|

x

|

ANNUAL REPORT PURSUANT TO SECTION

13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF

1934

|

|

¨

|

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF

1934

|

|

Delaware

|

95-4352386

|

|

(State

or other jurisdiction of incorporation or organization)

|

(I.R.S.

Employer Identification No.)

|

|

700

Milam Street, Suite 800

|

|

|

Houston,

Texas

|

77002

|

|

(Address

of principal executive offices)

|

(Zip

code)

|

|

Common

Stock, $ 0.003 par value

|

NYSE

Amex Equities

|

|

(Title

of Class)

|

(Name

of each exchange on which

registered)

|

|

Large accelerated filer ¨

|

Accelerated filer x

|

Non-accelerated filer ¨

|

Smaller reporting company ¨

|

|

(Do

not check if a smaller reporting company)

|

|||

|

|

•

|

statements

relating to the construction and operation of each of our proposed

liquefied natural gas (“LNG”) receiving terminals or our proposed natural

gas pipelines, or expansions or extensions thereof, including statements

concerning the completion or expansion thereof by certain dates or at all,

the costs related thereto and certain characteristics, including amounts

of regasification and storage capacity, the number of storage tanks and

docks, pipeline deliverability and the number of pipeline

interconnections, if any;

|

|

|

•

|

statements

that we expect to receive an order from the Federal Energy Regulatory

Commission (“FERC”) authorizing us to construct and operate proposed LNG

receiving terminals or proposed pipelines by certain dates, or at

all;

|

|

|

•

|

statements

regarding future levels of domestic natural gas production, supply or

consumption; future levels of LNG imports into North America; sales of

natural gas in North America; and the transportation, other infrastructure

or prices related to natural gas, LNG or other energy sources or

hydrocarbon products;

|

|

|

•

|

statements

regarding any financing or refinancing or recapitalization transactions or

arrangements, or ability to enter into such transactions, whether on the

part of Cheniere or at the project

level;

|

|

|

•

|

statements

regarding any terminal use agreement (“TUA”) or other commercial

arrangements presently contracted, optioned, marketed or potential

arrangements to be performed substantially in the future, including any

cash distributions and revenues anticipated to be received and the

anticipated timing thereof, and statements regarding the amounts of total

LNG regasification or storage capacity that are, or may become, subject to

TUAs or other contracts;

|

|

|

•

|

statements

regarding counterparties to our TUAs, construction contracts and other

contracts;

|

|

|

•

|

statements

regarding any business strategy, any business plans or any other plans,

forecasts, projections or objectives, including potential revenues and

capital expenditures, any or all of which are subject to

change;

|

|

|

•

|

statements

regarding legislative, governmental, regulatory, administrative or other

public body actions, requirements, permits, investigations, proceedings or

decisions;

|

|

|

•

|

statements

regarding our LNG and natural gas marketing activities;

and

|

|

|

•

|

any

other statements that relate to non-historical or future

information.

|

|

|

•

|

Bcf means billion cubic

feet;

|

|

|

•

|

Bcf/d means billion

cubic feet per day;

|

|

|

•

|

EPC means engineering,

procurement and construction;

|

|

|

•

|

EPCM means engineering,

procurement, construction and

management;

|

|

|

•

|

LNG means liquefied

natural gas;

|

|

|

•

|

MMcf/d means million

cubic feet per day;

|

|

|

•

|

MMBtu means million

British thermal units; and

|

|

|

•

|

TUA means terminal use

agreement.

|

|

|

•

|

LNG

receiving terminal business;

|

|

|

•

|

natural

gas pipeline business; and

|

|

|

•

|

LNG

and natural gas marketing business.

|

|

|

•

|

Total

Gas and Power North America, Inc. (formally known as Total LNG USA, Inc.)

(“Total”) has reserved approximately 1.0 Bcf/d of regasification capacity

and has agreed to make monthly capacity payments to Sabine Pass LNG

aggregating approximately $125 million per year for 20 years that

commenced April 1, 2009. Total, S.A. has guaranteed Total’s

obligations under its TUA up to $2.5 billion, subject to certain

exceptions; and

|

|

|

•

|

Chevron

U.S.A., Inc. (“Chevron”) has reserved approximately 1.0 Bcf/d of

regasification capacity and has agreed to make monthly capacity payments

to Sabine Pass LNG aggregating approximately $125 million per year for 20

years that commenced July 1, 2009. Chevron Corporation has guaranteed

Chevron’s obligations under its TUA up to 80% of the fees payable by

Chevron.

|

|

|

•

|

existing

producing regions in the United States, Canada and

Mexico;

|

|

|

•

|

frontier

regions in Alaska, northern Canada and offshore

deepwater;

|

|

|

•

|

areas

currently restricted from exploration and development due to public

policies, such as areas in the Rocky Mountains and offshore Atlantic,

Pacific and Gulf of Mexico coasts;

and

|

|

|

•

|

imported

LNG.

|

|

|

•

|

rates

and charges for natural gas transportation and related

services;

|

|

|

•

|

the

certification and construction of new

facilities;

|

|

|

•

|

the

extension and abandonment of services and

facilities;

|

|

|

•

|

the

maintenance of accounts and

records;

|

|

|

•

|

the

acquisition and disposition of

facilities;

|

|

|

•

|

the

initiation and discontinuation of services;

and

|

|

|

•

|

various

other matters.

|

|

|

•

|

large,

multinational and national companies with longer operating histories, more

development experience, greater name recognition, larger staffs and

substantially greater financial, technical and marketing

resources;

|

|

|

•

|

oil

and gas producers who sell or control LNG derived from their international

oil and gas properties; and

|

|

|

•

|

purchasers

located in other countries, in which prevailing market prices can be

substantially different than those in the

U.S.

|

|

|

•

|

major

integrated marketers who have large amounts of capital to support their

marketing operations and offer a full-range of services and market

numerous products other than natural

gas;

|

|

|

•

|

producer

marketers who sell their own natural gas production or the production of

their affiliated natural gas production

company;

|

|

|

•

|

small

geographically focused marketers who focus on marketing natural gas for

the geographic area in which their affiliated distributor operates;

and

|

|

|

•

|

aggregators

who gather small volumes of natural gas from various sources, combine them

and sell the larger volumes for more favorable prices and terms than would

be possible selling the smaller volumes

separately.

|

|

|

•

|

Risks

Relating to Our Financial Matters;

|

|

|

•

|

Risks

Relating to Our LNG Receiving Terminal

Business;

|

|

|

•

|

Risks

Relating to Our Natural Gas Pipeline

Business;

|

|

|

•

|

Risks

Relating to Our LNG and Natural Gas Marketing

Business;

|

|

|

•

|

Risks

Relating to Our LNG Businesses in General;

and

|

|

|

•

|

Risks

Relating to Our Business in

General.

|

|

|

•

|

borrowings,

debt issuances, or extensions of debt maturities may subject us to certain

restrictive covenants, including covenants restricting our ability to

raise additional capital or cross-defaults to our other

indebtedness;

|

|

|

•

|

borrowings

or debt issuances at the project level may subject the project entity to

restrictive covenants, including covenants restricting its ability to make

distributions to us or limiting our ability to sell our interests in such

entity;

|

|

|

•

|

offerings

of our equity securities could cause substantial dilution for holders of

our common stock and Series B Preferred

Stock;

|

|

|

•

|

additional

sales of interests in our projects would reduce our interest in future

revenues; and

|

|

|

•

|

the

prepayment of terminal use fees by, or a business development loan from,

prospective customers would reduce future revenues once an LNG receiving

terminal commence operations.

