0000003570false--12-312021FY11one yearP1YP2YP3YP4YP2YP3YP4YP3YP3YP3Y00000035702021-01-012021-12-3100000035702021-06-30iso4217:USD00000035702022-02-18xbrli:shares0000003570lng:SPACustomersMember2021-01-012021-12-310000003570lng:LiquefiedNaturalGasMember2021-01-012021-12-310000003570lng:LiquefiedNaturalGasMember2020-01-012020-12-310000003570lng:LiquefiedNaturalGasMember2019-01-012019-12-310000003570lng:RegasificationServiceMember2021-01-012021-12-310000003570lng:RegasificationServiceMember2020-01-012020-12-310000003570lng:RegasificationServiceMember2019-01-012019-12-310000003570us-gaap:ProductAndServiceOtherMember2021-01-012021-12-310000003570us-gaap:ProductAndServiceOtherMember2020-01-012020-12-310000003570us-gaap:ProductAndServiceOtherMember2019-01-012019-12-3100000035702020-01-012020-12-3100000035702019-01-012019-12-31iso4217:USDxbrli:shares00000035702021-12-3100000035702020-12-310000003570lng:CheniereEnergyPartnersLPMember2021-12-310000003570us-gaap:CommonStockMember2018-12-310000003570us-gaap:TreasuryStockMember2018-12-310000003570us-gaap:AdditionalPaidInCapitalMember2018-12-310000003570us-gaap:RetainedEarningsMember2018-12-310000003570us-gaap:NoncontrollingInterestMember2018-12-3100000035702018-12-310000003570us-gaap:CommonStockMember2019-01-012019-12-310000003570us-gaap:TreasuryStockMember2019-01-012019-12-310000003570us-gaap:AdditionalPaidInCapitalMember2019-01-012019-12-310000003570us-gaap:RetainedEarningsMember2019-01-012019-12-310000003570us-gaap:NoncontrollingInterestMember2019-01-012019-12-310000003570us-gaap:CommonStockMember2019-12-310000003570us-gaap:TreasuryStockMember2019-12-310000003570us-gaap:AdditionalPaidInCapitalMember2019-12-310000003570us-gaap:RetainedEarningsMember2019-12-310000003570us-gaap:NoncontrollingInterestMember2019-12-3100000035702019-12-310000003570us-gaap:CommonStockMember2020-01-012020-12-310000003570us-gaap:TreasuryStockMember2020-01-012020-12-310000003570us-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-310000003570us-gaap:RetainedEarningsMember2020-01-012020-12-310000003570us-gaap:NoncontrollingInterestMember2020-01-012020-12-310000003570us-gaap:CommonStockMember2020-12-310000003570us-gaap:TreasuryStockMember2020-12-310000003570us-gaap:AdditionalPaidInCapitalMember2020-12-310000003570us-gaap:RetainedEarningsMember2020-12-310000003570us-gaap:NoncontrollingInterestMember2020-12-310000003570us-gaap:CommonStockMember2021-01-012021-12-310000003570us-gaap:TreasuryStockMember2021-01-012021-12-310000003570us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310000003570us-gaap:RetainedEarningsMember2021-01-012021-12-310000003570us-gaap:NoncontrollingInterestMember2021-01-012021-12-310000003570us-gaap:CommonStockMember2021-12-310000003570us-gaap:TreasuryStockMember2021-12-310000003570us-gaap:AdditionalPaidInCapitalMember2021-12-310000003570us-gaap:RetainedEarningsMember2021-12-310000003570us-gaap:NoncontrollingInterestMember2021-12-31lng:unit0000003570lng:SabinePassLNGTerminalMember2021-01-012021-12-31lng:trainslng:milliontonnesutr:Ylng:item0000003570lng:CreoleTrailPipelineMember2021-01-012021-12-31utr:mi0000003570lng:CheniereEnergyPartnersLPMember2021-01-012021-12-31xbrli:pure0000003570lng:CorpusChristiLNGTerminalMember2021-01-012021-12-310000003570lng:CorpusChristiPipelineMember2021-01-012021-12-310000003570lng:CorpusChristiLNGTerminalExpansionMembersrt:MaximumMember2021-01-012021-12-310000003570lng:CorpusChristiLNGTerminalExpansionMember2021-01-012021-12-310000003570lng:SabinePassLNGLPMemberlng:TUACustomersMemberus-gaap:CustomerConcentrationRiskMember2021-01-012021-12-310000003570lng:SabinePassLNGTerminalMember2021-12-310000003570srt:MaximumMemberlng:SabinePassLNGTerminalMember2021-12-310000003570lng:CreoleTrailPipelineMember2021-12-310000003570lng:CorpusChristiPipelineMember2021-12-310000003570lng:A2045ConvertibleSeniorNotesMember2021-12-310000003570us-gaap:AccountingStandardsUpdate202006Memberlng:A2045ConvertibleSeniorNotesMember2021-12-310000003570lng:SPLProjectMember2021-12-310000003570lng:SPLProjectMember2020-12-310000003570lng:CCLProjectMember2021-12-310000003570lng:CCLProjectMember2020-12-310000003570lng:SubsidiaryCashMember2021-12-310000003570lng:SubsidiaryCashMember2020-12-310000003570lng:SabinePassLiquefactionAndCorpusChristiLiquefactionMember2021-12-310000003570lng:SabinePassLiquefactionAndCorpusChristiLiquefactionMember2020-12-310000003570lng:CheniereMarketingLLCMember2021-12-310000003570lng:CheniereMarketingLLCMember2020-12-310000003570lng:MaterialsInventoryMember2021-12-310000003570lng:MaterialsInventoryMember2020-12-310000003570lng:LiquefiedNaturalGasInTransitInventoryMember2021-12-310000003570lng:LiquefiedNaturalGasInTransitInventoryMember2020-12-310000003570lng:LiquefiedNaturalGasInventoryMember2021-12-310000003570lng:LiquefiedNaturalGasInventoryMember2020-12-310000003570lng:NaturalGasInventoryMember2021-12-310000003570lng:NaturalGasInventoryMember2020-12-310000003570lng:OtherInventoryMember2021-12-310000003570lng:OtherInventoryMember2020-12-310000003570lng:LngTerminalMember2021-12-310000003570lng:LngTerminalMember2020-12-310000003570lng:LngSiteAndRelatedCostsNetMember2021-12-310000003570lng:LngSiteAndRelatedCostsNetMember2020-12-310000003570us-gaap:ConstructionInProgressMember2021-12-310000003570us-gaap:ConstructionInProgressMember2020-12-310000003570lng:LngTerminalCostsMember2021-12-310000003570lng:LngTerminalCostsMember2020-12-310000003570us-gaap:OfficeEquipmentMember2021-12-310000003570us-gaap:OfficeEquipmentMember2020-12-310000003570us-gaap:FurnitureAndFixturesMember2021-12-310000003570us-gaap:FurnitureAndFixturesMember2020-12-310000003570us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2021-12-310000003570us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2020-12-310000003570us-gaap:LeaseholdImprovementsMember2021-12-310000003570us-gaap:LeaseholdImprovementsMember2020-12-310000003570us-gaap:LandMember2021-12-310000003570us-gaap:LandMember2020-12-310000003570us-gaap:OtherCapitalizedPropertyPlantAndEquipmentMember2021-12-310000003570us-gaap:OtherCapitalizedPropertyPlantAndEquipmentMember2020-12-310000003570lng:FixedAssetsMember2021-12-310000003570lng:FixedAssetsMember2020-12-310000003570us-gaap:AssetsHeldUnderCapitalLeasesMember2021-12-310000003570us-gaap:AssetsHeldUnderCapitalLeasesMember2020-12-310000003570srt:MinimumMember2021-01-012021-12-310000003570srt:MaximumMember2021-01-012021-12-310000003570lng:LNGStorageTanksMember2021-01-012021-12-310000003570us-gaap:PipelinesMember2021-01-012021-12-310000003570lng:MarineBerthElectricalFacilityAndRoadsMember2021-01-012021-12-310000003570lng:WaterPipelinesMember2021-01-012021-12-310000003570lng:RegasificationProcessingEquipmentRecondensersVaporizationAndVentsMember2021-01-012021-12-310000003570lng:SendoutPumpsMember2021-01-012021-12-310000003570srt:MinimumMemberlng:LiquefactionProcessingEquipmentMember2021-01-012021-12-310000003570lng:LiquefactionProcessingEquipmentMembersrt:MaximumMember2021-01-012021-12-310000003570us-gaap:OtherEnergyEquipmentMembersrt:MinimumMember2021-01-012021-12-310000003570us-gaap:OtherEnergyEquipmentMembersrt:MaximumMember2021-01-012021-12-310000003570us-gaap:FairValueInputsLevel1Memberlng:CCHInterestRateDerivativesMember2021-12-310000003570us-gaap:FairValueInputsLevel2Memberlng:CCHInterestRateDerivativesMember2021-12-310000003570us-gaap:FairValueInputsLevel3Memberlng:CCHInterestRateDerivativesMember2021-12-310000003570lng:CCHInterestRateDerivativesMember2021-12-310000003570us-gaap:FairValueInputsLevel1Memberlng:CCHInterestRateDerivativesMember2020-12-310000003570us-gaap:FairValueInputsLevel2Memberlng:CCHInterestRateDerivativesMember2020-12-310000003570us-gaap:FairValueInputsLevel3Memberlng:CCHInterestRateDerivativesMember2020-12-310000003570lng:CCHInterestRateDerivativesMember2020-12-310000003570us-gaap:FairValueInputsLevel1Memberus-gaap:PriceRiskDerivativeMember2021-12-310000003570us-gaap:PriceRiskDerivativeMemberus-gaap:FairValueInputsLevel2Member2021-12-310000003570us-gaap:PriceRiskDerivativeMemberus-gaap:FairValueInputsLevel3Member2021-12-310000003570us-gaap:PriceRiskDerivativeMember2021-12-310000003570us-gaap:FairValueInputsLevel1Memberus-gaap:PriceRiskDerivativeMember2020-12-310000003570us-gaap:PriceRiskDerivativeMemberus-gaap:FairValueInputsLevel2Member2020-12-310000003570us-gaap:PriceRiskDerivativeMemberus-gaap:FairValueInputsLevel3Member2020-12-310000003570us-gaap:PriceRiskDerivativeMember2020-12-310000003570us-gaap:FairValueInputsLevel1Memberlng:LNGTradingDerivativeMember2021-12-310000003570lng:LNGTradingDerivativeMemberus-gaap:FairValueInputsLevel2Member2021-12-310000003570lng:LNGTradingDerivativeMemberus-gaap:FairValueInputsLevel3Member2021-12-310000003570lng:LNGTradingDerivativeMember2021-12-310000003570us-gaap:FairValueInputsLevel1Memberlng:LNGTradingDerivativeMember2020-12-310000003570lng:LNGTradingDerivativeMemberus-gaap:FairValueInputsLevel2Member2020-12-310000003570lng:LNGTradingDerivativeMemberus-gaap:FairValueInputsLevel3Member2020-12-310000003570lng:LNGTradingDerivativeMember2020-12-310000003570us-gaap:FairValueInputsLevel1Memberus-gaap:ForeignExchangeContractMember2021-12-310000003570us