|

Exhibit

99.2

Cheniere

Energy

*Freeport

LNG L.P. (Cheniere 30% Limited Partner)

*Corpus

Christi LNG L.P. (Cheniere 100%)

*Sabine

Pass LNG L.P. (Cheniere 100%)

*Creole

Trail LNG L.P. (Cheniere 100%)

November

2005

|

|

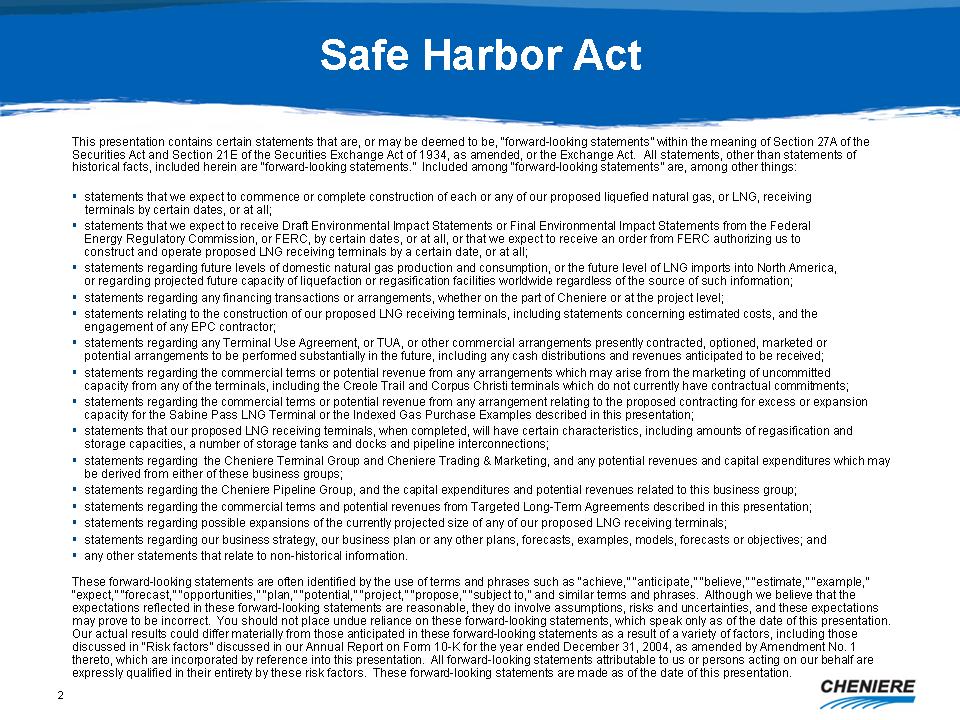

Corpus

Christi 2.6 Bcf/d

Freeport

(30%) 1.5 Bcf/d Under Construction

Sabine

Pass 4.0 Bcf/d Under Construction

Creole

Trail 3.3 B cf/d

-

4 Deepwater Ports

-

7 Unloading Docks

-

15 Storage Tanks (51.7 Bcf equivalent)

-

11.4 Bcf/d Regas Capacity

|

|

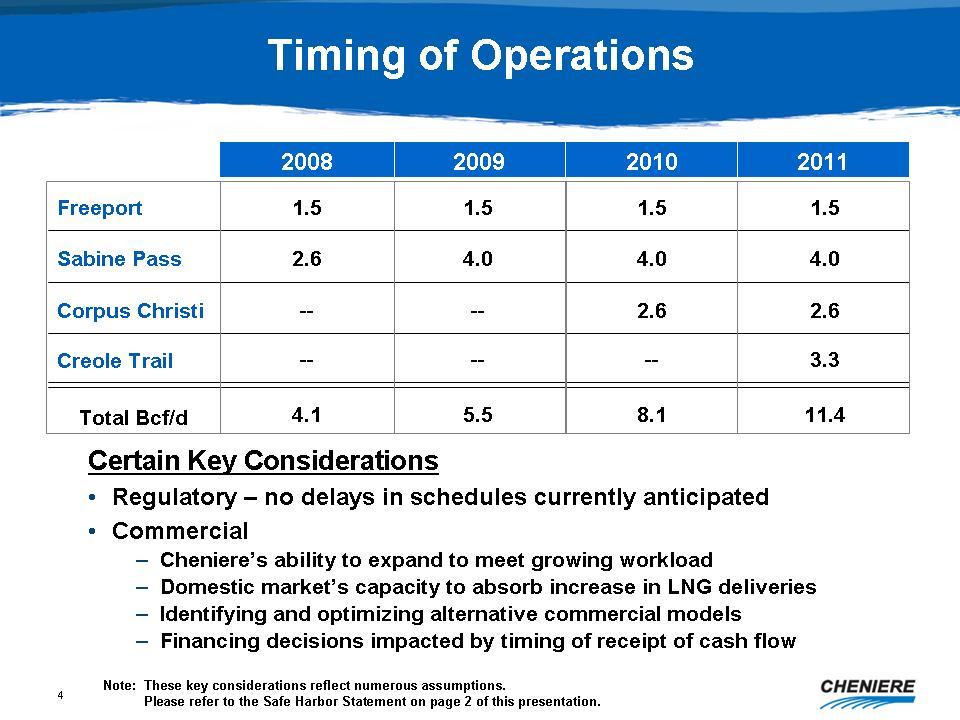

2008

|

2009

|

2010

|

2011

|

|

|

Freeport

|

1.5

|

1.5

|

1.5

|

1.5

|

|

Sabine

Pass

|

2.6

|

4.0

|

4.0

|

4.0

|

|

Corpus

Christi

|

-

|

-

|

2.6

|

2.6

|

|

Creole

Trail

|

-

|

-

|

-

|

3.3

|

|

Total

Bcf/d

|

4.1

|

5.5

|

8.1

|

11.4

|

| • |

Regulatory

– no delays in schedules currently

anticipated

|

| • |

Commercial

|

| – |

Cheniere’s

ability to expand to meet growing

workload

|

| – |

Domestic

market’s capacity to absorb increase in LNG

deliveries

|

| – |

Identifying

and optimizing alternative commercial

models

|

| – |

Financing

decisions impacted by timing of receipt of cash

flow

|

|

Is

Cheniere building too much capacity?

