UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2014

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File No. 001-16383

CHENIERE ENERGY, INC.

(Exact name of registrant as specified in its charter)

|

| |

Delaware | 95-4352386 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| |

700 Milam Street, Suite 1900 | |

Houston, Texas | 77002 |

(Address of principal executive offices) | (Zip code) |

Registrant’s telephone number, including area code: (713) 375-5000

Securities registered pursuant to Section 12(b) of the Act:

|

| |

Common Stock, $ 0.003 par value | NYSE MKT |

(Title of Class) | (Name of each exchange on which registered) |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| |

Large accelerated filer x | Accelerated filer ¨ |

Non-accelerated filer ¨ | Smaller reporting company ¨ |

(Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The aggregate market value of the registrant’s Common Stock held by non-affiliates of the registrant was approximately $16.2 billion as of June 30, 2014.

236,710,964 shares of the registrant’s Common Stock, $0.003 par value, were issued and outstanding as of January 29, 2015.

Documents incorporated by reference: The definitive proxy statement for the registrant’s Annual Meeting of Stockholders (to be filed within 120 days of the close of the registrant’s fiscal year) is incorporated by reference into Part III.

CHENIERE ENERGY, INC.

TABLE OF CONTENTS

CAUTIONARY STATEMENT

REGARDING FORWARD-LOOKING STATEMENTS

This annual report contains certain statements that are, or may be deemed to be, “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements, other than statements of historical facts, included herein or incorporated herein by reference are “forward-looking statements.” Included among “forward-looking statements” are, among other things:

| |

• | statements that we expect to commence or complete construction of our proposed liquefied natural gas (“LNG”) terminals, liquefaction facilities, pipeline facilities or other projects, or any expansions thereof, by certain dates, or at all; |

| |

• | statements regarding future levels of domestic and international natural gas production, supply or consumption or future levels of LNG imports into or exports from North America and other countries worldwide or purchases of natural gas, regardless of the source of such information, or the transportation or other infrastructure or demand for and prices related to natural gas, LNG or other hydrocarbon products; |

| |

• | statements regarding any financing transactions or arrangements, or ability to enter into such transactions; |

| |

• | statements relating to the construction of our natural gas liquefaction trains (“Trains”), including statements concerning the engagement of any engineering, procurement and construction (“EPC”) contractor or other contractor and the anticipated terms and provisions of any agreement with any EPC or other contractor, and anticipated costs related thereto; |

| |

• | statements regarding any agreement to be entered into or performed substantially in the future, including any revenues anticipated to be received and the anticipated timing thereof, and statements regarding the amounts of total LNG regasification, liquefaction or storage capacities that are, or may become, subject to contracts; |

| |

• | statements regarding counterparties to our commercial contracts, construction contracts and other contracts; |

| |

• | statements regarding our planned construction of additional Trains, including the financing of such Trains; |

| |

• | statements that our Trains, when completed, will have certain characteristics, including amounts of liquefaction capacities; |

| |

• | statements regarding our business strategy, our strengths, our business and operation plans or any other plans, forecasts, projections or objectives, including anticipated revenues and capital expenditures, any or all of which are subject to change; |

| |

• | statements regarding legislative, governmental, regulatory, administrative or other public body actions, approvals, requirements, permits, applications, filings, investigations, proceedings or decisions; |

| |

• | statements regarding our anticipated LNG and natural gas marketing activities; and |

| |

• | any other statements that relate to non-historical or future information. |

All of these types of statements, other than statements of historical fact, are forward-looking statements. In some cases, forward-looking statements can be identified by terminology such as “may,” “will,” “could,” “should,” “expect,” “plan,” “project,” “intend,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “pursue,” “target,” “continue,” the negative of such terms or other comparable terminology. The forward-looking statements contained in this annual report are largely based on our expectations, which reflect estimates and assumptions made by our management. These estimates and assumptions reflect our best judgment based on currently known market conditions and other factors. Although we believe that such estimates are reasonable, they are inherently uncertain and involve a number of risks and uncertainties beyond our control. In addition, assumptions may prove to be inaccurate. We caution that the forward-looking statements contained in this annual report are not guarantees of future performance and that such statements may not be realized or the forward-looking statements or events may not occur. Actual results may differ materially from those anticipated or implied in forward-looking statements due to factors described in this annual report and in the other reports and other information that we file with the Securities and Exchange Commission (“SEC”). These forward-looking statements speak only as of the date made, and other than as required by law, we undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

DEFINITIONS

As commonly used in the liquefied natural gas industry, to the extent applicable, and as used in this annual report, the following terms have the following meanings:

| |

• | Bcf/d means billion cubic feet per day; |

| |

• | Bcf/yr means billion cubic feet per year; |

| |

• | Bcfe means billion cubic feet equivalent; |

| |

• | Dthd means dekatherms per day; |

| |

• | EPC means engineering, procurement and construction; |

| |

• | Henry Hub means the final settlement price (in USD per MMBtu) for the New York Mercantile Exchange’s Henry Hub natural gas futures contract for the month in which a relevant cargo’s delivery window is scheduled to begin; |

| |

• | LNG means liquefied natural gas, a product of natural gas consisting primarily of methane (CH4) that is in liquid form at near atmospheric pressure; |

| |

• | MMBtu means million British thermal units, an energy unit; |

| |

• | MMBtu/d means million British thermal units per day; |

| |

• | MMBtu/yr means million British thermal units per year; |

| |

• | mtpa means million metric tonnes per annum; |

| |

• | SPA means an LNG sale and purchase agreement; |

| |

• | Tcf means trillion cubic feet; |

| |

• | Tcf/yr means trillion cubic feet per year; |

| |

• | Train means a compressor train used in the industrial process to convert natural gas into LNG; and |

| |

• | TUA means terminal use agreement. |

PART I

| |

ITEMS 1. AND 2. | BUSINESS AND PROPERTIES |

General

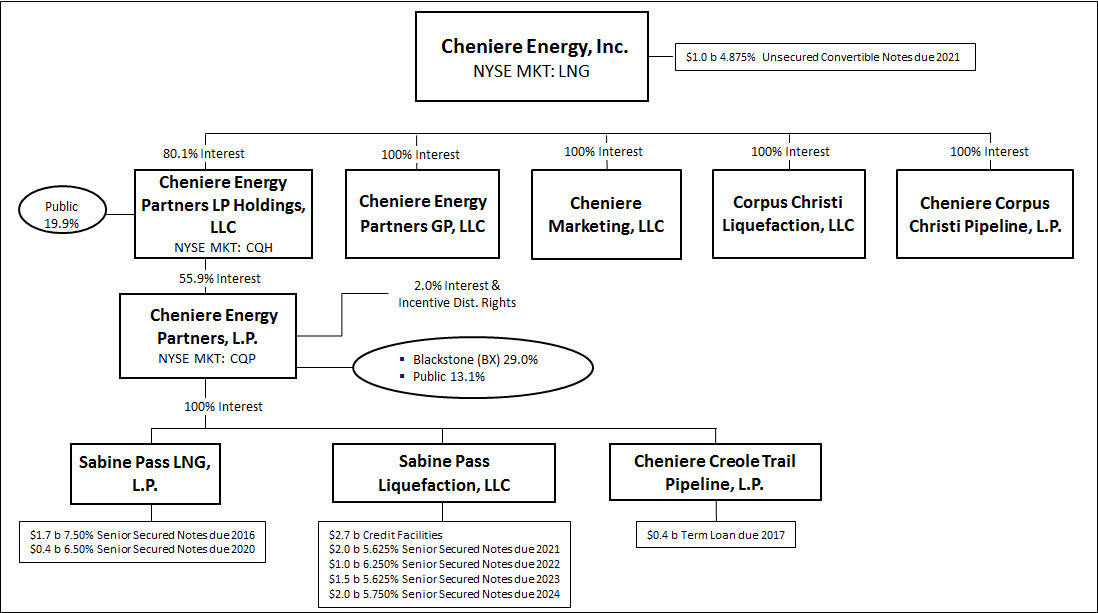

Cheniere Energy, Inc. (NYSE MKT: LNG), a Delaware corporation, is a Houston-based energy company primarily engaged in LNG-related businesses. We own and operate the Sabine Pass LNG terminal in Louisiana through our ownership interest in and management agreements with Cheniere Energy Partners, L.P. (“Cheniere Partners”) (NYSE MKT: CQP), which is a publicly traded limited partnership that we created in 2007. We own 100% of the general partner interest in Cheniere Partners and 80.1% of Cheniere Energy Partners LP Holdings, LLC (“Cheniere Holdings”) (NYSE MKT: CQH), which is a publicly traded limited liability company formed in 2013 that owns a 55.9% limited partner interest in Cheniere Partners.

