1

April 2005

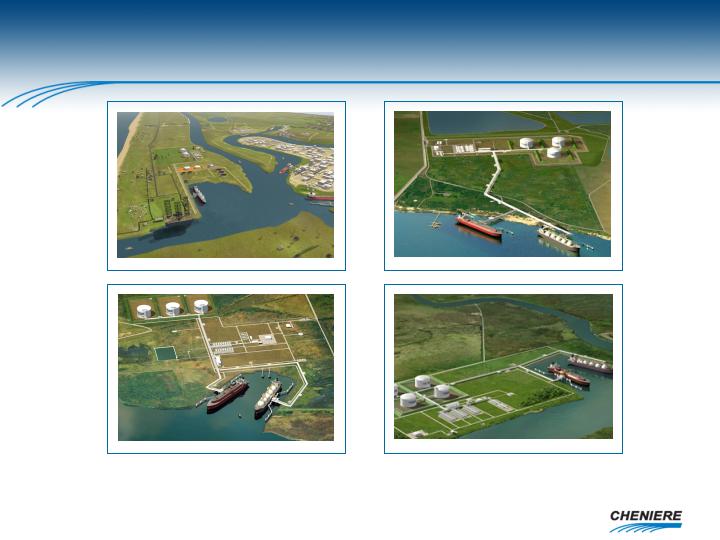

*Artist’s Rendition

*Creole Trail LNG L.P. (Cheniere 100%)

*Corpus Christi LNG L.P. (Cheniere 100%)

*Sabine Pass LNG L.P. (Cheniere 100%)

*Freeport LNG L.P. (Cheniere 30% Limited Partner)

Cheniere Energy, Inc.

Safe Harbor Act Statement Under the Private Securities Litigation Reform Act of

1995: Certain information in this presentation are forward looking statements that

are based on management's belief, as well

as assumptions made by, and

information currently available to management. While the company believes that its

expectations are based upon reasonable assumptions, there can be no assurances

that the company's financial goals will be realized. Numerous

uncertainties and risk

factors may affect the company's actual results and may cause results to differ

materially from those expressed in forward-looking statements made by or on

behalf of the company. These uncertainties and risk factors include

political,

economic, environmental and geological issues, including but not limited to, the

continued need for additional capital, the competition within the oil and gas

industry, the price of oil and gas, currency fluctuations, and other risks

detailed

from time to time in the company's periodic reports filed with the United States

Securities and Exchange Commission.