Availability

of supply

Competition

for regasification

Optimum

commercial arrangements

|

|

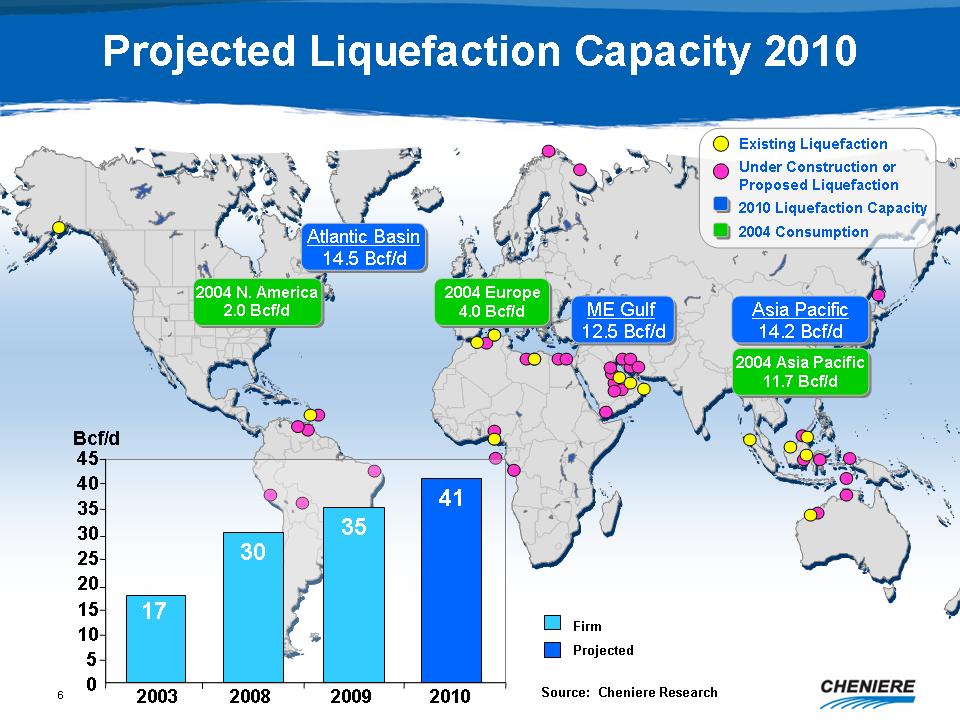

Liquefaction

Growth

World

LNG consumption in 2004 was 17 Bcf/d

Liquefaction

in 2010 is estimated to be 41 Bcf/d

Growth

in liquefaction is 24 Bcf/d

Where

will it go?

|

|

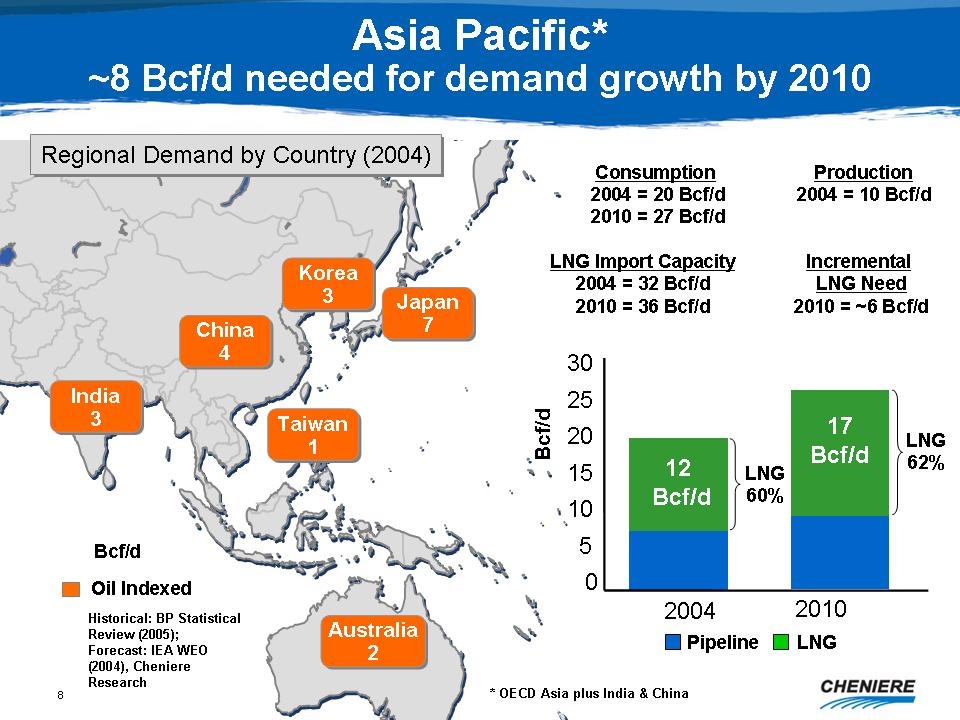

Asia

Pacific* ~8 Bcf/d needed for demand growth by 2010

Regional

Demand by Country (2004)

Japan

7, China 4, Korea 3, India 3, Australia 2, Taiwan 1

Consumption

2004=20 Bcf/d 2010=27 Bcf/d

Production

2004=10 Bcf/d

LNG

Import Capacity 2004=32 Bcf/d 2010=36 Bcf/d

Historical:

BP Statistical Review (2005); Forecast: IEA WEO (2004), Cheniere

Research

*OECD

Asia plus India & China

Incremental

LNG Need 2010=~6 Bcf/d

|

|

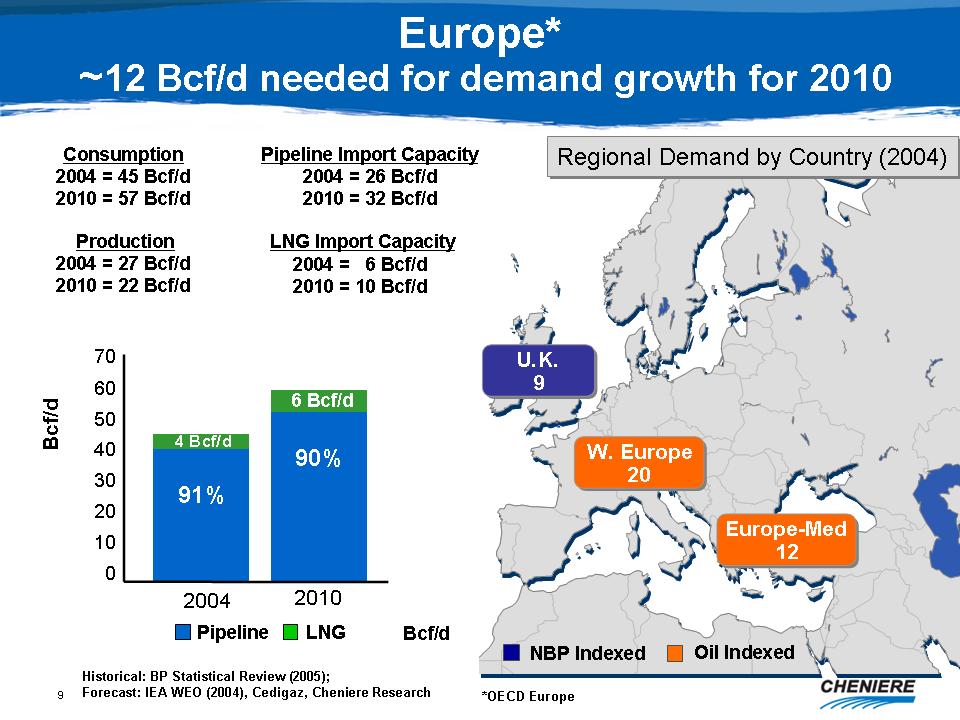

Europe*

~12 Bcf/d needed for demand growth for 2010

Consumption

2004=45 Bcf/d 2010=57 Bcf/d

Pipeline

Import Capacity 2004=26 Bcf/d 2010=32 Bcf/d

Production

2004=27 Bcf/d 2010=22 Bcf/d

LNG

Import Capacity 2004=6 Bcf/d 2010=10 Bcf/d

Regional

Demand by Country (2004) U.K. 9, W. Europe 20, Europe-Med 12

Historical:

BP Statistical Review (2005); Forecast: IEA WEO (2004), Cedigaz,

Cheniere

Research

*OECD

Europe

|

|

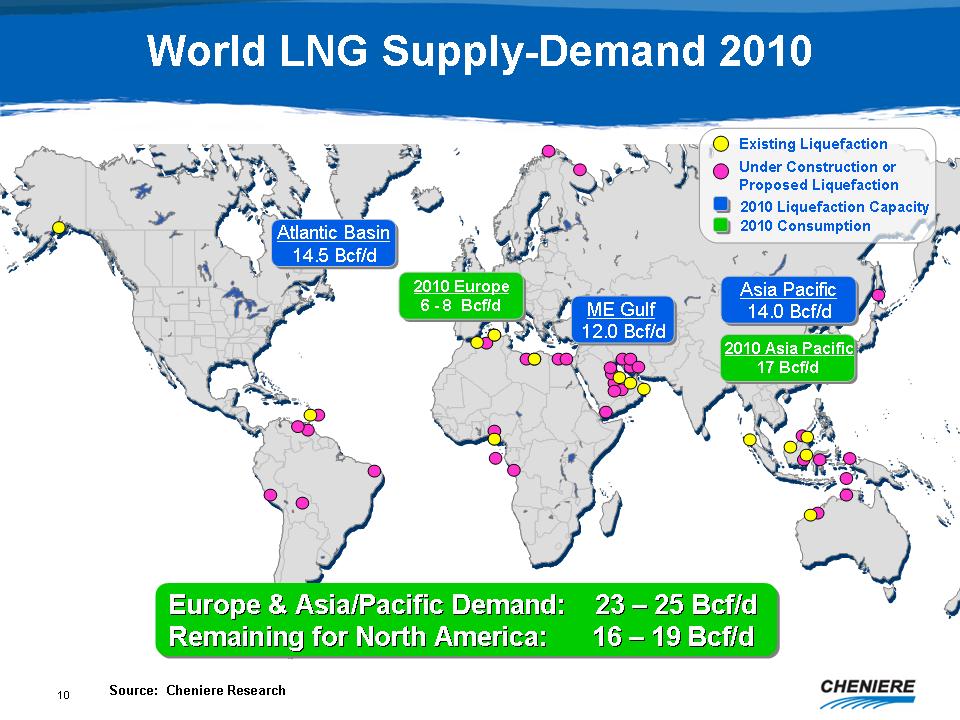

World

LNG Supply-Demand 2010

Atlantic

Basin 14.5 Bcf/d

2010

Europe 6 - 8 Bcf/d

ME

Gulf 12.0 Bcf/d

Asia

Pacific 14.0 Bcf/d

2010

Asia Pacific 17 Bcf/d

Europe

& Asia/Pacific Demand: 23 - 25 Bcf/d

Remaining

for North America: 16 - 19 Bcf/d

|

|

North

American Receiving Capacity

Can

North America receive 16 to 19 Bcf/d?

