0000003570false--12-312022FY1LIBOR or base rateLIBOR or base rateSOFR or base rateSOFR or base rateLIBOR or base rateP1YP2YP3YP4Y00000035702022-01-012022-12-3100000035702022-06-30iso4217:USD00000035702023-02-17xbrli:shares0000003570lng:LiquefiedNaturalGasMember2022-01-012022-12-310000003570lng:LiquefiedNaturalGasMember2021-01-012021-12-310000003570lng:LiquefiedNaturalGasMember2020-01-012020-12-310000003570lng:RegasificationServiceMember2022-01-012022-12-310000003570lng:RegasificationServiceMember2021-01-012021-12-310000003570lng:RegasificationServiceMember2020-01-012020-12-310000003570us-gaap:ProductAndServiceOtherMember2022-01-012022-12-310000003570us-gaap:ProductAndServiceOtherMember2021-01-012021-12-310000003570us-gaap:ProductAndServiceOtherMember2020-01-012020-12-3100000035702021-01-012021-12-3100000035702020-01-012020-12-31iso4217:USDxbrli:shares00000035702022-12-3100000035702021-12-310000003570us-gaap:TreasuryStockMember2022-12-310000003570us-gaap:TreasuryStockMember2021-12-310000003570lng:CheniereEnergyPartnersLPMember2022-12-310000003570us-gaap:CommonStockMember2019-12-310000003570us-gaap:TreasuryStockMember2019-12-310000003570us-gaap:AdditionalPaidInCapitalMember2019-12-310000003570us-gaap:RetainedEarningsMember2019-12-310000003570us-gaap:NoncontrollingInterestMember2019-12-3100000035702019-12-310000003570us-gaap:CommonStockMember2020-01-012020-12-310000003570us-gaap:TreasuryStockMember2020-01-012020-12-310000003570us-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-310000003570us-gaap:RetainedEarningsMember2020-01-012020-12-310000003570us-gaap:NoncontrollingInterestMember2020-01-012020-12-310000003570us-gaap:CommonStockMember2020-12-310000003570us-gaap:TreasuryStockMember2020-12-310000003570us-gaap:AdditionalPaidInCapitalMember2020-12-310000003570us-gaap:RetainedEarningsMember2020-12-310000003570us-gaap:NoncontrollingInterestMember2020-12-3100000035702020-12-310000003570us-gaap:CommonStockMember2021-01-012021-12-310000003570us-gaap:TreasuryStockMember2021-01-012021-12-310000003570us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310000003570us-gaap:RetainedEarningsMember2021-01-012021-12-310000003570us-gaap:NoncontrollingInterestMember2021-01-012021-12-310000003570us-gaap:CommonStockMember2021-12-310000003570us-gaap:AdditionalPaidInCapitalMember2021-12-310000003570us-gaap:RetainedEarningsMember2021-12-310000003570us-gaap:NoncontrollingInterestMember2021-12-310000003570us-gaap:CommonStockMember2022-01-012022-12-310000003570us-gaap:TreasuryStockMember2022-01-012022-12-310000003570us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310000003570us-gaap:RetainedEarningsMember2022-01-012022-12-310000003570us-gaap:NoncontrollingInterestMember2022-01-012022-12-310000003570us-gaap:CommonStockMember2022-12-310000003570us-gaap:AdditionalPaidInCapitalMember2022-12-310000003570us-gaap:RetainedEarningsMember2022-12-310000003570us-gaap:NoncontrollingInterestMember2022-12-31lng:unit0000003570lng:SabinePassLNGTerminalMember2022-01-012022-12-31lng:trainslng:milliontonnesutr:Ylng:item0000003570lng:CreoleTrailPipelineMember2022-01-012022-12-31utr:mi0000003570lng:CheniereEnergyPartnersLPMember2022-01-012022-12-31xbrli:pure0000003570lng:CorpusChristiLNGTerminalMember2022-01-012022-12-310000003570lng:CorpusChristiStage3ProjectMembersrt:MaximumMember2022-01-012022-12-310000003570lng:CorpusChristiStage3ProjectMembersrt:MinimumMember2022-01-012022-12-310000003570lng:CorpusChristiPipelineMember2022-01-012022-12-310000003570lng:CorpusChristiLNGTerminalExpansionMember2022-01-012022-12-310000003570us-gaap:CustomerConcentrationRiskMemberlng:SPACustomersMember2022-01-012022-12-31lng:customer0000003570lng:SPACustomersMember2022-01-012022-12-310000003570lng:SabinePassLNGTerminalMember2022-12-310000003570lng:SabinePassLNGTerminalMembersrt:MaximumMember2022-12-310000003570lng:CreoleTrailPipelineMember2022-12-310000003570lng:CorpusChristiPipelineMember2022-12-310000003570lng:CheniereMarketingLLCMember2022-01-012022-12-310000003570lng:CheniereMarketingLLCMember2021-01-012021-12-310000003570lng:CheniereMarketingLLCMember2020-01-012020-12-310000003570lng:A2045ConvertibleSeniorNotesMember2022-12-310000003570srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberlng:A2045ConvertibleSeniorNotesMemberus-gaap:AccountingStandardsUpdate202006Member2022-01-010000003570srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:AdditionalPaidInCapitalMemberlng:A2045ConvertibleSeniorNotesMemberus-gaap:AccountingStandardsUpdate202006Member2022-01-012022-01-010000003570srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:AdditionalPaidInCapitalMemberlng:A2045ConvertibleSeniorNotesMemberus-gaap:AccountingStandardsUpdate202006Member2022-01-010000003570srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberlng:A2045ConvertibleSeniorNotesMemberus-gaap:RetainedEarningsMemberus-gaap:AccountingStandardsUpdate202006Member2022-01-012022-01-010000003570lng:A2045ConvertibleSeniorNotesMember2022-01-052022-01-050000003570lng:SPLProjectMember2022-12-310000003570lng:SPLProjectMember2021-12-310000003570lng:CCLProjectMember2022-12-310000003570lng:CCLProjectMember2021-12-310000003570lng:SubsidiaryCashMember2022-12-310000003570lng:SubsidiaryCashMember2021-12-310000003570lng:SabinePassLiquefactionAndCorpusChristiLiquefactionMember2022-12-310000003570lng:SabinePassLiquefactionAndCorpusChristiLiquefactionMember2021-12-310000003570lng:CheniereMarketingLLCMember2022-12-310000003570lng:CheniereMarketingLLCMember2021-12-310000003570lng:LiquefiedNaturalGasInTransitInventoryMember2022-12-310000003570lng:LiquefiedNaturalGasInTransitInventoryMember2021-12-310000003570lng:LiquefiedNaturalGasInventoryMember2022-12-310000003570lng:LiquefiedNaturalGasInventoryMember2021-12-310000003570lng:MaterialsInventoryMember2022-12-310000003570lng:MaterialsInventoryMember2021-12-310000003570lng:NaturalGasInventoryMember2022-12-310000003570lng:NaturalGasInventoryMember2021-12-310000003570lng:OtherInventoryMember2022-12-310000003570lng:OtherInventoryMember2021-12-310000003570lng:LngTerminalMember2022-12-310000003570lng:LngTerminalMember2021-12-310000003570lng:LngSiteAndRelatedCostsNetMember2022-12-310000003570lng:LngSiteAndRelatedCostsNetMember2021-12-310000003570us-gaap:ConstructionInProgressMember2022-12-310000003570us-gaap:ConstructionInProgressMember2021-12-310000003570lng:LngTerminalCostsMember2022-12-310000003570lng:LngTerminalCostsMember2021-12-310000003570us-gaap:OfficeEquipmentMember2022-12-310000003570us-gaap:OfficeEquipmentMember2021-12-310000003570us-gaap:FurnitureAndFixturesMember2022-12-310000003570us-gaap:FurnitureAndFixturesMember2021-12-310000003570us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2022-12-310000003570us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2021-12-310000003570us-gaap:LeaseholdImprovementsMember2022-12-310000003570us-gaap:LeaseholdImprovementsMember2021-12-310000003570us-gaap:LandMember2022-12-310000003570us-gaap:LandMember2021-12-310000003570us-gaap:OtherCapitalizedPropertyPlantAndEquipmentMember2022-12-310000003570us-gaap:OtherCapitalizedPropertyPlantAndEquipmentMember2021-12-310000003570lng:FixedAssetsMember2022-12-310000003570lng:FixedAssetsMember2021-12-310000003570us-gaap:AssetsHeldUnderCapitalLeasesMember2022-12-310000003570us-gaap:AssetsHeldUnderCapitalLeasesMember2021-12-310000003570srt:MinimumMember2022-01-012022-12-310000003570srt:MaximumMember2022-01-012022-12-310000003570lng:LNGStorageTanksMember2022-01-012022-12-310000003570us-gaap:PipelinesMember2022-01-012022-12-310000003570lng:MarineBerthElectricalFacilityAndRoadsMember2022-01-012022-12-310000003570lng:WaterPipelinesMember2022-01-012022-12-310000003570lng:RegasificationProcessingEquipmentRecondensersVaporizationAndVentsMember2022-01-012022-12-310000003570lng:SendoutPumpsMember2022-01-012022-12-310000003570lng:LiquefactionProcessingEquipmentMembersrt:MinimumMember2022-01-012022-12-310000003570lng:LiquefactionProcessingEquipmentMembersrt:MaximumMember2022-01-012022-12-310000003570us-gaap:OtherEnergyEquipmentMembersrt:MinimumMember2022-01-012022-12-310000003570srt:MaximumMemberus-gaap:OtherEnergyEquipmentMember2022-01-012022-12-310000003570us-gaap:FairValueInputsLevel1Memberlng:CCHInterestRateDerivativesMember2022-12-310000003570us-gaap:FairValueInputsLevel2Memberlng:CCHInterestRateDerivativesMember2022-12-310000003570us-gaap:FairValueInputsLevel3Memberlng:CCHInterestRateDerivativesMember2022-12-310000003570lng:CCHInterestRateDerivativesMember2022-12-310000003570us-gaap:FairValueInputsLevel1Memberlng:CCHInterestRateDerivativesMember2021-12-310000003570us-gaap:FairValueInputsLevel2Memberlng:CCHInterestRateDerivativesMember2021-12-310000003570us-gaap:FairValueInputsLevel3Memberlng:CCHInterestRateDerivativesMember2021-12-310000003570lng:CCHInterestRateDerivativesMember2021-12-310000003570us-gaap:PriceRiskDerivativeMemberus-gaap:FairValueInputsLevel1Member2022-12-310000003570us-gaap:FairValueInputsLevel2Memberus-gaap:PriceRiskDerivativeMember2022-12-310000003570us-gaap:PriceRiskDerivativeMemberus-gaap:FairValueInputsLevel3Member2022-12-310000003570us-gaap:PriceRiskDerivativeMember2022-12-310000003570us-gaap:PriceRiskDerivativeMemberus-gaap:FairValueInputsLevel1Member2021-12-310000003570us-gaap:FairValueInputsLevel2Memberus-gaap:PriceRiskDerivativeMember2021-12-310000003570us