Cheniere Energy, Inc.

*Freeport LNG L.P. (Cheniere 30% Limited Partner)

*Sabine Pass LNG L.P. (Cheniere 100%)

*Corpus Christi LNG L.P. (Cheniere 100%)

*Creole Trail LNG L.P. (Cheniere 100%)

*Artist’s Rendition

May 2005

This presentation contains certain statements that are, or may be deemed to be, “forward-looking statements” within the meaning of Section 27A of the Securities

Act and Section 21E of the Securities

Exchange Act of 1934, as amended, or the Exchange Act. All statements, other than statements of historical facts, included

herein are “forward-looking statements.” Included among “forward-looking statements” are,

among other things:

statements that we expect to commence or complete construction of each or any of our proposed liquefied natural gas, or LNG, receiving terminals by

certain dates, or at all;

statements that we expect to receive Draft Environmental Impact Statements or Final Environmental Impact Statements from the Federal Energy

Regulatory Commission, or FERC, by certain dates, or at all, or

that we expect to receive an order from FERC authorizing us to construct and operate

proposed LNG receiving terminals by a certain date, or at all;

statements regarding future levels of domestic natural gas production and consumption, or the future level of LNG imports into North America, or

regarding projected future capacity of liquefaction or regasification

facilities worldwide regardless of the source of such information;

statements regarding any financing transactions or arrangements, whether on the part of Cheniere or at the project level;

statements relating to the construction of our proposed LNG receiving terminals, including statements concerning estimated costs, and the

engagement of any EPC contractor;

statements regarding any Terminal Use Agreement, or TUA, or other commercial arrangements presently contracted, optioned, marketed or potential

arrangements to be performed substantially in the future, including

any cash distributions and revenues anticipated to be received;

statements regarding the commercial terms or potential revenue from any arrangements which may arise from the marketing of uncommitted capacity

from any of the terminals, including the Creole Trail and Corpus

Christi terminals which do not currently have contractual commitments;

statements regarding the commercial terms or potential revenue from any arrangement relating to the proposed contracting for excess or expansion

capacity for the Sabine Pass LNG Terminal or the Indexed Gas

Purchase Examples described in this presentation;

statements that our proposed LNG receiving terminals, when completed, will have certain characteristics, including amounts of regasification and

storage capacities, a number of storage tanks and docks and

pipeline interconnections;

statements regarding possible expansions of the currently projected size of any of our proposed LNG receiving terminals;

statements regarding our business strategy, our business plan or any other plans, forecasts, examples, models, forecasts or objectives; and

any other statements that relate to non-historical information.

These forward-looking statements are often identified by the use of terms and phrases such as “achieve,” “anticipate,” “believe,” “estimate,” “example,” “expect,”

“forecast,” “opportunities,” “plan,” “potential,” “project,” “propose,” “subject to,” and similar terms and phrases. Although we believe that the expectations reflected in

these forward-looking statements are reasonable, they do involve assumptions, risks and uncertainties, and these expectations may prove to be incorrect. You

should not place undue reliance on these forward-looking statements, which speak

only as of the date of this presentation.

Our actual results could differ materially from those anticipated in these forward-looking statements as a result of a variety of factors, including those discussed

in “Risk factors” discussed in our Annual Report on Form 10-K for the year ended December 31, 2004, as amended by Amendment No. 1 thereto, which are

incorporated by reference into this presentation. All forward-looking statements attributable to us or persons acting on our

behalf are expressly qualified in their

entirety by these risk factors. These forward-looking statements are made as of the date of this presentation.

Safe Harbor Act

Cheniere LNG Receipt Network

4 Deepwater Ports

7 Unloading Docks

12 Storage Tanks

(40 Bcf equivalent)

10-11.4 Bcf/d Regas

Capacity

Sabine Pass

Freeport (30%)

Corpus Christi

Creole Trail

Optionality

Flexibility

Reliability

Liquidity

Low Cost

3.3 Bcf/d

2.6 – 4.0 Bcf/d

1.5 Bcf/d

2.6 Bcf/d

Project Overviews

Q3 2006 (exp.)