The Sabine Pass LNG terminal is located on the Sabine Pass deepwater shipping channel less than four miles from the Gulf Coast. The Sabine Pass LNG terminal has operational regasification facilities owned by Cheniere Partners’ wholly owned subsidiary, Sabine Pass LNG, L.P. (“Sabine Pass LNG”), that includes existing infrastructure of five LNG storage tanks with capacity of approximately 16.9 Bcfe, two docks that can accommodate vessels with nominal capacity of up to 266,000 cubic meters and vaporizers with regasification capacity of approximately 4.0 Bcf/d. Cheniere Partners is developing and constructing natural gas liquefaction facilities (the “Sabine Pass Liquefaction Project”) at the Sabine Pass LNG terminal adjacent to the existing regasification facilities through a wholly owned subsidiary, Sabine Pass Liquefaction, LLC (“Sabine Pass Liquefaction”). Cheniere Partners plans to construct up to six Trains, which are in various stages of development. Each Train is expected to have a nominal production capacity of approximately 4.5 mtpa of LNG. Cheniere Partners also owns the 94-mile Creole Trail Pipeline through a wholly owned subsidiary, Cheniere Creole Trail Pipeline, L.P. (“CTPL”), which interconnects the Sabine Pass LNG terminal with a number of large interstate pipelines.

We are developing a second natural gas liquefaction and export facility and related pipeline near Corpus Christi, Texas (the “Corpus Christi Liquefaction Project”) through wholly owned subsidiaries Corpus Christi Liquefaction, LLC (“Corpus Christi Liquefaction”) and Cheniere Corpus Christi Pipeline, L.P. (“Cheniere Corpus Christi Pipeline”), respectively. As currently contemplated, the Corpus Christi LNG terminal would be designed for up to three Trains, with expected aggregate nominal production capacity of approximately 13.5 mtpa of LNG, three LNG storage tanks with capacity of approximately 10.1 Bcfe and two docks that can accommodate vessels with nominal capacity of up to 266,000 cubic meters. The Corpus Christi Liquefaction Project also would include a 23-mile pipeline that would interconnect the Corpus Christi LNG terminal with several interstate and intrastate natural gas pipelines (the “Corpus Christi Pipeline”).

One of our subsidiaries, Cheniere Marketing, LLC (“Cheniere Marketing”), is engaged in the LNG and natural gas marketing business and is seeking to develop a portfolio of long-term, short-term and spot SPAs. Cheniere Marketing has entered into SPAs with Sabine Pass Liquefaction and Corpus Christi Liquefaction to purchase LNG produced by the Sabine Pass Liquefaction Project and the Corpus Christi Liquefaction Project.

We are also in various stages of developing other projects, which, among other things, will require acceptable commercial and financing arrangements before we make a final investment decision.

LNG is natural gas that, through a refrigeration process, has been cooled to a liquid state, which occupies a volume that is approximately 1/600th of its gaseous state. The liquefaction of natural gas into LNG allows it to be shipped economically from areas of the world where natural gas is abundant and inexpensive to produce to other areas where natural gas demand and infrastructure exist to justify economically the use of LNG. LNG is transported using large oceangoing LNG tankers specifically constructed for this purpose. LNG regasification facilities offload LNG from LNG tankers, store the LNG prior to processing, heat the LNG to return it to a gaseous state and deliver the resulting natural gas into pipelines for transportation to market.

Unless the context requires otherwise, references to the “Company,” “Cheniere,” “we,” “us” and “our” refer to Cheniere Energy, Inc. and its subsidiaries, including Cheniere Holdings and Cheniere Partners.

Although results are consolidated for financial reporting, we, Cheniere Holdings and Cheniere Partners operate with independent capital structures. The following diagram depicts our abbreviated capital structure, including our ownership of Cheniere Holdings, Cheniere Partners, Sabine Pass LNG, Sabine Pass Liquefaction, CTPL, Corpus Christi Liquefaction and Cheniere Corpus Christi Pipeline as of January 31, 2015:

Our Business Strategy

Our primary business strategy is to develop energy and infrastructure assets with a focus on integrating the U.S. energy market, where supplies are abundant and inexpensive to produce, with international markets, where existing energy supplies are either uncompetitive or insufficient to satisfy growing demand. We plan to implement our strategy by:

| |

• | completing construction and commencing operation of Sabine Pass Liquefaction’s Trains; |

| |

• | obtaining the requisite regulatory permits, long-term commercial contracts and financing to reach a final investment decision regarding the Corpus Christi Liquefaction Project; |

| |

• | safely, efficiently and reliably maintaining and operating our assets; |

| |

• | developing business relationships for the marketing of additional long-term and short-term agreements for Cheniere Marketing’s LNG volumes or additional LNG liquefaction projects or expansions; |

| |

• | expanding our existing asset base through acquisitions or development of complementary businesses or assets across the energy value chain; and |

| |

• | maintaining a flexible capital structure to finance the acquisition, development, construction and operation of the energy assets needed to supply our customers. |

Business Segments

Our business activities are conducted by two operating segments for which we provide information in our consolidated financial statements for the years ended December 31, 2014, 2013 and 2012. These two segments are our:

| |

• | LNG terminal business; and |

| |

• | LNG and natural gas marketing business. |

LNG Terminal Business

We began developing our LNG terminal business in 1999 and were among the first companies to secure sites and commence development of new LNG terminals in North America. We are currently focusing our development efforts on two LNG terminal projects: the Sabine Pass LNG terminal in western Cameron Parish, Louisiana, less than four miles from the Gulf Coast on the deepwater ship channel; and the Corpus Christi LNG terminal near Corpus Christi, Texas. We have constructed and are operating regasification facilities at the Sabine Pass LNG terminal and are developing and constructing the Sabine Pass Liquefaction Project, which is owned through Cheniere Partners. We own 100% of the general partner interest in Cheniere Partners and 80.1% of Cheniere Holdings, which owns a 55.9% limited partner interest in Cheniere Partners. We currently own a 100% interest in the Corpus Christi Liquefaction Project.

Sabine Pass LNG Terminal

Regasification Facilities

The Sabine Pass LNG terminal has operational regasification capacity of approximately 4.0 Bcf/d and aggregate LNG storage capacity of approximately 16.9 Bcfe. Approximately 2.0 Bcf/d of the regasification capacity at the Sabine Pass LNG terminal has been reserved under two long-term third-party TUAs, under which Sabine Pass LNG’s customers are required to pay fixed monthly fees, whether or not they use the LNG terminal. Each of Total Gas & Power North America, Inc. (“Total”) and Chevron U.S.A. Inc. (“Chevron”) has reserved approximately 1.0 Bcf/d of regasification capacity and is obligated to make monthly capacity payments to Sabine Pass LNG aggregating approximately $125 million annually for 20 years that commenced in 2009. Total S.A. has guaranteed Total’s obligations under its TUA up to $2.5 billion, subject to certain exceptions, and Chevron Corporation has guaranteed Chevron’s obligations under its TUA up to 80% of the fees payable by Chevron.

The remaining approximately 2.0 Bcf/d of capacity has been reserved under a TUA by Sabine Pass Liquefaction. Sabine Pass Liquefaction is obligated to make monthly capacity payments to Sabine Pass LNG aggregating approximately $250 million annually, continuing until at least 20 years after Sabine Pass Liquefaction delivers its first commercial cargo at the Sabine Pass Liquefaction Project, which may occur as early as late 2015. In September 2012, Sabine Pass Liquefaction entered into a partial TUA assignment agreement with Total, whereby Sabine Pass Liquefaction will progressively gain access to Total’s capacity and other services provided under Total’s TUA with Sabine Pass LNG. This agreement will provide Sabine Pass Liquefaction with additional berthing and storage capacity at the Sabine Pass LNG terminal that may be used to accommodate the development of Trains 5 and 6, provide increased flexibility in managing LNG cargo loading and unloading activity starting with the commencement of commercial operations of Train 3, and permit Sabine Pass Liquefaction to more flexibly manage its LNG storage capacity with the commencement of Train 1. Notwithstanding any arrangements between Total and Sabine Pass Liquefaction, payments required to be made by Total to Sabine Pass LNG will continue to be made by Total to Sabine Pass LNG in accordance with its TUA.

