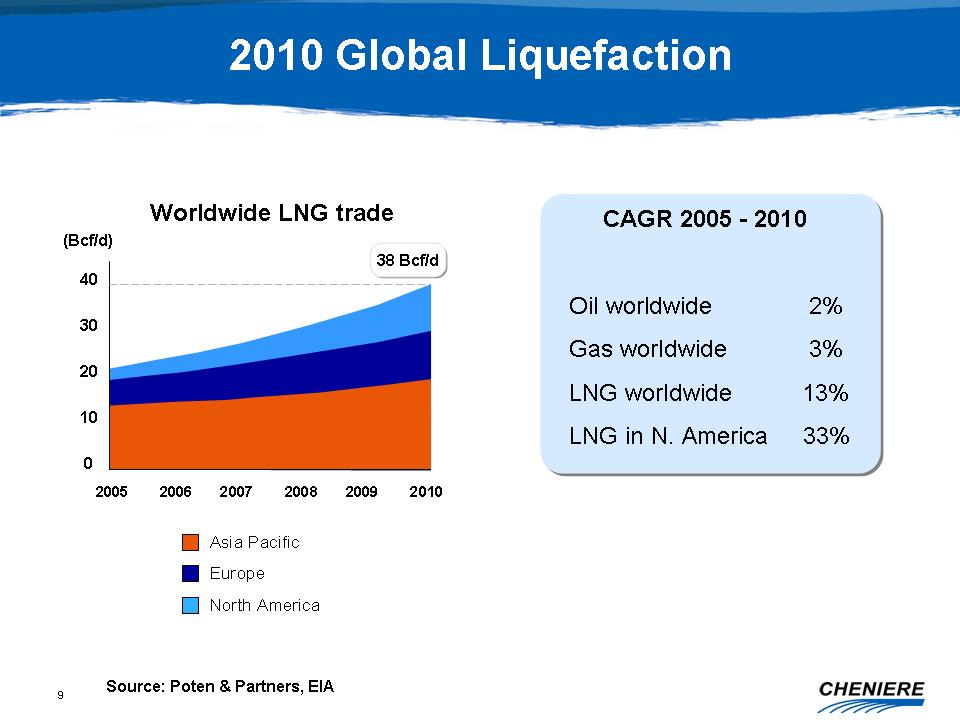

2010 Global Liquefaction 40 30 20 10 0 (Bcf/d) 2005 2006 2007 2008 2009 2010

Source: Poten & Partners, EIA CAGR 2005 - 2010 Oil worldwide 2% Gas

worldwide 3% LNG worldwide 13% LNG in N. America 33% Worldwide LNG trade

Asia

Pacific Europe North America 38 Bcf/d 38 Bcf/d

10

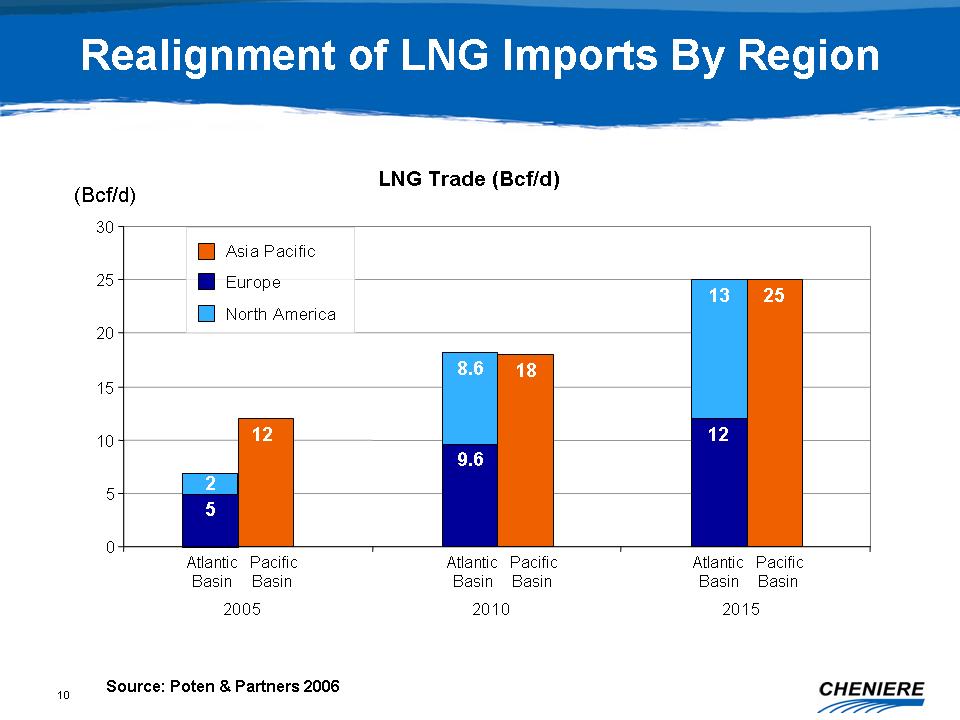

12 18 25 5 9.6 12 2 8.6 13 0 5 10 15 20 25 30 2005 2010 2015 Source: Poten

&

Partners 2006 LNG Trade (Bcf/d) Realignment of LNG Imports By Region (Bcf/d)