-gaap:PriceRiskDerivativeMemberus-gaap:FairValueInputsLevel3Member2021-12-310000003570us-gaap:PriceRiskDerivativeMember2021-12-310000003570us-gaap:FairValueInputsLevel1Memberlng:LNGTradingDerivativeMember2022-12-310000003570us-gaap:FairValueInputsLevel2Memberlng:LNGTradingDerivativeMember2022-12-310000003570us-gaap:FairValueInputsLevel3Memberlng:LNGTradingDerivativeMember2022-12-310000003570lng:LNGTradingDerivativeMember2022-12-310000003570us-gaap:FairValueInputsLevel1Memberlng:LNGTradingDerivativeMember2021-12-310000003570us-gaap:FairValueInputsLevel2Memberlng:LNGTradingDerivativeMember2021-12-310000003570us-gaap:FairValueInputsLevel3Memberlng:LNGTradingDerivativeMember2021-12-310000003570lng:LNGTradingDerivativeMember2021-12-310000003570us-gaap:FairValueInputsLevel1Memberus-gaap:ForeignExchangeContractMember2022-12-310000003570us-gaap:FairValueInputsLevel2Memberus-gaap:ForeignExchangeContractMember2022-12-310000003570us-gaap:FairValueInputsLevel3Memberus-gaap:ForeignExchangeContractMember2022-12-310000003570us-gaap:ForeignExchangeContractMember2022-12-310000003570us-gaap:FairValueInputsLevel1Memberus-gaap:ForeignExchangeContractMember2021-12-310000003570us-gaap:FairValueInputsLevel2Memberus-gaap:ForeignExchangeContractMember2021-12-310000003570us-gaap:FairValueInputsLevel3Memberus-gaap:ForeignExchangeContractMember2021-12-310000003570us-gaap:ForeignExchangeContractMember2021-12-310000003570us-gaap:FairValueInputsLevel3Memberlng:PhysicalLiquefactionSupplyDerivativesMember2022-12-310000003570srt:MinimumMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MarketApproachValuationTechniqueMemberlng:PhysicalLiquefactionSupplyDerivativesMember2022-01-012022-12-310000003570srt:MaximumMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MarketApproachValuationTechniqueMemberlng:PhysicalLiquefactionSupplyDerivativesMember2022-01-012022-12-310000003570srt:WeightedAverageMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MarketApproachValuationTechniqueMemberlng:PhysicalLiquefactionSupplyDerivativesMember2022-01-012022-12-310000003570us-gaap:ValuationTechniqueOptionPricingModelMembersrt:MinimumMemberus-gaap:FairValueInputsLevel3Memberlng:PhysicalLiquefactionSupplyDerivativesMember2022-01-012022-12-310000003570us-gaap:ValuationTechniqueOptionPricingModelMembersrt:MaximumMemberus-gaap:FairValueInputsLevel3Memberlng:PhysicalLiquefactionSupplyDerivativesMember2022-01-012022-12-310000003570us-gaap:ValuationTechniqueOptionPricingModelMembersrt:WeightedAverageMemberus-gaap:FairValueInputsLevel3Memberlng:PhysicalLiquefactionSupplyDerivativesMember2022-01-012022-12-310000003570lng:PhysicalLiquefactionSupplyDerivativesAndPhysicalLNGTradingDerivativeMember2021-12-310000003570lng:PhysicalLiquefactionSupplyDerivativesAndPhysicalLNGTradingDerivativeMember2020-12-310000003570lng:PhysicalLiquefactionSupplyDerivativesAndPhysicalLNGTradingDerivativeMember2019-12-310000003570lng:PhysicalLiquefactionSupplyDerivativesAndPhysicalLNGTradingDerivativeMember2022-01-012022-12-310000003570lng:PhysicalLiquefactionSupplyDerivativesAndPhysicalLNGTradingDerivativeMember2021-01-012021-12-310000003570lng:PhysicalLiquefactionSupplyDerivativesAndPhysicalLNGTradingDerivativeMember2020-01-012020-12-310000003570lng:PhysicalLiquefactionSupplyDerivativesAndPhysicalLNGTradingDerivativeMember2022-12-310000003570us-gaap:InterestRateContractMember2022-01-012022-12-310000003570us-gaap:GainLossOnDerivativeInstrumentsMemberlng:CCHInterestRateDerivativesMember2022-01-012022-12-310000003570us-gaap:GainLossOnDerivativeInstrumentsMemberlng:CCHInterestRateDerivativesMember2021-01-012021-12-310000003570us-gaap:GainLossOnDerivativeInstrumentsMemberlng:CCHInterestRateDerivativesMember2020-01-012020-12-310000003570us-gaap:GainLossOnDerivativeInstrumentsMemberlng:CCHInterestRateForwardStartDerivativesMember2022-01-012022-12-310000003570us-gaap:GainLossOnDerivativeInstrumentsMemberlng:CCHInterestRateForwardStartDerivativesMember2021-01-012021-12-310000003570us-gaap:GainLossOnDerivativeInstrumentsMemberlng:CCHInterestRateForwardStartDerivativesMember2020-01-012020-12-310000003570srt:MaximumMemberlng:PhysicalLiquefactionSupplyDerivativesMember2022-01-012022-12-310000003570srt:MaximumMemberlng:LNGTradingDerivativeMember2022-01-012022-12-310000003570us-gaap:CommodityContractMember2022-01-012022-12-31lng:tbtu0000003570us-gaap:SalesMemberlng:LNGTradingDerivativeMember2022-01-012022-12-310000003570us-gaap:SalesMemberlng:LNGTradingDerivativeMember2021-01-012021-12-310000003570us-gaap:SalesMemberlng:LNGTradingDerivativeMember2020-01-012020-12-310000003570us-gaap:CostOfSalesMemberlng:LNGTradingDerivativeMember2022-01-012022-12-310000003570us-gaap:CostOfSalesMemberlng:LNGTradingDerivativeMember2021-01-012021-12-310000003570us-gaap:CostOfSalesMemberlng:LNGTradingDerivativeMember2020-01-012020-12-310000003570us-gaap:PriceRiskDerivativeMemberus-gaap:SalesMember2022-01-012022-12-310000003570us-gaap:PriceRiskDerivativeMemberus-gaap:SalesMember2021-01-012021-12-310000003570us-gaap:PriceRiskDerivativeMemberus-gaap:SalesMember2020-01-012020-12-310000003570us-gaap:CostOfSalesMemberus-gaap:PriceRiskDerivativeMember2022-01-012022-12-310000003570us-gaap:CostOfSalesMemberus-gaap:PriceRiskDerivativeMember2021-01-012021-12-310000003570us-gaap:CostOfSalesMemberus-gaap:PriceRiskDerivativeMember2020-01-012020-12-310000003570srt:MaximumMemberus-gaap:ForeignExchangeContractMember2022-01-012022-12-310000003570us-gaap:ForeignExchangeContractMember2022-01-012022-12-310000003570us-gaap:SalesMemberus-gaap:ForeignExchangeContractMember2022-01-012022-12-310000003570us-gaap:SalesMemberus-gaap:ForeignExchangeContractMember2021-01-012021-12-310000003570us-gaap:SalesMemberus-gaap:ForeignExchangeContractMember2020-01-012020-12-310000003570us-gaap:DerivativeFinancialInstrumentsAssetsMemberlng:CCHInterestRateDerivativesMember2022-12-310000003570us-gaap:PriceRiskDerivativeMemberus-gaap:DerivativeFinancialInstrumentsAssetsMember2022-12-310000003570us-gaap:DerivativeFinancialInstrumentsAssetsMemberlng:LNGTradingDerivativeMember2022-12-310000003570us-gaap:DerivativeFinancialInstrumentsAssetsMemberus-gaap:ForeignExchangeContractMember2022-12-310000003570us-gaap:DerivativeFinancialInstrumentsAssetsMember2022-12-310000003570lng:NoncurrentDerivativeAssetsMemberlng:CCHInterestRateDerivativesMember2022-12-310000003570us-gaap:PriceRiskDerivativeMemberlng:NoncurrentDerivativeAssetsMember2022-12-310000003570lng:NoncurrentDerivativeAssetsMemberlng:LNGTradingDerivativeMember2022-12-310000003570lng:NoncurrentDerivativeAssetsMemberus-gaap:ForeignExchangeContractMember2022-12-310000003570lng:NoncurrentDerivativeAssetsMember2022-12-310000003570us-gaap:DerivativeFinancialInstrumentsLiabilitiesMemberlng:CCHInterestRateDerivativesMember2022-12-310000003570us-gaap:DerivativeFinancialInstrumentsLiabilitiesMemberus-gaap:PriceRiskDerivativeMember2022-12-310000003570us-gaap:DerivativeFinancialInstrumentsLiabilitiesMemberlng:LNGTradingDerivativeMember2022-12-310000003570us-gaap:DerivativeFinancialInstrumentsLiabilitiesMemberus-gaap:ForeignExchangeContractMember2022-12-310000003570us-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2022-12-310000003570lng:NoncurrentDerivativeLiabilitiesMemberlng:CCHInterestRateDerivativesMember2022-12-310000003570us-gaap:PriceRiskDerivativeMemberlng:NoncurrentDerivativeLiabilitiesMember2022-12-310000003570lng:NoncurrentDerivativeLiabilitiesMemberlng:LNGTradingDerivativeMember2022-12-310000003570lng:NoncurrentDerivativeLiabilitiesMemberus-gaap:ForeignExchangeContractMember2022-12-310000003570lng:NoncurrentDerivativeLiabilitiesMember2022-12-310000003570us-gaap:DerivativeFinancialInstrumentsAssetsMemberlng:CCHInterestRateDerivativesMember2021-12-310000003570us-gaap:PriceRiskDerivativeMemberus-gaap:DerivativeFinancialInstrumentsAssetsMember2021-12-310000003570us-gaap:DerivativeFinancialInstrumentsAssetsMemberlng:LNGTradingDerivativeMember2021-12-310000003570us-gaap:DerivativeFinancialInstrumentsAssetsMemberus-gaap:ForeignExchangeContractMember2021-12-310000003570us-gaap:DerivativeFinancialInstrumentsAssetsMember2021-12-310000003570lng:NoncurrentDerivativeAssetsMemberlng:CCHInterestRateDerivativesMember2021-12-310000003570us-gaap:PriceRiskDerivativeMemberlng:NoncurrentDerivativeAssetsMember2021-12-310000003570lng:NoncurrentDerivativeAssetsMemberlng:LNGTradingDerivativeMember2021-12-310000003570lng:NoncurrentDerivativeAssetsMemberus-gaap:ForeignExchangeContractMember2021-12-310000003570lng:NoncurrentDerivativeAssetsMember2021-12-310000003570us-gaap:DerivativeFinancialInstrumentsLiabilitiesMemberlng:CCHInterestRateDerivativesMember2021-12-310000003570us-gaap:DerivativeFinancialInstrumentsLiabilitiesMemberus-gaap:PriceRiskDerivativeMember2021-12-310000003570us-gaap:DerivativeFinancialInstrumentsLiabilitiesMemberlng:LNGTradingDerivativeMember2021-12-310000003570us-gaap:DerivativeFinancialInstrumentsLiabilitiesMemberus-gaap:ForeignExchangeContractMember2021-12-310000003570us-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2021-12-310000003570lng:NoncurrentDerivativeLiabilitiesMemberlng:CCHInterestRateDerivativesMember2021-12-310000003570us-gaap:PriceRiskDerivativeMemberlng:NoncurrentDerivativeLiabilitiesMember2021-12-310000003570lng:NoncurrentDerivativeLiabilitiesMemberlng:LNGTradingDerivativeMember2021-12-310000003570