Under each of these TUAs, Sabine Pass LNG is entitled to retain 2% of the LNG delivered to the Sabine Pass LNG terminal.

Liquefaction Facilities

The Sabine Pass Liquefaction Project is being developed and constructed at the Sabine Pass LNG terminal adjacent to the existing regasification facilities. We have received authorization from the Federal Energy Regulatory Commission (the “FERC”) to site, construct and operate Trains 1 through 4. We commenced construction of Trains 1 and 2 and the related new facilities needed to treat, liquefy, store and export natural gas in August 2012. Construction of Trains 3 and 4 and the related facilities commenced in May 2013. On September 30, 2013, we filed an application with the FERC for the approval to site, construct and operate Trains 5 and 6.

The U.S. Department of Energy (the “DOE”) has authorized the export of up to a combined total of the equivalent of 16 mtpa (approximately 803 Bcf/yr) of domestically produced LNG by vessel from the Sabine Pass LNG terminal to countries with which the United States has a free trade agreement providing for national treatment for trade in natural gas (“FTA countries”) for a 30-year term, beginning on the earlier of the date of first export or September 7, 2020; and to all countries without a free trade agreement providing for national treatment for trade in natural gas and with which trade is permitted (“non-FTA countries”) for a 20-year term, beginning on the earlier of the date of first export or August 7, 2017. The DOE further issued an order authorizing Sabine Pass Liquefaction to export up to the equivalent of approximately 203 Bcf/yr of domestically produced LNG from the Sabine Pass LNG terminal to FTA countries for a 25-year period. Additionally, the DOE further issued orders authorizing Sabine Pass Liquefaction to export an additional 503.3 Bcf/yr in total of domestically produced LNG from the Sabine Pass LNG terminal to FTA countries for a 20-year term. Sabine Pass Liquefaction’s applications for authorization to export that same 503.3 Bcf/yr of domestically produced LNG from the Sabine Pass LNG terminal to non-FTA countries are currently pending at the DOE.

As of December 31, 2014, the overall project completion percentages for Trains 1 and 2 and Trains 3 and 4 of the Sabine Pass Liquefaction Project were approximately 81% and 54%, respectively, which are ahead of the contractual schedule. Based on our current construction schedule, we anticipate that Train 1 will produce LNG as early as late 2015, and Trains 2, 3 and 4 are expected to commence operations on a staggered basis thereafter.

Customers

Sabine Pass Liquefaction has entered into four fixed price, 20-year SPAs with third parties that in the aggregate equate to 16 mtpa (approximately 803 Bcf/yr) of LNG that commence with the date of first commercial delivery for Trains 1 through 4, which are fully permitted. In addition, Sabine Pass Liquefaction has entered into two fixed price, 20-year SPAs with third parties for another 3.75 mtpa of LNG that commence with the date of first commercial delivery for Train 5. However, Sabine Pass Liquefaction has not yet received regulatory approval for construction of Train 5. Under the SPAs, the customers will purchase LNG from Sabine Pass Liquefaction for a price consisting of a fixed fee plus 115% of Henry Hub per MMBtu of LNG. In certain circumstances, the customers may elect to cancel or suspend deliveries of LNG cargoes, in which case the customers would still be required to pay the fixed fee with respect to cargoes that are not delivered. A portion of the fixed fee will be subject to annual adjustment for inflation. The SPAs and contracted volumes to be made available under the SPAs are not tied to a specific Train; however, the term of each SPA commences upon the start of operations of the specified Train. As of December 31, 2014, Sabine Pass Liquefaction had the following third-party SPAs:

| |

• | BG Gulf Coast LNG, LLC (“BG”) has entered into an SPA that commences upon the date of first commercial delivery for Train 1 and includes an annual contract quantity of 182,500,000 MMBtu of LNG with a fixed fee of $2.25 per MMBtu |

and includes additional annual contract quantities of 36,500,000 MMBtu, 34,000,000 MMBtu, and 33,500,000 MMBtu upon the date of first commercial delivery for Trains 2, 3 and 4, respectively, with a fixed fee of $3.00 per MMBtu. The total expected annual contracted cash flow from BG from fixed fees is approximately $723 million. In addition, Sabine Pass Liquefaction has agreed to make up to 500,000 MMBtu/d of LNG available to BG to the extent that Train 1 becomes commercially operable prior to the beginning of the first delivery window with a fixed fee of $2.25 per MMBtu, if produced. The obligations of BG are guaranteed by BG Energy Holdings Limited, a company organized under the laws of England and Wales.

| |

• | Gas Natural Aprovisionamientos SDG S.A. (“Gas Natural Fenosa”) has entered into an SPA that commences upon the date of first commercial delivery for Train 2 and includes an annual contract quantity of 182,500,000 MMBtu of LNG with a fixed fee of $2.49 per MMBtu, equating to expected annual contracted cash flow from fixed fees of approximately $454 million. In addition, Sabine Pass Liquefaction has agreed to make up to 285,000 MMBtu/d of LNG available to Gas Natural Fenosa to the extent that Train 2 becomes commercially operable prior to the beginning of the first delivery window with a fixed fee of $2.49 per MMBtu, if produced. The obligations of Gas Natural Fenosa are guaranteed by Gas Natural SDG S.A., a company organized under the laws of Spain. |

| |

• | Korea Gas Corporation (“KOGAS”) has entered into an SPA that commences upon the date of first commercial delivery for Train 3 and includes an annual contract quantity of 182,500,000 MMBtu of LNG with a fixed fee of $3.00 per MMBtu, equating to expected annual contracted cash flow from fixed fees of approximately $548 million. KOGAS is organized under the laws of the Republic of Korea. |

| |

• | GAIL (India) Limited (“GAIL”) has entered into an SPA that commences upon the date of first commercial delivery for Train 4 and includes an annual contract quantity of 182,500,000 MMBtu of LNG with a fixed fee of $3.00 per MMBtu, equating to expected annual contracted cash flow from fixed fees of approximately $548 million. GAIL is organized under the laws of India. |

| |

• | Total has entered into an SPA that commences upon the date of first commercial delivery for Train 5 and includes an annual contract quantity of 104,750,000 MMBtu of LNG with a fixed fee of $3.00 per MMBtu, equating to expected annual contracted cash flow from fixed fees of approximately $314 million. The obligations of Total are guaranteed by Total S.A., a company organized under the laws of France. |

| |

• | Centrica plc (“Centrica”) has entered into an SPA that commences upon the date of first commercial delivery for Train 5 and includes an annual contract quantity of 91,250,000 MMBtu of LNG with a fixed fee of $3.00 per MMBtu, equating to expected annual contracted cash flow from fixed fees of approximately $274 million. Centrica is organized under the laws of England and Wales. |

In aggregate, the fixed fee portion to be paid by these customers is approximately $2.3 billion annually for Trains 1 through 4, and $2.9 billion annually if we make a positive final investment decision with respect to Train 5, with the applicable fixed fees starting from the commencement of commercial operations of the applicable Train. These fixed fees equal approximately $411 million, $564 million, $650 million, $648 million and $588 million for each of Trains 1 through 5, respectively. The Total and Centrica SPAs contain certain conditions precedent, including, but not limited to, receiving regulatory approvals, securing necessary financing arrangements and making a final investment decision with respect to Train 5, which must be satisfied by June 30, 2015 or either party to the respective SPA may terminate its SPA.

In addition, Cheniere Marketing has entered into an amended and restated SPA (the “Cheniere Marketing SPA”) with Sabine Pass Liquefaction to purchase, at Cheniere Marketing’s option, any LNG produced by Sabine Pass Liquefaction in excess of that required for other customers at a price of 115% of Henry Hub plus $3.00 per MMBtu of LNG.

Natural Gas Transportation and Supply

For Sabine Pass Liquefaction’s natural gas feedstock transportation requirements, it has entered into transportation precedent agreements to secure firm pipeline transportation capacity with CTPL and third-party pipeline companies. Sabine Pass Liquefaction has also entered into enabling agreements and long-term natural gas purchase agreements with third parties in order to secure natural gas feedstock for the Sabine Pass Liquefaction Project. As of December 31, 2014, we have secured up to approximately 2,162,000,000 MMBtu of natural gas feedstock through long-term natural gas purchase agreements.

