Cheniere Energy, Inc. Capital Allocation Presentation June 17, 2024 Exhibit 99.2

Forward-Looking Statements This presentation contains certain statements that are, or may be deemed to be, “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical or present facts or conditions, included or incorporated by reference herein are “forward- looking statements.” Included among “forward-looking statements” are, among other things: • statements regarding the ability of Cheniere Energy Partners, L.P. to pay or increase distributions to its unitholders or Cheniere Energy, Inc. to pay or increase dividends to its shareholders or participate in share or unit buybacks; • statements regarding Cheniere Energy, Inc.’s or Cheniere Energy Partners, L.P.’s expected receipt of cash distributions from their respective subsidiaries; • statements that Cheniere Energy Partners, L.P. expects to commence or complete construction of its proposed liquefied natural gas (“LNG”) terminals, liquefaction facilities, pipeline facilities or other projects, or any expansions or portions thereof, by certain dates or at all; • statements that Cheniere Energy, Inc. expects to commence or complete construction of its proposed LNG terminals, liquefaction facilities, pipeline facilities or other projects, or any expansions or portions thereof, by certain dates or at all; • statements regarding future levels of domestic and international natural gas production, supply or consumption or future levels of LNG imports into or exports from North America and other countries worldwide, or purchases of natural gas, regardless of the source of such information, or the transportation or other infrastructure, or demand for and prices related to natural gas, LNG or other hydrocarbon products; • statements regarding any financing transactions or arrangements, or ability to enter into such transactions; • statements relating to Cheniere’s capital deployment, including intent, ability, extent, and timing of capital expenditures, debt repayment, dividends, share repurchases and execution on the capital allocation plan; • statements regarding our future sources of liquidity and cash requirements; • statements relating to the construction of our proposed liquefaction facilities and natural gas liquefaction trains (“Trains”) and the construction of our pipelines, including statements concerning the engagement of any engineering, procurement and construction ("EPC") contractor or other contractor and the anticipated terms and provisions of any agreement with any EPC or other contractor, and anticipated costs related thereto; • statements regarding any agreement to be entered into or performed substantially in the future, including any revenues anticipated to be received and the anticipated timing thereof, and statements regarding the amounts of total LNG regasification, natural gas, liquefaction or storage capacities that are, or may become, subject to contracts; • statements regarding counterparties to our commercial contracts, construction contracts and other contracts; • statements regarding our planned development and construction of additional Trains or pipelines, including the financing of such Trains or pipelines; • statements that our Trains, when completed, will have certain characteristics, including amounts of liquefaction capacities; • statements regarding our business strategy, our strengths, our business and operation plans or any other plans, forecasts, projections or objectives, including anticipated revenues, capital expenditures, maintenance and operating costs, free cash flow, run rate SG&A estimates, cash flows, EBITDA, Consolidated Adjusted EBITDA, distributable cash flow, distributable cash flow per share and unit, deconsolidated debt outstanding, and deconsolidated contracted EBITDA, any or all of which are subject to change; • statements regarding projections of revenues, expenses, earnings or losses, working capital or other financial items; • statements relating to our goals, commitments and strategies in relation to environmental matters; • statements regarding legislative, governmental, regulatory, administrative or other public body actions, approvals, requirements, permits, applications, filings, investigations, proceedings or decisions; • statements regarding our anticipated LNG and natural gas marketing activities; and • any other statements that relate to non-historical or future information. These forward-looking statements are often identified by the use of terms and phrases such as “achieve,” “anticipate,” “believe,” “contemplate,” “continue,” “could,” “develop,” “estimate,” “example,” “expect,” “forecast,” “goals,” ”guidance,” “intend,” “may,” “opportunities,” “plan,” “potential,” “predict,” “project,” “propose,” “pursue,” “should,” “subject to,” “strategy,” “target,” “will,” and similar terms and phrases, or by use of future tense. Although we believe that the expectations reflected in these forward-looking statements are reasonable, they do involve assumptions, risks and uncertainties, and these expectations may prove to be incorrect. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of a variety of factors, including those discussed in “Risk Factors” in the Cheniere Energy, Inc. and Cheniere Energy Partners, L.P. Annual Reports on Form 10-K filed with the SEC on February 22, 2024, which are incorporated by reference into this presentation. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by these ”Risk Factors.” These forward-looking statements are made as of the date of this presentation, and other than as required by law, we undertake no obligation to update or revise any forward-looking statement or provide reasons why actual results may differ, whether as a result of new information, future events or otherwise. Safe Harbor Statements 2

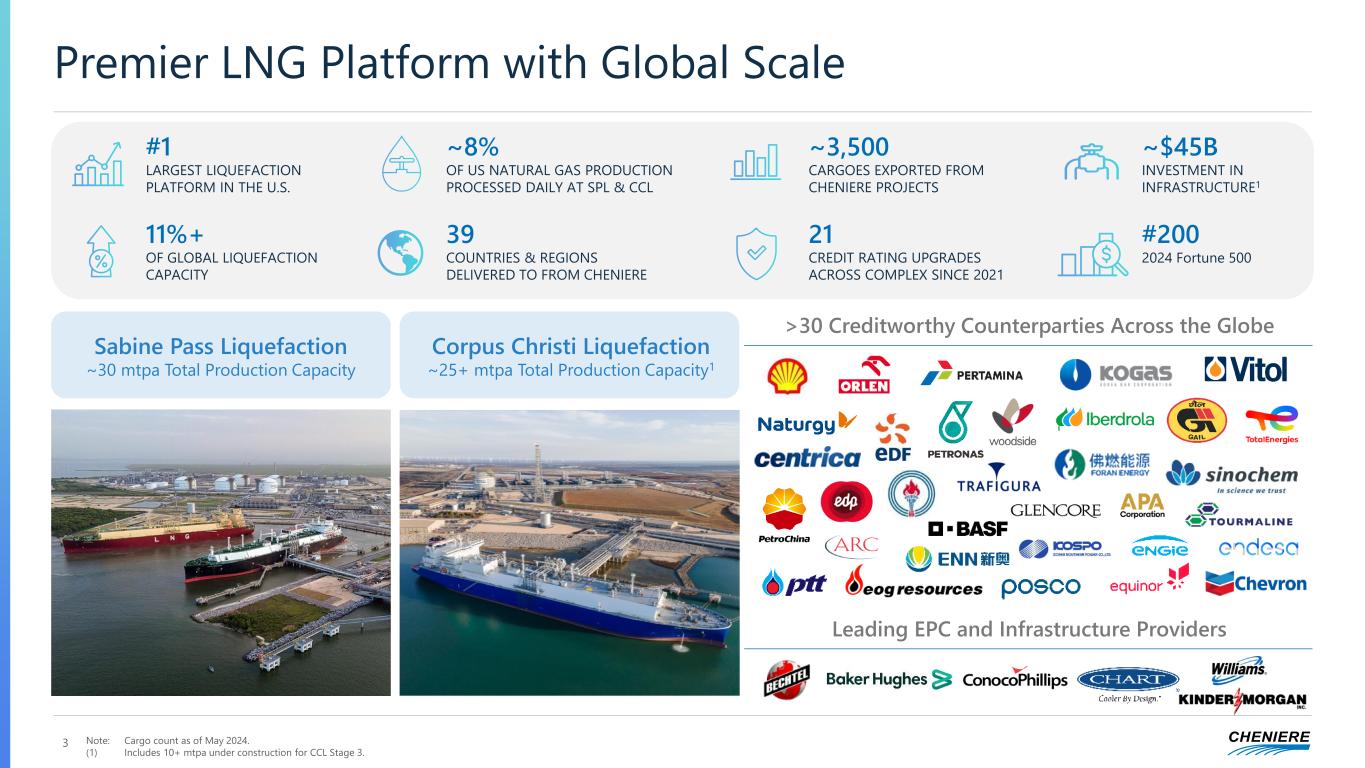

Premier LNG Platform with Global Scale #1 LARGEST LIQUEFACTION PLATFORM IN THE U.S. ~3,500 CARGOES EXPORTED FROM CHENIERE PROJECTS #200 2024 Fortune 500 ~8% OF US NATURAL GAS PRODUCTION PROCESSED DAILY AT SPL & CCL ~$45B INVESTMENT IN INFRASTRUCTURE1 21 CREDIT RATING UPGRADES ACROSS COMPLEX SINCE 2021 11%+ OF GLOBAL LIQUEFACTION CAPACITY Sabine Pass Liquefaction ~30 mtpa Total Production Capacity Corpus Christi Liquefaction ~25+ mtpa Total Production Capacity1 >30 Creditworthy Counterparties Across the Globe 39 COUNTRIES & REGIONS DELIVERED TO FROM CHENIERE Leading EPC and Infrastructure Providers Note: Cargo count as of May 2024. (1) Includes 10+ mtpa under construction for CCL Stage 3. 3