|

|

|

•

|

limiting

our ability to attract customers;

|

|

|

•

|

limiting

our ability to compete with other companies that are not as highly

leveraged;

|

|

|

•

|

limiting

our flexibility in and ability to plan for or react to changing market

conditions in our industry and to economic downturns, and making us more

vulnerable than our less leveraged competitors to an industry or economic

downturn;

|

|

|

•

|

limiting

our ability to use operating cash flow in other areas of our business

because we must dedicate a substantial portion of these funds to service

debt, including indebtedness that we may incur in the

future;

|

|

|

•

|

limiting

our ability to obtain additional financing to fund our capital

expenditures, working capital, acquisitions, debt service requirements or

liquidity needs for general business or other purposes;

and

|

|

|

•

|

resulting

in a material adverse effect on our business, results of operations and

financial condition if we are unable to service or refinance our

indebtedness or obtain additional financing, as

needed.

|

|

|

•

|

performing

below expected levels of

efficiency;

|

|

|

•

|

breakdown

or failures of equipment or

systems;

|

|

|

•

|

operational

errors by vessel or tug operators or

others;

|

|

|

•

|

operational

errors by us or any contracted facility operator or

others;

|

|

|

•

|

labor

disputes; and

|

|

|

•

|

weather-related

interruptions of operations.

|

|

|

•

|

we

may be unable to enter into contracts for the purchase of the LNG, and may

be unable to obtain vessels to deliver such LNG, on terms reasonably

acceptable to us or at all;

|

|

|

•

|

we

may bear the commodity price risk associated with purchasing the LNG,

holding it in inventory for a period of time and selling the regasified

LNG; and

|

|

|

•

|

we

may be unable to obtain financing for the purchase and shipment of the LNG

on terms that are reasonably acceptable to us or at

all.

|

|

|

•

|

perform

ongoing assessments of pipeline

integrity;

|

|

|

•

|

identify

and characterize applicable threats to pipeline segments that could impact

a high consequence area;

|

|

|

•

|

improve

data collection, integration and

analysis;

|

|

|

•

|

repair

and remediate the pipeline as necessary;

and

|

|

|

•

|

implement

preventive and mitigating actions.

|

|

|

•

|

Cheniere

Marketing does not have unconditional agreements or arrangements for any

supplies of LNG, or for the utilization of capacity that it has contracted

for under its TUA with us and may not be able to obtain such agreements or

arrangements on economical terms, or at

all;

|

|

|

•

|

Cheniere

Marketing does not have unconditional commitments from customers for the

purchase of the natural gas it proposes to sell from our LNG receiving

terminal, and it may not be able to obtain commitments or other

arrangements on economical terms, or at

all;

|

|

|

•

|

in

order to arrange for supplies of LNG, and for transportation, storage and

sales of natural gas, Cheniere Marketing will require significant credit

support and funding, which we may not be able to obtain on terms that are

acceptable to us, or at all; and

|

|

|

•

|

even

if Cheniere Marketing is able to arrange for and finance supplies and

transportation of LNG to the Sabine Pass LNG receiving terminal, and for

transportation, storage and sales of natural gas to customers, it may

experience negative cash flows and adverse liquidity effects due to

fluctuations in supply, demand and price for LNG, for transportation of

LNG, for natural gas and for storage and transportation of natural

gas.

|

|

|

•

|

expected

supply is less than the amount

hedged;

|

|

|

•

|

the

counterparty to the hedging contract defaults on its contractual

obligations; or

|

|

|

•

|

there

is a change in the expected differential between the underlying price in

the hedging agreement and actual prices

received.

|

|

|

•

|

relatively

minor changes in the supply of, and demand for, natural gas in relevant

markets;

|

|

|

•

|

political

conditions in international natural gas producing

regions;

|

|

|

•

|

the

extent of domestic production and importation of natural gas in relevant

markets;

|

|

|

•

|

the

level of demand for LNG and natural gas in relevant markets, including the

effects of economic downturns or

upturns;

|

|

|

•

|

weather

conditions;

|

|

|

•

|

the

competitive position of natural gas as a source of energy compared with

other energy sources; and

|

|

|

•

|

the

effect of government regulation on the production, transportation and sale

of natural gas.

|

|

|

•

|

additions

to competitive regasification capacity in North America, Europe, Asia and

other markets, which could divert LNG from our existing and proposed LNG

receiving terminals;

|

|

|

•

|

insufficient

LNG liquefaction capacity

worldwide;

|

|

|

•

|

insufficient

LNG tanker capacity;

|

|

|

•

|

reduced

demand and lower prices for natural

gas;

|

|

|

•

|

increased

natural gas production deliverable by pipelines, which could suppress

demand for LNG;

|

|

|

•

|

cost

improvements that allow competitors to offer LNG regasification services

at reduced prices;

|

|

|

•

|

changes

in supplies of, and prices for, alternative energy sources such as coal,

oil, nuclear, hydroelectric, wind and solar energy, which may reduce the

demand for natural gas;

|

|

|

•

|

changes

in regulatory, tax or other governmental policies regarding imported LNG,

natural gas or alternative energy sources, which may reduce the demand for

imported LNG and/or natural gas;

|

|

|

•

|

adverse

relative demand for LNG in North America compared to other markets, which

may decrease LNG imports into North America;

and

|

|

|

•

|

cyclical

trends in general business and economic conditions that cause changes in

the demand for natural gas.

|

|

|

•

|

increased

construction costs;

|

|

|

•

|

economic

downturns, increases in interest rates or other events that may affect the

availability of sufficient financing for LNG projects on commercially

reasonable terms;

|

|

|

•

|

decreases

in the price of LNG and natural gas, which might decrease the expected

returns relating to investments in LNG

projects;

|

|

|

•

|

the

inability of project owners or operators to obtain governmental approvals

to construct or operate LNG

facilities;

|

|

|

•

|

political

unrest in exporting countries or local community resistance in such

countries to the siting of LNG facilities due to safety, environmental or

security concerns; and

|

|

|

•

|

any

significant explosion, spill or similar incident involving an LNG

liquefaction facility or LNG

carrier.

|

|

|

•

|

an

inadequate number of shipyards constructing LNG vessels and a backlog of

orders at these shipyards;

|

|

|

•

|

political

or economic disturbances in the countries where the vessels are being

constructed;

|

|

|

•

|

changes

in governmental regulations or maritime self-regulatory

organizations;

|

|

|

•

|

work

stoppages or other labor disturbances at the

shipyards;

|

|

|

•

|

bankruptcy

or other financial crisis of

shipbuilders;

|

|

|

•

|

quality

or engineering problems;

|

|

|

•

|

weather

interference or a catastrophic event, such as a major earthquake, tsunami

or fire; and

|

|

|

•

|

shortages

of or delays in the receipt of necessary construction

materials.

|

|

|

•

|

currency

fluctuations;

|

|

|

•

|

war;

|

|

|

•

|

expropriation

or nationalization of assets;

|

|

|

•

|

renegotiation

or nullification of existing

contracts;

|

|

|

•

|

changing

political conditions;

|

|

|

•

|

changing

laws and policies affecting trade, taxation and

investment;

|

|

|

•

|

multiple

taxation due to different tax structures;

and

|

|

|

•

|

the

general hazards associated with the assertion of sovereignty over certain

areas in which operations are

conducted.