-gaap:FairValueInputsLevel2Memberus-gaap:ForeignExchangeContractMember2021-12-310000003570us-gaap:FairValueInputsLevel3Memberus-gaap:ForeignExchangeContractMember2021-12-310000003570us-gaap:ForeignExchangeContractMember2021-12-310000003570us-gaap:FairValueInputsLevel1Memberus-gaap:ForeignExchangeContractMember2020-12-310000003570us-gaap:FairValueInputsLevel2Memberus-gaap:ForeignExchangeContractMember2020-12-310000003570us-gaap:FairValueInputsLevel3Memberus-gaap:ForeignExchangeContractMember2020-12-310000003570us-gaap:ForeignExchangeContractMember2020-12-310000003570us-gaap:FairValueInputsLevel3Memberlng:PhysicalLiquefactionSupplyDerivativesMember2021-12-310000003570us-gaap:MarketApproachValuationTechniqueMembersrt:MinimumMemberus-gaap:FairValueInputsLevel3Memberlng:PhysicalLiquefactionSupplyDerivativesMember2021-01-012021-12-310000003570us-gaap:MarketApproachValuationTechniqueMemberus-gaap:FairValueInputsLevel3Membersrt:MaximumMemberlng:PhysicalLiquefactionSupplyDerivativesMember2021-01-012021-12-310000003570us-gaap:MarketApproachValuationTechniqueMemberus-gaap:FairValueInputsLevel3Memberlng:PhysicalLiquefactionSupplyDerivativesMembersrt:WeightedAverageMember2021-01-012021-12-310000003570srt:MinimumMemberus-gaap:FairValueInputsLevel3Memberlng:PhysicalLiquefactionSupplyDerivativesMemberus-gaap:ValuationTechniqueOptionPricingModelMember2021-01-012021-12-310000003570us-gaap:FairValueInputsLevel3Membersrt:MaximumMemberlng:PhysicalLiquefactionSupplyDerivativesMemberus-gaap:ValuationTechniqueOptionPricingModelMember2021-01-012021-12-310000003570us-gaap:FairValueInputsLevel3Memberlng:PhysicalLiquefactionSupplyDerivativesMembersrt:WeightedAverageMemberus-gaap:ValuationTechniqueOptionPricingModelMember2021-01-012021-12-310000003570lng:PhysicalLiquefactionSupplyDerivativesAndPhysicalLNGTradingDerivativeMember2020-12-310000003570lng:PhysicalLiquefactionSupplyDerivativesAndPhysicalLNGTradingDerivativeMember2019-12-310000003570lng:PhysicalLiquefactionSupplyDerivativesAndPhysicalLNGTradingDerivativeMember2018-12-310000003570lng:PhysicalLiquefactionSupplyDerivativesAndPhysicalLNGTradingDerivativeMember2021-01-012021-12-310000003570lng:PhysicalLiquefactionSupplyDerivativesAndPhysicalLNGTradingDerivativeMember2020-01-012020-12-310000003570lng:PhysicalLiquefactionSupplyDerivativesAndPhysicalLNGTradingDerivativeMember2019-01-012019-12-310000003570lng:PhysicalLiquefactionSupplyDerivativesAndPhysicalLNGTradingDerivativeMember2021-12-310000003570us-gaap:InterestRateContractMember2021-01-012021-12-310000003570lng:CCHInterestRateDerivativesMember2021-01-012021-12-310000003570us-gaap:GainLossOnDerivativeInstrumentsMemberlng:CCHInterestRateDerivativesMember2021-01-012021-12-310000003570us-gaap:GainLossOnDerivativeInstrumentsMemberlng:CCHInterestRateDerivativesMember2020-01-012020-12-310000003570us-gaap:GainLossOnDerivativeInstrumentsMemberlng:CCHInterestRateDerivativesMember2019-01-012019-12-310000003570us-gaap:GainLossOnDerivativeInstrumentsMemberlng:CCHInterestRateForwardStartDerivativesMember2021-01-012021-12-310000003570us-gaap:GainLossOnDerivativeInstrumentsMemberlng:CCHInterestRateForwardStartDerivativesMember2020-01-012020-12-310000003570us-gaap:GainLossOnDerivativeInstrumentsMemberlng:CCHInterestRateForwardStartDerivativesMember2019-01-012019-12-310000003570srt:MaximumMemberlng:PhysicalLiquefactionSupplyDerivativesMember2021-01-012021-12-310000003570lng:FinancialLiquefactionSupplyDerivativesMembersrt:MaximumMember2021-01-012021-12-310000003570lng:LNGTradingDerivativeMembersrt:MaximumMember2021-01-012021-12-310000003570us-gaap:CommodityContractMember2021-01-012021-12-31lng:tbtu0000003570lng:LNGTradingDerivativeMemberus-gaap:SalesMember2021-01-012021-12-310000003570lng:LNGTradingDerivativeMemberus-gaap:SalesMember2020-01-012020-12-310000003570lng:LNGTradingDerivativeMemberus-gaap:SalesMember2019-01-012019-12-310000003570lng:LNGTradingDerivativeMemberus-gaap:CostOfSalesMember2021-01-012021-12-310000003570lng:LNGTradingDerivativeMemberus-gaap:CostOfSalesMember2020-01-012020-12-310000003570lng:LNGTradingDerivativeMemberus-gaap:CostOfSalesMember2019-01-012019-12-310000003570us-gaap:PriceRiskDerivativeMemberus-gaap:SalesMember2021-01-012021-12-310000003570us-gaap:PriceRiskDerivativeMemberus-gaap:SalesMember2020-01-012020-12-310000003570us-gaap:PriceRiskDerivativeMemberus-gaap:SalesMember2019-01-012019-12-310000003570us-gaap:PriceRiskDerivativeMemberus-gaap:CostOfSalesMember2021-01-012021-12-310000003570us-gaap:PriceRiskDerivativeMemberus-gaap:CostOfSalesMember2020-01-012020-12-310000003570us-gaap:PriceRiskDerivativeMemberus-gaap:CostOfSalesMember2019-01-012019-12-310000003570srt:MaximumMemberus-gaap:ForeignExchangeContractMember2021-01-012021-12-310000003570us-gaap:ForeignExchangeContractMember2021-01-012021-12-310000003570us-gaap:SalesMemberus-gaap:ForeignExchangeContractMember2021-01-012021-12-310000003570us-gaap:SalesMemberus-gaap:ForeignExchangeContractMember2020-01-012020-12-310000003570us-gaap:SalesMemberus-gaap:ForeignExchangeContractMember2019-01-012019-12-310000003570us-gaap:DerivativeFinancialInstrumentsAssetsMemberlng:CCHInterestRateDerivativesMember2021-12-310000003570us-gaap:DerivativeFinancialInstrumentsAssetsMemberus-gaap:PriceRiskDerivativeMember2021-12-310000003570us-gaap:DerivativeFinancialInstrumentsAssetsMemberlng:LNGTradingDerivativeMember2021-12-310000003570us-gaap:DerivativeFinancialInstrumentsAssetsMemberus-gaap:ForeignExchangeContractMember2021-12-310000003570us-gaap:DerivativeFinancialInstrumentsAssetsMember2021-12-310000003570lng:NoncurrentDerivativeAssetsMemberlng:CCHInterestRateDerivativesMember2021-12-310000003570us-gaap:PriceRiskDerivativeMemberlng:NoncurrentDerivativeAssetsMember2021-12-310000003570lng:LNGTradingDerivativeMemberlng:NoncurrentDerivativeAssetsMember2021-12-310000003570lng:NoncurrentDerivativeAssetsMemberus-gaap:ForeignExchangeContractMember2021-12-310000003570lng:NoncurrentDerivativeAssetsMember2021-12-310000003570us-gaap:DerivativeFinancialInstrumentsLiabilitiesMemberlng:CCHInterestRateDerivativesMember2021-12-310000003570us-gaap:PriceRiskDerivativeMemberus-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2021-12-310000003570lng:LNGTradingDerivativeMemberus-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2021-12-310000003570us-gaap:DerivativeFinancialInstrumentsLiabilitiesMemberus-gaap:ForeignExchangeContractMember2021-12-310000003570us-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2021-12-310000003570lng:NoncurrentDerivativeLiabilitiesMemberlng:CCHInterestRateDerivativesMember2021-12-310000003570lng:NoncurrentDerivativeLiabilitiesMemberus-gaap:PriceRiskDerivativeMember2021-12-310000003570lng:NoncurrentDerivativeLiabilitiesMemberlng:LNGTradingDerivativeMember2021-12-310000003570lng:NoncurrentDerivativeLiabilitiesMemberus-gaap:ForeignExchangeContractMember2021-12-310000003570lng:NoncurrentDerivativeLiabilitiesMember2021-12-310000003570us-gaap:DerivativeFinancialInstrumentsAssetsMemberlng:CCHInterestRateDerivativesMember2020-12-310000003570us-gaap:DerivativeFinancialInstrumentsAssetsMemberus-gaap:PriceRiskDerivativeMember2020-12-310000003570us-gaap:DerivativeFinancialInstrumentsAssetsMemberlng:LNGTradingDerivativeMember2020-12-310000003570us-gaap:DerivativeFinancialInstrumentsAssetsMemberus-gaap:ForeignExchangeContractMember2020-12-310000003570us-gaap:DerivativeFinancialInstrumentsAssetsMember2020-12-310000003570lng:NoncurrentDerivativeAssetsMemberlng:CCHInterestRateDerivativesMember2020-12-310000003570us-gaap:PriceRiskDerivativeMemberlng:NoncurrentDerivativeAssetsMember2020-12-310000003570lng:LNGTradingDerivativeMemberlng:NoncurrentDerivativeAssetsMember2020-12-310000003570lng:NoncurrentDerivativeAssetsMemberus-gaap:ForeignExchangeContractMember2020-12-310000003570lng:NoncurrentDerivativeAssetsMember2020-12-310000003570us-gaap:DerivativeFinancialInstrumentsLiabilitiesMemberlng:CCHInterestRateDerivativesMember2020-12-310000003570us-gaap:PriceRiskDerivativeMemberus-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2020-12-310000003570lng:LNGTradingDerivativeMemberus-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2020-12-310000003570us-gaap:DerivativeFinancialInstrumentsLiabilitiesMemberus-gaap:ForeignExchangeContractMember2020-12-310000003570us-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2020-12-310000003570lng:NoncurrentDerivativeLiabilitiesMemberlng:CCHInterestRateDerivativesMember2020-12-310000003570lng:NoncurrentDerivativeLiabilitiesMemberus-gaap:PriceRiskDerivativeMember2020-12-310000003570lng:NoncurrentDerivativeLiabilitiesMemberlng:LNGTradingDerivativeMember2020-12-310000003570lng:NoncurrentDerivativeLiabilitiesMemberus-gaap:ForeignExchangeContractMember2020-12-310000003570lng:NoncurrentDerivativeLiabilitiesMember2020-12-310000003570lng:CCHInterestRateDerivativeAssetMember2021-12-310000003570lng:PriceRiskDerivativeAssetMember2021-12-310000003570lng:LNGTradingDerivativeAssetMember2021-12-310000003570lng:ForeignExchangeContractAssetMember2021-12-310000003570lng:CCHInterestRateDerivativeLiabilityMember2021-12-310000003570lng:PriceRiskDerivativeLiabilityMember2021-12-310000003570lng:LNGTradingDerivativesLiabilityMember2021-12-310000003570lng:ForeignExchangeContractLiabilityMember2021-12-310000003570lng:CCHInterestRateDerivativeAssetMember2020-12-310000003570lng:PriceRiskDerivativeAssetMember2020-12-310000003570lng:LNGTradingDerivativeAssetMember2020-12-310000003570lng:ForeignExchangeContractAssetMember2020-12-310000003570lng:CCHInterestRateDerivativeLiabilityMember2020-12-310000003570lng:PriceRiskDerivativeLiabilityMember2020-12-310000003570lng:LNGTradingDerivativesLiabilityMember2020-12-310000003570lng:ForeignExchangeContractLiabilityMember2020-12-310000003570lng:MidshipHoldingsLLCMember2021-01-012021-12-310000003570lng:MidshipHoldingsLLCMember2020-01-012020-12-310000003570lng:MidshipHoldingsLLCMember2019-01-012019-12-310000003570lng:MidshipHoldingsLLCMember2021-12-310000003570lng:MidshipHoldingsLLCMember2020-12-310000003570lng:CheniereEnergyPartnersLPMemberlng:CommonUnitsMember2021-12-310000003570lng:ClassBUnitsMemberlng:CheniereEnergyPartnersLPMemberlng:BlackstoneCqpHoldcoLpMember2012-01-012012-12-310000003570lng:CheniereEnergyPartnersGPLLCMemberlng:BlackstoneCqpHoldcoLpMember2021-01-012021-12-310000003570lng:CheniereEnergyPartnersGPLLCMemberlng:CheniereEnergyIncMember2021-01-012021-12-310000003570lng:CheniereEnergyPartnersGPLLCMemberlng:BlackstoneCQPHoldcoLPAndCheniereEnergyIncMember2021-01-012021-12-310000003570lng:BlackstoneCqpHoldcoLpMember2021-01-012021-12-310000003570lng:CheniereEnergyPartnersLPMemberlng:BlackstoneCqpHoldcoLpMemberlng:DirectorAppointmentEntitlementMinimumMember2021-01-012021-12-310000003570lng:CheniereEnergyPartnersLPMember2021-01-012021-12-310000003570lng:CheniereEnergyPartnersLPMember2020-12-310000003570lng:A2022SabinePassLiquefactionSeniorNotesMember2021-12-310000003570lng:A2022SabinePassLiquefactionSeniorNotesMember2020-12-310000003570lng:A2023SabinePassLiquefactionSeniorNotesMember2021-12-310000003570lng:A2023SabinePassLiquefactionSeniorNotesMember2020-12-310000003570lng:A2024SabinePassLiquefactionSeniorNotesMember2021-12-310000003570lng:A2024SabinePassLiquefactionSeniorNotesMember2020-12-310000003570lng:A2025SabinePassLiquefactionSeniorNotesMember2021-12-310000003570lng:A2025SabinePassLiquefactionSeniorNotesMember2020-12-310000003570lng:A2026SabinePassLiquefactionSeniorNotesMember2021-12-310000003570lng:A2026SabinePassLiquefactionSeniorNotesMember2020-12-310000003570lng:A2027SabinePassLiquefactionSeniorNotesMember2021-12-310000003570lng:A2027SabinePassLiquefactionSeniorNotesMember2020-12-310000003570lng:A2028SabinePassLiquefactionSeniorNotesMember2021-12-310000003570lng:A2028SabinePassLiquefactionSeniorNotesMember2020-12-310000003570lng:A2030SabinePassLiquefactionSeniorNotesMember2021-12-310000003570lng:A2030SabinePassLiquefactionSeniorNotesMember2020-12-310000003570lng:A2037SabinePassLiquefactionNotesMembersrt:WeightedAverageMember2021-12-310000003570lng:A2037SabinePassLiquefactionNotesMember2021-12-310000003570lng:A2037SabinePassLiquefactionNotesMember2020-12-310000003570lng:SabinePassLiquefactionSeniorNotesMember2021-12-310000003570lng:SabinePassLiquefactionSeniorNotesMember2020-12-310000003570lng:A2020SPLWorkingCapitalFacilityMember2021-12-310000003570lng:A2020SPLWorkingCapitalFacilityMember2020-12-310000003570lng:SabinePassLiquefactionMember2021-12-310000003570lng:SabinePassLiquefactionMember2020-12-310000003570lng:A2025CheniereEnergyPartnersSeniorNotesMember2021-12-310000003570lng:A2025CheniereEnergyPartnersSeniorNotesMember2020-12-310000003570lng:A2026CheniereEnergyPartnersSeniorNotesMember2021-12-310000003570lng:A2026CheniereEnergyPartnersSeniorNotesMember2020-12-310000003570lng:A2029CheniereEnergyPartnersSeniorNotesMember2021-12-310000003570lng:A2029CheniereEnergyPartnersSeniorNotesMember2020-12-310000003570lng:A2031CheniereEnergyPartnersSeniorNotesMember2021-12-310000003570lng:A2031CheniereEnergyPartnersSeniorNotesMember2020-12-310000003570lng:A2032CheniereEnergyPartnersSeniorNotesMember2021-12-310000003570lng:A2032CheniereEnergyPartnersSeniorNotesMember2020-12-310000003570lng:CheniereEnergyPartnersSeniorNotesMember2021-12-310000003570lng:CheniereEnergyPartnersSeniorNotesMember2020-12-310000003570lng:A2019CQPCreditFacilitiesMember2021-12-310000003570lng:A2019CQPCreditFacilitiesMember2020-12-310000003570lng:A2024CorpusChristiHoldingsSeniorNotesMember2021-12-310000003570lng:A2024CorpusChristiHoldingsSeniorNotesMember2020-12-310000003570lng:A2025CorpusChristiHoldingsSeniorNotesMember2021-12-310000003570lng:A2025CorpusChristiHoldingsSeniorNotesMember2020-12-310000003570lng:A2027CorpusChristiHoldingsSeniorNotesMember2021-12-310000003570lng:A2027CorpusChristiHoldingsSeniorNotesMember2020-12-310000003570lng:A2029CorpusChristiHoldingsSeniorNotesMember2021-12-310000003570lng:A2029CorpusChristiHoldingsSeniorNotesMember2020-12-310000003570lng:A2039CorpusChristiHoldingsSeniorNotesMembersrt:WeightedAverageMember2021-12-310000003570lng:A2039CorpusChristiHoldingsSeniorNotesMember2021-12-310000003570lng:A2039CorpusChristiHoldingsSeniorNotesMember2020-12-310000003570lng:CorpusChristiHoldingsSeniorNotesMember2021-12-310000003570lng:CorpusChristiHoldingsSeniorNotesMember2020-12-310000003570lng:A2015CCHTermLoanFacilityMember2021-12-310000003570lng:A2015CCHTermLoanFacilityMember2020-12-310000003570lng:CorpusChristiHoldingsWorkingCapitalFacilityMember2021-12-310000003570lng:CorpusChristiHoldingsWorkingCapitalFacilityMember2020-12-310000003570lng:CheniereCorpusChristiHoldingsLLCMember2021-12-310000003570lng:CheniereCorpusChristiHoldingsLLCMember2020-12-310000003570lng:A2028CheniereSeniorSecuredNotesMember2021-12-310000003570lng:A2028CheniereSeniorSecuredNotesMember2020-12-310000003570lng:A2021ConvertibleUnsecuredNotesMember2021-12-310000003570lng:A2021ConvertibleUnsecuredNotesMember2020-12-310000003570lng:A2045ConvertibleSeniorNotesMember2020-12-310000003570lng:CheniereRevolvingCreditFacilityMember2021-12-310000003570lng:CheniereRevolvingCreditFacilityMember2020-12-310000003570lng:CheniereTermLoanFacilityMember2021-12-310000003570lng:CheniereTermLoanFacilityMember2020-12-310000003570srt:ParentCompanyMember2021-12-310000003570srt:ParentCompanyMember2020-12-310000003570lng:CheniereMarketingTradeFinanceFacilitiesMember2021-12-310000003570lng:CheniereMarketingTradeFinanceFacilitiesMember2020-12-310000003570lng:A2020SPLWorkingCapitalFacilityMemberus-gaap:LondonInterbankOfferedRateLIBORMembersrt:MinimumMember2021-01-012021-12-31utr:Rate0000003570lng:A2020SPLWorkingCapitalFacilityMemberus-gaap:LondonInterbankOfferedRateLIBORMembersrt:MaximumMember2021-01-012021-12-310000003570lng:A2020SPLWorkingCapitalFacilityMembersrt:MinimumMemberus-gaap:BaseRateMember2021-01-012021-12-310000003570lng:A2020SPLWorkingCapitalFacilityMemberus-gaap:BaseRateMembersrt:MaximumMember2021-01-012021-12-310000003570us-gaap:LondonInterbankOfferedRateLIBORMembersrt:MinimumMemberlng:A2019CQPCreditFacilitiesMember2021-01-012021-12-310000003570us-gaap:LondonInterbankOfferedRateLIBORMembersrt:MaximumMemberlng:A2019CQPCreditFacilitiesMember2021-01-012021-12-310000003570srt:MinimumMemberus-gaap:BaseRateMemberlng:A2019CQPCreditFacilitiesMember2021-01-012021-12-310000003570us-gaap:BaseRateMembersrt:MaximumMemberlng:A2019CQPCreditFacilitiesMember2021-01-012021-12-310000003570us-gaap:LondonInterbankOfferedRateLIBORMemberlng:A2015CCHTermLoanFacilityMember2021-01-012021-12-310000003570lng:A2015CCHTermLoanFacilityMemberus-gaap:BaseRateMember2021-01-012021-12-310000003570us-gaap:LondonInterbankOfferedRateLIBORMembersrt:MinimumMemberlng:CorpusChristiHoldingsWorkingCapitalFacilityMember2021-01-012021-12-310000003570us-gaap:LondonInterbankOfferedRateLIBORMembersrt:MaximumMemberlng:CorpusChristiHoldingsWorkingCapitalFacilityMember2021-01-012021-12-310000003570srt:MinimumMemberus-gaap:BaseRateMemberlng:CorpusChristiHoldingsWorkingCapitalFacilityMember2021-01-012021-12-310000003570us-gaap:BaseRateMembersrt:MaximumMemberlng:CorpusChristiHoldingsWorkingCapitalFacilityMember2021-01-012021-12-310000003570us-gaap:LondonInterbankOfferedRateLIBORMembersrt:MinimumMemberlng:CheniereRevolvingCreditFacilityMember2021-01-012021-12-310000003570us-gaap:LondonInterbankOfferedRateLIBORMembersrt:MaximumMemberlng:CheniereRevolvingCreditFacilityMember2021-01-012021-12-310000003570srt:MinimumMemberus-gaap:BaseRateMemberlng:CheniereRevolvingCreditFacilityMember2021-01-012021-12-310000003570us-gaap:BaseRateMembersrt:MaximumMemberlng:CheniereRevolvingCreditFacilityMember2021-01-012021-12-310000003570lng:A2020SPLWorkingCapitalFacilityMember2021-01-012021-12-310000003570lng:A2019CQPCreditFacilitiesMember2021-01-012021-12-310000003570lng:CorpusChristiHoldingsWorkingCapitalFacilityMember2021-01-012021-12-310000003570lng:CheniereRevolvingCreditFacilityMember2021-01-012021-12-310000003570lng:A2015CCHTermLoanFacilityMember2021-01-012021-12-310000003570lng:A2045ConvertibleSeniorNotesMember2021-01-012021-12-310000003570us-gaap:ConvertibleDebtMember2021-01-012021-12-310000003570us-gaap:ConvertibleDebtMember2020-01-012020-12-310000003570us-gaap:ConvertibleDebtMember2019-01-012019-12-310000003570lng:DebtExcludingCapitalLeaseAndConvertibleDebtMember2021-01-012021-12-310000003570lng:DebtExcludingCapitalLeaseAndConvertibleDebtMember2020-01-012020-12-310000003570lng:DebtExcludingCapitalLeaseAndConvertibleDebtMember2019-01-012019-12-310000003570us-gaap:SeniorNotesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2021-12-310000003570us-gaap:SeniorNotesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2021-12-310000003570us-gaap:SeniorNotesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2020-12-310000003570us-gaap:SeniorNotesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2020-12-310000003570us-gaap:SeniorNotesMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2021-12-310000003570us-gaap:SeniorNotesMemberus-gaap:FairValueInputsLevel3Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2021-12-310000003570us-gaap:SeniorNotesMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2020-12-310000003570us-gaap:SeniorNotesMemberus-gaap:FairValueInputsLevel3Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2020-12-310000003570us-gaap:FairValueInputsLevel3Memberus-gaap:LineOfCreditMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2021-12-310000003570us-gaap:FairValueInputsLevel3Memberus-gaap:LineOfCreditMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2021-12-310000003570us-gaap:FairValueInputsLevel3Memberus-gaap:LineOfCreditMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2020-12-310000003570us-gaap:FairValueInputsLevel3Memberus-gaap:LineOfCreditMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2020-12-310000003570us-gaap:FairValueInputsLevel3Memberlng:A2021ConvertibleUnsecuredNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2021-12-310000003570us-gaap:FairValueInputsLevel3Memberlng:A2021ConvertibleUnsecuredNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2021-12-310000003570us-gaap:FairValueInputsLevel3Memberlng:A2021ConvertibleUnsecuredNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2020-12-310000003570us-gaap:FairValueInputsLevel3Memberlng:A2021ConvertibleUnsecuredNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2020-12-310000003570us-gaap:FairValueInputsLevel1Memberlng:A2045ConvertibleSeniorNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2021-12-310000003570us-gaap:FairValueInputsLevel1Memberlng:A2045ConvertibleSeniorNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2021-12-310000003570us-gaap:FairValueInputsLevel1Memberlng:A2045ConvertibleSeniorNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2020-12-310000003570us-gaap:FairValueInputsLevel1Memberlng:A2045ConvertibleSeniorNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2020-12-310000003570lng:OperatingLeaseAssetsMember2021-12-310000003570lng:OperatingLeaseAssetsMember2020-12-310000003570us-gaap:PropertyPlantAndEquipmentMember2021-12-310000003570us-gaap:PropertyPlantAndEquipmentMember2020-12-310000003570lng:CurrentOperatingLeaseLiabilitiesMember2021-12-310000003570lng:CurrentOperatingLeaseLiabilitiesMember2020-12-310000003570us-gaap:OtherCurrentLiabilitiesMember2021-12-310000003570us-gaap:OtherCurrentLiabilitiesMember2020-12-310000003570lng:NonCurrentOperatingLeaseLiabilitiesMember2021-12-310000003570lng:NonCurrentOperatingLeaseLiabilitiesMember2020-12-310000003570us-gaap:OtherNoncurrentLiabilitiesMember2021-12-310000003570us-gaap:OtherNoncurrentLiabilitiesMember2020-12-310000003570us-gaap:OperatingExpenseMember2021-01-012021-12-310000003570us-gaap:OperatingExpenseMember2020-01-012020-12-310000003570us-gaap:OperatingExpenseMember2019-01-012019-12-310000003570lng:DepreciationandAmortizationExpenseMember2021-01-012021-12-310000003570lng:DepreciationandAmortizationExpenseMember2020-01-012020-12-310000003570lng:DepreciationandAmortizationExpenseMember2019-01-012019-12-310000003570us-gaap:InterestExpenseMember2021-01-012021-12-310000003570us-gaap:InterestExpenseMember2020-01-012020-12-310000003570us-gaap:InterestExpenseMember2019-01-012019-12-310000003570srt:MaximumMember2021-12-310000003570lng:SuspensionFeesandLNGCoverDamagesRevenueMember2020-01-012020-12-310000003570lng:SuspensionFeesandLNGCoverDamagesRevenueMemberlng:SubsequentPeriodMember2020-01-012020-12-310000003570lng:SuspensionFeesandLNGCoverDamagesRevenueMember2019-01-012019-12-310000003570lng:SuspensionFeesandLNGCoverDamagesRevenueMember2021-01-012021-12-310000003570lng:LiquefiedNaturalGasProcuredFromThirdPartiesMember2021-01-012021-12-310000003570lng:LiquefiedNaturalGasProcuredFromThirdPartiesMember2020-01-012020-12-310000003570lng:LiquefiedNaturalGasProcuredFromThirdPartiesMember2019-01-012019-12-310000003570lng:TUACustomersMember2021-01-012021-12-310000003570lng:EachTUACustomerMember2021-01-012021-12-310000003570lng:TerminalUseAgreementRegasificationCapacityPartialMember2021-01-012021-12-310000003570lng:TerminalUseAgreementRegasificationCapacityPartialMember2020-01-012020-12-310000003570lng:TerminalUseAgreementRegasificationCapacityPartialMember2019-01-012019-12-3100000035702022-01-01lng:LiquefiedNaturalGasMember2021-12-310000003570lng:LiquefiedNaturalGasMember2021-01-012020-12-3100000035702022-01-01lng:RegasificationServiceMember2021-12-310000003570lng:RegasificationServiceMember2021-01-012020-12-3100000035702022-01-012021-12-3100000035702021-01-012020-12-310000003570lng:NaturalGasSupplyAgreementMember2021-01-012021-12-310000003570lng:CorpusChristiLiquefactionMemberus-gaap:PriceRiskDerivativeMemberlng:NaturalGasSupplyAgreementMember2021-12-310000003570lng:CorpusChristiLiquefactionMemberus-gaap:PriceRiskDerivativeMemberlng:NaturalGasSupplyAgreementMember2020-12-310000003570lng:CorpusChristiLiquefactionMemberlng:NaturalGasSupplyAgreementMember2021-01-012021-12-310000003570lng:CorpusChristiLiquefactionMemberlng:NaturalGasSupplyAgreementMember2020-01-012020-12-310000003570lng:CorpusChristiLiquefactionMemberlng:NaturalGasSupplyAgreementMember2019-01-012019-12-310000003570lng:CorpusChristiLiquefactionMemberus-gaap:PriceRiskDerivativeMemberlng:NaturalGasSupplyAgreementMember2021-01-012021-12-310000003570lng:CorpusChristiLiquefactionMemberus-gaap:PriceRiskDerivativeMemberlng:NaturalGasSupplyAgreementMember2020-01-012020-12-310000003570lng:CorpusChristiLiquefactionMemberus-gaap:PriceRiskDerivativeMemberlng:NaturalGasSupplyAgreementMember2019-01-012019-12-310000003570lng:NaturalGasTransportationAndStorageAgreementsMembersrt:MaximumMemberlng:SabinePassLiquefactionLLCAndCheniereCreoleTrailPipelineLPMember2021-01-012021-12-310000003570lng:NaturalGasTransportationAndStorageAgreementsMemberlng:SabinePassLiquefactionLLCAndCheniereCreoleTrailPipelineLPMember2021-01-012021-12-310000003570lng:NaturalGasTransportationAndStorageAgreementsMemberlng:SabinePassLiquefactionLLCAndCheniereCreoleTrailPipelineLPMember2020-01-012020-12-310000003570lng:NaturalGasTransportationAndStorageAgreementsMemberlng:SabinePassLiquefactionLLCAndCheniereCreoleTrailPipelineLPMember2021-12-310000003570lng:NaturalGasTransportationAndStorageAgreementsMemberlng:SabinePassLiquefactionLLCAndCheniereCreoleTrailPipelineLPMember2020-12-310000003570lng:NaturalGasTransportationAndStorageAgreementsMemberlng:CorpusChristiLiquefactionMember2021-01-012021-12-310000003570lng:NaturalGasTransportationAndStorageAgreementsMemberlng:CorpusChristiLiquefactionMember2020-01-012020-12-310000003570lng:NaturalGasTransportationAndStorageAgreementsMemberlng:CorpusChristiLiquefactionMember2021-12-310000003570lng:NaturalGasTransportationAndStorageAgreementsMemberlng:CorpusChristiLiquefactionMember2020-12-310000003570lng:OperationAndMaintenanceAgreementMemberus-gaap:ProductAndServiceOtherMemberlng:CheniereLNGOMServicesLLCMember2021-01-012021-12-310000003570lng:OperationAndMaintenanceAgreementMemberus-gaap:ProductAndServiceOtherMemberlng:CheniereLNGOMServicesLLCMember2020-01-012020-12-310000003570lng:OperationAndMaintenanceAgreementMemberus-gaap:ProductAndServiceOtherMemberlng:CheniereLNGOMServicesLLCMember2019-01-012019-12-310000003570lng:OperationAndMaintenanceAgreementMemberlng:CheniereLNGOMServicesLLCMember2020-12-310000003570lng:OperationAndMaintenanceAgreementMemberlng:CheniereLNGOMServicesLLCMember2021-12-310000003570us-gaap:DomesticCountryMember2021-12-310000003570us-gaap:StateAndLocalJurisdictionMember2021-12-310000003570us-gaap:ForeignCountryMember2021-12-310000003570us-gaap:DomesticCountryMemberus-gaap:InvestmentCreditMember2021-12-310000003570lng:A2011IncentivePlanMemberus-gaap:CommonStockMember2021-12-310000003570lng:A2020IncentivePlanMemberus-gaap:CommonStockMember2021-12-310000003570lng:EquityAwardsMember2021-01-012021-12-310000003570lng:EquityAwardsMember2020-01-012020-12-310000003570lng:EquityAwardsMember2019-01-012019-12-310000003570lng:LiabilityAwardsMember2021-01-012021-12-310000003570lng:LiabilityAwardsMember2020-01-012020-12-310000003570lng:LiabilityAwardsMember2019-01-012019-12-310000003570us-gaap:PerformanceSharesMember2021-01-012021-12-310000003570us-gaap:RestrictedStockMember2021-12-310000003570us-gaap:RestrictedStockMember2021-01-012021-12-310000003570lng:RestrictedShareUnitAndPerformanceStockUnitAwardsMember2021-12-310000003570lng:RestrictedShareUnitAndPerformanceStockUnitAwardsMember2021-01-012021-12-310000003570us-gaap:RestrictedStockMember2020-12-310000003570us-gaap:RestrictedStockMember2020-01-012020-12-310000003570