Q4 2005 (exp.)

Under Construction

Under Construction

Ground Breaking

NEPA pre-filing

January 2005

Final EIS

March 2005

Authorization to

construct

Q3 2005 (exp.)

Authorization to

construct

March 2005

Authorization to

construct

January 2005

FERC Status

1,463 acres

612 acres

853 acres

233 acres

Land

2010

2009

2008

2008

Est. Operational

13.5 Bcfe

10.1 Bcfe

10.1 Bcfe

6.7 Bcfe

Storage Capacity

$850 – $950

$650 – $750

$750 – $850

$750

Capex ($mm)1

4 tanks

3 tanks

3 tanks

2 tanks

Tanks

2 docks

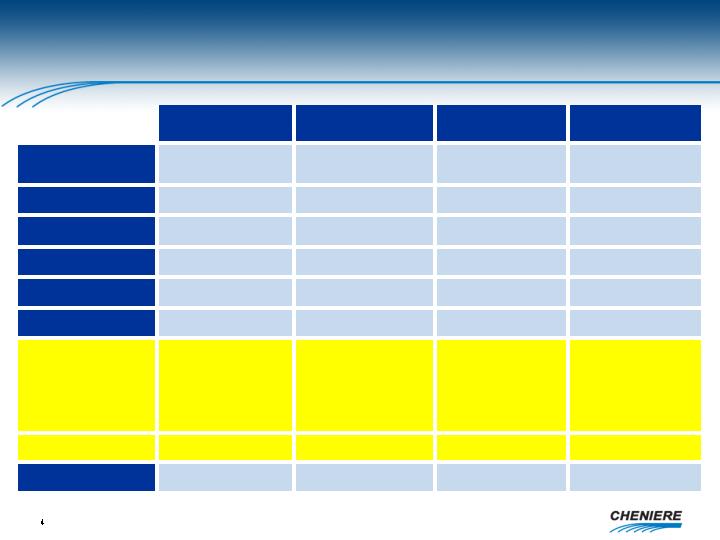

3.3 Bcf/d

Creole Trail

2 docks

2 docks

1 dock

Berths

Initial Capacity

2.6 Bcf/d

2.6 Bcf/d

1.5 Bcf/d

Corpus Christi

Sabine Pass

Freeport

1 Estimated construction costs before financing costs (includes EPC contract, owner’s cost, G&A and contingencies), subject to

change

due to such items as cost overruns, change orders and changes in commodity prices (particularly steel)