-

Gas consumption constraint

-

Regasification

|

|

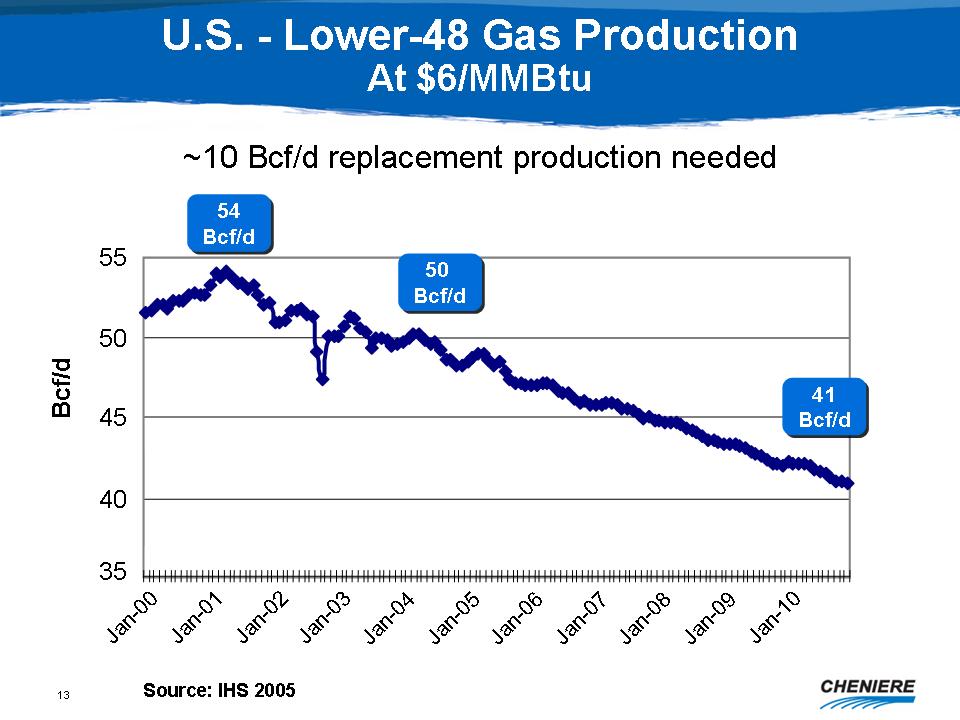

U.S.

- Lower-48 Gas Production At $6/MMBtu

~10

Bcf/d replacement production needed

Source:

IHS 2005

|

|

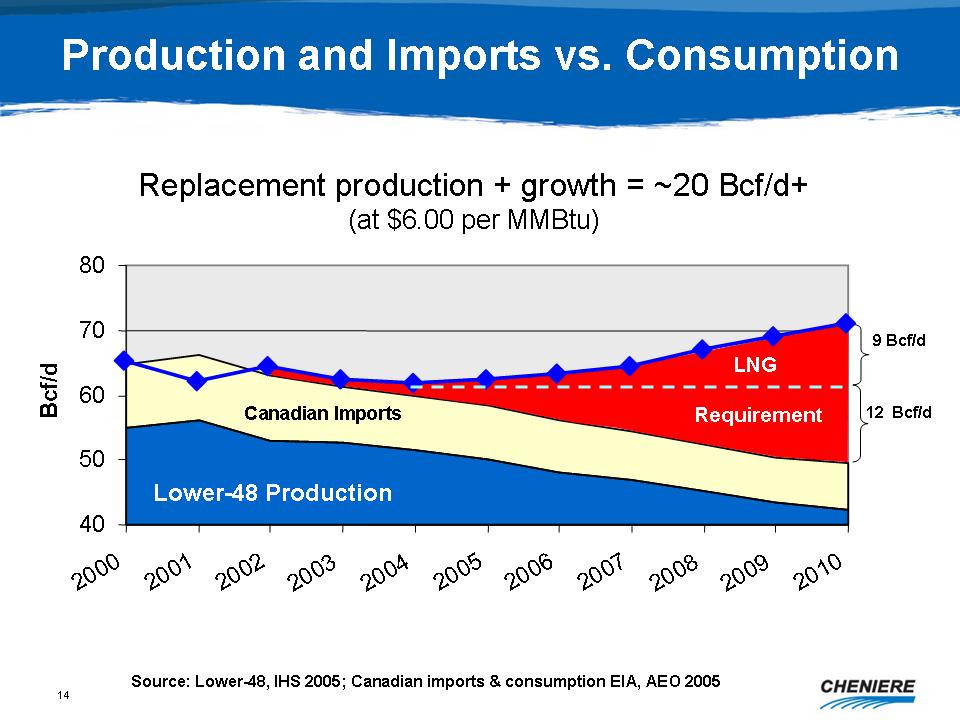

Production

and Imports vs. Consumption

Replacement

production + growth = ~20 Bcf/d+ (at $6.00 per MMBtu)

Source:

Lower-48, IHS 2005; Canadian imports & consumption EIA, AEO

2005

|

|

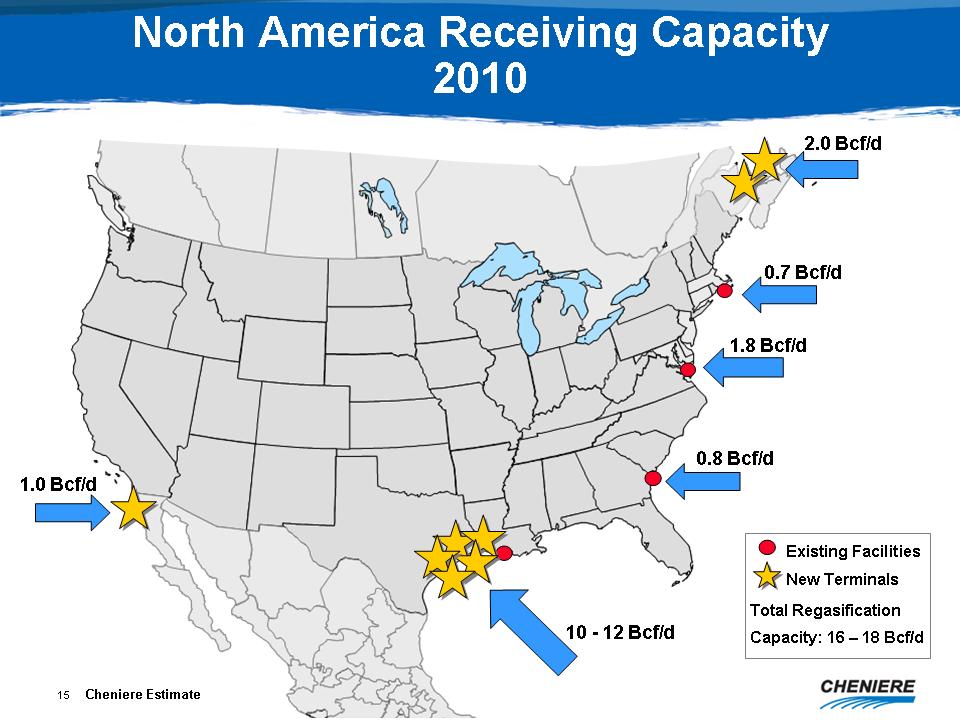

North

America Receiving Capacity 2010

1.0

Bcf/d

10

- 12 Bcf/d

2.0

Bcf/d

0.7

Bcf/d

1.8

Bcf/d

0.8

Bcf/d

|

|

North

America Receiving Capacity

Enough

capacity but not too much

Depends

on utilization rate

|

|

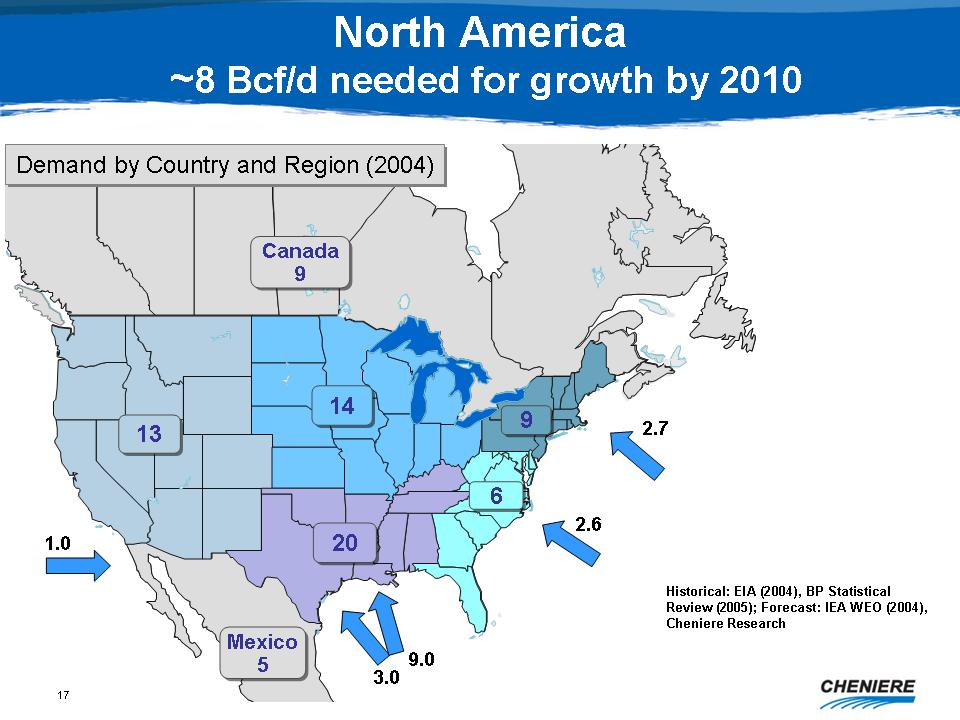

North

America ~8 Bcf/d needed for growth by 2010

Demand

by Country and Region (2004)

Canada

9, Mexico 5, 1.0, 13, 14, 20, 6, 9, 2.7, 2.6

Historical:

EIA (2004), BP Statistical Review (2005); Forecast: IEA WEO (2004),

Cheniere Research

|

|

Observations

Capacity

utilization probably under 75%

U.S.

will not receive sufficient gas at $6.00/MMBtu so prices will remain

higher on average

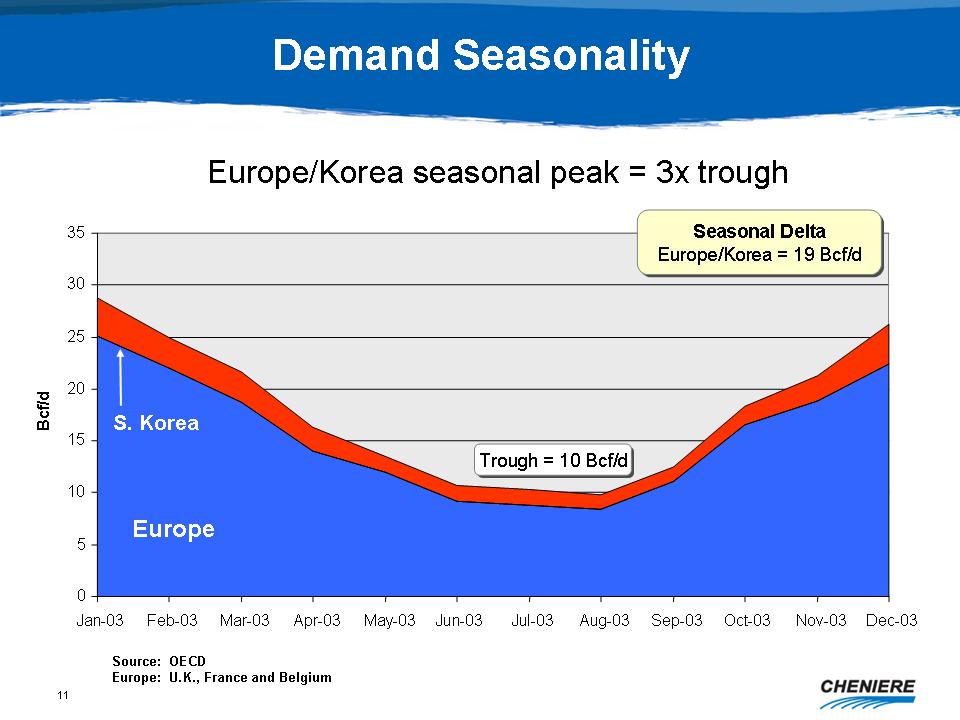

European

seasonality will increase volatility and reduce utilization

rates

NYMEX

will increasingly be a benchmark price

globally

|

|

Financing

-

Financing is not an issue any longer if:

-

Resource is controlled (hydrocarbon)

-

Market is accessible

-

Regasification

-

Customer base

-

NYMEX pricing is used

-

Trend is increasingly toward transactions between owners and

users

|

|

Cheniere's

LNG Receiving Portfolio

In

this context, what is the optimal business model for Cheniere's

capacity?