lng:NoncurrentDerivativeLiabilitiesMemberus-gaap:ForeignExchangeContractMember2021-12-310000003570lng:NoncurrentDerivativeLiabilitiesMember2021-12-310000003570lng:PriceRiskDerivativeAssetMember2022-12-310000003570lng:LNGTradingDerivativeAssetMember2022-12-310000003570lng:ForeignExchangeContractAssetMember2022-12-310000003570lng:PriceRiskDerivativeLiabilityMember2022-12-310000003570lng:LNGTradingDerivativesLiabilityMember2022-12-310000003570lng:ForeignExchangeContractLiabilityMember2022-12-310000003570lng:PriceRiskDerivativeAssetMember2021-12-310000003570lng:LNGTradingDerivativeAssetMember2021-12-310000003570lng:ForeignExchangeContractAssetMember2021-12-310000003570lng:PriceRiskDerivativeLiabilityMember2021-12-310000003570lng:LNGTradingDerivativesLiabilityMember2021-12-310000003570lng:ForeignExchangeContractLiabilityMember2021-12-310000003570lng:MidshipPipelineMember2022-01-012022-12-310000003570lng:MidshipHoldingsLLCMember2022-01-012022-12-310000003570lng:MidshipHoldingsLLCMember2021-01-012021-12-310000003570lng:MidshipHoldingsLLCMember2020-01-012020-12-310000003570lng:MidshipHoldingsLLCMember2022-12-310000003570lng:MidshipHoldingsLLCMember2021-12-310000003570lng:ADCCPipelineLLCMember2022-12-310000003570lng:ADCCPipelineMember2022-01-012022-12-310000003570lng:ADCCPipelineLLCMembersrt:MaximumMember2022-01-012022-12-310000003570lng:CheniereEnergyPartnersLPMemberlng:CommonUnitsMember2022-12-310000003570lng:CheniereEnergyPartnersLPMemberlng:ClassBUnitsMemberlng:BlackstoneCqpHoldcoLpMember2013-01-012013-12-310000003570lng:BlackstoneCqpHoldcoLpMemberlng:CheniereEnergyPartnersGPLLCMember2022-01-012022-12-310000003570lng:CheniereEnergyIncMemberlng:CheniereEnergyPartnersGPLLCMember2022-01-012022-12-310000003570lng:CheniereEnergyPartnersGPLLCMemberlng:BlackstoneCQPHoldcoLPAndCheniereEnergyIncMember2022-01-012022-12-310000003570lng:BlackstoneCqpHoldcoLpMember2022-01-012022-12-310000003570lng:DirectorAppointmentEntitlementMinimumMemberlng:CheniereEnergyPartnersLPMemberlng:BlackstoneCqpHoldcoLpMember2022-01-012022-12-310000003570lng:CheniereEnergyPartnersLPMember2022-01-012022-12-310000003570lng:CheniereEnergyPartnersLPMember2021-12-310000003570lng:A2023SabinePassLiquefactionSeniorNotesMember2022-12-310000003570lng:A2023SabinePassLiquefactionSeniorNotesMember2021-12-310000003570lng:A2024SabinePassLiquefactionSeniorNotesMember2022-12-310000003570lng:A2024SabinePassLiquefactionSeniorNotesMember2021-12-310000003570lng:A2025SabinePassLiquefactionSeniorNotesMember2022-12-310000003570lng:A2025SabinePassLiquefactionSeniorNotesMember2021-12-310000003570lng:A2026SabinePassLiquefactionSeniorNotesMember2022-12-310000003570lng:A2026SabinePassLiquefactionSeniorNotesMember2021-12-310000003570lng:A2027SabinePassLiquefactionSeniorNotesMember2022-12-310000003570lng:A2027SabinePassLiquefactionSeniorNotesMember2021-12-310000003570lng:A2028SabinePassLiquefactionSeniorNotesMember2022-12-310000003570lng:A2028SabinePassLiquefactionSeniorNotesMember2021-12-310000003570lng:A2030SabinePassLiquefactionSeniorNotesMember2022-12-310000003570lng:A2030SabinePassLiquefactionSeniorNotesMember2021-12-310000003570lng:A2037SabinePassLiquefactionNotesMembersrt:WeightedAverageMember2022-12-310000003570lng:A2037SabinePassLiquefactionNotesMember2022-12-310000003570lng:A2037SabinePassLiquefactionNotesMember2021-12-310000003570lng:SabinePassLiquefactionSeniorNotesMember2022-12-310000003570lng:SabinePassLiquefactionSeniorNotesMember2021-12-310000003570lng:A2020SPLWorkingCapitalFacilityMember2022-12-310000003570lng:A2020SPLWorkingCapitalFacilityMember2021-12-310000003570lng:SabinePassLiquefactionMember2022-12-310000003570lng:SabinePassLiquefactionMember2021-12-310000003570lng:A2029CheniereEnergyPartnersSeniorNotesMember2022-12-310000003570lng:A2029CheniereEnergyPartnersSeniorNotesMember2021-12-310000003570lng:A2031CheniereEnergyPartnersSeniorNotesMember2022-12-310000003570lng:A2031CheniereEnergyPartnersSeniorNotesMember2021-12-310000003570lng:A2032CheniereEnergyPartnersSeniorNotesMember2022-12-310000003570lng:A2032CheniereEnergyPartnersSeniorNotesMember2021-12-310000003570lng:CheniereEnergyPartnersSeniorNotesMember2022-12-310000003570lng:CheniereEnergyPartnersSeniorNotesMember2021-12-310000003570lng:A2019CQPCreditFacilitiesMember2022-12-310000003570lng:A2019CQPCreditFacilitiesMember2021-12-310000003570lng:A2024CorpusChristiHoldingsSeniorNotesMember2022-12-310000003570lng:A2024CorpusChristiHoldingsSeniorNotesMember2021-12-310000003570lng:A2025CorpusChristiHoldingsSeniorNotesMember2022-12-310000003570lng:A2025CorpusChristiHoldingsSeniorNotesMember2021-12-310000003570lng:A2027CorpusChristiHoldingsSeniorNotesMember2022-12-310000003570lng:A2027CorpusChristiHoldingsSeniorNotesMember2021-12-310000003570lng:A2029CorpusChristiHoldingsSeniorNotesMember2022-12-310000003570lng:A2029CorpusChristiHoldingsSeniorNotesMember2021-12-310000003570srt:WeightedAverageMemberlng:A2039CorpusChristiHoldingsSeniorNotesMember2022-12-310000003570lng:A2039CorpusChristiHoldingsSeniorNotesMember2022-12-310000003570lng:A2039CorpusChristiHoldingsSeniorNotesMember2021-12-310000003570lng:CorpusChristiHoldingsSeniorNotesMember2022-12-310000003570lng:CorpusChristiHoldingsSeniorNotesMember2021-12-310000003570lng:A2015CCHTermLoanFacilityMember2022-12-310000003570lng:A2015CCHTermLoanFacilityMember2021-12-310000003570lng:CorpusChristiHoldingsWorkingCapitalFacilityMember2022-12-310000003570lng:CorpusChristiHoldingsWorkingCapitalFacilityMember2021-12-310000003570lng:CheniereCorpusChristiHoldingsLLCMember2022-12-310000003570lng:CheniereCorpusChristiHoldingsLLCMember2021-12-310000003570lng:A2028CheniereSeniorSecuredNotesMember2022-12-310000003570srt:ParentCompanyMemberlng:A2028CheniereSeniorSecuredNotesMember2022-12-310000003570lng:A2028CheniereSeniorSecuredNotesMember2021-12-310000003570srt:ParentCompanyMemberlng:A2045ConvertibleSeniorNotesMember2022-12-310000003570lng:A2045ConvertibleSeniorNotesMember2021-12-310000003570srt:ParentCompanyMemberlng:CheniereRevolvingCreditFacilityMember2022-12-310000003570lng:CheniereRevolvingCreditFacilityMember2021-12-310000003570srt:ParentCompanyMember2022-12-310000003570srt:ParentCompanyMember2021-12-310000003570lng:CheniereMarketingTradeFinanceFacilitiesMember2022-12-310000003570lng:CheniereMarketingTradeFinanceFacilitiesMember2021-12-310000003570us-gaap:SubsequentEventMemberlng:CCHSeniorNotesDue20272029And2039Member2023-01-012023-02-160000003570us-gaap:SubsequentEventMemberlng:CCHSeniorNotesDue20272029And2039Member2023-02-170000003570lng:CheniereRevolvingCreditFacilityMember2022-12-310000003570us-gaap:LondonInterbankOfferedRateLIBORMemberlng:A2020SPLWorkingCapitalFacilityMembersrt:MinimumMember2022-01-012022-12-31utr:Rate0000003570us-gaap:LondonInterbankOfferedRateLIBORMemberlng:A2020SPLWorkingCapitalFacilityMembersrt:MaximumMember2022-01-012022-12-310000003570lng:A2020SPLWorkingCapitalFacilityMemberus-gaap:BaseRateMembersrt:MinimumMember2022-01-012022-12-310000003570lng:A2020SPLWorkingCapitalFacilityMembersrt:MaximumMemberus-gaap:BaseRateMember2022-01-012022-12-310000003570us-gaap:LondonInterbankOfferedRateLIBORMemberlng:A2019CQPCreditFacilitiesMembersrt:MinimumMember2022-01-012022-12-310000003570us-gaap:LondonInterbankOfferedRateLIBORMembersrt:MaximumMemberlng:A2019CQPCreditFacilitiesMember2022-01-012022-12-310000003570lng:A2019CQPCreditFacilitiesMemberus-gaap:BaseRateMembersrt:MinimumMember2022-01-012022-12-310000003570srt:MaximumMemberlng:A2019CQPCreditFacilitiesMemberus-gaap:BaseRateMember2022-01-012022-12-310000003570lng:A2015CCHTermLoanFacilityMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2022-01-012022-12-310000003570us-gaap:BaseRateMemberlng:A2015CCHTermLoanFacilityMember2022-01-012022-12-310000003570us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberlng:CorpusChristiHoldingsWorkingCapitalFacilityMember2022-01-012022-12-310000003570srt:MinimumMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberlng:CorpusChristiHoldingsWorkingCapitalFacilityMember2022-01-012022-12-310000003570srt:MaximumMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberlng:CorpusChristiHoldingsWorkingCapitalFacilityMember2022-01-012022-12-310000003570us-gaap:BaseRateMembersrt:MinimumMemberlng:CorpusChristiHoldingsWorkingCapitalFacilityMember2022-01-012022-12-310000003570srt:MaximumMemberus-gaap:BaseRateMemberlng:CorpusChristiHoldingsWorkingCapitalFacilityMember2022-01-012022-12-310000003570us-gaap:LondonInterbankOfferedRateLIBORMemberlng:CheniereRevolvingCreditFacilityMembersrt:MinimumMember2022-01-012022-12-310000003570us-gaap:LondonInterbankOfferedRateLIBORMembersrt:MaximumMemberlng:CheniereRevolvingCreditFacilityMember2022-01-012022-12-310000003570lng:CheniereRevolvingCreditFacilityMemberus-gaap:BaseRateMembersrt:MinimumMember2022-01-012022-12-310000003570srt:MaximumMemberlng:CheniereRevolvingCreditFacilityMemberus-gaap:BaseRateMember2022-01-012022-12-310000003570lng:A2020SPLWorkingCapitalFacilityMembersrt:MinimumMember2022-01-012022-12-310000003570lng:A2020SPLWorkingCapitalFacilityMembersrt:MaximumMember2022-01-012022-12-310000003570lng:A2019CQPCreditFacilitiesMembersrt:MinimumMember2022-01-012022-12-310000003570lng:A2019CQPCreditFacilitiesMembersrt:MaximumMember2022-01-012022-12-310000003570lng:A2015CCHTermLoanFacilityMember2022-01-012022-12-310000003570srt:MinimumMemberlng:CorpusChristiHoldingsWorkingCapitalFacilityMember2022-01-012022-12-310000003570srt:MaximumMemberlng:CorpusChristiHoldingsWorkingCapitalFacilityMember2022-01-012022-12-310000003570lng:CheniereRevolvingCreditFacilityMembersrt:MinimumMember2022-01-012022-12-310000003570srt:MaximumMemberlng:CheniereRevolvingCreditFacilityMember2022-01-012022-12-310000003570lng:A2020SPLWorkingCapitalFacilityMember2022-01-012022-12-310000003570lng:A2019CQPCreditFacilitiesMember2022-01-012022-12-310000003570lng:CorpusChristiHoldingsWorkingCapitalFacilityMember2022-01-012022-12-310000003570lng:CheniereRevolvingCreditFacilityMember2022-01-012022-12-310000003570lng:CCHCreditFacilityAndCCHWorkingCapitalFacilityMember2022-06-012022-06-300000003570lng:A2015CCHTermLoanFacilityMember2022-06-300000003570lng:CorpusChristiHoldingsWorkingCapitalFacilityMember2022-06-300000003570srt:MaximumMemberlng:A2015CCHTermLoanFacilityMember2022-01-012022-12-310000003570lng:A2045ConvertibleSeniorNotesMember2022-01-012022-12-310000003570lng:ChevronUSAIncMemberlng:GainLossOnExtinguishmentOfObligationsMember2022-01-012022-12-310000003570us-gaap:ConvertibleDebtMember2022-01-012022-12-310000003570us-gaap:ConvertibleDebtMember2021-01-012021-12-310000003570us-gaap:ConvertibleDebtMember2020-01-012020-12-310000003570lng:DebtExcludingCapitalLeaseAndConvertibleDebtMember2022-01-012022-12-310000003570lng:DebtExcludingCapitalLeaseAndConvertibleDebtMember2021-01-012021-12-310000003570lng:DebtExcludingCapitalLeaseAndConvertibleDebtMember2020-01-012020-12-310000003570us-gaap:FairValueInputsLevel2Memberus-gaap:SeniorNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2022-12-310000003570us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:SeniorNotesMember2022-12-310000003570us-gaap:FairValueInputsLevel2Memberus-gaap:SeniorNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2021-12-310000003570us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:SeniorNotesMember2021-12-310000003570us-gaap:SeniorNotesMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2022-12-310000003570us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:SeniorNotesMemberus-gaap:FairValueInputsLevel3Member2022-12-310000003570us-gaap:SeniorNotesMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2021-12-310000003570us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:SeniorNotesMemberus-gaap:FairValueInputsLevel3Member2021-12-310000003570us-gaap:FairValueInputsLevel1Memberlng:A2045ConvertibleSeniorNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2022-12-310000003570us-gaap:FairValueInputsLevel1Memberlng:A2045ConvertibleSeniorNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2022-12-310000003570us-gaap:FairValueInputsLevel1Memberlng:A2045ConvertibleSeniorNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2021-12-310000003570us-gaap:FairValueInputsLevel1Memberlng:A2045ConvertibleSeniorNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2021-12-310000003570lng:OperatingLeaseAssetsMember2022-12-310000003570lng:OperatingLeaseAssetsMember2021-12-310000003570us-gaap:PropertyPlantAndEquipmentMember2022-12-310000003570us-gaap:PropertyPlantAndEquipmentMember2021-12-310000003570lng:CurrentOperatingLeaseLiabilitiesMember2022-12-310000003570lng:CurrentOperatingLeaseLiabilitiesMember2021-12-310000003570us-gaap:OtherCurrentLiabilitiesMember2022-12-310000003570us-gaap:OtherCurrentLiabilitiesMember2021-12-310000003570lng:NonCurrentOperatingLeaseLiabilitiesMember2022-12-310000003570lng:NonCurrentOperatingLeaseLiabilitiesMember2021-12-310000003570us-gaap:OtherNoncurrentLiabilitiesMember2022-12-310000003570us-gaap:OtherNoncurrentLiabilitiesMember2021-12-310000003570us-gaap:OperatingExpenseMember2022-01-012022-12-310000003570us-gaap:OperatingExpenseMember2021-01-012021-12-310000003570us-gaap:OperatingExpenseMember2020-01-012020-12-310000003570lng:DepreciationandAmortizationExpenseMember2022-01-012022-12-310000003570lng:DepreciationandAmortizationExpenseMember2021-01-012021-12-310000003570lng:DepreciationandAmortizationExpenseMember2020-01-012020-12-310000003570us-gaap:InterestExpenseMember2022-01-012022-12-310000003570us-gaap:InterestExpenseMember2021-01-012021-12-310000003570us-gaap:InterestExpenseMember2020-01-012020-12-310000003570srt:MaximumMember2022-12-310000003570lng:SuspensionFeesAndLNGCoverDamagesRevenueMember2020-01-012020-12-310000003570lng:SubsequentPeriodMemberlng:SuspensionFeesAndLNGCoverDamagesRevenueMember2020-01-012020-12-310000003570lng:SuspensionFeesAndLNGCoverDamagesRevenueMember2022-01-012022-12-310000003570lng:SuspensionFeesAndLNGCoverDamagesRevenueMember2021-01-012021-12-310000003570lng:LiquefiedNaturalGasProcuredFromThirdPartiesMember2022-01-012022-12-310000003570lng:LiquefiedNaturalGasProcuredFromThirdPartiesMember2021-01-012021-12-310000003570lng:LiquefiedNaturalGasProcuredFromThirdPartiesMember2020-01-012020-12-310000003570lng:TotalEnergiesGasPowerNorthAmericaIncMember2022-01-012022-12-310000003570lng:ChevronUSAIncMember2022-01-012022-12-310000003570lng:SabinePassLiquefactionMember2022-01-012022-12-310000003570lng:TerminalUseAgreementRegasificationCapacityPartialMember2022-01-012022-12-310000003570lng:TerminalUseAgreementRegasificationCapacityPartialMember2021-01-012021-12-310000003570lng:TerminalUseAgreementRegasificationCapacityPartialMember2020-01-012020-12-310000003570lng:ChevronUSAIncMemberlng:RegasificationServiceMember2022-01-012022-12-310000003570lng:TerminatedCommitmentsMemberlng:ChevronUSAIncMember2022-01-012022-12-3100000035702023-01-01lng:LiquefiedNaturalGasMember2022-12-3100000035702022-01-01lng:LiquefiedNaturalGasMember2021-12-3100000035702023-01-01lng:RegasificationServiceMember2022-12-3100000035702022-01-01lng:RegasificationServiceMember2021-12-3100000035702023-01-012022-12-3100000035702022-01-012021-12-310000003570lng:LiquefiedNaturalGasMemberlng:NaturalGasTransportationAndStorageAgreementsMember2022-01-012022-12-310000003570lng:LiquefiedNaturalGasMemberlng:NaturalGasTransportationAndStorageAgreementsMember2021-01-012021-12-310000003570lng:LiquefiedNaturalGasMemberlng:NaturalGasTransportationAndStorageAgreementsMember2020-01-012020-12-310000003570us-gaap:ProductAndServiceOtherMemberlng:OperationAndMaintenanceAgreementMember2022-01-012022-12-310000003570us-gaap:ProductAndServiceOtherMemberlng:OperationAndMaintenanceAgreementMember2021-01-012021-12-310000003570us-gaap:ProductAndServiceOtherMemberlng:OperationAndMaintenanceAgreementMember2020-01-012020-12-310000003570lng:NaturalGasSupplyAgreementMember2022-01-012022-12-310000003570lng:NaturalGasSupplyAgreementMember2021-01-012021-12-310000003570lng:NaturalGasSupplyAgreementMember2020-01-012020-12-310000003570lng:NaturalGasTransportationAndStorageAgreementsMember2022-01-012022-12-310000003570lng:NaturalGasTransportationAndStorageAgreementsMember2021-01-012021-12-310000003570lng:NaturalGasTransportationAndStorageAgreementsMember2020-01-012020-12-310000003570lng:NaturalGasSupplyTransportationAndStorageServiceAgreementsMember2022-01-012022-12-310000003570lng:NaturalGasSupplyTransportationAndStorageServiceAgreementsMember2021-01-012021-12-310000003570lng:NaturalGasSupplyTransportationAndStorageServiceAgreementsMember2020-01-012020-12-310000003570us-gaap:PriceRiskDerivativeMemberlng:NaturalGasSupplyAgreementMember2022-01-012022-12-310000003570us-gaap:PriceRiskDerivativeMemberlng:NaturalGasSupplyAgreementMember2021-01-012021-12-310000003570us-gaap:PriceRiskDerivativeMemberlng:NaturalGasSupplyAgreementMember2020-01-012020-12-310000003570lng:SabinePassLiquefactionLLCAndCheniereCreoleTrailPipelineLPMemberlng:NaturalGasTransportationAndStorageAgreementsMember2022-12-310000003570lng:SabinePassLiquefactionLLCAndCheniereCreoleTrailPipelineLPMemberlng:NaturalGasTransportationAndStorageAgreementsMember2021-12-310000003570lng:CheniereLNGOMServicesLLCMemberlng:OperationAndMaintenanceAgreementMember2022-12-310000003570lng:CheniereLNGOMServicesLLCMemberlng:OperationAndMaintenanceAgreementMember2021-12-310000003570lng:CorpusChristiLiquefactionMemberlng:NaturalGasTransportationAndStorageAgreementsMember2021-12-310000003570lng:CorpusChristiLiquefactionMemberlng:NaturalGasTransportationAndStorageAgreementsMember2022-12-310000003570lng:ADCCPipelineLLCMemberlng:CorpusChristiLiquefactionMemberlng:NaturalGasTransportationAndStorageAgreementsMember2022-01-012022-12-310000003570lng:IcahnShareRepurchaseAgreementMember2022-06-302022-06-300000003570us-gaap:DomesticCountryMember2022-12-310000003570us-gaap:StateAndLocalJurisdictionMember2022-12-310000003570us-gaap:DomesticCountryMemberus-gaap:InvestmentCreditMember2022-12-310000003570us-gaap:ForeignCountryMember2022-12-310000003570us-gaap:CommonStockMemberlng:A2011IncentivePlanMember2022-12-310000003570lng:A2020IncentivePlanMemberus-gaap:CommonStockMember2022-12-310000003570lng:EquityAwardsMember2022-01-012022-12-310000003570lng:EquityAwardsMember2021-01-012021-12-310000003570lng:EquityAwardsMember2020-01-012020-12-310000003570lng:LiabilityAwardsMember2022-01-012022-12-310000003570lng:LiabilityAwardsMember2021-01-012021-12-310000003570lng:LiabilityAwardsMember2020-01-012020-12-310000003570us-gaap:PerformanceSharesMember2022-01-012022-12-310000003570us-gaap:PerformanceSharesMember2021-01-012021-12-310000003570us-gaap:RestrictedStockMember2022-12-310000003570us-gaap:RestrictedStockMember2022-01-012