Construction

Trains 1 through 4 are being designed, constructed and commissioned by Bechtel Oil, Gas and Chemicals, Inc. (“Bechtel”).

Sabine Pass Liquefaction entered into lump sum turnkey contracts with Bechtel for the engineering, procurement and construction of Train 1 and Train 2 (the “EPC Contract (Trains 1 and 2)”) and Train 3 and Train 4 (the “EPC Contract (Trains 3 and 4)”) under which Bechtel charges a lump sum for all work performed and generally bears project cost risk unless certain specified events occur, in which case Bechtel may cause Sabine Pass Liquefaction to enter into a change order, or Sabine Pass Liquefaction agrees with Bechtel to a change order.

The total contract price of the EPC Contract (Trains 1 and 2) and the total contract price of the EPC Contract (Trains 3 and 4) are approximately $4.1 billion and $3.8 billion, respectively, reflecting amounts incurred under change orders through December 31, 2014. Total expected capital costs for Trains 1 through 4 are estimated to be between $9.0 billion and $10.0 billion before financing costs, and between $12.0 billion and $13.0 billion after financing costs, including, in each case, estimated owner’s costs and contingencies.

Final Investment Decision on Train 5 and Train 6

We will contemplate making a final investment decision to commence construction of Train 5 and Train 6 of the Sabine Pass Liquefaction Project based upon, among other things, entering into an EPC contract, entering into acceptable commercial arrangements, receiving regulatory authorizations and obtaining adequate financing to construct the Trains.

Pipeline Facilities

CTPL owns the Creole Trail Pipeline, a 94-mile pipeline interconnecting the Sabine Pass LNG terminal with a number of large interstate pipelines. In December 2013, CTPL began construction of certain modifications to allow the Creole Trail Pipeline to be able to transport natural gas to the Sabine Pass LNG terminal. Cheniere Partners estimates that the capital costs to modify the Creole Trail Pipeline will be approximately $105 million. The modifications are expected to be in service in time for the commissioning and testing of Trains 1 and 2.

Corpus Christi LNG Terminal

Liquefaction Facilities

In September 2011, we formed Corpus Christi Liquefaction to develop a natural gas liquefaction facility near Corpus Christi, Texas on over 1,000 acres of land that we own or control. As currently contemplated, the Corpus Christi liquefaction facilities would be designed for up to three Trains, with expected aggregate nominal production capacity of approximately 13.5 mtpa of LNG, three LNG storage tanks with capacity of approximately 10.1 Bcfe and two docks that can accommodate vessels with nominal capacity of up to 266,000 cubic meters (the “Corpus Christi Liquefaction Facilities”).

On December 30, 2014, the FERC issued an order granting Corpus Christi Liquefaction authorization under Section 3 of the Natural Gas Act of 1938, as amended (“NGA”), to site, construct and operate Trains 1 through 3. The Sierra Club has requested a rehearing, and the FERC has not ruled on this request. In August 2012, Cheniere Marketing filed an application with the DOE to export up to the equivalent of 15 mtpa (approximately 767 Bcf/yr) of domestically produced LNG to FTA and non-FTA countries from the Corpus Christi Liquefaction Project. In October 2012, the DOE granted Cheniere Marketing authority to export up to the equivalent of 15 mtpa (approximately 767 Bcf/yr) of domestically produced LNG to FTA countries from the Corpus Christi Liquefaction Project. Corpus Christi Liquefaction was added as an additional authorization holder to the FTA permit and an additional applicant to the non-FTA application.

Customers

Corpus Christi Liquefaction has entered into nine fixed price, 20-year SPAs with seven third parties with aggregate annual contract quantities of approximately 8.4 mtpa of LNG. However, the Corpus Christi Liquefaction Project is not yet fully permitted. Under these SPAs, the customers will purchase LNG from Corpus Christi Liquefaction for a price consisting of a fixed fee of $3.50 plus 115% of Henry Hub per MMBtu of LNG. In certain circumstances, the customers may elect to cancel or suspend deliveries of LNG cargoes, in which case the customers would still be required to pay the fixed fee with respect to cargoes that are not delivered. A portion of the fixed fee will be subject to annual adjustment for inflation. The SPAs and contracted volumes to be made available under the SPAs are not tied to a specific Train; however, the term of each SPA commences upon the start of operations of the specified Train. As of December 31, 2014, Corpus Christi Liquefaction had the following third-party SPAs:

| |

• | Endesa Generación, S.A. (which subsequently assigned its SPA to Endesa S.A.) and Endesa S.A. (together, “Endesa”) have each entered into SPAs that commence upon the date of first commercial delivery for Train 1 and include an aggregate annual contract quantity of 117,322,500 MMBtu of LNG, equating to expected annual contracted cash flow from fixed fees of approximately $411 million. Endesa is organized under the laws of Spain. |

| |

• | Iberdrola S.A. (“Iberdrola”) has entered into an SPA that commences upon the date of first commercial delivery for Train 2 and includes an annual contract quantity of 39,670,000 MMBtu of LNG, equating to expected annual contracted cash flow from fixed fees of approximately $139 million. In addition, Corpus Christi Liquefaction will provide Iberdrola with bridging volumes of 19,840,000 MMBtu per contract year, starting on the date on which Train 1 of the Corpus Christi Liquefaction Project becomes commercially operable and ending on the date of the first commercial delivery of LNG from Train 2 of the Corpus Christi Liquefaction Project. Iberdrola is organized under the laws of Spain. |

| |

• | Gas Natural Fenosa LNG SL (“Gas Natural Fenosa LNG”) has entered into an SPA that commences upon the date of first commercial delivery for Train 2 and includes an annual contract quantity of 78,215,000 MMBtu of LNG, equating to expected annual contracted cash flow from fixed fees of approximately $274 million. Gas Natural Fenosa LNG is organized under the laws of Spain. |

| |

• | Woodside Energy Trading Singapore Pte Ltd (“Woodside”) has entered into an SPA that commences upon the date of first commercial delivery for Train 2 and includes an annual contract quantity of 44,120,000 MMBtu of LNG, equating to expected annual contracted cash flow from fixed fees of approximately $154 million. Woodside is organized under the laws of Singapore. |

| |

• | PT Pertamina (Persero) (“Pertamina”) has entered into two SPAs that commence upon the date of first commercial delivery for Trains 1 and 2, respectively, that include an annual contract quantity of 39,680,000 MMBtu of LNG from each Train, equating to expected aggregate annual contracted cash flow from fixed fees of approximately $278 million for each Train. Pertamina is organized under the laws of Indonesia. |

| |

• | Électricité de France, S.A. (“EDF”) has entered into an SPA that commences upon the date of first commercial delivery for Train 3 and includes an annual contract quantity of 40,000,000 MMBtu of LNG, equating to expected annual contracted cash flow from fixed fees of approximately $140 million. In addition, Corpus Christi Liquefaction will provide EDF with bridging volumes of 20,000,000 MMBtu per contract year, starting on the date on which Train 2 of the Corpus Christi Liquefaction Project becomes commercially operable and ending on the date of the first commercial delivery of LNG from Train 3 of the Corpus Christi Liquefaction Project. EDF is organized under the laws of France. |

| |

• | EDP Energias de Portugal S.A. (“EDP”) has entered into an SPA that commences upon the date of first commercial delivery for Train 3 and includes an annual contract quantity of 40,000,000 MMBtu of LNG, equating to expected annual contracted cash flow from fixed fees of approximately $140 million. EDP is organized under the laws of Portugal. |

Each of the SPAs contain certain conditions precedent, including, but not limited to, receiving regulatory approvals, securing necessary financing arrangements and making a final investment decision, which must be satisfied by June 30, 2015 or either party to each SPA may terminate its SPA.

Expected annual contracted cash flow from fixed fees is approximately $1.5 billion if we make a positive final investment decision with respect to Trains 1 through 3, with the applicable fixed fees starting from the commencement of commercial operations of the applicable Train. These fixed fees equal approximately $550 million, $706 million and $280 million for each of Trains 1 through 3, respectively.

