Cheniere Energy, Inc. Corporate Presentation August 2011

2

This presentation contains certain statements that are, or may be deemed to be, “forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended”. All statements, other than statements of historical facts, included herein are “forward-looking statements.” Included among “forward-looking statements” are, among other things: statements relating to the construction or operation of each of our proposed liquefied natural gas, or LNG, terminals or our proposed pipelines or liquefaction facilities, or expansions or extensions thereof, including statements concerning the completion or expansion thereof by certain dates or at all, the costs related thereto and certain characteristics, including amounts of regasification, transportation, liquefaction and storage capacity, the number of storage tanks, LNG trains, docks, pipeline deliverability and the number of pipeline interconnections, if any; statements that we expect to receive an order from the Federal Energy Regulatory Commission, or FERC, authorizing us to construct and operate proposed LNG receiving terminals, liquefaction facilities or proposed pipelines by certain dates, or at all; statements regarding future levels of domestic natural gas production, supply or consumption; future levels of LNG imports into North America; sales of natural gas in North America or other markets; exports of LNG from North America; and the transportation, other infrastructure or prices related to natural gas, LNG or other energy sources or hydrocarbon products; statements regarding any financing or refinancing transactions or arrangements, or ability to enter into such transactions or arrangements, whether on the part of Cheniere Energy, Inc., or Cheniere, or any subsidiary or at the project level; statements regarding any commercial arrangements presently contracted, optioned or marketed, or potential arrangements, to be performed substantially in the future, including any cash distributions and revenues anticipated to be received and the anticipated timing thereof, and statements regarding the amounts of total LNG regasification, liquefaction or storage capacity that are, or may become, subject to such commercial arrangements; statements regarding counterparties to our commercial contracts, construction contracts and other contracts; statements regarding any business strategy, any business plans or any other plans, forecasts, projections or objectives, including potential revenues and capital expenditures, any or all of which are subject to change; statements regarding legislative, governmental, regulatory, administrative or other public body actions, requirements, permits, investigations, proceedings or decisions; statements regarding our anticipated LNG and natural gas marketing activities; and any other statements that relate to non-historical or future information. These forward-looking statements are often identified by the use of terms and phrases such as “achieve,” “anticipate,” “believe,” “contemplate,” “develop,” “estimate,” “example,” “expect,” “forecast,” “opportunities,” “plan,” “potential,” “project,” “propose,” “subject to,” and similar terms and phrases. Although we believe that the expectations reflected in these forward-looking statements are reasonable, they do involve assumptions, risks and uncertainties, and these expectations may prove to be incorrect. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of a variety of factors, including those discussed in “Risk Factors” in the Cheniere Energy, Inc. Annual Report on Form 10-K filed with the Securities and Exchange Commission on March 5, 2011, which are incorporated by reference into this presentation. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by these ”Risk Factors”. These forward-looking statements are made as of the date of this presentation, and we undertake no obligation to publicly update or revise any forward-looking statements.

Forward Looking Statements

1

This presentation contains certain statements that are, or may be deemed to be, “forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended”. All statements, other than statements of historical facts, included herein are “forward-looking statements.” Included among “forward-looking statements” are, among other things: statements relating to the construction or operation of each of our proposed liquefied natural gas, or LNG, terminals or our proposed pipelines or liquefaction facilities, or expansions or extensions thereof, including statements concerning the completion or expansion thereof by certain dates or at all, the costs related thereto and certain characteristics, including amounts of regasification, transportation, liquefaction and storage capacity, the number of storage tanks, LNG trains, docks, pipeline deliverability and the number of pipeline interconnections, if any; statements that we expect to receive an order from the Federal Energy Regulatory Commission, or FERC, authorizing us to construct and operate proposed LNG receiving terminals, liquefaction facilities or proposed pipelines by certain dates, or at all; statements regarding future levels of domestic natural gas production, supply or consumption; future levels of LNG imports into North America; sales of natural gas in North America or other markets; exports of LNG from North America; and the transportation, other infrastructure or prices related to natural gas, LNG or other energy sources or hydrocarbon products; statements regarding any financing or refinancing transactions or arrangements, or ability to enter into such transactions or arrangements, whether on the part of Cheniere Energy, Inc., or Cheniere, or any subsidiary or at the project level; statements regarding any commercial arrangements presently contracted, optioned or marketed, or potential arrangements, to be performed substantially in the future, including any cash distributions and revenues anticipated to be received and the anticipated timing thereof, and statements regarding the amounts of total LNG regasification, liquefaction or storage capacity that are, or may become, subject to such commercial arrangements; statements regarding counterparties to our commercial contracts, construction contracts and other contracts; statements regarding any business strategy, any business plans or any other plans, forecasts, projections or objectives, including potential revenues and capital expenditures, any or all of which are subject to change; statements regarding legislative, governmental, regulatory, administrative or other public body actions, requirements, permits, investigations, proceedings or decisions; statements regarding our anticipated LNG and natural gas marketing activities; and any other statements that relate to non-historical or future information. These forward-looking statements are often identified by the use of terms and phrases such as “achieve,” “anticipate,” “believe,” “contemplate,” “develop,” “estimate,” “example,” “expect,” “forecast,” “opportunities,” “plan,” “potential,” “project,” “propose,” “subject to,” and similar terms and phrases. Although we believe that the expectations reflected in these forward-looking statements are reasonable, they do involve assumptions, risks and uncertainties, and these expectations may prove to be incorrect. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of a variety of factors, including those discussed in “Risk Factors” in the Cheniere Energy, Inc. Annual Report on Form 10-K filed with the Securities and Exchange Commission on March 5, 2011, which are incorporated by reference into this presentation. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by these ”Risk Factors”. These forward-looking statements are made as of the date of this presentation, and we undertake no obligation to publicly update or revise any forward-looking statements.

Forward Looking Statements

1

3

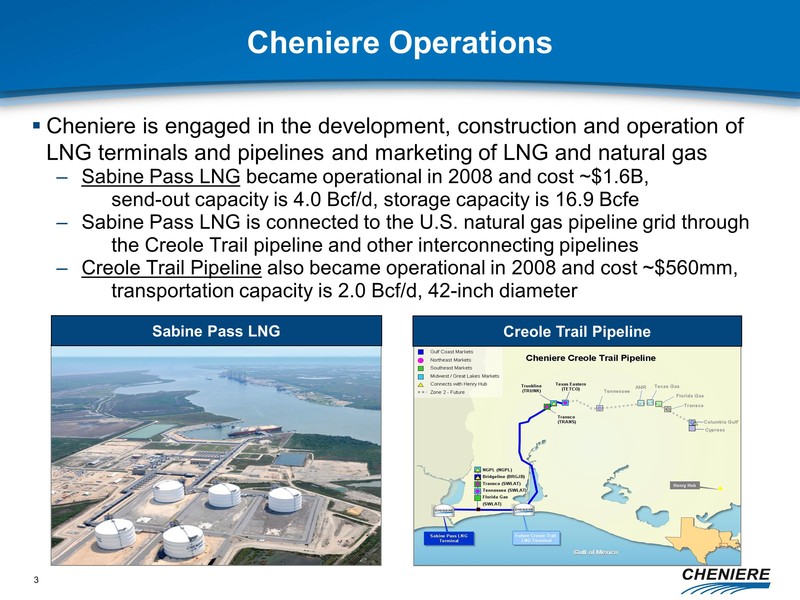

Cheniere Operations

Cheniere is engaged in the development, construction and operation of LNG terminals and pipelines and marketing of LNG and natural gas Sabine Pass LNG became operational in 2008 and cost ~$1.6B, send-out capacity is 4.0 Bcf/d, storage capacity is 16.9 Bcfe Sabine Pass LNG is connected to the U.S. natural gas pipeline grid through the Creole Trail pipeline and other interconnecting pipelines Creole Trail Pipeline also became operational in 2008 and cost ~$560mm, transportation capacity is 2.0 Bcf/d, 42-inch diameter

Sabine Pass LNG

Creole Trail Pipeline

Cheniere Operations

Cheniere is engaged in the development, construction and operation of LNG terminals and pipelines and marketing of LNG and natural gas Sabine Pass LNG became operational in 2008 and cost ~$1.6B, send-out capacity is 4.0 Bcf/d, storage capacity is 16.9 Bcfe Sabine Pass LNG is connected to the U.S. natural gas pipeline grid through the Creole Trail pipeline and other interconnecting pipelines Creole Trail Pipeline also became operational in 2008 and cost ~$560mm, transportation capacity is 2.0 Bcf/d, 42-inch diameter

Sabine Pass LNG

Creole Trail Pipeline

4

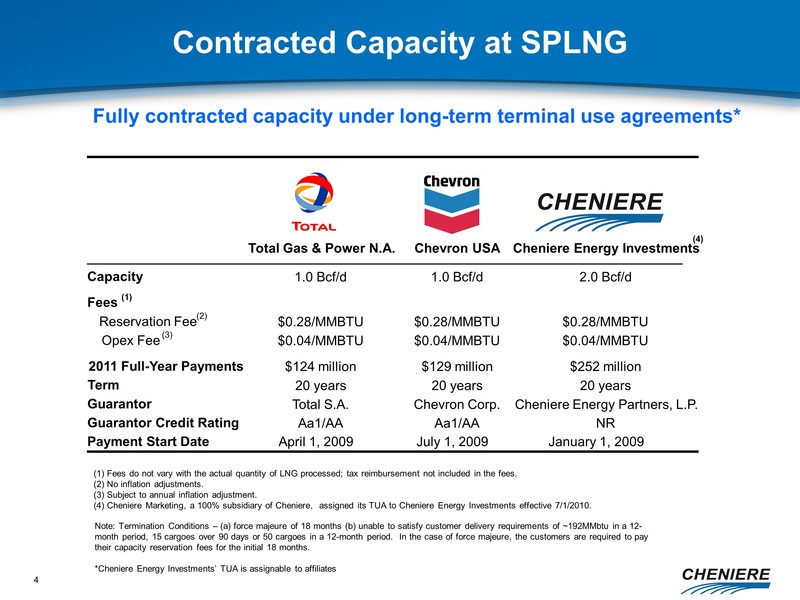

Contracted Capacity at SPLNG

Fully contracted capacity under long-term terminal use agreements*

Total Gas & Power N.A.