Asia Pacific Europe North America Atlantic Basin Pacific Basin Atlantic Basin

Pacific Basin Atlantic Basin Pacific Basin

11

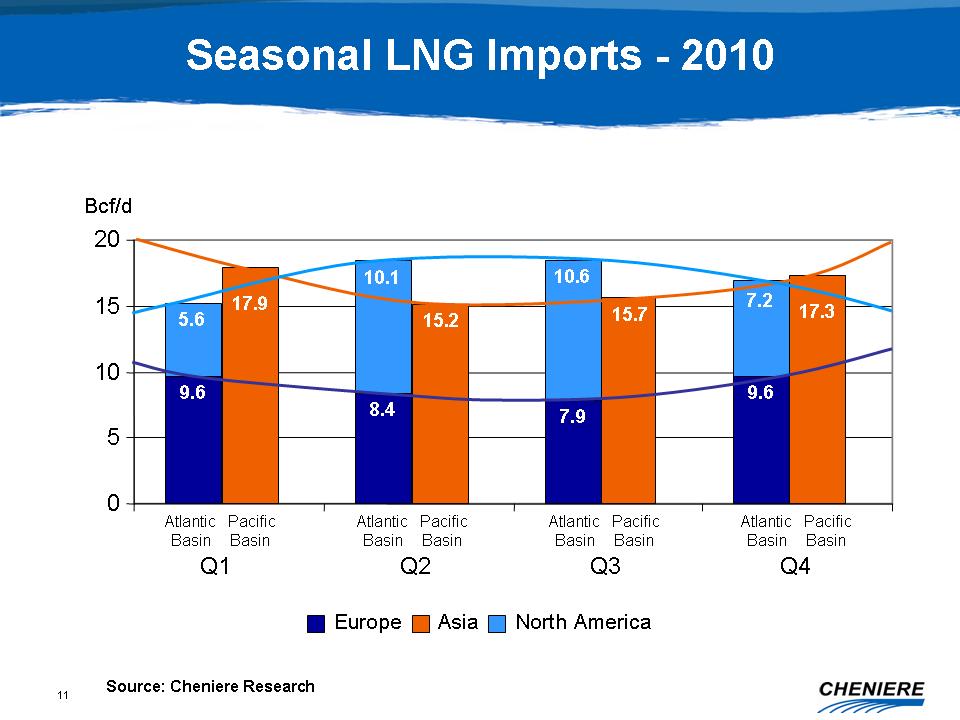

Seasonal LNG Imports - 2010 15.2 15.7 17.3 0 5 10 15 20 Atlantic Basin Q2

Q3 Q4

Bcf/d Europe Asia North America 9.6 5.6 8.4 10.1 7.9 10.6 9.6 7.2 Pacific

Basin

Atlantic Basin Pacific Basin Atlantic Basin Pacific Basin Atlantic Basin

Pacific

Basin Q1 17.9 Source: Cheniere Research

12

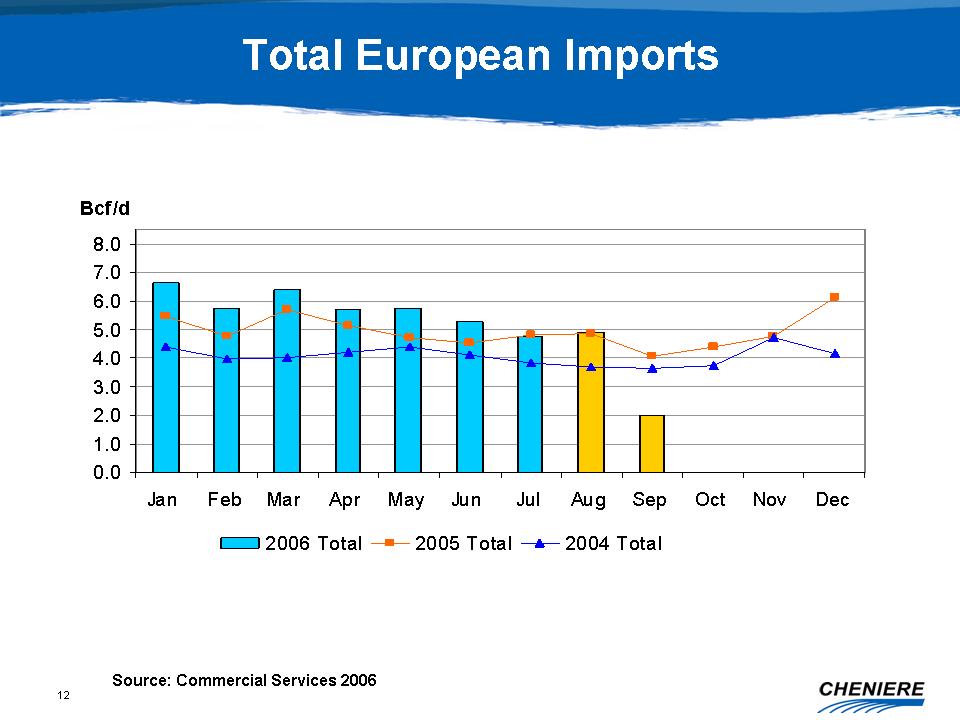

Europe Total Imports 0.0 1.0 2.0 3.0 4.0 5.0 6.0 7.0 8.0 Jan Feb Mar Apr

May Jun

Jul Aug Sep Oct Nov Dec Bcf/d 2006 Total 2005 Total 2004 Total Total European

Imports Source: Commercial Services 2006

13

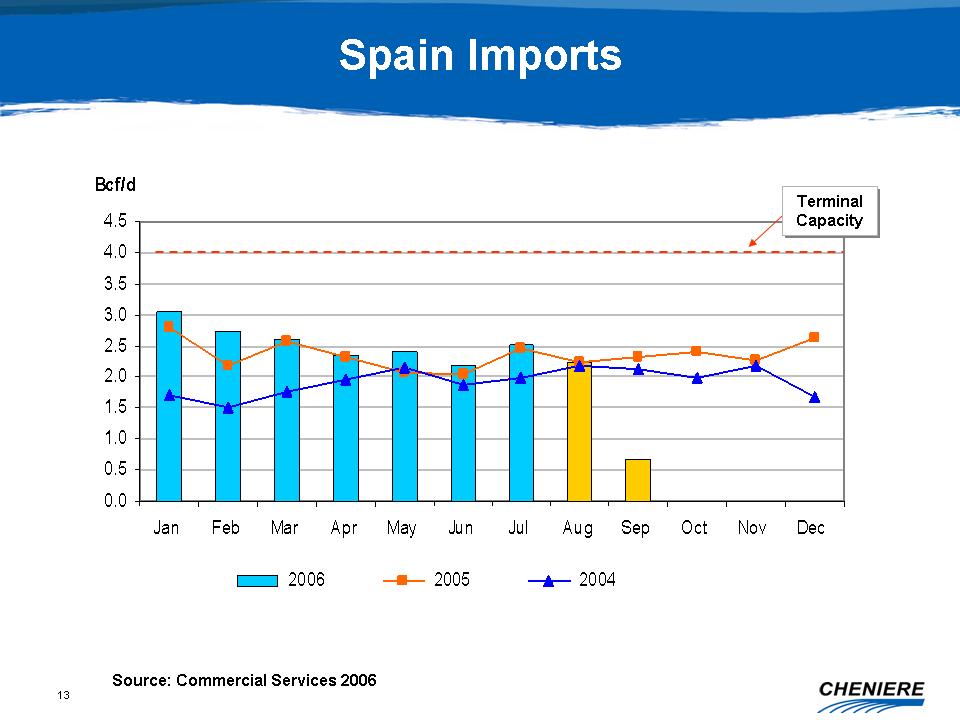

Spain Imports Source: Commercial Services 2006 0.0 0.5 1.0 1.5 2.0 2.5 3.0

3.5