Natural Gas Transportation and Supply

For Corpus Christi Liquefaction’s natural gas feedstock transportation requirements, it has entered into transportation precedent agreements to secure firm pipeline transportation capacity with third-party pipeline companies and Cheniere Corpus Christi Pipeline. Corpus Christi Liquefaction has also entered into enabling agreements with third parties and will continue to enter into such agreements in order to secure natural gas feedstock for the Corpus Christi Liquefaction Project.

Construction

In December 2013, Corpus Christi Liquefaction entered into contracts with Bechtel for the engineering, procurement and construction of Trains and related facilities for the Corpus Christi Liquefaction Project under which Bechtel charges a lump sum for all work performed and generally bears project cost risk unless certain specified events occur, in which case Bechtel may cause

Corpus Christi Liquefaction to enter into a change order, or Corpus Christi Liquefaction agrees with Bechtel to a change order. The Corpus Christi Liquefaction stage 1 EPC contract (the “Stage 1 EPC Contract”) with Bechtel includes two Trains, two LNG storage tanks, one complete berth and a second partial berth. The Corpus Christi Liquefaction stage 2 EPC contract (the “Stage 2 EPC Contract”) with Bechtel includes one Train, one additional LNG storage tank and completion of the second berth. The contract price for the Stage 1 EPC contract is approximately $7.1 billion, and the contract price for the Stage 2 EPC contract is approximately $2.4 billion. Total expected costs for the three Trains and the related facilities, excluding pipeline facilities, are estimated to be between $11.5 billion and $12.0 billion before financing costs, including an estimate for owner’s costs and contingencies.

Pipeline Facilities

On December 30, 2014, the FERC issued a certificate of public convenience and necessity under Section 7(c) of the NGA authorizing Cheniere Corpus Christi Pipeline to construct and operate the Corpus Christi Pipeline. The Corpus Christi Pipeline is designed to transport 2.25 Bcf/d of feed and fuel gas required by the Corpus Christi Liquefaction Project from the existing natural gas pipeline grid.

Final Investment Decision

We will contemplate making a final investment decision to commence construction of the Corpus Christi Liquefaction Project based upon, among other things, entering into acceptable commercial arrangements, receiving regulatory authorizations and obtaining adequate financing to construct the facility.

Sabine Pass Liquefaction Project and Corpus Christi Liquefaction Project Summaries

The following table summarizes significant milestones and anticipated completion dates in the development of the Sabine Pass Liquefaction Project and the Corpus Christi Liquefaction Project:

|

| | | | | | |

| | | | | | |

| | Target Date |

| | Sabine Pass Liquefaction | | Corpus Christi Liquefaction |

Milestone | | Trains 1 - 4 | | Trains 5 & 6 | | Trains

1 - 3 |

DOE export authorization | | Received | | Received FTA Pending Non-FTA | | Received FTA; Pending Non-FTA |

Definitive commercial agreements | | Completed 16.0 mtpa | | T5: Completed T6: 2015 | | T1-T2: Completed T3: 2015 |

- BG Gulf Coast LNG, LLC | | 5.5 mtpa | | | | |

- Gas Natural Fenosa | | 3.5 mtpa | | | | |

- KOGAS | | 3.5 mtpa | | | | |

- GAIL (India) Ltd. | | 3.5 mtpa | | | | |

- Total Gas & Power N.A. | | | | 2.0 mtpa | | |

- Centrica plc | | | | 1.75 mtpa | | |

- PT Pertamina (Persero) | | | | | | 1.52 mtpa |

- Endesa, S.A. | | | | | | 2.25 mtpa |

- Iberdrola, S.A. | | | | | | 0.76 mtpa |

- Gas Natural Fenosa LNG SL | | | | | | 1.50 mtpa |

- Woodside Energy Trading Singapore | | | | | | 0.85 mtpa |

- Électricité de France, S.A. | | | | | | 0.77 mtpa |

- EDP Energias de Portugal S.A. | | | | | | 0.77 mtpa |

EPC contract | | Completed | | 2015 | | Completed |

Financing | | Completed | | 2015 | | 2015 |

- Equity commitments | | | | | | Received |

- Debt commitments | | | | | | Received |

FERC authorization | | Completed | | | | |

- FERC Order | | | | 2015 | | Received |

- Certificate to commence construction | | | | 2015 | | 2015 |

Issue Notice to Proceed | | Completed | | 2015 | | 2015 |

Commence operations | | 2015 - 2017 | | 2018/2019 | | 2018/2019 |

Competition

Sabine Pass LNG currently does not experience competition for its terminal capacity because the entire approximately 4.0 Bcf/d of regasification capacity that is available at the Sabine Pass LNG terminal has been fully contracted. If and when Sabine Pass LNG has to replace any TUAs, it will compete with other then-existing LNG terminals for customers.

The Sabine Pass Liquefaction Project currently does not experience competition with respect to Trains 1 through 5. Sabine Pass Liquefaction has entered into six fixed price, 20-year SPAs with third parties that will utilize substantially all of the liquefaction capacity available from these Trains. The Corpus Christi Liquefaction Project currently does not experience competition with respect to Trains 1 and 2. Corpus Christi Liquefaction has entered into eight fixed price, 20-year SPAs with seven third parties that will utilize a substantial majority of the liquefaction capacity available from these Trains. Each customer will be required to pay an escalating fixed fee for its annual contract quantity even if it elects not to purchase any LNG from us.

If and when Sabine Pass Liquefaction or Corpus Christi Liquefaction needs to replace any existing SPA or enter into new SPAs, they will compete on the basis of price per contracted volume of LNG with each other and other natural gas liquefaction projects throughout the world. Revenues associated with any incremental volumes, including those under the Cheniere Marketing SPAs discussed above, will also be subject to market-based price competition. Many of the companies with which we compete

are major energy corporations with longer operating histories, more development experience, greater name recognition, greater financial, technical and marketing resources and greater access to markets than us.

CTPL currently does not experience competition for its pipeline capacity because it is fully contracted with Sabine Pass Liquefaction. Corpus Christi Liquefaction has committed to all capacity on the Corpus Christi Pipeline. If and when we have to replace any of our contracted pipeline capacity, we will compete with other interstate and/or intrastate pipelines that may connect with our LNG terminals.

Governmental Regulation

Our LNG terminals are subject to extensive regulation under federal, state and local statutes, rules, regulations and laws. These laws require that we engage in consultations with appropriate federal and state agencies and that we obtain and maintain applicable permits and other authorizations. This regulatory requirement increases our cost of operations and construction, and failure to comply with such laws could result in substantial penalties.

Federal Energy Regulatory Commission

The design, construction and operation of our proposed liquefaction facilities, the export of LNG and the transportation of natural gas through the Creole Trail Pipeline and the Corpus Christi Pipeline are highly regulated activities. In order to site and construct our LNG terminals, we need to obtain and maintain authorizations from the FERC under Section 3 of the NGA. The FERC’s approval under Section 3 of the NGA, as well as several other material governmental and regulatory approvals and permits, are required in order to site, construct and operate our liquefaction facilities.

The Energy Policy Act of 2005 (the “EPAct”) amended Section 3 of the NGA to establish or clarify the FERC’s exclusive authority to approve or deny an application for the siting, construction, expansion or operation of LNG terminals, although except as specifically provided in the EPAct, nothing in the EPAct is intended to affect otherwise applicable law related to any other federal agency’s authorities or responsibilities related to LNG terminals. The FERC issued final orders in April and July 2012 approving our application for an order under Section 3 of the NGA authorizing the siting, construction and operation of Trains 1 through 4 of the Sabine Pass Liquefaction Project. Subsequently, the FERC issued written approval to commence site preparation work for Trains 1 through 4. The FERC approval requires us to obtain certain additional FERC approvals as construction progresses. To date, we have been able to obtain these approvals as needed. On October 9, 2012, we applied to amend the FERC approval to reflect certain modifications to the Sabine Pass Liquefaction Project, and on August 2, 2013, the FERC issued an order approving the modifications. On October 25, 2013, we applied to further amend the FERC approval, requesting authorization to increase the total LNG production capacity of Trains 1 through 4 from the currently authorized 803 Bcf/yr to 1,006 Bcf/yr so as to more accurately reflect the estimated maximum LNG production capacity. On February 20, 2014, the FERC issued an order granting the request. The need for these approvals has not materially affected our construction progress. The FERC’s approval to site, construct and operate Trains 5 and 6 also will be required. In this regard, on September 30, 2013, we filed an application with the FERC for authorization to add Trains 5 and 6 to the Sabine Pass Liquefaction Project. Throughout the life of our LNG terminals, we will be subject to regular reporting requirements to the FERC and the U.S. Department of Transportation regarding the operation and maintenance of our facilities.