|

|

High

|

Low

|

|||||||

|

Three

Months Ended

|

||||||||

|

March

31, 2008

|

$ | 32.68 | $ | 19.80 | ||||

|

June

30, 2008

|

20.66 | 4.37 | ||||||

|

September

30, 2008

|

4.98 | 2.13 | ||||||

|

December

31, 2008

|

4.47 | 0.95 | ||||||

|

Three

Months Ended

|

||||||||

|

March

31, 2009

|

$ | 4.98 | $ | 3.01 | ||||

|

June

30, 2009

|

5.19 | 2.71 | ||||||

|

September

30, 2009

|

3.47 | 2.50 | ||||||

|

December

31, 2009

|

2.95 | 1.80 | ||||||

|

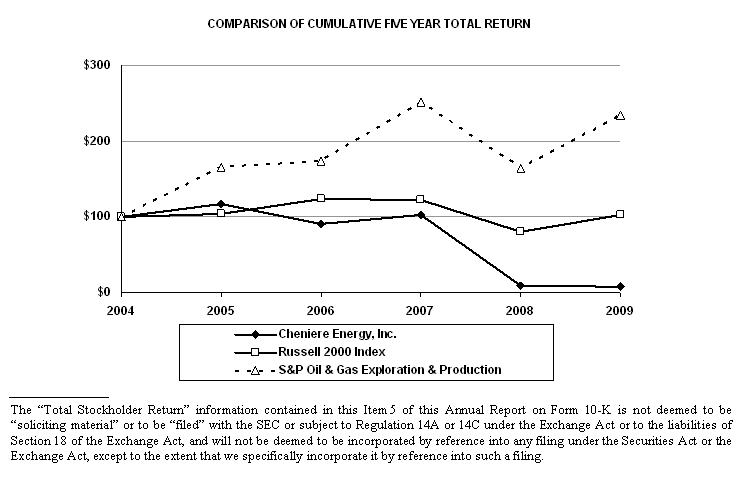

Company

/ Index

|

2005

|

2006

|

2007

|

2008

|

2009

|

|||||||||||||||

|

Cheniere

Energy, Inc.

|

$ | 117 | $ | 91 | $ | 102 | $ | 9 | $ | 8 | ||||||||||

|

Russell

2000 Index

|

$ | 105 | $ | 124 | $ | 122 | $ | 81 | $ | 103 | ||||||||||

|

S&P

Oil & Gas Exploration & Production

|

$ | 166 | $ | 174 | $ | 252 | $ | 165 | $ | 234 | ||||||||||

|

Year

Ended December 31,

|

||||||||||||||||||||

|

(in

thousands, except per share data)

|

||||||||||||||||||||

|

2009

|

2008

|

2007

|

2006

|

2005(6)

|

||||||||||||||||

|

(as

adjusted)

|

(as

adjusted)

|

(as

adjusted)

|

(as

adjusted)

|

|||||||||||||||||

|

Revenues

|

$ | 181,126 | $ | 7,144 | $ | 647 | $ | 2,371 | $ | 3,005 | ||||||||||

|

LNG

terminal and pipeline development expenses

|

223 | 10,556 | 34,656 | 12,099 | 22,020 | |||||||||||||||

|

LNG

terminal and pipeline operating expenses

|

36,857 | 14,522 | — | — | — | |||||||||||||||

|

Exploration

costs

|

— | 128 | 1,116 | 3,138 | 2,839 | |||||||||||||||

|

Depreciation,

depletion and amortization

|

54,229 | 24,346 | 6,393 | 3,131 | 1,325 | |||||||||||||||

|

General

and administrative expenses (1)

|

65,830 | 122,678 | 122,046 | 58,012 | 29,145 | |||||||||||||||

|

Restructuring

charges (2)

|

20 | 78,704 | — | — | — | |||||||||||||||

|

Income

(loss) from operations

|

23,496 | (244,188 | ) | (163,940 | ) | (75,874 | ) | (52,561 | ) | |||||||||||

|

Loss

from equity method investments

|

— | (4,800 | ) | (191 | ) | — | (1,031 | ) | ||||||||||||

|

Gain

on sale of investment in unconsolidated affiliate (3)

|

— | — | — | — | 20,206 | |||||||||||||||

|

Gain

(loss) on early extinguishment of debt (4)

|

45,363 | (10,691 | ) | — | (43,159 | ) | — | |||||||||||||

|

Derivative

gain (loss) (5)

|

5,277 | 4,652 | — | (20,070 | ) | 837 | ||||||||||||||

|

Interest

expense, net

|

(243,295 | ) | (147,136 | ) | (119,360 | ) | (67,252 | ) | (22,490 | ) | ||||||||||

|

Interest

income

|

1,405 | 20,337 | 82,635 | 49,087 | 17,520 | |||||||||||||||

|

Non-controlling

interest

|

6,165 | 8,777 | 3,425 | — | 97 | |||||||||||||||

|

Net

loss

|

(161,490 | ) | (372,959 | ) | (196,580 | ) | (159,137 | ) | (34,655 | ) | ||||||||||

|

Net

loss per share (basic and diluted) (6)

|

$ | (3.13 | ) | $ | (7.87 | ) | $ | (3.89 | ) | $ | (2.92 | ) | $ | (0.65 | ) | |||||

|

Weighted

average shares outstanding (basic and diluted) (6)

|

51,598 | 47,365 | 50,537 | 54,423 | 53,097 | |||||||||||||||

|

December

31,

|

||||||||||||||||||||

|

2009

|

2008

|

2007

|

2006

|

2005(6)

|

||||||||||||||||

|

(as

adjusted)

|

(as

adjusted)

|

(as

adjusted)

|

(as

adjusted)

|

|||||||||||||||||

|

Cash

and cash equivalents

|

$ | 88,372 | $ | 102,192 | $ | 296,530 | $ | 462,963 | $ | 692,592 | ||||||||||

|

Restricted

cash and cash equivalents (current)

|

138,309 | 301,550 | 228,085 | 176,827 | 161,561 | |||||||||||||||

|

Working

capital

|

220,063 | 350,459 | 427,511 | 588,034 | 810,141 | |||||||||||||||

|

Non-current

restricted cash and cash equivalents

|

82,892 | 138,483 | 478,225 | 1,071,722 | 16,500 | |||||||||||||||

|

Non-current

restricted U.S. Treasury securities

|

— | 20,829 | 63,923 | — | — | |||||||||||||||

|

Property,

plant and equipment, net

|

2,216,855 | 2,170,158 | 1,645,112 | 748,818 | 280,106 | |||||||||||||||

|

Debt

issuances costs, net

|

47,043 | 55,688 | 41,449 | 38,422 | 39,317 | |||||||||||||||

|

Goodwill

|

76,819 | 76,844 | 76,844 | 76,844 | 76,844 | |||||||||||||||

|

Total

assets

|

2,732,622 | 2,920,082 | 2,959,743 | 2,601,365 | 1,286,456 | |||||||||||||||

|

Long-term

debt, net of discount

|

2,692,740 | 2,750,308 | 2,657,579 | 2,242,209 | 788,857 | |||||||||||||||

|

Long-term

debt—related parties, net of discount

|

349,135 | 332,054 | — | — | — | |||||||||||||||

|

Long-term

deferred revenue

|

33,500 | 37,500 | 40,000 | 41,000 | 41,000 | |||||||||||||||

|

Total

liabilities

|

3,164,749 | 3,194,136 | 2,879,317 | 2,346,450 | 892,963 | |||||||||||||||

|

Total

stockholders’ equity (deficit)

|

$ | (649,732 | ) | $ | (524,216 | ) | $ | (205,249 | ) | $ | 254,915 | $ | 393,493 | |||||||

|

(1)

|

General

and administrative expenses include $19.2 million, $55.0 million, $56.6

million, $20.2 million and $3.6 million share-based compensation expense

recognized in the years ended December 31, 2009, 2008, 2007, 2006 and

2005, respectively.

|

|

(2)

|

In

the second quarter of 2008, we announced a cost savings program in

connection with the downsizing of our natural gas marketing business

activities, the nearing completion of significant construction activities

for both the Sabine Pass LNG receiving terminal and Creole Trail Pipeline

and the seeking of alternative arrangements for our time charter interest

in two LNG vessels (See Note 4—“Restructuring Charges”) of our Notes to

Consolidated Financial Statements).

|

|

(3)

|

In

2005, our investment in Gryphon Exploration Company was sold to Woodside

Energy (USA), generating net cash proceeds and a gain to Cheniere of $20.2

million.

|

|

(4)

|

Amount

in 2009 relates to gains on the termination of $120.4 million of our

Convertible Senior Unsecured Notes. Amount in 2008 relates to

losses on the termination of the $95.0 million bridge loan in August 2008.