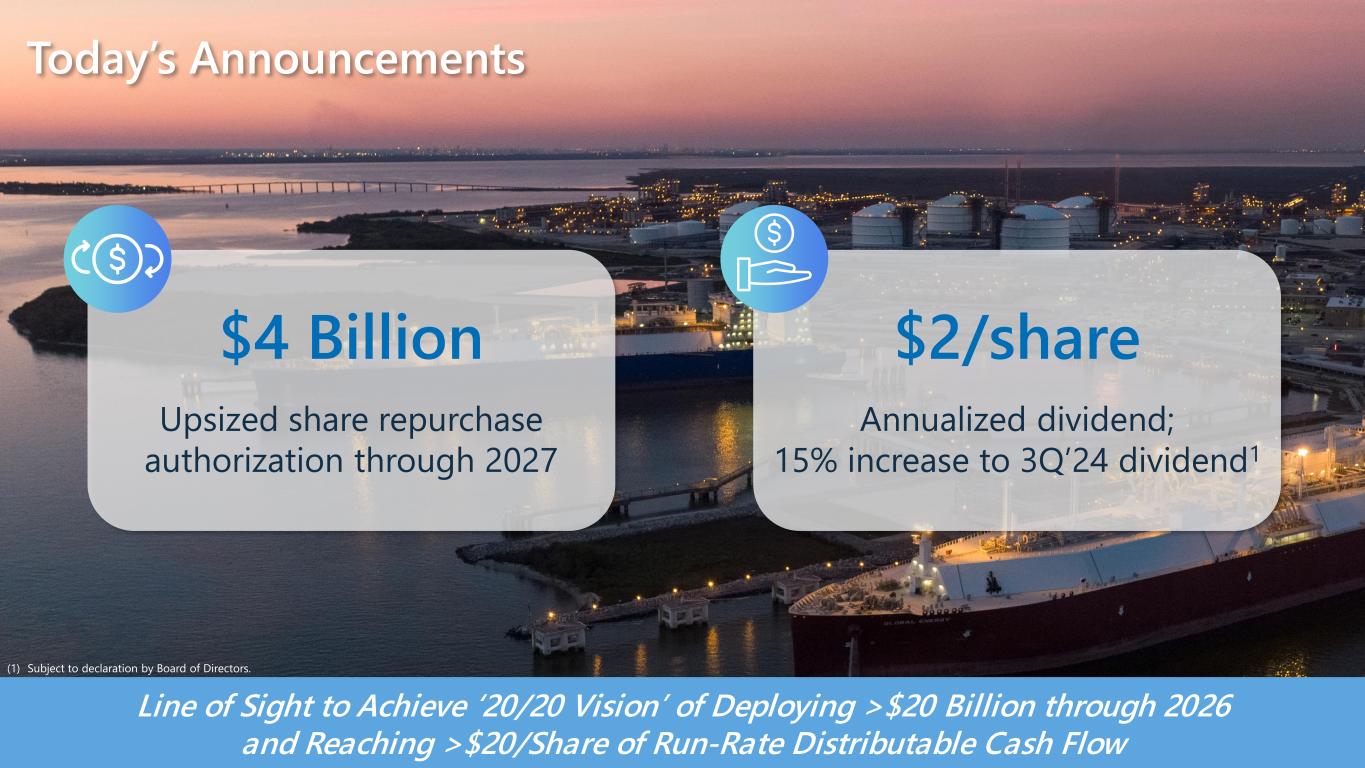

4 4 Today’s Announcements Line of Sight to Achieve ‘20/20 Vision’ of Deploying >$20 Billion through 2026 and Reaching >$20/Share of Run-Rate Distributable Cash Flow Upsized share repurchase authorization through 2027 $4 Billion Annualized dividend; 15% increase to 3Q’24 dividend1 $2/share (1) Subject to declaration by Board of Directors.

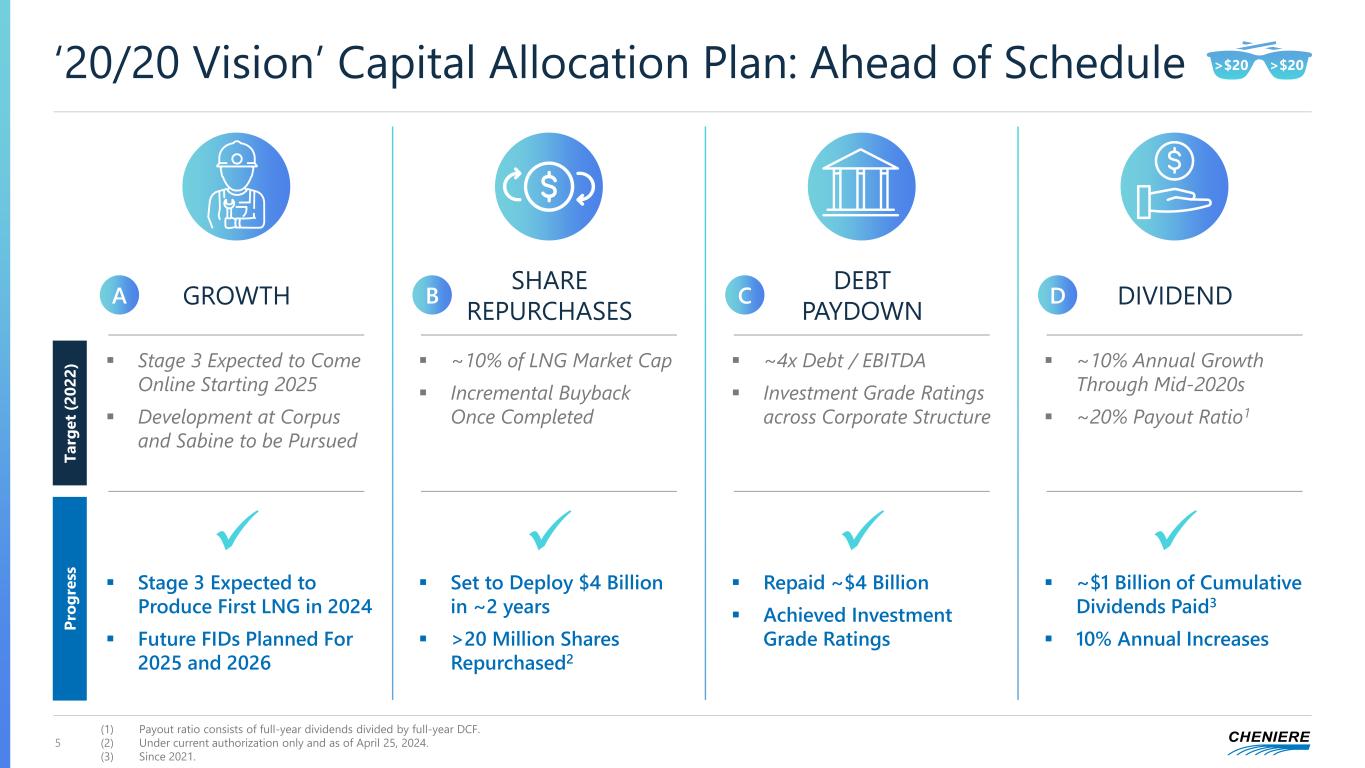

‘20/20 Vision’ Capital Allocation Plan: Ahead of Schedule 5 T a rg e t (2 0 2 2 ) P ro g re ss DEBT PAYDOWN ▪ ~4x Debt / EBITDA ▪ Investment Grade Ratings across Corporate Structure ▪ Repaid ~$4 Billion ▪ Achieved Investment Grade Ratings SHARE REPURCHASES ▪ ~10% of LNG Market Cap ▪ Incremental Buyback Once Completed ▪ Set to Deploy $4 Billion in ~2 years ▪ >20 Million Shares Repurchased2 ▪ ~10% Annual Growth Through Mid-2020s ▪ ~20% Payout Ratio1 DIVIDEND ▪ ~$1 Billion of Cumulative Dividends Paid3 ▪ 10% Annual Increases ▪ Stage 3 Expected to Come Online Starting 2025 ▪ Development at Corpus and Sabine to be Pursued GROWTH ▪ Stage 3 Expected to Produce First LNG in 2024 ▪ Future FIDs Planned For 2025 and 2026 (1) Payout ratio consists of full-year dividends divided by full-year DCF. (2) Under current authorization only and as of April 25, 2024. (3) Since 2021. A B C D ✓✓ ✓✓ >$20 >$20