Chevron USA

Cheniere Energy Investments

Capacity

1.0 Bcf/d

1.0 Bcf/d

2.0 Bcf/d

Fees

(1)

Reservation Fee

(2)

$0.28/MMBTU

$0.28/MMBTU

$0.28/MMBTU

Opex Fee

(3)

$0.04/MMBTU

$0.04/MMBTU

$0.04/MMBTU

2011 Full-Year Payments

$124 million

$129 million

$252 million

Term

20 years

20 years

20 years

Guarantor

Total S.A.

Chevron Corp.

Cheniere Energy Partners, L.P.

Guarantor Credit Rating

Aa1/AA

Aa1/AA

NR

Payment Start Date

April 1, 2009

July 1, 2009

January 1, 2009

(4)

(1) Fees do not vary with the actual quantity of LNG processed; tax reimbursement not included in the fees. (2) No inflation adjustments. (3) Subject to annual inflation adjustment. (4) Cheniere Marketing, a 100% subsidiary of Cheniere, assigned its TUA to Cheniere Energy Investments effective 7/1/2010.

Note: Termination Conditions – (a) force majeure of 18 months (b) unable to satisfy customer delivery requirements of ~192MMbtu in a 12-month period, 15 cargoes over 90 days or 50 cargoes in a 12-month period. In the case of force majeure, the customers are required to pay their capacity reservation fees for the initial 18 months. *Cheniere Energy Investments’ TUA is assignable to affiliates

Contracted Capacity at SPLNG

Fully contracted capacity under long-term terminal use agreements*

Total Gas & Power N.A.

Chevron USA

Cheniere Energy Investments

Capacity

1.0 Bcf/d

1.0 Bcf/d

2.0 Bcf/d

Fees

(1)

Reservation Fee

(2)

$0.28/MMBTU

$0.28/MMBTU

$0.28/MMBTU

Opex Fee

(3)

$0.04/MMBTU

$0.04/MMBTU

$0.04/MMBTU

2011 Full-Year Payments

$124 million

$129 million

$252 million

Term

20 years

20 years

20 years

Guarantor

Total S.A.

Chevron Corp.

Cheniere Energy Partners, L.P.

Guarantor Credit Rating

Aa1/AA

Aa1/AA

NR

Payment Start Date

April 1, 2009

July 1, 2009

January 1, 2009

(4)

(1) Fees do not vary with the actual quantity of LNG processed; tax reimbursement not included in the fees. (2) No inflation adjustments. (3) Subject to annual inflation adjustment. (4) Cheniere Marketing, a 100% subsidiary of Cheniere, assigned its TUA to Cheniere Energy Investments effective 7/1/2010.

Note: Termination Conditions – (a) force majeure of 18 months (b) unable to satisfy customer delivery requirements of ~192MMbtu in a 12-month period, 15 cargoes over 90 days or 50 cargoes in a 12-month period. In the case of force majeure, the customers are required to pay their capacity reservation fees for the initial 18 months. *Cheniere Energy Investments’ TUA is assignable to affiliates

Liquefaction Project

CHENIERE ENERGY

CHENIERE ENERGY

6

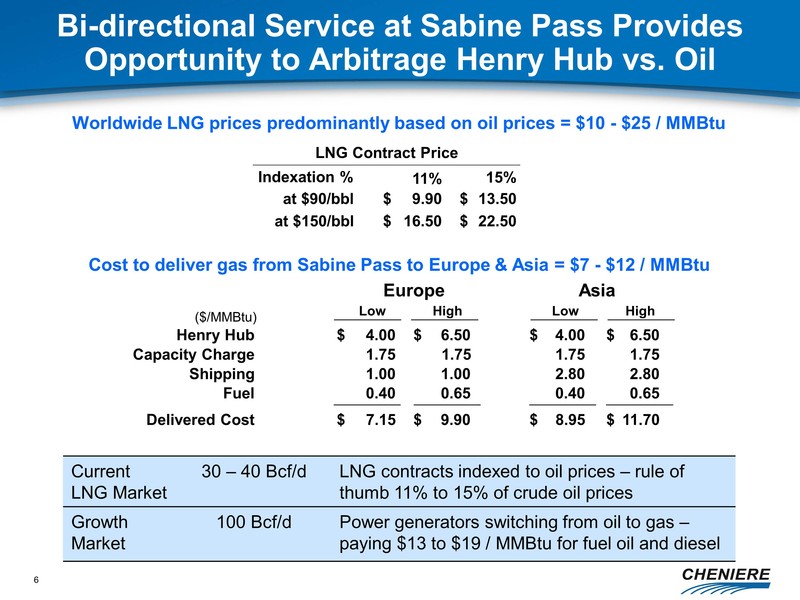

Bi-directional Service at Sabine Pass Provides Opportunity to Arbitrage Henry Hub vs. Oil

Low

High

Henry Hub

4.00

$

6.50

$

Capacity Charge

1.75

1.75

Shipping

1.00

1.00

Fuel

0.40

0.65

Delivered Cost

7.15

$

9.90

$

Low

High

4.00

$

6.50

$

1.75

1.75

2.80

2.80

0.40

0.65

8.95

$

11.70

$

Europe

Asia

($/MMBtu)

Cost to deliver gas from Sabine Pass to Europe & Asia = $7 - $12 / MMBtu

Worldwide LNG prices predominantly based on oil prices = $10 - $25 / MMBtu

Bi-directional Service at Sabine Pass Provides Opportunity to Arbitrage Henry Hub vs. Oil

Low

High

Henry Hub

4.00

$

6.50

$

Capacity Charge

1.75

1.75

Shipping

1.00

1.00

Fuel

0.40

0.65

Delivered Cost

7.15

$

9.90

$

Low

High

4.00

$

6.50

$

1.75

1.75

2.80

2.80

0.40

0.65

8.95

$

11.70

$

Europe

Asia

($/MMBtu)

Cost to deliver gas from Sabine Pass to Europe & Asia = $7 - $12 / MMBtu

Worldwide LNG prices predominantly based on oil prices = $10 - $25 / MMBtu

7

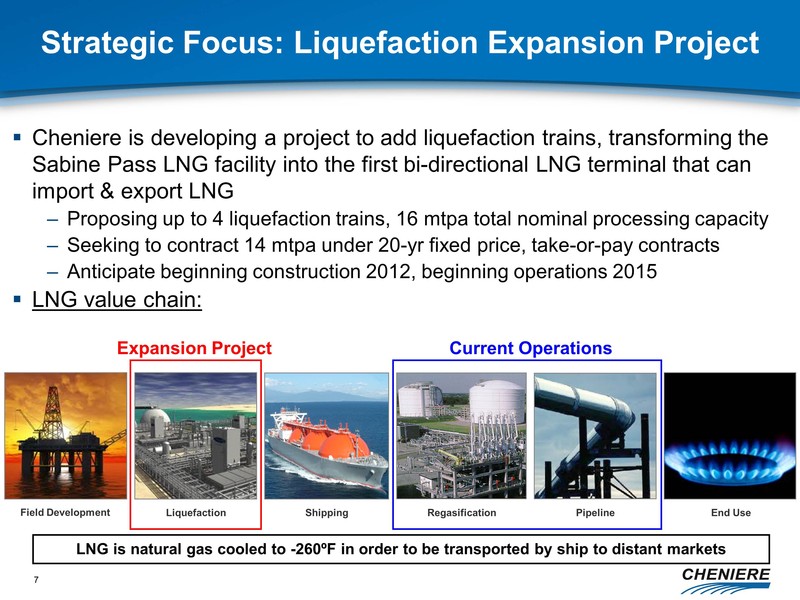

Strategic Focus: Liquefaction Expansion Project

Cheniere is developing a project to add liquefaction trains, transforming the Sabine Pass LNG facility into the first bi-directional LNG terminal that can import & export LNG Proposing up to 4 liquefaction trains, 16 mtpa total nominal processing capacity Seeking to contract 14 mtpa under 20-yr fixed price, take-or-pay contracts Anticipate beginning construction 2012, beginning operations 2015 LNG value chain:

Field Development

Liquefaction

Shipping

Regasification

Pipeline

End Use

Current Operations

Expansion Project

LNG is natural gas cooled to -260ºF in order to be transported by ship to distant markets

Strategic Focus: Liquefaction Expansion Project

Cheniere is developing a project to add liquefaction trains, transforming the Sabine Pass LNG facility into the first bi-directional LNG terminal that can import & export LNG Proposing up to 4 liquefaction trains, 16 mtpa total nominal processing capacity Seeking to contract 14 mtpa under 20-yr fixed price, take-or-pay contracts Anticipate beginning construction 2012, beginning operations 2015 LNG value chain:

Field Development

Liquefaction

Shipping

Regasification

Pipeline

End Use

Current Operations

Expansion Project

LNG is natural gas cooled to -260ºF in order to be transported by ship to distant markets

8

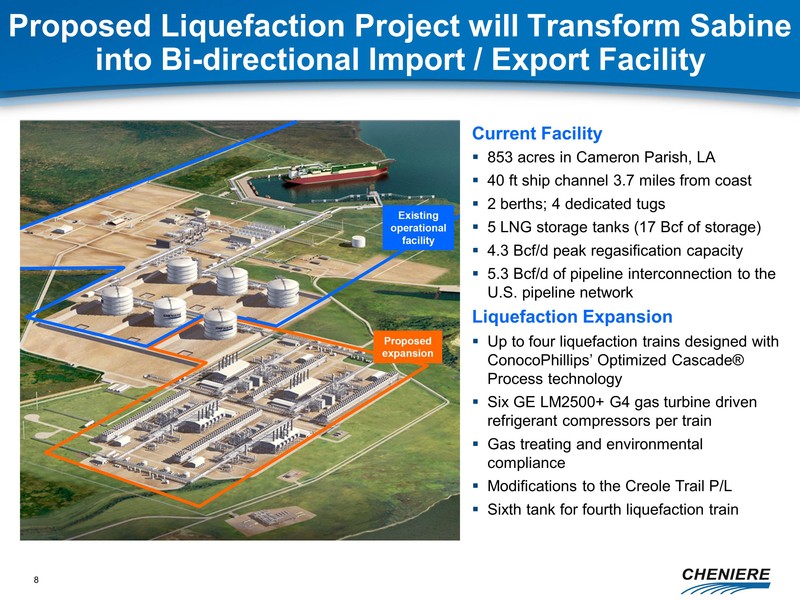

Proposed Liquefaction Project will Transform Sabine into Bi-directional Import / Export Facility

