Forward Looking Statements

1

This presentation contains certain statements that are, or may be deemed to be, “forward-looking statements” within the meaning of Section 27A of

the Securities Act and Section 21E of the Securities Exchange Act of 1933, as amended. All statements, other than statements of historical facts,

included herein are “forward-looking statements.” Included among “forward-looking statements” are, among other things:

§ statements that we expect to commence or complete construction of a liquefaction facility by certain dates, or at all;

§ statements that we expect to receive authorization from the Federal Energy Regulatory Commission, or FERC, or the Department of Energy, or

DOE to construct and operate a proposed liquefaction facility by a certain date, or at all;

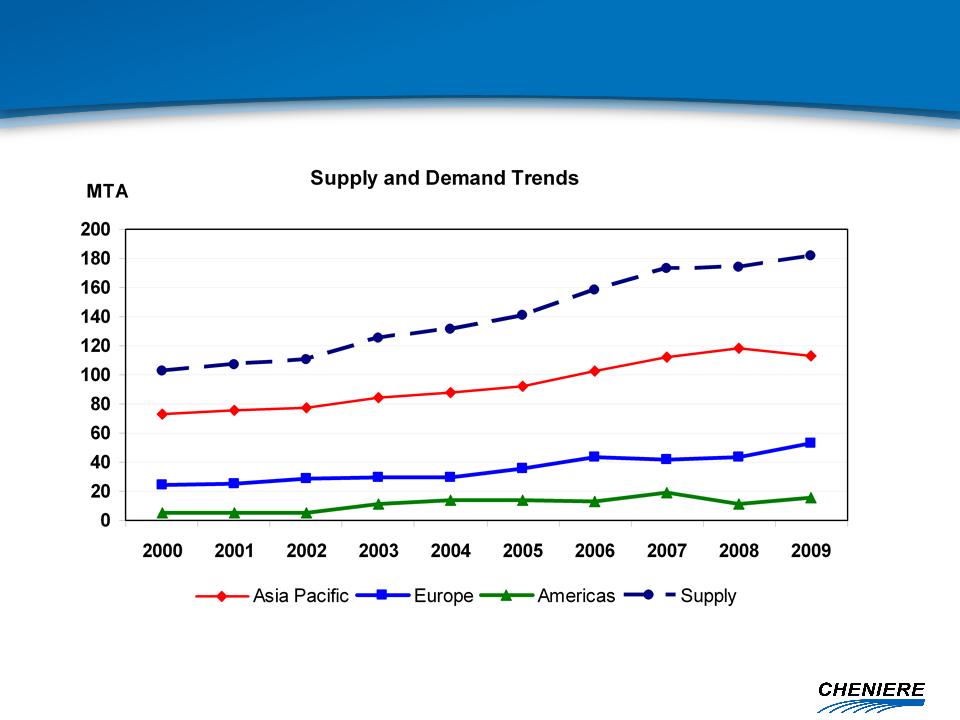

§ statements regarding future levels of domestic or foreign natural gas production and consumption, or the future level of LNG imports into North

America or exports from the U.S., or regarding projected future capacity of liquefaction or regasification facilities worldwide;

§ statements regarding any financing transactions or arrangements, whether on the part of Cheniere or at the project level;

§ statements regarding any commercial arrangements marketed or potential arrangements to be performed in the future, including any cash

distributions and revenues anticipated to be received;

§ statements regarding the commercial terms and potential revenues from activities described in this presentation;

§ statements that our proposed liquefaction facility, when completed, will have certain characteristics, including a number of trains;

§ statements regarding our business strategy, our business plan or any other plans, forecasts, examples, models, forecasts or objectives: any or all of

which are subject to change;

§ statements regarding estimated corporate overhead expenses; and

§ any other statements that relate to non-historical information.

These forward-looking statements are often identified by the use of terms and phrases such as “achieve,” “anticipate,” “believe,” “estimate,” “example,”

“expect,” “forecast,” “opportunities,” “plan,” “potential,” “project,” “propose,” “subject to,” and similar terms and phrases. Although we believe that the

expectations reflected in these forward-looking statements are reasonable, they do involve assumptions, risks and uncertainties, and these

expectations may prove to be incorrect. You should not place undue reliance on these forward-looking statements, which speak only as of the date of

this presentation. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of a variety of

factors, including those discussed in “Risk Factors” in the Cheniere Energy, Inc. and Cheniere Energy Partners, L.P. Annual Reports on Form 10-K for

the year ended December 31, 2009, which are incorporated by reference into this presentation. All forward-looking statements attributable to us or

persons acting on our behalf are expressly qualified in their entirety by these ”Risk Factors”. These forward-looking statements are made as of the

date of this presentation, and we undertake no obligation to publicly update or revise any forward-looking statements.