October 2015 Cheniere Energy, Inc.

Forward Looking Statements This presentation contains certain statements that are, or may be deemed to be, “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical facts, included or incorporated by reference herein are “forward-looking statements.” Included among “forward-looking statements” are, among other things: statements regarding the ability of Cheniere Energy Partners, L.P. to pay distributions to its unitholders or Cheniere Energy Partners LP Holdings, LLC to pay dividends to its shareholders; statements regarding Cheniere Energy Inc.’s, Cheniere Energy Partners LP Holdings, LLC’s or Cheniere Energy Partners, L.P.’s expected receipt of cash distributions from their respective subsidiaries; statements that Cheniere Energy Partners, L.P. expects to commence or complete construction of its proposed liquefied natural gas (“LNG”) terminals, liquefaction facilities, pipeline facilities or other projects, or any expansions thereof, by certain dates or at all; statements that Cheniere Energy, Inc. expects to commence or complete construction of its proposed LNG terminals, liquefaction facilities, pipeline facilities or other projects by certain dates or at all; statements regarding future levels of domestic and international natural gas production, supply or consumption or future levels of LNG imports into or exports from North America and other countries worldwide, or purchases of natural gas, regardless of the source of such information, or the transportation or other infrastructure, or demand for and prices related to natural gas, LNG or other hydrocarbon products; statements regarding any financing transactions or arrangements, or ability to enter into such transactions; statements relating to the construction of our proposed liquefaction facilities and natural gas liquefaction trains (“Trains”), or modifications to the Creole Trail Pipeline, including statements concerning the engagement of any engineering, procurement and construction ("EPC") contractor or other contractor and the anticipated terms and provisions of any agreement with any EPC or other contractor, and anticipated costs related thereto; statements regarding any agreement to be entered into or performed substantially in the future, including any revenues anticipated to be received and the anticipated timing thereof, and statements regarding the amounts of total LNG regasification, liquefaction or storage capacities that are, or may become, subject to contracts; statements regarding counterparties to our commercial contracts, construction contracts and other contracts; statements regarding our planned development and construction of additional Trains, including the financing of such Trains; statements that our Trains, when completed, will have certain characteristics, including amounts of liquefaction capacities; statements regarding our business strategy, our strengths, our business and operation plans or any other plans, forecasts, projections or objectives, including anticipated revenues and capital expenditures and EBITDA, any or all of which are subject to change; statements regarding projections of revenues, expenses, earnings or losses, working capital or other financial items; statements regarding legislative, governmental, regulatory, administrative or other public body actions, approvals, requirements, permits, applications, filings, investigations, proceedings or decisions; statements regarding our anticipated LNG and natural gas marketing activities; and any other statements that relate to non-historical or future information. These forward-looking statements are often identified by the use of terms and phrases such as “achieve,” “anticipate,” “believe,” “contemplate,” “develop,” “estimate,” “example,” “expect,” “forecast,” “goals,” “opportunities,” “plan,” “potential,” “project,” “propose,” “subject to,” “strategy,” “target,” and similar terms and phrases, or by use of future tense. Although we believe that the expectations reflected in these forward-looking statements are reasonable, they do involve assumptions, risks and uncertainties, and these expectations may prove to be incorrect. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of a variety of factors, including those discussed in “Risk Factors” in the Cheniere Energy, Inc., Cheniere Energy Partners, L.P. and Cheniere Energy Partners LP Holdings, LLC Annual Reports on Form 10-K filed with the SEC on February 20, 2015, which are incorporated by reference into this presentation. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by these ”Risk Factors.” These forward-looking statements are made as of the date of this presentation, and other than as required under the securities laws, we undertake no obligation to publicly update or revise any forward-looking statements. 2

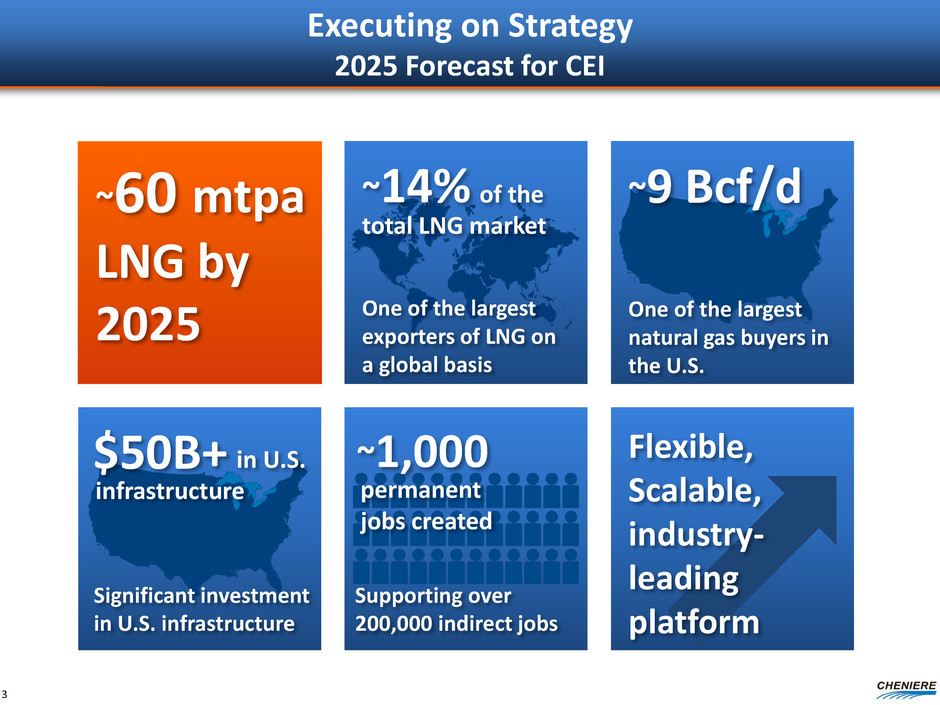

Executing on Strategy 2025 Forecast for CEI Flexible, Scalable, industry- leading platform $50B+ ~60 mtpa LNG by 2025 One of the largest natural gas buyers in the U.S. ~9 Bcf/d Supporting over 200,000 indirect jobs ~1,000 permanent jobs created One of the largest exporters of LNG on a global basis ~14% of the total LNG market in U.S. infrastructure Significant investment in U.S. infrastructure 3

Cheniere’s Key Businesses Four planned LNG terminals to be located along Gulf of Mexico ~60 mtpa planned Scalable platform SPL T1-5 and CCL 1- 2 underpinned by long-term contracts, competitive capital costs LNG sales, FOB or DES, provided to customers on a short, mid, and long-term basis ~9 mtpa LNG volumes expected from SPL T1-6 and CCL T1-3 3 chartered LNG vessels to date Developing/ investing in infrastructure to facilitate hydrocarbon revolution in Texas and beyond Optimize value of LNG platform Identify opportunities in related markets Providing feedstock for LNG production Redundant pipeline capacity ensures reliable gas deliverability Upstream pipeline capacity provides access to diverse supply sources LNG PLATFORM GAS PROCUREMENT CHENIERE MARKETING FUTURE DEVELOPMENTS 4

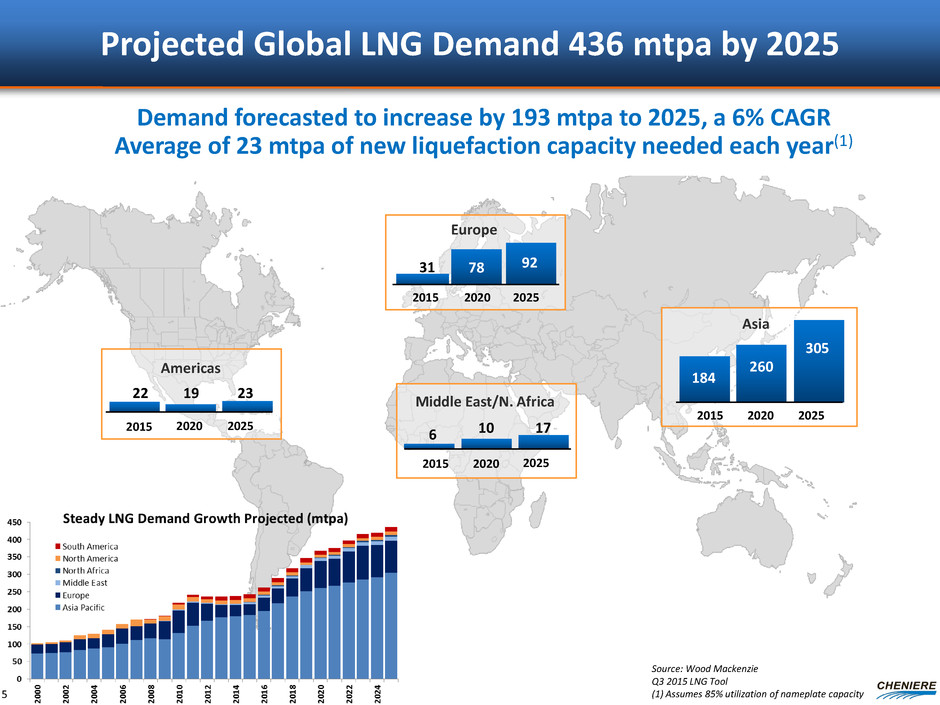

Projected Global LNG Demand 436 mtpa by 2025 22 19 23 2015 2020 2025 2015 2020 2025 6 10 17 2015 2020 2025 2015 2020 2025 Americas Asia Middle East/N. Africa 184 260 305 31 78 92 Europe Source: Wood Mackenzie Q3 2015 LNG Tool (1) Assumes 85% utilization of nameplate capacity Demand forecasted to increase by 193 mtpa to 2025, a 6% CAGR Average of 23 mtpa of new liquefaction capacity needed each year(1) 5

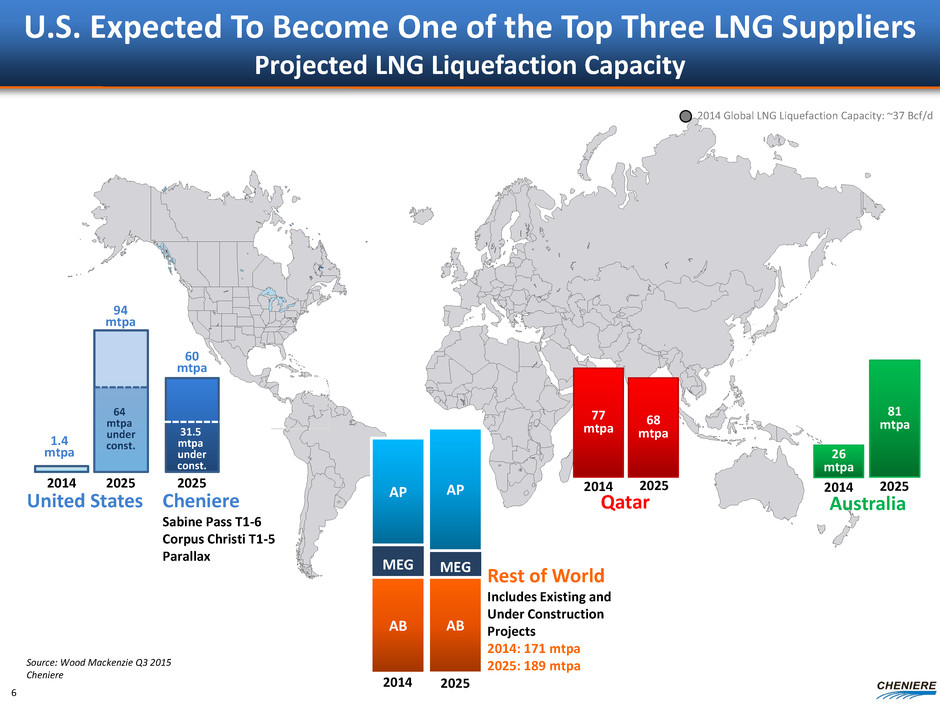

U.S. Expected To Become One of the Top Three LNG Suppliers Projected LNG Liquefaction Capacity 2014 Global LNG Liquefaction Capacity: ~37 Bcf/d 6 United States 77 mtpa 68 mtpa Qatar Source: Wood Mackenzie Q3 2015 Cheniere 2014 2025 2014 2025 2014 2025 MEG MEG Rest of World Includes Existing and Under Construction Projects 2014: 171 mtpa 2025: 189 mtpa AB 2014 2025 AB AP AP 1.4 mtpa 26 mtpa 81 mtpa Australia Cheniere Sabine Pass T1-6 Corpus Christi T1-5 Parallax 2025 64 mtpa under const. 31.5 mtpa under const. 94 mtpa 60 mtpa

