CHENIERE ENERGY, INC. March 2018 CHENIERE ENERGY, INC. NYSE American: LNG CORPORATE PRESENTATION August 2018

Safe Harbor Statements Forward-Looking Statements This presentation contains certain statements that are, or may be deemed to be, “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical or present facts or conditions, included or incorporated by reference herein are “forward-looking statements.” Included among “forward-looking statements” are, among other things: • Statements regarding Cheniere Energy, Inc.’s ability to consummate the transaction with Cheniere Energy Partners LP Holdings, LLC, pursuant to which we will acquire all of the publicly held shares of Cheniere Energy Partners LP Holdings, LLC not already owned by Cheniere Energy, Inc. in a stock for share transaction. • statements regarding the ability of Cheniere Energy Partners, L.P. to pay distributions to its unitholders or Cheniere Energy Partners LP Holdings, LLC or Cheniere Energy, Inc. to pay dividends to its shareholders or participate in share or unit buybacks; • statements regarding Cheniere Energy, Inc.’s, Cheniere Energy Partners LP Holdings, LLC’s or Cheniere Energy Partners, L.P.’s expected receipt of cash distributions from their respective subsidiaries; • statements that Cheniere Energy Partners, L.P. expects to commence or complete construction of its proposed liquefied natural gas (“LNG”) terminals, liquefaction facilities, pipeline facilities or other projects, or any expansions or portions thereof, by certain dates or at all; • statements that Cheniere Energy, Inc. expects to commence or complete construction of its proposed LNG terminals, liquefaction facilities, pipeline facilities or other projects, or any expansions or portions then of, by certain dates or at all; • statements regarding future levels of domestic and international natural gas production, supply or consumption or future levels of LNG imports into or exports from North America and other countries worldwide, or purchases of natural gas, regardless of the source of such information, or the transportation or other infrastructure, or demand for and prices related to natural gas, LNG or other hydrocarbon products; • statements regarding any financing transactions or arrangements, or ability to enter into such transactions; • statements relating to the construction of our proposed liquefaction facilities and natural gas liquefaction trains (“Trains”) and the construction of the Corpus Christi Pipeline, including statements concerning the engagement of any engineering, procurement and construction ("EPC") contractor or other contractor and the anticipated terms and provisions of any agreement with any EPC or other contractor, and anticipated costs related thereto; • statements regarding any agreement to be entered into or performed substantially in the future, including any revenues anticipated to be received and the anticipated timing thereof, and statements regarding the amounts of total LNG regasification, natural gas, liquefaction or storage capacities that are, or may become, subject to contracts; • statements regarding counterparties to our commercial contracts, construction contracts and other contracts; • statements regarding our planned development and construction of additional Trains or pipelines, including the financing of such Trains or pipelines; • statements that our Trains, when completed, will have certain characteristics, including amounts of liquefaction capacities; • statements regarding our business strategy, our strengths, our business and operation plans or any other plans, forecasts, projections or objectives, including anticipated revenues, capital expenditures, maintenance and operating costs, run-rate SG&A estimates, cash flows, EBITDA, Consolidated Adjusted EBITDA, distributable cash flow, distributable cash flow per share and unit, deconsolidated debt outstanding, and deconsolidated contracted EBITDA, any or all of which are subject to change; • statements regarding projections of revenues, expenses, earnings or losses, working capital or other financial items; • statements regarding legislative, governmental, regulatory, administrative or other public body actions, approvals, requirements, permits, applications, filings, investigations, proceedings or decisions; • statements regarding our anticipated LNG and natural gas marketing activities; and • any other statements that relate to non-historical or future information. These forward-looking statements are often identified by the use of terms and phrases such as “achieve,” “anticipate,” “believe,” “contemplate,” “develop,” “estimate,” “example,” “expect,” “forecast,” “goals,” ”guidance,” “opportunities,” “plan,” “potential,” “project,” “propose,” “subject to,” “strategy,” “target,” and similar terms and phrases, or by use of future tense. Although we believe that the expectations reflected in these forward-looking statements are reasonable, they do involve assumptions, risks and uncertainties, and these expectations may prove to be incorrect. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of a variety of factors, including those discussed in “Risk Factors” in the Cheniere Energy, Inc., Cheniere Energy Partners, L.P. and Cheniere Energy Partners LP Holdings, LLC Annual Reports on Form 10-K filed with the SEC on February 21, 2018, which are incorporated by reference into this presentation. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by these ”Risk Factors.” These forward-looking statements are made as of the date of this presentation, and other than as required by law, we undertake no obligation to update or revise any forward-looking statement or provide reasons why actual results may differ, whether as a result of new information, future events or otherwise. Reconciliation to U.S. GAAP Financial Information The following presentation includes certain “non-GAAP financial measures” as defined in Regulation G under the Securities Exchange Act of 1934, as amended. Schedules are included in the appendix hereto that reconcile the non-GAAP financial measures included in the following presentation to the most directly comparable financial measures calculated and presented in accordance with U.S. GAAP. 2

Safe Harbor Statements (cont’d) Additional Information and Where to Find It This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of a written consent in connection with the announced transaction between Cheniere Energy, Inc. and Cheniere Energy Partners LP Holdings, LLC. The information discussed today is qualified in its entirety by the registration statement and consent solicitation that Cheniere Energy, Inc. and Cheniere Energy Partners LP Holdings, LLC have filed with the SEC in connection with the proposed transaction. The shareholders of Cheniere Energy, Inc. and Cheniere Energy Partners LP Holdings, LLC are urged to read those filings carefully because they contain important information about the proposed transaction between Cheniere Energy, Inc. and Cheniere Energy Partners LP Holdings, LLC. Investors and security holders may obtain copies of the registration statement and consent solicitation, and any other documents that may be filed with the SEC, free of charge at the SEC’s website at http://www.sec.gov. Copies of documents filed with the SEC by Cheniere Energy, Inc. will also be made available free of charge on its website at www.cheniere.com. Copies of documents filed with the SEC by Cheniere Energy Partners LP Holdings, LLC will also be made available free of charge on its website at www.cheniere.com. Participants in the Solicitation Cheniere Energy, Inc., Cheniere Energy Partners LP Holdings, LLC and their respective directors and executive officers may be deemed to be participants in any solicitation of written consents from Cheniere Energy Partners LP Holdings, LLC’s shareholders with respect to the proposed transaction. Information about Cheniere Energy Partners LP Holdings, LLC’s directors and executive officers is set forth in Cheniere Energy Partners LP Holdings, LLC’s 2017 annual report on Form 10-K, which was filed with the SEC on February 21, 2018. Information about Cheniere Energy, Inc.’s directors and executive officers is set forth in Cheniere Energy, Inc.’s proxy statement for its 2018 Annual Meeting of Shareholders, which was filed with the SEC on April 13, 2018. Other information regarding the participants in the consent solicitation and a description of their direct and indirect interests, by security holdings or otherwise, is contained in the registration statement and consent solicitation that Cheniere Energy, Inc. and Cheniere Energy Partners LP Holdings, LLC have filed with the SEC in connection with the proposed transaction. The shareholders of Cheniere Energy, Inc. and Cheniere Energy Partners LP Holdings, LLC are urged to read those filings carefully because they contain important information about the proposed transaction between Cheniere Energy, Inc. and Cheniere Energy Partners LP Holdings, LLC. 3

COMPANY OVERVIEW

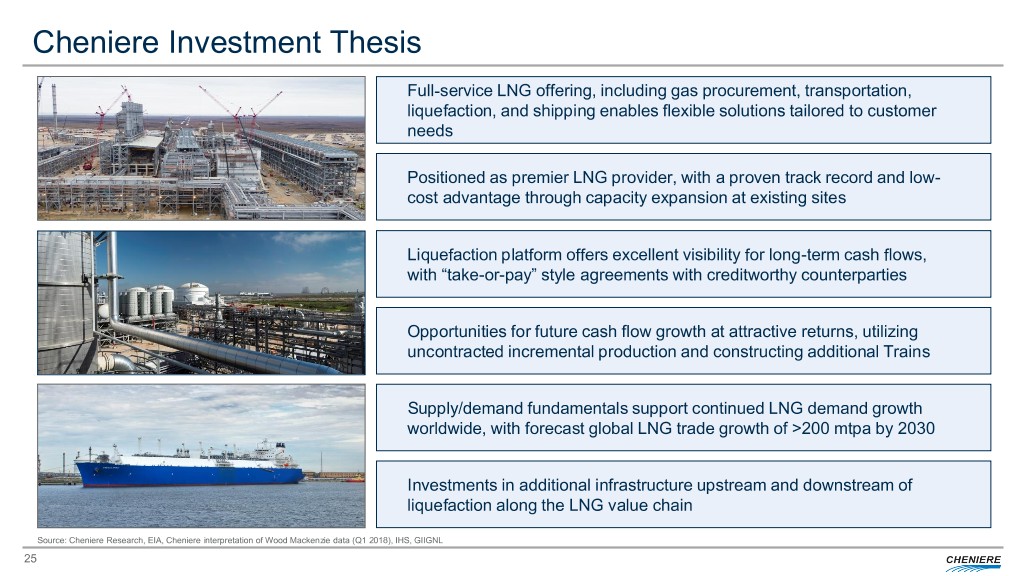

Cheniere Investment Thesis Full-service LNG offering, including gas procurement, transportation, liquefaction, and shipping enables flexible solutions tailored to customer needs Positioned as premier LNG provider, with a proven track record and low- cost advantage through capacity expansion at existing sites Liquefaction platform offers excellent visibility for long-term cash flows, with “take-or-pay” style agreements with creditworthy counterparties Opportunities for future cash flow growth at attractive returns, utilizing uncontracted incremental production and constructing additional Trains Supply/demand fundamentals support continued LNG demand growth worldwide, with forecast global LNG trade growth of >200 mtpa by 2030 Investments in additional infrastructure upstream and downstream of liquefaction along the LNG value chain Source: Cheniere Research, EIA, Cheniere interpretation of Wood Mackenzie data (Q1 2018), IHS, GIIGNL 5

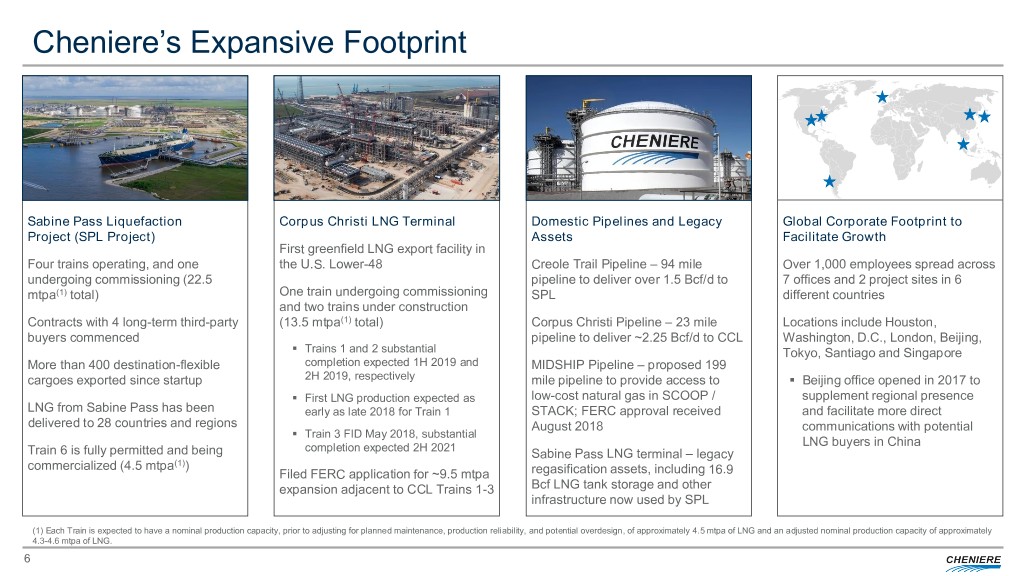

Cheniere’s Expansive Footprint Sabine Pass Liquefaction Corpus Christi LNG Terminal Domestic Pipelines and Legacy Global Corporate Footprint to Project (SPL Project) Assets Facilitate Growth First greenfield LNG export facility in Four trains operating, and one the U.S. Lower-48 Creole Trail Pipeline – 94 mile Over 1,000 employees spread across undergoing commissioning (22.5 pipeline to deliver over 1.5 Bcf/d to 7 offices and 2 project sites in 6 mtpa(1) total) One train undergoing commissioning SPL different countries and two trains under construction Contracts with 4 long-term third-party (13.5 mtpa(1) total) Corpus Christi Pipeline – 23 mile Locations include Houston, buyers commenced . pipeline to deliver ~2.25 Bcf/d to CCL Washington, D.C., London, Beijing, Trains 1 and 2 substantial Tokyo, Santiago and Singapore More than 400 destination-flexible completion expected 1H 2019 and MIDSHIP Pipeline – proposed 199 cargoes exported since startup 2H 2019, respectively mile pipeline to provide access to . Beijing office opened in 2017 to . First LNG production expected as low-cost natural gas in SCOOP / supplement regional presence LNG from Sabine Pass has been early as late 2018 for Train 1 STACK; FERC approval received and facilitate more direct delivered to 28 countries and regions August 2018 communications with potential . Train 3 FID May 2018, substantial LNG buyers in China Train 6 is fully permitted and being completion expected 2H 2021 Sabine Pass LNG terminal – legacy commercialized (4.5 mtpa(1)) Filed FERC application for ~9.5 mtpa regasification assets, including 16.9 expansion adjacent to CCL Trains 1-3 Bcf LNG tank storage and other infrastructure now used by SPL (1) Each Train is expected to have a nominal production capacity, prior to adjusting for planned maintenance, production reliability, and potential overdesign, of approximately 4.5 mtpa of LNG and an adjusted nominal production capacity of approximately 4.3-4.6 mtpa of LNG. 6