4.0 4.5 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Bcf/d 2006 Total

2005

Total 2004 Total Terminal Capacity Terminal Capacity

14

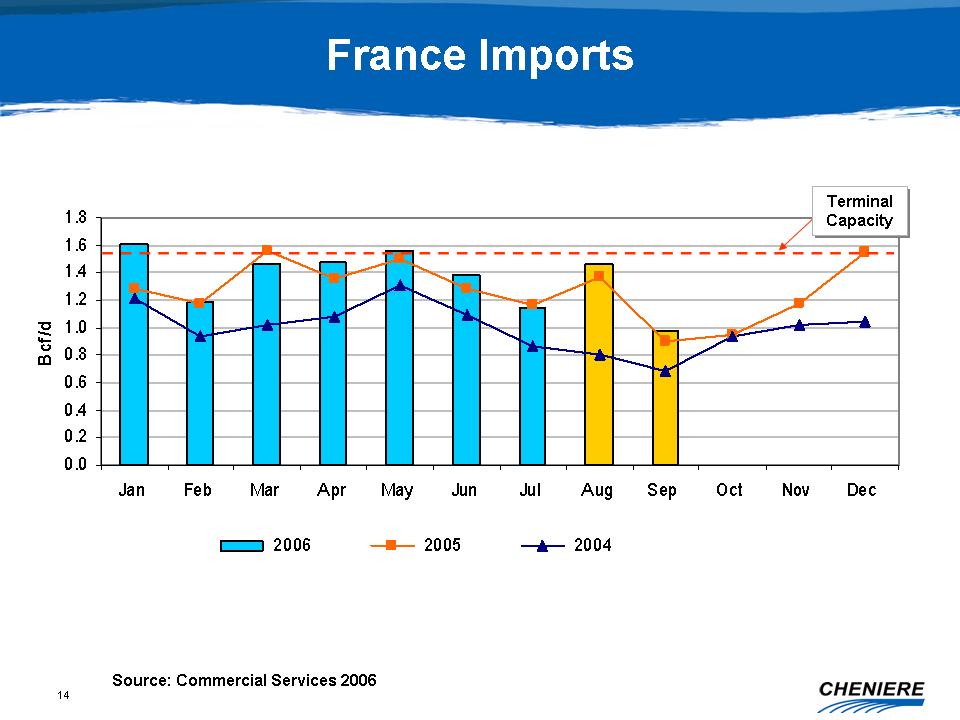

France Imports Source: Commercial Services 2006 France Total Imports 0.0

0.2 0.4

0.6 0.8 1.0 1.2 1.4 1.6 1.8 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

Bcf/d 2006 Total 2005 Total 2004 Total Terminal Capacity Terminal

Capacity

15

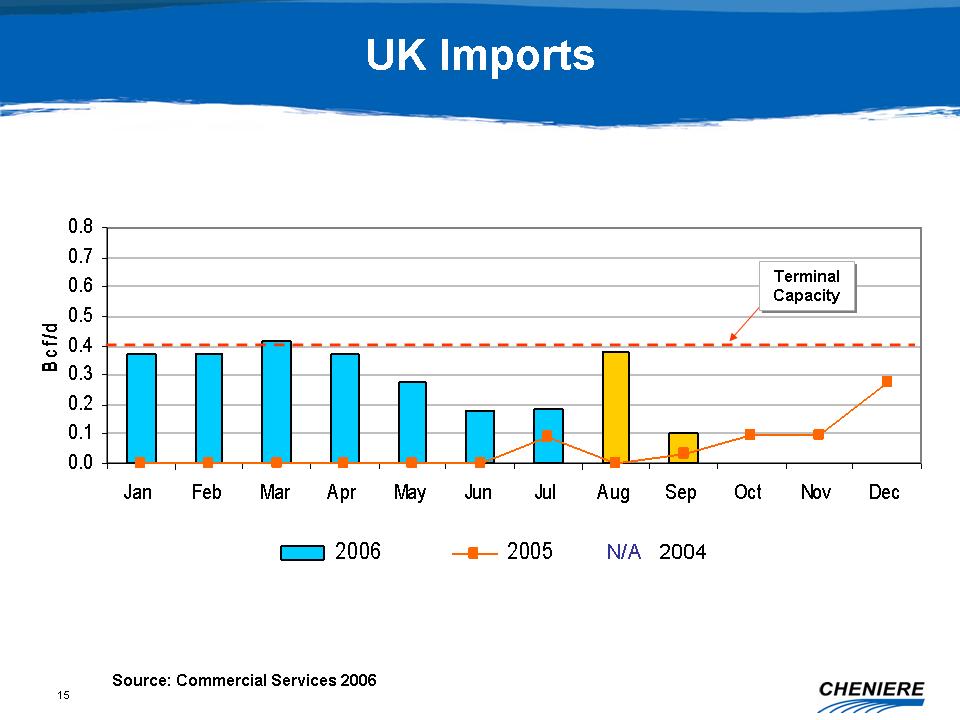

UK Imports Source: Commercial Services 2006 UK Isle of Grain Imports 0.0

0.1 0.2

0.3 0.4 0.5 0.6 0.7 0.8 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Bcf/d

2006 Total 2005 Total Terminal Capacity Terminal Capacity N/A

2004

16

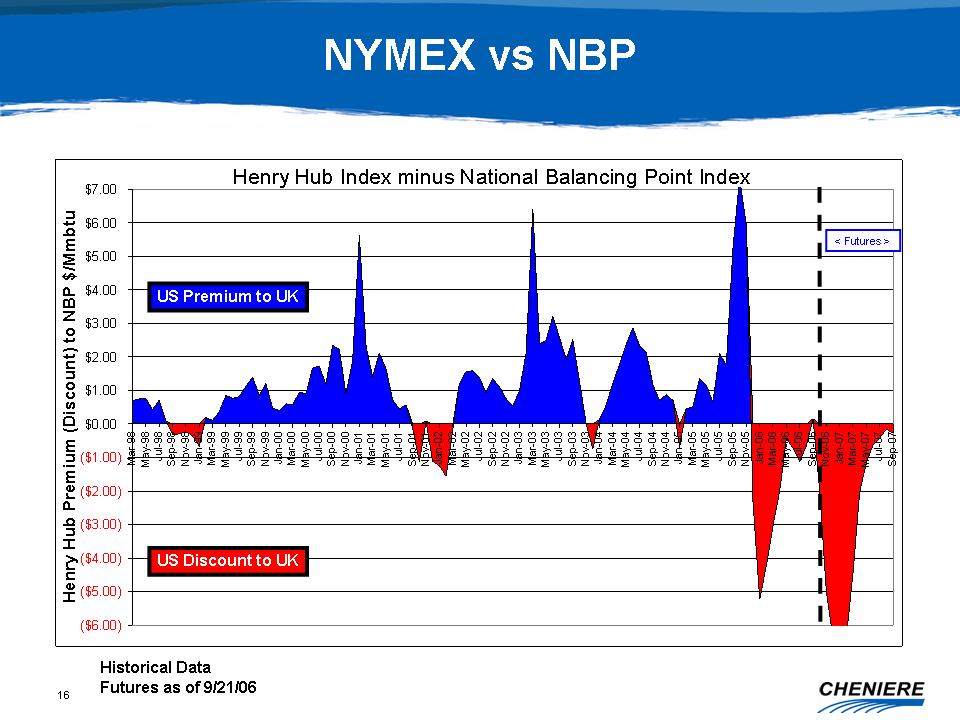

Henry Hub Index minus National Balancing Point Index ($6.00) ($5.00) ($4.00)