In order to construct, own, operate and maintain the Creole Trail Pipeline, CTPL received a certificate of public convenience and necessity from the FERC under Section 7 of the NGA. The FERC’s approval under Section 7 of the NGA, as well as several other material governmental and regulatory approvals and permits, may be required prior to making any modifications to the Creole Trail Pipeline as it is a regulated, interstate natural gas pipeline. The FERC also approved CTPL’s application for authorization to construct, own, operate and maintain certain new facilities in order to enable bi-directional natural gas flow on the Creole Trail Pipeline system to allow for the delivery of up to 1,530,000 Dthd of feed gas to the Sabine Pass Liquefaction Project. In November 2013, CTPL received approval from the Louisiana Department of Environmental Quality (“LDEQ”) for the proposed modifications and, with subsequent final FERC clearance, construction began in December 2013.

On December 30, 2014, the FERC issued an order granting Corpus Christi Liquefaction authorization under Section 3 of the NGA to site, construct and operate Trains 1 through 3 of the Corpus Christi Liquefaction Project. The Sierra Club has requested a rehearing, and the FERC has not ruled on this request. In addition, the FERC issued an order granting Cheniere Corpus Christi Pipeline a certificate of public convenience and necessity under Section 7(c) of the NGA to construct and operate the Corpus Christi Pipeline. Several other material governmental and regulatory approvals and permits will be required prior to construction

and operation of the Corpus Christi Liquefaction Project. In addition, the FERC approval requires us to obtain certain additional FERC approvals as construction progresses.

In addition to the siting and construction authority with respect to the LNG terminals under the NGA, the FERC is granted authority to approve, and if necessary, set “just and reasonable rates” for the transportation or sale of natural gas in interstate commerce. In addition, under the NGA, our pipelines are not permitted to unduly discriminate or grant undue preference as to rates or the terms and conditions of service. The FERC has the authority to grant certificates allowing construction and operation of facilities used in interstate gas transportation and authorizing the provision of services. Under the NGA, the FERC’s jurisdiction generally extends to the transportation of natural gas in interstate commerce, to the sale in interstate commerce of natural gas for resale for ultimate consumption for domestic, commercial, industrial, or any other use, and to natural gas companies engaged in such transportation or sale. However, the FERC’s jurisdiction does not extend to the production, gathering or local distribution of natural gas.

In general, the FERC’s authority to regulate interstate natural gas pipelines and the services that they provide includes:

| |

• | rates and charges for natural gas transportation and related services; |

| |

• | the certification and construction of new facilities; |

| |

• | the extension and abandonment of services and facilities; |

| |

• | the maintenance of accounts and records; |

| |

• | the acquisition and disposition of facilities; |

| |

• | the initiation and discontinuation of services; and |

The EPAct amended the NGA to prohibit market manipulation, and increased civil and criminal penalties for any violations of the NGA and any rules, regulations or orders of the FERC, up to $1.0 million per day per violation. In accordance with the EPAct, the FERC issued a final rule making it unlawful for any entity, in connection with the purchase or sale of natural gas or transportation service subject to the FERC’s jurisdiction, to defraud, make an untrue statement of material fact or omit a material fact or engage in any practice, act or course of business that operates or would operate as a fraud or deceit upon any entity.

For a number of years the FERC has implemented certain rules referred to as Standards of Conduct aimed at ensuring that an interstate natural gas pipeline not provide certain affiliated entities with preferential access to transportation service or non-public information about such service. These rules have been subject to revision by the FERC from time to time, most recently in 2008 when the FERC issued a final rule, Order No. 717, on Standards of Conduct for Transmission Providers. Order No. 717, as amended, eliminated the concept of energy affiliates and adopted a “functional approach” that applies Standards of Conduct to individual officers and employees based on their job functions, not on the company or division in which the individual works. The general principles of the Standards of Conduct are non-discrimination, independent functioning, no conduit and transparency. These general principles govern the relationship between marketing function employees conducting transactions with affiliated pipeline companies and transportation function employees. CTPL has established the required policies and procedures to comply with the Standards of Conduct and is subject to audit by the FERC to review compliance, policies and its training programs.

DOE Export License

The DOE has authorized the export of up to a combined total of the equivalent of 16 mtpa (approximately 803 Bcf/yr) of domestically produced LNG by vessel from the Sabine Pass LNG terminal to FTA countries for a 30-year term, beginning on the earlier of the date of first export or September 7, 2020; and to non-FTA countries for a 20-year term, beginning on the earlier of the date of first export or August 7, 2017. The DOE further issued an order authorizing Sabine Pass Liquefaction to export up to the equivalent of approximately 203 Bcf/yr of domestically produced LNG from the Sabine Pass LNG terminal to FTA countries for a 25-year period.

Additionally, the DOE further issued three orders authorizing the export of an additional 503.3 Bcf/yr in total of domestically produced LNG from the Sabine Pass LNG terminal to FTA countries for a 20-year term. One order authorized the export of 101 Bcf/yr of domestically produced LNG pursuant to the SPA with Total, beginning on the earlier of the date of first export or July 11, 2021; the second order authorized the export of 88.3 Bcf/yr of domestically produced LNG pursuant to the SPA with Centrica, beginning on the earlier of the date of first export or July 12, 2021; and the third order authorized the export of 314 Bcf/yr of

domestically produced LNG, beginning on the earlier of the date of first export or January 22, 2022. Additional applications to the DOE for permits to allow the export of the additional 503.3 Bcf/yr of domestically produced LNG to non-FTA countries are pending.

The DOE has authorized the export of up to the equivalent of 15 mtpa (approximately 767 Bcf/yr) of domestically produced LNG by vessel from the Corpus Christi Liquefaction Project to FTA countries for a 25-year term, beginning on the earlier of the date of first export or October 16, 2022. On October 29, 2014, the DOE issued an order amending the authorization to include Corpus Christi Liquefaction as an additional authorization holder. An application to export LNG to non-FTA countries was filed on August 31, 2012 by Cheniere Marketing and is still pending DOE authorization. The DOE’s October 29, 2014 order also added Corpus Christi Liquefaction as an applicant to this pending application.

Exports of natural gas to FTA countries are “deemed to be consistent with the public interest” and authorization to export LNG to FTA countries shall be granted by the DOE without “modification or delay.” FTA countries which import LNG now or will do so by 2016 include Chile, Mexico, Singapore, South Korea and the Dominican Republic. Exports of natural gas to non-FTA countries are considered by the DOE in the context of a comment period whereby interveners are provided the opportunity to assert that such authorization would not be consistent with the public interest.

Pipelines

The Creole Trail Pipeline and the Corpus Christi Pipeline are also subject to regulation by the U.S. Department of Transportation (“DOT”), under the Pipeline and Hazardous Material Safety Administration (“PHMSA”), pursuant to which the PHMSA has established requirements relating to the design, installation, testing, construction, operation, replacement and management of pipeline facilities.

The Pipeline Safety Improvement Act of 2002, as amended (“PSIA”), which is administered by the PHMSA Office of Pipeline Safety, governs the areas of testing, education, training and communication. The PSIA requires pipeline companies to perform extensive integrity tests on natural gas transportation pipelines that exist in high population density areas designated as “high consequence areas.” Pipeline companies are required to perform the integrity tests on a seven-year cycle. The risk ratings are based on numerous factors, including the population density in the geographic regions served by a particular pipeline, as well as the age and condition of the pipeline and its protective coating. Testing consists of hydrostatic testing, internal electronic testing, or direct assessment of the piping. In addition to the pipeline integrity tests, pipeline companies must implement a qualification program to make certain that employees are properly trained. Pipeline operators also must develop integrity management programs for gas transportation pipelines, which requires pipeline operators to perform ongoing assessments of pipeline integrity; identify and characterize applicable threats to pipeline segments that could impact a high consequence area; improve data collection, integration and analysis; repair and remediate the pipeline, as necessary; and implement preventive and mitigation actions.

