0000003570false--12-312021Q21LIBOR or base rateLIBOR or base rateLIBOR or base rateLIBOR or base rateLIBOR or base rateone year00000035702021-01-012021-06-30xbrli:shares00000035702021-07-30iso4217:USD0000003570lng:LiquefiedNaturalGasMember2021-04-012021-06-300000003570lng:LiquefiedNaturalGasMember2020-04-012020-06-300000003570lng:LiquefiedNaturalGasMember2021-01-012021-06-300000003570lng:LiquefiedNaturalGasMember2020-01-012020-06-300000003570lng:RegasificationServiceMember2021-04-012021-06-300000003570lng:RegasificationServiceMember2020-04-012020-06-300000003570lng:RegasificationServiceMember2021-01-012021-06-300000003570lng:RegasificationServiceMember2020-01-012020-06-300000003570us-gaap:ProductAndServiceOtherMember2021-04-012021-06-300000003570us-gaap:ProductAndServiceOtherMember2020-04-012020-06-300000003570us-gaap:ProductAndServiceOtherMember2021-01-012021-06-300000003570us-gaap:ProductAndServiceOtherMember2020-01-012020-06-3000000035702021-04-012021-06-3000000035702020-04-012020-06-3000000035702020-01-012020-06-300000003570lng:CheniereTermLoanFacilityMembersrt:ParentCompanyMember2021-01-012021-06-30iso4217:USDxbrli:shares00000035702021-06-3000000035702020-12-310000003570lng:CheniereEnergyPartnersLPMember2021-06-300000003570us-gaap:CommonStockMember2020-12-310000003570us-gaap:TreasuryStockMember2020-12-310000003570us-gaap:AdditionalPaidInCapitalMember2020-12-310000003570us-gaap:RetainedEarningsMember2020-12-310000003570us-gaap:NoncontrollingInterestMember2020-12-310000003570us-gaap:CommonStockMember2021-01-012021-03-310000003570us-gaap:TreasuryStockMember2021-01-012021-03-310000003570us-gaap:AdditionalPaidInCapitalMember2021-01-012021-03-310000003570us-gaap:RetainedEarningsMember2021-01-012021-03-310000003570us-gaap:NoncontrollingInterestMember2021-01-012021-03-3100000035702021-01-012021-03-3100000035702021-03-310000003570us-gaap:CommonStockMember2021-03-310000003570us-gaap:TreasuryStockMember2021-03-310000003570us-gaap:AdditionalPaidInCapitalMember2021-03-310000003570us-gaap:RetainedEarningsMember2021-03-310000003570us-gaap:NoncontrollingInterestMember2021-03-310000003570us-gaap:CommonStockMember2021-04-012021-06-300000003570us-gaap:TreasuryStockMember2021-04-012021-06-300000003570us-gaap:AdditionalPaidInCapitalMember2021-04-012021-06-300000003570us-gaap:RetainedEarningsMember2021-04-012021-06-300000003570us-gaap:NoncontrollingInterestMember2021-04-012021-06-300000003570us-gaap:CommonStockMember2021-06-300000003570us-gaap:TreasuryStockMember2021-06-300000003570us-gaap:AdditionalPaidInCapitalMember2021-06-300000003570us-gaap:RetainedEarningsMember2021-06-300000003570us-gaap:NoncontrollingInterestMember2021-06-3000000035702019-12-310000003570us-gaap:CommonStockMember2019-12-310000003570us-gaap:TreasuryStockMember2019-12-310000003570us-gaap:AdditionalPaidInCapitalMember2019-12-310000003570us-gaap:RetainedEarningsMember2019-12-310000003570us-gaap:NoncontrollingInterestMember2019-12-310000003570us-gaap:CommonStockMember2020-01-012020-03-310000003570us-gaap:TreasuryStockMember2020-01-012020-03-310000003570us-gaap:AdditionalPaidInCapitalMember2020-01-012020-03-310000003570us-gaap:RetainedEarningsMember2020-01-012020-03-310000003570us-gaap:NoncontrollingInterestMember2020-01-012020-03-3100000035702020-01-012020-03-3100000035702020-03-310000003570us-gaap:CommonStockMember2020-03-310000003570us-gaap:TreasuryStockMember2020-03-310000003570us-gaap:AdditionalPaidInCapitalMember2020-03-310000003570us-gaap:RetainedEarningsMember2020-03-310000003570us-gaap:NoncontrollingInterestMember2020-03-310000003570us-gaap:CommonStockMember2020-04-012020-06-300000003570us-gaap:TreasuryStockMember2020-04-012020-06-300000003570us-gaap:AdditionalPaidInCapitalMember2020-04-012020-06-300000003570us-gaap:RetainedEarningsMember2020-04-012020-06-300000003570us-gaap:NoncontrollingInterestMember2020-04-012020-06-3000000035702020-06-300000003570us-gaap:CommonStockMember2020-06-300000003570us-gaap:TreasuryStockMember2020-06-300000003570us-gaap:AdditionalPaidInCapitalMember2020-06-300000003570us-gaap:RetainedEarningsMember2020-06-300000003570us-gaap:NoncontrollingInterestMember2020-06-30lng:unitlng:trains0000003570lng:SabinePassLNGTerminalMember2021-01-012021-06-30lng:milliontonnesutr:Ylng:itemutr:mi0000003570lng:CreoleTrailPipelineMember2021-01-012021-06-30xbrli:pure0000003570lng:CheniereEnergyPartnersLPMember2021-01-012021-06-300000003570lng:CorpusChristiLNGTerminalMember2021-01-012021-06-300000003570lng:CorpusChristiPipelineMember2021-01-012021-06-300000003570lng:CorpusChristiLNGTerminalExpansionMembersrt:MaximumMember2021-01-012021-06-300000003570lng:CorpusChristiLNGTerminalExpansionMember2021-01-012021-06-300000003570lng:A2045ConvertibleSeniorNotesMember2021-06-300000003570lng:A2045ConvertibleSeniorNotesMemberus-gaap:AccountingStandardsUpdate202006Member2021-06-300000003570lng:SPLProjectMember2021-06-300000003570lng:SPLProjectMember2020-12-310000003570lng:CCLProjectMember2021-06-300000003570lng:CCLProjectMember2020-12-310000003570lng:SubsidiaryCashMember2021-06-300000003570lng:SubsidiaryCashMember2020-12-310000003570lng:SabinePassLiquefactionAndCorpusChristiLiquefactionMember2021-06-300000003570lng:SabinePassLiquefactionAndCorpusChristiLiquefactionMember2020-12-310000003570lng:CheniereMarketingLLCMember2021-06-300000003570lng:CheniereMarketingLLCMember2020-12-310000003570lng:MaterialsInventoryMember2021-06-300000003570lng:MaterialsInventoryMember2020-12-310000003570lng:LiquefiedNaturalGasInTransitInventoryMember2021-06-300000003570lng:LiquefiedNaturalGasInTransitInventoryMember2020-12-310000003570lng:LiquefiedNaturalGasInventoryMember2021-06-300000003570lng:LiquefiedNaturalGasInventoryMember2020-12-310000003570lng:NaturalGasInventoryMember2021-06-300000003570lng:NaturalGasInventoryMember2020-12-310000003570lng:OtherInventoryMember2021-06-300000003570lng:OtherInventoryMember2020-12-310000003570lng:LngTerminalMember2021-06-300000003570lng:LngTerminalMember2020-12-310000003570lng:LngSiteAndRelatedCostsNetMember2021-06-300000003570lng:LngSiteAndRelatedCostsNetMember2020-12-310000003570us-gaap:ConstructionInProgressMember2021-06-300000003570us-gaap:ConstructionInProgressMember2020-12-310000003570lng:LngTerminalCostsMember2021-06-300000003570lng:LngTerminalCostsMember2020-12-310000003570us-gaap:OfficeEquipmentMember2021-06-300000003570us-gaap:OfficeEquipmentMember2020-12-310000003570us-gaap:FurnitureAndFixturesMember2021-06-300000003570us-gaap:FurnitureAndFixturesMember2020-12-310000003570us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2021-06-300000003570us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2020-12-310000003570us-gaap:LeaseholdImprovementsMember2021-06-300000003570us-gaap:LeaseholdImprovementsMember2020-12-310000003570us-gaap:LandMember2021-06-300000003570us-gaap:LandMember2020-12-310000003570us-gaap:OtherCapitalizedPropertyPlantAndEquipmentMember2021-06-300000003570us-gaap:OtherCapitalizedPropertyPlantAndEquipmentMember2020-12-310000003570lng:FixedAssetsMember2021-06-300000003570lng:FixedAssetsMember2020-12-310000003570us-gaap:AssetsHeldUnderCapitalLeasesMember2021-06-300000003570us-gaap:AssetsHeldUnderCapitalLeasesMember2020-12-310000003570us-gaap:FairValueInputsLevel1Memberlng:CCHInterestRateDerivativesMember2021-06-300000003570lng:CCHInterestRateDerivativesMemberus-gaap:FairValueInputsLevel2Member2021-06-300000003570lng:CCHInterestRateDerivativesMemberus-gaap:FairValueInputsLevel3Member2021-06-300000003570lng:CCHInterestRateDerivativesMember2021-06-300000003570us-gaap:FairValueInputsLevel1Memberlng:CCHInterestRateDerivativesMember2020-12-310000003570lng:CCHInterestRateDerivativesMemberus-gaap:FairValueInputsLevel2Member2020-12-310000003570lng:CCHInterestRateDerivativesMemberus-gaap:FairValueInputsLevel3Member2020-12-310000003570lng:CCHInterestRateDerivativesMember2020-12-310000003570us-gaap:PriceRiskDerivativeMemberus-gaap:FairValueInputsLevel1Member2021-06-300000003570us-gaap:PriceRiskDerivativeMemberus-gaap:FairValueInputsLevel2Member2021-06-300000003570us-gaap:PriceRiskDerivativeMemberus-gaap:FairValueInputsLevel3Member2021-06-300000003570us-gaap:PriceRiskDerivativeMember2021-06-300000003570us-gaap:PriceRiskDerivativeMemberus-gaap:FairValueInputsLevel1Member2020-12-310000003570us-gaap:PriceRiskDerivativeMemberus-gaap:FairValueInputsLevel2Member2020-12-310000003570us-gaap:PriceRiskDerivativeMemberus-gaap:FairValueInputsLevel3Member2020-12-310000003570us-gaap:PriceRiskDerivativeMember2020-12-310000003570lng:LNGTradingDerivativeMemberus-gaap:FairValueInputsLevel1Member2021-06-300000003570lng:LNGTradingDerivativeMemberus-gaap:FairValueInputsLevel2Member2021-06-300000003570lng:LNGTradingDerivativeMemberus-gaap:FairValueInputsLevel3Member2021-06-300000003570lng:LNGTradingDerivativeMember2021-06-300000003570lng:LNGTradingDerivativeMemberus-gaap:FairValueInputsLevel1Member2020-12-310000003570lng:LNGTradingDerivativeMemberus-gaap:FairValueInputsLevel2Member2020-12-310000003570lng:LNGTradingDerivativeMemberus-gaap:FairValueInputsLevel3Member2020-12-310000003570lng:LNGTradingDerivativeMember2020-12-310000003570us-gaap:FairValueInputsLevel1Memberus-gaap:ForeignExchangeContractMember2021-06-300000003570us-gaap:ForeignExchangeContractMemberus-gaap:FairValueInputsLevel2Member2021-06-300000003570us-gaap:ForeignExchangeContractMemberus-gaap:FairValueInputsLevel3Member