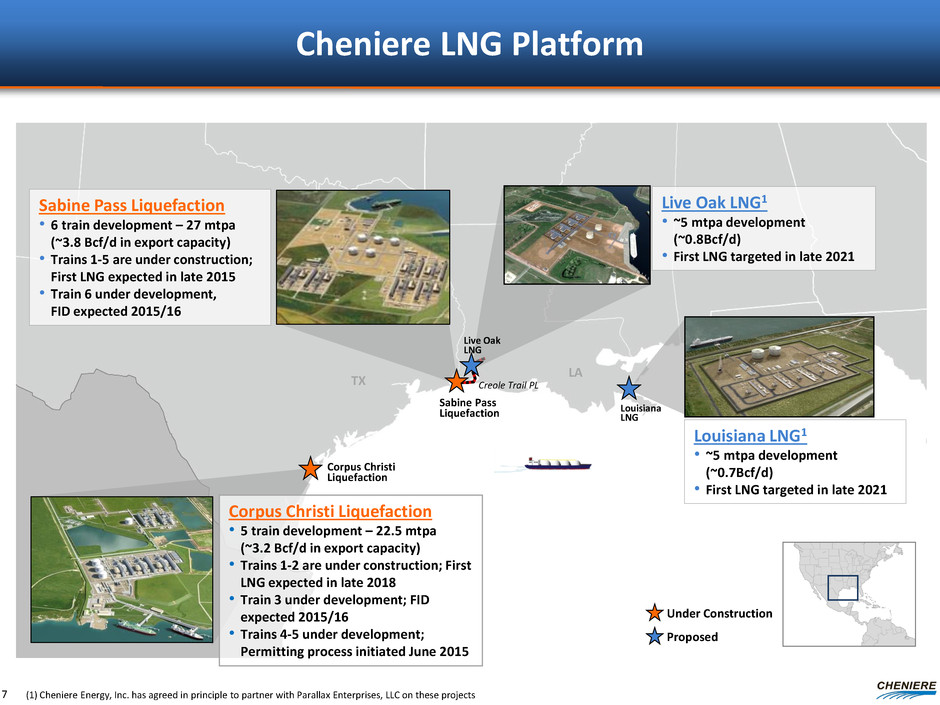

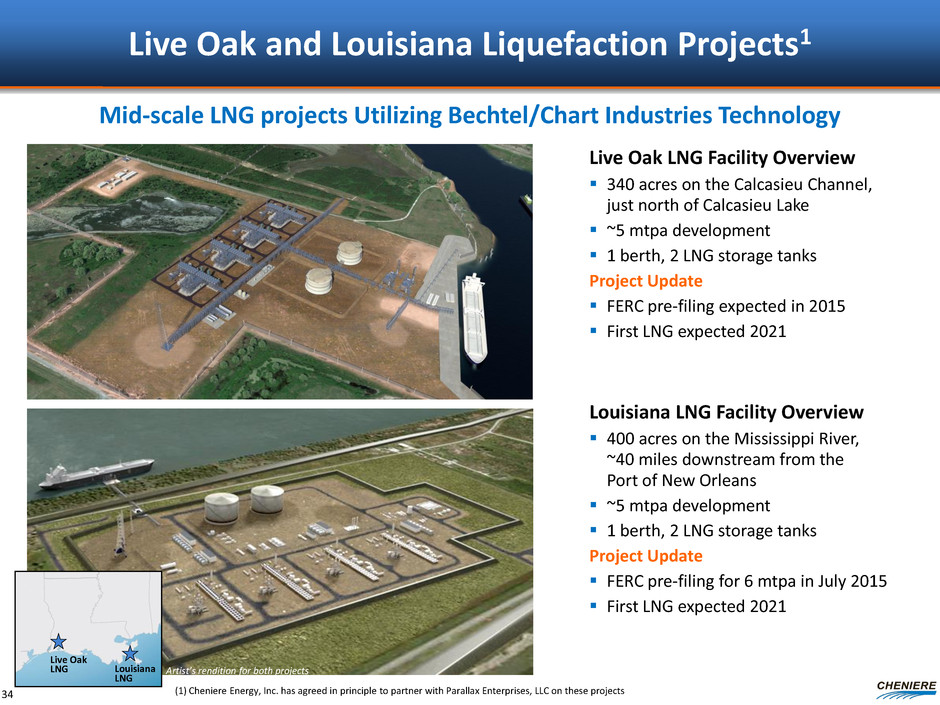

Cheniere LNG Platform Sabine Pass Liquefaction TX LA Creole Trail PL Sabine Pass Liquefaction • 6 train development – 27 mtpa (~3.8 Bcf/d in export capacity) • Trains 1-5 are under construction; First LNG expected in late 2015 • Train 6 under development, FID expected 2015/16 Corpus Christi Liquefaction 7 Corpus Christi Liquefaction • 5 train development – 22.5 mtpa (~3.2 Bcf/d in export capacity) • Trains 1-2 are under construction; First LNG expected in late 2018 • Train 3 under development; FID expected 2015/16 • Trains 4-5 under development; Permitting process initiated June 2015 Live Oak LNG Live Oak LNG1 • ~5 mtpa development (~0.8Bcf/d) • First LNG targeted in late 2021 Louisiana LNG1 • ~5 mtpa development (~0.7Bcf/d) • First LNG targeted in late 2021 Louisiana LNG Under Construction Proposed (1) Cheniere Energy, Inc. has agreed in principle to partner with Parallax Enterprises, LLC on these projects

Aerial View of SPL Construction – August 2015 Train 1 Train 3 Train 4 Propane Condenser Area T2 Ethylene Cold Box T2 Methane Cold Box Train 2 Air Coolers T1 Methane Cold Box T1 Ethylene Cold Box T3 Ethylene Cold Box T3 Methane Cold Box Train 5 T5 Soil Stabilization Train 6 Under Development

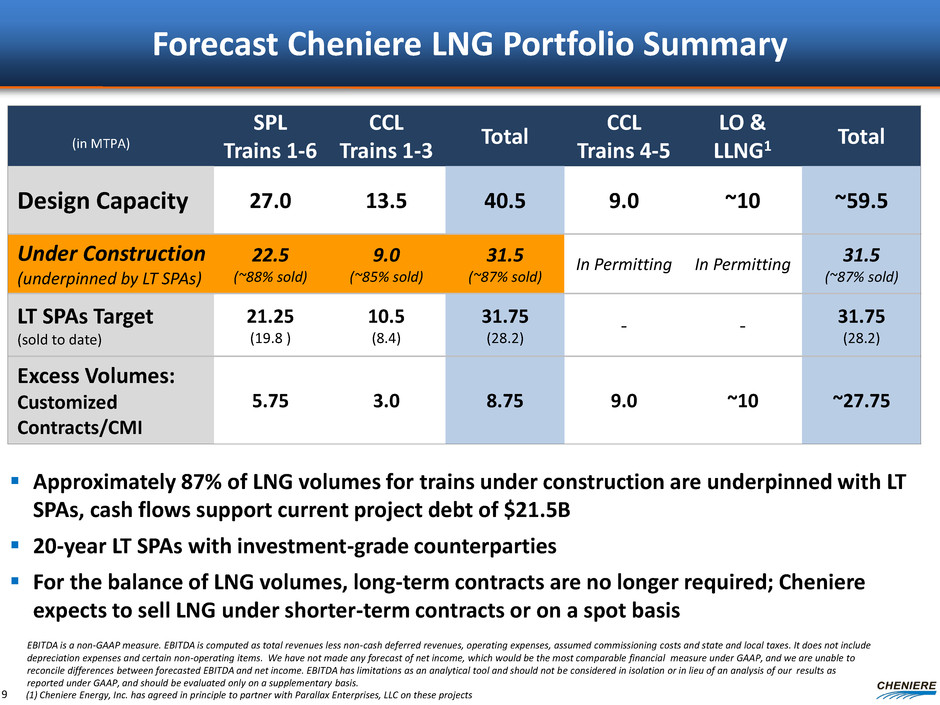

Forecast Cheniere LNG Portfolio Summary Approximately 87% of LNG volumes for trains under construction are underpinned with LT SPAs, cash flows support current project debt of $21.5B 20-year LT SPAs with investment-grade counterparties For the balance of LNG volumes, long-term contracts are no longer required; Cheniere expects to sell LNG under shorter-term contracts or on a spot basis 9 SPL Trains 1-6 CCL Trains 1-3 Total CCL Trains 4-5 LO & LLNG1 Total Design Capacity 27.0 13.5 40.5 9.0 ~10 ~59.5 Under Construction (underpinned by LT SPAs) 22.5 (~88% sold) 9.0 (~85% sold) 31.5 (~87% sold) In Permitting In Permitting 31.5 (~87% sold) LT SPAs Target (sold to date) 21.25 (19.8 ) 10.5 (8.4) 31.75 (28.2) - - 31.75 (28.2) Excess Volumes: Customized Contracts/CMI 5.75 3.0 8.75 9.0 ~10 ~27.75 EBITDA is a non-GAAP measure. EBITDA is computed as total revenues less non-cash deferred revenues, operating expenses, assumed commissioning costs and state and local taxes. It does not include depreciation expenses and certain non-operating items. We have not made any forecast of net income, which would be the most comparable financial measure under GAAP, and we are unable to reconcile differences between forecasted EBITDA and net income. EBITDA has limitations as an analytical tool and should not be considered in isolation or in lieu of an analysis of our results as reported under GAAP, and should be evaluated only on a supplementary basis. (in MTPA) (1) Cheniere Energy, Inc. has agreed in principle to partner with Parallax Enterprises, LLC on these projects

Cheniere’s LNG Export Projects Underpinned with Attractive SPA Features 10 Proven record of execution; proven technology SPAs feature parent guarantees & HH + fixed fee (no price reopeners) Cheniere LNG SPAs: LNG price tied to Henry Hub, destination flexibility, upstream gas procurement services, no lifting requirements

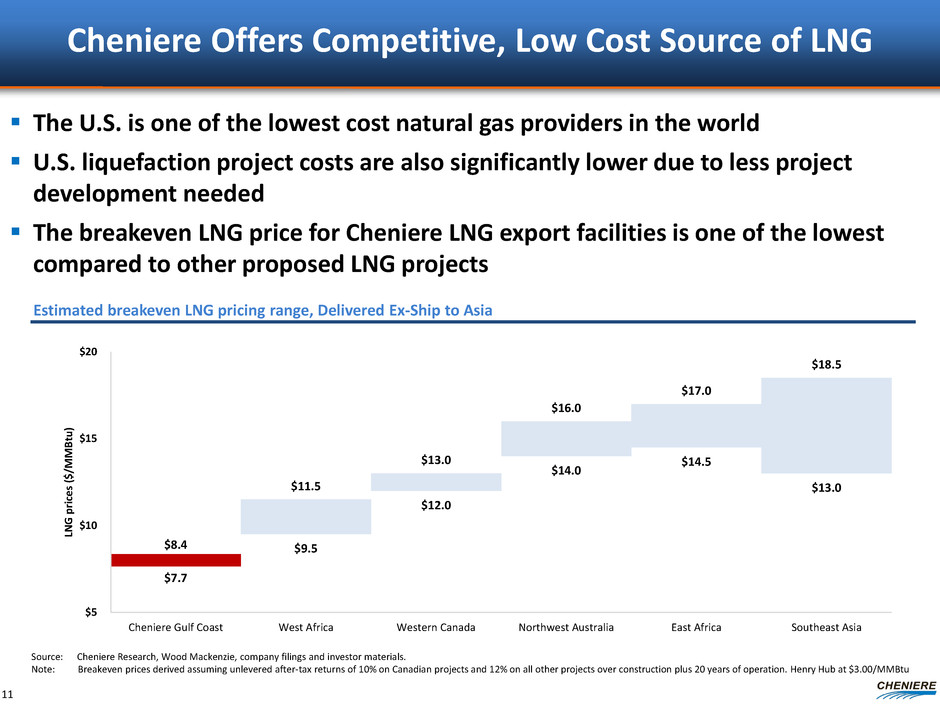

$7.7 $9.5 $12.0 $14.0 $14.5 $13.0 $8.4 $11.5 $13.0 $16.0 $17.0 $18.5 $5 $10 $15 $20 Cheniere Gulf Coast West Africa Western Canada Northwest Australia East Africa Southeast Asia LN G p rice s ($ /M MBt u) Cheniere Offers Competitive, Low Cost Source of LNG The U.S. is one of the lowest cost natural gas providers in the world U.S. liquefaction project costs are also significantly lower due to less project development needed The breakeven LNG price for Cheniere LNG export facilities is one of the lowest compared to other proposed LNG projects 11 Estimated breakeven LNG pricing range, Delivered Ex-Ship to Asia Source: Cheniere Research, Wood Mackenzie, company filings and investor materials. Note: Breakeven prices derived assuming unlevered after-tax returns of 10% on Canadian projects and 12% on all other projects over construction plus 20 years of operation. Henry Hub at $3.00/MMBtu