Safe Harbor Act

2

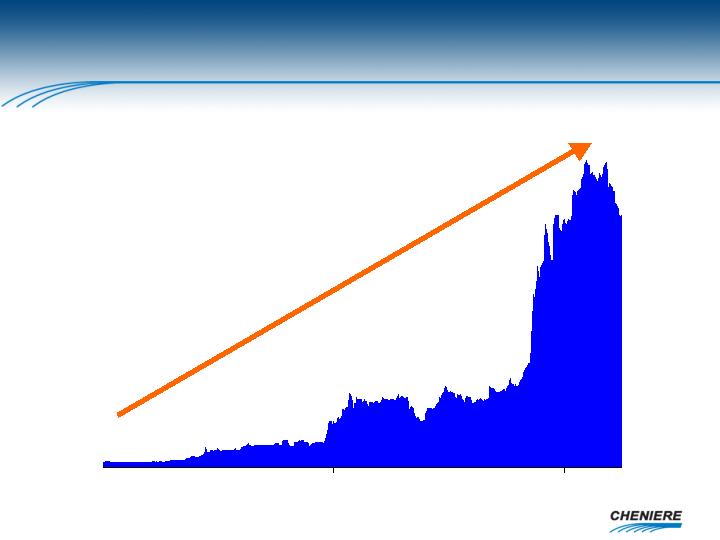

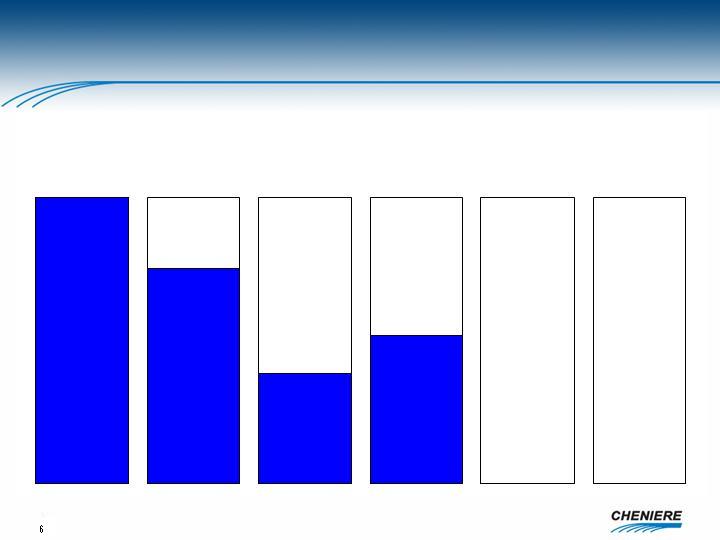

Market Performance

DEC 31

2002

DEC 31

2003

DEC 31

2004

MAR 31

2005

*Percentage increase based on a stock closing price of $1.28 at December 31, 2002 and $64.51 at March 31, 2005.

*

4940%

$0

$10

$20

$30

$40

$50

$60

$70

$80

$90

$/Share Closing Price

0%

500%

1000%

1500%

2000%

2500%

3000%

3500%

4000%

4500%

5000%

$0

$10

$20

$30

$40

$50

$60

$70

$80

$90

4

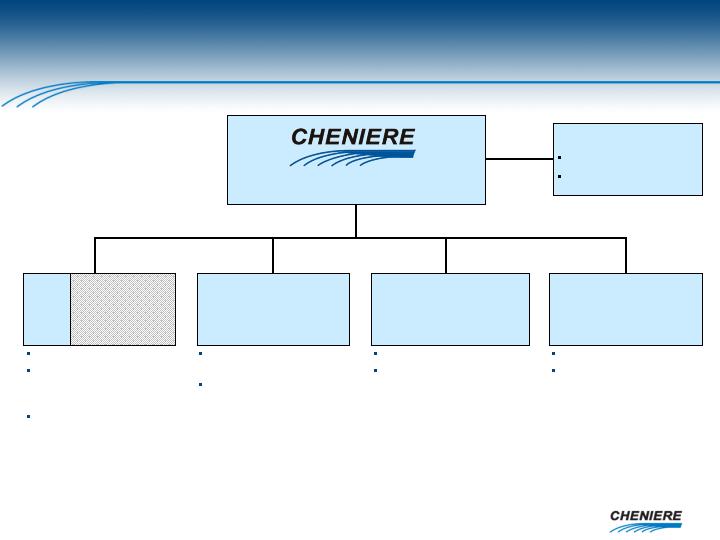

Business Structure

Freeport LNG

30%

Corpus Christi LNG

100%

Sabine Pass LNG

100%

100%

Creole Trail LNG

1

2

$1.7 billion equity market cap1

5

J&S Cheniere

E&P

Capacity sold out

Majority of financing

provided by

ConocoPhillips

Minimal capital

commitments by Cheniere

Market capitalization based on 26.76 million shares outstanding as of March 31, 2005 and a stock price of $64.62 as of April 13, 2005