2021-06-300000003570us-gaap:ForeignExchangeContractMember2021-06-300000003570us-gaap:FairValueInputsLevel1Memberus-gaap:ForeignExchangeContractMember2020-12-310000003570us-gaap:ForeignExchangeContractMemberus-gaap:FairValueInputsLevel2Member2020-12-310000003570us-gaap:ForeignExchangeContractMemberus-gaap:FairValueInputsLevel3Member2020-12-310000003570us-gaap:ForeignExchangeContractMember2020-12-310000003570lng:PhysicalLiquefactionSupplyDerivativesMemberus-gaap:FairValueInputsLevel3Member2021-06-300000003570lng:PhysicalLiquefactionSupplyDerivativesMemberus-gaap:MarketApproachValuationTechniqueMemberus-gaap:FairValueInputsLevel3Membersrt:MinimumMember2021-01-012021-06-300000003570lng:PhysicalLiquefactionSupplyDerivativesMemberus-gaap:MarketApproachValuationTechniqueMembersrt:MaximumMemberus-gaap:FairValueInputsLevel3Member2021-01-012021-06-300000003570srt:WeightedAverageMemberlng:PhysicalLiquefactionSupplyDerivativesMemberus-gaap:MarketApproachValuationTechniqueMemberus-gaap:FairValueInputsLevel3Member2021-01-012021-06-300000003570us-gaap:ValuationTechniqueOptionPricingModelMemberlng:PhysicalLiquefactionSupplyDerivativesMemberus-gaap:FairValueInputsLevel3Membersrt:MinimumMember2021-01-012021-06-300000003570us-gaap:ValuationTechniqueOptionPricingModelMemberlng:PhysicalLiquefactionSupplyDerivativesMembersrt:MaximumMemberus-gaap:FairValueInputsLevel3Member2021-01-012021-06-300000003570srt:WeightedAverageMemberus-gaap:ValuationTechniqueOptionPricingModelMemberlng:PhysicalLiquefactionSupplyDerivativesMemberus-gaap:FairValueInputsLevel3Member2021-01-012021-06-300000003570lng:PhysicalLNGTradingDerivativeMemberus-gaap:FairValueInputsLevel3Member2021-06-300000003570us-gaap:ValuationTechniqueOptionPricingModelMemberlng:PhysicalLNGTradingDerivativeMemberus-gaap:FairValueInputsLevel3Membersrt:MinimumMember2021-01-012021-06-300000003570us-gaap:ValuationTechniqueOptionPricingModelMemberlng:PhysicalLNGTradingDerivativeMembersrt:MaximumMemberus-gaap:FairValueInputsLevel3Member2021-01-012021-06-300000003570srt:WeightedAverageMemberus-gaap:ValuationTechniqueOptionPricingModelMemberlng:PhysicalLNGTradingDerivativeMemberus-gaap:FairValueInputsLevel3Member2021-01-012021-06-300000003570lng:PhysicalLiquefactionSupplyDerivativesAndPhysicalLNGTradingDerivativeMember2021-03-310000003570lng:PhysicalLiquefactionSupplyDerivativesAndPhysicalLNGTradingDerivativeMember2020-03-310000003570lng:PhysicalLiquefactionSupplyDerivativesAndPhysicalLNGTradingDerivativeMember2020-12-310000003570lng:PhysicalLiquefactionSupplyDerivativesAndPhysicalLNGTradingDerivativeMember2019-12-310000003570lng:PhysicalLiquefactionSupplyDerivativesAndPhysicalLNGTradingDerivativeMember2021-04-012021-06-300000003570lng:PhysicalLiquefactionSupplyDerivativesAndPhysicalLNGTradingDerivativeMember2020-04-012020-06-300000003570lng:PhysicalLiquefactionSupplyDerivativesAndPhysicalLNGTradingDerivativeMember2021-01-012021-06-300000003570lng:PhysicalLiquefactionSupplyDerivativesAndPhysicalLNGTradingDerivativeMember2020-01-012020-06-300000003570lng:PhysicalLiquefactionSupplyDerivativesAndPhysicalLNGTradingDerivativeMember2021-06-300000003570lng:PhysicalLiquefactionSupplyDerivativesAndPhysicalLNGTradingDerivativeMember2020-06-300000003570us-gaap:InterestRateContractMember2021-01-012021-06-300000003570lng:CCHInterestRateDerivativesMember2021-01-012021-06-300000003570us-gaap:GainLossOnDerivativeInstrumentsMemberlng:CCHInterestRateDerivativesMember2021-04-012021-06-300000003570us-gaap:GainLossOnDerivativeInstrumentsMemberlng:CCHInterestRateDerivativesMember2020-04-012020-06-300000003570us-gaap:GainLossOnDerivativeInstrumentsMemberlng:CCHInterestRateDerivativesMember2021-01-012021-06-300000003570us-gaap:GainLossOnDerivativeInstrumentsMemberlng:CCHInterestRateDerivativesMember2020-01-012020-06-300000003570us-gaap:GainLossOnDerivativeInstrumentsMemberlng:CCHInterestRateForwardStartDerivativesMember2021-04-012021-06-300000003570us-gaap:GainLossOnDerivativeInstrumentsMemberlng:CCHInterestRateForwardStartDerivativesMember2020-04-012020-06-300000003570us-gaap:GainLossOnDerivativeInstrumentsMemberlng:CCHInterestRateForwardStartDerivativesMember2021-01-012021-06-300000003570us-gaap:GainLossOnDerivativeInstrumentsMemberlng:CCHInterestRateForwardStartDerivativesMember2020-01-012020-06-300000003570lng:PhysicalLiquefactionSupplyDerivativesMembersrt:MaximumMember2021-01-012021-06-300000003570lng:FinancialLiquefactionSupplyDerivativesMembersrt:MaximumMember2021-01-012021-06-300000003570lng:LNGTradingDerivativeMembersrt:MaximumMember2021-01-012021-06-300000003570us-gaap:CommodityContractMember2021-01-012021-06-30lng:tbtu0000003570lng:LNGTradingDerivativeMemberus-gaap:SalesMember2021-04-012021-06-300000003570lng:LNGTradingDerivativeMemberus-gaap:SalesMember2020-04-012020-06-300000003570lng:LNGTradingDerivativeMemberus-gaap:SalesMember2021-01-012021-06-300000003570lng:LNGTradingDerivativeMemberus-gaap:SalesMember2020-01-012020-06-300000003570lng:LNGTradingDerivativeMemberus-gaap:CostOfSalesMember2021-04-012021-06-300000003570lng:LNGTradingDerivativeMemberus-gaap:CostOfSalesMember2020-04-012020-06-300000003570lng:LNGTradingDerivativeMemberus-gaap:CostOfSalesMember2021-01-012021-06-300000003570lng:LNGTradingDerivativeMemberus-gaap:CostOfSalesMember2020-01-012020-06-300000003570us-gaap:SalesMemberus-gaap:PriceRiskDerivativeMember2021-04-012021-06-300000003570us-gaap:SalesMemberus-gaap:PriceRiskDerivativeMember2020-04-012020-06-300000003570us-gaap:SalesMemberus-gaap:PriceRiskDerivativeMember2021-01-012021-06-300000003570us-gaap:SalesMemberus-gaap:PriceRiskDerivativeMember2020-01-012020-06-300000003570us-gaap:PriceRiskDerivativeMemberus-gaap:CostOfSalesMember2021-04-012021-06-300000003570us-gaap:PriceRiskDerivativeMemberus-gaap:CostOfSalesMember2020-04-012020-06-300000003570us-gaap:PriceRiskDerivativeMemberus-gaap:CostOfSalesMember2021-01-012021-06-300000003570us-gaap:PriceRiskDerivativeMemberus-gaap:CostOfSalesMember2020-01-012020-06-300000003570us-gaap:ForeignExchangeContractMembersrt:MaximumMember2021-01-012021-06-300000003570us-gaap:ForeignExchangeContractMember2021-01-012021-06-300000003570us-gaap:SalesMemberus-gaap:ForeignExchangeContractMember2021-04-012021-06-300000003570us-gaap:SalesMemberus-gaap:ForeignExchangeContractMember2020-04-012020-06-300000003570us-gaap:SalesMemberus-gaap:ForeignExchangeContractMember2021-01-012021-06-300000003570us-gaap:SalesMemberus-gaap:ForeignExchangeContractMember2020-01-012020-06-300000003570us-gaap:DerivativeFinancialInstrumentsAssetsMemberlng:CCHInterestRateDerivativesMember2021-06-300000003570us-gaap:PriceRiskDerivativeMemberus-gaap:DerivativeFinancialInstrumentsAssetsMember2021-06-300000003570lng:LNGTradingDerivativeMemberus-gaap:DerivativeFinancialInstrumentsAssetsMember2021-06-300000003570us-gaap:ForeignExchangeContractMemberus-gaap:DerivativeFinancialInstrumentsAssetsMember2021-06-300000003570us-gaap:DerivativeFinancialInstrumentsAssetsMember2021-06-300000003570lng:NoncurrentDerivativeAssetsMemberlng:CCHInterestRateDerivativesMember2021-06-300000003570us-gaap:PriceRiskDerivativeMemberlng:NoncurrentDerivativeAssetsMember2021-06-300000003570lng:LNGTradingDerivativeMemberlng:NoncurrentDerivativeAssetsMember2021-06-300000003570lng:NoncurrentDerivativeAssetsMemberus-gaap:ForeignExchangeContractMember2021-06-300000003570lng:NoncurrentDerivativeAssetsMember2021-06-300000003570us-gaap:DerivativeFinancialInstrumentsLiabilitiesMemberlng:CCHInterestRateDerivativesMember2021-06-300000003570us-gaap:PriceRiskDerivativeMemberus-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2021-06-300000003570lng:LNGTradingDerivativeMemberus-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2021-06-300000003570us-gaap:DerivativeFinancialInstrumentsLiabilitiesMemberus-gaap:ForeignExchangeContractMember2021-06-300000003570us-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2021-06-300000003570lng:NoncurrentDerivativeLiabilitiesMemberlng:CCHInterestRateDerivativesMember2021-06-300000003570lng:NoncurrentDerivativeLiabilitiesMemberus-gaap:PriceRiskDerivativeMember2021-06-300000003570lng:NoncurrentDerivativeLiabilitiesMemberlng:LNGTradingDerivativeMember2021-06-300000003570lng:NoncurrentDerivativeLiabilitiesMemberus-gaap:ForeignExchangeContractMember2021-06-300000003570lng:NoncurrentDerivativeLiabilitiesMember2021-06-300000003570us-gaap:DerivativeFinancialInstrumentsAssetsMemberlng:CCHInterestRateDerivativesMember2020-12-310000003570us-gaap:PriceRiskDerivativeMemberus-gaap:DerivativeFinancialInstrumentsAssetsMember2020-12-310000003570lng:LNGTradingDerivativeMemberus-gaap:DerivativeFinancialInstrumentsAssetsMember2020-12-310000003570us-gaap:ForeignExchangeContractMemberus-gaap:DerivativeFinancialInstrumentsAssetsMember2020-12-310000003570us-gaap:DerivativeFinancialInstrumentsAssetsMember2020-12-310000003570lng:NoncurrentDerivativeAssetsMemberlng:CCHInterestRateDerivativesMember2020-12-310000003570us-gaap:PriceRiskDerivativeMemberlng:NoncurrentDerivativeAssetsMember2020-12-310000003570lng:LNGTradingDerivativeMemberlng:NoncurrentDerivativeAssetsMember2020-12-310000003570lng:NoncurrentDerivativeAssetsMemberus-gaap:ForeignExchangeContractMember2020-12-310000003570lng:NoncurrentDerivativeAssetsMember2020-12-310000003570us-gaap:DerivativeFinancialInstrumentsLiabilitiesMemberlng:CCHInterestRateDerivativesMember2020-12-310000003