April 8, 2015 2015 Cheniere Energy Investor / Analyst Day

Forward Looking Statements 2 This presentation contains certain statements that are, or may be deemed to be, “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical facts, included herein are “forward-looking statements.” Included among “forward-looking statements” are, among other things: statements regarding the ability of Cheniere Energy Partners, L.P. to pay distributions to its unitholders or Cheniere Energy Partners LP Holdings, LLC to pay dividends to its shareholders; statements regarding Cheniere Energy Inc.’s, Cheniere Energy Partners LP Holdings, LLC’s or Cheniere Energy Partners, L.P.’s expected receipt of cash distributions from their respective subsidiaries; statements that Cheniere Energy Partners, L.P. expects to commence or complete construction of its proposed liquefied natural gas (“LNG”) terminals, liquefaction facilities, pipeline facilities or other projects, or any expansions thereof, by certain dates or at all; statements that Cheniere Energy, Inc. expects to commence or complete construction of its proposed LNG terminals, liquefaction facilities, pipeline facilities or other projects by certain dates or at all; statements regarding future levels of domestic and international natural gas production, supply or consumption or future levels of LNG imports into or exports from North America and other countries worldwide, or purchases of natural gas, regardless of the source of such information, or the transportation or other infrastructure, or demand for and prices related to natural gas, LNG or other hydrocarbon products; statements regarding any financing transactions or arrangements, or ability to enter into such transactions; statements relating to the construction of our proposed liquefaction facilities and natural gas liquefaction trains (“Trains”), or modifications to the Creole Trail Pipeline, including statements concerning the engagement of any engineering, procurement and construction ("EPC") contractor or other contractor and the anticipated terms and provisions of any agreement with any EPC or other contractor, and anticipated costs related thereto; statements regarding any agreement to be entered into or performed substantially in the future, including any revenues anticipated to be received and the anticipated timing thereof, and statements regarding the amounts of total LNG regasification, liquefaction or storage capacities that are, or may become, subject to contracts; statements regarding counterparties to our commercial contracts, construction contracts and other contracts; statements regarding our planned construction of additional Trains, including the financing of such Trains; statements that our Trains, when completed, will have certain characteristics, including amounts of liquefaction capacities; statements regarding our business strategy, our strengths, our business and operation plans or any other plans, forecasts, projections or objectives, including anticipated revenues and capital expenditures and EBITDA, any or all of which are subject to change; statements regarding projections of revenues, expenses, earnings or losses, working capital or other financial items; statements regarding legislative, governmental, regulatory, administrative or other public body actions, approvals, requirements, permits, applications, filings, investigations, proceedings or decisions; statements regarding our anticipated LNG and natural gas marketing activities; and any other statements that relate to non-historical or future information. These forward-looking statements are often identified by the use of terms and phrases such as “achieve,” “anticipate,” “believe,” “contemplate,” “develop,” “estimate,” “example,” “expect,” “forecast,” “goal,” “opportunities,” “plan,” “potential,” “project,” “propose,” “subject to,” “strategy,” “target,” and similar terms and phrases, or by use of future tense. Although we believe that the expectations reflected in these forward-looking statements are reasonable, they do involve assumptions, risks and uncertainties, and these expectations may prove to be incorrect. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of a variety of factors, including those discussed in “Risk Factors” in the Cheniere Energy, Inc., Cheniere Energy Partners, L.P. and Cheniere Energy Partners LP Holdings, LLC Annual Reports on Form 10-K filed with the SEC on February 20, 2015, which are incorporated by reference into this presentation. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by these ”Risk Factors.” These forward-looking statements are made as of the date of this presentation, and other than as required under the securities laws, we undertake no obligation to publicly update or revise any forward-looking statements.

Charif Souki – Chairman, President, and CEO Welcome & Introduction

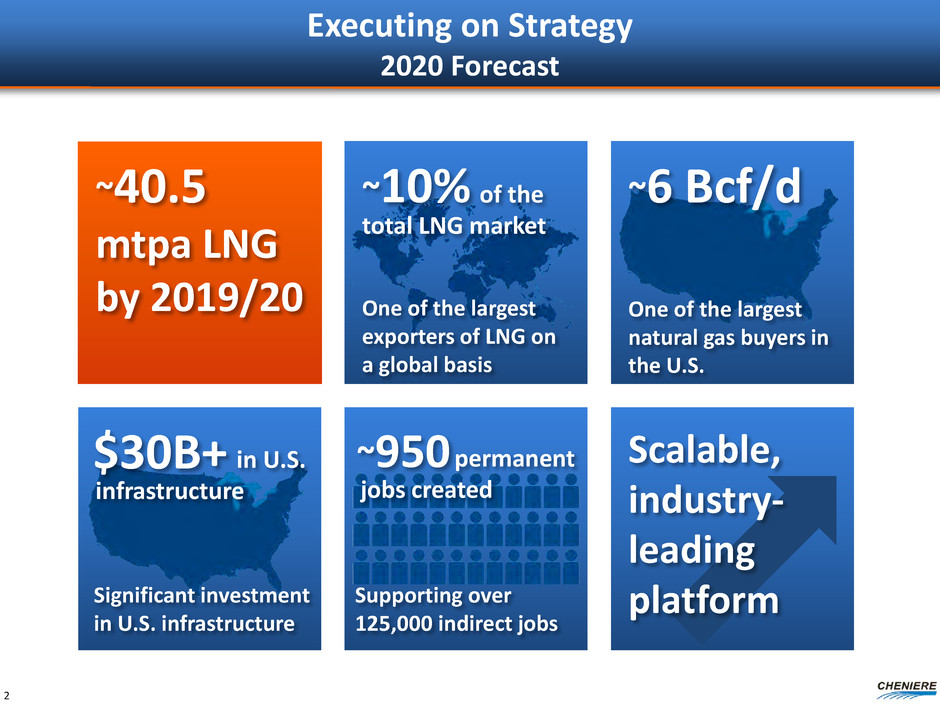

Executing on Strategy 2020 Forecast 2 Scalable, industry- leading platform $30B+ ~40.5 mtpa LNG by 2019/20 One of the largest natural gas buyers in the U.S. ~6 Bcf/d Supporting over 125,000 indirect jobs ~950 permanent jobs created One of the largest exporters of LNG on a global basis ~10% of the total LNG market in U.S. infrastructure Significant investment in U.S. infrastructure

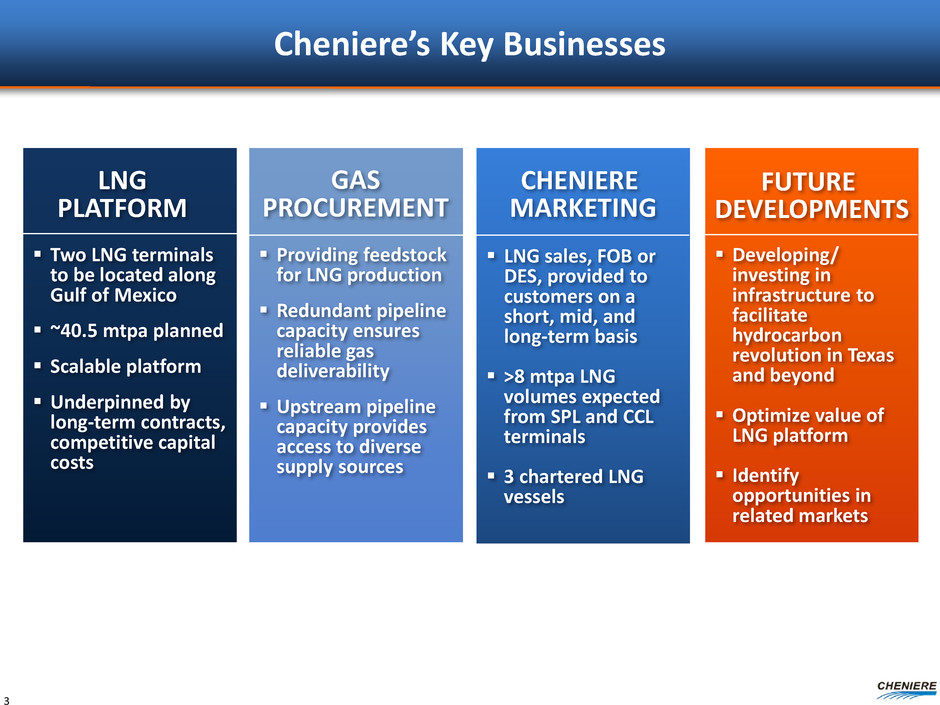

Cheniere’s Key Businesses Two LNG terminals to be located along Gulf of Mexico ~40.5 mtpa planned Scalable platform Underpinned by long-term contracts, competitive capital costs LNG sales, FOB or DES, provided to customers on a short, mid, and long-term basis >8 mtpa LNG volumes expected from SPL and CCL terminals 3 chartered LNG vessels Developing/ investing in infrastructure to facilitate hydrocarbon revolution in Texas and beyond Optimize value of LNG platform Identify opportunities in related markets Providing feedstock for LNG production Redundant pipeline capacity ensures reliable gas deliverability Upstream pipeline capacity provides access to diverse supply sources LNG PLATFORM GAS PROCUREMENT CHENIERE MARKETING FUTURE DEVELOPMENTS 3

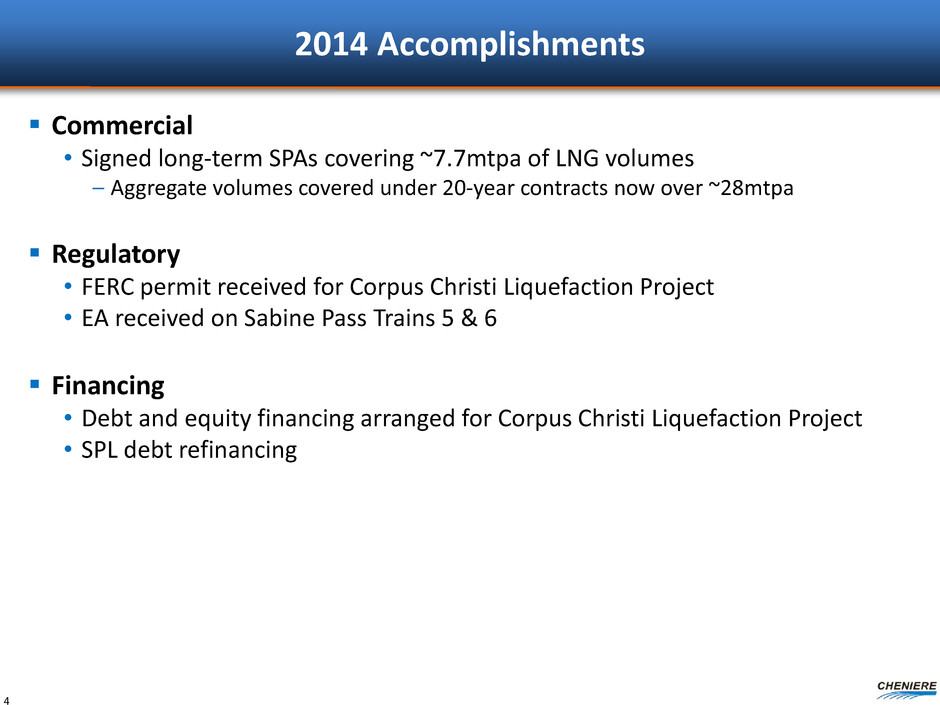

2014 Accomplishments Commercial • Signed long-term SPAs covering ~7.7mtpa of LNG volumes – Aggregate volumes covered under 20-year contracts now over ~28mtpa Regulatory • FERC permit received for Corpus Christi Liquefaction Project • EA received on Sabine Pass Trains 5 & 6 Financing • Debt and equity financing arranged for Corpus Christi Liquefaction Project • SPL debt refinancing 4

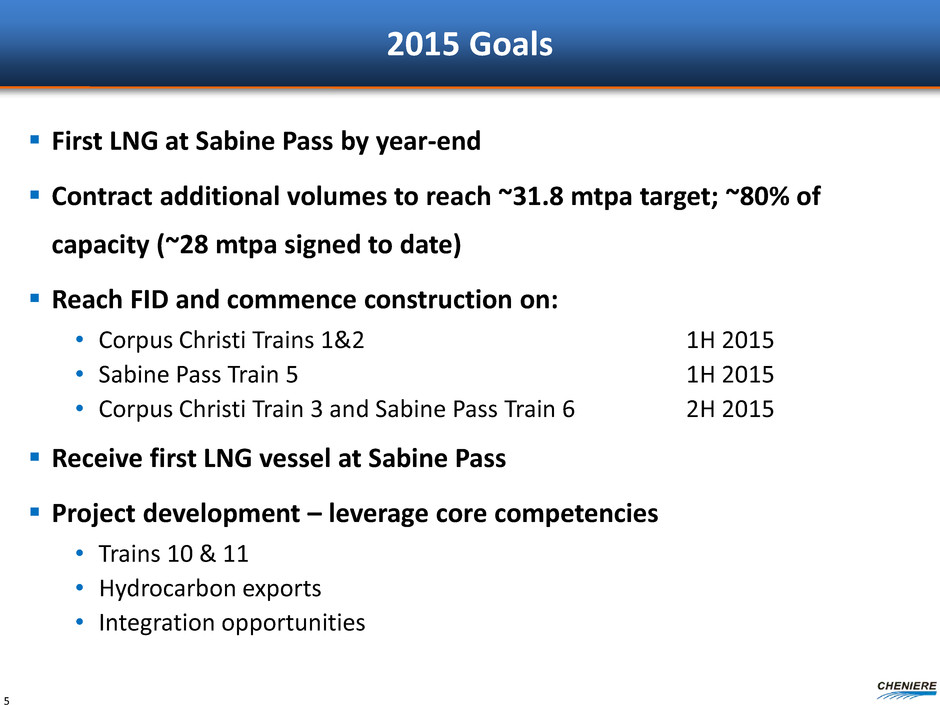

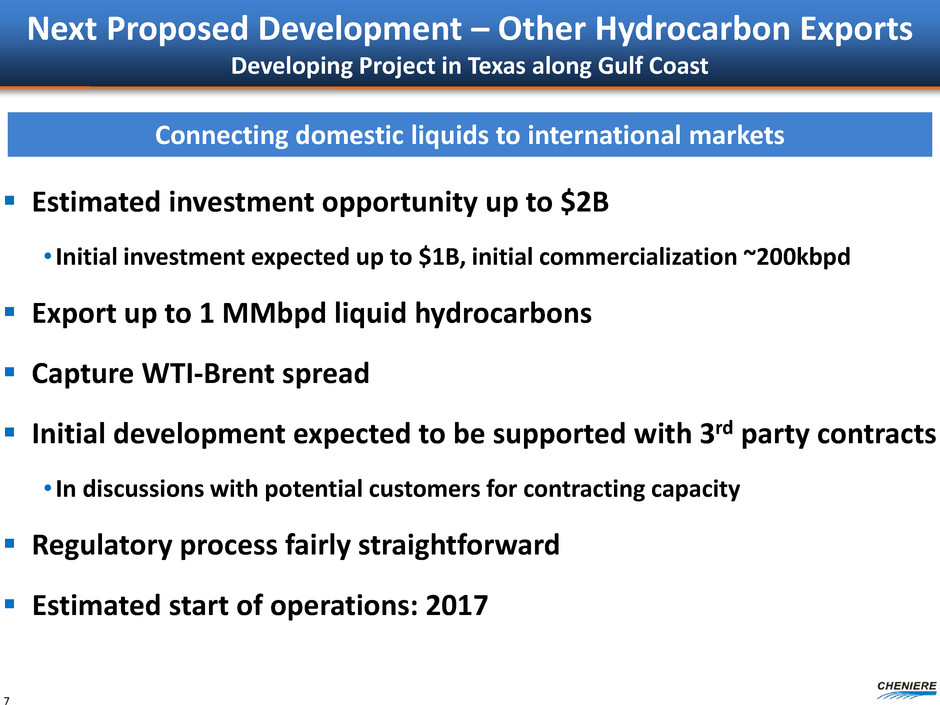

2015 Goals First LNG at Sabine Pass by year-end Contract additional volumes to reach ~31.8 mtpa target; ~80% of capacity (~28 mtpa signed to date) Reach FID and commence construction on: • Corpus Christi Trains 1&2 1H 2015 • Sabine Pass Train 5 1H 2015 • Corpus Christi Train 3 and Sabine Pass Train 6 2H 2015 Receive first LNG vessel at Sabine Pass Project development – leverage core competencies • Trains 10 & 11 • Hydrocarbon exports • Integration opportunities 5

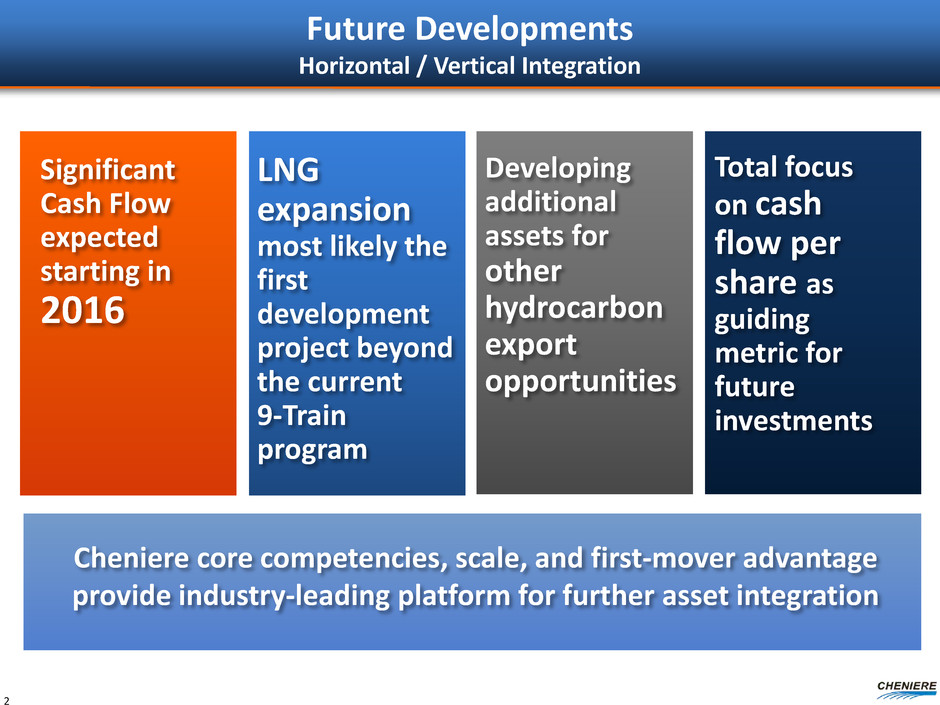

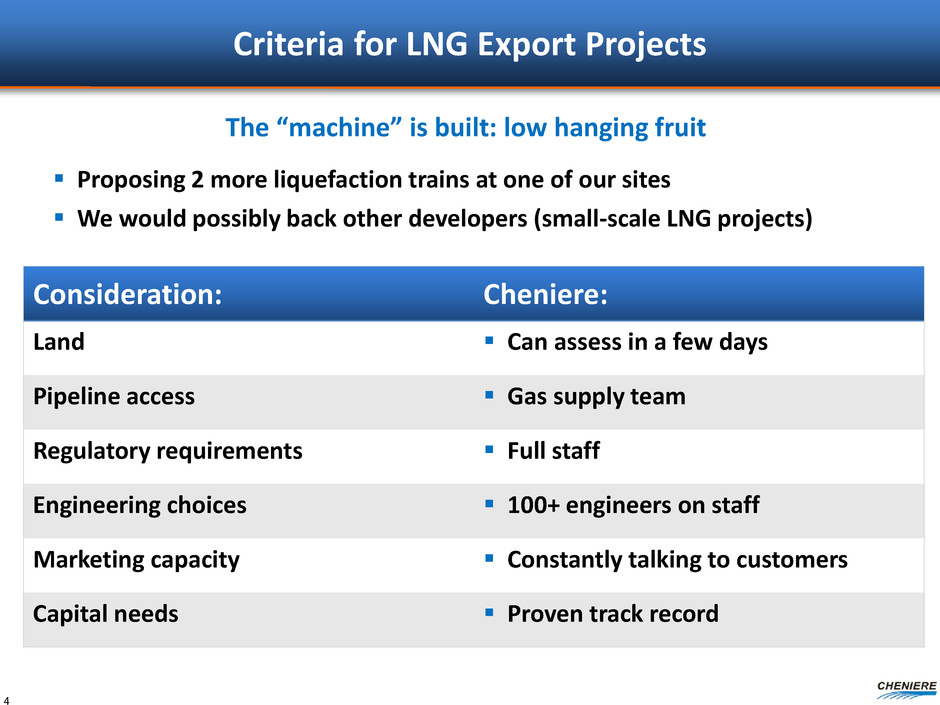

Cheniere Vision Diversify into new energy-related businesses through a horizontal and vertical integration strategy 6 There are no “pure-plays” Create shareholder value, with focus on cash flow per share

Anatol Feygin – Senior Vice President, Strategy & Corporate Development Energy Fundamentals Outlook

Durable Fundamental Trends What Hasn’t Changed • Global hydrocarbon demand is expected to exhibit stable growth What Has Changed • Unconventional supply, driven by the U.S., transforming global balances • A new hydrocarbon world order What This Means For Cheniere • This revolution is in Cheniere’s backyard and we are positioned to capitalize on this transformation 2

Global Gas and Liquids Fundamentals Overview U.S. transforming global hydrocarbon balances • Global demand growth steady with no major shift in expectations • Driven by Texas, Lower 48 seeing unprecedented hydrocarbon output growth • Production at sufficient scale to tip global supply and demand balance U.S. to continue leading the charge, spurring a more dynamic market and driving cyclical volatility • U.S. combines necessary attributes to scale unconventional revolution • Oil cycles now shorter, more frequent and reach equilibrium faster • Unconventional growth already dramatically affecting global markets Cheniere well-positioned to capitalize on export-focused opportunities • LNG infrastructure – most expensive component – is mostly contracted, financed • Location ideal for potential future horizontal extension into liquid hydrocarbons • Possible vertical integration of upstream assets & downstream market development 3

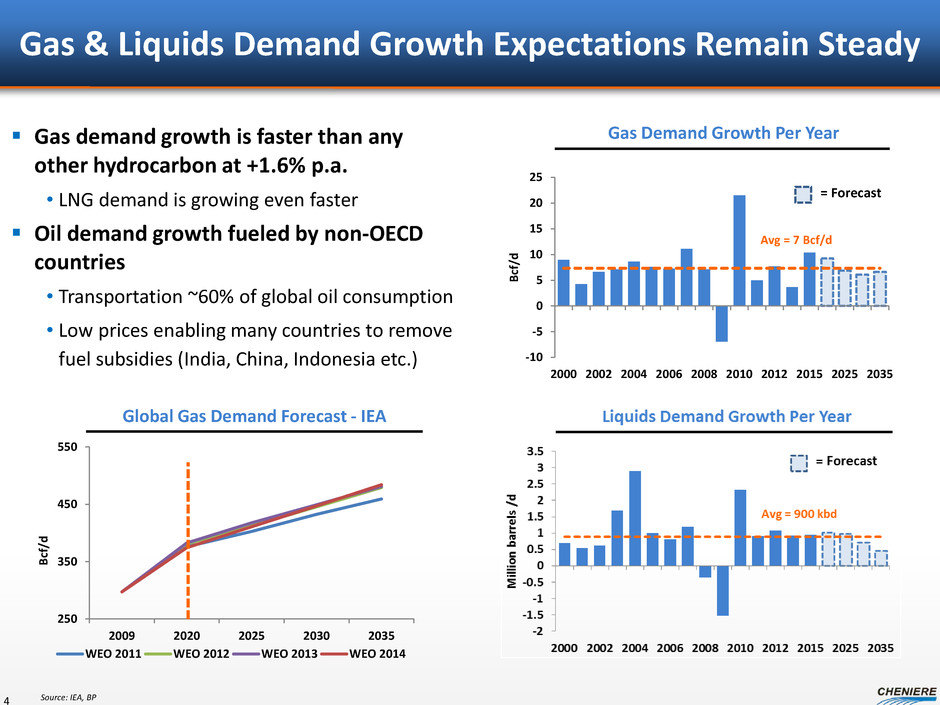

-10 -5 0 5 10 15 20 25 2000 2002 2004 2006 2008 2010 2012 2015 2025 2035 B cf /d Avg = 7 Bcf/d = Forecast Gas & Liquids Demand Growth Expectations Remain Steady Gas demand growth is faster than any other hydrocarbon at +1.6% p.a. • LNG demand is growing even faster Oil demand growth fueled by non-OECD countries • Transportation ~60% of global oil consumption • Low prices enabling many countries to remove fuel subsidies (India, China, Indonesia etc.) 4 Source: IEA, BP 250 350 450 550 2009 2020 2025 2030 2035 B cf /d WEO 2011 WEO 2012 WEO 2013 WEO 2014 Global Gas Demand Forecast - IEA Gas Demand Growth Per Year

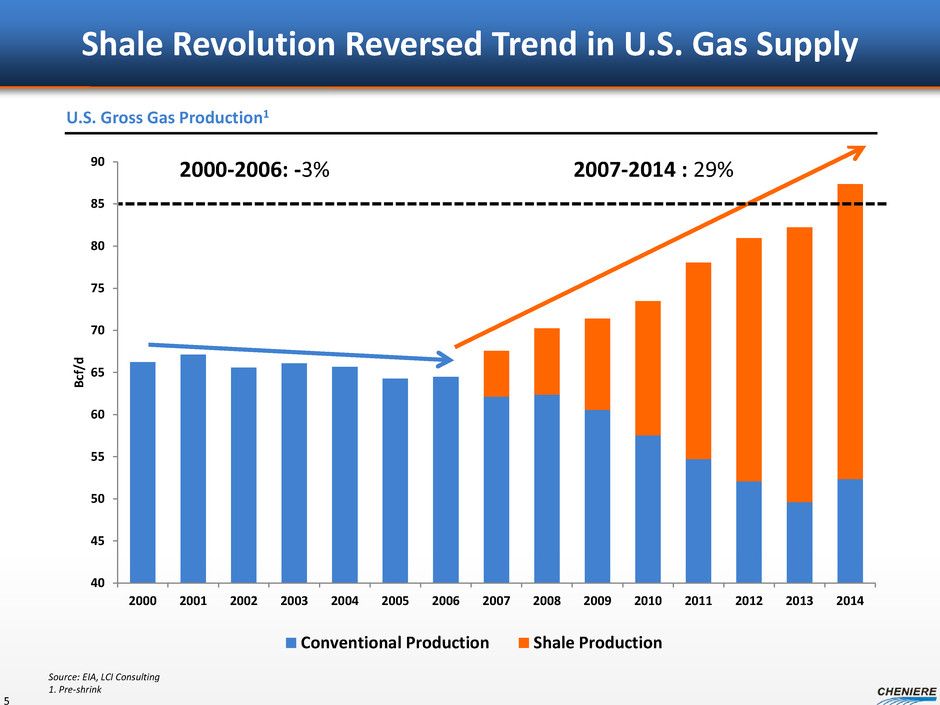

Shale Revolution Reversed Trend in U.S. Gas Supply 5 Source: EIA, LCI Consulting 1. Pre-shrink U.S. Gross Gas Production1 40 45 50 55 60 65 70 75 80 85 90 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 B cf /d Conventional Production Shale Production 2000-2006: -3% 2007-2014 : 29%

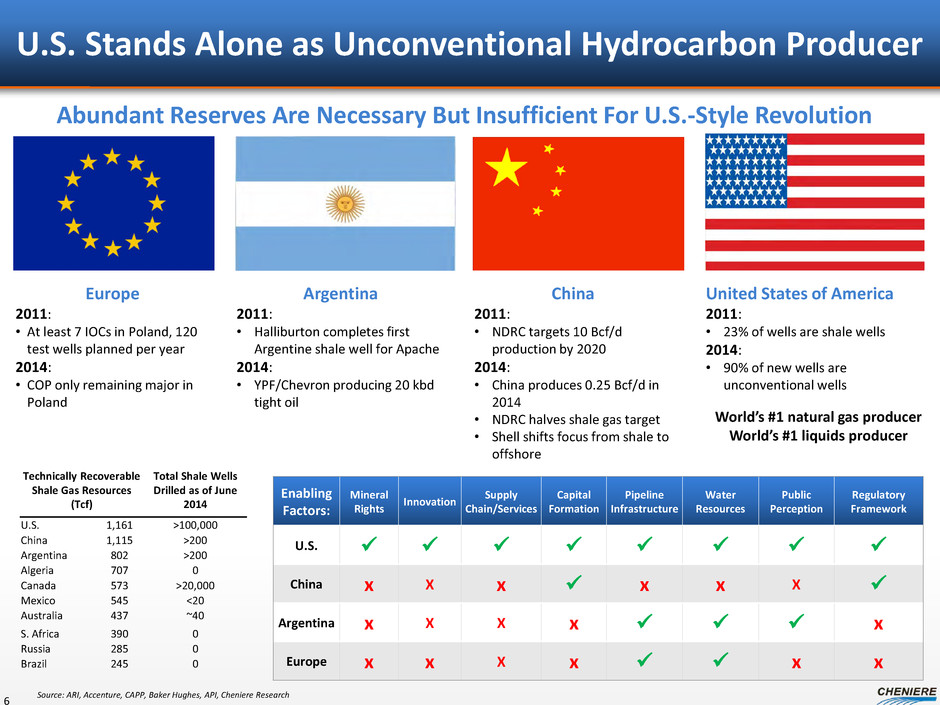

U.S. Stands Alone as Unconventional Hydrocarbon Producer 6 Technically Recoverable Shale Gas Resources (Tcf) Total Shale Wells Drilled as of June 2014 U.S. 1,161 >100,000 China 1,115 >200 Argentina 802 >200 Algeria 707 0 Canada 573 >20,000 Mexico 545 <20 Australia 437 ~40 S. Africa 390 0 Russia 285 0 Brazil 245 0 Source: ARI, Accenture, CAPP, Baker Hughes, API, Cheniere Research Enabling Factors: Mineral Rights Innovation Supply Chain/Services Capital Formation Pipeline Infrastructure Water Resources Public Perception Regulatory Framework U.S. China x X x x x X Argentina x X X x x Europe x x X x x x Europe 2011: • At least 7 IOCs in Poland, 120 test wells planned per year 2014: • COP only remaining major in Poland Argentina 2011: • Halliburton completes first Argentine shale well for Apache 2014: • YPF/Chevron producing 20 kbd tight oil China 2011: • NDRC targets 10 Bcf/d production by 2020 2014: • China produces 0.25 Bcf/d in 2014 • NDRC halves shale gas target • Shell shifts focus from shale to offshore United States of America 2011: • 23% of wells are shale wells 2014: • 90% of new wells are unconventional wells Abundant Reserves Are Necessary But Insufficient For U.S.-Style Revolution World’s #1 natural gas producer World’s #1 liquids producer

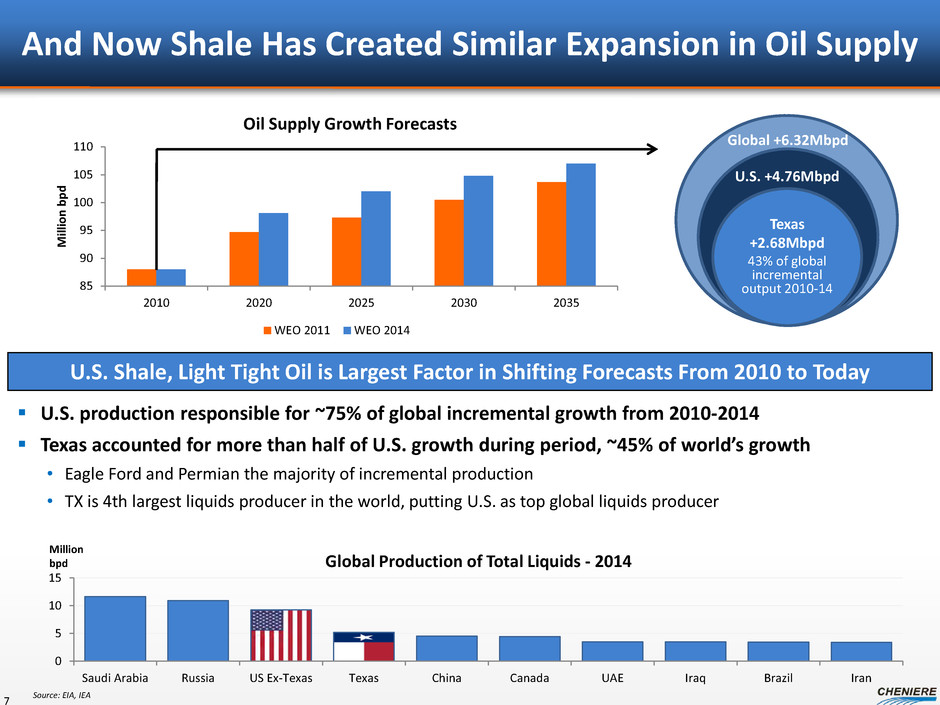

And Now Shale Has Created Similar Expansion in Oil Supply 7 Global +6.32Mbpd U.S. +4.76Mbpd 85 90 95 100 105 110 2010 2020 2025 2030 2035 M ill io n bp d Oil Supply Growth Forecasts WEO 2011 WEO 2014 0 5 10 15 Saudi Arabia Russia US Ex-Texas Texas China Canada UAE Iraq Brazil Iran Global Production of Total Liquids - 2014 Million bpd Texas +2.68Mbpd 43% of global incremental output 2010-14 Source: EIA, IEA U.S. production responsible for ~75% of global incremental growth from 2010-2014 Texas accounted for more than half of U.S. growth during period, ~45% of world’s growth • Eagle Ford and Permian the majority of incremental production • TX is 4th largest liquids producer in the world, putting U.S. as top global liquids producer U.S. Shale, Light Tight Oil is Largest Factor in Shifting Forecasts From 2010 to Today

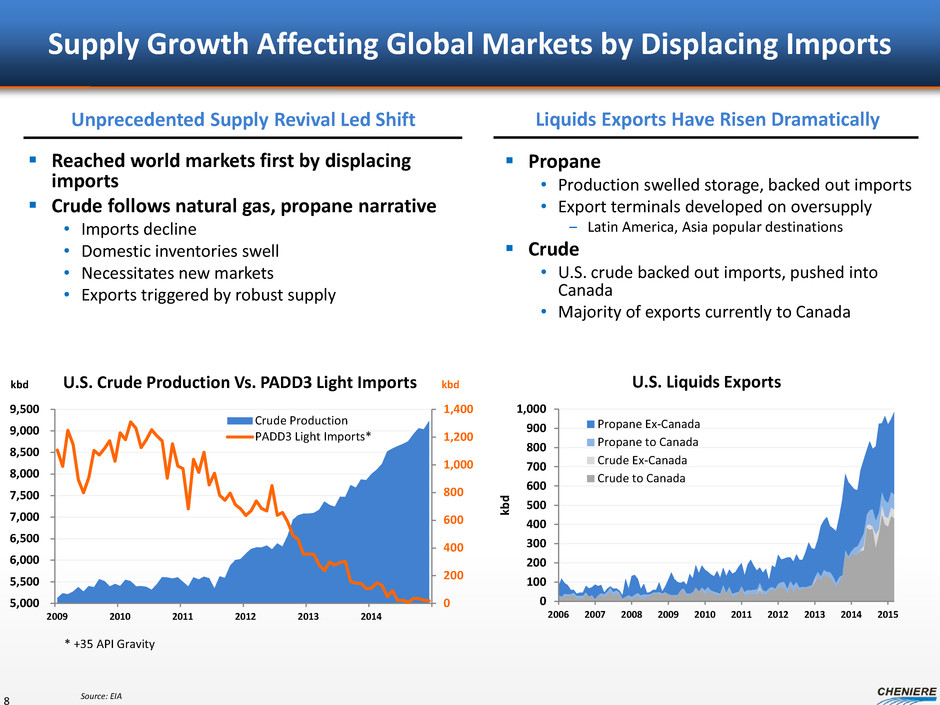

Supply Growth Affecting Global Markets by Displacing Imports Reached world markets first by displacing imports Crude follows natural gas, propane narrative • Imports decline • Domestic inventories swell • Necessitates new markets • Exports triggered by robust supply 8 Source: EIA 0 100 200 300 400 500 600 700 800 900 1,000 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 kb d U.S. Liquids Exports Propane Ex-Canada Propane to Canada Crude Ex-Canada Crude to Canada 0 200 400 600 800 1,000 1,200 1,400 5,000 5,500 6,000 6,500 7,000 7,500 8,000 8,500 9,000 9,500 2009 2010 2011 2012 2013 2014 U.S. Crude Production Vs. PADD3 Light Imports Crude Production PADD3 Light Imports* kbd kbd * +35 API Gravity Propane • Production swelled storage, backed out imports • Export terminals developed on oversupply – Latin America, Asia popular destinations Crude • U.S. crude backed out imports, pushed into Canada • Majority of exports currently to Canada Liquids Exports Have Risen Dramatically Unprecedented Supply Revival Led Shift

