|

| |

| 600 Travis, Suite 4200 Houston, Texas 77002 713.220.4200 Phone 713.220.4285 Fax andrewskurth.com

|

December 14, 2012

Mr. Andrew D. Mew

Accounting Branch Chief

Securities and Exchange Commission

Washington, DC 20549

Cheniere Energy Partners, L.P.

Form 10-K for Fiscal Period Ended December 31, 2011

Filed February 24, 2012

Definitive Proxy Statement on Schedule 14A

Filed April 19, 2012

File Nos. 1-16383 and 1-33366

Dear Mr. Mew:

On behalf of Cheniere Energy, Inc., a Delaware corporation (the “Company”), and Cheniere Energy Partners, L.P. (the “Partnership”), a Delaware limited partnership, we enclose the responses of the Company and the Partnership to comments received from the staff of the Division of Corporation Finance (the “Staff”) of the Securities and Exchange Commission (the “Commission”) by letter dated December 4, 2012, with respect to the Company's and the Partnership's Form 10-Ks for fiscal year ended December 31, 2011 (File Nos. 1-16383 and 1-33366) (the “10-Ks”). For your convenience, the responses are prefaced by the exact text of the Staff's corresponding comment.

The Company and the Partnership acknowledge the following: (i) the Company or the Partnership, as applicable, is responsible for the adequacy and accuracy of the disclosures in the filing; (ii) Staff comments or changes to disclosure in response to Staff comments do not foreclose the Commission from taking any action with respect to the filing; and (iii) the Company and the Partnership may not assert Staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States.

Please let us know if you have any questions or if we can provide additional information or otherwise be of assistance in expediting the review process.

|

| | | |

| | Very truly yours, | |

| | | |

| | /s/ Meredith S. Mouer | |

| | Meredith S. Mouer | |

cc: Meg A. Gentle, Senior Vice President and Chief Financial Officer (the Company and the Partnership)

Cheniere Energy, Inc.

Cheniere Energy Partners, L.P.

Form 10-K for the Fiscal Period Ended December 31, 2011

Definitive Proxy Statement on Schedule 14A

File Nos. 1-16383 and 1-33366

Registrant's Responses to

SEC Comment Letter dated December 4, 2012

Cheniere Energy, Inc.

Form 10-K for the Fiscal Year Ended December 31, 2011

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operation, page 33

Summary of Critical Accounting Policies and Estimates, page 48

Goodwill, page 50

| |

1. | We note goodwill was $76.8 million comprising approximately 3% of your total assets as of December 31, 2011 and attributable to your LNG terminal segment. Please tell us and revise your disclosure to clarify how you determine your reporting units. |

Response:

We acknowledge the Staff's comment and will revise our disclosure in future filings as follows:

We have three reporting units: LNG terminal business, natural gas pipeline business and LNG and natural gas marketing business. We determine our reporting units by identifying each unit that engaged in business activities from which it may earn revenues and incur expenses, had operating results regularly reviewed by the entities' chief operating decision makers for purposes of resource allocation and performance assessment, and had discrete financial information.

| |

2. | To the extent your reporting unit has an estimated fair value that is not substantially in excess of its carrying value and goodwill for such reporting unit, if impaired, could materially impact your results of operations, please identify and provide the following disclosures in future filings: |

| |

• | Percentage by which fair value of your reporting unit exceeded its carrying values as of the date of the most recent test; |

| |

• | Description of the methods and key assumptions used and how the key assumptions were determined; |

| |

• | Discussion of the degree of uncertainty associated with the key assumptions. |

| |

• | Description of potential events and/or changes in circumstances that could reasonably be expected to negatively affect the key assumptions. |

If you have determined the estimated fair value substantially exceeds the carrying value of your reporting unit, please disclose that determination in future filings. Refer to Item 303 of Regulation S-K.

Response:

We acknowledge the Staff's comment and will disclose in future filings the information above or our determination that the estimated fair value substantially exceeds the carrying value.

Cheniere Energy, Inc.

Cheniere Energy Partners, L.P.