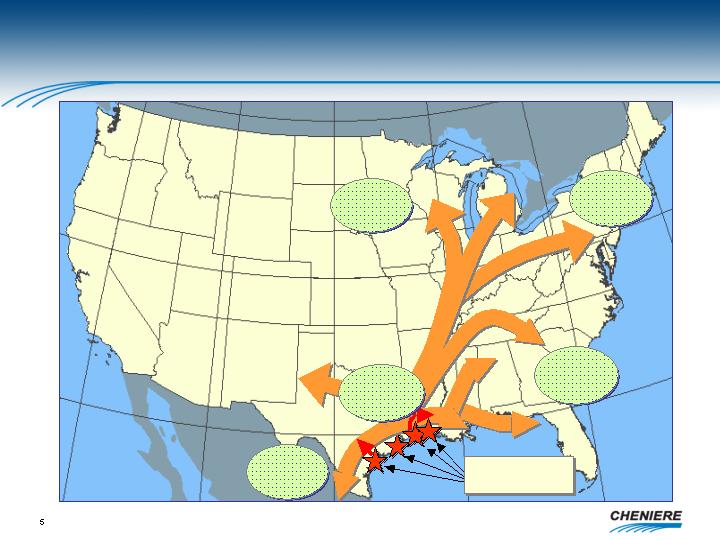

Target Gas Demand Corridor

Market Access – 29 Bcf/d

Midwest

Markets

11.8 Bcf/d

Northeast

Markets

5.7 Bcf/d

Southeast

Markets

4.6 Bcf/d

Gulf Coast

Markets

4.9 Bcf/d

Mexican

Markets

1.7 Bcf/d

Source: Cheniere Research

Cheniere LNG

Receipt Network

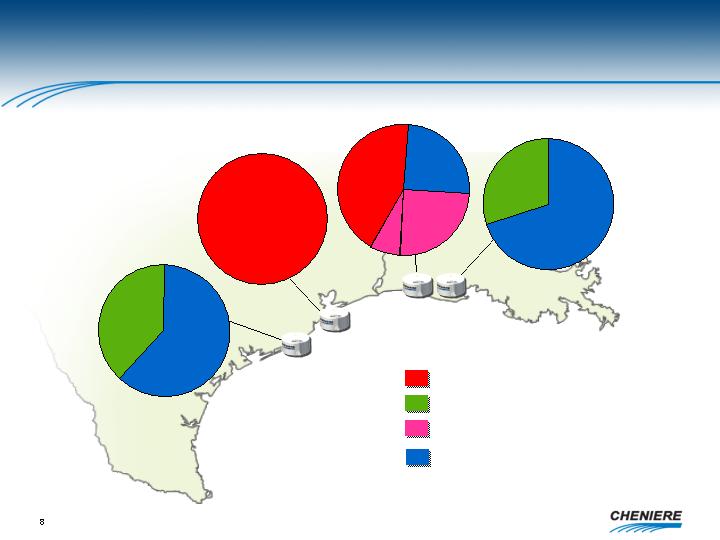

Coastal States Gas Consumption

1.0

1.9

1.0

0.7

1.2

0.7

0.7

0.2

0.4

0.6

0.7

Top 5 Coastal Consumers

TX, CA, LA, NY, FLA

Source: EIA, NG Monthly, April 2004

In Bcf/d

2003

11.2

3.4

1.9

6.1

3.1

1.7

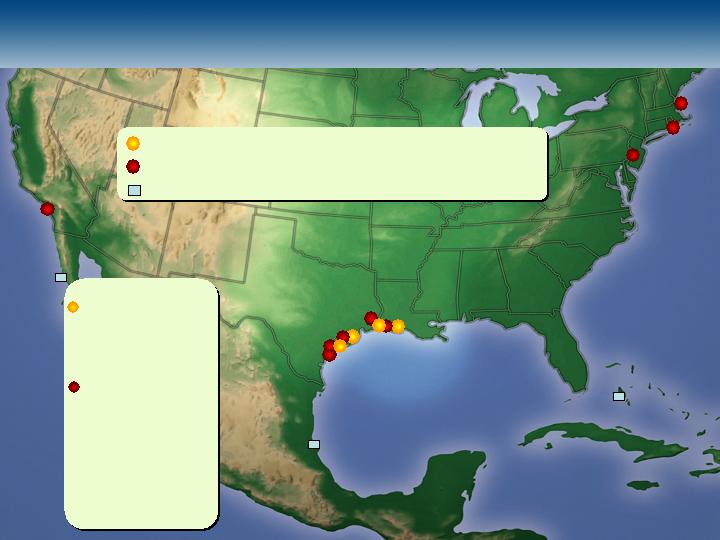

FERC Permit Status

4 Onshore applications approved by FERC – 8.2 Bcf/d

9 Onshore applications filed w/ FERC – 9.8 Bcf/d

Outside U.S. for U.S. Markets (Bahamas and Mexico)

FERC Approved

Cameron LNG (LA)

Corpus Christi – (TX)

Freeport LNG (TX)

Sabine Pass – (LA)

Filed with FERC

Calhoun LNG – (TX)

Weaver’s Cove – (MA)

Golden Pass – (TX)

Ingleside Energy – (TX)

Sound Energy – (CA)

Providence – (RI)

Vista del Sol – (TX)

Port Arthur - (TX)

Crown Landing - (NJ)