Current Facility 853 acres in Cameron Parish, LA 40 ft ship channel 3.7 miles from coast 2 berths; 4 dedicated tugs 5 LNG storage tanks (17 Bcf of storage) 4.3 Bcf/d peak regasification capacity 5.3 Bcf/d of pipeline interconnection to the U.S. pipeline network Liquefaction Expansion Up to four liquefaction trains designed with ConocoPhillips’ Optimized Cascade® Process technology Six GE LM2500+ G4 gas turbine driven refrigerant compressors per train Gas treating and environmental compliance Modifications to the Creole Trail P/L Sixth tank for fourth liquefaction train

Proposed Liquefaction Project will Transform Sabine into Bi-directional Import / Export Facility

Current Facility 853 acres in Cameron Parish, LA 40 ft ship channel 3.7 miles from coast 2 berths; 4 dedicated tugs 5 LNG storage tanks (17 Bcf of storage) 4.3 Bcf/d peak regasification capacity 5.3 Bcf/d of pipeline interconnection to the U.S. pipeline network Liquefaction Expansion Up to four liquefaction trains designed with ConocoPhillips’ Optimized Cascade® Process technology Six GE LM2500+ G4 gas turbine driven refrigerant compressors per train Gas treating and environmental compliance Modifications to the Creole Trail P/L Sixth tank for fourth liquefaction train

9

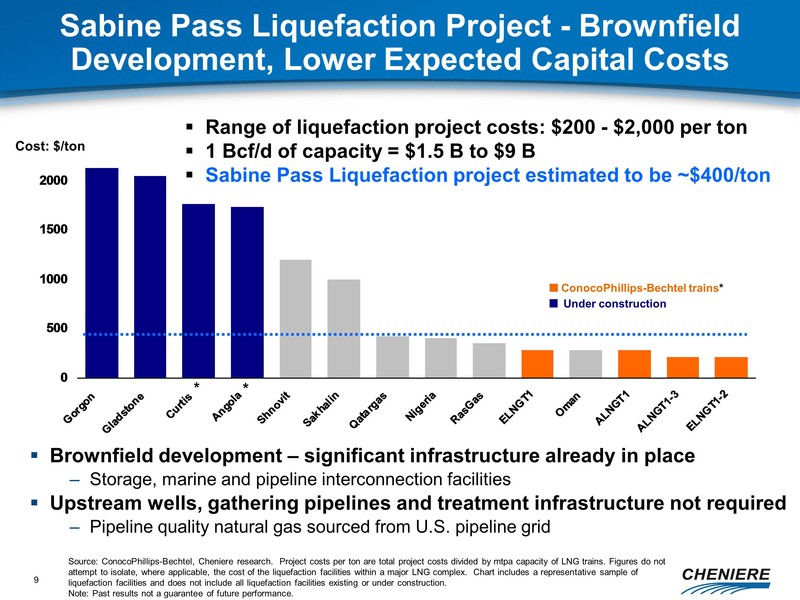

Sabine Pass Liquefaction Project - Brownfield Development, Lower Expected Capital Costs

Source: ConocoPhillips-Bechtel, Cheniere research. Project costs per ton are total project costs divided by mtpa capacity of LNG trains. Figures do not attempt to isolate, where applicable, the cost of the liquefaction facilities within a major LNG complex. Chart includes a representative sample of liquefaction facilities and does not include all liquefaction facilities existing or under construction. Note: Past results not a guarantee of future performance.

ConocoPhillips-Bechtel trains*

Cost: $/ton

Brownfield development – significant infrastructure already in place Storage, marine and pipeline interconnection facilities Upstream wells, gathering pipelines and treatment infrastructure not required Pipeline quality natural gas sourced from U.S. pipeline grid

Under construction

*

*

Range of liquefaction project costs: $200 - $2,000 per ton 1 Bcf/d of capacity = $1.5 B to $9 B Sabine Pass Liquefaction project estimated to be ~$400/ton

Sabine Pass Liquefaction Project - Brownfield Development, Lower Expected Capital Costs

Source: ConocoPhillips-Bechtel, Cheniere research. Project costs per ton are total project costs divided by mtpa capacity of LNG trains. Figures do not attempt to isolate, where applicable, the cost of the liquefaction facilities within a major LNG complex. Chart includes a representative sample of liquefaction facilities and does not include all liquefaction facilities existing or under construction. Note: Past results not a guarantee of future performance.

ConocoPhillips-Bechtel trains*

Cost: $/ton

Brownfield development – significant infrastructure already in place Storage, marine and pipeline interconnection facilities Upstream wells, gathering pipelines and treatment infrastructure not required Pipeline quality natural gas sourced from U.S. pipeline grid

Under construction

*

*

Range of liquefaction project costs: $200 - $2,000 per ton 1 Bcf/d of capacity = $1.5 B to $9 B Sabine Pass Liquefaction project estimated to be ~$400/ton

10

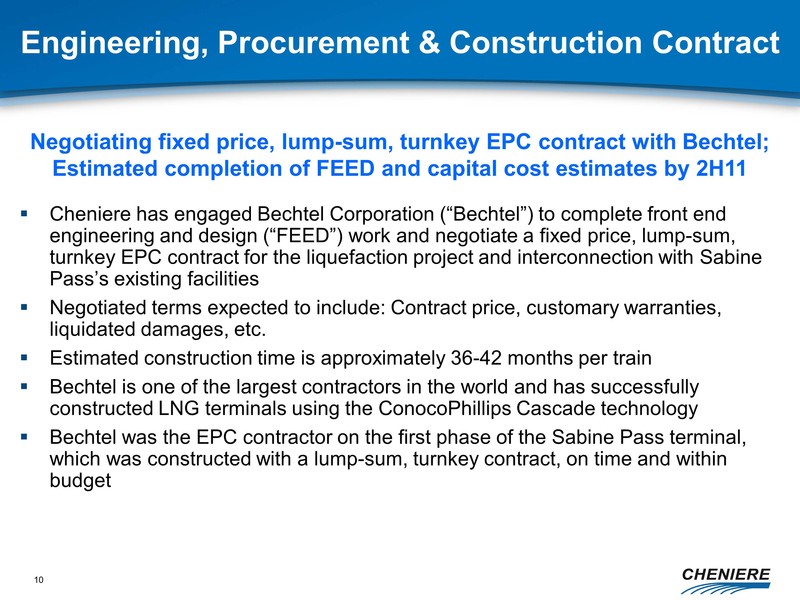

Engineering, Procurement & Construction Contract

Cheniere has engaged Bechtel Corporation (“Bechtel”) to complete front end engineering and design (“FEED”) work and negotiate a fixed price, lump-sum, turnkey EPC contract for the liquefaction project and interconnection with Sabine Pass’s existing facilities Negotiated terms expected to include: Contract price, customary warranties, liquidated damages, etc. Estimated construction time is approximately 36-42 months per train Bechtel is one of the largest contractors in the world and has successfully constructed LNG terminals using the ConocoPhillips Cascade technology Bechtel was the EPC contractor on the first phase of the Sabine Pass terminal, which was constructed with a lump-sum, turnkey contract, on time and within budget

Negotiating fixed price, lump-sum, turnkey EPC contract with Bechtel; Estimated completion of FEED and capital cost estimates by 2H11

Engineering, Procurement & Construction Contract

Cheniere has engaged Bechtel Corporation (“Bechtel”) to complete front end engineering and design (“FEED”) work and negotiate a fixed price, lump-sum, turnkey EPC contract for the liquefaction project and interconnection with Sabine Pass’s existing facilities Negotiated terms expected to include: Contract price, customary warranties, liquidated damages, etc. Estimated construction time is approximately 36-42 months per train Bechtel is one of the largest contractors in the world and has successfully constructed LNG terminals using the ConocoPhillips Cascade technology Bechtel was the EPC contractor on the first phase of the Sabine Pass terminal, which was constructed with a lump-sum, turnkey contract, on time and within budget

Negotiating fixed price, lump-sum, turnkey EPC contract with Bechtel; Estimated completion of FEED and capital cost estimates by 2H11

11

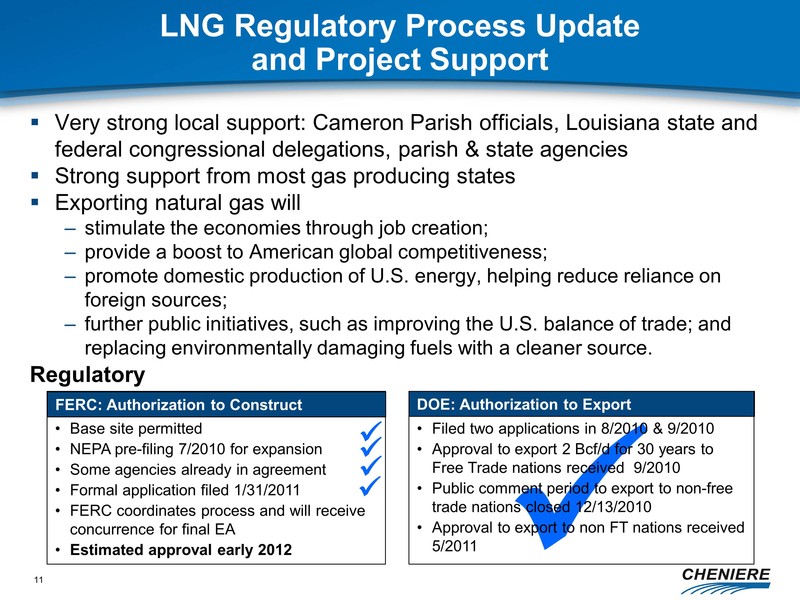

Base site permitted NEPA pre-filing 7/2010 for expansion Some agencies already in agreement Formal application filed 1/31/2011 FERC coordinates process and will receive concurrence for final EA Estimated approval early 2012