In 2010, the PHMSA issued a final rule (known as “Control Room Management/Human Factors Rule”) requiring pipeline operators to write and institute certain control room procedures that address human factors and fatigue management. In August 2011, the PHMSA issued an advanced notice of proposed rulemaking addressing whether changes are needed to the regulations governing the safety of gas transmission pipelines. Specifically, PHMSA is considering whether integrity management requirements should be changed, including whether the definition of “high consequence area” should be revised and whether additional restrictions should be placed on the use of specific pipeline assessment methods. The PHMSA is also considering whether to revise requirements for non-integrity management issues, such as mainline valves, corrosion control issues and the safety of gathering lines. This advanced notice of proposed rulemaking is still pending at the PHMSA.

Natural Gas Pipeline Safety Act of 1968 (“NGPSA”)

Louisiana and Texas administer federal pipeline safety standards under the NGPSA, which requires certain pipelines to comply with safety standards in constructing and operating the pipelines and subjects the pipelines to regular inspections. Failure to comply with the NGPSA may result in the imposition of administrative, civil and criminal remedies.

Pipeline Safety, Regulatory Certainty, and Jobs Creation Act of 2011

The Creole Trail Pipeline and Corpus Christi Pipeline are also subject to the Pipeline Safety, Regulatory Certainty, and Jobs Creation Act of 2011, which regulates safety requirements in the design, construction, operation and maintenance of interstate natural gas transmission facilities. Under the Pipeline Safety, Regulatory Certainty, and Job Creation Act of 2011, PHMSA has civil penalty authority up to $200,000 per day (increased from the prior $100,000), with a maximum of $2 million for any related series of violations (increased from the prior $1 million).

Other Governmental Permits, Approvals and Authorizations

The construction and operation of the Sabine Pass LNG terminal and the Corpus Christi Liquefaction Project are subject to additional federal permits, orders, approvals and consultations required by other federal agencies, including the DOE, Advisory Council on Historic Preservation, U.S. Army Corps of Engineers (“USACE”), U.S. Department of Commerce, National Marine Fisheries Services, U.S. Department of the Interior, U.S. Fish and Wildlife Service, Environmental Protection Agency (“EPA”) and U.S. Department of Homeland Security.

Three significant permits are the USACE Section 404 of the Clean Water Act/Section 10 of the Rivers and Harbors Act Permit (the “Section 10/404 Permit”), the Clean Air Act Title V (“Title V”) Operating Permit and the Prevention of Significant Deterioration (“PSD”) Permit, the latter two permits being issued by the LDEQ for the Sabine Pass LNG terminal and by the Texas Commission on Environmental Quality (“TCEQ”) for the Corpus Christi Liquefaction Project.

The application for revision of the Sabine Pass LNG terminal’s Section 10/404 Permit to authorize construction of Train 1 through Train 4 was submitted in January 2011. The process included a public comment period which commenced in March 2011 and closed in April 2011. The revised Section 10/404 Permit was received from the USACE in March 2012. An application for a further revision to the Section 10/404 Permit, to address wetlands impacted by the construction of Trains 5 and 6, is currently pending before the USACE. We do not anticipate obtaining this permit until after FERC issues an order approving the expansion of the Liquefaction Project. In addition, a Section 10/404 permit application is pending with respect to the expansion of the Creole Trail Pipeline. Both of these permits, if issued, will require us to provide mitigation to compensate for the wetlands impacted by the respective projects. The application to amend the Sabine Pass LNG terminal’s existing Title V and PSD permits to authorize construction of Train 1 through Train 4 was initially submitted in December 2010 and revised in March 2011. The process included a public comment period from June 2011 to August 2011 and a public hearing in August 2011. The final revised Title V and PSD permits were issued by the LDEQ in December 2011. Although these permits are final, a petition with the EPA has been filed pursuant to the Clean Air Act requesting that the EPA object to the Title V permit. The EPA has not ruled on this petition. In June 2012, Cheniere Partners applied to the LDEQ for a further amendment to the Title V and PSD permits to reflect proposed modifications to the Sabine Pass Liquefaction Project that were filed with the FERC in October 2012. The LDEQ issued the amended PSD and Title V permits in March 2013. These permits are final. In September 2013, Cheniere Partners applied to the LDEQ for another amendment to its PSD and Title V permits seeking approval to, among other things, construct and operate Train 5 and Train 6. Cheniere Partners anticipates, but cannot guarantee, that the revised Title V and PSD permits authorizing, among other things, construction and operation of Train 5 and Train 6 will be issued in the second quarter of 2015.

An application for an amendment to Corpus Christi Liquefaction’s Section 10/404 Permit to authorize construction of the Corpus Christi Liquefaction Project was submitted in August 2012. The process included a public comment period which commenced in May 2013 and closed in June 2013. The permit was issued by the USACE on July 23, 2014 and subsequently modified on October 29, 2014. Corpus Christi Liquefaction applied for new PSD and Title V permits with the TCEQ in August 2012. On September 16, 2014, the TCEQ issued the PSD permit for criteria pollutants. On December 29, 2014, the TCEQ issued a preliminary decision approving Corpus Christi Liquefaction’s application for a Greenhouse Gas (“GHG”) PSD permit. Issuance of Corpus Christi Liquefaction’s Title V permit is pending issuance of the GHG PSD permit so any applicable requirements in the GHG PSD permit can be incorporated into the Title V permit.

CTPL was issued new Title V and PSD permits for the proposed modifications to the Creole Trail Pipeline system by the LDEQ in November 2013.

In August 2012, Cheniere Corpus Christi Pipeline applied to the TCEQ for new PSD and Title V permits for the proposed compressor station at Sinton, Texas (the “Sinton Compressor Station”). The PSD permit for criteria pollutants at the Sinton Compressor Station was issued by the TCEQ on December 20, 2013; and on November 18, 2014, the TCEQ approved an alteration

to the permit to reflect that the Sinton Compressor Station is now considered a minor source, and voided the PSD permit number. The Title V permit remains pending.

In August 2014, the Sabine Pass LNG terminal’s existing wastewater discharge permit was modified by LDEQ to authorize the discharge of wastewaters from the liquefaction facilities, including wastewaters generated with respect to the anticipated operations of Trains 5 and 6. Corpus Christi Liquefaction was issued a waste water discharge permit in January 2014 authorizing discharges from the liquefaction facilities. The permit was issued on January 28, 2014.

The Sabine Pass LNG terminal and the Corpus Christi LNG terminal are subject to DOT safety regulations and standards for the transportation and storage of LNG and regulations of the U.S. Coast Guard relating to maritime safety and facility security.

Commodity Futures Trading Commission

Congress adopted comprehensive financial reform legislation that establishes federal oversight and regulation of the over-the-counter derivatives market and entities, such as us, that participate in that market. This legislation, known as the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”), is designed primarily to (1) regulate certain participants in the swaps markets, including entities falling within the categories of “Swap Dealer” and “Major Swap Participant,” (2) require clearing and exchange-trading of certain swaps that the Commodity Futures Trading Commission (the “CFTC”) designated by rule to be cleared, (3) increase swap market transparency through robust reporting and recordkeeping requirements, (4) reduce financial risks in the derivatives market by imposing margin or collateral requirements on both cleared and, in certain cases, uncleared swaps, and (5) enhance the CFTC’s rulemaking and enforcement authority, including the authority to establish position limits on certain swaps and futures products. As required by the Dodd-Frank Act, the CFTC, the SEC and other regulators have been promulgating rules and regulations implementing the swaps regulatory provisions of the Dodd-Frank Act, although neither the CFTC nor the SEC has yet adopted all of the rules required by the Dodd-Frank Act. As a result of the Dodd-Frank Act’s provisions, the CFTC, in order to regulate excessive speculation in commodities, must adopt rules imposing new position limits on futures and options contracts and economically equivalent physical commodity swaps, on swaps traded on registered swap trading platforms and on over-the-counter swaps that perform a significant price discovery function with respect to certain markets.

After a court vacated the final rules that the CFTC adopted imposing position limits on certain core futures and equivalent swaps contracts for physical commodities, including Henry Hub natural gas, the CFTC published in the Federal Register on December 12, 2013, proposed new position limits rules that would modify and expand the applicability of position limits on the amounts of core futures and equivalent swaps contracts of such types that market participants could hold, subject to exceptions for certain bona fide hedging transactions. An extended comment period on such proposed position limits rules has expired, but the CFTC has not yet acted to adopt the proposed rules.