Amounts in 2006 primarily relate to losses on the termination of a Sabine

Pass LNG credit facility and term loan in November 2006. See Note

19—“Long-Term Debt and Long-Term Debt—Related Parties” of our Notes to

Consolidated Financial Statements.

|

|

(5)

|

Amounts

in 2006 primarily relate to losses on the termination of hedge

transactions related to the termination of a Sabine Pass LNG credit

facility and term loan in November

2006.

|

|

(6)

|

Net

loss per share and weighted average shares outstanding have been restated

to reflect a two-for-one stock split that occurred on April 22,

2005.

|

|

(7)

|

Amounts

reported for the years ended December 31, 2005 have been adjusted to

reflect the change in our method of accounting for investments in oil and

gas properties from the full cost method to the successful efforts

method.

|

|

|

|

|

|

•

|

Overview

of Business

|

|

|

•

|

Overview

of Significant 2009 Events

|

|

|

•

|

Liquidity

and Capital Resources

|

|

|

•

|

Contractual

Obligations

|

|

|

•

|

Results

of Operations

|

|

|

•

|

Off-Balance

Sheet Arrangements

|

|

|

•

|

Inflation

and Changing Prices

|

|

|

•

|

Summary

of Critical Accounting Policies and

Estimates

|

|

|

•

|

Recent

Accounting Standards

|

|

|

•

|

we

completed construction and achieved full operability of the Sabine Pass

LNG receiving terminal with approximately 4.0 Bcf/d of total sendout

capacity and five LNG storage tanks with approximately 16.9 Bcf of

aggregate storage capacity;

|

|

|

•

|

Sabine

Pass LNG received capacity reservation fee payments from Cheniere

Marketing, our wholly owned subsidiary, Total and Chevron and successfully

unloaded and processed LNG for each

customer;

|

|

|

•

|

Cheniere

Marketing successfully purchased, transported and unloaded commercial LNG

cargos into the Sabine Pass LNG receiving terminal and sold resultant

natural gas;

|

|

|

•

|

we

reduced debt by exchanging $120.4 million aggregate principal amount of

our 2¼% Convertible Senior Unsecured Notes due 2012 (“Convertible Senior

Unsecured Notes”) for a combination of $30.0 million cash and cash

equivalents and 4.0 million shares of our common stock, reducing our

principal amount due in 2012 to $204.6 million, at December 31, 2009;

and

|

|

|

•

|

we

began receiving limited partner distributions from Freeport

LNG.

|

|

(in

thousands)

|

Sabine

Pass

LNG, L.P.

|

Cheniere

Energy

Partners,

L.P.

|

Other

Cheniere Energy, Inc.

|

Consolidated

Cheniere Energy,

Inc.

|

||||||||||||

|

Cash

and cash equivalents

|

$

|

—

|

$

|

—

|

$

|

88,372

|

$

|

88,372

|

||||||||

|

Restricted

cash and cash equivalents

|

213,537

|

130

|

7,534

|

221,201

|

||||||||||||

|

Total

|

$

|

213,537

|

$

|

130

|

$

|

95,906

|

$

|

309,573

|

||||||||

|

|

•

|

Total

Gas and Power North America, Inc. (formerly known as Total LNG USA, Inc.)

(“Total”) has reserved approximately 1.0 Bcf/d of regasification capacity

and has agreed to make monthly capacity payments to Sabine Pass LNG

aggregating approximately $125 million per year for 20 years that

commenced April 1, 2009. Total, S.A. has guaranteed Total’s

obligations under its TUA up to $2.5 billion, subject to certain

exceptions; and

|

|

|

•

|

Chevron

U.S.A., Inc. (“Chevron”) has reserved approximately 1.0 Bcf/d of

regasification capacity and has agreed to make monthly capacity payments

to Sabine Pass LNG aggregating approximately $125 million per year for 20

years that commenced July 1, 2009. Chevron Corporation has guaranteed

Chevron’s obligations under its TUA up to 80% of the fees payable by

Chevron.

|

|

For

the Year Ended December 31, 2009

|

||||||||||

|

LNG

and natural gas marketing revenue

(GAAP

measure)

|

Adjusted

LNG and natural gas marketing revenue

(Non-GAAP

measure)

|

Difference

|

||||||||

|

Physical

natural gas sales

|

$

|

6,146

|

$

|

6,146

|

$

|

—

|

||||

|

Cost

of LNG

|

(3,850

|

)

|

(38,218

|

)

|

34,368

|

(a)

|

||||

|

Realized

natural gas derivative gain

|

9,635

|

9,635

|

—

|

|||||||

|

Unrealized

gas derivative loss

|

(1,029

|

)

|

(1,029

|

)

|

—

|

|||||

|

Inventory

lower-of-cost-or-market adjustments

|

(3,323

|

)

|

—

|

(3,323

|

)

|

(b)

|

||||

|

Future

inventory value

|

—

|

41,261

|

(41,261

|

)

|

(c)

|

|||||

|

Other

energy trading activities

|

508

|

722

|

(214

|

)

|

||||||

|

LNG

and natural gas revenue

|

$

|

8,087

|

$

|

18,517

|

$

|

(10,430

|

)

|

|||

|

(a)

|

The

cost of LNG GAAP measure takes into consideration only the cost of LNG

that was regasified and sold during the year ended December 31, 2009,

using the weighed average cost method for LNG inventory. The

cost of LNG non-GAAP measure takes into consideration the cost for all of

the LNG purchased during the year ended December 31,

2009.

|

|

(b)

|

The

inventory LCM adjustments GAAP measure represents the inventory

write-downs that were recorded during the year ended December 31, 2009, as

required by GAAP codification.

|

|

(c)

|

The

future inventory value non-GAAP measure represents the inventory fair

value at December 31, 2009, based on published forward natural gas price

curve prices corresponding to the future months when the regasified LNG is

planned to be sold.

|

|

2009

|

2008

|

2007

|

||||||||||

|

Sources

of cash and cash equivalents

|

(as

adjusted)

|

(as

adjusted)

|

||||||||||

|

Use

of restricted cash and cash equivalents

|

$ | 241,101 | $ | 465,323 | $ | 527,043 | ||||||

|

Distribution

from limited partnership investment in Freeport LNG

|

15,300 | — | — | |||||||||

|

Proceeds

from debt issuance

|

— | 239,965 | 400,000 | |||||||||

|

Proceeds

from debt issuance—related parties

|

— | 250,000 | — | |||||||||

|

Use

of restricted U.S. Treasury securities

|

— | 16,702 | — | |||||||||

|

Sale

of common stock

|

— | 472 | 3,158 | |||||||||

|

Proceeds

from sale of common units in partnership

|

— | — | 203,946 | |||||||||

|

Proceeds

from issuance of common units to non-controlling owners in

partnership

|

— | — | 98,442 | |||||||||

|

Other

|

— | — | 1,048 | |||||||||

|

Total

sources of cash and cash equivalents

|

256,401 | 972,462 | 1,233,637 | |||||||||

|

Uses

of cash and cash equivalents

|

||||||||||||

|

LNG

receiving terminal and pipeline construction-in-process,

net

|

(112,317 | ) | (583,871 | ) | (788,517 | ) | ||||||

|

Operating

cash flow

|

(97,857 | ) | (142,145 | ) | (84,291 | ) | ||||||

|

Repayment

of debt

|

(30,030 | ) | (95,000 | ) | — | |||||||

|

Distributions

to non-controlling interest

|

(26,392 | ) | (26,393 | ) | (13,631 | ) | ||||||

|

Purchase

of treasury shares

|

(999 | ) | (4,902 | ) | (325,101 | ) | ||||||

|

Purchases

of intangible and fixed assets, net of sales

|

(522 | ) | (2,889 | ) | (41,684 | ) | ||||||

|

Debt

issuance cost

|

(121 | ) | (34,504 | ) | (9,787 | ) | ||||||

|

Investment

in restricted cash and cash equivalents

|

— | (248,767 | ) | — | ||||||||

|

Advances

under long-term contracts, net of transfers to

construction-in-process

|

— | (14,032 | ) | (38,617 | ) | |||||||

|

Purchases

of LNG for commissioning, net of amounts transferred to LNG receiving

terminal construction-in-process

|

— | (9,923 | ) | — | ||||||||

|

Investment

in U.S. Treasury securities

|

— | — | (98,442 | ) | ||||||||

|

Other

|

(1,983 | ) | (4,374 | ) | — | |||||||

|

Total

uses of cash and cash equivalents

|

(270,221 | ) | (1,166,800 | ) | (1,400,070 | ) | ||||||

|

Net

decrease in cash and cash equivalents

|

(13,820 | ) | (194,338 | ) | (166,433 | ) | ||||||

|

Cash

and cash equivalents—beginning of year

|

102,192 | 296,530 | 462,963 | |||||||||

|

Cash

and cash equivalents—end of year

|

$ | 88,372 | $ | 102,192 | $ | 296,530 | ||||||

|

Sabine

Pass

LNG, L.P.