LNG Regulatory Process Update and Project Support

Very strong local support: Cameron Parish officials, Louisiana state and federal congressional delegations, parish & state agencies Strong support from most gas producing states Exporting natural gas will stimulate the economies through job creation; provide a boost to American global competitiveness; promote domestic production of U.S. energy, helping reduce reliance on foreign sources; further public initiatives, such as improving the U.S. balance of trade; and replacing environmentally damaging fuels with a cleaner source. Regulatory

FERC: Authorization to Construct

DOE: Authorization to Export

Filed two applications in 8/2010 & 9/2010 Approval to export 2 Bcf/d for 30 years to Free Trade nations received 9/2010 Public comment period to export to non-free trade nations closed 12/13/2010 Approval to export to non FT nations received 5/2011

Base site permitted NEPA pre-filing 7/2010 for expansion Some agencies already in agreement Formal application filed 1/31/2011 FERC coordinates process and will receive concurrence for final EA Estimated approval early 2012

LNG Regulatory Process Update and Project Support

Very strong local support: Cameron Parish officials, Louisiana state and federal congressional delegations, parish & state agencies Strong support from most gas producing states Exporting natural gas will stimulate the economies through job creation; provide a boost to American global competitiveness; promote domestic production of U.S. energy, helping reduce reliance on foreign sources; further public initiatives, such as improving the U.S. balance of trade; and replacing environmentally damaging fuels with a cleaner source. Regulatory

FERC: Authorization to Construct

DOE: Authorization to Export

Filed two applications in 8/2010 & 9/2010 Approval to export 2 Bcf/d for 30 years to Free Trade nations received 9/2010 Public comment period to export to non-free trade nations closed 12/13/2010 Approval to export to non FT nations received 5/2011

12

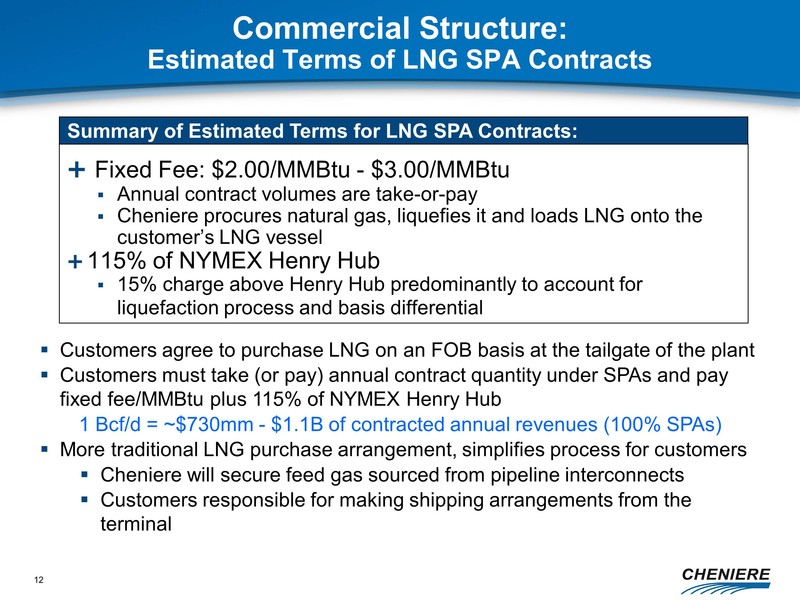

Fixed Fee: $2.00/MMBtu - $3.00/MMBtu Annual contract volumes are take-or-pay Cheniere procures natural gas, liquefies it and loads LNG onto the customer’s LNG vessel 115% of NYMEX Henry Hub 15% charge above Henry Hub predominantly to account for liquefaction process and basis differential

Commercial Structure: Estimated Terms of LNG SPA Contracts

Customers agree to purchase LNG on an FOB basis at the tailgate of the plant Customers must take (or pay) annual contract quantity under SPAs and pay fixed fee/MMBtu plus 115% of NYMEX Henry Hub 1 Bcf/d = ~$730mm - $1.1B of contracted annual revenues (100% SPAs) More traditional LNG purchase arrangement, simplifies process for customers Cheniere will secure feed gas sourced from pipeline interconnects Customers responsible for making shipping arrangements from the terminal

Summary of Estimated Terms for LNG SPA Contracts:

Fixed Fee: $2.00/MMBtu - $3.00/MMBtu Annual contract volumes are take-or-pay Cheniere procures natural gas, liquefies it and loads LNG onto the customer’s LNG vessel 115% of NYMEX Henry Hub 15% charge above Henry Hub predominantly to account for liquefaction process and basis differential

Commercial Structure: Estimated Terms of LNG SPA Contracts

Customers agree to purchase LNG on an FOB basis at the tailgate of the plant Customers must take (or pay) annual contract quantity under SPAs and pay fixed fee/MMBtu plus 115% of NYMEX Henry Hub 1 Bcf/d = ~$730mm - $1.1B of contracted annual revenues (100% SPAs) More traditional LNG purchase arrangement, simplifies process for customers Cheniere will secure feed gas sourced from pipeline interconnects Customers responsible for making shipping arrangements from the terminal

Summary of Estimated Terms for LNG SPA Contracts:

13

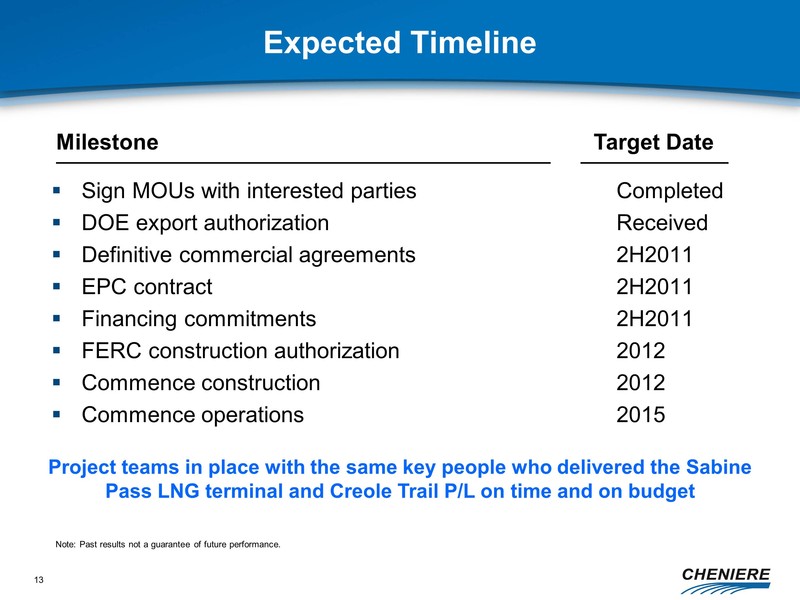

Expected Timeline

Sign MOUs with interested parties Completed DOE export authorization Received Definitive commercial agreements 2H2011 EPC contract 2H2011 Financing commitments 2H2011 FERC construction authorization 2012 Commence construction 2012 Commence operations 2015

Milestone

Target Date

Note: Past results not a guarantee of future performance.

Project teams in place with the same key people who delivered the Sabine Pass LNG terminal and Creole Trail P/L on time and on budget

Expected Timeline

Sign MOUs with interested parties Completed DOE export authorization Received Definitive commercial agreements 2H2011 EPC contract 2H2011 Financing commitments 2H2011 FERC construction authorization 2012 Commence construction 2012 Commence operations 2015

Milestone

Target Date

Note: Past results not a guarantee of future performance.

Project teams in place with the same key people who delivered the Sabine Pass LNG terminal and Creole Trail P/L on time and on budget

14

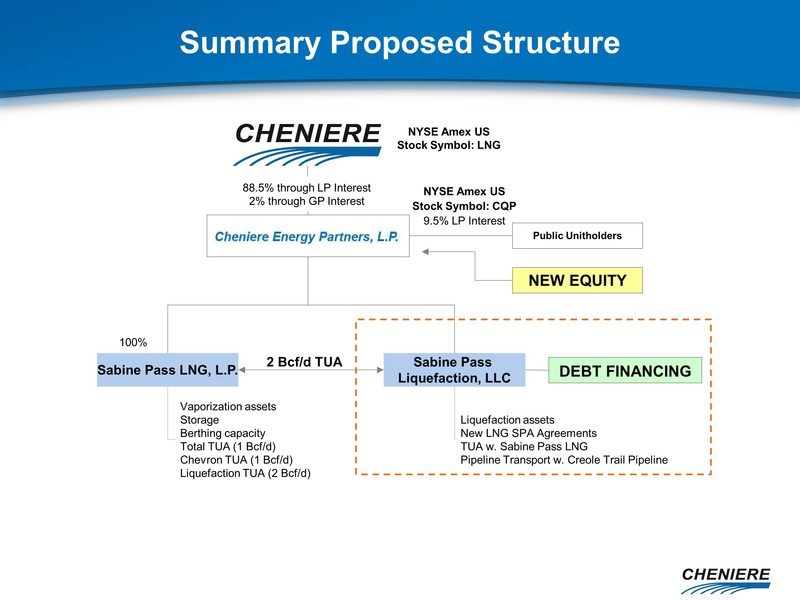

Summary Proposed Structure

Sabine Pass LNG, L.P.

88.5% through LP Interest 2% through GP Interest

NYSE Amex US Stock Symbol: LNG

NYSE Amex US Stock Symbol: CQP 9.5% LP Interest

Public Unitholders

Sabine Pass Liquefaction, LLC

Vaporization assets Storage Berthing capacity Total TUA (1 Bcf/d) Chevron TUA (1 Bcf/d) Liquefaction TUA (2 Bcf/d)

100%

Liquefaction assets New LNG SPA Agreements TUA w. Sabine Pass LNG Pipeline Transport w. Creole Trail Pipeline

2 Bcf/d TUA

DEBT FINANCING

NEW EQUITY

Summary Proposed Structure

Sabine Pass LNG, L.P.