us-gaap:RestrictedStockMember2019-01-012019-12-310000003570us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310000003570us-gaap:PerformanceSharesMembersrt:MinimumMember2021-01-012021-12-310000003570us-gaap:PerformanceSharesMembersrt:MaximumMember2021-01-012021-12-310000003570lng:RestrictedShareUnitAndPerformanceStockUnitAwardsMember2020-12-310000003570us-gaap:CommonStockMember2021-01-012021-12-310000003570lng:RestrictedShareUnitAndPerformanceStockUnitAwardsMember2020-01-012020-12-310000003570lng:RestrictedShareUnitAndPerformanceStockUnitAwardsMember2019-01-012019-12-310000003570us-gaap:PhantomShareUnitsPSUsMember2021-01-012021-12-310000003570us-gaap:PhantomShareUnitsPSUsMember2020-01-012020-12-310000003570us-gaap:PhantomShareUnitsPSUsMember2019-01-012019-12-310000003570lng:UnvestedStockMember2021-01-012021-12-310000003570lng:UnvestedStockMember2020-01-012020-12-310000003570lng:UnvestedStockMember2019-01-012019-12-310000003570lng:A2021CheniereConvertibleUnsecuredNotesMember2021-01-012021-12-310000003570lng:A2021CheniereConvertibleUnsecuredNotesMember2020-01-012020-12-310000003570lng:A2021CheniereConvertibleUnsecuredNotesMember2019-01-012019-12-310000003570lng:A2025CCHHoldCoIIConvertibleNotesMember2021-01-012021-12-310000003570lng:A2025CCHHoldCoIIConvertibleNotesMember2020-01-012020-12-310000003570lng:A2025CCHHoldCoIIConvertibleNotesMember2019-01-012019-12-310000003570lng:A2045ConvertibleSeniorNotesMember2021-01-012021-12-310000003570lng:A2045ConvertibleSeniorNotesMember2020-01-012020-12-310000003570lng:A2045ConvertibleSeniorNotesMember2019-01-012019-12-310000003570lng:InitialBoardApprovalMember2021-01-012021-12-310000003570lng:InitialBoardApprovalMember2021-12-310000003570lng:SubsequentBoardApprovedIncreaseMember2021-12-310000003570lng:SubsequentBoardApprovedIncreaseMember2021-01-012021-12-310000003570srt:ParentCompanyMember2021-01-012021-12-310000003570srt:ParentCompanyMember2020-01-012020-12-310000003570srt:ParentCompanyMember2019-01-012019-12-310000003570srt:ParentCompanyMemberus-gaap:SubsequentEventMember2022-01-252022-01-250000003570lng:BechtelEPCContractTrainSixMemberlng:SabinePassLiquefactionMember2021-01-012021-12-310000003570lng:BechtelEPCContractTrainSixMemberlng:SabinePassLiquefactionMember2021-12-310000003570srt:MaximumMemberlng:SabinePassLiquefactionCorpusChristiLiquefactionandCheniereCorpusChristiLiquefactionStageIIIMemberus-gaap:InventoriesMember2021-01-012021-12-310000003570lng:SabinePassLiquefactionAndCorpusChristiLiquefactionMembersrt:MaximumMemberus-gaap:NaturalGasGatheringTransportationMarketingAndProcessingMember2021-01-012021-12-310000003570lng:SabinePassLiquefactionMembersrt:MaximumMemberus-gaap:NaturalGasStorageMember2021-01-012021-12-310000003570lng:CorpusChristiLiquefactionMembersrt:MaximumMemberus-gaap:NaturalGasStorageMember2021-01-012021-12-310000003570lng:SabinePassLiquefactionCorpusChristiLiquefactionandCheniereCorpusChristiLiquefactionStageIIIMemberlng:NaturalGasSupplyTransportationAndStorageServiceAgreementsMember2021-01-012021-12-310000003570lng:SabinePassLiquefactionCorpusChristiLiquefactionandCheniereCorpusChristiLiquefactionStageIIIMemberlng:NaturalGasSupplyTransportationAndStorageServiceAgreementsMember2021-12-310000003570lng:A2022EOGIPMAgreementMemberlng:EOGResourcesIncMember2021-01-012021-12-310000003570lng:A2022EOGGasSupplyAgreementMemberlng:EOGResourcesIncMember2021-01-012021-12-310000003570us-gaap:SalesRevenueNetMemberlng:CustomerAMemberus-gaap:CustomerConcentrationRiskMember2021-01-012021-12-310000003570us-gaap:SalesRevenueNetMemberlng:CustomerAMemberus-gaap:CustomerConcentrationRiskMember2020-01-012020-12-310000003570us-gaap:SalesRevenueNetMemberlng:CustomerAMemberus-gaap:CustomerConcentrationRiskMember2019-01-012019-12-310000003570lng:AccountsReceivableAndContractAssetsMemberlng:CustomerAMemberus-gaap:CustomerConcentrationRiskMember2021-01-012021-12-310000003570lng:AccountsReceivableAndContractAssetsMemberlng:CustomerAMemberus-gaap:CustomerConcentrationRiskMember2020-01-012020-12-310000003570lng:CustomerBMemberus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2021-01-012021-12-310000003570lng:CustomerBMemberus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2020-01-012020-12-310000003570lng:CustomerBMemberus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2019-01-012019-12-310000003570lng:CustomerBMemberlng:AccountsReceivableAndContractAssetsMemberus-gaap:CustomerConcentrationRiskMember2020-01-012020-12-310000003570lng:CustomerCMemberus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2021-01-012021-12-310000003570lng:CustomerCMemberus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2020-01-012020-12-310000003570lng:CustomerCMemberus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2019-01-012019-12-310000003570us-gaap:SalesRevenueNetMemberlng:CustomerDMemberus-gaap:CustomerConcentrationRiskMember2020-01-012020-12-310000003570us-gaap:SalesRevenueNetMemberlng:CustomerDMemberus-gaap:CustomerConcentrationRiskMember2019-01-012019-12-310000003570country:IEus-gaap:GeographicConcentrationRiskMember2021-01-012021-12-310000003570country:IEus-gaap:GeographicConcentrationRiskMember2020-01-012020-12-310000003570country:IEus-gaap:GeographicConcentrationRiskMember2019-01-012019-12-310000003570country:SGus-gaap:GeographicConcentrationRiskMember2021-01-012021-12-310000003570country:SGus-gaap:GeographicConcentrationRiskMember2020-01-012020-12-310000003570country:SGus-gaap:GeographicConcentrationRiskMember2019-01-012019-12-310000003570country:KRus-gaap:GeographicConcentrationRiskMember2021-01-012021-12-310000003570country:KRus-gaap:GeographicConcentrationRiskMember2020-01-012020-12-310000003570country:KRus-gaap:GeographicConcentrationRiskMember2019-01-012019-12-310000003570country:ESus-gaap:GeographicConcentrationRiskMember2021-01-012021-12-310000003570country:ESus-gaap:GeographicConcentrationRiskMember2020-01-012020-12-310000003570country:ESus-gaap:GeographicConcentrationRiskMember2019-01-012019-12-310000003570country:INus-gaap:GeographicConcentrationRiskMember2021-01-012021-12-310000003570country:INus-gaap:GeographicConcentrationRiskMember2020-01-012020-12-310000003570country:INus-gaap:GeographicConcentrationRiskMember2019-01-012019-12-310000003570country:USus-gaap:GeographicConcentrationRiskMember2021-01-012021-12-310000003570country:USus-gaap:GeographicConcentrationRiskMember2020-01-012020-12-310000003570country:USus-gaap:GeographicConcentrationRiskMember2019-01-012019-12-310000003570country:GBus-gaap:GeographicConcentrationRiskMember2021-01-012021-12-310000003570country:GBus-gaap:GeographicConcentrationRiskMember2020-01-012020-12-310000003570country:GBus-gaap:GeographicConcentrationRiskMember2019-01-012019-12-310000003570lng:OtherCountriesMemberus-gaap:GeographicConcentrationRiskMember2021-01-012021-12-310000003570lng:OtherCountriesMemberus-gaap:GeographicConcentrationRiskMember2020-01-012020-12-310000003570lng:OtherCountriesMemberus-gaap:GeographicConcentrationRiskMember2019-01-012019-12-310000003570srt:ParentCompanyMember2019-12-310000003570srt:ParentCompanyMember2018-12-310000003570srt:ParentCompanyMemberlng:OperatingLeaseAssetsMember2021-12-310000003570srt:ParentCompanyMemberlng:OperatingLeaseAssetsMember2020-12-310000003570srt:ParentCompanyMemberlng:CurrentOperatingLeaseLiabilitiesMember2021-12-310000003570srt:ParentCompanyMemberlng:CurrentOperatingLeaseLiabilitiesMember2020-12-310000003570lng:NonCurrentOperatingLeaseLiabilitiesMembersrt:ParentCompanyMember2021-12-310000003570lng:NonCurrentOperatingLeaseLiabilitiesMembersrt:ParentCompanyMember2020-12-310000003570srt:ParentCompanyMemberus-gaap:GeneralAndAdministrativeExpenseMember2021-01-012021-12-310000003570srt:ParentCompanyMemberus-gaap:GeneralAndAdministrativeExpenseMember2020-01-012020-12-310000003570srt:ParentCompanyMemberlng:InitialBoardApprovalMember2019-06-032019-06-030000003570srt:ParentCompanyMemberlng:InitialBoardApprovalMember2019-06-030000003570srt:ParentCompanyMemberlng:SubsequentBoardApprovedIncreaseMember2021-09-070000003570srt:ParentCompanyMemberlng:SubsequentBoardApprovedIncreaseMember2021-01-012021-12-310000003570us-gaap:AllowanceForCreditLossMember2020-12-310000003570us-gaap:AllowanceForCreditLossMember2021-01-012021-12-310000003570us-gaap:AllowanceForCreditLossMember2021-12-310000003570us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2020-12-310000003570us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2021-01-012021-12-310000003570us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2021-12-310000003570us-gaap:AllowanceForCreditLossMember2019-12-310000003570us-gaap:AllowanceForCreditLossMember2020-01-012020-12-310000003570us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2019-12-310000003570us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2020-01-012020-12-310000003570us-gaap:AllowanceForCreditLossMember2018-12-310000003570us-gaap:AllowanceForCreditLossMember2019-01-012019-12-310000003570us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2018-12-310000003570us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2019-01-012019-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2021