|

Cheniere

Energy

Partners,

L.P.

|

Other

Cheniere Energy, Inc.

|

Consolidated

Cheniere Energy,

Inc.

|

|||||||||||||

|

Long-term

debt (including related parties)

|

||||||||||||||||

|

Senior

Notes (including related parties)

|

$ | 2,215,500 | $ | — | $ | — | $ | 2,215,500 | ||||||||

|

2007

Term Loan

|

— | — | 400,000 | 400,000 | ||||||||||||

|

2008

Convertible Loans (including related parties)

|

— | — | 293,714 | 293,714 | ||||||||||||

|

Convertible

Senior Unsecured Notes

|

— | — | 204,630 | 204,630 | ||||||||||||

|

Total

long-term debt

|

2,215,500 | — | 898,344 | 3,113,844 | ||||||||||||

|

Debt

discount (including related parties)

|

||||||||||||||||

|

Senior

Notes (including related parties) (1)

|

(32,471 | ) | — | — | (32,471 | ) | ||||||||||

|

Convertible

Senior Unsecured Notes (2)

|

— | — | (39,498 | ) | (39,498 | ) | ||||||||||

|

Total

debt discount

|

(32,471 | ) | (39,498 | ) | (71,969 | ) | ||||||||||

|

Long-term

debt (including related parties), net of discount

|

$ | 2,183,029 | $ | — | $ | 858,846 | $ | 3,041,875 | ||||||||

|

|

(1)

|

In

September 2008, Sabine Pass LNG issued an additional $183.5 million, par

value, of 2016 Notes. The net proceeds from the additional

issuance of the 2016 Notes were $145.0 million. The difference

between the par value and the net

|

|

|

|

proceeds

is the debt discount, which will be amortized through the maturity of the

2016 Notes.

|

|

|

(2)

|

Effective

as of January 1, 2009, we are required to record a debt discount on our

Convertible Senior Unsecured Notes. The unamortized discount

will be amortized through the maturity of the Convertible Senior Unsecured

Notes.

|

|

Payments

Due for Years Ended December 31,

|

||||||||||||||||||||

|

Total

|

2010

|

2011- 2012 | 2013- 2014 |

Thereafter

|

||||||||||||||||

|

Long-term

debt (excluding interest) (1)

|

$ | 3,174,821 | $ | — | $ | 959,321 | $ | 550,000 | $ | 1,665,500 | ||||||||||

|

Operating

lease obligations (2)(3)

|

326,521 | 13,853 | 28,208 | 28,028 | 256,432 | |||||||||||||||

|

Construction

and purchase obligations (4)

|

7,408 | 7,408 | — | — | — | |||||||||||||||

|

Other

obligations (5)

|

20,707 | 3,781 | 7,114 | 4,906 | 4,906 | |||||||||||||||

|

Total

|

$ | 3,529,457 | $ | 25,042 | $ | 994,643 | $ | 582,934 | $ | 1,926,838 | ||||||||||

|

(1)

|

Based

on the total debt balance, scheduled maturities and interest rates in

effect at December 31, 2009, our cash payments for interest would be

$208.4 million in 2010, $208.4 million in 2011, $183.7 million in 2012,

$161.5 million in 2013, $124.9 million in 2014 and $239.5 million for the

remaining years for a total of $1,126.4 million. See “Note

19—Long-Term Debt and Long-Term Debt—Related Parties” of our Notes to

Consolidated Financial Statements.

|

|

(2)

|

A

discussion of these obligations can be found at Note 8—“Leases” of our

Notes to Consolidated Financial

Statements.

|

|

(3)

|

Minimum

lease payments have not been reduced by a minimum sublease rental of $98.9

million due in the future under noncancelable subleases. A discussion of

these sublease rental payments can be found at Note 8—“Leases” of our

Notes to Consolidated Financial

Statements

|

|

(4)

|

A

discussion of these obligations can be found at Note 24—“Commitments and

Contingencies” of our Notes to Consolidated Financial

Statements.

|

|

(5)

|

Includes

obligations for cooperative endeavor agreements, LNG receiving terminal

security services, telecommunication services and software

licensing.

|

|

Years

Ended December 31,

|

||||||||||||

|

2009

|

2008

|

2007

|

||||||||||

|

Physical

natural gas sales, net of costs

|

$ | 2,296 | $ | 943 | $ | 52 | ||||||

|

Inventory

lower-of-cost-or-market write-downs

|

(3,323 | ) | — | — | ||||||||

|

Gain

(loss) from derivatives

|

8,606 | (1,435 | ) | (4,391 | ) | |||||||

|

Other

energy trading activities

|

508 | 3,406 | (390 | ) | ||||||||

|

Total

LNG and Natural Gas Marketing Revenue

|

$ | 8,087 | $ | 2,914 | $ | (4,729 | ) | |||||

|

|

•

|

inability

to recover cost increases due to rate caps and rate case

moratoriums;

|

|

|

•

|

inability

to recover capitalized costs, including an adequate return on those costs

through the rate-making process and the FERC

proceedings;

|

|

|

•

|

excess

capacity;

|

|

|

•

|

increased

competition and discounting in the markets we serve;

and

|

|

|

•

|

impacts

of ongoing regulatory initiatives in the natural gas

industry.

|

|

By:

|

/s/

CHARIF SOUKI

|

By:

|

/s/

Meg A. Gentle

|

|

|

Charif

Souki

Chief

Executive Officer and President

|

Meg

A. Gentle

Senior

Vice President

and

Chief Financial Officer

|

|

/s/ ERNST

& YOUNG LLP

|

|

ERNST &

YOUNG LLP

|

|

/s/ ERNST

& YOUNG LLP

|

|

ERNST &

YOUNG LLP

|

|

December

31,

|

||||||||

|

2009

|

2008

|

|||||||

|

ASSETS

|

(as

adjusted)