88.5% through LP Interest 2% through GP Interest

NYSE Amex US Stock Symbol: LNG

NYSE Amex US Stock Symbol: CQP 9.5% LP Interest

Public Unitholders

Sabine Pass Liquefaction, LLC

Vaporization assets Storage Berthing capacity Total TUA (1 Bcf/d) Chevron TUA (1 Bcf/d) Liquefaction TUA (2 Bcf/d)

100%

Liquefaction assets New LNG SPA Agreements TUA w. Sabine Pass LNG Pipeline Transport w. Creole Trail Pipeline

2 Bcf/d TUA

DEBT FINANCING

NEW EQUITY

15

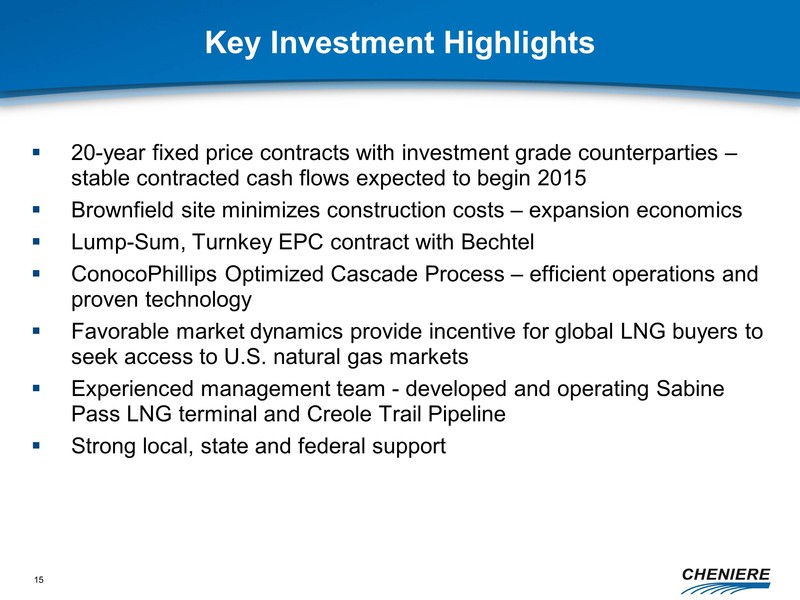

Key Investment Highlights

20-year fixed price contracts with investment grade counterparties – stable contracted cash flows expected to begin 2015 Brownfield site minimizes construction costs – expansion economics Lump-Sum, Turnkey EPC contract with Bechtel ConocoPhillips Optimized Cascade Process – efficient operations and proven technology Favorable market dynamics provide incentive for global LNG buyers to seek access to U.S. natural gas markets Experienced management team - developed and operating Sabine Pass LNG terminal and Creole Trail Pipeline Strong local, state and federal support

Key Investment Highlights

20-year fixed price contracts with investment grade counterparties – stable contracted cash flows expected to begin 2015 Brownfield site minimizes construction costs – expansion economics Lump-Sum, Turnkey EPC contract with Bechtel ConocoPhillips Optimized Cascade Process – efficient operations and proven technology Favorable market dynamics provide incentive for global LNG buyers to seek access to U.S. natural gas markets Experienced management team - developed and operating Sabine Pass LNG terminal and Creole Trail Pipeline Strong local, state and federal support

Financial Overview (All numbers reflect pre-Liquefaction financials)

CHENIERE ENERGY

CHENIERE ENERGY

17

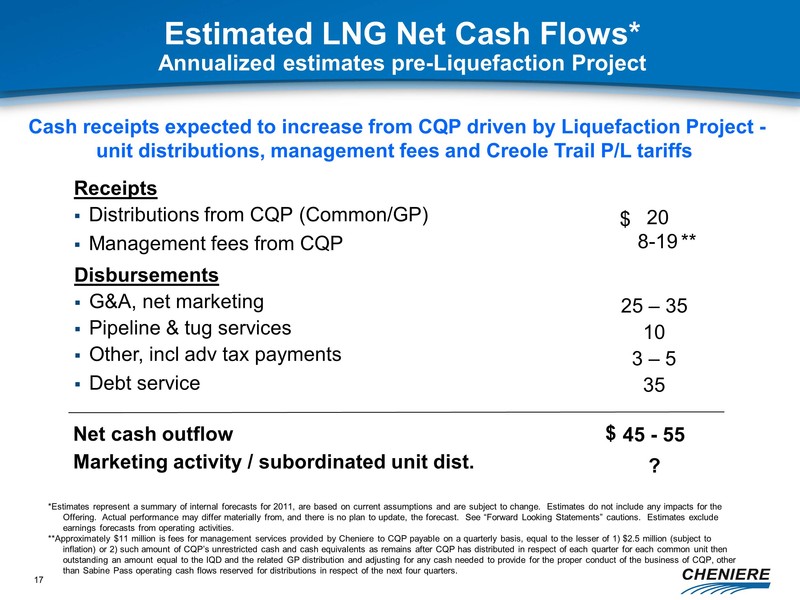

Disbursements G&A, net marketing Pipeline & tug services Other, incl adv tax payments Debt service

Receipts Distributions from CQP (Common/GP) Management fees from CQP

45 - 55

*Estimates represent a summary of internal forecasts for 2011, are based on current assumptions and are subject to change. Estimates do not include any impacts for the Offering. Actual performance may differ materially from, and there is no plan to update, the forecast. See “Forward Looking Statements” cautions. Estimates exclude earnings forecasts from operating activities. **Approximately $11 million is fees for management services provided by Cheniere to CQP payable on a quarterly basis, equal to the lesser of 1) $2.5 million (subject to inflation) or 2) such amount of CQP’s unrestricted cash and cash equivalents as remains after CQP has distributed in respect of each quarter for each common unit then outstanding an amount equal to the IQD and the related GP distribution and adjusting for any cash needed to provide for the proper conduct of the business of CQP, other than Sabine Pass operating cash flows reserved for distributions in respect of the next four quarters.

Net cash outflow

Marketing activity / subordinated unit dist.

?

20 8-19

25 – 35 10 3 – 5 35

$

$

Cash receipts expected to increase from CQP driven by Liquefaction Project - unit distributions, management fees and Creole Trail P/L tariffs

Estimated LNG Net Cash Flows* Annualized estimates pre-Liquefaction Project

**

Disbursements G&A, net marketing Pipeline & tug services Other, incl adv tax payments Debt service

Receipts Distributions from CQP (Common/GP) Management fees from CQP

45 - 55

*Estimates represent a summary of internal forecasts for 2011, are based on current assumptions and are subject to change. Estimates do not include any impacts for the Offering. Actual performance may differ materially from, and there is no plan to update, the forecast. See “Forward Looking Statements” cautions. Estimates exclude earnings forecasts from operating activities. **Approximately $11 million is fees for management services provided by Cheniere to CQP payable on a quarterly basis, equal to the lesser of 1) $2.5 million (subject to inflation) or 2) such amount of CQP’s unrestricted cash and cash equivalents as remains after CQP has distributed in respect of each quarter for each common unit then outstanding an amount equal to the IQD and the related GP distribution and adjusting for any cash needed to provide for the proper conduct of the business of CQP, other than Sabine Pass operating cash flows reserved for distributions in respect of the next four quarters.

Net cash outflow

Marketing activity / subordinated unit dist.

?

20 8-19

25 – 35 10 3 – 5 35

$

$

Cash receipts expected to increase from CQP driven by Liquefaction Project - unit distributions, management fees and Creole Trail P/L tariffs

Estimated LNG Net Cash Flows* Annualized estimates pre-Liquefaction Project

**

18

$

$

$ 0 – 250

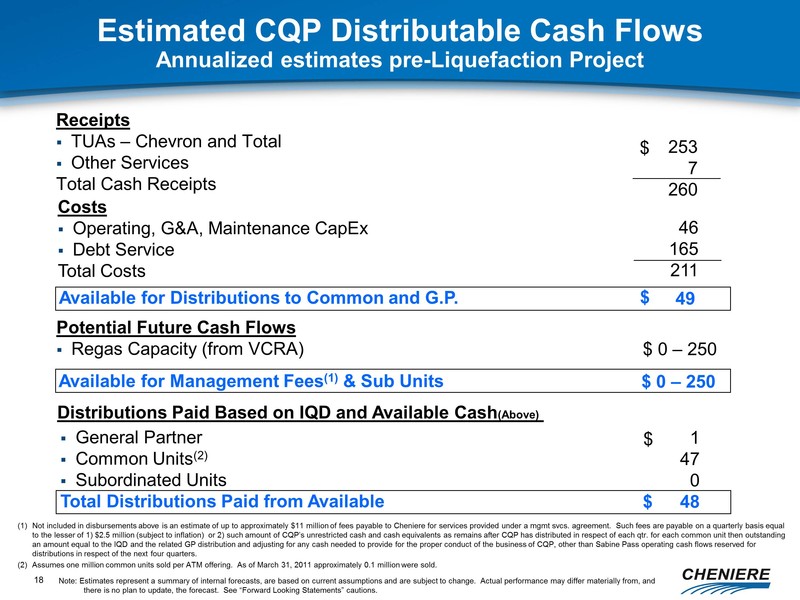

Estimated CQP Distributable Cash Flows Annualized estimates pre-Liquefaction Project

Receipts TUAs – Chevron and Total Other Services Total Cash Receipts

Note: Estimates represent a summary of internal forecasts, are based on current assumptions and are subject to change. Actual performance may differ materially from, and there is no plan to update, the forecast. See “Forward Looking Statements” cautions.

Available for Distributions to Common and G.P.

Not included in disbursements above is an estimate of up to approximately $11 million of fees payable to Cheniere for services provided under a mgmt svcs. agreement. Such fees are payable on a quarterly basis equal to the lesser of 1) $2.5 million (subject to inflation) or 2) such amount of CQP’s unrestricted cash and cash equivalents as remains after CQP has distributed in respect of each qtr. for each common unit then outstanding an amount equal to the IQD and the related GP distribution and adjusting for any cash needed to provide for the proper conduct of the business of CQP, other than Sabine Pass operating cash flows reserved for distributions in respect of the next four quarters. Assumes one million common units sold per ATM offering. As of March 31, 2011 approximately 0.1 million were sold.