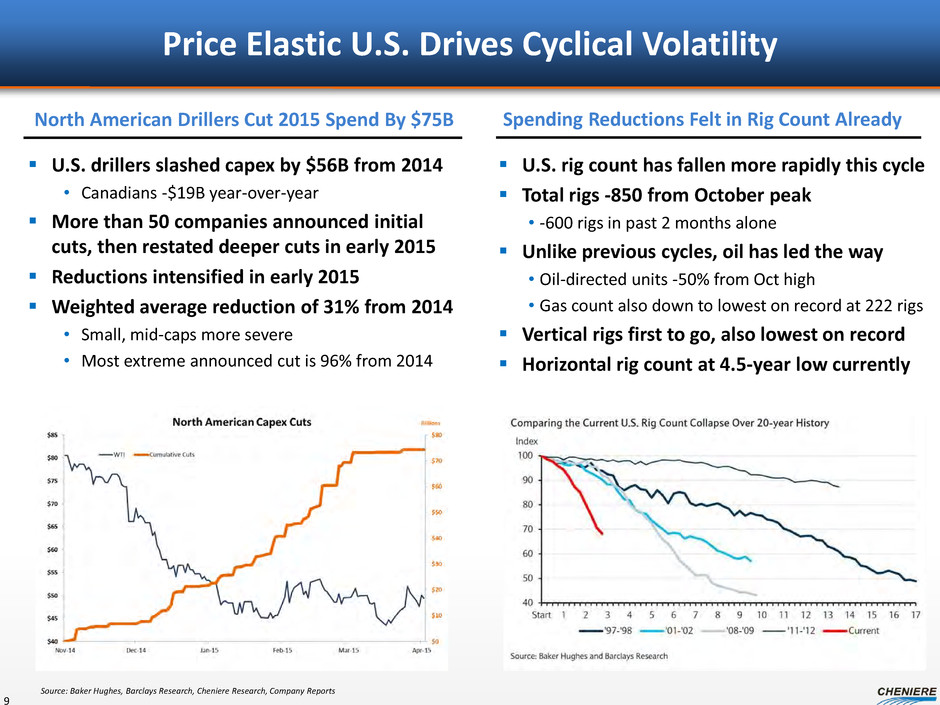

Price Elastic U.S. Drives Cyclical Volatility 9 U.S. drillers slashed capex by $56B from 2014 • Canadians -$19B year-over-year More than 50 companies announced initial cuts, then restated deeper cuts in early 2015 Reductions intensified in early 2015 Weighted average reduction of 31% from 2014 • Small, mid-caps more severe • Most extreme announced cut is 96% from 2014 U.S. rig count has fallen more rapidly this cycle Total rigs -850 from October peak • -600 rigs in past 2 months alone Unlike previous cycles, oil has led the way • Oil-directed units -50% from Oct high • Gas count also down to lowest on record at 222 rigs Vertical rigs first to go, also lowest on record Horizontal rig count at 4.5-year low currently Spending Reductions Felt in Rig Count Already North American Drillers Cut 2015 Spend By $75B Source: Baker Hughes, Barclays Research, Cheniere Research, Company Reports

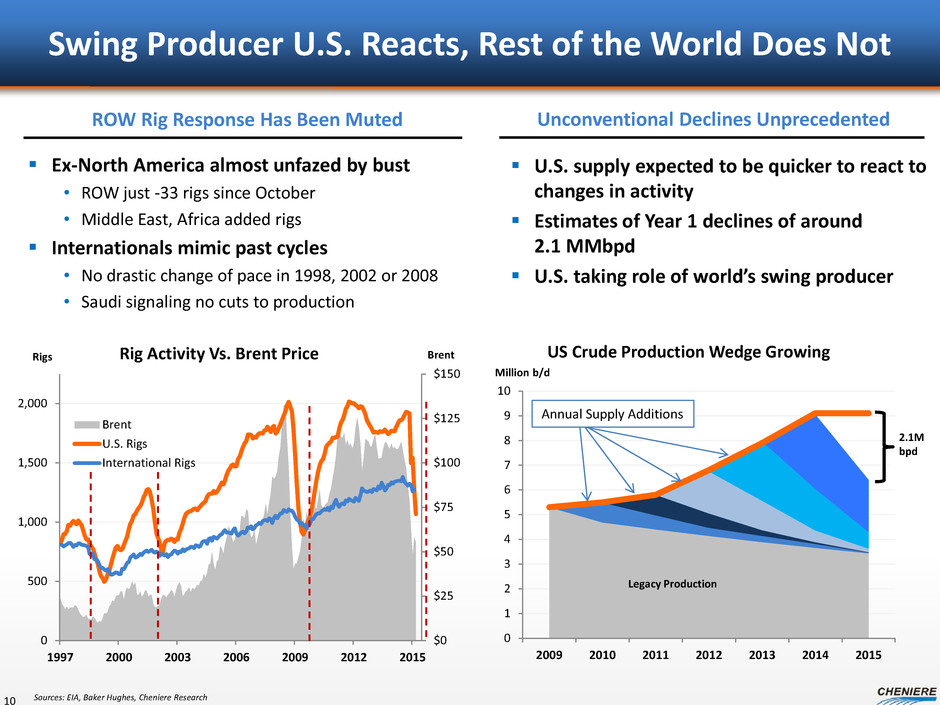

Swing Producer U.S. Reacts, Rest of the World Does Not 10 $0 $25 $50 $75 $100 $125 $150 0 500 1,000 1,500 2,000 1997 2000 2003 2006 2009 2012 2015 Rig Activity Vs. Brent Price Brent U.S. Rigs International Rigs 0 1 2 3 4 5 6 7 8 9 10 2009 2010 2011 2012 2013 2014 2015 US Crude Production Wedge Growing 2.1M bpd Sources: EIA, Baker Hughes, Cheniere Research Unconventional Declines Unprecedented ROW Rig Response Has Been Muted Ex-North America almost unfazed by bust • ROW just -33 rigs since October • Middle East, Africa added rigs Internationals mimic past cycles • No drastic change of pace in 1998, 2002 or 2008 • Saudi signaling no cuts to production U.S. supply expected to be quicker to react to changes in activity Estimates of Year 1 declines of around 2.1 MMbpd U.S. taking role of world’s swing producer Rigs Brent Legacy Production Million b/d Annual Supply Additions

Global Fundamentals Support Continued Growth of Exports Stable global demand growth for energy expected to continue The U.S./Texas is the low cost incremental producer Displacement of imports has largely played out We believe continued growth in U.S. exports is required to efficiently rebalance the global market 11

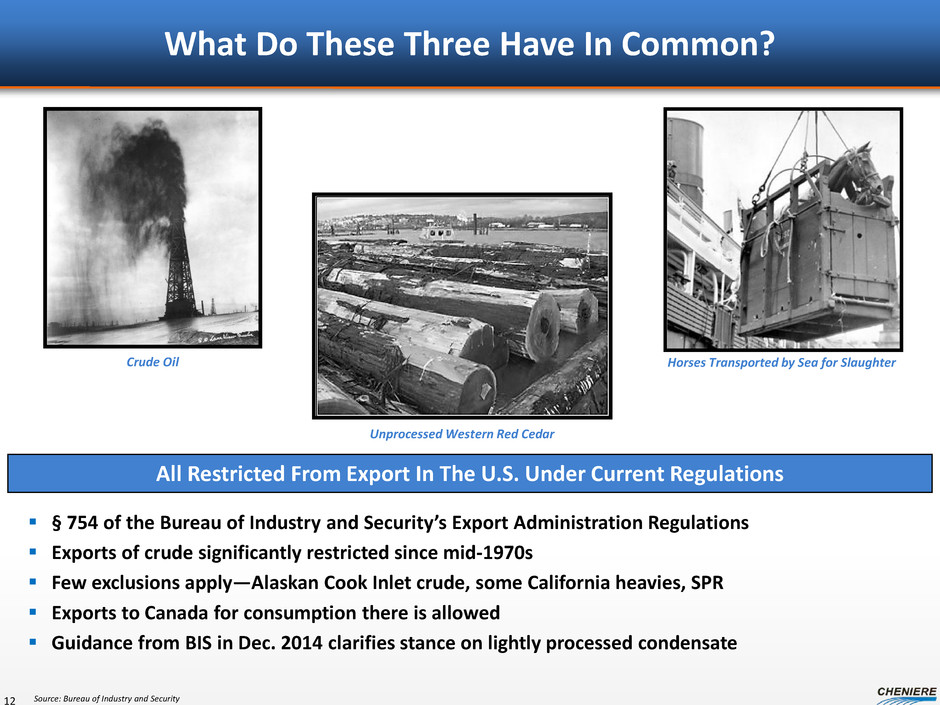

What Do These Three Have In Common? § 754 of the Bureau of Industry and Security’s Export Administration Regulations Exports of crude significantly restricted since mid-1970s Few exclusions apply—Alaskan Cook Inlet crude, some California heavies, SPR Exports to Canada for consumption there is allowed Guidance from BIS in Dec. 2014 clarifies stance on lightly processed condensate 12 Crude Oil Unprocessed Western Red Cedar Horses Transported by Sea for Slaughter Source: Bureau of Industry and Security All Restricted From Export In The U.S. Under Current Regulations

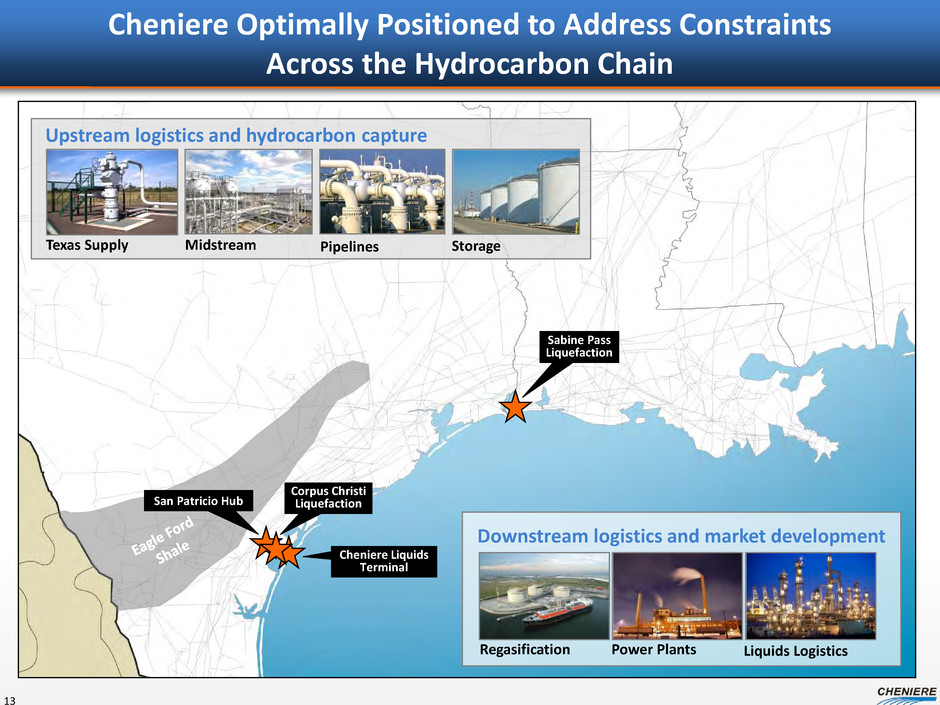

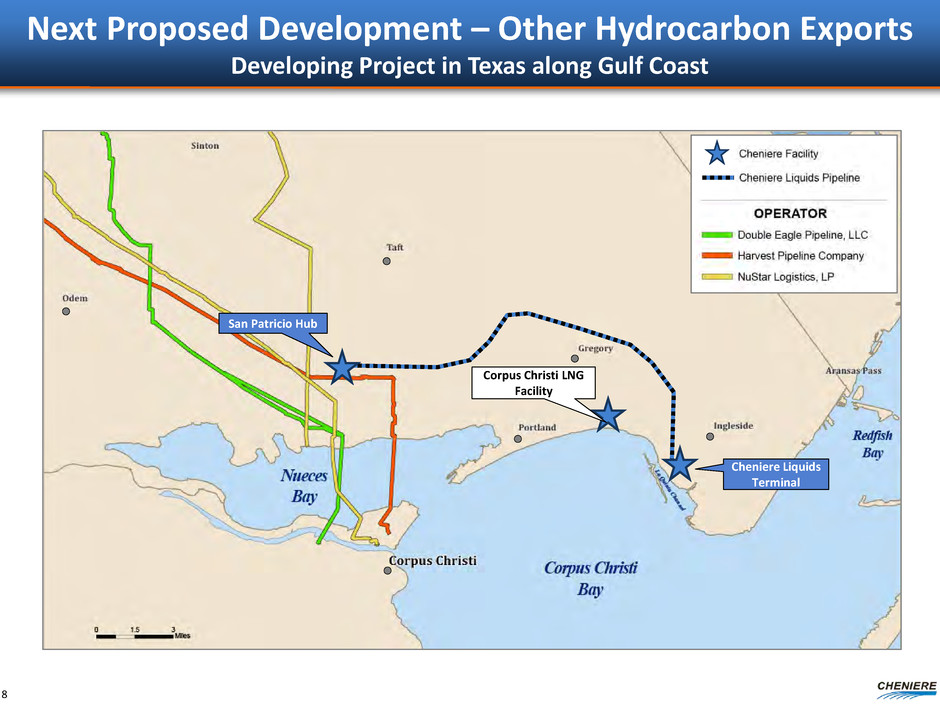

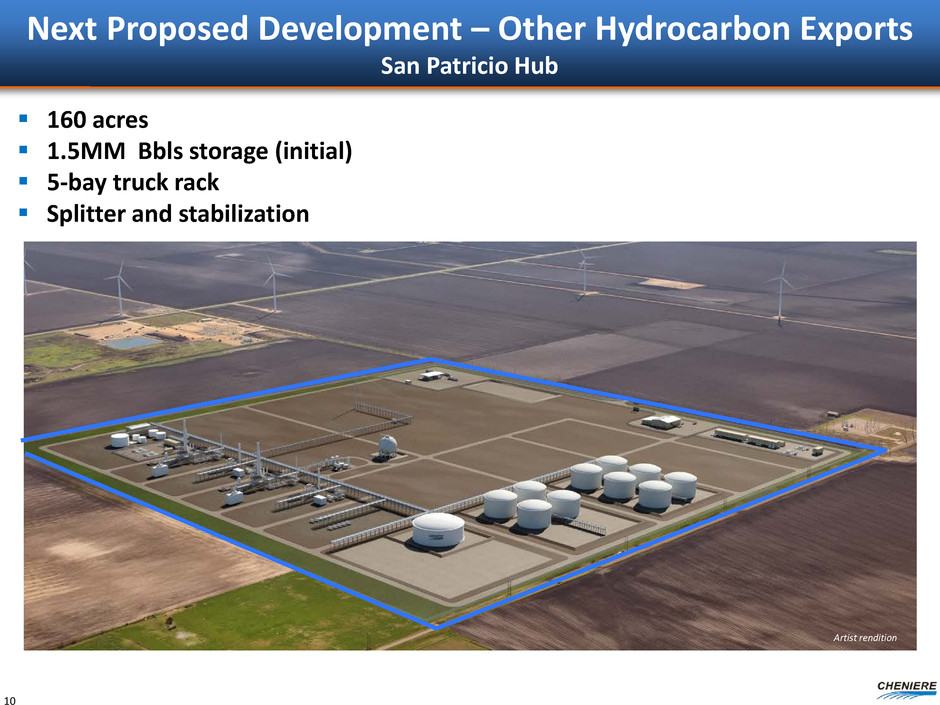

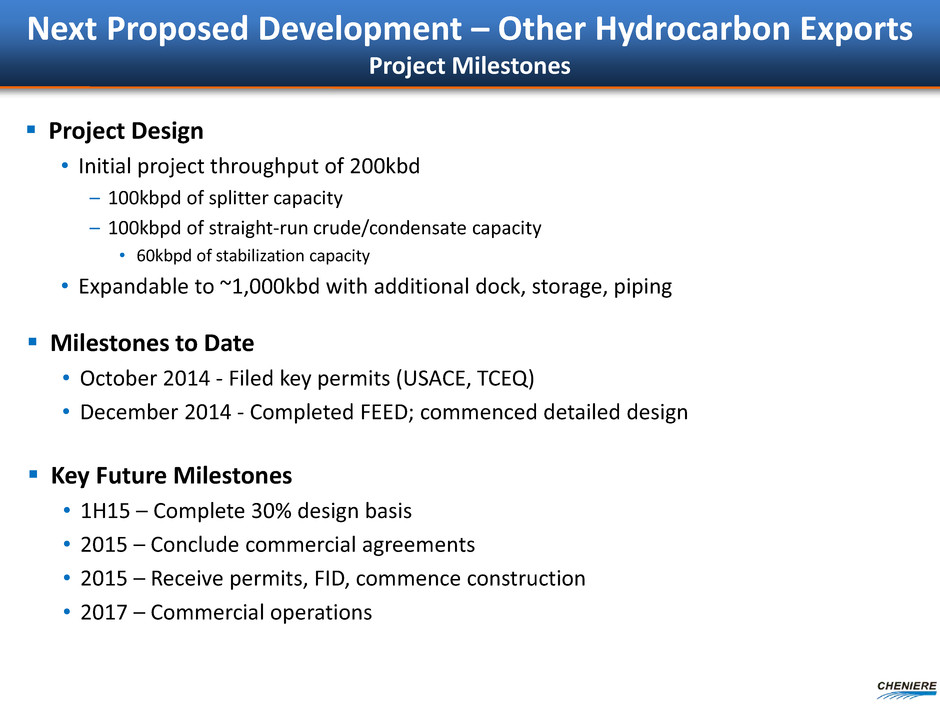

Cheniere Optimally Positioned to Address Constraints Across the Hydrocarbon Chain 13 Downstream logistics and market development Regasification Power Plants Liquids Logistics Upstream logistics and hydrocarbon capture Texas Supply Midstream Pipelines Storage Sabine Pass Liquefaction Corpus Christi Liquefaction Cheniere Liquids Terminal San Patricio Hub

Keith Teague – Executive Vice President, Asset Group LNG Platform Update

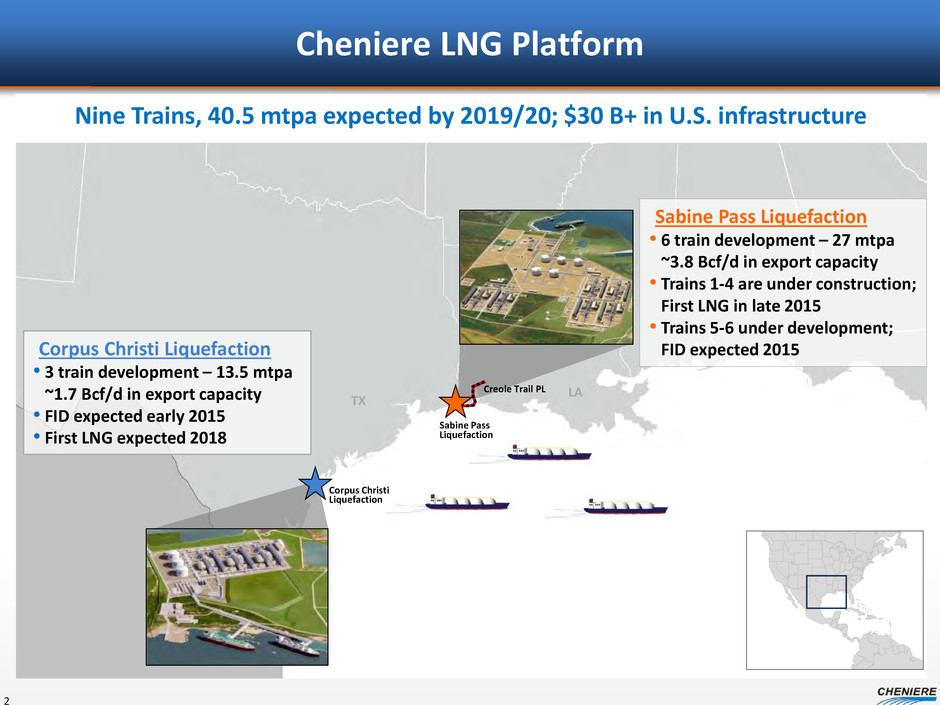

Cheniere LNG Platform Sabine Pass Liquefaction TX LA Creole Trail PL Sabine Pass Liquefaction • 6 train development – 27 mtpa ~3.8 Bcf/d in export capacity • Trains 1-4 are under construction; First LNG in late 2015 • Trains 5-6 under development; FID expected 2015 Corpus Christi Liquefaction • 3 train development – 13.5 mtpa ~1.7 Bcf/d in export capacity • FID expected early 2015 • First LNG expected 2018 Corpus Christi Liquefaction Nine Trains, 40.5 mtpa expected by 2019/20; $30 B+ in U.S. infrastructure 2

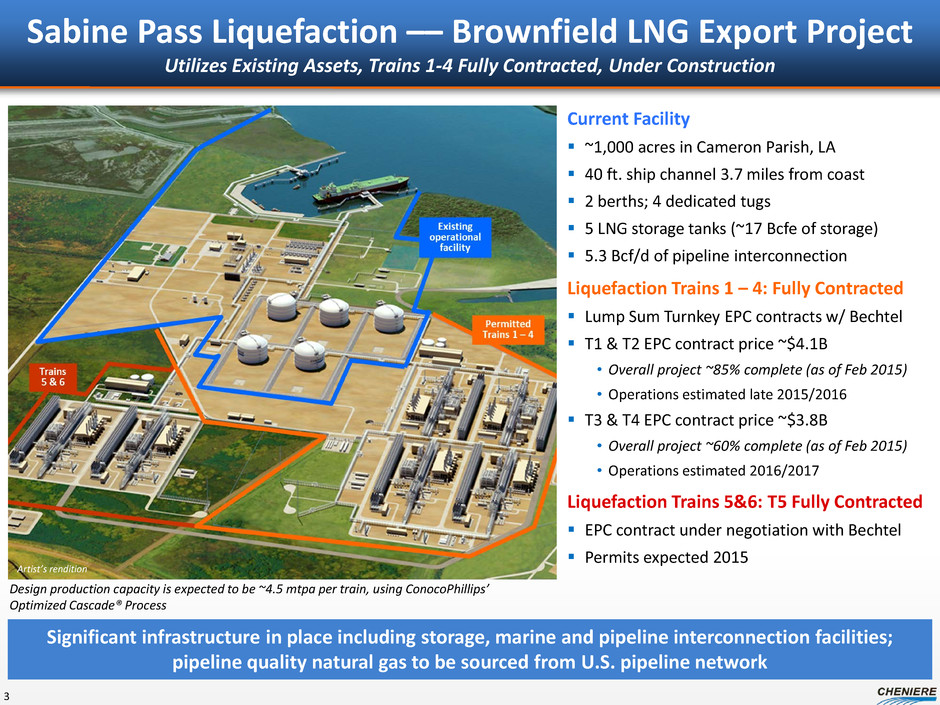

Sabine Pass Liquefaction –– Brownfield LNG Export Project Utilizes Existing Assets, Trains 1-4 Fully Contracted, Under Construction 3 Significant infrastructure in place including storage, marine and pipeline interconnection facilities; pipeline quality natural gas to be sourced from U.S. pipeline network Design production capacity is expected to be ~4.5 mtpa per train, using ConocoPhillips’ Optimized Cascade® Process Current Facility ~1,000 acres in Cameron Parish, LA 40 ft. ship channel 3.7 miles from coast 2 berths; 4 dedicated tugs 5 LNG storage tanks (~17 Bcfe of storage) 5.3 Bcf/d of pipeline interconnection Liquefaction Trains 1 – 4: Fully Contracted Lump Sum Turnkey EPC contracts w/ Bechtel T1 & T2 EPC contract price ~$4.1B • Overall project ~85% complete (as of Feb 2015) • Operations estimated late 2015/2016 T3 & T4 EPC contract price ~$3.8B • Overall project ~60% complete (as of Feb 2015) • Operations estimated 2016/2017 Liquefaction Trains 5&6: T5 Fully Contracted EPC contract under negotiation with Bechtel Permits expected 2015 Artist’s rendition

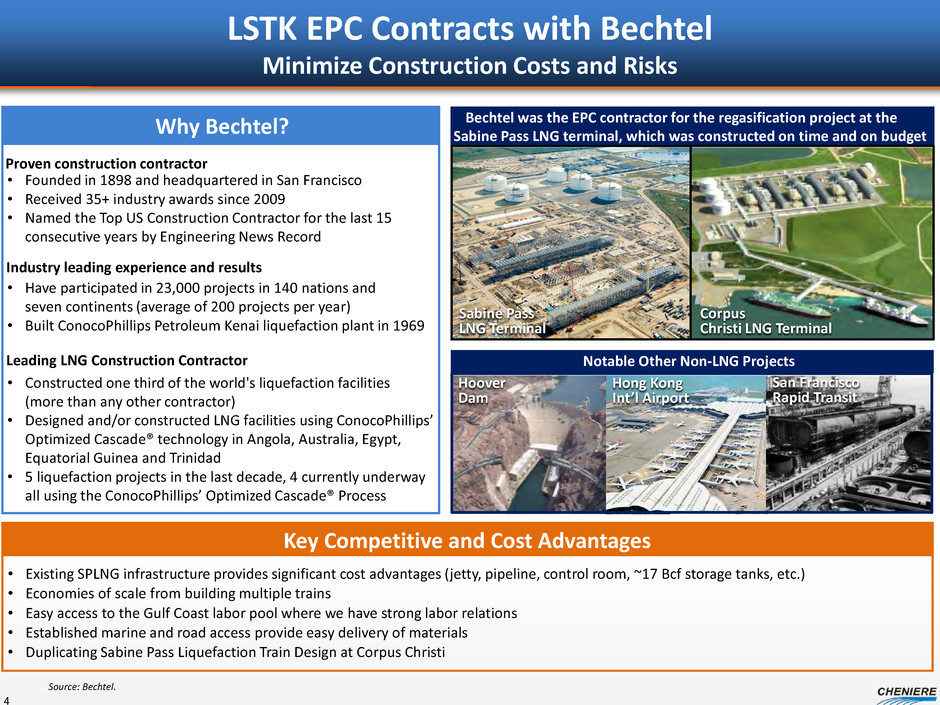

LSTK EPC Contracts with Bechtel Minimize Construction Costs and Risks Hoover Dam Hong Kong Int’l Airport San Francisco Rapid Transit Source: Bechtel. Bechtel was the EPC contractor for the regasification project at the Sabine Pass LNG terminal, which was constructed on time and on budget Proven construction contractor • Founded in 1898 and headquartered in San Francisco • Received 35+ industry awards since 2009 • Named the Top US Construction Contractor for the last 15 consecutive years by Engineering News Record Industry leading experience and results • Have participated in 23,000 projects in 140 nations and seven continents (average of 200 projects per year) • Built ConocoPhillips Petroleum Kenai liquefaction plant in 1969 Leading LNG Construction Contractor Notable Other Non-LNG Projects Key Competitive and Cost Advantages • Existing SPLNG infrastructure provides significant cost advantages (jetty, pipeline, control room, ~17 Bcf storage tanks, etc.) • Economies of scale from building multiple trains • Easy access to the Gulf Coast labor pool where we have strong labor relations • Established marine and road access provide easy delivery of materials • Duplicating Sabine Pass Liquefaction Train Design at Corpus Christi Why Bechtel? • Constructed one third of the world's liquefaction facilities (more than any other contractor) • Designed and/or constructed LNG facilities using ConocoPhillips’ Optimized Cascade® technology in Angola, Australia, Egypt, Equatorial Guinea and Trinidad • 5 liquefaction projects in the last decade, 4 currently underway all using the ConocoPhillips’ Optimized Cascade® Process Sabine Pass LNG Terminal Corpus Christi LNG Terminal 4

Aerial View of SPLNG – Spring 2012

Aerial View of SPL Construction – March 2015 6

Project Execution – Spring 2014

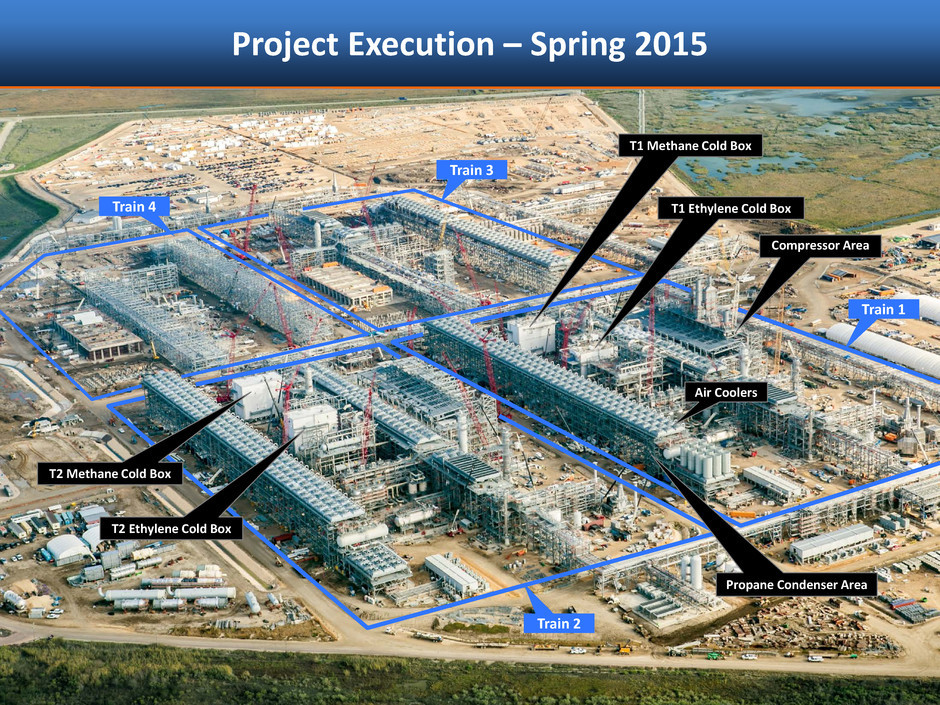

Project Execution – Spring 2015

Project Execution – Spring 2015 Train 1 Train 2 Train 3 Train 4 Air Coolers Compressor Area Propane Condenser Area T1 Ethylene Cold Box T1 Methane Cold Box T2 Ethylene Cold Box T2 Methane Cold Box

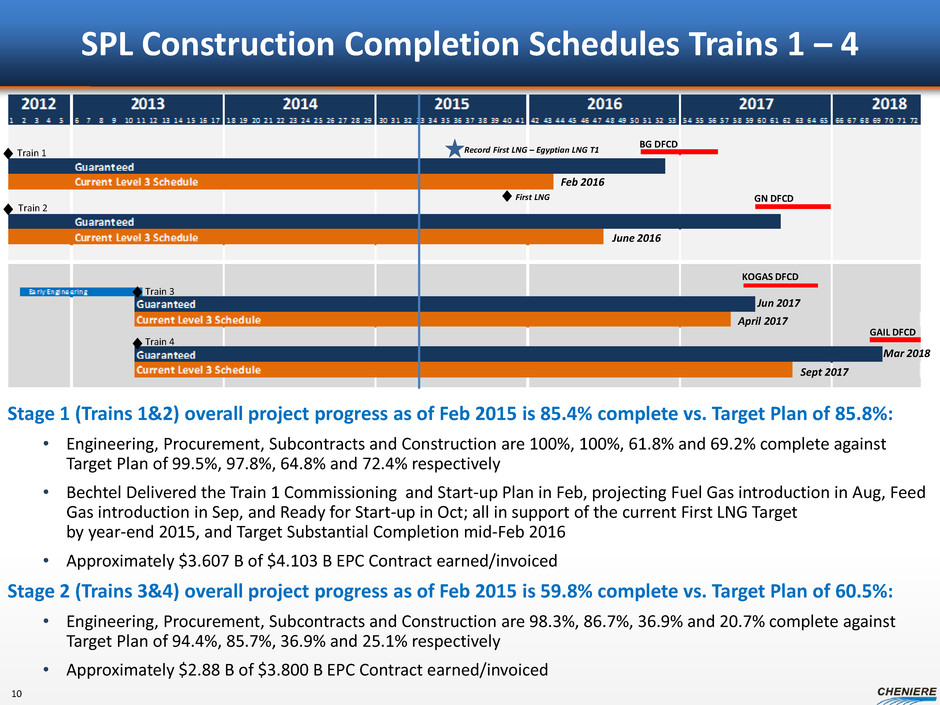

SPL Construction Completion Schedules Trains 1 – 4 Stage 1 (Trains 1&2) overall project progress as of Feb 2015 is 85.4% complete vs. Target Plan of 85.8%: • Engineering, Procurement, Subcontracts and Construction are 100%, 100%, 61.8% and 69.2% complete against Target Plan of 99.5%, 97.8%, 64.8% and 72.4% respectively • Bechtel Delivered the Train 1 Commissioning and Start-up Plan in Feb, projecting Fuel Gas introduction in Aug, Feed Gas introduction in Sep, and Ready for Start-up in Oct; all in support of the current First LNG Target by year-end 2015, and Target Substantial Completion mid-Feb 2016 • Approximately $3.607 B of $4.103 B EPC Contract earned/invoiced Stage 2 (Trains 3&4) overall project progress as of Feb 2015 is 59.8% complete vs. Target Plan of 60.5%: • Engineering, Procurement, Subcontracts and Construction are 98.3%, 86.7%, 36.9% and 20.7% complete against Target Plan of 94.4%, 85.7%, 36.9% and 25.1% respectively • Approximately $2.88 B of $3.800 B EPC Contract earned/invoiced 10 BG DFCD GN DFCD KOGAS DFCD GAIL DFCD Record First LNG – Egyptian LNG T1 First LNG Train 1 Train 2 Train 3 Train 4 Feb 2016 April 2017 Jun 2017 Mar 2018 June 2016 Sept 2017

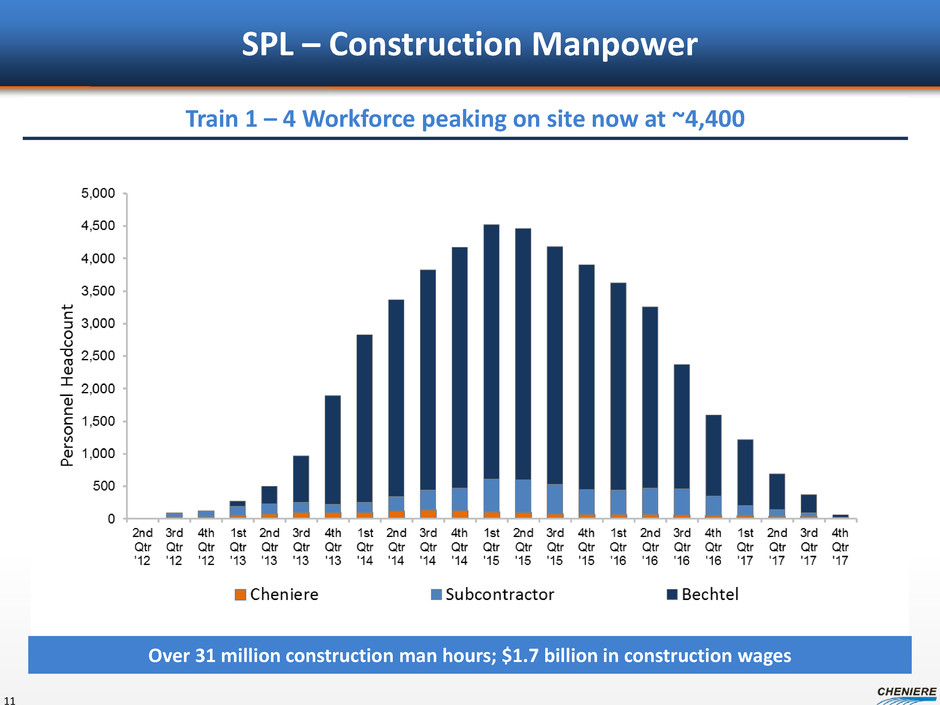

SPL – Construction Manpower 11 Over 31 million construction man hours; $1.7 billion in construction wages Train 1 – 4 Workforce peaking on site now at ~4,400