Onshore

Commercial Status

Corpus Christi

2.6 Bcf/d

Freeport

1.5 Bcf/d

Sabine Pass2

4.0 Bcf/d

Creole Trail

3.3 Bcf/d

Firm TUAs

Marketing TUAs

Under Option, subject to negotiation

1.5

1.0

1.6

2.3

1.0

1.71

1.0

1.0

.31

Cheniere Retained

1

Chevron has 0.7 Bcf/d of reserved capacity with the option to reduce to 0.5 Bcf/d by July 1, 2005 or

increase to 1.0 Bcf/d by December 1, 2005

2

Assumes expansion of 1.4 Bcf/d, which is currently not contracted

Terminal Use Agreements (TUAs)

Sabine TUA monthly payment amounts of $0.32/MMbtu

plus retain 2% of the LNG delivered for use as fuel at the

facility

20 years or longer

Take-or-pay contract terms

Investment grade tenants

F r e e p o r t L N G

Dow Chemical Company*

ConocoPhillips Company*

S a b i n e P a s s L N G

Total LNG U.S.A., Inc.

Chevron U.S.A., Inc.

* TUA economic terms are confidential

$230

3.2

Total

Contracted

Contracted

Contracted

TUA

Status

$0.32

$0.32

Fee

($/MMbtu)

$ 15

1.5

Freeport

$125

$ 90

Calculated

Revenue to

Cheniere ($mm)1

1.0

0.7 2

Sabine Pass3

Total, S.A.

Chevron

TUA

Capacity

(Bcf/d)

Estimated TUA Annual Revenue

1

Revenue calculations are based solely on TUAs and reflect numerous assumptions; Freeport revenues represent the

midpoint of currently estimated pre-tax cash distributions of $10—$20 million

per year.

2

Chevron has 0.7 Bcf/d of reserved capacity with the option to reduce to 0.5 Bcf/d ($65 million in revenues) by July 1, 2005

or increase to 1.0 Bcf/d ($129 million in revenues) by December 1,

2005

3

Fixed cash operating expenses for each terminal are estimated to be $25—$30 million per year; Sabine Pass LNG,

Corpus Christi LNG and Creole Trail LNG will also retain 2% of throughput for

fuel usage

$39

$0.32

0.31

Option

Chevron

$129

1.3

Total

Option -

subject to

negotiation

TUA

Status

$0.24

Fee

($/MMbtu)

$90

Calculated

Revenue to

Cheniere ($MM)

1.0

Expansion of

existing customers

TUA

Capacity

(Bcf/d)

Sabine Pass Capacity Opportunities

1 Chevron has 0.7 Bcf/d of reserved capacity with the option to reduce to 0.5 Bcf/d by July 1, 2005 or increase to

1.0

Bcf/d by December 1, 2005

Current Marketing Efforts

Marketing Efforts

2 Bcf/d at Corpus or Creole at $0.32 / MMBtu

Potential Revenues:

$250 million

Indexed Gas Purchase - Example

1 Bcf/d Gulf Coast delivery at 83% of Henry Hub price

Potential Revenues:

17% of $4.00/MMBtu @ Henry Hub:

$260 million

$609

6.5

Total

250

2.0

Corpus Christi or

Creole Trail

Marketing Capacity*

90

1.0

Expansion of Existing

Customers**

39

0.3

Chevron*

Sabine Pass Capacity

Opportunities

215

1.7

Sabine Pass

$15

1.5

Freeport

Contracted Capacity

Calculated Revenue

to Cheniere ($MM)

TUA Capacity

(Bcf/d)

Terminal Use Agreement Summary

* Capacity currently offered at $0.32/MMbtu.

** Expansion capacity under option at $0.24/MMbtu

There can be no assurances that contracts will be secured for these volumes at these rates.