Consistently Delivering on Our Promises “Cheniere is well-positioned for success as a global Four Trains at Sabine Pass completed within 17 months LNG market leader and I look forward to building upon safely, within budget, and ahead of schedule the many successes achieved to date. Our priorities will Anticipated completion of Sabine T5 and Corpus T1-T2 in be focused on continued execution and completion of 2019, also within budget and ahead of schedule the LNG trains, both under construction and under Reached Date of First Commercial Delivery under SPAs(1) development, and further commercialization of our LNG for the four Trains in operation portfolio.” Produced more than 14 million tonnes of LNG in 2017 – - Jack Fusco ~5% of global supply May 12, 2016 More than 400 cumulative cargoes have been exported from Sabine Pass, with deliveries to 28 countries and regions worldwide(2) Successfully sold and delivered more than 9 million tonnes Cheniere to expand Corpus Christi complex of portfolio and commissioning volumes from Sabine Pass By Katherine Blunt Managed a shipping portfolio of up to 25 vessels on the Houston's Cheniere Energy has decided to build a third unit to process liquefied water simultaneously natural gas at its export facility under construction in Corpus Christi. Captured optimization opportunities within the LNG market Limited construction began last year, and Cheniere will give its builder, Bechtel, notice to proceed with the project. It's the first commitment to build Generated ~$3.8B in Revenues and over $1.4B new U.S. liquefaction capacity since 2015, Cheniere said. Consolidated Adjusted EBITDA in 1H 2018 Note: Consolidated Adjusted EBITDA is a non-GAAP measure. A definition of this non-GAAP measure and a reconciliation to Net income (loss) attributable to common stockholders, the most comparable U.S. GAAP measure, is included in the appendix. (1) Date of First Commercial Delivery for Trains 1 through 4 for the primary SPA for each Train. (2) As of July 31, 2018. 7

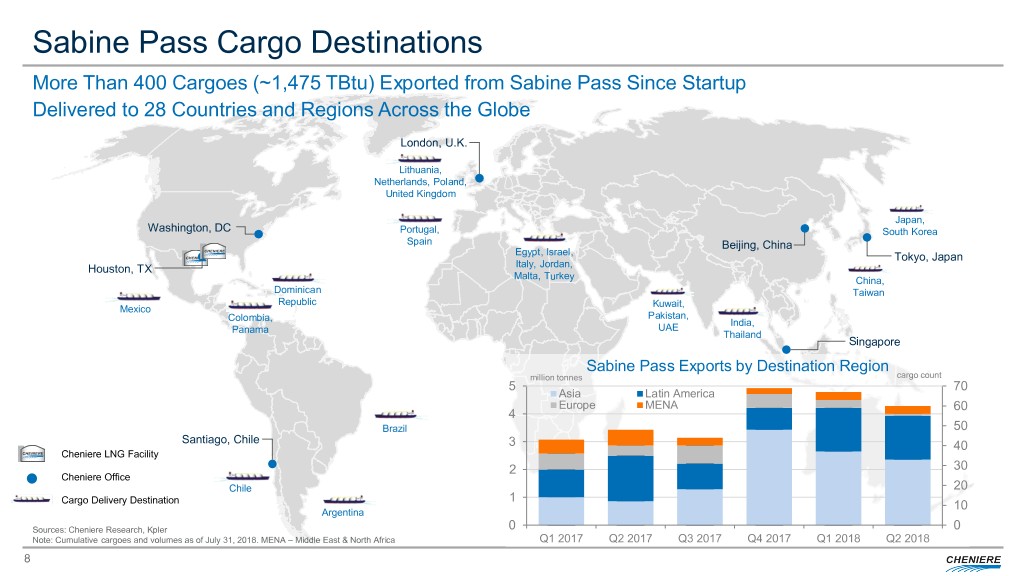

Sabine Pass Cargo Destinations More Than 400 Cargoes (~1,475 TBtu) Exported from Sabine Pass Since Startup Delivered to 28 Countries and Regions Across the Globe London, U.K. Lithuania, Netherlands, Poland, United Kingdom Japan, Washington, DC Portugal, South Korea Spain Beijing, China Egypt, Israel, Tokyo, Japan Italy, Jordan, Houston, TX Malta, Turkey China, Dominican Taiwan Republic Kuwait, Mexico Colombia, Pakistan, India, Panama UAE Thailand Singapore Sabine Pass Exports by Destination Region million tonnes cargo count 5 70 Asia Latin America Europe MENA 60 4 Brazil 50 Santiago, Chile 3 40 Cheniere LNG Facility 2 30 Cheniere Office Chile 20 1 Cargo Delivery Destination 10 Argentina Sources: Cheniere Research, Kpler 0 0 Note: Cumulative cargoes and volumes as of July 31, 2018. MENA – Middle East & North Africa Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 8

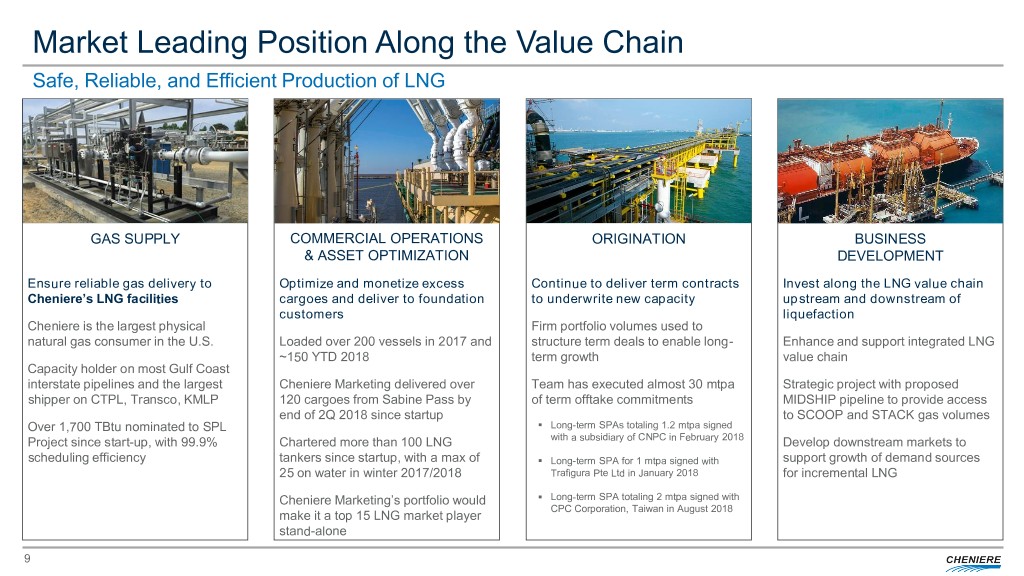

Market Leading Position Along the Value Chain Safe, Reliable, and Efficient Production of LNG GAS SUPPLY COMMERCIAL OPERATIONS ORIGINATION BUSINESS & ASSET OPTIMIZATION DEVELOPMENT Ensure reliable gas delivery to Optimize and monetize excess Continue to deliver term contracts Invest along the LNG value chain Cheniere’s LNG facilities cargoes and deliver to foundation to underwrite new capacity upstream and downstream of customers liquefaction Cheniere is the largest physical Firm portfolio volumes used to natural gas consumer in the U.S. Loaded over 200 vessels in 2017 and structure term deals to enable long- Enhance and support integrated LNG ~150 YTD 2018 term growth value chain Capacity holder on most Gulf Coast interstate pipelines and the largest Cheniere Marketing delivered over Team has executed almost 30 mtpa Strategic project with proposed shipper on CTPL, Transco, KMLP 120 cargoes from Sabine Pass by of term offtake commitments MIDSHIP pipeline to provide access end of 2Q 2018 since startup . to SCOOP and STACK gas volumes Over 1,700 TBtu nominated to SPL Long-term SPAs totaling 1.2 mtpa signed Project since start-up, with 99.9% Chartered more than 100 LNG with a subsidiary of CNPC in February 2018 Develop downstream markets to scheduling efficiency tankers since startup, with a max of . Long-term SPA for 1 mtpa signed with support growth of demand sources 25 on water in winter 2017/2018 Trafigura Pte Ltd in January 2018 for incremental LNG . Cheniere Marketing’s portfolio would Long-term SPA totaling 2 mtpa signed with CPC Corporation, Taiwan in August 2018 make it a top 15 LNG market player stand-alone 9

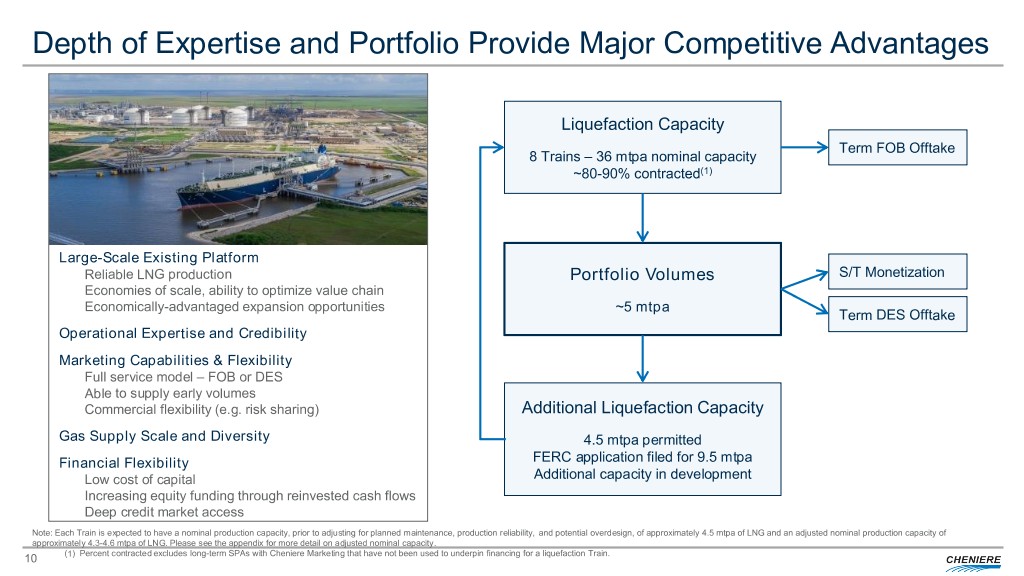

Depth of Expertise and Portfolio Provide Major Competitive Advantages Liquefaction Capacity Term FOB Offtake 8 Trains – 36 mtpa nominal capacity ~80-90% contracted(1) Large-Scale Existing Platform Reliable LNG production Portfolio Volumes S/T Monetization Economies of scale, ability to optimize value chain Economically-advantaged expansion opportunities ~5 mtpa Term DES Offtake Operational Expertise and Credibility Marketing Capabilities & Flexibility Full service model – FOB or DES Able to supply early volumes Commercial flexibility (e.g. risk sharing) Additional Liquefaction Capacity Gas Supply Scale and Diversity 4.5 mtpa permitted Financial Flexibility FERC application filed for 9.5 mtpa Low cost of capital Additional capacity in development Increasing equity funding through reinvested cash flows Deep credit market access Note: Each Train is expected to have a nominal production capacity, prior to adjusting for planned maintenance, production reliability, and potential overdesign, of approximately 4.5 mtpa of LNG and an adjusted nominal production capacity of approximately 4.3-4.6 mtpa of LNG. Please see the appendix for more detail on adjusted nominal capacity. 10 (1) Percent contracted excludes long-term SPAs with Cheniere Marketing that have not been used to underpin financing for a liquefaction Train.