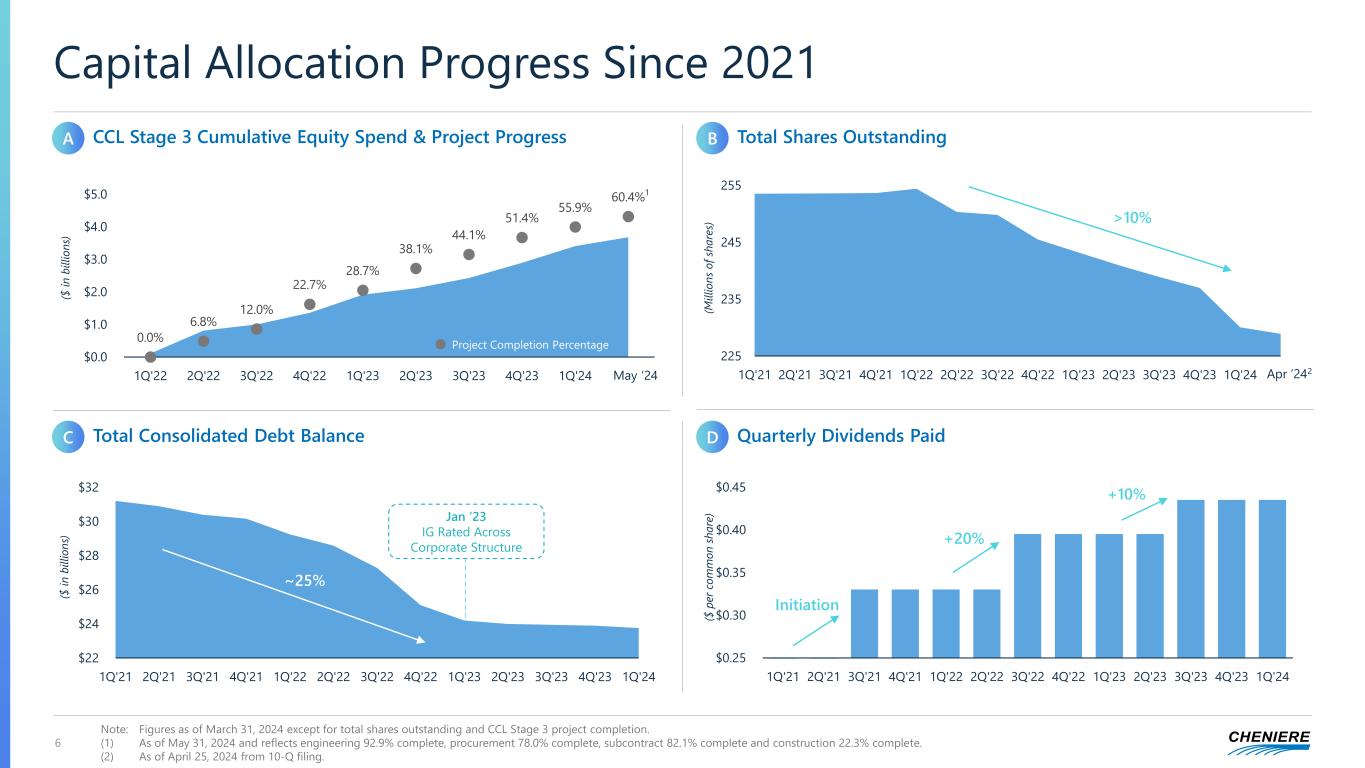

Capital Allocation Progress Since 2021 6 Note: Figures as of March 31, 2024 except for total shares outstanding and CCL Stage 3 project completion. (1) As of May 31, 2024 and reflects engineering 92.9% complete, procurement 78.0% complete, subcontract 82.1% complete and construction 22.3% complete. (2) As of April 25, 2024 from 10-Q filing. Total Shares Outstanding (M il li o n s o f sh a re s) 225 235 245 255 1Q'21 2Q'21 3Q'21 4Q'21 1Q'22 2Q'22 3Q'22 4Q'22 1Q'23 2Q'23 3Q'23 4Q'23 1Q'24 Today >10% Apr ’242 CCL Stage 3 Cumulative Equity Spend & Project Progress ($ i n b il li o n s) 0.0% 6.8% 12.0% 22.7% 28.7% 38.1% 44.1% 51.4% 55.9% 60.4% $0.0 $1.0 $2.0 $3.0 $4.0 $5.0 1Q'22 2Q'22 3Q'22 4Q'22 1Q'23 2Q'23 3Q'23 4Q'23 1Q'24 Today Project Completion Percentage May ‘24 1 Quarterly Dividends Paid ($ p e r co m m o n s h a re ) $0.25 $0.30 $0.35 $0.40 $0.45 1Q'21 2Q'21 3Q'21 4Q'21 1Q'22 2Q'22 3Q'22 4Q'22 1Q'23 2Q'23 3Q'23 4Q'23 1Q'24 +20% +10% Initiation $22 $24 $26 $28 $30 $32 1Q'21 2Q'21 3Q'21 4Q'21 1Q'22 2Q'22 3Q'22 4Q'22 1Q'23 2Q'23 3Q'23 4Q'23 1Q'24 Total Consolidated Debt Balance ($ i n b il li o n s) ~25% Jan ‘23 IG Rated Across Corporate Structure A B C D

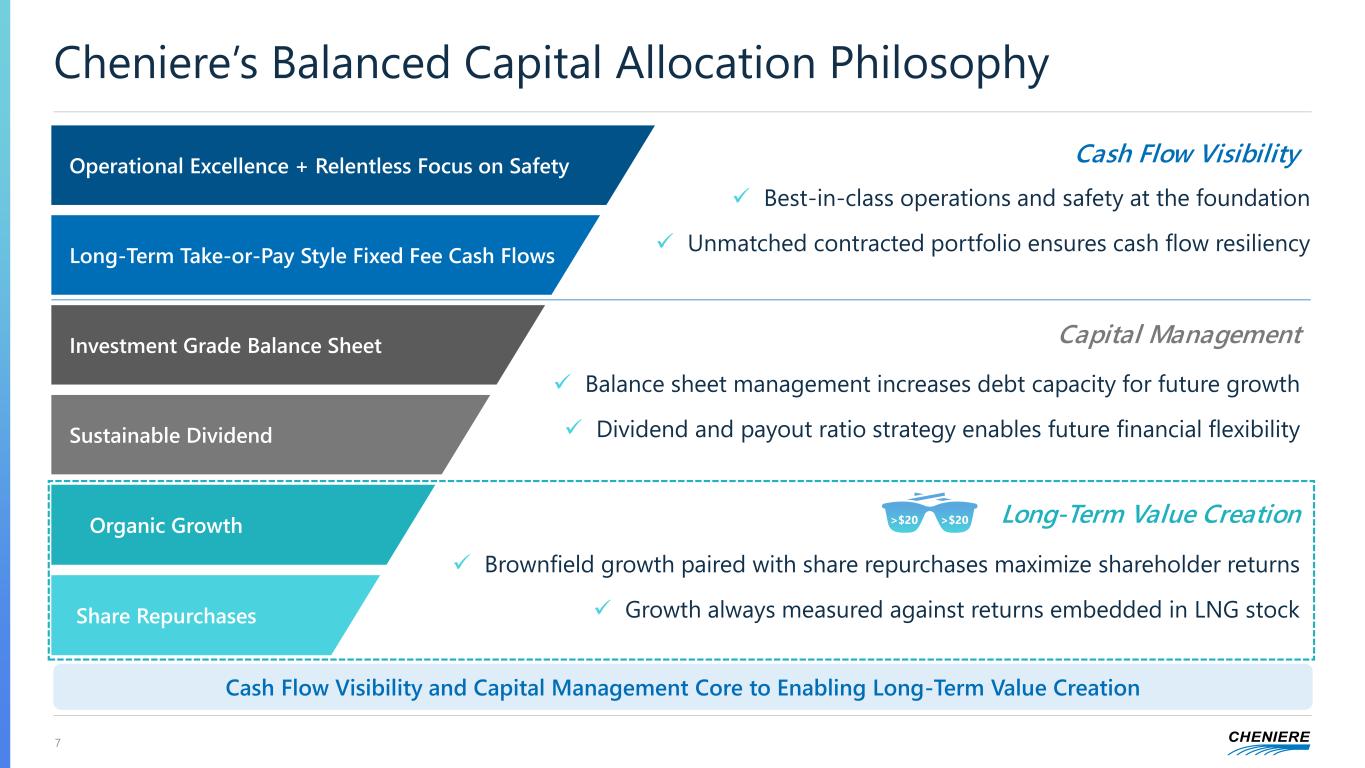

7 Cheniere’s Balanced Capital Allocation Philosophy Cash Flow Visibility Capital Management Long-Term Value Creation ✓ Best-in-class operations and safety at the foundation ✓ Unmatched contracted portfolio ensures cash flow resiliency ✓ Balance sheet management increases debt capacity for future growth ✓ Dividend and payout ratio strategy enables future financial flexibility ✓ Brownfield growth paired with share repurchases maximize shareholder returns ✓ Growth always measured against returns embedded in LNG stock Operational Excellence + Relentless Focus on Safety Long-Term Take-or-Pay Style Fixed Fee Cash Flows Investment Grade Balance Sheet Sustainable Dividend >$20 >$20Organic Growth Share Repurchases Cash Flow Visibility and Capital Management Core to Enabling Long-Term Value Creation

Today’s Updates Under ‘20/20 Vision’ 8 (1) Subject to declaration by Board of Directors. (2) Payout ratio consists of full-year dividends divided by full-year DCF. Significant Cash Flow Generation and Visibility Enable Follow-Through on All-of-the-Above Capital Allocation Plan Accretive Growth ▪ Committed to financially disciplined, brownfield growth accretive to stock ▪ Target FID of Midscale Trains 8 & 9 in 2025 ▪ Target FID of SPL Expansion Project in 2026 Long-Term Sustainable IG Balance Sheet ▪ Sustain long-term, run-rate leverage of <4x ▪ Target ‘BBB’ corporate credit ratings over time ▪ Increase future debt capacity for LNG build-out and enhance free cash flow throughout Share Repurchase Program ▪ Upsized authorization by additional $4 billion through 2027 ▪ Target repurchasing another ~10% of LNG market cap ▪ Remain opportunistic with track to reach ~200 million shares outstanding Growing Dividend ▪ Increase annual dividend by ~15% to $2.00/share for 3Q’241 ▪ Plan to continue ~10% annual growth rate guidance to achieve ~20% payout ratio2 later this decade ▪ Competitive and growing shareholder return in combination with share repurchases >$20 >$20 A B C D