SPL – Craft Labor Incentive 12

Sabine Pass Liquefaction Project Execution Keys to Success World class terminal site • Deep channel in close proximity to the coast • Sufficient acreage to satisfy siting challenges, both regulatory and physical World class contractor • Bechtel has constructed one third of the world’s liquefaction facilities • Long, successful relationship between Cheniere and Bechtel • LSTK EPC Agreements where Bechtel generally bears cost, schedule & performance risk • Work proceeding on budget and well ahead of schedule guarantees World class engineering and operations team • Over 1,050 years of experience in oil and gas facility construction • Over 560 years of LNG experience • On site O&M Team currently at 240 persons; expect to exit 2015 at ~310 • 30+ operating employees with liquefaction experience from Trinidad, Angola, Egypt, Qatar, Peru, Oman, etc.; over 11 years each, on average 13

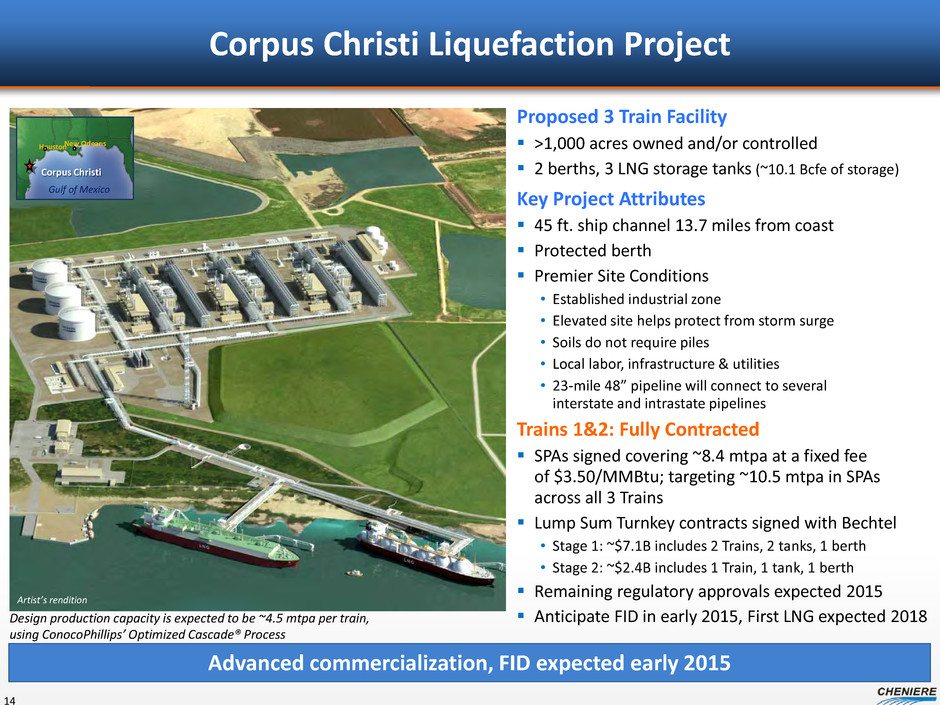

Corpus Christi Liquefaction Project 14 Proposed 3 Train Facility >1,000 acres owned and/or controlled 2 berths, 3 LNG storage tanks (~10.1 Bcfe of storage) Key Project Attributes 45 ft. ship channel 13.7 miles from coast Protected berth Premier Site Conditions • Established industrial zone • Elevated site helps protect from storm surge • Soils do not require piles • Local labor, infrastructure & utilities • 23-mile 48” pipeline will connect to several interstate and intrastate pipelines Trains 1&2: Fully Contracted SPAs signed covering ~8.4 mtpa at a fixed fee of $3.50/MMBtu; targeting ~10.5 mtpa in SPAs across all 3 Trains Lump Sum Turnkey contracts signed with Bechtel • Stage 1: ~$7.1B includes 2 Trains, 2 tanks, 1 berth • Stage 2: ~$2.4B includes 1 Train, 1 tank, 1 berth Remaining regulatory approvals expected 2015 Anticipate FID in early 2015, First LNG expected 2018 Houston New Orleans Gulf of Mexico Corpus Christi Advanced commercialization, FID expected early 2015 Artist’s rendition Design production capacity is expected to be ~4.5 mtpa per train, using ConocoPhillips’ Optimized Cascade® Process

Key Differences Between CCL and SPL Grassroots construction at CCL; SPL utilizes existing assets at the regasification terminal Full containment LNG storage tanks at CCL instead of single containment Dry low emissions (DLE) combustors on refrigeration gas turbines rather than water injection (SAC combustors) Better soils at CCL; no piling needed on shore CCL will import electrical power from the local grid; SPL self generates power No LNG regasification capacity initially at CCL (although permitted) 15

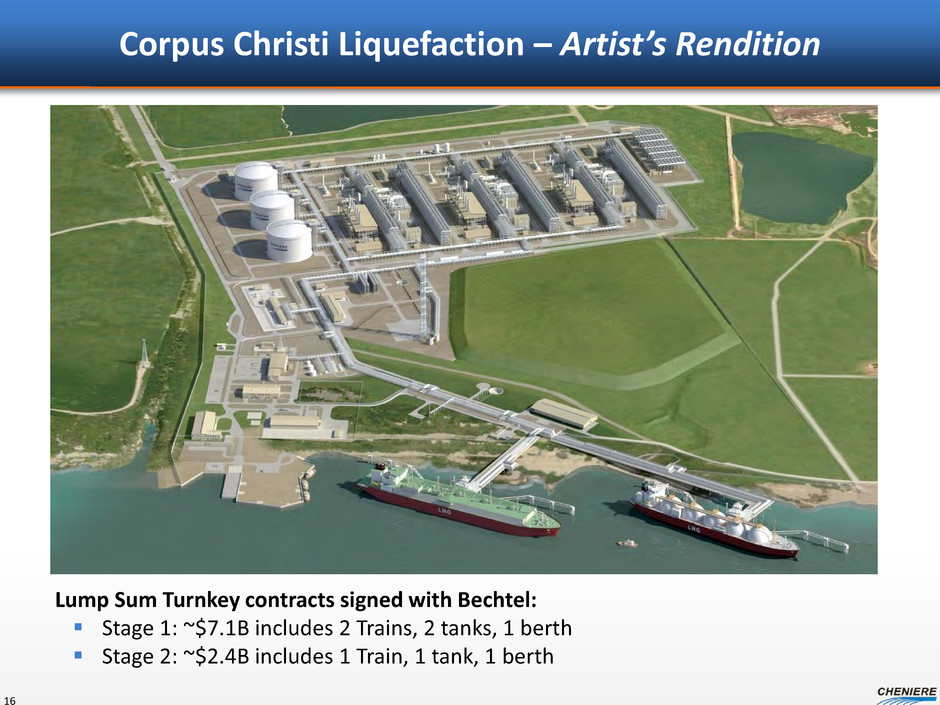

Corpus Christi Liquefaction – Artist’s Rendition Lump Sum Turnkey contracts signed with Bechtel: Stage 1: ~$7.1B includes 2 Trains, 2 tanks, 1 berth Stage 2: ~$2.4B includes 1 Train, 1 tank, 1 berth 16

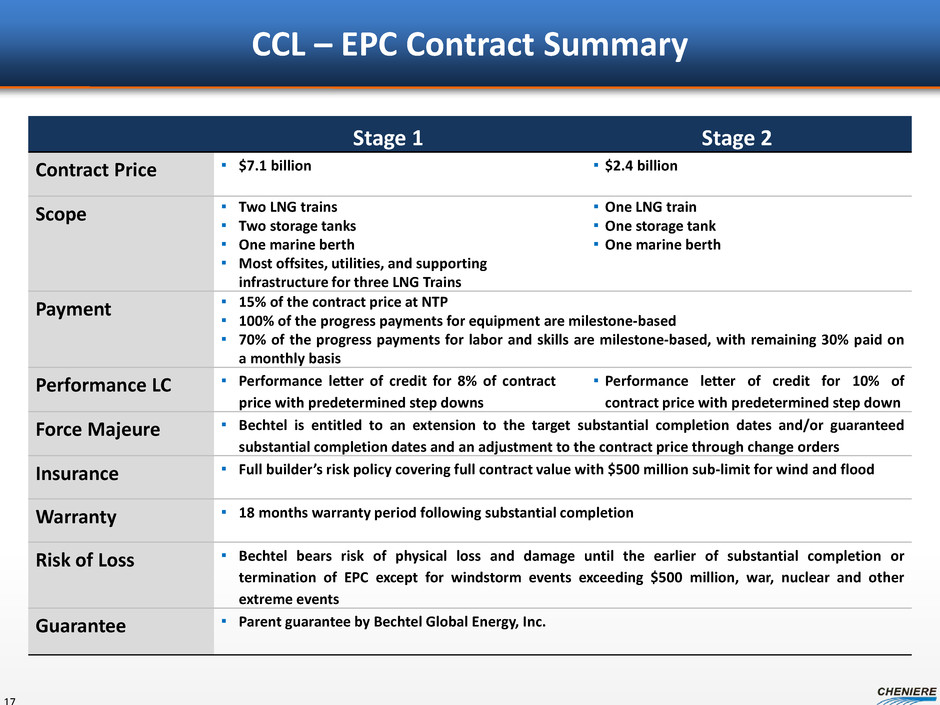

CCL – EPC Contract Summary Stage 1 Stage 2 Contract Price $7.1 billion $2.4 billion Scope Two LNG trains Two storage tanks One marine berth Most offsites, utilities, and supporting infrastructure for three LNG Trains One LNG train One storage tank One marine berth Payment 15% of the contract price at NTP 100% of the progress payments for equipment are milestone-based 70% of the progress payments for labor and skills are milestone-based, with remaining 30% paid on a monthly basis Performance LC Performance letter of credit for 8% of contract price with predetermined step downs Performance letter of credit for 10% of contract price with predetermined step down Force Majeure Bechtel is entitled to an extension to the target substantial completion dates and/or guaranteed substantial completion dates and an adjustment to the contract price through change orders Insurance Full builder’s risk policy covering full contract value with $500 million sub-limit for wind and flood Warranty 18 months warranty period following substantial completion Risk of Loss Bechtel bears risk of physical loss and damage until the earlier of substantial completion or termination of EPC except for windstorm events exceeding $500 million, war, nuclear and other extreme events Guarantee Parent guarantee by Bechtel Global Energy, Inc. 17

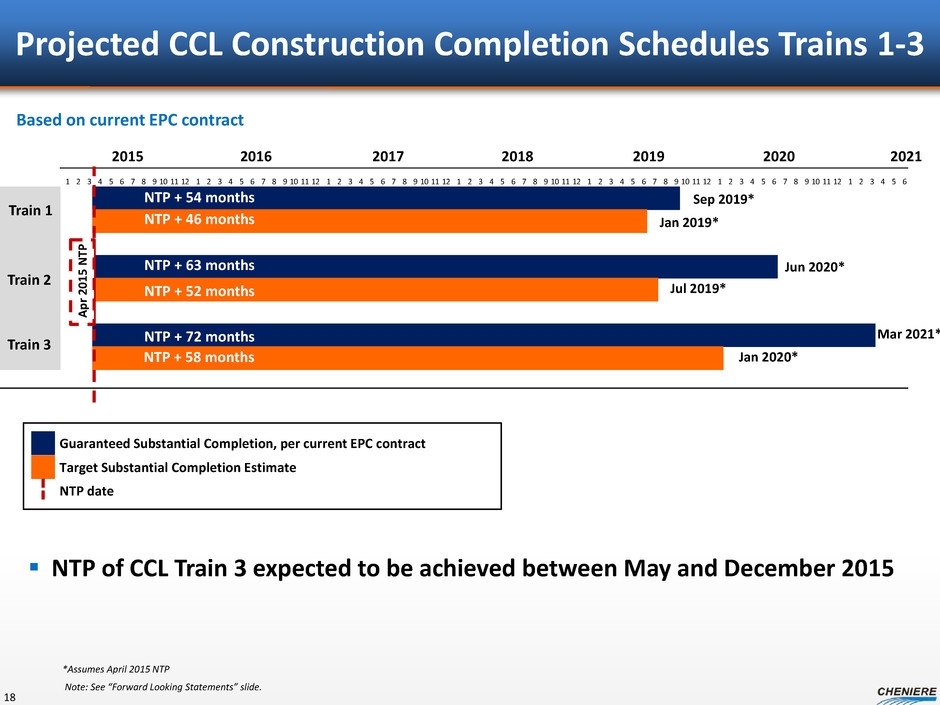

2015 2016 2017 2018 2019 2020 2021 1 2 3 4 5 6 7 8 9 10 11 12 1 2 3 4 5 6 7 8 9 10 11 12 1 2 3 4 5 6 7 8 9 10 11 12 1 2 3 4 5 6 7 8 9 10 11 12 1 2 3 4 5 6 7 8 9 10 11 12 1 2 3 4 5 6 7 8 9 10 11 12 1 2 3 4 5 6 Projected CCL Construction Completion Schedules Trains 1-3 18 Note: See “Forward Looking Statements” slide. A pr 2 01 5 N TP Sep 2019* Jan 2019* Jul 2019* Jun 2020* Jan 2020* Mar 2021* NTP + 54 months NTP + 46 months NTP + 63 months NTP + 52 months NTP + 72 months NTP + 58 months Guaranteed Substantial Completion, per current EPC contract Target Substantial Completion Estimate NTP date NTP of CCL Train 3 expected to be achieved between May and December 2015 *Assumes April 2015 NTP 2015 2016 2017 2018 2019 2020 2021 Train 1 Train 2 Train 3 Based on current EPC contract

CCL Early Works – Access Road Widening & Pipeline Relocation 19 1

CCL Liquefaction Area – Artist’s Rendition 20

CCL Storage Area & Train 1 – Artist’s Rendition 21

CCL Marine Area – Artist’s Rendition 22 22

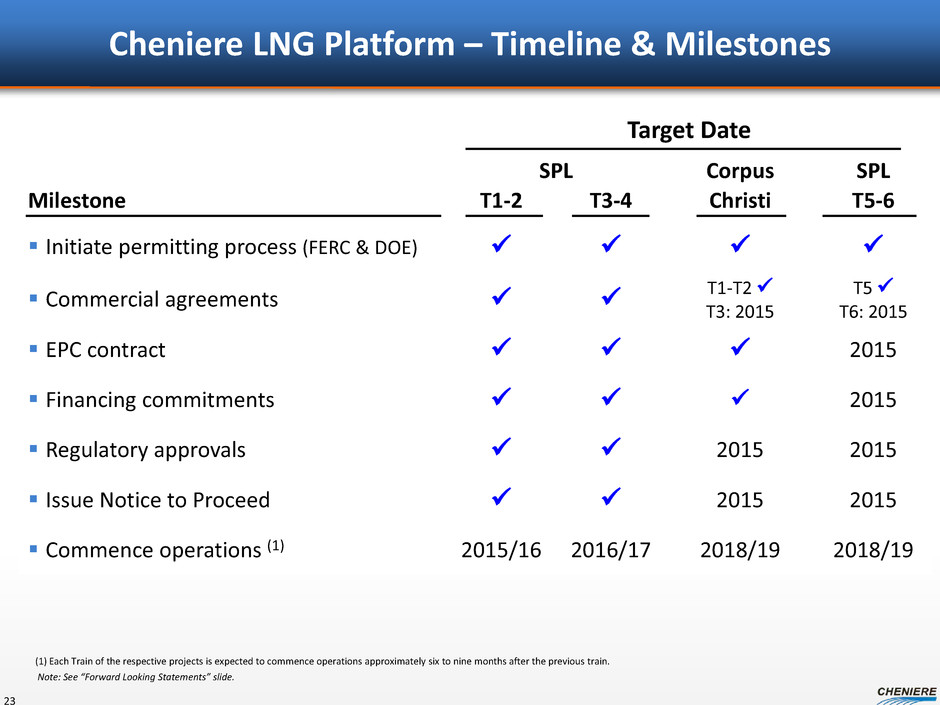

Cheniere LNG Platform – Timeline & Milestones Target Date SPL Corpus SPL Milestone T1-2 T3-4 Christi T5-6 Initiate permitting process (FERC & DOE) Commercial agreements T1-T2 T3: 2015 T5 T6: 2015 EPC contract 2015 Financing commitments 2015 Regulatory approvals 2015 2015 Issue Notice to Proceed 2015 2015 Commence operations (1) 2015/16 2016/17 2018/19 2018/19 (1) Each Train of the respective projects is expected to commence operations approximately six to nine months after the previous train. Note: See “Forward Looking Statements” slide. 23

Corey Grindal – Vice President, Supply Gas Procurement

Agenda Review of 2014 Stated Gas Supply Guiding Principals 2015 Status of Sabine Pass Supply 2015 Status of Corpus Christi Supply Balance of Calendar 2015 and Forward Supply Strategy 2

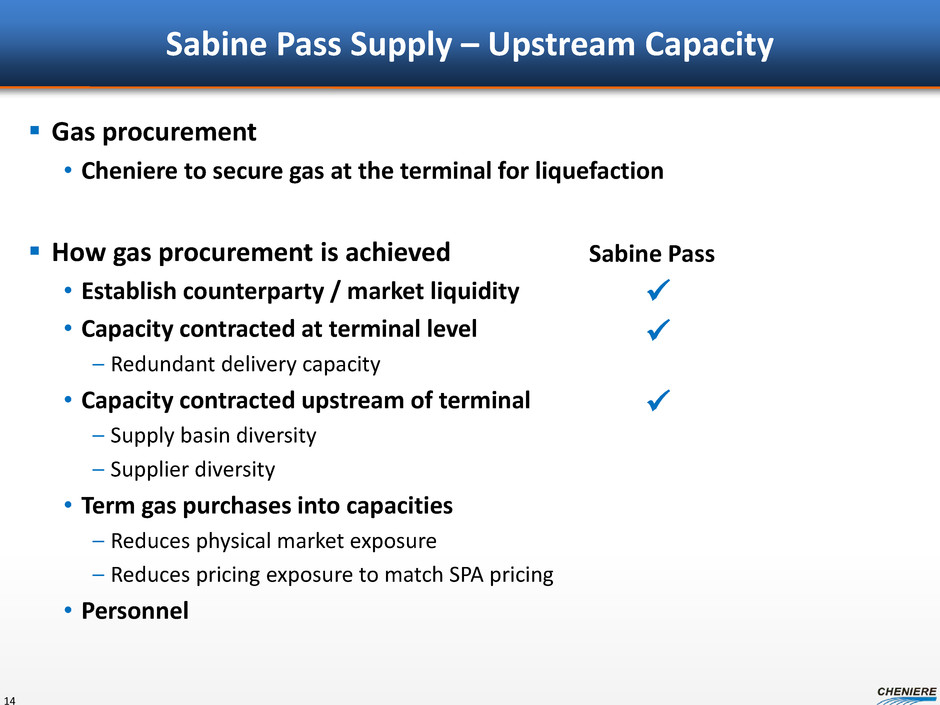

Gas Supply Group Principals 3 Gas procurement • Cheniere to secure gas at the terminal for liquefaction How gas procurement is achieved • Establish counterparty / market liquidity • Capacity contracted at terminal level – Redundant delivery capacity • Capacity contracted upstream of terminal – Supply basin diversity – Supplier diversity • Term gas purchases into capacities – Reduces physical market exposure – Reduces pricing exposure to match SPA pricing • Personnel

2015 Status of Sabine Pass Supply 4 Artist rendition

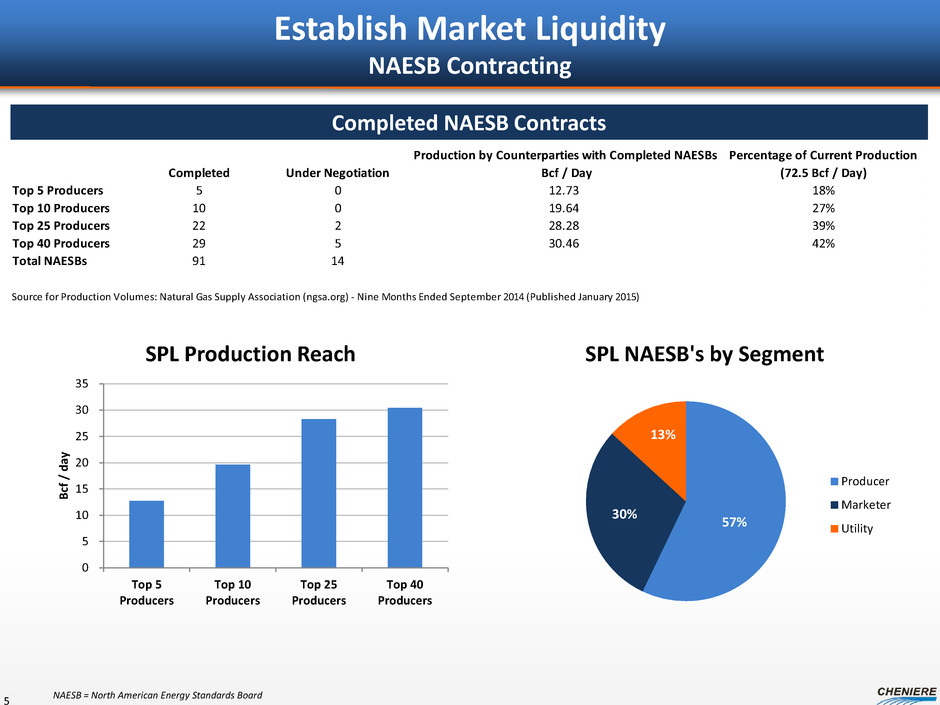

Establish Market Liquidity NAESB Contracting 5 Completed NAESB Contracts Completed Under Negotiation Production by Counterparties with Completed NAESBs Bcf / Day Percentage of Current Production (72.5 Bcf / Day) Top 5 Producers 5 0 12.73 18% Top 10 Producers 10 0 19.64 27% Top 25 Producers 22 2 28.28 39% Top 40 Producers 29 5 30.46 42% Total NAESBs 91 14 Source for Production Volumes: Natural Gas Supply Association (ngsa.org) - Nine Months Ended September 2014 (Published January 2015) NAESB = North American Energy Standards Board 57% 30% 13% SPL NAESB's by Segment Producer Marketer Utility 0 5 10 15 20 25 30 35 Top 5 Producers Top 10 Producers Top 25 Producers Top 40 Producers B cf / d ay SPL Production Reach

Sabine Pass Supply – Counterparty Liquidity 6 Sabine Pass Gas procurement • Cheniere to secure gas at the terminal for liquefaction How gas procurement is achieved • Establish counterparty / market liquidity • Capacity contracted at terminal level – Redundant delivery capacity • Capacity contracted upstream of terminal – Supply basin diversity – Supplier diversity • Term gas purchases into capacities – Reduces physical market exposure – Reduces pricing exposure to match SPA pricing • Personnel

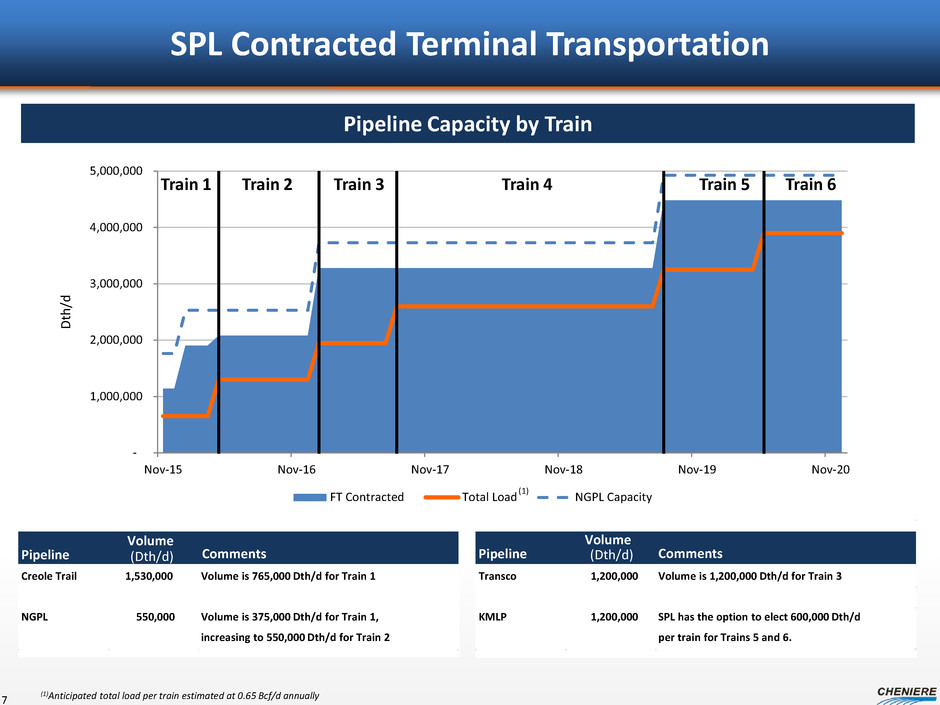

- 1,000,000 2,000,000 3,000,000 4,000,000 5,000,000 Nov-15 Nov-16 Nov-17 Nov-18 Nov-19 Nov-20 FT Contracted Total Load NGPL Capacity SPL Contracted Terminal Transportation 7 Pipeline Capacity by Train Train 1 Train 2 Train 3 Train 4 Train 5 Train 6 D th /d (1)Anticipated total load per train estimated at 0.65 Bcf/d annually (1) Pipeline Volume (Dth/d) Comments Pipeline Volume (Dth/d) Comments Creole Trail 1,530,000 Volume is 765,000 Dth/d for Train 1 Transco 1,200,000 Volume is 1,200,000 Dth/d for Train 3 NGPL 550,000 Volume is 375,000 Dth/d for Train 1, increasing to 550,000 Dth/d for Train 2 KMLP 1,200,000 SPL has the option to elect 600,000 Dth/d per train for Trains 5 and 6.

Sabine Pass Supply – Terminal Capacity 8 Sabine Pass Gas procurement • Cheniere to secure gas at the terminal for liquefaction How gas procurement is achieved • Establish counterparty / market liquidity • Capacity contracted at terminal level – Redundant delivery capacity • Capacity contracted upstream of terminal – Supply basin diversity – Supplier diversity • Term gas purchases into capacities – Reduces physical market exposure – Reduces pricing exposure to match SPA pricing • Personnel

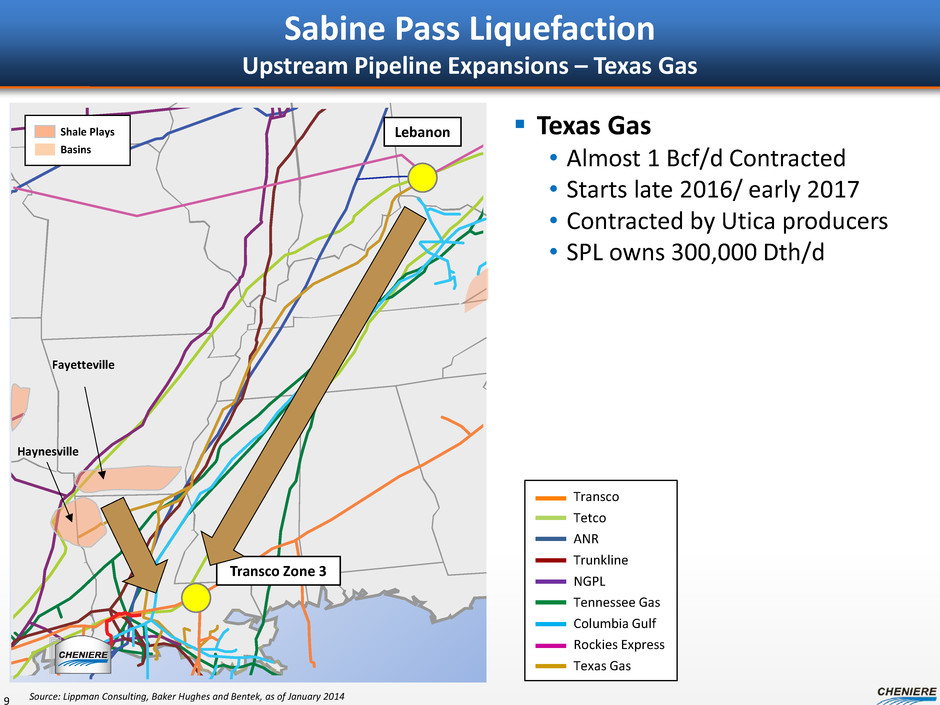

Sabine Pass Liquefaction Upstream Pipeline Expansions – Texas Gas Texas Gas • Almost 1 Bcf/d Contracted • Starts late 2016/ early 2017 • Contracted by Utica producers • SPL owns 300,000 Dth/d 9 Source: Lippman Consulting, Baker Hughes and Bentek, as of January 2014 Haynesville Fayetteville Lebanon Transco Zone 3 Transco Tetco ANR Trunkline NGPL Tennessee Gas Columbia Gulf Rockies Express Texas Gas Shale Plays Basins Haynesville

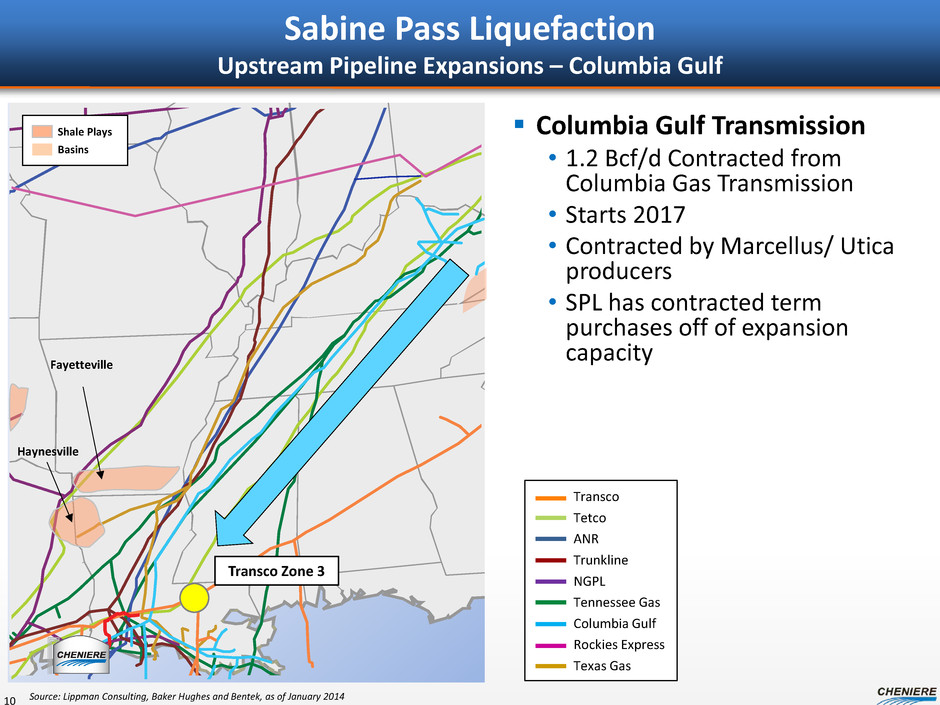

Sabine Pass Liquefaction Upstream Pipeline Expansions – Columbia Gulf Columbia Gulf Transmission • 1.2 Bcf/d Contracted from Columbia Gas Transmission • Starts 2017 • Contracted by Marcellus/ Utica producers • SPL has contracted term purchases off of expansion capacity 10 Haynesville Fayetteville Transco Zone 3 Transco Tetco ANR Trunkline NGPL Tennessee Gas Columbia Gulf Rockies Express Texas Gas Shale Plays Basins Source: Lippman Consulting, Baker Hughes and Bentek, as of January 2014 Haynesville

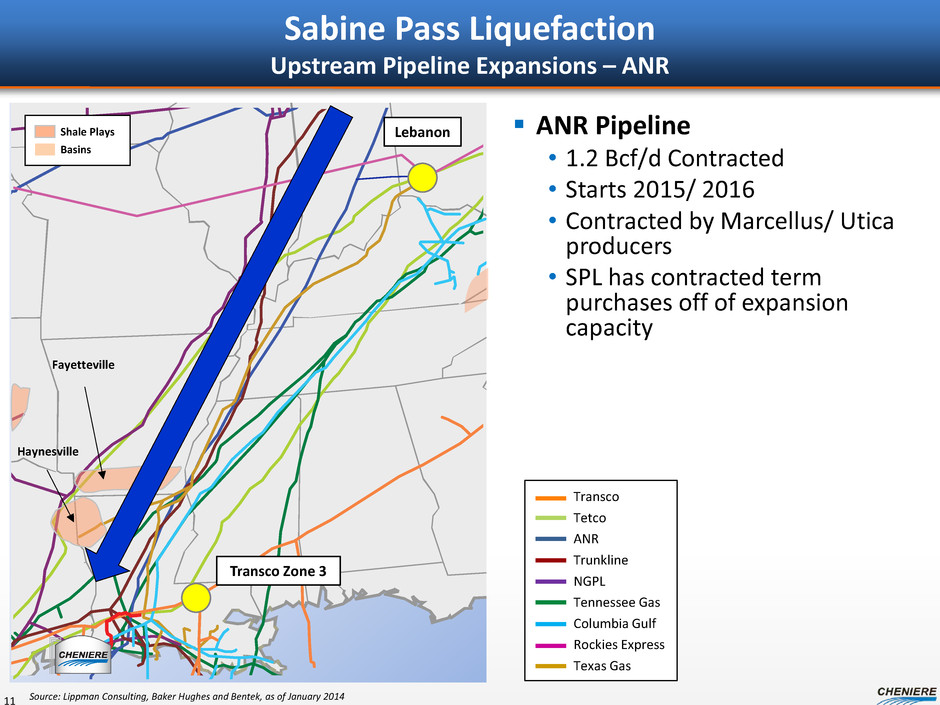

Sabine Pass Liquefaction Upstream Pipeline Expansions – ANR ANR Pipeline • 1.2 Bcf/d Contracted • Starts 2015/ 2016 • Contracted by Marcellus/ Utica producers • SPL has contracted term purchases off of expansion capacity 11 Transco Tetco ANR Trunkline NGPL Tennessee Gas Columbia Gulf Rockies Express Texas Gas Source: Lippman Consulting, Baker Hughes and Bentek, as of January 2014 Haynesville Fayetteville Lebanon Transco Zone 3 Shale Plays Basins Haynesville

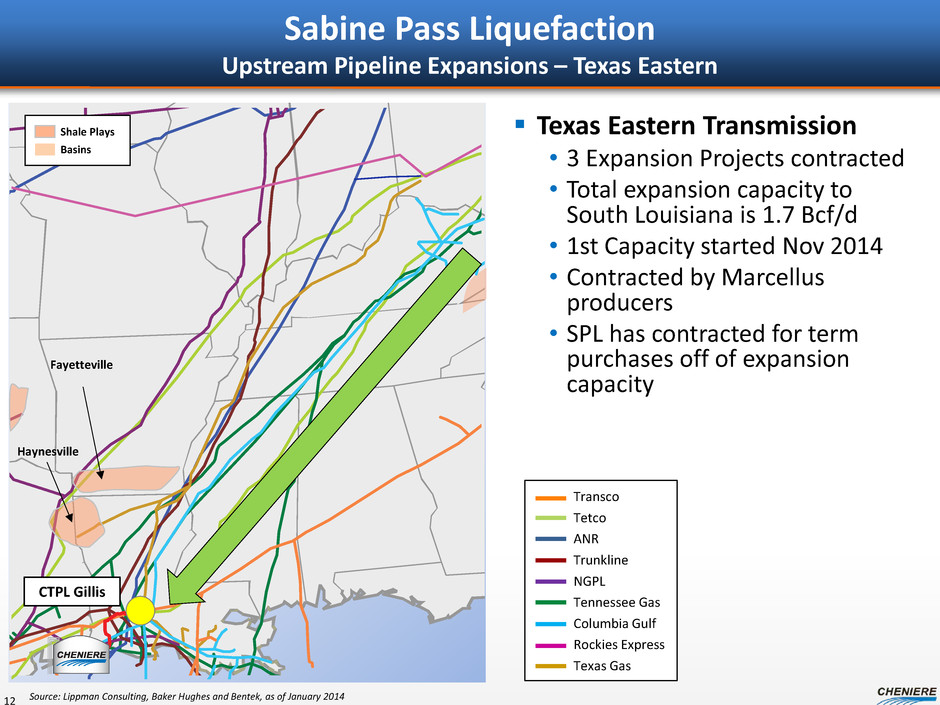

Sabine Pass Liquefaction Upstream Pipeline Expansions – Texas Eastern Texas Eastern Transmission • 3 Expansion Projects contracted • Total expansion capacity to South Louisiana is 1.7 Bcf/d • 1st Capacity started Nov 2014 • Contracted by Marcellus producers • SPL has contracted for term purchases off of expansion capacity 12 Transco Tetco ANR Trunkline NGPL Tennessee Gas Columbia Gulf Rockies Express Texas Gas Source: Lippman Consulting, Baker Hughes and Bentek, as of January 2014 Haynesville Fayetteville CTPL Gillis Shale Plays Basins Haynesville