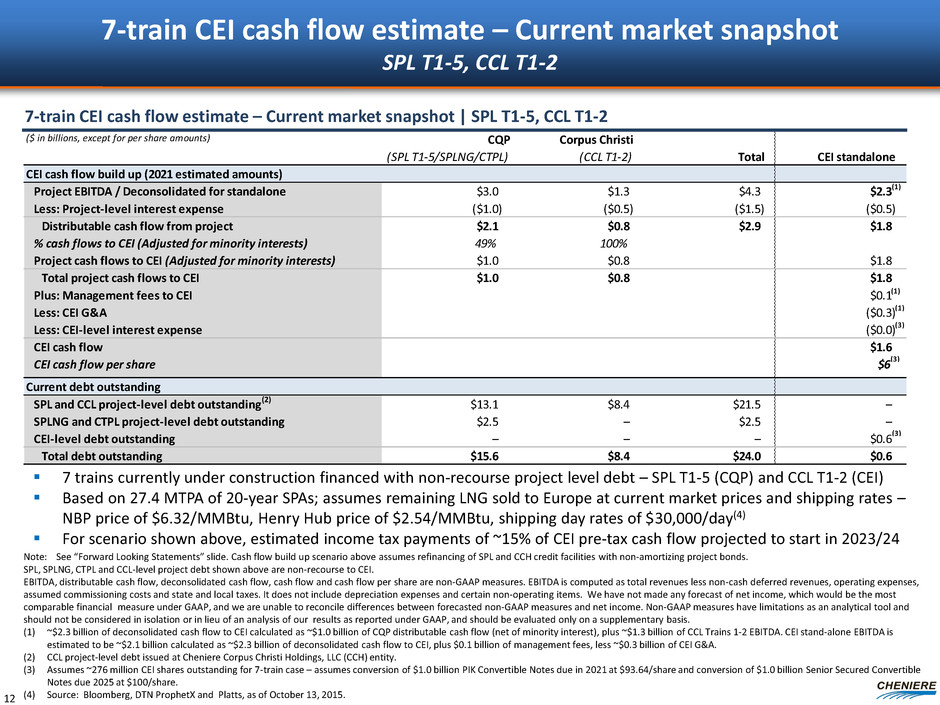

($ in billions, except for per share amounts) Corpus Christi (CCL T1-2) Total CEI standalone CEI cash flow build up (2021 estimated amounts) Project EBITDA / Deconsolidated for standalone $3.0 $1.3 $4.3 $2.3 Less: Project-level interest expense ($1.0) ($0.5) ($1.5) ($0.5) Distributable cash flow from project $2.1 $0.8 $2.9 $1.8 % cash flows to CEI (Adjusted for minority interests) 49% 100% Project cash flows to CEI (Adjusted for minority interests) $1.0 $0.8 $1.8 Total project cash flows to CEI $1.0 $0.8 $1.8 Plus: Management fees to CEI $0.1 Less: CEI G&A ($0.3) Less: CEI-level interest expense ($0.0) CEI cash flow $1.6 CEI cash flow per share $6 Current debt outstanding SPL and CCL project-level debt outstanding(2) $13.1 $8.4 $21.5 – SPLNG and CTPL project-level debt outstanding $2.5 – $2.5 – CEI-level debt outstanding – – – $0.6 Total debt outstanding $15.6 $8.4 $24.0 $0.6 CQP (SPL T1-5/SPLNG/CTPL) (1) (3) (3) (3) (1) (1) 7-train CEI cash flow estimate – Current market snapshot SPL T1-5, CCL T1-2 7-train CEI cash flow estimate – Current market snapshot | SPL T1-5, CCL T1-2 7 trains currently under construction financed with non-recourse project level debt – SPL T1-5 (CQP) and CCL T1-2 (CEI) Based on 27.4 MTPA of 20-year SPAs; assumes remaining LNG sold to Europe at current market prices and shipping rates – NBP price of $6.32/MMBtu, Henry Hub price of $2.54/MMBtu, shipping day rates of $30,000/day(4) For scenario shown above, estimated income tax payments of ~15% of CEI pre-tax cash flow projected to start in 2023/24 12 Note: See “Forward Looking Statements” slide. Cash flow build up scenario above assumes refinancing of SPL and CCH credit facilities with non-amortizing project bonds. SPL, SPLNG, CTPL and CCL-level project debt shown above are non-recourse to CEI. EBITDA, distributable cash flow, deconsolidated cash flow, cash flow and cash flow per share are non-GAAP measures. EBITDA is computed as total revenues less non-cash deferred revenues, operating expenses, assumed commissioning costs and state and local taxes. It does not include depreciation expenses and certain non-operating items. We have not made any forecast of net income, which would be the most comparable financial measure under GAAP, and we are unable to reconcile differences between forecasted non-GAAP measures and net income. Non-GAAP measures have limitations as an analytical tool and should not be considered in isolation or in lieu of an analysis of our results as reported under GAAP, and should be evaluated only on a supplementary basis. (1) ~$2.3 billion of deconsolidated cash flow to CEI calculated as ~$1.0 billion of CQP distributable cash flow (net of minority interest), plus ~$1.3 billion of CCL Trains 1‐2 EBITDA. CEI stand‐alone EBITDA is estimated to be ~$2.1 billion calculated as ~$2.3 billion of deconsolidated cash flow to CEI, plus $0.1 billion of management fees, less ~$0.3 billion of CEI G&A. (2) CCL project-level debt issued at Cheniere Corpus Christi Holdings, LLC (CCH) entity. (3) Assumes ~276 million CEI shares outstanding for 7-train case – assumes conversion of $1.0 billion PIK Convertible Notes due in 2021 at $93.64/share and conversion of $1.0 billion Senior Secured Convertible Notes due 2025 at $100/share. (4) Source: Bloomberg, DTN ProphetX and Platts, as of October 13, 2015.

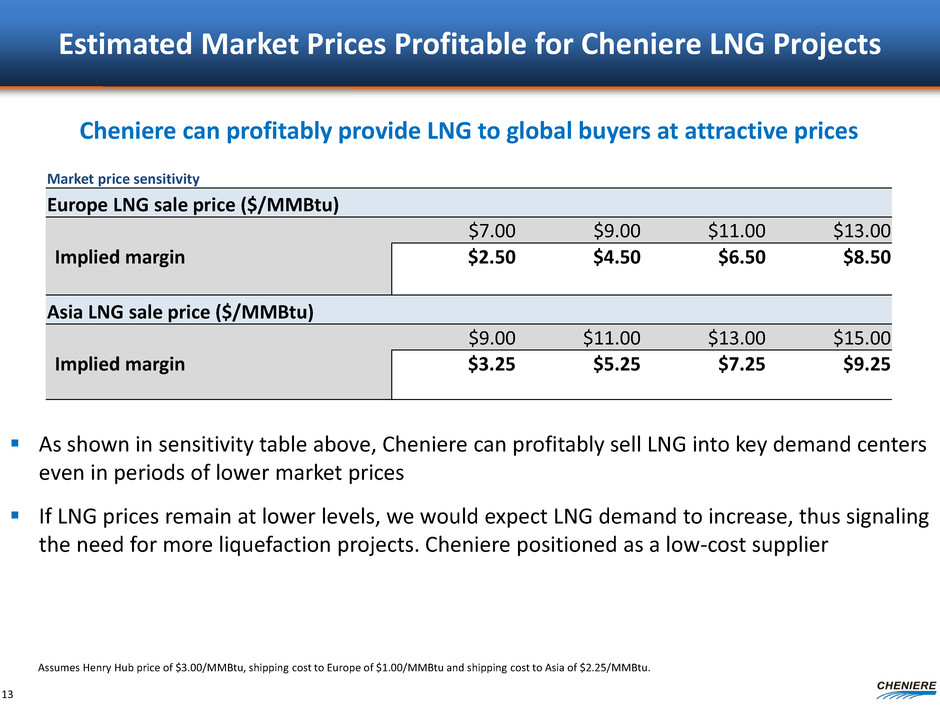

Estimated Market Prices Profitable for Cheniere LNG Projects 13 As shown in sensitivity table above, Cheniere can profitably sell LNG into key demand centers even in periods of lower market prices If LNG prices remain at lower levels, we would expect LNG demand to increase, thus signaling the need for more liquefaction projects. Cheniere positioned as a low-cost supplier Cheniere can profitably provide LNG to global buyers at attractive prices Assumes Henry Hub price of $3.00/MMBtu, shipping cost to Europe of $1.00/MMBtu and shipping cost to Asia of $2.25/MMBtu. Market price sensitivity Europe LNG sale price ($/MMBtu) $7.00 $9.00 $11.00 $13.00 Implied margin $2.50 $4.50 $6.50 $8.50 Asia LNG sale price ($/MMBtu) $9.00 $11.00 $13.00 $15.00 Implied margin $3.25 $5.25 $7.25 $9.25

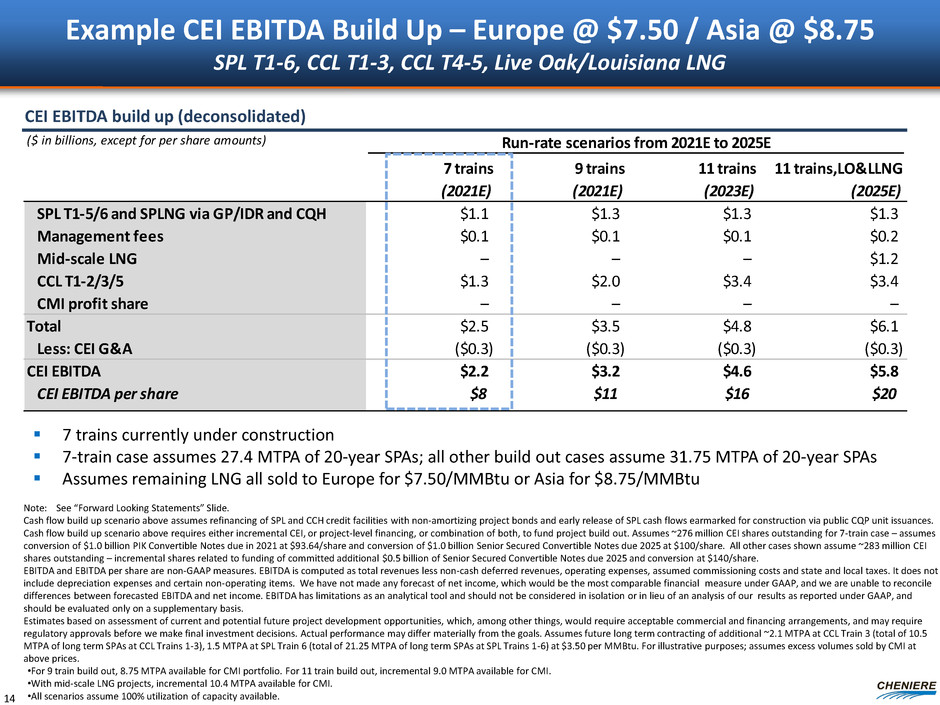

($ in billions, except for per share amounts) Run-rate scenarios from 2021E to 2025E 7 trains (2021E) 9 trains (2021E) 11 trains (2023E) 11 trains,LO&LLNG (2025E) SPL T1-5/6 and SPLNG via GP/IDR and CQH $1.1 $1.3 $1.3 $1.3 Management fees $0.1 $0.1 $0.1 $0.2 Mid-scale LNG – – – $1.2 CCL T1-2/3/5 $1.3 $2.0 $3.4 $3.4 CMI profit share – – – – Total $2.5 $3.5 $4.8 $6.1 Less: CEI G&A ($0.3) ($0.3) ($0.3) ($0.3) CEI EBITDA $2.2 $3.2 $4.6 $5.8 CEI EBITDA per share $8 $11 $16 $20 Example CEI EBITDA Build Up – Europe @ $7.50 / Asia @ $8.75 SPL T1-6, CCL T1-3, CCL T4-5, Live Oak/Louisiana LNG CEI EBITDA build up (deconsolidated) 7 trains currently under construction 7-train case assumes 27.4 MTPA of 20-year SPAs; all other build out cases assume 31.75 MTPA of 20-year SPAs Assumes remaining LNG all sold to Europe for $7.50/MMBtu or Asia for $8.75/MMBtu 14 Note: See “Forward Looking Statements” Slide. Cash flow build up scenario above assumes refinancing of SPL and CCH credit facilities with non-amortizing project bonds and early release of SPL cash flows earmarked for construction via public CQP unit issuances. Cash flow build up scenario above requires either incremental CEI, or project-level financing, or combination of both, to fund project build out. Assumes ~276 million CEI shares outstanding for 7-train case – assumes conversion of $1.0 billion PIK Convertible Notes due in 2021 at $93.64/share and conversion of $1.0 billion Senior Secured Convertible Notes due 2025 at $100/share. All other cases shown assume ~283 million CEI shares outstanding – incremental shares related to funding of committed additional $0.5 billion of Senior Secured Convertible Notes due 2025 and conversion at $140/share. EBITDA and EBITDA per share are non-GAAP measures. EBITDA is computed as total revenues less non-cash deferred revenues, operating expenses, assumed commissioning costs and state and local taxes. It does not include depreciation expenses and certain non-operating items. We have not made any forecast of net income, which would be the most comparable financial measure under GAAP, and we are unable to reconcile differences between forecasted EBITDA and net income. EBITDA has limitations as an analytical tool and should not be considered in isolation or in lieu of an analysis of our results as reported under GAAP, and should be evaluated only on a supplementary basis. Estimates based on assessment of current and potential future project development opportunities, which, among other things, would require acceptable commercial and financing arrangements, and may require regulatory approvals before we make final investment decisions. Actual performance may differ materially from the goals. Assumes future long term contracting of additional ~2.1 MTPA at CCL Train 3 (total of 10.5 MTPA of long term SPAs at CCL Trains 1-3), 1.5 MTPA at SPL Train 6 (total of 21.25 MTPA of long term SPAs at SPL Trains 1-6) at $3.50 per MMBtu. For illustrative purposes; assumes excess volumes sold by CMI at above prices. •For 9 train build out, 8.75 MTPA available for CMI portfolio. For 11 train build out, incremental 9.0 MTPA available for CMI. •With mid-scale LNG projects, incremental 10.4 MTPA available for CMI. •All scenarios assume 100% utilization of capacity available.