Total S.A. has 1.0 Bcf/d of reserved capacity and ChevronTexaco has 0.7 Bcf/d of reserved capacity with the option to reduce to 0.5 Bcf/d

by July 1, 2005 or increase to 1.0 Bcf/d by December 1, 2005, leaving

current retained capacity of 0.9 Bcf/d

Other Businesses

Marketed capacity sold

out2

$822 million project

financing closed on

February 25, 2005

Marketing capacity

Evaluating financing

strategy

Marketing capacity

Evaluating financing

strategy

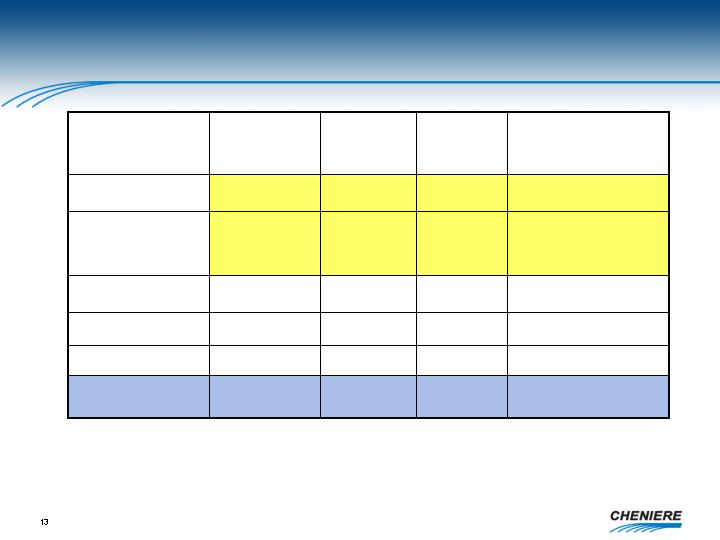

Site Selection

100%

Permitting

75%

Financing

37%

TUAs

52%

Arrangements

0%

Long Term Other

Commercial Commercial

Arrangements

0%

4 of 4

Sites

3 of 4

Terminals

$1.1 of $3

billion

3.2 of 6.2

Bcf/d

0 of 1

Bcf/d

0 of 4

Bcf/d

Other

Executing the Business Plan

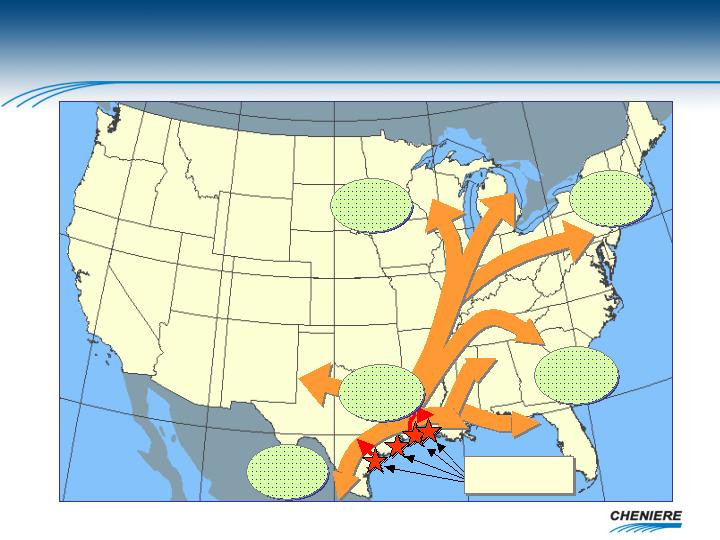

Cheniere LNG Receipt Network

Sabine Pass

Freeport (30%)

Corpus Christi

Creole Trail

7

Optionality

Flexibility

Reliability

Liquidity

Low Cost

4 Deepwater Ports

7 Unloading Docks

12 Storage Tanks

(40 Bcf equivalent)

10 Bcf/d Sendout

Target Gas Demand Corridor

Market Access – 29 Bcf/d

Midwest

Markets

11.8 Bcf/d

Northeast

Markets

5.7 Bcf/d

Southeast

Markets

4.6 Bcf/d

Gulf Coast

Markets

4.9 Bcf/d

Mexican

Markets

1.7 Bcf/d

Source: Cheniere Research

Cheniere LNG

Receipt Network

8

Cheniere Holds 3 of 4 Permits

4 Onshore applications approved by FERC – 8.2 Bcf/d

7 Onshore applications filed w/ FERC – 7.1 Bcf/d

Outside U.S. for U.S. Markets (Bahamas and Mexico)