Form 10-K for the Fiscal Period Ended December 31, 2011

Definitive Proxy Statement on Schedule 14A

File Nos. 1-16383 and 1-33366

Registrant's Responses to

SEC Comment Letter dated December 4, 2012

Item 8. Financial Statements and Supplementary Data, page 53

Note 2 - Summary of Significant Accounting Policies, page 61

Asset Retirement Obligations, page 65

| |

3. | We note your disclosure that you have determined the cost to surrender the Sabine Pass LNG terminal in the required condition will be minimal and therefore you have not recorded an ARO. In a prior response letter to us dated August 13, 2009 you stated you believed that you had no obligation at the end of the lease to perform retirement activities that would require expenditures by you; and therefore, no asset retirement obligation liability was required. Please tell us when you determined you had a minimal obligation and explain to us how your determination not to record your obligation because it was minimal is consistent with the requirements of FASB ASC 410-20-25. See also SAB Topic 1:M. Further, please advise us of the language in the real estate property lease agreements that you considered in concluding your cost to surrender would be minimal and clarify what is meant by "required condition." |

Response:

Required condition means in good order and repair, with normal wear and tear and casualty expected. The lease agreement at the Sabine Pass LNG terminal stipulates that at the end of the lease, the Company will turn the LNG terminal over to the lessor in good working order as is/where is. Specifically, the lease states that "at the expiration of the term or any renewals or extensions thereof, the Company shall surrender the premises in good order and repair, with normal wear and tear and casualty excepted; provided however, that notwithstanding any term, condition or stipulation of the lease to the contrary, the Company shall never have any obligation whatsoever to fill in any areas of the ship entry slip and turning basin, and the Company shall be entitled to leave all such areas “as is/where is” upon termination or cancellation of the lease.”

Management currently expects to continue to operate and maintain the LNG terminal throughout the term of the lease. As a result, the future costs to operate and maintain the LNG terminal in the required condition represent future operating and maintenance costs that will be recorded in the period in which they are incurred. Based on the terms of the lease and the fact that we currently expect to continue to operate and maintain the LNG terminal throughout the term of the lease, the Company has no obligation at the end of the lease to perform retirement activities; and therefore, no asset retirement obligation liability was recorded. Although we expect no costs to be incurred to surrender the LNG terminal, we used the term "minimal" to convey that any costs incurred would be immaterial. We believe that we comply with the requirements of FASB ASC 410-20-25 and SAB Topic 1:M.

We will revise our disclosure in future filings to clarify our assessment as follows:

"We have determined that the cost to surrender the LNG terminal in good order and repair, with normal wear and tear and casualty expected, is zero. Therefore, we have not recorded an asset retirement obligation associated with the LNG Terminal."

Cheniere Energy, Inc.

Cheniere Energy Partners, L.P.

Form 10-K for the Fiscal Period Ended December 31, 2011

Definitive Proxy Statement on Schedule 14A

File Nos. 1-16383 and 1-33366

Registrant's Responses to

SEC Comment Letter dated December 4, 2012

Note 10 - Property, Plant and Equipment, page 71

Natural Gas Pipeline Costs, page 72

| |

4. | Tell us and disclose the nature and amounts of your regulatory assets and liabilities for the most recent two fiscal years ended December 31, 2011. Further, discuss for us any material variances in the amounts of regulatory assets and liabilities between fiscal years. |

Response:

Regulatory assets and liabilities for the Creole Trail Pipeline (the "Pipeline") are tariff provisions related to a “Deferred Fuel Account” (fuel tracker). The Pipeline collects and retains a portion of shippers' gas (retainage) received by the Pipeline at the Pipeline's receipt points to reimburse the Pipeline for actual fuel usage, incidental fuel usage, and lost and unaccounted for gas. Regulatory assets are recorded for net volumes of fuel gas under-retained and regulatory liabilities are recorded for net volumes of fuel gas over-retained. The balance of the over- or under-retained fuel for the period is valued at an appropriate index rate (monthly midpoint average price for Louisiana-Onshore South, Henry Hub as published in Platts Gas Daily Price Guide).

•Balance at 12/31/2011: Under-retained 8,588 Decatherm ("Dth") @ $3.173 = $ 27,250 Regulatory Asset

•Balance at 12/31/2010: Over-retained 4,812 Dth @ $4.219 = $ 20,302 Regulatory Liability

The variance between the two fiscal years is not material. We will revise future filings to describe the nature of our regulatory assets and liabilities and will disclose their amounts if and when they become material.