022-12-310000003570lng:RestrictedShareUnitAndPerformanceStockUnitAwardsMember2022-12-310000003570lng:RestrictedShareUnitAndPerformanceStockUnitAwardsMember2022-01-012022-12-310000003570us-gaap:RestrictedStockMember2021-01-012021-12-310000003570us-gaap:RestrictedStockMember2020-01-012020-12-310000003570us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310000003570srt:MaximumMemberus-gaap:PerformanceSharesMember2022-01-012022-12-310000003570us-gaap:PerformanceSharesMembersrt:MinimumMember2022-01-012022-12-310000003570lng:RestrictedShareUnitAndPerformanceStockUnitAwardsMember2021-12-310000003570us-gaap:CommonStockMember2022-01-012022-12-310000003570lng:RestrictedShareUnitAndPerformanceStockUnitAwardsMember2021-01-012021-12-310000003570lng:RestrictedShareUnitAndPerformanceStockUnitAwardsMember2020-01-012020-12-310000003570us-gaap:PhantomShareUnitsPSUsMember2022-01-012022-12-310000003570us-gaap:PhantomShareUnitsPSUsMember2021-01-012021-12-310000003570us-gaap:PhantomShareUnitsPSUsMember2020-01-012020-12-310000003570us-gaap:SubsequentEventMember2023-01-272023-01-270000003570lng:UnvestedStockMember2022-01-012022-12-310000003570lng:UnvestedStockMember2021-01-012021-12-310000003570lng:UnvestedStockMember2020-01-012020-12-310000003570lng:A2045ConvertibleSeniorNotesMember2022-01-012022-12-310000003570lng:A2045ConvertibleSeniorNotesMember2021-01-012021-12-310000003570lng:A2045ConvertibleSeniorNotesMember2020-01-012020-12-3100000035702021-09-3000000035702021-01-012021-09-300000003570lng:SubsequentBoardApprovedIncreaseMember2022-10-010000003570lng:SubsequentBoardApprovedIncreaseMember2022-10-012022-10-010000003570lng:BechtelEPCContractCorpusChristiStage3Memberlng:CorpusChristiLiquefactionMember2022-01-012022-12-310000003570lng:BechtelEPCContractCorpusChristiStage3Memberlng:CorpusChristiLiquefactionMember2022-12-310000003570lng:SabinePassLiquefactionCorpusChristiLiquefactionandCheniereCorpusChristiLiquefactionStageIIIMembersrt:MaximumMemberus-gaap:InventoriesMember2022-01-012022-12-310000003570srt:MaximumMemberus-gaap:NaturalGasGatheringTransportationMarketingAndProcessingMemberlng:SabinePassLiquefactionAndCorpusChristiLiquefactionMember2022-01-012022-12-310000003570srt:MaximumMemberus-gaap:NaturalGasStorageMemberlng:SabinePassLiquefactionMember2022-01-012022-12-310000003570srt:MaximumMemberus-gaap:NaturalGasStorageMemberlng:CorpusChristiLiquefactionMember2022-01-012022-12-310000003570lng:NaturalGasSupplyTransportationAndStorageServiceAgreementsMemberlng:SabinePassLiquefactionCorpusChristiLiquefactionandCheniereCorpusChristiLiquefactionStageIIIMember2022-01-012022-12-310000003570lng:ThirdPartyMemberlng:NaturalGasSupplyTransportationAndStorageServiceAgreementsMemberlng:SabinePassLiquefactionCorpusChristiLiquefactionandCheniereCorpusChristiLiquefactionStageIIIMember2022-12-310000003570lng:RelatedPartyMemberlng:NaturalGasSupplyTransportationAndStorageServiceAgreementsMemberlng:SabinePassLiquefactionCorpusChristiLiquefactionandCheniereCorpusChristiLiquefactionStageIIIMember2022-12-310000003570lng:PartialTUAAssignmentAgreementAndOtherAgreementsMemberlng:SabinePassLiquefactionMember2022-01-012022-12-310000003570us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberlng:CustomerAMember2021-01-012021-12-310000003570us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberlng:CustomerAMember2020-01-012020-12-310000003570us-gaap:CustomerConcentrationRiskMemberlng:AccountsReceivableAndContractAssetsMemberlng:CustomerAMember2021-01-012021-12-310000003570us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberlng:CustomerBMember2021-01-012021-12-310000003570us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberlng:CustomerBMember2020-01-012020-12-310000003570us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberlng:CustomerCMember2021-01-012021-12-310000003570us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberlng:CustomerCMember2020-01-012020-12-310000003570us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberlng:CustomerDMember2020-01-012020-12-310000003570country:USus-gaap:GeographicConcentrationRiskMember2022-01-012022-12-310000003570country:USus-gaap:GeographicConcentrationRiskMember2021-01-012021-12-310000003570country:USus-gaap:GeographicConcentrationRiskMember2020-01-012020-12-310000003570us-gaap:GeographicConcentrationRiskMembercountry:GB2022-01-012022-12-310000003570us-gaap:GeographicConcentrationRiskMembercountry:GB2021-01-012021-12-310000003570us-gaap:GeographicConcentrationRiskMembercountry:GB2020-01-012020-12-310000003570country:SGus-gaap:GeographicConcentrationRiskMember2022-01-012022-12-310000003570country:SGus-gaap:GeographicConcentrationRiskMember2021-01-012021-12-310000003570country:SGus-gaap:GeographicConcentrationRiskMember2020-01-012020-12-310000003570country:IEus-gaap:GeographicConcentrationRiskMember2022-01-012022-12-310000003570country:IEus-gaap:GeographicConcentrationRiskMember2021-01-012021-12-310000003570country:IEus-gaap:GeographicConcentrationRiskMember2020-01-012020-12-310000003570country:ESus-gaap:GeographicConcentrationRiskMember2022-01-012022-12-310000003570country:ESus-gaap:GeographicConcentrationRiskMember2021-01-012021-12-310000003570country:ESus-gaap:GeographicConcentrationRiskMember2020-01-012020-12-310000003570country:KRus-gaap:GeographicConcentrationRiskMember2022-01-012022-12-310000003570country:KRus-gaap:GeographicConcentrationRiskMember2021-01-012021-12-310000003570country:KRus-gaap:GeographicConcentrationRiskMember2020-01-012020-12-310000003570country:INus-gaap:GeographicConcentrationRiskMember2022-01-012022-12-310000003570country:INus-gaap:GeographicConcentrationRiskMember2021-01-012021-12-310000003570country:INus-gaap:GeographicConcentrationRiskMember2020-01-012020-12-310000003570country:DEus-gaap:GeographicConcentrationRiskMember2022-01-012022-12-310000003570country:DEus-gaap:GeographicConcentrationRiskMember2021-01-012021-12-310000003570country:DEus-gaap:GeographicConcentrationRiskMember2020-01-012020-12-310000003570country:CHus-gaap:GeographicConcentrationRiskMember2022-01-012022-12-310000003570country:CHus-gaap:GeographicConcentrationRiskMember2021-01-012021-12-310000003570country:CHus-gaap:GeographicConcentrationRiskMember2020-01-012020-12-310000003570us-gaap:GeographicConcentrationRiskMemberlng:OtherCountriesMember2022-01-012022-12-310000003570us-gaap:GeographicConcentrationRiskMemberlng:OtherCountriesMember2021-01-012021-12-310000003570us-gaap:GeographicConcentrationRiskMemberlng:OtherCountriesMember2020-01-012020-12-310000003570srt:ParentCompanyMember2022-01-012022-12-310000003570srt:ParentCompanyMember2021-01-012021-12-310000003570srt:ParentCompanyMember2020-01-012020-12-310000003570srt:ParentCompanyMember2020-12-310000003570srt:ParentCompanyMember2019-12-310000003570srt:ParentCompanyMemberlng:A2028CheniereSeniorSecuredNotesMember2021-12-310000003570srt:ParentCompanyMemberlng:A2045ConvertibleSeniorNotesMember2021-12-310000003570srt:ParentCompanyMemberlng:CheniereRevolvingCreditFacilityMember2021-12-310000003570lng:CheniereTermLoanFacilityMembersrt:ParentCompanyMember2022-12-310000003570lng:CheniereTermLoanFacilityMembersrt:ParentCompanyMember2021-12-310000003570srt:ParentCompanyMemberlng:OperatingLeaseAssetsMember2022-12-310000003570srt:ParentCompanyMemberlng:OperatingLeaseAssetsMember2021-12-310000003570srt:ParentCompanyMemberlng:CurrentOperatingLeaseLiabilitiesMember2022-12-310000003570srt:ParentCompanyMemberlng:CurrentOperatingLeaseLiabilitiesMember2021-12-310000003570lng:NonCurrentOperatingLeaseLiabilitiesMembersrt:ParentCompanyMember2022-12-310000003570lng:NonCurrentOperatingLeaseLiabilitiesMembersrt:ParentCompanyMember2021-12-310000003570srt:ParentCompanyMemberus-gaap:GeneralAndAdministrativeExpenseMember2022-01-012022-12-310000003570srt:ParentCompanyMemberus-gaap:GeneralAndAdministrativeExpenseMember2021-01-012021-12-310000003570srt:ParentCompanyMemberus-gaap:GeneralAndAdministrativeExpenseMember2020-01-012020-12-310000003570srt:ParentCompanyMemberlng:SubsequentBoardApprovedIncreaseMember2022-10-012022-10-010000003570srt:ParentCompanyMemberus-gaap:SubsequentEventMember2023-01-272023-01-270000003570srt:ParentCompanyMemberlng:BondRepurchasesMember2022-01-012022-12-310000003570srt:ParentCompanyMemberlng:InterestOnBondMember2022-01-012022-12-310000003570us-gaap:AllowanceForCreditLossMember2021-12-310000003570us-gaap:AllowanceForCreditLossMember2022-01-012022-12-310000003570us-gaap:AllowanceForCreditLossMember2022-12-310000003570us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2021-12-310000003570us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2022-01-012022-12-310000003570us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2022-12-310000003570us-gaap:AllowanceForCreditLossMember2020-12-310000003570us-gaap:AllowanceForCreditLossMember2021-01-012021-12-310000003570us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2020-12-310000003570us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2021-01-012021-12-310000003570us-gaap:AllowanceForCreditLossMember2019-12-310000003570us-gaap:AllowanceForCreditLossMember2020-01-012020-12-310000003570us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2019-12-310000003570us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2020-01-012020-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2022