570us-gaap:PriceRiskDerivativeMemberus-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2020-12-310000003570lng:LNGTradingDerivativeMemberus-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2020-12-310000003570us-gaap:DerivativeFinancialInstrumentsLiabilitiesMemberus-gaap:ForeignExchangeContractMember2020-12-310000003570us-gaap:DerivativeFinancialInstrumentsLiabilitiesMember2020-12-310000003570lng:NoncurrentDerivativeLiabilitiesMemberlng:CCHInterestRateDerivativesMember2020-12-310000003570lng:NoncurrentDerivativeLiabilitiesMemberus-gaap:PriceRiskDerivativeMember2020-12-310000003570lng:NoncurrentDerivativeLiabilitiesMemberlng:LNGTradingDerivativeMember2020-12-310000003570lng:NoncurrentDerivativeLiabilitiesMemberus-gaap:ForeignExchangeContractMember2020-12-310000003570lng:NoncurrentDerivativeLiabilitiesMember2020-12-310000003570lng:CCHInterestRateDerivativeAssetMember2021-06-300000003570lng:PriceRiskDerivativeAssetMember2021-06-300000003570lng:LNGTradingDerivativeAssetMember2021-06-300000003570lng:ForeignExchangeContractAssetMember2021-06-300000003570lng:CCHInterestRateDerivativeLiabilityMember2021-06-300000003570lng:PriceRiskDerivativeLiabilityMember2021-06-300000003570lng:LNGTradingDerivativesLiabilityMember2021-06-300000003570lng:ForeignExchangeContractLiabilityMember2021-06-300000003570lng:CCHInterestRateDerivativeAssetMember2020-12-310000003570lng:PriceRiskDerivativeAssetMember2020-12-310000003570lng:LNGTradingDerivativeAssetMember2020-12-310000003570lng:ForeignExchangeContractAssetMember2020-12-310000003570lng:CCHInterestRateDerivativeLiabilityMember2020-12-310000003570lng:PriceRiskDerivativeLiabilityMember2020-12-310000003570lng:LNGTradingDerivativesLiabilityMember2020-12-310000003570lng:ForeignExchangeContractLiabilityMember2020-12-310000003570lng:MidshipHoldingsLLCMember2021-01-012021-06-300000003570lng:MidshipHoldingsLLCMember2021-06-300000003570lng:MidshipHoldingsLLCMember2020-12-310000003570lng:CheniereEnergyPartnersLPMemberlng:CommonUnitsMember2021-06-300000003570lng:CheniereEnergyPartnersLPMember2021-01-012021-06-300000003570lng:CheniereEnergyPartnersLPMember2020-12-310000003570us-gaap:SeniorNotesMemberlng:SabinePassLiquefactionMembersrt:MinimumMember2021-06-300000003570us-gaap:SeniorNotesMemberlng:SabinePassLiquefactionMembersrt:MaximumMember2021-06-300000003570lng:SabinePassLiquefactionMember2021-06-300000003570lng:SabinePassLiquefactionMember2020-12-310000003570us-gaap:SeniorNotesMemberlng:CheniereEnergyPartnersLPMembersrt:MinimumMember2021-06-300000003570us-gaap:SeniorNotesMemberlng:CheniereEnergyPartnersLPMembersrt:MaximumMember2021-06-300000003570us-gaap:SeniorNotesMemberlng:CheniereCorpusChristiHoldingsLLCMembersrt:MinimumMember2021-06-300000003570us-gaap:SeniorNotesMemberlng:CheniereCorpusChristiHoldingsLLCMembersrt:MaximumMember2021-06-300000003570lng:CheniereCorpusChristiHoldingsLLCMember2021-06-300000003570lng:CheniereCorpusChristiHoldingsLLCMember2020-12-310000003570lng:A2028CheniereSeniorSecuredNotesMembersrt:ParentCompanyMember2021-06-300000003570srt:ParentCompanyMember2021-06-300000003570srt:ParentCompanyMember2020-12-310000003570us-gaap:LongTermDebtMember2021-06-300000003570us-gaap:LongTermDebtMember2020-12-310000003570lng:A2022SabinePassLiquefactionSeniorNotesMemberlng:SabinePassLiquefactionMember2021-06-300000003570lng:CheniereCorpusChristiHoldingsLLCMemberlng:CorpusChristiHoldingsWorkingCapitalFacilityMember2021-06-300000003570lng:A2021ConvertibleUnsecuredNotesMembersrt:ParentCompanyMember2021-06-300000003570us-gaap:ShortTermDebtMember2021-06-300000003570us-gaap:ShortTermDebtMember2020-12-310000003570lng:A2037PrivatePlacementSeniorSecuredNotesMember2021-06-300000003570lng:A2031CheniereEnergyPartnersSeniorNotesMemberlng:CheniereEnergyPartnersLPMember2021-06-300000003570lng:CheniereTermLoanFacilityMembersrt:ParentCompanyMember2021-04-012021-06-300000003570lng:CheniereRevolvingCreditFacilityMembersrt:ParentCompanyMember2021-04-012021-06-300000003570lng:A2025CheniereEnergyPartnersSeniorNotesMemberlng:CheniereEnergyPartnersLPMember2021-06-300000003570lng:A2025CheniereEnergyPartnersSeniorNotesMemberlng:CheniereEnergyPartnersLPMember2021-01-012021-03-310000003570lng:CheniereTermLoanFacilityMembersrt:ParentCompanyMember2021-01-012021-03-310000003570lng:A2021ConvertibleUnsecuredNotesMembersrt:ParentCompanyMember2021-04-012021-06-300000003570lng:A2025CheniereEnergyPartnersSeniorNotesMemberlng:CheniereEnergyPartnersLPMember2021-01-012021-06-300000003570lng:A2020SPLWorkingCapitalFacilityMember2021-06-300000003570lng:A2019CQPCreditFacilitiesMember2021-06-300000003570lng:A2015CCHTermLoanFacilityMember2021-06-300000003570lng:CorpusChristiHoldingsWorkingCapitalFacilityMember2021-06-300000003570lng:CheniereRevolvingCreditFacilityMember2021-06-30utr:Rate0000003570us-gaap:LondonInterbankOfferedRateLIBORMembersrt:MinimumMemberlng:A2020SPLWorkingCapitalFacilityMember2021-01-012021-06-300000003570us-gaap:LondonInterbankOfferedRateLIBORMembersrt:MaximumMemberlng:A2020SPLWorkingCapitalFacilityMember2021-01-012021-06-300000003570us-gaap:BaseRateMembersrt:MinimumMemberlng:A2020SPLWorkingCapitalFacilityMember2021-01-012021-06-300000003570us-gaap:BaseRateMembersrt:MaximumMemberlng:A2020SPLWorkingCapitalFacilityMember2021-01-012021-06-300000003570us-gaap:LondonInterbankOfferedRateLIBORMemberlng:A2019CQPCreditFacilitiesMembersrt:MinimumMember2021-01-012021-06-300000003570us-gaap:LondonInterbankOfferedRateLIBORMemberlng:A2019CQPCreditFacilitiesMembersrt:MaximumMember2021-01-012021-06-300000003570us-gaap:BaseRateMemberlng:A2019CQPCreditFacilitiesMembersrt:MinimumMember2021-01-012021-06-300000003570us-gaap:BaseRateMemberlng:A2019CQPCreditFacilitiesMembersrt:MaximumMember2021-01-012021-06-300000003570lng:A2015CCHTermLoanFacilityMemberus-gaap:LondonInterbankOfferedRateLIBORMember2021-01-012021-06-300000003570lng:A2015CCHTermLoanFacilityMemberus-gaap:BaseRateMember2021-01-012021-06-300000003570us-gaap:LondonInterbankOfferedRateLIBORMemberlng:CorpusChristiHoldingsWorkingCapitalFacilityMembersrt:MinimumMember2021-01-012021-06-300000003570us-gaap:LondonInterbankOfferedRateLIBORMemberlng:CorpusChristiHoldingsWorkingCapitalFacilityMembersrt:MaximumMember2021-01-012021-06-300000003570us-gaap:BaseRateMemberlng:CorpusChristiHoldingsWorkingCapitalFacilityMembersrt:MinimumMember2021-01-012021-06-300000003570us-gaap:BaseRateMemberlng:CorpusChristiHoldingsWorkingCapitalFacilityMembersrt:MaximumMember2021-01-012021-06-300000003570us-gaap:LondonInterbankOfferedRateLIBORMemberlng:CheniereRevolvingCreditFacilityMembersrt:MinimumMember2021-01-012021-06-300000003570us-gaap:LondonInterbankOfferedRateLIBORMemberlng:CheniereRevolvingCreditFacilityMembersrt:MaximumMember2021-01-012021-06-300000003570lng:CheniereRevolvingCreditFacilityMemberus-gaap:BaseRateMembersrt:MinimumMember2021-01-012021-06-300000003570lng:CheniereRevolvingCreditFacilityMemberus-gaap:BaseRateMembersrt:MaximumMember2021-01-012021-06-300000003570lng:A2020SPLWorkingCapitalFacilityMember2021-01-012021-06-300000003570lng:A2019CQPCreditFacilitiesMember2021-01-012021-06-300000003570lng:A2015CCHTermLoanFacilityMember2021-01-012021-06-300000003570lng:CorpusChristiHoldingsWorkingCapitalFacilityMember2021-01-012021-06-300000003570lng:CheniereRevolvingCreditFacilityMember2021-01-012021-06-300000003570srt:MinimumMemberlng:A2020SPLWorkingCapitalFacilityMember2021-01-012021-06-300000003570srt:MaximumMemberlng:A2020SPLWorkingCapitalFacilityMember2021-01-012021-06-300000003570lng:A2045ConvertibleSeniorNotesMember2021-01-012021-06-300000003570us-gaap:ConvertibleDebtMember2021-04-012021-06-300000003570us-gaap:ConvertibleDebtMember2020-04-012020-06-300000003570us-gaap:ConvertibleDebtMember2021-01-012021-06-300000003570us-gaap:ConvertibleDebtMember2020-01-012020-06-300000003570lng:DebtExcludingCapitalLeaseAndConvertibleDebtMember2021-04-012021-06-300000003570lng:DebtExcludingCapitalLeaseAndConvertibleDebtMember2020-04-012020-06-300000003570lng:DebtExcludingCapitalLeaseAndConvertibleDebtMember2021-01-012021-06-300000003570lng:DebtExcludingCapitalLeaseAndConvertibleDebtMember2020-01-012020-06-300000003570us-gaap:SeniorNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Member2021-06-300000003570us-gaap:SeniorNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Member2021-06-300000003570us-gaap:SeniorNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Member2020-12-310000003570us-gaap:SeniorNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Member2020-12-310000003570us-gaap:SeniorNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:FairValueInputsLevel3Member2021-06-300000003570us-gaap:SeniorNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel3Member2021-06-300000003570us-gaap:SeniorNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:FairValueInputsLevel3Member2020-12-310000003570us-gaap:SeniorNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel3Member2020-12-310000003570us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:LineOfCreditMember2021-06-300000003570us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:LineOfCreditMember2021-06-300000003570us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:LineOfCreditMember2020-12-310000003570us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:LineOfCreditMember2020-12-310000003570lng:A2021ConvertibleUnsecuredNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2021-06-300000003570lng:A2021ConvertibleUnsecuredNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2021-06-300000003570lng:A2021ConvertibleUnsecuredNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2020-12-310000003570lng:A2021ConvertibleUnsecuredNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2020-12-310000003570lng:A2045ConvertibleSeniorNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2021-06-300000003570lng:A2045ConvertibleSeniorNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2021-06-300000003570lng:A2045ConvertibleSeniorNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2020-12-310000003570lng:A2045ConvertibleSeniorNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2020-12-310000003570lng:OperatingLeaseAssetsMember2021-06-300000003570lng:OperatingLeaseAssetsMember2020-12-310000003570us-gaap:PropertyPlantAndEquipmentMember2021-06-300000003570us-gaap:PropertyPlantAndEquipmentMember2020-12-310000003570lng:CurrentOperatingLeaseLiabilitiesMember2021-06-300000003570lng:CurrentOperatingLeaseLiabilitiesMember2020-12-310000003570us-gaap:OtherCurrentLiabilitiesMember2021-06-300000003570us-gaap:OtherCurrentLiabilitiesMember2020-12-310000003570lng:NonCurrentOperatingLeaseLiabilitiesMember2021-06-300000003570lng:NonCurrentOperatingLeaseLiabilitiesMember2020-12-310000003570us-gaap:OtherNoncurrentLiabilitiesMember2021-06-300000003570us-gaap:OtherNoncurrentLiabilitiesMember2020-12-310000003570us-gaap:OperatingExpenseMember2021-04-012021-06-300000003570us-gaap:OperatingExpenseMember2020-04-012020-06-300000003570us-gaap:OperatingExpenseMember2021-01-012021-06-300000003570us-gaap:OperatingExpenseMember2020-01-012020-06-300000003570lng:DepreciationandAmortizationExpenseMember2021-04-012021-06-300000003570lng:DepreciationandAmortizationExpenseMember2020-04-012020-06-300000003570lng:DepreciationandAmortizationExpenseMember2021-01-012021-06-300000003570lng:DepreciationandAmortizationExpenseMember2020-01-012020-06-300000003570us-gaap:InterestExpenseMember2021-04-012021-06-300000003570us-gaap:InterestExpenseMember2020-04-012020-06-300000003570us-gaap:InterestExpenseMember2021-01-012021-06-300000003570us-gaap:InterestExpenseMember2020-01-012020-06-300000003570srt:MaximumMember2021-06-300000003570lng:SuspensionFeesandLNGCoverDamagesRevenueMember2020-04-012020-06-300000003570lng:SuspensionFeesandLNGCoverDamagesRevenueMember2020-01-012020-06-300000003570lng:SubsequentPeriodMemberlng:SuspensionFeesandLNGCoverDamagesRevenueMember2020-01-012020-06-300000003570lng:SubsequentPeriodMemberlng:SuspensionFeesandLNGCoverDamagesRevenueMember2020-04-012020-06-300000003570lng:SuspensionFeesandLNGCoverDamagesRevenueMemberlng:CurrentPeriodMember2020-04-012020-06-300000003570lng:SuspensionFeesandLNGCoverDamagesRevenueMemberlng:CurrentPeriodMember2021-01-012021-06-300000003570lng:SuspensionFeesandLNGCoverDamagesRevenueMember2021-04-012021-06-300000003570lng:SuspensionFeesandLNGCoverDamagesRevenueMember2021-01-012021-06-3000000035702021-07-01lng:LiquefiedNaturalGasMember2021-06-300000003570lng:LiquefiedNaturalGasMember2021-01-012020-12-3100000035702021-07-01lng:RegasificationServiceMember2021-06-300000003570lng:RegasificationServiceMember2021-01-012020-12-3100000035702021-07-012021-06-3000000035702021-01-012020-12-310000003570lng:SabinePassLiquefactionMemberlng:NaturalGasSupplyAgreementMember2021-01-012021-06-300000003570lng:SabinePassLiquefactionMemberlng:NaturalGasSupplyAgreementMember2021-06-300000003570lng:SabinePassLiquefactionMemberlng:NaturalGasSupplyAgreementMember2020-12-310000003570lng:CorpusChristiLiquefactionMemberlng:NaturalGasSupplyAgreementMember2021-06-300000003570lng:CorpusChristiLiquefactionMemberlng:NaturalGasSupplyAgreementMember2020-12-310000003570lng:NaturalGasSupplyAgreementMember2021-01-012021-06-300000003570us-gaap:PriceRiskDerivativeMemberlng:CorpusChristiLiquefactionMemberlng:NaturalGasSupplyAgreementMember2021-06-300000003570us-gaap:PriceRiskDerivativeMemberlng:CorpusChristiLiquefactionMemberlng:NaturalGasSupplyAgreementMember2020-12-310000003570lng:CorpusChristiLiquefactionMemberlng:NaturalGasSupplyAgreementMember2021-04-012021-06-300000003570lng:CorpusChristiLiquefactionMemberlng:NaturalGasSupplyAgreementMember2020-04-012020-06-300000003570lng:CorpusChristiLiquefactionMemberlng:NaturalGasSupplyAgreementMember2021-01-012021-06-300000003570lng:CorpusChristiLiquefactionMemberlng:NaturalGasSupplyAgreementMember2020-01-012020-06-300000003570us-gaap:PriceRiskDerivativeMemberlng:CorpusChristiLiquefactionMemberlng:NaturalGasSupplyAgreementMember2021-04-012021-06-300000003570us-gaap:PriceRiskDerivativeMemberlng:CorpusChristiLiquefactionMemberlng:NaturalGasSupplyAgreementMember2020-04-012020-06-300000003570us-gaap:PriceRiskDerivativeMemberlng:CorpusChristiLiquefactionMemberlng:NaturalGasSupplyAgreementMember2021-01-012021-06-300000003570us-gaap:PriceRiskDerivativeMemberlng:CorpusChristiLiquefactionMemberlng:NaturalGasSupplyAgreementMember2020-01-012020-06-300000003570lng:SabinePassLiquefactionLLCAndCheniereCreoleTrailPipelineLPMembersrt:MaximumMemberlng:NaturalGasTransportationAndStorageAgreementsMember2021-01-012021-06-300000003570lng:SabinePassLiquefactionLLCAndCheniereCreoleTrailPipelineLPMemberlng:NaturalGasTransportationAndStorageAgreementsMember2021-04-012021-06-300000003570lng:SabinePassLiquefactionLLCAndCheniereCreoleTrailPipelineLPMemberlng:NaturalGasTransportationAndStorageAgreementsMember2021-01-012021-06-300000003570lng:SabinePassLiquefactionLLCAndCheniereCreoleTrailPipelineLPMemberlng:NaturalGasTransportationAndStorageAgreementsMember2021-06-300000003570lng:SabinePassLiquefactionLLCAndCheniereCreoleTrailPipelineLPMemberlng:NaturalGasTransportationAndStorageAgreementsMember2020-12-310000003570lng:CheniereLNGOMServicesLLCMemberus-gaap:ProductAndServiceOtherMemberlng:OperationAndMaintenanceAgreementMember2021-04-012021-06-300000003570lng:CheniereLNGOMServicesLLCMemberus-gaap:ProductAndServiceOtherMemberlng:OperationAndMaintenanceAgreementMember2020-04-012020-06-300000003570lng:CheniereLNGOMServicesLLCMemberus-gaap:ProductAndServiceOtherMemberlng:OperationAndMaintenanceAgreementMember2021-01-012021-06-300000003570lng:CheniereLNGOMServicesLLCMemberus-gaap:ProductAndServiceOtherMemberlng:OperationAndMaintenanceAgreementMember2020-01-012020-06-300000003570lng:CheniereLNGOMServicesLLCMemberlng:OperationAndMaintenanceAgreementMember2021-06-300000003570lng:CheniereLNGOMServicesLLCMemberlng:OperationAndMaintenanceAgreementMember2020-12-310000003570lng:A2020IncentivePlanMemberus-gaap:RestrictedStockUnitsRSUMember2021-01-012021-06-300000003570us-gaap:PerformanceSharesMemberlng:A2020IncentivePlanMember2021-01-012021-06-300000003570us-gaap:CommonStockMember2021-01-012021-06-300000003570us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-06-300000003570us-gaap:PerformanceSharesMember2021-01-012021-06-300000003570us-gaap:PerformanceSharesMembersrt:MinimumMember2021-01-012021-06-300000003570us-gaap:PerformanceSharesMembersrt:MaximumMember2021-01-012021-06-300000003570lng:EquityAwardsMember2021-04-012021-06-300000003570lng:EquityAwardsMember2020-04-012020-06-300000003570lng:EquityAwardsMember2021-01-012021-06-300000003570lng:EquityAwardsMember2020-01-012020-06-300000003570lng:LiabilityAwardsMember2021-04-012021-06-300000003570lng:LiabilityAwardsMember2020-04-012020-06-300000003570lng:LiabilityAwardsMember2021-01-012021-06-300000003570lng:LiabilityAwardsMember2020-01-012020-06-300000003570lng:UnvestedStockMember2021-04-012021-06-300000003570lng:UnvestedStockMember2020-04-012020-06-300000003570lng:UnvestedStockMember2021-01-012021-06-300000003570lng:UnvestedStockMember2020-01-012020-06-300000003570lng:A2045ConvertibleSeniorNotesMember2021-04-012021-06-300000003570lng:A2045ConvertibleSeniorNotesMember2020-04-012020-06-300000003570lng:A2045ConvertibleSeniorNotesMember2021-01-012021-06-300000003570lng:A2045ConvertibleSeniorNotesMember2020-01-012020-06-300000003570lng:CustomerAMemberus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2021-04-012021-06-300000003570lng:CustomerAMemberus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2020-04-012020-06-300000003570lng:CustomerAMemberus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2021-01-012021-06-300000003570lng:CustomerAMemberus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2020-01-012020-06-300000003570lng:AccountsReceivableAndContractAssetsMemberlng:CustomerAMemberus-gaap:CustomerConcentrationRiskMember2020-01-012020-12-310000003570us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMemberlng:CustomerBMember2021-04-012021-06-300000003570us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMemberlng:CustomerBMember2020-04-012020-06-300000003570us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMemberlng:CustomerBMember2021-01-012021-06-300000003570us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMemberlng:CustomerBMember2020-01-012020-06-300000003570lng:AccountsReceivableAndContractAssetsMemberus-gaap:CustomerConcentrationRiskMemberlng:CustomerBMember2020-01-012020-12-310000003570lng:CustomerCMemberus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2020-04-012020-06-300000003570lng:CustomerCMemberus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2021-01-012021-06-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2021