($3.00) ($2.00) ($1.00) $0.00 $1.00 $2.00 $3.00 $4.00 $5.00 $6.00 $7.00 Mar-98

May-98 Jul-98 Sep-98 Nov-98 Jan-99 Mar-99 May-99 Jul-99 Sep-99 Nov-99 Jan-00

Mar-00 May-00 Jul-00 Sep-00 Nov-00 Jan-01 Mar-01 May-01 Jul-01 Sep-01 Nov-01

Jan-02 Mar-02 May-02 Jul-02 Sep-02 Nov-02 Jan-03 Mar-03 May-03 Jul-03 Sep-03

Nov-03 Jan-04 Mar-04 May-04 Jul-04 Sep-04 Nov-04 Jan-05 Mar-05 May-05 Jul-05

Sep-05 Nov-05 Jan-06 Mar-06 May-06 Jul-06 Sep-06 Nov-06 Jan-07 Mar-07 May-07

Jul-07 Sep-07 Henry Hub Premium (Discount) to NBP $/Mmbtu < Futures > US

Premium to UK US Discount to UK NYMEX vs NBP Historical Data Futures as of

9/21/06

17

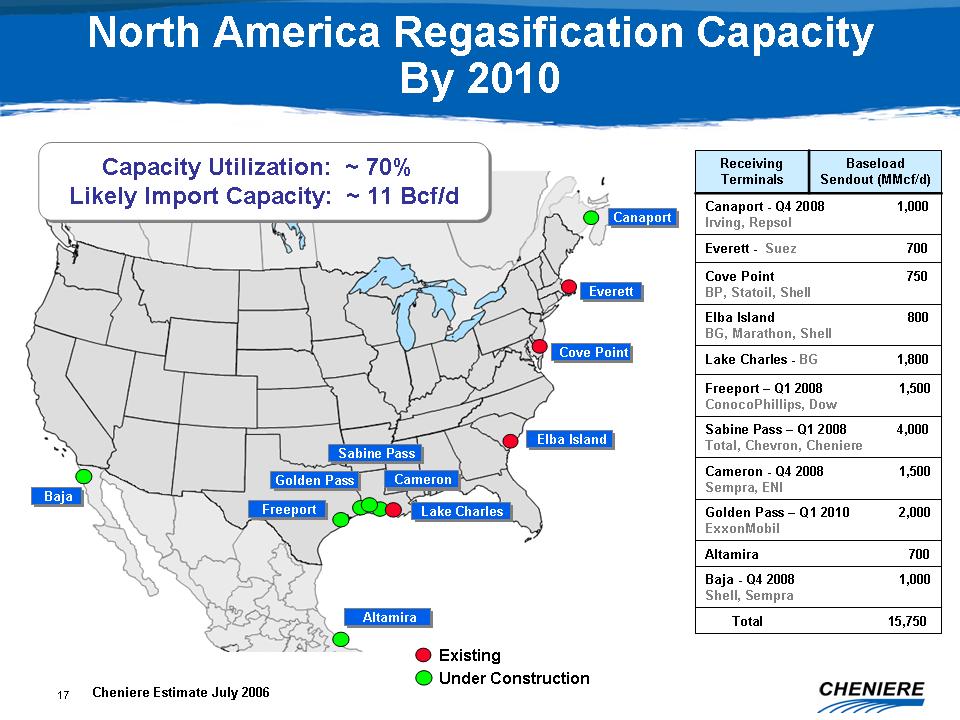

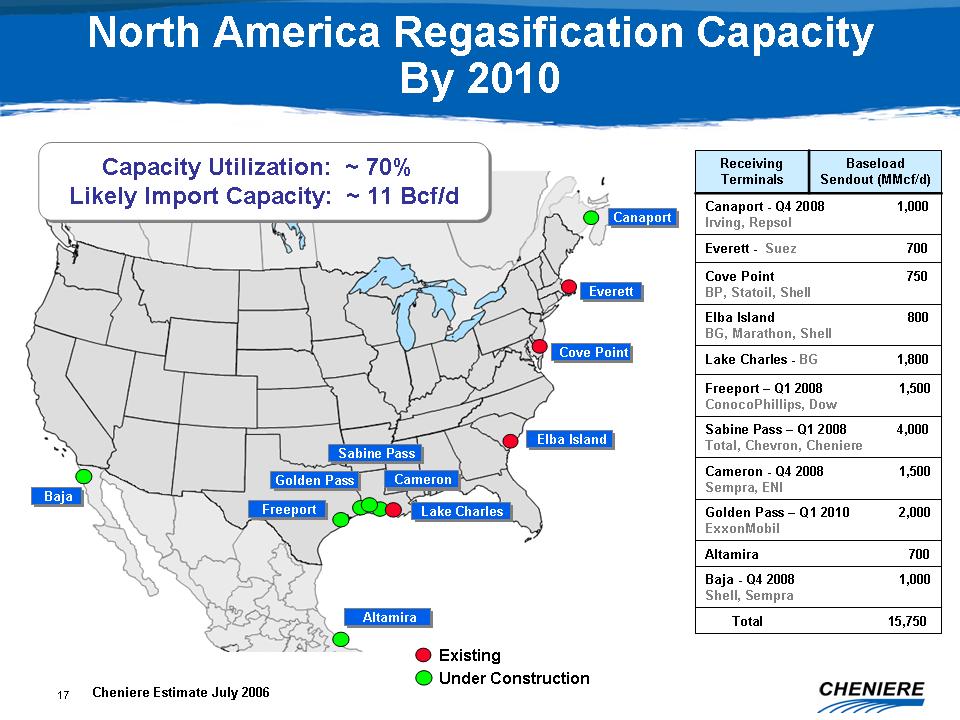

Cheniere Estimate July 2006 North America Regasification Capacity By 2010

Capacity Utilization: ~ 70% Likely Import Capacity: ~ 11 Bcf/d Capacity