Available for Management Fees(1) & Sub Units

253 7 260

1 47 0 48

Potential Future Cash Flows Regas Capacity (from VCRA)

49

$

$ 0 – 250

General Partner Common Units(2) Subordinated Units Total Distributions Paid from Available

Distributions Paid Based on IQD and Available Cash(Above)

Costs Operating, G&A, Maintenance CapEx Debt Service Total Costs

46 165 211

$

$

$

$ 0 – 250

Estimated CQP Distributable Cash Flows Annualized estimates pre-Liquefaction Project

Receipts TUAs – Chevron and Total Other Services Total Cash Receipts

Note: Estimates represent a summary of internal forecasts, are based on current assumptions and are subject to change. Actual performance may differ materially from, and there is no plan to update, the forecast. See “Forward Looking Statements” cautions.

Available for Distributions to Common and G.P.

Not included in disbursements above is an estimate of up to approximately $11 million of fees payable to Cheniere for services provided under a mgmt svcs. agreement. Such fees are payable on a quarterly basis equal to the lesser of 1) $2.5 million (subject to inflation) or 2) such amount of CQP’s unrestricted cash and cash equivalents as remains after CQP has distributed in respect of each qtr. for each common unit then outstanding an amount equal to the IQD and the related GP distribution and adjusting for any cash needed to provide for the proper conduct of the business of CQP, other than Sabine Pass operating cash flows reserved for distributions in respect of the next four quarters. Assumes one million common units sold per ATM offering. As of March 31, 2011 approximately 0.1 million were sold.

Available for Management Fees(1) & Sub Units

253 7 260

1 47 0 48

Potential Future Cash Flows Regas Capacity (from VCRA)

49

$

$ 0 – 250

General Partner Common Units(2) Subordinated Units Total Distributions Paid from Available

Distributions Paid Based on IQD and Available Cash(Above)

Costs Operating, G&A, Maintenance CapEx Debt Service Total Costs

46 165 211

$

19

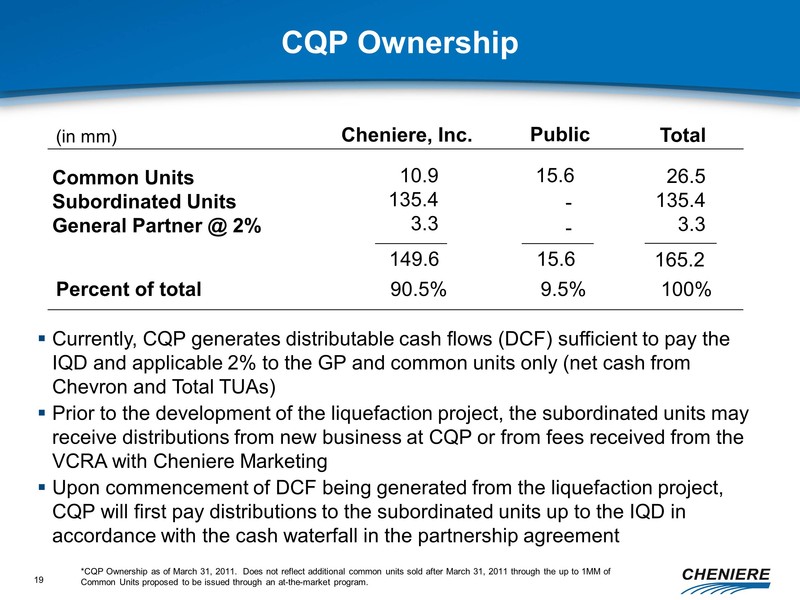

CQP Ownership

Common Units Subordinated Units General Partner @ 2%

15.6

10.9 135.4 3.3

Public

Cheniere, Inc.

15.6

149.6

(in mm)

26.5 135.4 3.3

165.2

Total

90.5%

9.5%

100%

Percent of total

*CQP Ownership as of March 31, 2011. Does not reflect additional common units sold after March 31, 2011 through the up to 1MM of Common Units proposed to be issued through an at-the-market program.

-

-

Currently, CQP generates distributable cash flows (DCF) sufficient to pay the IQD and applicable 2% to the GP and common units only (net cash from Chevron and Total TUAs) Prior to the development of the liquefaction project, the subordinated units may receive distributions from new business at CQP or from fees received from the VCRA with Cheniere Marketing Upon commencement of DCF being generated from the liquefaction project, CQP will first pay distributions to the subordinated units up to the IQD in accordance with the cash waterfall in the partnership agreement

CQP Ownership

Common Units Subordinated Units General Partner @ 2%

15.6

10.9 135.4 3.3

Public

Cheniere, Inc.

15.6

149.6

(in mm)

26.5 135.4 3.3

165.2

Total

90.5%

9.5%

100%

Percent of total

*CQP Ownership as of March 31, 2011. Does not reflect additional common units sold after March 31, 2011 through the up to 1MM of Common Units proposed to be issued through an at-the-market program.

-

-

Currently, CQP generates distributable cash flows (DCF) sufficient to pay the IQD and applicable 2% to the GP and common units only (net cash from Chevron and Total TUAs) Prior to the development of the liquefaction project, the subordinated units may receive distributions from new business at CQP or from fees received from the VCRA with Cheniere Marketing Upon commencement of DCF being generated from the liquefaction project, CQP will first pay distributions to the subordinated units up to the IQD in accordance with the cash waterfall in the partnership agreement

20

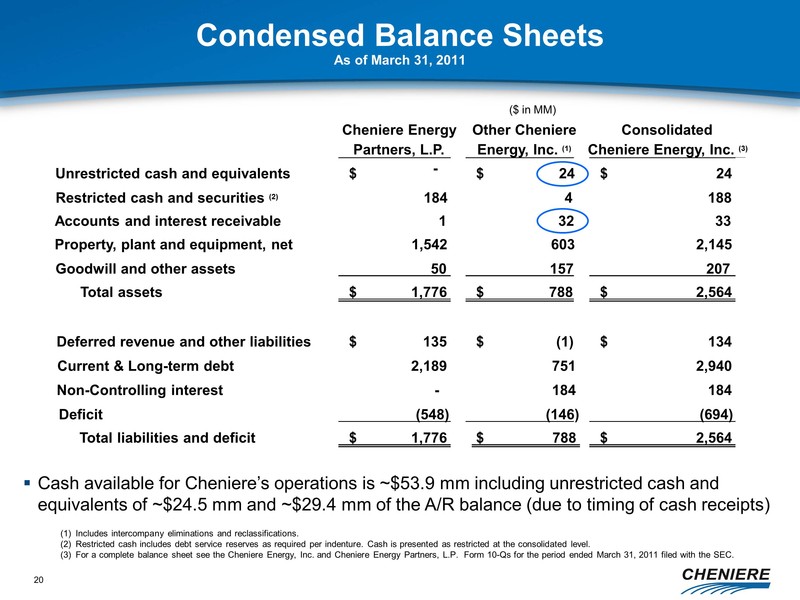

Condensed Balance Sheets As of March 31, 2011

Cheniere Energy

Other Cheniere

Consolidated

Partners, L.P.

Energy, Inc. (1)

Cheniere Energy, Inc. (3)

Unrestricted cash and equivalents

$

-

24

$

24

$

Restricted cash and securities (2)

184

4

188

Property, plant and equipment, net

1,542

603

2,145

Goodwill and other assets

50

157

207

Total assets

1,776

$

788

$

2,564

$

Deferred revenue and other liabilities

135

$

(1)

$

134

$

Current & Long-term debt

2,189

751

2,940

Non-Controlling interest

-

184

184

Deficit

(548)

(146)

(694)

1,776

$

788

$

2,564

$

Includes intercompany eliminations and reclassifications. Restricted cash includes debt service reserves as required per indenture. Cash is presented as restricted at the consolidated level. For a complete balance sheet see the Cheniere Energy, Inc. and Cheniere Energy Partners, L.P. Form 10-Qs for the period ended March 31, 2011 filed with the SEC.

-

Accounts and interest receivable

1

32

33

Total liabilities and deficit

Cash available for Cheniere’s operations is ~$53.9 mm including unrestricted cash and equivalents of ~$24.5 mm and ~$29.4 mm of the A/R balance (due to timing of cash receipts)

($ in MM)

Condensed Balance Sheets As of March 31, 2011

Cheniere Energy

Other Cheniere

Consolidated

Partners, L.P.

Energy, Inc. (1)

Cheniere Energy, Inc. (3)

Unrestricted cash and equivalents

$

-

24

$

24

$

Restricted cash and securities (2)

184

4

188

Property, plant and equipment, net

1,542

603

2,145

Goodwill and other assets

50

157

207

Total assets

1,776

$

788

$

2,564

$

Deferred revenue and other liabilities

135

$

(1)

$

134

$

Current & Long-term debt

2,189

751

2,940

Non-Controlling interest

-

184

184

Deficit

(548)

(146)

(694)

1,776

$

788

$

2,564

$

Includes intercompany eliminations and reclassifications. Restricted cash includes debt service reserves as required per indenture. Cash is presented as restricted at the consolidated level. For a complete balance sheet see the Cheniere Energy, Inc. and Cheniere Energy Partners, L.P. Form 10-Qs for the period ended March 31, 2011 filed with the SEC.

-

Accounts and interest receivable

1

32

33

Total liabilities and deficit

Cash available for Cheniere’s operations is ~$53.9 mm including unrestricted cash and equivalents of ~$24.5 mm and ~$29.4 mm of the A/R balance (due to timing of cash receipts)

($ in MM)

21

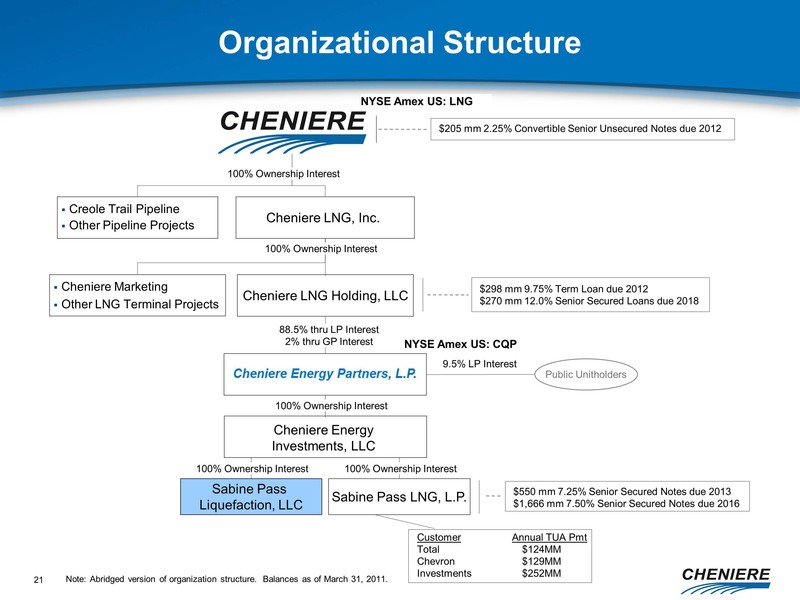

Organizational Structure

9.5% LP Interest

100% Ownership Interest

$205 mm 2.25% Convertible Senior Unsecured Notes due 2012

NYSE Amex US: LNG

NYSE Amex US: CQP

$298 mm 9.75% Term Loan due 2012 $270 mm 12.0% Senior Secured Loans due 2018

Note: Abridged version of organization structure. Balances as of March 31, 2011.