|

|

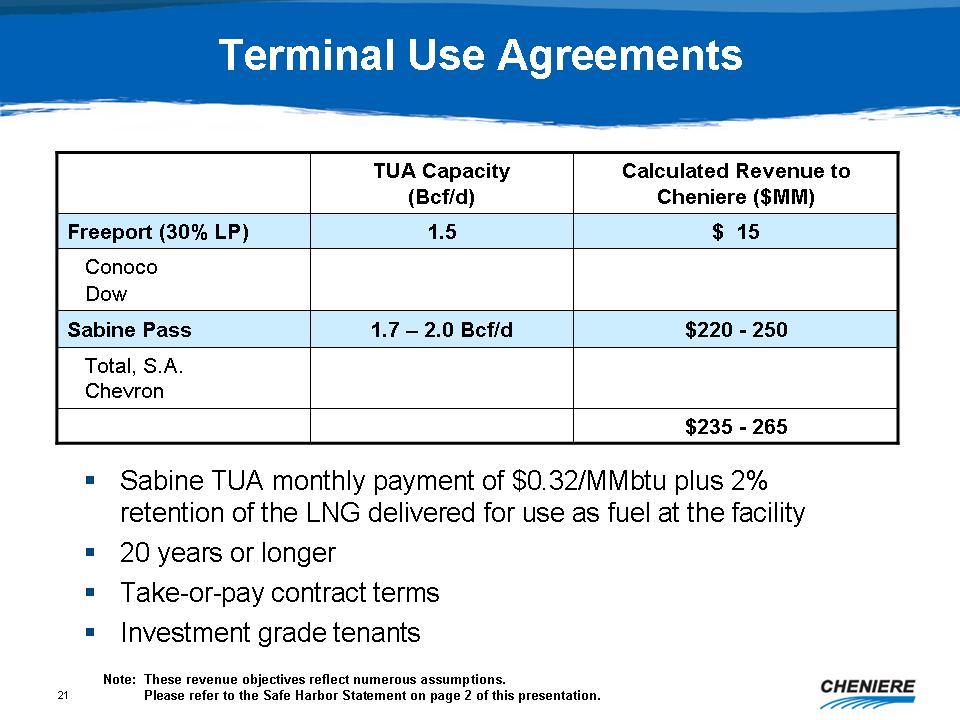

Terminal

Use Agreements

TUA

Capacity (Bcf/d)

Calculated

Revenue to Cheniere ($MM)

Freeport

(30% LP) 1.5 $15

Conoco

Dow

Sabine

Pass 1.7 - 2.0 Bcf/d $220 - 250

Total,

S.A.

Chevron

$235

- 265

Sabine

TUA monthly payment of $0.32/MMbtu plus 2% retention of the LNG delivered

for use as fuel at the facility

20

years or longer

Take-or-pay

contract terms

Investment

grade tenants

Note:

These revenue objectives reflect numerous assumptions.

Please

refer to the Safe Harbor Statement on page 2 of this

presentation.

|

|

Three

Major Business Groups

Cheniere

Terminal Group

Non-regulated

fee based

Cheniere

Pipeline Group

Mostly

regulated fee based

Cheniere

Trading and Marketing

Transaction

based

|

|

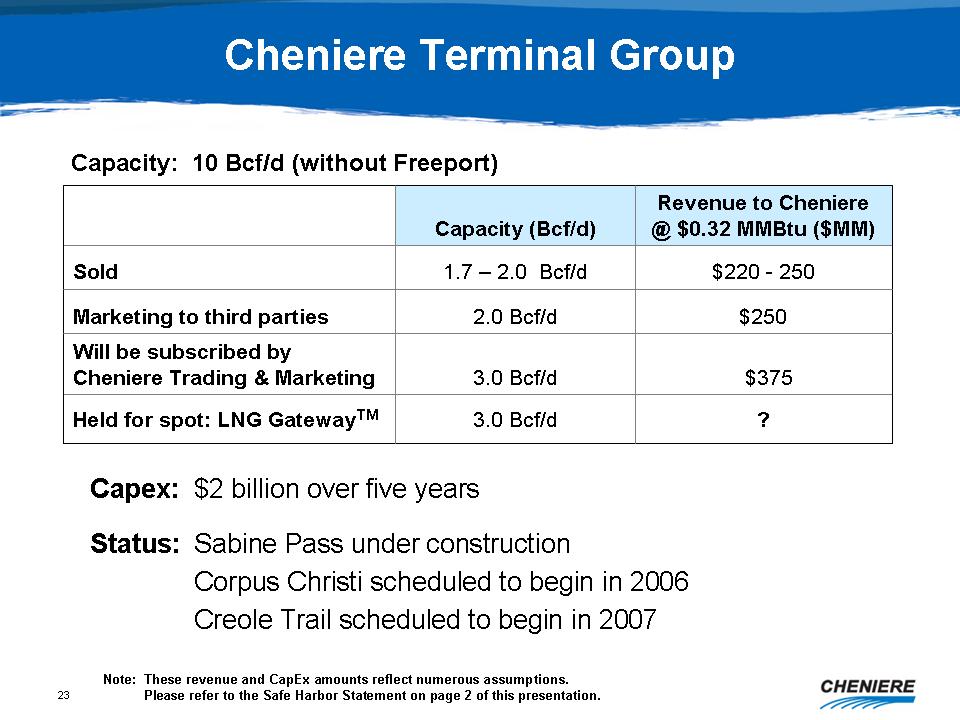

Cheniere

Terminal Group

Capacity:

10 Bcf/d (without Freeport)

Capacity

(Bcf/d)

Revenue

to Cheniere @ $0.32 MMBtu ($MM)

Sold

1.7 - 2.0 Bcf/d $220 - 250 Marketing

to third parties 2.0 Bcf/d $250

Will

be subscribed by Cheniere Trading & Marketing 3.0 Bcf/d

$375

Held

for spot: LNG GatewayTM 3.0 Bcf/d ? Capex:

$2 billion over five yearsStatus:

Sabine Pass under construction

Corpus

Christi scheduled to begin in 2006Creole

Trail scheduled to begin in 2007 Note:

These revenue and CapEx amounts reflect numerous assumptions.