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number 001-16383

CHENIERE ENERGY, INC.

(Exact name of registrant as specified in its charter)

| | | | | |

| Delaware | 95-4352386 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

700 Milam Street, Suite 1900

Houston, Texas 77002

(Address of principal executive offices) (Zip Code)

(713) 375-5000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, $ 0.003 par value | LNG | NYSE American |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | |

| Large accelerated filer | ☒ | | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | | Smaller reporting company | ☐ |

| | | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the registrant’s Common Stock held by non-affiliates of the registrant was approximately $33.4 billion as of June 30, 2022.

As of February 17, 2023, the issuer had 243,703,983 shares of Common Stock outstanding.

Documents incorporated by reference: The definitive proxy statement for the registrant’s Annual Meeting of Stockholders (to be filed within 120 days of the close of the registrant’s fiscal year) is incorporated by reference into Part III.

CHENIERE ENERGY, INC.

TABLE OF CONTENTS

DEFINITIONS

As used in this annual report, the terms listed below have the following meanings:

Common Industry and Other Terms

| | | | | | | | |

| ASU | | Accounting Standards Update |

| Bcf | | billion cubic feet |

| Bcf/d | | billion cubic feet per day |

| Bcf/yr | | billion cubic feet per year |

| Bcfe | | billion cubic feet equivalent |

| DOE | | U.S. Department of Energy |

| EPC | | engineering, procurement and construction |

| FASB | | Financial Accounting Standards Board |

| FERC | | Federal Energy Regulatory Commission |

| FID | | final investment decision |

| FTA countries | | countries with which the United States has a free trade agreement providing for national treatment for trade in natural gas |

| GAAP | | generally accepted accounting principles in the United States |

| Henry Hub | | the final settlement price (in USD per MMBtu) for the New York Mercantile Exchange’s Henry Hub natural gas futures contract for the month in which a relevant cargo’s delivery window is scheduled to begin |

| IPM agreements | | integrated production marketing agreements in which the gas producer sells to us gas on a global LNG index price, less a fixed liquefaction fee, shipping and other costs |

| LIBOR | | London Interbank Offered Rate |

| LNG | | liquefied natural gas, a product of natural gas that, through a refrigeration process, has been cooled to a liquid state, which occupies a volume that is approximately 1/600th of its gaseous state |

| MMBtu | | million British thermal units; one British thermal unit measures the amount of energy required to raise the temperature of one pound of water by one degree Fahrenheit |

| mtpa | | million tonnes per annum |

| | |

| non-FTA countries | | countries with which the United States does not have a free trade agreement providing for national treatment for trade in natural gas and with which trade is permitted |

| SEC | | U.S. Securities and Exchange Commission |

| SOFR | | Secured Overnight Financing Rate |

| SPA | | LNG sale and purchase agreement |

| TBtu | | trillion British thermal units; one British thermal unit measures the amount of energy required to raise the temperature of one pound of water by one degree Fahrenheit |

| Train | | an industrial facility comprised of a series of refrigerant compressor loops used to cool natural gas into LNG |

| TUA | | terminal use agreement |

Abbreviated Legal Entity Structure

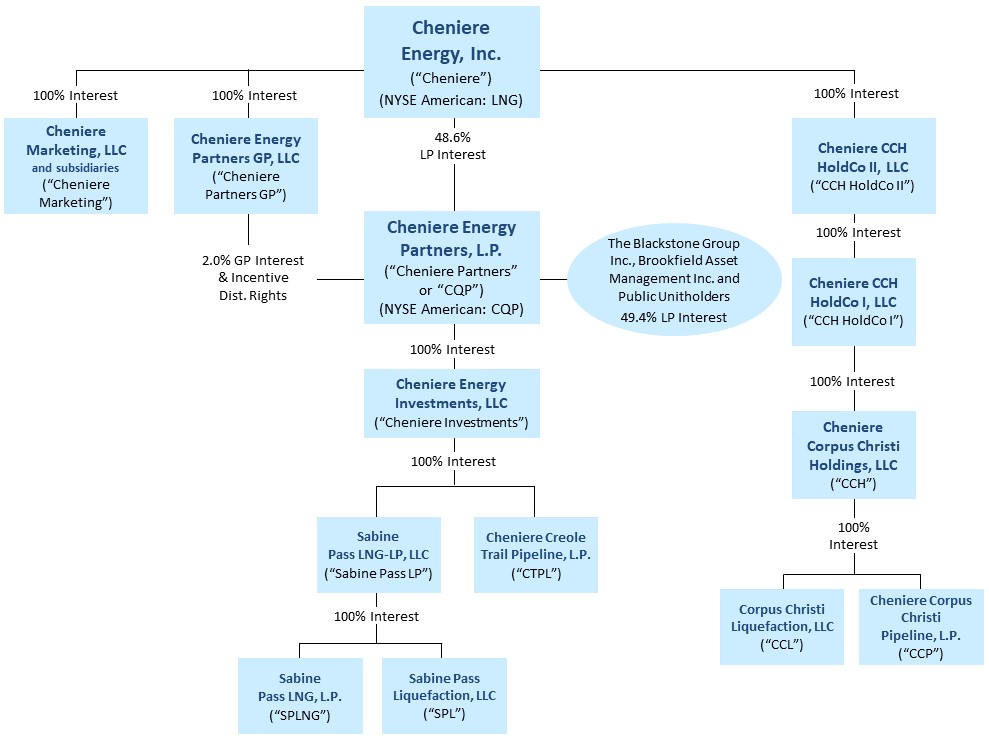

The following diagram depicts our abbreviated legal entity structure as of December 31, 2022, including our ownership of certain subsidiaries, and the references to these entities used in this annual report:

Unless the context requires otherwise, references to “Cheniere,” the “Company,” “we,” “us” and “our” refer to Cheniere Energy, Inc. and its consolidated subsidiaries, including our publicly traded subsidiary, CQP.