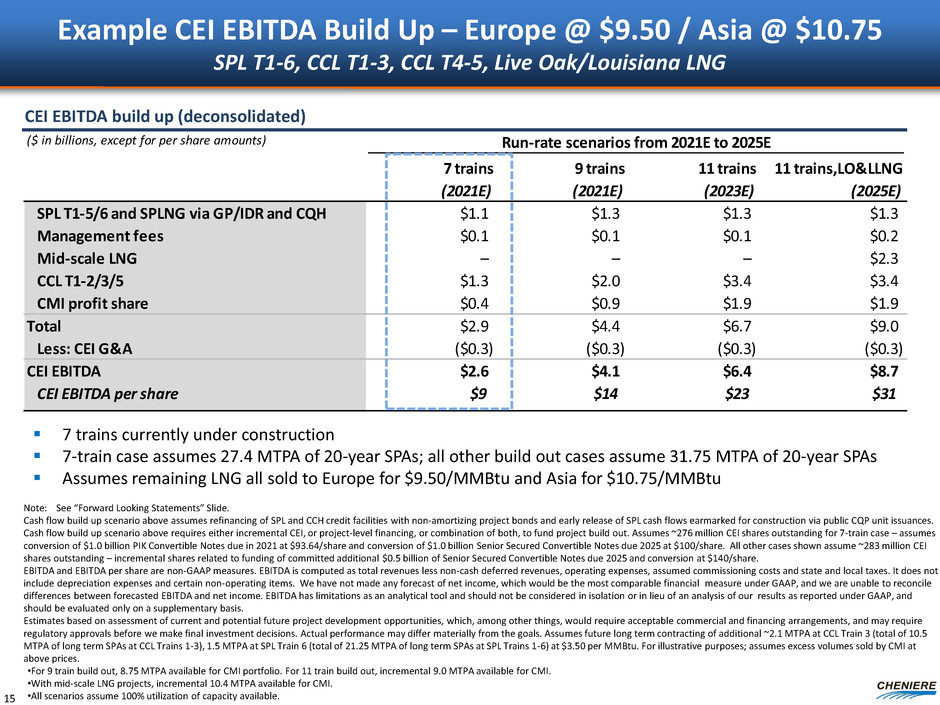

($ in billions, except for per share amounts) Run-rate scenarios from 2021E to 2025E 7 trains (2021E) 9 trains (2021E) 11 trains (2023E) 11 trains,LO&LLNG (2025E) SPL T1-5/6 and SPLNG via GP/IDR and CQH $1.1 $1.3 $1.3 $1.3 Management fees $0.1 $0.1 $0.1 $0.2 Mid-scale LNG – – – $2.3 CCL T1-2/3/5 $1.3 $2.0 $3.4 $3.4 CMI profit share $0.4 $0.9 $1.9 $1.9 Total $2.9 $4.4 $6.7 $9.0 Less: CEI G&A ($0.3) ($0.3) ($0.3) ($0.3) CEI EBITDA $2.6 $4.1 $6.4 $8.7 CEI EBITDA per share $9 $14 $23 $31 Example CEI EBITDA Build Up – Europe @ $9.50 / Asia @ $10.75 SPL T1-6, CCL T1-3, CCL T4-5, Live Oak/Louisiana LNG 15 7 trains currently under construction 7-train case assumes 27.4 MTPA of 20-year SPAs; all other build out cases assume 31.75 MTPA of 20-year SPAs Assumes remaining LNG all sold to Europe for $9.50/MMBtu and Asia for $10.75/MMBtu CEI EBITDA build up (deconsolidated) Note: See “Forward Looking Statements” Slide. Cash flow build up scenario above assumes refinancing of SPL and CCH credit facilities with non-amortizing project bonds and early release of SPL cash flows earmarked for construction via public CQP unit issuances. Cash flow build up scenario above requires either incremental CEI, or project-level financing, or combination of both, to fund project build out. Assumes ~276 million CEI shares outstanding for 7-train case – assumes conversion of $1.0 billion PIK Convertible Notes due in 2021 at $93.64/share and conversion of $1.0 billion Senior Secured Convertible Notes due 2025 at $100/share. All other cases shown assume ~283 million CEI shares outstanding – incremental shares related to funding of committed additional $0.5 billion of Senior Secured Convertible Notes due 2025 and conversion at $140/share. EBITDA and EBITDA per share are non-GAAP measures. EBITDA is computed as total revenues less non-cash deferred revenues, operating expenses, assumed commissioning costs and state and local taxes. It does not include depreciation expenses and certain non-operating items. We have not made any forecast of net income, which would be the most comparable financial measure under GAAP, and we are unable to reconcile differences between forecasted EBITDA and net income. EBITDA has limitations as an analytical tool and should not be considered in isolation or in lieu of an analysis of our results as reported under GAAP, and should be evaluated only on a supplementary basis. Estimates based on assessment of current and potential future project development opportunities, which, among other things, would require acceptable commercial and financing arrangements, and may require regulatory approvals before we make final investment decisions. Actual performance may differ materially from the goals. Assumes future long term contracting of additional ~2.1 MTPA at CCL Train 3 (total of 10.5 MTPA of long term SPAs at CCL Trains 1-3), 1.5 MTPA at SPL Train 6 (total of 21.25 MTPA of long term SPAs at SPL Trains 1-6) at $3.50 per MMBtu. For illustrative purposes; assumes excess volumes sold by CMI at above prices. •For 9 train build out, 8.75 MTPA available for CMI portfolio. For 11 train build out, incremental 9.0 MTPA available for CMI. •With mid-scale LNG projects, incremental 10.4 MTPA available for CMI. •All scenarios assume 100% utilization of capacity available.

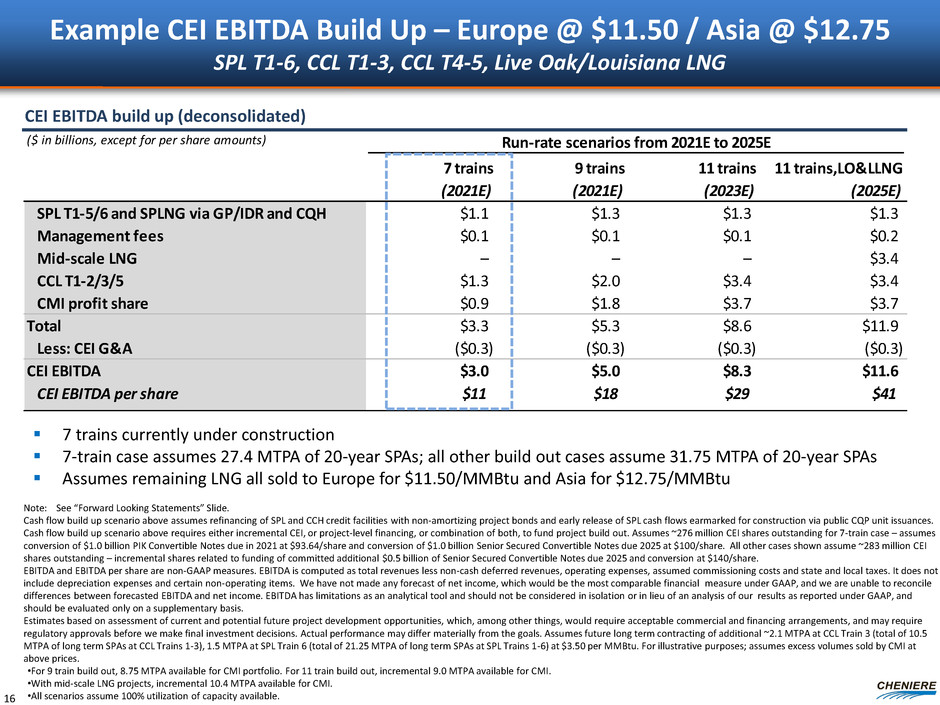

($ in billions, except for per share amounts) Run-rate scenarios from 2021E to 2025E 7 trains (2021E) 9 trains (2021E) 11 trains (2023E) 11 trains,LO&LLNG (2025E) SPL T1-5/6 and SPLNG via GP/IDR and CQH $1.1 $1.3 $1.3 $1.3 Management fees $0.1 $0.1 $0.1 $0.2 Mid-scale LNG – – – $3.4 CCL T1-2/3/5 $1.3 $2.0 $3.4 $3.4 CMI profit share $0.9 $1.8 $3.7 $3.7 Total $3.3 $5.3 $8.6 $11.9 Less: CEI G&A ($0.3) ($0.3) ($0.3) ($0.3) CEI EBITDA $3.0 $5.0 $8.3 $11.6 CEI EBITDA per share $11 $18 $29 $41 Example CEI EBITDA Build Up – Europe @ $11.50 / Asia @ $12.75 SPL T1-6, CCL T1-3, CCL T4-5, Live Oak/Louisiana LNG 16 CEI EBITDA build up (deconsolidated) 7 trains currently under construction 7-train case assumes 27.4 MTPA of 20-year SPAs; all other build out cases assume 31.75 MTPA of 20-year SPAs Assumes remaining LNG all sold to Europe for $11.50/MMBtu and Asia for $12.75/MMBtu Note: See “Forward Looking Statements” Slide. Cash flow build up scenario above assumes refinancing of SPL and CCH credit facilities with non-amortizing project bonds and early release of SPL cash flows earmarked for construction via public CQP unit issuances. Cash flow build up scenario above requires either incremental CEI, or project-level financing, or combination of both, to fund project build out. Assumes ~276 million CEI shares outstanding for 7-train case – assumes conversion of $1.0 billion PIK Convertible Notes due in 2021 at $93.64/share and conversion of $1.0 billion Senior Secured Convertible Notes due 2025 at $100/share. All other cases shown assume ~283 million CEI shares outstanding – incremental shares related to funding of committed additional $0.5 billion of Senior Secured Convertible Notes due 2025 and conversion at $140/share. EBITDA and EBITDA per share are non-GAAP measures. EBITDA is computed as total revenues less non-cash deferred revenues, operating expenses, assumed commissioning costs and state and local taxes. It does not include depreciation expenses and certain non-operating items. We have not made any forecast of net income, which would be the most comparable financial measure under GAAP, and we are unable to reconcile differences between forecasted EBITDA and net income. EBITDA has limitations as an analytical tool and should not be considered in isolation or in lieu of an analysis of our results as reported under GAAP, and should be evaluated only on a supplementary basis. Estimates based on assessment of current and potential future project development opportunities, which, among other things, would require acceptable commercial and financing arrangements, and may require regulatory approvals before we make final investment decisions. Actual performance may differ materially from the goals. Assumes future long term contracting of additional ~2.1 MTPA at CCL Train 3 (total of 10.5 MTPA of long term SPAs at CCL Trains 1-3), 1.5 MTPA at SPL Train 6 (total of 21.25 MTPA of long term SPAs at SPL Trains 1-6) at $3.50 per MMBtu. For illustrative purposes; assumes excess volumes sold by CMI at above prices. •For 9 train build out, 8.75 MTPA available for CMI portfolio. For 11 train build out, incremental 9.0 MTPA available for CMI. •With mid-scale LNG projects, incremental 10.4 MTPA available for CMI. •All scenarios assume 100% utilization of capacity available.

Gas Procurement Sabine Pass Terminal Securing feedstock for LNG production with balanced portfolio approach • To date, have entered into term gas supply contracts with producers under 1-7 year contracts • Supply contracts cover ~50% of the required daily load for Trains 1-4 at Sabine Pass • Pricing averages HH - $0.10 discount Redundant pipeline capacity helps ensure reliable gas deliverability • To date, we have secured firm pipeline transportation capacity of approximately ~4.2 Bcf/d of deliverability into Sabine Pass, or ~160% of the total load for Trains 1-4 Upstream pipeline capacity provides access to diverse supply sources • High degree of visibility into our ability to consistently deliver gas to Sabine Pass on a variable basis at Henry Hub flat 17

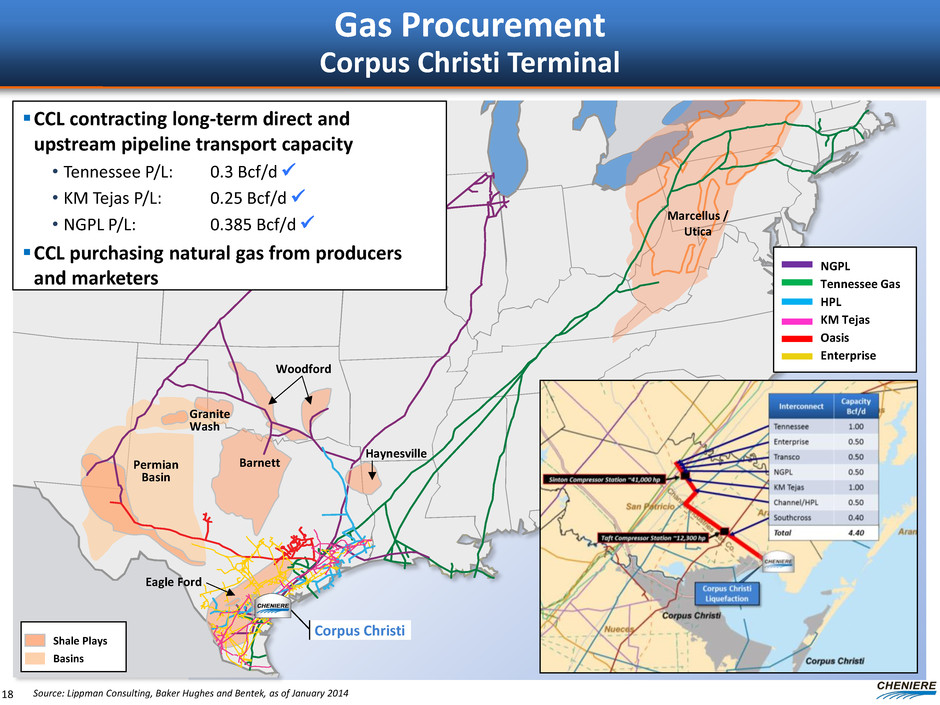

Shale Plays Basins Source: Lippman Consulting, Baker Hughes and Bentek, as of January 2014 NGPL Tennessee Gas HPL KM Tejas Oasis Enterprise Permian Basin Barnett Granite Wash Eagle Ford Haynesville Marcellus / Utica Corpus Christi Woodford Gas Procurement Corpus Christi Terminal CCL contracting long-term direct and upstream pipeline transport capacity • Tennessee P/L: 0.3 Bcf/d • KM Tejas P/L: 0.25 Bcf/d • NGPL P/L: 0.385 Bcf/d CCL purchasing natural gas from producers and marketers 18

Cheniere Marketing Scale up for > 10 mtpa including LNG purchases from Cheniere terminals and other places Buyers & sellers of LNG cargoes SPAs with SPL and CCL for all LNG volumes not sold to 3rd parties Chartered 3 LNG vessels for deliveries in 2015 and 2016 (1st vessel received June 2015) Developing complementary, high-value markets through small-scale asset investments Professional staff based in London, Houston, Washington, Santiago, and Singapore ~340 million MMBtu sold to date primarily based on 1–2 year terms at prices linked to HH or TTF Cheniere platform for LNG sales - short, mid, long-term sales, FOB or DES basis Singapore Houston, TX Santiago, Chile London, U.K. Chartered 3 LNG Vessels SPA with SPL SPAs with CCL Deliveries in 2015 & 2016 First LNG for SPL Expected 2015 First LNG Expected 2018 19 Washington, D.C.