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number 001-16383

CHENIERE ENERGY, INC.

(Exact name of registrant as specified in its charter)

| | | | | |

| Delaware | 95-4352386 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

700 Milam Street, Suite 1900

Houston, Texas 77002

(Address of principal executive offices) (Zip Code)

(713) 375-5000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, $ 0.003 par value | LNG | NYSE American |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | |

| Large accelerated filer | ☒ | | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | | Smaller reporting company | ☐ |

| | | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of July 30, 2021, the issuer had 253,606,918 shares of Common Stock outstanding.

CHENIERE ENERGY, INC.

TABLE OF CONTENTS

DEFINITIONS

As used in this quarterly report, the terms listed below have the following meanings:

Common Industry and Other Terms

| | | | | | | | |

| Bcf | | billion cubic feet |

| Bcf/d | | billion cubic feet per day |

| Bcf/yr | | billion cubic feet per year |

| Bcfe | | billion cubic feet equivalent |

| DOE | | U.S. Department of Energy |

| EPC | | engineering, procurement and construction |

| FERC | | Federal Energy Regulatory Commission |

| FTA countries | | countries with which the United States has a free trade agreement providing for national treatment for trade in natural gas |

| GAAP | | generally accepted accounting principles in the United States |

| Henry Hub | | the final settlement price (in USD per MMBtu) for the New York Mercantile Exchange’s Henry Hub natural gas futures contract for the month in which a relevant cargo’s delivery window is scheduled to begin |

| LIBOR | | London Interbank Offered Rate |

| LNG | | liquefied natural gas, a product of natural gas that, through a refrigeration process, has been cooled to a liquid state, which occupies a volume that is approximately 1/600th of its gaseous state |

| MMBtu | | million British thermal units; one British thermal unit measures the amount of energy required to raise the temperature of one pound of water by one degree Fahrenheit |

| mtpa | | million tonnes per annum |

| | |

| non-FTA countries | | countries with which the United States does not have a free trade agreement providing for national treatment for trade in natural gas and with which trade is permitted |

| SEC | | U.S. Securities and Exchange Commission |

| SPA | | LNG sale and purchase agreement |

| TBtu | | trillion British thermal units; one British thermal unit measures the amount of energy required to raise the temperature of one pound of water by one degree Fahrenheit |

| Train | | an industrial facility comprised of a series of refrigerant compressor loops used to cool natural gas into LNG |

| TUA | | terminal use agreement |

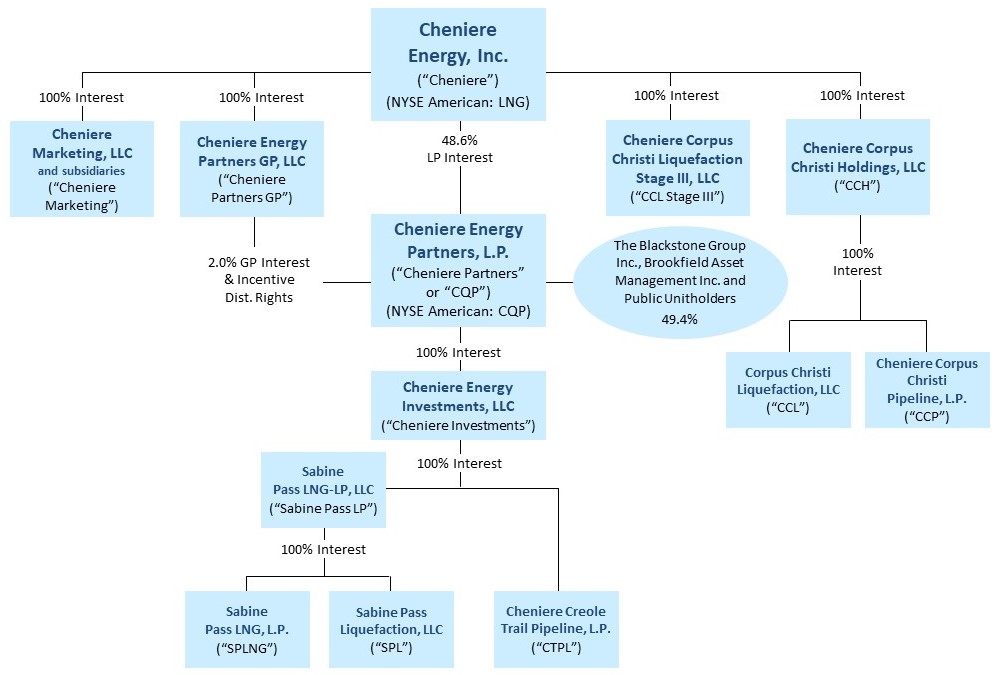

Abbreviated Legal Entity Structure

The following diagram depicts our abbreviated legal entity structure as of June 30, 2021, including our ownership of certain subsidiaries, and the references to these entities used in this quarterly report:

Unless the context requires otherwise, references to “Cheniere,” the “Company,” “we,” “us” and “our” refer to Cheniere Energy, Inc. and its consolidated subsidiaries, including our publicly traded subsidiary, Cheniere Partners.

Unless the context requires otherwise, references to the “CCH Group” refer to CCH HoldCo II, CCH HoldCo I, CCH, CCL and CCP, collectively.

PART I. FINANCIAL INFORMATION

ITEM 1. CONSOLIDATED FINANCIAL STATEMENTS

CHENIERE ENERGY, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(in millions, except per share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2021 | | 2020 | | 2021 | | 2020 | | |

| Revenues | | | | | | | | | |

| LNG revenues | $ | 2,913 | | | $ | 2,295 | | | $ | 5,912 | | | $ | 4,863 | | | |

| Regasification revenues | 67 | | | 68 | | | 134 | | | 135 | | | |

| Other revenues | 37 | | | 39 | | | 61 | | | 113 | | | |

| | | | | | | | | |

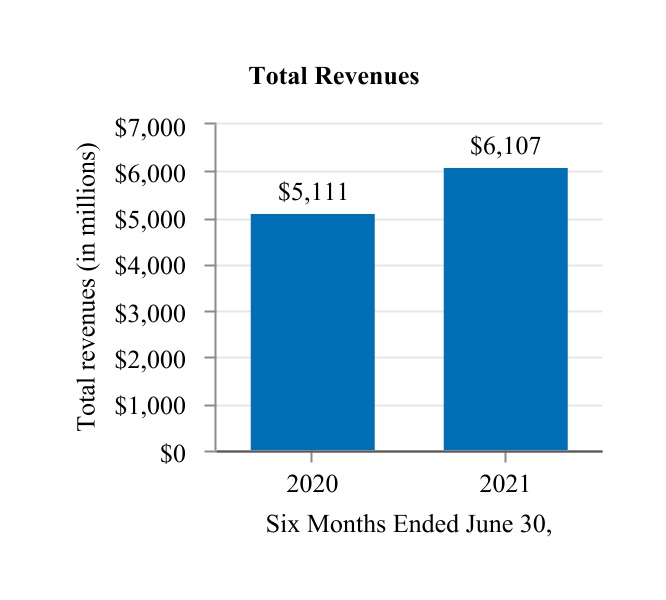

| Total revenues | 3,017 | | | 2,402 | | | 6,107 | | | 5,111 | | | |

| | | | | | | | | |

| Operating costs and expenses | | | | | | | | | |

| Cost of sales (excluding items shown separately below) | 2,154 | | | 803 | | | 3,540 | | | 1,527 | | | |