Pursuant to rules adopted by the CFTC, six classes of over-the-counter (“OTC”) interest rate and credit default swaps must be cleared on a designated clearing organization and also must be executed on an exchange or swap execution facility. The CFTC has not yet proposed to designate any other classes of swaps, including swaps relating to physical commodities, for mandatory clearing and trade execution, but could do so in the future. Although we expect to qualify for the “end-user exception” from the mandatory clearing and exchange-trading requirements applicable to any swaps we enter into to hedge our commercial risks, the mandatory clearing and exchange-trading requirements may apply to other market participants, such as our counterparties (who may be registered as Swap Dealers), and the application of such rules may change the cost and availability of the swaps that we use for hedging. For uncleared swaps, the CFTC or federal banking regulators may require our counterparties to require us to enter into credit support documentation with them and/or require us to post initial and variation margin with respect to our uncleared swaps. On September 24, 2014, the banking regulators published in the Federal Register proposed joint rules to establish minimum margin and capital requirements for registered Swap Dealers, Major Swap Participants, security-based Swap Dealers, and major security-based swap participants regulated by the banking regulators, although those requirements would not require collection of initial or variation margin from non-financial end users. On October 3, 2014, the CFTC published in the Federal Register similar proposed rules for initial and variation margin requirements. The proposed CFTC rules establish initial and variation margin requirements for Swap Dealers and Major Swap Participants, but do not require these entities to collect margin from non-financial end users. However, the proposed rules are not yet final and therefore the application of those provisions to us is uncertain at this time. On January 12, 2015, President Obama signed into law legislation modifying the Dodd-Frank Act and clarifying that any rules for the collection of initial or variation margin for uncleared swaps shall not apply to non-financial end users that qualify for the end user exception to clearing. Other provisions of the Dodd-Frank Act may also cause our derivatives counterparties to spin off some or all of their derivatives activities to a separate entity, and such separate entity, who could be our counterparty in future swaps, may not be as creditworthy as the current counterparty. The Dodd-Frank Act’s swaps regulatory provisions and the related

rules may also adversely affect our existing derivative contracts and restrict our ability to monetize such contracts, cause us to restructure certain contracts, reduce the availability of derivatives to protect against risks or to optimize assets, adversely affect our ability to execute our hedging strategies and impact the liquidity of certain swaps products, all of which could increase our business costs.

Under the Commodity Exchange Act, the CFTC is directed generally to prevent manipulation and fraud in two markets: (a) physical commodities traded in interstate commerce, including physical energy and other commodities, as well as (b) financial instruments, such as futures, options and swaps. Pursuant to the Dodd-Frank Act, the CFTC has adopted additional anti-manipulation, anti-fraud and anti-disruptive trading practices regulations that prohibit, among other things, fraud and price manipulation in the physical commodities, futures, options and swaps markets. Should we violate these laws and regulations, we could be subject to a CFTC enforcement action and material penalties, possibly resulting in changes in the rates we can charge.

European Market Infrastructure Regulation (“EMIR”)

EMIR is a European Union (“EU”) regulation designed to increase the stability of the over-the-counter (“OTC”) derivative markets throughout the EU states that came into force on August 16, 2012. EMIR regulates OTC derivatives, central counterparties and trade repositories, and imposes requirements for certain market participants with respect to derivatives reporting, clearing and risk mitigation. In addition, certain OTC derivatives are subject to a central counterparty clearing obligation and collateral requirements. All non-cleared derivatives require risk management, including timely confirmations of transactions, portfolio reconciliation, portfolio compression (when there exists 500 or more OTC derivatives outstanding with a counterparty) and dispute resolution. Further, for non-cleared derivatives, outstanding contracts must be marked to market value daily or marked to model where conditions necessitate. Other EMIR risk management requirements for non-cleared derivatives are being considered, but those rules have yet to be finalized.

On February 12, 2014, EMIR reporting requirements took effect. Under EMIR, covered entities must report all derivatives concluded and any modification or termination to a registered or recognized trade repository within one business day of the transaction. Records related to derivatives must be retained for at least five years following termination.

Our subsidiaries and affiliates operating in the EU may, in the future, be subject to EMIR and its increased regulatory requirements for record keeping, marking to market, timely confirmation, derivative contract reporting, portfolio reconciliation and dispute resolution. Regulation under EMIR could significantly increase the cost of derivative contracts, materially alter the terms of derivatives contracts and reduce the availability of derivatives to protect against risks that we encounter.

Regulation on Wholesale Energy Market Integrity and Transparency (“REMIT”)

REMIT is an EU regulation that came into force on December 28, 2011. REMIT prohibits market manipulation and insider trading in wholesale energy markets, and imposes various obligations on participants in these markets. REMIT requires persons who professionally arrange wholesale energy transactions to notify the Office of Gas and Electricity Markets (“Ofgem”) (as national regulatory authority in the United Kingdom) of suspected breaches and implement procedures to identify breaches. All market participants, such as us, must disclose inside information and cannot use inside information to buy or sell wholesale energy products for their own account or on behalf of a third party, directly or indirectly, induce others to buy or sell wholesale information based on inside information, or disclose such inside information to any other person except in the normal course of employment. Market participants must also register with Ofgem and provide a record of wholesale energy market transactions to the European Agency for the Cooperation of Energy Regulators and information on capacity and utilization for production, storage, consumption or transmission. Should we violate these laws and regulations, we could be subject to investigation and penalties.

Environmental Regulation

Our LNG terminals are subject to various federal, state and local laws and regulations relating to the protection of the environment and natural resources. These environmental laws and regulations may impose substantial penalties for noncompliance and substantial liabilities for pollution. Many of these laws and regulations restrict or prohibit the types, quantities and concentration of substances that can be released into the environment and can lead to substantial civil and criminal fines and penalties for non-compliance.

Clean Air Act (“CAA”)

Our LNG terminals are subject to the federal CAA and comparable state and local laws. We may be required to incur certain capital expenditures over the next several years for air pollution control equipment in connection with maintaining or obtaining permits and approvals addressing air emission-related issues. We do not believe, however, that our operations, or the construction and operations of our liquefaction facilities, will be materially and adversely affected by any such requirements.

In 2009, the EPA promulgated and finalized the Mandatory Greenhouse Gas Reporting Rule for multiple sections of the economy. This rule requires mandatory reporting of GHG emissions from stationary fuel combustion sources as well as all fugitive emissions throughout LNG terminals. From time to time, Congress has considered proposed legislation directed at reducing GHG emissions, and the EPA has defined GHG emissions thresholds for requiring certain permits for new and existing industrial sources. In addition, many states have already taken regulatory action to monitor and/or reduce emissions of GHGs, primarily through the development of GHG emission inventories or regional GHG cap and trade programs. It is not possible at this time to predict how future regulations or legislation may address GHG emissions and impact our business. However, future regulations and laws could result in increased compliance costs or additional operating restrictions and could have a material adverse effect on our business, financial position, results of operations and cash flows.

Coastal Zone Management Act (“CZMA”)

Our LNG terminals are subject to the review and possible requirements of the CZMA throughout the construction of facilities located within the coastal zone. The CZMA is administered by the states (in Louisiana, by the Department of Natural Resources, and in Texas, by the General Land Office). This program is implemented to ensure that impacts to coastal areas are consistent with the intent of the CZMA to manage the coastal areas.

Clean Water Act (“CWA”)

Our LNG terminals are subject to the federal CWA and analogous state and local laws. The CWA imposes strict controls on the discharge of pollutants into the navigable waters of the United States, including discharges of wastewater and storm water runoff and fill/discharges into waters of the United States. Permits must be obtained prior to discharging pollutants into state and federal waters. The CWA is administered by the EPA, the USACE and by the states (in Louisiana, by the LDEQ, and in Texas, by the TCEQ).

Resource Conservation and Recovery Act (“RCRA”)

The federal RCRA and comparable state statutes govern the disposal of solid and hazardous wastes. In the event such wastes are generated in connection with our facilities, we will be subject to regulatory requirements affecting the handling, transportation, treatment, storage and disposal of such wastes

Endangered Species Act

Our LNG terminals may be restricted by requirements under the Endangered Species Act, which seeks to protect endangered or threatened animal, fish and plant species and designated habitats.

LNG and Natural Gas Marketing Business