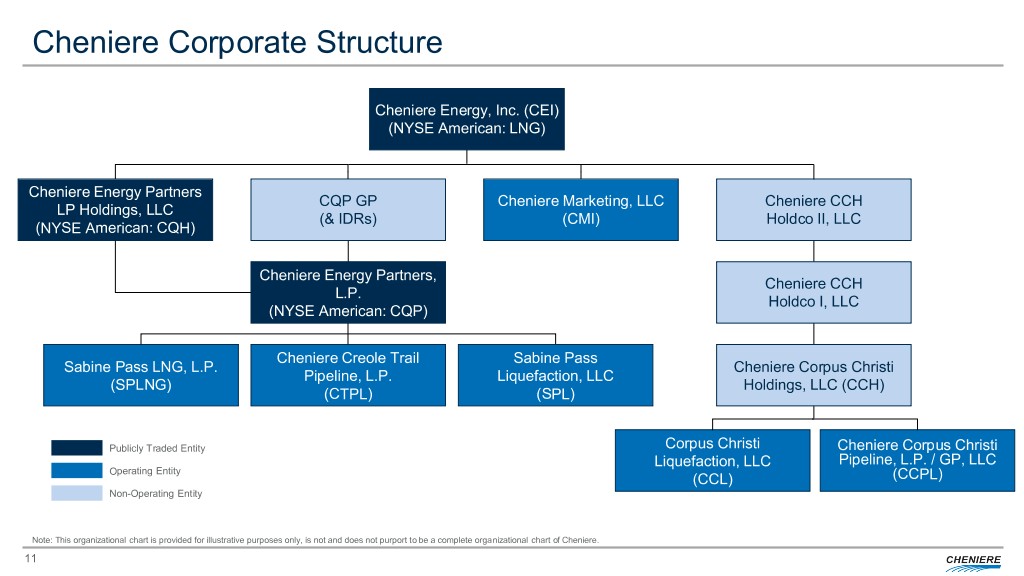

Cheniere Corporate Structure Cheniere Energy, Inc. (CEI) (NYSE American: LNG) Cheniere Energy Partners CQP GP Cheniere Marketing, LLC Cheniere CCH LP Holdings, LLC (& IDRs) (CMI) Holdco II, LLC (NYSE American: CQH) Cheniere Energy Partners, Cheniere CCH L.P. Holdco I, LLC (NYSE American: CQP) Cheniere Creole Trail Sabine Pass Sabine Pass LNG, L.P. Cheniere Corpus Christi Pipeline, L.P. Liquefaction, LLC (SPLNG) Holdings, LLC (CCH) (CTPL) (SPL) Publicly Traded Entity Corpus Christi Cheniere Corpus Christi Liquefaction, LLC Pipeline, L.P. / GP, LLC Operating Entity (CCL) (CCPL) Non-Operating Entity Note: This organizational chart is provided for illustrative purposes only, is not and does not purport to be a complete organizational chart of Cheniere. 11

LIQUEFACTION PROJECTS UPDATE

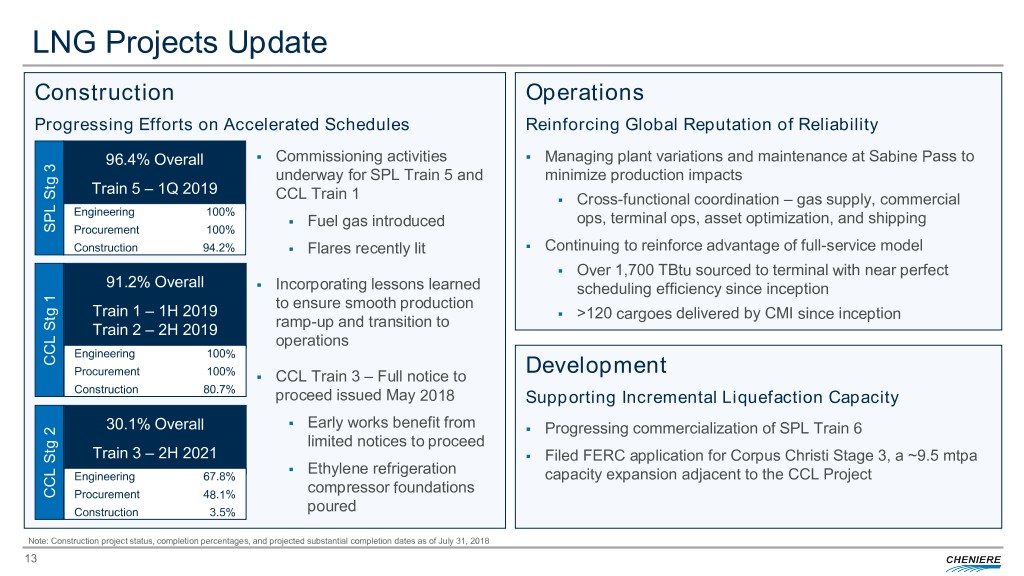

LNG Projects Update Construction Operations Progressing Efforts on Accelerated Schedules Reinforcing Global Reputation of Reliability . . 96.4% Overall Commissioning activities Managing plant variations and maintenance at Sabine Pass to underway for SPL Train 5 and minimize production impacts Train 5 – 1Q 2019 CCL Train 1 . Cross-functional coordination – gas supply, commercial Engineering 100% . Fuel gas introduced ops, terminal ops, asset optimization, and shipping SPL Stg 3 Stg SPL Procurement 100% . Construction 94.2% . Flares recently lit Continuing to reinforce advantage of full-service model . Over 1,700 TBtu sourced to terminal with near perfect 91.2% Overall . Incorporating lessons learned scheduling efficiency since inception to ensure smooth production Train 1 – 1H 2019 . >120 cargoes delivered by CMI since inception ramp-up and transition to Train 2 – 2H 2019 operations Engineering 100% CCL Stg 1 Stg CCL Procurement 100% . CCL Train 3 – Full notice to Development Construction 80.7% proceed issued May 2018 Supporting Incremental Liquefaction Capacity . 30.1% Overall Early works benefit from . Progressing commercialization of SPL Train 6 limited notices to proceed Train 3 – 2H 2021 . Filed FERC application for Corpus Christi Stage 3, a ~9.5 mtpa . Ethylene refrigeration Engineering 67.8% capacity expansion adjacent to the CCL Project compressor foundations CCL Stg 2 Stg CCL Procurement 48.1% Construction 3.5% poured Note: Construction project status, completion percentages, and projected substantial completion dates as of July 31, 2018 13

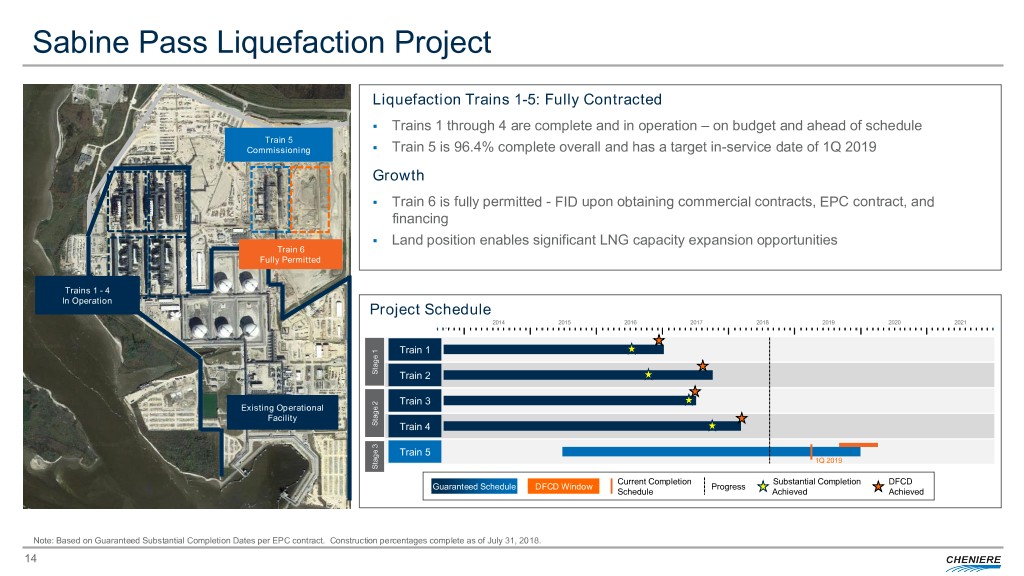

Sabine Pass Liquefaction Project Liquefaction Trains 1-5: Fully Contracted . Trains 1 through 4 are complete and in operation – on budget and ahead of schedule Train 5 . Commissioning Train 5 is 96.4% complete overall and has a target in-service date of 1Q 2019 Growth . Train 6 is fully permitted - FID upon obtaining commercial contracts, EPC contract, and financing . Land position enables significant LNG capacity expansion opportunities Train 6 Fully Permitted Trains 1 - 4 In Operation Project Schedule … 2014 2015 2016 2017 2018 2019 2020 2021 Train 1 Stage 1 Stage Train 2 Train 3 Existing Operational Facility Stage 2 Stage Train 4 Train 5 1Q 2019 Stage 3 Stage Current Completion Substantial Completion DFCD Guaranteed Schedule DFCD Window Progress Schedule Achieved Achieved Note: Based on Guaranteed Substantial Completion Dates per EPC contract. Construction percentages complete as of July 31, 2018. 14

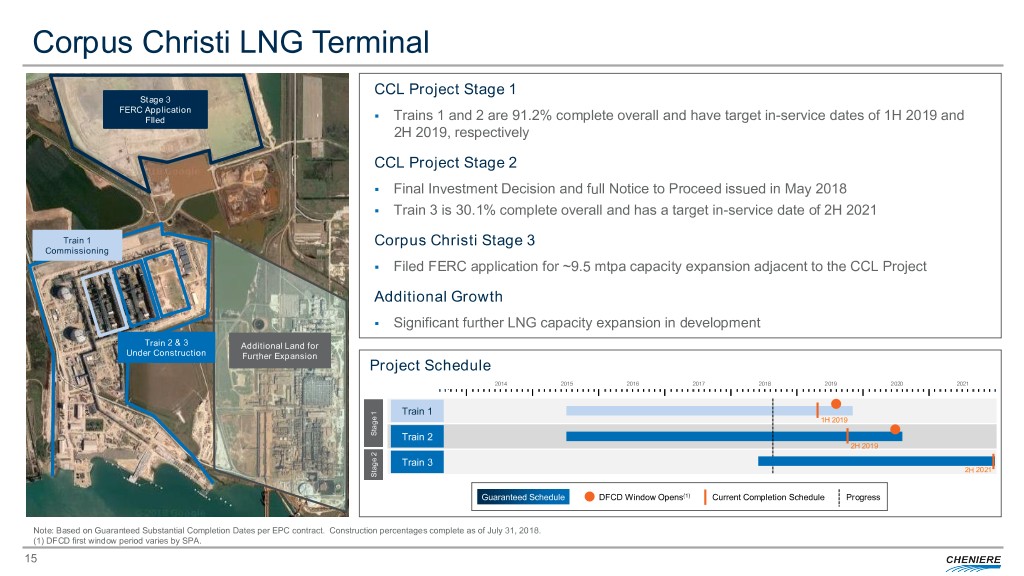

Corpus Christi LNG Terminal CCL Project Stage 1 Stage 3 FERC Application . FIled Trains 1 and 2 are 91.2% complete overall and have target in-service dates of 1H 2019 and 2H 2019, respectively CCL Project Stage 2 . Final Investment Decision and full Notice to Proceed issued in May 2018 . Train 3 is 30.1% complete overall and has a target in-service date of 2H 2021 Train 1 Corpus Christi Stage 3 Commissioning . Filed FERC application for ~9.5 mtpa capacity expansion adjacent to the CCL Project Additional Growth . Significant further LNG capacity expansion in development Train 2 & 3 Additional Land for Under Construction Further Expansion Project Schedule … 2014 2015 2016 2017 2018 2019 2020 2021 Train 1 1H 2019 Stage 1 Stage Train 2 2H 2019 Train 3 2H 2021 Stage 2 Stage Guaranteed Schedule DFCD Window Opens(1) Current Completion Schedule Progress Note: Based on Guaranteed Substantial Completion Dates per EPC contract. Construction percentages complete as of July 31, 2018. (1) DFCD first window period varies by SPA. 15