| | | | | | | | | |

| Operating and maintenance expense | 385 | | | 355 | | | 707 | | | 671 | | | |

| Development expense | 2 | | | 1 | | | 3 | | | 5 | | | |

| Selling, general and administrative expense | 73 | | | 73 | | | 154 | | | 154 | | | |

| Depreciation and amortization expense | 258 | | | 233 | | | 494 | | | 466 | | | |

| | | | | | | | | |

| Impairment expense and loss (gain) on disposal of assets | (1) | | | — | | | (1) | | | 5 | | | |

| | | | | | | | | |

| | | | | | | | | |

| Total operating costs and expenses | 2,871 | | | 1,465 | | | 4,897 | | | 2,828 | | | |

| | | | | | | | | |

| Income from operations | 146 | | | 937 | | | 1,210 | | | 2,283 | | | |

| | | | | | | | | |

| Other income (expense) | | | | | | | | | |

| Interest expense, net of capitalized interest | (368) | | | (407) | | | (724) | | | (819) | | | |

| Loss on modification or extinguishment of debt | (4) | | | (43) | | | (59) | | | (44) | | | |

| Interest rate derivative loss, net | (2) | | | (25) | | | (1) | | | (233) | | | |

| Other income, net | 4 | | | 5 | | | 10 | | | 14 | | | |

| Total other expense | (370) | | | (470) | | | (774) | | | (1,082) | | | |

| | | | | | | | | |

| Income (loss) before income taxes and non-controlling interest | (224) | | | 467 | | | 436 | | | 1,201 | | | |

| Less: income tax provision (benefit) | (93) | | | 63 | | | (4) | | | 194 | | | |

| Net income (loss) | (131) | | | 404 | | | 440 | | | 1,007 | | | |

| Less: net income attributable to non-controlling interest | 198 | | | 207 | | | 376 | | | 435 | | | |

| Net income (loss) attributable to common stockholders | $ | (329) | | | $ | 197 | | | $ | 64 | | | $ | 572 | | | |

| | | | | | | | | |

| Net income (loss) per share attributable to common stockholders—basic (1) | $ | (1.30) | | | $ | 0.78 | | | $ | 0.25 | | | $ | 2.27 | | | |

| Net income (loss) per share attributable to common stockholders—diluted (1) | $ | (1.30) | | | $ | 0.78 | | | $ | 0.25 | | | $ | 2.26 | | | |

| | | | | | | | | |

| Weighted average number of common shares outstanding—basic | 253.5 | | | 252.1 | | | 253.2 | | | 252.6 | | | |

| Weighted average number of common shares outstanding—diluted | 253.5 | | | 252.4 | | | 254.7 | | | 253.3 | | | |

(1) Earnings per share in the table may not recalculate exactly due to rounding because it is calculated based on whole numbers, not the rounded numbers presented.

The accompanying notes are an integral part of these consolidated financial statements.

3

CHENIERE ENERGY, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS (1)

(in millions, except share data)

| | | | | | | | | | | |

| |

| June 30, | | December 31, |

| 2021 | | 2020 |

| ASSETS | (unaudited) | | |

| Current assets | | | |

| Cash and cash equivalents | $ | 1,806 | | | $ | 1,628 | |

| Restricted cash | 424 | | | 449 | |

| Accounts and other receivables, net of current expected credit losses | 613 | | | 647 | |

| | | |

| Inventory | 363 | | | 292 | |

| Current derivative assets | 178 | | | 32 | |

| Other current assets | 281 | | | 121 | |

| Total current assets | 3,665 | | | 3,169 | |

| | | |

| | | |

| Property, plant and equipment, net of accumulated depreciation | 30,288 | | | 30,421 | |

| Operating lease assets | 1,698 | | | 759 | |

| | | |

| Derivative assets | 96 | | | 376 | |

| Goodwill | 77 | | | 77 | |

| Deferred tax assets | 497 | | | 489 | |

| Other non-current assets, net | 431 | | | 406 | |

| Total assets | $ | 36,752 | | | $ | 35,697 | |

| | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities | | | |

| Accounts payable | $ | 83 | | | $ | 35 | |

| Accrued liabilities | 1,197 | | | 1,175 | |

| | | |

| Current debt, net of discount and debt issuance costs | 949 | | | 372 | |

| Deferred revenue | 105 | | | 138 | |

| Current operating lease liabilities | 365 | | | 161 | |

| Current derivative liabilities | 822 | | | 313 | |

| Other current liabilities | 5 | | | 2 | |

| Total current liabilities | 3,526 | | | 2,196 | |

| | | |

| Long-term debt, net of premium, discount and debt issuance costs | 29,327 | | | 30,471 | |

| Operating lease liabilities | 1,332 | | | 597 | |

| Finance lease liabilities | 57 | | | 57 | |

| | | |

| Derivative liabilities | 145 | | | 151 | |

| Other non-current liabilities | 8 | | | 7 | |

| | | |

| | | |

| | | |

| Stockholders’ equity | | | |

Preferred stock, $0.0001 par value, 5.0 million shares authorized, none issued | — | | | — | |

Common stock, $0.003 par value, 480.0 million shares authorized; 275.0 million shares and 273.1 million shares issued at June 30, 2021 and December 31, 2020, respectively | 1 | | | 1 | |

| | | |

| | | |

| | | |

Treasury stock: 21.4 million shares and 20.8 million shares at June 30, 2021 and December 31, 2020, respectively, at cost | (915) | | | (872) | |

| Additional paid-in-capital | 4,337 | | | 4,273 | |

| Accumulated deficit | (3,529) | | | (3,593) | |

| Total stockholders' deficit | (106) | | | (191) | |

| Non-controlling interest | 2,463 | | | 2,409 | |

| Total equity | 2,357 | | | 2,218 | |

| Total liabilities and stockholders’ equity | $ | 36,752 | | | $ | 35,697 | |

(1) Amounts presented include balances held by our consolidated variable interest entity (“VIE”), Cheniere Partners, as further discussed in Note 8— Non-controlling Interest and Variable Interest Entity. As of June 30, 2021, total assets and liabilities of Cheniere Partners, which are included in our Consolidated Balance Sheets, were $18.9 billion and $18.5 billion, respectively, including $1.2 billion of cash and cash equivalents and $0.1 billion of restricted cash.

The accompanying notes are an integral part of these consolidated financial statements.

4

CHENIERE ENERGY, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(in millions)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three and Six Months Ended June 30, 2021 | | | | | | | | | | | | | | | |

| Total Stockholders’ Equity | | | |

| | Common Stock | | Treasury Stock | | Additional Paid-in Capital | | Accumulated Deficit | | Non-controlling Interest | | Total

Equity |

| | Shares | | Par Value Amount | | Shares | | Amount | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Balance at December 31, 2020 | 252.3 | | | $ | 1 | | | 20.8 | | | $ | (872) | | | $ | 4,273 | | | $ | (3,593) | | | $ | 2,409 | | | $ | 2,218 | |

| Vesting of restricted stock units and performance stock units | 1.8 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| Share-based compensation | — | | | — | | | — | | | — | | | 33 | | | — | | | — | | | 33 | |

| Issued shares withheld from employees related to share-based compensation, at cost | (0.6) | | | — | | | 0.6 | | | (42) | | | — | | | — | | | — | | | (42) | |

| | | | | | | | | | | | | | | |

| Net income attributable to non-controlling interest | — | | | — | | | — | | | — | | | — | | | — | | | 178 | | | 178 | |

| Distributions to non-controlling interest | — | | | — | | | — | | | — | | | — | | | — | | | (160) | | | (160) | |

| Net income | — | | | — | | | — | | | — | | | — | | | 393 | | | — | | | 393 | |

| Balance at March 31, 2021 | 253.5 | | | 1 | | | 21.4 | | | (914) | | | 4,306 | | | (3,200) | | | 2,427 | | | 2,620 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Vesting of restricted stock units and performance stock units | 0.1 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| Share-based compensation | — | | | — | | | — | | | — | | | 31 | | | — | | | — | | | 31 | |

| Issued shares withheld from employees related to share-based compensation, at cost | — | | | — | | | — | | | (1) | | | — | | | — | | | — | | | (1) | |

| | | | | | | | | | | | | | | |

| Net income attributable to non-controlling interest | — | | | — | | | — | | | — | | | — | | | — | | | 198 | | | 198 | |

| | | | | | | | | | | | | | | |

| Distributions to non-controlling interest | — | | | — | | | — | | | — | | | — | | | — | | | (162) | | | (162) | |

| Net loss | — | | | — | | | — | | | — | | | — | | | (329) | | | — | | | (329) | |

| Balance at June 30, 2021 | 253.6 | | | $ | 1 | | | 21.4 | | | $ | (915) | | | $ | 4,337 | | | $ | (3,529) | | | $ | 2,463 | | | $ | 2,357 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three and Six Months Ended June 30, 2020 | | | | | | | | | | | | | | | |

| Total Stockholders’ Equity | | | |

| | Common Stock | | Treasury Stock | | Additional Paid-in Capital | | Accumulated Deficit | | Non-controlling Interest | | Total

Equity |

| | Shares | | Par Value Amount | | Shares | | Amount | | | | |

| Balance at December 31, 2019 | 253.6 | | | $ | 1 | | | 17.1 | | | $ | (674) | | | $ | 4,167 | | | $ | (3,508) | | | $ | 2,449 | | | $ | 2,435 | |

| Vesting of restricted stock units and performance stock units | 2.1 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| Share-based compensation | — | | | — | | | — | | | — | | | 29 | | | — | | | — | | | 29 | |

| Issued shares withheld from employees related to share-based compensation, at cost | (0.7) | | | — | | | 0.7 | | | (39) | | | — | | | — | | | — | | | (39) | |

| Shares repurchased, at cost | (2.9) | | | — | | | 2.9 | | | (155) | | | — | | | — | | | — | | | (155) | |

| Net income attributable to non-controlling interest | — | | | — | | | — | | | — | | | — | | | — | | | 228 | | | 228 | |

| Distributions to non-controlling interest | — | | | — | | | — | | | — | | | — | | | — | | | (154) | | | (154) | |

| Net income | — | | | — | | | — | | | — | | | — | | | 375 | | | — | | | 375 | |

| Balance at March 31, 2020 | 252.1 | | | 1 | | | 20.7 | | | (868) | | | 4,196 | | | (3,133) | | | 2,523 | | | 2,719 | |

| Vesting of restricted stock units and performance stock units | 0.1 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| Share-based compensation | — | | | — | | | — | | | — | | | 31 | | | — | | | — | | | 31 | |

| Issued shares withheld from employees related to share-based compensation, at cost | — | | | — | | | — | | | (2) | | | — | | | — | | | — | | | (2) | |

| | | | | | | | | | | | | | | |

| Net income attributable to non-controlling interest | — | | | — | | | — | | | — | | | — | | | — | | | 207 | | | 207 | |

| | | | | | | | | | | | | | | |

| Distributions and dividends to non-controlling interest | — | | | — | | | — | | | — | | | — | | | — | | | (156) | | | (156) | |

| Net income | — | | | — | | | — | | | — | | | — | | | 197 | | | — | | | 197 | |

| Balance at June 30, 2020 | 252.2 | | | $ | 1 | | | 20.7 | | | $ | (870) | | | $ | 4,227 | | | $ | (2,936) | | | $ | 2,574 | | | $ | 2,996 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these consolidated financial statements.