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number 001-16383

CHENIERE ENERGY, INC.

(Exact name of registrant as specified in its charter)

| | | | | |

| Delaware | 95-4352386 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

700 Milam Street, Suite 1900

Houston, Texas 77002

(Address of principal executive offices) (Zip Code)

(713) 375-5000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, $ 0.003 par value | LNG | NYSE American |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | |

| Large accelerated filer | ☒ | | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | | Smaller reporting company | ☐ |

| | | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the registrant’s Common Stock held by non-affiliates of the registrant was approximately $21.8 billion as of June 30, 2021.

As of February 18, 2022, the issuer had 254,397,855 shares of Common Stock outstanding.

Documents incorporated by reference: The definitive proxy statement for the registrant’s Annual Meeting of Stockholders (to be filed within 120 days of the close of the registrant’s fiscal year) is incorporated by reference into Part III.

CHENIERE ENERGY, INC.

TABLE OF CONTENTS

DEFINITIONS

As used in this annual report, the terms listed below have the following meanings:

Common Industry and Other Terms

| | | | | | | | |

| Bcf | | billion cubic feet |

| Bcf/d | | billion cubic feet per day |

| Bcf/yr | | billion cubic feet per year |

| Bcfe | | billion cubic feet equivalent |

| DOE | | U.S. Department of Energy |

| EPC | | engineering, procurement and construction |

| FERC | | Federal Energy Regulatory Commission |

| FTA countries | | countries with which the United States has a free trade agreement providing for national treatment for trade in natural gas |

| GAAP | | generally accepted accounting principles in the United States |

| Henry Hub | | the final settlement price (in USD per MMBtu) for the New York Mercantile Exchange’s Henry Hub natural gas futures contract for the month in which a relevant cargo’s delivery window is scheduled to begin |

| IPM agreements | | integrated production marketing agreements in which the gas producer sells to us gas on a global LNG index price, less a fixed liquefaction fee, shipping and other costs |

| LIBOR | | London Interbank Offered Rate |

| LNG | | liquefied natural gas, a product of natural gas that, through a refrigeration process, has been cooled to a liquid state, which occupies a volume that is approximately 1/600th of its gaseous state |

| MMBtu | | million British thermal units; one British thermal unit measures the amount of energy required to raise the temperature of one pound of water by one degree Fahrenheit |

| mtpa | | million tonnes per annum |

| | |

| non-FTA countries | | countries with which the United States does not have a free trade agreement providing for national treatment for trade in natural gas and with which trade is permitted |

| SEC | | U.S. Securities and Exchange Commission |

| SOFR | | Secured Overnight Financing Rate |

| SPA | | LNG sale and purchase agreement |

| TBtu | | trillion British thermal units; one British thermal unit measures the amount of energy required to raise the temperature of one pound of water by one degree Fahrenheit |

| Train | | an industrial facility comprised of a series of refrigerant compressor loops used to cool natural gas into LNG |

| TUA | | terminal use agreement |

Abbreviated Legal Entity Structure

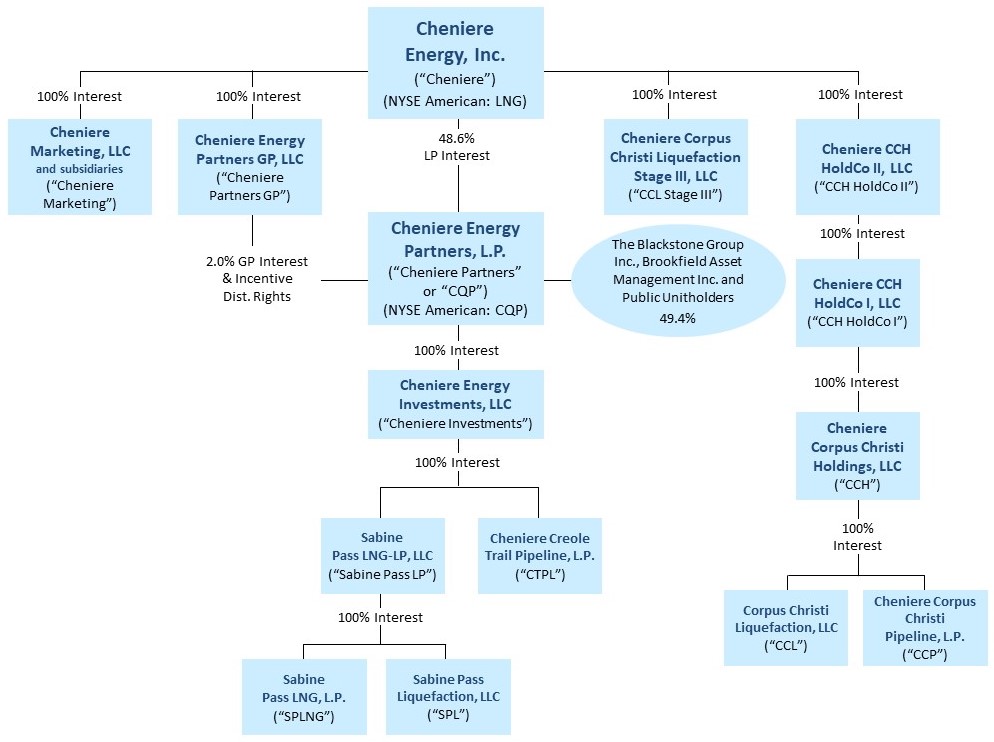

The following diagram depicts our abbreviated legal entity structure as of December 31, 2021, including our ownership of certain subsidiaries, and the references to these entities used in this annual report:

Unless the context requires otherwise, references to “Cheniere,” the “Company,” “we,” “us” and “our” refer to Cheniere Energy, Inc. and its consolidated subsidiaries, including our publicly traded subsidiary, CQP.

Unless the context requires otherwise, references to the “CCH Group” refer to CCH, CCL and CCP, collectively.