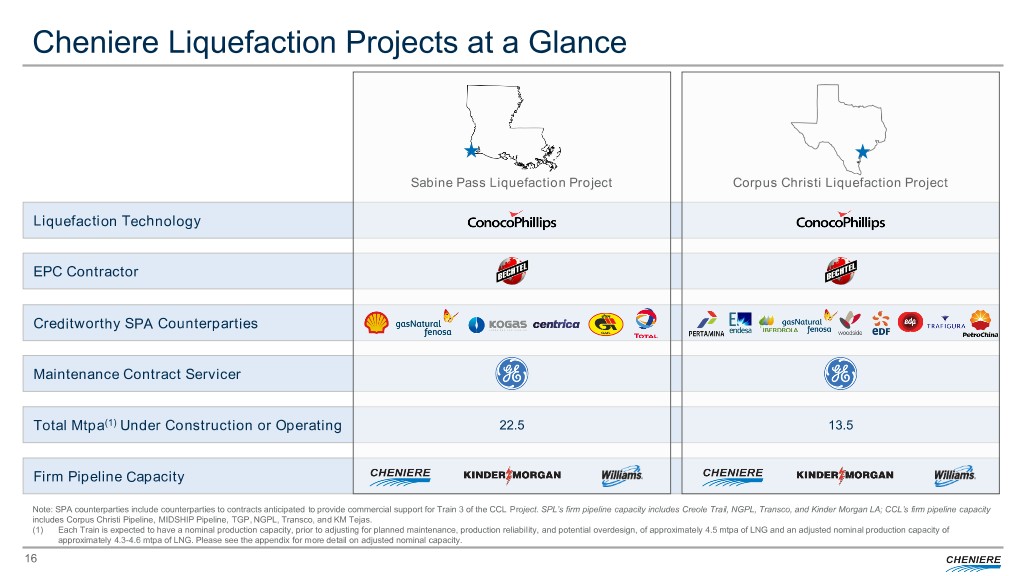

Cheniere Liquefaction Projects at a Glance Sabine Pass Liquefaction Project Corpus Christi Liquefaction Project Liquefaction Technology EPC Contractor Creditworthy SPA Counterparties Maintenance Contract Servicer Total Mtpa(1) Under Construction or Operating 22.5 13.5 Firm Pipeline Capacity Note: SPA counterparties include counterparties to contracts anticipated to provide commercial support for Train 3 of the CCL Project. SPL’s firm pipeline capacity includes Creole Trail, NGPL, Transco, and Kinder Morgan LA; CCL’s firm pipeline capacity includes Corpus Christi Pipeline, MIDSHIP Pipeline, TGP, NGPL, Transco, and KM Tejas. (1) Each Train is expected to have a nominal production capacity, prior to adjusting for planned maintenance, production reliability, and potential overdesign, of approximately 4.5 mtpa of LNG and an adjusted nominal production capacity of approximately 4.3-4.6 mtpa of LNG. Please see the appendix for more detail on adjusted nominal capacity. 16

CHENIERE OVERVIEW LNG MARKET OUTLOOK

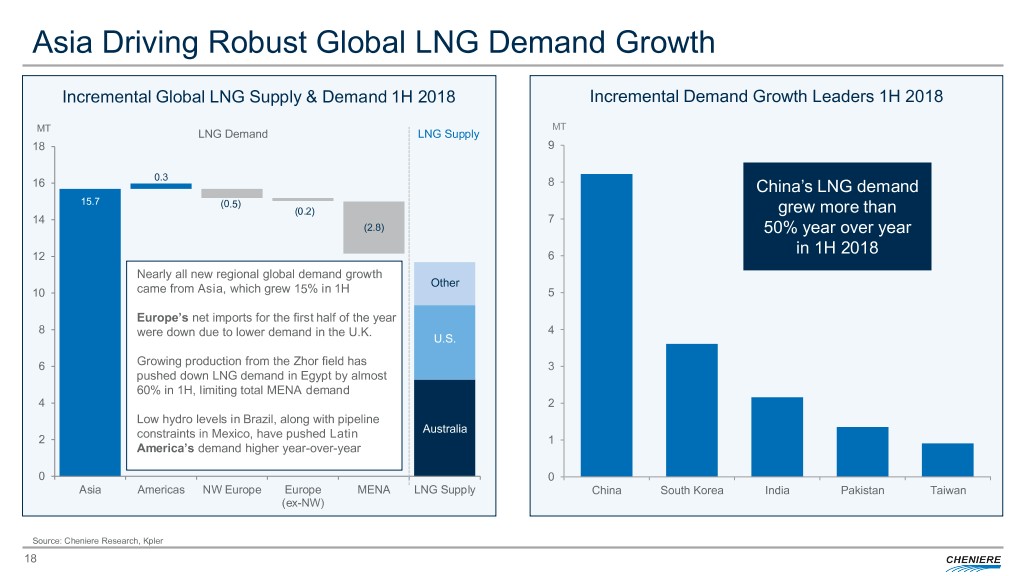

Asia Driving Robust Global LNG Demand Growth Incremental Global LNG Supply & Demand 1H 2018 Incremental Demand Growth Leaders 1H 2018 MT MT LNG Demand LNG Supply 18 9 0.3 16 8 China’s LNG demand 15.7 (0.5) (0.2) grew more than 14 7 (2.8) 50% year over year 12 6 in 1H 2018 Nearly all new regional global demand growth Other 10 came from Asia, which grew 15% in 1H 5 Europe’s net imports for the first half of the year 8 were down due to lower demand in the U.K. 4 U.S. 6 Growing production from the Zhor field has 3 pushed down LNG demand in Egypt by almost 60% in 1H, limiting total MENA demand 4 2 Low hydro levels in Brazil, along with pipeline constraints in Mexico, have pushed Latin Australia 2 1 America’s demand higher year-over-year 0 0 Asia Americas NW Europe Europe MENA LNG Supply China South Korea India Pakistan Taiwan (ex-NW) Source: Cheniere Research, Kpler 18

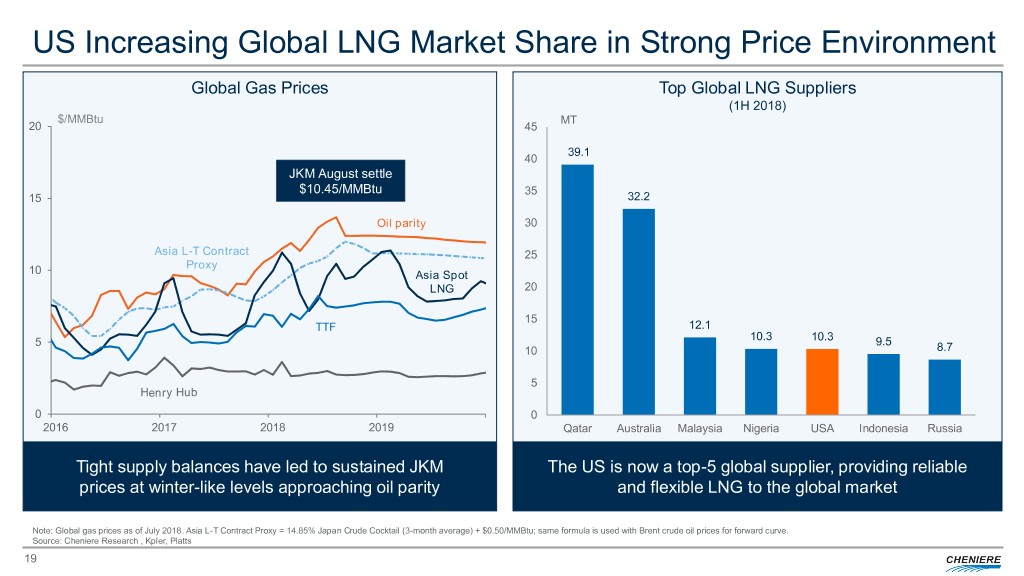

US Increasing Global LNG Market Share in Strong Price Environment Global Gas Prices Top Global LNG Suppliers (1H 2018) $/MMBtu MT 20 45 39.1 40 JKM August settle $10.45/MMBtu 35 15 32.2 Oil parity 30 Asia L-T Contract 25 Proxy 10 Asia Spot LNG 20 15 TTF 12.1 5 10.3 10.3 9.5 10 8.7 5 Henry Hub 0 0 2016 2017 2018 2019 Qatar Australia Malaysia Nigeria USA Indonesia Russia Tight supply balances have led to sustained JKM The US is now a top-5 global supplier, providing reliable prices at winter-like levels approaching oil parity and flexible LNG to the global market Note: Global gas prices as of July 2018. Asia L-T Contract Proxy = 14.85% Japan Crude Cocktail (3-month average) + $0.50/MMBtu; same formula is used with Brent crude oil prices for forward curve. Source: Cheniere Research , Kpler, Platts 19

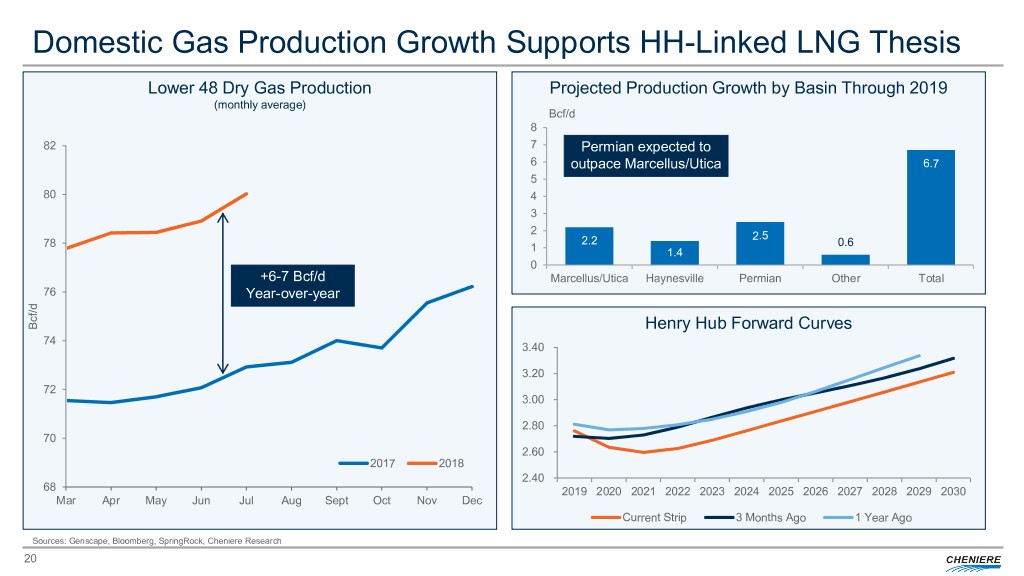

Domestic Gas Production Growth Supports HH-Linked LNG Thesis Lower 48 Dry Gas Production Projected Production Growth by Basin Through 2019 (monthly average) Bcf/d 8 82 7 Permian expected to 6 outpace Marcellus/Utica 6.7 5 80 4 3 2 2.5 78 2.2 0.6 1 1.4 0 +6-7 Bcf/d Marcellus/Utica Haynesville Permian Other Total 76 Year-over-year Bcf/d Henry Hub Forward Curves 74 3.40 3.20 72 3.00 2.80 70 2.60 2017 2018 2.40 68 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 Mar Apr May Jun Jul Aug Sept Oct Nov Dec Current Strip 3 Months Ago 1 Year Ago Sources: Genscape, Bloomberg, SpringRock, Cheniere Research 20