5

CHENIERE ENERGY, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in millions)

(unaudited)

| | | | | | | | | | | | | |

| Six Months Ended June 30, |

| | | |

| 2021 | | 2020 | | |

| Cash flows from operating activities | | | | | |

| Net income | $ | 440 | | | $ | 1,007 | | | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | | |

| Depreciation and amortization expense | 494 | | | 466 | | | |

| Share-based compensation expense | 63 | | | 57 | | | |

| Non-cash interest expense | 14 | | | 34 | | | |

| Amortization of debt issuance costs, premium and discount | 40 | | | 70 | | | |

| Reduction of right-of-use assets | 172 | | | 166 | | | |

| Loss on modification or extinguishment of debt | 59 | | | 44 | | | |

| Total losses (gains) on derivatives, net | 748 | | | (361) | | | |

| Net cash provided by (used for) settlement of derivative instruments | (111) | | | 117 | | | |

| Impairment expense and loss (gain) on disposal of assets | (1) | | | 5 | | | |

| Impairment expense and loss (income) on equity method investments | (8) | | | 1 | | | |

| Deferred taxes | (7) | | | 192 | | | |

| Repayment of paid-in-kind interest related to repurchase of convertible notes | (190) | | | — | | | |

| | | | | |

| Changes in operating assets and liabilities: | | | | | |

| Accounts and other receivables, net of current expected credit losses | 33 | | | (155) | | | |

| | | | | |

| Inventory | (66) | | | 104 | | | |

| Other current assets | (163) | | | (37) | | | |

| Accounts payable and accrued liabilities | 88 | | | (369) | | | |

| | | | | |

| Deferred revenue | (33) | | | (138) | | | |

| Operating lease liabilities | (173) | | | (145) | | | |

| | | | | |

| Other, net | (26) | | | (30) | | | |

| Net cash provided by operating activities | 1,373 | | | 1,028 | | | |

| | | | | |

| Cash flows from investing activities | | | | | |

| Property, plant and equipment | (440) | | | (983) | | | |

| Proceeds from sale of fixed assets | 68 | | | — | | | |

| Investment in equity method investment | — | | | (100) | | | |

| Other | (11) | | | (7) | | | |

| Net cash used in investing activities | (383) | | | (1,090) | | | |

| | | | | |

| Cash flows from financing activities | | | | | |

| Proceeds from issuances of debt | 2,184 | | | 2,597 | | | |

| Repayments of debt | (2,603) | | | (2,380) | | | |

| Debt issuance and other financing costs | (20) | | | (59) | | | |

| Debt modification or extinguishment costs | (41) | | | (40) | | | |

| | | | | |

| Distributions to non-controlling interest | (322) | | | (310) | | | |

| Payments related to tax withholdings for share-based compensation | (43) | | | (41) | | | |

| Repurchase of common stock | — | | | (155) | | | |

| Other | 8 | | | — | | | |

| Net cash used in financing activities | (837) | | | (388) | | | |

| | | | | |

| Net increase (decrease) in cash, cash equivalents and restricted cash | 153 | | | (450) | | | |

| Cash, cash equivalents and restricted cash—beginning of period | 2,077 | | | 2,994 | | | |

| Cash, cash equivalents and restricted cash—end of period | $ | 2,230 | | | $ | 2,544 | | | |

Balances per Consolidated Balance Sheets:

| | | | | | | |

| June 30, |

| 2021 | | |

| Cash and cash equivalents | $ | 1,806 | | | |

| Restricted cash | 424 | | | |

| | | |

| Total cash, cash equivalents and restricted cash | $ | 2,230 | | | |

The accompanying notes are an integral part of these consolidated financial statements.

6

CHENIERE ENERGY, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

NOTE 1—NATURE OF OPERATIONS AND BASIS OF PRESENTATION

We operate two natural gas liquefaction and export facilities at Sabine Pass and Corpus Christi (respectively, the “Sabine Pass LNG Terminal” and “Corpus Christi LNG Terminal”).

Cheniere Partners owns the Sabine Pass LNG Terminal located in Cameron Parish, Louisiana, which has natural gas liquefaction facilities consisting of five operational natural gas liquefaction Trains and one additional Train under construction that is expected to be substantially completed in the first half of 2022, for a total production capacity of approximately 30 mtpa of LNG (the “SPL Project”). The Sabine Pass LNG Terminal also has operational regasification facilities that include five LNG storage tanks, vaporizers and two marine berths, with an additional marine berth that is under construction. Cheniere Partners also owns a 94-mile pipeline that interconnects the Sabine Pass LNG Terminal with a number of large interstate pipelines (the “Creole Trail Pipeline”) through its subsidiary, CTPL. As of June 30, 2021, we owned 100% of the general partner interest and 48.6% of the limited partner interest in Cheniere Partners.

The Corpus Christi LNG Terminal is located near Corpus Christi, Texas. We currently operate three Trains, for a total production capacity of approximately 15 mtpa of LNG. We also own a 23-mile natural gas supply pipeline that interconnects the Corpus Christi LNG Terminal with several interstate and intrastate natural gas pipelines (the “Corpus Christi Pipeline” and together with the Trains, the “CCL Project”) through our subsidiary CCP, as part of the CCH Group. The CCL Project also contains three LNG storage tanks and two marine berths.

Additionally, separate from the CCH Group, we are developing an expansion of the Corpus Christi LNG Terminal adjacent to the CCL Project (“Corpus Christi Stage 3”) through our subsidiary CCL Stage III, for up to seven midscale Trains with an expected total production capacity of approximately 10 mtpa of LNG. We received approval from FERC in November 2019 to site, construct and operate the expansion project.

We remain focused on operational excellence and customer satisfaction. Increasing demand for LNG has allowed us to expand our liquefaction infrastructure in a financially disciplined manner. We have increased available liquefaction capacity at the SPL Project and the CCL Project (collectively, the “Liquefaction Projects”) as a result of debottlenecking and other optimization projects. We hold significant land positions at both the Sabine Pass LNG Terminal and the Corpus Christi LNG Terminal which provide opportunity for further liquefaction capacity expansion. The development of these sites or other projects, including infrastructure projects in support of natural gas supply and LNG demand, will require, among other things, acceptable commercial and financing arrangements before we make a final investment decision (“FID”).

Basis of Presentation

The accompanying unaudited Consolidated Financial Statements of Cheniere have been prepared in accordance with GAAP for interim financial information and with Rule 10-01 of Regulation S-X. Accordingly, they do not include all of the information and footnotes required by GAAP for complete financial statements and should be read in conjunction with the Consolidated Financial Statements and accompanying notes included in our annual report on Form 10-K for the fiscal year ended December 31, 2020.

Results of operations for the three and six months ended June 30, 2021 are not necessarily indicative of the results of operations that will be realized for the year ending December 31, 2021.

Recent Accounting Standards

In August 2020, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2020-06, Debt—Debt with Conversion and Other Options (Subtopic 470-20) and Derivatives and Hedging—Contracts in Entity’s Own Equity (Subtopic 815-40): Accounting for Convertible Instruments and Contracts in an Entity’s Own Equity. This guidance simplifies the accounting for convertible instruments primarily by eliminating the existing cash conversion and beneficial conversion models within Subtopic 470-20, which will result in fewer embedded conversion options being accounted for separately from the debt host. The guidance also amends and simplifies the calculation of earnings per share relating to convertible instruments. This guidance is effective for annual periods beginning after December 15, 2021, including interim periods within that reporting period, with earlier adoption permitted for fiscal years beginning after December 15, 2020, including interim periods within that reporting period, using either a full or modified retrospective approach. We plan to adopt

CHENIERE ENERGY, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—CONTINUED

(unaudited)

this guidance on January 1, 2022 using the modified retrospective approach. Preliminarily, we anticipate the adoption of ASU 2020-06 will primarily result in the reclassification of the previously bifurcated equity component associated with the 4.25% Convertible Senior Notes due 2045 (the “2045 Cheniere Convertible Senior Notes”) to debt as a result of the elimination of the cash conversion model. We currently estimate that the reclassification of the $194 million equity component will result in an approximate $190 million increase in the carrying value of our 2045 Cheniere Convertible Senior Notes, with the difference primarily impacting retained earnings as of January 1, 2022. We continue to evaluate the impact of the provisions of this guidance on our Consolidated Financial Statements and related disclosures. See Note 10—Debt for further discussion on the 2045 Cheniere Convertible Senior Notes.

In March 2020, the FASB issued ASU 2020-04, Reference Rate Reform (Topic 848): Facilitation of the Effects of Reference Rate Reform on Financial Reporting. This guidance primarily provides temporary optional expedients which simplify the accounting for contract modifications to existing contracts expected to arise from the market transition from LIBOR to alternative reference rates. We have various credit facilities and interest rate swaps indexed to LIBOR, as further described in Note 6—Derivative Instruments and Note 10—Debt. The optional expedients were available to be used upon issuance of this guidance but we have not yet applied the guidance because we have not yet modified any of our existing contracts for reference rate reform. Once we apply an optional expedient to a modified contract and adopt this standard, the guidance will be applied to all subsequent applicable contract modifications until December 31, 2022, at which time the optional expedients are no longer available.