Note 23 - Subsequent Events (Unaudited), page 86

| |

5. | We note in January 2012, you repaid the outstanding principal balance of the $298 million 2007 Term Loan due in May 2012. In this regard, it is not evident that your auditors' assumed responsibility for reviewing transactions and events occurring after the balance sheet date through the date of their report on February 24, 2012. Please advise or revise to remove "unaudited." See AU 560, Subsequent Events and AU. 530, Dating of Independent Auditors' Report. |

Response:

The subsequent event footnote discloses a type II subsequent event that did not result in the adjustment of the financial statements, as described in AU 560, Subsequent Events. Our auditors assumed responsibility for reviewing transactions and events occurring after the balance sheet date and applied the procedures prescribed by AU 560.12 to ascertain the occurrence of subsequent events that may require adjustment or disclosure essential to a fair presentation of the financial statements. The date of the auditor's report was February 24, 2012, the date of the end of the auditor's field work and the date on which the Form 10-K was filed.

Although the scope of the audit procedures in AU 560.12 appear to be limited in nature, we acknowledge your comment and will not refer to Type II subsequent events as “unaudited” in future filings.

Cheniere Energy, Inc.

Cheniere Energy Partners, L.P.

Form 10-K for the Fiscal Period Ended December 31, 2011

Definitive Proxy Statement on Schedule 14A

File Nos. 1-16383 and 1-33366

Registrant's Responses to

SEC Comment Letter dated December 4, 2012

Definitive Proxy Statement on Schedule 14A

