September 25, 2009

Mr. H. Roger Schwall

Assistant Director

Securities and Exchange Commission

100 F Street N.E., Stop 7010

Washington, D.C. 20549

|

Re: |

Cheniere Energy, Inc. |

|

|

Form 10-K for Fiscal Year Ended December 31, 2008 |

Dear Mr. Schwall:

On behalf of Cheniere Energy, Inc., a Delaware corporation (the “Company”), we enclose the responses of the Company to comments received from the staff of the Division of Corporation Finance (the “Staff”)

of the Securities and Exchange Commission (the “Commission”) by letter dated September 11, 2009, with respect to the Company’s Form 10-K for fiscal year ended December 31, 2008 (File No. 001-16383) (the “10-K”). For your convenience, the responses are prefaced by the exact text of the Staff’s corresponding comment.

The Company acknowledges the following: (i) the Company is responsible for the adequacy and accuracy of the disclosure in the 10-K; (ii) Staff comments or changes to disclosure in response to Staff comments do not foreclose the Commission from taking any action with respect to the 10-K; and (iii) the Company may not assert Staff

comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States.

Please let us know if you have any questions or if we can provide additional information or otherwise be of assistance in expediting the review process.

Sincerely,

Meredith S. Mouer

cc: Meg A. Gentle (Cheniere Energy, Inc.)

Austin Beijing Dallas Houston London New York The Woodlands Washington, DC

Cheniere Energy, Inc.

Form 10-K (File No. 001-16383)

Company’s Responses to

SEC Comment Letter dated September 11, 2009

Form 10-K for the Fiscal Year Ended December 31, 2008

Note 19—Financial Instruments, page 86

|

1. |

With regard to your 2007 Term Loan and 2008 Convertible Loans, we note your disclosure in footnotes three and four that the estimated fair value of these instruments as presented in the table “was stated at its carrying amount due to it being a non-trading instrument with no liquid market.” Based on your disclosure,

please confirm, if true, that you are relying on the exception described in paragraph 14 of FAS 107 for estimating the fair value of a financial instrument, or otherwise advise. Please expand your disclosure to explain in greater detail the reason why you are not able to calculate an estimated fair value. |

Response:

We confirm that we rely on the exception found in paragraph 14 of FAS 107 for estimating the fair value of these financial instruments. The 2007 Term Loan and 2008 Convertible Loans have been, and are currently, held by very few holders. Purchases and sales of the loans are infrequent and are conducted on a bilateral

basis without price discovery by the Company. The loans are not rated and are therefore impractical to benchmark against other publicly traded instruments. The loans have unique covenants and collateral packages such that any comparison to other instruments would be imprecise and inadequate and therefore would not be meaningful to the readers of the financial statements or disclosures. For the reasons stated above, it is impractical to estimate the fair value of the 2007 Term

Loan and 2008 Convertible Loans.

Based on your comment, we will expand our disclosure using the language and concepts above to describe why it is impractical to estimate fair value for the 2007 Term Loan and 2008 Convertible Loans.

Note 24—Business Segment Information, page 97

|

2. |

We have considered your response to our prior comment number 12 and note your statement that your uncompleted LNG receiving terminals do not, at this point, represent a business for which discrete financial information is available; therefore, segment management cannot regularly review the operating results of such components. We

also note your disclosure on page 97 that your “operating segments reflect lines of business for which separate financial information is produced internally and are subject to evaluation by our chief operating decision makers in deciding how to allocate resources.” Based on this information, please provide an analysis for each of the three operating segments you identify as i) LNG receiving terminal business, ii) natural gas pipeline business and iii) LNG and natural gas marketing business,

that supports how you have applied the guidance provided by paragraph 10 of FAS 131. As part of your response, identify for us your chief operating decision maker (CODM) and provide an example set of information regularly reviewed by your CODM to make resource allocation decisions and to assess performance. |

Response:

Paragraph 10 of FAS 131 defines an operating segment as i) it engages in business activities from which it may earn revenues and incur expenses, ii) its operating results are regularly reviewed by the enterprise’s CODM to make decisions about resources to be allocated to the segment and assess its performance, and iii) its discrete

financial information is available.

Cheniere Energy, Inc.

Form 10-K (File No. 001-16383)

Company’s Responses to

SEC Comment Letter dated September 11, 2009

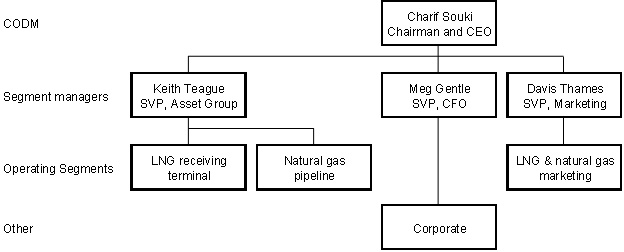

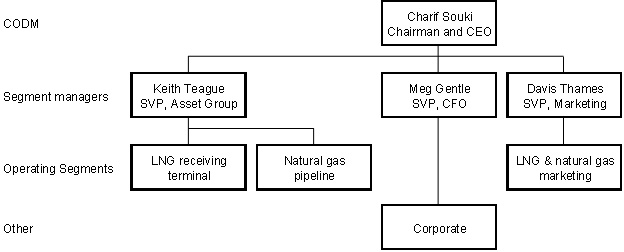

The Company has defined three operating segments: LNG receiving terminal business, natural gas pipeline business and LNG and natural gas marketing business. These operating segments reflect how the Company manages its business, including the organization of senior management responsible for resource allocation and performance. The

CODM of the Company is Charif Souki, Chairman and Chief Executive Officer. Mr. Souki is ultimately responsible for allocating resources to and assessing the performance of the Company’s segments. The Company has aligned its operating segments with personnel who report directly to Mr. Souki and who are directly accountable to and maintain regular contact with Mr. Souki to discuss operating activities, financial results, forecasts, or plans for the segments (the “Segment Managers”). Below

is a table that identifies the CODM and each Segment Manager.