CAUTIONARY STATEMENT

REGARDING FORWARD-LOOKING STATEMENTS

This annual report contains certain statements that are, or may be deemed to be, “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements, other than statements of historical or present facts or conditions, included herein or incorporated herein by reference are “forward-looking statements.” Included among “forward-looking statements” are, among other things:

•statements that we expect to commence or complete construction of our proposed LNG terminals, liquefaction facilities, pipeline facilities or other projects, or any expansions or portions thereof, by certain dates, or at all;

•statements regarding future levels of domestic and international natural gas production, supply or consumption or future levels of LNG imports into or exports from North America and other countries worldwide or purchases of natural gas, regardless of the source of such information, or the transportation or other infrastructure or demand for and prices related to natural gas, LNG or other hydrocarbon products;

•statements regarding any financing transactions or arrangements, or our ability to enter into such transactions;

•statements relating to Cheniere’s capital deployment, including intent, ability, extent, and timing of capital expenditures, debt repayment, dividends, and share repurchases;

•statements regarding our future sources of liquidity and cash requirements;

•statements relating to the construction of our Trains and pipelines, including statements concerning the engagement of any EPC contractor or other contractor and the anticipated terms and provisions of any agreement with any EPC or other contractor, and anticipated costs related thereto;

•statements regarding any SPA or other agreement to be entered into or performed substantially in the future, including any revenues anticipated to be received and the anticipated timing thereof, and statements regarding the amounts of total LNG regasification, natural gas liquefaction or storage capacities that are, or may become, subject to contracts;

•statements regarding counterparties to our commercial contracts, construction contracts and other contracts;

•statements regarding our planned development and construction of additional Trains or pipelines, including the financing of such Trains or pipelines;

•statements that our Trains, when completed, will have certain characteristics, including amounts of liquefaction capacities;

•statements regarding our business strategy, our strengths, our business and operation plans or any other plans, forecasts, projections, or objectives, including anticipated revenues, capital expenditures, maintenance and operating costs and cash flows, any or all of which are subject to change;

•statements regarding legislative, governmental, regulatory, administrative or other public body actions, approvals, requirements, permits, applications, filings, investigations, proceedings or decisions;

•statements regarding our anticipated LNG and natural gas marketing activities;

•statements regarding the COVID-19 pandemic and its impact on our business and operating results, including any customers not taking delivery of LNG cargoes, the ongoing creditworthiness of our contractual counterparties, any disruptions in our operations or construction of our Trains and the health and safety of our employees, and on our customers, the global economy and the demand for LNG;

•any other statements that relate to non-historical or future information; and

All of these types of statements, other than statements of historical or present facts or conditions, are forward-looking statements. In some cases, forward-looking statements can be identified by terminology such as “may,” “will,” “could,” “should,” “achieve,” “anticipate,” “believe,” “contemplate,” “continue,” “estimate,” “expect,” “intend,” “plan,” “potential,” “predict,” “project,” “pursue,” “target,” the negative of such terms or other comparable terminology. The forward-looking statements contained in this annual report are largely based on our expectations, which reflect estimates and assumptions made by our management. These estimates and assumptions reflect our best judgment based on currently known market conditions and other factors. Although we believe that such estimates are reasonable, they are inherently uncertain and involve a number of risks and uncertainties beyond our control. In addition, assumptions may prove to be inaccurate. We caution that the

CAUTIONARY STATEMENT

REGARDING FORWARD-LOOKING STATEMENTS

forward-looking statements contained in this annual report are not guarantees of future performance and that such statements may not be realized or the forward-looking statements or events may not occur. Actual results may differ materially from those anticipated or implied in forward-looking statements as a result of a variety of factors described in this annual report and in the other reports and other information that we file with the SEC. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by these risk factors. These forward-looking statements speak only as of the date made, and other than as required by law, we undertake no obligation to update or revise any forward-looking statement or provide reasons why actual results may differ, whether as a result of new information, future events or otherwise.

PART I

ITEMS 1. AND 2. BUSINESS AND PROPERTIES

General

Cheniere Energy, Inc. (“Cheniere”), a Delaware corporation, is a Houston-based energy infrastructure company primarily engaged in LNG-related businesses. We provide clean, secure and affordable LNG to integrated energy companies, utilities and energy trading companies around the world. We aspire to conduct our business in a safe and responsible manner, delivering a reliable, competitive and integrated source of LNG to our customers.

LNG is natural gas (methane) in liquid form. The LNG we produce is shipped all over the world, turned back into natural gas (called “regasification”) and then transported via pipeline to homes and businesses and used as an energy source that is essential for heating, cooking and other industrial uses. Natural gas is a cleaner-burning, abundant and affordable source of energy. When LNG is converted back to natural gas, it can be used instead of coal, which reduces the amount of pollution traditionally produced from burning fossil fuels, like sulfur dioxide and particulate matter that enters the air we breathe. Additionally, compared to coal, it produces significantly fewer carbon emissions. By liquefying natural gas, we are able to reduce its volume by 600 times so that we can load it onto special LNG carriers designed to keep the LNG cold and in liquid form for efficient transport overseas.

We own and operate the Sabine Pass LNG terminal in Louisiana, one of the largest LNG production facilities in the world, through our ownership interest in and management agreements with Cheniere Energy Partners, L.P. (“CQP”), which is a publicly traded limited partnership that we created in 2007. As of December 31, 2021, we owned 100% of the general partner interest and 48.6% of the limited partner interest in CQP.

CQP owns the Sabine Pass LNG terminal located in Cameron Parish, Louisiana, which has natural gas liquefaction facilities consisting of six operational Trains, with Train 6 which achieved substantial completion on February 4, 2022, for a total production capacity of approximately 30 mtpa of LNG (the “SPL Project”). The Sabine Pass LNG terminal also has operational regasification facilities that include five LNG storage tanks with aggregate capacity of approximately 17 Bcfe, two existing marine berths and one under construction that can each accommodate vessels with nominal capacity of up to 266,000 cubic meters and vaporizers with regasification capacity of approximately 4 Bcf/d. CQP also owns a 94-mile pipeline through its subsidiary, Cheniere Creole Trail Pipeline, L.P. (“CTPL”), that interconnects the Sabine Pass LNG terminal with a number of large interstate pipelines (the “Creole Trail Pipeline”).

We also own the Corpus Christi LNG terminal near Corpus Christi, Texas, which has natural gas liquefaction facilities consisting of three operational Trains for a total production capacity of approximately 15 mtpa of LNG. Additionally, we operate a 21.5-mile natural gas supply pipeline that interconnects the Corpus Christi LNG terminal with several interstate and intrastate natural gas pipelines (the “Corpus Christi Pipeline” and together with the Trains, the “CCL Project”) through our subsidiaries Corpus Christi Liquefaction, LLC (“CCL”) and Cheniere Corpus Christi Pipeline, L.P. (“CCP”), respectively, as part of the CCH Group. The CCL Project also includes three LNG storage tanks with aggregate capacity of approximately 10 Bcfe and two marine berths that can each accommodate vessels with nominal capacity of up to 266,000 cubic meters.

We are the largest producer of LNG in the United States and the second largest LNG producer globally, based on the total production capacity of our asset platforms of approximately 40 mtpa as of December 31, 2021, which increased to approximately 45 mtpa upon our ninth Train which achieved substantial completion on February 4, 2022. We are also the largest consumer of natural gas in the United States on a daily basis, at full utilization of the Trains in operation.

Additionally, separate from the CCH Group, we are developing an expansion of the Corpus Christi LNG terminal adjacent to the CCL Project (“Corpus Christi Stage 3”) through our subsidiary Cheniere Corpus Christi Liquefaction Stage III, LLC (“CCL Stage III”) for up to seven midscale Trains with an expected total production capacity of over 10 mtpa of LNG. We received approval from FERC in November 2019 to site, construct and operate the expansion project.

Our customer arrangements provide us with significant, stable and long-term cash flows. As further discussed below, we contract our anticipated production capacity under SPAs, in which our customers are generally required to pay a fixed fee with respect to the contracted volumes irrespective of their election to cancel or suspend deliveries of LNG cargoes, and under IPM agreements, in which the gas producer sells to us gas on a global LNG index price, less a fixed liquefaction fee, shipping and

other costs. We have contracted approximately 95% of the total production capacity from the SPL Project and the CCL Project (collectively, the “Liquefaction Projects”), including those contracts executed to support Corpus Christi Stage 3. Substantially all of our contracted capacity is from contracts with terms exceeding 10 years. Excluding contracts with terms less than 10 years, our SPAs and IPM agreements had approximately 17 years of weighted average remaining life as of December 31, 2021. We also market and sell LNG produced by the Liquefaction Projects that is not required for other customers through our integrated marketing function. For further discussion of the contracted future cash flows under our revenue arrangements, see Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources.

We remain focused on operational excellence and customer satisfaction. Increasing demand for LNG has allowed us to expand our liquefaction infrastructure in a financially disciplined manner. We have increased available liquefaction capacity at our Liquefaction Projects as a result of debottlenecking and other optimization projects. We hold significant land positions at both the Sabine Pass LNG terminal and the Corpus Christi LNG terminal, which provide opportunity for further liquefaction capacity expansion. The development of these sites or other projects, including infrastructure projects in support of natural gas supply and LNG demand, will require, among other things, acceptable commercial and financing arrangements before we can make a final investment decision (“FID”).

Additionally, we are committed to the responsible and proactive management of our most important environmental, social and governance (“ESG”) impacts, risks and opportunities. We published our 2020 Corporate Responsibility (“CR”) report, which details our strategy and progress on ESG issues, as well as our efforts on integrating climate considerations into our business strategy and taking a leadership position on increased environmental transparency, including conducting a climate scenario analysis and our plan to provide LNG customers with Cargo Emission Tags. In August 2021, we also announced a peer-reviewed LNG life cycle assessment study which allows for improved greenhouse gas emissions assessment, which was published in the American Chemical Society Sustainable Chemistry & Engineering Journal. Our CR report is available at cheniere.com/IMPACT. Information on our website, including the CR report, is not incorporated by reference into this Annual Report on Form 10-K. For further discussion on social and governance matters, see Human Capital Resources.

Our Business Strategy

Our primary business strategy is to be a full service LNG provider to worldwide end-use customers. We accomplish this objective by owning, constructing and operating LNG and natural gas infrastructure facilities to meet our long-term customers’ energy demands and:

•safely, efficiently and reliably operating and maintaining our assets;

•procuring natural gas and pipeline transport capacity to our facilities;

•providing value to our customers through destination flexibility, options not to lift cargoes and diversity of price and geography;

•continuing to secure long-term customer contracts to support our planned expansion, including the FID of Corpus Christi Stage 3;

•completing our expansion construction projects safely, on-time and on-budget;

•maximizing the production of LNG to serve our customers and generating steady and stable revenues and operating cash flows;

•maintaining a flexible capital structure to finance the acquisition, development, construction and operation of the energy assets needed to supply our customers;

•executing our “all of the above” capital allocation strategy, focused on strengthening our balance sheet, funding financially disciplined growth and returning capital to our shareholders; and

•strategically identifying actionable environmental solutions.