Executive Compensation, page 23

Compensation Discussion and Analysis, page 23

| |

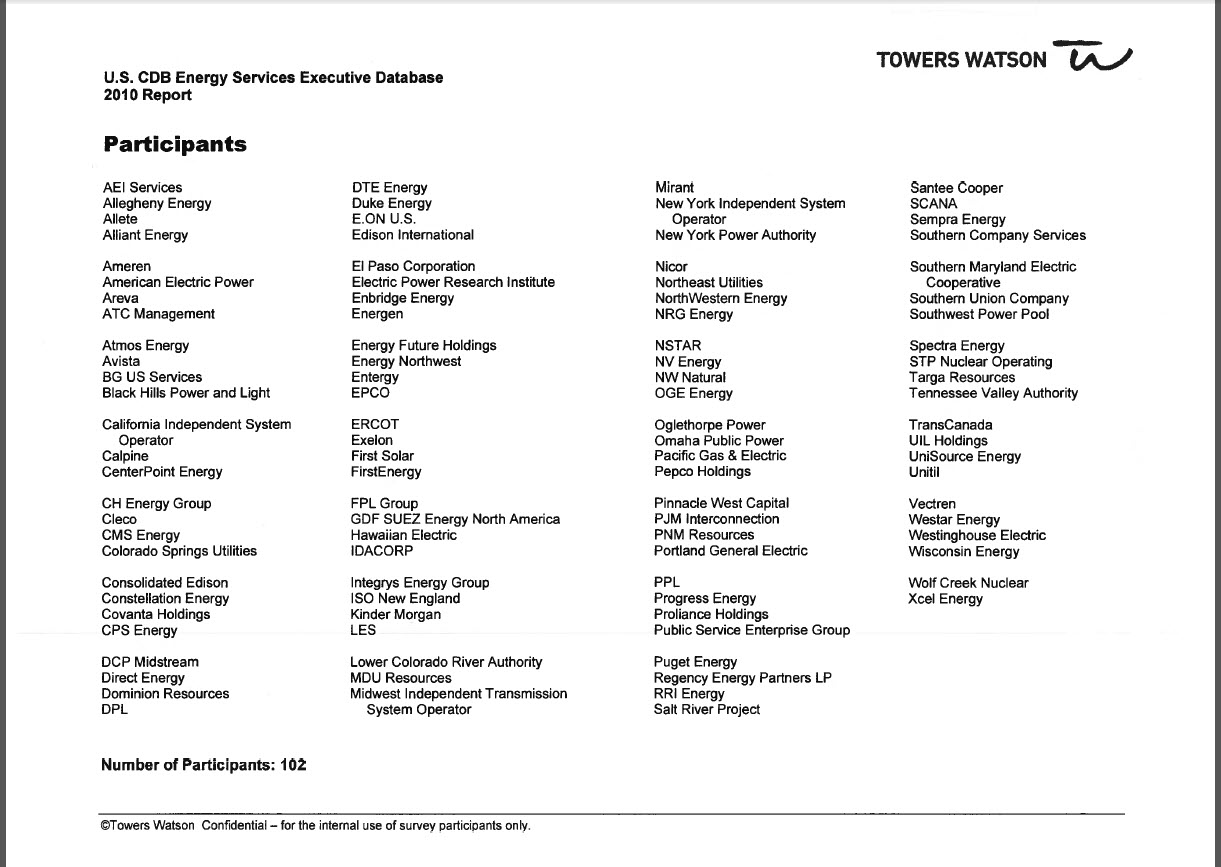

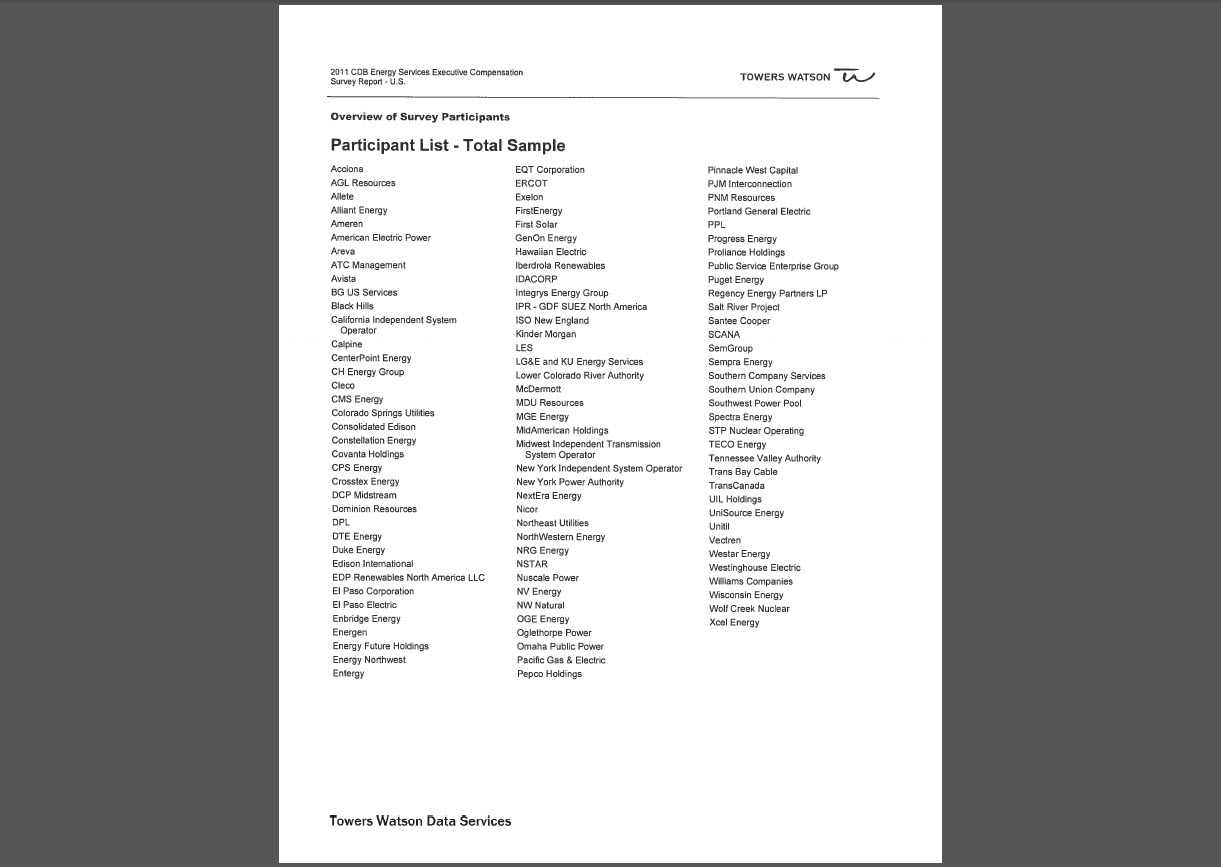

6. | To the extent you use market data to benchmark your named executive officers' total compensation or any material element of compensation, please disclose the component companies of the benchmark. For example, we note that you relied on the Towers Watson U.S. Compensation Data Bank Energy Services Executive Database to benchmark total compensation and base salary. If you use such database or a similar database in the future, please disclose the component companies. See Item 402(b)(2)(xiv) of Regulation S-K. |

Response:

We acknowledge the Staff's comment. Attached hereto as Attachments 1 and 2 are the lists of the component companies included in the 2010 and 2011 Towers Watson U.S. Compensation Data Bank Energy Services Executive Database. The Company is providing the lists of component companies because the 2010 and 2011 Towers Watson U.S. Compensation Data Bank Energy Services Executive Database surveys were used for benchmarking purposes in the Compensation Committee's determination of our named executive officers' compensation. In future filings, to the extent the Compensation Committee continues to benchmark any material element of our named executive officers' compensation and such benchmark is material to the Compensation Committee's determination of the compensation of our named executive officers, we will identify the benchmark, and if applicable, its component companies. We intend to include such disclosure in a currently contemplated preliminary proxy statement.