Future Developments Horizontal / Vertical Integration Total focus on cash flow per share as guiding metric for future investments Announced brownfield expansion at Corpus Christi and mid-scale LNG investment Significant revenue expected starting in 2016 Cheniere core competencies, scale, and first-mover advantage provide industry-leading platform for further asset integration Developing additional assets for other hydrocarbon export opportunities 20

Appendix

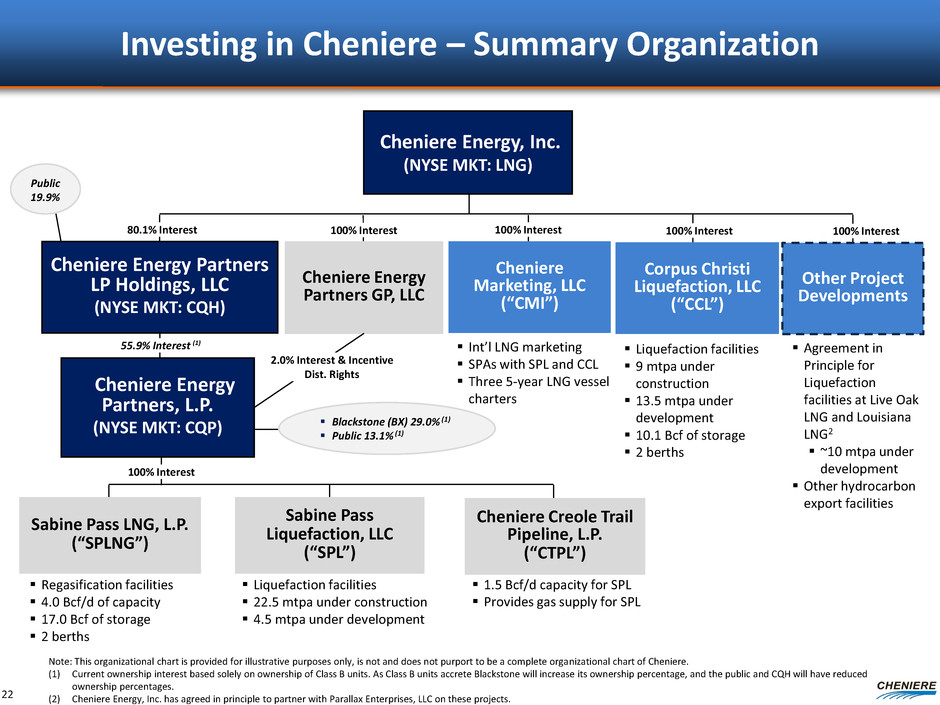

Investing in Cheniere – Summary Organization Cheniere Energy, Inc. (NYSE MKT: LNG) Sabine Pass LNG, L.P. (“SPLNG”) Sabine Pass Liquefaction, LLC (“SPL”) Cheniere Energy Partners, L.P. (NYSE MKT: CQP) Cheniere Creole Trail Pipeline, L.P. (“CTPL”) Corpus Christi Liquefaction, LLC (“CCL”) Cheniere Marketing, LLC (“CMI”) Cheniere Energy Partners GP, LLC 100% Interest 100% Interest 100% Interest 100% Interest Note: This organizational chart is provided for illustrative purposes only, is not and does not purport to be a complete organizational chart of Cheniere. (1) Current ownership interest based solely on ownership of Class B units. As Class B units accrete Blackstone will increase its ownership percentage, and the public and CQH will have reduced ownership percentages. (2) Cheniere Energy, Inc. has agreed in principle to partner with Parallax Enterprises, LLC on these projects. Liquefaction facilities 9 mtpa under construction 13.5 mtpa under development 10.1 Bcf of storage 2 berths Regasification facilities 4.0 Bcf/d of capacity 17.0 Bcf of storage 2 berths Liquefaction facilities 22.5 mtpa under construction 4.5 mtpa under development Cheniere Energy Partners LP Holdings, LLC (NYSE MKT: CQH) 1.5 Bcf/d capacity for SPL Provides gas supply for SPL 80.1% Interest 55.9% Interest (1) 2.0% Interest & Incentive Dist. Rights Int’l LNG marketing SPAs with SPL and CCL Three 5-year LNG vessel charters Blackstone (BX) 29.0% (1) Public 13.1% (1) Public 19.9% 22 Other Project Developments 100% Interest Agreement in Principle for Liquefaction facilities at Live Oak LNG and Louisiana LNG2 ~10 mtpa under development Other hydrocarbon export facilities

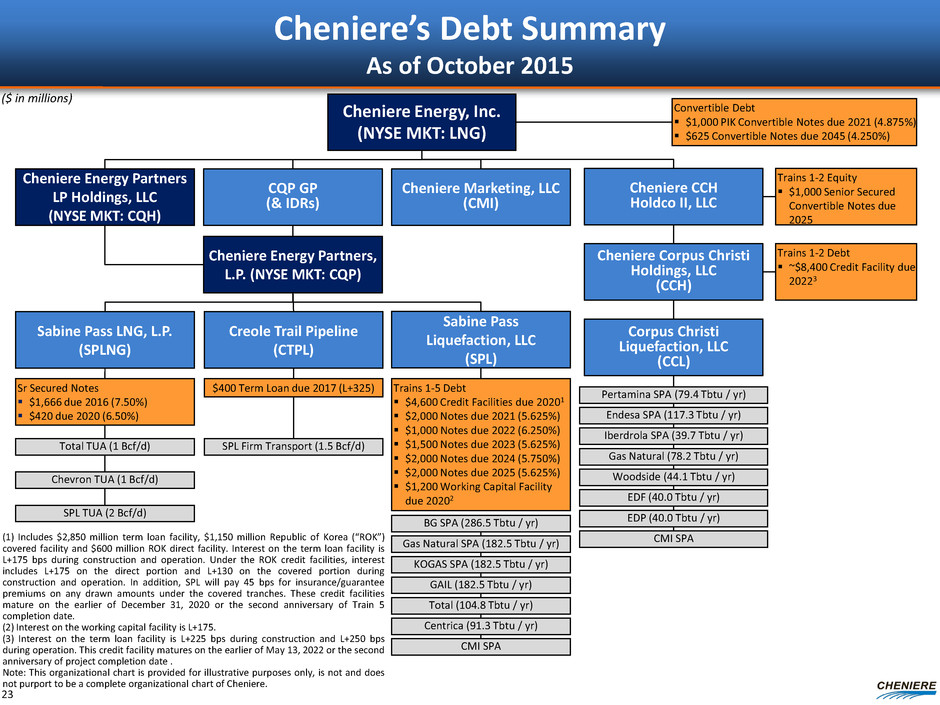

Cheniere’s Debt Summary As of October 2015 Cheniere Energy, Inc. (NYSE MKT: LNG) Cheniere Energy Partners, L.P. (NYSE MKT: CQP) Sabine Pass LNG, L.P. (SPLNG) Total TUA (1 Bcf/d) Chevron TUA (1 Bcf/d) SPL TUA (2 Bcf/d) Sr Secured Notes $1,666 due 2016 (7.50%) $420 due 2020 (6.50%) ($ in millions) Cheniere Marketing, LLC (CMI) Trains 1-5 Debt $4,600 Credit Facilities due 20201 $2,000 Notes due 2021 (5.625%) $1,000 Notes due 2022 (6.250%) $1,500 Notes due 2023 (5.625%) $2,000 Notes due 2024 (5.750%) $2,000 Notes due 2025 (5.625%) $1,200 Working Capital Facility due 20202 Sabine Pass Liquefaction, LLC (SPL) Creole Trail Pipeline (CTPL) $400 Term Loan due 2017 (L+325) CQP GP (& IDRs) (1) Includes $2,850 million term loan facility, $1,150 million Republic of Korea (“ROK”) covered facility and $600 million ROK direct facility. Interest on the term loan facility is L+175 bps during construction and operation. Under the ROK credit facilities, interest includes L+175 on the direct portion and L+130 on the covered portion during construction and operation. In addition, SPL will pay 45 bps for insurance/guarantee premiums on any drawn amounts under the covered tranches. These credit facilities mature on the earlier of December 31, 2020 or the second anniversary of Train 5 completion date. (2) Interest on the working capital facility is L+175. (3) Interest on the term loan facility is L+225 bps during construction and L+250 bps during operation. This credit facility matures on the earlier of May 13, 2022 or the second anniversary of project completion date . Note: This organizational chart is provided for illustrative purposes only, is not and does not purport to be a complete organizational chart of Cheniere. Cheniere Energy Partners LP Holdings, LLC (NYSE MKT: CQH) 23 Cheniere CCH Holdco II, LLC Convertible Debt $1,000 PIK Convertible Notes due 2021 (4.875%) $625 Convertible Notes due 2045 (4.250%) SPL Firm Transport (1.5 Bcf/d) BG SPA (286.5 Tbtu / yr) Gas Natural SPA (182.5 Tbtu / yr) KOGAS SPA (182.5 Tbtu / yr) GAIL (182.5 Tbtu / yr) Total (104.8 Tbtu / yr) Centrica (91.3 Tbtu / yr) CMI SPA Pertamina SPA (79.4 Tbtu / yr) Endesa SPA (117.3 Tbtu / yr) Iberdrola SPA (39.7 Tbtu / yr) Gas Natural (78.2 Tbtu / yr) Woodside (44.1 Tbtu / yr) EDF (40.0 Tbtu / yr) EDP (40.0 Tbtu / yr) CMI SPA Cheniere Corpus Christi Holdings, LLC (CCH) Trains 1-2 Equity $1,000 Senior Secured Convertible Notes due 2025 Trains 1-2 Debt ~$8,400 Credit Facility due 20223 Corpus Christi Liquefaction, LLC (CCL)

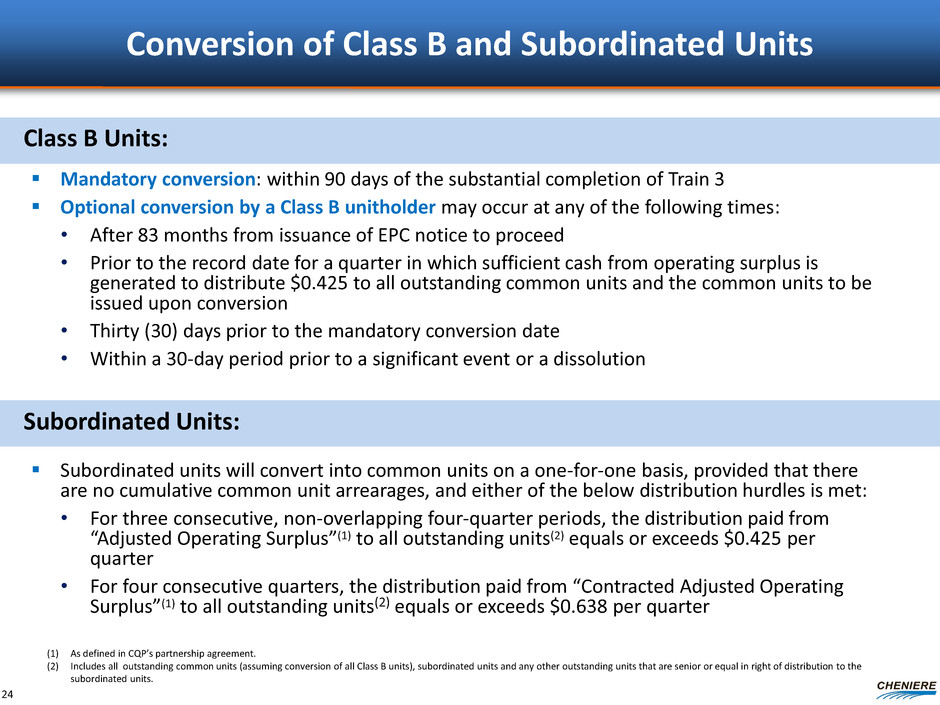

Conversion of Class B and Subordinated Units Mandatory conversion: within 90 days of the substantial completion of Train 3 Optional conversion by a Class B unitholder may occur at any of the following times: • After 83 months from issuance of EPC notice to proceed • Prior to the record date for a quarter in which sufficient cash from operating surplus is generated to distribute $0.425 to all outstanding common units and the common units to be issued upon conversion • Thirty (30) days prior to the mandatory conversion date • Within a 30-day period prior to a significant event or a dissolution Subordinated units will convert into common units on a one-for-one basis, provided that there are no cumulative common unit arrearages, and either of the below distribution hurdles is met: • For three consecutive, non-overlapping four-quarter periods, the distribution paid from “Adjusted Operating Surplus”(1) to all outstanding units(2) equals or exceeds $0.425 per quarter • For four consecutive quarters, the distribution paid from “Contracted Adjusted Operating Surplus”(1) to all outstanding units(2) equals or exceeds $0.638 per quarter Class B Units: Subordinated Units: (1) As defined in CQP’s partnership agreement. (2) Includes all outstanding common units (assuming conversion of all Class B units), subordinated units and any other outstanding units that are senior or equal in right of distribution to the subordinated units. 24