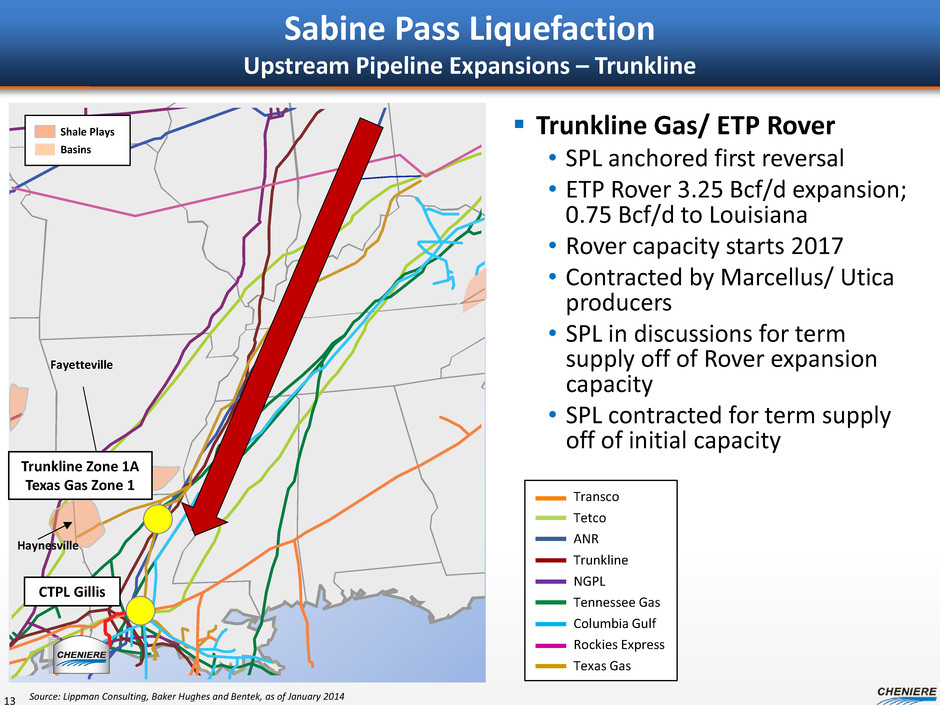

Sabine Pass Liquefaction Upstream Pipeline Expansions – Trunkline Trunkline Gas/ ETP Rover • SPL anchored first reversal • ETP Rover 3.25 Bcf/d expansion; 0.75 Bcf/d to Louisiana • Rover capacity starts 2017 • Contracted by Marcellus/ Utica producers • SPL in discussions for term supply off of Rover expansion capacity • SPL contracted for term supply off of initial capacity 13 Transco Tetco ANR Trunkline NGPL Tennessee Gas Columbia Gulf Rockies Express Texas Gas Source: Lippman Consulting, Baker Hughes and Bentek, as of January 2014 Haynesville Fayetteville CTPL Gillis Trunkline Zone 1A Texas Gas Zone 1 Shale Plays Basins Haynesville

Sabine Pass Supply – Upstream Capacity 14 Sabine Pass Gas procurement • Cheniere to secure gas at the terminal for liquefaction How gas procurement is achieved • Establish counterparty / market liquidity • Capacity contracted at terminal level – Redundant delivery capacity • Capacity contracted upstream of terminal – Supply basin diversity – Supplier diversity • Term gas purchases into capacities – Reduces physical market exposure – Reduces pricing exposure to match SPA pricing • Personnel

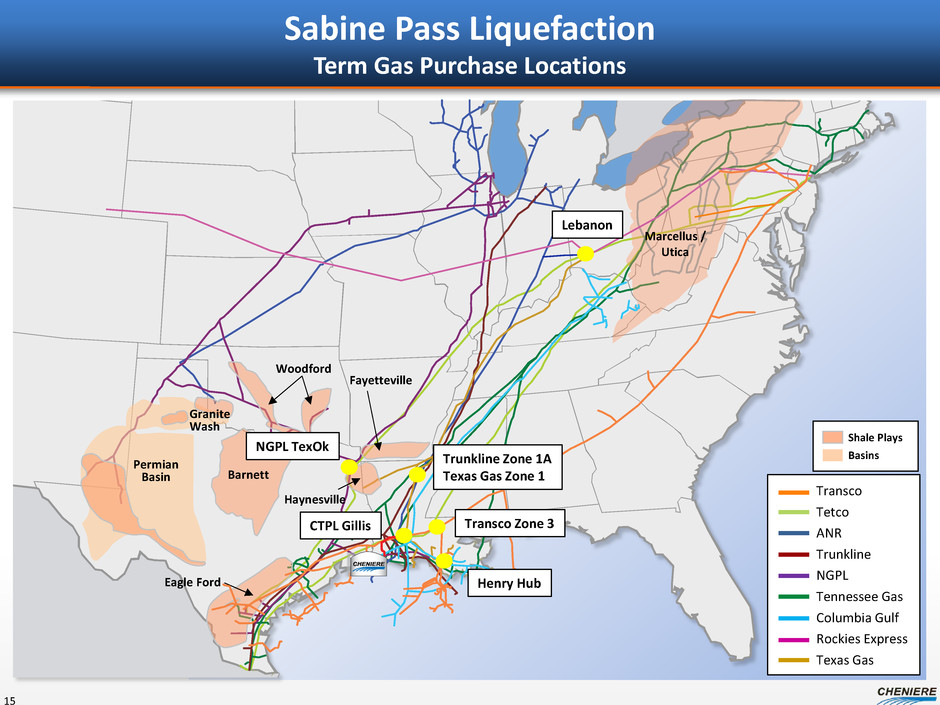

Sabine Pass Liquefaction Term Gas Purchase Locations 15 Permian Basin Barnett Granite Wash Eagle Ford Haynesville Woodford Fayetteville Marcellus / Utica Transco Tetco ANR Trunkline NGPL Tennessee Gas Columbia Gulf Rockies Express Texas Gas Shale Plays Basins Henry Hub Transco Zone 3 CTPL Gillis Trunkline Zone 1A Texas Gas Zone 1 NGPL TexOk Lebanon

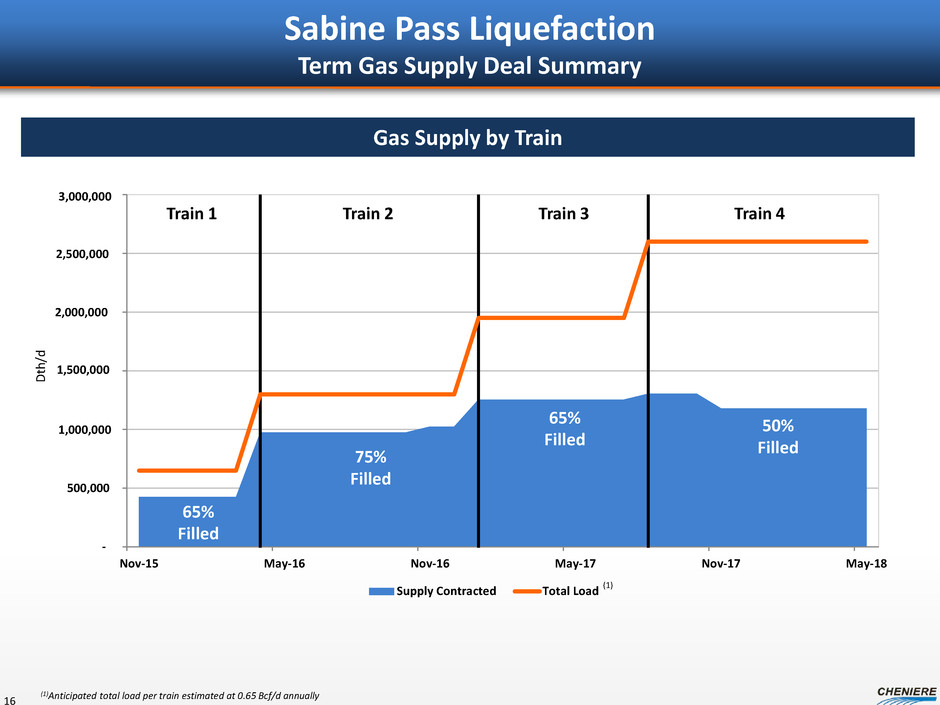

- 500 1,000 1,500 2,000 2,500 3,000 Nov-15 May-16 Nov-16 May-17 Nov-17 May-18 Supply Contracted Total Load 65% Filled 75% Filled 65% Filled 50% Filled Sabine Pass Liquefaction Term Gas Supply Deal Summary 16 Train 1 Train 2 Train 3 Train 4 (1)Anticipated total load per train estimated at 0.65 Bcf/d annually (1) 3,000,000 2,500,000 2,000,000 1,500,00 1,000 D th /d 500,0 Gas Supply by Train

Sabine Pass Supply – Term Gas Purchases 17 Sabine Pass Gas procurement • Cheniere to secure gas at the terminal for liquefaction How gas procurement is achieved • Establish counterparty / market liquidity • Capacity contracted at terminal level – Redundant delivery capacity • Capacity contracted upstream of terminal – Supply basin diversity – Supplier diversity • Term gas purchases into capacities – Reduces physical market exposure – Reduces pricing exposure to match SPA pricing • Personnel

Sabine Pass Supply – Gas Supply Personnel Have hired the full front office team to manage supply and logistics Over 19 years each of average of energy experience • Trading • Infrastructure Development and Analysis • Fundamental Analysis • Meteorologist • Scheduling and Logistics Mid and Back Office staff in place • Confirmations • Risk • Reporting • Accounting • Treasury ETRM system installed and operating Platform established for Sabine Pass – transferrable for Corpus Christi 18

Sabine Pass Supply – Personnel 19 Sabine Pass Gas procurement • Cheniere to secure gas at the terminal for liquefaction How gas procurement is achieved • Establish counterparty / market liquidity • Capacity contracted at terminal level – Redundant delivery capacity • Capacity contracted upstream of terminal – Supply basin diversity – Supplier diversity • Term gas purchases into capacities – Reduces physical market exposure – Reduces pricing exposure to match SPA pricing • Personnel

2015 Status of Corpus Christi Supply 20 Artist rendition

Corpus Christi Counterparty Contracting Current Actions • Have contracted some “Texas-only” producers that can’t get to SPL • Replicating supply strategy executed in SPL for CCL volumes Plan for 2015 • After achieving FID, will start similar process for obtaining NAESBs as SPL • Plan to have achieved contracting by end of 2015 21

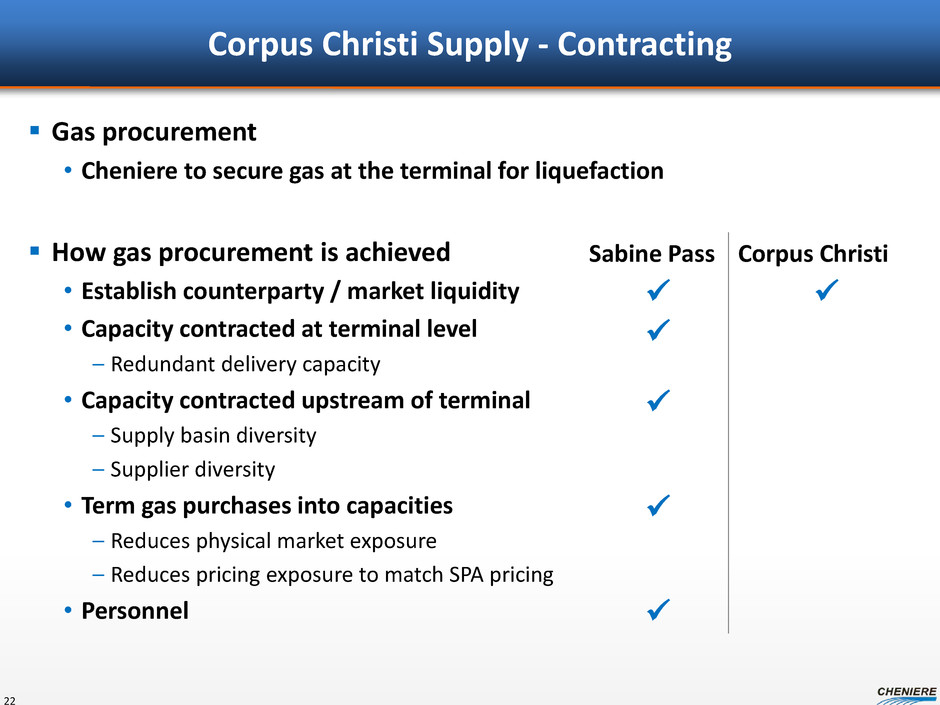

Corpus Christi Supply - Contracting 22 Sabine Pass Corpus Christi Gas procurement • Cheniere to secure gas at the terminal for liquefaction How gas procurement is achieved • Establish counterparty / market liquidity • Capacity contracted at terminal level – Redundant delivery capacity • Capacity contracted upstream of terminal – Supply basin diversity – Supplier diversity • Term gas purchases into capacities – Reduces physical market exposure – Reduces pricing exposure to match SPA pricing • Personnel

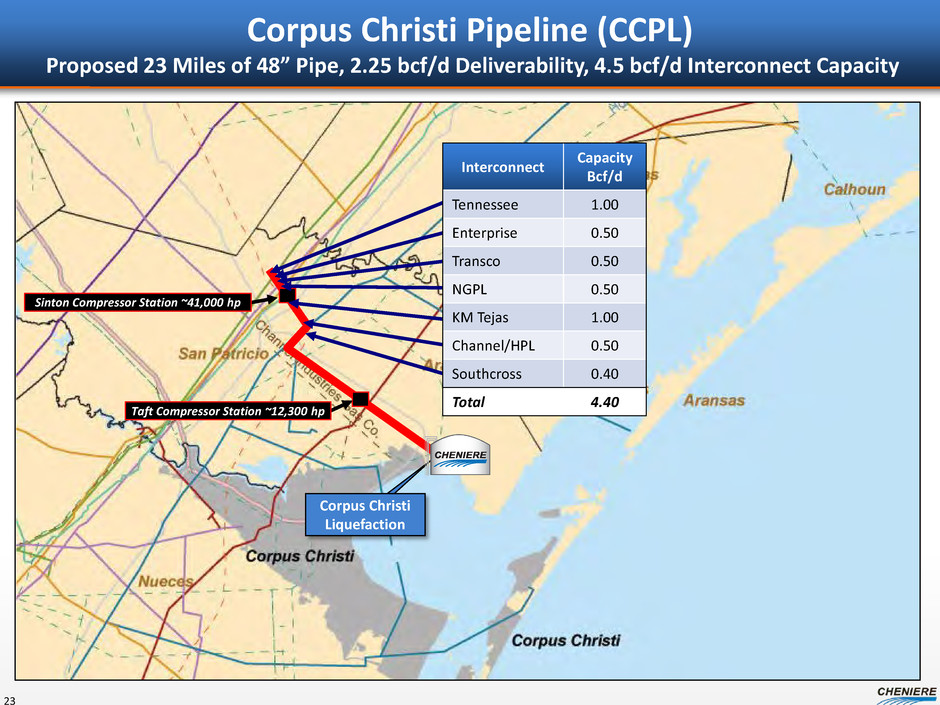

Corpus Christi Pipeline (CCPL) Proposed 23 Miles of 48” Pipe, 2.25 bcf/d Deliverability, 4.5 bcf/d Interconnect Capacity 23 Corpus Christi Liquefaction Interconnect Capacity Bcf/d Tennessee 1.00 Enterprise 0.50 Transco 0.50 NGPL 0.50 KM Tejas 1.00 Channel/HPL 0.50 Southcross 0.40 Total 4.40 Sinton Compressor Station ~41,000 hp Taft Compressor Station ~12,300 hp

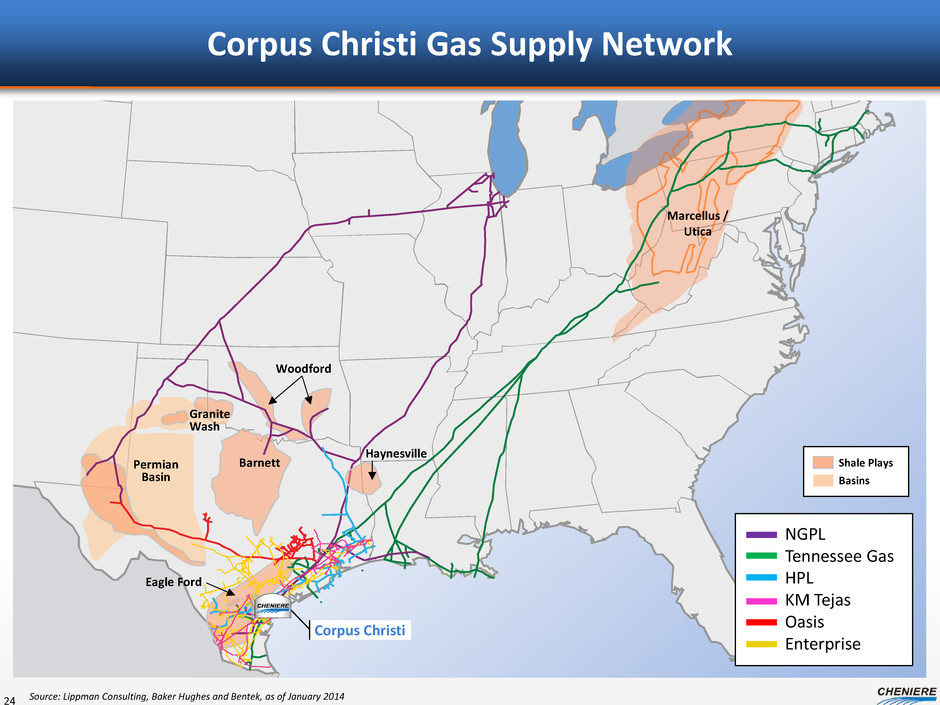

Corpus Christi Gas Supply Network 24 Shale Plays Basins NGPL Tennessee Gas HPL KM Tejas Oasis Enterprise Permian Basin Barnett Granite Wash Eagle Ford Haynesville Marcellus / Utica Corpus Christi Woodford Source: Lippman Consulting, Baker Hughes and Bentek, as of January 2014

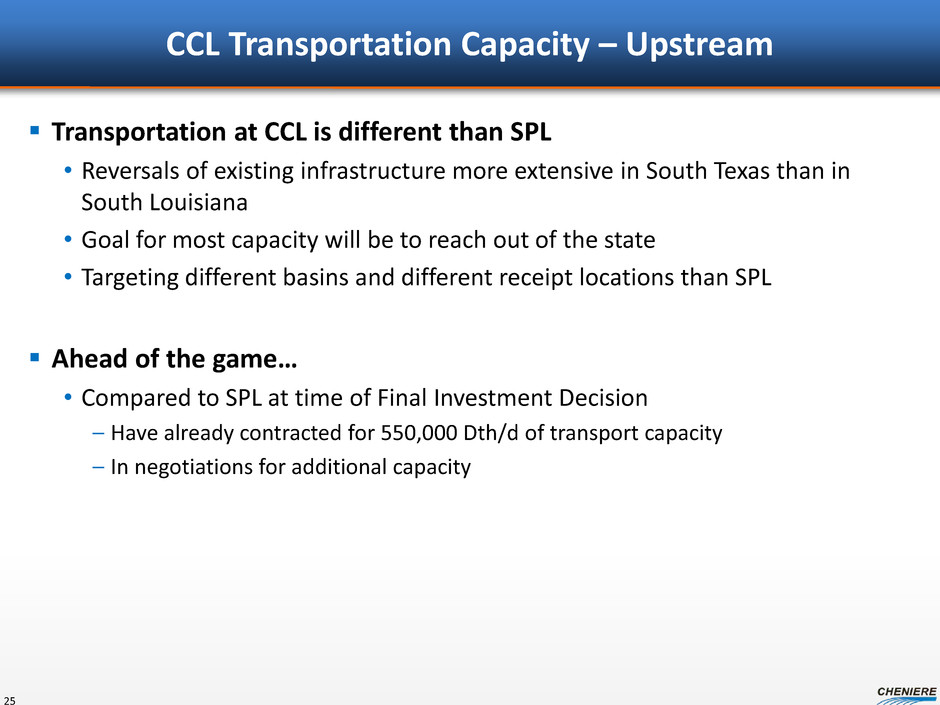

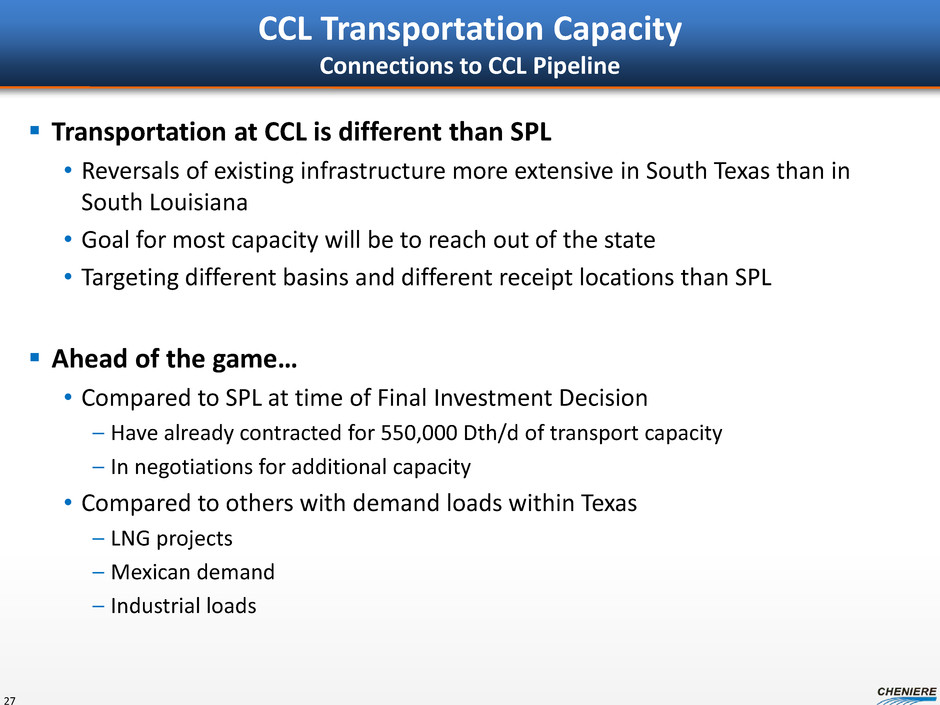

CCL Transportation Capacity – Upstream Transportation at CCL is different than SPL • Reversals of existing infrastructure more extensive in South Texas than in South Louisiana • Goal for most capacity will be to reach out of the state • Targeting different basins and different receipt locations than SPL Ahead of the game… • Compared to SPL at time of Final Investment Decision – Have already contracted for 550,000 Dth/d of transport capacity – In negotiations for additional capacity 25

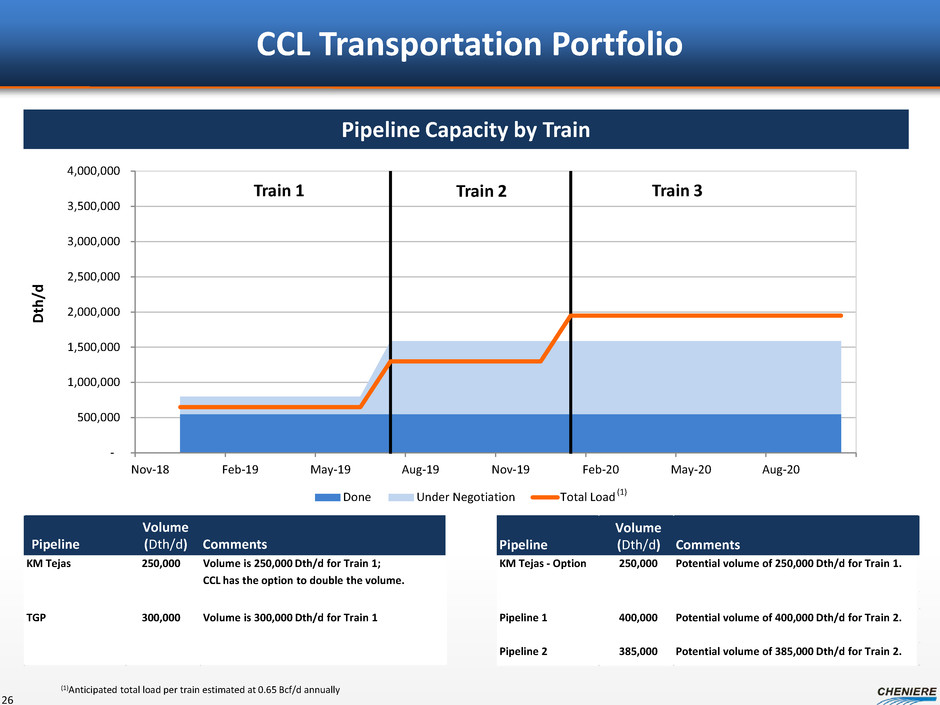

- 500,000 1,000,000 1,500,000 2,000,000 2,500,000 3,000,000 3,500,000 4,000,000 Nov-18 Feb-19 May-19 Aug-19 Nov-19 Feb-20 May-20 Aug-20 Done Under Negotiation Total Load CCL Transportation Portfolio 26 Pipeline Capacity by Train (1)Anticipated total load per train estimated at 0.65 Bcf/d annually Train 1 Train 2 Train 3 D th /d (1) Pipeline Volume (Dth/d) Comments Pipeline Volume (Dth/d) Comments KM Tejas 250,000 Volume is 250,000 Dth/d for Train 1; CCL has the option to double the volume. KM Tejas - Option 250,000 Potential volume of 250,000 Dth/d for Train 1. TGP 300,000 Volume is 300,000 Dth/d for Train 1 Pipeline 1 400,000 Potential volume of 400,000 Dth/d for Train 2. Pipeline 2 385,000 Potential volume of 385,000 Dth/d for Train 2.

CCL Transportation Capacity Connections to CCL Pipeline Transportation at CCL is different than SPL • Reversals of existing infrastructure more extensive in South Texas than in South Louisiana • Goal for most capacity will be to reach out of the state • Targeting different basins and different receipt locations than SPL Ahead of the game… • Compared to SPL at time of Final Investment Decision – Have already contracted for 550,000 Dth/d of transport capacity – In negotiations for additional capacity • Compared to others with demand loads within Texas – LNG projects – Mexican demand – Industrial loads 27

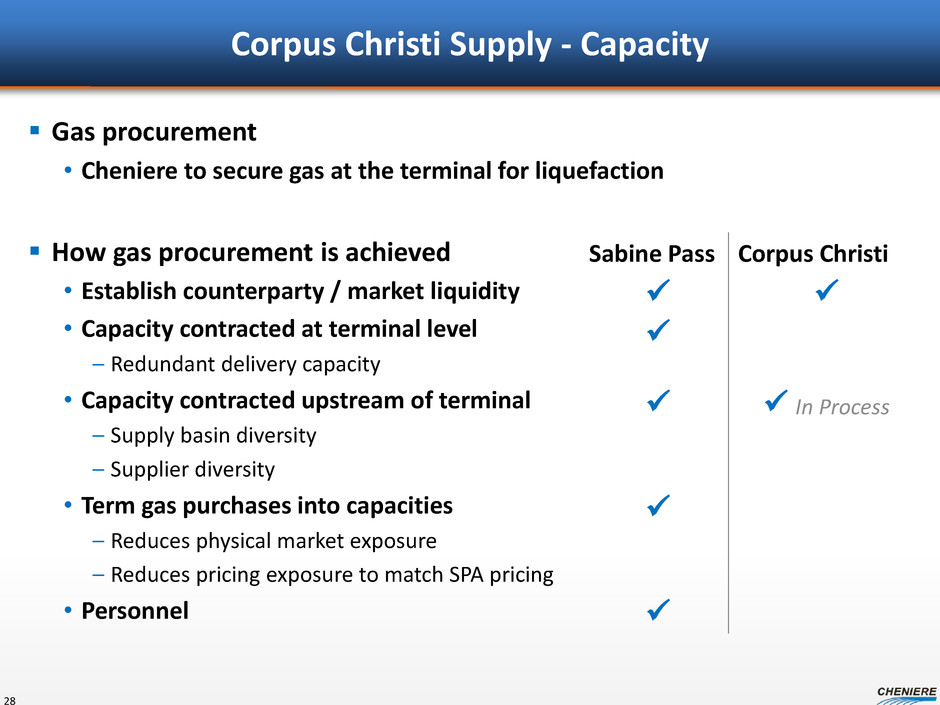

Corpus Christi Supply - Capacity Gas procurement • Cheniere to secure gas at the terminal for liquefaction How gas procurement is achieved • Establish counterparty / market liquidity • Capacity contracted at terminal level – Redundant delivery capacity • Capacity contracted upstream of terminal – Supply basin diversity – Supplier diversity • Term gas purchases into capacities – Reduces physical market exposure – Reduces pricing exposure to match SPA pricing • Personnel 28 Sabine Pass Corpus Christi In Process

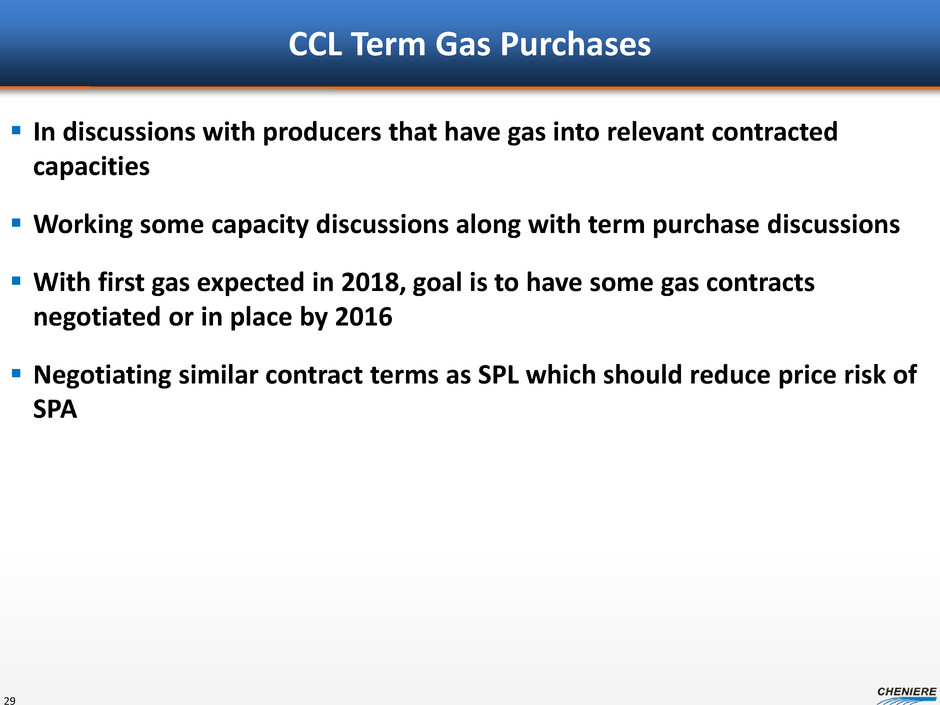

CCL Term Gas Purchases In discussions with producers that have gas into relevant contracted capacities Working some capacity discussions along with term purchase discussions With first gas expected in 2018, goal is to have some gas contracts negotiated or in place by 2016 Negotiating similar contract terms as SPL which should reduce price risk of SPA 29

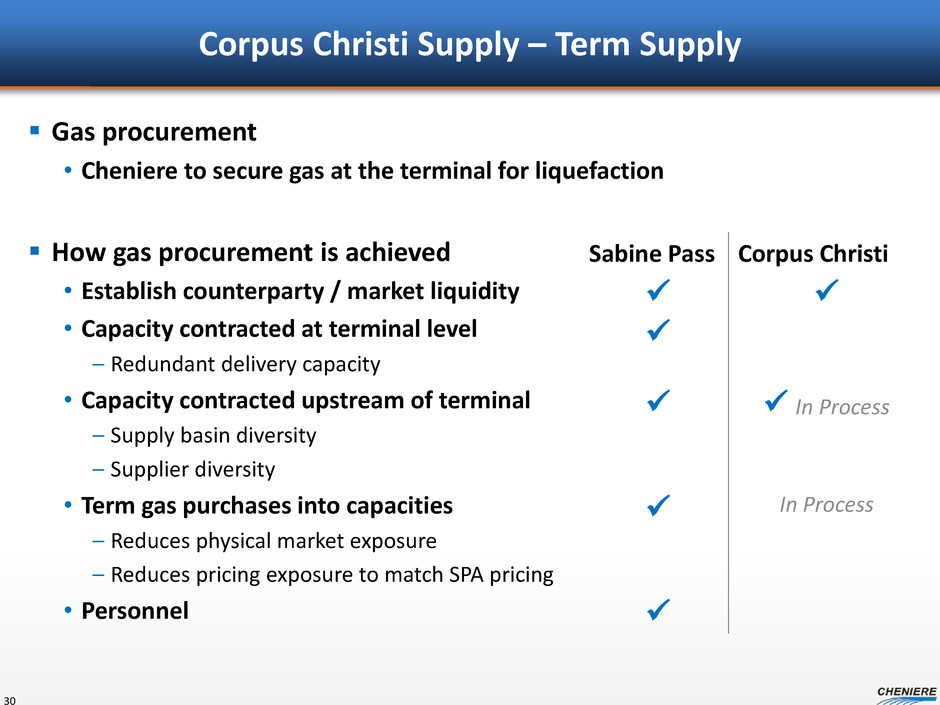

Corpus Christi Supply – Term Supply 30 Sabine Pass Corpus Christi In Process In Process Gas procurement • Cheniere to secure gas at the terminal for liquefaction How gas procurement is achieved • Establish counterparty / market liquidity • Capacity contracted at terminal level – Redundant delivery capacity • Capacity contracted upstream of terminal – Supply basin diversity – Supplier diversity • Term gas purchases into capacities – Reduces physical market exposure – Reduces pricing exposure to match SPA pricing • Personnel

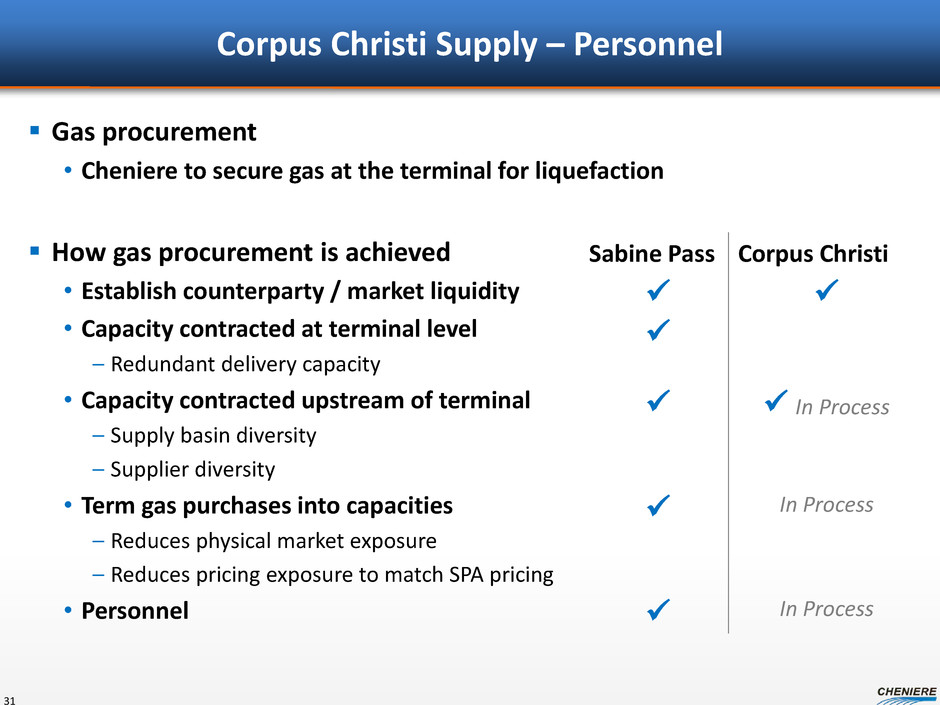

Corpus Christi Supply – Personnel 31 Sabine Pass Corpus Christi In Process In Process In Process Gas procurement • Cheniere to secure gas at the terminal for liquefaction How gas procurement is achieved • Establish counterparty / market liquidity • Capacity contracted at terminal level – Redundant delivery capacity • Capacity contracted upstream of terminal – Supply basin diversity – Supplier diversity • Term gas purchases into capacities – Reduces physical market exposure – Reduces pricing exposure to match SPA pricing • Personnel