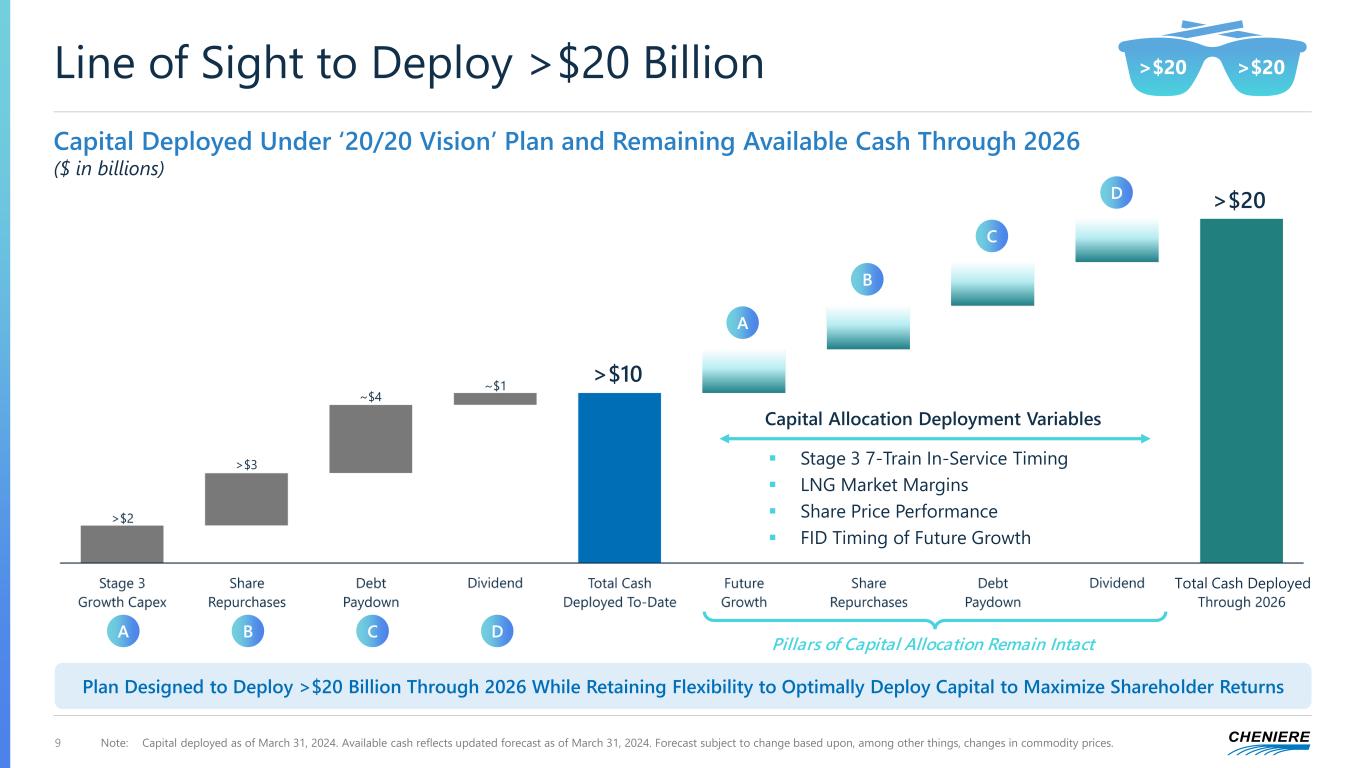

Line of Sight to Deploy >$20 Billion 9 Capital Deployed Under ‘20/20 Vision’ Plan and Remaining Available Cash Through 2026 ($ in billions) Note: Capital deployed as of March 31, 2024. Available cash reflects updated forecast as of March 31, 2024. Forecast subject to change based upon, among other things, changes in commodity prices. Plan Designed to Deploy >$20 Billion Through 2026 While Retaining Flexibility to Optimally Deploy Capital to Maximize Shareholder Returns >$20 >$10 Capital Allocation Deployment Variables ▪ Stage 3 7-Train In-Service Timing ▪ LNG Market Margins ▪ Share Price Performance ▪ FID Timing of Future Growth Pillars of Capital Allocation Remain Intact A CB D A C B D ~$4 >$3 >$20 >$20 Total Cash Deployed

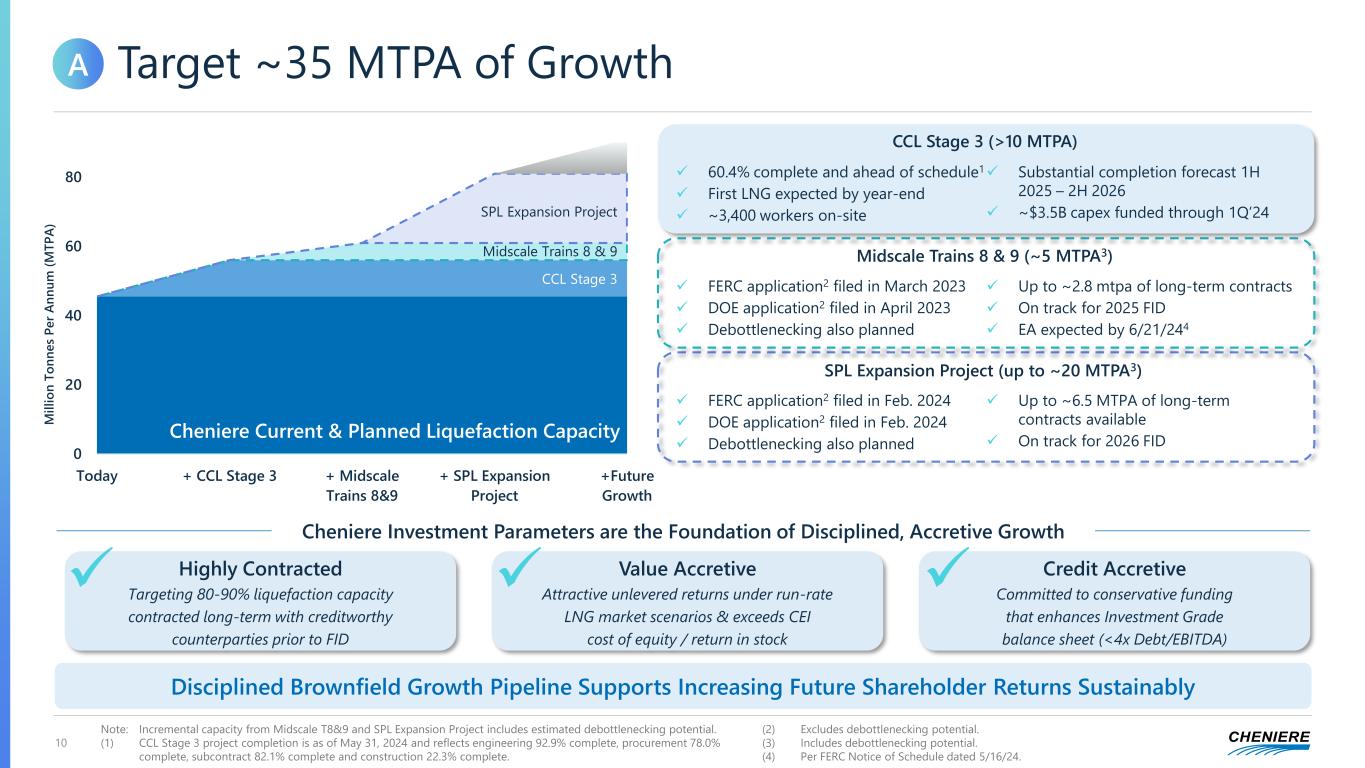

0 20 40 60 80 Today + CCL Stage 3 + Midscale Trains 8&9 + SPL Expansion Project +Future Growth Target ~35 MTPA of Growth 10 M il li o n T o n n e s P e r A n n u m ( M T P A ) Note: Incremental capacity from Midscale T8&9 and SPL Expansion Project includes estimated debottlenecking potential. (1) CCL Stage 3 project completion is as of May 31, 2024 and reflects engineering 92.9% complete, procurement 78.0% complete, subcontract 82.1% complete and construction 22.3% complete. (2) Excludes debottlenecking potential. (3) Includes debottlenecking potential. (4) Per FERC Notice of Schedule dated 5/16/24. Cheniere Current & Planned Liquefaction Capacity Cheniere Investment Parameters are the Foundation of Disciplined, Accretive Growth Highly Contracted Targeting 80-90% liquefaction capacity contracted long-term with creditworthy counterparties prior to FID Value Accretive Attractive unlevered returns under run-rate LNG market scenarios & exceeds CEI cost of equity / return in stock Credit Accretive Committed to conservative funding that enhances Investment Grade balance sheet (<4x Debt/EBITDA) CCL Stage 3 Midscale Trains 8 & 9 SPL Expansion Project A Disciplined Brownfield Growth Pipeline Supports Increasing Future Shareholder Returns Sustainably SPL Expansion Project (up to ~20 MTPA3) ✓ FERC application2 filed in Feb. 2024 ✓ DOE application2 filed in Feb. 2024 ✓ Debottlenecking also planned ✓ Up to ~6.5 MTPA of long-term contracts available ✓ On track for 2026 FID Midscale Trains 8 & 9 (~5 MTPA3) ✓ FERC application2 filed in March 2023 ✓ DOE application2 filed in April 2023 ✓ Debottlenecking also planned ✓ Up to ~2.8 mtpa of long-term contracts ✓ On track for 2025 FID ✓ EA expected by 6/21/244 CCL Stage 3 (>10 MTPA) ✓ 60.4% complete and ahead of schedule1 ✓ First LNG expected by year-end ✓ ~3,400 workers on-site ✓ Substantial completion forecast 1H 2025 – 2H 2026 ✓ ~$3.5B capex funded through 1Q’24 ✓ ✓ ✓