|

|||||||

|

CURRENT

ASSETS

|

||||||||

|

Cash

and cash equivalents

|

$ | 88,372 | $ | 102,192 | ||||

|

Restricted

cash and cash equivalents

|

138,309 | 301,550 | ||||||

|

Accounts

and interest receivable

|

9,899 | 3,630 | ||||||

|

LNG

inventory

|

32,602 | — | ||||||

|

Prepaid

expenses and other

|

17,093 | 9,220 | ||||||

|

Total

current assets

|

286,275 | 416,592 | ||||||

|

NON-CURRENT

RESTRICTED CASH AND CASH EQUIVALENTS

|

82,892 | 138,483 | ||||||

|

NON-CURRENT

RESTRICTED U.S. TREASURY SECURITIES

|

— | 20,829 | ||||||

|

PROPERTY,

PLANT AND EQUIPMENT, NET

|

2,216,855 | 2,170,158 | ||||||

|

DEBT

ISSUANCE COSTS, NET

|

47,043 | 55,688 | ||||||

|

GOODWILL

|

76,819 | 76,844 | ||||||

|

INTANGIBLE

LNG ASSETS

|

6,088 | 6,106 | ||||||

|

LNG

HELD FOR COMMISSIONING

|

— | 9,923 | ||||||

|

ADVANCES

UNDER LONG-TERM CONTRACTS

|

1,021 | 10,705 | ||||||

|

OTHER

|

15,629 | 14,754 | ||||||

|

Total

assets

|

$ | 2,732,622 | $ | 2,920,082 | ||||

|

LIABILITIES

AND STOCKHOLDERS’ DEFICIT

|

||||||||

|

CURRENT

LIABILITIES

|

||||||||

|

Accounts

payable

|

$ | 426 | $ | 1,220 | ||||

|

Accrued

liabilities

|

38,425 | 61,883 | ||||||

|

Deferred

revenue

|

26,456 | 2,500 | ||||||

|

Other

|

905 | 530 | ||||||

|

Total

current liabilities

|

66,212 | 66,133 | ||||||

|

LONG-TERM

DEBT, NET OF DISCOUNT

|

2,692,740 | 2,750,308 | ||||||

|

LONG-TERM

DEBT—RELATED PARTIES

|

349,135 | 332,054 | ||||||

|

DEFERRED

REVENUE

|

33,500 | 37,500 | ||||||

|

OTHER

NON-CURRENT LIABILITIES

|

23,162 | 8,141 | ||||||

|

COMMITMENTS

AND CONTINGENCIES

|

— | — | ||||||

|

STOCKHOLDERS’

DEFICIT

|

||||||||

|

Preferred

stock, $.0001 par value, 5,000,000 shares authorized, none

issued

|

— | — | ||||||

|

Common

stock, $.003 par value

|

||||||||

|

Authorized:

240,000,000 and 120,000,000 shares at December 31, 2009 and

2008

|

||||||||

|

Issued

and outstanding: 56,651,000 and 52,297,000 shares at December 31,

2009 and 2008, respectively

|

170 | 157 | ||||||

|

Treasury

stock: 697,000 and 179,000 shares at December 31, 2009 and 2008,

respectively, at cost

|

(1,494 | ) | (496 | ) | ||||

|

Additional

paid-in-capital

|

336,971 | 300,033 | ||||||

|

Accumulated

deficit

|

(985,246 | ) | (823,756 | ) | ||||

|

Accumulated

other comprehensive loss

|

(133 | ) | (154 | ) | ||||

|

Total

stockholders’ deficit

|

(649,732 | ) | (524,216 | ) | ||||

|

NON-CONTROLLING

INTEREST

|

217,605 | 250,162 | ||||||

|

Total

deficit

|

(432,127 | ) | (274,054 | ) | ||||

|

Total

liabilities and deficit

|

$ | 2,732,622 | $ | 2,920,082 | ||||

|

Year

Ended December 31,

|

||||||||||||

|

2009

|

2008

|

2007

|

||||||||||

|

(as

adjusted)

|

(as

adjusted)

|

|||||||||||

|

Revenues

|

||||||||||||

|

LNG

receiving terminal revenue

|

$ | 170,071 | $ | — | $ | — | ||||||

|

Oil

and gas sales

|

2,866 | 4,215 | 5,376 | |||||||||

|

Marketing

and trading gain (loss)

|

8,087 | 2,914 | (4,729 | ) | ||||||||

|

Pipeline

revenue

|

102 | 15 | — | |||||||||

|

Total

revenues

|

181,126 | 7,144 | 647 | |||||||||

|

Operating

costs and expenses

|

||||||||||||

|

LNG

receiving terminal and pipeline development expense

|

223 | 10,556 | 34,656 | |||||||||

|

LNG

receiving terminal and pipeline operating expense

|

36,857 | 14,522 | — | |||||||||

|

Exploration

costs

|

— | 128 | 1,116 | |||||||||

|

Oil

and gas production costs

|

471 | 398 | 358 | |||||||||

|

Impairment

of fixed assets

|

— | — | 18 | |||||||||

|

Depreciation,

depletion and amortization

|

54,229 | 24,346 | 6,393 | |||||||||

|

General

and administrative expenses

|

65,830 | 122,678 | 122,046 | |||||||||

|

Restructuring

charges

|

20 | 78,704 | — | |||||||||

|

Total

operating costs and expenses

|

157,630 | 251,332 | 164,587 | |||||||||

|

Income

(loss) from operations

|

23,496 | (244,188 | ) | (163,940 | ) | |||||||

|

Loss

from equity method investments

|

— | (4,800 | ) | (191 | ) | |||||||

|

Gain/(loss)

on early extinguishment of debt

|

45,363 | (10,691 | ) | — | ||||||||

|

Derivative

gain

|

5,277 | 4,652 | — | |||||||||

|

Interest

expense, net

|

(243,295 | ) | (147,136 | ) | (119,360 | ) | ||||||

|

Interest

income

|

1,405 | 20,337 | 82,635 | |||||||||

|

Other

income

|

99 | 90 | 851 | |||||||||

|

Loss

before income taxes and non-controlling interest

|

(167,655 | ) | (381,736 | ) | (200,005 | ) | ||||||

|

Income

tax provision

|

— | — | — | |||||||||

|

Loss

before non-controlling interest

|

(167,655 | ) | (381,736 | ) | (200,205 | ) | ||||||

|

Non-controlling

interest

|

6,165 | 8,777 | 3,425 | |||||||||

|

Net

loss

|

$ | (161,490 | ) | $ | (372,959 | ) | $ | (196,580 | ) | |||

|

Net

loss per common share—basic and diluted

|

$ | (3.13 | ) | $ | (7.87 | ) | $ | (3.89 | ) | |||

|

Weighted

average number of common shares outstanding—basic and

diluted

|

51,598 | 47,365 | 50,537 | |||||||||

|

Accumulated

|

||||||||||||||||||||||||||

|

Additional

|

Other

|

Non-

|

Total

|

|||||||||||||||||||||||

|

Common

Stock

|

Treasury

Stock

|

Paid-in

|

Accumulated

|

Comprehensive

|

controlling

|

Equity

|

||||||||||||||||||||

|

Shares

|

Amount

|

Shares

|

Amount

|

Capital

|

Deficit

|

Loss

|

Interest

|

(Deficit)

|

||||||||||||||||||

|

Balance—December

31, 2006

|

55,213

|

$

|

166

|

—

|

$

|

—

|

$

|

390,256

|

$

|

(247,141

|

)

|

$

|

(34

|

)

|

$

|

—

|

$

|

143,247

|

||||||||

|

Cumulative

effect of accounting change

|

—

|

—

|

—

|

—

|

118,744

|

(7,076

|

)

|

111,668

|

||||||||||||||||||

|

Balance—December

31, 2006 (as adjusted)

|

55,213

|

166

|

—

|

—

|

509,000

|

(254,217

|

)

|

(34

|

)

|

—

|

254,915

|

|||||||||||||||

|

Issuances

of stock

|

688

|

2

|

—

|

—

|

3,155

|

—

|

—

|

—

|

3,157

|

|||||||||||||||||

|

Issuances

of restricted stock

|

1,029

|

2

|

—

|

—

|

(2

|

)

|

—

|

—

|

—

|

—

|

||||||||||||||||

|

Forfeitures

of restricted stock

|

(20

|

)

|

—

|

20

|

—

|

—

|

—

|

—

|

—

|

—

|

||||||||||||||||

|

Stock-based

compensation

|

—

|

—

|

—

|

—

|

58,331

|

—

|

—

|

—

|

58,331

|

|||||||||||||||||

|

Treasury

stock acquired

|

(9,179

|

)

|

(27

|

)

|

9,179

|

(325,101

|

)

|

27

|

—

|

—

|

—

|

(325,101

|

)

|

|||||||||||||

|

Treasury

stock retired

|

—

|

—

|

(7

|

)

|

62

|

(62

|

)