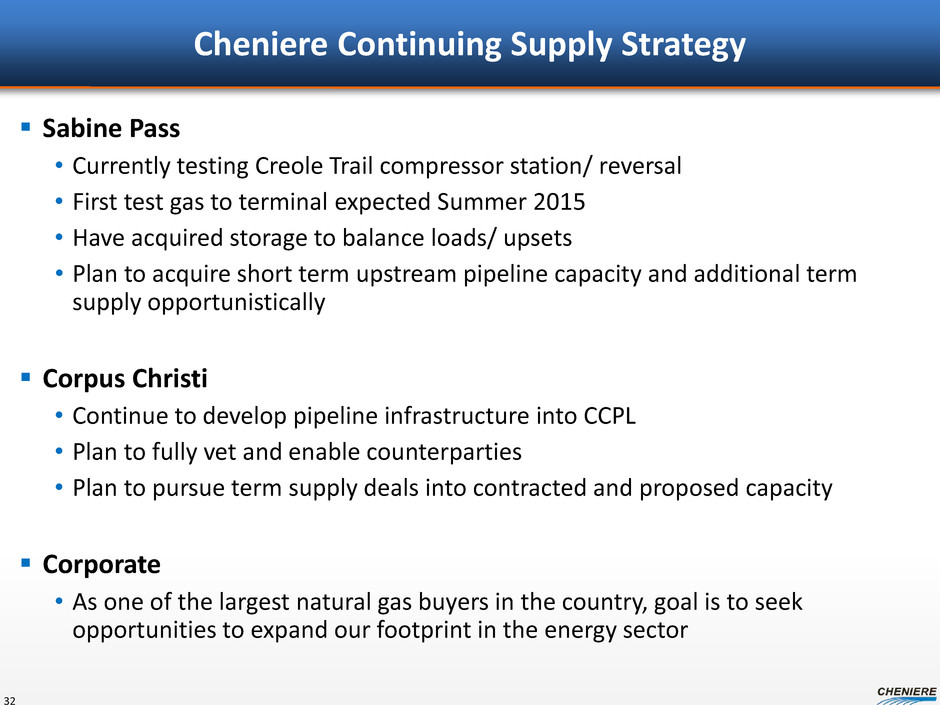

Cheniere Continuing Supply Strategy Sabine Pass • Currently testing Creole Trail compressor station/ reversal • First test gas to terminal expected Summer 2015 • Have acquired storage to balance loads/ upsets • Plan to acquire short term upstream pipeline capacity and additional term supply opportunistically Corpus Christi • Continue to develop pipeline infrastructure into CCPL • Plan to fully vet and enable counterparties • Plan to pursue term supply deals into contracted and proposed capacity Corporate • As one of the largest natural gas buyers in the country, goal is to seek opportunities to expand our footprint in the energy sector 32

Meg Gentle – Executive Vice President, Marketing Cheniere Marketing

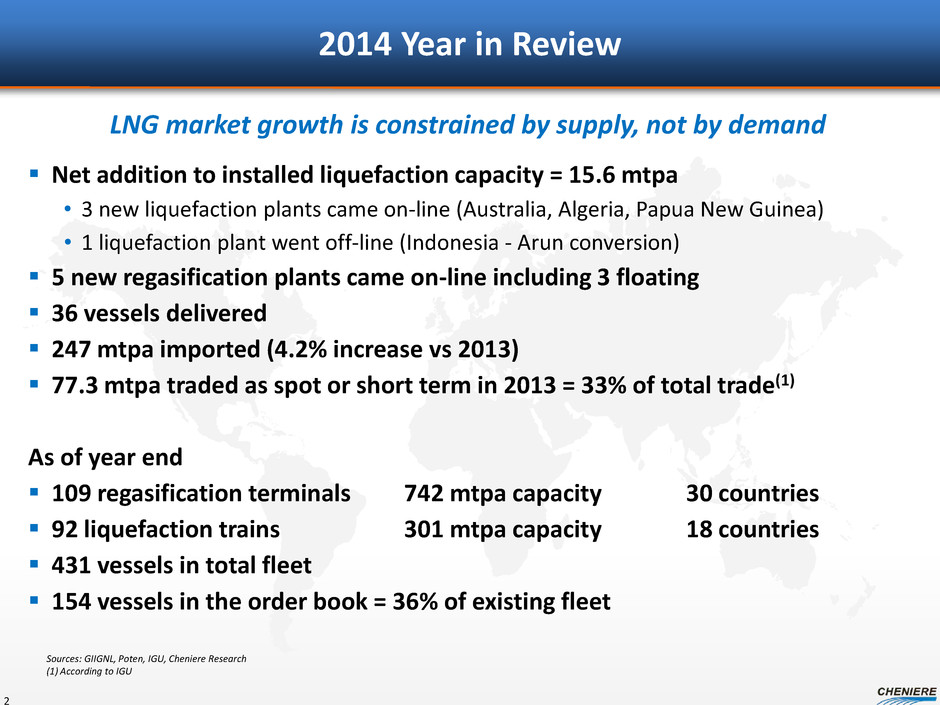

2014 Year in Review Net addition to installed liquefaction capacity = 15.6 mtpa • 3 new liquefaction plants came on-line (Australia, Algeria, Papua New Guinea) • 1 liquefaction plant went off-line (Indonesia - Arun conversion) 5 new regasification plants came on-line including 3 floating 36 vessels delivered 247 mtpa imported (4.2% increase vs 2013) 77.3 mtpa traded as spot or short term in 2013 = 33% of total trade(1) As of year end 109 regasification terminals 742 mtpa capacity 30 countries 92 liquefaction trains 301 mtpa capacity 18 countries 431 vessels in total fleet 154 vessels in the order book = 36% of existing fleet LNG market growth is constrained by supply, not by demand Sources: GIIGNL, Poten, IGU, Cheniere Research (1) According to IGU 2

Projected Future Changes in the LNG Market Steady demand growth Three large supply centers Shorter term contracting Flexibility Physical liquidity LNG market pricing Trading 3

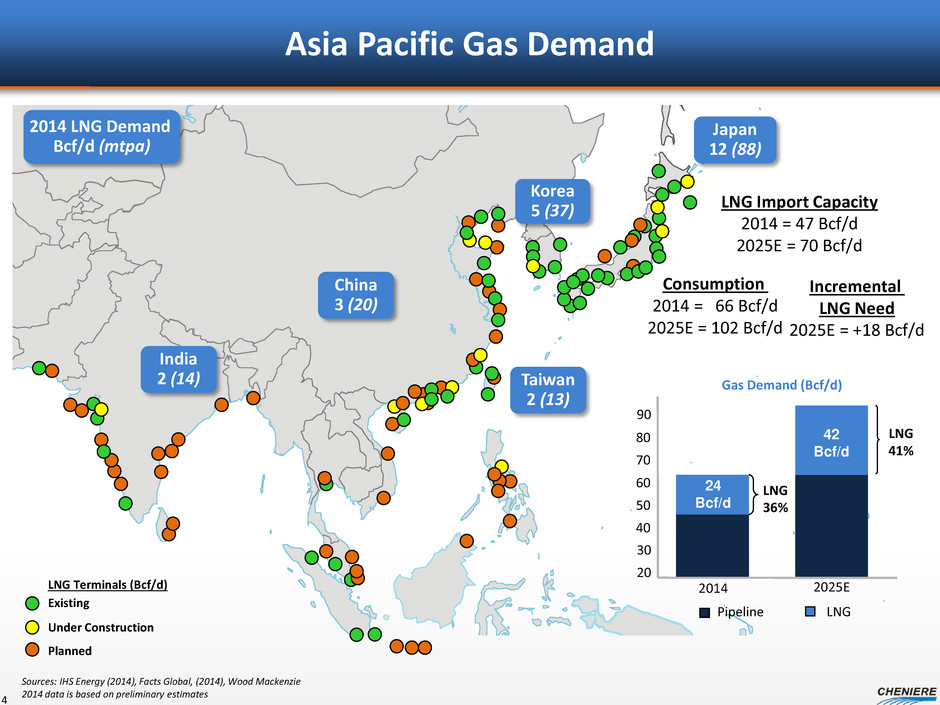

Asia Pacific Gas Demand LNG Terminals (Bcf/d) Existing Under Construction Planned Sources: IHS Energy (2014), Facts Global, (2014), Wood Mackenzie 2014 data is based on preliminary estimates 170 Incremental LNG Need 2025E = +18 Bcf/d Consumption 2014 = 66 Bcf/d 2025E = 102 Bcf/d LNG Import Capacity 2014 = 47 Bcf/d 2025E = 70 Bcf/d Pipeline LNG Pipeline 80 70 60 50 40 30 20 2014 2025E 24 Bcf/d 42 Bcf/d LNG 36% LNG 41% Gas Demand (Bcf/d) 90 Japan 12 (88) Korea 5 (37) China 3 (20) India 2 (14) Taiwan 2 (13) 2014 LNG Demand Bcf/d (mtpa) 4

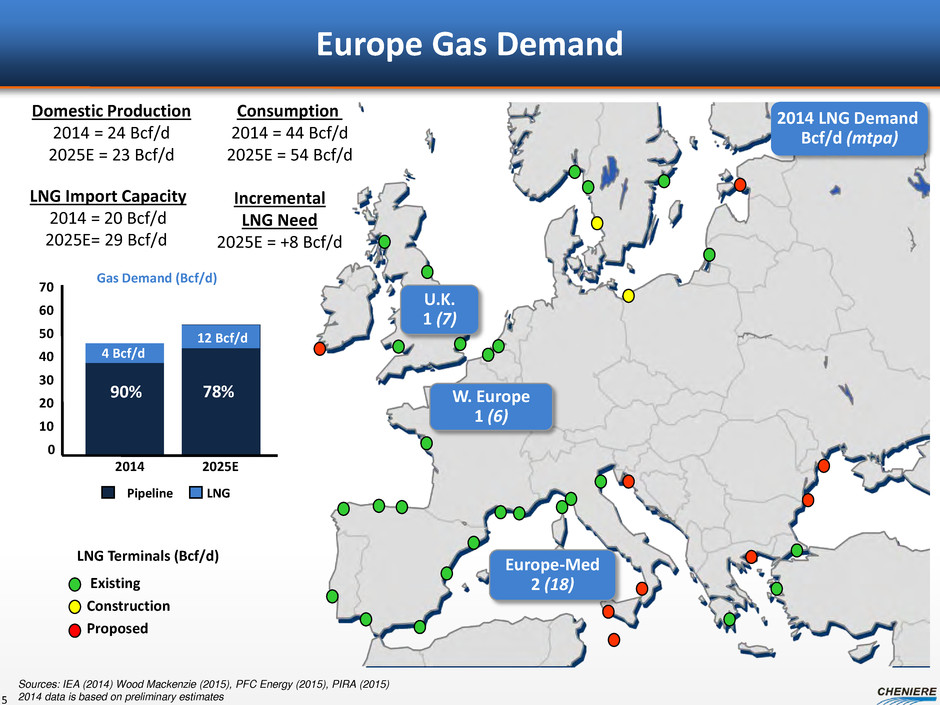

Europe Gas Demand LNG Terminals (Bcf/d) Existing Construction Proposed Sources: IEA (2014) Wood Mackenzie (2015), PFC Energy (2015), PIRA (2015) 2014 data is based on preliminary estimates 5.03 Europe-Med 2 (18) W. Europe 1 (6) U.K. 1 (7) LNG Import Capacity 2014 = 20 Bcf/d 2025E= 29 Bcf/d Consumption 2014 = 44 Bcf/d 2025E = 54 Bcf/d Incremental LNG Need 2025E = +8 Bcf/d Domestic Production 2014 = 24 Bcf/d 2025E = 23 Bcf/d Gas Demand (Bcf/d) Pipeline 70 60 50 40 30 20 10 0 2014 2025E Pipeline LNG 78% 90% 12 Bcf/d 4 Bcf/d 2014 LNG Demand Bcf/d (mtpa) 5

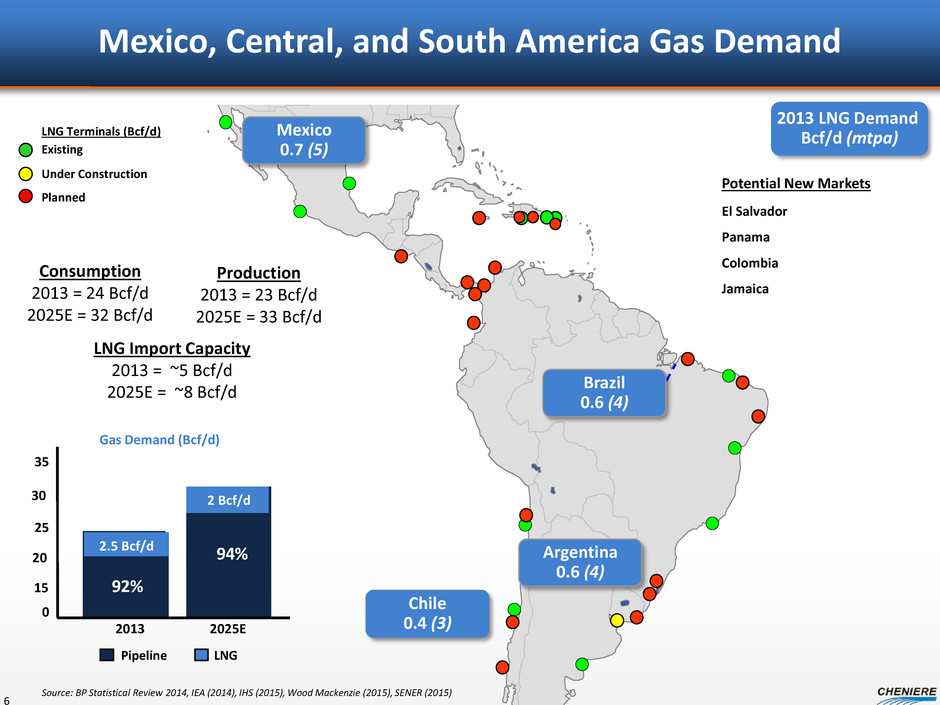

Mexico, Central, and South America Gas Demand Source: BP Statistical Review 2014, IEA (2014), IHS (2015), Wood Mackenzie (2015), SENER (2015) Gas Demand (Bcf/d) Pipeline 35 30 25 15 0 2013 2025E Pipeline LNG 94% 88% 2 Bcf/d LNG Import Capacity 2013 = ~5 Bcf/d 2025E = ~8 Bcf/d Consumption 2013 = 24 Bcf/d 2025E = 32 Bcf/d Brazil 0.6 (4) Argentina 0.6 (4) Chile 0.4 (3) Production 2013 = 23 Bcf/d 2025E = 33 Bcf/d LNG Terminals (Bcf/d) Existing Under Construction Planned Potential New Markets El Salvador Panama Colombia Jamaica Mexico 0.7 (5) 94% 92% 2 cf/d 2.5 Bcf/d 20 2013 LNG Demand Bcf/d (mtpa) 6

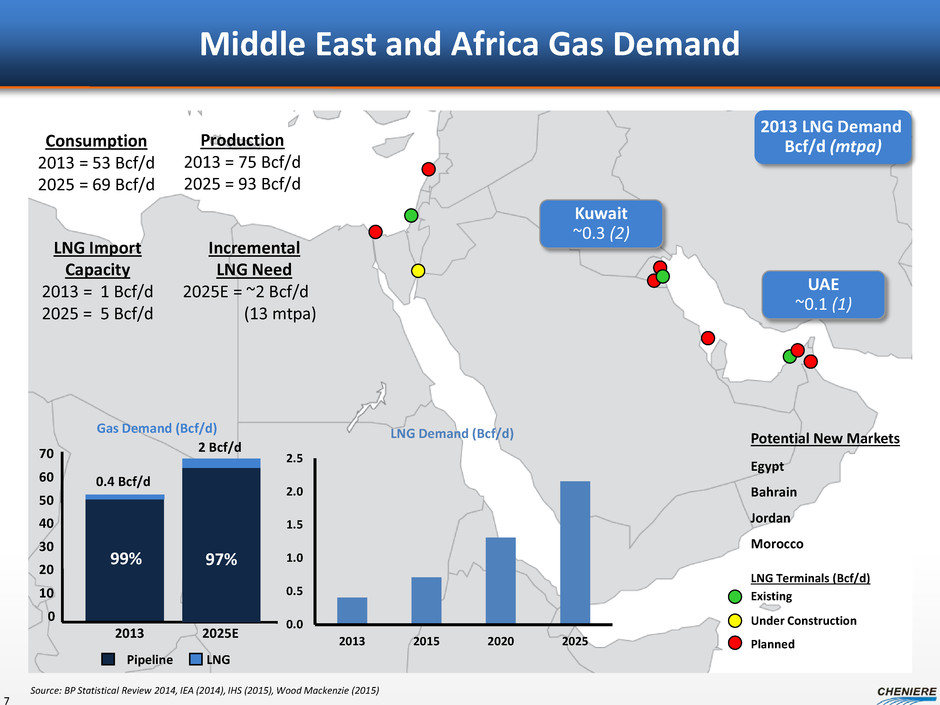

Middle East and Africa Gas Demand LNG Terminals (Bcf/d) Existing Under Construction Planned Gas Demand (Bcf/d) Pipeline 70 60 50 40 30 20 10 0 2013 2025E Pipeline LNG 97% 99% 2 Bcf/d 0.4 Bcf/d LNG Import Capacity 2013 = 1 Bcf/d 2025 = 5 Bcf/d Consumption 2013 = 53 Bcf/d 2025 = 69 Bcf/d Production 2013 = 75 Bcf/d 2025 = 93 Bcf/d Source: BP Statistical Review 2014, IEA (2014), IHS (2015), Wood Mackenzie (2015) Incremental LNG Need 2025E = ~2 Bcf/d (13 mtpa) Kuwait ~0.3 (2) 2013 LNG Demand Bcf/d (mtpa) UAE ~0.1 (1) Potential New Markets Egypt Bahrain Jordan Morocco 0.0 0.5 1.0 1.5 2.0 2.5 2013 2015 2020 2025 LNG Demand (Bcf/d) 7

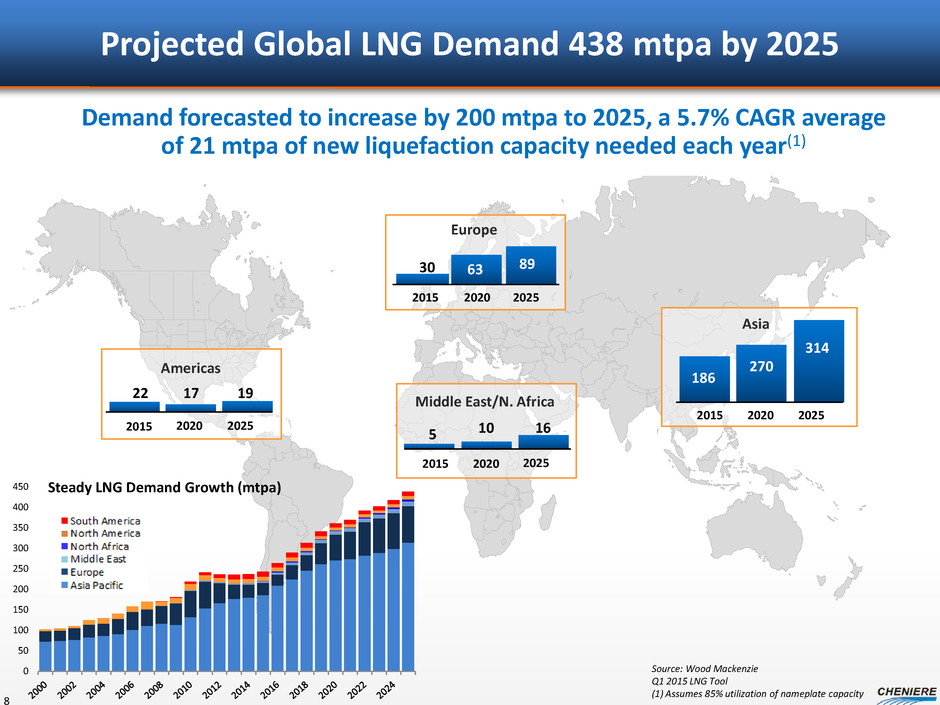

Projected Global LNG Demand 438 mtpa by 2025 8 22 17 19 2015 2020 2025 2015 2020 2025 5 10 16 2015 2020 2025 2015 2020 2025 Americas Asia Middle East/N. Africa 186 270 314 30 63 89 Europe Source: Wood Mackenzie Q1 2015 LNG Tool (1) Assumes 85% utilization of nameplate capacity Demand forecasted to increase by 200 mtpa to 2025, a 5.7% CAGR average of 21 mtpa of new liquefaction capacity needed each year(1) 0 50 100 150 200 250 300 350 400 450 Steady LNG Demand Growth (mtpa)

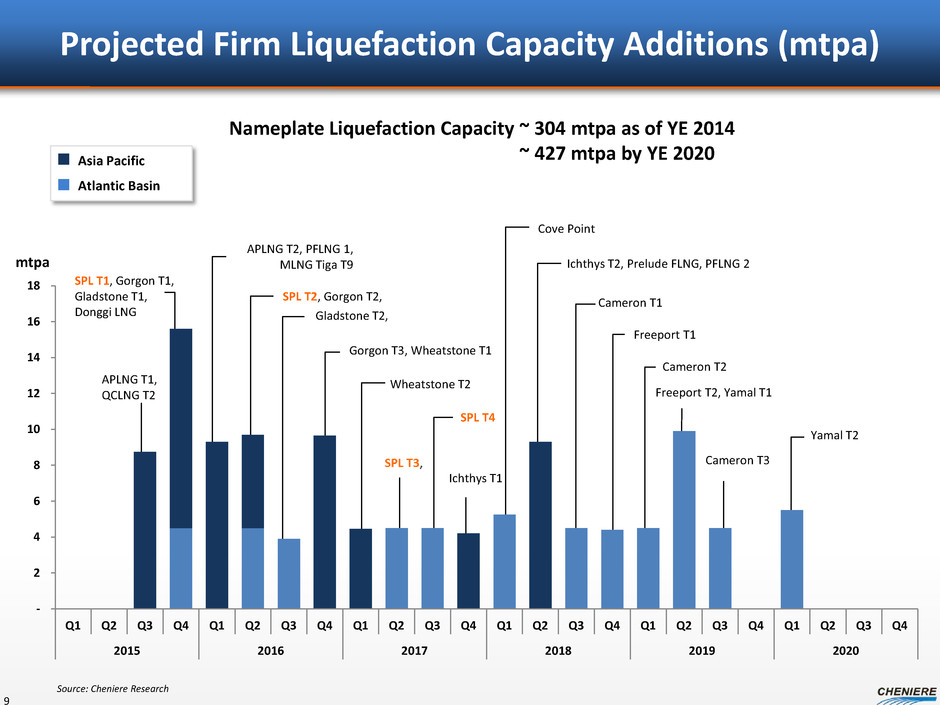

Projected Firm Liquefaction Capacity Additions (mtpa) 9 Source: Cheniere Research Nameplate Liquefaction Capacity ~ 304 mtpa as of YE 2014 ~ 427 mtpa by YE 2020 Asia Pacific Atlantic Basin SPL T1, Gorgon T1, Gladstone T1, Donggi LNG Gorgon T3, Wheatstone T1 APLNG T2, PFLNG 1, MLNG Tiga T9 Wheatstone T2 Gladstone T2, SPL T4 Freeport T1 Ichthys T2, Prelude FLNG, PFLNG 2 Yamal T2 SPL T2, Gorgon T2, Ichthys T1 mtpa APLNG T1, QCLNG T2 Cameron T1 Cameron T2 Cameron T3 Freeport T2, Yamal T1 Cove Point - 2 4 6 8 10 12 14 16 18 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 2015 2016 2017 2018 2019 2020

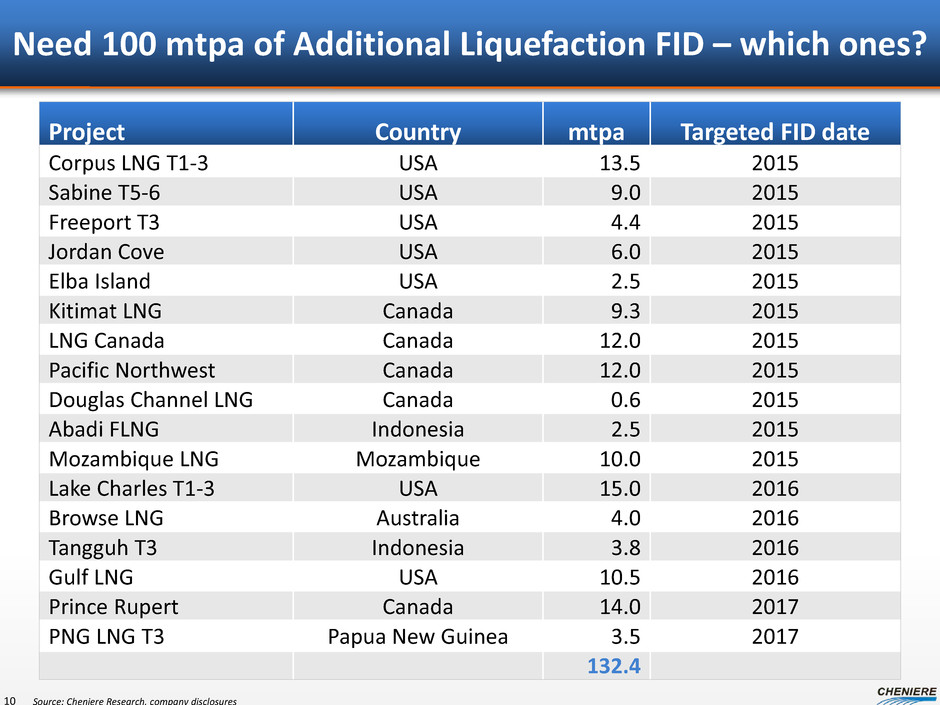

Need 100 mtpa of Additional Liquefaction FID – which ones? 10 Source: Cheniere Research, company disclosures Project Country mtpa Targeted FID date Corpus LNG T1-3 USA 13.5 2015 Sabine T5-6 USA 9.0 2015 Freeport T3 USA 4.4 2015 Jordan Cove USA 6.0 2015 Elba Island USA 2.5 2015 Kitimat LNG Canada 9.3 2015 LNG Canada Canada 12.0 2015 Pacific Northwest Canada 12.0 2015 Douglas Channel LNG Canada 0.6 2015 Abadi FLNG Indonesia 2.5 2015 Mozambique LNG Mozambique 10.0 2015 Lake Charles T1-3 USA 15.0 2016 Browse LNG Australia 4.0 2016 Tangguh T3 Indonesia 3.8 2016 Gulf LNG USA 10.5 2016 Prince Rupert Canada 14.0 2017 PNG LNG T3 Papua New Guinea 3.5 2017 132.4

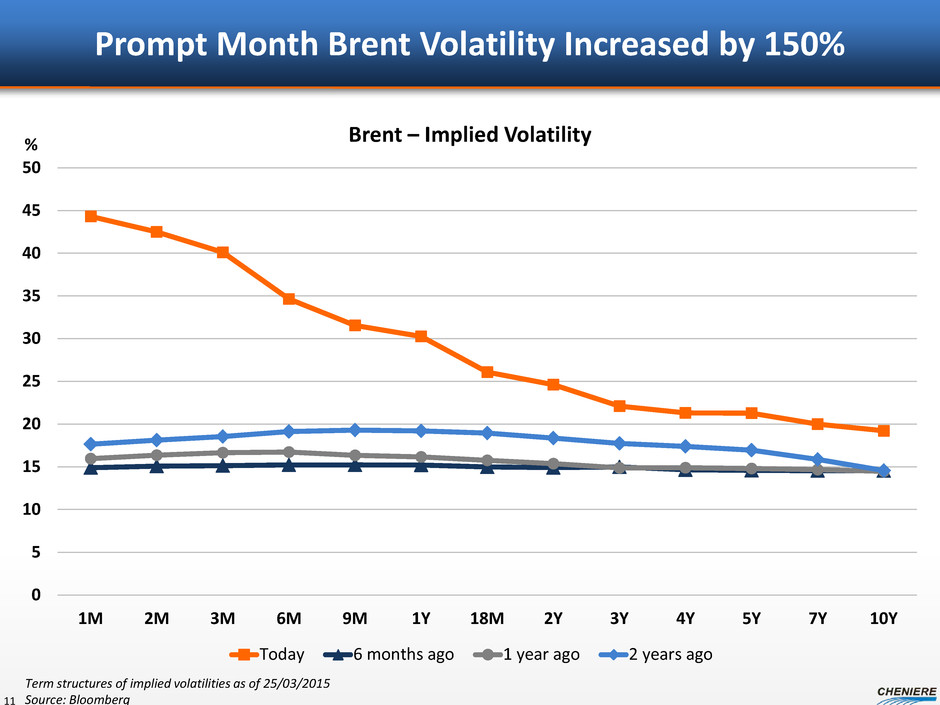

Prompt Month Brent Volatility Increased by 150% 11 Term structures of implied volatilities as of 25/03/2015 Source: Bloomberg 0 5 10 15 20 25 30 35 40 45 50 1M 2M 3M 6M 9M 1Y 18M 2Y 3Y 4Y 5Y 7Y 10Y % Brent – Implied Volatility Today 6 months ago 1 year ago 2 years ago

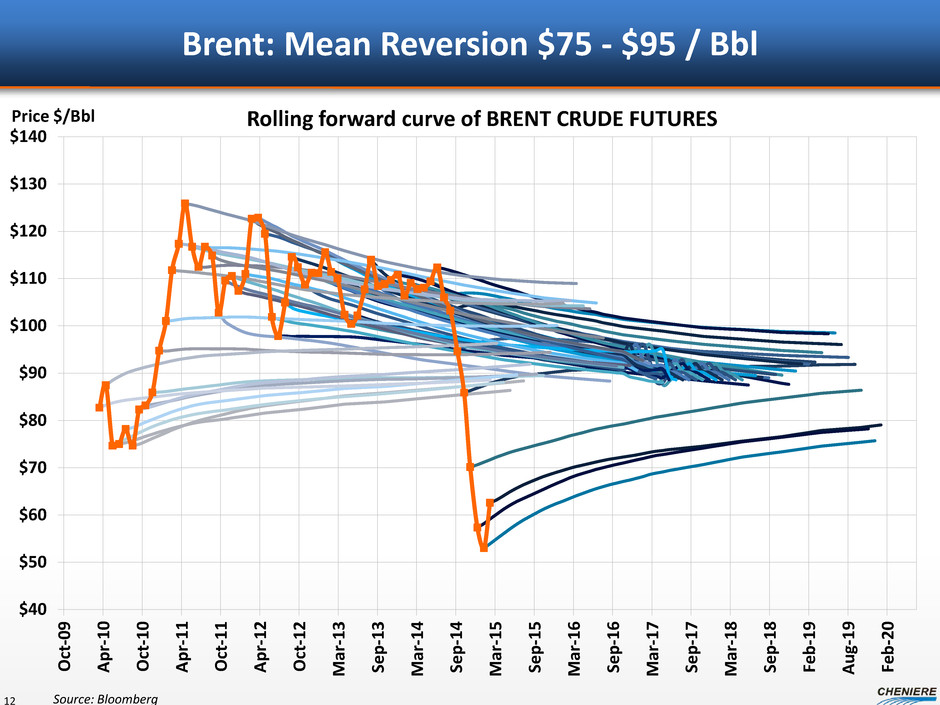

Brent: Mean Reversion $75 - $95 / Bbl 12 Source: Bloomberg $40 $50 $60 $70 $80 $90 $100 $110 $120 $130 $140 O ct -0 9 A pr -1 0 O ct -1 0 A pr -1 1 O ct -1 1 A pr -1 2 O ct -1 2 M ar -1 3 Se p- 13 M ar -1 4 Se p- 14 M ar -1 5 Se p- 15 M ar -1 6 Se p- 16 M ar -1 7 Se p- 17 M ar -1 8 Se p- 18 Fe b- 19 A ug -1 9 Fe b- 20 Price $/Bbl Rolling forward curve of BRENT CRUDE FUTURES

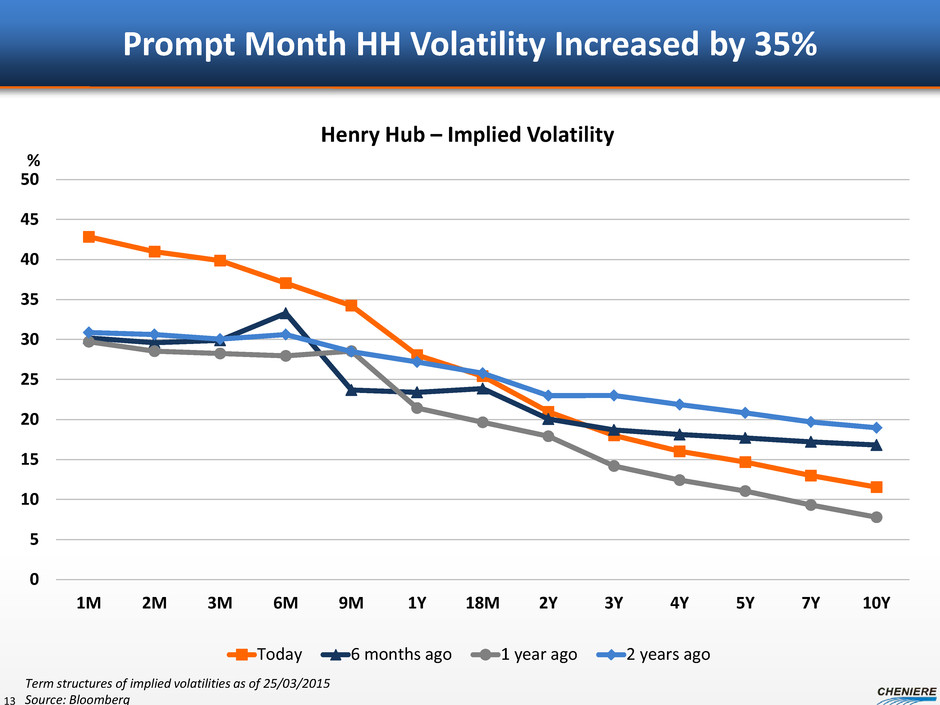

Prompt Month HH Volatility Increased by 35% 13 0 5 10 15 20 25 30 35 40 45 50 1M 2M 3M 6M 9M 1Y 18M 2Y 3Y 4Y 5Y 7Y 10Y % Henry Hub – Implied Volatility Today 6 months ago 1 year ago 2 years ago Term structures of implied volatilities as of 25/03/2015 Source: Bloomberg

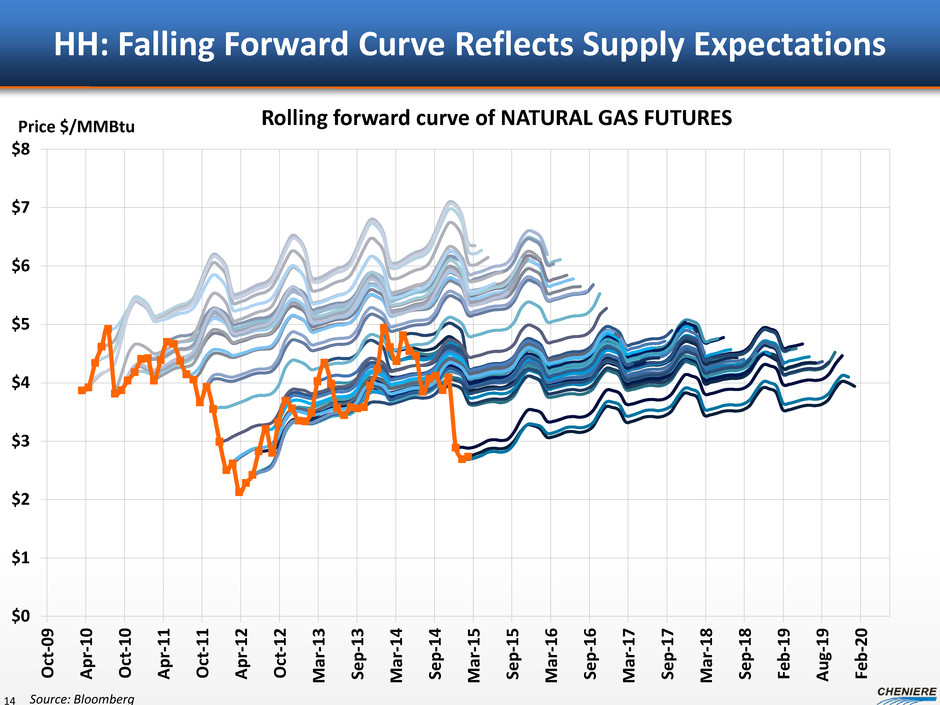

HH: Falling Forward Curve Reflects Supply Expectations 14 Source: Bloomberg $0 $1 $2 $3 $4 $5 $6 $7 $8 O ct -0 9 A pr -1 0 O ct -1 0 A pr -1 1 O ct -1 1 A pr -1 2 O ct -1 2 M ar -1 3 Se p- 13 M ar -1 4 Se p- 14 M ar -1 5 Se p- 15 M ar -1 6 Se p- 16 M ar -1 7 Se p- 17 M ar -1 8 Se p- 18 Fe b- 19 A ug -1 9 Fe b- 20 Price $/MMBtu Rolling forward curve of NATURAL GAS FUTURES