In June 2022, as part of the internal restructuring of Cheniere’s subsidiaries, Cheniere contributed its equity interest in Corpus Christi Liquefaction Stage III, LLC (“CCL Stage III”), formerly a wholly owned direct subsidiary of Cheniere, to CCH, and CCL Stage III was subsequently merged with and into CCL, the surviving entity of the merger and a wholly owned subsidiary of CCH.

CAUTIONARY STATEMENT

REGARDING FORWARD-LOOKING STATEMENTS

This annual report contains certain statements that are, or may be deemed to be, “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements, other than statements of historical or present facts or conditions, included herein or incorporated herein by reference are “forward-looking statements.” Included among “forward-looking statements” are, among other things:

•statements that we expect to commence or complete construction of our proposed LNG terminals, liquefaction facilities, pipeline facilities or other projects, or any expansions or portions thereof, by certain dates, or at all;

•statements regarding future levels of domestic and international natural gas production, supply or consumption or future levels of LNG imports into or exports from North America and other countries worldwide or purchases of natural gas, regardless of the source of such information, or the transportation or other infrastructure or demand for and prices related to natural gas, LNG or other hydrocarbon products;

•statements regarding any financing transactions or arrangements, or our ability to enter into such transactions;

•statements relating to Cheniere’s capital deployment, including intent, ability, extent and timing of capital expenditures, debt repayment, dividends, share repurchases and execution on the capital allocation plan;

•statements regarding our future sources of liquidity and cash requirements;

•statements relating to the construction of our Trains and pipelines, including statements concerning the engagement of any EPC contractor or other contractor and the anticipated terms and provisions of any agreement with any EPC or other contractor, and anticipated costs related thereto;

•statements regarding any SPA or other agreement to be entered into or performed substantially in the future, including any revenues anticipated to be received and the anticipated timing thereof, and statements regarding the amounts of total LNG regasification, natural gas liquefaction or storage capacities that are, or may become, subject to contracts;

•statements regarding counterparties to our commercial contracts, construction contracts and other contracts;

•statements regarding our planned development and construction of additional Trains or pipelines, including the financing of such Trains or pipelines;

•statements that our Trains, when completed, will have certain characteristics, including amounts of liquefaction capacities;

•statements regarding our business strategy, our strengths, our business and operation plans or any other plans, forecasts, projections, or objectives, including anticipated revenues, capital expenditures, maintenance and operating costs and cash flows, any or all of which are subject to change;

•statements regarding legislative, governmental, regulatory, administrative or other public body actions, approvals, requirements, permits, applications, filings, investigations, proceedings or decisions;

•statements regarding our anticipated LNG and natural gas marketing activities;

•any other statements that relate to non-historical or future information; and

All of these types of statements, other than statements of historical or present facts or conditions, are forward-looking statements. In some cases, forward-looking statements can be identified by terminology such as “may,” “will,” “could,” “should,” “achieve,” “anticipate,” “believe,” “contemplate,” “continue,” “estimate,” “expect,” “intend,” “plan,” “potential,” “predict,” “project,” “pursue,” “target,” the negative of such terms or other comparable terminology. The forward-looking statements contained in this annual report are largely based on our expectations, which reflect estimates and assumptions made by our management. These estimates and assumptions reflect our best judgment based on currently known market conditions and other factors. Although we believe that such estimates are reasonable, they are inherently uncertain and involve a number of risks and uncertainties beyond our control. In addition, assumptions may prove to be inaccurate. We caution that the forward-looking statements contained in this annual report are not guarantees of future performance and that such statements may not be realized or the forward-looking statements or events may not occur. Actual results may differ materially from those anticipated or implied in forward-looking statements as a result of a variety of factors described in this annual report and in the other reports and other information that we file with the SEC. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by these risk factors. These forward-looking statements speak only as of the date made, and other than as required by law, we undertake no obligation to update or revise any forward-looking statement or provide reasons why actual results may differ, whether as a result of new information, future events or otherwise.

PART I

ITEMS 1. AND 2. BUSINESS AND PROPERTIES

General

Cheniere, a Delaware corporation, is a Houston-based energy infrastructure company primarily engaged in LNG-related businesses. We provide clean, secure and affordable LNG to integrated energy companies, utilities and energy trading companies around the world. We aspire to conduct our business in a safe and responsible manner, delivering a reliable, competitive and integrated source of LNG to our customers.

LNG is natural gas (methane) in liquid form. The LNG we produce is shipped all over the world, turned back into natural gas (called “regasification”) and then transported via pipeline to homes and businesses and used as an energy source that is essential for heating, cooking and other industrial uses. Natural gas is a cleaner-burning, abundant and affordable source of energy. When LNG is converted back to natural gas, it can be used instead of coal, which reduces the amount of pollution traditionally produced from burning fossil fuels, like sulfur dioxide and particulate matter that enters the air we breathe. Additionally, compared to coal, it produces significantly fewer carbon emissions. By liquefying natural gas, we are able to reduce its volume by 600 times so that we can load it onto special LNG carriers designed to keep the LNG cold and in liquid form for efficient transport overseas.

We are the largest producer of LNG in the United States and the second largest LNG operator globally, based on the total operational production capacity of our liquefaction facilities in operation, which totals approximately 45 mtpa as of December 31, 2022.

We own and operate a natural gas liquefaction and export facility located in Cameron Parish, Louisiana at Sabine Pass (the “Sabine Pass LNG Terminal”), one of the largest LNG production facilities in the world, through our ownership interest in and management agreements with CQP, which is a publicly traded limited partnership that we formed in 2007. As of December 31, 2022, we owned 100% of the general partner interest and a 48.6% limited partner interest in CQP. The Sabine Pass LNG Terminal has six operational Trains, with Train 6 having achieved substantial completion on February 4, 2022, for a total operational production capacity of approximately 30 mtpa of LNG (the “SPL Project”). The Sabine Pass LNG Terminal also has three marine berths, with the third berth having achieved substantial completion on October 27, 2022, two of which can accommodate vessels with nominal capacity of up to 266,000 cubic meters, and the third berth which can accommodate vessels with nominal capacity of up to 200,000 cubic meters and operational regasification facilities that include five LNG storage tanks with aggregate capacity of approximately 17 Bcfe and vaporizers with regasification capacity of approximately 4 Bcf/d. The Sabine Pass LNG Terminal also includes a 94-mile pipeline owned by CTPL, a subsidiary of CQP, that interconnects our facilities to several interstate and intrastate pipelines (the “Creole Trail Pipeline”).

We also own and operate a natural gas liquefaction and export facility located near Corpus Christi, Texas (the “Corpus Christi LNG Terminal”) through CCL, which has natural gas liquefaction facilities consisting of three operational Trains for a total operational production capacity of approximately 15 mtpa of LNG, three LNG storage tanks with aggregate capacity of approximately 10 Bcfe and two marine berths that can each accommodate vessels with nominal capacity of up to 266,000 cubic meters. Additionally, we are constructing an expansion of the Corpus Christi LNG Terminal (the “Corpus Christi Stage 3 Project”) for up to seven midscale Trains with an expected total operational production capacity over 10 mtpa of LNG. In June 2022, our board of directors (our “Board”) made a positive FID with respect to the Corpus Christi Stage 3 Project and issued a full notice to proceed with construction to Bechtel effective June 16, 2022. In connection with the positive FID, CCL Stage III, through which we were developing and constructing the Corpus Christi Stage 3 Project, was contributed to CCH and subsequently merged with and into CCL, with CCL as the surviving entity of the merger and a wholly owned subsidiary of CCH. We also own and operate through CCP a 21.5-mile natural gas supply pipeline that interconnects the Corpus Christi LNG Terminal with several interstate and intrastate natural gas pipelines (the “Corpus Christi Pipeline” and together with the existing operational Trains, midscale Trains, storage tanks and marine berths, the “CCL Project”).

Our long-term customer arrangements form the foundation of our business and provide us with significant, stable, long-term cash flows. We have contracted substantially all of our anticipated production capacity under SPAs, in which our customers are generally required to pay a fixed fee with respect to the contracted volumes irrespective of their election to cancel or suspend deliveries of LNG cargoes, and under IPM agreements, in which the gas producer sells natural gas to us on a global LNG index price, less a fixed liquefaction fee, shipping and other costs. Through our SPAs and IPM agreements, we have contracted approximately 95% of the total anticipated production from the SPL Project and the CCL Project (collectively, the

“Liquefaction Projects”) through the mid-2030s, inclusive of contracts executed to support additional liquefaction capacity at the Corpus Christi LNG Terminal beyond the Corpus Christi Stage 3 Project. Excluding contracts with terms less than 10 years and contracts executed to support additional liquefaction capacity at the Corpus Christi LNG Terminal beyond the Corpus Christi Stage 3 Project, our SPAs and IPM agreements had approximately 17 years of weighted average remaining life as of December 31, 2022. We also market and sell LNG produced by the Liquefaction Projects that is not contracted by CCL or SPL through our integrated marketing function. For further discussion of the contracted future cash flows under our revenue arrangements, see Liquidity and Capital Resources in Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

We remain focused on safety, operational excellence and customer satisfaction. Increasing demand for LNG has allowed us to expand our liquefaction infrastructure in a financially disciplined manner. We have increased available liquefaction capacity at our Liquefaction Projects as a result of debottlenecking and other optimization projects. We hold significant land positions at both the Sabine Pass LNG Terminal and the Corpus Christi LNG Terminal, which provide opportunity for further liquefaction capacity expansion. In September 2022, certain of our subsidiaries entered the pre-filing review process with the FERC under the National Environmental Policy Act for an expansion adjacent to the CCL Project consisting of two midscale Trains with an expected total production capacity of approximately 3 mtpa of LNG (“CCL Midscale Trains 8 and 9”). The development of CCL Midscale Trains 8 and 9 or other projects, including infrastructure projects in support of natural gas supply and LNG demand, will require, among other things, acceptable commercial and financing arrangements before we make a positive FID.