SPL Project CHENIERE OVERVIEW FINANCIAL UPDATE

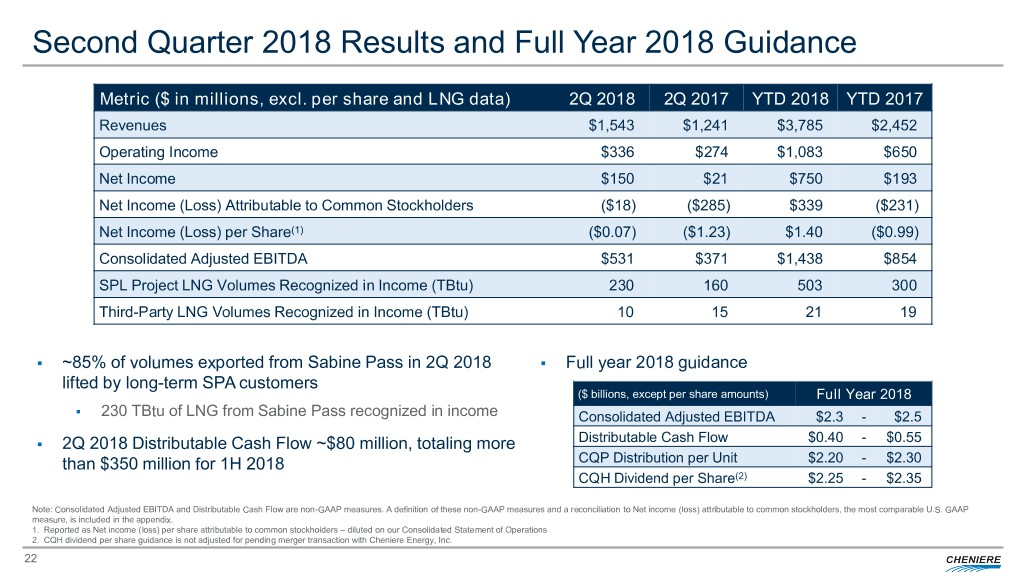

Second Quarter 2018 Results and Full Year 2018 Guidance Metric ($ in millions, excl. per share and LNG data) 2Q 2018 2Q 2017 YTD 2018 YTD 2017 Revenues $1,543 $1,241 $3,785 $2,452 Operating Income $336 $274 $1,083 $650 Net Income $150 $21 $750 $193 Net Income (Loss) Attributable to Common Stockholders ($18) ($285) $339 ($231) Net Income (Loss) per Share(1) ($0.07) ($1.23) $1.40 ($0.99) Consolidated Adjusted EBITDA $531 $371 $1,438 $854 SPL Project LNG Volumes Recognized in Income (TBtu) 230 160 503 300 Third-Party LNG Volumes Recognized in Income (TBtu) 10 15 21 19 . ~85% of volumes exported from Sabine Pass in 2Q 2018 . Full year 2018 guidance lifted by long-term SPA customers ($ billions, except per share amounts) Full Year 2018 . 230 TBtu of LNG from Sabine Pass recognized in income Consolidated Adjusted EBITDA $2.3 - $2.5 . 2Q 2018 Distributable Cash Flow ~$80 million, totaling more Distributable Cash Flow $0.40 - $0.55 than $350 million for 1H 2018 CQP Distribution per Unit $2.20 - $2.30 CQH Dividend per Share(2) $2.25 - $2.35 Note: Consolidated Adjusted EBITDA and Distributable Cash Flow are non-GAAP measures. A definition of these non-GAAP measures and a reconciliation to Net income (loss) attributable to common stockholders, the most comparable U.S. GAAP measure, is included in the appendix. 1. Reported as Net income (loss) per share attributable to common stockholders – diluted on our Consolidated Statement of Operations 2. CQH dividend per share guidance is not adjusted for pending merger transaction with Cheniere Energy, Inc. 22

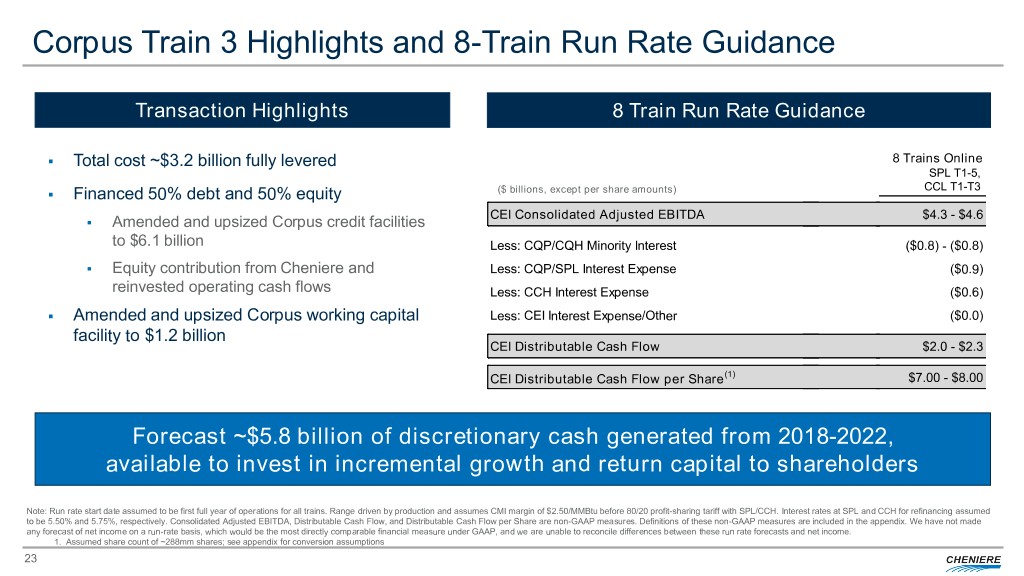

Corpus Train 3 Highlights and 8-Train Run Rate Guidance Transaction Highlights 8 Train Run Rate Guidance 7 Trains Online 8 Trains Online 7 Trains Online7 Trains Online 8 Trains Online8 Trains Online . Total cost ~$3.2 billion fully levered 7 TrainsSPL Online T1-5, 8 TrainsSPL Online T1-5, SPL T1-5, SPL T1-5, SPL T1-5, SPL T1-5, SPL T1-5, ($bn, except per share and per unit amounts or unless otherwise($bn, noted)except per($bn, share except and per per share unit amounts and per unitor unless amounts otherwise or CCHunlessSPL noted) T1-2T1-5, otherwise noted) CCHSPL T1-5,T1-3 CCH T1-2 CCH T1-2 CCH T1-3 CCH T1-3 . Financed 50% debt and($bn, 50%except perequity share and per unit amounts or unless otherwise($ billions, noted) except per share amounts) CCH T1-2 CCLCCH T1 T1-3-T3 . CEI Consolidated Adjusted EBITDA CEI ConsolidatedCEI Consolidated Adjusted EBITDAAdjusted EBITDA$3.8 - $4.1 $4.3 - $4.6 $3.8 - $4.1$3.8 - $4.1 $4.3 - $4.6$4.3 - $4.6 Amended and upsizedCEI Consolidated Corpus credit Adjusted facilities EBITDA $3.8 - $4.1 $4.3 - $4.6 to $6.1 billion Less: CQP/CQH Minority Interest Less: CQP/CQHLess: CQP/CQHMinority Interest Minority Interest ($0.8) - ($0.8) ($0.8) - ($0.8) ($0.8) - ($0.8)($0.8) - ($0.8) ($0.8) - ($0.8)($0.8) - ($0.8) Less: CQP/CQH Minority Interest ($0.8) - ($0.8) ($0.8) - ($0.8) . Equity contributionLess: from CQP/SPL Cheniere Interest and Expense Less: CQP/SPLLess: InterestCQP/SPL Expense Interest Expense ($0.9) ($0.9) ($0.9) ($0.9) ($0.9) ($0.9) Less: CQP/SPL Interest Expense ($0.9) ($0.9) reinvested operatingLess: CCH cash Interest flows Expense Less: CCHLess: Interest CCH Expense Interest Expense ($0.5) ($0.6) ($0.5) ($0.5) ($0.6) ($0.6) Less: CCH Interest Expense ($0.5) ($0.6) . Amended and upsizedLess: Corpus CEI Interest working Expense/Other capital Less: CEI InterestLess: CEI Expense/Other Interest Expense/Other ($0.0) ($0.0) ($0.0) ($0.0) ($0.0) ($0.0) Less: CEI Interest Expense/Other ($0.0) ($0.0) facility to $1.2 billion CEI Distributable Cash Flow CEI DistributableCEI Distributable Cash Flow Cash Flow $1.7 - $1.9 $2.0 - $2.3 $1.7 - $1.9$1.7 - $1.9 $2.0 - $2.3$2.0 - $2.3 CEI Distributable Cash Flow $1.7 - $1.9 $2.0 - $2.3 (1) (1) (1) CEI Distributable Cash Flow per Share (1) CEI DistributableCEI Distributable Cash Flow Cash per ShareFlow per $5.70Share - $6.60 $7.00 - $8.00 $5.70 - $6.60$5.70 - $6.60 $7.00 - $8.00$7.00 - $8.00 CEI Distributable Cash Flow per Share $5.70 - $6.60 $7.00 - $8.00 CQP Distributable Cash Flow per Unit CQP DistributableCQP Distributable Cash Flow Cash per UnitFlow per$3.20 Unit - $3.40 $3.20 - $3.40 $3.20 - $3.40$3.20 - $3.40 $3.20 - $3.40$3.20 - $3.40 CQP Distributable Cash Flow per Unit $3.20 - $3.40 $3.20 - $3.40 ForecastCQH ~$5.8CQH Distributable Distributable billion Cash Cash Flowof Flow discretionaryper per Share Share CQH Distributable cashCQH Distributable Cashgenerated Flow Cash per ShareFlow from per$3.00$3.00 Share 2018- - $3.10 $3.10 -2022, $3.00$3.00 - $3.10 $3.00 - $3.10$3.00 - $3.10 $3.00 - $3.10$3.00 - $3.10 available to invest in incremental growth and return capital to shareholders Note: Run rate start date assumed to be first full year of operations for all trains. Range driven by production and assumes CMI margin of $2.50/MMBtu before 80/20 profit-sharing tariff with SPL/CCH. Interest rates at SPL and CCH for refinancing assumed to be 5.50% and 5.75%, respectively. Consolidated Adjusted EBITDA, Distributable Cash Flow, and Distributable Cash Flow per Share are non-GAAP measures. Definitions of these non-GAAP measures are included in the appendix. We have not made any forecast of net income on a run-rate basis, which would be the most directly comparable financial measure under GAAP, and we are unable to reconcile differences between these run rate forecasts and net income. 1. Assumed share count of ~288mm shares; see appendix for conversion assumptions 23

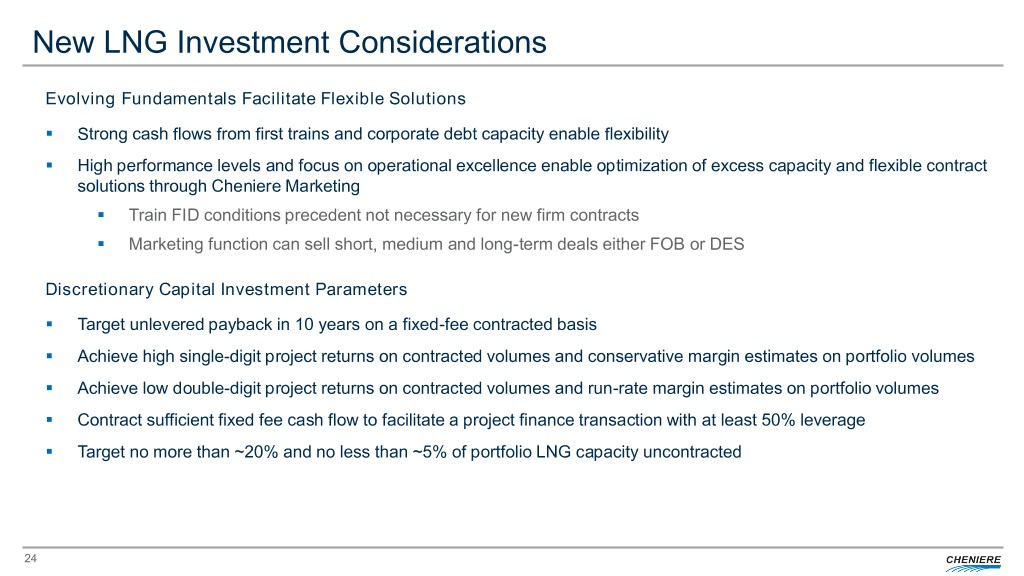

New LNG Investment Considerations Evolving Fundamentals Facilitate Flexible Solutions . Strong cash flows from first trains and corporate debt capacity enable flexibility . High performance levels and focus on operational excellence enable optimization of excess capacity and flexible contract solutions through Cheniere Marketing . Train FID conditions precedent not necessary for new firm contracts . Marketing function can sell short, medium and long-term deals either FOB or DES Discretionary Capital Investment Parameters . Target unlevered payback in 10 years on a fixed-fee contracted basis . Achieve high single-digit project returns on contracted volumes and conservative margin estimates on portfolio volumes . Achieve low double-digit project returns on contracted volumes and run-rate margin estimates on portfolio volumes . Contract sufficient fixed fee cash flow to facilitate a project finance transaction with at least 50% leverage . Target no more than ~20% and no less than ~5% of portfolio LNG capacity uncontracted 24

Cheniere Investment Thesis Full-service LNG offering, including gas procurement, transportation, liquefaction, and shipping enables flexible solutions tailored to customer needs Positioned as premier LNG provider, with a proven track record and low- cost advantage through capacity expansion at existing sites Liquefaction platform offers excellent visibility for long-term cash flows, with “take-or-pay” style agreements with creditworthy counterparties Opportunities for future cash flow growth at attractive returns, utilizing uncontracted incremental production and constructing additional Trains Supply/demand fundamentals support continued LNG demand growth worldwide, with forecast global LNG trade growth of >200 mtpa by 2030 Investments in additional infrastructure upstream and downstream of liquefaction along the LNG value chain Source: Cheniere Research, EIA, Cheniere interpretation of Wood Mackenzie data (Q1 2018), IHS, GIIGNL 25