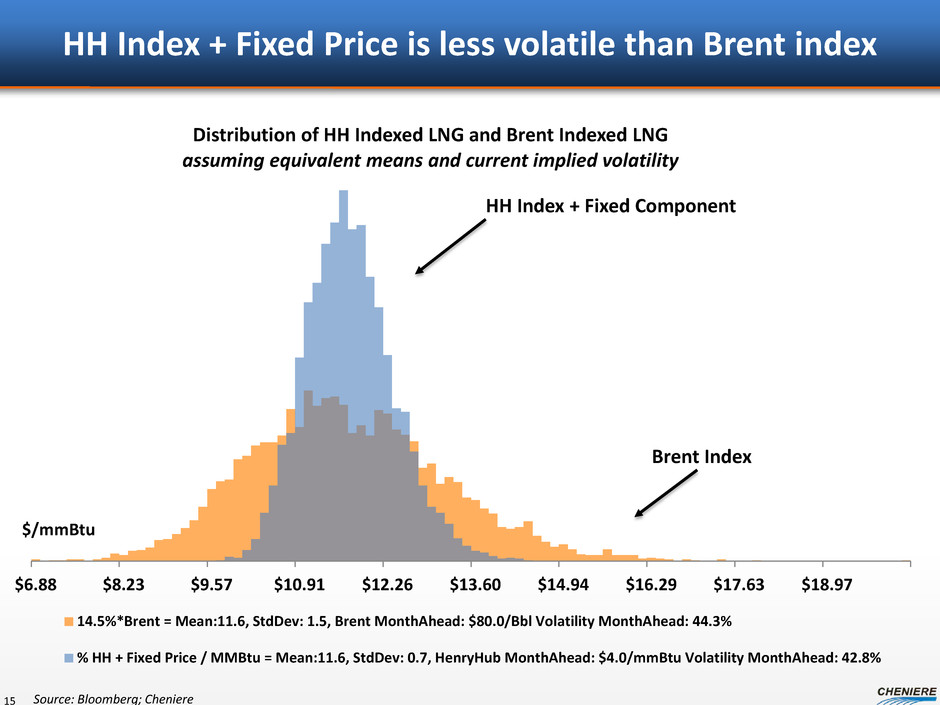

HH Index + Fixed Price is less volatile than Brent index 15 Source: Bloomberg; Cheniere $6.88 $8.23 $9.57 $10.91 $12.26 $13.60 $14.94 $16.29 $17.63 $18.97 $/mmBtu Distribution of HH Indexed LNG and Brent Indexed LNG assuming equivalent means and current implied volatility 14.5%*Brent = Mean:11.6, StdDev: 1.5, Brent MonthAhead: $80.0/Bbl Volatility MonthAhead: 44.3% % HH + Fixed Price / MMBtu = Mean:11.6, StdDev: 0.7, HenryHub MonthAhead: $4.0/mmBtu Volatility MonthAhead: 42.8% HH Index + Fixed Component Brent Index

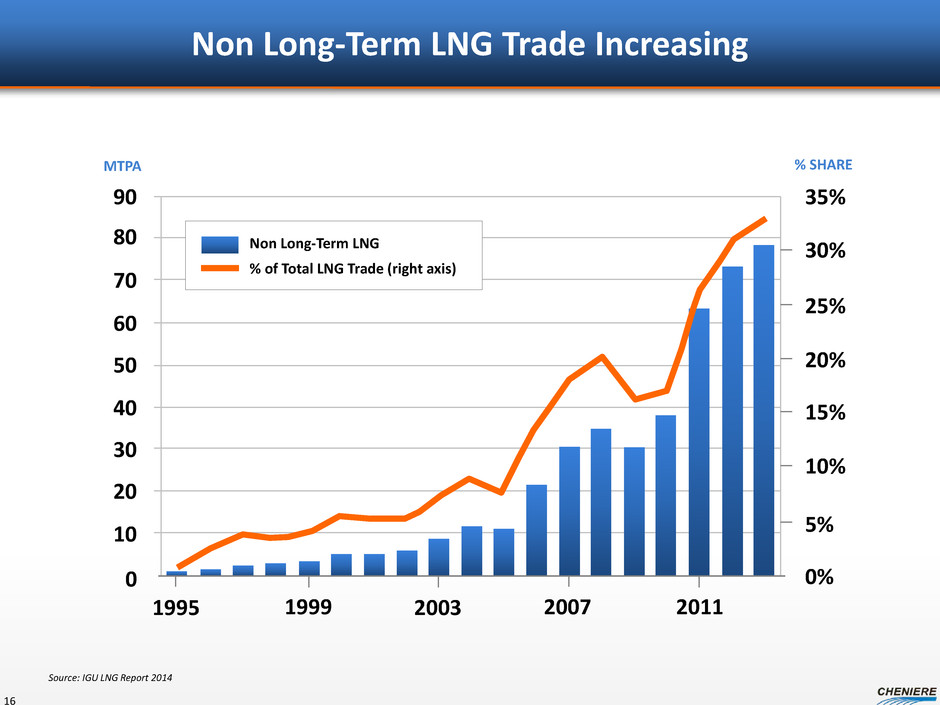

Non Long-Term LNG Trade Increasing 16 90 80 70 60 50 40 30 20 10 MTPA 35% 30% 25% 20% 15% 10% 5% 0% 0 % SHARE 1995 1999 2003 2007 2011 Non Long-Term LNG % of Total LNG Trade (right axis) Source: IGU LNG Report 2014

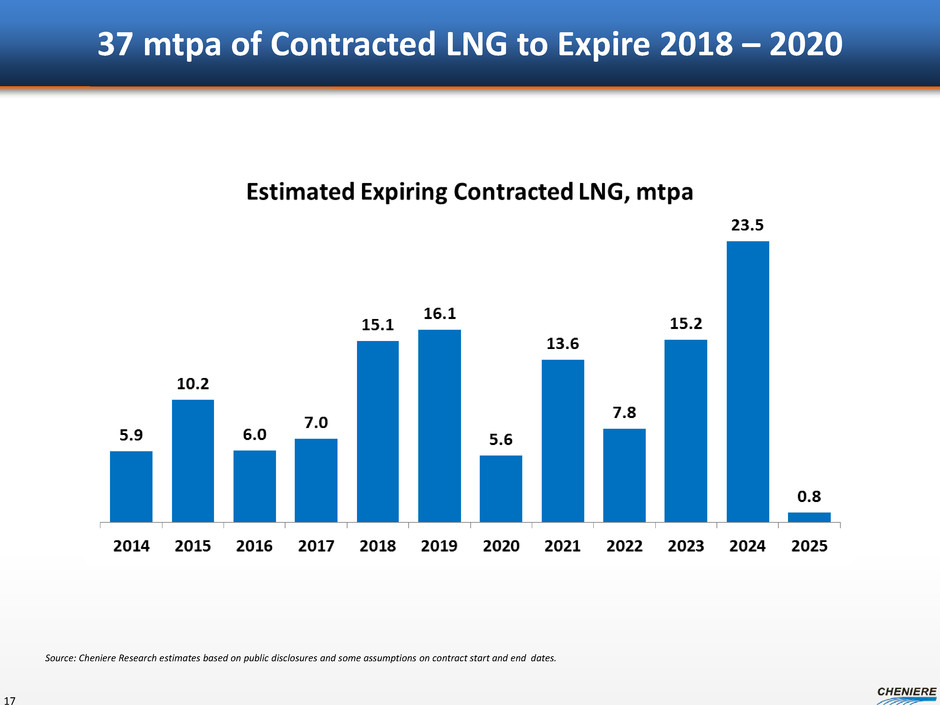

37 mtpa of Contracted LNG to Expire 2018 – 2020 17 Source: Cheniere Research estimates based on public disclosures and some assumptions on contract start and end dates.

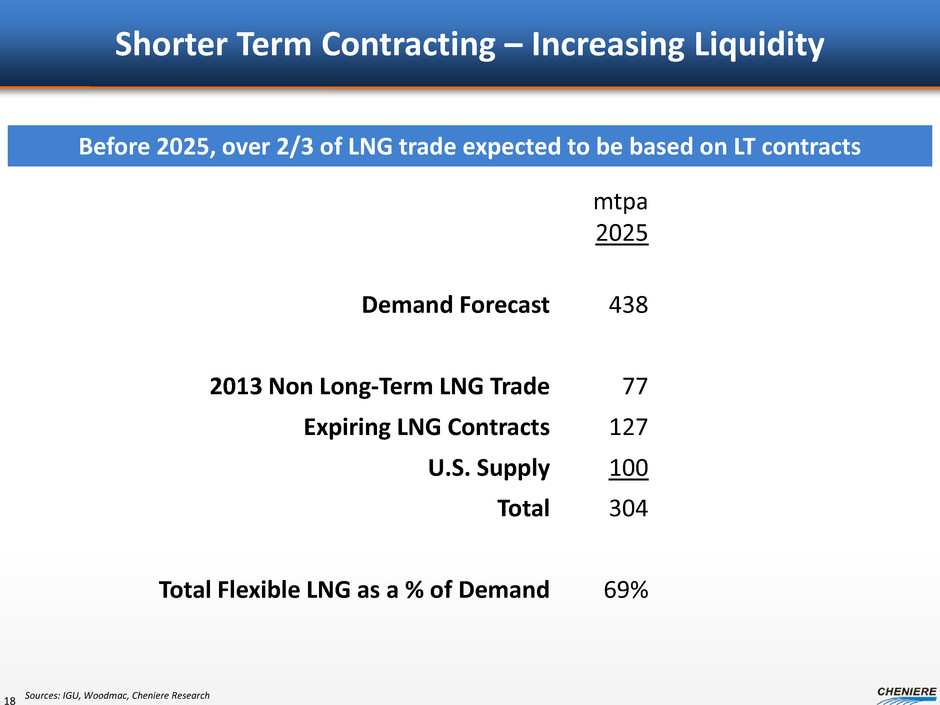

Shorter Term Contracting – Increasing Liquidity mtpa 2025 Demand Forecast 438 2013 Non Long-Term LNG Trade 77 Expiring LNG Contracts 127 U.S. Supply 100 Total 304 Total Flexible LNG as a % of Demand 69% 18 Sources: IGU, Woodmac, Cheniere Research Before 2025, over 2/3 of LNG trade expected to be based on LT contracts

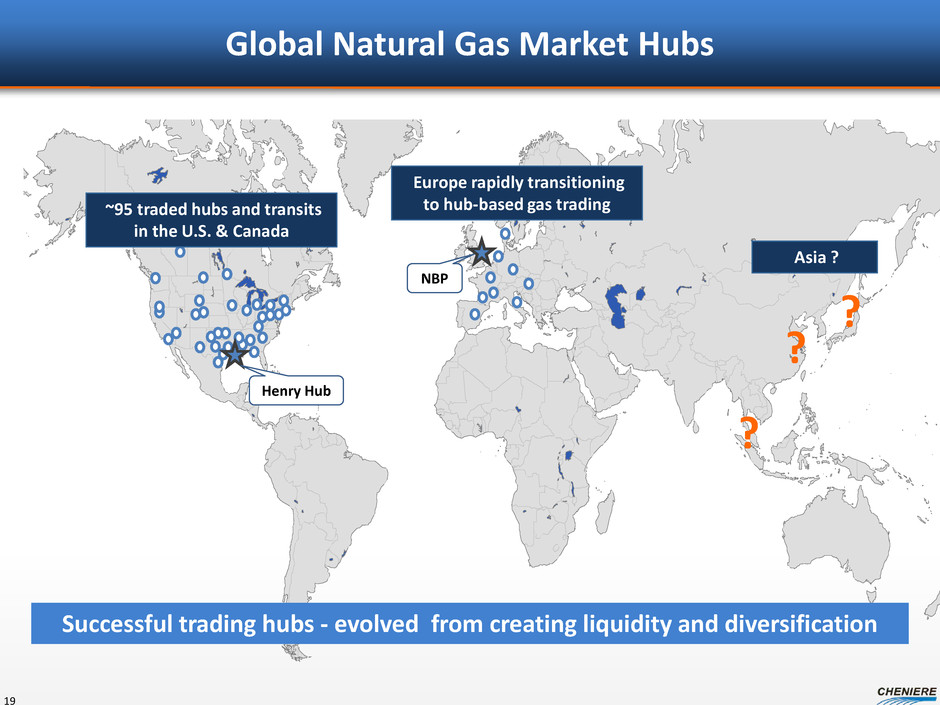

Global Natural Gas Market Hubs 19 ~95 traded hubs and transits in the U.S. & Canada NBP ? ? ? Europe rapidly transitioning to hub-based gas trading Asia ? Successful trading hubs - evolved from creating liquidity and diversification Henry Hub

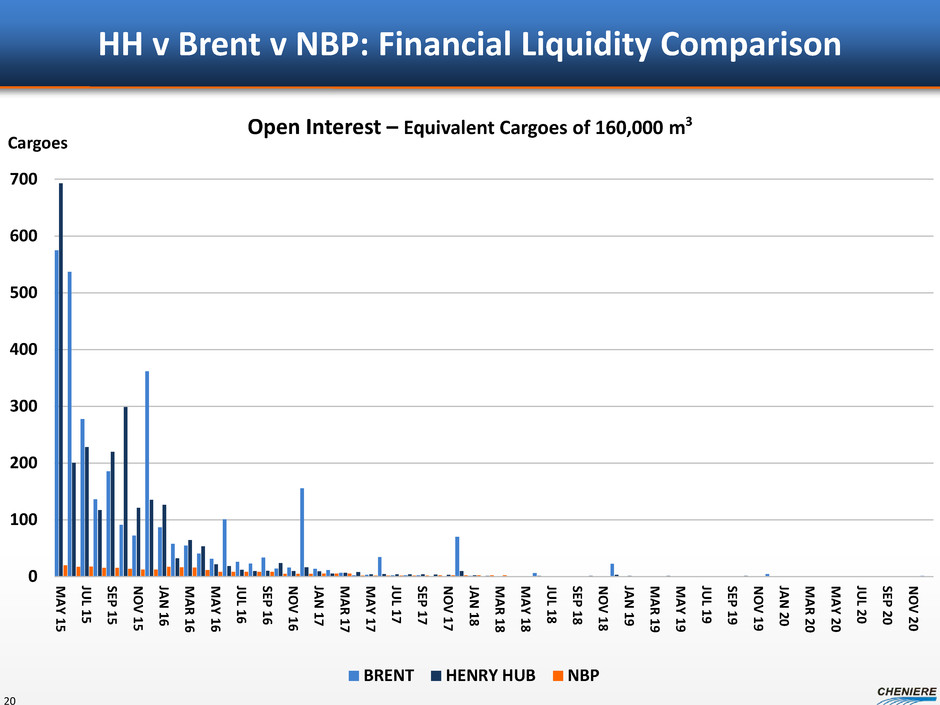

HH v Brent v NBP: Financial Liquidity Comparison 20 0 100 200 300 400 500 600 700 M A Y 15 JU L 15 SEP 15 N O V 15 JA N 16 M A R 16 M A Y 16 JU L 16 SEP 16 N O V 16 JA N 17 M A R 17 M A Y 17 JU L 17 SEP 17 N O V 17 JA N 18 M A R 18 M A Y 18 JU L 18 SEP 18 N O V 18 JA N 19 M A R 19 M A Y 19 JU L 19 SEP 19 N O V 19 JA N 20 M A R 20 M A Y 20 JU L 20 SEP 20 N O V 20 Cargoes Open Interest – Equivalent Cargoes of 160,000 m3 BRENT HENRY HUB NBP

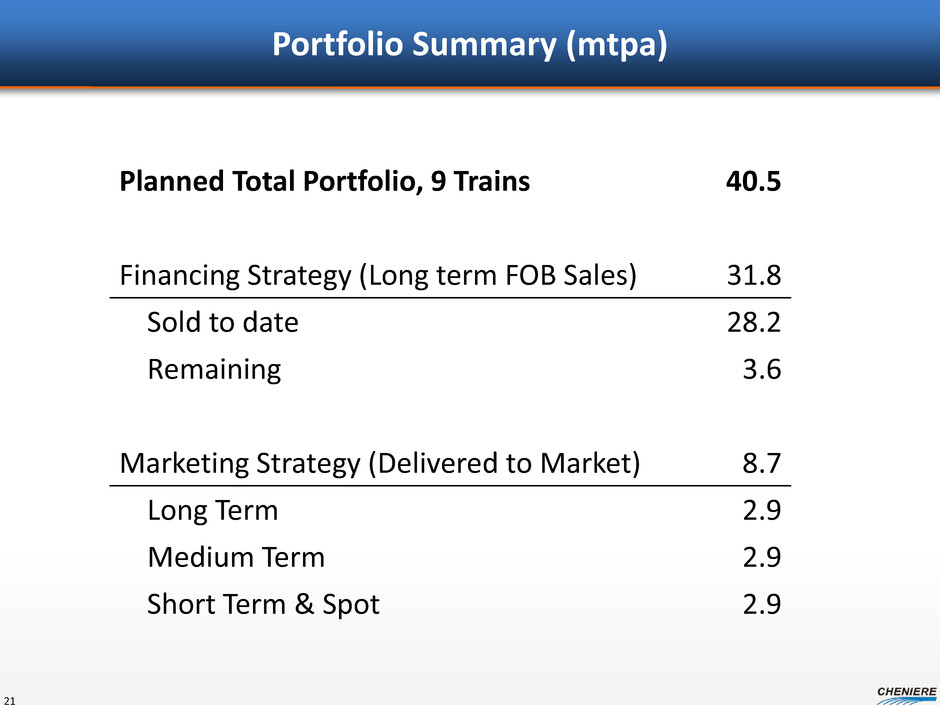

Portfolio Summary (mtpa) 21 Planned Total Portfolio, 9 Trains 40.5 Financing Strategy (Long term FOB Sales) 31.8 Sold to date 28.2 Remaining 3.6 Marketing Strategy (Delivered to Market) 8.7 Long Term 2.9 Medium Term 2.9 Short Term & Spot 2.9

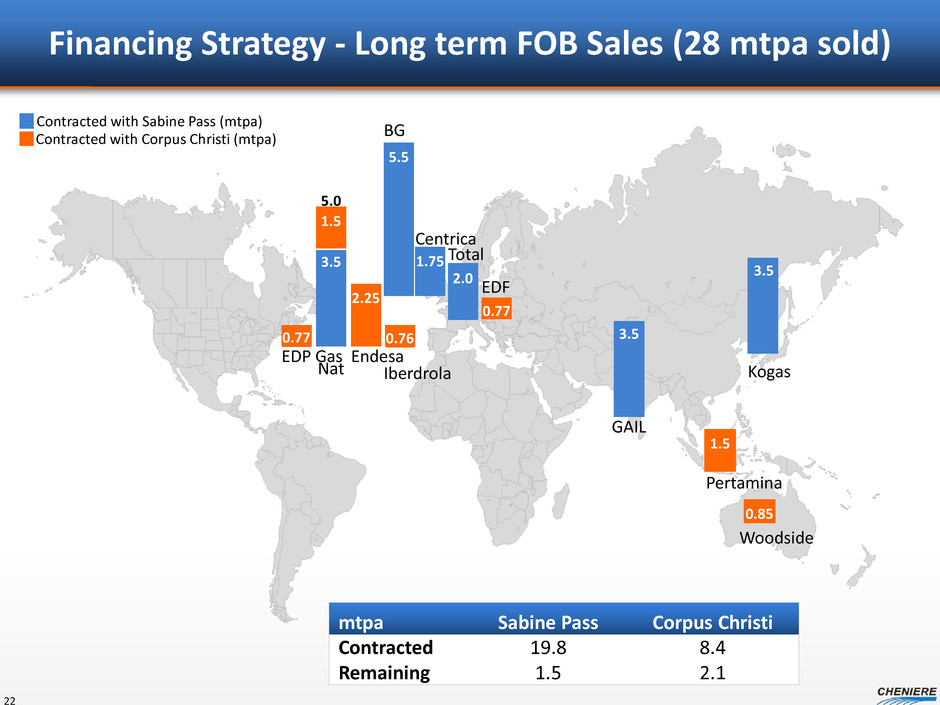

Financing Strategy - Long term FOB Sales (28 mtpa sold) 22 383 1.5 2.25 0.76 0.85 0.77 0.77 BG GAIL Kogas Total Centrica Pertamina Endesa Iberdrola Woodside EDF EDP 5.5 3.5 3.5 2.0 1.75 Contracted with Sabine Pass (mtpa) Contracted with Corpus Christi (mtpa) Gas Nat 1.5 3.5 5.0 mtpa Sabine Pass Corpus Christi Contracted 19.8 8.4 Remaining 1.5 2.1

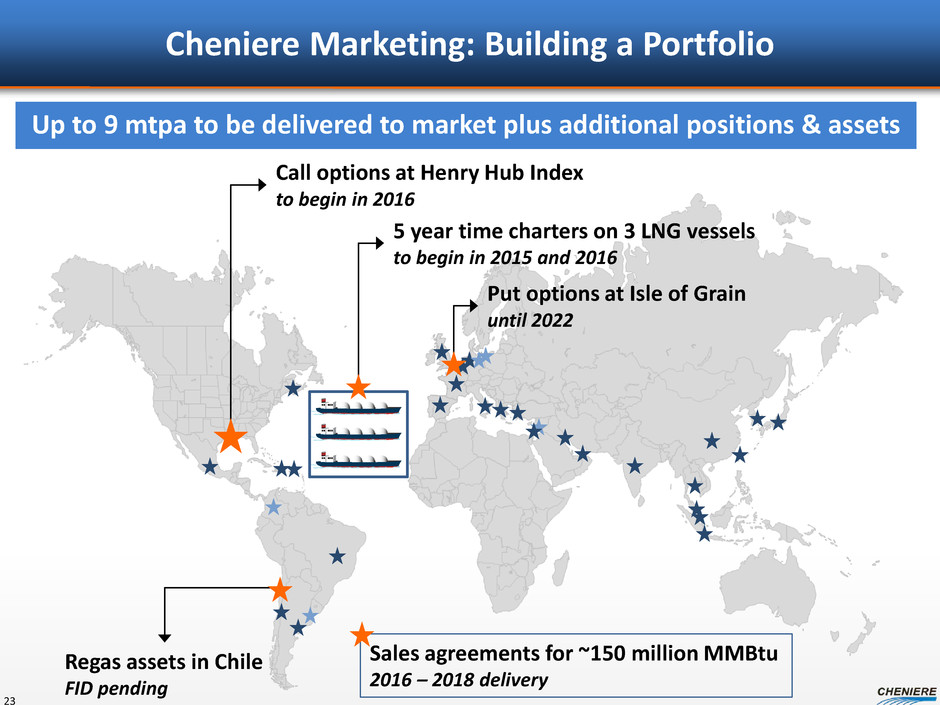

Cheniere Marketing: Building a Portfolio Up to 9 mtpa to be delivered to market plus additional positions & assets 23 Call options at Henry Hub Index to begin in 2016 Put options at Isle of Grain until 2022 5 year time charters on 3 LNG vessels to begin in 2015 and 2016 Regas assets in Chile FID pending Sales agreements for ~150 million MMBtu 2016 – 2018 delivery

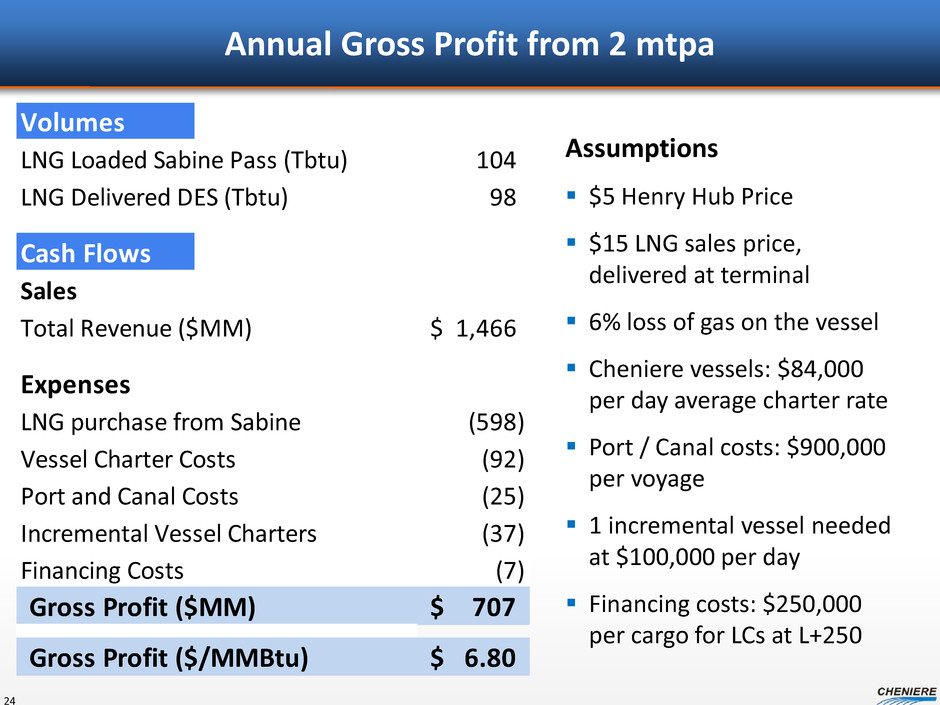

Annual Gross Profit from 2 mtpa 24 Assumptions $5 Henry Hub Price $15 LNG sales price, delivered at terminal 6% loss of gas on the vessel Cheniere vessels: $84,000 per day average charter rate Port / Canal costs: $900,000 per voyage 1 incremental vessel needed at $100,000 per day Financing costs: $250,000 per cargo for LCs at L+250 Volumes LNG Loaded Sabine Pass (Tbtu) 104 LNG Delivered DES (Tbtu) 98 Cash Flows Sales Total Revenue ($MM) 1,466$ Expenses LNG purchase from Sabine (598) Vessel Charter Costs (92) Port and Canal Costs (25) Incremental Vessel Charters (37) Financing Costs (7) Gross Profit ($MM) 707$ Gross Profit ($/MMBtu) 6.80$

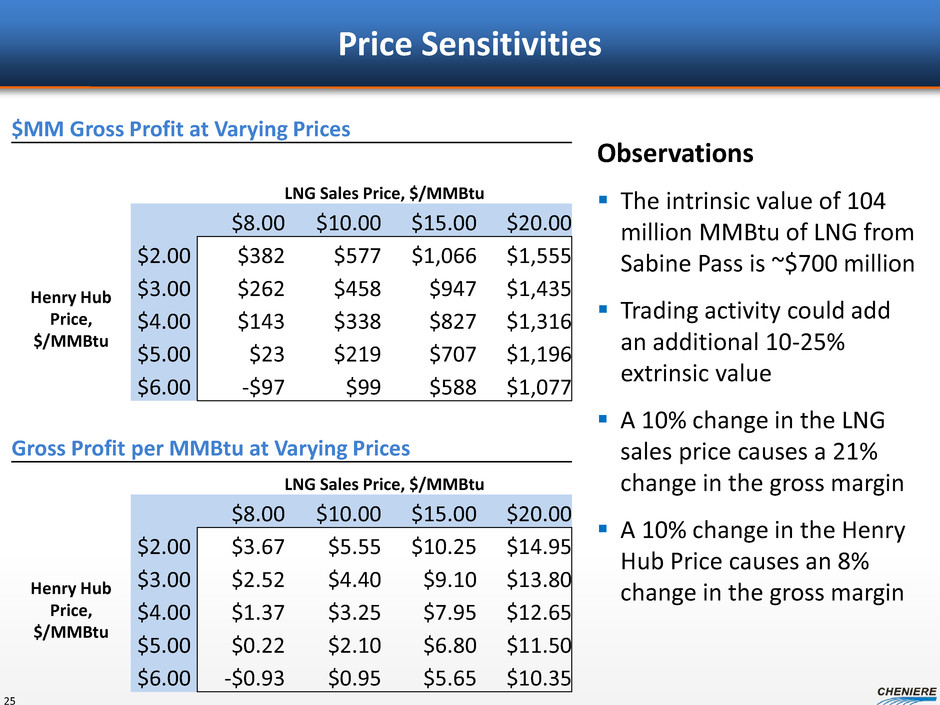

Price Sensitivities 25 Observations The intrinsic value of 104 million MMBtu of LNG from Sabine Pass is ~$700 million Trading activity could add an additional 10-25% extrinsic value A 10% change in the LNG sales price causes a 21% change in the gross margin A 10% change in the Henry Hub Price causes an 8% change in the gross margin $MM Gross Profit at Varying Prices LNG Sales Price, $/MMBtu $8.00 $10.00 $15.00 $20.00 Henry Hub Price, $/MMBtu $2.00 $382 $577 $1,066 $1,555 $3.00 $262 $458 $947 $1,435 $4.00 $143 $338 $827 $1,316 $5.00 $23 $219 $707 $1,196 $6.00 -$97 $99 $588 $1,077 Gross Profit per MMBtu at Varying Prices LNG Sales Price, $/MMBtu $8.00 $10.00 $15.00 $20.00 Henry Hub Price, $/MMBtu $2.00 $3.67 $5.55 $10.25 $14.95 $3.00 $2.52 $4.40 $9.10 $13.80 $4.00 $1.37 $3.25 $7.95 $12.65 $5.00 $0.22 $2.10 $6.80 $11.50 $6.00 -$0.93 $0.95 $5.65 $10.35

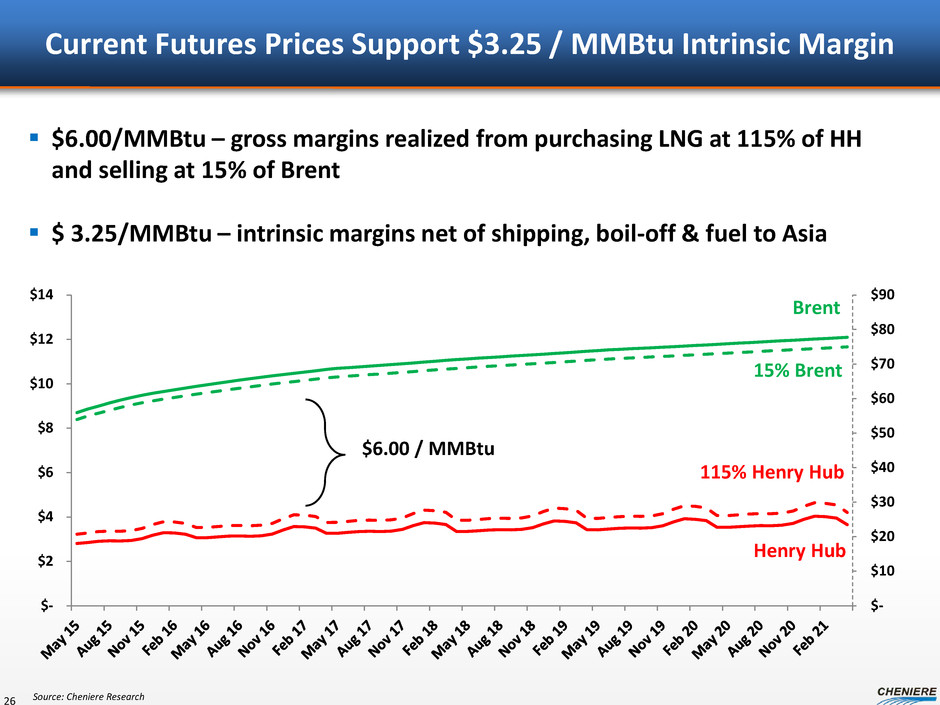

Current Futures Prices Support $3.25 / MMBtu Intrinsic Margin $6.00/MMBtu – gross margins realized from purchasing LNG at 115% of HH and selling at 15% of Brent $ 3.25/MMBtu – intrinsic margins net of shipping, boil-off & fuel to Asia 26 $- $10 $20 $30 $40 $50 $60 $70 $80 $90 $- $2 $4 $6 $8 $10 $12 $14 Brent 15% Brent 115% Henry Hub Henry Hub $6.00 / MMBtu Source: Cheniere Research

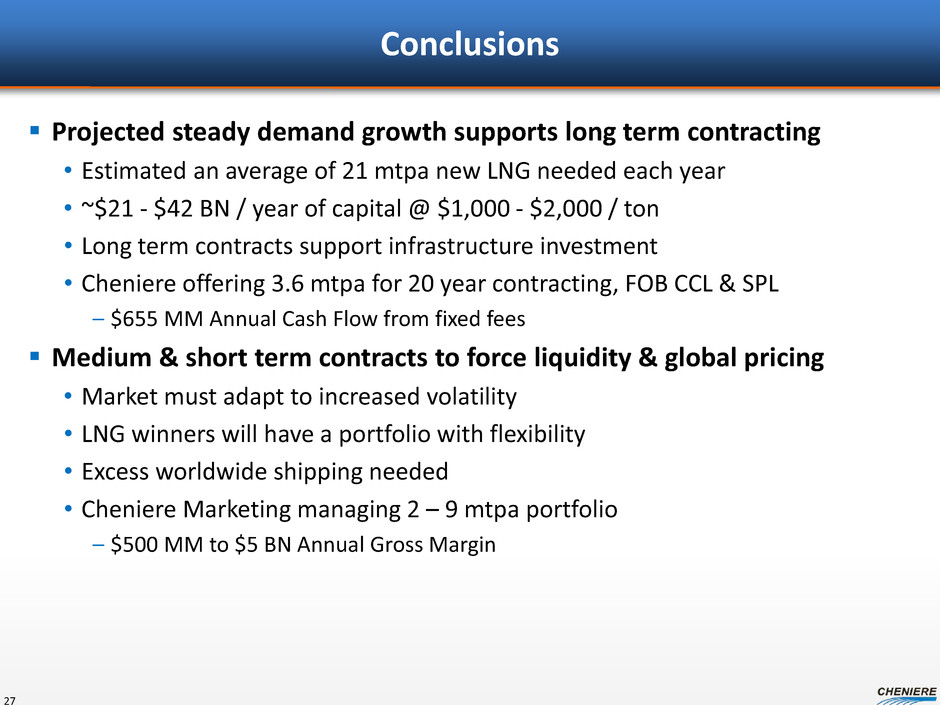

Conclusions Projected steady demand growth supports long term contracting • Estimated an average of 21 mtpa new LNG needed each year • ~$21 - $42 BN / year of capital @ $1,000 - $2,000 / ton • Long term contracts support infrastructure investment • Cheniere offering 3.6 mtpa for 20 year contracting, FOB CCL & SPL – $655 MM Annual Cash Flow from fixed fees Medium & short term contracts to force liquidity & global pricing • Market must adapt to increased volatility • LNG winners will have a portfolio with flexibility • Excess worldwide shipping needed • Cheniere Marketing managing 2 – 9 mtpa portfolio – $500 MM to $5 BN Annual Gross Margin 27