Analysis of Executive Officers' Total Compensation for 2011, page 29

2011 Long-Term Incentive Awards, page 32

| |

7. | Please disclose how you determined the amount of restricted shares to award to each named executive officer. See Item 402(b)(1)(v) of Regulation S-K. |

Response:

We acknowledge the Staff's comment and will expand our disclosure in future filings regarding the “2011 Long-Term Incentive Awards” to disclose how the amount of restricted shares awarded to each named executive officer was determined. Below is the expanded disclosure we will include in future filings, including a currently contemplated preliminary proxy statement, to the extent applicable:

“2011 Long-Term Incentive Awards

On January 4, 2011, the Compensation Committee determined that the Company had achieved significant corporate debt reduction resulting in the improvement of the Company's liquidity position and regulatory, engineering and commercial milestones related to the liquefaction project adjacent to the Sabine Pass LNG terminal during 2010 that deserved recognition and used its discretion to approve a pool of 2,000,000 shares of restricted stock of the Company to be granted to certain employees, including the Executive Officers (the “2011 Long-Term Incentive Awards”). Of the 2,000,000 shares of restricted stock of the Company approved by the Compensation Committee for the 2011 Long-Term Incentive Awards, 935,000 shares were allocated by the Compensation Committee to the Executive Officers based on a recommendation by the CEO and each Executive Officer's contributions during 2010. In addition, the Compensation Committee reviewed a detailed history of each Executive Officer's long-term incentive grants since 2008 to determine if the size of each Executive Officer's 2011 Long-Term Incentive Award was appropriate. Because the Executive Officers would not have any outstanding equity awards after 2011 when the 2009 Phantom Stock Awards would expire, the Compensation Committee determined that the 2011 Long-Term Incentive Awards were appropriate so that the Executive Officers would continue to have a significant equity investment in the long-term success of the Company beyond 2011. The 2011 Long-Term Incentive Awards were granted on January 14, 2011, under the Cheniere Energy, Inc. 2003 Stock Incentive Plan, as amended (the “2003 Plan”). The 2011 Long-Term Incentive Awards vest in three equal annual installments. The first tranche of restricted stock vested on June 30, 2011 and the second tranche vested on June 30, 2012. The third tranche will vest on June 30, 2013. Except as set forth below, an

Cheniere Energy, Inc.

Cheniere Energy Partners, L.P.

Form 10-K for the Fiscal Period Ended December 31, 2011

Definitive Proxy Statement on Schedule 14A

File Nos. 1-16383 and 1-33366

Registrant's Responses to

SEC Comment Letter dated December 4, 2012

Executive Officer will forfeit any unvested portion of his or her 2011 Long-Term Incentive Award if the Executive Officer's employment with the Company terminates for any reason prior to the applicable vesting dates; provided, however, that any unvested portion of the 2011 Long-Term Incentive Award will vest upon the (i) termination, resignation or removal of the Executive Officer for any reason within one year of the effective date of a Change of Control (as defined in the 2003 Plan) or (ii) death or disability of the Executive Officer.

Messrs. Souki, Abiteboul and Thames and Ms. Gentle each received a 2011 Long-Term Incentive Award, in the form of a restricted stock grant, as follows:

•Mr. Souki received a grant of 398,000 shares of restricted stock of the Company for his implementation of the Company's overall strategy and business plan in 2010.

•Ms. Gentle received a grant of 150,000 shares of restricted stock of the Company for her contributions related to corporate debt reduction and the elimination of significant interest expense resulting in the improvement of the Company's liquidity position.

•Mr. Abiteboul received a grant of 75,000 shares of restricted stock of the Company for his efforts in working towards obtaining customers related to the liquefaction project adjacent to the Sabine Pass LNG terminal.