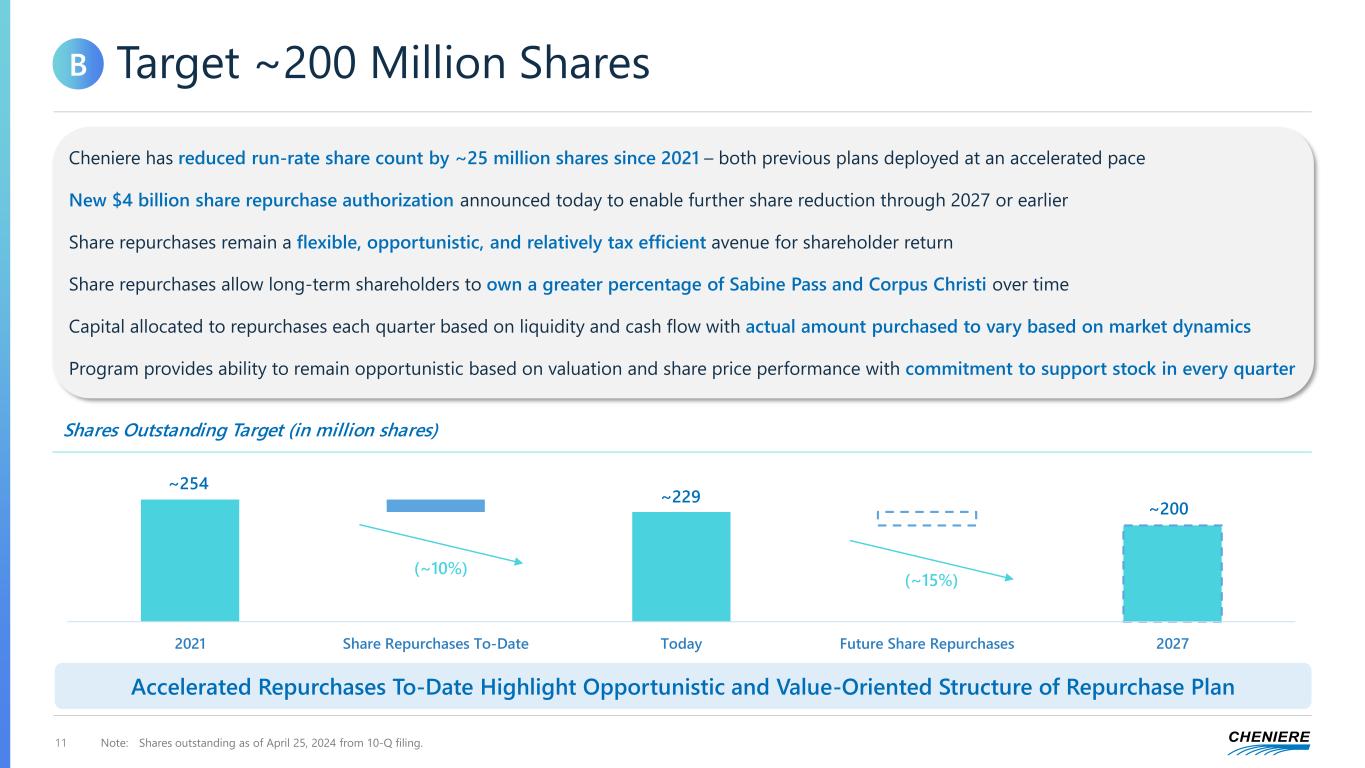

11 Cheniere has reduced run-rate share count by ~25 million shares since 2021 – both previous plans deployed at an accelerated pace New $4 billion share repurchase authorization announced today to enable further share reduction through 2027 or earlier Share repurchases remain a flexible, opportunistic, and relatively tax efficient avenue for shareholder return Share repurchases allow long-term shareholders to own a greater percentage of Sabine Pass and Corpus Christi over time Capital allocated to repurchases each quarter based on liquidity and cash flow with actual amount purchased to vary based on market dynamics Program provides ability to remain opportunistic based on valuation and share price performance with commitment to support stock in every quarter 2021 Share Repurchases To-Date Today Future Share Repurchases 2027 Shares Outstanding Target (in million shares) ~254 ~229 ~200 (~10%) (~15%) Target ~200 Million Shares Note: Shares outstanding as of April 25, 2024 from 10-Q filing. B Accelerated Repurchases To-Date Highlight Opportunistic and Value-Oriented Structure of Repurchase Plan

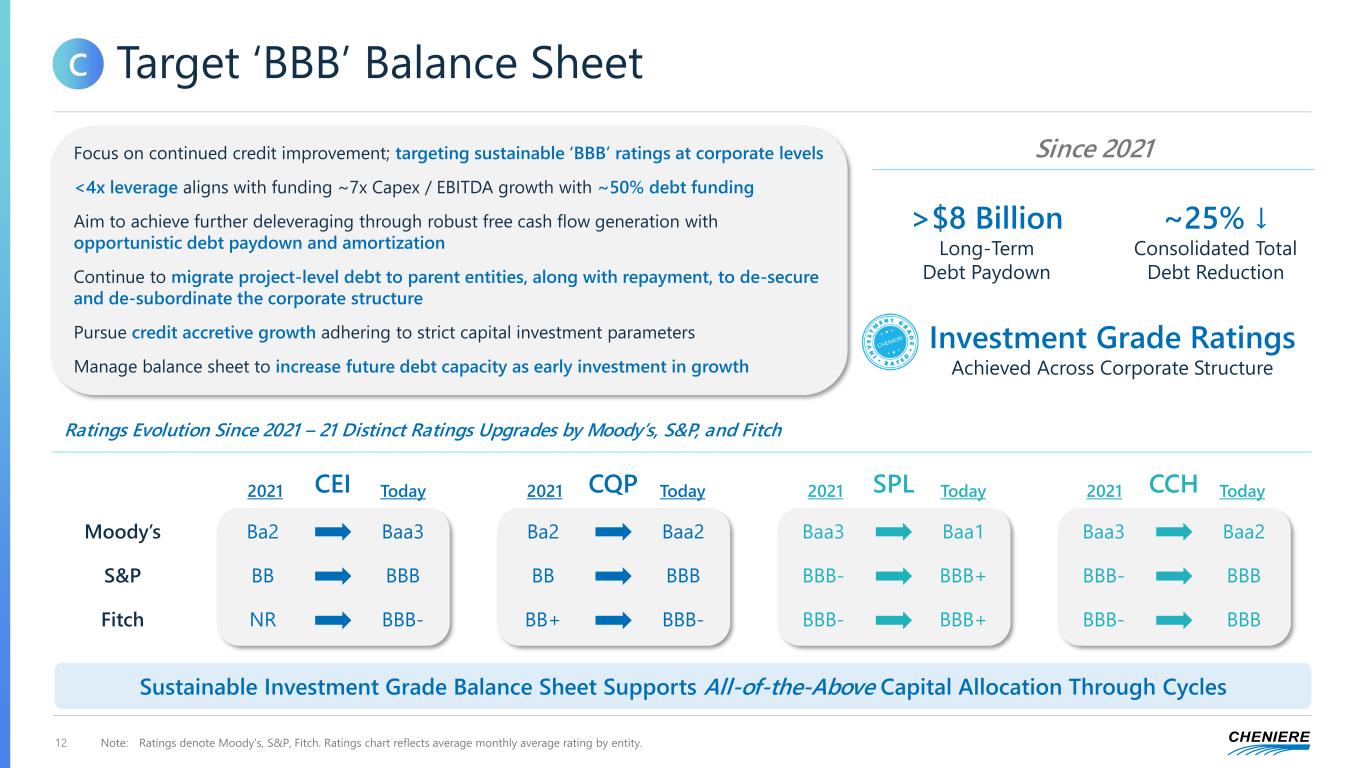

Target ‘BBB’ Balance Sheet 12 Focus on continued credit improvement; targeting sustainable ‘BBB’ ratings at corporate levels <4x leverage aligns with funding ~7x Capex / EBITDA growth with ~50% debt funding Aim to achieve further deleveraging through robust free cash flow generation with opportunistic debt paydown and amortization Continue to migrate project-level debt to parent entities, along with repayment, to de-secure and de-subordinate the corporate structure Pursue credit accretive growth adhering to strict capital investment parameters Manage balance sheet to increase future debt capacity as early investment in growth >$8 Billion Long-Term Debt Paydown Since 2021 ~25% ↓ Consolidated Total Debt Reduction Investment Grade Ratings Achieved Across Corporate Structure Note: Ratings denote Moody’s, S&P, Fitch. Ratings chart reflects average monthly average rating by entity. C Sustainable Investment Grade Balance Sheet Supports All-of-the-Above Capital Allocation Through Cycles Ratings Evolution Since 2021 – 21 Distinct Ratings Upgrades by Moody’s, S&P, and Fitch CEI CQP SPL CCH Moody’s Ba2 Baa3 Ba2 Baa2 Baa3 Baa1 Baa3 Baa2 S&P BB BBB BB BBB BBB- BBB+ BBB- BBB Fitch NR BBB- BB+ BBB- BBB- BBB+ BBB- BBB 2021 Today 2021 Today 2021 Today 2021 Today