Michael Wortley – Chief Financial Officer Finance Update

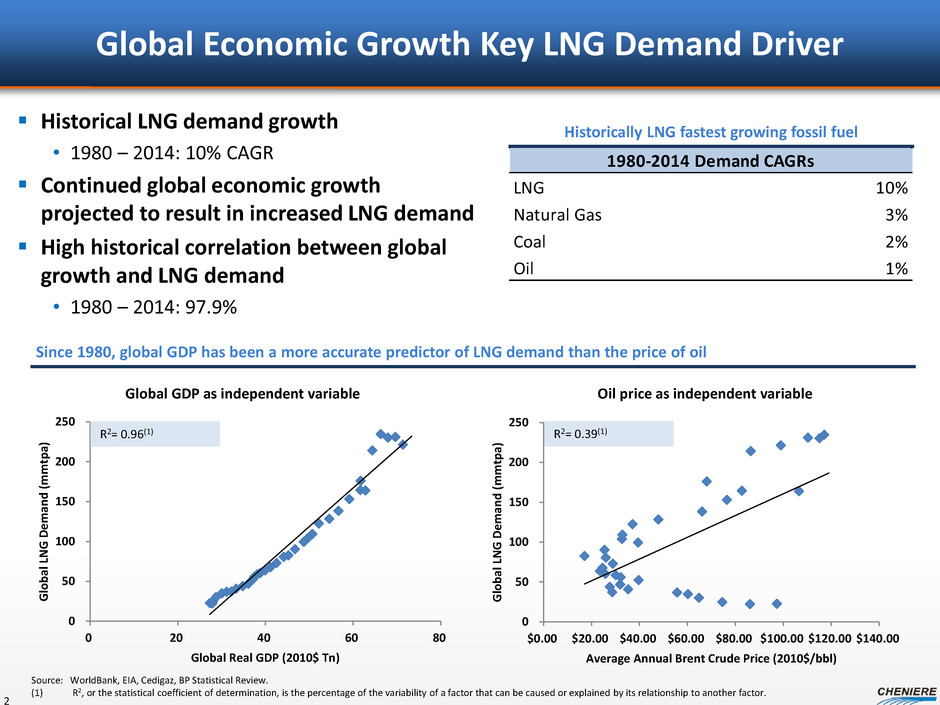

0 50 100 150 200 250 $0.00 $20.00 $40.00 $60.00 $80.00 $100.00 $120.00 $140.00 G lo ba l L N G D em an d (m m tp a) Average Annual Brent Crude Price (2010$/bbl) 0 50 100 150 200 250 0 20 40 60 80 G lo ba l L N G D em an d (m m tp a) Global Real GDP (2010$ Tn) 1980-2014 Demand CAGRs LNG 10% Natural Gas 3% Coal 2% Oil 1% Global Economic Growth Key LNG Demand Driver Historical LNG demand growth • 1980 – 2014: 10% CAGR Continued global economic growth projected to result in increased LNG demand High historical correlation between global growth and LNG demand • 1980 – 2014: 97.9% 2 Since 1980, global GDP has been a more accurate predictor of LNG demand than the price of oil Historically LNG fastest growing fossil fuel Global GDP as independent variable Oil price as independent variable Source: WorldBank, EIA, Cedigaz, BP Statistical Review. (1) R2, or the statistical coefficient of determination, is the percentage of the variability of a factor that can be caused or explained by its relationship to another factor. R2= 0.39(1) R2= 0.96(1)

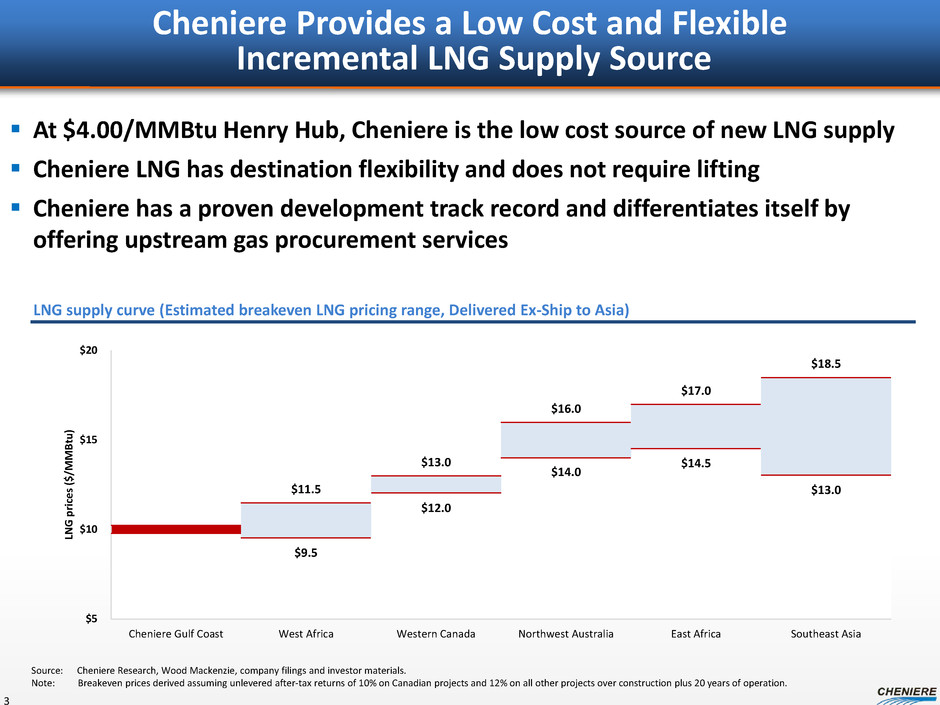

$9.5 $12.0 $14.0 $14.5 $13.0$11.5 $13.0 $16.0 $17.0 $18.5 $5 $10 $15 $20 Cheniere Gulf Coast West Africa Western Canada Northwest Australia East Africa Southeast Asia LN G p ri ce s ($ /M M B tu ) Cheniere Provides a Low Cost and Flexible Incremental LNG Supply Source At $4.00/MMBtu Henry Hub, Cheniere is the low cost source of new LNG supply Cheniere LNG has destination flexibility and does not require lifting Cheniere has a proven development track record and differentiates itself by offering upstream gas procurement services 3 LNG supply curve (Estimated breakeven LNG pricing range, Delivered Ex-Ship to Asia) Source: Cheniere Research, Wood Mackenzie, company filings and investor materials. Note: Breakeven prices derived assuming unlevered after-tax returns of 10% on Canadian projects and 12% on all other projects over construction plus 20 years of operation.

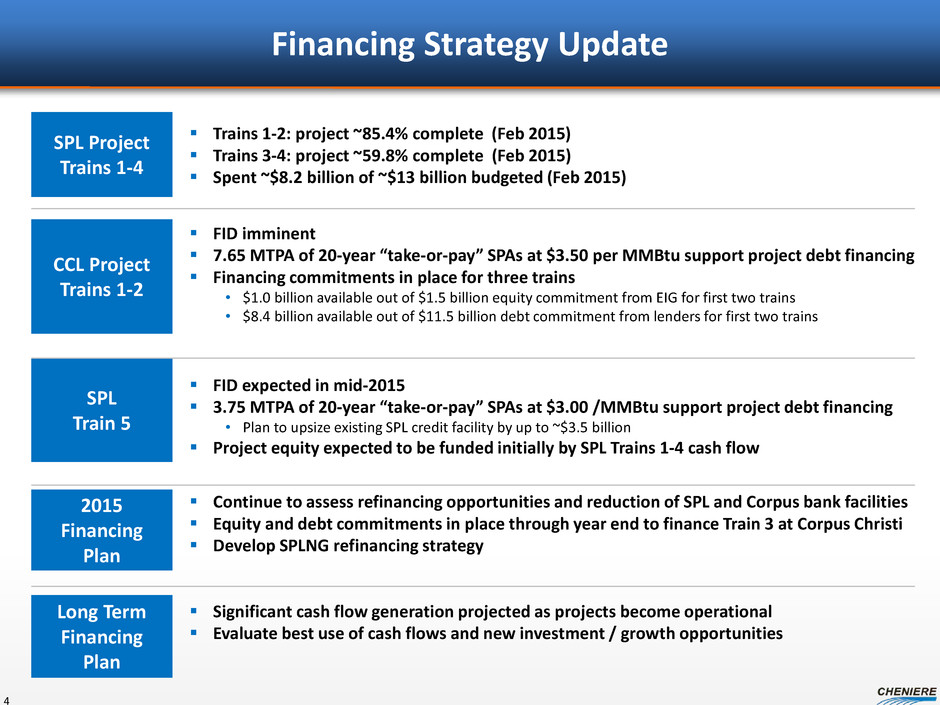

Financing Strategy Update Trains 1-2: project ~85.4% complete (Feb 2015) Trains 3-4: project ~59.8% complete (Feb 2015) Spent ~$8.2 billion of ~$13 billion budgeted (Feb 2015) 4 SPL Project Trains 1-4 CCL Project Trains 1-2 SPL Train 5 2015 Financing Plan Long Term Financing Plan FID imminent 7.65 MTPA of 20-year “take-or-pay” SPAs at $3.50 per MMBtu support project debt financing Financing commitments in place for three trains • $1.0 billion available out of $1.5 billion equity commitment from EIG for first two trains • $8.4 billion available out of $11.5 billion debt commitment from lenders for first two trains FID expected in mid-2015 3.75 MTPA of 20-year “take-or-pay” SPAs at $3.00 /MMBtu support project debt financing • Plan to upsize existing SPL credit facility by up to ~$3.5 billion Project equity expected to be funded initially by SPL Trains 1-4 cash flow Continue to assess refinancing opportunities and reduction of SPL and Corpus bank facilities Equity and debt commitments in place through year end to finance Train 3 at Corpus Christi Develop SPLNG refinancing strategy Significant cash flow generation projected as projects become operational Evaluate best use of cash flows and new investment / growth opportunities

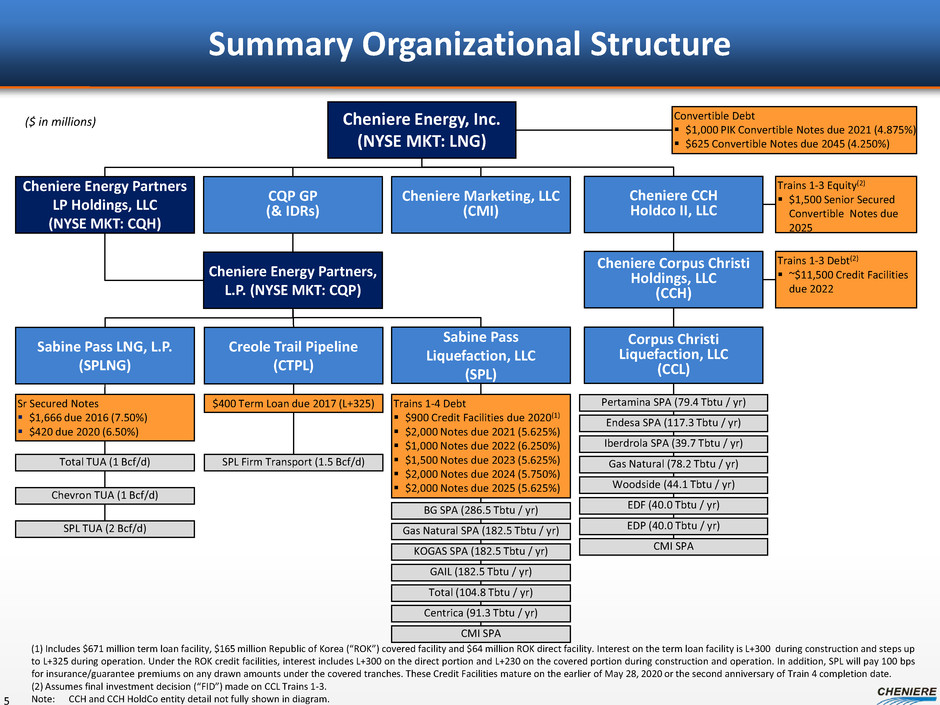

Summary Organizational Structure Cheniere Energy, Inc. (NYSE MKT: LNG) Cheniere Energy Partners, L.P. (NYSE MKT: CQP) Sabine Pass LNG, L.P. (SPLNG) Total TUA (1 Bcf/d) Chevron TUA (1 Bcf/d) SPL TUA (2 Bcf/d) Sr Secured Notes $1,666 due 2016 (7.50%) $420 due 2020 (6.50%) ($ in millions) Cheniere Marketing, LLC (CMI) Trains 1-4 Debt $900 Credit Facilities due 2020(1) $2,000 Notes due 2021 (5.625%) $1,000 Notes due 2022 (6.250%) $1,500 Notes due 2023 (5.625%) $2,000 Notes due 2024 (5.750%) $2,000 Notes due 2025 (5.625%) Sabine Pass Liquefaction, LLC (SPL) Creole Trail Pipeline (CTPL) $400 Term Loan due 2017 (L+325) CQP GP (& IDRs) (1) Includes $671 million term loan facility, $165 million Republic of Korea (“ROK”) covered facility and $64 million ROK direct facility. Interest on the term loan facility is L+300 during construction and steps up to L+325 during operation. Under the ROK credit facilities, interest includes L+300 on the direct portion and L+230 on the covered portion during construction and operation. In addition, SPL will pay 100 bps for insurance/guarantee premiums on any drawn amounts under the covered tranches. These Credit Facilities mature on the earlier of May 28, 2020 or the second anniversary of Train 4 completion date. (2) Assumes final investment decision (“FID”) made on CCL Trains 1-3. Note: CCH and CCH HoldCo entity detail not fully shown in diagram. Cheniere Energy Partners LP Holdings, LLC (NYSE MKT: CQH) 5 Cheniere CCH Holdco II, LLC Convertible Debt $1,000 PIK Convertible Notes due 2021 (4.875%) $625 Convertible Notes due 2045 (4.250%) SPL Firm Transport (1.5 Bcf/d) BG SPA (286.5 Tbtu / yr) Gas Natural SPA (182.5 Tbtu / yr) KOGAS SPA (182.5 Tbtu / yr) GAIL (182.5 Tbtu / yr) Total (104.8 Tbtu / yr) Centrica (91.3 Tbtu / yr) CMI SPA Pertamina SPA (79.4 Tbtu / yr) Endesa SPA (117.3 Tbtu / yr) Iberdrola SPA (39.7 Tbtu / yr) Gas Natural (78.2 Tbtu / yr) Woodside (44.1 Tbtu / yr) EDF (40.0 Tbtu / yr) EDP (40.0 Tbtu / yr) CMI SPA Cheniere Corpus Christi Holdings, LLC (CCH) Trains 1-3 Equity(2) $1,500 Senior Secured Convertible Notes due 2025 Trains 1-3 Debt(2) ~$11,500 Credit Facilities due 2022 Corpus Christi Liquefaction, LLC (CCL)

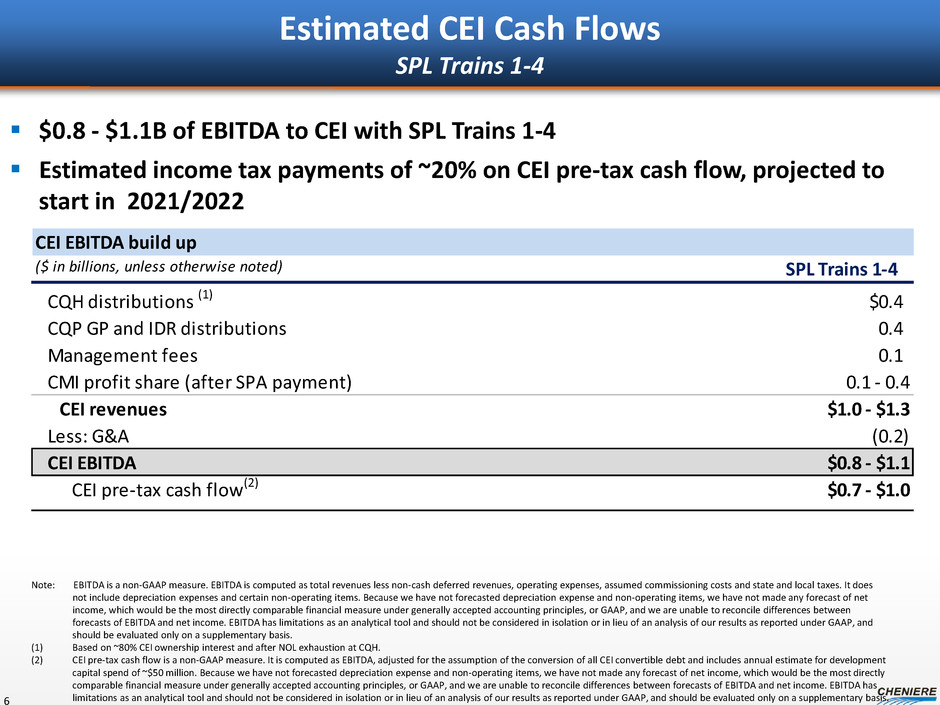

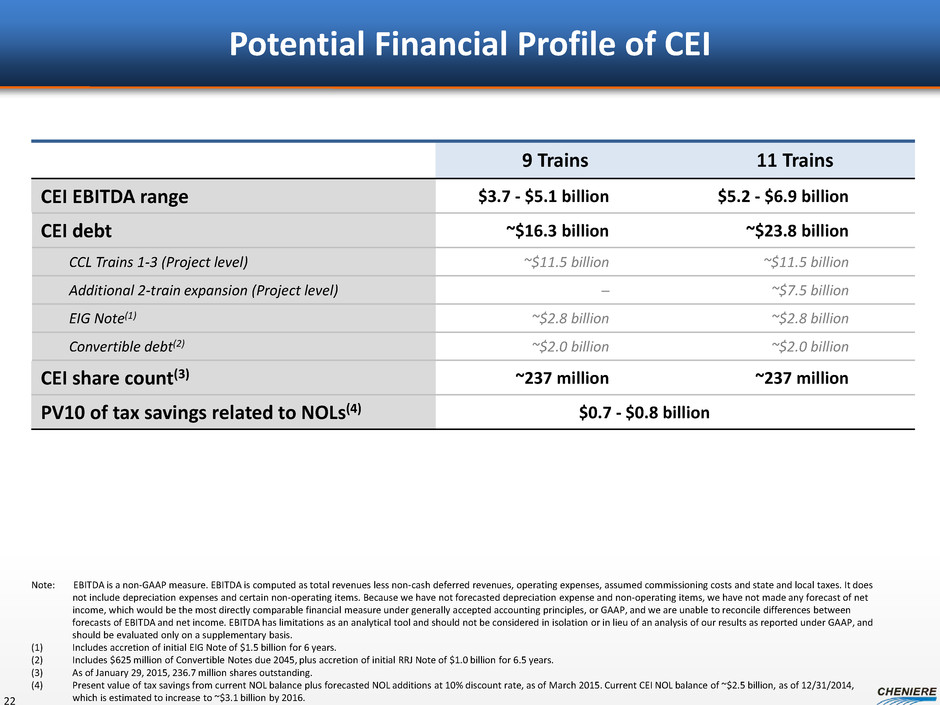

CEI EBITDA build up ($ in billions, unless otherwise noted) SPL Trains 1-4 CQH distributions (1) $0.4 CQP GP and IDR distributions 0.4 Management fees 0.1 CMI profit share (after SPA payment) 0.1 - 0.4 CEI revenues $1.0 - $1.3 Less: G&A (0.2) CEI EBITDA $0.8 - $1.1 CEI pre-tax cash flow(2) $0.7 - $1.0 Estimated CEI Cash Flows SPL Trains 1-4 6 Note: EBITDA is a non-GAAP measure. EBITDA is computed as total revenues less non-cash deferred revenues, operating expenses, assumed commissioning costs and state and local taxes. It does not include depreciation expenses and certain non-operating items. Because we have not forecasted depreciation expense and non-operating items, we have not made any forecast of net income, which would be the most directly comparable financial measure under generally accepted accounting principles, or GAAP, and we are unable to reconcile differences between forecasts of EBITDA and net income. EBITDA has limitations as an analytical tool and should not be considered in isolation or in lieu of an analysis of our results as reported under GAAP, and should be evaluated only on a supplementary basis. (1) Based on ~80% CEI ownership interest and after NOL exhaustion at CQH. (2) CEI pre-tax cash flow is a non-GAAP measure. It is computed as EBITDA, adjusted for the assumption of the conversion of all CEI convertible debt and includes annual estimate for development capital spend of ~$50 million. Because we have not forecasted depreciation expense and non-operating items, we have not made any forecast of net income, which would be the most directly comparable financial measure under generally accepted accounting principles, or GAAP, and we are unable to reconcile differences between forecasts of EBITDA and net income. EBITDA has limitations as an analytical tool and should not be considered in isolation or in lieu of an analysis of our results as reported under GAAP, and should be evaluated only on a supplementary basis. $0.8 - $1.1B of EBITDA to CEI with SPL Trains 1-4 Estimated income tax payments of ~20% on CEI pre-tax cash flow, projected to start in 2021/2022

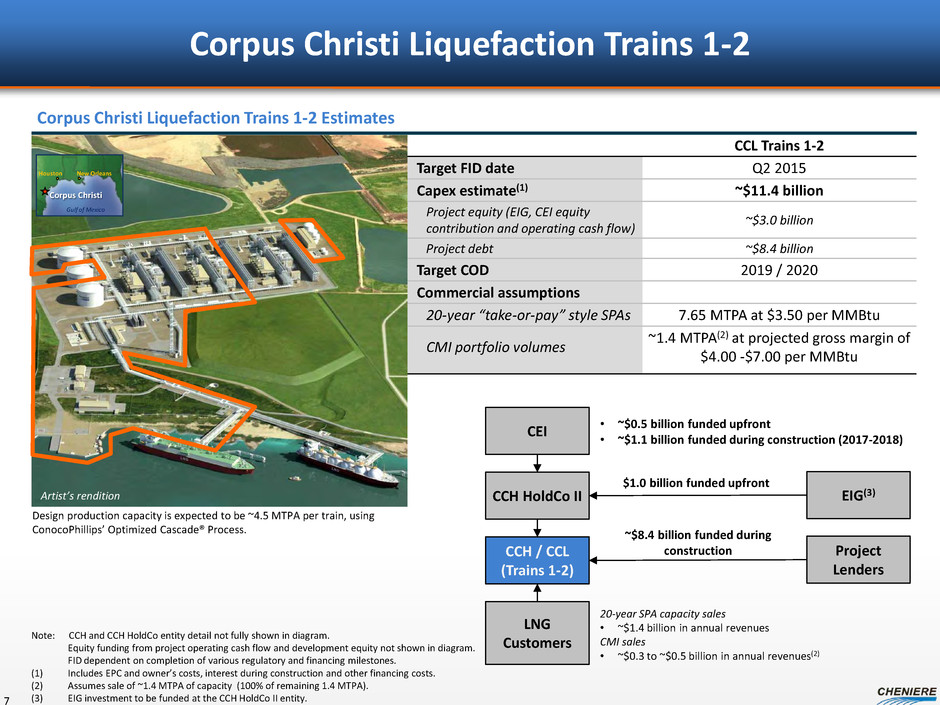

Corpus Christi Liquefaction Trains 1-2 7 Corpus Christi Liquefaction Trains 1-2 Estimates Design production capacity is expected to be ~4.5 MTPA per train, using ConocoPhillips’ Optimized Cascade® Process. CEI CCH / CCL (Trains 1-2) LNG Customers Project Lenders ~$8.4 billion funded during construction CCL Trains 1-2 Target FID date Q2 2015 Capex estimate(1) ~$11.4 billion Project equity (EIG, CEI equity contribution and operating cash flow) ~$3.0 billion Project debt ~$8.4 billion Target COD 2019 / 2020 Commercial assumptions 20-year “take-or-pay” style SPAs 7.65 MTPA at $3.50 per MMBtu CMI portfolio volumes ~1.4 MTPA(2) at projected gross margin of $4.00 -$7.00 per MMBtu Note: CCH and CCH HoldCo entity detail not fully shown in diagram. Equity funding from project operating cash flow and development equity not shown in diagram. FID dependent on completion of various regulatory and financing milestones. (1) Includes EPC and owner’s costs, interest during construction and other financing costs. (2) Assumes sale of ~1.4 MTPA of capacity (100% of remaining 1.4 MTPA). (3) EIG investment to be funded at the CCH HoldCo II entity. 20-year SPA capacity sales • ~$1.4 billion in annual revenues CMI sales • ~$0.3 to ~$0.5 billion in annual revenues(2) • ~$0.5 billion funded upfront • ~$1.1 billion funded during construction (2017-2018) Houston New Orleans Gulf of Mexico Corpus Christi Artist’s rendition CCH HoldCo II EIG(3) $1.0 billion funded upfront

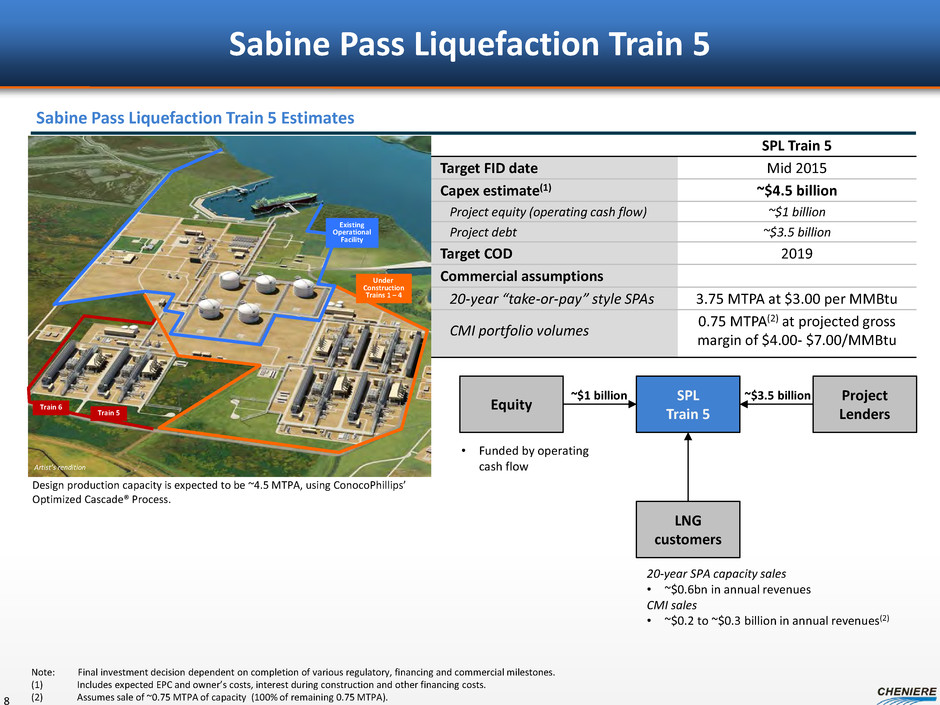

Sabine Pass Liquefaction Train 5 8 Sabine Pass Liquefaction Train 5 Estimates Equity SPL Train 5 LNG customers Project Lenders ~$3.5 billion ~$1 billion Note: Final investment decision dependent on completion of various regulatory, financing and commercial milestones. (1) Includes expected EPC and owner’s costs, interest during construction and other financing costs. (2) Assumes sale of ~0.75 MTPA of capacity (100% of remaining 0.75 MTPA). Design production capacity is expected to be ~4.5 MTPA, using ConocoPhillips’ Optimized Cascade® Process. SPL Train 5 Target FID date Mid 2015 Capex estimate(1) ~$4.5 billion Project equity (operating cash flow) ~$1 billion Project debt ~$3.5 billion Target COD 2019 Commercial assumptions 20-year “take-or-pay” style SPAs 3.75 MTPA at $3.00 per MMBtu CMI portfolio volumes 0.75 MTPA(2) at projected gross margin of $4.00- $7.00/MMBtu • Funded by operating cash flow 20-year SPA capacity sales • ~$0.6bn in annual revenues CMI sales • ~$0.2 to ~$0.3 billion in annual revenues(2) Artist’s rendition Existing Operational Facility Under Construction Trains 1 – 4 Train 6 Train 5

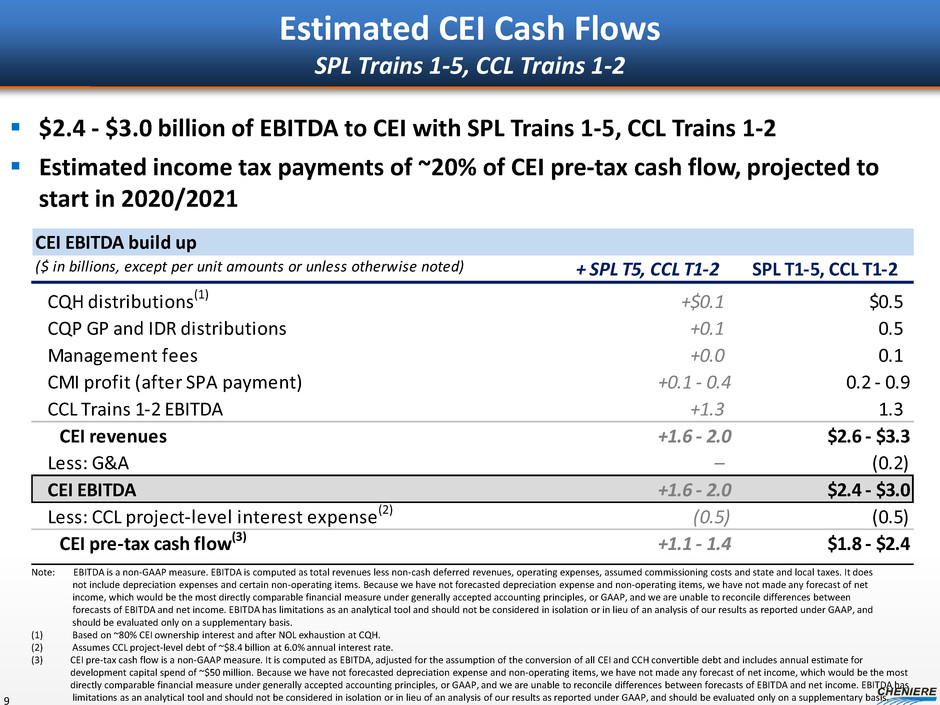

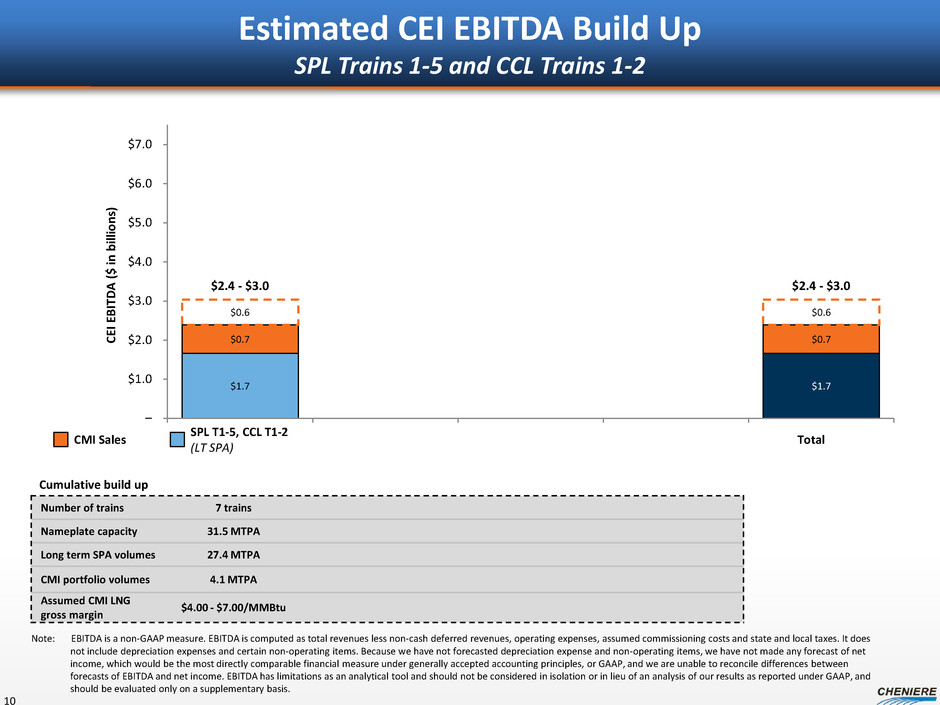

CEI EBITDA build up ($ in billions, except per unit amounts or unless otherwise noted) + SPL T5, CCL T1-2 SPL T1-5, CCL T1-2 CQH distributions(1) +$0.1 $0.5 CQP GP and IDR distributions +0.1 0.5 Management fees +0.0 0.1 CMI profit (after SPA payment) +0.1 - 0.4 0.2 - 0.9 CCL Trains 1-2 EBITDA +1.3 1.3 CEI revenues +1.6 - 2.0 $2.6 - $3.3 Less: G&A – (0.2) CEI EBITDA +1.6 - 2.0 $2.4 - $3.0 Less: CCL project-level interest expense(2) (0.5) (0.5) CEI pre-tax cash flow(3) +1.1 - 1.4 $1.8 - $2.4 Estimated CEI Cash Flows SPL Trains 1-5, CCL Trains 1-2 9 $2.4 - $3.0 billion of EBITDA to CEI with SPL Trains 1-5, CCL Trains 1-2 Estimated income tax payments of ~20% of CEI pre-tax cash flow, projected to start in 2020/2021 Note: EBITDA is a non-GAAP measure. EBITDA is computed as total revenues less non-cash deferred revenues, operating expenses, assumed commissioning costs and state and local taxes. It does not include depreciation expenses and certain non-operating items. Because we have not forecasted depreciation expense and non-operating items, we have not made any forecast of net income, which would be the most directly comparable financial measure under generally accepted accounting principles, or GAAP, and we are unable to reconcile differences between forecasts of EBITDA and net income. EBITDA has limitations as an analytical tool and should not be considered in isolation or in lieu of an analysis of our results as reported under GAAP, and should be evaluated only on a supplementary basis. (1) Based on ~80% CEI ownership interest and after NOL exhaustion at CQH. (2) Assumes CCL project-level debt of ~$8.4 billion at 6.0% annual interest rate. (3) CEI pre-tax cash flow is a non-GAAP measure. It is computed as EBITDA, adjusted for the assumption of the conversion of all CEI and CCH convertible debt and includes annual estimate for development capital spend of ~$50 million. Because we have not forecasted depreciation expense and non-operating items, we have not made any forecast of net income, which would be the most directly comparable financial measure under generally accepted accounting principles, or GAAP, and we are unable to reconcile differences between forecasts of EBITDA and net income. EBITDA has limitations as an analytical tool and should not be considered in isolation or in lieu of an analysis of our results as reported under GAAP, and should be evaluated only on a supplementary basis.

$1.7 $0.7 $0.6 $1.7 $0.7 $0.6 $2.4 - $3.0 $2.4 - $3.0 – $1.0 $2.0 $3.0 $4.0 $5.0 $6.0 $7.0 CE I E B IT D A ( $ in b ill io ns ) Estimated CEI EBITDA Build Up SPL Trains 1-5 and CCL Trains 1-2 10 Number of trains 7 trains Nameplate capacity 31.5 MTPA Long term SPA volumes 27.4 MTPA CMI portfolio volumes 4.1 MTPA Assumed CMI LNG gross margin $4.00 - $7.00/MMBtu Note: EBITDA is a non-GAAP measure. EBITDA is computed as total revenues less non-cash deferred revenues, operating expenses, assumed commissioning costs and state and local taxes. It does not include depreciation expenses and certain non-operating items. Because we have not forecasted depreciation expense and non-operating items, we have not made any forecast of net income, which would be the most directly comparable financial measure under generally accepted accounting principles, or GAAP, and we are unable to reconcile differences between forecasts of EBITDA and net income. EBITDA has limitations as an analytical tool and should not be considered in isolation or in lieu of an analysis of our results as reported under GAAP, and should be evaluated only on a supplementary basis. Cumulative build up SPL T1-5, CCL T1-2 (LT SPA) CMI Sales Total

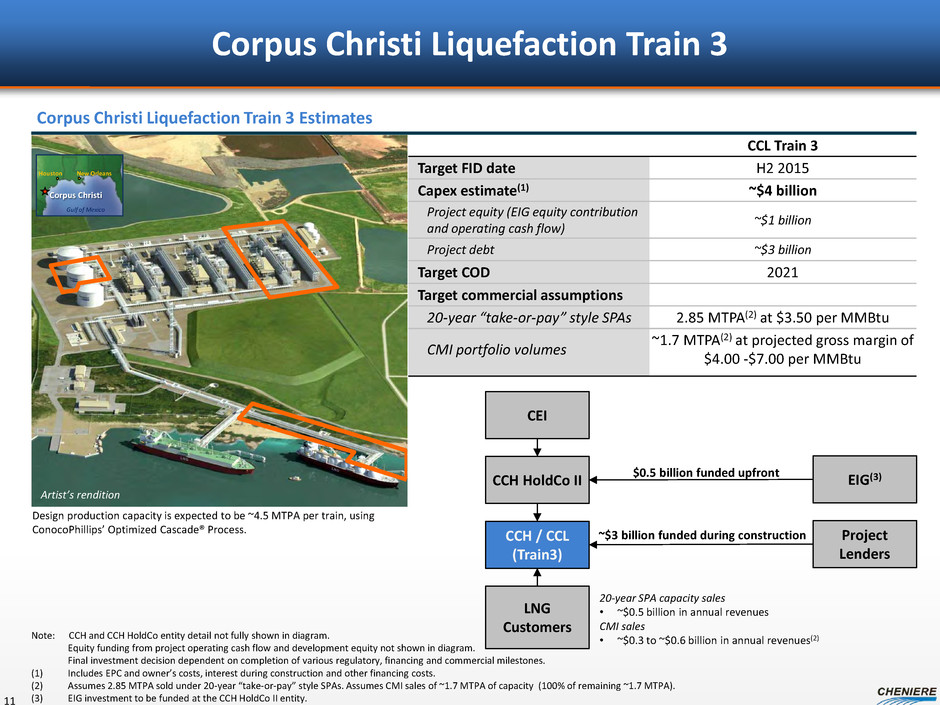

Corpus Christi Liquefaction Train 3 11 Corpus Christi Liquefaction Train 3 Estimates Design production capacity is expected to be ~4.5 MTPA per train, using ConocoPhillips’ Optimized Cascade® Process. CCL Train 3 Target FID date H2 2015 Capex estimate(1) ~$4 billion Project equity (EIG equity contribution and operating cash flow) ~$1 billion Project debt ~$3 billion Target COD 2021 Target commercial assumptions 20-year “take-or-pay” style SPAs 2.85 MTPA(2) at $3.50 per MMBtu CMI portfolio volumes ~1.7 MTPA(2) at projected gross margin of $4.00 -$7.00 per MMBtu Artist’s rendition Houston New Orleans Gulf of Mexico Corpus Christi CEI CCH / CCL (Train3) LNG Customers Project Lenders ~$3 billion funded during construction 20-year SPA capacity sales • ~$0.5 billion in annual revenues CMI sales • ~$0.3 to ~$0.6 billion in annual revenues(2) CCH HoldCo II EIG(3) $0.5 billion funded upfront Note: CCH and CCH HoldCo entity detail not fully shown in diagram. Equity funding from project operating cash flow and development equity not shown in diagram. Final investment decision dependent on completion of various regulatory, financing and commercial milestones. (1) Includes EPC and owner’s costs, interest during construction and other financing costs. (2) Assumes 2.85 MTPA sold under 20-year “take-or-pay” style SPAs. Assumes CMI sales of ~1.7 MTPA of capacity (100% of remaining ~1.7 MTPA). (3) EIG investment to be funded at the CCH HoldCo II entity.