Utilization: ~ 70% Likely Import Capacity: ~ 11 Bcf/d Everett Everett Cove

Point

Cove Point Elba Island Elba Island Lake Charles Lake Charles Sabine Pass

Sabine

Pass Freeport Freeport Golden Pass Golden Pass Cameron Cameron Baja Baja

Canaport Canaport Altamira 700 Baja - Q4 2008 1,000 Shell, Sempra Canaport

- Q4

2008 1,000 Irving, Repsol Total 15,750 Golden Pass - Q1 2010 2,000 ExxonMobil

Cameron - Q4 2008 1,500 Sempra, ENI Sabine Pass - Q1 2008 4,000 Total, Chevron,

Cheniere Freeport - Q1 2008 1,500 ConocoPhillips, Dow Lake Charles - BG 1,800

Elba Island 800 BG, Marathon, Shell Cove Point 750 BP, Statoil, Shell Everett

-

Suez 700 Baseload Sendout (MMcf/d) Receiving Terminals Existing Under

Construction Altamira Altamira

18

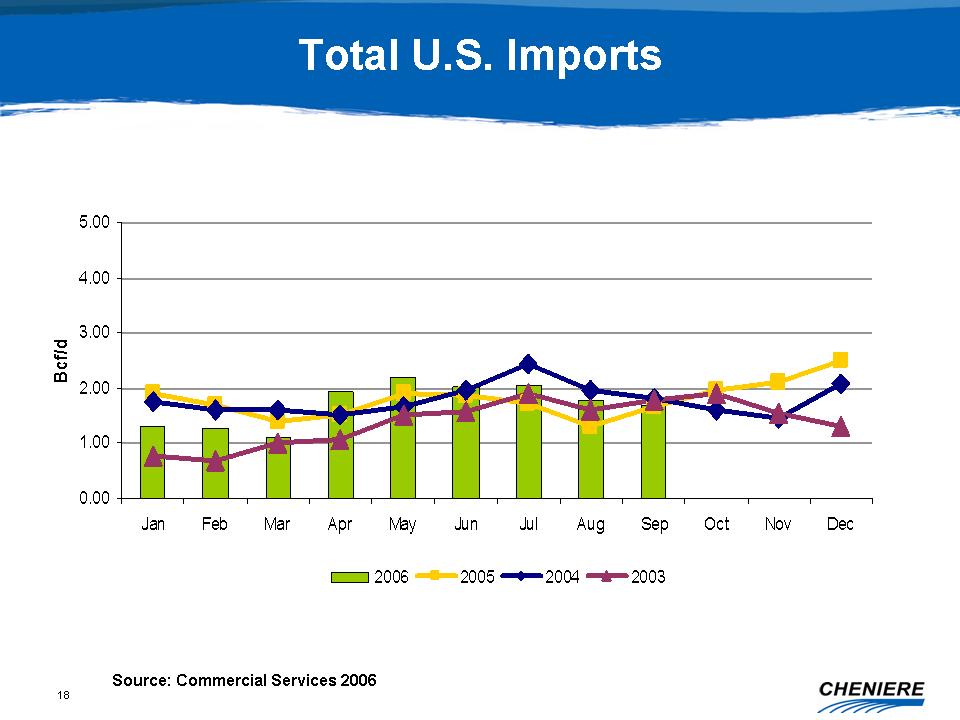

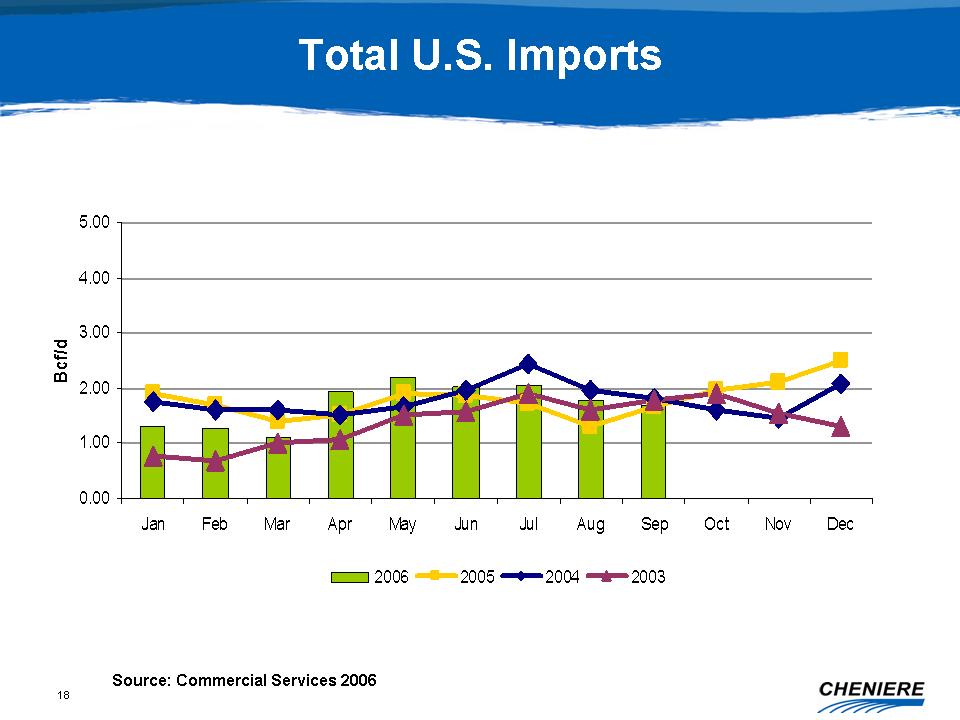

0.00 1.00 2.00 3.00 4.00 5.00 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov

Dec

Bcf/d 2006 2005 2004 2003 Total U.S. Imports Source: Commercial Services

2006

19

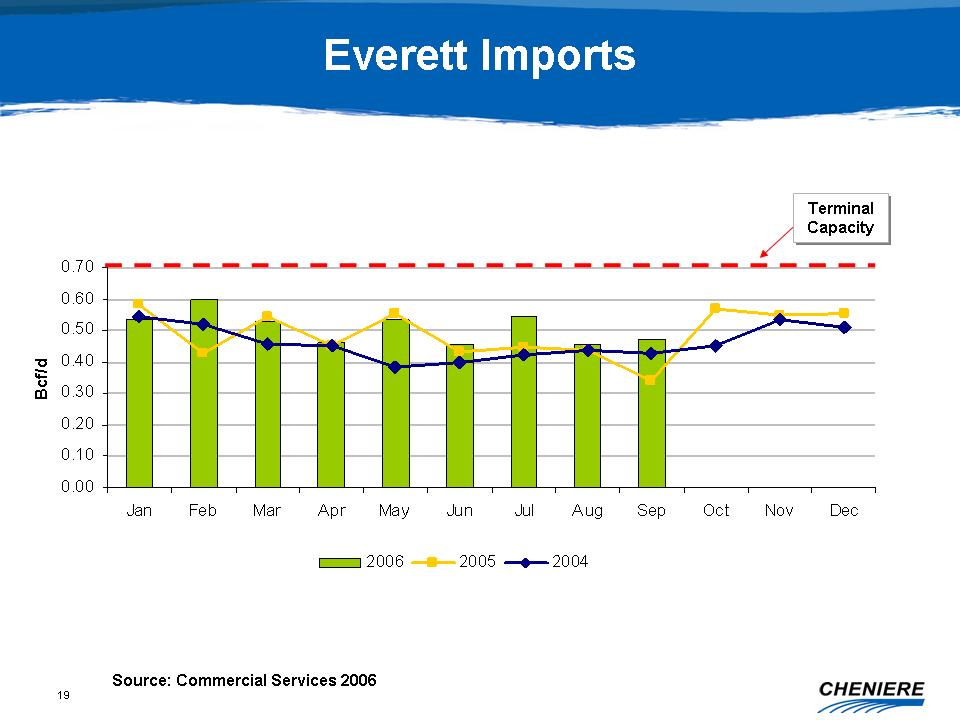

0.00 0.10 0.20 0.30 0.40 0.50 0.60 0.70 Jan Feb Mar Apr May Jun Jul Aug Sep

Oct

Nov Dec Bcf/d 2006 2005 2004 Everett Imports Source: Commercial Services

2006

Terminal Capacity Terminal Capacity

20

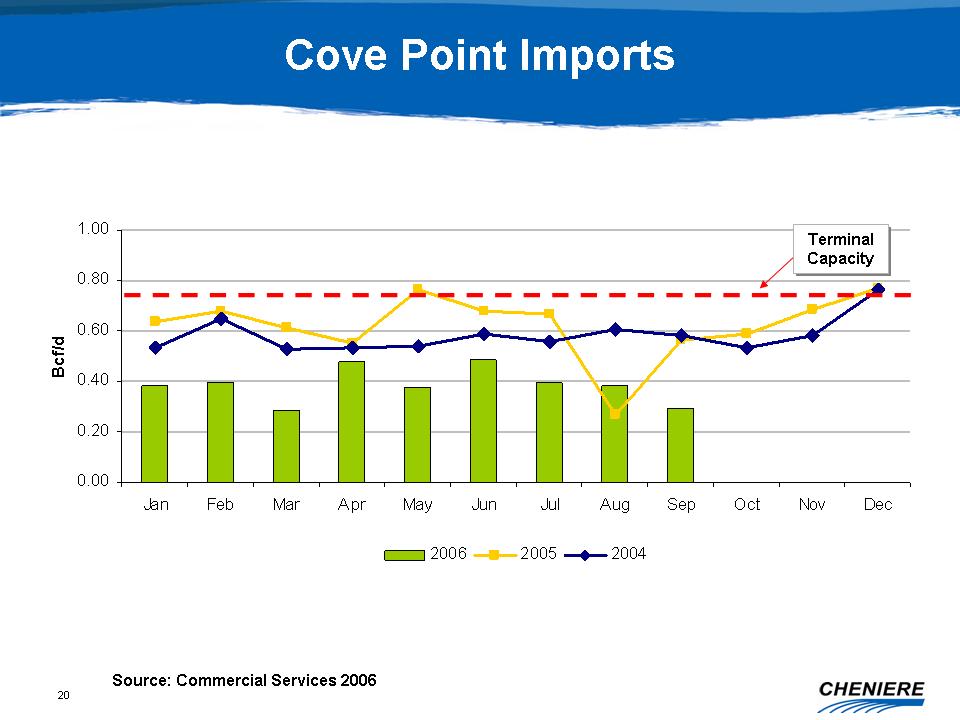

0.00 0.20 0.40 0.60 0.80 1.00 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov

Dec

Bcf/d 2006 2005 2004 Cove Point Imports Source: Commercial Services 2006

Terminal Capacity Terminal Capacity

21

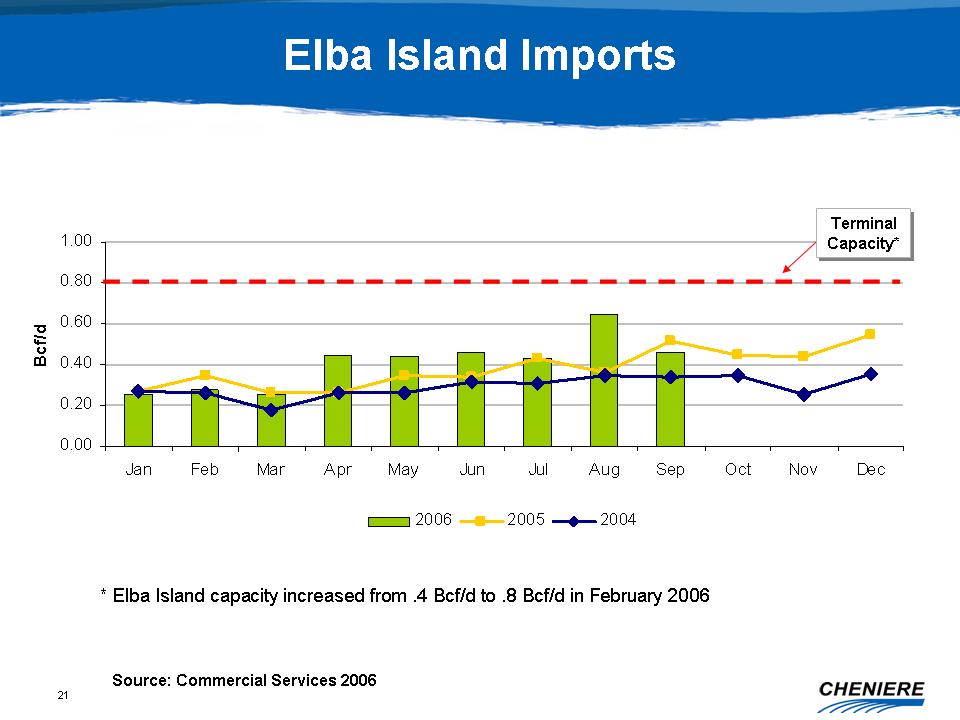

0.00 0.20 0.40 0.60 0.80 1.00 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov

Dec

Bcf/d 2006 2005 2004 Elba Island Imports Source: Commercial Services 2006

Terminal Capacity* Terminal Capacity* * Elba Island capacity increased from

.4

Bcf/d to .8 Bcf/d in February 2006

22

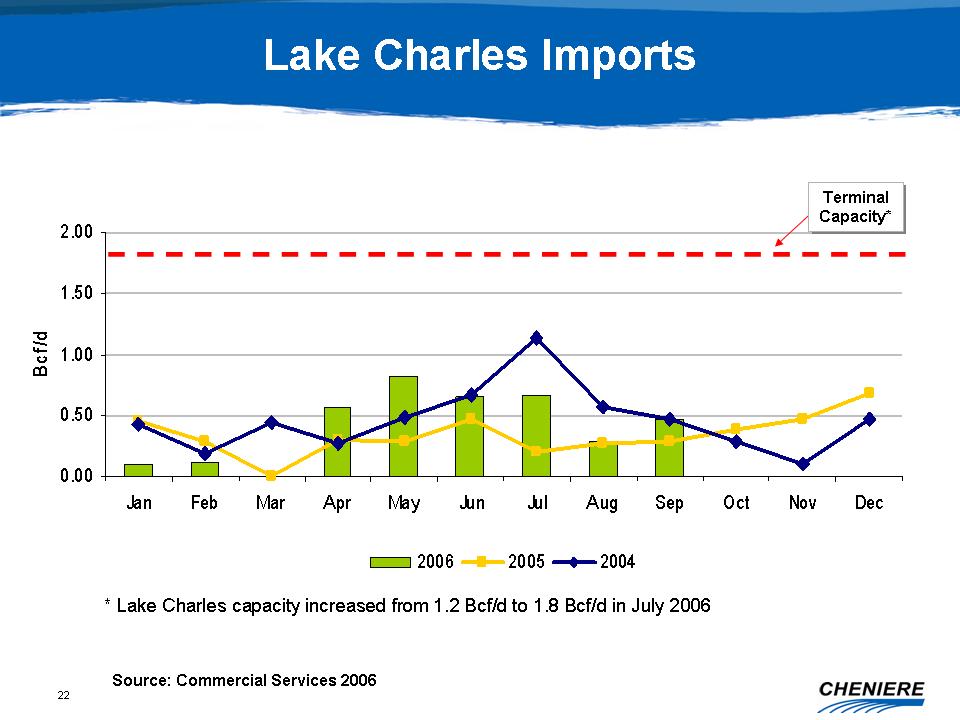

0.00 0.50 1.00 1.50 2.00 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

Bcf/d

2006 2005 2004 Lake Charles Imports Source: Commercial Services 2006 Terminal

Capacity* Terminal Capacity* * Lake Charles capacity increased from 1.2 Bcf/d

to

1.8 Bcf/d in July 2006

23

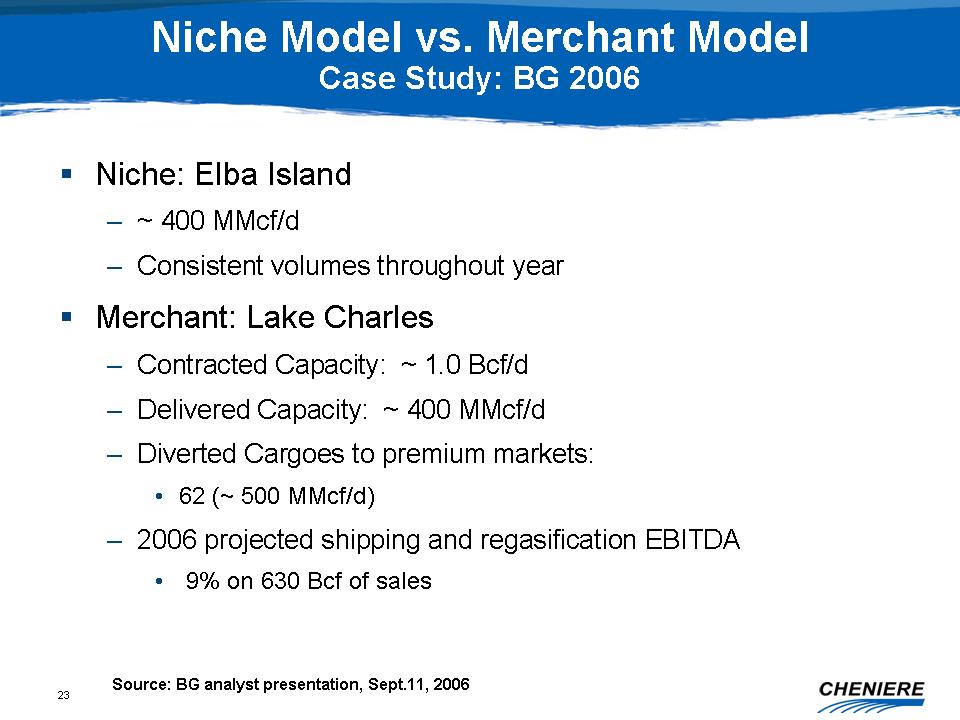

Niche Model vs. Merchant Model Case Study: BG 2006 Source: BG analyst

presentation, Sept.11, 2006 ⑀⍽ Niche: Elba Island - ~ 400 MMcf/d - Consistent

volumes throughout year ⑀⍽ Merchant: Lake Charles - Contracted Capacity: ~ 1.0

Bcf/d - Delivered Capacity: ~ 400 MMcf/d - Diverted Cargoes to premium markets:

• 62 (~ 500 MMcf/d) - 2006 projected shipping and regasification EBITDA • 9% on

630 Bcf of sales

24

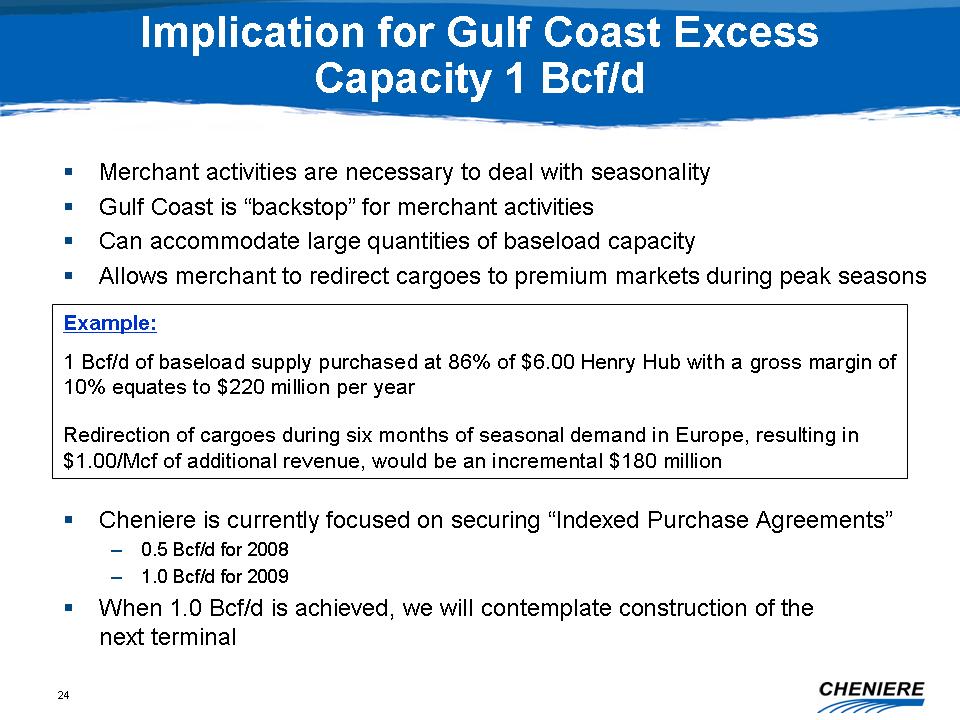

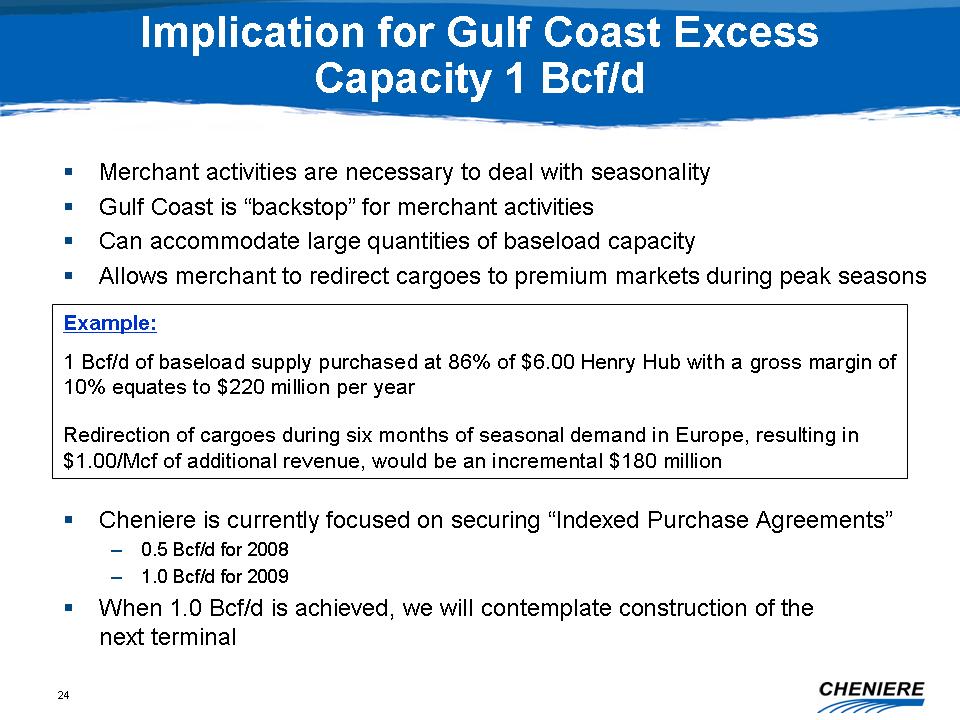

Implication for Gulf Coast Excess Capacity 1 Bcf/d ⑀⍽ Merchant activities are

necessary to deal with seasonality ⑀⍽ Gulf Coast is “backstop” for merchant

activities ⑀⍽ Can accommodate large quantities of baseload capacity ⑀⍽ Allows

merchant to redirect cargoes to premium markets during peak seasons Example:

1

Bcf/d of baseload supply purchased at 86% of $6.00 Henry Hub with a gross

margin

of 10% equates to $220 million per year Redirection of cargoes during six

months

of seasonal demand in Europe, resulting in $1.00/Mcf of additional revenue,

would be an incremental $180 million ⑀⍽ Cheniere is currently focused on

securing “Indexed Purchase Agreements” - 0.5 Bcf/d for 2008 - 1.0 Bcf/d for 2009

⑀⍽ When 1.0 Bcf/d is achieved, we will contemplate construction of the next

terminal

25

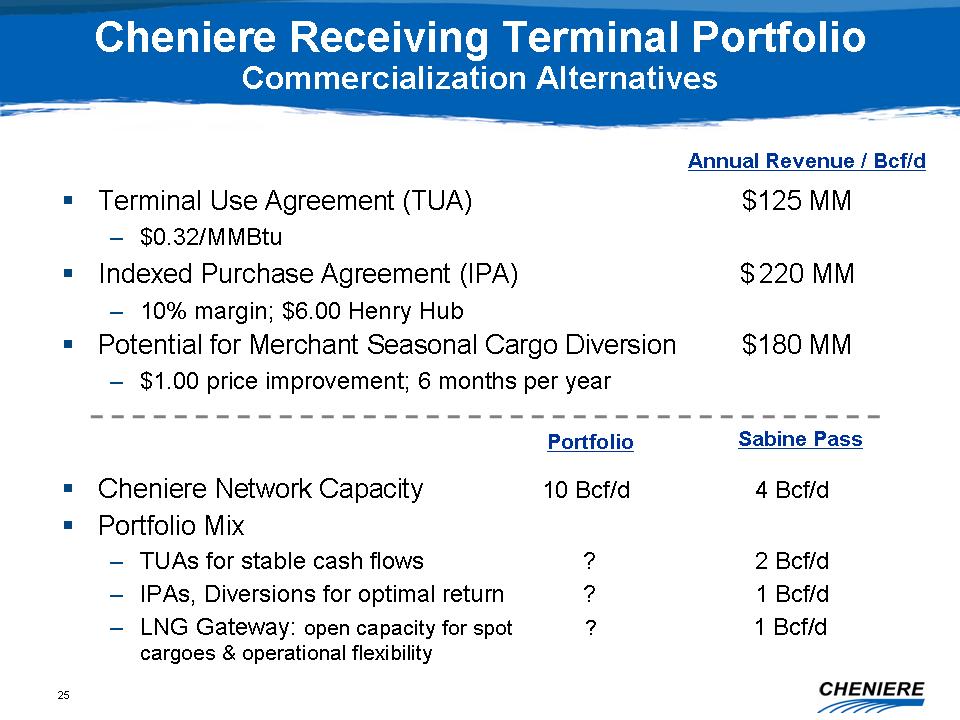

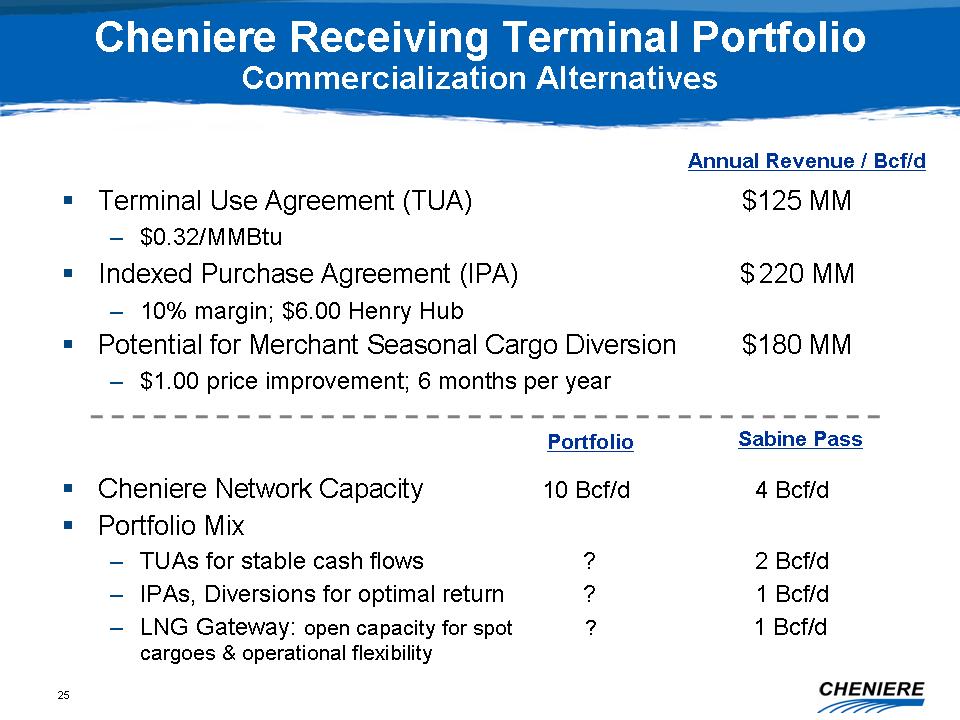

Cheniere Receiving Terminal Portfolio Commercialization Alternatives ⑀⍽ Terminal

Use Agreement (TUA) $125 MM - $0.32/MMBtu ⑀⍽ Indexed Purchase Agreement (IPA) $

220 MM - 10% margin; $6.00 Henry Hub ⑀⍽ Potential for Merchant Seasonal Cargo

Diversion $180 MM - $1.00 price improvement; 6 months per year ⑀⍽ Cheniere

Network Capacity 10 Bcf/d 4 Bcf/d ⑀⍽ Portfolio Mix - TUAs for stable cash flows

? 2 Bcf/d - IPAs, Diversions for optimal return ? 1 Bcf/d - LNG Gateway:

open

capacity for spot ? 1 Bcf/d cargoes & operational flexibility Annual Revenue

/ Bcf/d Sabine Pass Portfolio