|

—

|

—

|

—

|

—

|

|||||||||||||||

|

Comprehensive

loss: Foreign currency translation

|

—

|

—

|

—

|

—

|

—

|

—

|

29

|

—

|

29

|

|||||||||||||||||

|

Net

proceeds from non-controlling interest

|

—

|

—

|

—

|

—

|

—

|

—

|

—

|

302,731

|

302,731

|

|||||||||||||||||

|

Loss

attributable to non-controlling interest

|

—

|

—

|

—

|

—

|

—

|

—

|

—

|

(3,425

|

)

|

(3,425

|

)

|

|||||||||||||||

|

Distribution

to non-controlling interest

|

—

|

—

|

—

|

—

|

—

|

—

|

—

|

(13,631

|

)

|

(13,631

|

)

|

|||||||||||||||

|

Net

loss (as adjusted)

|

—

|

—

|

—

|

—

|

—

|

(196,580

|

)

|

—

|

—

|

(196,580

|

)

|

|||||||||||||||

|

Balance—December

31, 2007

|

47,731

|

143

|

9,192

|

(325,039

|

)

|

570,449

|

(450,797

|

)

|

(5

|

)

|

285,675

|

80,426

|

||||||||||||||

|

Issuances

of stock

|

145

|

—

|

—

|

—

|

472

|

—

|

—

|

—

|

472

|

|||||||||||||||||

|

Issuances

of restricted stock

|

4,910

|

15

|

—

|

—

|

(15

|

)

|

—

|

—

|

—

|

—

|

||||||||||||||||

|

Forfeitures

of restricted stock

|

(172

|

)

|

—

|

172

|

—

|

—

|

—

|

—

|

—

|

—

|

||||||||||||||||

|

Stock-based

compensation

|

—

|

—

|

—

|

—

|

58,571

|

—

|

—

|

—

|

58,571

|

|||||||||||||||||

|

Treasury

stock acquired

|

(317

|

)

|

(1

|

)

|

317

|

(4,901

|

)

|

—

|

—

|

—

|

—

|

(4,902

|

)

|

|||||||||||||

|

Treasury

stock retired

|

—

|

—

|

(9,502

|

)

|

329,444

|

(329,444

|

)

|

—

|

—

|

—

|

—

|

|||||||||||||||

|

Comprehensive

gain (loss): Foreign currency translation

|

—

|

—

|

—

|

—

|

—

|

—

|

(149

|

)

|

—

|

(149

|

)

|

|||||||||||||||

|

Loss

attributable to non-controlling interest

|

—

|

—

|

—

|

—

|

—

|

—

|

—

|

(9,120

|

)

|

(9,120

|

)

|

|||||||||||||||

|

Distribution

to non-controlling interest

|

—

|

—

|

—

|

—

|

—

|

—

|

—

|

(26,393

|

)

|

(26,393

|

)

|

|||||||||||||||

|

Net

loss (as adjusted)

|

—

|

—

|

—

|

—

|

—

|

(372,959

|

)

|

—

|

—

|

(372,959

|

)

|

|||||||||||||||

|

Balance—December

31, 2008

|

52,297

|

157

|

179

|

(496

|

)

|

300,033

|

(823,756

|

)

|

(154

|

)

|

250,162

|

(274,054

|

)

|

|||||||||||||

|

Issuances

of stock

|

3,985

|

12

|

—

|

—

|

16,212

|

—

|

—

|

—

|

16,224

|

|||||||||||||||||

|

Issuances

of restricted stock

|

886

|

3

|

—

|

—

|

(3

|

)

|

—

|

—

|

—

|

—

|

||||||||||||||||

|

Forfeitures

of restricted stock

|

(89

|

)

|

—

|

89

|

—

|

—

|

—

|

—

|

—

|

—

|

||||||||||||||||

|

Stock-based

compensation

|

—

|

—

|

—

|

—

|

20,728

|

—

|

—

|

—

|

20,728

|

|||||||||||||||||

|

Treasury

stock acquired

|

(428

|

)

|

(2

|

)

|

429

|

(998

|

)

|

1

|

—

|

—

|

—

|

(999

|

)

|

|||||||||||||

|

Comprehensive

loss: Foreign currency translation

|

—

|

—

|

—

|

—

|

—

|

—

|

21

|

—

|

21

|

|||||||||||||||||

|

Loss

attributable to non-controlling interest

|

—

|

—

|

—

|

—

|

—

|

—

|

—

|

(6,165

|

)

|

(6,165

|

)

|

|||||||||||||||

|

Distribution

to non-controlling interest

|

—

|

—

|

—

|

—

|

—

|

—

|

—

|

(26,392

|

)

|

(26,392

|

)

|

|||||||||||||||

|

Net

loss

|

—

|

—

|

—

|

—

|

—

|

(161,490

|

)

|

—

|

—

|

(161,490

|

)

|

|||||||||||||||

|

Balance—December

31, 2009

|

56,651

|

$

|

170

|

697

|

$

|

(1,494

|

)

|

$

|

336,971

|

$

|

(985,246

|

)

|

$

|

(133

|

)

|

$

|

217,605

|

$

|

(432,127

|

)

|

||||||

|

Year Ended December

31,

|

||||||||||||

|

2009

|

2008

|

2007

|

||||||||||

|

CASH

FLOWS FROM OPERATING ACTIVITIES:

|

(as

adjusted)

|

(as

adjusted)

|

||||||||||

|

Net

loss

|

$ | (161,490 | ) | $ | (372,959 | ) | $ | (196,580 | ) | |||

|

Adjustments

to reconcile net loss to net cash used in operating

activities:

|

||||||||||||

|

Depreciation,

depletion and amortization

|

54,229 | 24,346 | 6,393 | |||||||||

|

(Gain)/loss

on early extinguishment of debt

|

(45,363 | ) | 10,716 | — | ||||||||

|

Non-cash

interest expense on 2008 Convertible Loans

|

32,321 | 11,393 | — | |||||||||

|

Amortization

of debt issuance and discount costs

|

27,549 | 26,435 | 21,123 | |||||||||

|

Non-cash

compensation

|

19,204 | 55,030 | 56,638 | |||||||||

|

Non-cash

inventory write-downs

|

3,516 | — | — | |||||||||

|

Non-controlling

interest

|

(6,165 | ) | (8,777 | ) | (3,425 | ) | ||||||

|

Restricted

interest income on restricted cash and cash equivalents

|

(2,794 | ) | (18,495 | ) | (53,327 | ) | ||||||

|

Use

of restricted cash and cash equivalents

|

1,353 | 94,610 | 103,043 | |||||||||

|

Non-cash

restructuring charges

|

415 | 17,669 | — | |||||||||

|

Other

|

2,232 | (3,311 | ) | 1,015 | ||||||||

|

Changes

in operating assets and liabilities:

|

||||||||||||

|

Accounts

and interest receivable

|

(1,343 | ) | 45,157 | (41,654 | ) | |||||||

|

Accounts

payable and accrued liabilities

|

253 | (42,066 | ) | 42,007 | ||||||||

|

LNG

inventory

|

(32,628 | ) | — | — | ||||||||

|

Deferred

revenue

|

19,956 | — | — | |||||||||

|

Prepaid

expenses and other

|

(9,102 | ) | 18,107 | (19,524 | ) | |||||||

|

NET

CASH USED IN OPERATING ACTIVITIES

|

(97,857 | ) | (142,145 | ) | (84,291 | ) | ||||||

|

CASH

FLOWS FROM INVESTING ACTIVITIES:

|

||||||||||||

|

LNG

terminal and pipeline construction-in-process, net

|

(112,317 | ) | (583,871 | ) | (788,517 | ) | ||||||

|

Use

of restricted cash and cash equivalents

|

110,399 | 465,323 | 526,318 | |||||||||

|

Distributions

from limited partnership investment

|

15,300 | — | — | |||||||||

|

Purchases

of intangible and fixed assets, net of sales

|

(522 | ) | (2,889 | ) | (41,684 | ) | ||||||

|

Oil

and gas property, net of sales

|

(474 | ) | (564 | ) | 17 | |||||||

|

Use

of (investment in) restricted U.S. Treasury securities

|

— | 16,702 | (98,442 | ) | ||||||||

|

Purchases

of LNG commissioning, net of amounts transferred to LNG terminal

construction-in-process

|

— | (9,923 | ) | — | ||||||||

|

Advances

under long-term contracts, net of transfers to

construction-in-process

|

— | (14,032 | ) | (38,617 | ) | |||||||

|

Other

|

(402 | ) | (3,808 | ) | 1,031 | |||||||

|

NET

CASH PROVIDED BY (USED IN) INVESTING ACTIVITIES

|

11,984 | (133,062 | ) | (439,894 | ) | |||||||

|

CASH

FLOWS FROM FINANCING ACTIVITIES:

|

||||||||||||

|

Use

of (investment in) restricted cash and cash equivalents

|

130,702 | (248,767 | ) | 725 | ||||||||

|

Repayment

of debt

|

(30,030 | ) | (95,000 | ) | — | |||||||

|

Distributions

to non-controlling interest

|

(26,392 | ) | (26,393 | ) | (13,631 | ) | ||||||

|

Purchase

of treasury shares

|

(999 | ) | (4,902 | ) | (325,101 | ) | ||||||

|

Debt

issuance cost

|

(121 | ) | (34,504 | ) | (9,787 | ) | ||||||

|

Proceeds

from debt issuance

|

— | 239,965 | — | |||||||||

|

Proceeds

from debt issuance—related parties

|

— | 250,000 | — | |||||||||

|

Proceeds

from sale of common units in partnership

|

— | — | 203,946 | |||||||||

|

Proceeds

from issuance of common units to non-controlling owners in

partnership

|

— | — | 98,442 | |||||||||

|

Proceeds

from 2007 term loan

|

— | — | 400,000 | |||||||||

|

Other

|

(1,107 | ) | 470 | 3,158 | ||||||||

|

NET

CASH PROVIDED BY FINANCING ACTIVITIES

|

72,053 | 80,869 | 357,752 | |||||||||

|

NET

DECREASE IN CASH AND CASH EQUIVALENTS

|

(13,820 | ) | (194,338 | ) | (166,433 | ) | ||||||

|

CASH

AND CASH EQUIVALENTS—BEGINNING OF PERIOD

|

102,192 | 296,530 | 462,963 | |||||||||

|

CASH

AND CASH EQUIVALENTS—END OF PERIOD

|

$ | 88,372 | $ | 102,192 | $ | 296,530 | ||||||

|

Year

Ended

December

31, 2008

|

Years

Ended

December

31, 2007

|

|||||||||||||||||||||||

|

Prior

to

adoption

|

Effect

of

adoption

|

As

adjusted

|

Prior

to

adoption

|

Effect

of

adoption

|

As

adjusted

|

|||||||||||||||||||

|

Increase:

|

||||||||||||||||||||||||

|

Interest

expense, net

|

$

|

(130,648

|

)

|

$

|

(16,488

|

)

|

$

|

(147,136

|

)

|

$

|

(104,557

|

)

|

$

|

(14,803

|

)

|

$

|

(119,360

|

)

|

||||||

|

Net

loss

|

(356,471

|

)

|

(16,488

|

)

|

(372,959

|

)

|

(181,777

|

)

|

(14,803

|

)

|

(196,580

|

)

|

||||||||||||

|

Basic

and diluted net loss per share

|

$

|

(7.53

|

)

|

$

|

(0.34

|

)

|

$

|

(7.87

|

)

|

$

|

(3.60

|

)

|

$

|

(0.29

|

)

|

$

|

(3.89

|

)

|

||||||

|

December

31, 2008

|

||||||||||||

|

Prior

to

adoption

|

Effect

of

adoption

|

As

adjusted

|

||||||||||

|

Increase/(decrease):

|

||||||||||||

|

Debt

issuance costs

|

$

|

57,676

|

$

|

(1,988

|

)

|

$

|

55,688

|

|||||

|

Long-term

debt, net of discount

|

2,832,673

|

(82,365

|

)

|

2,750,308

|

||||||||

|

Additional

paid-in capital

|

181,289

|

118,744

|

300,033

|

|||||||||

|

Accumulated

deficit

|

(785,389

|

)

|

(38,367

|

)

|

(823,756

|

)

|

||||||

|

|

•

|

inability

to recover cost increases due to rate caps and rate case

moratoriums;

|

|

|

•

|

inability

to recover capitalized costs, including an adequate return on those costs

through the rate-making process and the FERC

proceedings;

|

|

|

•

|

excess

capacity;

|

|

|

•

|

increased

competition and discounting in the markets we serve;

and

|

|

|

•

|

impacts

of ongoing regulatory initiatives in the natural gas

industry.

|

|

|

•

|

Holdings

contributed its ownership interests in the entities that directly or

indirectly own the Sabine Pass LNG receiving terminal to Cheniere Energy

Investments, LLC, a wholly-owned subsidiary of Cheniere

Partners;

|

|

|

•

|

Cheniere

Partners issued 21,362,193 common units, 135,383,831 subordinated units,

3,302,045 general partner units (representing a 2% general partner

interest) and certain general partner incentive distribution rights to

wholly-owned subsidiaries of

Cheniere;

|

|

|

•

|

Cheniere

Partners issued 5,054,164 common units to the public and received net

proceeds of $98.4 million; and

|

|

|

•

|

Holdings

initially sold 8,445,836 common units to the public and received net

proceeds of $164.5 million, after which Cheniere and the public owned

89.8% and 8.2% limited partner interests in Cheniere Partners,

respectively. Holdings also granted the underwriters an option to purchase

an additional 2,025,000 of its Cheniere Partners common units to cover

over-allotments in connection with the Cheniere Partners

Offering.

|

|

Severance

Costs

|

Facility

Costs

|

Marketing

Costs

|

Total

|

|||||||||||||

|

Estimated

restructuring charges (at inception of program)

|

$ | 12,400 | $ | — | $ | 69,400 | $ | 81,800 | ||||||||

|

Adjustment

to estimated restructuring charges as of

December 31, 2008

|

(6,071 | ) | 2,583 | 1,292 | (2,196 | ) | ||||||||||

|

Restructuring charges recognized as of December 31, 2008

|

(5,429 | ) | (2,583 | ) | (70,692 | ) | (78,704 | ) | ||||||||

|

Estimated restructuring charges as of December 31,

2008

|

900 | — | — | 900 | ||||||||||||

|

Adjustment to estimated restructuring charges as of

December 31, 2009

|

(880 | ) | — | — | (880 | ) | ||||||||||

|

Restructuring charges recognized as of December 31, 2009

|

(20 | ) | — | — | (20 | ) | ||||||||||

|

Estimated restructuring charges as of December 31,

2009

|

$ | — | $ | — | $ | — | $ | — | ||||||||

|

Net

proceeds from Cheniere Partners’ issuance of common units

(1)

|

$

|

98,442

|

|

|

Net

proceeds from Holdings’ sale of Cheniere Partners common units

(2)

|

203,946

|

||

|

Distributions

to Cheniere Partners’ non-controlling interest

|

(66,415

|

)

|

|

|

Non-controlling

interest share of loss of Cheniere Partners

|

(18,368

|

)

|

|

|

Non-controlling

interest at December 31, 2009

|

$

|

217,605

|

|

(1)

|

In

March and April 2007, we and Cheniere Energy Partners, L.P. (“Cheniere

Partners”) completed a public offering of 15,525,000 Cheniere Partners

common units (“Cheniere Partners Offering”). Through the Cheniere Partners

Offering, Cheniere Partners received $98.4 million in net proceeds from

the issuance of its common units to the public. Prior to January 1, 2009,