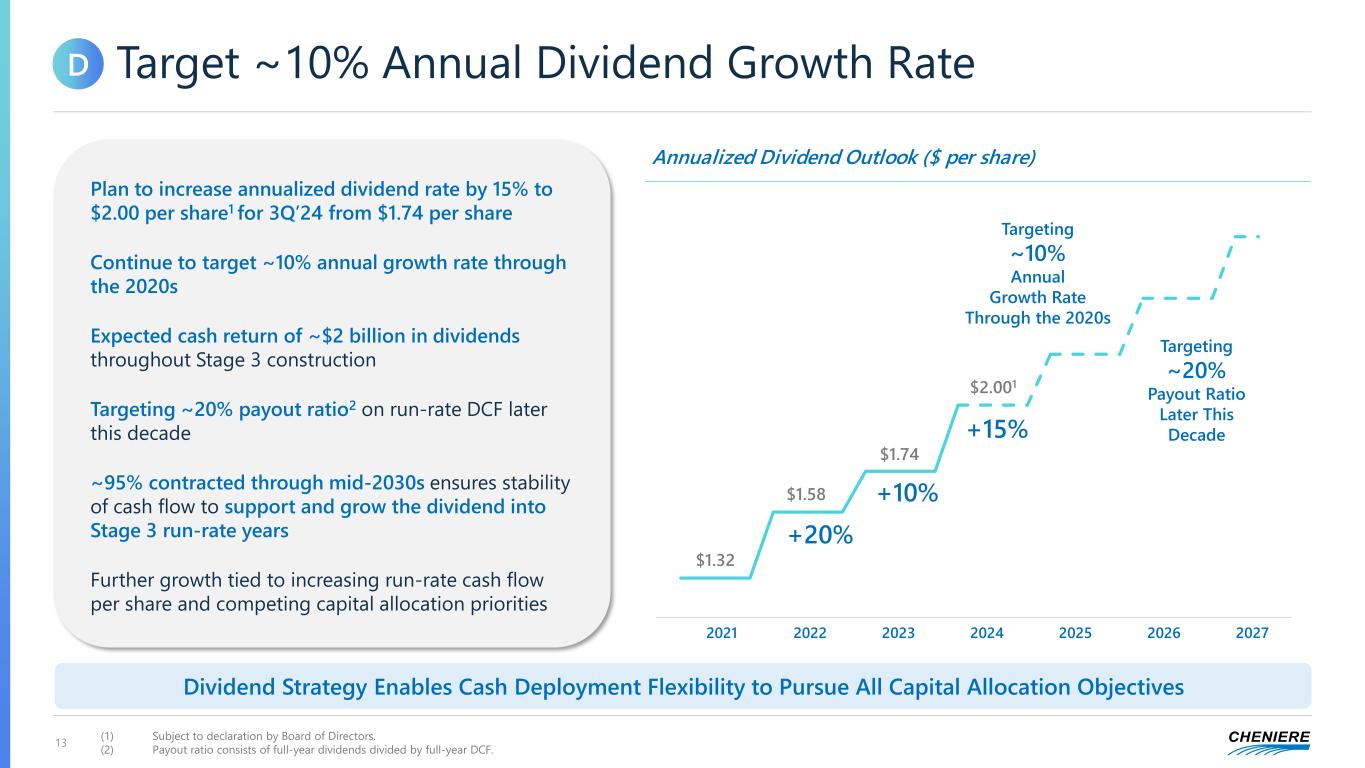

13 Target ~10% Annual Dividend Growth Rate Plan to increase annualized dividend rate by 15% to $2.00 per share1 for 3Q’24 from $1.74 per share Continue to target ~10% annual growth rate through the 2020s Expected cash return of ~$2 billion in dividends throughout Stage 3 construction Targeting ~20% payout ratio2 on run-rate DCF later this decade ~95% contracted through mid-2030s ensures stability of cash flow to support and grow the dividend into Stage 3 run-rate years Further growth tied to increasing run-rate cash flow per share and competing capital allocation priorities Annualized Dividend Outlook ($ per share) 2021 2022 2023 2024 2025 2026 2027 +20% +10% +15% Targeting ~10% Annual Growth Rate Through the 2020s Targeting ~20% Payout Ratio Later This Decade $1.32 $1.58 $2.001 (1) Subject to declaration by Board of Directors. (2) Payout ratio consists of full-year dividends divided by full-year DCF. D Dividend Strategy Enables Cash Deployment Flexibility to Pursue All Capital Allocation Objectives $1.74

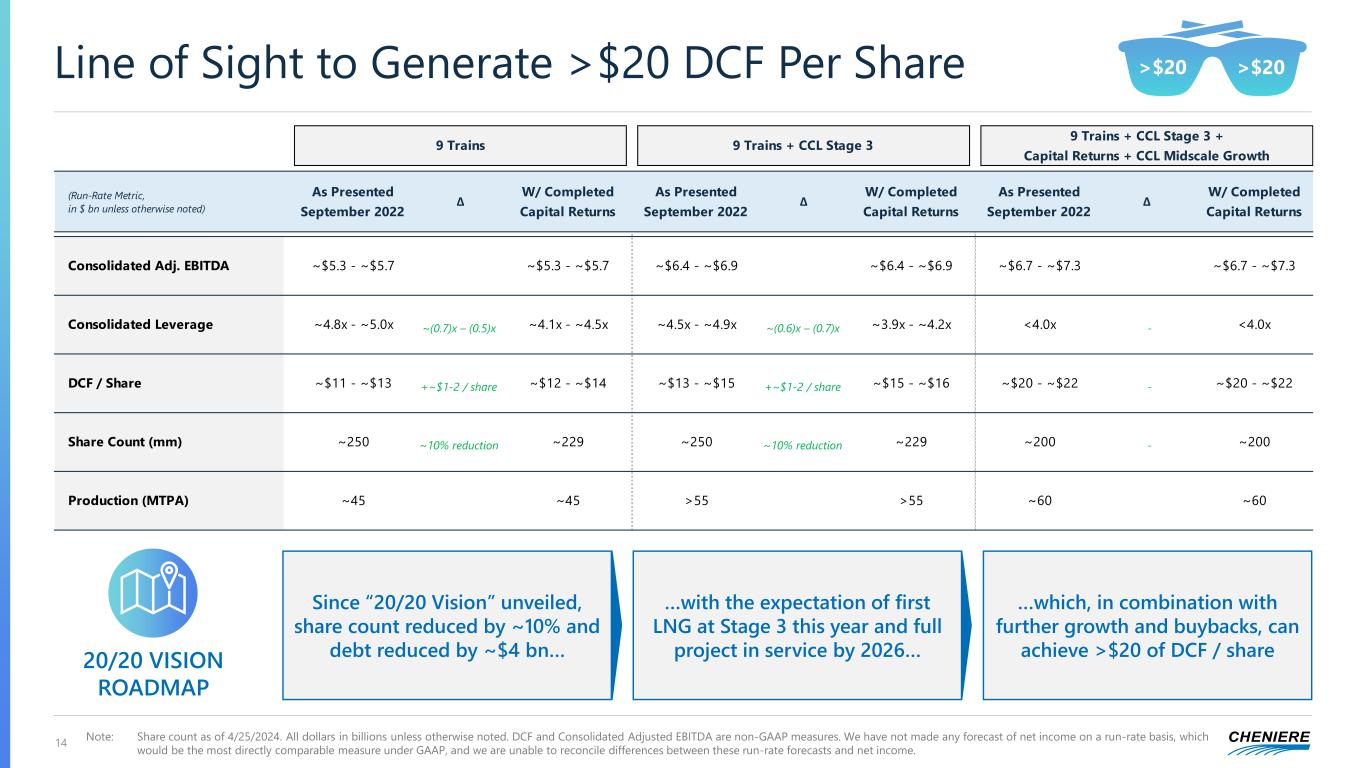

Since “20/20 Vision” unveiled, share count reduced by ~10% and debt reduced by ~$4 bn… …with the expectation of first LNG at Stage 3 this year and full project in service by 2026… …which, in combination with further growth and buybacks, can achieve >$20 of DCF / share Line of Sight to Generate >$20 DCF Per Share 14 20/20 VISION ROADMAP Note: Share count as of 4/25/2024. All dollars in billions unless otherwise noted. DCF and Consolidated Adjusted EBITDA are non-GAAP measures. We have not made any forecast of net income on a run-rate basis, which would be the most directly comparable measure under GAAP, and we are unable to reconcile differences between these run-rate forecasts and net income. ~(0.7)x – (0.5)x +~$1-2 / share ~10% reduction ~(0.6)x – (0.7)x +~$1-2 / share ~10% reduction - - - 9 Trains 9 Trains + CCL Stage 3 9 Trains + CCL Stage 3 + Capital Returns + CCL Midscale Growth (Run-Rate Metric, in $ bn unless otherwise noted) As Presented September 2022 ∆ W/ Completed Capital Returns As Presented September 2022 ∆ W/ Completed Capital Returns As Presented September 2022 ∆ W/ Completed Capital Returns Consolidated Adj. EBITDA ~$5.3 - ~$5.7 ~$5.3 - ~$5.7 ~$6.4 - ~$6.9 ~$6.4 - ~$6.9 ~$6.7 - ~$7.3 ~$6.7 - ~$7.3 Consolidated Leverage ~4.8x - ~5.0x ~4.1x - ~4.5x ~4.5x - ~4.9x ~3.9x - ~4.2x <4.0x <4.0x DCF / Share ~$11 - ~$13 ~$12 - ~$14 ~$13 - ~$15 ~$15 - ~$16 ~$20 - ~$22 ~$20 - ~$22 Share Count (mm) ~250 ~229 ~250 ~229 ~200 ~200 Production (MTPA) ~45 ~45 >55 >55 ~60 ~60 >$20 >$20