•Mr. Thames received a grant of 135,000 shares of restricted stock of the Company for the success of the marketing business in securing margins on LNG cargo purchases and working towards obtaining customers related to the liquefaction project adjacent to the Sabine Pass LNG terminal."

Cheniere Energy Partners, L.P.

Form 10-K for the Fiscal Year Ended December 31, 2011

Item 8. Financial Statements and Supplementary Data, page 48

Note 3 - Summary of Significant Accounting Policies, page 57

Income Taxes, page 58

| |

8. | Please revise to clarify if Cheniere can demand payment for Texas franchise taxes as well as other state and local taxes that Sabine Pass LNG would have been required to pay on a separate company basis from the effective date of the agreement and/or if Cheniere has, in its sole discretion, demanded payment at any time since the effective date of the agreement. |

Response:

On page 58, the disclosure provides, "If Cheniere, in its sole discretion, demands payment, then Sabine Pass LNG will pay to Cheniere an amount equal to the Texas franchise tax that Sabine Pass LNG would be required to pay if its Texas franchise tax liability were computed on a separate company basis." Cheniere, in its sole discretion, can demand payment for Texas franchise taxes. In addition, the disclosure provides, "The State Tax Sharing Agreement contains similar provisions for other state and local taxes required to be filed by Cheniere and Sabine Pass LNG on a combined, consolidated or unitary basis. The State Tax Sharing Agreement is effective for tax returns first due on or after January 1, 2008." We will clarify in future filings that Cheniere, in its sole discretion, can demand payments from Sabine Pass LNG for other state and local taxes required to be filed by Cheniere and Sabine Pass LNG on a combined, consolidated or unitary basis. The amount of state and local taxes that Cheniere could demand from Sabine Pass LNG is equal to the amount of such state and local taxes computed on a separate company basis. There have been no Texas franchise taxes or other state and local taxes paid by Cheniere for which Cheniere could have demanded payment from Sabine Pass LNG under the State Tax Sharing Agreement; therefore, Cheniere has not demanded any such payments from Sabine Pass LNG.

Cheniere Energy, Inc.

Cheniere Energy Partners, L.P.

Form 10-K for the Fiscal Period Ended December 31, 2011

Definitive Proxy Statement on Schedule 14A

File Nos. 1-16383 and 1-33366

Registrant's Responses to

SEC Comment Letter dated December 4, 2012

Asset Retirement Obligations, page 59

| |

9. | We note your disclosure that you have determined the cost to surrender the Sabine Pass LNG terminal in the required condition will be minimal and therefore you have not recorded an ARO. Please explain to us how your determination not to record your obligation because it was minimal is consistent with the requirements of FASB ASC 410-20-25. See also SAB Topic 1:M. Further, please advise us of the language in the real estate property lease agreements that you considered in concluding your cost to surrender would be minimal. |

Response:

Required condition means in good order and repair, with normal wear and tear and casualty expected. The lease agreement at the Sabine Pass LNG terminal stipulates that at the end of the lease, the Company will turn the LNG terminal over to the lessor in good working order as is/where is. Specifically, the lease states that "at the expiration of the term or any renewals or extensions thereof, the Company shall surrender the premises in good order and repair, with normal wear and tear and casualty excepted; provided however, that notwithstanding any term, condition or stipulation of the lease to the contrary, the Company shall never have any obligation whatsoever to fill in any areas of the ship entry slip and turning basin, and the Company shall be entitled to leave all such areas “as is/where is” upon termination or cancellation of the lease.”

Management currently expects to continue to operate and maintain the LNG terminal throughout the term of the lease. As a result, the future costs to operate and maintain the LNG terminal in the required condition represent future operating and maintenance costs that will be recorded in the period in which they are incurred. Based on the terms of the lease and the fact that we currently expect to continue to operate and maintain the LNG terminal throughout the term of the lease, the Company has no obligation at the end of the lease to perform retirement activities; and therefore, no asset retirement obligation liability was recorded. Although we expect no costs to be incurred to surrender the LNG terminal, we used the term "minimal" to convey that any costs incurred would be immaterial. We believe that we comply with the requirements of FASB ASC 410-20-25 and SAB Topic 1:M.

We will revise our disclosure in future filings to clarify our assessment as follows:

"We have determined that the cost to surrender the LNG terminal in good order and repair, with normal wear and tear and casualty expected, is zero. Therefore, we have not recorded an asset retirement obligation associated with the LNG Terminal."