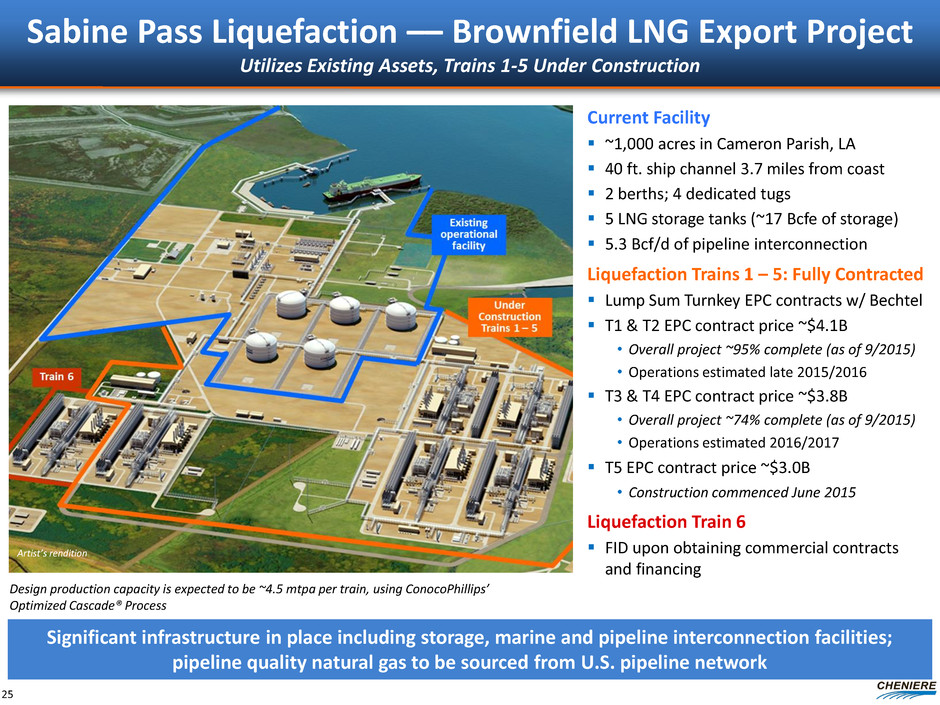

Sabine Pass Liquefaction –– Brownfield LNG Export Project Utilizes Existing Assets, Trains 1-5 Under Construction Significant infrastructure in place including storage, marine and pipeline interconnection facilities; pipeline quality natural gas to be sourced from U.S. pipeline network Design production capacity is expected to be ~4.5 mtpa per train, using ConocoPhillips’ Optimized Cascade® Process Current Facility ~1,000 acres in Cameron Parish, LA 40 ft. ship channel 3.7 miles from coast 2 berths; 4 dedicated tugs 5 LNG storage tanks (~17 Bcfe of storage) 5.3 Bcf/d of pipeline interconnection Liquefaction Trains 1 – 5: Fully Contracted Lump Sum Turnkey EPC contracts w/ Bechtel T1 & T2 EPC contract price ~$4.1B • Overall project ~95% complete (as of 9/2015) • Operations estimated late 2015/2016 T3 & T4 EPC contract price ~$3.8B • Overall project ~74% complete (as of 9/2015) • Operations estimated 2016/2017 T5 EPC contract price ~$3.0B • Construction commenced June 2015 Liquefaction Train 6 FID upon obtaining commercial contracts and financing Artist’s rendition 25

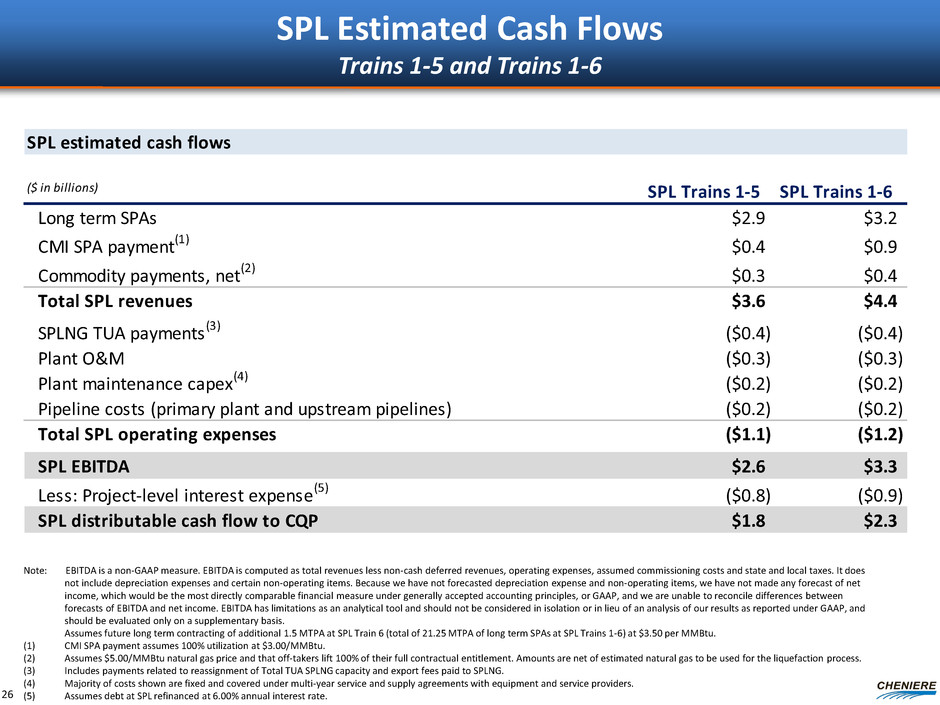

SPL estimated cash flows ($ in billions) SPL Trains 1-5 SPL Trains 1-6 Long term SPAs $2.9 $3.2 CMI SPA payment (1) $0.4 $0.9 Commodity payments, net(2) $0.3 $0.4 Total SPL revenues $3.6 $4.4 SPLNG TUA payments(3) ($0.4) ($0.4) Plant O&M ($0.3) ($0.3) Plant maintenance capex (4) ($0.2) ($0.2) Pipeline costs (primary plant and upstream pipelines) ($0.2) ($0.2) Total SPL operating expenses ($1.1) ($1.2) SPL EBITDA $2.6 $3.3 Less: Project-level interest expense(5) ($0.8) ($0.9) SPL distributable cash flow to CQP $1.8 $2.3 SPL Estimated Cash Flows Trains 1-5 and Trains 1-6 26 Note: EBITDA is a non-GAAP measure. EBITDA is computed as total revenues less non-cash deferred revenues, operating expenses, assumed commissioning costs and state and local taxes. It does not include depreciation expenses and certain non-operating items. Because we have not forecasted depreciation expense and non-operating items, we have not made any forecast of net income, which would be the most directly comparable financial measure under generally accepted accounting principles, or GAAP, and we are unable to reconcile differences between forecasts of EBITDA and net income. EBITDA has limitations as an analytical tool and should not be considered in isolation or in lieu of an analysis of our results as reported under GAAP, and should be evaluated only on a supplementary basis. Assumes future long term contracting of additional 1.5 MTPA at SPL Train 6 (total of 21.25 MTPA of long term SPAs at SPL Trains 1-6) at $3.50 per MMBtu. (1) CMI SPA payment assumes 100% utilization at $3.00/MMBtu. (2) Assumes $5.00/MMBtu natural gas price and that off-takers lift 100% of their full contractual entitlement. Amounts are net of estimated natural gas to be used for the liquefaction process. (3) Includes payments related to reassignment of Total TUA SPLNG capacity and export fees paid to SPLNG. (4) Majority of costs shown are fixed and covered under multi-year service and supply agreements with equipment and service providers. (5) Assumes debt at SPL refinanced at 6.00% annual interest rate.

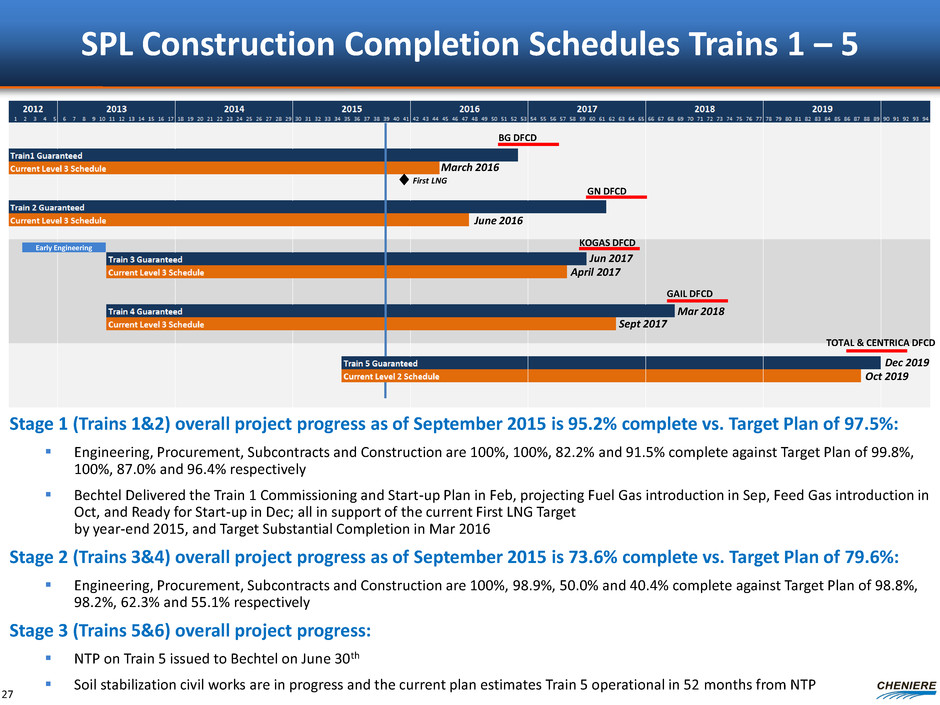

SPL Construction Completion Schedules Trains 1 – 5 Stage 1 (Trains 1&2) overall project progress as of September 2015 is 95.2% complete vs. Target Plan of 97.5%: Engineering, Procurement, Subcontracts and Construction are 100%, 100%, 82.2% and 91.5% complete against Target Plan of 99.8%, 100%, 87.0% and 96.4% respectively Bechtel Delivered the Train 1 Commissioning and Start-up Plan in Feb, projecting Fuel Gas introduction in Sep, Feed Gas introduction in Oct, and Ready for Start-up in Dec; all in support of the current First LNG Target by year-end 2015, and Target Substantial Completion in Mar 2016 Stage 2 (Trains 3&4) overall project progress as of September 2015 is 73.6% complete vs. Target Plan of 79.6%: Engineering, Procurement, Subcontracts and Construction are 100%, 98.9%, 50.0% and 40.4% complete against Target Plan of 98.8%, 98.2%, 62.3% and 55.1% respectively Stage 3 (Trains 5&6) overall project progress: NTP on Train 5 issued to Bechtel on June 30th Soil stabilization civil works are in progress and the current plan estimates Train 5 operational in 52 months from NTP BG DFCD GN DFCD KOGAS DFCD GAIL DFCD First LNG March 2016 April 2017 Jun 2017 Mar 2018 June 2016 Sept 2017 27 Dec 2019 Oct 2019 Early Engineering TOTAL & CENTRICA DFCD

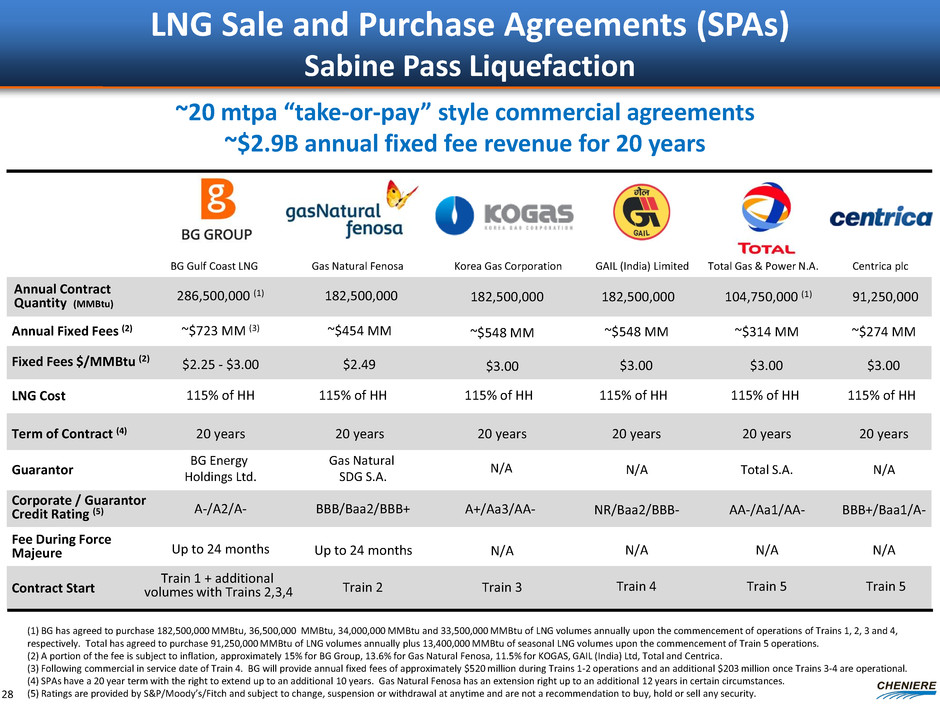

LNG Sale and Purchase Agreements (SPAs) Sabine Pass Liquefaction (1) BG has agreed to purchase 182,500,000 MMBtu, 36,500,000 MMBtu, 34,000,000 MMBtu and 33,500,000 MMBtu of LNG volumes annually upon the commencement of operations of Trains 1, 2, 3 and 4, respectively. Total has agreed to purchase 91,250,000 MMBtu of LNG volumes annually plus 13,400,000 MMBtu of seasonal LNG volumes upon the commencement of Train 5 operations. (2) A portion of the fee is subject to inflation, approximately 15% for BG Group, 13.6% for Gas Natural Fenosa, 11.5% for KOGAS, GAIL (India) Ltd, Total and Centrica. (3) Following commercial in service date of Train 4. BG will provide annual fixed fees of approximately $520 million during Trains 1-2 operations and an additional $203 million once Trains 3-4 are operational. (4) SPAs have a 20 year term with the right to extend up to an additional 10 years. Gas Natural Fenosa has an extension right up to an additional 12 years in certain circumstances. (5) Ratings are provided by S&P/Moody’s/Fitch and subject to change, suspension or withdrawal at anytime and are not a recommendation to buy, hold or sell any security. BG Gulf Coast LNG Gas Natural Fenosa Annual Contract Quantity (MMBtu) 286,500,000 (1) Fixed Fees $/MMBtu (2) Annual Fixed Fees (2) ~$723 MM (3) ~$454 MM Term of Contract (4) Guarantor 20 years BG Energy Holdings Ltd. Gas Natural SDG S.A. Corporate / Guarantor Credit Rating (5) A-/A2/A- BBB/Baa2/BBB+ Fee During Force Majeure Up to 24 months Up to 24 months 20 years GAIL (India) Limited ~$548 MM 20 years NR/Baa2/BBB- N/A N/A Contract Start Train 1 + additional volumes with Trains 2,3,4 Train 2 Train 4 $2.25 - $3.00 $2.49 $3.00 182,500,000 182,500,000 20 years N/A N/A A+/Aa3/AA- Train 3 $3.00 ~$548 MM Korea Gas Corporation 182,500,000 ~$314 MM 20 years AA-/Aa1/AA- N/A Total S.A. Train 5 $3.00 104,750,000 (1) Total Gas & Power N.A. ~$274 MM 20 years BBB+/Baa1/A- N/A N/A $3.00 91,250,000 Centrica plc Train 5 LNG Cost 115% of HH 115% of HH 115% of HH 115% of HH 115% of HH 115% of HH ~20 mtpa “take-or-pay” style commercial agreements ~$2.9B annual fixed fee revenue for 20 years 28