Appendix

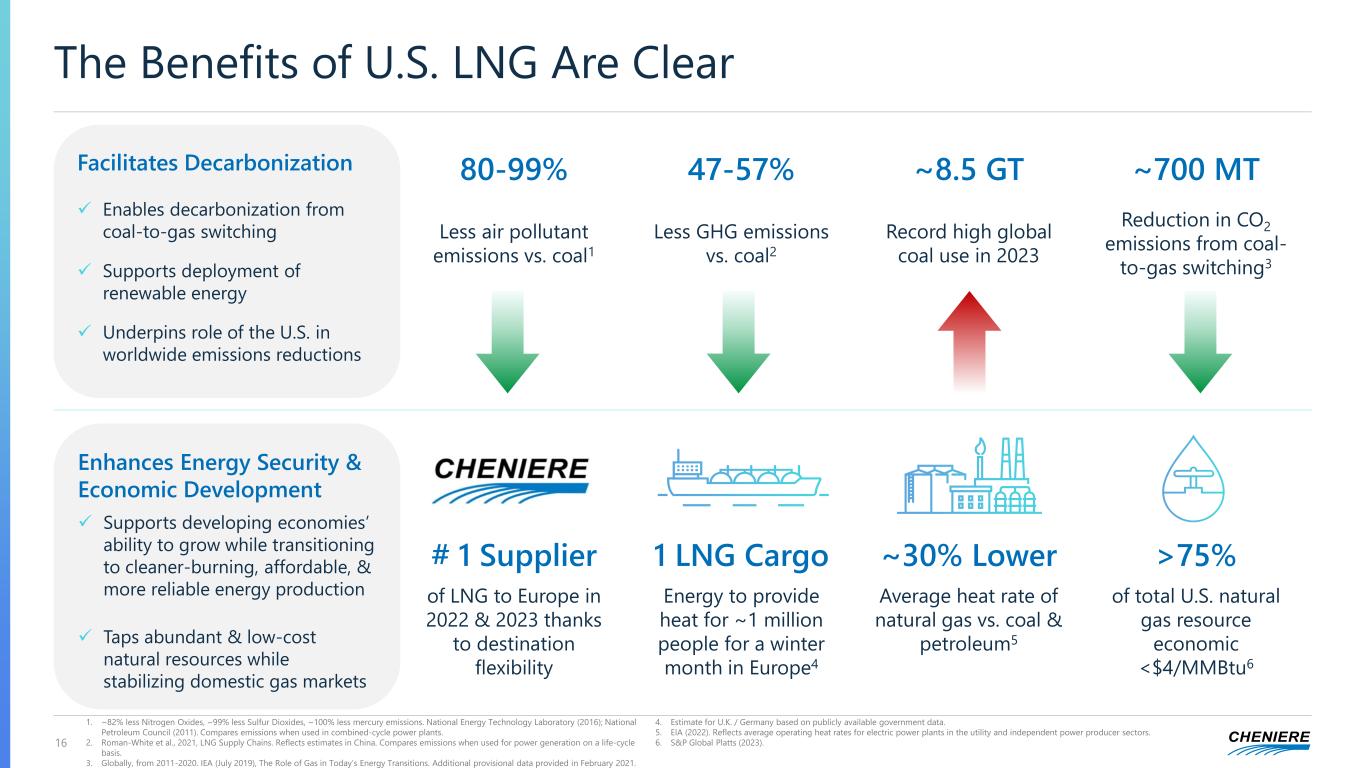

The Benefits of U.S. LNG Are Clear 16 1. ~82% less Nitrogen Oxides, ~99% less Sulfur Dioxides, ~100% less mercury emissions. National Energy Technology Laboratory (2016); National Petroleum Council (2011). Compares emissions when used in combined-cycle power plants. 2. Roman-White et al., 2021, LNG Supply Chains. Reflects estimates in China. Compares emissions when used for power generation on a life-cycle basis. 3. Globally, from 2011-2020. IEA (July 2019), The Role of Gas in Today’s Energy Transitions. Additional provisional data provided in February 2021. 4. Estimate for U.K. / Germany based on publicly available government data. 5. EIA (2022). Reflects average operating heat rates for electric power plants in the utility and independent power producer sectors. 6. S&P Global Platts (2023). Enhances Energy Security & Economic Development ✓ Supports developing economies’ ability to grow while transitioning to cleaner-burning, affordable, & more reliable energy production ✓ Taps abundant & low-cost natural resources while stabilizing domestic gas markets # 1 Supplier 1 LNG Cargo ~30% Lower >75% of LNG to Europe in 2022 & 2023 thanks to destination flexibility Energy to provide heat for ~1 million people for a winter month in Europe4 Average heat rate of natural gas vs. coal & petroleum5 of total U.S. natural gas resource economic <$4/MMBtu6 Facilitates Decarbonization ✓ Enables decarbonization from coal-to-gas switching ✓ Supports deployment of renewable energy ✓ Underpins role of the U.S. in worldwide emissions reductions 80-99% 47-57% ~8.5 GT ~700 MT Less air pollutant emissions vs. coal1 Less GHG emissions vs. coal2 Record high global coal use in 2023 Reduction in CO2 emissions from coal- to-gas switching3

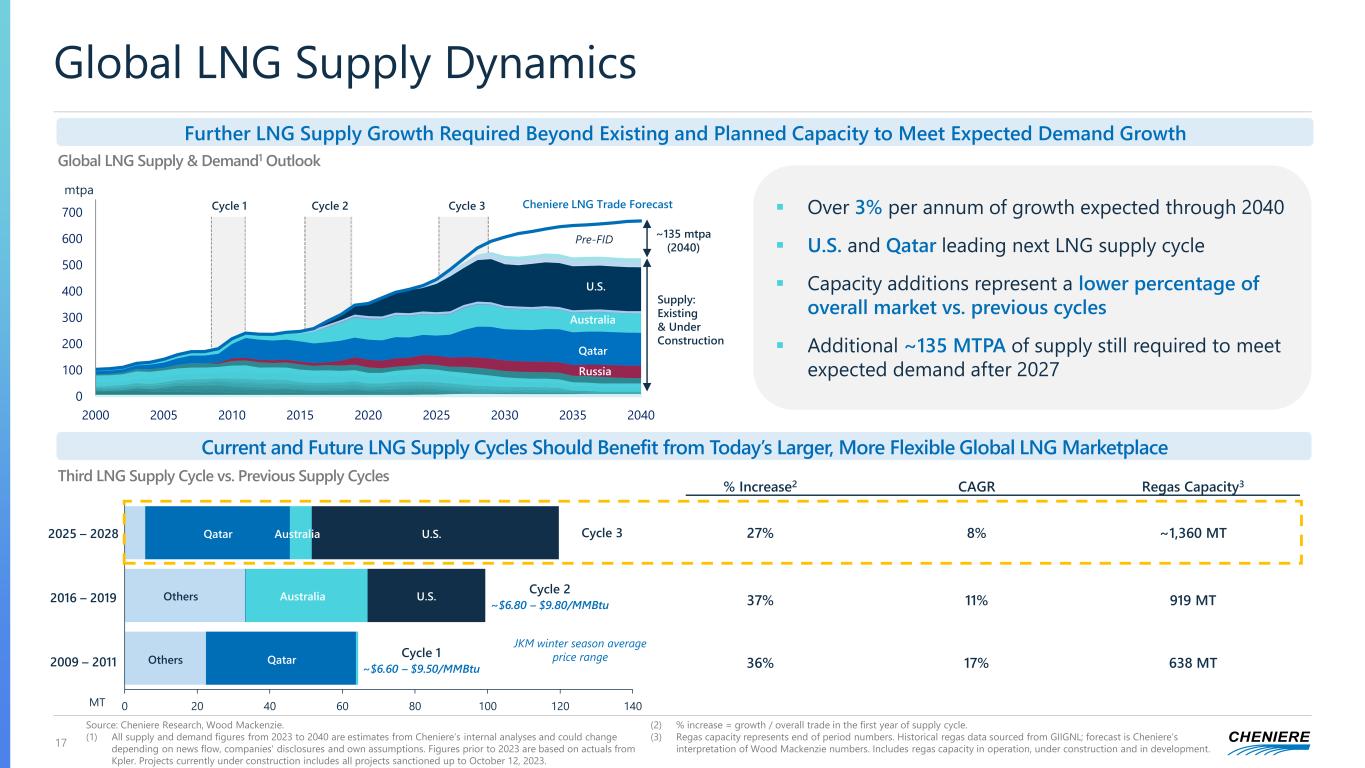

Cycle 2 Cycle 3 % Increase2 CAGR Regas Capacity3 27% 8% ~1,360 MT 37% 11% 919 MT 36% 17% 638 MT Global LNG Supply Dynamics 17 Further LNG Supply Growth Required Beyond Existing and Planned Capacity to Meet Expected Demand Growth Europe Global LNG Supply & Demand1 Outlook Current and Future LNG Supply Cycles Should Benefit from Today’s Larger, More Flexible Global LNG Marketplace Third LNG Supply Cycle vs. Previous Supply Cycles Source: Cheniere Research, Wood Mackenzie. (1) All supply and demand figures from 2023 to 2040 are estimates from Cheniere’s internal analyses and could change depending on news flow, companies' disclosures and own assumptions. Figures prior to 2023 are based on actuals from Kpler. Projects currently under construction includes all projects sanctioned up to October 12, 2023. (2) % increase = growth / overall trade in the first year of supply cycle. (3) Regas capacity represents end of period numbers. Historical regas data sourced from GIIGNL; forecast is Cheniere’s interpretation of Wood Mackenzie numbers. Includes regas capacity in operation, under construction and in development. 0 20 40 60 80 100 120 140 Qatar U.S./Aus. U.S./Qatar MT JKM winter season average price rangeCycle 1 ~$6.60 – $9.50/MMBtu Qatar Australia U.S. Others Others Qatar Australia U.S. Cycle 2 ~$6.80 – $9.80/MMBtu Cycle 32025 – 2028 2016 – 2019 2009 – 2011 ▪ Over 3% per annum of growth expected through 2040 ▪ U.S. and Qatar leading next LNG supply cycle ▪ Capacity additions represent a lower percentage of overall market vs. previous cycles ▪ Additional ~135 MTPA of supply still required to meet expected demand after 2027 Qatar Australia U.S. 0 100 200 300 400 500 600 700 2000 2005 2010 2015 2020 2025 2030 2035 2040 mtpa Russia Cycle 1 ~135 mtpa (2040) Cheniere LNG Trade Forecast Pre-FID Supply: Existing & Under Construction