Sabine Pass LNG, L.P.

Sabine Pass Liquefaction, LLC

Cheniere LNG, Inc.

Creole Trail Pipeline Other Pipeline Projects

100% Ownership Interest

88.5% thru LP Interest 2% thru GP Interest

$550 mm 7.25% Senior Secured Notes due 2013 $1,666 mm 7.50% Senior Secured Notes due 2016

Cheniere Marketing Other LNG Terminal Projects

Public Unitholders

100% Ownership Interest

100% Ownership Interest

Cheniere LNG Holding, LLC

100% Ownership Interest

Customer Annual TUA Pmt Total $124MM Chevron $129MM Investments $252MM

Organizational Structure

9.5% LP Interest

100% Ownership Interest

$205 mm 2.25% Convertible Senior Unsecured Notes due 2012

NYSE Amex US: LNG

NYSE Amex US: CQP

$298 mm 9.75% Term Loan due 2012 $270 mm 12.0% Senior Secured Loans due 2018

Note: Abridged version of organization structure. Balances as of March 31, 2011.

Sabine Pass LNG, L.P.

Sabine Pass Liquefaction, LLC

Cheniere LNG, Inc.

Creole Trail Pipeline Other Pipeline Projects

100% Ownership Interest

88.5% thru LP Interest 2% thru GP Interest

$550 mm 7.25% Senior Secured Notes due 2013 $1,666 mm 7.50% Senior Secured Notes due 2016

Cheniere Marketing Other LNG Terminal Projects

Public Unitholders

100% Ownership Interest

100% Ownership Interest

Cheniere LNG Holding, LLC

100% Ownership Interest

Customer Annual TUA Pmt Total $124MM Chevron $129MM Investments $252MM

CHENIERE ENERGY

Appendix

Appendix

23

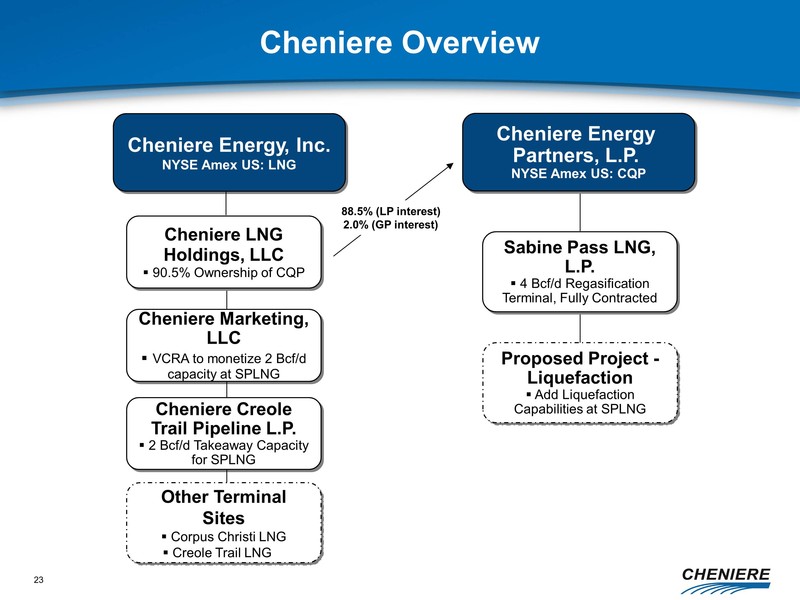

Cheniere Overview

Cheniere Energy, Inc. NYSE Amex US: LNG

Cheniere Marketing, LLC VCRA to monetize 2 Bcf/d capacity at SPLNG

Cheniere LNG Holdings, LLC 90.5% Ownership of CQP

Cheniere Energy Partners, L.P. NYSE Amex US: CQP

Cheniere Creole Trail Pipeline L.P. 2 Bcf/d Takeaway Capacity for SPLNG

Sabine Pass LNG, L.P. 4 Bcf/d Regasification Terminal, Fully Contracted

Proposed Project - Liquefaction Add Liquefaction Capabilities at SPLNG

88.5% (LP interest) 2.0% (GP interest)

Other Terminal Sites Corpus Christi LNG Creole Trail LNG…

Cheniere Overview

Cheniere Energy, Inc. NYSE Amex US: LNG

Cheniere Marketing, LLC VCRA to monetize 2 Bcf/d capacity at SPLNG

Cheniere LNG Holdings, LLC 90.5% Ownership of CQP

Cheniere Energy Partners, L.P. NYSE Amex US: CQP

Cheniere Creole Trail Pipeline L.P. 2 Bcf/d Takeaway Capacity for SPLNG

Sabine Pass LNG, L.P. 4 Bcf/d Regasification Terminal, Fully Contracted

Proposed Project - Liquefaction Add Liquefaction Capabilities at SPLNG

88.5% (LP interest) 2.0% (GP interest)

Other Terminal Sites Corpus Christi LNG Creole Trail LNG…

24

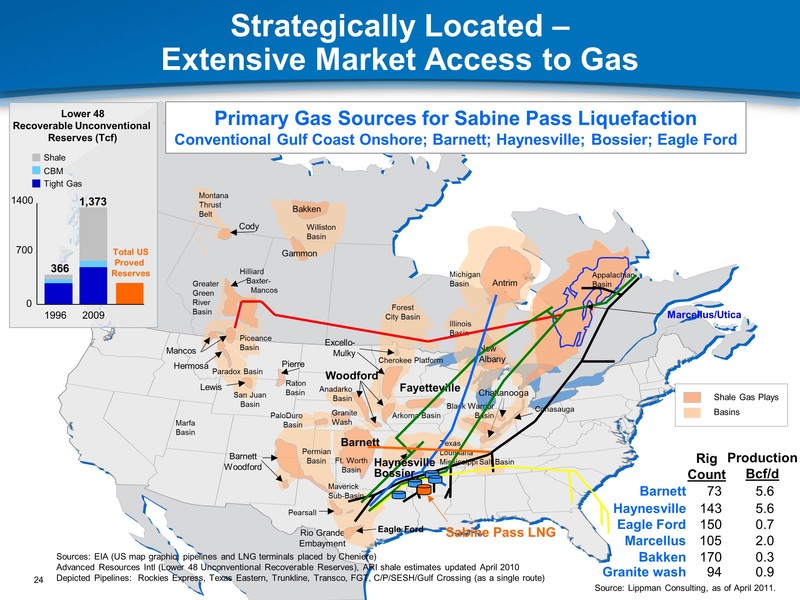

Strategically Located – Extensive Market Access to Gas

Montana Thrust Belt

Cody

Gammon

Hilliard Baxter- Mancos

Greater Green River Basin

Forest City Basin

Pierre

Illinois Basin

Piceance Basin

Lewis

San Juan Basin

Raton Basin

Anadarko Basin

PaloDuro Basin

Permian Basin

Barnett Woodford

Pearsall

Eagle Ford

Rio Grande Embayment

Barnett

Woodford

Michigan Basin

Antrim

New Albany

Chattanooga

Texas Louisiana Mississippi Salt Basin

Fayetteville

Ft. Worth Basin

Arkoma Basin

Conasauga

Black Warrior Basin

Marfa Basin

Paradox Basin

Maverick Sub-Basin

Hermosa

Mancos

Cherokee Platform

Excello- Mulky

Appalachian Basin

Marcellus/Utica

Shale Gas Plays Basins

366

1,373

Lower 48 Recoverable Unconventional Reserves (Tcf)

0

700

1400

1996

2009

Shale

CBM

Tight Gas

Total US Proved Reserves

Sabine Pass LNG

Haynesville Bossier

Granite Wash

Williston Basin

Bakken

Primary Gas Sources for Sabine Pass Liquefaction Conventional Gulf Coast Onshore; Barnett; Haynesville; Bossier; Eagle Ford

Sources: EIA (US map graphic, pipelines and LNG terminals placed by Cheniere) Advanced Resources Intl (Lower 48 Unconventional Recoverable Reserves), ARI shale estimates updated April 2010 Depicted Pipelines: Rockies Express, Texas Eastern, Trunkline, Transco, FGT, C/P/SESH/Gulf Crossing (as a single route)

Rig Count

Production Bcf/d

Marcellus

105

2.0

Source: Lippman Consulting, as of April 2011.