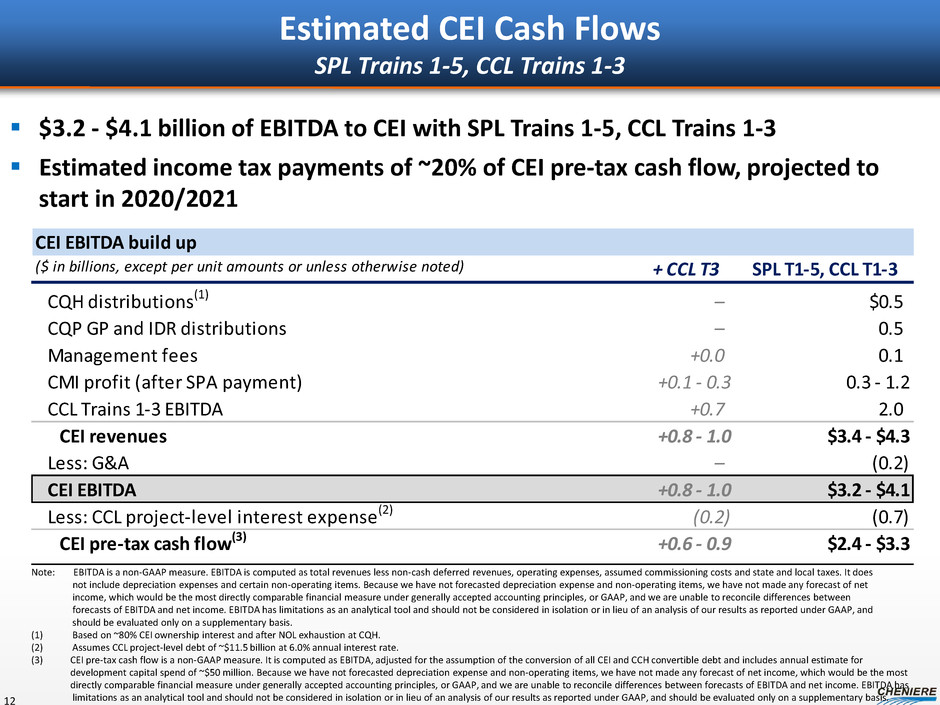

CEI EBITDA build up ($ in billions, except per unit amounts or unless otherwise noted) + CCL T3 SPL T1-5, CCL T1-3 CQH distributions(1) – $0.5 CQP GP and IDR distributions – 0.5 Management fees +0.0 0.1 CMI profit (after SPA payment) +0.1 - 0.3 0.3 - 1.2 CCL Trains 1-3 EBITDA +0.7 2.0 CEI revenues +0.8 - 1.0 $3.4 - $4.3 Less: G&A – (0.2) CEI EBITDA +0.8 - 1.0 $3.2 - $4.1 Less: CCL project-level interest expense(2) (0.2) (0.7) CEI pre-tax cash flow(3) +0.6 - 0.9 $2.4 - $3.3 Estimated CEI Cash Flows SPL Trains 1-5, CCL Trains 1-3 12 $3.2 - $4.1 billion of EBITDA to CEI with SPL Trains 1-5, CCL Trains 1-3 Estimated income tax payments of ~20% of CEI pre-tax cash flow, projected to start in 2020/2021 Note: EBITDA is a non-GAAP measure. EBITDA is computed as total revenues less non-cash deferred revenues, operating expenses, assumed commissioning costs and state and local taxes. It does not include depreciation expenses and certain non-operating items. Because we have not forecasted depreciation expense and non-operating items, we have not made any forecast of net income, which would be the most directly comparable financial measure under generally accepted accounting principles, or GAAP, and we are unable to reconcile differences between forecasts of EBITDA and net income. EBITDA has limitations as an analytical tool and should not be considered in isolation or in lieu of an analysis of our results as reported under GAAP, and should be evaluated only on a supplementary basis. (1) Based on ~80% CEI ownership interest and after NOL exhaustion at CQH. (2) Assumes CCL project-level debt of ~$11.5 billion at 6.0% annual interest rate. (3) CEI pre-tax cash flow is a non-GAAP measure. It is computed as EBITDA, adjusted for the assumption of the conversion of all CEI and CCH convertible debt and includes annual estimate for development capital spend of ~$50 million. Because we have not forecasted depreciation expense and non-operating items, we have not made any forecast of net income, which would be the most directly comparable financial measure under generally accepted accounting principles, or GAAP, and we are unable to reconcile differences between forecasts of EBITDA and net income. EBITDA has limitations as an analytical tool and should not be considered in isolation or in lieu of an analysis of our results as reported under GAAP, and should be evaluated only on a supplementary basis.

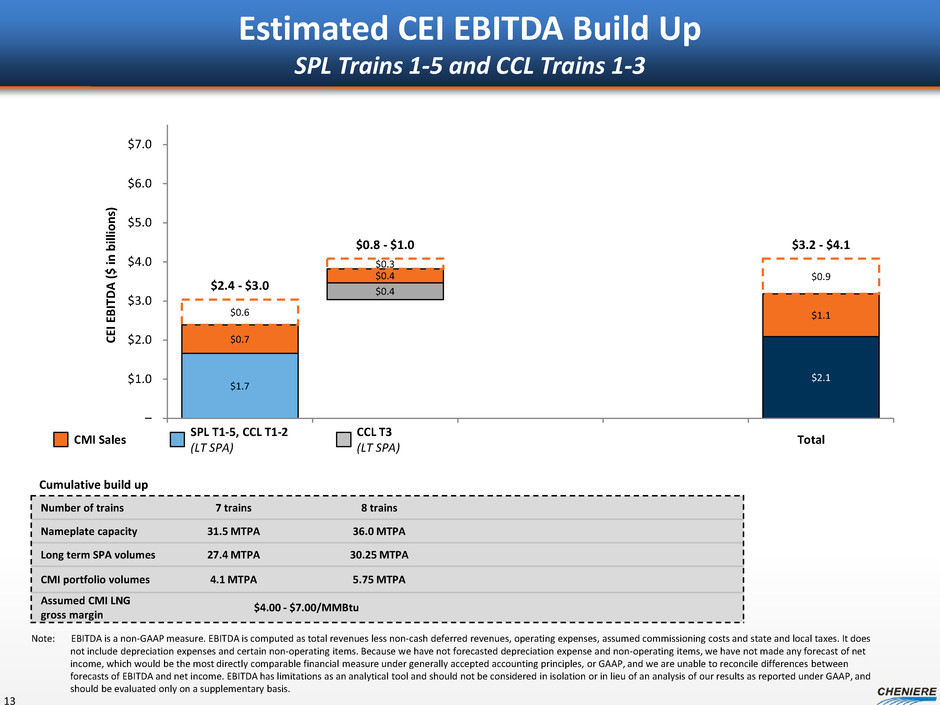

$1.7 $0.7 $0.6 $0.4 $0.4 $0.3 $2.1 $1.1 $0.9 $2.4 - $3.0 $0.8 - $1.0 $3.2 - $4.1 – $1.0 $2.0 $3.0 $4.0 $5.0 $6.0 $7.0 CE I E B IT D A ( $ in b ill io ns ) Estimated CEI EBITDA Build Up SPL Trains 1-5 and CCL Trains 1-3 13 Number of trains 7 trains 8 trains Nameplate capacity 31.5 MTPA 36.0 MTPA Long term SPA volumes 27.4 MTPA 30.25 MTPA CMI portfolio volumes 4.1 MTPA 5.75 MTPA Assumed CMI LNG gross margin $4.00 - $7.00/MMBtu Note: EBITDA is a non-GAAP measure. EBITDA is computed as total revenues less non-cash deferred revenues, operating expenses, assumed commissioning costs and state and local taxes. It does not include depreciation expenses and certain non-operating items. Because we have not forecasted depreciation expense and non-operating items, we have not made any forecast of net income, which would be the most directly comparable financial measure under generally accepted accounting principles, or GAAP, and we are unable to reconcile differences between forecasts of EBITDA and net income. EBITDA has limitations as an analytical tool and should not be considered in isolation or in lieu of an analysis of our results as reported under GAAP, and should be evaluated only on a supplementary basis. Cumulative build up CCL T3 (LT SPA) SPL T1-5, CCL T1-2 (LT SPA) CMI Sales Total

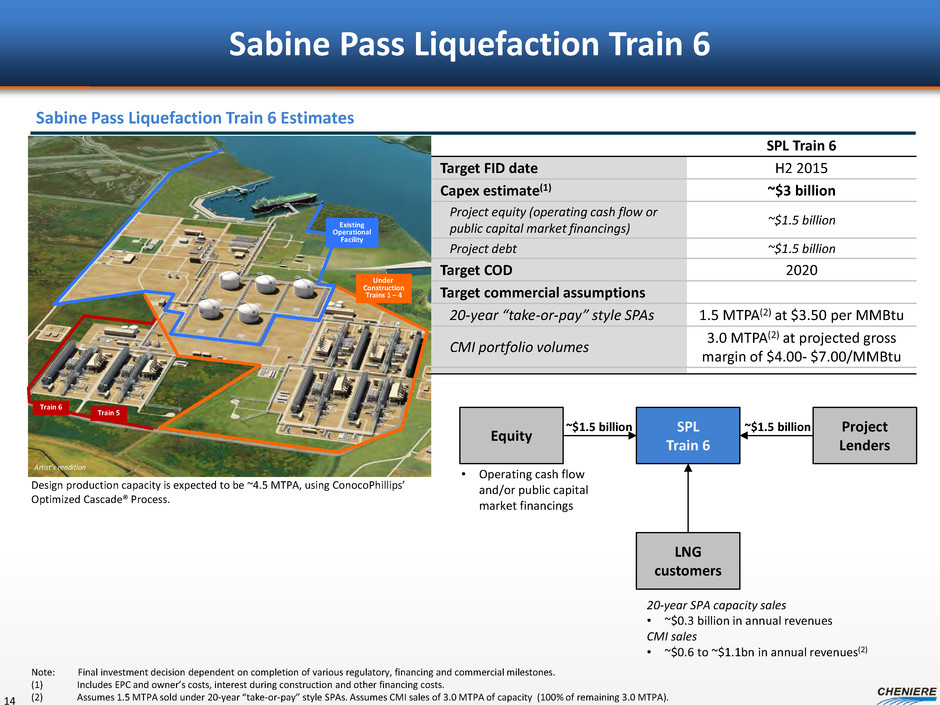

Sabine Pass Liquefaction Train 6 14 Sabine Pass Liquefaction Train 6 Estimates Design production capacity is expected to be ~4.5 MTPA, using ConocoPhillips’ Optimized Cascade® Process. SPL Train 6 Target FID date H2 2015 Capex estimate(1) ~$3 billion Project equity (operating cash flow or public capital market financings) ~$1.5 billion Project debt ~$1.5 billion Target COD 2020 Target commercial assumptions 20-year “take-or-pay” style SPAs 1.5 MTPA(2) at $3.50 per MMBtu CMI portfolio volumes 3.0 MTPA(2) at projected gross margin of $4.00- $7.00/MMBtu Note: Final investment decision dependent on completion of various regulatory, financing and commercial milestones. (1) Includes EPC and owner’s costs, interest during construction and other financing costs. (2) Assumes 1.5 MTPA sold under 20-year “take-or-pay” style SPAs. Assumes CMI sales of 3.0 MTPA of capacity (100% of remaining 3.0 MTPA). Equity SPL Train 6 LNG customers Project Lenders ~$1.5 billion ~$1.5 billion • Operating cash flow and/or public capital market financings 20-year SPA capacity sales • ~$0.3 billion in annual revenues CMI sales • ~$0.6 to ~$1.1bn in annual revenues(2) Artist’s rendition Existing Operational Facility Under Construction Trains 1 – 4 Train 6 Train 5

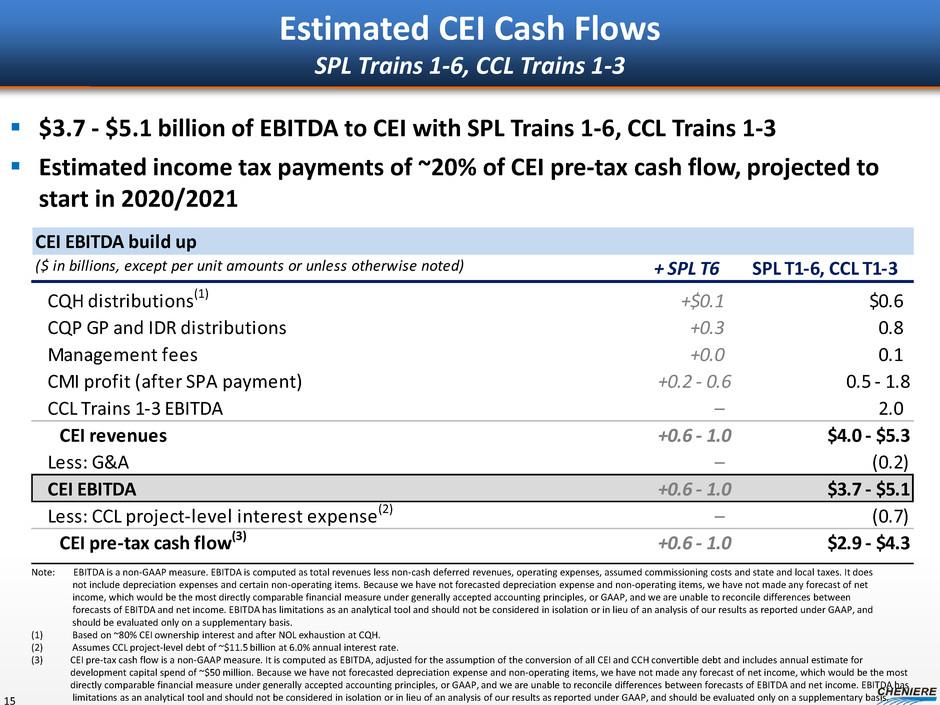

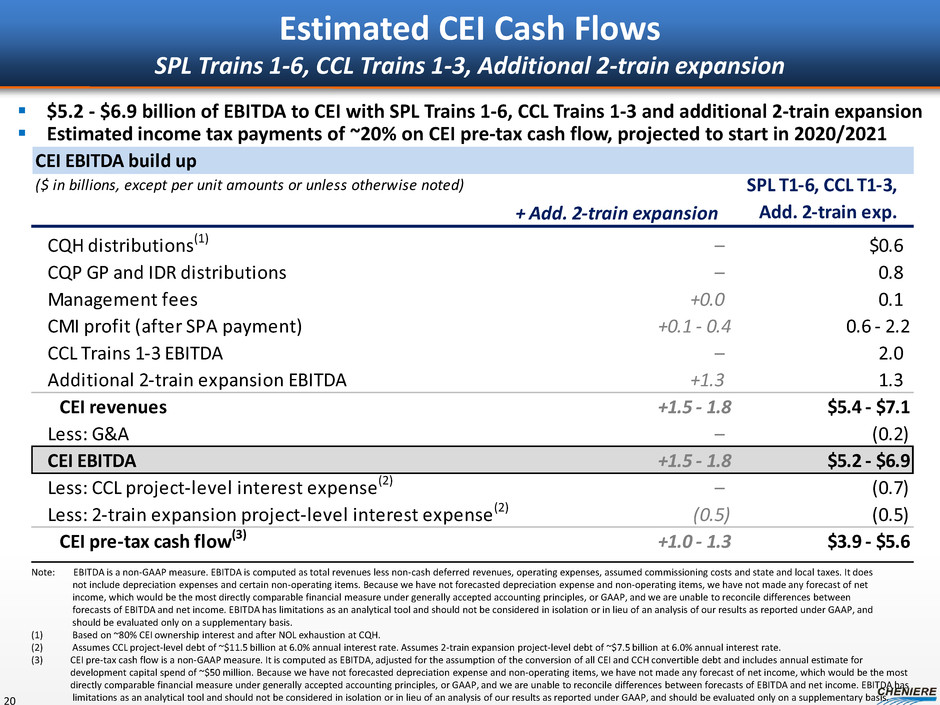

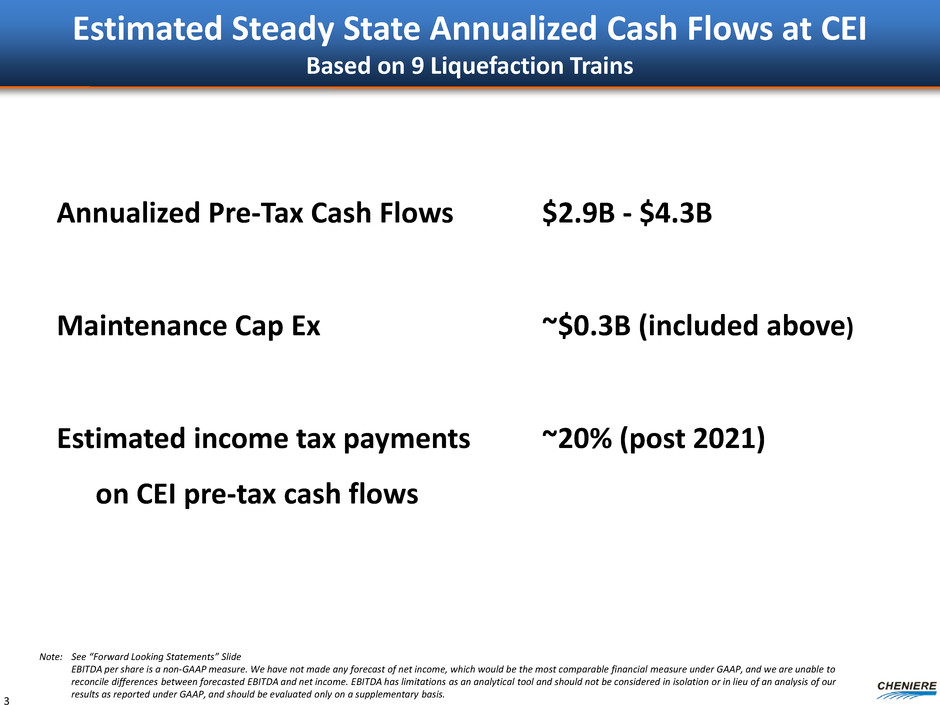

CEI EBITDA build up ($ in billions, except per unit amounts or unless otherwise noted) + SPL T6 SPL T1-6, CCL T1-3 CQH distributions(1) +$0.1 $0.6 CQP GP and IDR distributions +0.3 0.8 Management fees +0.0 0.1 CMI profit (after SPA payment) +0.2 - 0.6 0.5 - 1.8 CCL Trains 1-3 EBITDA – 2.0 CEI revenues +0.6 - 1.0 $4.0 - $5.3 Less: G&A – (0.2) CEI EBITDA +0.6 - 1.0 $3.7 - $5.1 Less: CCL project-level interest expense(2) – (0.7) CEI pre-tax cash flow(3) +0.6 - 1.0 $2.9 - $4.3 Estimated CEI Cash Flows SPL Trains 1-6, CCL Trains 1-3 15 $3.7 - $5.1 billion of EBITDA to CEI with SPL Trains 1-6, CCL Trains 1-3 Estimated income tax payments of ~20% of CEI pre-tax cash flow, projected to start in 2020/2021 Note: EBITDA is a non-GAAP measure. EBITDA is computed as total revenues less non-cash deferred revenues, operating expenses, assumed commissioning costs and state and local taxes. It does not include depreciation expenses and certain non-operating items. Because we have not forecasted depreciation expense and non-operating items, we have not made any forecast of net income, which would be the most directly comparable financial measure under generally accepted accounting principles, or GAAP, and we are unable to reconcile differences between forecasts of EBITDA and net income. EBITDA has limitations as an analytical tool and should not be considered in isolation or in lieu of an analysis of our results as reported under GAAP, and should be evaluated only on a supplementary basis. (1) Based on ~80% CEI ownership interest and after NOL exhaustion at CQH. (2) Assumes CCL project-level debt of ~$11.5 billion at 6.0% annual interest rate. (3) CEI pre-tax cash flow is a non-GAAP measure. It is computed as EBITDA, adjusted for the assumption of the conversion of all CEI and CCH convertible debt and includes annual estimate for development capital spend of ~$50 million. Because we have not forecasted depreciation expense and non-operating items, we have not made any forecast of net income, which would be the most directly comparable financial measure under generally accepted accounting principles, or GAAP, and we are unable to reconcile differences between forecasts of EBITDA and net income. EBITDA has limitations as an analytical tool and should not be considered in isolation or in lieu of an analysis of our results as reported under GAAP, and should be evaluated only on a supplementary basis.

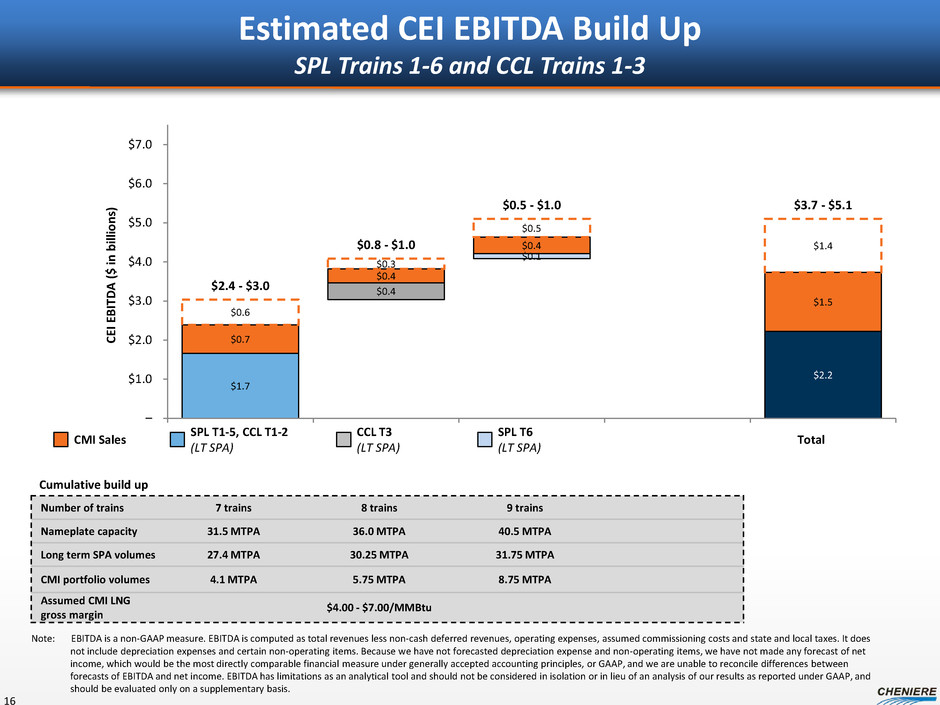

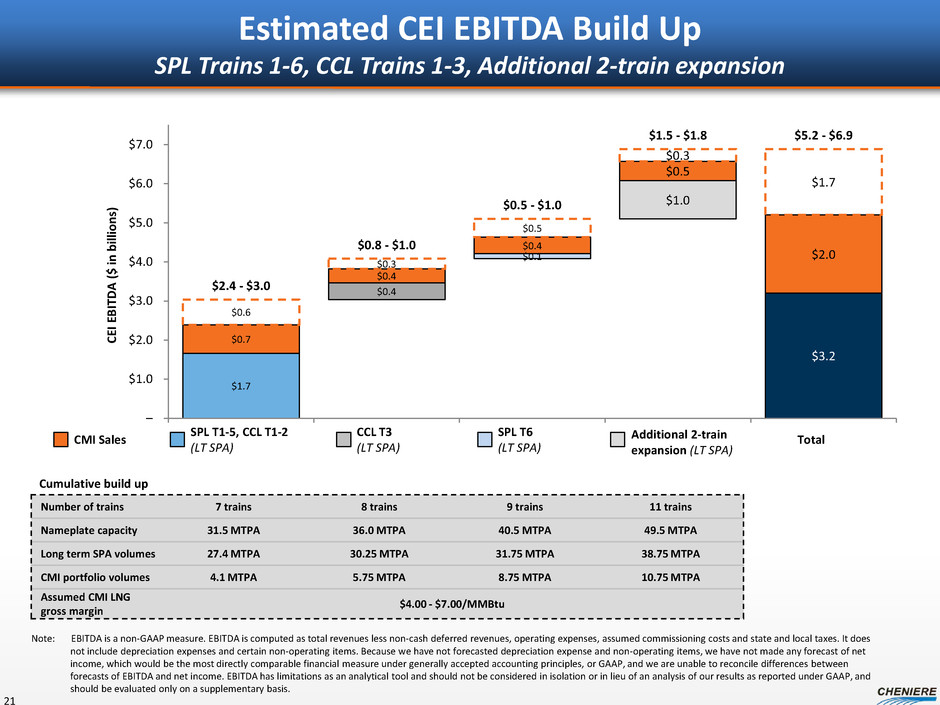

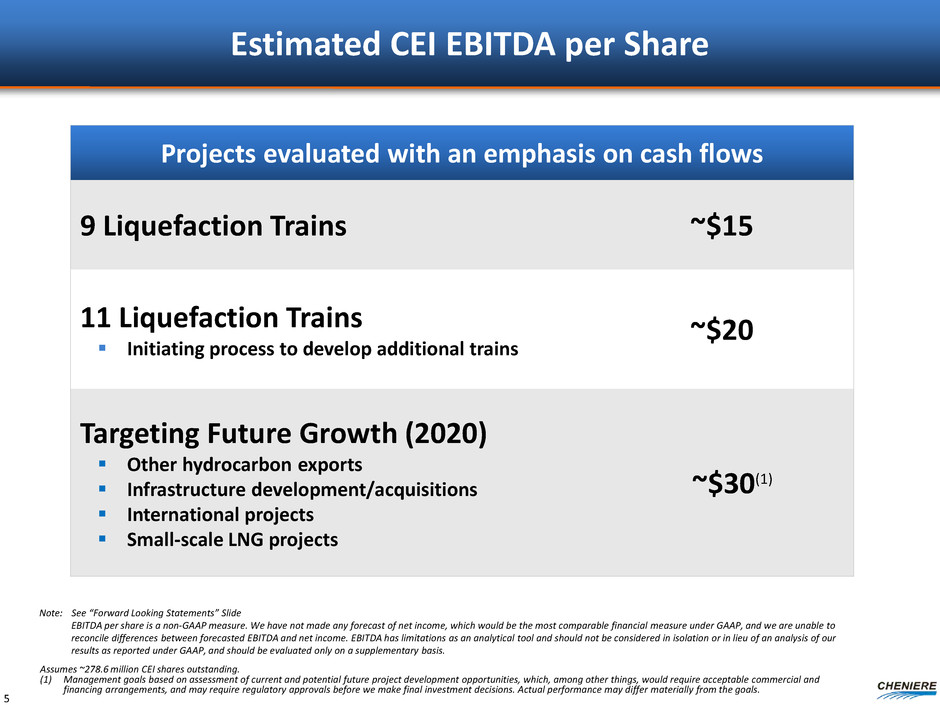

$1.7 $0.7 $0.6 $0.4 $0.4 $0.3 $0.1 $0.4 $0.5 $2.2 $1.5 $1.4 $2.4 - $3.0 $0.8 - $1.0 $0.5 - $1.0 $3.7 - $5.1 – $1.0 $2.0 $3.0 $4.0 $5.0 $6.0 $7.0 CE I E B IT D A ( $ in b ill io ns ) Estimated CEI EBITDA Build Up SPL Trains 1-6 and CCL Trains 1-3 16 Number of trains 7 trains 8 trains 9 trains Nameplate capacity 31.5 MTPA 36.0 MTPA 40.5 MTPA Long term SPA volumes 27.4 MTPA 30.25 MTPA 31.75 MTPA CMI portfolio volumes 4.1 MTPA 5.75 MTPA 8.75 MTPA Assumed CMI LNG gross margin $4.00 - $7.00/MMBtu Note: EBITDA is a non-GAAP measure. EBITDA is computed as total revenues less non-cash deferred revenues, operating expenses, assumed commissioning costs and state and local taxes. It does not include depreciation expenses and certain non-operating items. Because we have not forecasted depreciation expense and non-operating items, we have not made any forecast of net income, which would be the most directly comparable financial measure under generally accepted accounting principles, or GAAP, and we are unable to reconcile differences between forecasts of EBITDA and net income. EBITDA has limitations as an analytical tool and should not be considered in isolation or in lieu of an analysis of our results as reported under GAAP, and should be evaluated only on a supplementary basis. Cumulative build up CCL T3 (LT SPA) SPL T1-5, CCL T1-2 (LT SPA) SPL T6 (LT SPA) CMI Sales Total

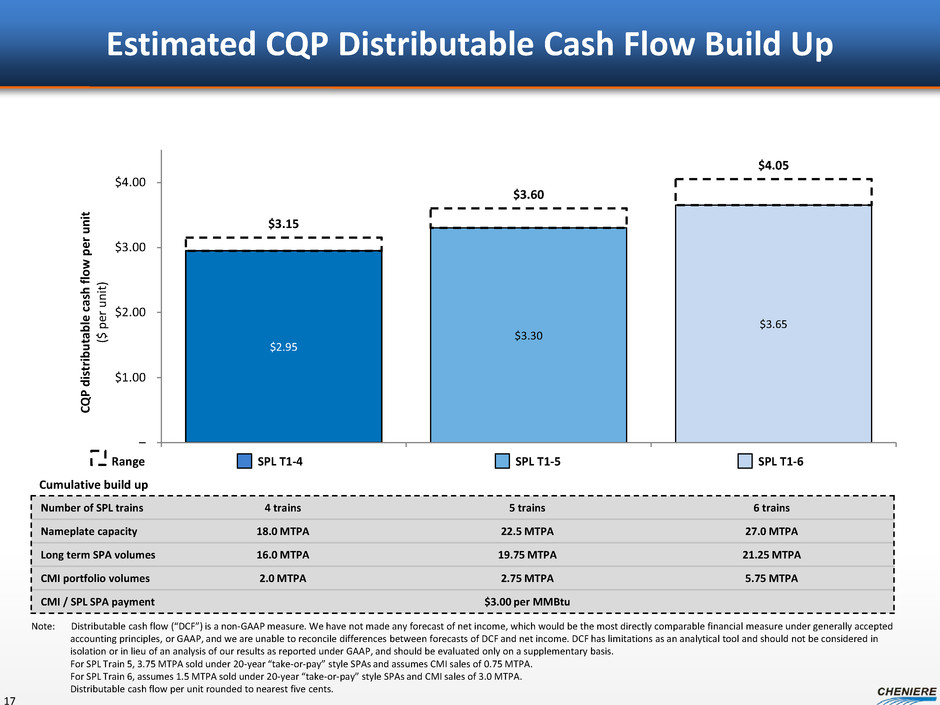

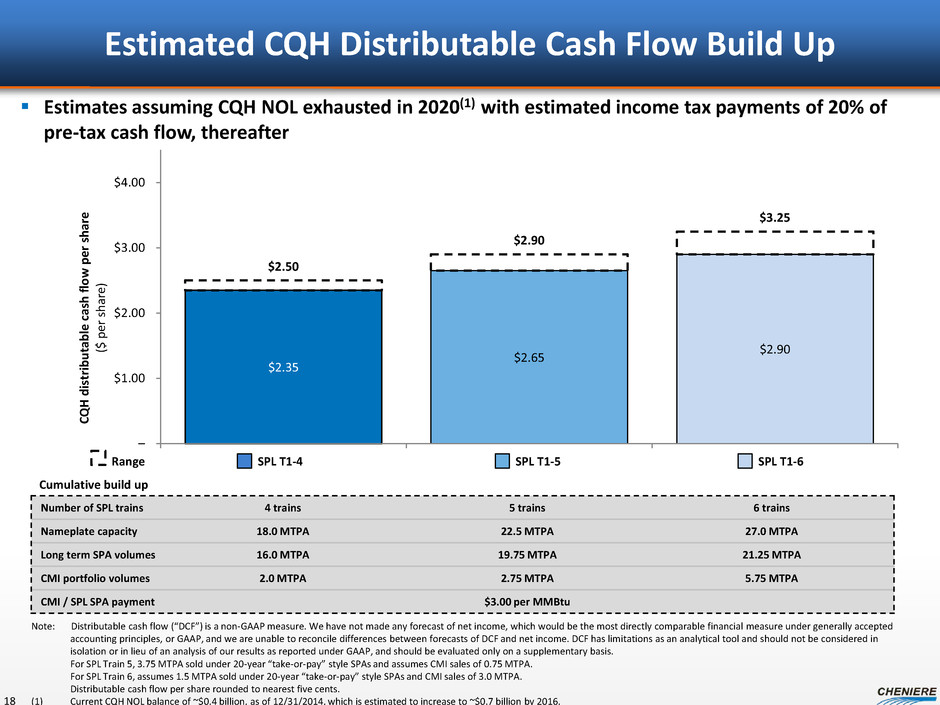

$2.95 $3.30 $3.65 $3.15 $3.60 $4.05 – $1.00 $2.00 $3.00 $4.00 CQ P di st ri bu ta bl e ca sh fl ow p er u ni t ($ p er u ni t) Estimated CQP Distributable Cash Flow Build Up 17 Note: Distributable cash flow (“DCF”) is a non-GAAP measure. We have not made any forecast of net income, which would be the most directly comparable financial measure under generally accepted accounting principles, or GAAP, and we are unable to reconcile differences between forecasts of DCF and net income. DCF has limitations as an analytical tool and should not be considered in isolation or in lieu of an analysis of our results as reported under GAAP, and should be evaluated only on a supplementary basis. For SPL Train 5, 3.75 MTPA sold under 20-year “take-or-pay” style SPAs and assumes CMI sales of 0.75 MTPA. For SPL Train 6, assumes 1.5 MTPA sold under 20-year “take-or-pay” style SPAs and CMI sales of 3.0 MTPA. Distributable cash flow per unit rounded to nearest five cents. Number of SPL trains 4 trains 5 trains 6 trains Nameplate capacity 18.0 MTPA 22.5 MTPA 27.0 MTPA Long term SPA volumes 16.0 MTPA 19.75 MTPA 21.25 MTPA CMI portfolio volumes 2.0 MTPA 2.75 MTPA 5.75 MTPA CMI / SPL SPA payment $3.00 per MMBtu Cumulative build up SPL T1-4 SPL T1-5 SPL T1-6 Range