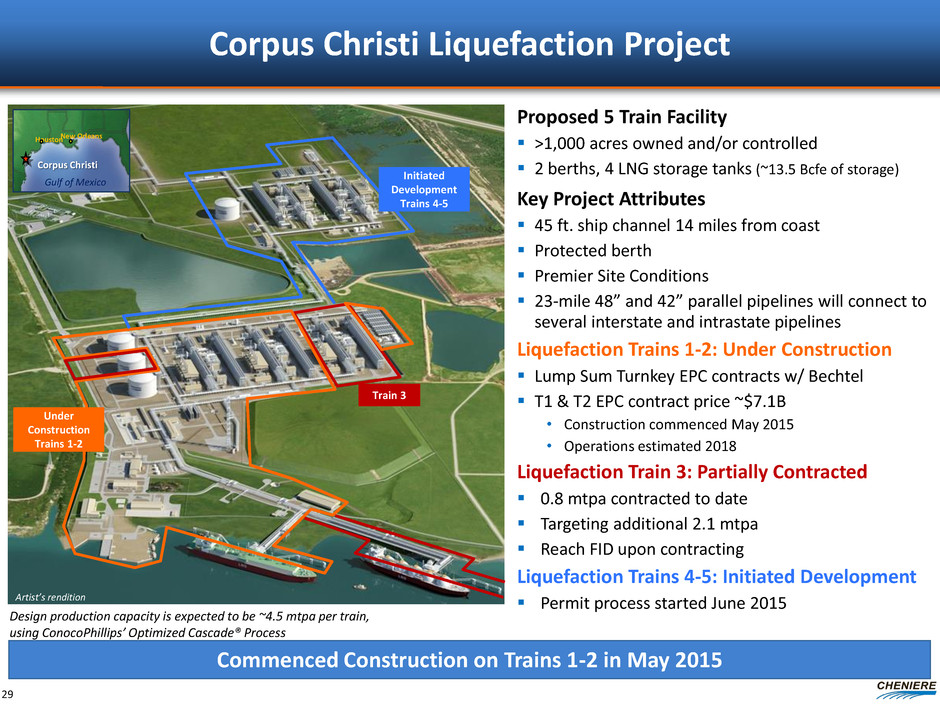

Corpus Christi Liquefaction Project 29 Proposed 5 Train Facility >1,000 acres owned and/or controlled 2 berths, 4 LNG storage tanks (~13.5 Bcfe of storage) Key Project Attributes 45 ft. ship channel 14 miles from coast Protected berth Premier Site Conditions 23-mile 48” and 42” parallel pipelines will connect to several interstate and intrastate pipelines Liquefaction Trains 1-2: Under Construction Lump Sum Turnkey EPC contracts w/ Bechtel T1 & T2 EPC contract price ~$7.1B • Construction commenced May 2015 • Operations estimated 2018 Liquefaction Train 3: Partially Contracted 0.8 mtpa contracted to date Targeting additional 2.1 mtpa Reach FID upon contracting Liquefaction Trains 4-5: Initiated Development Permit process started June 2015 Houston New Orleans Gulf of Mexico Corpus Christi Commenced Construction on Trains 1-2 in May 2015 Artist’s rendition Design production capacity is expected to be ~4.5 mtpa per train, using ConocoPhillips’ Optimized Cascade® Process Under Construction Trains 1-2 Train 3 Initiated Development Trains 4-5

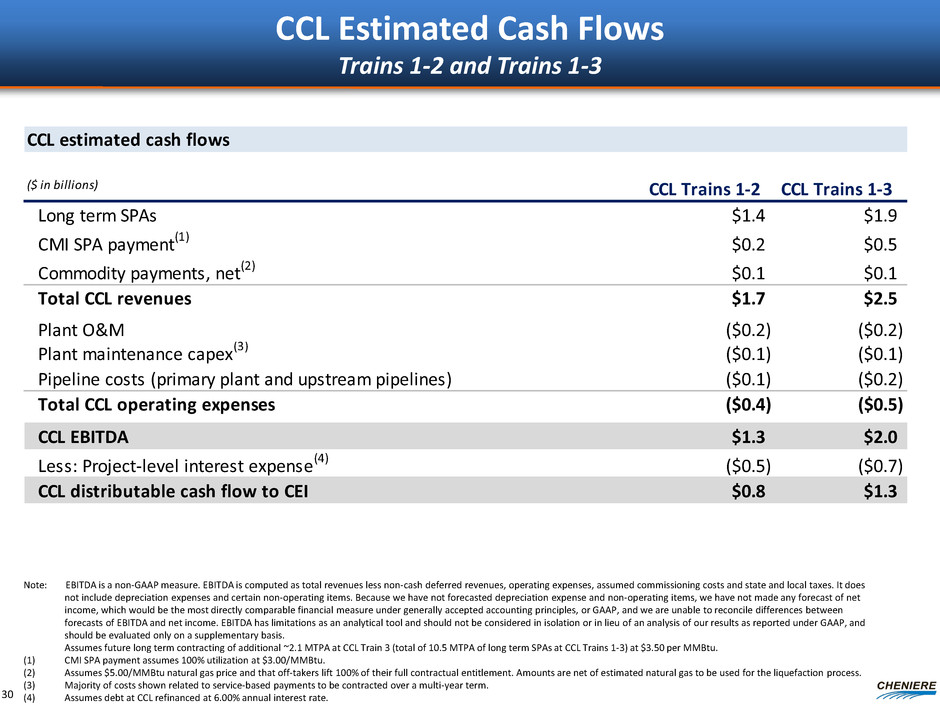

CCL estimated cash flows ($ in billions) CCL Trains 1-2 CCL Trains 1-3 Long term SPAs $1.4 $1.9 CMI SPA payment(1) $0.2 $0.5 Commodity payments, net(2) $0.1 $0.1 Total CCL revenues $1.7 $2.5 Plant O&M ($0.2) ($0.2) Plant maintenance capex (3) ($0.1) ($0.1) Pipeline costs (primary plant and upstream pipelines) ($0.1) ($0.2) Total CCL operating expenses ($0.4) ($0.5) CCL EBITDA $1.3 $2.0 Less: Project-level interest expense(4) ($0.5) ($0.7) CCL distributable cash flow to CEI $0.8 $1.3 CCL Estimated Cash Flows Trains 1-2 and Trains 1-3 30 Note: EBITDA is a non-GAAP measure. EBITDA is computed as total revenues less non-cash deferred revenues, operating expenses, assumed commissioning costs and state and local taxes. It does not include depreciation expenses and certain non-operating items. Because we have not forecasted depreciation expense and non-operating items, we have not made any forecast of net income, which would be the most directly comparable financial measure under generally accepted accounting principles, or GAAP, and we are unable to reconcile differences between forecasts of EBITDA and net income. EBITDA has limitations as an analytical tool and should not be considered in isolation or in lieu of an analysis of our results as reported under GAAP, and should be evaluated only on a supplementary basis. Assumes future long term contracting of additional ~2.1 MTPA at CCL Train 3 (total of 10.5 MTPA of long term SPAs at CCL Trains 1-3) at $3.50 per MMBtu. (1) CMI SPA payment assumes 100% utilization at $3.00/MMBtu. (2) Assumes $5.00/MMBtu natural gas price and that off-takers lift 100% of their full contractual entitlement. Amounts are net of estimated natural gas to be used for the liquefaction process. (3) Majority of costs shown related to service-based payments to be contracted over a multi-year term. (4) Assumes debt at CCL refinanced at 6.00% annual interest rate.

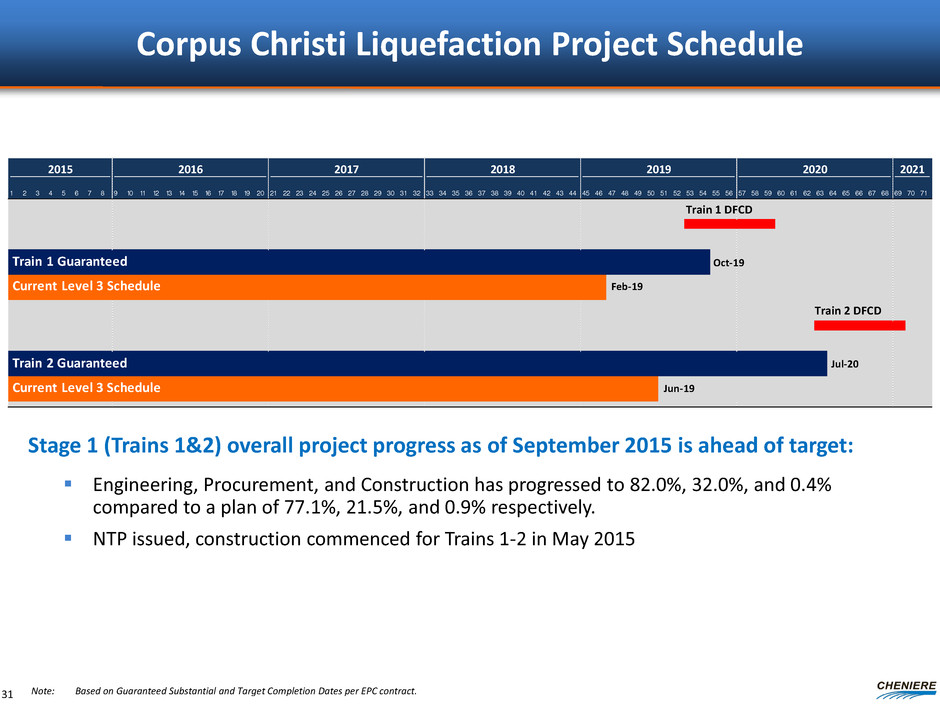

Corpus Christi Liquefaction Project Schedule Stage 1 (Trains 1&2) overall project progress as of September 2015 is ahead of target: Engineering, Procurement, and Construction has progressed to 82.0%, 32.0%, and 0.4% compared to a plan of 77.1%, 21.5%, and 0.9% respectively. NTP issued, construction commenced for Trains 1-2 in May 2015 31 Note: Based on Guaranteed Substantial and Target Completion Dates per EPC contract. 2015 2016 2017 2018 2019 2020 2021 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 Train 1 Guaranteed Current Level 3 Schedule Train 2 Guaranteed Current Level 3 Schedule Train 1 DFCD Train 2 DFCD Oct-19 Feb-19 Jul-20 Jun-19

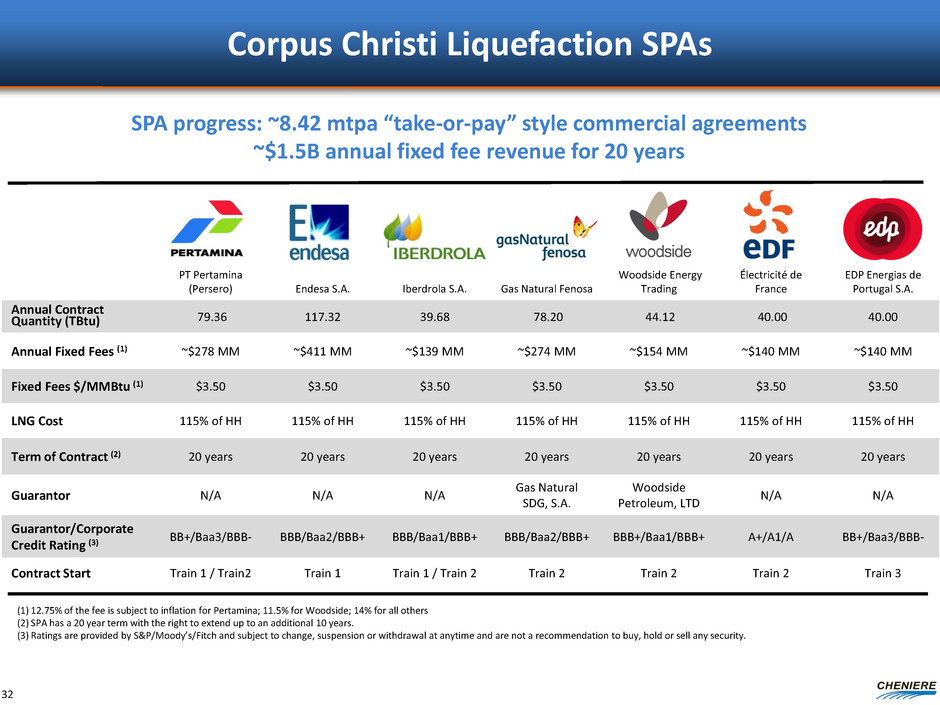

PT Pertamina (Persero) Endesa S.A. Iberdrola S.A. Gas Natural Fenosa Woodside Energy Trading Électricité de France EDP Energias de Portugal S.A. Annual Contract Quantity (TBtu) 79.36 117.32 39.68 78.20 44.12 40.00 40.00 Annual Fixed Fees (1) ~$278 MM ~$411 MM ~$139 MM ~$274 MM ~$154 MM ~$140 MM ~$140 MM Fixed Fees $/MMBtu (1) $3.50 $3.50 $3.50 $3.50 $3.50 $3.50 $3.50 LNG Cost 115% of HH 115% of HH 115% of HH 115% of HH 115% of HH 115% of HH 115% of HH Term of Contract (2) 20 years 20 years 20 years 20 years 20 years 20 years 20 years Guarantor N/A N/A N/A Gas Natural SDG, S.A. Woodside Petroleum, LTD N/A N/A Guarantor/Corporate Credit Rating (3) BB+/Baa3/BBB- BBB/Baa2/BBB+ BBB/Baa1/BBB+ BBB/Baa2/BBB+ BBB+/Baa1/BBB+ A+/A1/A BB+/Baa3/BBB- Contract Start Train 1 / Train2 Train 1 Train 1 / Train 2 Train 2 Train 2 Train 2 Train 3 Corpus Christi Liquefaction SPAs SPA progress: ~8.42 mtpa “take-or-pay” style commercial agreements ~$1.5B annual fixed fee revenue for 20 years (1) 12.75% of the fee is subject to inflation for Pertamina; 11.5% for Woodside; 14% for all others (2) SPA has a 20 year term with the right to extend up to an additional 10 years. (3) Ratings are provided by S&P/Moody’s/Fitch and subject to change, suspension or withdrawal at anytime and are not a recommendation to buy, hold or sell any security. 32