CHENIERE OVERVIEW APPENDIX

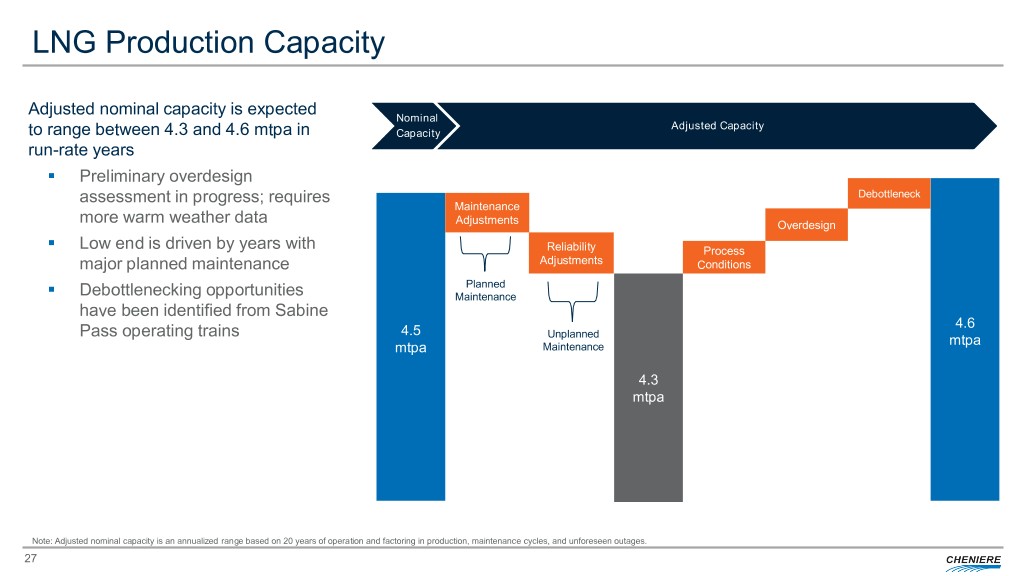

LNG Production Capacity Adjusted nominal capacity is expected Nominal Adjusted Capacity to range between 4.3 and 4.6 mtpa in Capacity run-rate years . Preliminary overdesign assessment in progress; requires Debottleneck Maintenance more warm weather data Adjustments Overdesign . Low end is driven by years with Reliability Process major planned maintenance Adjustments Conditions . Planned Debottlenecking opportunities Maintenance have been identified from Sabine 4.6 Pass operating trains 4.5 Unplanned mtpa mtpa Maintenance 4.3 mtpa Note: Adjusted nominal capacity is an annualized range based on 20 years of operation and factoring in production, maintenance cycles, and unforeseen outages. 27

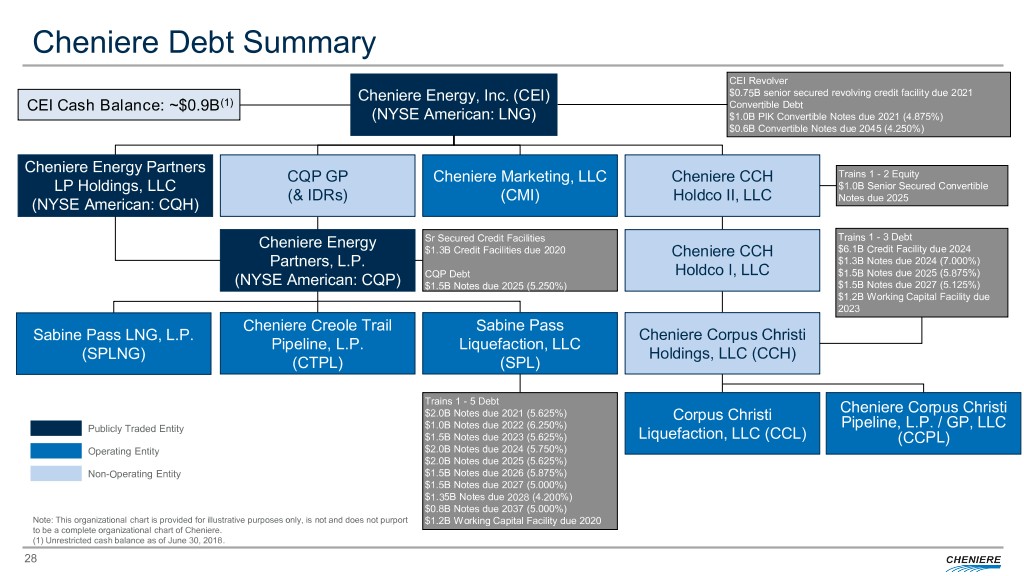

Cheniere Debt Summary CEI Revolver Cheniere Energy, Inc. (CEI) $0.75B senior secured revolving credit facility due 2021 CEI Cash Balance: ~$0.9B(1) Convertible Debt (NYSE American: LNG) $1.0B PIK Convertible Notes due 2021 (4.875%) $0.6B Convertible Notes due 2045 (4.250%) Cheniere Energy Partners CQP GP Cheniere Marketing, LLC Cheniere CCH Trains 1 - 2 Equity LP Holdings, LLC $1.0B Senior Secured Convertible (& IDRs) (CMI) Holdco II, LLC Notes due 2025 (NYSE American: CQH) Sr Secured Credit Facilities Trains 1 - 3 Debt Cheniere Energy $1.3B Credit Facilities due 2020 Cheniere CCH $6.1B Credit Facility due 2024 Partners, L.P. $1.3B Notes due 2024 (7.000%) CQP Debt Holdco I, LLC $1.5B Notes due 2025 (5.875%) (NYSE American: CQP) $1.5B Notes due 2025 (5.250%) $1.5B Notes due 2027 (5.125%) $1.2B Working Capital Facility due 2023 Cheniere Creole Trail Sabine Pass Sabine Pass LNG, L.P. Cheniere Corpus Christi Pipeline, L.P. Liquefaction, LLC (SPLNG) Holdings, LLC (CCH) (CTPL) (SPL) Trains 1 - 5 Debt Cheniere Corpus Christi $2.0B Notes due 2021 (5.625%) Corpus Christi $1.0B Notes due 2022 (6.250%) Pipeline, L.P. / GP, LLC Publicly Traded Entity $1.5B Notes due 2023 (5.625%) Liquefaction, LLC (CCL) (CCPL) Operating Entity $2.0B Notes due 2024 (5.750%) $2.0B Notes due 2025 (5.625%) Non-Operating Entity $1.5B Notes due 2026 (5.875%) $1.5B Notes due 2027 (5.000%) $1.35B Notes due 2028 (4.200%) $0.8B Notes due 2037 (5.000%) Note: This organizational chart is provided for illustrative purposes only, is not and does not purport $1.2B Working Capital Facility due 2020 to be a complete organizational chart of Cheniere. (1) Unrestricted cash balance as of June 30, 2018. 28

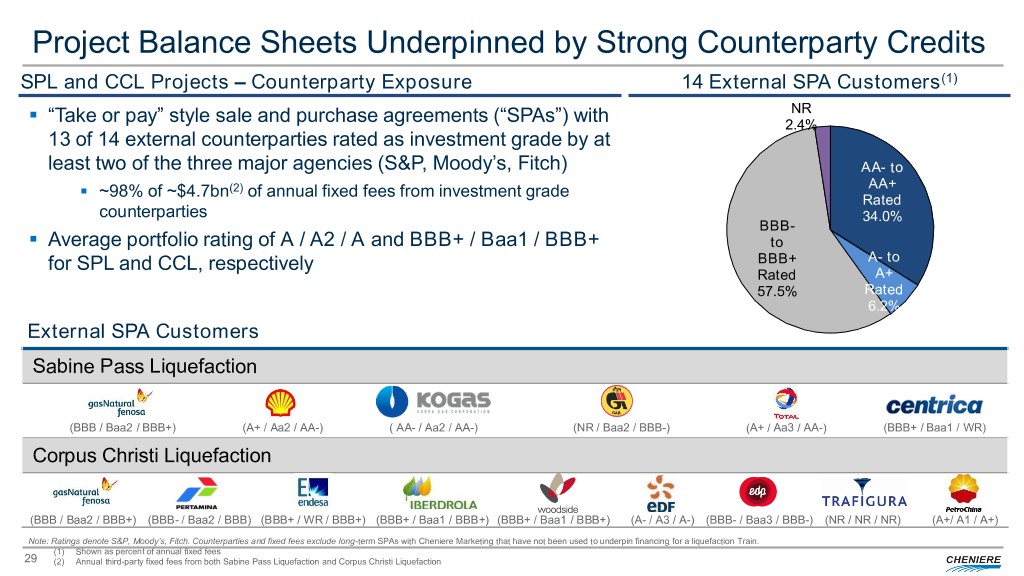

Project Balance Sheets Underpinned by Strong Counterparty Credits SPL and CCL Projects – Counterparty Exposure 14 External SPA Customers(1) . NR “Take or pay” style sale and purchase agreements (“SPAs”) with 2.4% 13 of 14 external counterparties rated as investment grade by at least two of the three major agencies (S&P, Moody’s, Fitch) AA- to . ~98% of ~$4.7bn(2) of annual fixed fees from investment grade AA+ Rated counterparties 34.0% . BBB- Average portfolio rating of A / A2 / A and BBB+ / Baa1 / BBB+ to for SPL and CCL, respectively BBB+ A- to Rated A+ 57.5% Rated 6.2% External SPA Customers Sabine Pass Liquefaction (BBB / Baa2 / BBB+) (A+ / Aa2 / AA-) ( AA- / Aa2 / AA-) (NR / Baa2 / BBB-) (A+ / Aa3 / AA-) (BBB+ / Baa1 / WR) Corpus Christi Liquefaction (BBB / Baa2 / BBB+) (BBB- / Baa2 / BBB) (BBB+ / WR / BBB+) (BBB+ / Baa1 / BBB+) (BBB+ / Baa1 / BBB+) (A- / A3 / A-) (BBB- / Baa3 / BBB-) (NR / NR / NR) (A+/ A1 / A+) Note: Ratings denote S&P, Moody’s, Fitch. Counterparties and fixed fees exclude long-term SPAs with Cheniere Marketing that have not been used to underpin financing for a liquefaction Train. (1) Shown as percent of annual fixed fees 29 (2) Annual third-party fixed fees from both Sabine Pass Liquefaction and Corpus Christi Liquefaction