Please

refer to the Safe Harbor Statement on page 2 of this

presentation.

|

|

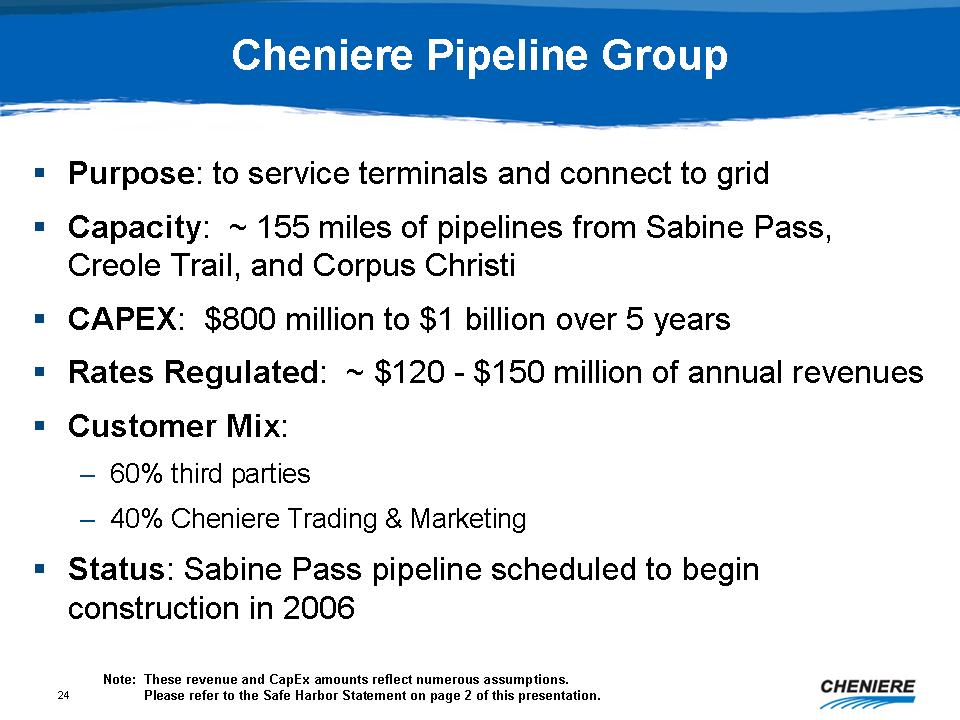

Cheniere

Pipeline Group

Purpose:

to service terminals and connect to grid

Capacity:

~ 155 miles of pipeline from Sabine Pass, Creole Trail, and Corpus

Christi

CAPEX:

$800 million to $1 billion over 5 years

Rates

Regulated: ~$120 - $150 million of annual revenues

Customer

Mix:

-

60% third parties

-

40% Cheniere Trading & Marketing

Status:

Sabine Pass pipeline scheduled to begin construction in 2006

Note:

These revenue and CapEx amounts reflect numerous assumptions.

Please

refer to the Safe Harbor Statement on page 2 of this

presentation.

|

|

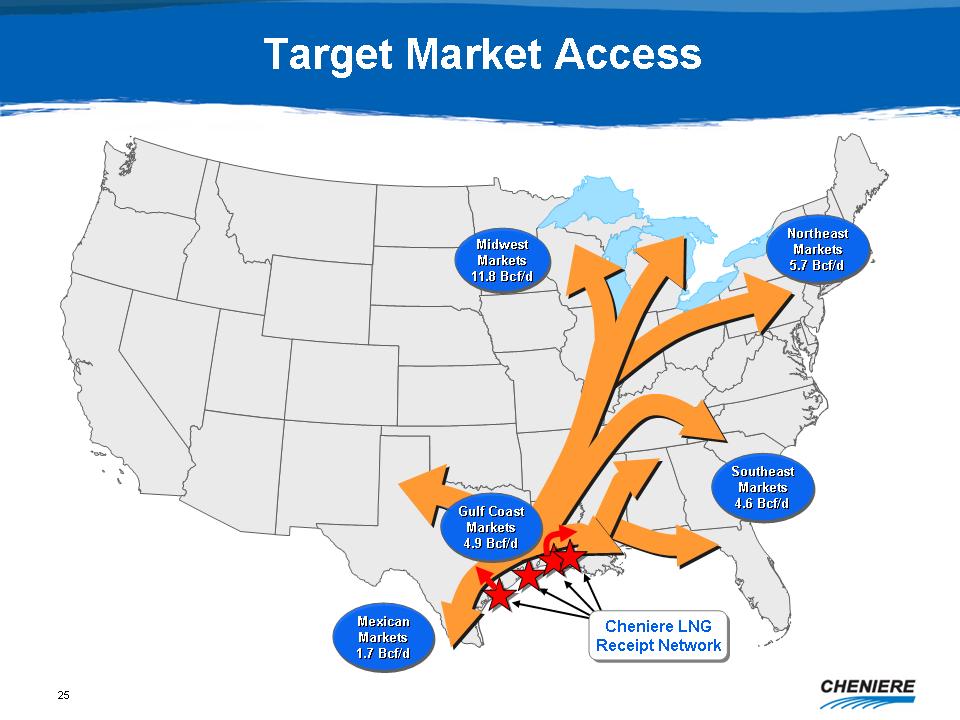

Target

Market Access

Midwest

Markets 11.8 Bcf/d

Northeast

Markets 5.7 Bcf/d

Gulf

Coast Markets 4.9 Bcf/d

Mexican

Markets 1.7 Bcf/d

Southeast

Markets 4.6 Bcf/d

Cheniere

LNG Receipt Network

|

|

Cheniere

Trading & Marketing

Developing

portfolio of gas purchase and gas sale agreements

Manage

LNG GatewayTM

|

|

Targeted

Long-Term Agreements

Long-term

purchase transactions currently between 83% and 87% of NYMEX delivered

at

the terminal

When

purchase agreements are concluded, Cheniere Trading & Marketing will

enter into corresponding agreements with Cheniere's Terminal Group

-

imputed opportunity cost $0.32

Domestic

sale agreements to deliver gas to customers at various liquidity

points

starting at the tailgate of the terminal

Will

encourage purchasers to enter into agreements with Cheniere's Pipeline

Group.