FERC Approved

Cameron LNG (TX)

Corpus Christi – (TX)

Freeport LNG (TX)

Sabine Pass – (LA)

Filed with FERC

Calhoun LNG – (TX)

Fall River – (MA)

Golden Pass – (TX)

Ingleside – (TX)

Long Beach – (CA)

Providence – (RI)

Vista del Sol – (TX)

Onshore

Only 2 Onshore Terminals

Now Under Construction

Sabine Pass LNG Construction Site

Freeport LNG Construction Site

10

$1,122

TOTAL

$ 822

Project Finance for Sabine Pass

February 2005

$ 300

Equity at $60 per share

December 2004

$ Million

Sources of Funds

11

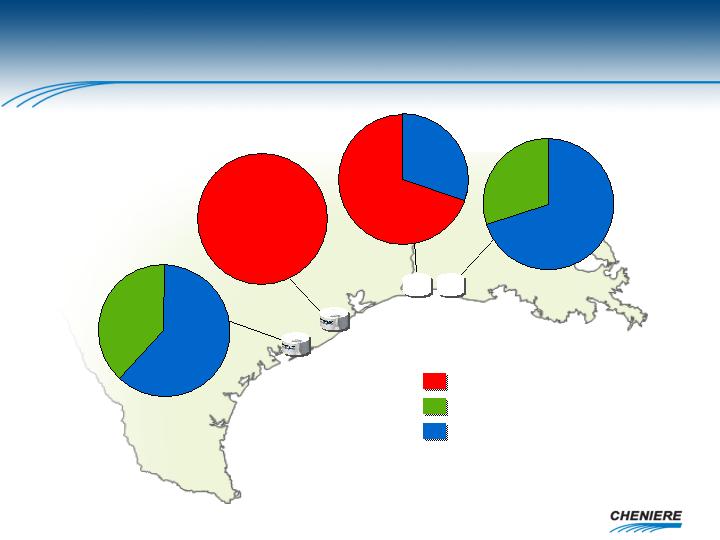

Marketing Status

Corpus Christi

2.6 Bcf/d

Freeport

1.5 Bcf/d

Sabine Pass*

2.6 Bcf/d

Creole Trail

3.3 Bcf/d

Contracted

Marketing TUA’s

Other Commercial

Arrangements

1.5

1.7

0.9

1.0

1.6

2.3

1.0

1 ChevronTexaco has 0.7 Bcf/d of reserved capacity with the option to reduce to 0.5 Bcf/d by July 1, 2005 or increase to

1.0 Bcf/d by December 1, 2005

*Excludes possible expansion to 4.0 Bcf/d

1

12

$230 + ???

6.2

Total

?

1.0

Marketing

Creole Trail2

Marketing

Marketing

Contracted

Contracted

Contracted

TUA

Status

$0.32

$0.32

Fee

($/MMbtu)

$ 15

1.5

Freeport

?

?

$125

$ 90

Calculated

Revenue to Cheniere

($mm)1

1.0

Corpus Christi2

1.0

Sabine Expansion2

1.0

0.73

Sabine Pass

Total

ChevronTexaco

TUA

Capacity

(Bcf/d)

TUA Annual Revenue

1 Revenue calculations are based solely on TUAs and reflect numerous assumptions; Freeport revenues represent the midpoint

of currently

estimated pre-tax cash distributions of $10—$20 million per year, excluding effects of potential expansion