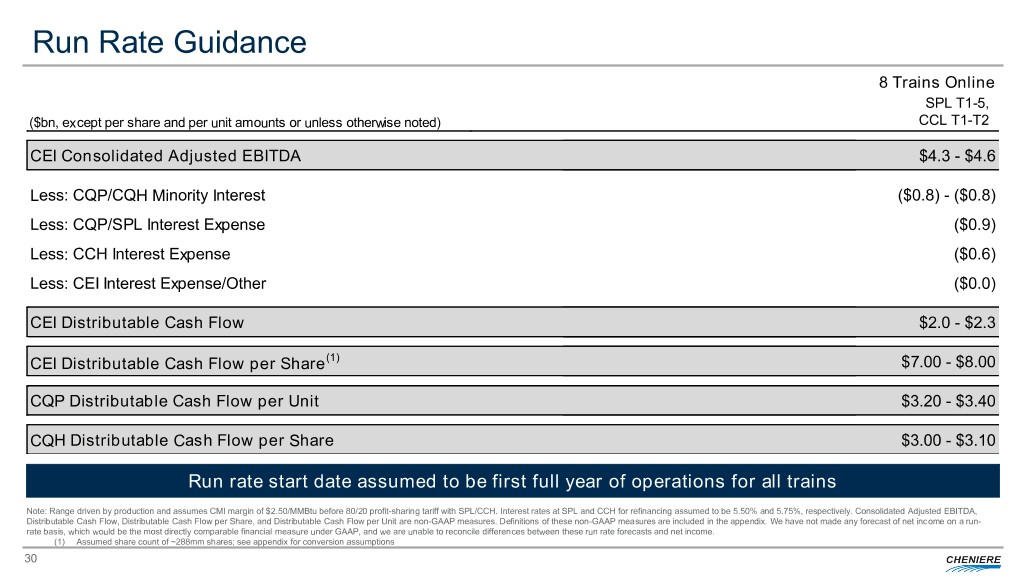

Run Rate Guidance 7 Trains Online 78 Trains Online 8 Trains Online 7 TrainsSPL Online T1-5, 8 TrainsSPL Online T1-5, SPL T1-5, SPL T1-5, SPL T1T1-5,-5, ($bn, except per share and per unit ($bn,amounts except or unless per share otherwise and per noted) unit amounts or unless otherwise noted) CCH T1-2 CCH T1-2T1-3 CCH T1-3 ($bn, except per share and per unit amounts or unless otherwise noted) CCH T1-2 CCLCCH T1 T1-3-T2 CEI Consolidated AdjustedCEI EBITDA Consolidated Adjusted EBITDA $3.8 - $4.1 $3.8$4.3 - $4.1$4.6 $4.3 - $4.6 CEI Consolidated Adjusted EBITDA $3.8 - $4.1 $4.3 - $4.6 Less: CQP/CQH Minority InterestLess: CQP/CQH Minority Interest ($0.8) - ($0.8) ($0.8) - ($0.8) ($0.8) - ($0.8) Less: CQP/CQH Minority Interest ($0.8) - ($0.8) ($0.8) - ($0.8) Less: CQP/SPL Interest ExpenseLess: CQP/SPL Interest Expense ($0.9) ($0.9) ($0.9) Less: CQP/SPL Interest Expense ($0.9) ($0.9) Less: CCH Interest Expense Less: CCH Interest Expense ($0.5) ($0.5)($0.6) ($0.6) Less: CCH Interest Expense ($0.5) ($0.6) Less: CEI Interest Expense/OtherLess: CEI Interest Expense/Other ($0.0) ($0.0) ($0.0) Less: CEI Interest Expense/Other ($0.0) ($0.0) CEI Distributable Cash FlowCEI Distributable Cash Flow $1.7 - $1.9 $1.7$2.0 - $1.9$2.3 $2.0 - $2.3 CEI Distributable Cash Flow $1.7 - $1.9 $2.0 - $2.3 CEI Distributable Cash FlowCEI per Distributable Share(1) Cash Flow per Share(1) $5.70 - $6.60 $5.70$7.00 - $6.60$8.00 $7.00 - $8.00 CEI Distributable Cash Flow per Share(1) $5.70 - $6.60 $7.00 - $8.00 CQP Distributable Cash FlowCQP per Distributable Unit Cash Flow per Unit $3.20 - $3.40 $3.20 - $3.40 $3.20 - $3.40 CQP Distributable Cash Flow per Unit $3.20 - $3.40 $3.20 - $3.40 CQH Distributable Cash FlowCQH per Distributable Share Cash Flow per Share $3.00 - $3.10 $3.00 - $3.10 $3.00 - $3.10 CQH Distributable Cash Flow per Share $3.00 - $3.10 $3.00 - $3.10 Run rate start date assumed to be first full year of operations for all trains Note: Range driven by production and assumes CMI margin of $2.50/MMBtu before 80/20 profit-sharing tariff with SPL/CCH. Interest rates at SPL and CCH for refinancing assumed to be 5.50% and 5.75%, respectively. Consolidated Adjusted EBITDA, Distributable Cash Flow, Distributable Cash Flow per Share, and Distributable Cash Flow per Unit are non-GAAP measures. Definitions of these non-GAAP measures are included in the appendix. We have not made any forecast of net income on a run- rate basis, which would be the most directly comparable financial measure under GAAP, and we are unable to reconcile differences between these run rate forecasts and net income. (1) Assumed share count of ~288mm shares; see appendix for conversion assumptions 30

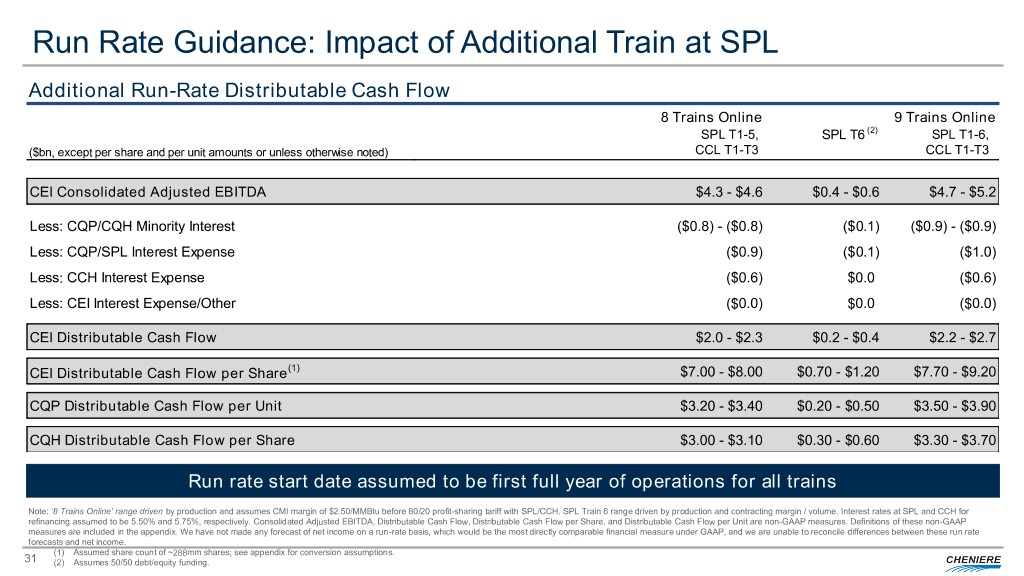

Run Rate Guidance: Impact of Additional Train at SPL Additional Run-Rate Distributable Cash Flow 8 Trains Online 9 Trains Online SPL T1T1-5,-5, SPL T6 (2) SPLSPL T1 T-6,-6, ($bn, except per share and per unit amounts or unless otherwise noted) CCLCCH T1 T1-3-T3 CCLCCH T1 T1-3-T3 CEI Consolidated Adjusted EBITDA $4.3 - $4.6 $0.4 - $0.6 $4.7 - $5.2 Less: CQP/CQH Minority Interest ($0.8) - ($0.8) ($0.1) ($0.9) - ($0.9) Less: CQP/SPL Interest Expense ($0.9) ($0.1) ($1.0) Less: CCH Interest Expense ($0.6) $0.0 ($0.6) Less: CEI Interest Expense/Other ($0.0) $0.0 ($0.0) CEI Distributable Cash Flow $2.0 - $2.3 $0.2 - $0.4 $2.2 - $2.7 CEI Distributable Cash Flow per Share(1) $7.00 - $8.00 $0.70 - $1.20 $7.70 - $9.20 CQP Distributable Cash Flow per Unit $3.20 - $3.40 $0.20 - $0.50 $3.50 - $3.90 CQH Distributable Cash Flow per Share $3.00 - $3.10 $0.30 - $0.60 $3.30 - $3.70 Run rate start date assumed to be first full year of operations for all trains Note: ‘8 Trains Online’ range driven by production and assumes CMI margin of $2.50/MMBtu before 80/20 profit-sharing tariff with SPL/CCH. SPL Train 6 range driven by production and contracting margin / volume. Interest rates at SPL and CCH for refinancing assumed to be 5.50% and 5.75%, respectively. Consolidated Adjusted EBITDA, Distributable Cash Flow, Distributable Cash Flow per Share, and Distributable Cash Flow per Unit are non-GAAP measures. Definitions of these non-GAAP measures are included in the appendix. We have not made any forecast of net income on a run-rate basis, which would be the most directly comparable financial measure under GAAP, and we are unable to reconcile differences between these run rate forecasts and net income. (1) Assumed share count of ~288mm shares; see appendix for conversion assumptions. 31 (2) Assumes 50/50 debt/equity funding.

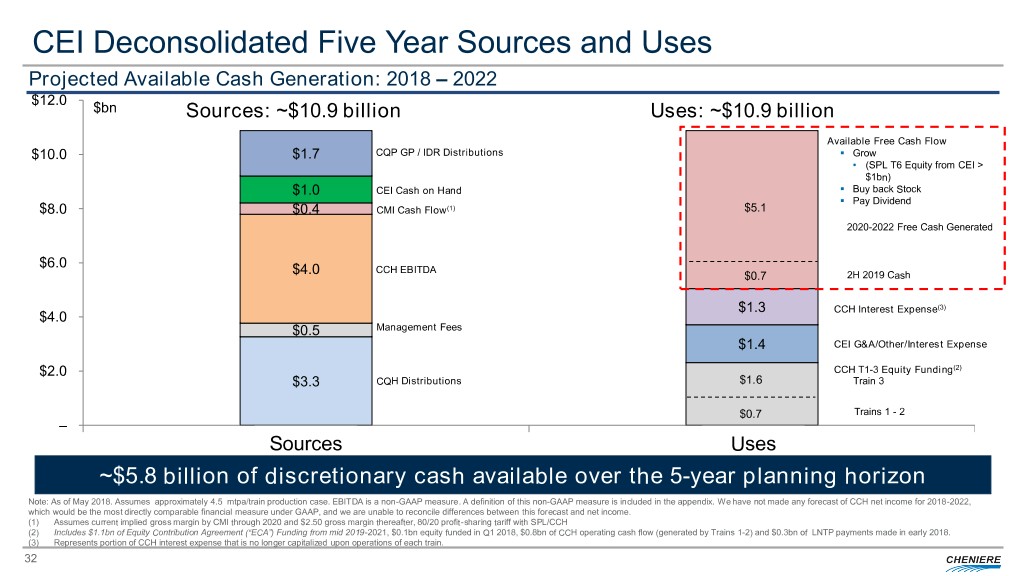

CEI Deconsolidated Five Year Sources and Uses Projected Available Cash Generation: 2018 – 2022 $12.0 $bn Sources: ~$10.9 billion Uses: ~$10.9 billion Available Free Cash Flow $10.0 $1.7 CQP GP / IDR Distributions . Grow • (SPL T6 Equity from CEI > $1bn) . $1.0 CEI Cash on Hand Buy back Stock . Pay Dividend $8.0 $0.4 CMI Cash Flow(1) $5.1 2020-2022 Free Cash Generated $6.0 CCH EBITDA $4.0 $0.7 2H 2019 Cash $1.3 CCH Interest Expense(3) $4.0 $0.5 Management Fees $1.4 CEI G&A/Other/Interest Expense $2.0 CCH T1-3 Equity Funding(2) $3.3 CQH Distributions $1.6 Train 3 $0.7 Trains 1 - 2 – SourcesSources UsesUses ~$5.8 billion of discretionary cash available over the 5-year planning horizon Note: As of May 2018. Assumes approximately 4.5 mtpa/train production case. EBITDA is a non-GAAP measure. A definition of this non-GAAP measure is included in the appendix. We have not made any forecast of CCH net income for 2018-2022, which would be the most directly comparable financial measure under GAAP, and we are unable to reconcile differences between this forecast and net income. (1) Assumes current implied gross margin by CMI through 2020 and $2.50 gross margin thereafter, 80/20 profit-sharing tariff with SPL/CCH (2) Includes $1.1bn of Equity Contribution Agreement (“ECA”) Funding from mid 2019-2021, $0.1bn equity funded in Q1 2018, $0.8bn of CCH operating cash flow (generated by Trains 1-2) and $0.3bn of LNTP payments made in early 2018. (3) Represents portion of CCH interest expense that is no longer capitalized upon operations of each train. 32

Long-term Capital Structure Plan . Utilize leverage capacity at CQP and CEI (the corporate levels) to delever SPL and CCH (the project levels) over the next 5-10 years . Debt incurrence test will force the deleveraging of SPL and CCH over time at 1.5x/1.4x DSCR . By migrating project debt up to CQP and CEI (subject to target ~4.0x decon. debt / EBITDA constraint), project level debt amortization requirements can be pushed out to the mid to late 2020s . Plan maximizes value to equity holders while adhering to indenture amortization requirements at the project levels . Investment grade ratings at the project levels and strong high yield (“HY”) ratings (BB / Ba) at the corporate levels can be achieved and maintained . This framework provides CEI significant free cash flow to invest and grow which can further defer substantial debt pay down, while at the same time returning capital to shareholders via share repurchases and/or dividends By taking advantage of leverage capacity at the corporate levels, project level debt amortization not required until the mid to late 2020s, even with no growth beyond 8 trains 33