|

|

LNG

GatewayTM

Because

of seasonality and volatility we think the market for short-term

transactions will continue to grow

Opportunity

to purchase LNG on better conditions

Plan

to start receiving cargoes beginning in 2008 and gauge market

reaction

|

|

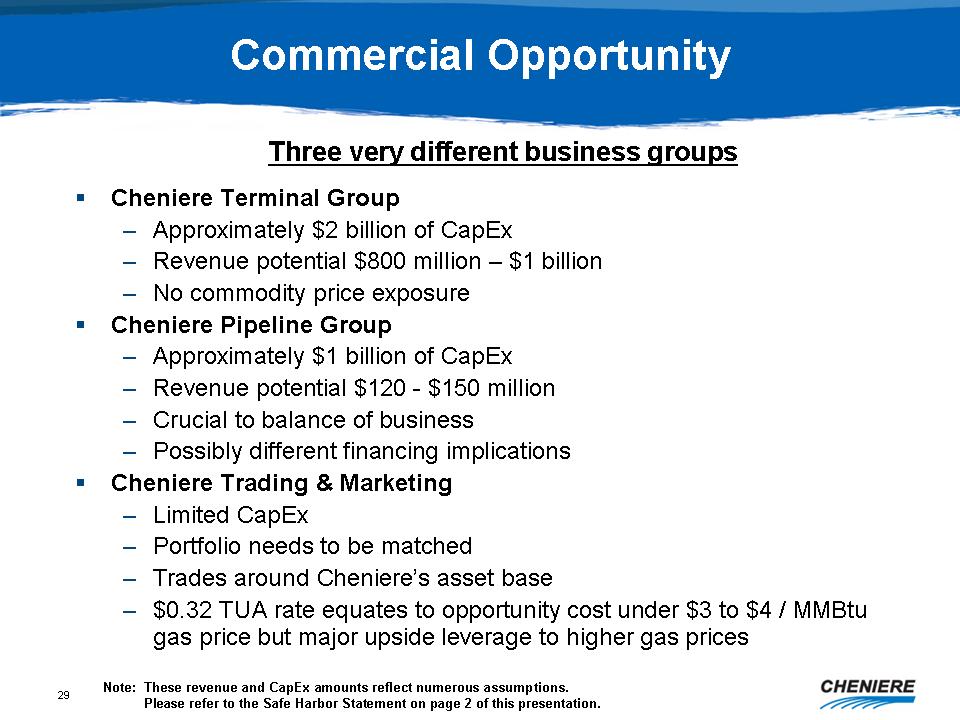

Commercial

Opportunity

Three

very different business groups

Cheniere

Terminal Group

Approximately

$2 billion of CapEx

Revenue

potential $800 million - $1 billion

No

commodity price exposure

Cheniere

Pipeline Group

Approximately

$1 billion of CapEx

Revenue

potential $120 - $150 million

Crucial

to balance of business

Possibly

different financing implications

Cheniere

Trading & Marketing

Limited

CapEx

Portfolio

needs to be matched

Trades

around Cheniere's asset base

$0.32

TUA rate equates to opportunity cost under $3 to $4 / MMBtu gas price

but

major upside leverage to higher gas prices

Note:

These revenue and CapEx amounts reflect numerous assumptions.

Please

refer to the Safe Harbor Statement on page 2 of this

presentation.

|

|

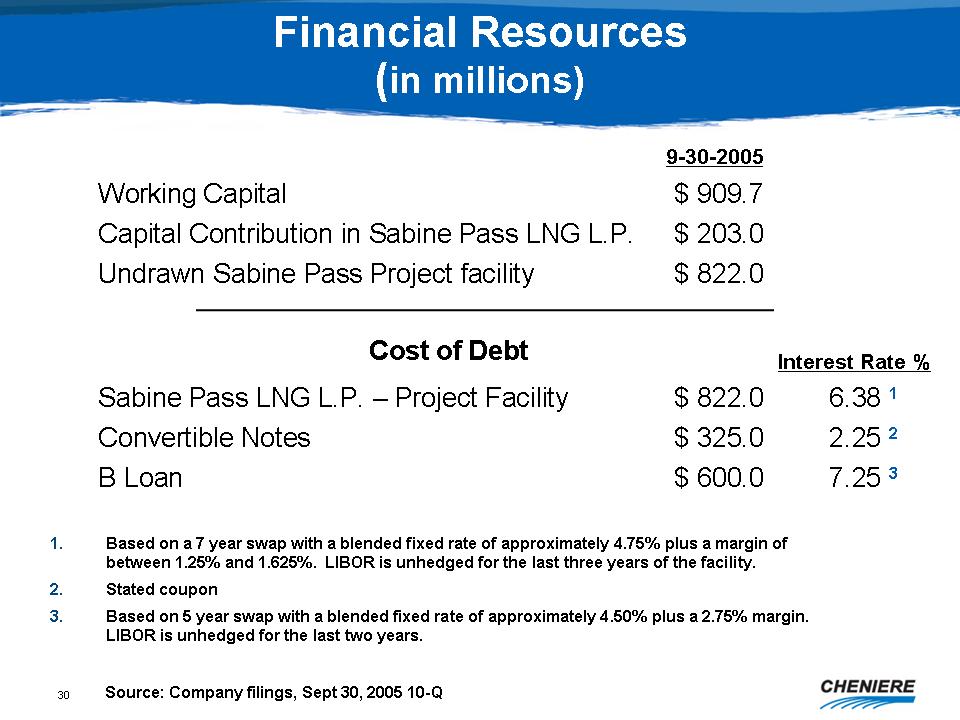

Financial

Resources (in millions)

9-30-2005

Working

Capital $909.7

Capital

Contribution in Sabine Pass LNG L.P. $203.0

Undrawn

Sabine Pass Project facility $822.0

Cost

of Debt

Interest

Rate %

Sabine

Pass LNG L.P. - Project Facility $822.0 6.38 1

Convertible

Notes $325.0 2.25 2

B

Loan $600.0 7.25 3

1.

Based on a 7 year swap with a blended fixed rate of approximately

4.75%

plus a margin of between 1.25% and 1.625%. LIBOR is unhedged for

the last

three years of the facility.

2.

Stated coupon

3.

Based on 5 year swap with a blended fixed rate of approximately 4.50%

plus

a 2.75% margin. LIBOR is unhedged for the last two years.

Source:

Company filings, Sept 30, 2005

10-Q

|