The Company does not use aggregation to determine its operating segments. Below is an analysis of each operating segment and its economic characteristics.

LNG receiving terminal business segment – The Company’s portfolio of LNG receiving terminals consists of: the Sabine Pass LNG receiving terminal, the Corpus Christi LNG receiving terminal, the Creole Trail LNG receiving terminal and 30% of the equity interests

of Freeport LNG, LP. Although in different stages of development, these LNG receiving terminals are designed to provide similar services, for negotiated fees, to customers seeking terminal capacity to deliver LNG to the Gulf Coast of the United States. These LNG receiving terminals are required to conduct their business activities in similar regulatory environments.

Natural gas pipeline business segment – The Company’s portfolio of natural gas pipelines consists of: the Creole Trail pipeline, the Corpus Christi pipeline, the Southern Trail pipeline and the Sonora/Teranova pipeline. Although in different stages

of development, these pipelines are designed to provide natural gas transportation services, for regulated fees, to customers seeking pipeline capacity to deliver natural gas to North American markets. These natural gas pipelines are required to conduct their business activities in similar regulatory environments.

LNG & natural gas marketing business segment – The Company is developing its LNG & natural gas marketing activities through its wholly-owned subsidiary Cheniere Marketing, LLC (“Cheniere Marketing”). Cheniere Marketing’s primary

asset is its terminal use agreement (“TUA”) capacity held at the Sabine Pass LNG receiving terminal. Cheniere Marketing is seeking to develop a portfolio of long-term, short-term, and spot LNG purchase agreements to monetize its TUA capacity at the Sabine Pass LNG receiving terminal.

Cheniere Energy, Inc.

Form 10-K (File No. 001-16383)

Company’s Responses to

SEC Comment Letter dated September 11, 2009

Mr. Souki reviews the Company’s operating results on a quarterly basis using the information found in the quarterly business segment footnote filed in our SEC filings. Due to the limited number of customers and the recurring nature of the Company’s current operating and administrative activities, a quarterly review

of the GAAP basis segment information is deemed appropriate at this time. However, due to the Company’s current focus on its cash position, Mr. Souki reviews a monthly cash report containing actual and forecast cash flows and an analysis of any variances to budget. The monthly cash flow report is comprised of two models: 1) the “CQP” model that reflects cash receipts and cash expenditures of activities within Cheniere Energy Partners, L.P., the Company’s

90% owned master limited partnership that owns 100% of the equity interests of the Sabine Pass LNG receiving terminal and 2) the “CEI” model that reflects cash receipts and cash expenditures of all other activities outside “CQP”, including the non-CQP portion of the terminal segment, the pipeline segment, the marketing segment, and the corporate and other activities that are not defined by any of our segments.

The cash analysis is reviewed in this format due to the legal structure in place and the restrictions on cash within the consolidated structure of the Company. Each Segment Manager is directly accountable for the components of his or her respective operating segment results and performance that are analyzed in the monthly cash report and quarterly operating results. Regular contact is maintained between the Segment Managers and Mr. Souki in order to assess performance and allocate resources.

|

3. |

An example of the monthly cash report has been provided in a supplemental submission requesting confidential treatment to protect the confidential nature of the cash projections. Please reconcile the information in the table on page 99 for revenues by segment to that shown for the individual revenue line items on your consolidated

statements of operations on page 62. In this regard, it is not clear, for example, how the amount in the table for LNG Receiving Terminal revenues of $15,000 equates to what is shown on your consolidated statements of operations for the year ended December 31, 2008. |

Response:

The $15.0 million revenue disclosed in the Company’s LNG receiving terminal segment is intercompany revenue earned from its LNG & natural gas marketing segment. The $15.0 million represents LNG & natural gas marketing business segment’s charge for its capacity under its TUA with the Company’s LNG receiving

terminal segment. The presentation of the $15.0 million cost of the TUA as a net amount in revenue by the Company’s LNG & natural gas marketing segment causes the intersegment transaction to be eliminated when totaling to the Company’s consolidated revenue.

The $1.0 million revenue disclosed in the Company’s natural gas pipeline segment is primarily intercompany revenue earned from transportation fees from the LNG receiving terminal segment. This $1.0 million revenue was eliminated in the corporate and other column as noted in note (1) that states, “…and certain

intercompany eliminations.” The $3.2 million of corporate and other revenue represents the $4.2 million oil and gas sales on the Consolidated Statements of Operations, offset by the $1.0 million elimination of the intercompany pipeline revenue.

The Company will expand its disclosure in future filings to clarify that the intersegment transaction between the Company’s different business segments is eliminated to arrive at the total consolidated revenue amount found in the consolidated statements of operations for each respective period.