Indexed Purchase Agreements

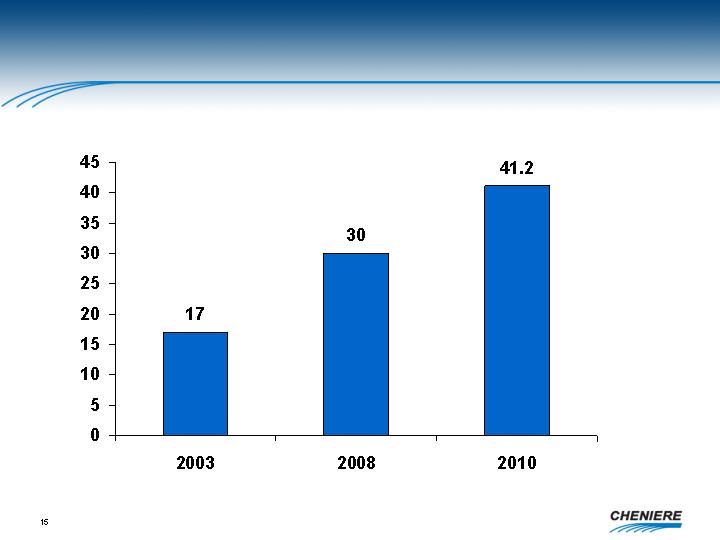

Growth of liquefaction

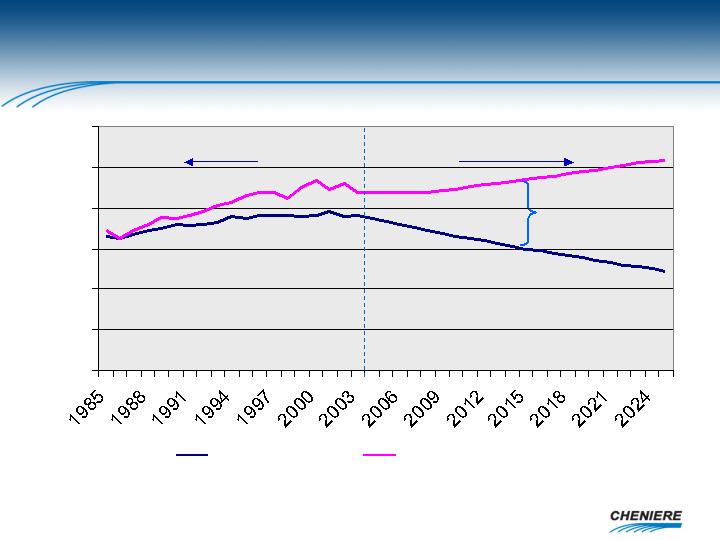

Increasing domestic supply/demand gap

Scarcity of flexible, cheap receiving terminals

Cheniere’s retention of remaining capacity is

strategically important

Projected Liquefaction Growth

Source: Cheniere Research

Bcf/d

Production vs Consumption (Tcf)

Cheniere estimate based on 2% annual average decline in production,

1% annual average growth in consumption post-2008 based on EIA, AEO

Historical production and consumption EIA

8 Tcf or

22 Bcf/d

0

5

10

15

20

25

30

Forecast

Historical

Domestic Production

Consumption

16

U.S. Onshore Regasification Terminals

Currently Under Construction

S a b i n e P a s s L N G

F r e e p o r t L N G

Future Business Development

3.9

Total

1.0

Index Gas

Purchases

11.4

4.9

2.0

1.3

3.2

Total

3.3

2.3

1.0

Creole Trail

2.6

1.6

1.0

Corpus

Christi

4.0

1.0

1.3

1.7

Sabine Pass

1.5

1.5

Freeport

Total

Excess

Capacity

Marketing

Efforts

TUA

Opportunities

Under

Negotiation

Contracted

TUAs

Bcf/d

Indexed Purchase Agreement Model

Regasification costs and transportation to

liquidity points

Additional Costs:

At $4.00 Mcf; $0.68 per MMbtu; $260 million

Revenue Example:

Seller’s responsibility

Shipping:

83% of NYMEX

Cost Assumption:

U.S. Gulf Coast at any Cheniere LNG

regasification terminal

Delivery:

Volume: 1 Bcf/d

Long-Term Model

$MM

Freeport

15

Contracted TUAs

215

Optioned – subject to negotiation

129

TUAs Under Marketing Efforts

250

$609

Potential Indexed Gas

Purchases - 1 Bcf/d

$260

Total Potential Revenues

$845

Cheniere Future Business

Development (Bcf/d)

3.9

NOTE: These are revenue objectives and are subject to operating expenses, transportation, fuel, and terminal location.

Excess Capacity for