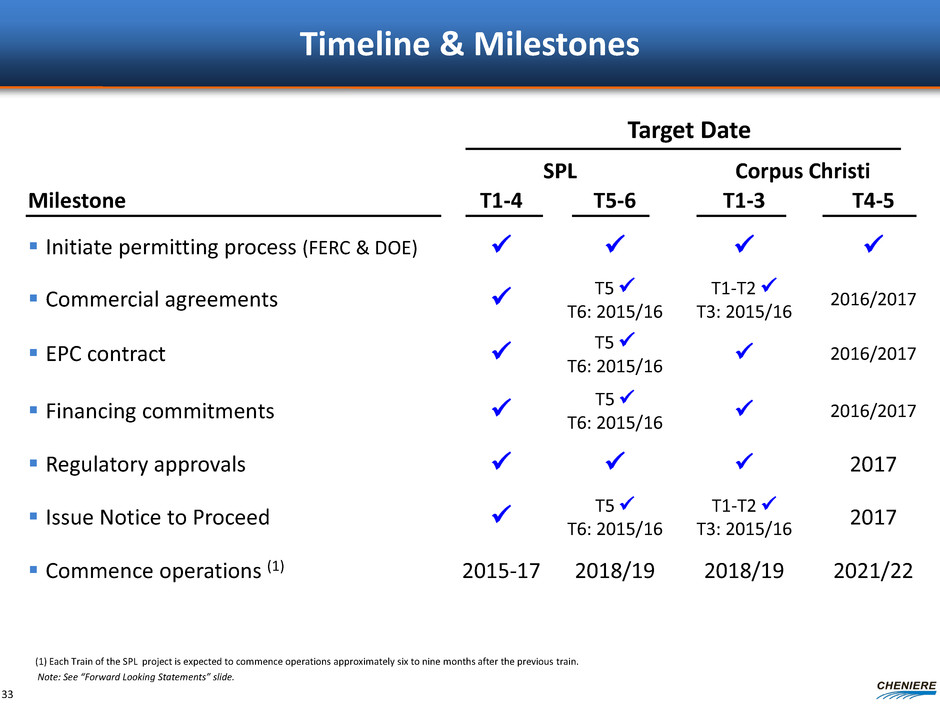

Timeline & Milestones Target Date SPL Corpus Christi Milestone T1-4 T5-6 T1-3 T4-5 Initiate permitting process (FERC & DOE) Commercial agreements T5 T6: 2015/16 T1-T2 T3: 2015/16 2016/2017 EPC contract T5 T6: 2015/16 2016/2017 Financing commitments T5 T6: 2015/16 2016/2017 Regulatory approvals 2017 Issue Notice to Proceed T5 T6: 2015/16 T1-T2 T3: 2015/16 2017 Commence operations (1) 2015-17 2018/19 2018/19 2021/22 (1) Each Train of the SPL project is expected to commence operations approximately six to nine months after the previous train. Note: See “Forward Looking Statements” slide. 33

Live Oak and Louisiana Liquefaction Projects1 34 Live Oak LNG Facility Overview 340 acres on the Calcasieu Channel, just north of Calcasieu Lake ~5 mtpa development 1 berth, 2 LNG storage tanks Project Update FERC pre-filing expected in 2015 First LNG expected 2021 Louisiana LNG Facility Overview 400 acres on the Mississippi River, ~40 miles downstream from the Port of New Orleans ~5 mtpa development 1 berth, 2 LNG storage tanks Project Update FERC pre-filing for 6 mtpa in July 2015 First LNG expected 2021 Artist’s rendition for both projects Mid-scale LNG projects Utilizing Bechtel/Chart Industries Technology Live Oak LNG Louisiana LNG (1) Cheniere Energy, Inc. has agreed in principle to partner with Parallax Enterprises, LLC on these projects

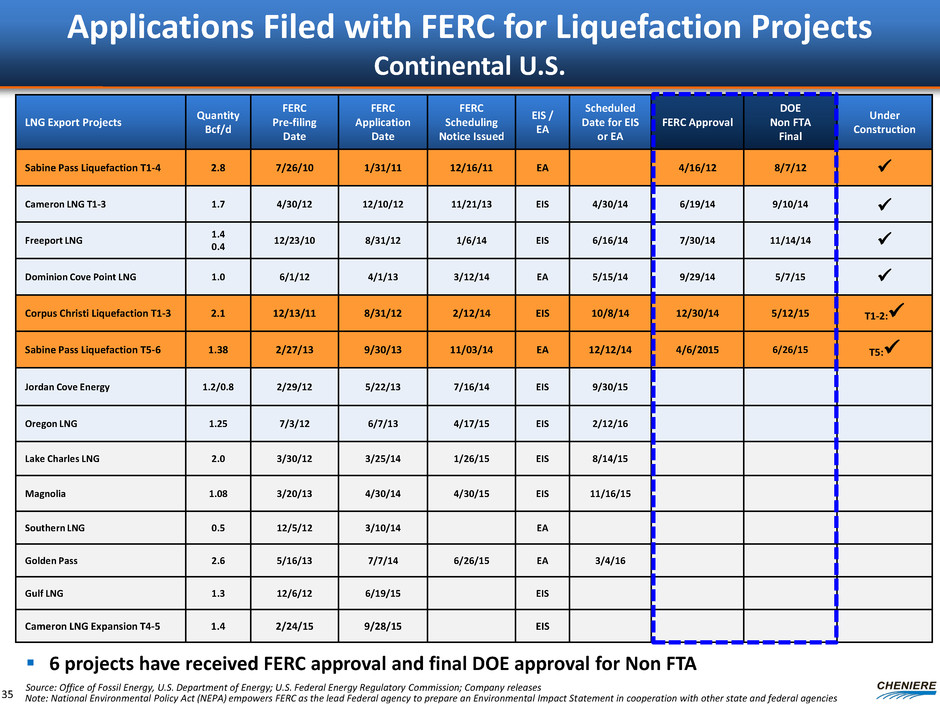

Applications Filed with FERC for Liquefaction Projects Continental U.S. LNG Export Projects Quantity Bcf/d FERC Pre-filing Date FERC Application Date FERC Scheduling Notice Issued EIS / EA Scheduled Date for EIS or EA FERC Approval DOE Non FTA Final Under Construction Sabine Pass Liquefaction T1-4 2.8 7/26/10 1/31/11 12/16/11 EA 4/16/12 8/7/12 Cameron LNG T1-3 1.7 4/30/12 12/10/12 11/21/13 EIS 4/30/14 6/19/14 9/10/14 Freeport LNG 1.4 0.4 12/23/10 8/31/12 1/6/14 EIS 6/16/14 7/30/14 11/14/14 Dominion Cove Point LNG 1.0 6/1/12 4/1/13 3/12/14 EA 5/15/14 9/29/14 5/7/15 Corpus Christi Liquefaction T1-3 2.1 12/13/11 8/31/12 2/12/14 EIS 10/8/14 12/30/14 5/12/15 T1-2: Sabine Pass Liquefaction T5-6 1.38 2/27/13 9/30/13 11/03/14 EA 12/12/14 4/6/2015 6/26/15 T5: Jordan Cove Energy 1.2/0.8 2/29/12 5/22/13 7/16/14 EIS 9/30/15 Oregon LNG 1.25 7/3/12 6/7/13 4/17/15 EIS 2/12/16 Lake Charles LNG 2.0 3/30/12 3/25/14 1/26/15 EIS 8/14/15 Magnolia 1.08 3/20/13 4/30/14 4/30/15 EIS 11/16/15 Southern LNG 0.5 12/5/12 3/10/14 EA Golden Pass 2.6 5/16/13 7/7/14 6/26/15 EA 3/4/16 Gulf LNG 1.3 12/6/12 6/19/15 EIS Cameron LNG Expansion T4-5 1.4 2/24/15 9/28/15 EIS Note: National Environmental Policy Act (NEPA) empowers FERC as the lead Federal agency to prepare an Environmental Impact Statement in cooperation with other state and federal agencies Source: Office of Fossil Energy, U.S. Department of Energy; U.S. Federal Energy Regulatory Commission; Company releases 6 projects have received FERC approval and final DOE approval for Non FTA 35

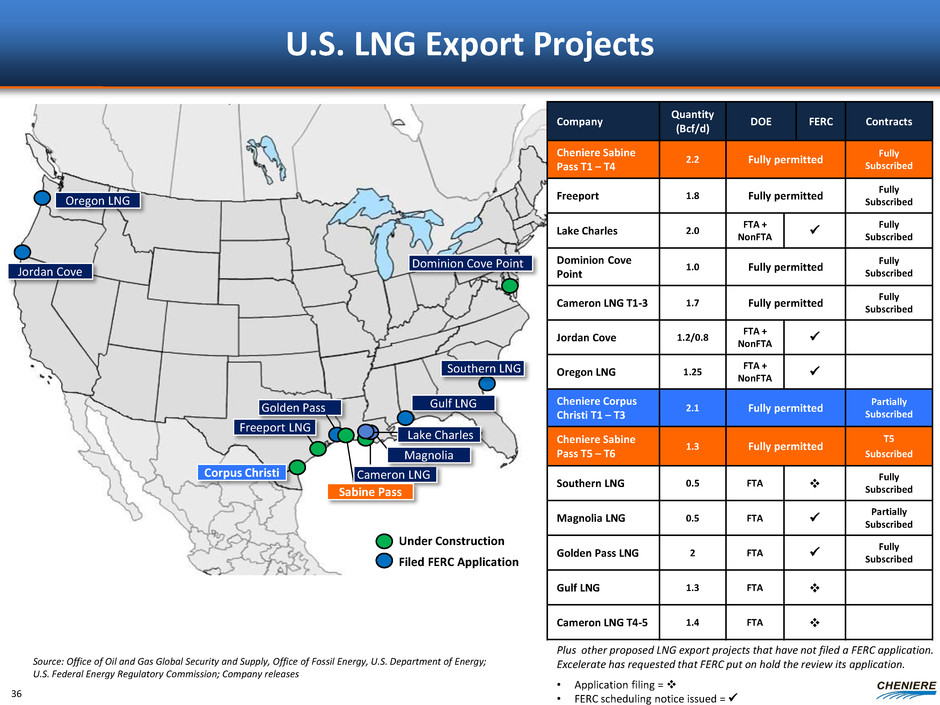

Source: Office of Oil and Gas Global Security and Supply, Office of Fossil Energy, U.S. Department of Energy; U.S. Federal Energy Regulatory Commission; Company releases U.S. LNG Export Projects Dominion Cove Point Under Construction Company Quantity (Bcf/d) DOE FERC Contracts Cheniere Sabine Pass T1 – T4 2.2 Fully permitted Fully Subscribed Freeport 1.8 Fully permitted Fully Subscribed Lake Charles 2.0 FTA + NonFTA Fully Subscribed Dominion Cove Point 1.0 Fully permitted Fully Subscribed Cameron LNG T1-3 1.7 Fully permitted Fully Subscribed Jordan Cove 1.2/0.8 FTA + NonFTA Oregon LNG 1.25 FTA + NonFTA Cheniere Corpus Christi T1 – T3 2.1 Fully permitted Partially Subscribed Cheniere Sabine Pass T5 – T6 1.3 Fully permitted T5 Subscribed Southern LNG 0.5 FTA v Fully Subscribed Magnolia LNG 0.5 FTA Partially Subscribed Golden Pass LNG 2 FTA Fully Subscribed Gulf LNG 1.3 FTA v Cameron LNG T4-5 1.4 FTA v Freeport LNG Corpus Christi Plus other proposed LNG export projects that have not filed a FERC application. Excelerate has requested that FERC put on hold the review its application. • Application filing = v • FERC scheduling notice issued = Filed FERC Application Jordan Cove Oregon LNG Cameron LNG Lake Charles Sabine Pass 36 Southern LNG Gulf LNG Golden Pass Magnolia

Randy Bhatia: Director, Finance and Investor Relations – (713) 375-5479, randy.bhatia@cheniere.com Katy Cox: Senior Analyst, Investor Relations – (713) 375-5079, katy.cox@cheniere.com Investor Relations Contacts