Our Business Strategy

Our primary business strategy is to be a full-service LNG provider to worldwide end-use customers. We accomplish this objective by owning, constructing and operating LNG and natural gas infrastructure facilities to meet our long-term customers’ energy demands and:

•safely, efficiently and reliably operating and maintaining our assets;

•procuring natural gas and pipeline transport capacity to our facilities;

•providing value to our customers through destination flexibility, options not to lift cargoes and diversity of price and geography;

•continuing to secure long-term customer contracts to support our planned expansion, including the FID of potential expansion projects beyond the Corpus Christi Stage 3 Project;

•completing our expansion construction projects safely, on-time and on-budget;

•maximizing the production of LNG to serve our customers and generating steady and stable revenues and operating cash flows;

•maintaining a flexible capital structure to finance the acquisition, development, construction and operation of the energy assets needed to supply our customers;

•executing our “all of the above” capital allocation strategy, focused on strengthening our balance sheet, funding financially disciplined growth and returning capital to our stockholders; and

•strategically identifying actionable environmental solutions.

Our Business

We shipped our first LNG cargo in February 2016 and as of February 17, 2023, approximately 2,650 cumulative LNG cargoes totaling over 180 million tonnes of LNG have been produced, loaded and exported from the Liquefaction Projects. Our LNG has been shipped to 39 countries and regions around the world.

Below is a discussion of our operations. For further discussion of our contractual obligations and cash requirements related to these operations, refer to Liquidity and Capital Resources in Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Sabine Pass LNG Terminal

Liquefaction Facilities

The SPL Project, as described above under the caption General, is one of the largest LNG production facilities in the world with six Trains and three marine berths.

The following summarizes the volumes of natural gas for which we have received approvals from FERC to site, construct and operate the SPL Project and the orders we have received from the DOE authorizing the export of domestically produced LNG by vessel from the Sabine Pass LNG Terminal through December 31, 2050:

| | | | | | | | | | | | | | | | | | | | | | | |

| FERC Approved Volume | | DOE Approved Volume |

| (in Bcf/yr) | | (in mtpa) | | (in Bcf/yr) | | (in mtpa) |

| FTA countries | 1,661.94 | | 33 | | 1,661.94 | | 33 |

| Non-FTA countries | 1,661.94 | | 33 | | 1,661.94 | | 33 |

Natural Gas Supply, Transportation and Storage

SPL has secured natural gas feedstock for the Sabine Pass LNG Terminal through long-term natural gas supply agreements, including an IPM agreement. Additionally, to ensure that SPL is able to transport natural gas feedstock to the Sabine Pass LNG Terminal and manage inventory levels, it has entered into firm pipeline transportation and storage contracts with third parties.

Regasification Facilities

The Sabine Pass LNG Terminal, as described above under the caption General, has operational regasification capacity of approximately 4 Bcf/d and aggregate LNG storage capacity of approximately 17 Bcfe. SPLNG has a long-term, third party TUA for 1 Bcf/d with TotalEnergies Gas & Power North America, Inc. (“TotalEnergies”), under which TotalEnergies is required to pay fixed monthly fees, whether or not it uses the regasification capacity they have reserved. Prior to its cancellation effective December 31, 2022, SPLNG also had a TUA for 1 Bcf/d with Chevron. Approximately 2 Bcf/d of the remaining capacity has been reserved under a TUA by SPL. SPL also has a partial TUA assignment agreement with TotalEnergies, as further described in Note 13—Revenues of our Notes to Consolidated Financial Statements.

Corpus Christi LNG Terminal

Liquefaction Facilities

The CCL Project, as described above under the caption General, includes three Trains and two marine berths and the construction of the Corpus Christi Stage 3 Project with up to seven midscale Trains. Additionally, in September 2022, certain of our subsidiaries entered the pre-filing review process with the FERC under the National Environmental Policy Act for CCL Midscale Trains 8 and 9.

The following table summarizes the project completion and construction status of the Corpus Christi Stage 3 Project as of January 31, 2023:

| | | | | | | | | | | |

| | |

| Overall project completion percentage | | 24.5% |

| Completion percentage of: | | |

| Engineering | | 41.3% |

| Procurement | | 36.9% |

| Subcontract work | | 29.5% |

| Construction | | 2.2% |

| Date of expected substantial completion | | 2H 2025 - 1H 2027 |

The following summarizes the volumes of natural gas for which we have received approvals from FERC to site, construct and operate the CCL Project and the orders we have received from the DOE authorizing the export of domestically produced LNG by vessel from the Corpus Christi LNG Terminal through December 31, 2050:

| | | | | | | | | | | | | | | | | | | | | | | |

| FERC Approved Volume | | DOE Approved Volume |

| (in Bcf/yr) | | (in mtpa) | | (in Bcf/yr) | | (in mtpa) |

| Trains 1 through 3 of the CCL Project: | | | | | | | |

| FTA countries | 875.16 | | 17 | | 875.16 | | 17 |

| Non-FTA countries | 875.16 | | 17 | | 875.16 | | 17 |

| Corpus Christi Stage 3 Project: | | | | | | | |

| FTA countries | 582.14 | | 11.45 | | 582.14 | | 11.45 |

| Non-FTA countries | 582.14 | | 11.45 | | 582.14 | | 11.45 |

Pipeline Facilities

In November 2019, the FERC authorized CCP to construct and operate the pipeline for the Corpus Christi Stage 3 Project, which is designed to transport 1.5 Bcf/d of natural gas feedstock required by the Corpus Christi Stage 3 Project from the existing regional natural gas pipeline grid.

Natural Gas Supply, Transportation and Storage

CCL has secured natural gas feedstock for the Corpus Christi LNG Terminal through traditional long-term natural gas supply and IPM agreements. Additionally, to ensure that CCL is able to transport and manage the natural gas feedstock to the Corpus Christi LNG Terminal, it has entered into transportation precedent and other agreements to secure firm pipeline transportation and storage capacity from third parties.

Additionally, as described in Note 18—Other Non-current Assets, Net of our Notes to Consolidated Financial Statements, in June 2022, we acquired a 30% equity interest in ADCC Pipeline, LLC (“ADCC Pipeline”) through our wholly owned subsidiary Cheniere ADCC Investments, LLC. ADCC Pipeline will develop, own, construct and operate an approximately 42-mile natural gas pipeline project connecting the Agua Dulce natural gas hub to the CCL Project.

Marketing

We market and sell LNG produced by the Liquefaction Projects that is not contracted by CCL or SPL to other customers through Cheniere Marketing, our integrated marketing function. We have, and continue to develop, a portfolio of long-, medium- and short-term SPAs to transport and deliver commercial LNG cargoes to locations worldwide.

Customers

The following table shows customers with revenues of 10% or greater of total revenues from external customers:

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Percentage of Total Revenues from External Customers |

| | | | Year Ended December 31, |

| | | | | | 2022 | | 2021 | | 2020 |

BG Gulf Coast LNG, LLC and affiliates | | | | | | * | | 12% | | 14% |

Naturgy LNG GOM, Limited | | | | | | * | | 12% | | 12% |

Korea Gas Corporation | | | | | | * | | 10% | | 10% |

GAIL (India) Limited | | | | | | * | | * | | 10% |

| | | | | | | | | | |

* Less than 10%

All of the above customers contribute to our LNG revenues through SPA contracts.

Governmental Regulation

Our LNG terminals and pipelines are subject to extensive regulation under federal, state and local statutes, rules, regulations and laws. These laws require that we engage in consultations with appropriate federal and state agencies and that we obtain and maintain applicable permits and other authorizations. These rigorous regulatory requirements increase the cost of construction and operation, and failure to comply with such laws could result in substantial penalties and/or loss of necessary authorizations.

Federal Energy Regulatory Commission

The design, construction, operation, maintenance and expansion of our liquefaction facilities, the import or export of LNG and the purchase and transportation of natural gas in interstate commerce through our pipelines (including our Creole Trail Pipeline and Corpus Christi Pipeline) are highly regulated activities subject to the jurisdiction of the FERC pursuant to the Natural Gas Act of 1938, as amended (the “NGA”). Under the NGA, the FERC’s jurisdiction generally extends to the transportation of natural gas in interstate commerce, to the sale for resale of natural gas in interstate commerce, to natural gas companies engaged in such transportation or sale and to the construction, operation, maintenance and expansion of LNG terminals and interstate natural gas pipelines.

The FERC’s authority to regulate interstate natural gas pipelines and the services that they provide generally includes regulation of:

•rates and charges, and terms and conditions for natural gas transportation, storage and related services;

•the certification and construction of new facilities and modification of existing facilities;

•the extension and abandonment of services and facilities;

•the administration of accounting and financial reporting regulations, including the maintenance of accounts and records;

•the acquisition and disposition of facilities;

•the initiation and discontinuation of services; and

•various other matters.

Under the NGA, our pipelines are not permitted to unduly discriminate or grant undue preference as to rates or the terms and conditions of service to any shipper, including its own marketing affiliate. Those rates, terms and conditions must be public, and on file with the FERC. In contrast to pipeline regulation, the FERC does not require LNG terminal owners to provide open-access services at cost-based or regulated rates. Although the provisions that codified the FERC’s policy in this area expired on January 1, 2015, we see no indication that the FERC intends to change its policy in this area. On February 18, 2022, the FERC updated its 1999 Policy Statement on certification of new interstate natural gas facilities and the framework for the FERC’s decision-making process, modifying the standards FERC uses to evaluate applications to include, among other things, reasonably foreseeable greenhouse gas emissions that may be attributable to the project and the project’s impact on environmental justice communities. On March 24, 2022, the FERC pulled back the Policy Statement, re-issued it as a draft and it remains pending. At this time, we do not expect it to have a material adverse effect on our operations.

We are permitted to make sales of natural gas for resale in interstate commerce pursuant to a blanket marketing certificate granted by the FERC with the issuance of our Certificate of Public Convenience and Necessity to our marketing affiliates. Our sales of natural gas will be affected by the availability, terms and cost of pipeline transportation. As noted above, the price and terms of access to pipeline transportation are subject to extensive federal and state regulation.