Strategically Located – Extensive Market Access to Gas

Montana Thrust Belt

Cody

Gammon

Hilliard Baxter- Mancos

Greater Green River Basin

Forest City Basin

Pierre

Illinois Basin

Piceance Basin

Lewis

San Juan Basin

Raton Basin

Anadarko Basin

PaloDuro Basin

Permian Basin

Barnett Woodford

Pearsall

Eagle Ford

Rio Grande Embayment

Barnett

Woodford

Michigan Basin

Antrim

New Albany

Chattanooga

Texas Louisiana Mississippi Salt Basin

Fayetteville

Ft. Worth Basin

Arkoma Basin

Conasauga

Black Warrior Basin

Marfa Basin

Paradox Basin

Maverick Sub-Basin

Hermosa

Mancos

Cherokee Platform

Excello- Mulky

Appalachian Basin

Marcellus/Utica

Shale Gas Plays Basins

366

1,373

Lower 48 Recoverable Unconventional Reserves (Tcf)

0

700

1400

1996

2009

Shale

CBM

Tight Gas

Total US Proved Reserves

Sabine Pass LNG

Haynesville Bossier

Granite Wash

Williston Basin

Bakken

Primary Gas Sources for Sabine Pass Liquefaction Conventional Gulf Coast Onshore; Barnett; Haynesville; Bossier; Eagle Ford

Sources: EIA (US map graphic, pipelines and LNG terminals placed by Cheniere) Advanced Resources Intl (Lower 48 Unconventional Recoverable Reserves), ARI shale estimates updated April 2010 Depicted Pipelines: Rockies Express, Texas Eastern, Trunkline, Transco, FGT, C/P/SESH/Gulf Crossing (as a single route)

Rig Count

Production Bcf/d

Marcellus

105

2.0

Source: Lippman Consulting, as of April 2011.

25

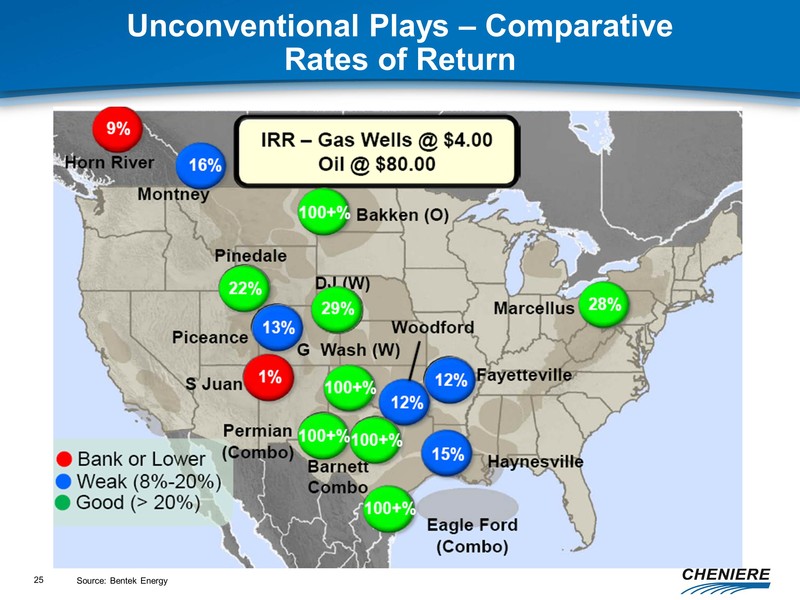

Unconventional Plays – Comparative Rates of Return

Source: Bentek Energy

Unconventional Plays – Comparative Rates of Return

Source: Bentek Energy

26

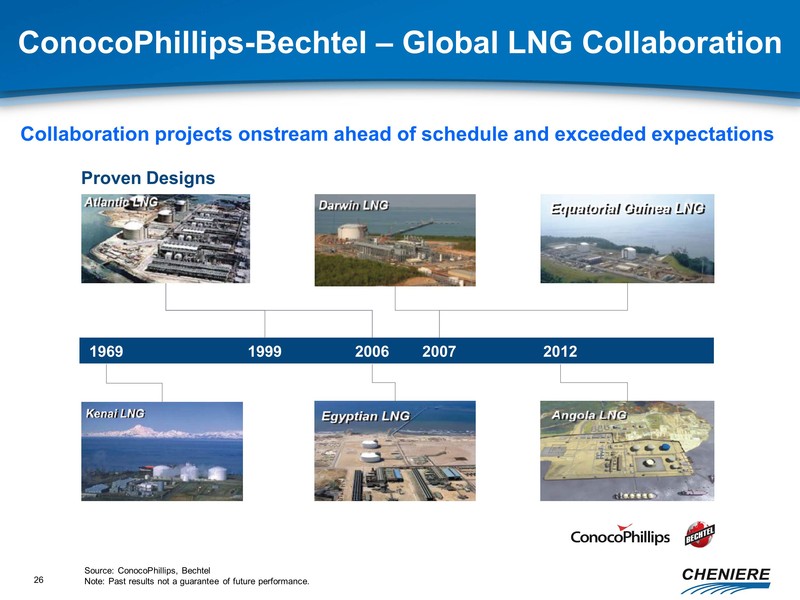

ConocoPhillips-Bechtel – Global LNG Collaboration

Source: ConocoPhillips, Bechtel Note: Past results not a guarantee of future performance.

Proven Designs

Collaboration projects onstream ahead of schedule and exceeded expectations

1969

1999

2007

2012

2006

ConocoPhillips-Bechtel – Global LNG Collaboration

Source: ConocoPhillips, Bechtel Note: Past results not a guarantee of future performance.

Proven Designs

Collaboration projects onstream ahead of schedule and exceeded expectations

1969

1999

2007

2012

2006

27

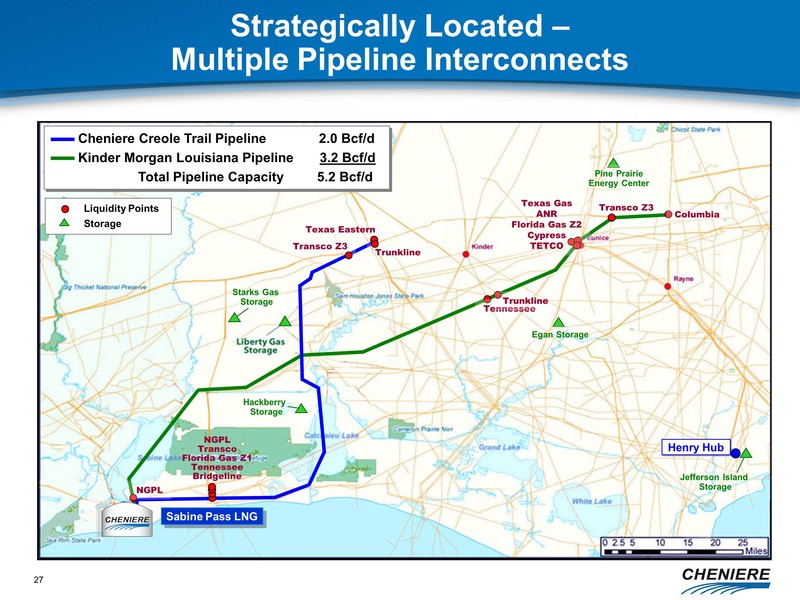

Strategically Located – Multiple Pipeline Interconnects

Cheniere Creole Trail Pipeline 2.0 Bcf/d Kinder Morgan Louisiana Pipeline 3.2 Bcf/d Total Pipeline Capacity 5.2 Bcf/d

Transco Z3

Texas Eastern

Trunkline

Transco Z3

Pine Prairie Energy Center

Egan Storage

Jefferson Island Storage

Hackberry Storage

NGPL Transco Florida Gas Z1 Tennessee Bridgeline

Texas Gas ANR Florida Gas Z2 Cypress TETCO

Tennessee

Trunkline

Columbia

NGPL

Sabine Pass LNG

Liquidity Points Storage

Henry Hub

Strategically Located – Multiple Pipeline Interconnects

Cheniere Creole Trail Pipeline 2.0 Bcf/d Kinder Morgan Louisiana Pipeline 3.2 Bcf/d Total Pipeline Capacity 5.2 Bcf/d

Transco Z3

Texas Eastern

Trunkline

Transco Z3

Pine Prairie Energy Center

Egan Storage

Jefferson Island Storage

Hackberry Storage

NGPL Transco Florida Gas Z1 Tennessee Bridgeline

Texas Gas ANR Florida Gas Z2 Cypress TETCO

Tennessee

Trunkline

Columbia

NGPL

Sabine Pass LNG

Liquidity Points Storage

Henry Hub

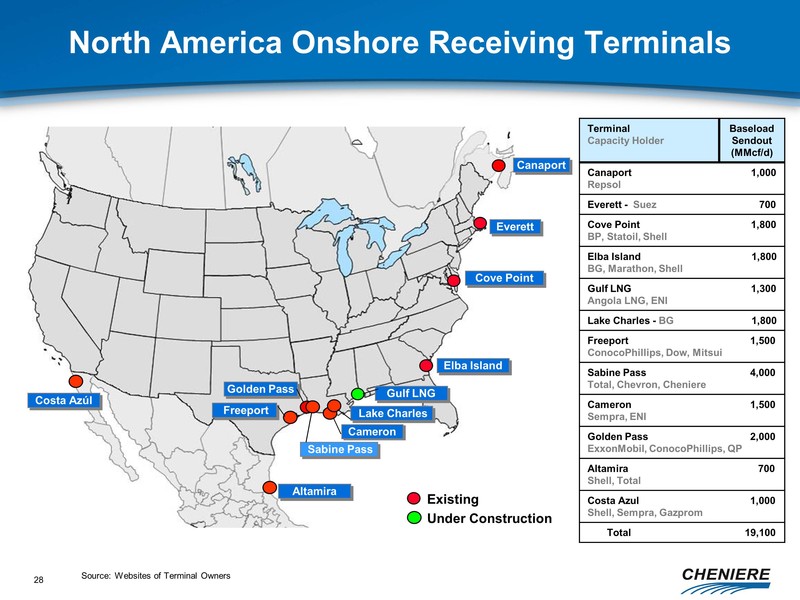

28

Everett

Cove Point

Elba Island

Lake Charles

Sabine Pass

Freeport

Golden Pass

Cameron

Costa Azúl

Canaport

Existing Under Construction

Altamira

Source: Websites of Terminal Owners

North America Onshore Receiving Terminals

Gulf LNG

Everett

Cove Point

Elba Island

Lake Charles

Sabine Pass

Freeport

Golden Pass

Cameron

Costa Azúl

Canaport

Existing Under Construction

Altamira

Source: Websites of Terminal Owners

North America Onshore Receiving Terminals

Gulf LNG

Cheniere Energy Contacts Katie Pipkin, Vice President Finance & Investor Relations (713) 375-5110 – katie.pipkin@cheniere.com Christina Burke, Manager Investor Relations (713) 375-5104 – christina.burke@cheniere.com

CHENIERE ENERGY

CHENIERE ENERGY