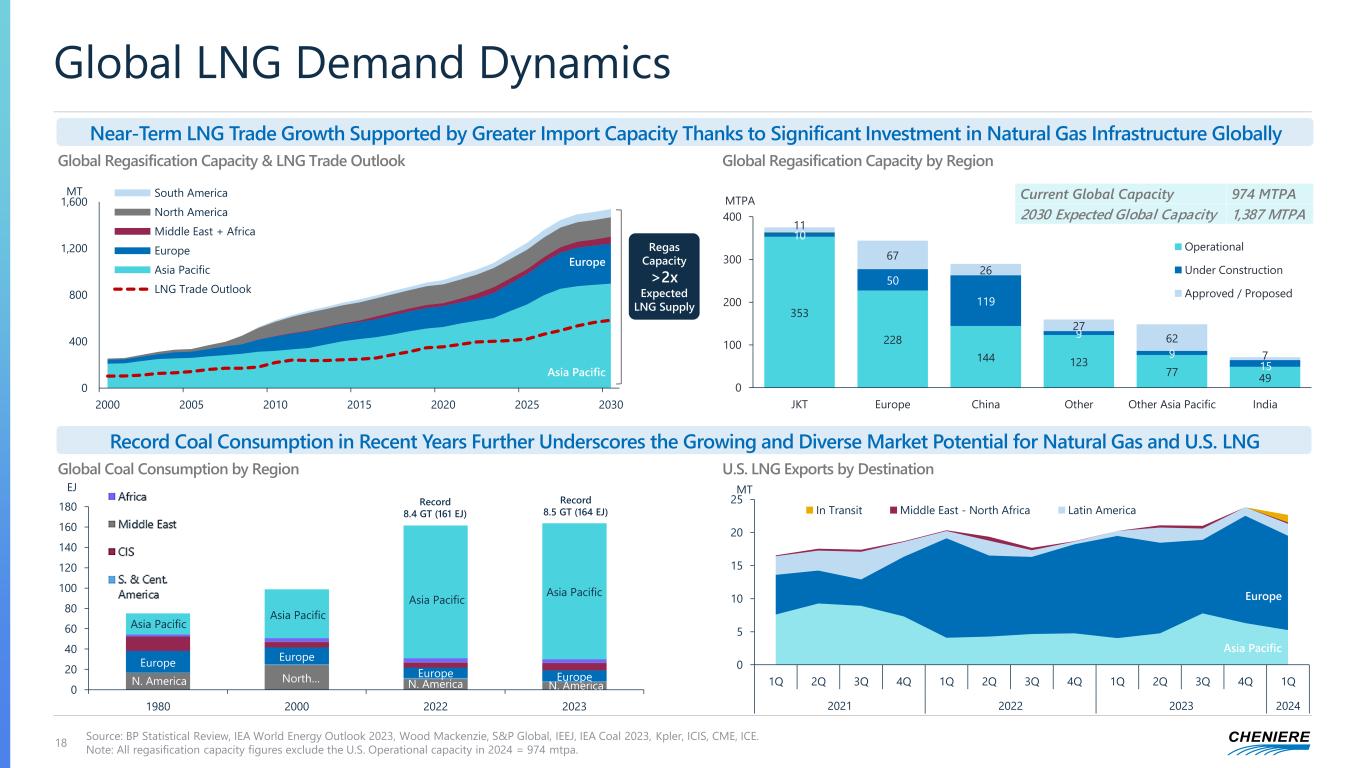

0 400 800 1,200 1,600 2000 2005 2010 2015 2020 2025 2030 MT South America North America Middle East + Africa Europe Asia Pacific LNG Trade Outlook Source: BP Statistical Review, IEA World Energy Outlook 2023, Wood Mackenzie, S&P Global, IEEJ, IEA Coal 2023, Kpler, ICIS, CME, ICE. Note: All regasification capacity figures exclude the U.S. Operational capacity in 2024 = 974 mtpa. Global LNG Demand Dynamics 18 Near-Term LNG Trade Growth Supported by Greater Import Capacity Thanks to Significant Investment in Natural Gas Infrastructure Globally N. America North … N. America N. America Europe Europe Europe Europe Asia Pacific Asia Pacific Asia Pacific Asia Pacific 0 20 40 60 80 100 120 140 160 180 1980 2000 2022 2023 EJ 353 228 144 123 77 49 10 50 119 9 9 15 11 67 26 27 62 7 0 100 200 300 400 JKT Europe China Other Other Asia Pacific India MTPA Operational Under Construction Approved / Proposed 0 5 10 15 20 25 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2021 2022 2023 2024 MT In Transit Middle East - North Africa Latin America Europe Asia Pacific Current Global Capacity 974 MTPA 2030 Expected Global Capacity 1,387 MTPA Europe Asia Pacific Global Regasification Capacity & LNG Trade Outlook Global Regasification Capacity by Region Record Coal Consumption in Recent Years Further Underscores the Growing and Diverse Market Potential for Natural Gas and U.S. LNG Global Coal Consumption by Region U.S. LNG Exports by Destination Record 8.4 GT (161 EJ) Record 8.5 GT (164 EJ) Regas Capacity >2x Expected LNG Supply

Regulation G Reconciliations This presentation contains non-GAAP financial measures. Consolidated Adjusted EBITDA, Distributable Cash Flow, Distributable Cash Flow per Share, and Distributable Cash Flow per Unit are non-GAAP financial measures that we use to facilitate comparisons of operating performance across periods. These non-GAAP measures should be viewed as a supplement to and not a substitute for our U.S. GAAP measures of performance and the financial results calculated in accordance with U.S. GAAP and reconciliations from these results should be carefully evaluated. Consolidated Adjusted EBITDA is commonly used as a supplemental financial measure by our management and external users of our consolidated financial statements to assess the financial performance of our assets without regard to financing methods, capital structures, or historical cost basis. Consolidated Adjusted EBITDA is not intended to represent cash flows from operations or net income as defined by U.S. GAAP and is not necessarily comparable to similarly titled measures reported by other companies. We believe Consolidated Adjusted EBITDA provides relevant and useful information to management, investors and other users of our financial information in evaluating the effectiveness of our operating performance in a manner that is consistent with management’s evaluation of financial and operating performance. Consolidated Adjusted EBITDA is calculated by taking net income attributable to Cheniere before net income attributable to non-controlling interest, interest expense, net of capitalized interest, taxes, depreciation and amortization, and adjusting for the effects of certain non-cash items, other non-operating income or expense items, and other items not otherwise predictive or indicative of ongoing operating performance, including the effects of modification or extinguishment of debt, impairment expense and loss on disposal of assets, changes in the fair value of our commodity and FX derivatives prior to contractual delivery or termination, and non-cash compensation expense. The change in fair value of commodity and FX derivatives is considered in determining Consolidated Adjusted EBITDA given that the timing of recognizing gains and losses on these derivative contracts differs from the recognition of the related item economically hedged. We believe the exclusion of these items enables investors and other users of our financial information to assess our sequential and year-over-year performance and operating trends on a more comparable basis and is consistent with management’s own evaluation of performance. Distributable Cash Flow is defined as cash generated from the operations of Cheniere and its subsidiaries and adjusted for non-controlling interest. The Distributable Cash Flow of Cheniere’s subsidiaries is calculated by taking the subsidiaries’ EBITDA less interest expense, net of capitalized interest, interest rate derivatives, taxes, maintenance capital expenditures and other non-operating income or expense items, and adjusting for the effect of certain non-cash items and other items not otherwise predictive or indicative of ongoing operating performance, including the effects of modification or extinguishment of debt, amortization of debt issue costs, premiums or discounts, changes in fair value of interest rate derivatives, impairment of equity method investment and deferred taxes. Cheniere’s Distributable Cash Flow includes 100% of the Distributable Cash Flow of Cheniere’s wholly-owned subsidiaries. For subsidiaries with non-controlling investors, our share of Distributable Cash Flow is calculated as the Distributable Cash Flow of the subsidiary reduced by the economic interest of the non-controlling investors as if 100% of the Distributable Cash Flow were distributed in order to reflect our ownership interests and our incentive distribution rights, if applicable. The Distributable Cash Flow attributable to non-controlling interest is calculated in the same method as Distributions to non-controlling interest as presented on Statements of Stockholders’ Equity. This amount may differ from the actual distributions paid to non-controlling investors by the subsidiary for a particular period. CQP Distributable Cash Flow is defined as CQP Adjusted EBITDA adjusted for taxes, maintenance capital expenditures, interest expense net of capitalized interest, interest income, and changes in the fair value and non-recurring settlement of interest rate derivatives. Distributable Cash Flow per Share and Distributable Cash Flow per Unit are calculated by dividing Distributable Cash Flow by the weighted average number of common shares or units outstanding. We believe Distributable Cash Flow is a useful performance measure for management, investors and other users of our financial information to evaluate our performance and to measure and estimate the ability of our assets to generate cash earnings after servicing our debt, paying cash taxes and expending sustaining capital, that could be considered for deployment by our Board of Directors pursuant to our capital allocation plan, such as by way of common stock dividends, stock repurchases, retirement of debt, or expansion capital expenditures.1 Distributable Cash Flow is not intended to represent cash flows from operations or net income as defined by U.S. GAAP and is not necessarily comparable to similarly titled measures reported by other companies. Non-GAAP measures have limitations as an analytical tool and should not be considered in isolation or in lieu of an analysis of our results as reported under GAAP and should be evaluated only on a supplementary basis. Note: We have not made any forecast of net income on a run rate basis, which would be the most directly comparable financial measure under GAAP, in part because net income includes the impact of derivative transactions, which cannot be determined at this time, and we are unable to reconcile differences between run rate Consolidated Adjusted EBITDA and Distributable Cash Flow and income. 1 Capital spending for our business consists primarily of: • Maintenance capital expenditures. These expenditures include costs which qualify for capitalization that are required to sustain property, plant and equipment reliability and safety and to address environmental or other regulatory requirements rather than to generate incremental distributable cash flow; and • Expansion capital expenditures. These expenditures are undertaken primarily to generate incremental distributable cash flow and include investment in accretive organic growth, acquisition or construction of additional complementary assets to grow our business, along with expenditures to enhance the productivity and efficiency of our existing facilities. Reconciliation to Non-GAAP Measures 19

© 2024 Cheniere Energy, Inc. All Rights Reserved Investor Relations Contacts Randy Bhatia Vice President, Investor Relations – (713) 375-5479, randy.bhatia@cheniere.com Frances Smith Director, Investor Relations – (713) 375-5753, frances.smith@cheniere.com