Our Business

We shipped our first LNG cargo in February 2016 and as of February 18, 2022, over 2,000 cumulative LNG cargoes totaling approximately 140 million tonnes of LNG have been produced, loaded and exported from the Liquefaction Projects. Cheniere’s LNG has been shipped to 37 countries and regions around the world.

Sabine Pass LNG Terminal

Liquefaction Facilities

The SPL Project is one of the largest LNG production facilities in the world. Through CQP we operate six Trains, including Train 6 which achieved substantial completion on February 4, 2022, and two marine berths at the SPL Project, and are constructing a third marine berth. The SPL Project has a lump sum turnkey contract with Bechtel Oil, Gas and Chemicals, Inc. (“Bechtel”) for the EPC of Train 6 of the SPL Project. The following table summarizes the project completion and construction status of Train 6 as of December 31, 2021:

| | | | | | | | | | | |

| | SPL Train 6 |

| Overall project completion percentage | | 99.5% |

| Completion percentage of: | | |

| Engineering | | 100.0% |

| Procurement | | 100.0% |

| Subcontract work | | 99.6% |

| Construction | | 98.8% |

| Date of substantial completion | | February 4, 2022 |

The following summarizes the volumes of natural gas for which we have received approvals from FERC to site, construct and operate the SPL Project and the orders we have received from the DOE authorizing the export of domestically produced LNG by vessel from the Sabine Pass LNG terminal through December 31, 2050:

| | | | | | | | | | | | | | | | | | | | | | | |

| FERC Approved Volume | | DOE Approved Volume |

| (in Bcf/yr) | | (in mtpa) | | (in Bcf/yr) | | (in mtpa) |

| FTA countries | 1,661.94 | | 33 | | 1,661.94 | | 33 |

| Non-FTA countries | 1,661.94 | | 33 | | 1,509.3 (1) | | 30 |

(1)The authorization for an additional 152.64 Bcf/yr (approximately 3 mtpa) of natural gas is currently pending.

Natural Gas Supply, Transportation and Storage

SPL has secured natural gas feedstock for the Sabine Pass LNG terminal through long-term natural gas supply agreements. Additionally, to ensure that SPL is able to transport natural gas feedstock to the Sabine Pass LNG terminal and manage inventory levels, it has entered into transportation precedent and other agreements to secure firm pipeline transportation and storage capacity from third parties.

Regasification Facilities

The Sabine Pass LNG terminal has operational regasification capacity of approximately 4 Bcf/d and aggregate LNG storage capacity of approximately 17 Bcfe. SPLNG has entered into two long-term, third party TUAs for an aggregate of 2 Bcf/d, under which SPLNG’s customers are required to pay fixed monthly fees, whether or not they use the regasification capacity they have reserved at the Sabine Pass LNG terminal. The remaining approximately 2 Bcf/d of capacity has been reserved under a TUA by SPL.

Corpus Christi LNG Terminal

Liquefaction Facilities

We operate three Trains and two marine berths at the CCL Project. We commenced commercial operating activities of Trains 1, 2 and 3 of the CCL Project in February 2019, August 2019 and March 2021, respectively. Separate from the CCH Group, we are also developing Corpus Christi Stage 3 with up to seven midscale Trains through our subsidiary CCL Stage III, adjacent to the CCL Project.

The following summarizes the volumes of natural gas for which we have received approvals from FERC to site, construct and operate the CCL Project and Corpus Christi Stage 3 and the orders we have received from the DOE authorizing the export of domestically produced LNG by vessel from the Corpus Christi LNG terminal through December 31, 2050:

| | | | | | | | | | | | | | | | | | | | | | | |

| FERC Approved Volume | | DOE Approved Volume |

| (in Bcf/yr) | | (in mtpa) | | (in Bcf/yr) | | (in mtpa) |

| CCL Project: | | | | | | | |

| FTA countries | 875.16 | | 17 | | 875.16 | | 17 |

| Non-FTA countries | 875.16 | | 17 | | 767 (1) | | 15 |

| Corpus Christi Stage 3: | | | | | | | |

| FTA countries | 582.14 | | 11.45 | | 582.14 | | 11.45 |

| Non-FTA countries | 582.14 | | 11.45 | | 582.14 | | 11.45 |

(1)The authorization for an additional 108.16 Bcf/yr (approximately 2 mtpa) of natural gas is currently pending.

Pipeline Facilities

In November 2019, the FERC authorized CCP to construct and operate the pipeline for Corpus Christi Stage 3. The pipeline will be designed to transport 1.5 Bcf/d of natural gas feedstock required by Corpus Christi Stage 3 from the existing regional natural gas pipeline grid.

Natural Gas Supply, Transportation and Storage

CCL has secured natural gas feedstock for the Corpus Christi LNG terminal through traditional long-term natural gas supply and IPM agreements. CCL Stage III has also entered into long-term natural gas supply contracts with third parties, including IPM agreements, and anticipates continuing to enter into such agreements, in order to secure natural gas feedstock for Corpus Christi Stage 3. Additionally, to ensure that CCL is able to transport and manage the natural gas feedstock to the Corpus Christi LNG terminal, it has entered into transportation precedent and other agreements to secure firm pipeline transportation and storage capacity from third parties.

Final Investment Decision for Corpus Christi Stage 3

FID for Corpus Christi Stage 3 will be subject to, among other things, entering into an EPC contract for the project and securing the necessary financing arrangements.

Marketing

We market and sell LNG produced by the Liquefaction Projects that is not required for other customers through Cheniere Marketing, our integrated marketing function. We have, and continue to develop, a portfolio of long-, medium- and short-term SPAs to transport and unload commercial LNG cargoes to locations worldwide.

Customers

The following table shows customers with revenues of 10% or greater of total revenues from external customers:

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Percentage of Total Revenues from External Customers |

| | | | Year Ended December 31, |

| | | | | | 2021 | | 2020 | | 2019 |

BG Gulf Coast LNG, LLC and affiliates | | | | | | 12% | | 14% | | 16% |

Naturgy LNG GOM, Limited | | | | | | 12% | | 12% | | 10% |

Korea Gas Corporation | | | | | | 10% | | 10% | | 11% |

GAIL (India) Limited | | | | | | * | | 10% | | 11% |

| | | | | | | | | | |

* Less than 10%

All of the above customers contribute to our LNG revenues through SPA contracts.

Governmental Regulation

Our LNG terminals and pipelines are subject to extensive regulation under federal, state and local statutes, rules, regulations and laws. These laws require that we engage in consultations with appropriate federal and state agencies and that we obtain and maintain applicable permits and other authorizations. These rigorous regulatory requirements increase the cost of construction and operation, and failure to comply with such laws could result in substantial penalties and/or loss of necessary authorizations.

Federal Energy Regulatory Commission

The design, construction, operation, maintenance and expansion of our liquefaction facilities, the import or export of LNG and the purchase and transportation of natural gas in interstate commerce through our pipelines (including our Creole Trail Pipeline and Corpus Christi Pipeline) are highly regulated activities subject to the jurisdiction of the FERC pursuant to the Natural Gas Act of 1938, as amended (the “NGA”). Under the NGA, the FERC’s jurisdiction generally extends to the transportation of natural gas in interstate commerce, to the sale for resale of natural gas in interstate commerce, to natural gas companies engaged in such transportation or sale and to the construction, operation, maintenance and expansion of LNG terminals and interstate natural gas pipelines.

The FERC’s authority to regulate interstate natural gas pipelines and the services that they provide generally includes regulation of:

•rates and charges, and terms and conditions for natural gas transportation, storage and related services;

•the certification and construction of new facilities and modification of existing facilities;

•the extension and abandonment of services and facilities;

•the administration of accounting and financial reporting regulations, including the maintenance of accounts and records;

•the acquisition and disposition of facilities;

•the initiation and discontinuation of services; and

•various other matters.

Under the NGA, our pipelines are not permitted to unduly discriminate or grant undue preference as to rates or the terms and conditions of service to any shipper, including its own marketing affiliate. Those rates, terms and conditions must be public, and on file with the FERC. In contrast to pipeline regulation, the FERC does not require LNG terminal owners to provide open-access services at cost-based or regulated rates. Although the provisions that codified FERC’s policy in this area expired on January 1, 2015, we see no indication that the FERC intends to change its policy in this area. On February 18, 2022,

FERC updated its 1999 Policy Statement on certification of new interstate natural gas facilities and the framework for FERC’s decision-making process, which would now include, among other things, reasonably foreseeable greenhouse gas emissions that may be attributable to the project and the project’s impact on environmental justice communities. These FERC changes are the first revision in more than 20 years to FERC’s policy for the certification of new interstate natural gas pipeline projects under Section 7 of the NGA. The updated Policy Statement has more limited applicability to LNG projects regulated under Section 3 of the Natural Gas Act. While the impact on our future projects and expansions is not known at this time, we do not expect it to have a material adverse effect on our operations.

We are permitted to make sales of natural gas for resale in interstate commerce pursuant to a blanket marketing certificate granted by the FERC with the issuance of our Certificate of Public Convenience and Necessity to our marketing affiliates. Our sales of natural gas will be affected by the availability, terms and cost of pipeline transportation. As noted above, the price and terms of access to pipeline transportation are subject to extensive federal and state regulation.

In order to site, construct and operate our LNG terminals, we received and are required to maintain authorizations from the FERC under Section 3 of the NGA as well as other material governmental and regulatory approvals and permits. The Energy Policy Act of 2005 (the “EPAct”) amended Section 3 of the NGA to establish or clarify the FERC’s exclusive authority to approve or deny an application for the siting, construction, expansion or operation of LNG terminals, unless specifically provided otherwise in the EPAct, amendments to the NGA. For example, nothing in the EPAct amendments to the NGA were intended to affect otherwise applicable law related to any other federal agency’s authorities or responsibilities related to LNG terminals or those of a state acting under federal law.