2 Fixed cash operating expenses for each terminal are estimated to be $25—$30 million per year; Sabine Pass LNG,

Corpus Christi LNG and

Creole Trail LNG will also retain 2% of throughput for fuel usage

3 ChevronTexaco has 0.7 Bcf/d of reserved capacity with the option to reduce to 0.5 Bcf/d ($65 million in revenues)

by July 1, 2005 or increase

to 1.0 Bcf/d ($129 million in revenues) by December 1, 2005

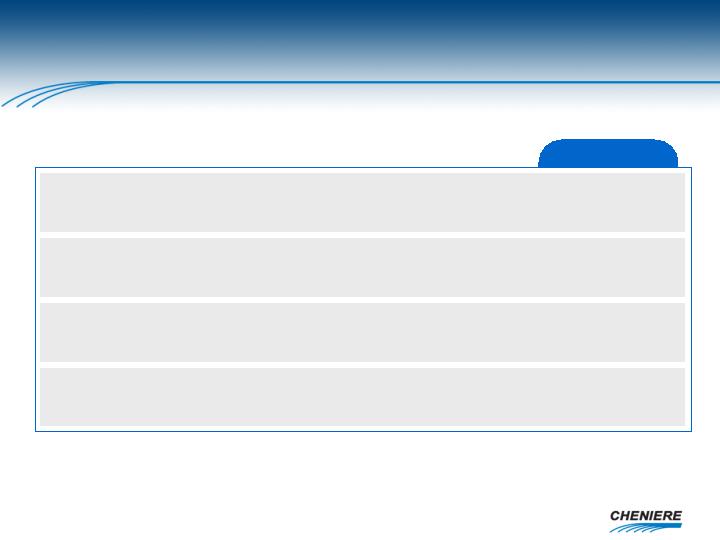

TUA Characteristics

Securing long-term terminal use agreements (TUAs)

Sell approximately one-half of existing and future

regasification capacity under TUAs

TUAs are 20 years or longer

Agreements made with investment grade customers

Take-or-pay contract terms

Provides stable stream of contracted cash flows

14

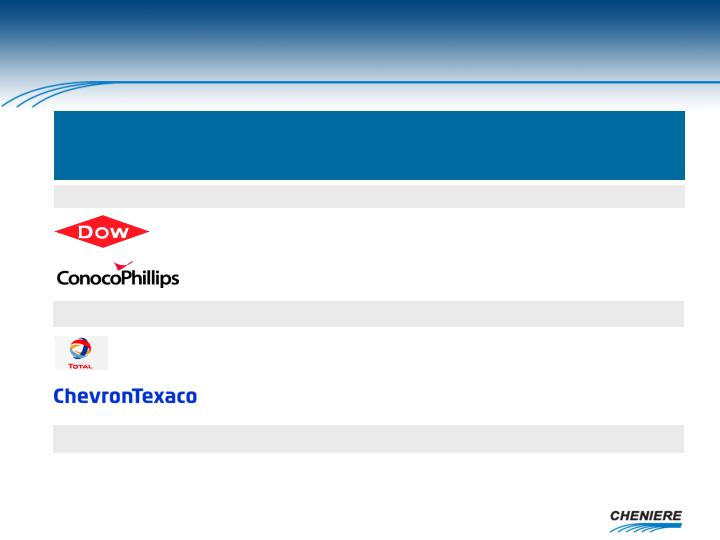

Investment Grade Anchor Customers

1 ChevronTexaco has 0.7 Bcf/d of reserved capacity with the option to reduce to 0.5 Bcf/d by July 1, 2005 or increase

to

1.0 Bcf/d by December 1, 2005

1

Reserved

Capacity

(Bcf/d)

Equity market

Capitalization

($billion)

Credit

ratings

Freeport

0.5

$48

A

-

/ A3

1.0

$80

A

-

/ A3

Sabine Pass

1.0

$149

AA / Aa2

0.7

$120

AA / Aa2

Corpus Christi and Creole Trail

Currently marketing to similarly large investment grade energy companies

15

Other Commercial Arrangements

Capacity reservation fees indexed to NYMEX prices

Gas purchase and sales indexed to NYMEX prices

Gas purchase and sales based on market area prices

Spot market terminal usage

16

Current Status

$230 million revenue stream per year secured

$1.1 billion financing completed

Marketing

Sabine Pass Expansion 1.0 Bcf/d

Corpus & Creole TUA’s 2.0 Bcf/d

Other Long-term Commercial 1.0 Bcf/d

Arrangements

Other marketing arrangements 1.0 Bcf/d