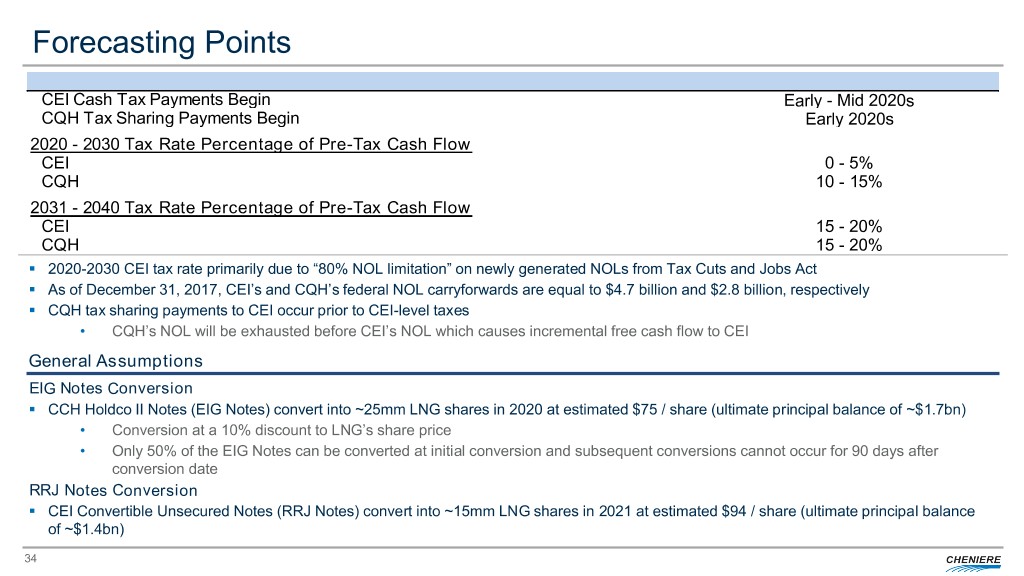

Forecasting Points CEI Cash Tax Payments Begin Early - Mid 2020s CQH Tax Sharing Payments Begin Early 2020s 2020 - 2030 Tax Rate Percentage of Pre-Tax Cash Flow CEI 0 - 5% CQH 10 - 15% 2031 - 2040 Tax Rate Percentage of Pre-Tax Cash Flow CEI 15 - 20% CQH 15 - 20% . 2020-2030 CEI tax rate primarily due to “80% NOL limitation” on newly generated NOLs from Tax Cuts and Jobs Act . As of December 31, 2017, CEI’s and CQH’s federal NOL carryforwards are equal to $4.7 billion and $2.8 billion, respectively . CQH tax sharing payments to CEI occur prior to CEI-level taxes • CQH’s NOL will be exhausted before CEI’s NOL which causes incremental free cash flow to CEI General Assumptions EIG Notes Conversion . CCH Holdco II Notes (EIG Notes) convert into ~25mm LNG shares in 2020 at estimated $75 / share (ultimate principal balance of ~$1.7bn) • Conversion at a 10% discount to LNG’s share price • Only 50% of the EIG Notes can be converted at initial conversion and subsequent conversions cannot occur for 90 days after conversion date RRJ Notes Conversion . CEI Convertible Unsecured Notes (RRJ Notes) convert into ~15mm LNG shares in 2021 at estimated $94 / share (ultimate principal balance of ~$1.4bn) 34

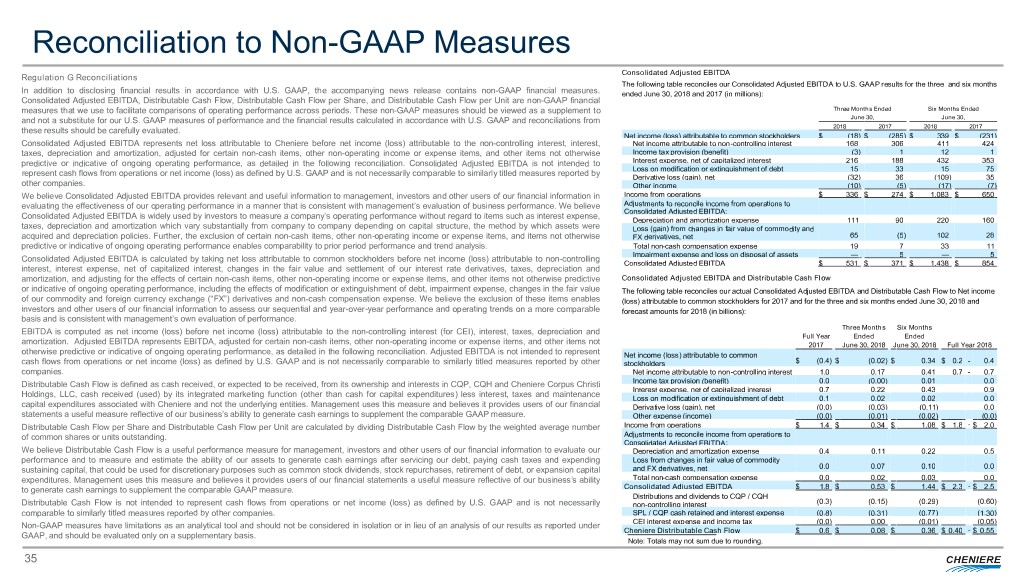

Reconciliation to Non-GAAP Measures Consolidated Adjusted EBITDA Regulation G Reconciliations The following table reconciles our Consolidated Adjusted EBITDA to U.S. GAAP results for the three and six months In addition to disclosing financial results in accordance with U.S. GAAP, the accompanying news release contains non-GAAP financial measures. ended June 30, 2018 and 2017 (in millions): Consolidated Adjusted EBITDA, Distributable Cash Flow, Distributable Cash Flow per Share, and Distributable Cash Flow per Unit are non-GAAP financial measures that we use to facilitate comparisons of operating performance across periods. These non-GAAP measures should be viewed as a supplement to Three Months Ended Six Months Ended and not a substitute for our U.S. GAAP measures of performance and the financial results calculated in accordance with U.S. GAAP and reconciliations from June 30, June 30, these results should be carefully evaluated. 2018 2017 2018 2017 Net income (loss) attributable to common stockholders $ (18 ) $ (285 ) $ 339 $ (231 ) Consolidated Adjusted EBITDA represents net loss attributable to Cheniere before net income (loss) attributable to the non-controlling interest, interest, Net income attributable to non-controlling interest 168 306 411 424 taxes, depreciation and amortization, adjusted for certain non-cash items, other non-operating income or expense items, and other items not otherwise Income tax provision (benefit) (3 ) 1 12 1 predictive or indicative of ongoing operating performance, as detailed in the following reconciliation. Consolidated Adjusted EBITDA is not intended to Interest expense, net of capitalized interest 216 188 432 353 Loss on modification or extinguishment of debt 15 33 15 75 represent cash flows from operations or net income (loss) as defined by U.S. GAAP and is not necessarily comparable to similarly titled measures reported by Derivative loss (gain), net (32 ) 36 (109 ) 35 other companies. Other income (10 ) (5 ) (17 ) (7 ) We believe Consolidated Adjusted EBITDA provides relevant and useful information to management, investors and other users of our financial information in Income from operations $ 336 $ 274 $ 1,083 $ 650 evaluating the effectiveness of our operating performance in a manner that is consistent with management’s evaluation of business performance. We believe Adjustments to reconcile income from operations to Consolidated Adjusted EBITDA: Consolidated Adjusted EBITDA is widely used by investors to measure a company’s operating performance without regard to items such as interest expense, Depreciation and amortization expense 111 90 220 160 taxes, depreciation and amortization which vary substantially from company to company depending on capital structure, the method by which assets were Loss (gain) from changes in fair value of commodity and acquired and depreciation policies. Further, the exclusion of certain non-cash items, other non-operating income or expense items, and items not otherwise FX derivatives, net 65 (5 ) 102 28 predictive or indicative of ongoing operating performance enables comparability to prior period performance and trend analysis. Total non-cash compensation expense 19 7 33 11 Impairment expense and loss on disposal of assets — 5 — 5 Consolidated Adjusted EBITDA is calculated by taking net loss attributable to common stockholders before net income (loss) attributable to non-controlling Consolidated Adjusted EBITDA $ 531 $ 371 $ 1,438 $ 854 interest, interest expense, net of capitalized interest, changes in the fair value and settlement of our interest rate derivatives, taxes, depreciation and amortization, and adjusting for the effects of certain non-cash items, other non-operating income or expense items, and other items not otherwise predictive Consolidated Adjusted EBITDA and Distributable Cash Flow or indicative of ongoing operating performance, including the effects of modification or extinguishment of debt, impairment expense, changes in the fair value The following table reconciles our actual Consolidated Adjusted EBITDA and Distributable Cash Flow to Net income of our commodity and foreign currency exchange (“FX”) derivatives and non-cash compensation expense. We believe the exclusion of these items enables (loss) attributable to common stockholders for 2017 and for the three and six months ended June 30, 2018 and investors and other users of our financial information to assess our sequential and year-over-year performance and operating trends on a more comparable forecast amounts for 2018 (in billions): basis and is consistent with management’s own evaluation of performance. EBITDA is computed as net income (loss) before net income (loss) attributable to the non-controlling interest (for CEI), interest, taxes, depreciation and Three Months Six Months Full Year Ended Ended amortization. Adjusted EBITDA represents EBITDA, adjusted for certain non-cash items, other non-operating income or expense items, and other items not 2017 June 30, 2018 June 30, 2018 Full Year 2018 otherwise predictive or indicative of ongoing operating performance, as detailed in the following reconciliation. Adjusted EBITDA is not intended to represent Net income (loss) attributable to common cash flows from operations or net income (loss) as defined by U.S. GAAP and is not necessarily comparable to similarly titled measures reported by other stockholders $ (0.4) $ (0.02 ) $ 0.34 $ 0.2 - 0.4 companies. Net income attributable to non-controlling interest 1.0 0.17 0.41 0.7 - 0.7 Distributable Cash Flow is defined as cash received, or expected to be received, from its ownership and interests in CQP, CQH and Cheniere Corpus Christi Income tax provision (benefit) 0.0 (0.00 ) 0.01 0.0 Interest expense, net of capitalized interest 0.7 0.22 0.43 0.9 Holdings, LLC, cash received (used) by its integrated marketing function (other than cash for capital expenditures) less interest, taxes and maintenance Loss on modification or extinguishment of debt 0.1 0.02 0.02 0.0 capital expenditures associated with Cheniere and not the underlying entities. Management uses this measure and believes it provides users of our financial Derivative loss (gain), net (0.0) (0.03 ) (0.11 ) 0.0 statements a useful measure reflective of our business’s ability to generate cash earnings to supplement the comparable GAAP measure. Other expense (income) (0.0) (0.01 ) (0.02 ) (0.0 ) Distributable Cash Flow per Share and Distributable Cash Flow per Unit are calculated by dividing Distributable Cash Flow by the weighted average number Income from operations $ 1.4 $ 0.34 $ 1.08 $ 1.8 - $ 2.0 of common shares or units outstanding. Adjustments to reconcile income from operations to Consolidated Adjusted EBITDA: We believe Distributable Cash Flow is a useful performance measure for management, investors and other users of our financial information to evaluate our Depreciation and amortization expense 0.4 0.11 0.22 0.5 performance and to measure and estimate the ability of our assets to generate cash earnings after servicing our debt, paying cash taxes and expending Loss from changes in fair value of commodity sustaining capital, that could be used for discretionary purposes such as common stock dividends, stock repurchases, retirement of debt, or expansion capital and FX derivatives, net 0.0 0.07 0.10 0.0 expenditures. Management uses this measure and believes it provides users of our financial statements a useful measure reflective of our business’s ability Total non-cash compensation expense 0.0 0.02 0.03 0.0 - to generate cash earnings to supplement the comparable GAAP measure. Consolidated Adjusted EBITDA $ 1.8 $ 0.53 $ 1.44 $ 2.3 $ 2.5 Distributions and dividends to CQP / CQH Distributable Cash Flow is not intended to represent cash flows from operations or net income (loss) as defined by U.S. GAAP and is not necessarily (0.3) (0.15 ) (0.29 ) (0.60 ) non-controlling interest comparable to similarly titled measures reported by other companies. SPL / CQP cash retained and interest expense (0.8) (0.31 ) (0.77 ) (1.30 ) Non-GAAP measures have limitations as an analytical tool and should not be considered in isolation or in lieu of an analysis of our results as reported under CEI interest expense and income tax (0.0) 0.00 (0.01 ) (0.05 ) Cheniere Distributable Cash Flow $ 0.6 $ 0.08 $ 0.36 $ 0.40 - $ 0.55 GAAP, and should be evaluated only on a supplementary basis. Note: Totals may not sum due to rounding. CQH non-controlling interest reflects an approximate 91.9% ownership by Cheniere. 35

CHENIERE ENERGY, INC. INVESTOR RELATIONS CONTACTS Randy Bhatia Vice President, Investor Relations – (713) 375-5479, randy.bhatia@cheniere.com Megan Light Manager, Investor Relations – (713) 375-5492, megan.light@cheniere.com