NOTE 2—RESTRICTED CASH

Restricted cash consists of funds that are contractually or legally restricted as to usage or withdrawal and have been presented separately from cash and cash equivalents on our Consolidated Balance Sheets. As of June 30, 2021 and December 31, 2020, restricted cash consisted of the following (in millions):

| | | | | | | | | | | | | | |

| | |

| | June 30, | | December 31, |

| | 2021 | | 2020 |

| Restricted cash | | | | |

| SPL Project | | $ | 65 | | | $ | 97 | |

| | | | |

| CCL Project | | 122 | | | 70 | |

| Cash held by our subsidiaries that is restricted to Cheniere | | 237 | | | 282 | |

| Total restricted cash | | $ | 424 | | | $ | 449 | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Pursuant to the accounts agreements entered into with the collateral trustees for the benefit of SPL’s debt holders and CCH’s debt holders, SPL and CCH are required to deposit all cash received into reserve accounts controlled by the collateral trustees. The usage or withdrawal of such cash is restricted to the payment of liabilities related to the Liquefaction Projects and other restricted payments. The majority of the cash held by our subsidiaries that is restricted to Cheniere relates to advance funding for operation and construction needs of the Liquefaction Projects.

NOTE 3—ACCOUNTS AND OTHER RECEIVABLES, NET OF CURRENT EXPECTED CREDIT LOSSES

As of June 30, 2021 and December 31, 2020, accounts and other receivables, net of current expected credit losses consisted of the following (in millions):

| | | | | | | | | | | | | | |

| | |

| | June 30, | | December 31, |

| | 2021 | | 2020 |

| Trade receivables | | | | |

| SPL and CCL | | $ | 405 | | | $ | 482 | |

| | | | |

| Cheniere Marketing | | 123 | | | 113 | |

| Other accounts receivable, net of current expected credit losses | | 85 | | | 52 | |

| | | | |

| Total accounts and other receivables, net of current expected credit losses | | $ | 613 | | | $ | 647 | |

CHENIERE ENERGY, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—CONTINUED

(unaudited)

NOTE 4—INVENTORY

As of June 30, 2021 and December 31, 2020, inventory consisted of the following (in millions):

| | | | | | | | | | | | | | |

| | |

| | June 30, | | December 31, |

| | 2021 | | 2020 |

| Materials | | $ | 162 | | | $ | 150 | |

| LNG in-transit | | 102 | | | 88 | |

| LNG | | 61 | | | 27 | |

| Natural gas | | 36 | | | 26 | |

| Other | | 2 | | | 1 | |

| Total inventory | | $ | 363 | | | $ | 292 | |

NOTE 5—PROPERTY, PLANT AND EQUIPMENT, NET OF ACCUMULATED DEPRECIATION

As of June 30, 2021 and December 31, 2020, property, plant and equipment, net of accumulated depreciation consisted of the following (in millions):

| | | | | | | | | | | | | | |

| | |

| | June 30, | | December 31, |

| | 2021 | | 2020 |

| LNG terminal | | | | |

| LNG terminal and interconnecting pipeline facilities | | $ | 30,598 | | | $ | 27,475 | |

| LNG site and related costs | | 343 | | | 324 | |

| LNG terminal construction-in-process | | 2,650 | | | 5,378 | |

| Accumulated depreciation | | (3,413) | | | (2,935) | |

| Total LNG terminal, net of accumulated depreciation | | 30,178 | | | 30,242 | |

| Fixed assets and other | | | | |

| Computer and office equipment | | 27 | | | 25 | |

| Furniture and fixtures | | 20 | | | 19 | |

| Computer software | | 120 | | | 117 | |

| Leasehold improvements | | 45 | | | 45 | |

| Land | | 1 | | | 59 | |

| Other | | 20 | | | 25 | |

| Accumulated depreciation | | (175) | | | (164) | |

| Total fixed assets and other, net of accumulated depreciation | | 58 | | | 126 | |

| Assets under finance lease | | | | |

| Tug vessels | | 60 | | | 60 | |

| Accumulated depreciation | | (8) | | | (7) | |

| Total assets under finance lease, net of accumulated depreciation | | 52 | | | 53 | |

| Property, plant and equipment, net of accumulated depreciation | | $ | 30,288 | | | $ | 30,421 | |

The following table shows depreciation expense and offsets to LNG terminal costs during the three and six months ended June 30, 2021 and 2020 (in millions):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2021 | | 2020 | | 2021 | | 2020 | | |

| Depreciation expense | | $ | 258 | | | $ | 231 | | | $ | 492 | | | $ | 463 | | | |

| Offsets to LNG terminal costs (1) | | 36 | | | — | | | 227 | | | — | | | |

(1) We recognize offsets to LNG terminal costs related to the sale of commissioning cargoes because these amounts were earned or loaded prior to the start of commercial operations of the respective Trains of the Liquefaction Projects during the testing phase for its construction.

CHENIERE ENERGY, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—CONTINUED

(unaudited)

NOTE 6—DERIVATIVE INSTRUMENTS

We have entered into the following derivative instruments that are reported at fair value:

•interest rate swaps (“CCH Interest Rate Derivatives”) to hedge the exposure to volatility in a portion of the floating-rate interest payments on CCH’s amended and restated credit facility (the “CCH Credit Facility”) and previously, to hedge against changes in interest rates that could impact anticipated future issuance of debt by CCH (“CCH Interest Rate Forward Start Derivatives” and, collectively with the CCH Interest Rate Derivatives, the “Interest Rate Derivatives”);

•commodity derivatives consisting of natural gas supply contracts for the commissioning and operation of the Liquefaction Projects and potential future development of Corpus Christi Stage 3 (“Physical Liquefaction Supply Derivatives”) and associated economic hedges (“Financial Liquefaction Supply Derivatives,” and collectively with the Physical Liquefaction Supply Derivatives, the “Liquefaction Supply Derivatives”);

•physical derivatives consisting of liquified natural gas contracts in which we have contractual net settlement (“Physical LNG Trading Derivatives”) and financial derivatives to hedge the exposure to the commodity markets in which we have contractual arrangements to purchase or sell physical LNG (collectively, “LNG Trading Derivatives”); and

•foreign currency exchange (“FX”) contracts to hedge exposure to currency risk associated with cash flows denominated in currencies other than United States dollar (“FX Derivatives”), associated with both LNG Trading Derivatives and operations in countries outside of the United States.

We recognize our derivative instruments as either assets or liabilities and measure those instruments at fair value. None of our derivative instruments are designated as cash flow or fair value hedging instruments, and changes in fair value are recorded within our Consolidated Statements of Operations to the extent not utilized for the commissioning process, in which case it is capitalized.

The following table shows the fair value of our derivative instruments that are required to be measured at fair value on a recurring basis as of June 30, 2021 and December 31, 2020 (in millions):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fair Value Measurements as of |

| June 30, 2021 | | December 31, 2020 |

| Quoted Prices in Active Markets

(Level 1) | | Significant Other Observable Inputs

(Level 2) | | Significant Unobservable Inputs

(Level 3) | | Total | | Quoted Prices in Active Markets

(Level 1) | | Significant Other Observable Inputs

(Level 2) | | Significant Unobservable Inputs

(Level 3) | | Total |

| CCH Interest Rate Derivatives liability | $ | — | | | $ | (91) | | | $ | — | | | $ | (91) | | | $ | — | | | $ | (140) | | | $ | — | | | $ | (140) | |

| | | | | | | | | | | | | | | |

| Liquefaction Supply Derivatives asset (liability) | (7) | | | 4 | | | (194) | | | (197) | | | 5 | | | (6) | | | 241 | | | 240 | |

| LNG Trading Derivatives asset (liability) | 20 | | | (226) | | | (195) | | | (401) | | | (3) | | | (131) | | | — | | | (134) | |

| FX Derivatives liability | — | | | (4) | | | — | | | (4) | | | — | | | (22) | | | — | | | (22) | |

| | | | | | | | | | | | | | | |

We value our Interest Rate Derivatives using an income-based approach utilizing observable inputs to the valuation model including interest rate curves, risk adjusted discount rates, credit spreads and other relevant data. We value our LNG Trading Derivatives and our Liquefaction Supply Derivatives using a market or option-based approach incorporating present value techniques, as needed, using observable commodity price curves, when available, and other relevant data. We value our FX Derivatives with a market approach using observable FX rates and other relevant data.

The fair value of our Physical Liquefaction Supply Derivatives and LNG Trading Derivatives are predominantly driven by observable and unobservable market commodity prices and, as applicable to our natural gas supply contracts, our assessment of the associated events deriving fair value, including evaluating whether the respective market is available as pipeline infrastructure is developed. The fair value of our Physical Liquefaction Supply Derivatives incorporates risk premiums related to the satisfaction of conditions precedent, such as completion and placement into service of relevant pipeline infrastructure to accommodate marketable physical gas flow. As of June 30, 2021 and December 31, 2020, some of our Physical Liquefaction

CHENIERE ENERGY, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—CONTINUED

(unaudited)

Supply Derivatives existed within markets for which the pipeline infrastructure was under development to accommodate marketable physical gas flow.

We include our Physical LNG Trading Derivatives and a portion of our Physical Liquefaction Supply Derivatives as Level 3 within the valuation hierarchy as the fair value is developed through the use of internal models which incorporate significant unobservable inputs. In instances where observable data is unavailable, consideration is given to the assumptions that market participants would use in valuing the asset or liability. This includes assumptions about market risks, such as future prices of energy units for unobservable periods, liquidity, volatility and contract duration.

The Level 3 fair value measurements of our Physical LNG Trading Derivatives and the natural gas positions within our Physical Liquefaction Supply Derivatives could be materially impacted by a significant change in certain natural gas and international LNG prices. The following table includes quantitative information for the unobservable inputs for our Level 3 Physical Liquefaction Supply Derivatives and Physical LNG Trading Derivatives as of June 30, 2021:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Net Fair Value Liability

(in millions) | | Valuation Approach | | Significant Unobservable Input | | Range of Significant Unobservable Inputs / Weighted Average (1) |

| Physical Liquefaction Supply Derivatives | | $(194) | | Market approach incorporating present value techniques | | Henry Hub basis spread | | $(0.573) - $0.385 / $(0.009) |